Bill to Ship to Invoice Template for Efficient Invoicing

When managing transactions in any business, ensuring accuracy and clarity in payment requests is crucial. A well-organized document that captures the necessary details about a transaction can simplify processes for both the seller and the buyer. This section will walk you through the essential components of a structured payment request document, designed to ensure seamless communication and reduce the chances of errors or misunderstandings.

Efficient record-keeping starts with clear documentation. From the customer’s address to the shipment details, every piece of information plays a key role in ensuring that payments are processed correctly and timely. Creating a functional and precise document helps not only in maintaining business efficiency but also in fostering trust with clients.

In this guide, we’ll explore the core principles of crafting such documents, highlighting how you can customize them to fit your specific needs. Whether you are a small business owner or a larger corporation, mastering this aspect of your operations can save time, prevent confusion, and improve overall workflow.

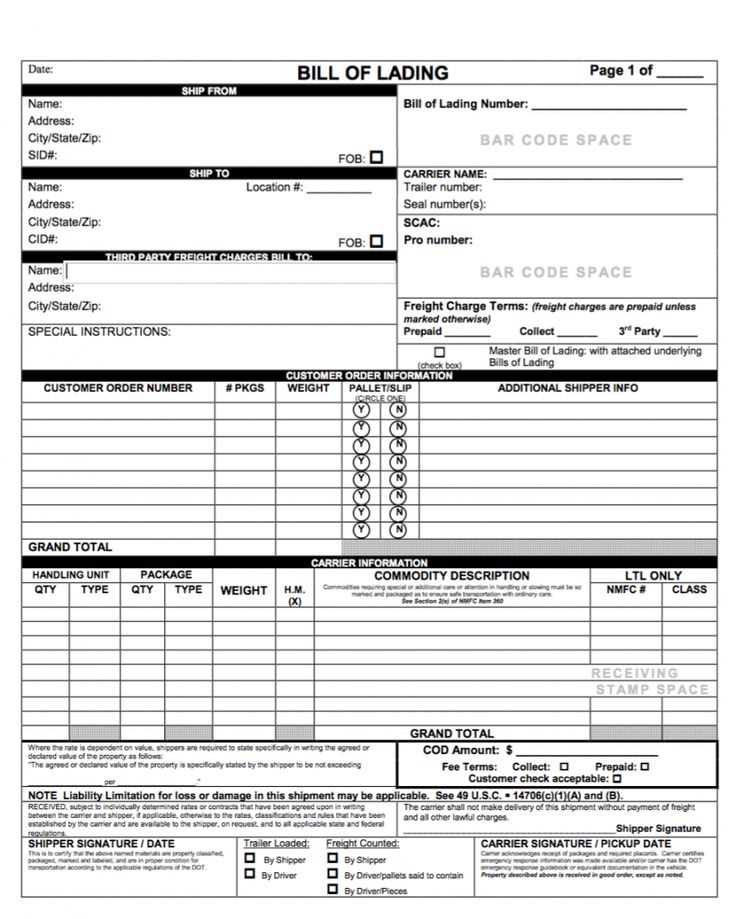

Billing and Delivery Document Guide

Creating an effective payment request document is vital for businesses that handle both the billing and shipping aspects of transactions. These records must clearly communicate essential details about both the buyer’s and the recipient’s information, ensuring smooth communication between all parties involved. A well-structured record not only guarantees accurate payment processing but also minimizes confusion when goods are being shipped or delivered.

Key Components of a Proper Document

The document should include key details such as the customer’s contact information, shipping address, payment terms, and a breakdown of the goods or services provided. Including these elements helps both the seller and the buyer track important aspects of the transaction and ensures that the goods reach the correct destination while maintaining transparency in the payment process.

Customizing Your Document for Specific Needs

To tailor the document to the unique needs of your business, consider including any additional information that may be relevant to specific clients or transaction types. For example, offering different payment terms or including discounts can help cater to varied customer needs. Customization ensures that the document not only serves its functional purpose but also aligns with the branding and style of your business.

Understanding Billing and Delivery Document

In any business transaction, clear communication of payment details and delivery information is essential. The record capturing both the buyer’s billing details and the destination address for goods must be carefully structured to ensure accuracy and reduce potential errors. Understanding how to properly combine these elements into a cohesive document is key to maintaining smooth operations and client satisfaction.

Essential Elements of the Record

Each document should contain specific pieces of information to ensure both the financial and logistical aspects are properly covered. The following are the most important components to include:

- Customer Billing Information: This section should outline the buyer’s name, address, and contact details for payment purposes.

- Recipient Details: If different from the billing address, this should include the name, address, and contact information of the party receiving the goods.

- Payment Terms: Clear terms should be listed, including the total amount due, payment deadlines, and accepted methods of payment.

- Goods/Services Description: An accurate breakdown of items or services provided should be listed with appropriate quantities and pricing.

Ensuring Accuracy and Clarity

To avoid mistakes and ensure the document fulfills its intended purpose, it’s important to cross-check both the payment details and delivery information before finalizing the record. A well-organized document that clearly separates billing and delivery addresses, payment expectations, and itemized lists helps to prevent confusion, especially when dealing with multiple parties or complex transactions.

