Free Sales Invoice Template for Quick and Easy Billing

Managing payments and ensuring smooth transactions is crucial for any business. One of the key aspects of financial operations is creating clear and professional documents that detail services rendered or goods sold. Whether you’re a freelancer, small business owner, or managing a larger company, having the right tools to streamline your billing process can save you time and reduce errors.

Customizable billing documents offer a simple yet effective way to maintain professionalism and keep your financial records organized. These documents help you present essential information clearly, ensuring that your clients have all the necessary details to process payments accurately and on time.

With the right tool, you can easily generate professional documents without needing to start from scratch every time. Accessing ready-made designs allows you to focus more on running your business rather than worrying about formatting or tracking down missing details. This makes it an invaluable resource for businesses of any size.

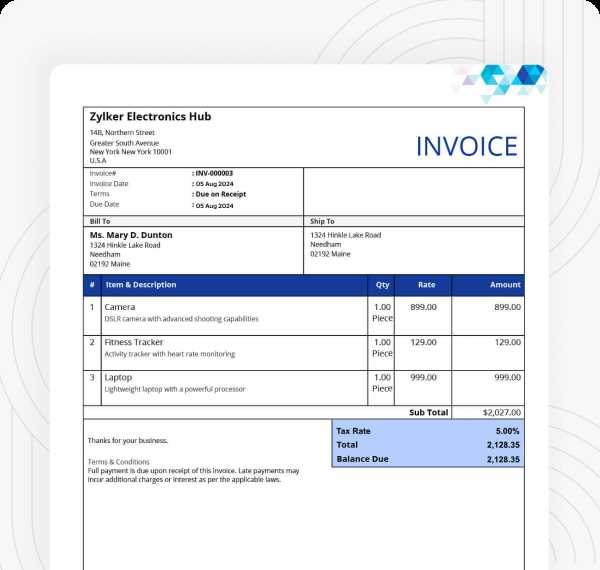

Sales Invoice Template Free

When managing financial transactions, having a well-organized and structured document is essential for both you and your clients. This document acts as a record of the services provided or goods sold, ensuring clarity and accuracy in communication. Using pre-designed documents can help businesses maintain consistency while saving time on formatting and design.

Benefits of Using Ready-Made Billing Documents

Ready-to-use billing formats offer numerous advantages, especially for small business owners and freelancers. They simplify the process by providing a clear structure, ensuring you don’t miss any crucial details. By using such a tool, you can quickly create documents that are not only professional but also tailored to your specific needs.

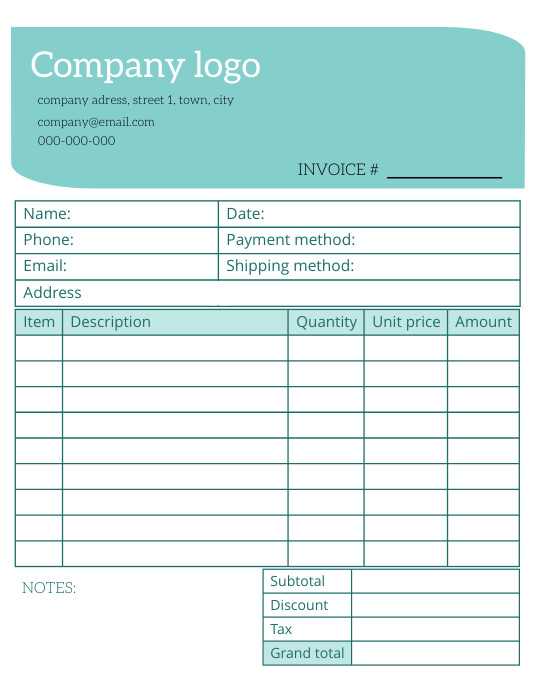

How to Access and Customize Your Document

Customizing a pre-designed billing form is easy and can be done in just a few steps. Most of these resources allow you to adjust text fields, company information, payment terms, and more. With a few edits, you can produce a polished and accurate document ready for distribution to your clients. The flexibility of these tools ensures that you can adapt them to fit your business’s unique requirements.

