Free Rent Invoice Template Download

Managing financial transactions can be time-consuming, but having the right tools can simplify the process. For property owners, ensuring accurate and professional documentation of payments is essential for maintaining a smooth relationship with tenants. Using structured forms for recording payments not only helps streamline administrative tasks but also ensures clarity for both parties involved.

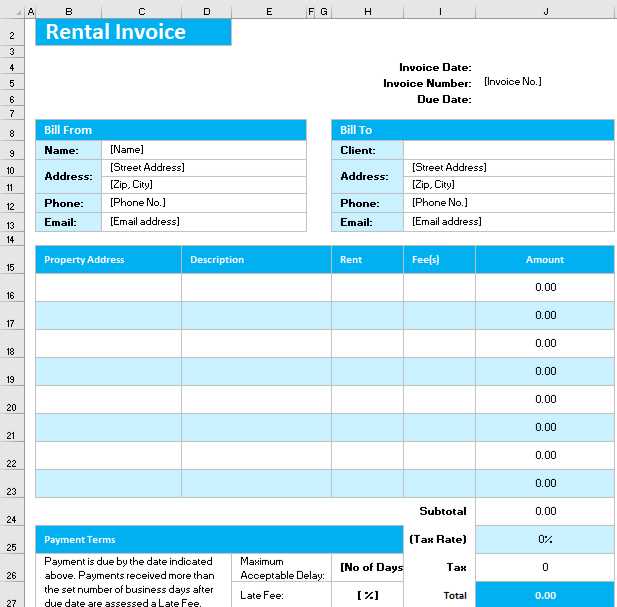

Templates designed for this purpose can save time and reduce errors. These resources are customizable, allowing landlords to create documents that fit their specific needs. By choosing an appropriate layout, property owners can maintain consistency in all their financial records, making it easier to track payments and resolve disputes when necessary.

Having the ability to quickly generate these documents without starting from scratch is a valuable resource. Whether managing one unit or multiple properties, it is essential to have a reliable system in place that simplifies the billing process while ensuring professionalism and compliance.

Free Rent Invoice Templates for Download

For property owners and managers, using pre-designed documents for recording payments can greatly simplify financial management. Having an easily accessible resource allows for quick and efficient creation of official documents for each transaction. These structured forms ensure consistency and professionalism, helping to avoid any misunderstandings with tenants.

Benefits of Using Pre-Designed Forms

Pre-designed documents are highly beneficial for those who need to generate official records without spending excessive time on formatting. With ready-to-use structures, landlords can simply fill in the relevant details and produce a professional-looking statement in no time. This approach saves effort while maintaining accuracy and reducing human error.

Where to Find Accessible Resources

Many websites offer a wide range of options that are available to anyone in need. These resources can be quickly accessed and are ready for immediate use. Whether you’re managing a few properties or several, having reliable documents at your fingertips can make managing your finances more straightforward and efficient.

How to Create a Rent Invoice

Creating a well-structured document for documenting financial transactions is an essential task for property owners. A clear and professional form helps ensure that both parties understand the terms of the payment, preventing any confusion or disputes. The process of creating such a document involves several important steps to ensure it includes all necessary details.

Here is a simple guide to help you create an effective payment statement:

- Include Contact Information: Make sure to list the property owner’s details and the tenant’s contact information at the top of the document.

- Provide a Clear Title: Label the document clearly to identify its purpose, such as “Payment Record” or “Transaction Summary.”

- List Payment Details: Mention the amount owed, the payment period, and any relevant charges or discounts.

- Specify Payment Terms: Clearly state the due date and any late fees or penalties that may apply.

- Include Unique Reference Number: Add a unique identifier for easy tracking and future reference.

By following these steps, you can easily create a document that helps maintain clarity and transparency between you and your tenants.

Benefits of Using a Rent Invoice

Utilizing well-structured documents for financial transactions offers a range of advantages for property owners. These records not only streamline the payment process but also ensure accuracy and transparency, which can lead to better relationships with tenants. By relying on organized forms, both parties can avoid potential misunderstandings and stay on top of financial obligations.

Here are some key benefits of using such documents:

- Clarity and Transparency: Properly formatted records provide clear details about the amount due, payment dates, and any additional charges, helping both parties stay informed.

- Time Efficiency: Pre-designed structures save time by eliminating the need to create documents from scratch every time a payment is made.

