How to Use an Invoice Digital Template for Efficient Billing

In today’s fast-paced business environment, efficiency is key, especially when it comes to managing payments. Having a streamlined system for creating and sending billing statements can save you time, reduce errors, and ensure prompt payments. Whether you’re a freelancer, small business owner, or part of a larger organization, adopting a modern approach to invoicing is essential for smooth financial operations.

With the right tools, generating professional and consistent payment requests can become a seamless part of your workflow. Gone are the days of manually crafting documents from scratch. Now, you can rely on customizable solutions that are both user-friendly and adaptable to your specific needs. By incorporating these tools, you can create clear and organized documents in just a few clicks, allowing you to focus more on growing your business and less on administrative tasks.

In this section, we’ll explore how to optimize your billing system with readily available options, highlighting key features, benefits, and tips for improving your financial operations. Understanding how to leverage these modern tools will help you stay on top of your finances and maintain a professional image with every transaction.

What is an Invoice Digital Template

In the modern business world, creating professional billing documents has become simpler and more efficient. A structured system that allows you to generate and manage payment requests automatically has become essential for businesses of all sizes. These pre-designed forms help ensure that every transaction is accurately recorded and delivered in a clear, consistent format.

Essentially, such a system provides a standardized format for requesting payments from clients or customers. Instead of creating each request from scratch, users can select a customized version that includes all necessary fields, such as amounts, dates, and contact information. This approach not only saves time but also minimizes the risk of errors in documentation.

Moreover, these solutions can be easily adjusted to fit the specific needs of different industries and payment structures. Whether you’re a freelancer billing for services or a large company tracking multiple transactions, this tool simplifies the overall billing process, making it more organized and efficient.

Benefits of Using Digital Invoice Templates

Adopting pre-designed forms for payment requests offers numerous advantages, especially for businesses looking to streamline their administrative tasks. Instead of starting from scratch each time, users can rely on structured solutions that make creating and sending billing documents faster and more accurate. Below are some of the key benefits of using these tools in your billing process.

Time Efficiency

- Quick Creation: Pre-built designs allow you to generate payment documents in a matter of minutes, freeing up time for other important tasks.

- Automation: By inputting basic information into the pre-established fields, you reduce the manual work involved in creating payment requests, leading to quicker turnarounds.

Improved Accuracy and Consistency

- Less Human Error: Automated calculations and standardized fields reduce the chances of errors, ensuring all your documents are consistent and correct.

- Professional Appearance: Consistent formatting across all your payment requests enhances your company’s image and fosters trust with clients.

Cost-Effectiveness

- Reduced Paper Use: Switching to an electronic format eliminates the need for printing, saving money on paper, ink, and postage.

- Free or Low-Cost Tools: Many pre-designed solutions are available for free or at a low cost, offering a budget-friendly way to improve your billing system.

By using these efficient solutions, businesses can not only improve their operations but also create a more professional, reliable billing process that keeps clients satisfied and payments flowing smoothly.