Why Use a Free Invoice Template

When it comes to managing financial documents, efficiency and accuracy are key. Having a ready-made solution allows businesses to streamline their billing processes, saving valuable time and reducing the likelihood of errors. Instead of designing documents from scratch, many business owners turn to pre-built solutions that are both cost-effective and customizable.

Here are some reasons why using such a tool can benefit your business:

- Time Savings: Ready-to-use documents allow you to quickly generate billing forms without starting from scratch, speeding up the entire process.

- Consistency: Using a standardized format ensures that all your documents look professional and contain the same essential information every time.

- Customization: Most tools allow you to adjust details such as company name, payment terms, and other important fields, giving you flexibility without sacrificing professionalism.

- Cost-Effective: Many of these resources are available at no cost, making them an ideal choice for small businesses or freelancers who need to keep overhead low.

- Accuracy: Pre-designed formats often include common fields that reduce the risk of missing important details, which can prevent confusion or disputes with clients.

Ultimately, using a pre-designed document format helps ensure that your billing process is smooth, professional, and efficient–without the need for complicated software or design skills.

Benefits of Customizable Sales Invoices

Having the ability to personalize your financial documents provides numerous advantages for businesses of all sizes. Customizable formats allow you to tailor each document to meet specific business needs, enhance professionalism, and improve communication with clients. By adjusting certain elements, you can make sure your documents reflect your brand while maintaining accuracy and consistency.

Enhancing Professionalism and Brand Identity

Customizing your documents helps reinforce your business’s brand and professionalism. By adding your company logo, adjusting colors, or using a unique layout, you create a cohesive experience for your clients. This attention to detail can foster trust and help your business stand out in a competitive market.

Improving Accuracy and Efficiency

Personalized forms also allow for more precise tracking and better management of your financial records. You can include specific payment terms, delivery dates, and client references, ensuring that no essential details are overlooked. Additionally, by saving your customized version, you can reuse it without needing to re-enter the same information each time.

| Benefit | Description |

|---|---|

| Branding | Personalized documents help promote your business’s identity, making your paperwork instantly recognizable. |

| Efficiency | Custom formats save time by allowing you to reuse pre-filled sections with every transaction. |

| Accuracy | Including specific client and service details reduces errors and ensures consistent communication. |

| Professionalism | A well-designed document makes a positive impression and builds trust with clients. |

By using a customizable format, you not only save time but also create a more efficient and professional system for managing financial transactions. This flexibility can be particularly helpful for businesses with varying requirements or different client needs.

How to Download a Free Template

Getting access to a pre-designed document that fits your business needs is easier than ever. Many platforms offer downloadable resources that allow you to generate professional records without the need for complex design tools. By following a few simple steps, you can quickly obtain a customizable document that will help streamline your billing process.

Steps to Download Your Document

Follow these basic steps to get your customizable form and start using it right away:

- Find a Reliable Source: Search for trusted websites or platforms that offer downloadable files for business documents. Look for reviews or recommendations to ensure the resource is reputable.

- Choose Your Preferred Format: Many platforms offer different file types, such as Word, Excel, or PDF. Choose the format that is most compatible with your system and easy for you to edit.

- Download the File: Click on the download link and save the file to your device. Ensure that the download is from a secure website to avoid potential risks.

- Open and Customize: Once the file is downloaded, open it with the appropriate software and personalize the fields with your company information, terms, and other necessary details.

- Save and Use: After making the necessary adjustments, save the document and use it for your upcoming transactions.

Where to Find Trusted Resources

There are many reliable websites offering downloadable documents for businesses. Some of the most popular options include:

- Business Resource Platforms: Websites dedicated to business tools and resources often provide high-quality forms for various needs.

- Online Document Libraries: Some online libraries specialize in free downloads for entrepreneurs and small businesses.

- Industry-Specific Websites: Depending on your business sector, there may be industry-specific resources that provide tailored formats to meet particular needs.

Once you’ve downloaded and customized your document, you’ll be ready to streamline your billing and keep your financial operations running smoothly.

Top Features of an Invoice Template

A well-designed billing document can make a significant difference in how your business is perceived by clients. A comprehensive, organized format ensures that all essential details are clearly presented and easy to understand. The right document not only simplifies the billing process but also contributes to a professional and trustworthy image. Below are some of the most important features to look for when choosing or creating such a document.

