Get Your Free Invoice Template Today

Managing payments efficiently is crucial for any business, whether you’re just starting out or have been operating for years. The right tools can save valuable time and reduce errors in your financial documentation. Accessing ready-made solutions to handle invoicing tasks ensures you can focus on growing your business rather than spending hours creating documents from scratch.

Many entrepreneurs and freelancers struggle with organizing their payment requests, often resorting to manual calculations or complex software that can be difficult to use. Fortunately, there are simple, cost-effective options available that provide a clean, professional layout and all the essential details needed to request payment from clients.

By using ready-made solutions, you not only simplify your administrative workload but also present a polished, consistent image to your clients. These documents can easily be customized to meet your specific business needs, making it easier to maintain a streamlined and professional approach to your financial transactions.

Why Use a Free Invoice Template

When managing a business, especially in its early stages, every decision counts. Handling financial records and requesting payments from clients shouldn’t be a time-consuming or complex task. Having access to ready-made documents that already follow industry standards can make this process much simpler, allowing you to focus on what matters most–growing your business.

Save Time and Effort

Using pre-designed documents can significantly reduce the time you spend creating payment requests. Instead of starting from scratch, you can quickly fill in the necessary details, ensuring consistency and accuracy. This saves you the effort of designing layouts and calculating formulas manually, allowing you to dedicate more time to your core business operations.

Professional Appearance at No Cost

Even small businesses and freelancers can present a polished, professional image by using these free solutions. With minimal effort, you can deliver well-organized documents to clients, enhancing their confidence in your services. By having access to templates that are easy to personalize, you can maintain a consistent style without incurring extra costs.

Efficiency is key in running a successful business. The use of ready-to-go documents ensures that you never miss a critical detail, from payment terms to due dates, ultimately streamlining the entire process and preventing delays. Whether you’re handling a few transactions or numerous payments each month, using these pre-made documents can make a noticeable difference in your workflow.

Top Benefits of Invoice Templates

Having a structured and consistent approach to requesting payments can bring significant advantages to any business. Instead of manually designing financial documents each time, using a pre-made solution offers several key benefits that enhance both efficiency and professionalism. Below are the top advantages of utilizing ready-made billing documents.

- Time Efficiency: Pre-designed documents allow you to focus on other aspects of your business. Simply fill in the necessary information and you’re done, eliminating the need for manual formatting or layout work.

- Consistency: Using the same format for each client interaction ensures that all essential details are included, reducing the risk of mistakes or missing information.

- Professionalism: A well-organized and clean layout reflects positively on your business. It shows clients that you take your work seriously and that you are organized and trustworthy.

- Customization: Ready-made documents are designed to be easily personalized with your business logo, branding, and specific payment terms, giving you control over the final look.

- Reduced Errors: With built-in fields for all necessary details, you minimize the chance of making errors that could lead to confusion or delayed payments.

- Cost-Effective: Many ready-made solutions are available at no charge, meaning you can access high-quality, professional documents without any added expense.

By adopting these pre-built documents, businesses can streamline their operations, present a more organized image to clients, and reduce the time spent on administrative tasks. This simple yet powerful tool helps to ensure smoother financial transactions and greater peace of mind.

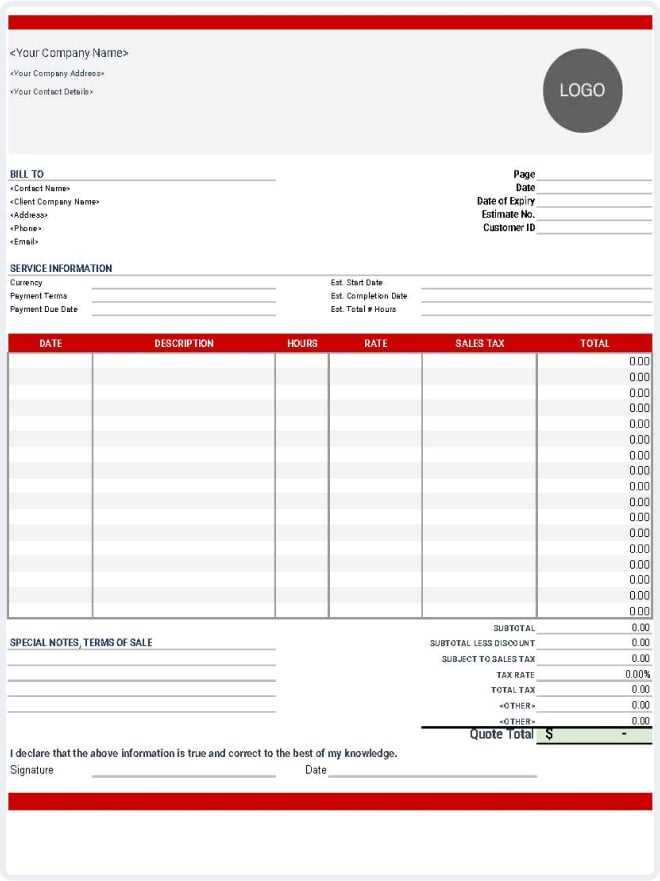

How to Customize an Invoice Template

Adapting a pre-designed document to reflect your unique business needs is an essential step in maintaining a professional appearance. Customization ensures that your documents align with your branding and include all the necessary details for smooth financial transactions. The process is simple and can be done in just a few steps.