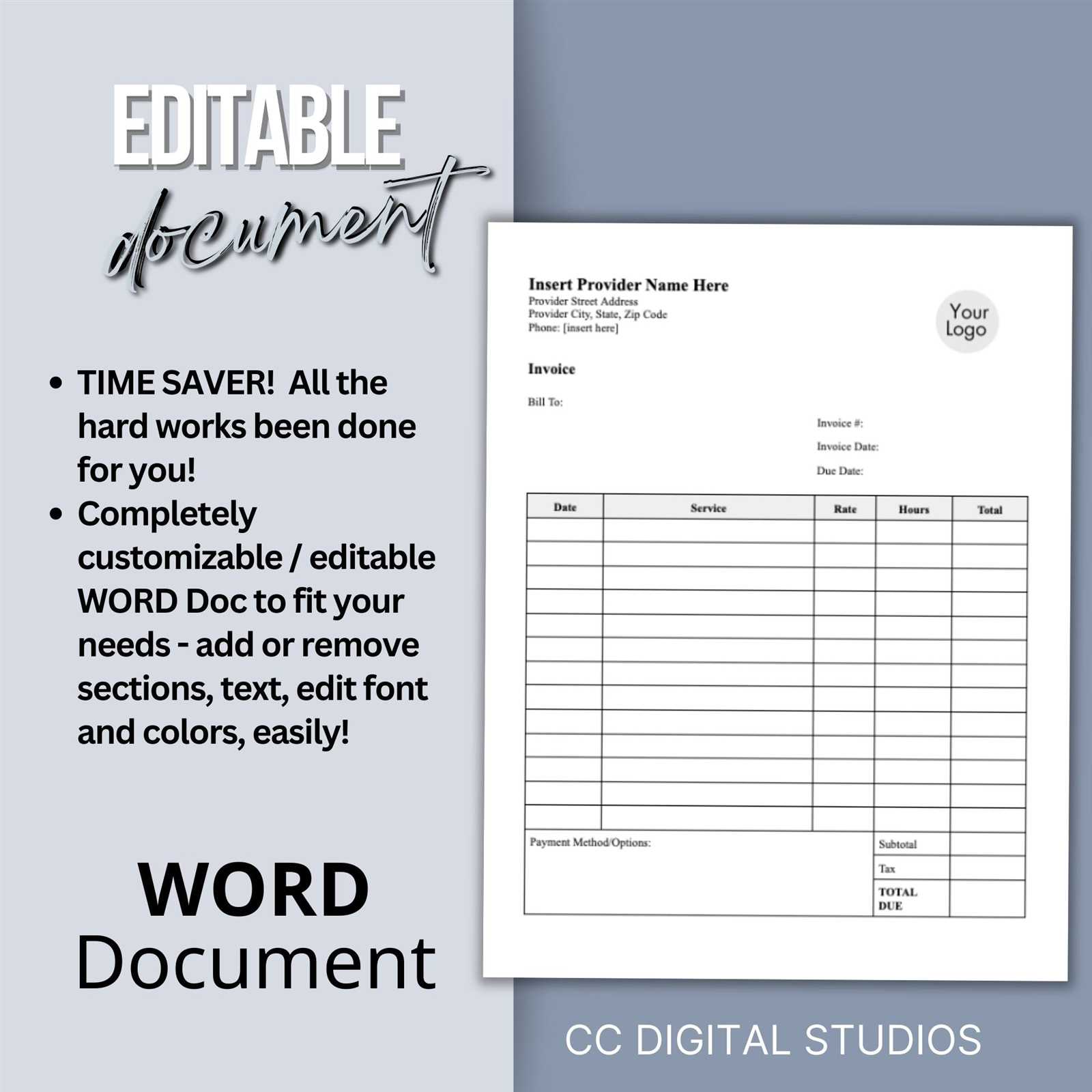

How to Customize Your Invoice Template

Personalizing your billing documents is essential for creating a professional and branded experience for your clients. With the right tools, customizing a pre-designed form is quick and easy, allowing you to add a personal touch while maintaining consistency across all your transactions. Below are the key steps to tailor your billing forms to meet your specific needs.

Step 1: Choose a Suitable Layout

- Select a Clean Design: Choose a layout that is easy to read and visually appealing, ensuring all necessary information is clearly presented.

- Adapt to Your Brand: Incorporate your company’s logo, colors, and fonts to match your brand identity and enhance recognition.

Step 2: Add Custom Information

- Company Details: Include your business name, address, contact information, and any other relevant details to ensure clients can easily reach you.

- Payment Terms: Specify your payment conditions, such as due dates, late fees, or preferred methods of payment.

Step 3: Set Up Automatic Fields

- Pre-fill Client Data: Input client names, addresses, and payment history to save time and avoid mistakes when generating new documents.

- Include Automatic Calculations: Set up formulas to automatically calculate totals, taxes, and discounts, minimizing the need for manual calculations.

Step 4: Adjust the Layout for Specific Needs

- Tailor to Your Industry: Add specialized sections or fields based on your business type, such as itemized lists for service providers or project-based rates for consultants.

- Flexible Fields: Make sure the form allows for easy addition or removal of fields to accommodate varying transaction types or billing requirements.

By customizing your billing documents, you can ensure they reflect your brand, meet your clients’ expectations, and maintain professionalism across all interactions.

Top Features of Invoice Templates

When choosing a pre-designed solution for billing, there are several key features that can make the process smoother, more efficient, and error-free. These features not only save time but also ensure consistency and professionalism in every transaction. Below are some of the most important attributes to look for when selecting the right solution for your business needs.

1. Customization Options

- Branding Integration: Easily add your company logo, color scheme, and fonts to align the document with your brand identity.

- Flexible Layouts: Choose from various designs that can be tailored to fit different industries and specific business needs.

- Adjustable Fields: Modify or add new sections to include any unique information, such as project details, hourly rates, or custom discounts.

2. Automation Features

- Automatic Calculations: Built-in formulas for adding totals, taxes, and discounts, reducing the risk of human error and saving time.

- Client Data Integration: Pre-fill client information for repeated transactions to streamline the process and avoid mistakes.

- Recurring Billing: Set up automatic generation of billing statements for long-term clients or subscription-based services, saving time on repetitive tasks.