Essential Elements for Clear Communication

Effective billing documents should include several key features that help facilitate smooth transactions. These elements ensure that both you and your clients have all the necessary information to avoid confusion or delays.

- Company Information: Always include your company’s name, logo, address, and contact details at the top of the document for easy identification.

- Client Details: Include the name, address, and contact information of your client to personalize the document and make communication clear.

- Itemized List: Clearly list each product or service provided, including descriptions, quantities, and unit prices. This helps prevent disputes and clarifies what is being billed.

- Payment Terms: Include clear payment instructions, such as due dates, acceptable payment methods, and any late fees or discounts available.

- Unique Reference Number: Assigning a unique identifier helps both parties track and manage payments more easily.

Customizable Options for Flexibility

Another key feature of an effective billing document is the ability to customize it to fit your specific business needs. Customizable options allow you to adapt the document for different clients, industries, or transaction types.

- Customizable Fields: The ability to adjust specific fields–such as adding your business’s terms and conditions or adjusting payment instructions–allows you to tailor each document for your clients.

- Multiple Currency Support: If you work internationally, having the option to select or change currencies ensures that your clients can easily understand their obligations.

- Design Flexibility: Personalize your documents by adjusting fonts, colors, and layouts to align with your branding and create a more professional appearance.

By incorporating these features, you can ensure that your billing documents not only look professional but also provide all the necessary details to help both you and your clients stay organized and on track.

Essential Information for Sales Invoices

To ensure smooth financial transactions and avoid misunderstandings, it’s crucial to include all necessary details in your billing documents. A well-structured record not only helps in clear communication between you and your clients but also serves as an official document for accounting and tax purposes. Having the right information ensures both parties are aligned and reduces the risk of errors or delays in payment processing.

Key Details to Include

A comprehensive document should cover the following fundamental components to ensure completeness and clarity:

- Your Business Information: Include your company’s name, logo, address, and contact details. This helps your clients recognize the document as coming from your business.

- Client Information: Clearly state the recipient’s name, company name (if applicable), address, and contact details. Personalizing this section ensures that the document is directed to the correct party.

- Unique Document Number: Assign a distinct identifier to each record, such as an order number or reference number. This helps both you and your clients easily track the transaction.

- Description of Goods or Services: List each item or service provided, with detailed descriptions, quantities, unit prices, and total amounts. This itemized breakdown prevents confusion about what is being billed.

- Payment Terms: Clearly state the terms, including due dates, payment methods, and any late fees or early payment discounts, if applicable. This helps ensure both parties are clear on when and how payment should be made.

- Tax Information: If applicable, specify any taxes, VAT, or other fees included in the total cost, along with their respective percentages. This transparency helps clients understand the full payment breakdown.

- Subtotal, Taxes, and Total: Ensure the document includes a clear calculation of the subtotal, taxes, and the final total amount due. This makes it easier for clients to understand how the total was calculated.

- Payment Instructions: Provide clear instructions for how and where to send payments, including bank details or online payment methods, depending on your preferences.

Additional Elements for Clarity

Depending on your business and client needs, you may want to add extra details that provide further clarity and improve the overall experience:

- Delivery Terms: If relevant, include information about delivery dates, shipping terms, or any other contractual details that might affect payment timing.

- Notes or Special Instructions: Include any personalized comments or instructions for your client, such as thank-you notes, special offers, or instructions for using the products or services purchased.

- Contact for Queries: Provide a designated contact person or department where clients can reach out for questions or clarifications regarding the document.

By including these key pieces of information, you ensure that your document is thorough, transparent, and easy to understand, reducing the risk of confusion and helping maintain good business relationships.

Simple Steps to Fill Out Your Invoice

Completing a billing document can seem daunting at first, but following a few straightforward steps can make the process quick and simple. By organizing the required information into clear sections, you can ensure accuracy and professionalism every time. Whether you’re sending a bill for services rendered or products sold, these steps will guide you through filling out the document with ease.