- Add Your Business Information: The first step is to include your company name, address, contact number, and email. You may also want to add a logo for a more polished look.

- Include Client Details: Make sure to fill in the client’s name, company name, and address. This helps personalize the document and ensures there is no confusion regarding the recipient of the payment.

- Set Payment Terms: Clearly state the payment due date and any late fees or early payment discounts. Defining these terms will help manage expectations and avoid misunderstandings.

- Itemize Products or Services: Include a detailed list of goods or services provided, along with quantities, rates, and total amounts. This gives your client a clear breakdown of the charges and helps prevent disputes.

- Adjust Currency and Taxes: If applicable, ensure the correct currency symbol is displayed and that any taxes or additional charges are properly calculated. Many tools can automatically add tax, but double-checking is always a good practice.

- Customize Design Elements: Change font styles, colors, or layouts to match your branding. This step ensures your financial documents are consistent with the overall aesthetic of your business.

Once all the necessary details are filled in, you can save the document and send it to your client. Customizing these pre-made solutions not only saves you time but also ensures that your payment requests reflect your business’s professional standards and unique identity.

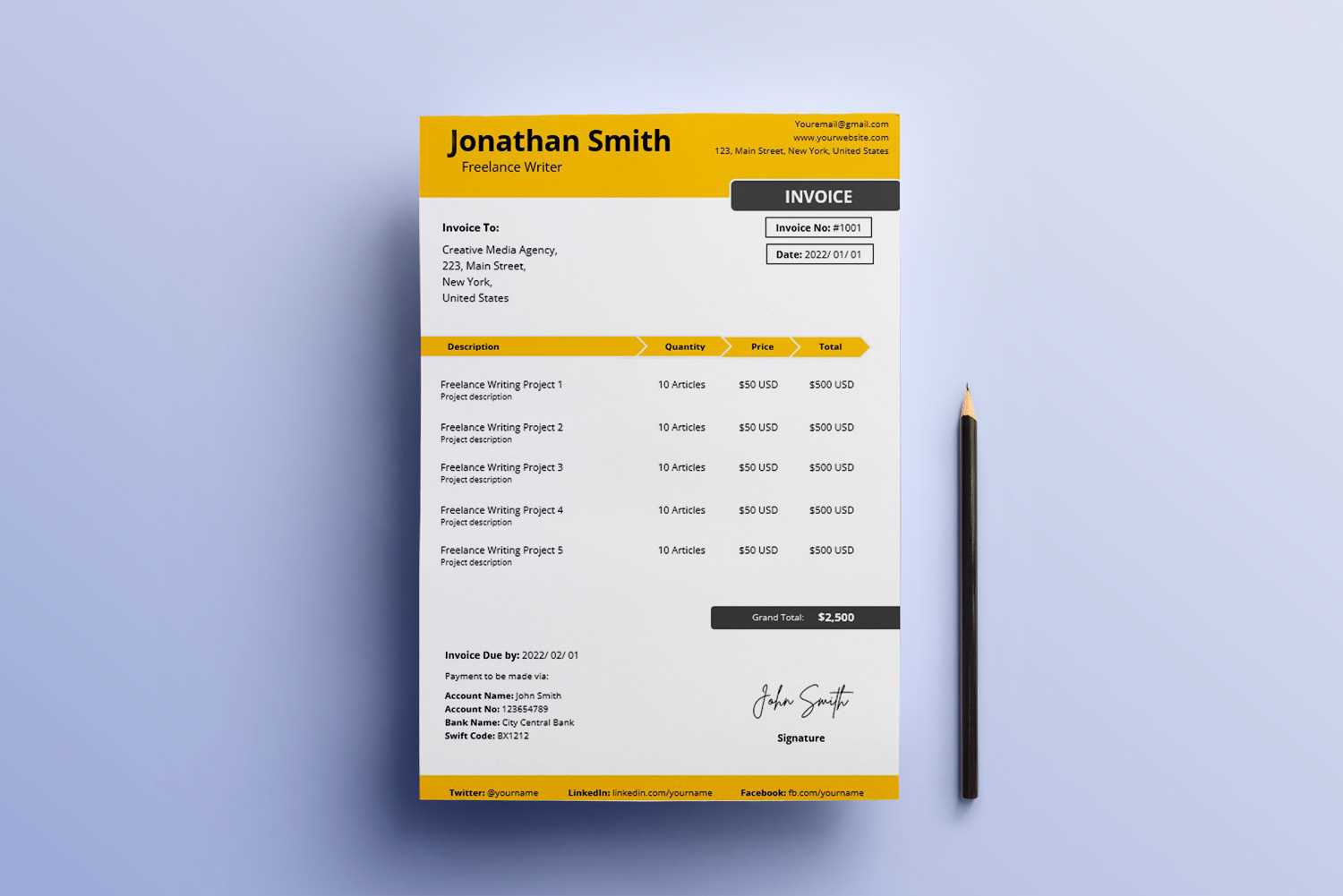

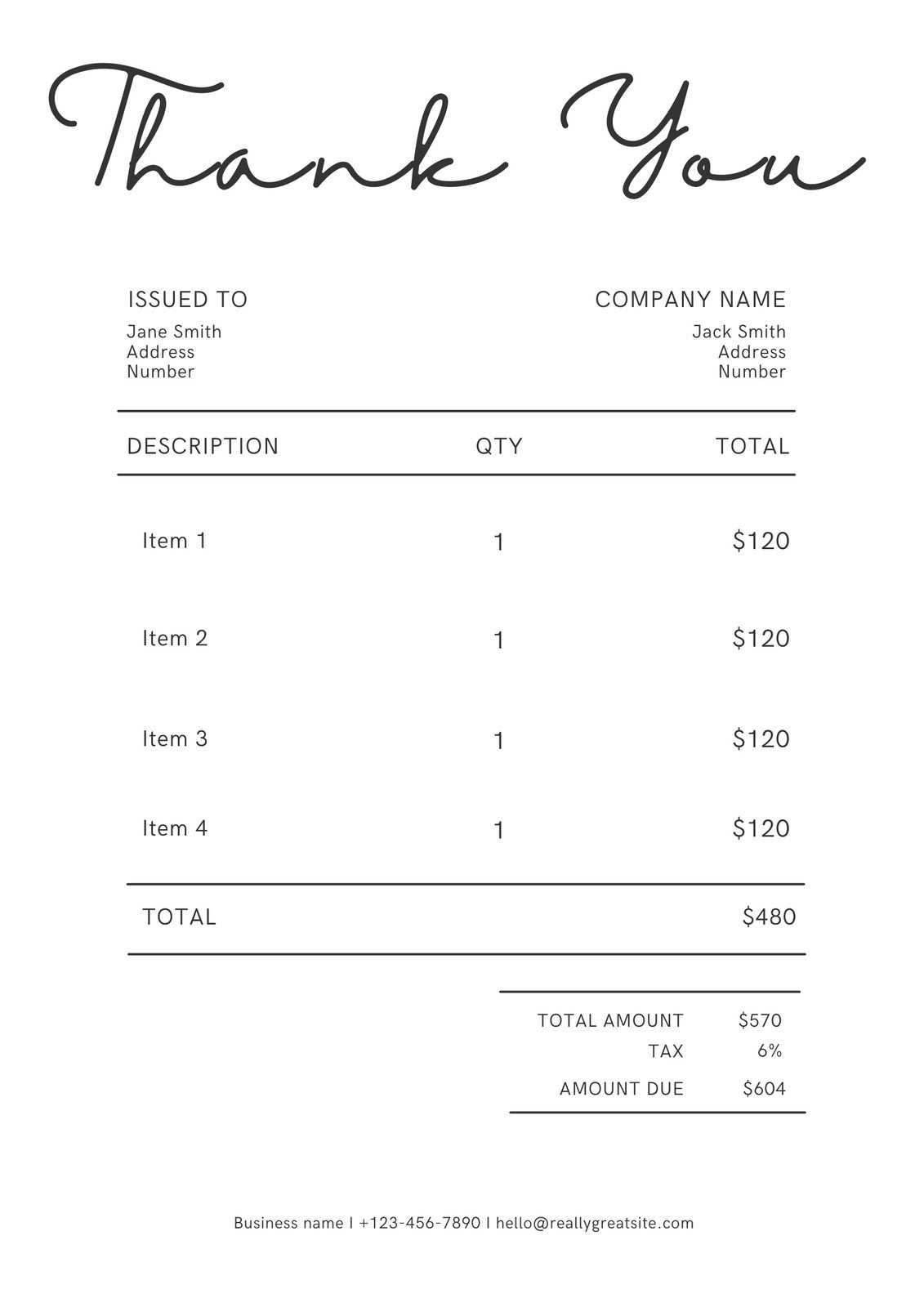

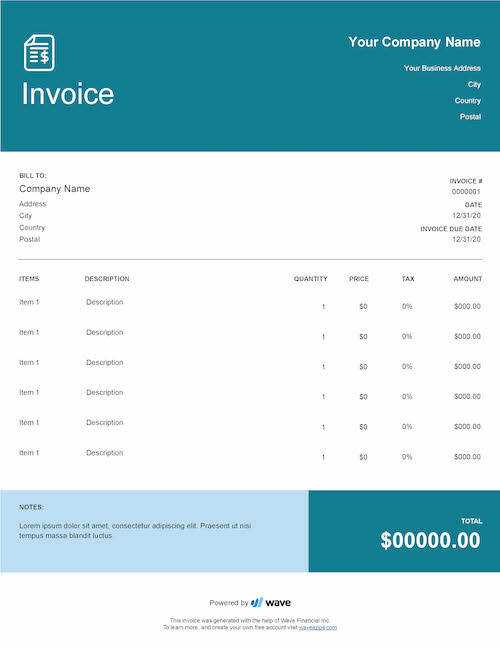

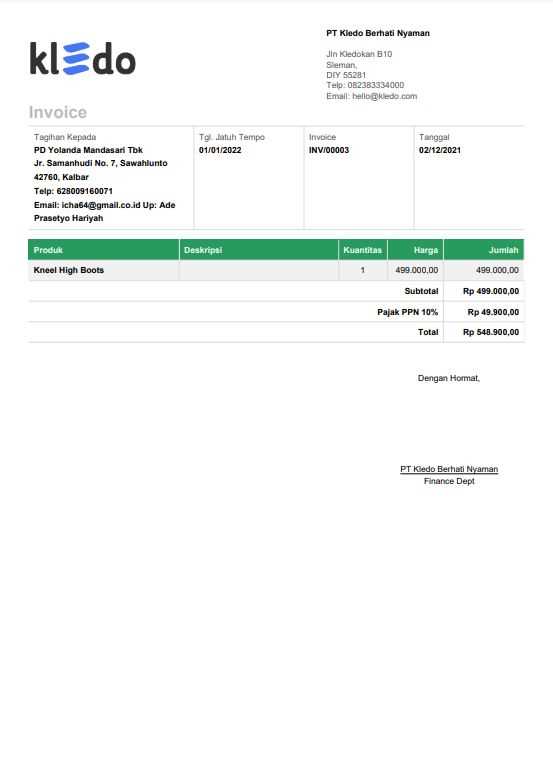

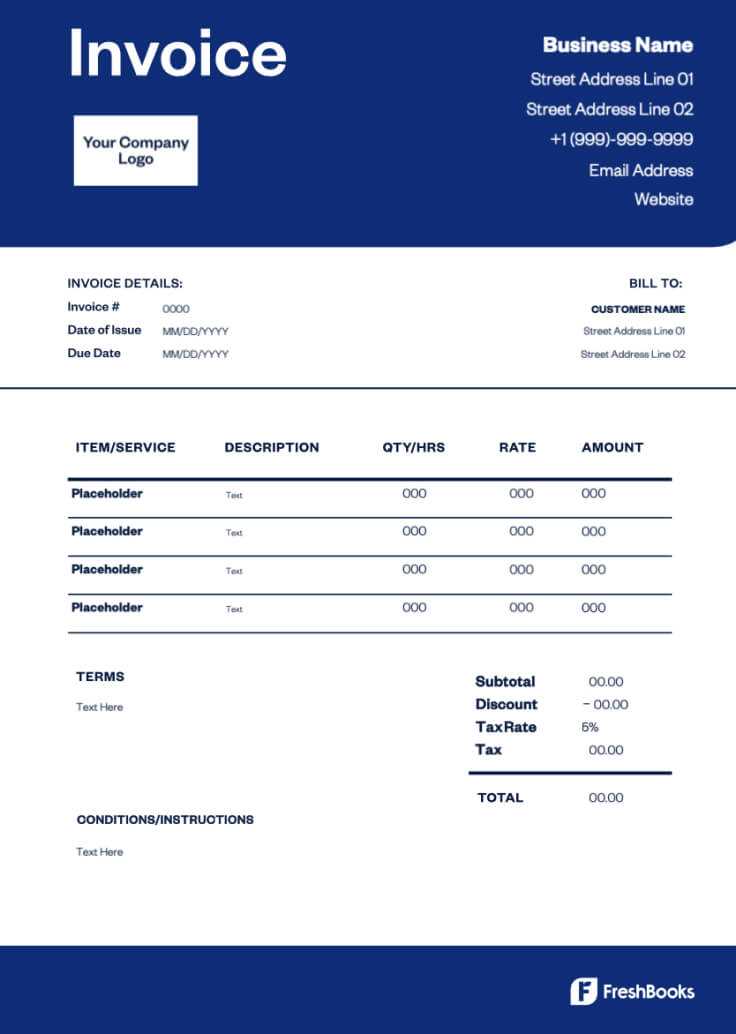

Best Free Invoice Templates for Small Businesses

For small businesses, managing finances efficiently is crucial to ensure steady cash flow and maintain professional relationships with clients. Using a pre-designed billing document can simplify this process, offering clean layouts and essential features. Below are some of the best options that cater to the unique needs of small business owners, providing all the necessary tools without the cost.

- Simple and Clean Design: A minimalist layout that focuses on clarity, with easy-to-fill sections for client details, services, and payment terms. This design works well for businesses looking for quick and straightforward documentation without unnecessary clutter.

- Detailed Breakdown Format: This option offers a more detailed breakdown of services or products provided, perfect for businesses that need to itemize charges for clients. It includes columns for description, quantity, rate, and total, ensuring everything is clearly laid out.

- Customizable Branding: Many free solutions allow you to insert your logo, choose brand colors, and modify fonts. This customization ensures your billing documents match your company’s identity while maintaining a professional appearance.

- Automatic Calculations: Some pre-made documents come with built-in formulas to automatically calculate totals, taxes, and discounts. This feature saves time and reduces the chance of errors when filling out financial documents.

- Simple Integration with Accounting Tools: A number of free documents can be integrated into popular accounting software. This makes tracking payments, managing invoices, and reconciling finances more seamless for small business owners.

