Free Rent Invoice Template for Simple Billing

Managing property payments efficiently requires a structured approach to documentation. Having a reliable system in place ensures that all financial transactions are recorded accurately and can be referred to whenever necessary. This approach not only streamlines the payment process but also supports clear communication between landlords and tenants.

Utilizing well-designed documents for financial tracking helps to maintain transparency and avoid misunderstandings. These documents can be easily customized to reflect specific agreements and rental terms, offering a professional touch to every transaction. Whether you are a first-time landlord or an experienced property manager, using these tools effectively can simplify your workflow and contribute to smoother financial operations.

Emphasizing accuracy and consistency in payment records fosters trust and ensures both parties are on the same page. Such an approach to documentation provides an organized method for managing rental agreements, making it easier to handle disputes, taxes, and ongoing communication. With the right tools, every property manager can achieve a seamless billing experience.

Free Rent Invoice Template Overview

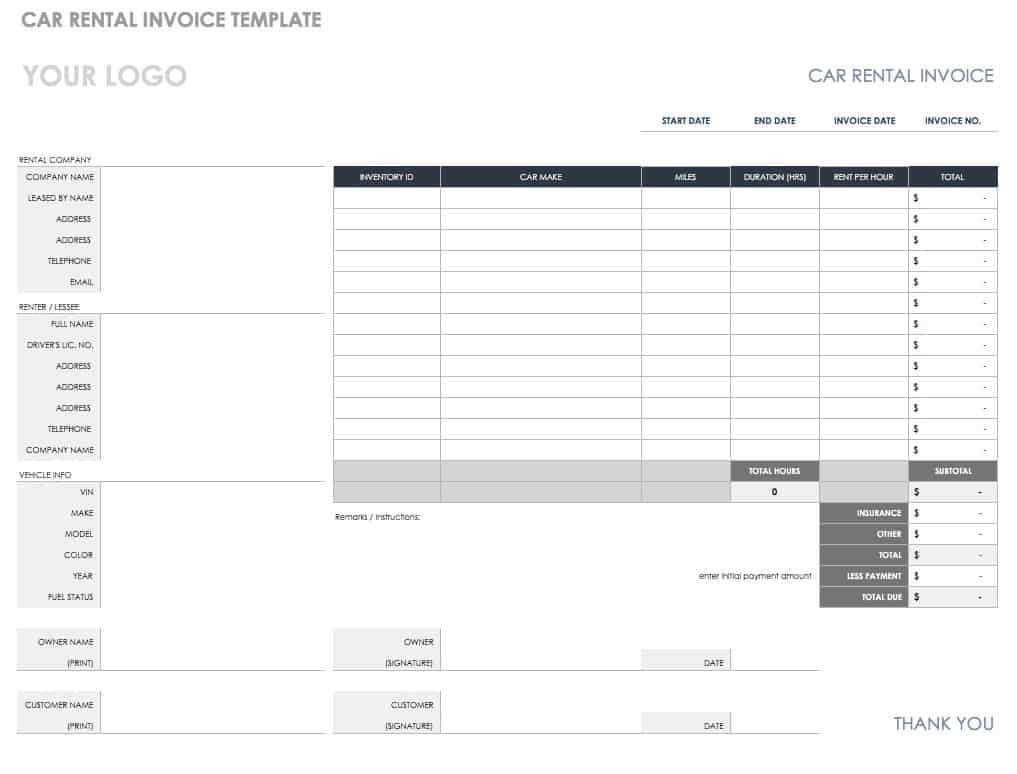

When managing property transactions, it’s essential to have a reliable tool for recording payments. A well-structured document helps ensure clarity in financial exchanges, allowing both parties to maintain an organized record of amounts due and paid. These documents are customizable, offering flexibility to suit various rental agreements and can be adapted to different property types and payment conditions.

Such documents typically contain key sections that highlight the essential details of the transaction. For example, the document may include the tenant’s and landlord’s information, the payment period, and any applicable terms or penalties. By using a structured approach, it becomes easier to track payments, resolve any disputes, and ensure timely processing.

| Section | Details Included |

|---|---|

| Landlord Information | Name, contact details, address |

| Tenant Information | Name, contact details, address |

| Payment Period | Start and end dates of payment |

| Amount Due | Total amount payable |

| Terms | Due date, late fees, penalties |

Having a clear and easy-to-use document can save time and reduce potential confusion between landlords and tenants. Whether you manage a single property or multiple units, using such resources will help keep finances organized and ensure that all obligations are met in a timely manner.