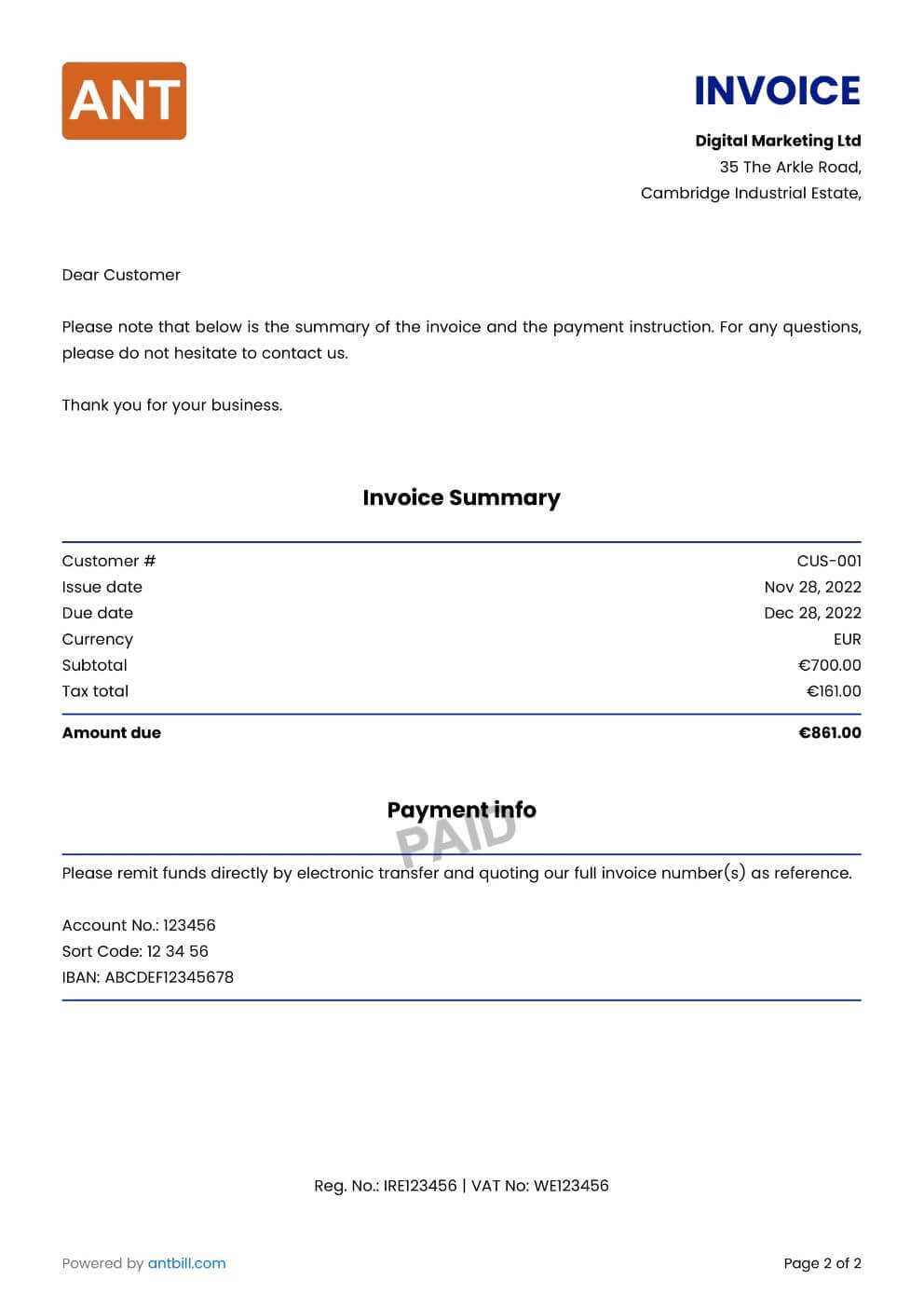

3. Payment Integration

- Embedded Payment Links: Include direct payment options such as bank details, online payment links, or QR codes to facilitate fast and secure payments.

- Clear Payment Terms: Clearly state due dates, late fees, and preferred methods of payment, ensuring clients understand the terms from the start.

With these features, you can significantly improve your billing process, reduce errors, and enhance your professional image while ensuring smoother transactions for both you and your clients.

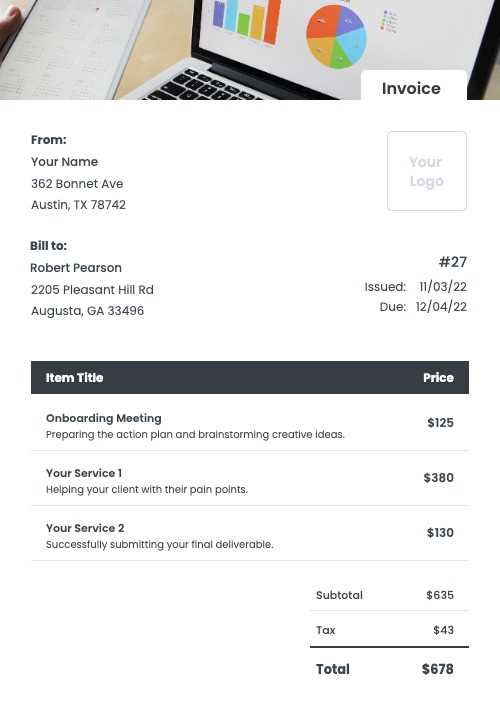

How to Create a Professional Invoice

Creating a polished and professional billing document is crucial for maintaining a strong business reputation and ensuring timely payments. A well-organized payment request not only makes it easier for clients to understand the charges but also enhances your company’s credibility. Here are the essential steps to help you craft a professional and effective document for your transactions.

