Download and Customize Billing Invoice Template for Microsoft Word

Managing financial transactions efficiently is essential for any business. One of the key elements of this process is creating clear and professional payment documents. Having a ready-made solution that can be customized for your specific needs not only saves time but also ensures consistency in your financial communication.

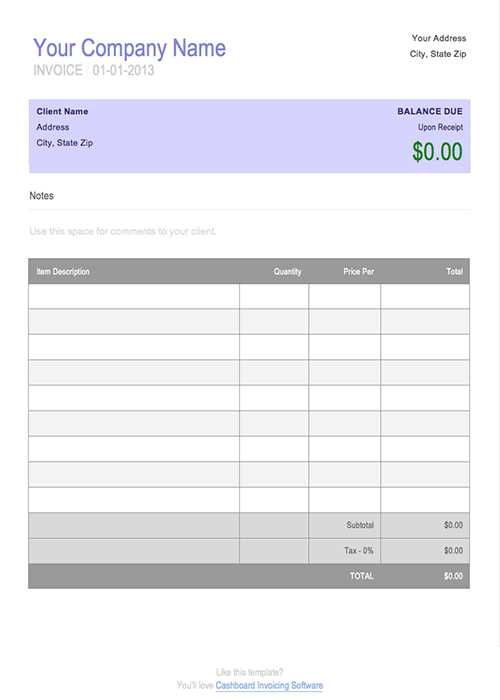

By using a digital document format that allows for quick editing, you can easily adjust the details for each transaction, such as amounts, dates, and payment terms. These customizable files are perfect for businesses of all sizes, from freelancers to large corporations, as they streamline the process of preparing and sending important financial paperwork.

With the right set of tools, you can produce visually appealing and accurate payment documents in no time. Whether you need to include tax rates, discounts, or different currencies, these editable options provide all the flexibility you need to meet your clients’ or customers’ expectations.

Billing Invoice Template for Professionals

For any professional, the ability to create clear and organized financial documents is essential. A well-structured document not only enhances credibility but also ensures that all necessary payment details are presented in a concise and easily understandable manner. Using a customizable tool for this purpose can streamline the creation process and allow for consistent formatting across all transactions.