Why Use a Rent Invoice Template

Utilizing a structured document for managing financial transactions between landlords and tenants simplifies the process and enhances clarity. With a standardized format, both parties can clearly understand their obligations and the agreed-upon terms. Such tools help avoid mistakes, streamline billing, and maintain consistent records, which is crucial for proper property management.

Benefits of Using a Structured Document

- Organization: Keeps payment details neatly arranged for easy tracking.

- Consistency: Helps ensure that all necessary information is included every time.

- Clarity: Provides a transparent record that is easy to understand for both parties.

How It Saves Time and Effort

By relying on a pre-built structure, you eliminate the need to start from scratch every time you need to send a payment request. This allows for quicker processing and reduces the chances of errors or missed information. Additionally, these documents can be adapted to various situations, making them versatile tools for all types of property agreements.

- Quickly create documents with pre-set fields.

- Minimize the chances of forgetting important details.

- Reduce time spent managing and tracking payments.

Overall, having access to a reliable resource streamlines the management of financial transactions, fostering smoother interactions between landlords and tenants.

Key Features of a Rent Invoice

When managing financial transactions for property agreements, it’s essential to include specific details that ensure accuracy and clarity. A well-organized document includes crucial elements that both parties can refer to throughout the lease term. These components help define the payment structure, provide a transparent record, and facilitate timely processing of payments.

Essential Information to Include

Each document should contain basic but important details to ensure both the tenant and landlord are on the same page. Key pieces of information help avoid confusion and ensure payments are processed smoothly. Here are the most common features:

| Feature | Description |

|---|---|

| Property Details | Information about the property being rented (address, unit number, etc.) |

| Landlord Contact | Name, phone number, and email of the landlord |

| Tenant Contact | Name, phone number, and email of the tenant |

| Payment Due Date | The exact date the payment should be made |

| Total Amount Due | The full amount that is expected to be paid |

| Payment Terms | Details about late fees, payment methods, and other conditions |

Why These Features Matter

Including these key features provides transparency and ensures that both parties are aware of their responsibilities. This also helps reduce disputes over payment amounts, deadlines, and terms. Additionally, this clarity can aid in resolving any future disagreements and will be useful for tax purposes.

How to Customize a Rent Invoice

Personalizing financial documents is an important step in ensuring that they meet the specific needs of both the landlord and the tenant. Customization allows you to tailor the document to reflect the unique terms of the agreement, such as payment schedules, property details, and any additional clauses or conditions. By adjusting certain sections, you can make sure that the document is accurate and professional, minimizing any chances of confusion or errors.

To customize such a document, it’s essential to focus on key details that might vary based on the agreement. This includes the payment amount, due dates, and other conditions that may change depending on the type of lease or rental agreement. Additionally, including any special instructions or personal touches can add clarity and professionalism to the transaction.

Key areas to customize include:

- Payment Amount: Adjust the amount to reflect the terms agreed upon with the tenant.

- Due Dates: Set specific dates for when the payment should be made, considering the lease duration.

- Tenant and Landlord Information: Ensure the contact details for both parties are accurate and up-to-date.

- Payment Terms: Include any late fees, discounts, or other conditions that apply to the agreement.

- Property Details: List the rental property’s address and any relevant information for identification.

By adjusting these elements, you can create a personalized and effective document that clearly reflects the terms of the agreement. Customization also ensures that both parties are well-informed and that the document serves as a reliable record for future reference.

Benefits of Digital Rent Invoices

Using electronic documents for managing payments offers numerous advantages over traditional paper-based methods. Digital formats provide greater efficiency, ease of access, and the ability to store records securely. These benefits not only streamline the payment process but also enhance the overall management of property transactions.

One of the main advantages is time-saving. With digital tools, landlords can quickly create, send, and track payment records, eliminating the need for manual paperwork and reducing the chances of errors. Furthermore, electronic documents can be automatically saved and backed up, ensuring that records are never lost or misplaced.

Additional benefits include:

- Convenience: Easily access, send, and store documents from any device.

- Eco-friendly: Reduces paper usage, contributing to environmental sustainability.

- Cost-effective: Saves money on printing, postage, and physical storage.

