Handyman Invoice Template XLS for Easy Billing and Payment Tracking

Managing the financial side of any service-based business can be challenging, especially when it comes to keeping track of payments and charges. Using the right tools to organize your records is essential for smooth operations and ensuring timely compensation. A well-designed document can help you quickly calculate amounts due, track hours worked, and provide professional receipts for clients.

With the help of digital spreadsheets, you can easily customize your documents to fit your needs. These tools offer built-in formulas that automate calculations, saving you time and reducing the risk of human error. Whether you’re a contractor, technician, or any other skilled worker, having a reliable system for billing can improve your workflow and enhance client satisfaction.

In this guide, we’ll explore how you can create and personalize these digital documents to meet the specific requirements of your business. Learn how to use simple templates that are both efficient and professional, while making your billing process easier and more accurate.

Handyman Invoice Template XLS Overview

For any service provider, clear and accurate documentation of charges is essential for maintaining a smooth financial process. A customizable billing sheet allows you to structure charges, add necessary details, and ensure clients receive precise and professional records of the work completed. These documents not only save time but also help maintain transparency in transactions.

By using a digital document with customizable fields, you can adjust the layout, categories, and formulas to fit your specific needs. This system streamlines the calculation of amounts due, taxes, discounts, and any other relevant details. It also allows for easy tracking of payments and outstanding balances, ensuring that nothing is overlooked.

Whether you’re managing small tasks or large projects, a well-organized billing sheet helps you present a polished image to your clients. With the right structure, you can confidently handle multiple jobs, offering a professional and efficient service experience.

Why Choose XLS for Invoices

When it comes to billing for services rendered, flexibility and ease of use are key factors to consider. A digital document allows for quick customization and makes it easier to calculate totals automatically, reducing the risk of manual errors. Using a spreadsheet format to handle your payment records offers a number of practical advantages, from simplicity to powerful features that save time.

Customization and Flexibility

One of the major reasons to opt for a digital document is the ability to tailor it to your specific needs. Unlike pre-printed forms, a customizable file allows you to adjust columns, rows, and formulas, making it possible to track additional charges or services. This level of control ensures that you only include the necessary information for each job, without unnecessary clutter.

Automation and Accuracy

Another strong reason for choosing a spreadsheet format is the built-in functionality for automated calculations. With formulas, you can instantly calculate totals, taxes, discounts, and other figures, minimizing human error. This feature not only speeds up the billing process but also enhances accuracy, ensuring that the amounts you present to clients are always correct.

Benefits of Using a Template

Using a ready-made document for billing offers a variety of advantages that can significantly improve efficiency in your daily operations. By relying on a pre-structured format, you eliminate the need to design a new record each time a transaction occurs. This approach not only saves time but also ensures consistency across all your financial documents.

Time-saving and Efficiency – One of the main benefits of using a pre-built format is the speed at which you can generate records. Instead of starting from scratch every time you need to document a payment, you can simply fill in the necessary fields and make any quick adjustments. This reduces the time spent on administrative tasks, allowing you to focus more on your core work.

Professional Appearance – A well-designed document gives a polished, business-like impression to clients. Even when you’re working with smaller projects or one-time jobs, providing a consistent, professional-looking document shows that you take your business seriously. It reflects positively on your brand and can build trust with your clients.

Accuracy and Organization – Having a standardized format helps prevent mistakes. With clear sections for charges, payment terms, and contact information, it’s easy to ensure no important details are overlooked. The organized layout also helps both you and your clients stay on top of transactions and avoid confusion.

How to Customize an Invoice Template

Personalizing a billing document to fit your specific needs is a straightforward process that can enhance both efficiency and professionalism. Customization allows you to adjust fields, change the layout, and ensure that all necessary details are included. By tailoring the document, you can reflect the unique aspects of your services and create a consistent experience for your clients.

Follow these simple steps to customize your billing record:

| Step | Action |

|---|---|

| 1 | Modify the Header: Add your business name, logo, and contact information at the top of the document to establish your brand. |

| 2 | Adjust the Date and Payment Terms: Ensure the date of service is accurate and include clear payment deadlines and methods. |

| 3 | Update Service Descriptions: Customize the list of services provided, ensuring each charge is clearly explained for transparency. |

| 4 | Include Calculations: Add necessary formulas to calculate totals, taxes, and discounts automatically for quicker and more accurate results. |

| 5 | Personalize the Footer: Include any legal disclaimers, refund policies, or additional notes for clients at the bottom of the document. |

Once these sections are personalized, your document will be ready for use, helping you maintain a professional appearance while offering accurate, customized billing to your clients.