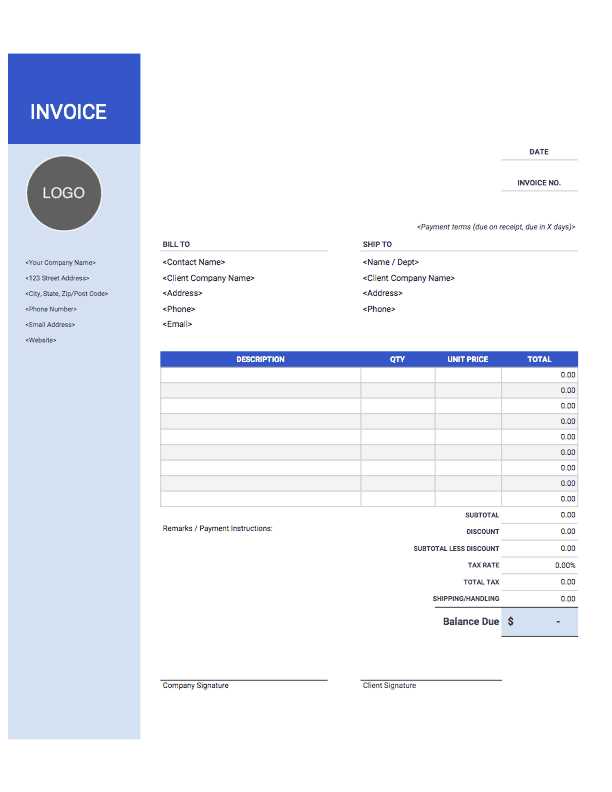

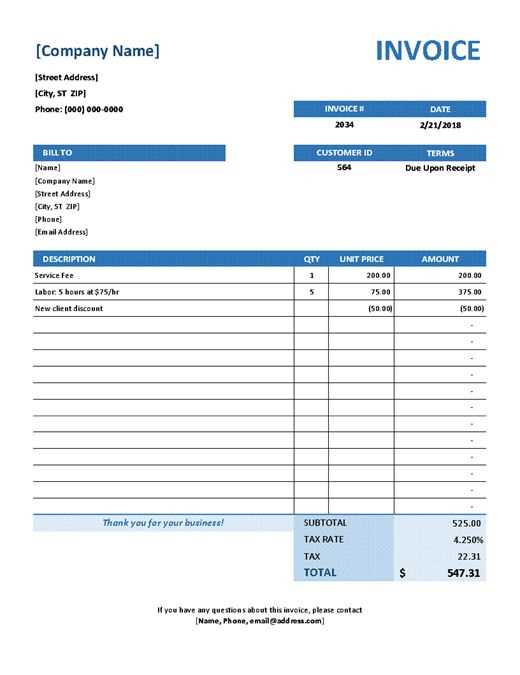

Professionals often need to send payment requests that reflect their business’s image and provide a clear breakdown of services or products delivered. A customizable document format can be adjusted to include client information, itemized charges, payment terms, and more, helping you maintain accuracy and professionalism in every communication.

Key Features for Professionals

When selecting a format for creating your financial documents, it’s important to consider the following features:

| Feature | Description |

|---|---|

| Customizable Fields | Ability to edit company details, client information, and payment terms. |

| Itemized List | Allows a detailed breakdown of products or services provided. |

| Professional Design | A clean, easy-to-read layout that aligns with business branding. |

| Tax and Discount Sections | Spaces to add tax rates, discount percentages, and other relevant charges. |

| Payment Terms | Clear fields for specifying payment methods and due dates. |

Why Choose This Approach?

Choosing a customizable document format allows for quick adjustments while maintaining a professional appearance. Whether you are handling a small freelance project or managing larger corporate accounts, this flexibility ensures you can present your payment requests in a polished and consistent manner, fostering trust and efficiency in your business dealings.

How to Create an Invoice in Word

Creating professional payment documents doesn’t have to be complicated. With the right approach and tools, you can design an effective document that clearly communicates the details of a transaction. Using a familiar text editing program, you can customize each document to suit your needs and ensure that all necessary information is included, from client details to payment terms.

Whether you’re preparing a simple document for a freelance project or a more detailed one for a business transaction, the process of creating a professional-looking financial statement is straightforward. By following a few key steps, you can produce a polished document quickly and easily, saving time and effort on your administrative tasks.

Step-by-Step Guide

To get started, follow these simple steps:

- Open a New Document: Start by opening a new file in your text editing program and set the page layout to your preference.

- Include Basic Information: Add fields for your company’s name, address, and contact details. Include space for the recipient’s name and contact info as well.

- Add Transaction Details: Create sections to list the items or services provided, along with their corresponding prices and quantities.

- Set Payment Terms: Specify due dates, accepted payment methods, and any applicable taxes or discounts.

- Format for Clarity: Use bold or italicized text for headings and section titles to make the document easy to read and understand.

Design Tips for a Polished Look

To ensure that your document looks professional, keep the layout clean and consistent. Use tables to organize information such as pricing and item descriptions. Make sure the font is legible and that there is enough spacing between sections to avoid a cluttered appearance. You may also want to add your company logo or branding colors to enhance the document’s visual appeal.

By following these simple steps, you can create an efficient, well-organized document that communicates all the necessary details in a clear and professional way.

Benefits of Using Microsoft Word Templates

Using pre-designed document formats can significantly simplify the process of creating professional financial paperwork. These ready-to-use solutions offer numerous advantages, making them a popular choice for businesses of all sizes. Instead of starting from scratch, you can focus on customizing the content while ensuring that the layout remains clean and consistent.

By leveraging a structured format, you can save time, reduce errors, and maintain a high standard of professionalism in your financial communications. These advantages are particularly valuable for small business owners, freelancers, and anyone who regularly needs to create accurate and polished payment-related documents.

Time and Effort Saving

One of the most significant benefits of using ready-made formats is the amount of time it saves. Rather than spending hours creating a layout from scratch, you can:

- Quickly adjust pre-built designs: Just fill in the relevant details and the format is ready to go.

- Focus on customization: Personalize the document with your company’s logo, colors, and other branding elements.

- Eliminate formatting errors: Pre-designed structures reduce the risk of mistakes related to text alignment, font sizes, or margins.

Professional Appearance

Consistency in business documents is key to building trust with clients and customers. Ready-to-use designs ensure that your documents appear uniform and professional every time. These formats often include:

- Clean, organized layouts: Information is presented in a structured manner, making it easy to follow.

- Clear sections: Proper space for details such as services, costs, and payment terms, helping you avoid cluttered or difficult-to-read content.

- Legible typography: Easy-to-read fonts and formatting choices that improve the overall presentation of your documents.

By using a structured format, you can ensure that each document is consistently professional and clear, which is critical when dealing with financial matters.