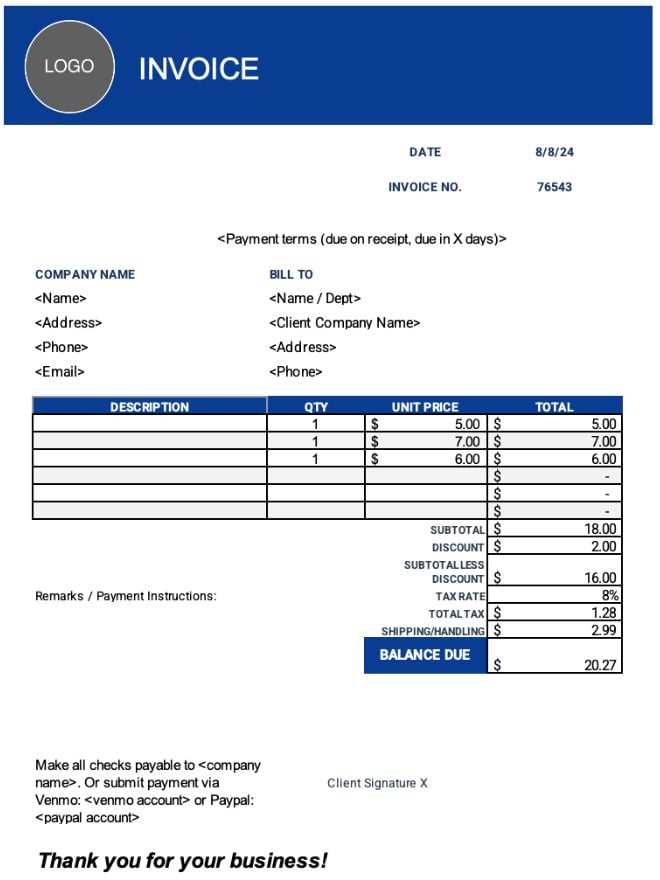

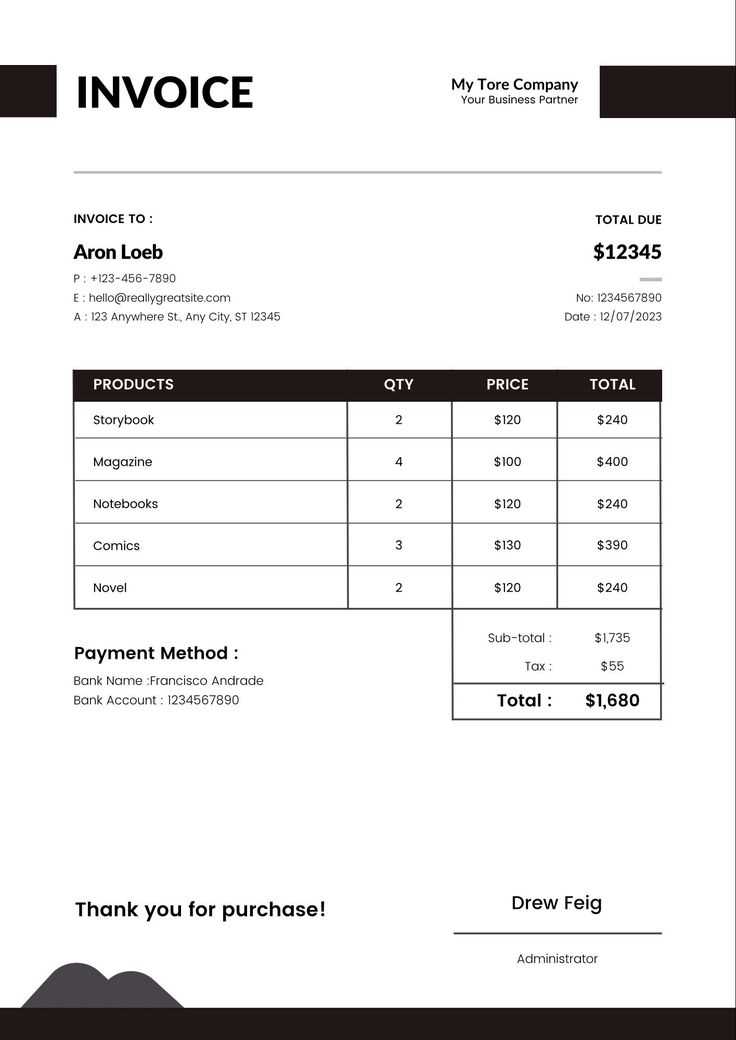

Step 1: Include Essential Business Information

Start by adding all necessary details that make your document look official and ensure clarity. Key elements to include are:

- Your Company Information: Include your business name, address, phone number, and email for easy communication.

- Client Details: Ensure that your client’s full name or company name, address, and contact information are clearly listed.

- Unique Identification Number: Give your document a unique reference number for easy tracking and future reference.

Step 2: Clearly Outline the Charges

One of the most important aspects of a well-crafted document is the accurate breakdown of the services or products provided. To ensure clarity:

- Itemized List: Break down all services or products provided, including quantities, descriptions, unit prices, and totals for each item.

- Subtotal and Taxes: Clearly show the subtotal, taxes applied, and any discounts given, ensuring transparency in your pricing structure.

- Total Amount Due: Always highlight the final amount due to avoid confusion. This should include all charges, taxes, and applicable fees.

Step 3: Add Payment Terms and Due Date

To avoid any misunderstandings, clearly specify the terms of payment:

- Due Date: Indicate when the payment is due, and make sure the client knows how much time they have before penalties, if any, apply.

- Payment Methods: List the accepted payment methods, such as bank transfer, check, or online payment portals.

- Late Fees (Optional): If applicable, include details about late fees or interest charges that will be applied for overdue payments.

By following these steps, you can ensure that your billing document is both professional and comprehensive, creating a positive impression on your clients and improving your chances of timely payments.

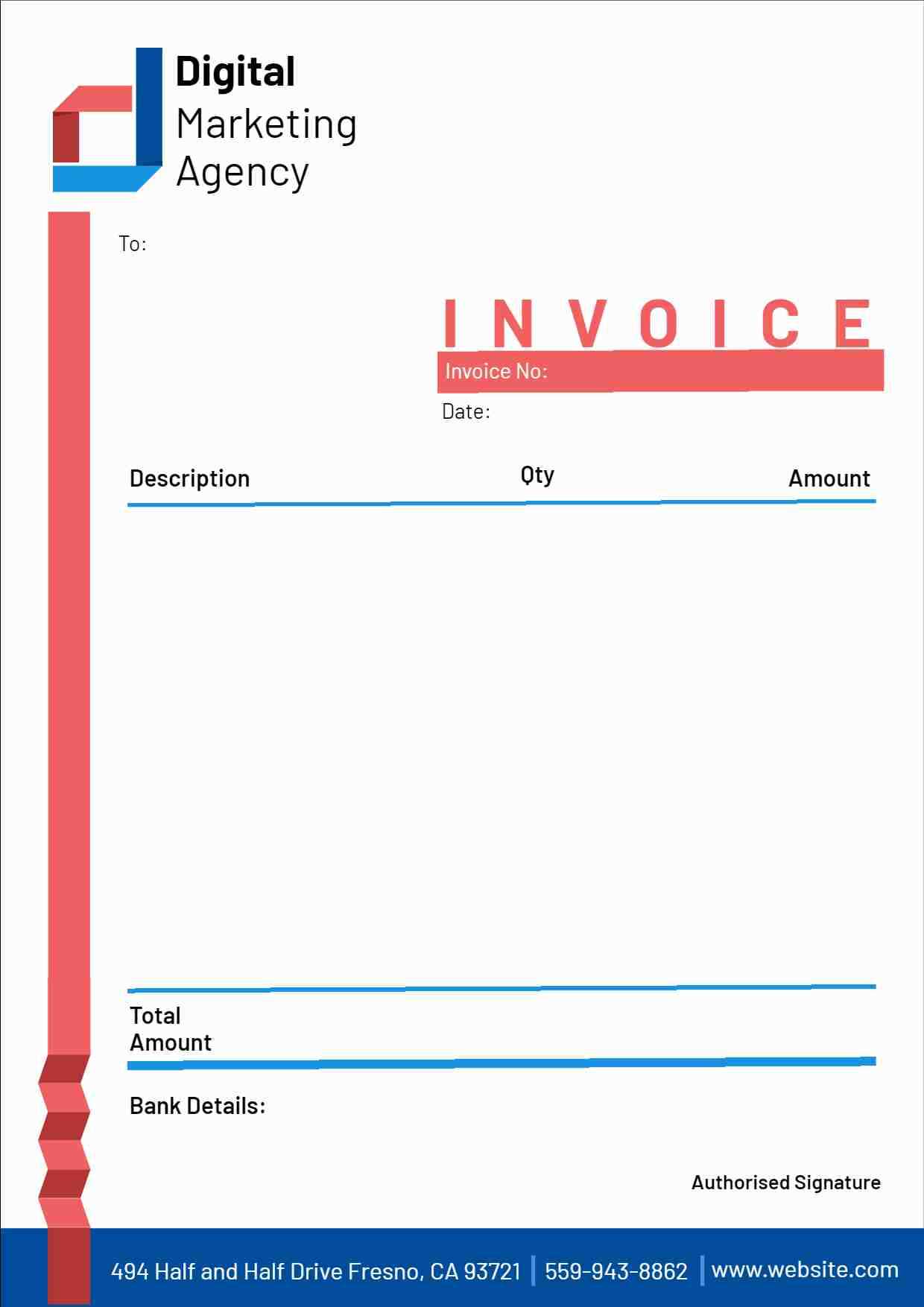

Choosing the Right Invoice Template for Your Business

Selecting the right billing document design is crucial for presenting your business in a professional light while ensuring the efficiency and accuracy of your financial operations. The right structure will not only make it easier for your clients to understand the charges but also help you manage and track payments effectively. Here are key considerations when choosing the right solution for your business needs.

