Template Invoice Indonesia How to Create Professional Invoices for Your Business

Efficient financial management is crucial for the success of any business. One key aspect of this is having a streamlined process for generating accurate and clear billing documents. These essential papers not only ensure proper payment but also reflect the professionalism of your company. The right approach to creating these documents can save you time and reduce the risk of errors, helping you maintain strong relationships with your clients.

Customizable formats are available to suit various industries, ensuring that every transaction is properly documented and easy to understand. Whether you are an entrepreneur or manage a larger enterprise, choosing the right structure for your billing papers can make a significant difference. With the proper tools, creating these important documents becomes a simple and quick task that guarantees both legal compliance and a polished presentation.

This guide will walk you through the essentials of generating professional billing papers, from understanding necessary elements to selecting the most efficient software for creating them. We will explore the features that make these documents not just a formality, but a valuable part of your business operations.

Template Invoice Indonesia Overview

For businesses of all sizes, having a standardized and professional way to document financial transactions is essential. This practice not only ensures clear communication with clients but also helps maintain organization and compliance with local regulations. By utilizing well-structured documents, companies can streamline their billing processes, minimize errors, and build trust with customers.

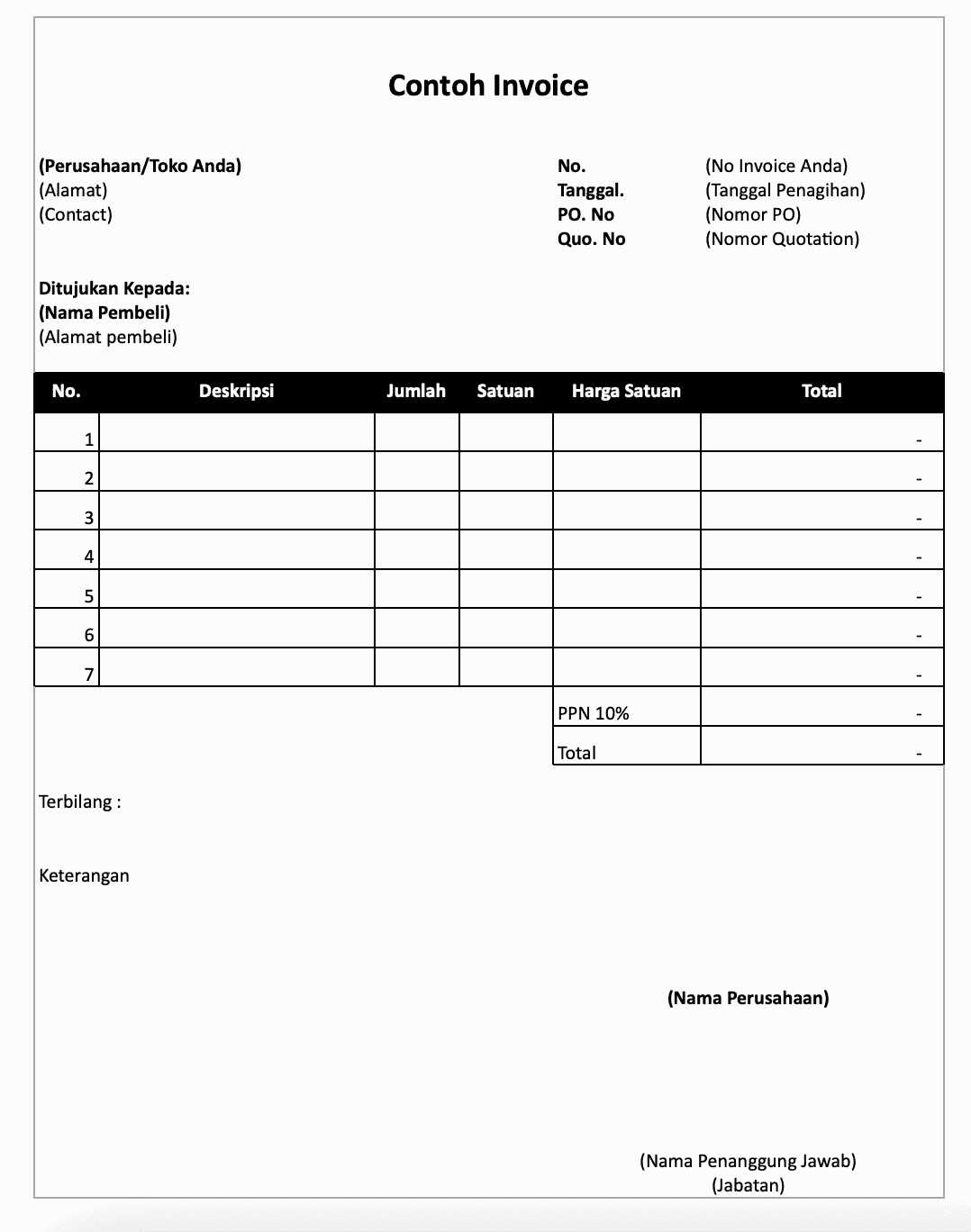

In various sectors, from small startups to large enterprises, customized documents are an effective solution for managing sales and payments. These forms typically include essential details such as service descriptions, amounts, and payment terms, while also accommodating specific needs like tax inclusion and unique branding. Understanding how to design and implement these resources is key to improving business operations.

Additionally, creating professional documents can help businesses meet legal requirements and stay aligned with industry standards. By adopting a consistent format, entrepreneurs and managers can ensure they are not only meeting client expectations but also complying with necessary fiscal and legal guidelines in their respective regions.

Why Use Invoice Templates in Indonesia

Adopting a standardized approach to creating financial documents brings significant advantages to businesses. It simplifies the process of billing, minimizes the chance of errors, and enhances the overall professionalism of your operations. When consistent, clear documents are sent to clients, it promotes better communication and helps establish trust. This practice also ensures that essential details are not overlooked, reducing the risk of misunderstandings or payment delays.

Improved Efficiency and Time-Saving

By using pre-designed formats, business owners and accountants can save valuable time that would otherwise be spent manually creating each document. With all the required fields already set, all that is needed is to fill in the details for each transaction. This streamlined process helps companies operate more efficiently, allowing them to focus on core activities like customer service and growth.

Compliance with Local Standards

Using the right structure for your billing documents ensures that you meet the necessary legal and fiscal requirements. In many regions, businesses must follow specific guidelines for documenting sales and payments. By using well-crafted forms that include all required elements such as tax information and company registration numbers, you reduce the risk of non-compliance. This is particularly important for companies operating in areas with strict regulatory frameworks.

In summary, utilizing structured and customizable documents not only ensures smooth business operations but also enhances transparency and trust in your transactions. This approach helps businesses remain compliant, avoid errors, and maintain a professional image with clients and authorities alike.