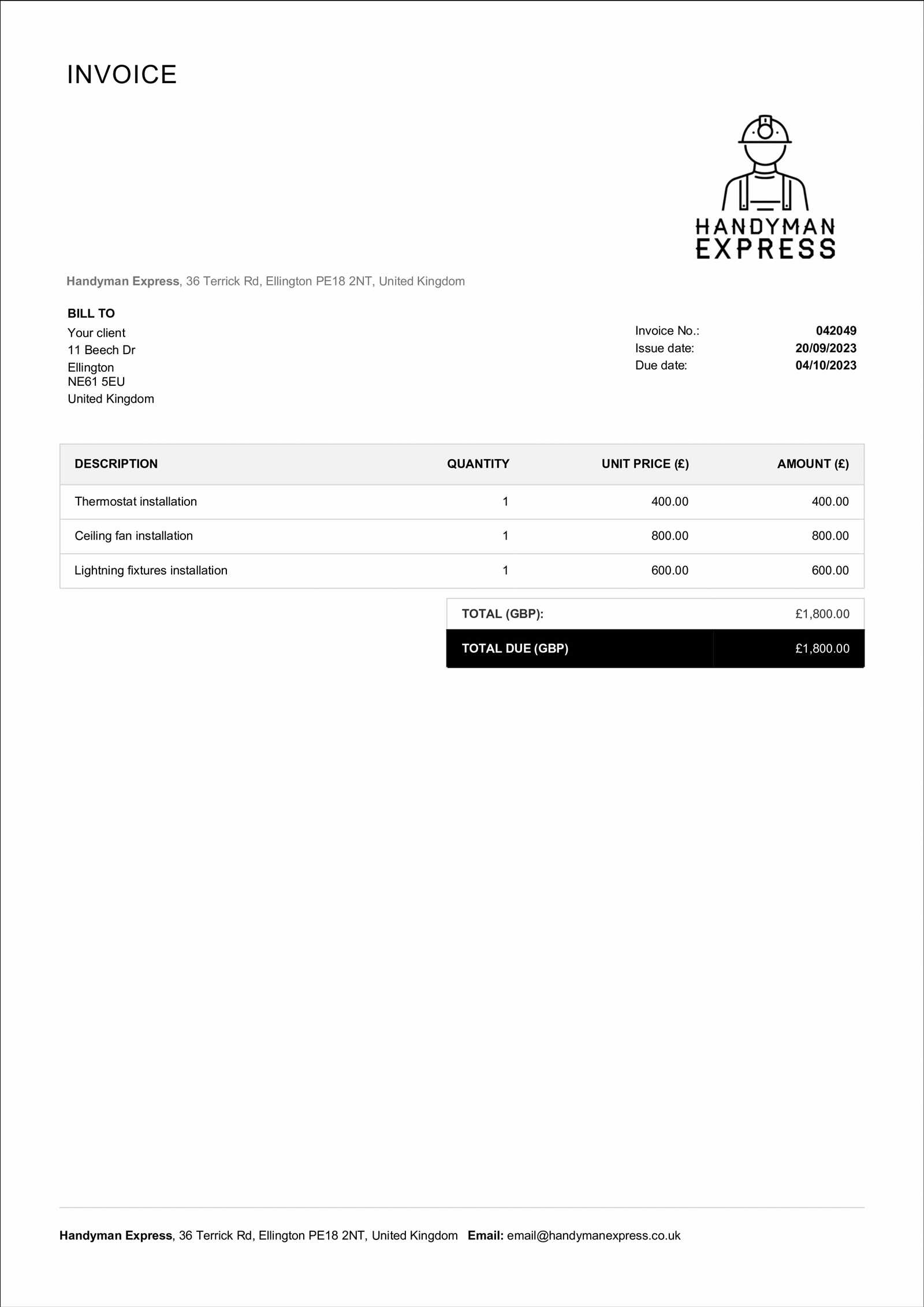

Key Elements of a Handyman Invoice

To ensure clarity and professionalism in your billing process, it’s essential to include all necessary information in your financial documents. A well-structured record should cover key details that make it easy for both you and your client to understand the charges and terms. These elements not only help in maintaining transparency but also ensure smooth payment processing.

Here are the key components that should be included in your billing document:

- Contact Information: Both your business details and the client’s contact information should be clearly displayed at the top of the document. This includes names, addresses, phone numbers, and email addresses.

- Date of Service: Include the exact date when the work was completed. This helps in tracking the timeline of services provided and can be useful for both parties in case of disputes or future references.

- Description of Services: Provide a detailed breakdown of the tasks completed. Each service should be listed separately with a clear description, ensuring your client understands what they are being charged for.

- Cost Breakdown: List the cost for each service performed, including hourly rates or flat fees. Be sure to include any materials or additional expenses as separate line items.

- Taxes and Fees: Specify any applicable taxes or additional fees (e.g., travel charges) that may apply to the total amount. This section ensures transparency in how the total is calculated.