Efficiency is a priority for any small business. Using a pre-built document that meets all your needs can help streamline financial operations, making your job easier and more organized. With these options, you can quickly create accurate, professional billing documents, leaving more time to focus on your business growth.

Where to Find Invoice Templates Online

Finding the right pre-designed billing documents online is easier than ever, with numerous websites offering free and customizable options for businesses of all sizes. These platforms provide a wide range of formats and designs, catering to different industries and business needs. Below is a list of some of the most popular resources to help you get started.

| Website | Features | Best For |

|---|---|---|

| Canva | Customizable designs with drag-and-drop interface, easy branding options. | Businesses looking for creative, fully customizable documents. |

| Microsoft Office | Simple, professional designs available in Word and Excel formats. | Small businesses already using Microsoft Office tools. |

| Google Docs | Free, cloud-based options with easy sharing and collaboration. | Teams needing quick access and real-time editing. |

| Zoho | Free templates with customization options and integrated invoicing tools. | Small businesses looking for an all-in-one online solution. |

| Invoice Generator | Quick and simple, no sign-up required, with automatic calculations. | Freelancers and small business owners needing quick invoices. |

These resources provide a variety of formats to suit your needs, whether you prefer a minimalist design or a more detailed, itemized breakdown. Finding the right solution online can save you time and effort while maintaining a professional image for your business.

How Invoice Templates Save Time

Efficiency is essential for any business, and managing payment requests is no exception. By using pre-designed documents, businesses can significantly reduce the time spent on administrative tasks. Instead of manually formatting or creating financial records from scratch, these ready-to-use solutions streamline the process, enabling quick and accurate billing.

Streamlined Document Creation

- Pre-filled Fields: Many pre-made solutions include pre-set fields for client details, dates, and services or products. This eliminates the need to manually input the same information repeatedly.

- Automated Calculations: Built-in formulas automatically calculate totals, taxes, and discounts, saving you the time it would take to manually do the math.

- Consistency: Using the same layout for every document ensures that you never miss important details, speeding up the overall process and minimizing errors.

Reduced Back-and-Forth with Clients

- Clear Payment Terms: With essential payment terms clearly outlined, clients have a better understanding of due dates, payment methods, and any potential penalties for late payments, reducing the need for clarification.

- Faster Approvals: A professional and organized document increases the likelihood of a quick response from clients, allowing for faster processing of payments.

By adopting ready-to-use solutions, businesses eliminate the repetitive tasks of document creation, calculation, and communication. This not only saves time but also improves the accuracy of financial records, contributing to smoother cash flow and reduced administrative overhead.

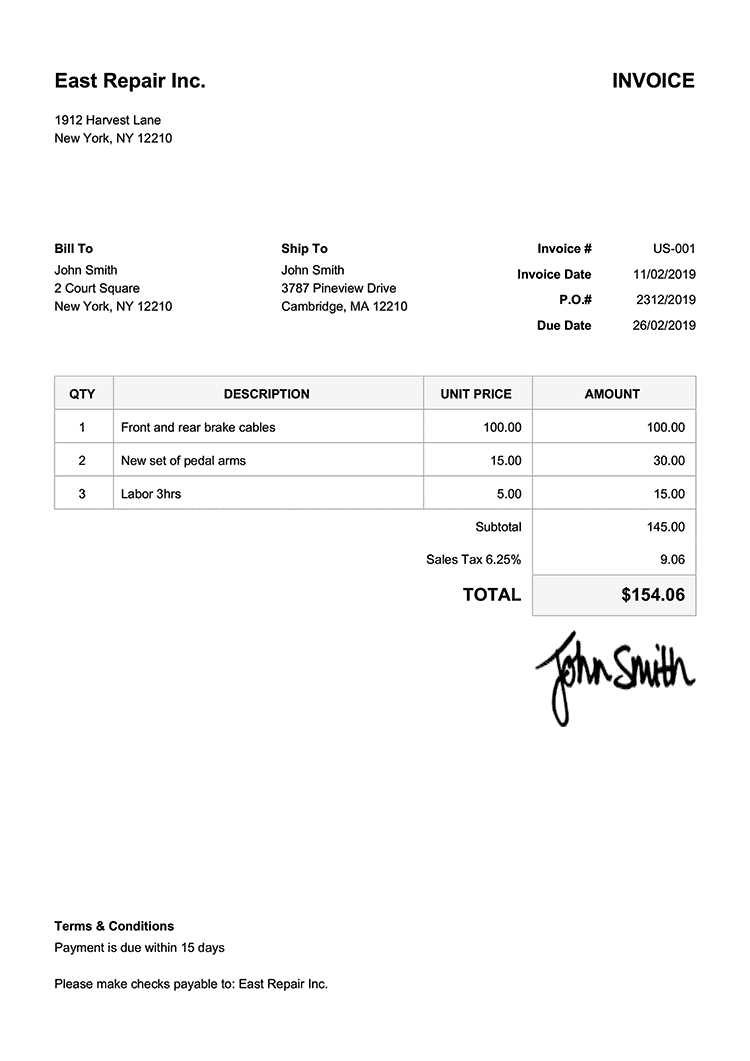

Key Features of a Good Invoice

A well-structured billing document plays a critical role in maintaining clear financial communication with clients. It not only ensures accurate tracking of payments but also reflects professionalism and transparency. A good document should contain essential details that help both the business and the client understand the transaction clearly and without confusion.