Free Billing Templates for Small Business

For small businesses, managing finances efficiently can be challenging, especially when dealing with multiple transactions and clients. Having access to pre-designed document formats helps streamline this process by allowing business owners to focus on their core operations while maintaining professional communication. These free resources offer a great starting point, ensuring that every document is accurate, consistent, and easy to generate.

Whether you’re a freelancer, a startup, or a growing small enterprise, using ready-made financial forms can save you time and reduce administrative burdens. Customizable formats give you the flexibility to adapt each document to the unique needs of your business, from pricing and payment terms to personalized branding.

Advantages for Small Business Owners

Using ready-made formats comes with a variety of benefits, particularly for those running smaller operations. Some key advantages include:

- Cost-effective solution: Many high-quality, free resources are available, reducing the need for expensive software or services.

- Quick setup: Pre-designed layouts allow you to create documents in just a few minutes without needing advanced technical skills.

- Customization: Adapt the format to suit your business needs, whether you’re offering different services or managing multiple clients.

- Consistency: Use the same format for all transactions, ensuring a uniform appearance and improving your business’s overall presentation.

Where to Find Free Resources

There are numerous websites offering free downloadable financial document formats specifically designed for small businesses. Many of these are compatible with commonly used text editors and are fully customizable. Popular platforms that offer these resources include:

- Online business communities: Many offer free downloadable forms shared by other entrepreneurs.

- Document resource websites: Websites focused on providing business-related documents often include a wide range of formats tailored to different industries.

- Freelance and small business platforms: Many sites that cater to freelancers also provide useful resources like this as part of their service offerings.

By taking advantage of these free resources, small business owners can ensure that their transactions are handled professionally, all while saving valuable time and money.

Steps to Customize an Invoice Template

Customizing a ready-made document format allows you to create personalized financial statements that reflect your business’s branding and specific needs. With a few simple adjustments, you can tailor the layout, content, and design to suit every client or transaction. This step-by-step guide will help you make the most out of these pre-built resources, saving you time while maintaining a professional appearance.

By customizing your documents, you ensure that all the necessary details, such as company information, payment terms, and itemized charges, are accurate and clear. The following steps will help you create documents that are both functional and visually appealing, ensuring consistency across all your transactions.

Step-by-Step Customization Process

Follow these steps to personalize your document:

- Open the Pre-designed Document: Start by opening the blank or pre-formatted document in your text editor of choice.

- Update Company Information: Replace the default business name, address, phone number, and email with your own contact details.

- Modify Client Details: Add the recipient’s name, address, and contact information to ensure the document is specific to the transaction.

- Adjust the Itemized List: Edit the list of products or services, including descriptions, quantities, and prices, according to your offerings.

- Specify Payment Terms: Update the payment due date, accepted methods, and any late fees or discounts, as required.

- Include Additional Information: Add extra fields for notes, tax calculations, or special terms to ensure the document covers all aspects of the transaction.

Design and Format Adjustments

Once the content is updated, focus on improving the design and readability of the document. Here’s how:

- Consistent Fonts: Use easy-to-read fonts for headings and body text. Make sure font sizes are consistent throughout the document.

- Align Information Properly: Use tables to keep product details and amounts aligned neatly, making the document look organized.

- Highlight Important Sections: Use bold or underlined text to emphasize payment terms, due dates, or any discounts offered.

- Incorporate Branding: Add your company logo, colors, or any other branding elements to make the document uniquely yours.

By following these steps, you can create professional, personalized financial statements that are tailored to your specific business needs and ensure a seamless client experience.

Why Choose Word for Invoices

When it comes to creating professional financial documents, many businesses turn to commonly available text-editing software. This option offers several advantages, such as ease of use, familiarity, and the ability to create polished and customizable documents without requiring specialized software. Its simple interface and powerful features make it an ideal choice for generating documents that need to be both functional and aesthetically pleasing.

Choosing a versatile document editor helps ensure that you can produce a wide range of business materials, including transaction statements, contracts, and other important paperwork, with a consistent format and professional look. Its compatibility with different devices and file-sharing platforms adds to its accessibility and usefulness.

Advantages of Using a Document Editor

Here are several reasons why this tool is often the go-to option for creating financial paperwork:

- Familiarity: Most users are already familiar with the software, reducing the learning curve and making it easy to get started.

- Customizability: You can tailor the design to fit your business needs, including adding logos, adjusting fonts, or modifying layouts.