- Total Amount Due: Clearly state the total amount due for services rendered, ensuring that the subtotal, taxes, and any discounts are included in the final calculation.

- Payment Terms: Outline the payment methods accepted and the due date for payment. This section should also include any late fees or penalties for delayed payments, if applicable.

- Notes or Special Instructions: Include any additional notes, such as warranties on services, specific instructions, or reminders for the client. This section can also serve to highlight any agreements made during the job.

By including these key elements in your billing document, you provide a clear and professional summary of the work performed while ensuring that both parties are on the same page regarding payment terms and expectations.

Free Handyman Invoice Templates Download

For those looking to streamline their billing process, finding an easy-to-use, free document can save both time and effort. There are numerous resources available online where you can download pre-designed files that are ready for immediate use. These ready-made formats are customizable, allowing you to adapt them to your specific business needs while maintaining a professional look.

Here are some of the key benefits of downloading free billing documents:

- Quick Setup: You can download a file in minutes and start using it right away, without needing to design or format a new document from scratch.

- Customization: The downloadable formats are editable, so you can adjust fields such as service descriptions, rates, and payment terms to fit your services.

- Cost-Effective: Free resources allow you to access high-quality documents without spending any money on software or premium services.

- Variety: Many sites offer a wide selection of designs, so you can choose the layout that best suits your brand or industry.

- Instant Access: Once downloaded, the file is yours to keep, and you can easily print or share it electronically with clients as needed.

To get started, visit websites that specialize in free business resources, and explore their library of billing documents. Many offer simple, straightforward formats that can be customized to match your specific needs, making it easier than ever to stay organized and professional.

How to Track Payments with XLS

Keeping track of payments is an essential part of managing any service-based business. Using a digital spreadsheet offers an easy and effective way to monitor outstanding balances, payment dates, and amounts received. By organizing your financial records in a structured format, you can quickly identify which payments have been made and which are still pending.

Creating a Payment Tracking System – A simple way to track payments is by setting up a column for each payment detail. Include the client’s name, service description, total amount, payment due date, and payment status. You can mark payments as “Paid,” “Pending,” or “Overdue” to keep an eye on each transaction’s status.

Using Formulas for Automation – One of the major advantages of using a digital document is the ability to automate calculations. You can set up formulas to calculate totals, track overdue payments, or even calculate remaining balances. This makes it easier to manage multiple clients and ensures that nothing slips through the cracks.

Example Formula: To track the remaining balance, simply subtract the amount paid from the total due. The formula could look like this: =Total Amount – Amount Paid. This will automatically update the balance as payments are recorded.

With this approach, you can quickly identify unpaid balances, set reminders for upcoming payments, and ensure that your records are always up-to-date without needing to manually review each transaction.

Using Formulas for Automatic Calculations

One of the greatest advantages of working with a digital spreadsheet is the ability to automate complex calculations. By utilizing built-in formulas, you can reduce the likelihood of human error and save valuable time. Formulas can help calculate totals, taxes, discounts, and other variables automatically, ensuring your records are always accurate and up-to-date.

Here are some essential formulas you can use to streamline your calculations:

- Sum Formula: This basic formula adds up multiple values. For example, to calculate the total amount for all services, use: =SUM(Cell Range).

- Tax Calculation: Automatically calculate the tax by multiplying the subtotal by the tax rate. For example: =Subtotal*Tax Rate.

- Discount Formula: If you offer discounts, you can calculate them with this formula: =Total Amount – (Total Amount * Discount Percentage).

- Remaining Balance: If payments are made over time, calculate the balance due by subtracting the amount paid from the total amount due: =Total Due – Amount Paid.

- Due Date Alerts: Use conditional formatting to highlight overdue payments. For example, if the payment due date has passed, set the cell to display in red, using a rule like: =IF(Due Date .

With these formulas, you can easily automate the most important calculations, freeing up time to focus on providing excellent service while ensuring accurate financial records.

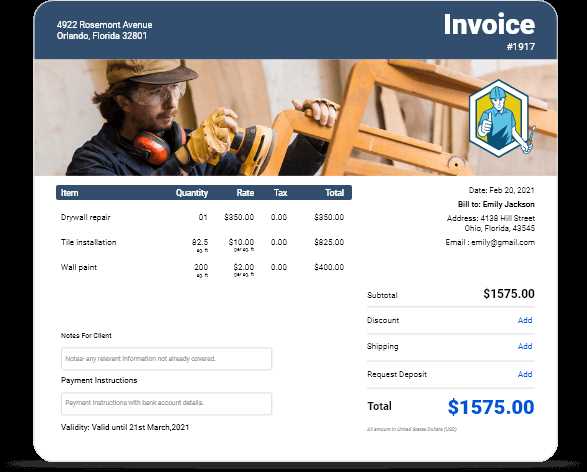

Designing a Professional Invoice

A well-designed billing document not only reflects your business professionalism but also enhances the client experience. A clean, organized layout makes it easy for clients to understand charges and ensures that your details are presented clearly. An effective design goes beyond aesthetics–it should facilitate smooth communication and prevent misunderstandings regarding payments.