1. Understand Your Business Requirements

- Industry-Specific Needs: Different industries may have varying requirements for billing. For example, service-based businesses might need detailed hourly rates, while product-based businesses require clear itemization of goods.

- Payment Methods: Choose a design that allows you to specify your preferred payment methods, whether that’s online payments, bank transfers, or checks.

- Repetition or One-Time Billing: If you offer recurring services, find a solution that allows you to automate or streamline the process of generating similar documents for each billing cycle.

2. Focus on Customization and Flexibility

- Easy to Modify: Select a system that allows you to quickly update client information, pricing, and payment terms, especially when dealing with long-term or project-based clients.

- Adjustable Layout: Look for designs that allow you to customize the layout to suit your brand. This may include adding logos, adjusting font styles, or changing the color scheme to align with your business identity.

- Additional Fields: Ensure that the design can accommodate specific sections for discounts, taxes, or special terms that are important to your business.

3. Ensure Clarity and Professionalism

- Clean and Simple Layout: A cluttered document can confuse clients and delay payments. Choose a structure that prioritizes readability and organizes information logically.

- Clear Payment Terms: Ensure that payment deadlines, terms, and penalties for late payments are clearly highlighted to avoid misunderstandings.

- Consistency Across Documents: Use a consistent style for all your payment requests to create a unified, professional image that reinforces your brand’s reliability.

By considering your specific business needs and focusing on customization, clarity, and professionalism, you can select a solution that improves the billing process and fosters stronger client relationships.

How to Automate Billing with Templates

Automating your billing process can save you significant time and effort, especially for businesses with recurring payments or large client bases. By leveraging pre-built forms and automated features, you can generate payment requests quickly and accurately, reducing manual errors and ensuring timely invoicing. Here are some steps to automate your billing process effectively.

1. Set Up Recurring Payment Templates

For businesses offering subscription services or regular contracts, creating automated billing cycles is essential. Most billing systems allow you to:

- Automate Frequency: Choose a payment interval (e.g., weekly, monthly, quarterly) and set it to automatically generate the corresponding document at the specified time.

- Pre-fill Client Data: Save client details such as billing addresses, payment methods, and pricing structures for seamless, recurring transactions.

- Customize Notifications: Set up email reminders for clients to notify them about upcoming payments or due dates, reducing late payments.

2. Use Integrated Payment Processing

Integrating payment gateways directly into your billing documents makes the process more efficient for both you and your clients. Here’s how to do it:

- Link Payment Methods: Include direct payment links or embedded options like credit card processing or bank transfer details, allowing clients to pay instantly from the document.

- Track Payments Automatically: Many systems will automatically mark payments as completed once a transaction is processed, helping you keep records up to date.

- Generate Payment Receipts: After a payment is made, automatically send a receipt or confirmation to clients, streamlining communication and ensuring transparency.

By automating the generation and delivery of payment requests, you can improve the efficiency of your operations, reduce administrative workload, and ensure that no payments are missed.