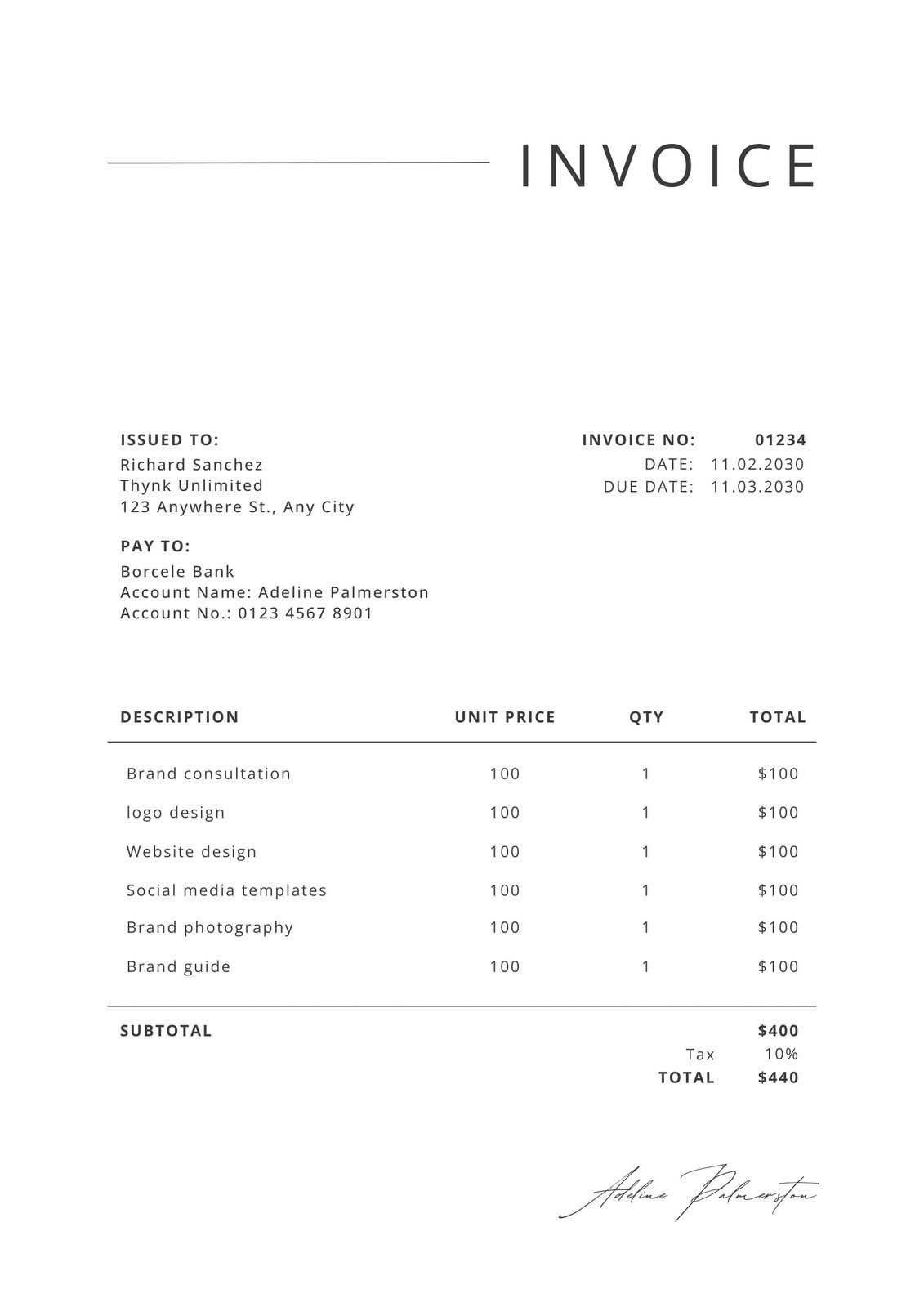

Top Features of an Invoice Template

When creating professional billing documents, certain features are essential to ensure clarity, accuracy, and functionality. These characteristics not only make the process easier for business owners but also enhance the overall experience for clients. A well-designed document serves as a clear record of the transaction, providing both parties with the information they need for payment and bookkeeping.

Clear Contact Information

One of the most important elements of any financial document is the inclusion of both the business and the client’s contact details. This section should include names, addresses, phone numbers, and email addresses, ensuring that communication can flow smoothly if any issues arise. Accurate contact information helps prevent delays or misunderstandings regarding payments.

Itemized Breakdown

Having a detailed list of products or services provided is crucial for both the business and the client. This section typically includes quantities, descriptions, unit prices, and total amounts. By breaking down the charges in a clear manner, clients can easily understand what they are being billed for, while also helping businesses keep track of their transactions.

Payment Terms and Deadlines

Including clear payment terms and deadlines in your document ensures that both parties are on the same page regarding expectations. This section typically specifies the due date for payment, any late fees that may apply, and acceptable payment methods. By setting these terms, businesses can help avoid delays and disputes related to payment collection.