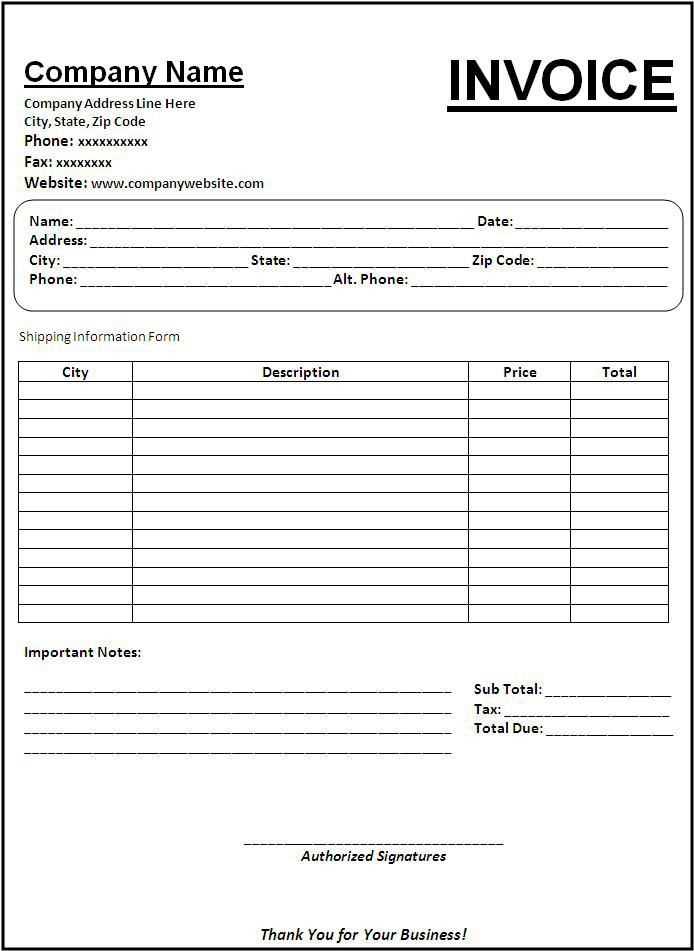

Key Elements of a Payment Request Document

For any transaction, the document used to request payment must include several key elements that ensure both clarity and accuracy. These essential components allow both the sender and the recipient to understand the details of the agreement, helping to avoid errors or misunderstandings. By including all necessary information, you make sure the payment process runs smoothly and efficiently.

Important Details to Include

The following elements should be present to ensure the document is complete and legally binding:

- Contact Information: Include the full name, address, and contact details of both the buyer and the seller. This ensures all parties are clearly identified.

- Transaction Breakdown: A clear list of goods or services provided, with quantities, descriptions, and pricing for each item. This transparency prevents confusion about what was purchased.

- Payment Terms: Specify the total amount due, due dates, applicable taxes, and any early payment discounts or late fees.

- Unique Reference Number: A reference number helps in tracking and managing records, particularly when dealing with multiple transactions.

- Delivery and Billing Addresses: If applicable, both the buyer’s billing address and the destination address for the goods should be clearly noted.

Additional Considerations

Beyond the basic elements, you may also want to consider including optional details that could improve the document’s usefulness:

- Payment Methods: Clearly outline the acceptable methods of payment (e.g., bank transfer, credit card, online payment portals).

- Terms of Service: Any specific terms regarding returns, warranties, or service agreements should be mentioned to avoid disputes later on.

How to Create a Payment Request Document

Creating a well-structured document to request payment for goods or services is essential for both the seller and the buyer. To ensure that the process is clear and efficient, the document must include all relevant information in an organized manner. Following a step-by-step approach will help you create a functional and professional record that meets the needs of both parties involved.

Step-by-Step Guide

Follow these steps to create an effective payment request document:

- Start with Contact Details: Begin by including the name, address, and contact information for both the buyer and the seller. This ensures that both parties can easily be identified and contacted if necessary.

- Include Transaction Information: List all goods or services provided, along with quantities, descriptions, and individual prices. This breakdown helps prevent any confusion about what is being billed.

- Specify Payment Terms: Clearly outline the total amount due, the due date, and any taxes or additional fees. If applicable, include payment options and discounts for early payments.

- Add Delivery Details: If the items are being shipped to a different address, include the recipient’s contact information and delivery address. This ensures accurate and timely delivery.

- Include a Reference Number: Adding a unique reference number helps with record-keeping and tracking of payments.

Customizing the Document

Once the essential elements are in place, you can customize the document to fit your specific needs:

- Design and Branding: Customize the document’s layout and design to align with your business’s branding. Adding your logo and business colors helps create a professional look.

- Payment Methods: Specify the payment methods that you accept, such as bank transfers, checks, or online payment platforms.

- Terms and Conditions: If there are specific terms regarding refunds, warranties, or late payments, make sure these are clearly stated on the document.

Benefits of Using a Payment Request Document Format

Utilizing a standardized format for creating payment requests can significantly improve efficiency, accuracy, and consistency in business operations. A well-structured document helps ensure that all essential information is included, reduces the chance of errors, and saves time when creating multiple records. By following a consistent format, businesses can streamline their billing process and focus on delivering value to their clients.

Time and Effort Savings

One of the primary benefits of using a predefined structure is the time saved. When creating payment request documents, you don’t need to start from scratch each time. With a reusable format, you can easily input new details for each transaction, which speeds up the process and frees up time for other tasks. The consistency of using a standard layout also minimizes the effort required to maintain accurate records.

Increased Professionalism and Accuracy

A standardized structure ensures that your documents are professional in appearance and clear in their details. It provides a clean and organized format that clients can easily understand, which helps build trust and credibility. Additionally, by following a set format, you reduce the risk of omitting important information, such as payment terms or shipping details, which could lead to confusion or payment delays.

Incorporating templates into your process not only enhances the overall experience for your clients but also provides long-term benefits in terms of efficiency and reliability. It allows businesses to scale their operations smoothly while maintaining consistency across all transactions.