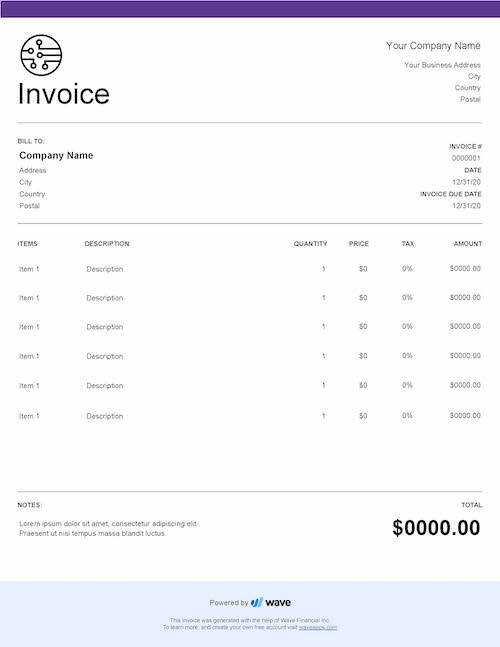

Best Tools for Creating Digital Invoices

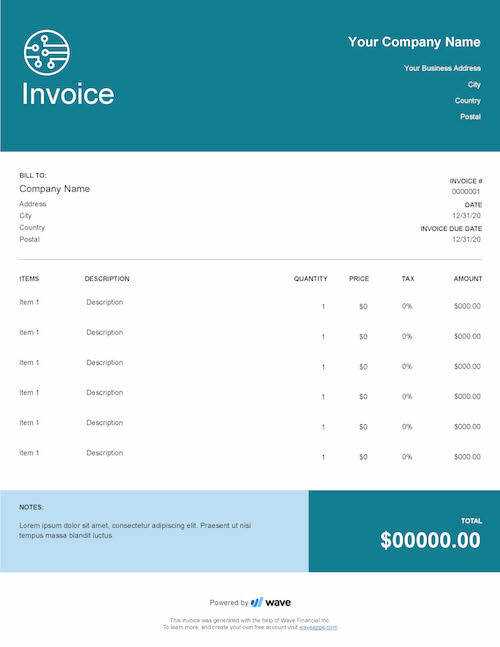

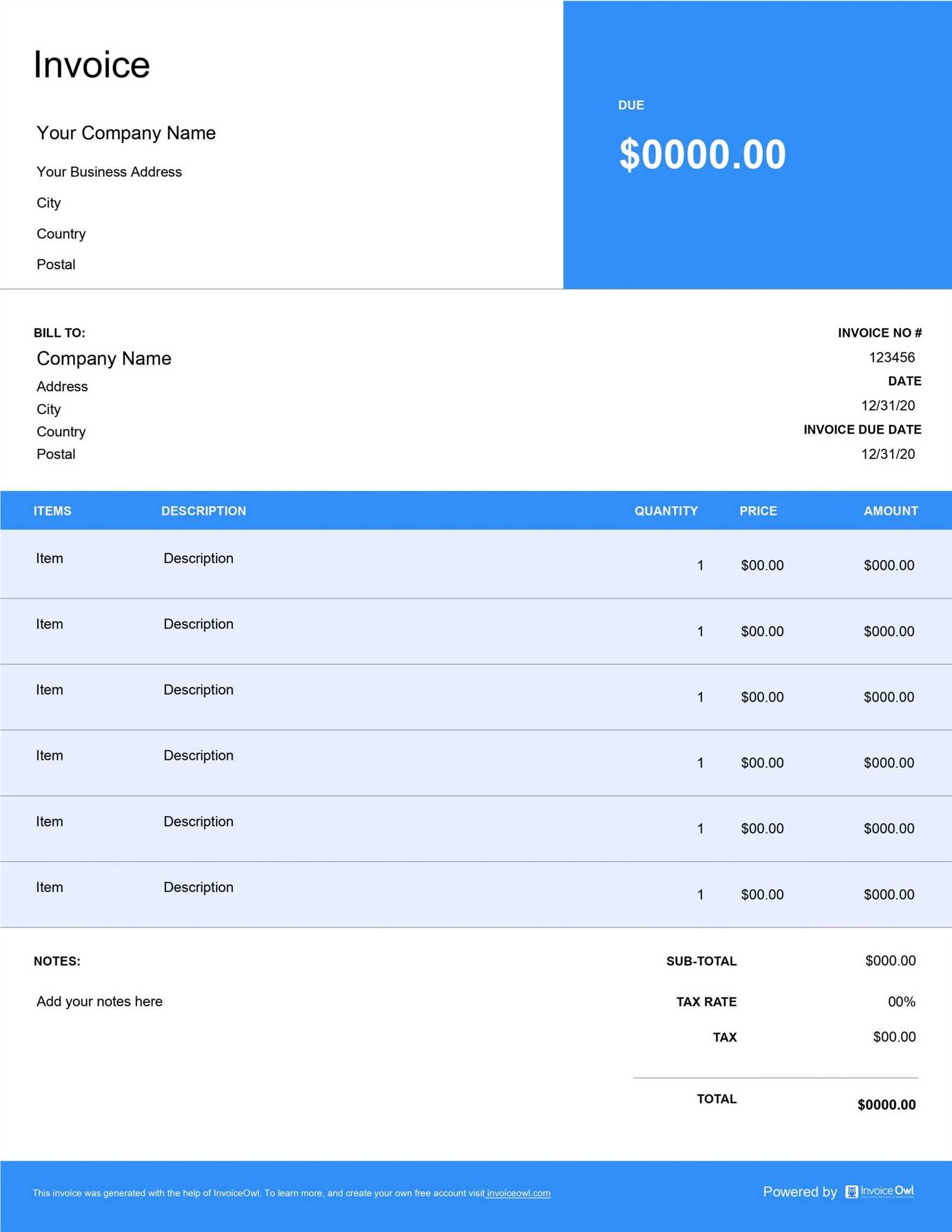

Choosing the right software for generating billing documents can greatly enhance the efficiency of your business. There are various tools available that can help streamline the process, offering customization, automation, and integration features that save time and improve accuracy. Below is a selection of some of the best tools for creating and managing payment requests in a professional and easy-to-use format.

Top Features to Consider

When selecting a tool, look for features that suit your business needs. Here are some key factors to keep in mind:

- Customization: The ability to modify designs, include your branding, and adjust the layout to suit your business type.

- Automation: Look for tools that can automate recurring billing and send reminders to clients for overdue payments.

- Integration: Choose software that integrates with your existing accounting system, payment gateways, and client management tools.

Comparison of Top Tools

| Tool | Key Features | Price |

|---|---|---|

| FreshBooks | Easy-to-use interface, automated reminders, client management | $15/month |

| QuickBooks | Comprehensive accounting features, payment tracking, custom designs | $25/month |

| Zoho Invoice | Customizable templates, multi-currency support, time tracking | Free for small businesses |

| Wave | Free software, online payments, automatic transaction syncing | Free |

| Invoice Ninja | Open-source, recurring billing, client portal | Free, with premium options available |

Each of these tools offers unique features suited to different business needs, from freelancers to larger organizations. Choosing the right one depends on your specific requirements, such as the level of customization needed, your budget, and how you prefer to manage your finances.

Why Digital Invoices are More Efficient

The process of creating and managing billing documents has evolved significantly with the introduction of modern solutions that offer far more efficiency than traditional methods. Automated systems and electronic formats streamline many aspects of the transaction process, saving both time and resources. These advancements make it easier for businesses to manage payments, improve accuracy, and ensure quicker processing times. Below are some of the key reasons why these systems are becoming a go-to choice for businesses worldwide.

1. Faster and More Accurate Processing

One of the main benefits of using automated billing systems is the speed at which documents can be created and sent. What once took hours or even days to process manually can now be completed in just a few clicks. Additionally, built-in formulas for calculations eliminate human errors, ensuring that totals, taxes, and discounts are accurate every time.

2. Reduced Costs and Resource Use

Traditional paper-based methods incur significant costs related to printing, postage, and storage. With electronic solutions, businesses can cut these costs dramatically. There’s no need for paper, ink, or physical mailing, and all records are stored digitally, making retrieval faster and more convenient. This shift also contributes to a greener environment by reducing paper waste.