Tax and Legal Information

Another essential feature is the inclusion of tax details, such as applicable sales tax or VAT. These details not only help ensure compliance with local regulations but also provide transparency in financial dealings. For businesses operating in regions with specific tax laws, this section is critical to avoid legal complications.

Professional Design and Branding

A well-designed document not only looks more professional but also reinforces your brand identity. Customizing the document with your logo, colors, and business information ensures that the billing process is consistent with your company’s image. A polished look makes a positive impression and can help instill confidence in clients.

In conclusion, a well-crafted document with these key features serves as a vital tool for businesses to streamline their billing processes, maintain accuracy, and build strong, trustworthy relationships with clients.

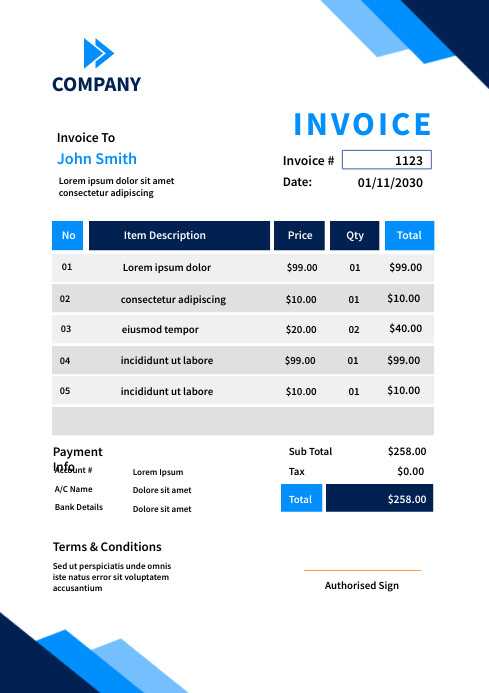

Creating Customizable Invoice Templates

Designing flexible and personalized billing documents allows businesses to cater to their specific needs while maintaining a professional standard. Customization ensures that each transaction is clearly represented, aligns with company branding, and meets legal or industry requirements. Tailoring your documents can improve clarity, efficiency, and customer satisfaction, making it an essential part of managing finances.