- Tracking and Reminders: Automated systems can send reminders and confirm when payments are made.

- Security: Digital records can be encrypted and protected from unauthorized access.

Incorporating digital solutions into property management not only improves efficiency but also helps maintain a more organized and secure system for both landlords and tenants. By leveraging technology, both parties can benefit from faster processing times and increased transparency in financial transactions.

Steps to Create a Rent Invoice

Creating a clear and accurate document for financial transactions is crucial for maintaining a smooth relationship between landlords and tenants. A well-organized payment document helps ensure that both parties are aware of the agreed-upon terms and can easily refer back to the information as needed. Below are the essential steps for crafting an effective payment record.

Step-by-Step Guide to Crafting a Payment Document

- Gather Necessary Information: Collect details such as the tenant’s name, address, payment amount, and due dates. Make sure you have up-to-date contact information for both the tenant and the property owner.

- Include Property Information: Ensure that the property address and any unit numbers are clearly stated, especially if you manage multiple properties.

- Specify Payment Amount and Terms: Include the total amount due, payment methods, and any terms such as late fees or discounts for early payments.

- Set the Due Date: Clearly state the exact date the payment is due to avoid confusion and late payments.

- Add Payment Instructions: If applicable, include instructions on how the payment should be made, such as bank details or online payment options.

- Check for Accuracy: Before finalizing the document, review all the details to ensure there are no errors or omissions that could lead to misunderstandings.

Final Touches

- Save a Copy: Always keep a copy of the document for your records, either digitally or printed.

- Send to Tenant: Distribute the finalized document promptly, ensuring the tenant has enough time to process the payment before the due date.

By following these steps, you can create a professional and effective payment document that ensures clarity and efficiency for both parties.

How to Include Rent Payment Terms

Clearly outlining payment terms is essential for maintaining a transparent and fair agreement between property owners and tenants. By specifying the expectations for payments, deadlines, and any penalties for late submissions, both parties can avoid confusion and ensure that the financial aspects of the arrangement are understood from the outset. A well-defined payment section helps set clear boundaries and reduces potential disputes.

When drafting payment terms, focus on the following key elements:

- Due Date: Clearly specify the exact date the payment is expected. This helps avoid delays and ensures the tenant knows when to make the payment.

- Late Fees: If applicable, include information about penalties for late payments. Be sure to state the amount or percentage charged for overdue payments and the time frame in which late fees will apply.

- Payment Methods: List acceptable methods for making payments, such as bank transfers, checks, or online platforms. This gives the tenant clear options for how to settle the bill.

- Payment Frequency: Define the frequency of payments, whether it is weekly, monthly, or another schedule. This ensures there are no misunderstandings regarding when payments are due.

- Discounts or Incentives: If you offer any discounts for early payment or other incentives, be sure to mention them in the terms. This can encourage tenants to make timely payments.

By clearly outlining these details in the agreement, both the landlord and tenant are better equipped to manage payments effectively, ensuring a smoother relationship throughout the lease period.

Common Mistakes in Rent Invoices

When preparing financial documents for property agreements, it’s easy to overlook certain details that could lead to misunderstandings or delays. Mistakes in these records can cause confusion, missed payments, and unnecessary disputes. Being aware of common errors can help ensure that the document is accurate and professionally prepared, allowing both the landlord and tenant to avoid issues in the future.

Some of the most frequent mistakes include:

- Incorrect Payment Amount: One of the most common errors is listing an incorrect payment amount. This can happen due to manual entry errors or miscalculations. Always double-check the total before sending it.

- Missing or Incorrect Due Date: Failing to include or incorrectly specifying the due date can lead to confusion about when payment is expected. This could cause delays or unnecessary late fees.

- Lack of Payment Methods: Not clearly stating how payments should be made can create unnecessary barriers for tenants. Be sure to provide all accepted payment methods, such as bank transfer details or online payment options.

- Inconsistent Terms: Confusion often arises when terms like late fees, discounts, or payment schedules aren’t clearly stated or are inconsistent with the agreement. Ensure these terms are specific and unambiguous.

- Omitting Tenant or Landlord Details: Leaving out contact information or property details can cause delays and issues if clarification is needed later. Always include both parties’ contact information and property specifics.

By avoiding these common mistakes, you can ensure that financial transactions are processed smoothly and that both parties have a clear understanding of their responsibilities.