3. Improved Tracking and Organization

Modern systems allow for easier tracking of payments and document status. Automated reminders for overdue payments help keep collections on track, while digital records can be instantly accessed and reviewed. Businesses can easily sort, search, and categorize their financial documents, leading to better organization and fewer misplaced records.

In conclusion, switching to automated solutions for creating and managing payment requests enhances productivity, reduces overhead, and helps businesses stay organized. With the added benefits of improved speed, accuracy, and tracking, it’s clear why electronic methods have become the preferred choice for businesses of all sizes.

Common Mistakes When Using Invoice Templates

While using pre-designed solutions for generating billing documents can greatly streamline the process, there are common pitfalls that businesses often encounter. These errors can result in confusion, delayed payments, or even damaged client relationships. Being aware of these mistakes and taking steps to avoid them can help ensure your billing process remains smooth and professional.

1. Incorrect or Missing Information

- Incomplete Client Details: Failing to include essential contact information or billing addresses can lead to communication issues and delays in payment.

- Wrong Payment Terms: Missing or inaccurate payment terms, such as due dates, can cause confusion and potentially result in late payments.

- Incorrect Item Descriptions: Be sure to provide clear and detailed descriptions of the services or goods provided to avoid misunderstandings about the charges.

2. Lack of Customization

- Not Aligning with Brand Identity: Using a generic design without incorporating your company logo or branding can make the document appear unprofessional and less trustworthy.

- Standardized Content: Relying on one-size-fits-all documents without adjusting them for specific clients or projects may lead to confusion or errors in pricing.

3. Failing to Automate

- Manual Data Entry: Entering information manually every time is time-consuming and prone to errors. Take advantage of automated fields for client details, dates, and itemized charges to save time and reduce mistakes.

- Missing Recurring Billing Setup: If your business requires frequent, recurring requests, failing to set up automatic generation can lead to missed or late billing cycles.

4. Not Tracking Payments

- Forget to Record Payments: Failing to keep track of payments and mark them as received can lead to confusion and missed payments.

- Inadequate Reminders: Not setting up automated reminders for overdue payments can lead to cash flow issues and missed revenue.

Avoiding these common mistakes can help streamline your billing process, reduce errors, and improve the overall professionalism of your business operations. By paying attention to detail and using automation, you can ensure that your billing system is efficient, accurate, and reliable.

How to Organize Your Invoice Records

Maintaining a well-organized record of billing documents is essential for efficient financial management. Proper organization not only helps you stay on top of payments and avoid confusion but also ensures smooth tax preparation, financial audits, and overall business transparency. Here are some practical strategies to help you manage and store your billing records effectively.

1. Use a Consistent Naming System

One of the simplest ways to keep track of your documents is by using a consistent and logical naming convention. Each record should have a unique identifier that makes it easy to find and reference. For example, consider using a combination of the client’s name or company, the date, and a unique reference number. This method will help you sort and locate documents quickly when needed.

2. Categorize by Client or Project

Organizing your records by client or project is a great way to keep everything streamlined. This approach is especially helpful if you work with multiple clients or have different types of projects. You can create folders (either physical or digital) for each client or project, and store all related documents in those categories. This way, when you need to retrieve a specific record, you know exactly where to look.

3. Implement a Digital Filing System

If you’re not already using a digital system, now is a great time to make the switch. Digital filing systems offer several advantages, including easy access, search functionality, and space-saving storage. You can organize records by date, client name, or project type. Many cloud-based storage solutions also offer automatic backups, ensuring your documents are safe and secure.

4. Set Up a Payment Tracking System

In addition to organizing your billing documents, it’s crucial to track the payments you’ve received. A payment tracking system can help you keep an eye on outstanding balances and ensure that no payment goes unrecorded. This could be as simple as an Excel spreadsheet or a more sophisticated financial management tool that integrates with your billing records.

5. Regularly Review and Archive Old Records

As time passes, you may accumulate a large number of billing records. It’s important to periodically review these records and archive older ones that are no longer immediately needed. You can store older records in a secure digital archive or a physical storage solution, ensuring they are still accessible if required for future reference or audits.

By following these strategies, you can ensure that your billing records are organized, easily accessible, and properly managed, helping to improve your workflow and reduce stress during tax season or financial reviews.

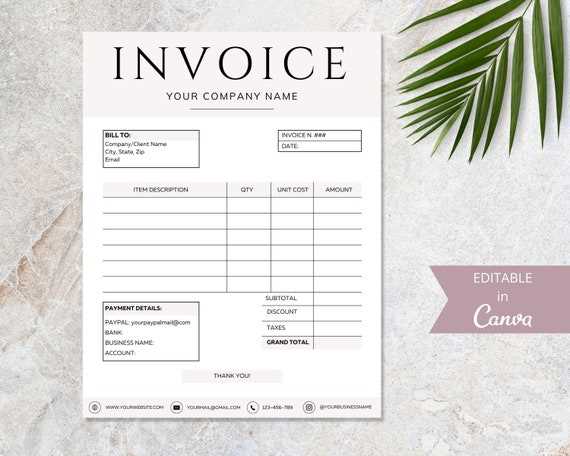

Design Tips for a Clear Invoice Template

Creating a clear and professional billing document is essential for effective communication with your clients. The design of your financial request plays a significant role in how quickly and smoothly payments are processed. A well-organized, easy-to-read layout ensures that all the necessary details are highlighted and easily understood. Here are some design tips to help you create a clear and professional document for your business.

1. Use a Clean and Simple Layout

A cluttered design can confuse your clients and delay payments. Opt for a clean, minimalist layout that organizes information in a logical manner. Key elements like the total amount, payment terms, and client information should be clearly separated and easy to spot. Avoid using too many colors or fonts that can distract from the important details.

- Leave Adequate Space: Proper spacing between sections improves readability and prevents the document from feeling crowded.

- Limit the Number of Fonts: Stick to one or two font styles for a polished, professional look. Use bold text sparingly to highlight important information like totals or due dates.