To create a customizable billing document, consider the following steps:

- Choose a platform or software: Select a tool that offers flexibility and ease of use. Many online platforms allow you to modify elements, add logos, and adjust fields to suit your business’s specific requirements.

- Include key sections: Ensure the document includes necessary fields such as contact details, itemized lists of services or products, payment terms, and tax information. These components should be easily editable to reflect the specifics of each transaction.

- Maintain a clean layout: The structure should be easy to navigate. Prioritize legibility and organization, with clear headings for each section. This allows for quick updates and ensures the document remains user-friendly for both you and your clients.

- Incorporate your branding: Personalize the document with your company’s logo, colors, and fonts. A customized design reinforces your brand identity and ensures that your documents align with your overall business image.

- Ensure compliance: Make sure the document meets all local regulatory standards, including tax calculations and necessary legal disclosures. Customization should never compromise compliance with local laws.

By implementing these strategies, businesses can easily adapt their billing documents for various situations, ensuring accuracy and professionalism in every transaction.

Legal Requirements for Invoices in Indonesia

For businesses operating in various regions, adhering to local financial regulations is crucial when issuing billing documents. In certain countries, these documents must meet specific criteria to be legally valid. These requirements often include details such as business registration numbers, tax identification numbers, and clear breakdowns of applicable taxes. Failing to comply with these regulations can result in fines, disputes, or delayed payments. Understanding the legal requirements ensures that your company remains compliant and avoids potential legal challenges.

Key Legal Elements

To ensure compliance, certain elements must be included in each financial document. The following are required for businesses in many regions:

- Tax Identification Number (NPWP): Businesses are required to display their official tax identification number, which is used for all tax-related transactions.

- Business Registration Number: Including your company’s registration number ensures the document is legally linked to your official business entity.

- Clear Tax Breakdown: Documents must clearly indicate any applicable sales tax (VAT) and the total amount for the transaction, including the tax value.

- Transaction Date and Due Date: The date when the transaction took place and the due date for payment must be clearly noted, avoiding confusion about payment terms.

Consequences of Non-Compliance

Failure to include required details in your financial documents may lead to issues with tax authorities, delayed payments, or disputes with clients. In some cases, businesses may be subject to audits or penalties if proper documentation is not provided. By ensuring all the necessary legal information is present, businesses can protect themselves from these risks and maintain smooth financial operations.

How to Add Taxes in Invoice Templates

Including taxes in billing documents is a critical aspect of business transactions, ensuring compliance with local regulations and providing transparency for both the business and its clients. Whether it’s value-added tax (VAT), sales tax, or other applicable taxes, properly calculating and displaying tax amounts helps maintain accuracy and prevents legal issues. Here’s a guide on how to include taxes correctly in your financial records.

Steps for Adding Taxes

Follow these steps to ensure that taxes are properly incorporated into your billing documents:

- Determine the Tax Rate: Find out the applicable tax rate for your products or services. Different goods and services may be taxed at different rates, and it’s important to know the local tax regulations to ensure compliance.

- Calculate the Tax Amount: Multiply the taxable amount by the tax rate. For example, if the total cost of services or products is $100 and the tax rate is 10%, the tax amount will be $10.

- Include Tax Breakdown: Display both the subtotal (before tax) and the tax amount separately. This makes it clear to clients how much of the total is allocated to taxes and helps prevent confusion.

- Display Total After Tax: After calculating the tax, add it to the subtotal to show the total amount due. Ensure that this total is prominently displayed at the bottom of the document.

Tax Information to Include

When including taxes, make sure to add the following key details to your document:

- Tax Type: Clearly state the type of tax being applied, whether it’s VAT, sales tax, or another form of tax.

- Tax Percentage: Include the exact tax rate used, such as 5%, 10%, or another rate based on the applicable laws.

- Tax Number (if applicable): In some jurisdictions, you may need to display your business’s tax registration number or the client’s tax number for official purposes.

Properly adding taxes ensures both clarity and compliance, which is crucial for maintaining smooth financial operations and avoiding future issues with tax authorities.

Design Tips for Professional Invoices

Creating visually appealing and well-structured billing documents is essential for making a lasting impression on clients. A professional design not only enhances the readability of important information but also reflects the credibility and trustworthiness of your business. By following key design principles, you can ensure that your documents are both functional and polished.

Key Design Elements

Here are several design elements to consider when crafting your financial documents:

- Clean Layout: Avoid clutter by using a simple, easy-to-follow structure. Organize sections logically, with enough white space between different elements to ensure clarity.