- Formatting Flexibility: Use built-in features like tables, bullet points, and customizable styles to make your documents organized and easy to read.

- Wide Compatibility: The documents can be opened and edited across different platforms and shared with clients without compatibility issues.

How This Helps Your Business

Using a widely available document editor helps you maintain consistency across your business paperwork while ensuring ease of use. The ability to create, edit, and save your documents quickly contributes to smoother administrative operations and fosters a more professional image in your client interactions.

Tips for Efficient Invoice Design

Designing financial documents that are both functional and easy to read is essential for maintaining a professional image and ensuring clarity. A well-organized layout can improve the client’s experience and make it easier for them to understand the charges, payment terms, and other important details. With the right design elements, you can create documents that not only convey necessary information but also reflect your business’s professionalism.

By following some simple design principles, you can enhance the readability, organization, and visual appeal of your financial documents, making them more effective and helping streamline your administrative processes.

Essential Design Elements

Here are some key elements to consider when designing your document:

- Clear Headings: Use bold, larger text for section titles to make them stand out and guide the reader through the document.

- Proper Use of Tables: Organize information like charges, quantities, and item descriptions in tables to ensure clarity and consistency.

- Consistent Layout: Stick to a uniform format for every document you create. Consistency enhances professionalism and makes your documents easily recognizable.

- Whitespace: Don’t overcrowd the document. Use adequate spacing between sections to make the content less intimidating and more approachable.

Practical Tips for Visual Appeal

To make your documents not only functional but visually appealing, consider the following design tips:

- Font Choice: Use easy-to-read fonts such as Arial or Times New Roman. Keep the font size for body text between 10-12 points to maintain readability.

- Color Scheme: Stick to a simple color palette that complements your branding. Too many colors can distract from the content.

- Logo and Branding: Include your company logo and brand colors to give the document a personalized and professional touch.

- Alignment: Ensure all text and tables are aligned properly. Consistent left-alignment for text and right-alignment for numbers or amounts can help make the document neat and easier to navigate.

By keeping these design tips in mind, you can create documents that are not only functional but also enhance your brand’s image and professionalism in every interaction.

Common Mistakes in Invoice Creation

Creating financial documents requires careful attention to detail to ensure accuracy and professionalism. Mistakes in these documents can lead to confusion, delayed payments, and even damage to your business’s reputation. Understanding the most common errors and how to avoid them is crucial for maintaining smooth operations and fostering trust with your clients.

While preparing payment requests may seem straightforward, several common pitfalls can make these documents less effective or professional. Below are some of the most frequent mistakes made when drafting payment statements and how to avoid them.

Frequent Errors in Document Creation

Here are the most common mistakes to watch out for when creating your financial documents:

- Missing or Incorrect Client Information: Failing to include or inaccurately listing your client’s name, address, or contact details can cause confusion and delays in payment. Always double-check client details before finalizing the document.

- Inconsistent or Unclear Payment Terms: Not specifying clear payment terms such as due dates, payment methods, and late fees can lead to misunderstandings. Ensure all terms are easy to understand and prominently displayed.

- Incorrect or Unclear Charges: Errors in pricing, quantities, or item descriptions can create disputes. Always verify the amounts and ensure that each charge is correctly explained and calculated.

- Omitting Tax Information: Failing to include applicable taxes or neglecting to break them down clearly can lead to issues, especially for businesses that are legally required to collect taxes. Always include the tax rate and total amount due.

- Formatting Issues: Poor formatting can make a document difficult to read and look unprofessional. Avoid overcrowding the document with too much text or information. Use appropriate headings, spacing, and alignment to ensure the document is easy to navigate.

How to Prevent These Mistakes

By following best practices and checking your work carefully, you can minimize the risk of errors:

- Review Client Information: Double-check all personal and business details before sending the document to ensure they are accurate and up-to-date.

- Clarify Payment Terms: Clearly state payment deadlines, accepted methods, and any discounts or penalties for late payments. Ensure there’s no ambiguity.

- Proofread for Accuracy: Always review each line for spelling, arithmetic, and clarity before finalizing your document.

- Use Templates: Consider using pre-built formats that guide you through the process, helping you avoid common mistakes while saving time.

By being aware of these mistakes and taking steps to avoid them, you can ensure that your documents are accurate, clear, and professional, leading to smoother business transactions and a stronger reputation with your clients.

How to Add Company Branding to Invoices

Incorporating your company’s branding into financial documents not only enhances their professionalism but also reinforces your brand identity with clients. By adding consistent design elements such as logos, colors, and fonts, you ensure that your documents reflect your company’s image and make a lasting impression.