Step-by-Step Process

Here’s a step-by-step guide to help you complete the document correctly:

- Fill in Your Business Details: Start by adding your business name, logo, address, and contact information at the top of the document.

- Enter Client Information: Below your business details, include the recipient’s name, address, and contact details to personalize the document.

- Assign a Unique Number: Create a unique reference or document number to help track the transaction easily. This could be a sequential number or a customized reference.

- Describe the Goods or Services: List each item or service you are billing for. Include descriptions, quantities, prices, and total amounts for each line item.

- Calculate the Total: Add the subtotal for all items, apply taxes (if necessary), and include any discounts or additional charges to determine the total amount due.

- Set Payment Terms: Clearly specify the payment due date, methods of payment accepted, and any late payment penalties if applicable.

- Review and Save: Double-check the document for accuracy, ensure all fields are filled out, and save it in your preferred format (Word, Excel, or PDF).

Additional Considerations

While the basic structure is straightforward, consider the following additional points to ensure your document is comprehensive:

- Include Tax Information: If your country or industry requires it, make sure to break down applicable taxes or VAT separately for clarity.

- Payment Instructions: If necessary, add clear instructions on how the client can make a payment, including bank account details or online payment links.

- Client References: If you have a client reference number, job number, or project code, make sure to include it to help your client track the payment.

Following these steps ensures that your document is filled out correctly and professionally, making the payment process smoother for both you and your clients.

Common Mistakes in Sales Invoices

Even a small mistake in your billing documents can cause confusion and delays in payments. To ensure smooth transactions and maintain professionalism, it’s essential to avoid common errors that could affect the clarity and accuracy of your records. By being mindful of these common pitfalls, you can improve your billing process and build stronger relationships with clients.

Frequent Errors to Avoid

Here are some of the most common mistakes people make when creating financial documents, along with tips on how to avoid them:

- Missing or Incorrect Client Information: Failing to include the correct details for your client, such as their full name, address, or contact information, can lead to confusion and delays. Always double-check this information before sending.

- Omitting Itemized Details: A lack of clear descriptions for goods or services can create misunderstandings. Ensure that each item is described in detail, along with its quantity and unit price, to avoid disputes over charges.

- Incorrect Calculations: Simple arithmetic mistakes, such as adding the wrong total or tax amount, can cause significant problems. Always double-check your calculations or use a tool that automates this process to reduce the chance of errors.

- Unclear Payment Terms: Vague or missing payment terms can result in confusion about when payments are due or how to make them. Clearly specify due dates, payment methods, and any applicable late fees or discounts to avoid misunderstandings.

- Failing to Include a Unique Reference Number: Without a unique identifier, both you and your client may have difficulty tracking the transaction. Always assign a reference number to each document for easy identification and future reference.

- Not Including Taxes: If taxes are applicable, failing to include them or showing them incorrectly can lead to disputes. Clearly itemize taxes and their rates to ensure transparency and avoid issues with compliance.

How to Prevent These Mistakes

To avoid the issues mentioned above, consider implementing the following strategies:

- Use Automated Tools: Many online platforms and software offer automated billing systems that can reduce errors by calculating totals and taxes for you.

- Double-Check Information: Always review the document before sending it to your client to ensure all fields are filled out correctly and that there are no calculation mistakes.

- Standardize Your Process: By using a consistent format and structure for your documents, you can avoid missing important information or forgetting key details.

By paying attention to these common mistakes and taking steps to avoid them, you can create clear, accurate, and professional billing documents that improve your overall business operations.

Free vs Paid Invoice Templates: Which to Choose

When it comes to creating billing documents, you have a choice between using a no-cost option or investing in a paid service. Both options offer distinct advantages depending on your needs, business type, and level of customization. Understanding the key differences between the two can help you make the best decision for your operations.