- Consistent Branding: Incorporate your company’s logo, brand colors, and fonts to create a cohesive and professional look that aligns with your brand identity.

- Clear Typography: Choose legible fonts and maintain consistent font sizes for headings, body text, and totals. This ensures that important details, such as amounts due, stand out.

- Section Headings: Use bold or larger font sizes for section titles to help readers navigate the document more easily. This helps to distinguish between different parts, such as billing details, tax information, and payment terms.

- Color Contrast: Use contrasting colors for text and background to improve legibility. Dark text on a light background is typically easier to read than light text on dark backgrounds.

Additional Tips

In addition to the main design elements, consider the following suggestions to further enhance your document:

- Brand-Specific Style: Ensure that your document’s style is consistent with other business materials, such as contracts, business cards, or website design.

- Logo Placement: Position your logo at the top of the document, making it the first thing clients see. This reinforces your brand identity and adds a professional touch.

- Payment Information: Highlight payment terms, due dates, and total amounts due in a clear, easy-to-read format to reduce the likelihood of missed payments.

- Mobile-Friendly Format: Make sure your documents are optimized for both print and digital viewing. Many clients prefer to receive their bills electronically, so ensure that your design looks good on mobile devices as well as desktops.

By following these design principles, you can create professional billing documents that leave a positive impression and contribute to smoother business transactions.

Free Invoice Template Resources in Indonesia

For businesses looking to create professional billing documents without investing in expensive software, there are several free resources available. These platforms offer customizable formats that help ensure accuracy, compliance, and professionalism in financial dealings. Whether you’re a small startup or a growing enterprise, these tools provide accessible options for creating customized documents quickly and efficiently.

Many of these free resources come with a variety of features, such as automatic calculations, easy-to-edit fields, and the ability to include branding elements. By taking advantage of these tools, businesses can streamline their billing process, maintain organization, and avoid costly mistakes while staying within budget.

Top Free Resources

- Google Docs and Sheets: Google offers free templates that can be customized to suit your business needs. These templates are easy to modify and can be shared or downloaded in multiple formats, making them a versatile option for managing your billing documents.

- Canva: Canva offers free design tools that allow users to create visually appealing and customizable billing documents. With a wide variety of templates and design elements, it’s a great choice for businesses looking to incorporate their brand’s colors and logos.

- Zoho Invoice: Zoho provides free invoicing software with professional-grade templates that allow businesses to create and send bills instantly. The platform also includes features like recurring billing and automatic reminders, making it a valuable resource for small businesses.

- Microsoft Office Templates: Microsoft offers a range of free templates for Word and Excel that are designed for professional billing. These templates are straightforward to use and can be modified to include all the necessary details for your transactions.

- FreshBooks: FreshBooks offers a free trial with easy-to-use invoice generation tools. Although the service is paid, the trial version can be used for small businesses to create and manage their documents with

Common Mistakes in Invoice Creation

Creating accurate and professional billing documents is essential for maintaining smooth business operations and ensuring timely payments. However, many businesses make simple but costly mistakes that can lead to confusion, delays, or disputes. Identifying and avoiding these common errors can help streamline your billing process and improve your relationships with clients.

Key Mistakes to Avoid

Here are some of the most frequent mistakes businesses make when preparing financial documents:

- Incorrect Contact Information: Failing to include accurate details such as your business name, address, and tax ID can cause confusion or delays. Make sure all contact information is up to date and correct.

- Missing or Incorrect Dates: One of the most common errors is not including the correct transaction date or due date. Always ensure that the billing date is accurate and the due date is clear to avoid payment delays.

- Omitting Tax Information: Not including taxes or miscalculating them can lead to compliance issues and dissatisfaction from clients. Always double-check your tax rates and ensure they are properly reflected in the final amount due.

- Unclear Payment Terms: Vague or unclear payment terms can lead to misunderstandings. Be specific about how and when payments are due, and if there are any late fees or discounts for early payment, include them clearly.

- Errors in Amounts: Simple mathematical mistakes, such as incorrect totals or missing charges, can cause significant problems. Double-check your calculations and make sure the amounts match the agreed-upon pricing.

- Failure to Include Itemized Lists: Not breaking down the products or services provided can make it difficult for clients to understand the charges. An itemized list helps ensure transparency and avoids confusion over the billing details.

Consequences of Mistakes

Even small errors in your financial documents can lead to delayed payments, damaged trust, or legal complications. It’s important to review every document carefully before sending it to ensure all details are correct. By avoiding these common mistakes, businesses can improve cash flow, maintain positive client relationships, and ensure compliance with legal standards.