- Professionalism: Consistent and neatly formatted records reflect a high level of professionalism, which can improve tenant relationships.

- Trackable and Organized: With a system in place, property owners can easily track payments and keep their financial records organized for future reference.

- Reduce Errors: Using predefined forms minimizes the risk of mistakes, ensuring that all necessary details are included and accurate.

Key Elements of a Rent Invoice

When creating a formal document to record financial transactions, certain components are essential to ensure clarity and completeness. These key elements help both the property owner and tenant understand the terms of the payment and avoid any confusion or disputes. Including all necessary details in the document ensures transparency and accuracy in financial dealings.

The essential components to include are:

- Title of the Document: Clearly label the document to indicate its purpose, such as “Payment Summary” or “Transaction Record.”

- Property Owner and Tenant Information: Include full names, addresses, and contact details for both parties involved in the transaction.

- Amount Due: Specify the exact amount to be paid, including any applicable taxes or additional charges.

- Payment Period: Clearly state the time period the payment covers, such as monthly or weekly.

- Due Date: Provide the date by which the payment should be made to avoid penalties or late fees.

- Unique Reference Number: Assign a unique number for easy identification and tracking of the document.

- Payment Terms: Outline any specific terms related to payment, such as discounts, late fees, or payment methods.

Customizable Templates for Rent Invoices

Having the ability to modify and personalize financial documents offers great flexibility for property owners. Customizable structures allow landlords to adjust various elements based on their specific needs, making the process of documenting payments more efficient and tailored to individual circumstances. With editable formats, landlords can create documents that align with their unique business practices and tenant agreements.

Using such adaptable resources comes with several benefits:

- Personalization: Customize sections such as payment terms, charges, and due dates to reflect specific arrangements with tenants.

- Consistency: Maintain a uniform style across all documents for a professional and organized appearance.

- Flexibility: Easily update or modify details for each transaction, accommodating changes in the rental agreement or special conditions.

- Efficiency: Quickly generate documents by adjusting predefined fields, saving time and reducing the chance of errors.

By using adjustable formats, property owners can create documents that best serve their needs, ensuring smooth communication with tenants while staying organized and professional.

Why Choose a Free Rent Template

Selecting no-cost options for creating financial documents offers numerous advantages, particularly for those managing multiple properties. These accessible resources provide an efficient way to maintain organized records without the need for expensive software or complex systems. By opting for available solutions, property owners can ensure consistency while keeping costs minimal.

Here are some reasons why using no-cost options makes sense:

- Cost Efficiency: Save money by utilizing tools that do not require purchasing specialized software or services.

- Ease of Use: Simple to access and use, these resources often come with pre-filled fields that allow for quick document generation.

- Time Saving: Ready-made forms can be filled in rapidly, allowing property owners to focus on other tasks instead of creating documents from scratch.

- Professional Quality: Despite being available at no cost, these documents maintain a high standard of appearance and clarity.

- Convenience: Easily accessible online and ready to use at any time, ensuring you always have a document when needed.

Choosing these no-cost options can simplify your administrative tasks and help you maintain organized records without additional expenses or time commitments.

How to Fill Out a Rent Invoice

Completing a financial document for a property transaction requires careful attention to detail to ensure accuracy. The process involves entering specific information that outlines the terms of payment, amounts due, and important dates. By following a systematic approach, you can create a clear and organized document that avoids confusion and serves both parties’ needs effectively.

Step-by-Step Guide

To properly fill out the document, follow these essential steps:

- Include the Parties’ Information: Start by entering the full name, address, and contact details of both the property owner and the tenant.

- State the Payment Amount: Clearly specify the total sum due, including any additional fees or charges that may apply.

- Provide the Payment Period: Indicate the period the payment covers, such as monthly or weekly intervals, to ensure clarity on the time frame.

- Specify the Due Date: Mention the deadline for payment to ensure both parties are aware of when the amount is due.

Final Touches

Before finalizing, double-check that all information is correct and that the format is clear and professional. Adding a reference number can also help with tracking and organizing your financial documents for future reference.

Top Features in Rent Invoice Templates

When creating financial documents for rental transactions, certain key elements ensure the document is both functional and professional. These features are essential for clarity, organization, and proper record-keeping. The right structure can help streamline the process and make the document easier to understand for both property owners and tenants.