Advantages and Disadvantages of Both Options

Choosing between a free or a paid solution depends on factors such as the complexity of your requirements, your business size, and how often you need to generate documents. Below is a comparison of the pros and cons of each option to help you decide which works best for your situation.

| Feature | Free Option | Paid Option |

|---|---|---|

| Cost | Zero cost, no upfront fee | Requires payment, subscription, or one-time fee |

| Customization | Limited customization options, may require manual editing | Greater flexibility, advanced design and personalization features |

| Design Options | Basic designs, usually without advanced features | Professionally designed templates with enhanced functionality |

| Support | No customer support, rely on user guides or forums | Access to customer support, assistance with setup and troubleshooting |

| Ease of Use | Simple to use for basic needs, might lack advanced features | User-friendly, designed for professionals, may include automated features |

| Updates | Rarely updated, may become outdated over time | Regular updates, bug fixes, and new features |

Which Option is Right for You?

The choice between a free and paid solution comes down to your specific needs and business context. For small businesses or freelancers with basic billing needs, a free option may be sufficient. It offers simplicity and saves on costs, though it may lack advanced features and customizability. However, for larger businesses or those requiring more robust features, such as automation, branded designs, and customer support, investing in a paid option may offer more long-term value.

Ultimately, choosing the right billing document solution will depend on how often you need to generate such documents, how much customization is required, and whether you are willing to invest in premium features for added convenience and professionalism.

Best Practices for Professional Invoices

Creating well-structured billing documents is essential for maintaining professionalism and ensuring timely payments. A clear and detailed record not only reflects positively on your business but also helps avoid confusion and disputes. Following best practices when designing and sending your billing documents can streamline the process and improve your client relationships.

Key Practices for Effective Billing Documents

Here are some best practices to follow when creating professional billing documents:

| Best Practice | Description |

|---|---|

| Clear and Concise Information | Ensure all relevant details such as client information, item descriptions, quantities, and prices are clearly listed and easy to understand. |

| Include a Unique Reference Number | Assign a unique number to each document to make tracking and future reference easier for both you and the client. |

| Professional Design | Use a clean, easy-to-read layout with consistent fonts, colors, and alignment. A polished design enhances your business’s credibility. |

| Timely Submission | Send the document promptly after the transaction is completed to avoid any delays in payment processing. |

| Clearly Defined Payment Terms | Be explicit about payment methods, due dates, and any late fees or discounts. This ensures the client understands when and how to pay. |

| Tax Information | If applicable, include the relevant tax rates and amounts. This ensures transparency and reduces the risk of disputes over pricing. |

| Proof of Transaction | Whenever possible, provide supporting documentation such as receipts, delivery notes, or contracts to back up the charges. |

Additional Tips for Smooth Transactions

In addition to the above best practices, consider these additional tips for ensuring smooth and efficient billing:

- Stay Organized: Keep a record of all billing documents and payments for easy tracking and future reference.

- Follow Up on Late Payments: If payments are delayed, send a polite reminder with clear details of the outstanding amount and due date.

- Maintain Professional Language: Keep your tone polite an

How Billing Documents Improve Your Business

Well-structured billing records are essential for maintaining smooth financial operations and building trust with clients. Proper documentation not only ensures that transactions are clear and transparent, but it also plays a key role in improving cash flow, customer relations, and overall business efficiency. By using organized and detailed billing statements, businesses can streamline processes, reduce errors, and enhance their professionalism.

Key Benefits for Your Business

Here’s how accurate and professional billing records can have a positive impact on your business:

Benefit Explanation Improved Cash Flow Clear billing documents ensure that clients are aware of payment terms and due dates, helping to speed up payments and reduce delays. Better Client Relationships Accurate and transparent records demonstrate professionalism and help build trust with clients, fostering long-term relationships. Increased Organization Having structured billing records helps businesses stay organized by tracking outstanding payments and maintaining a clear financial history. Legal Protection Well-documented transactions serve as legal proof of services or products provided, offering protection in case of disputes or misunderstandings. Improved Tax Compliance Accurate records are crucial for proper tax reporting, helping to ensure your business stays compliant with tax regulations and avoids penalties. How to Maximize the Impact of Your Billing Documents

To fully leverage the benefits of billing records, consider the following tips:

- Stay Consistent: Use a standardized format for all your records to ensure consistency and reduce errors.

- Automate the Process: Implement invoicing software to reduce manual work, minimize mistakes, and ensure timely billing.

- Follow Up Promptly: If payments are delayed, follow up with clients in a polite and professional manner to keep cash flow on track.