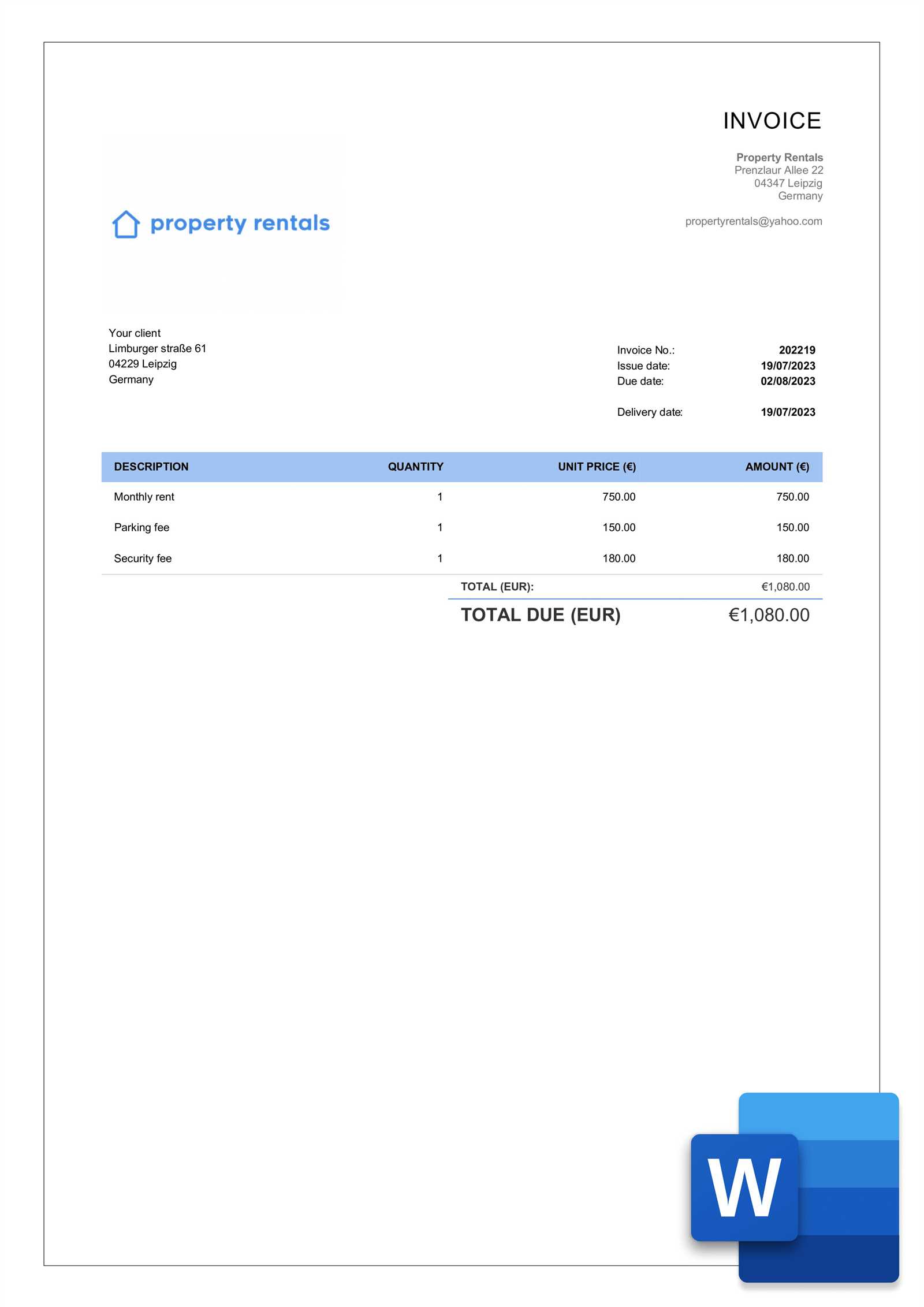

What Information Should Be Included

For a payment document to be effective, it must contain all the necessary details that clearly outline the terms of the agreement between both parties. The more specific the information, the less room there is for misunderstanding or error. A well-drafted document serves as a clear reference for both the payer and the recipient, ensuring that all aspects of the payment process are transparent and understood.

Essential Details to Include

- Identification Information: Include the names and contact details of both the property owner and the tenant, as well as the address of the property in question.