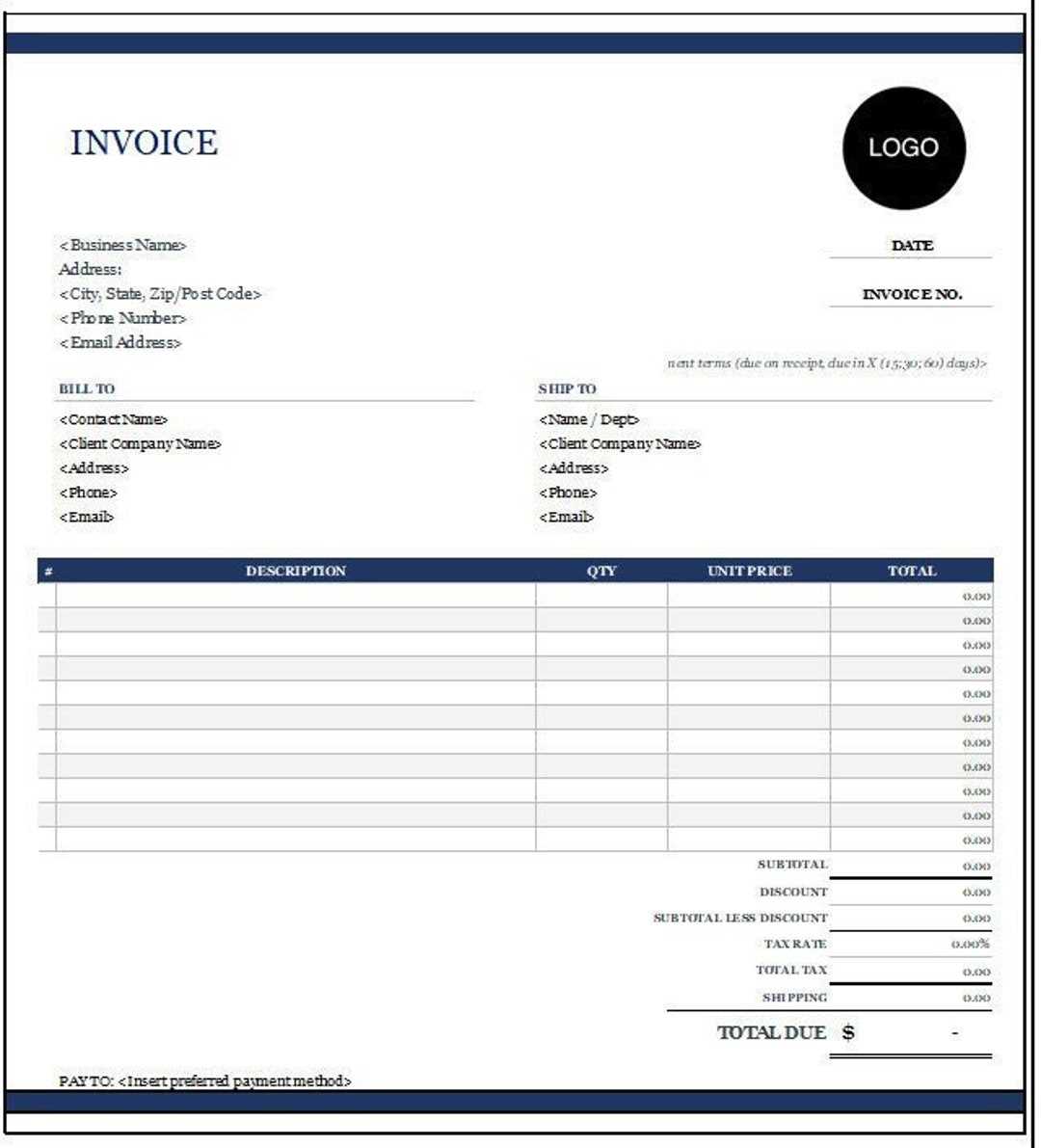

Customizing Your Payment Request Document

Customizing your payment request document is an important step in ensuring that it aligns with your business’s specific needs and branding. By adjusting various elements, you can create a document that not only serves its functional purpose but also reinforces your brand image and improves communication with your clients. Tailoring your document allows you to cater to different customer preferences and transaction requirements.

Key areas for customization include design elements, layout, and the inclusion of any additional terms or details that may be relevant for specific transactions. Customization makes it easier to incorporate necessary information without cluttering the document, ensuring clarity and professionalism.

Design and Branding Adjustments

One of the first things you can modify is the design of the document. Adding your company’s logo, colors, and fonts gives the document a professional touch and makes it instantly recognizable to clients. A clean and branded design also creates a sense of consistency across all your business communications.

Additional Information and Sections

Depending on the nature of the transaction, you might want to include extra sections such as:

- Special Terms: Include any specific payment terms, discounts for early payments, or conditions regarding late fees.

- Payment Methods: Clearly outline all accepted methods of payment, such as credit cards, bank transfers, or online payment portals.

- Notes for Clients: Add a personal touch or brief instructions regarding the payment process or delivery options.

By personalizing your document in these ways, you can create a more efficient and tailored experience for both your business and your clients.

Common Mistakes to Avoid in Payment Request Documents

When creating documents to request payments, small errors can have a significant impact on the overall transaction process. These mistakes can lead to confusion, delayed payments, or even disputes. Understanding the common pitfalls and taking steps to avoid them can help streamline your billing process and ensure that everything is clear and professional.

Missing or Incorrect Contact Information

One of the most critical errors is failing to include or incorrectly listing the contact details of either the seller or the buyer. Always double-check that the addresses, phone numbers, and email addresses are accurate. Incorrect information can delay communication and lead to problems with payment processing or shipment.

Omitting or Misleading Payment Terms

Clearly stating the payment terms is essential. Omitting these details or providing unclear terms can create misunderstandings. Make sure to include:

- Due Date: Clearly state when the payment is expected.

- Accepted Payment Methods: Specify the methods of payment you accept.

- Late Fees or Penalties: If applicable, mention any fees for late payments.

Incorrect Pricing and Quantities

Providing incorrect prices or quantities can lead to confusion and frustration for both parties. Always double-check the itemized list, ensuring the pricing and quantities are accurate. An error in this area could result in overcharging or undercharging, which could harm your reputation and damage client relationships.

Lack of Unique Reference Number

Not including a unique reference number or transaction ID is another mistake that can make tracking and organizing documents difficult. A reference number helps both you and your clients keep track of payments, especially when dealing with large volumes of transactions. It also makes it easier to manage records and resolve any potential issues.

By avoiding these common errors, you can ensure that your payment requests are professional, clear, and efficient, leading to smoother transactions and better customer relationships.

How to Manage Shipping and Billing Details

Efficiently managing both payment and delivery information is crucial to ensuring smooth transactions and customer satisfaction. Proper organization and attention to detail in handling these aspects help prevent errors, delays, and confusion. By establishing a clear system for tracking both the buyer’s payment address and delivery address, businesses can streamline their operations and enhance the overall client experience.

Managing Payment Information

Accurate payment details are necessary for timely and secure transactions. Here’s how to manage them effectively:

- Ensure Accuracy: Double-check that all contact and payment details are correct. Any errors in these details can lead to delayed or missed payments.