By making sure your billing process is efficient, organized, and transparent, you can not only improve your cash flow and cl

Integrating Templates with Accounting Software

Integrating billing documents with accounting software can greatly enhance the efficiency of your financial management. By automating the creation and tracking of records, this integration helps streamline operations, reduce errors, and ensure accurate reporting. Connecting your billing process with accounting tools allows for better organization, faster payments, and seamless synchronization with other financial activities.

Benefits of Integration

Here are some key advantages of integrating your billing records with accounting software:

- Automatic Data Entry: Reduces manual input by automatically transferring billing data into your accounting system, saving time and minimizing errors.

- Real-Time Updates: Changes made to your billing documents, such as updates to totals or payment statuses, are instantly reflected in your financial records.

- Improved Reporting: Integration allows for more accurate financial reports by ensuring all transactions are properly recorded and categorized.

- Faster Payment Processing: By linking to payment gateways or tracking systems, clients can pay quickly and efficiently, improving cash flow.

- Better Tax Compliance: The system can automatically calculate taxes and generate reports to assist with accurate tax filings.

Steps to Integrate Billing Documents with Accounting Software

To integrate your billing documents with accounting software, follow these steps:

- Choose Compatible Software: Ensure that your accounting software can integrate with your existing billing platform or document creation tool.

- Set Up Your Accounts: Configure your software to match your business needs, including setting up clients, payment methods, and tax rates.

- Link Documents to Accounting Records: Use the integration feature to automatically sync new billing entries with your accounting system.

- Test the Integration: Run a few test transactions to ensure the system is working correctly and data is being accurately transferred.

- Train Your Team: Make sure your staff is familiar with the new process to fully take advantage of the integration.

By integrating your billing processes with accounting software, you not only save time and reduce errors but also gain a more comprehensive view of your financial health, allowing for better decision-making and improved business growth.

How to Personalize Your Invoice Template

Customizing your billing documents not only enhances professionalism but also ensures that your branding is consistently represented. By adjusting certain elements, you can create a unique and personalized look that aligns with your business’s identity. Personalizing your documents helps leave a lasting impression on clients and provides clarity in your communications, making it easier for them to process and understand your charges.

Steps to Personalize Your Billing Documents

Here are some effective ways to personalize your billing documents:

- Include Your Business Logo: Adding your company logo at the top of the document reinforces your brand identity and makes the document look more professional.

- Customize Colors and Fonts: Use your brand’s colors and fonts to create a cohesive look across all your documents, making them easily recognizable to your clients.

- Add a Personal Touch with a Message: Including a short, professional note or thank you message at the bottom of the document can make clients feel appreciated and strengthen your business relationship.

- Provide Detailed Item Descriptions: Personalize the descriptions of products or services to clearly explain what was provided, adding value and transparency for your clients.

- Set Custom Payment Terms: Include tailored payment instructions or options that best suit your business operations, whether it’s bank transfer, online payment links, or other methods.

- Unique Reference Number: Assign a distinct reference number for every document to help keep things organized and easy to track in your records.

Why Personalization Matters

Personalizing your billing records not only sets you apart from competitors but also helps in establishing your brand’s voice. It adds professionalism and helps in building trust with your clients, which is essential for long-term relationships. A personalized approach also reduces confusion by providing clear and concise information in a format your clients are familiar with, which can accelerate payment processing.

By taking the time to make your billing documents reflect your business’s personality, you contribute to a better client experience while ensuring that your transactions are organized and professional.

Free Billing Documents for Small Businesses

For small businesses, managing financial transactions efficiently is essential to maintaining smooth operations. One of the most important tools for any business is having a reliable and simple system for generating detailed billing statements. Using pre-designed documents that are available at no cost can help small business owners streamline their financial processes without investing in expensive software or services. These ready-made solutions often include essential features and a professional design, allowing you to focus on what matters most–growing your business.

Many no-cost billing options are available for small businesses, offering flexibility and customization. These documents often come in a variety of formats, from simple templates to more detailed layouts, ensuring that you can select the one that fits your specific needs. Whether you’re a freelancer, a contractor, or a small business owner, these documents help ensure that your transactions are clear, professional, and easy for clients to understand.