Layout and Structure

The layout of your document should prioritize readability. Organize key information logically, using sections and headings to guide the client through the document. Begin with your contact details at the top, followed by the client’s information, service descriptions, and pricing breakdown. Ensure that there is ample space between sections to avoid a cluttered appearance.

Branding and Consistency

Incorporating your business logo, colors, and fonts can help reinforce your brand identity. A cohesive design across all client-facing materials, including your billing documents, creates a more professional and memorable impression. However, keep the design simple and avoid overloading the document with unnecessary elements that might distract from the essential information.

Key Design Tips:

- Clear Typography: Use legible fonts that are easy to read, even on smaller screens. Avoid overly decorative fonts that could make the document difficult to interpret.

- Strategic Use of Color: Use color to highlight important sections, such as totals or due dates, but limit the color palette to two or three shades to maintain a professional look.

- Consistent Formatting: Ensure that headings, text, and numbers are aligned properly, and avoid excessive bolding or italicizing. A uniform format gives your document a polished appearance.

- White Space: Don’t overcrowd the page. Use white space effectively to create a balanced layout and improve the document’s overall flow.

By focusing on clean design and organized presentation, you can create billing documents that convey professionalism and attention to detail, helping you build stronger relationships with your clients.

Common Mistakes in Handyman Invoices

When creating a billing document, small errors can lead to confusion and delays in payment. Avoiding common mistakes is essential to maintaining professionalism and ensuring that your clients clearly understand the charges. By addressing these issues upfront, you can streamline your billing process and reduce the risk of payment disputes.

Common Errors to Watch For

- Incomplete Client Information: Failing to include the client’s full name, address, or contact details can lead to misunderstandings and issues with communication. Always double-check that all contact information is accurate and complete.

- Missing or Incorrect Service Descriptions: Vague or incorrect descriptions of the services provided can confuse clients. Be specific about the work performed, including hours worked, materials used, and any other relevant details.

- Incorrect Calculations: Simple math errors can cause discrepancies in the total amount due. Always use formulas or double-check your math to ensure accuracy in your totals, taxes, and discounts.

- Not Including Payment Terms: It’s crucial to outline clear payment expectations. Without due dates, accepted methods of payment, or late fee terms, clients may delay payment or be unclear on when and how to pay.

- Forgetting to Add Taxes or Additional Fees: Sometimes taxes, travel fees, or additional costs are overlooked. Make sure these are itemized separately and clearly stated to avoid any confusion later on.

- Unclear Due Dates: Without a clearly defined due date, clients may not prioritize paying on time. Always include a specific date by which the payment should be made to avoid delays.

How to Avoid These Mistakes

- Review All Details: Before sending any documents, always review the details carefully, ensuring that all sections are complete and correct.

- Use Professional Software: Using specialized tools or digital spreadsheets with built-in checks and formulas can help prevent errors in calculations and formatting.

- Set Clear Expectations: Clearly define the payment terms, including due dates and acceptable payment methods, to avoid confusion or delays in payment.

By being mindful of these common mistakes and taking the time to review your documents, you can ensure a smoother transaction process and avoid unnecessary complications with your clients.

Best Practices for Invoice Organization

Properly organizing your billing documents is key to maintaining clear and efficient financial records. An organized system allows you to quickly access past transactions, track payments, and resolve disputes with minimal effort. Whether you’re managing a few clients or hundreds, a structured approach ensures accuracy and consistency in all your financial dealings.

Key Tips for Keeping Your Billing Documents Organized:

- Use Consistent Naming Conventions: Develop a consistent system for naming your documents, such as including the client’s name, the date, and a reference number in the filename. For example, “ClientName_2024-04-15_12345”. This makes it easier to search and locate specific records later on.

- Organize by Client or Project: Group your financial documents by client or project to keep related files together. This reduces the time spent looking for individual records and ensures you can quickly review all relevant transactions for a specific client or job.

- Maintain a Centralized Database: Store all billing records in a centralized location, whether it’s a cloud-based platform or a local folder. Having a single location for all files minimizes the risk of losing documents and makes retrieval much faster.

- Use Folders and Subfolders: Break down larger categories into smaller subcategories, such as separating documents by year, project, or payment status (e.g., “Paid”, “Unpaid”, “Pending”). This keeps everything orderly and allows you to quickly find specific records.

- Set Regular Review Dates: Schedule periodic reviews of your billing records to ensure everything is up-to-date and accurately categorized. This practice can also help identify any overdue payments or unresolved issues.