- Define Payment Terms: Specify due dates, acceptable payment methods, and any penalties for late payments. Clear terms reduce the likelihood of disputes.

- Use a Unique Reference: Assigning a unique reference number for each transaction helps in tracking and managing payments, providing an easy way to cross-reference details later.

Managing Delivery Information

Properly handling delivery addresses ensures that products reach their intended destination without issue. Follow these steps to manage this information:

- Request Full Address Details: Always request complete delivery information, including the recipient’s name, street address, city, postal code, and contact number.

- Verify Addresses: Before dispatching goods, confirm that the address provided is correct and complete. This can prevent costly delays or errors in shipping.

- Communicate Shipping Status: Keep your customers informed about the status of their order, including estimated delivery dates and tracking information if available.

By carefully managing both payment and delivery information, you ensure an efficient and professional process that fosters trust and satisfaction with your clients, reducing the risk of errors and enhancing your business’s reputation.

Automation Tools for Payment Request Creation

Using automation tools for creating payment requests can save businesses significant time and effort while minimizing human error. These tools allow for the quick generation of professional, accurate documents without the need for manual entry each time. With customizable settings, automation can streamline repetitive tasks, ensuring that all necessary information is included and formatted correctly with minimal input from the user.

Key Features of Automation Tools

When selecting an automation tool for generating payment requests, look for the following features:

- Customizable Fields: The ability to tailor document elements such as company name, client information, payment terms, and amounts.

- Recurring Billing: For businesses that need to generate regular payments, automation tools can create recurring requests based on predefined schedules.

- Real-time Updates: Automation tools often integrate with accounting software or customer databases, ensuring that any changes in pricing or details are reflected instantly.

Benefits of Using Automation for Payment Requests

Automating the creation of payment requests offers numerous advantages, including:

- Efficiency: Automating the process drastically reduces the time spent on document creation, allowing you to focus on other aspects of your business.

- Accuracy: Automated systems ensure consistent formatting and the inclusion of all required information, reducing errors and improving overall document quality.

- Scalability: As your business grows, automation tools allow you to handle an increasing volume of transactions without additional manual effort.

Incorporating automation into your business operations can significantly improve the speed, consistency, and professionalism of your payment request documents, creating a more efficient workflow and enhancing customer satisfaction.

Legal Considerations in Payment Request Design

When creating documents to request payments, it’s essential to be aware of the legal requirements that ensure your documents are compliant with local laws and regulations. These documents serve not only as a tool for requesting funds but also as official records that may be used in legal proceedings if disputes arise. Including the correct legal information and adhering to industry standards can protect your business and provide clarity to your clients.

Essential Legal Information to Include

To ensure your payment request is legally sound, consider the following:

- Business Information: Include your legal business name, registered address, and any necessary registration numbers or tax IDs. This establishes your legitimacy and helps prevent any confusion regarding the source of the request.

- Payment Terms: Clearly outline payment terms such as due dates, late fees, and any interest charges for overdue amounts. These terms should be stated in a way that can be legally enforced if necessary.

- Tax Compliance: Ensure that any applicable taxes, such as sales tax or VAT, are clearly listed, including the tax rate and amount. Accurate tax information ensures compliance with local taxation laws.

Protecting Your Business and Clients

Payment requests should also include disclaimers or clauses to protect both parties involved:

- Liability Clauses: Specify your liability in cases of errors, delays, or other issues. This helps manage expectations and clarifies your business’s role in the transaction process.

- Dispute Resolution: If a conflict arises, indicate the process for resolving the dispute, such as through mediation or arbitration, and specify the jurisdiction where legal matters will be addressed.

By considering these legal elements when designing your payment request documents, you not only ensure compliance with relevant laws but also create a document that fosters trust and transparency with your clients, protecting your business in the long run.

Best Practices for Payment Request Clarity

Ensuring that your payment request documents are clear and easy to understand is essential for a smooth transaction process. Clear communication not only minimizes confusion but also builds trust with your clients. By following best practices in design and organization, you can create documents that convey the necessary information in a straightforward and professional manner.

Organizing Information Effectively

To improve the readability of your payment request, consider the following tips:

- Use Clear Headings: Organize your document with clear and concise headings, such as “Payment Amount,” “Client Information,” and “Terms and Conditions.” This helps the recipient quickly locate important details.

- Keep it Simple: Avoid unnecessary jargon and complex language. Use simple, direct phrases that everyone can easily understand.

- Break Information into Sections: Group related items together, such as the list of purchased goods or services, payment deadlines, and any other relevant details. This makes the document easier to follow.

Designing for Clarity

The design of your payment request also plays a critical role in its clarity:

- Use Legible Fonts: Choose fonts that are easy to read both on paper and digital devices. Stick to professional, simple fonts like Arial or Times New Roman.

- Highlight Key Information: Use bold or italics to emphasize important details, such as payment due dates and amounts. This draws attention to the most crucial elements of the document.

- Ensure Proper Alignment: Align text and numbers neatly. For example, list all monetary amounts in the same column to create a clean, professional appearance.

By following these best practices, you ensure that your payment request is not only professional but also easy for your clients to understand. Clear, well-organized documents reduce the likelihood of misunderstandings and payment delays, ultimately fostering positive business relationships.

Tracking Payments Using Payment Request Documents

Effectively tracking payments is crucial for maintaining healthy cash flow and managing your business finances. By using structured payment request documents, you can easily monitor incoming payments, keep accurate records, and follow up on overdue amounts. These documents not only provide a formal record of transactions but also help streamline the payment tracking process, ensuring nothing is overlooked.

Organizing Payment Information

To track payments efficiently, it’s important to include specific details within your payment requests:

- Unique Identification Number: Assign a unique number or reference code to each document. This makes it easier to identify and search for specific transactions.

- Payment Status: Clearly indicate whether the payment has been received, is pending, or is overdue. This will help you quickly assess which transactions require attention.

- Payment Dates: Include the payment due date and the actual payment received date to monitor delays and ensure timely processing.