Essential Information

- Business Information: Your company name, contact details, and any legal identifiers (such as tax numbers) should be clearly displayed at the top. This ensures the client knows who issued the document.

- Client Information: Including the client’s name, address, and contact details is vital for clear identification and smooth communication regarding the payment.

- Unique Reference Number: A unique document number helps track transactions and makes it easier to reference past interactions in the future.

- Issue and Due Dates: Clearly stating the date of issuance and the due date helps both parties stay on the same page regarding payment timelines.

Clarity and Transparency

- Detailed Breakdown: Listing individual items or services provided, with quantities, rates, and totals, ensures transparency and helps the client understand exactly what they’re being charged for.

- Payment Terms: Clear instructions on how and when the payment should be made, including accepted payment methods and any potential late fees, remove any ambiguity.

- Totals and Taxes: Always include a subtotal, applicable taxes, and the final amount due. This helps avoid confusion and ensures that the client can easily verify the amount to be paid.

These key features help streamline the payment process, reduce misunderstandings, and present a professional image to your clients. A well-designed and complete document can make a significant difference in the smooth flow of business transactions.

Simple Steps to Create an Invoice

Creating a professional billing document doesn’t have to be a complicated task. With a few basic steps, you can easily generate a clear and accurate request for payment. The process involves gathering the right information, filling in necessary fields, and ensuring that all terms are properly stated. Below is a simple guide to help you create a payment request quickly and effectively.

Step-by-Step Guide

| Step | Description |

|---|---|

| 1. Add Business and Client Information | Fill in your business name, contact details, and logo. Include your client’s name, company, and contact information for clarity. |

| 2. Assign a Unique Document Number | Generate a unique number for tracking purposes. This helps with reference and record-keeping. |

| 3. List Products or Services | Include a detailed list of what was provided, with corresponding quantities and rates for each item or service. |

| 4. Calculate the Total Amount | Ensure all amounts are calculated, including applicable taxes and any discounts. Display a subtotal and the final amount due. |

| 5. Define Payment Terms | Clearly state the due date for payment, accepted payment methods, and any penalties for late payments. |

Final Touches

After entering all the necessary details, double-check for accuracy. Once the document is complete, save it and send it to the client via email or print it out for physical delivery. By following these simple steps, you can create a clear, professional request for payment that will help ensure timely transactions and maintain positive client relationships.

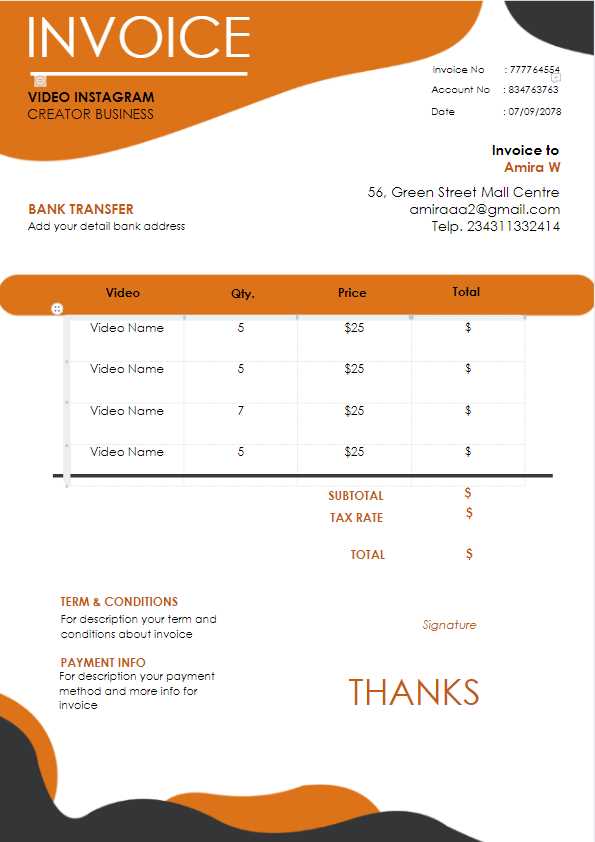

Free Invoice Templates for Freelancers

Freelancers often juggle multiple projects and clients, making it essential to maintain organized and professional billing practices. Using pre-designed documents can save time and reduce the risk of mistakes, allowing freelancers to focus on their work while ensuring timely payments. Below are some of the best free options that cater specifically to the needs of freelancers.

- Simple and Professional Designs: Ideal for freelancers who want a clean, minimalist look. These documents are easy to customize with your contact information, project details, and payment terms, ensuring your billing is straightforward and professional.

- Detailed Breakdown of Services: For those who need to itemize their work, these options provide fields to list each service, hours worked, and individual rates. This transparency helps clients understand the value of your work and reduces the likelihood of disputes.