Here are the most important characteristics to look for in a well-constructed financial form:

- Clear Layout: A clean and organized design makes the document easy to read and ensures that all necessary information is highlighted appropriately.

- Predefined Fields: Templates with preset fields for essential information, such as payment amount, tenant details, and due date, help speed up the process and reduce errors.

- Customizable Sections: The ability to adjust certain parts of the document allows property owners to tailor the form to meet specific terms or agreements.

- Professional Design: A polished appearance conveys a sense of professionalism, helping to maintain a positive relationship between the landlord and tenant.

- Tracking and Reference Numbers: Including reference numbers makes it easier to track payments and organize documents for future reference.

These features ensure that the document is not only effective in capturing the necessary information but also contributes to a smooth and transparent transaction process.

How to Edit a Rent Invoice Template

Modifying a financial document for property transactions involves making specific adjustments to fit individual needs and agreements. Whether you’re adding personalized details, adjusting terms, or updating payment amounts, editing the document is essential for accuracy and clarity. Here’s a simple guide on how to make changes effectively while ensuring the document remains professional.

Steps to Edit the Document

Follow these steps to update your document efficiently:

- Open the Document: Begin by opening the file in the program or software that supports the format (e.g., Word, Excel, Google Docs).

- Locate Editable Fields: Identify the sections that need updating, such as the tenant’s name, payment amount, and due date.

- Modify Payment Information: Ensure the payment amount and any additional charges are accurate, adjusting them as necessary to reflect the agreed-upon terms.

- Update Dates: Double-check that the dates for payment periods and due dates are correct to avoid confusion.

Finalizing the Document

After making the necessary changes, review the document for any formatting issues or missing information. Once everything looks good, save the file with a new name to maintain a record of the updated version. If applicable, you can now print or share the document as needed.

Rent Invoice Template for Landlords

For property owners, creating a detailed and professional financial document is an essential part of managing rental agreements and payments. Such documents not only help maintain clarity between the landlord and tenant but also ensure that all payment terms and conditions are accurately outlined. Here’s an overview of how property managers and landlords can customize and utilize these essential documents effectively.

Essential Features for Landlords

When crafting a payment document for tenants, it’s important to include specific details to avoid misunderstandings. Key elements include:

- Tenant Information: Name, address, and contact details of the person responsible for payments.

- Payment Breakdown: Clearly specify amounts due, including rent, utility charges, and any additional fees or adjustments.

- Due Dates: Include accurate dates to ensure timely payments and avoid late fees.

How to Customize the Document

Landlords should personalize their payment documents to suit their specific rental agreements. This includes adjusting payment schedules, adding late fees, and ensuring all contact information is correct. These adjustments will help streamline the communication process and ensure both parties are on the same page.

How Rent Invoice Templates Save Time

In today’s fast-paced world, managing financial documents efficiently is essential for both property owners and tenants. Streamlining the process of creating and sending these documents can save a significant amount of time. Using pre-made formats for these records allows for quicker preparation, fewer errors, and greater consistency in communication.

Automation and Efficiency

By utilizing pre-designed formats, landlords and property managers can automate key aspects of financial documentation. This reduces the time spent on repetitive tasks and enhances the overall productivity of property management. Key benefits include:

- Time-saving: Quickly fill in tenant details, payment amounts, and dates without manually writing each document from scratch.

- Consistency: Ensure uniformity across all documents, reducing the chances of errors or omissions.

- Professional Appearance: Ready-made formats often look more polished and organized, leaving a professional impression on tenants.

Reduced Manual Errors

With the use of structured formats, the risk of mistakes like incorrect payment amounts, missed details, or omitted information is significantly lowered. This not only saves time spent on correcting errors but also ensures that documents are accurate and reliable from the outset.

What Makes a Good Invoice Template

An effective financial document is one that ensures clarity, professionalism, and ease of use. The key to creating a good template lies in its ability to communicate all necessary information in a straightforward, organized manner. A well-structured format provides a clear breakdown of amounts due, payment terms, and other important details, helping both parties understand the expectations from the outset.

Clear Layout and Structure

A good design ensures that all essential information is easy to find. It should be clean, organized, and free from unnecessary clutter. Important elements should be highlighted, such as:

- Payment due date: Clearly visible, so there is no confusion about when payment is expected.

- Amount due: Presented in an easy-to-understand format with any relevant breakdowns (e.g., taxes or additional fees).