Branding these documents can help establish trust and recognition with clients, making your communications feel more cohesive. It’s an important step for businesses looking to maintain a consistent visual identity across all their materials, from marketing content to transactional paperwork.

Key Branding Elements to Include

When customizing financial documents with your brand, consider these key elements:

- Logo: Add your company’s logo at the top of the document. This is often placed in the header, either centered or aligned to the left or right, depending on your preferred layout.

- Color Scheme: Use your brand’s color palette for text, borders, and headings to create a unified look. Ensure the colors are professional and easy to read.

- Font Selection: Stick to the fonts that are part of your brand guidelines. Choose a clean, readable font for the body text and a more distinctive font for headings or titles.

- Tagline or Slogan: If your company has a tagline, consider including it below your logo or at the bottom of the document for added brand reinforcement.

Practical Steps for Customizing Documents

To incorporate your branding into these documents effectively, follow these simple steps:

- Upload Your Logo: Insert your logo in a prominent location, typically at the top of the document. Ensure it is clear and appropriately sized for readability.

- Apply Brand Colors: Adjust the background, text, and accent colors to align with your branding. Use them for headings, borders, or highlights to create visual harmony.

- Adjust Fonts: Set the fonts for the document according to your company’s style guide. Ensure the fonts are legible, professional, and consistent throughout.

- Include Contact Information: Add your company’s contact details, such as website, phone number, and email, in a footer or at the top to make it easy for clients to reach out.

By following these guidelines, you can ensure that your financial documents align with your company’s overall brand, promoting a professional and cohesive image with every transaction.

Best Practices for Invoice Formatting

Proper formatting is essential when creating financial documents, as it ensures clarity, professionalism, and ease of understanding for both you and your clients. A well-structured document allows clients to quickly locate the information they need, such as the total amount due, payment terms, and a breakdown of charges. Following best practices for document layout and design can help you create organized and visually appealing records that facilitate smooth transactions.

By adhering to proven formatting strategies, you can make sure your documents are not only functional but also polished, improving the client experience and reducing the chances of misunderstandings or disputes.

Key Elements of Effective Document Layout

When formatting your documents, consider these important design elements:

- Clear Headings and Sections: Break the document into logical sections (e.g., contact details, services rendered, payment terms) with distinct headings to make it easy for readers to navigate.

- Readable Font Size and Style: Use a standard font size (10–12 pt) for the body text and a larger size (14–16 pt) for headings. Choose professional, easy-to-read fonts like Arial, Calibri, or Times New Roman.

- Consistent Alignment: Align text uniformly, using left alignment for most content and right alignment for numeric values (like amounts or totals) to enhance readability.

- Use of Whitespace: Don’t overcrowd the document. Adequate spacing between sections and rows makes the content easier to digest and gives the document a clean, professional appearance.

Additional Formatting Tips

Here are a few more suggestions to optimize your document formatting:

- Tables for Clarity: Use tables to organize item descriptions, quantities, unit prices, and totals. This ensures the document remains neat and the information is easy to follow.

- Bold or Highlight Key Information: Make key information, like total amounts due or payment due dates, stand out by bolding or highlighting them, so they are easily noticeable.

- Footer for Contact Information: Include your company’s contact details (phone number, email, website) in the footer for easy reference by your client.

By following these best practices, you can create well-organized, visually appealing financial documents that promote transparency and professionalism, ensuring a positive client experience and smoother payment processes.

How to Include Tax and Discounts

Including taxes and discounts in your financial documents is an essential part of accurate and transparent billing. Properly calculating and displaying these amounts ensures that both parties are clear about the total charges and helps prevent any confusion or disputes later on. Taxes should reflect the applicable rate for your region or industry, while discounts can be used to encourage prompt payments or reward loyal customers.

Understanding how to properly calculate and present these amounts is key to maintaining a professional and trustworthy relationship with your clients. Here’s a guide on how to include taxes and discounts clearly and correctly in your documents.

Including Tax in Your Document

To include tax in your financial documents, follow these steps:

- Determine the Correct Tax Rate: Ensure you know the appropriate tax rate based on your region or the nature of the product or service you’re offering. Different items may be taxed at different rates, so always check local laws.

- Calculate the Tax Amount: Multiply the subtotal (the total of all items or services) by the tax rate. For example, if the subtotal is $100 and the tax rate is 10%, the tax amount would be $10.