Using Digital Tools for Tracking

Incorporating digital tools into your payment tracking system can provide additional benefits:

- Automated Reminders: Set up automated reminders to notify clients when payments are due or overdue. This can reduce manual follow-ups and improve on-time payments.

- Integrated Accounting Systems: Connect your payment request documents to accounting software. This allows for real-time updates, reducing the need for manual data entry and ensuring accurate financial records.

- Payment Dashboards: Many digital tools offer dashboards that give you an overview of your payment statuses, helping you track multiple transactions at once.

By incorporating these strategies, you can streamline the payment tracking process, ensuring that you maintain accurate records and prompt payments, ultimately leading to better financial management and client relationships.

How to Handle Payment Request Discrepancies

Discrepancies in payment request documents can sometimes arise, leading to confusion or disputes between the sender and the recipient. Whether it’s a mismatch in the amounts due, missing details, or errors in the service descriptions, addressing these issues promptly is key to maintaining smooth business operations. Having a clear process in place can help resolve any discrepancies efficiently and maintain strong professional relationships.

Identifying the Source of the Discrepancy

The first step in resolving any discrepancy is to identify where the issue lies. Common causes of discrepancies include:

- Calculation Errors: Double-check the arithmetic for totals, taxes, and discounts to ensure the correct amounts are listed.

- Missing Information: Sometimes key details, such as the quantity of goods or services, may be omitted, leading to confusion.

- Incorrect Pricing: Verify that the prices for each item or service match the agreed-upon terms or the contract.

Steps to Resolve Discrepancies

Once you’ve identified the source, follow these steps to address the issue:

- Review the Original Agreement: Ensure the details in the payment request align with the original contract or order agreement. If there are any inconsistencies, refer to the signed documents to clarify the correct terms.

- Communicate with the Recipient: Contact the client or customer promptly to inform them of the discrepancy and clarify any misunderstandings. Clear communication is essential for resolving issues without escalation.

- Adjust the Document: If the discrepancy is legitimate, correct the document and reissue it. Ensure all changes are clearly marked and communicated to avoid confusion.

By following these steps, discrepancies can be resolved efficiently, preventing delays in payment processing and maintaining professional relationships with clients.

Integrating Payment Requests with Accounting Systems

Integrating payment request documents with accounting systems is a key strategy for streamlining financial operations. By connecting these records directly to your accounting software, you can automate data entry, reduce human error, and gain real-time insights into your financial status. This integration not only saves time but also ensures that your financial records are always up to date and accurate.

Benefits of Integration

Integrating your payment request documents with accounting platforms offers several advantages:

- Automation: Automating the transfer of payment details reduces manual data entry, saving time and preventing errors in calculations.

- Real-time Updates: Integration allows for instantaneous updates to your financial records as payments are made or received, keeping your system current without needing manual adjustments.

- Better Reporting: With integrated data, you can generate more accurate and detailed financial reports, helping you make informed business decisions.

Steps to Integrate Payment Request Documents

To integrate payment request documents with your accounting system, follow these steps:

- Select Compatible Software: Choose an accounting platform that supports integration with your document management tools. Popular platforms often offer built-in integration options or third-party apps for seamless syncing.

- Connect Your Accounts: Link your payment request system to your accounting software. This may require configuring API connections or using integration tools provided by the software vendors.

- Set Up Data Syncing: Ensure that the relevant data from your payment requests, such as amounts, payment statuses, and customer details, are automatically transferred to your accounting system.

- Monitor and Maintain: Regularly check the integration to ensure it’s working smoothly and that data is being synced correctly. Periodic maintenance may be required to adjust settings or update software versions.

By following these steps, you can efficiently integrate payment request documents into your accounting system, making financial management easier and more accurate.

Ensuring Accuracy in Shipping Information

Accurate delivery details are crucial for smooth operations in any business that involves the movement of goods. Properly handling these details ensures that products reach the correct recipients without delays or errors. By verifying and maintaining correct information, you can reduce mistakes, enhance customer satisfaction, and minimize costs related to re-shipments or returns.

Common Challenges in Managing Shipping Information

Managing delivery data comes with its own set of challenges. Some common issues include:

- Incorrect Addresses: Minor errors in street names, zip codes, or city names can lead to significant delivery delays.

- Incomplete Contact Information: Missing phone numbers or email addresses can prevent the carrier from contacting the recipient in case of issues.

- Inconsistent Format: Different systems may store shipping information in varying formats, leading to potential confusion when processing orders.

Best Practices for Ensuring Accurate Delivery Information

To prevent errors and ensure smooth deliveries, consider the following practices:

- Double-check Addresses: Always confirm shipping addresses with customers before finalizing the order, especially for international shipments where details are crucial.

- Use Address Validation Tools: Many modern systems and software offer address validation services that automatically check for accuracy and completeness.

- Standardize Data Entry: Set up clear guidelines for how shipping details should be entered and format them consistently across all systems.

- Confirm Contact Information: Ensure that customers provide accurate phone numbers or email addresses so that the delivery process can proceed without issues.

By following these practices, you can significantly reduce the risk of shipping errors and ensure that deliveries are made efficiently and correctly. This will not only improve operational efficiency but also contribute to better customer relationships and business success.