- Contact information: Both parties should be able to find each other’s details for quick resolution of any questions or concerns.

Customizability and Flexibility

One of the key features of a great format is its adaptability. A good design should allow for customization to meet different business needs, such as adding specific service charges, adjusting payment terms, or changing the branding and contact details. This flexibility ensures the document suits a variety of uses while maintaining consistency in presentation.

Common Mistakes in Rent Invoices

When preparing a financial document for payment, it is essential to avoid common pitfalls that can lead to confusion or delays. Inaccurate or incomplete information can result in disputes, missed payments, or strained business relationships. Below are some frequent errors to watch out for when creating a payment request.

Missing or Incorrect Contact Information

One of the most significant mistakes is neglecting to include correct contact details for both parties involved. This includes:

- Incorrect names or addresses: Double-check the recipient’s name and address to ensure it’s accurate.

- Missing phone number or email: Make sure that all communication channels are clearly listed for prompt resolution of issues.

Failure to Specify Payment Terms

Not outlining payment terms can cause confusion about when and how the payment should be made. Important details to include are:

- Due date: Specify exactly when payment is expected to avoid misunderstandings.

- Late fees: If applicable, clarify any penalties for overdue payments.

Unclear Breakdown of Charges

Omitting or misrepresenting the breakdown of amounts due is another common issue. This can lead to disputes over what the customer is being asked to pay for. Be sure to clearly list:

- Base amount: Clearly state the core amount being charged.

- Additional fees: Itemize any extra charges, such as taxes or late fees, to avoid confusion.

Rent Invoice Templates for Businesses

For businesses that handle regular transactions, having a standardized method for creating financial documents can streamline operations and improve efficiency. These documents are essential for maintaining clear communication and ensuring smooth payment processes. Here, we’ll explore why having a well-organized structure for these documents is crucial for businesses.

Consistency and Professionalism

Having a consistent format for financial documents helps to maintain professionalism. It ensures that all necessary information is included every time, preventing errors and omissions. A structured approach also makes it easier for businesses to manage their accounting and track payments.

Improved Accuracy and Efficiency

Using a consistent structure reduces the chance of making mistakes in financial calculations or missing out on key details. Whether it’s the amount due, due dates, or contact information, a standard format can help businesses avoid confusion and speed up the billing process.

How to Organize Rent Payments Efficiently

Properly managing payments is essential for ensuring smooth financial operations. By organizing payment schedules and tracking them effectively, you can prevent delays and simplify your administrative tasks. Here are some strategies to help you streamline the process and ensure timely transactions.

Set Clear Payment Terms

Establishing clear terms at the beginning helps both parties understand when payments are due and what the consequences of late payments might be. Make sure the payment amounts, deadlines, and methods are well-defined from the start.

Track Payments Regularly

Keeping a record of each transaction is vital for both accountability and organization. Regularly updating and reviewing payment records will help you stay on top of your finances and prevent any misunderstandings.

| Payment Date | Amount | Status |

|---|---|---|

| January 1, 2024 | $1,200 | Paid |

| February 1, 2024 | $1,200 | Pending |

| March 1, 2024 | $1,200 | Paid |

Using a table to record payments makes it easier to keep track of when payments were made and what remains outstanding. It can also help to identify trends or issues with payment timelines.

Understanding Rent Invoice Formatting Options

When creating a document to request payment, the way it’s structured plays a crucial role in ensuring clarity and ease of use. A well-organized layout helps both the issuer and the recipient understand the transaction details quickly. Different formatting choices can enhance readability and streamline the process of processing payments.

Key Elements to Include

A proper layout should clearly display essential information, such as the amounts due, due dates, and payment methods. Using a logical structure allows both parties to easily review and confirm the details without confusion.

| Element | Description |

|---|---|

| Header | Include the name of the person or company requesting the payment, along with contact details. |

| Payment Breakdown | List individual charges or fees clearly, specifying amounts, dates, and services involved. |

| Total Amount | Clearly display the final sum due after all deductions and adjustments. |

| Payment Instructions | Specify the accepted methods of payment and any relevant account or reference numbers. |

These elements should be clearly separated to avoid confusion. Additionally, the document can benefit from using bold fonts for important sections and ensuring all information is easy to locate and understand. A well-structured document improves the likelihood of timely payments and reduces potential misunderstandings.