By using these no-cost solutions, small businesses can save time, reduce administrative overhead, and maintain a professional image with minimal effort. Simple, customizable billing statements are a great starting point for those looking to optimize their invoicing without breaking the bank.

What Makes a Good Billing Document

A well-designed billing document is more than just a request for payment; it serves as a professional representation of your business and a key tool for maintaining clear communication with your clients. The right document ensures that all the necessary details are presented in a clear and organized manner, making it easy for both parties to understand the terms of the transaction. A good billing document helps build trust, streamline payments, and minimize the risk of confusion or disputes.

To be effective, a billing document must include several key features that make it easy to read, complete, and track. These features ensure that all relevant information is included and easy to access. Additionally, the document should be customizable to fit the unique needs of your business and reflect your brand’s identity, providing a professional and cohesive appearance.

In the next sections, we will explore the essential elements that make a billing document effective and how they contribute to efficient financial management.

How to Save Time with Templates

Using pre-designed documents for business transactions can significantly reduce the time spent on administrative tasks. Instead of creating each document from scratch, having a structured format allows you to quickly fill in the necessary details, such as client information, pricing, and dates. This streamlined approach saves you time and minimizes errors, allowing you to focus on other important aspects of running your business.

Key Advantages of Using Pre-Designed Documents

Here are some of the key benefits of using pre-made formats for your financial records:

- Faster Creation: Pre-designed formats eliminate the need for repetitive setup, enabling you to quickly generate professional records with just a few clicks.

- Consistency: Using the same structure for all your transactions ensures consistency, reducing the chances of errors and confusion.

- Customization: Most formats are customizable, allowing you to adapt them to your specific business needs while maintaining a professional look.

- Time-Efficiency: By reusing the same framework, you free up time to focus on other critical tasks like customer service or product development.

Practical Tips for Maximizing Efficiency

To further maximize time savings, consider the following strategies:

- Automate Repetitive Tasks: Use software that can auto-fill standard information, like client details or product descriptions, to speed up the process.

- Organize Your Files: Keep all your documents stored in an easily accessible format, so you can quickly retrieve and modify them when needed.

- Use Cloud-Based Solutions: Access and edit your documents from anywhere, ensuring that you’re never far from completing an essential task.

By incorporating pre-designed formats into your business workflow, you can cut down on time spent on paperwork and improve overall efficiency, ultimately helping your business run smoother and more effectively.

Invoice Document Resources for Entrepreneurs

As an entrepreneur, managing your business finances efficiently is essential for growth and stability. One of the key tools for achieving this is having access to reliable resources that help you create professional billing documents. Fortunately, there are numerous resources available online that provide customizable, easy-to-use documents designed specifically for business owners. These resources help save time, ensure consistency, and streamline your financial processes, allowing you to focus more on running and expanding your business.

Top Resources for Entrepreneurs

Here are some of the most popular platforms and tools that entrepreneurs can use to access customizable billing documents:

Resource Description Google Docs A free tool that offers simple, customizable documents that can be tailored to your business needs, allowing for quick edits and easy sharing with clients. Microsoft Word Microsoft Word provides professional templates that can be easily personalized. Many businesses prefer this option due to its extensive formatting and editing capabilities. Invoice Generator An online tool that allows entrepreneurs to generate and customize billing documents quickly, often with the option to download or email them directly. Zoho Invoice A comprehensive invoicing platform that provides a variety of templates and allows for integration with other business tools like accounting and CRM systems. Canva Canva offers visually appealing and easy-to-customize document templates, making it an ideal choice for businesses that want to create eye-catching, professional records. Why These Resources Matter for Entrepreneurs

Having access to these resources can save entrepreneurs valuable time and effort. By using ready-made formats, entrepreneurs can quickly create and send documents without worrying about formatting or design. This helps keep operations running smoothly, reduces administrative tasks, and ensures that financial documentation is accurate and professional. Moreover, many of these platforms allow for easy tracking of payments, automated reminders, and integration with accounting systems, all of which contribute to a more organized and efficient business workflow.

By leveraging these resources, entrepreneurs can focus more on growing their business and less on administrative details, while ensuring that their clients always receive clear and professional financial documents.