- Payment Amount: Clearly state the total amount that is due, breaking it down if necessary (e.g., base rent, additional charges, or services provided).

- Due Date: Specify the exact date by which the payment should be made to avoid any confusion or late charges.

- Payment Method: Indicate the acceptable methods for making the payment, such as bank transfer, check, or online platforms.

- Payment Frequency: Clarify whether the payment is due weekly, monthly, or according to another schedule as per the agreement.

Additional Optional Information

- Late Fees: Include any penalties or interest that may apply in the event of late payments.

- Discounts: If there are any discounts for early payment or other incentives, clearly specify them.

- Special Conditions: Any terms specific to the lease agreement, such as maintenance responsibilities or other clauses, should be noted as well.

Including these details ensures that both parties are well-informed and that the document serves as a reliable record for future reference.

How to Use Rent Invoice Templates Effectively

Using pre-made documents can save time and ensure consistency when managing financial transactions. These ready-made forms are designed to simplify the process by providing a structure that includes all the essential details. However, to make the most of them, it is important to adapt and use them correctly for your specific needs. Understanding how to leverage these resources effectively can help you maintain accuracy and professionalism.

Best Practices for Using Pre-made Documents

- Personalize the Details: While the basic structure is set, ensure that you fill in all necessary fields with accurate and up-to-date information. This includes payment amounts, dates, and contact details.

- Ensure Clarity: Double-check that the document clearly outlines the payment terms, due dates, and any other relevant conditions to avoid confusion.

- Keep Track of Payments: Use the form not only as a way to request payments but also as a record for both parties to track transactions. It’s helpful to maintain a copy for your records.

- Adapt to Different Situations: Depending on the nature of the agreement, you may need to adjust or add terms such as late fees, maintenance charges, or discounts for early payments.

Benefits of Using Pre-made Forms

| Benefit | Explanation |

|---|---|

| Efficiency: | Saves time by eliminating the need to create a document from scratch for each transaction. |

| Consistency: | Ensures that all necessary information is included in every transaction, reducing the chance of errors. |

| Professionalism: | Using a well-structured document helps present a professional image and fosters trust with tenants. |

| Clarity: | Pre-made forms help outline terms and conditions in a clear and straightforward manner, reducing misunderstandings. |

By following these practices, you can maximize the effectiveness of ready-made forms, ensuring smooth financial transactions and a professional approach to managing agreements.

Best Software for Rent Invoices

Managing financial records can become overwhelming without the right tools. Using specialized software designed for generating billing statements can streamline the process, saving both time and effort. These tools provide customizable templates, automated calculations, and storage for easy access to past transactions. Choosing the right software can significantly enhance the efficiency of tracking payments and creating accurate documentation for property agreements.

Top Features to Look For

- Customizable Templates: Look for software that offers pre-designed forms which can be personalized to meet specific needs. This allows for consistent formatting without the need to start from scratch.

- Automation: Automation features, such as automatic calculations of totals and taxes, help reduce errors and save time.

- Integration with Payment Systems: Software that integrates with payment processing platforms makes it easier to track and confirm payments directly through the system.

- Cloud Storage: Storing all documents online ensures easy access, secure backups, and the ability to retrieve previous records at any time.

- Reporting Capabilities: Advanced tools provide reports that can summarize payment history, outstanding balances, and other financial data to give you a clear overview of transactions.

Recommended Software Options

- QuickBooks: Well known for its comprehensive accounting features, QuickBooks allows users to create and manage all types of financial documents, including billing statements, with ease.

- Zoho Invoice: A user-friendly tool that enables easy customization and integration with other Zoho apps, making it ideal for managing finances in small businesses.

- FreshBooks: Known for its simplicity, FreshBooks offers an intuitive platform for generating statements and tracking payments with helpful invoicing tools.

- Wave: A free software option that provides all the essential features, including customizable billing documents, and integrates with various payment gateways.

By using the right software, you can ensure that your financial documents are both accurate and professiona

Understanding Rent Invoice Formatting

Proper formatting of financial documents is essential for clear communication and professionalism. When preparing these documents, organizing the content in a structured way not only ensures that all necessary details are included but also makes the document easy to read and understand. A well-formatted document helps to prevent misunderstandings and allows both parties to quickly access critical information, such as payment amounts, dates, and terms.

- Clarity: Ensure that the document is easy to read, with legible fonts and proper spacing. The goal is to present the information in a way that is clear and simple to follow.