- Clearly Label Tax: Display the tax amount in a separate line or section, and clearly label it so that it’s easy for your client to see. For example, you can use “Tax (10%)” or “Sales Tax” with the corresponding amount.

- Total Amount: After including tax, sum up the subtotal and the tax to get the final total amount due. Ensure this total is highlighted or bolded for clarity.

Adding Discounts to Your Document

Discounts can be a great way to reward loyal clients or incentivize early payment. Here’s how to include them:

- Specify Discount Type: Clearly state the type of discount being applied, whether it’s a percentage off or a fixed amount. For example, “5% discount for early payment” or “$10 off for returning customers.”

- Calculate the Discount: If it’s a percentage discount, multiply the subtotal by the percentage. For example, if the subtotal is $100 and the discount is 5%, the discount amount is $5. If it’s a fixed amount, simply subtract that from the total.

- Subtract the Discount: Deduct the discount from the subtotal to show the adjusted amount. Ensure the discount is clearly marked in the document so your client can see how it affects the total.

- Show the Adjusted Total: After applying the discount, display the new total amount due. Make sure it’s easy to distinguish from the original total to avoid confusion.

By including taxes and discounts in a transparent and organized manner, you help e

Ensuring Accuracy in Financial Documents

Creating accurate financial documents is critical to maintaining professional relationships and ensuring smooth business transactions. Any errors, whether in calculations, client details, or terms, can cause confusion, delayed payments, and potential disputes. A simple mistake can undermine trust and complicate the payment process, so it’s essential to carefully review all aspects before finalizing the document.

Here are some practical steps and best practices for ensuring accuracy in your financial records, particularly when using word processing software to create and edit them.

Key Steps to Guarantee Accuracy

Follow these steps to avoid common errors and ensure your documents are accurate:

- Double-Check Client Information: Verify that the client’s name, address, contact details, and any other personal information are accurate. This can prevent confusion and ensure that the document reaches the right person or department.

- Review Product or Service Descriptions: Make sure that all items or services listed are described correctly, with the appropriate quantity and price. Double-check the item codes or service names to ensure there are no discrepancies.

- Verify Calculations: Before finalizing the document, carefully check the math behind the charges. Use a calculator or automated tool if needed to ensure that subtotals, taxes, discounts, and totals are accurate.

- Check Payment Terms: Ensure that the payment terms (due date, late fees, and payment methods) are clear and correct. These should match any previous agreements or arrangements with the client.

Best Practices for Proofreading

To catch any errors before sending your document, implement these proofreading best practices:

- Take a Break Before Proofreading: After creating the document, step away for a short time before reviewing it. This helps you approach it with fresh eyes and increases your chances of spotting mistakes.

- Use Spell Check: Make use of the built-in spelling and grammar check tools in your word processing software to catch any typos or grammatical issues.

- Cross-Reference with Previous Documents: If you have a similar document or contract in place, compare it with the new one to ensure consistency in terms and figures.

- Get a Second Opinion: If possible, have a colleague or another team member review the document for accuracy before sending it to the client. A fresh perspective can help identify mistakes you may have overlooked.

By following these tips, you can significantly reduce the risk of errors and ensure that your financial documents are accurate, professional, and ready for use. This attention to detail not only saves time but also strengthens your client relationships and fosters trust in your business practices.

Making Your Documents Look Professional

When creating financial documents for clients, presentation matters just as much as the information itself. A well-designed, polished document not only conveys professionalism but also enhances trust and helps ensure that the payment process goes smoothly. The visual appeal of your document can leave a lasting impression, influencing how clients perceive your business and their experience with you.

Ensuring that your documents look professional involves more than just clarity in content; it requires thoughtful formatting, consistent branding, and attention to detail. By following a few key principles, you can elevate the overall appearance of your financial documents and make them stand out for all the right reasons.

Designing for Professionalism

Here are some essential design elements to consider when creating documents that reflect your professionalism:

- Use a Clean Layout: Keep the layout simple and uncluttered. Avoid overcrowding the document with too much text or unnecessary design elements. Make sure there is enough white space to allow the reader’s eyes to rest and the content to be easily digestible.

- Incorporate Your Brand Identity: Add your company’s logo, color scheme, and brand fonts to the document to ensure it aligns with your overall brand image. Consistent use of your branding across all materials helps to create a cohesive and professional appearance.

- Proper Alignment and Spacing: Align text and numerical data properly. Left-align text for readability and right-align numerical values for easy comparison. Maintain consistent spacing between sections, rows, and columns for a balanced and clean look.