- Flexible Payment Terms: Pre-made solutions allow you to include your preferred payment methods, due dates, and late fee policies, making it easier to communicate payment expectations to your clients.

- Customizable Branding: Some options allow you to add your logo, adjust colors, and include other branding elements, giving your billing documents a personal touch that reflects your unique freelance brand.

- Time-Saving Features: Many of these free solutions come with automatic calculation fields for totals, taxes, and discounts. This reduces the amount of time spent manually calculating and ensures accuracy.

Using these free resources, freelancers can easily create polished, accurate billing documents that help maintain professionalism and streamline the payment process. Whether you’re just starting out or are a seasoned professional, these pre-designed options are a valuable tool to manage your business finances more efficiently.

What to Include in an Invoice

Creating a professional billing document is essential for clear communication between a business and its clients. A well-structured payment request ensures all necessary details are provided, making it easier for clients to understand charges and process payments. Below are the key components that should always be included in any payment request to avoid confusion and streamline the payment process.

Essential Details

- Your Business Information: This includes your business name, address, contact number, and email. Adding your company’s logo is optional but can help establish a professional image.

- Client Information: Include the client’s name, company name, address, and contact details to ensure that the correct party receives the payment request.

- Unique Reference Number: Each document should have a unique identifier for tracking and reference purposes. This helps both parties manage records efficiently.

- Issue Date: Clearly state when the document is being issued, which helps both parties track the timing of the transaction.

- Due Date: Always include a clear due date for payment to avoid any misunderstandings about when payment is expected.

Payment Breakdown

- Detailed List of Products or Services: Include a description of the goods or services provided, including quantities and individual prices, so that the client can clearly see what they are being charged for.

- Subtotal: The total amount for the items or services before any additional costs such as taxes or discounts.

- Taxes and Additional Fees: Include any applicable taxes, shipping fees, or other charges that should be added to the subtotal.

- Final Total: The final amount due, which is the sum of the subtotal, taxes, and any additional fees.

- Payment Terms: State the accepted methods of payment, and if necessary, include details of any late payment penalties or discounts for early payment.

By ensuring these elements are included in your billing documents, you can improve clarity, reduce payment delays, and maintain professionalism in your business transactions.

Understanding Invoice Template Formats

When creating billing documents, it’s important to choose the right format that suits your business needs. The layout and structure of a document can affect both the ease of use and the professionalism it conveys to your clients. There are several different formats available, each with its unique features and benefits. Understanding these options can help you select the most effective solution for your business.

Common Formats for Billing Documents

- Word Documents: Word-based documents offer flexibility and customization. You can easily modify the design, add logos, and adjust text. This format is ideal for businesses that prefer detailed editing but may require manual calculations.

- Excel Spreadsheets: Excel files are perfect for those who need automatic calculations, such as tax or discounts. They allow for easy data entry and quick adjustments, especially for businesses with frequent or recurring billing needs.

- PDF Files: PDF documents are a popular choice for final versions, as they maintain their formatting across all devices. Once completed, these can be easily emailed to clients, ensuring that the document looks professional and doesn’t change during transmission.

- Online Platforms: Many businesses opt for cloud-based solutions that provide templates through a web interface. These platforms often come with built-in functionality, such as automatic tax calculations and integration with accounting software. They’re convenient for teams and businesses that need to create and share documents quickly.

- Google Docs/Sheets: A cloud-based option similar to Word or Excel, Google Docs and Sheets allow for collaboration and easy access from anywhere. These tools are great for teams and freelancers who need flexibility and real-time editing.

Choosing the Right Format

- For Simplicity: If you want something straightforward and easy to fill out, Word documents or simple PDFs may be the best option.

- For Automation: Excel spreadsheets or online invoicing platforms can automate calculations, reducing the risk of errors and saving time.

- For Professionalism: If you’re aiming for a polished, business-grade appearance, PDF files are ideal for sending finalized documents to clients.

By understanding the different formats available, you can choose the one that best fits your workflow and ensures a smooth, professional billing experience.

How to Use Excel for Invoices

Excel is a powerful tool that can simplify the process of creating and managing billing documents. With its built-in features, such as formulas for automatic calculations and customizable layouts, Excel makes it easy to create accurate and professional payment requests. Whether you’re a freelancer or a small business owner, using Excel for your payment documents can save time and reduce errors.

To get started, you can either use a pre-made Excel document or create your own from scratch. Here are a few key steps to help you efficiently use Excel for your billing needs:

- Create a New Spreadsheet: Open a new workbook in Excel. Set up a clear structure by organizing sections for your company details, client information, list of services, totals, and payment terms.

- Set Up Columns: For the list of services or products, create columns for the description, quantity, rate, and total cost. Excel can then automatically calculate totals by multiplying quantities by rates, saving you time.

- Use Formulas for Automatic Calculations: Excel allows you to use formulas to calculate the subtotal, taxes, and final amount due. For example, use the SUM function to add up totals and apply percentages for tax rates.

- Format for Clarity: Use bold text for headers, and align your data neatly into rows and columns to ensure that your document is easy to read. Excel’s gridlines can help maintain structure, but consider removing them for a cleaner, professional look when sending the document.