- Logical Structure: A good format follows a logical progression, starting with the parties involved, followed by the specifics of the transaction, and concluding with payment instructions and due dates.

- Consistency: Use a uniform structure across all documents to maintain consistency. This includes the placement of headings, contact information, and payment terms.

- Professional Appearance: The format should reflect professionalism, as it represents your business and its credibility. Consider using a clean, formal design that avoids clutter.

- Essential Information: The format should leave room for key details such as the payer and payee names, amounts, due dates, and any terms or conditions that may apply to the payment process.

By adhering to a clear and logical structure, you can ensure that all necessary information is easily accessible, reducing the risk of errors and improving the overall efficiency of the transaction process.

When to Send a Rent Invoice

Timing is a crucial factor when preparing financial documents for transactions. Sending these statements at the right time ensures that both parties are well-informed about the payment expectations. It also helps maintain a smooth financial flow and keeps records up to date. Knowing when to send these documents can prevent confusion and help with timely payments.

Before the Payment is Due

It’s recommended to send the document ahead of the due date. Doing so allows the recipient ample time to review the details and make arrangements for payment. Sending it a few days or a week before the payment deadline can encourage prompt action and minimize delays.

After the Payment is Made

In some cases, it’s appropriate to issue a confirmation document after receiving the payment. This serves as a receipt for the transaction and helps maintain accurate records for both parties. It can also provide peace of mind to the payer, confirming that the amount has been settled as agreed.

- Reminder Notices: If payment has not been received by the due date, sending a polite reminder can encourage quick action.

- End of the Lease Term: For longer-term agreements, providing a final document at the end of the rental period is necessary to confirm any remaining balances or adjustments.

By understanding the ideal timing for sending these documents, you can ensure smooth communication and reduce the likelihood of late payments or misunderstandings.

How Rent Invoices Help with Taxes

Proper documentation of financial transactions plays an essential role in managing taxes. Having detailed records for each transaction provides a transparent overview of income and expenses, which is crucial for accurate tax reporting. Clear and consistent records help both landlords and tenants ensure they meet their tax obligations, making the process smoother and more efficient.

Benefits for Landlords

For property owners, keeping track of payments made by tenants is vital for tax purposes. It allows landlords to report rental income accurately, which is necessary for calculating taxes owed. Additionally, having a clear record of all financial interactions ensures deductions for allowable expenses such as maintenance or property management fees can be properly claimed.

Benefits for Tenants

Tenants can also benefit from receiving well-documented records for their payments. Such documentation may be needed when claiming deductions for business use of rental property, or for other tax-related purposes. It also serves as proof of payment in case any discrepancies arise in the future.

| For Landlords | For Tenants |

|---|---|

| Helps report rental income | Proof of payment for tax claims |

| Enables property-related deductions | Records for business use deductions |

| Facilitates tracking of rental payments | Helps prevent disputes over payments |

By keeping accurate and organized records, both landlords and tenants can navigate the complexities of tax filing more effectively, ensuring they stay compliant and reduce the risk of any issues with tax authorities.

Free Rent Invoice Templates vs Paid Options

When choosing a solution for generating financial documents, it’s important to weigh the advantages and drawbacks of free versus paid options. Each type offers different features, and the right choice depends on the specific needs of the user, such as frequency of use, customization, and additional functionalities. Understanding the key differences can help you make an informed decision.

Advantages of Free Options

Free solutions can be very appealing, especially for those who only need basic features. Many free tools offer pre-designed layouts that are easy to use, allowing quick and straightforward document creation. However, there are limitations to consider:

- Basic Functionality: Most free tools provide limited customization options and features.

- Limited Templates: Options for customization might be fewer, restricting design and formatting flexibility.

- Less Support: Free options often come without customer support or updates, leaving you to resolve issues on your own.

Benefits of Paid Options

Paid solutions generally offer a wider array of features and support, making them a better choice for those with more complex needs. These services are usually subscription-based, providing access to more advanced functionalities that are tailored to business operations:

- Greater Customization: Paid tools allow you to tailor the documents more precisely to your brand or personal preferences.

- Advanced Features: Additional options like automatic calculations, integration with accounting software, and reporting capabilities are often included.

- Professional Support: Paid plans often come with access to customer service, ensuring you get help when you need it.

Which Option is Right for You?