Being mindful of these issues can help create smoother billing processes, foster trust with clients, and ultimately improve the efficiency of your business operations.

How to Ensure Invoice Compliance

Ensuring that your financial documents comply with local laws and regulations is essential for protecting your business from legal issues, penalties, and disputes. Compliance not only helps you avoid costly mistakes but also strengthens your credibility with clients and tax authorities. By understanding and adhering to the requirements for documentation, businesses can operate more smoothly and confidently.

Key Steps for Ensuring Compliance

To ensure that your financial documents are fully compliant with legal standards, consider the following guidelines:

- Include Required Legal Information: Make sure to include essential details such as your company’s tax ID number, business registration number, and the client’s information. This is important for both tax reporting and legal transparency.

- Accurate Tax Calculations: Verify that the correct tax rates are applied based on the products or services provided. Miscalculating taxes can lead to legal problems with authorities and disputes with clients. Always double-check your calculations and ensure they align with current local tax laws.

- Clearly Defined Payment Terms: Your payment terms should be clear and unambiguous. Specify the payment due date, any late fees, and the acceptable methods of payment. Failing to do so may result in payment delays or misunderstandings.

- Properly Itemized Details: Make sure all charges are clearly listed and explained. An itemized list of products or services is not only a best practice but also a requirement in many regions to maintain transparency and avoid any confusion.

- Comply with Local Business Regulations: Different regions may have varying requirements for the structure and content of financial documents. Ensure that you are familiar with the specific rules governing business transactions in your area and adhere to them closely.

Regular Audits and Updates

Compliance is an ongoing process. Regularly auditing your business processes and financial documents ensures that you are staying up to date with any changes in local regulations. Keep track of updates to tax laws, business registration requirements, and other legal standards to ensure your documentation remains accurate and compliant.

By following these steps and staying vigilant about changes in legal requirements, businesses can avoid compliance issues, build trust with clients, and ensure their financial operations run smoothly and without interruption.

Using Invoice Templates for Small Businesses

For small businesses, managing finances efficiently can be a challenging task. Creating professional and accurate billing documents is essential for maintaining cash flow and ensuring timely payments. Using pre-designed documents can simplify the process by providing a consistent format that ensures all necessary information is included. These ready-to-use tools allow small businesses to focus on growth while keeping their financial processes organized and error-free.

Benefits for Small Businesses

There are several advantages for small business owners when they use pre-designed billing formats:

- Time Efficiency: Pre-designed documents save time by eliminating the need to start from scratch for each transaction. Simply fill in the necessary details and send it out.

- Consistency: Using the same format for all transactions ensures consistency across all business documents, which strengthens your brand image.

- Professional Appearance: Pre-made formats are designed to look professional and are tailored to meet industry standards, helping build trust with clients.

- Cost-Effective: Many resources offer these tools for free or at a low cost, providing an affordable option for small businesses with limited budgets.

Essential Components for Small Business Billing

Regardless of the format used, there are certain key details that must be included in every billing document:

Component Description Business Information Include your company’s name, address, contact details, and tax identification number. Client Details Ensure the client’s name, company, and address are clearly listed for proper identification. Itemized Charges Break down the products or services provided with corresponding prices for each item or service. Tax Information Include applicable tax rates and amounts to ensure the document complies with local tax laws. Payment Terms Specify the due date, late fees (if any), and accepted payment methods. By incorporating these components into each document, small businesses can create clear and accurate billing statements that improve their financial organization and foster positive client relationships.

Tracking Payments with Invoice Templates

For businesses, keeping track of payments is crucial for maintaining positive cash flow and ensuring financial stability. A well-organized system for tracking outstanding payments allows you to quickly identify overdue balances and take appropriate action. By using structured billing formats, businesses can easily monitor which payments have been received and which are still pending, simplifying the entire process and minimizing the risk of missed payments.

Benefits of Tracking Payments

Having a clear method for tracking payments provides several key advantages:

- Improved Cash Flow Management: By consistently tracking payments, businesses can forecast cash flow more accurately, helping to avoid shortages and plan for upcoming expenses.

- Reduced Risk of Overdue Payments: With a clear system, you can follow up with clients who have not yet made a payment, reducing the chances of late or missed payments.

- Better Client Relationships: Clear payment records show professionalism and transparency, which fosters trust with clients and reduces confusion or disputes.

- Efficient Financial Reporting: Accurate records of paid and unpaid balances simplify accounting, making it easier to generate financial reports for tax filing or business assessments.