- Leverage Digital Tools for Organization: Use specialized software or spreadsheets that offer sorting and filtering features to organize and track your records. Digital tools can help automate processes like sorting by date or payment status, making the organization process much more efficient.

Maintain a Clear and Consistent Format: Keep the layout of your billing documents consistent. Using a similar structure for all your records helps you quickly review important information, like payment dates, due amounts, and client details, without confusion.

By following these best practices, you can stay on top of your financial documents, save time, and ensure smooth, efficient operations for your business.

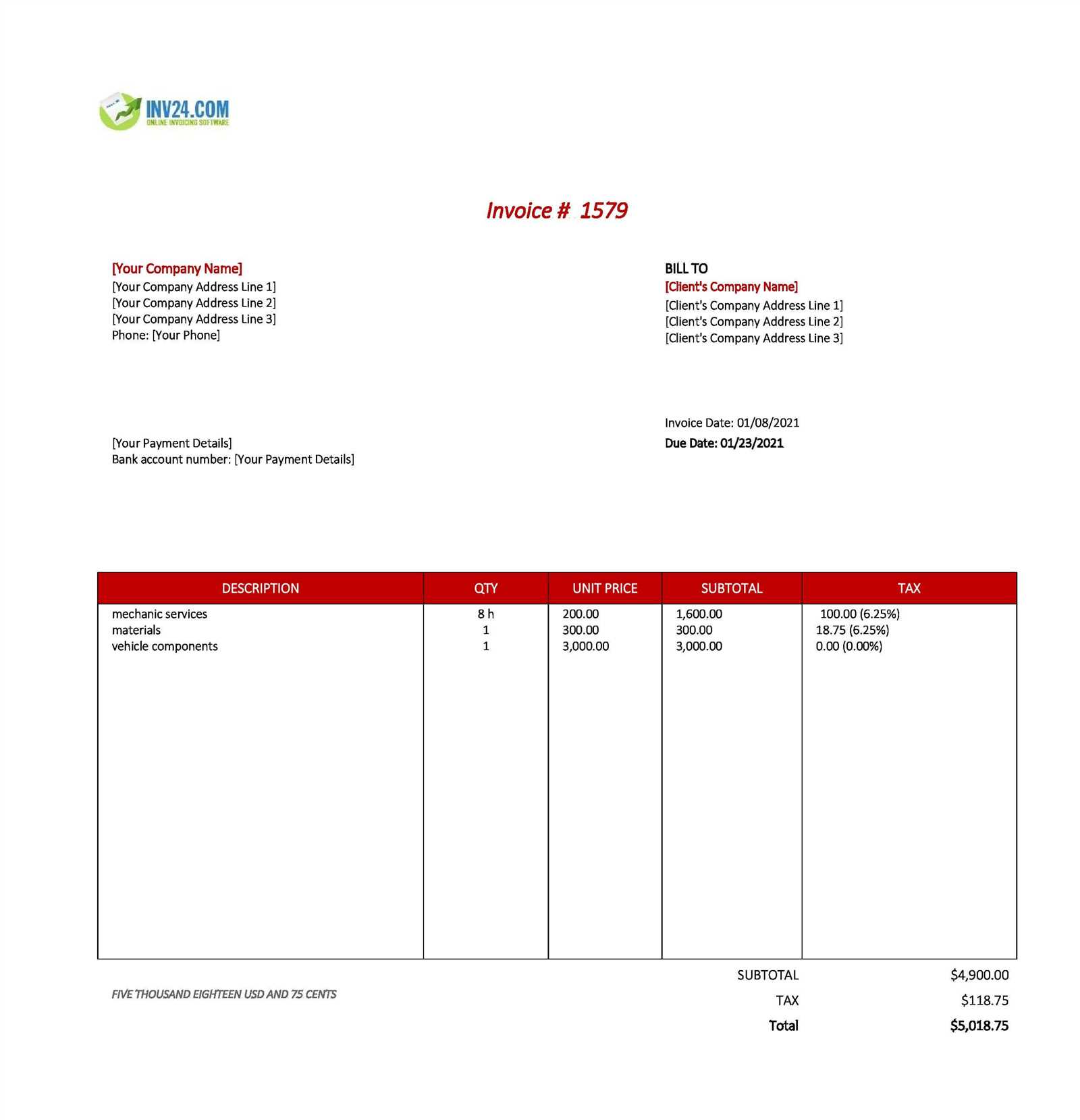

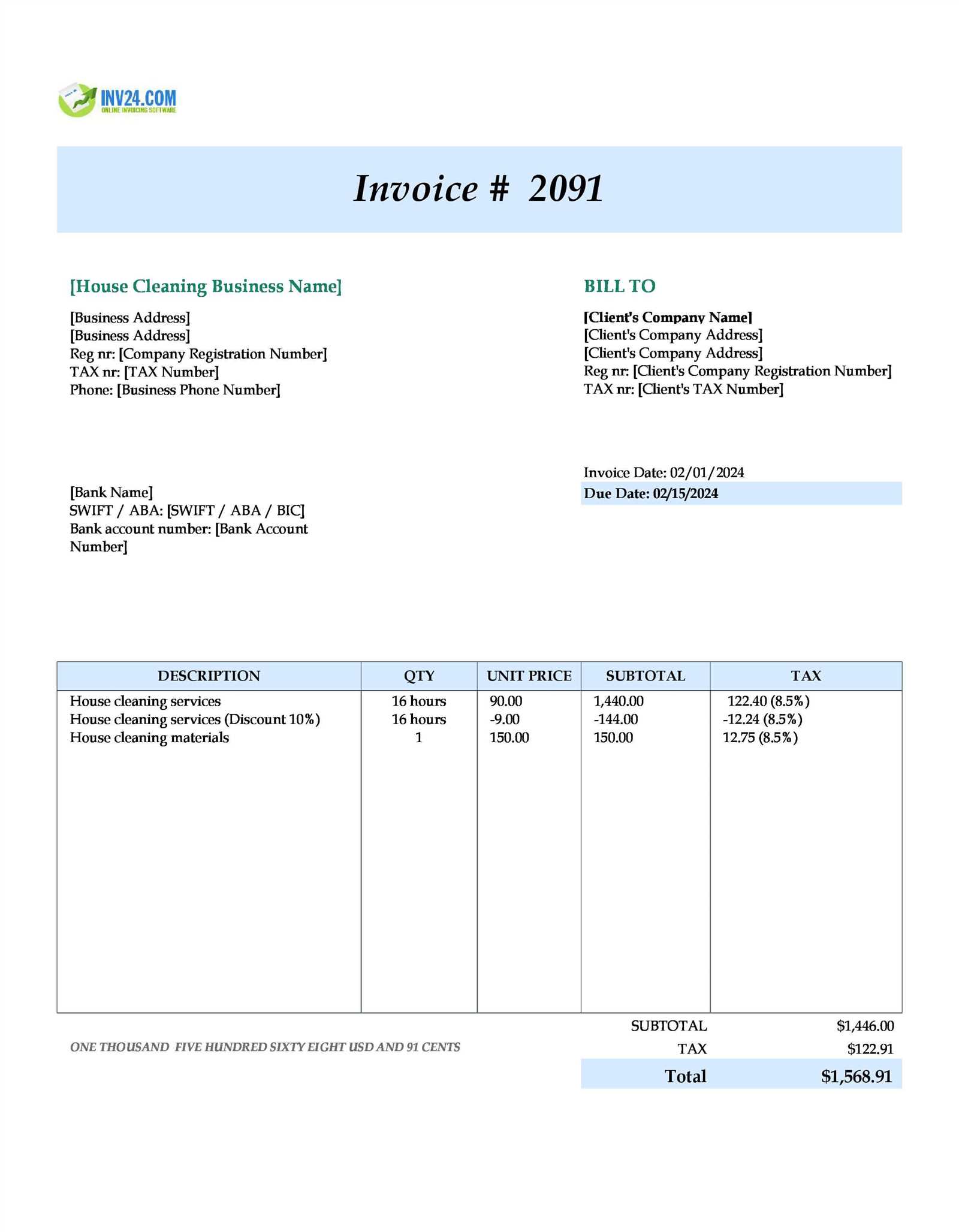

How to Add Discounts to Invoices

Offering discounts can be a great way to build customer loyalty and incentivize prompt payments. When applying discounts to your financial documents, it’s important to ensure that the discount is clearly outlined, calculated correctly, and integrated seamlessly with the rest of the charges. This prevents confusion and ensures both parties understand the adjusted total amount due.

Types of Discounts to Include

- Percentage-Based Discount: A common way to apply a discount is by offering a certain percentage off the total amount. For example, a 10% discount on a $500 service would reduce the amount by $50.

- Flat-Rate Discount: This discount type offers a fixed amount off the total price. For instance, you may offer a $25 discount regardless of the total service cost.

- Early Payment Discount: You can incentivize faster payments by offering a discount if payment is made within a specific timeframe, such as 5% off if paid within 10 days.

How to Include Discounts in Your Documents

When adding a discount to your financial record, follow these steps:

- Include a Separate Line for Discounts: List the discount as a separate item on the document to clearly show how it affects the total price. This ensures transparency and helps the client understand the reduction in charges.

- Calculate the Discount Properly: Ensure that the discount is applied correctly based on the total amount before taxes, or if applicable, the subtotal after taxes. Use formulas to automate the calculation to avoid errors.

- Adjust the Total Amount: After applying the discount, update the total amount due. If you’re using a digital document, be sure the final total reflects the discount correctly.