- Choose a Professional Font: Select a simple, legible font that reflects a polished image. Avoid overly decorative fonts that can detract from the content. Stick with standard fonts like Arial, Helvetica, or Times New Roman, ensuring the font size is large enough for readability (10–12pt).

Formatting Best Practices

Beyond design elements, there are several formatting best practices that can enhance the professionalism of your documents:

- Clear Headings and Subheadings: Organize your document with distinct headings and subheadings. These help break down the content and guide the reader through the document.

- Highlight Key Information: Use bold or larger fonts for important information, such as the total amount due, due dates, or payment terms. This helps ensure these details are easily noticeable.

- Consistent Table Formatting: If you are listing items or services, use tables with uniform borders and consistent cell padding.

Managing Payments with Invoice Templates

Effectively tracking and managing payments is a crucial aspect of running a business. Having a clear, organized document for your financial transactions ensures that payments are tracked, processed, and recorded efficiently. By utilizing structured formats, businesses can provide clients with all necessary details for making payments, reducing confusion and improving cash flow.

One of the most effective ways to manage payments is by utilizing professional, well-organized payment documents. These documents provide the necessary information in an easy-to-read format and make the process of managing outstanding payments much smoother.

Key Information to Include for Effective Payment Management

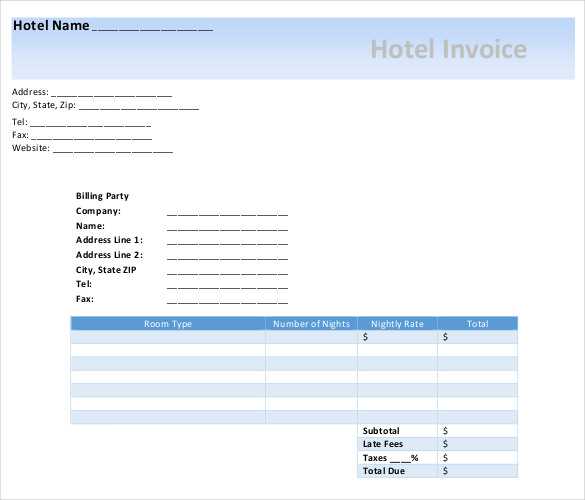

To facilitate smooth and timely payments, certain details must always be included in your financial documents:

- Client and Business Information: Ensure that both your contact details and the client’s are clearly listed. This ensures that both parties can communicate effectively regarding the payment.

- Clear Payment Terms: Clearly state when the payment is due, any applicable late fees, and the accepted payment methods (bank transfer, check, online payment, etc.).

- Payment Breakdown: Itemize the services or goods provided, including their individual prices, quantities, and subtotals. This transparency helps clients understand exactly what they are paying for.

- Tax and Additional Fees: If taxes or additional charges are applicable, ensure they are calculated and clearly displayed to avoid confusion.

Tracking Payments with Organized Documents

Once you’ve issued the document, it’s important to keep track of payments effectively. Using clear records with well-organized columns and rows can help you easily monitor when payments are made or overdue. Here’s a simple way to structure this information:

Service Description Unit Price Quantity Subtotal Tax Total Web Development $100.00 5 $500.00 $50.00 $550.00 Consultation $50.00 2 $100.00 $10.00 $110.00 Having a clear table like this helps both the business and the client understand the total amount due and the breakdown of charges. It’s also easier to update this document to reflect payments received, outstanding amounts, and any adjustments needed.

By using well-structured payment documents, businesses can efficiently manage cash flow, reduce errors, and ensure that clients are provided with clear and transparent information for making payments.

How to Save and Reuse Your Financial Document

Once you’ve created a well-structured and professional financial document, it’s important to save it properly so that it can be easily reused for future transactions. By saving your document in a reusable format, you can quickly update the details, such as amounts, dates, or client information, without having to start from scratch each time. This process not only saves time but also ensures consistency and accuracy across your documents.

Whether you need to send similar documents regularly or want to maintain a standard format for your business, reusing a previously created document can simplify your workflow and improve efficiency. Here are some practical steps on how to save and reuse your financial documents effectively.

Saving Your Document for Future Use

To make sure you can access and reuse your document quickly, consider the following options:

- Choose the Right File Format: Save your document in a widely used format like PDF or DOCX. PDF ensures that the layout remains intact and can be easily shared with clients, while DOCX allows you to make future edits if needed.

- Create a Template Folder: Keep all of your saved documents in a specific folder designated for financial documents or templates. This way, you can easily find and organize your files for future reference.