How to Track Payments Effectively

Here are some methods for efficiently tracking payments through your billing process:

- Include Payment Status on Documents: Ensure that your financial records indicate the status of each payment (e.g., paid, pending, overdue). This will give both you and your clients a quick overview of the payment status.

- Set Payment Reminders: Use automated reminders or manual follow-ups to notify clients of upcoming or overdue payments. Timely reminders can prompt faster payments and avoid the need for escalation.

- Track Payment Dates and Amounts: Maintain a detailed log of when payments were made and the exact amounts received. This helps prevent discrepancies and provides a clear record for both parties.

- Utilize Digital Tools: Consider using software or online tools that automatically track payments, send reminders, and update the payment status on your documents. These systems help save time and reduce human error.

By following these steps and maintaining an organized approach, businesses can stay on top of payments, avoid cash flow problems, and ensure timely compensation for their services or products.

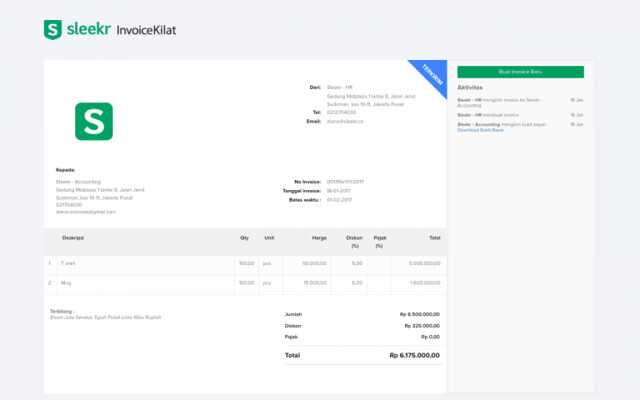

Automating Invoices for Indonesian Businesses

For businesses operating in Indonesia, automating the process of creating and sending billing documents can significantly streamline financial operations. By eliminating manual tasks, automation saves time, reduces the potential for human error, and ensures consistency across all transactions. Automated systems allow businesses to focus on growth while maintaining accurate and timely billing practices, ultimately enhancing customer satisfaction and improving cash flow.

Advantages of Automation

Here are several key benefits of automating your billing process:

- Time Savings: Automation reduces the time spent on manual data entry and document creation, allowing business owners and employees to focus on more strategic tasks.

- Improved Accuracy: By removing human error from the process, automated systems ensure that calculations, dates, and client details are consistent and accurate.

- Consistency and Professionalism: Automated systems use predefined templates, ensuring that each document follows a consistent format and meets professional standards.

- Faster Payment Processing: By automating reminders and payment tracking, businesses can speed up the payment collection process, reducing delays and improving cash flow.

- Compliance: Automation helps businesses stay compliant with local regulations by ensuring that all necessary legal information is included in each document, such as tax identification numbers and proper tax calculations.

How to Implement Automation

To automate your billing process effectively, consider these practical steps:

- Choose the Right Software: Select an invoicing automation tool that fits your business needs. Look for features such as customizable templates, automated reminders, and integration with payment systems.

- Integrate with Accounting Systems: Ensure that your automated system can integrate with your accounting software. This allows seamless tracking of payments, expenses, and financial reporting.

- Set Up Recurring Billing: For businesses with repeat customers, set up automated recurring billing. This reduces the need to manually create documents for every transaction and ensures timely payments without extra effort.

- Customize Templates: Tailor your automated documents to reflect your brand by adding your logo, colors, and specific terms. Customization enhances your professionalism and maintains brand consistency.

- Monitor and Adjust: Regularly review the automated system to ensure that it continues to meet your business needs and remains compliant with any changes in local regulations.

By adopting automation, businesses in

How to Personalize Invoice Templates

Personalizing your billing documents is essential for creating a professional image and reinforcing your brand identity. A well-designed, customized document not only ensures clarity but also helps build stronger relationships with clients. By tailoring these documents to reflect your business values, you can stand out and make a lasting impression. Personalization can be done easily by adding key elements that align with your company’s aesthetics and communication style.

Steps to Personalize Billing Documents

To make your billing documents more personalized and effective, follow these simple yet impactful steps:

- Customize Your Business Branding: Incorporate your company’s logo, colors, and font styles to make the document instantly recognizable. Consistency in design enhances your professional image and strengthens your brand presence.

- Include Clear Contact Information: Ensure your company’s name, address, phone number, and email are prominently displayed. This makes it easier for clients to reach you and provides transparency.

- Set a Personal Tone in Language: Tailor the wording in the document to match the tone of your business. Whether it’s formal or friendly, using a consistent tone in communication will make your brand feel more authentic to clients.