2. Organize Information Hierarchically

Make sure the most important information stands out immediately. Use larger font sizes or bold text to highlight key sections such as client name, payment amount, and due date. Break down the document into clearly defined sections for easier navigation. For example, start with the client’s details at the top, followed by a breakdown of services or goods provided, and then list payment instructions at the bottom.

- Client and Business Information: Place both your business details and the client’s contact information at the top of the document.

- Clear Breakdown: List each service or item with a brief description, quantity, rate, and total for transparency.

3. Highlight Payment Terms and Due Dates

The due date and payment terms should be prominently displayed so that there is no confusion about when the payment is expected. Use bold text or a larger font size to make these details stand out. Also, ensure that any late fees, discounts, or payment instructions are clearly visible to avoid misunderstandings.

By following these design tips, you can create a professional, easy-to-understand billing document that not only enhances the appearance of your business but also helps to ensure that payments are processed in a timely and accurate manner.

How to Integrate Payment Options in Invoices

Providing multiple payment methods on your billing documents can help speed up transactions and improve customer satisfaction. By offering clients various ways to pay, you cater to different preferences and ensure more efficient collection of payments. Below are some methods you can use to integrate payment options into your financial requests, making the process smoother for both you and your clients.

1. Offer Multiple Payment Methods

Different clients may have different preferences when it comes to payment. Some might prefer traditional methods like bank transfers, while others may opt for digital payments like credit cards or online services. Providing a variety of payment options allows you to accommodate your clients’ needs and speed up payment processing. Here are some common options you can consider:

- Credit and Debit Cards: Enable payments via major credit card providers such as Visa, MasterCard, and American Express.

- Bank Transfers: Include your bank account details for clients who prefer to pay directly from their bank account.

- Online Payment Platforms: Integrate options like PayPal, Stripe, or Square to allow fast, secure payments from clients anywhere in the world.

- Mobile Payments: Use mobile payment options like Apple Pay or Google Pay to make it easy for clients to pay directly from their phones.

2. Include Clear Payment Instructions

Clear instructions are essential to help clients navigate the payment process without confusion. Ensure that payment options are prominently displayed, with step-by-step instructions for each method. If you’re offering online payments, include clickable links or buttons that lead directly to the payment platform.

Here’s how you can organize payment instructions:

| Payment Method | Instructions |

|---|---|

| Credit Card | Click the “Pay Now” button to pay via credit card through our secure portal. |

| Bank Transfer | Transfer the total amount to the following bank account: [Bank Account Details]. |

| PayPal | Click the PayPal link to make a payment using your PayPal account or card. |

| Mobile Payment | Use Apple Pay or Google Pay to scan the QR code and complete the payment. |

By making these payment options clear and accessible, you can increase the likelihood of receiving timely payments and reduce the number of payment-related queries from your clients.

Legal Aspects of Digital Invoicing

The use of electronic billing systems has become increasingly popular due to their efficiency and convenience. However, when transitioning from paper-based methods to electronic formats, it is important to consider the legal requirements that govern these processes. In many countries, specific regulations exist to ensure that electronic records are legitimate, secure, and recognized as valid for financial and tax purposes. Understanding these legal aspects is crucial for businesses to avoid potential legal issues and ensure compliance.

1. Compliance with Tax Laws

One of the most important legal considerations when using electronic systems for financial documentation is compliance with tax laws. Many countries require businesses to keep accurate records of transactions and provide proof of purchases and payments for tax purposes. It’s essential that your electronic billing system complies with the local tax authorities’ regulations. This may include:

- Retention Periods: Laws may specify how long electronic records must be kept, often ranging from five to ten years, depending on your jurisdiction.

- Data Integrity: The data must be stored in a format that ensures it cannot be altered or tampered with. This may involve using secure, encrypted storage solutions.

- Tax Information: Make sure that all required tax details, such as tax ID numbers, VAT rates, and tax amounts, are included in every transaction record.

2. Security and Privacy Considerations

As businesses move toward electronic systems, ensuring the security and privacy of sensitive financial data becomes a critical legal concern. Depending on the region, laws such as the GDPR (General Data Protection Regulation) in the European Union or the CCPA (California Consumer Privacy Act) in the United States mandate strict data protection standards. Businesses need to implement measures to:

- Data Encryption: Use encryption methods to protect personal and financial information from unauthorized access.

- Access Control: Implement user authentication and access controls to ensure that only authorized personnel can view or modify financial documents.

- Data Backup and Recovery: Regularly back up electronic records and ensure that they can be restored in the event of system failure or data loss.

By adhering to these legal and regulatory requirements, businesses can confidently transition to electronic billing methods while minimizing the risk of legal complications and ensuring compliance with relevant laws.

How Digital Templates Improve Cash Flow Management

Managing cash flow is one of the most critical aspects of running a successful business. Efficiently tracking and receiving payments ensures that the business can meet its financial obligations, reinvest in growth, and maintain profitability. By utilizing automated solutions for creating and managing billing documents, companies can streamline their financial processes, reduce delays, and keep cash flow consistent. Below are some ways in which automated billing solutions can have a positive impact on cash flow management.

1. Faster Billing and Payment Processing

Automated billing systems allow businesses to create and send out financial requests quickly and accurately. With the ability to generate customized documents at the click of a button, businesses no longer need to spend time manually preparing bills. This leads to faster delivery of payment requests, which in turn results in quicker payment cycles. By reducing the time it takes to issue and deliver billing documents, businesses can see cash flow improvements within a shorter timeframe.

2. Improved Accuracy and Reduced Errors

Manual entry of billing information can lead to errors such as incorrect amounts, missing client details, or duplicated charges. These mistakes not only cause delays but can also harm customer relationships. Automated systems minimize the risk of human error by automatically populating fields and calculating totals, taxes, and discounts. This ensures that the amount billed is always correct, reducing disputes and ensuring that payments are processed without unnecessary delays.

By implementing such automated systems, businesses can improve their overall cash flow by ensuring that the payment process is quick, accurate, and hassle-free. As a result, they can maintain better control over their financial stability and keep operations running smoothly.