- Version Control: If you plan to make frequent updates, it’s helpful to save each version with a unique name, including a date or version number. This makes it easier to track changes and avoid confusion when wo

Using Document Formats for International Transactions

When conducting business globally, it’s essential to create clear and effective financial records that adhere to the requirements of different countries and cultures. International transactions often involve various currencies, languages, tax regulations, and other country-specific details. To streamline the process, having a well-structured document format that can easily be adapted to meet the needs of different clients worldwide is invaluable.

By utilizing pre-designed formats, businesses can quickly adjust their documents for international use, ensuring consistency and compliance with global standards. Whether you’re dealing with cross-border payments, offering products or services overseas, or working with clients who speak different languages, adapting your financial records to meet international requirements can save time and reduce errors.

Key Considerations for International Transactions

Here are some important factors to keep in mind when preparing documents for clients in different countries:

- Currency Conversion: Always ensure that the currency is clearly stated, and if necessary, provide conversion rates or the option to choose a preferred currency. Make sure that all prices are displayed correctly according to the current exchange rate.

- Language and Local Terminology: For clients in different regions, consider translating key sections of your document into their language. This ensures clarity and avoids any misunderstandings, particularly when using terms like payment terms or taxes.

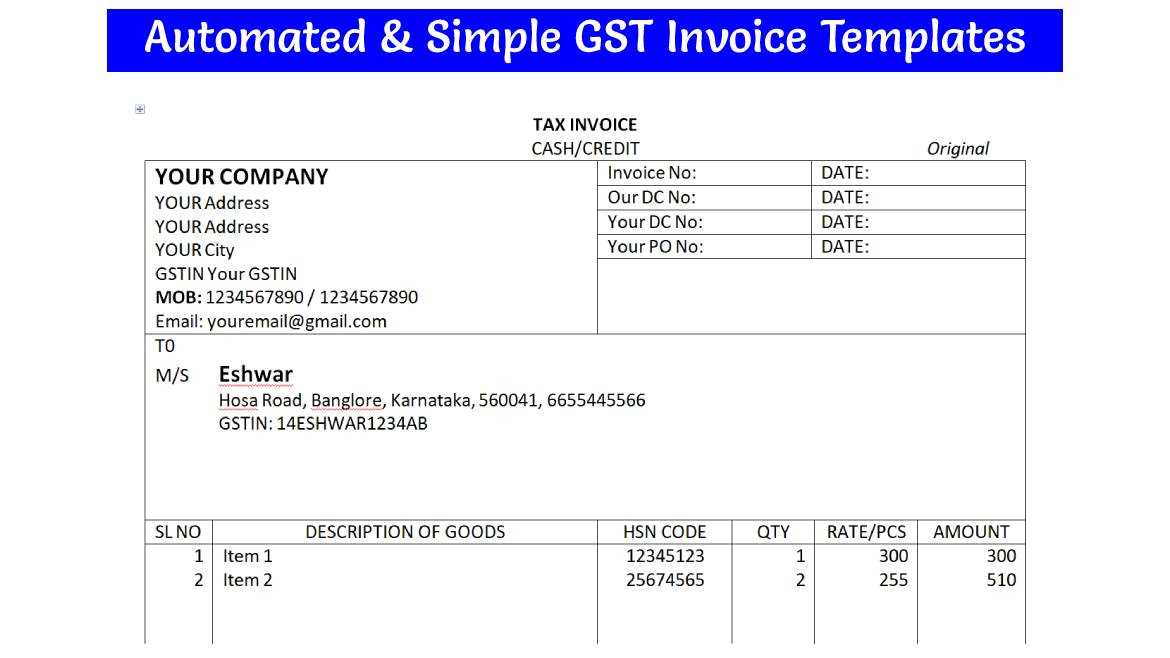

- Tax Regulations: Different countries have different tax laws. Make sure your documents reflect the appropriate tax rates, VAT (Value Added Tax), or GST (Goods and Services Tax) as required by the local government.

- Customs or Shipping Fees: If you’re shipping goods internationally, include any applicable customs duties or shipping fees in the document. These details are essential for both the buyer and seller to avoid surprises at later stages.

Formatting Your Documents for International Use

To keep your documents professional and easy to read, especially for international clients, follow these formatting tips:

Item Description Unit Price (USD) Quantity Subtotal Tax (VAT) Total (EUR) Product A $50.00 3 $150.00 $30.00 €160.00 Product B $70.00 2 $140.00 $28.00