- Include Payment Terms and Instructions: Clearly state payment terms, deadlines, and accepted methods of payment. Adding payment instructions can also help streamline the process and minimize confusion.

- Offer Customization Options for Clients: Provide clients with the ability to choose certain aspects of their billing experience. For example, they might be able to select whether they prefer paper or digital copies, or if they want to receive recurring bills automatically.

- Utilize Personalized Notes: Including a personal message or a thank-you note can go a long way in fostering a good relationship with your clients. A simple thank you for their business or a reminder of your services can make a big difference.

Benefits of Personalizing Billing Documents

By personalizing your documents, you can create a more professional and cohesive brand identity, enhance customer experience, and reduce the risk of misunderstandings. Personalized billing documents convey a sense of attention to detail and care, fostering long-term trust and loyalty with your clients.

Taking the time to personalize your business documents demonstrates professionalism and can significantly improve your client relations, setting your business apart from competitors.

Benefits of Digital Invoice Templates

As businesses move towards digital solutions, using electronic billing formats has become an increasingly popular option. Digital documents provide a host of benefits, from ease of access to enhanced accuracy, that help streamline financial processes. By adopting these modern methods, businesses can improve efficiency, reduce costs, and ensure compliance with local laws while offering clients a more convenient and professional service.

Efficiency and Convenience

One of the key advantages of using electronic billing systems is the significant time saved compared to traditional paper-based methods. With a digital solution, you can generate, send, and track transactions within minutes. Key benefits include:

- Faster Processing: Creating and sending billing documents digitally allows for quick distribution, eliminating postal delays and reducing wait times for both the business and the client.

- Easy Access: Clients and business owners alike can access documents at any time and from any device. This convenience helps avoid lost or misplaced paperwork.

- Automated Updates: Digital systems can automatically update payment statuses and track overdue balances, reducing the manual effort required for follow-ups.

Cost Savings and Environmental Impact

Going digital can significantly reduce operational costs associated with paper, printing, and postage. These savings can have a direct impact on your bottom line. In addition to financial savings, there are other environmental benefits:

- Lower Operational Costs: By eliminating the need for paper, ink, and postage, businesses can save on material and logistical costs. This is particularly beneficial for small businesses with tight budgets.

- Eco-Friendly: Reducing paper waste helps minimize the environmental impact of business operations, contributing to a greener, more sustainable future.

Incorporating digital billing formats into your business practices not only simplifies operations but also enhances client satisfaction by providing a modern, efficient service. The ability to quickly generate, send, and track payments gives businesses more control over their financial processes, improving cash flow management and ensuring a smoother overall operation.

How to Share Invoices in Indonesia

Sharing billing documents efficiently is crucial for businesses to ensure timely payments and maintain professional relationships with clients. With various digital tools available today, sending documents electronically has become the preferred method. Not only does this approach save time and reduce costs, but it also provides a more secure and environmentally friendly alternative to traditional paper methods.

Methods for Sharing Billing Documents

There are several ways businesses can share their billing statements with clients, each offering distinct advantages:

- Email: The most common and efficient method. Simply attach the billing document in a PDF or another accessible format and send it directly to the client. Email allows for quick delivery, easy tracking, and ensures that the client has all the necessary information at their fingertips.

- Cloud Storage Services: Platforms like Google Drive, Dropbox, or OneDrive allow businesses to store their documents in a secure location and share links with clients. This method is ideal for sharing multiple files or larger documents that may be difficult to send as email attachments.

- Accounting or Billing Software: Many businesses use specialized software to generate and send documents automatically. These tools typically allow for customized, secure sharing and tracking of transactions, ensuring that both the business and the client have access to real-time updates.

- Printed Copies: Although less common in today’s digital age, businesses may still opt to send hard copies of billing documents via postal services, particularly if required by clients or legal authorities.

Best Practices for Sharing Billing Documents

To ensure that your documents are well-received and facilitate smooth transactions, consider these best practices:

- Use Clear Subject Lines: When sending an email, make sure the subject line is clear and informative, such as “Billing Statement for [Month] – [Your Company Name]”. This helps clients quickly identify the document and avoid confusion.

- Ensure Proper Format: Sending billing documents in a universally accessible format like PDF ensures that clients can open, view, and print the document easily, regardless of their device.

- Include Payment Instructions: Make sure the payment terms, due dates, and payment methods are clearly outlined. This eliminates any ambiguity and helps clients process payments promptly.

- Follow Up: After sending the billing document, consider following up with clients to confirm receipt and answer any questions they may have about the document.

By choosing the right method and following these practices, businesses can ensure that their billing documents are delivered efficiently, improving client satisfaction and accelerating payment cycles.