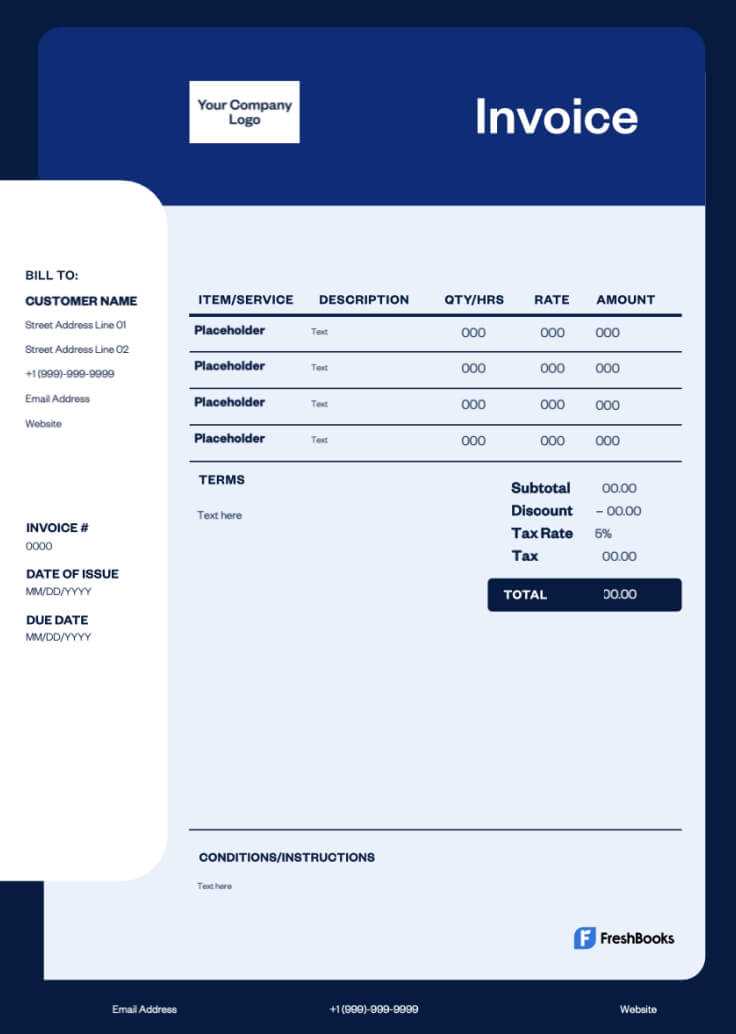

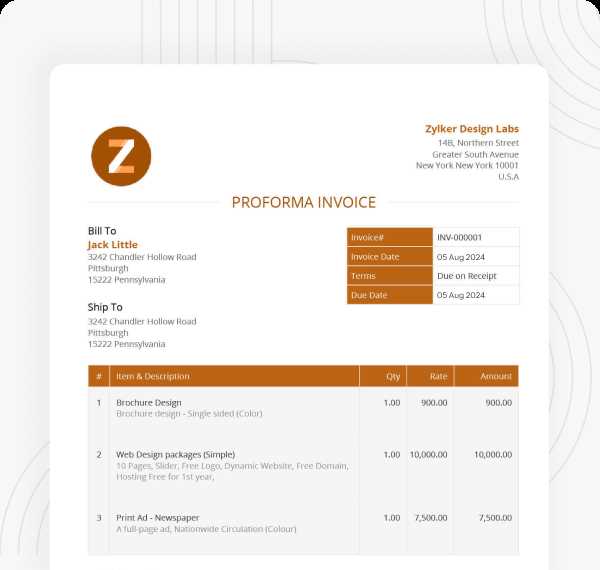

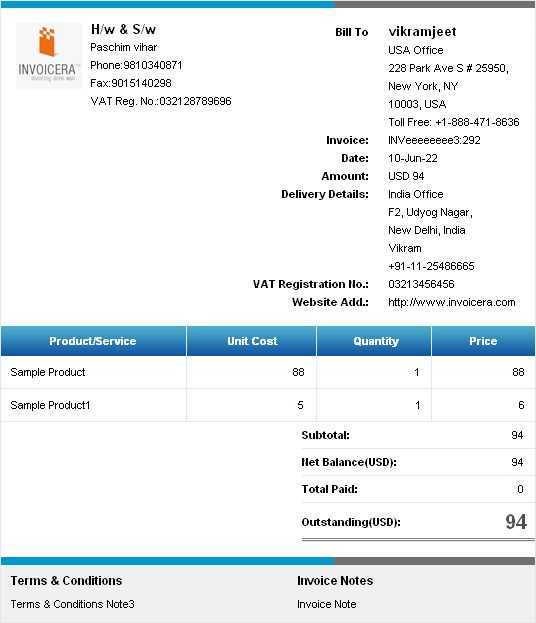

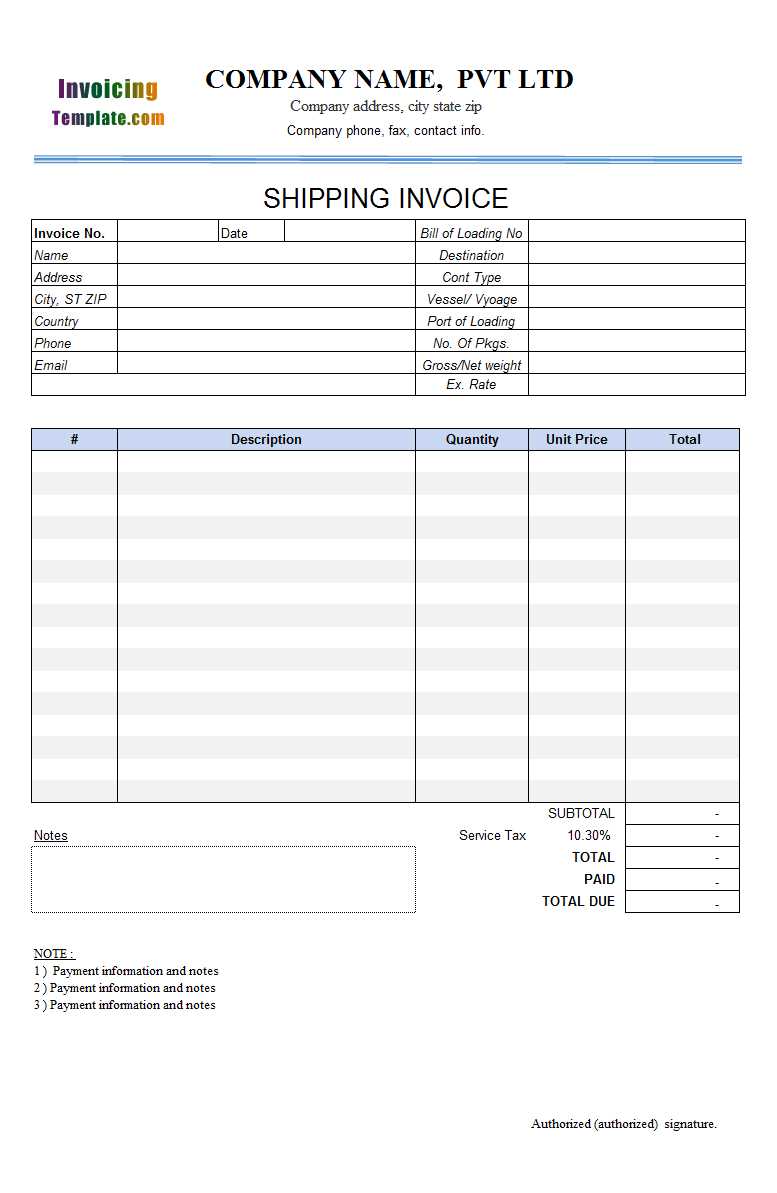

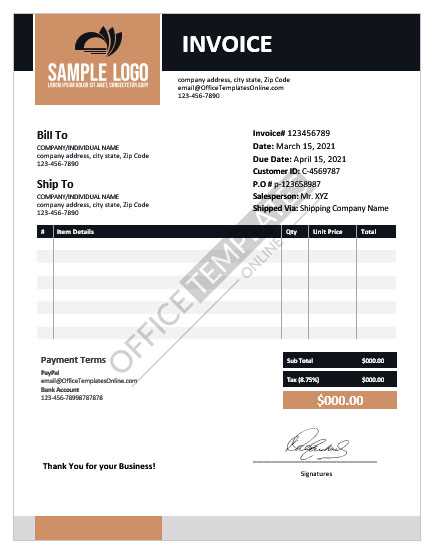

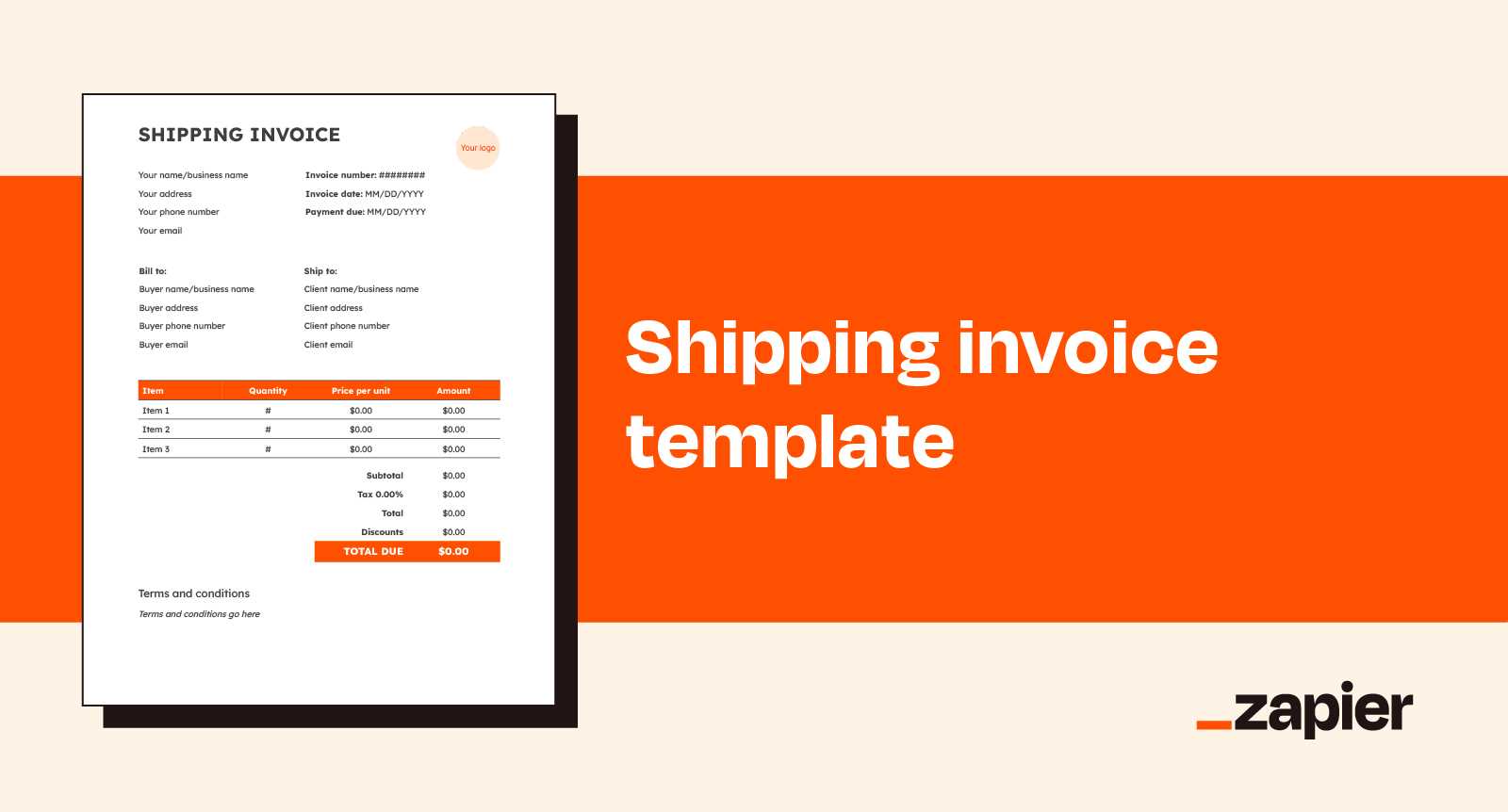

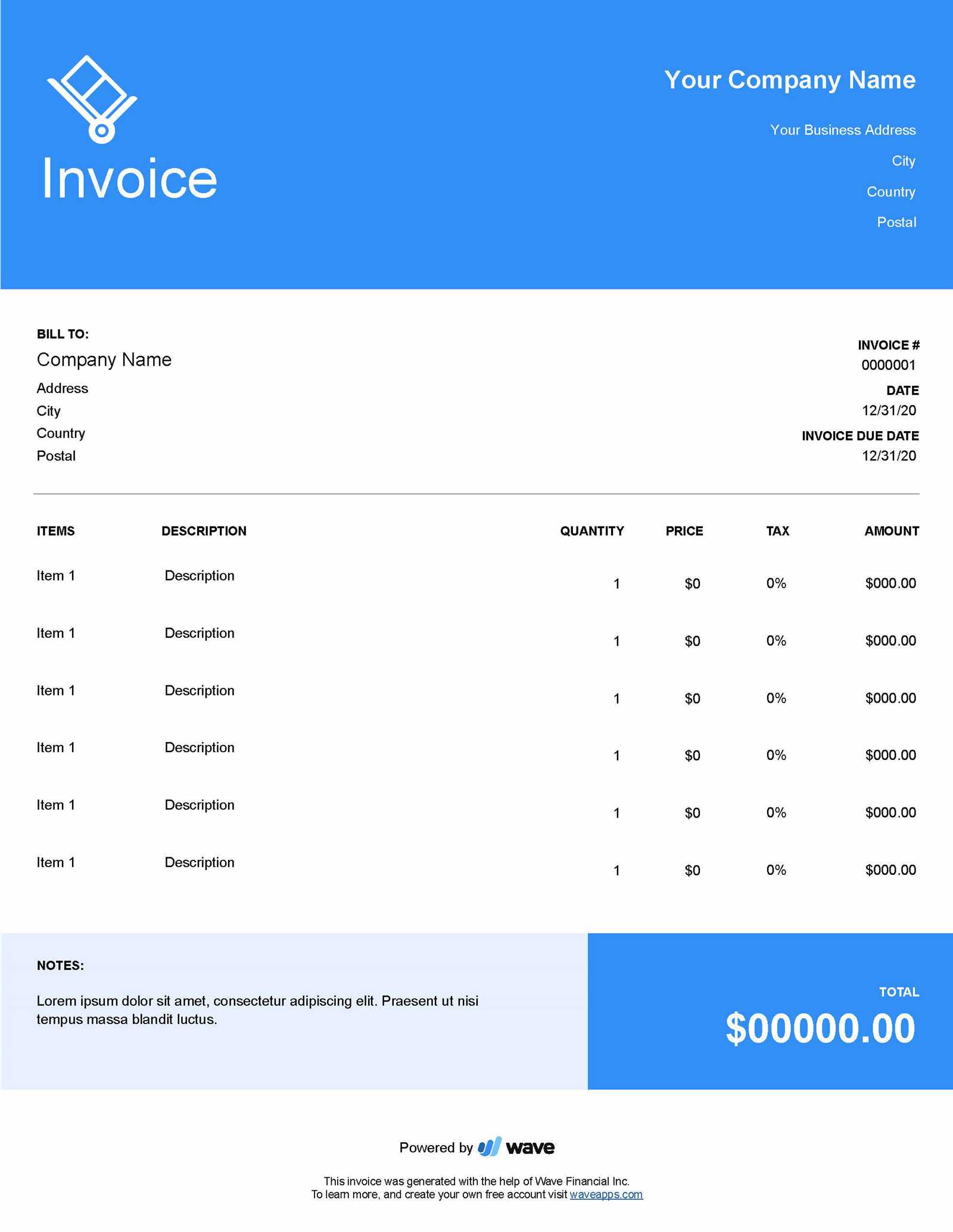

Invoice Template Formats and Software

When creating documents for financial transactions, choosing the right format and software is essential to streamline the process. Different formats cater to various needs, from simple lists of charges to more complex layouts that include multiple sections and calculations. The right tools can help automate the creation of these documents, ensuring accuracy, consistency, and efficiency in financial record-keeping.

Several formats exist, each designed to meet different business requirements. For example, some businesses might opt for a basic design that includes key details like amounts and dates, while others may need more elaborate formats that account for tax rates, discounts, and multiple itemized charges. Understanding these options can help businesses choose the best fit for their operations.

Along with choosing the format, selecting appropriate software can significantly improve workflow. There are a variety of software options available, ranging from simple spreadsheet templates to specialized applications that automate calculations and track payments. These tools are often customizable, allowing businesses to create documents that reflect their brand identity and meet legal or regulatory standards.