Example Calculation: If the total amount is $500 and you apply a 10% discount, the formula would be: =$500 – ($500 * 10%) = $450. This adjusted amount should be clearly shown at the bottom of the document as the total due.

Offering discounts can not only encourage timely payments but also strengthen your customer relationships. Just be sure that discounts are calculated correctly and communicated transparently to maintain professionalism.

Ensuring Accuracy in Service Charges

Accurate pricing is fundamental to maintaining trust and ensuring that your clients are satisfied with both the service provided and the final cost. Whether you’re working on a simple repair or a complex project, it’s crucial that all charges are calculated correctly and presented clearly to avoid misunderstandings or disputes. This not only ensures transparency but also helps with timely payments and long-term customer relationships.

Steps to Ensure Accuracy in Service Charges:

- Clearly Define Service Rates: Always ensure that your rates are well-defined and consistently applied. Specify whether your charges are hourly, flat-rate, or based on materials used, and make sure this is communicated clearly to the client before the job begins.

- Break Down Costs: Provide a detailed breakdown of all charges. List individual services, labor hours, materials, and any additional fees separately. This helps clients understand exactly what they are paying for and prevents confusion.

- Use Reliable Measurement Units: If the job involves measurements, such as square footage or quantity of materials, ensure that the units are clearly stated and calculated correctly. Double-check conversions, as even small errors can lead to significant discrepancies.

- Track Time Accurately: If you charge by the hour, keep precise records of the time spent on the job. A simple time tracker or manual log can help ensure that you bill the correct amount of time. Rounding or estimating time can lead to overcharging or undercharging.

- Account for Materials and Supplies: If materials are used, ensure that they are itemized clearly and reflect the actual cost. Don’t forget to include any shipping, handling, or delivery charges if applicable.

- Double-Check Calculations: Use formulas, calculators, or professional software to ensure all totals are accurate. Double-checking math is crucial, especially when multiple items or services are involved.

- Be Transparent About Additional Fees: If there are any extra charges, such as for emergency service or travel, make sure to mention these up front and provide a clear explanation in the breakdown.

By following these practices, you can ensure that your service charges are accurate, transparent, and professionally presented. This reduces the risk of disputes and fosters trust, which is vital for long-term success.

Setting Up Payment Terms in XLS

Establishing clear payment terms is essential to ensure timely payments and avoid confusion with your clients. By setting up payment conditions in your financial documents, you can communicate expectations effectively and reduce the chances of delayed or missed payments. When working with spreadsheets, configuring these terms is straightforward and can help automate and streamline the billing process.

Steps to Set Up Payment Terms:

- Define Payment Due Dates: Specify a clear due date for payments, whether it’s a fixed number of days after the service is completed or a specific calendar date. This will help clients understand when they need to make the payment.

- Offer Early Payment Discounts: If you wish to incentivize faster payments, you can set up a discount formula that calculates a reduction in the total if paid before a certain date. For example, offer a 5% discount for payments made within 10 days.

- Include Late Payment Fees: Add a clause that outlines a fee for overdue payments. You can set this up by creating a simple formula that adds a fixed fee or percentage of the outstanding amount after the due date passes.

- Set Accepted Payment Methods: Clearly list the methods through which clients can pay, such as bank transfer, credit card, or online payment services. This makes it easier for clients to pay and ensures there’s no confusion about the process.

- Adjust Payment Terms for Specific Clients: If necessary, you can tailor the payment terms based on your relationship with the client or the nature of the work. This may include extended payment deadlines or flexible installment options.

How to Implement Payment Terms in a Spreadsheet:

- Due Date Cell: Create a designated cell to enter the payment due date, and use conditional formatting to highlight overdue amounts if the payment date passes.

- Discount and Late Fee Formulas: Use formulas to calculate any discounts for early payments or penalties for late payments. For example, use =IF(DatePaid to apply a 5% discount if the payment is made early.

- Payment Status Tracker: Add a column to track whether the payment has been made, and use conditional formatting to highlight any overdue entries. You can use a simple formula like =IF(TODAY()>DueDate,”Overdue”,”On Time”

How to Include Taxes on Handyman Invoices

Including taxes in your billing documents is a vital step in ensuring compliance with tax laws and providing clients with a clear breakdown of the total cost. Taxes can vary depending on your location, the type of service provided, and even the specific materials used. Accurately calculating and including taxes not only helps you stay legally compliant but also builds trust with your clients by offering transparency in the final amount due.

Steps for Including Taxes in Billing Documents

- Know the Applicable Tax Rates: Before adding taxes, it’s important to understand the local tax laws in your area. This includes knowing whether a sales tax or a service tax applies to your work and what the current rate is.

- Calculate the Tax Amount: Once you know the applicable tax rate, multiply the subtotal (the total amount before tax) by the tax rate. For example, if your subtotal is $500 and the tax rate is 8%, the tax amount would be $500 * 0.08 = $40.