- Include Payment Terms: At the bottom of the sheet, add your payment instructions, due date, and any penalties for late payments. This ensures that your client knows exactly how and when to pay.

Once you’ve filled in all the details, you can save the file in Excel format for further edits or export it as a PDF for easy sharing. Using Excel for billing documents not only makes the process quicker and more efficient but also allows for easy record-keeping and updates when necessary.

How to Ensure Invoice Accuracy

Ensuring the accuracy of billing documents is crucial for maintaining professionalism and avoiding disputes with clients. Mistakes in pricing, totals, or payment terms can lead to delays, confusion, and even lost revenue. By following a few simple steps, you can significantly reduce the likelihood of errors and improve the efficiency of your payment collection process.

Double-Check Key Information

- Client Details: Verify that the client’s name, address, and contact information are correct. Mistakes in this section can lead to your document being sent to the wrong person or business.

- Dates: Ensure the issue date and due date are accurate. Incorrect dates can cause confusion regarding payment deadlines, which may affect timely payments.

- Descriptions of Services or Products: Double-check that all items or services listed are accurate, including quantities, rates, and any applicable discounts. Missing or incorrect details can lead to discrepancies when the client reviews the document.

Verify Calculations and Totals

- Subtotal and Total: Always calculate the subtotal by adding up individual costs before applying taxes or discounts. Ensure that these numbers match the final total.

- Taxes and Fees: Double-check the tax rates and any additional fees (such as shipping) to ensure they are applied correctly. Use formulas to automate this process whenever possible to minimize human error.

- Payment Terms: Clearly outline payment terms, including methods of payment, late fees, and discounts. Ensure that these terms are consistent with your business’s policies and previous agreements with the client.

By carefully reviewing all the elements of your billing document before sending it out, you can prevent errors that might delay payment or harm your professional reputation. Accuracy not only makes your transactions smoother but also builds trust with your clients.

Legal Considerations for Invoice Templates

When creating a billing document, it’s important to be aware of the legal aspects that can affect the accuracy, enforceability, and clarity of your request for payment. Ensuring compliance with local laws and regulations can prevent potential issues down the line and protect both you and your clients. Below are key legal considerations to keep in mind when creating your payment documents.

Essential Legal Elements

- Business Identification: Your document should include your business name, address, and registration details, where applicable. This helps establish your legal identity and ensures that the client knows who is requesting payment.

- Tax Information: Depending on your jurisdiction, you may be required to include your tax identification number (TIN) or VAT number. Ensure that all relevant tax details are correctly listed to comply with tax regulations.

- Clear Payment Terms: Specify payment deadlines, late fees, and interest rates for overdue payments. These terms should be in line with your business policies and legally enforceable under the relevant contract laws.

- Dispute Resolution Clauses: Including clauses that outline the process for handling disputes can prevent legal complications. This might include specifying mediation or arbitration as the first steps in case of disagreements.

Additional Considerations

- Currency and Payment Methods: Clearly indicate the currency in which payment is expected and the acceptable methods of payment. This can prevent confusion, especially in international transactions.

- Local and International Compliance: Make sure that your documents adhere to local laws, such as data protection and privacy regulations. For example, you may need to keep client details confidential and adhere to GDPR in the EU.

- Record-Keeping: Keep a copy of all issued documents for your own records. This can be important for legal purposes, especially if you need to provide proof of a transaction or if there’s a dispute over payment terms.

By incorporating these legal elements into your billing practices, you can ensure that your documents are legally sound, protect your business, and foster trust with your clients. Being proactive about legal considerations will help you avoid potential disputes and ensure that your transactions proceed smoothly.

Improve Cash Flow with Invoice Templates

Effective management of your payment requests can have a significant impact on your business’s cash flow. By using structured and professional documents, you can streamline the payment process, reduce delays, and ensure that you receive payments on time. Timely and accurate payment requests not only improve your financial stability but also help build a trustworthy relationship with clients. Below are some ways that using well-designed payment documents can directly benefit your cash flow.

Faster Payments

- Clear and Professional Design: A well-organized and easy-to-read document ensures that your clients can quickly understand the payment amount, due date, and any additional terms. This clarity can encourage faster processing of payments.

- Automated Calculations: By using tools that automatically calculate totals, taxes, and discounts, you eliminate the risk of errors, reducing the chances of delays due to discrepancies and disputes.

- Consistency in Billing: Regularly issuing payment requests on a consistent schedule helps set expectations and reminds clients to pay on time. The more streamlined the process, the faster the money comes in.

Reduced Administrative Time

- Pre-designed Fields: Using pre-structured documents that include fields for all necessary information reduces the time spent creating each request. This efficiency allows you to focus on other aspects of your business.

- Easy Tracking: When using a standardized format, tracking past due amounts and organizing your financial records becomes simpler. You can easily follow up on overdue payments and maintain better records of transactions.

By incorporating these practices into your payment process, you can create a smoother, more predictable cash flow. A well-designed payment document not only speeds up payments but also reduces the chances of errors or confusion, improving both your cash position and client relationships.