Key Considerations:

- Customizability: Choose software that allows you to personalize the layout and content based on your business needs.

- Automation: Look for software that automates calculations and updates totals based on data inputs.

- Integration: Consider tools that integrate with your accounting or payment systems to streamline record-keeping.

- User-Friendly Interface: Opt for software with an intuitive design to make document creation simple for all users.

By choosing the right format and software, businesses can enhance their financial operations, improve accuracy, and save time in the long run.

Improving Business Efficiency with Templates

Implementing standardized documents in business operations can greatly enhance productivity and reduce human error. By using predefined formats, companies can speed up routine tasks, ensuring that essential information is captured consistently and accurately. This approach helps streamline workflows, allowing employees to focus on higher-priority tasks instead of repetitive administrative duties.

Pre-designed forms are particularly useful for tasks such as managing financial transactions, tracking customer orders, and creating professional correspondence. With the right design, these documents not only ensure accuracy but also help maintain brand consistency across communications. The use of efficient templates helps businesses save both time and resources while also improving the overall quality of their work.

Benefits of Using Standardized Documents

- Time-saving: Ready-made formats eliminate the need to recreate documents from scratch, speeding up the process of completing routine tasks.

- Consistency: Standardized layouts ensure uniformity in every document, reducing confusion and enhancing professionalism.

- Accuracy: With predefined sections, there’s less room for mistakes, ensuring that important details are not overlooked.

- Cost Efficiency: By streamlining processes and reducing errors, businesses can save money on resources and administrative time.

Maximizing the Use of Predefined Formats

- Customization: Ensure that the format is adaptable to your specific needs. A flexible design allows for quick adjustments when necessary.

- Automation: Integrate automated features to reduce manual data entry, improving both efficiency and accuracy.

- Integration: Use formats that easily integrate with your existing business systems, such as accounting or customer management software, to streamline workflows.

By adopting well-designed, reusable formats for business documents, companies can improve their efficiency, minimize errors, and focus on what matters most–delivering value to their clients and growing their operations.