Your decision depends on your specific requirements. For occasional use with minimal needs, free options may suffice. However, if you manage multiple transactions or require more control over the look and functionality of your documents, a paid service could be a worthwhile investment. Consider how often you need to create such documents, the importance of customization, and whether advanced features could save time or enhance accuracy in your processes.

Legal Considerations for Rent Invoices

When creating financial documents related to leasing agreements, it’s essential to be aware of the legal aspects that govern their use. Proper documentation helps ensure transparency, compliance with tax regulations, and protection in case of disputes. There are several key factors to consider when preparing and issuing these documents to avoid legal issues.

Key Legal Requirements

Depending on the jurisdiction, certain elements are mandatory when creating financial records for leasing. Below are some of the common legal requirements that must be included:

- Clear Identification of Parties: Always ensure the names and contact information of both the payer and the recipient are included. This prevents confusion in case of disputes.

- Accurate Payment Details: The amount due, payment due date, and any applicable late fees must be clearly stated to avoid misinterpretations.

- Compliance with Tax Laws: In many cases, tax identification numbers or business registration information must be listed. This is especially important if the transactions involve taxable services or goods.

Staying Compliant with Local Laws

Different regions or countries may have unique legal requirements when it comes to financial documentation. For example, in some areas, there are specific regulations on how to calculate late fees or penalties, while others may require specific language to be included regarding the payment process. Here are some points to consider for staying compliant:

- Review Local Regulations: Familiarize yourself with local and state laws to ensure that your documents meet all legal standards.

- Retention of Documents: Understand how long you are required to keep financial records in case they need to be referred to in the future or audited.

- Dispute Resolution Clauses: Consider including terms that outline how disputes will be handled, whether through arbitration or legal channels.

Avoiding Common Legal Pitfalls

In addition to following the legal requirements, it’s important to be mindful of common mistakes that could lead to complications. Some of these include:

- Ambiguity in Terms: Avoid vague language or unclear payment terms, as this could lead to misunderstandings.

- Failure to Issue on Time: Timeliness is critical, and failure to issue the necessary documents promptly may cause complications, especially in legal proceedings.

- Incorrect Amounts: Double-check calculations to ensure accuracy, as errors may lead to disputes or financial penalties.

By taking these legal considerations into account when creating financial documents, you can minimize the risk of future complications and ensure that your practices are fully compliant with a

How to Track Rent Payments

Keeping track of financial transactions between landlords and tenants is essential for maintaining clear records and ensuring both parties fulfill their obligations. Accurate tracking allows property owners to monitor overdue amounts, reconcile payments, and avoid potential legal disputes. There are several effective methods for tracking these payments and staying organized.

Manual Tracking Methods

For those who prefer traditional methods, tracking payments manually can still be effective. Below are some of the common ways to do this:

- Ledger Books: Using a physical ledger to record each payment is a simple and straightforward method. Write down the amount paid, the date received, and any relevant notes.

- Receipts: Providing physical receipts for each transaction allows both parties to keep a hard copy of each payment, which can be useful for future reference.

- Paper Files: Maintain a file for each tenant, keeping all relevant documents such as signed agreements, payment receipts, and correspondence related to payments.

Digital Tracking Methods

For those looking to streamline the process, digital tools can be incredibly helpful in organizing and automating payment tracking. Here are some options:

- Spreadsheet Software: Programs like Excel or Google Sheets can be used to create customized payment logs that automatically calculate outstanding balances and due dates.

- Accounting Software: Platforms like QuickBooks or Zoho allow property owners to manage payments, issue reminders, and generate financial reports with ease.

- Online Payment Platforms: Many property owners choose to use services like PayPal, Venmo, or bank transfers to collect payments, as these platforms often come with built-in tracking tools.

Automation for Efficiency

Automating payment tracking reduces the potential for human error and saves time. Here’s how you can make the process more efficient:

- Set Up Recurring Payments: For tenants who have fixed schedules, setting up recurring payments can eliminate the need to manually track each transaction.

- Send Payment Reminders: Use automated email or text reminders to notify tenants when payments are due, reducing the chances of missed payments.

- Link Bank Accounts: Some property management software integrates with bank accounts to directly track incoming payments, offering real-time insights into financial status.

By implementing a consistent tracking system, whether through manual or digital methods, property owners can maintain organized records, ensure timely payments, and avoid misunderstandings in the future.