- Clearly Display Tax Breakdown: Include a separate line for taxes on your document, labeled with the applicable tax rate (e.g., “Sales Tax (8%)”). This ensures transparency and helps your client see exactly how the tax amount was calculated.

- Include Total with Taxes: Add the calculated tax amount to the subtotal to determine the final amount due. Clearly label this as the total due after tax, so the client understands the final payment required.

- Handle Different Tax Rates: If multiple types of tax apply, or if different rates apply for certain materials or services, break these down into separate lines. For example, you might have one tax rate for labor and another for materials.

Example Calculation:

- Subtotal: $500

- Tax Rate (8%): $500 * 0.08 = $40

- Total Due: $500 + $40 = $540

Optional Tax Fields: In some cases, you may need to include additional fields, such as tax exemption numbers for certain clients or special tax categories. Make sure your document is flexible enough to accommodate these situations while keeping everything clear and organized.

By following these guidelines, you ensure that your billing documents are accurate, transparent, and compliant with tax regulations. Properly handling taxes also reduces the risk of confusion or disputes, making the payment process smoother for both you and your client.

Managing Multiple Clients with Templates

Effectively managing multiple clients can become challenging without the right tools, especially when it comes to tracking various projects, payments, and specific client details. Using standardized documents for each client helps streamline this process, ensuring consistency and reducing the time spent on administrative tasks. Customizing documents for different clients while keeping a consistent format allows for quick adaptation to each unique project and client requirement.

Benefits of Using Standardized Documents for Multiple Clients

- Time Efficiency: Using pre-made forms saves time when creating new records for each client. You can quickly adjust the details, like project scope, pricing, and payment terms, without starting from scratch every time.

- Consistency: Keeping a consistent structure for all clients helps maintain professional standards. It also ensures that all essential information is included, such as payment deadlines, services rendered, and agreed-upon charges.

- Organization: Managing multiple clients becomes much easier when you have a clear and organized document structure. Standard fields and sections, such as service descriptions, costs, and payment schedules, ensure that all details are recorded and easy to access.

- Minimized Errors: Using consistent forms reduces the likelihood of errors, like forgetting to include a specific service or incorrectly calculating a charge. Templates can automate some of the calculations, further improving accuracy.

How to Customize Documents for Different Clients

- Client-Specific Information: Personalize each document by adding the client’s name, contact information, and project details. This ensures that every document is unique and relevant to the particular client.

- Adjust Payment Terms: Different clients may have different payment preferences, such as due dates or installment plans. Customizing payment terms ensures that all expectations are clear and aligned with each client’s specific situation.

- Service Descriptions: Even if the structure remains the same, the specific services offered to each client may vary. Modify the descriptions to reflect the exact work completed or to be done.

- Pricing Adjustments: While templates provide a standardized framework, you can still adjust prices for different clients based on factors like location, complexity of work, or custom requests.

By using standardized forms for managing client relationships, you can significantly reduce the time and effort spent on administrative tasks while maintaining accuracy and professionalism. Customizing these forms for each client ensures you’re delivering personalized service while staying organized.

Why Invoicing is Critical for Handyman Businesses

In any service-oriented business, the process of documenting completed work and tracking payments is essential for maintaining a steady cash flow and ensuring the long-term sustainability of the business. When service providers clearly communicate charges and expectations with clients, it not only fosters trust but also minimizes confusion and disputes. Properly structured payment requests are a key component of this process, making invoicing a critical task for any business offering on-demand or project-based services.

Ensuring Timely Payment

One of the main reasons for issuing detailed payment requests is to ensure timely compensation for the work completed. Without a proper record of the agreed-upon charges and payment terms, it can be difficult to track what’s owed and when. A well-documented request for payment sets clear expectations for the client, reducing the chances of delays or misunderstandings. Additionally, having a formal payment structure in place encourages clients to settle their bills on time, helping maintain consistent cash flow.

Building Professional Relationships

When clients receive a clear and professional breakdown of the work performed and the associated costs, it instills confidence in the service provider’s professionalism. A properly formatted document shows that the provider is serious about their business and respects the client’s need for transparency. It also serves as a reference in case of any disputes, ensuring that both parties are aligned on the agreed terms. This clarity helps build a more positive, trust-based relationship with clients, which can lead to repeat business and referrals.

Invoicing also plays a role in managing the financial side of the business. Tracking services rendered, payments received, and outstanding balances is crucial for effective budgeting, tax reporting, and financial planning. Without it, a business might struggle to understand its profitability or even risk missing out on payments.

In conclusion, invoicing is not just an administrative task–it’s a critical tool for ensuring financial stability, fostering professional relationships, and maintaining clear communication with clients. Proper documentation helps streamline the payment process and is an indispensable part of any successful service-based business.