Basic Freelance Invoice Template for Efficient Billing

For those working outside of traditional employment structures, getting paid on time is crucial. A well-structured billing document ensures clients understand the work done and the amount due. These documents not only help clarify payment expectations but also maintain a professional appearance, which can enhance client relationships.

Designing a clear and organized payment request is essential for any independent professional. It simplifies the transaction process, reduces misunderstandings, and acts as a record for both the service provider and the client. Whether you’re providing creative services, consulting, or technical support, an effective payment request is a valuable tool in your business operations.

In this guide, we will explore how to craft a straightforward yet professional document that meets your needs. We will discuss the key components, customization options, and practical tips for creating a document that helps ensure you get paid on time and without hassle.

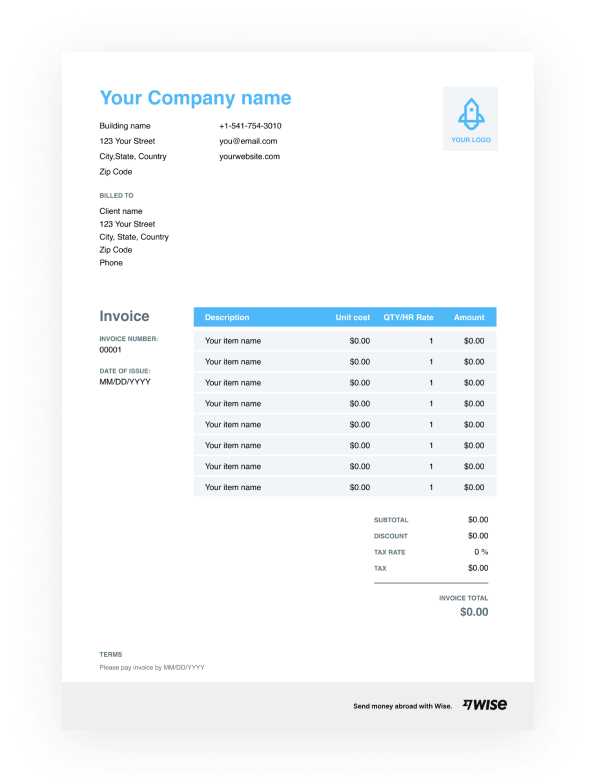

Basic Freelance Invoice Template

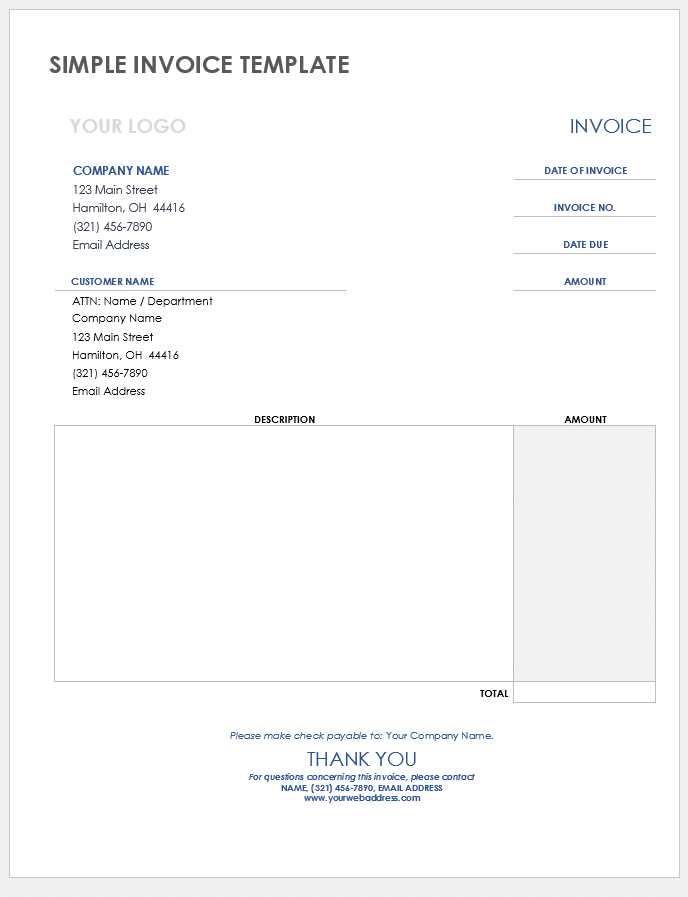

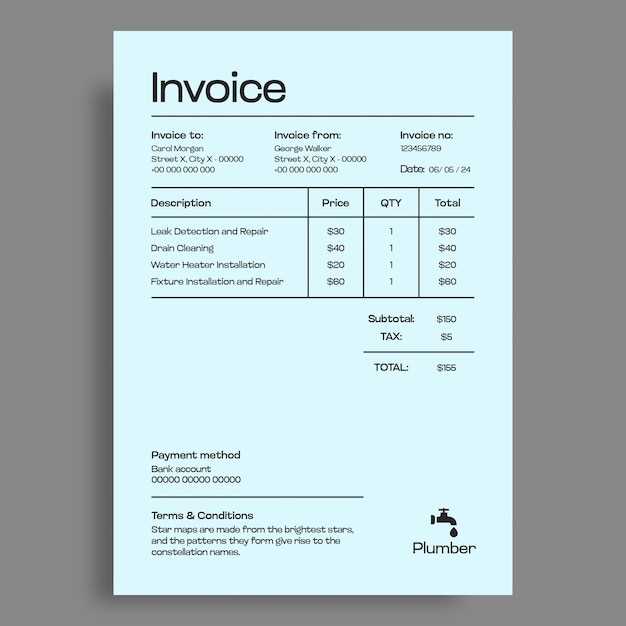

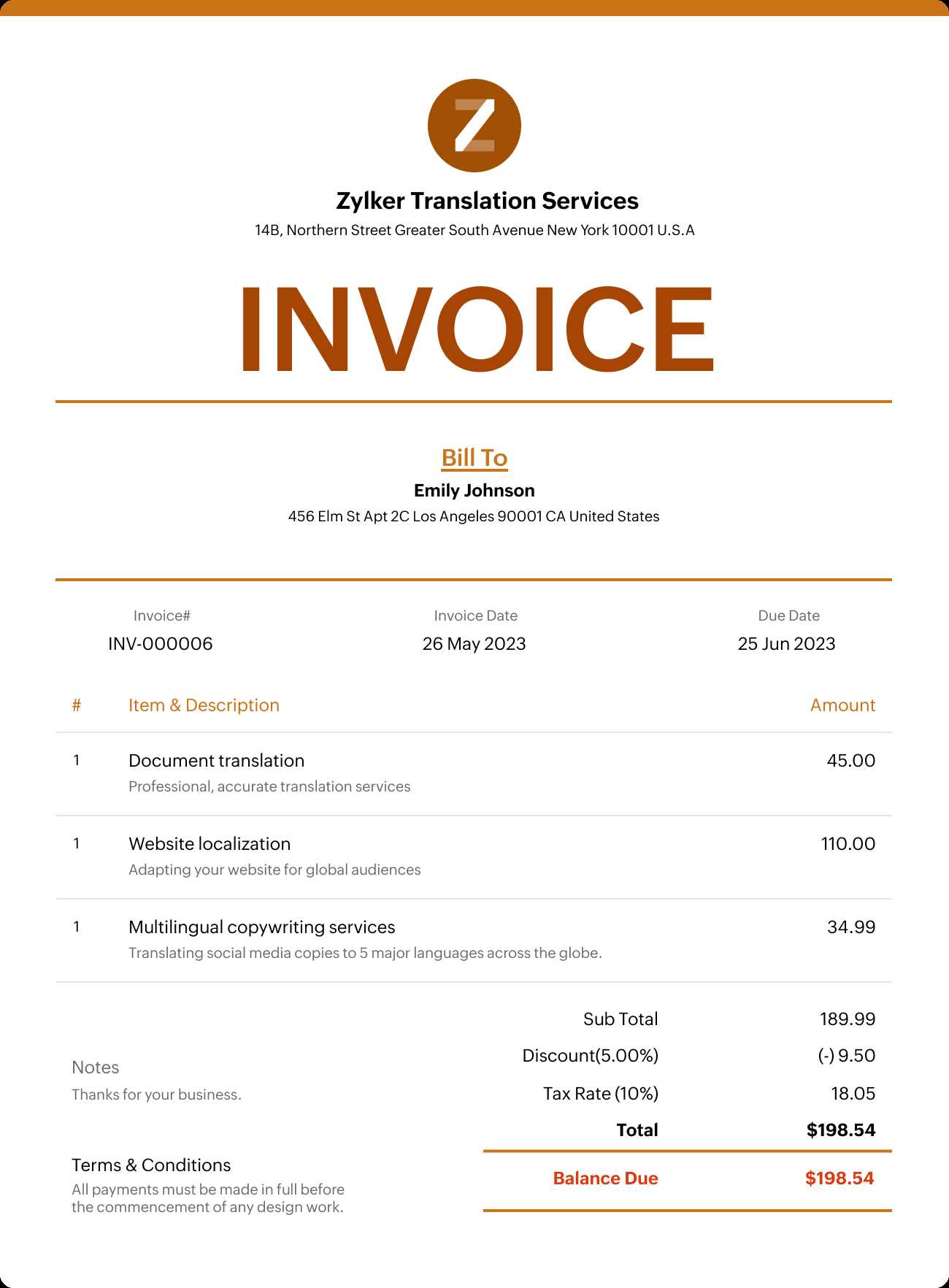

Creating a simple yet effective billing document is essential for any independent contractor. A well-organized payment request helps both parties track the scope of work completed and the amount due, preventing confusion or delayed payments. Below is an example of a straightforward structure that covers all the necessary details without being overly complex.

| Section | Description |

|---|---|

| Your Information | Include your full name, business name (if applicable), address, and contact details for easy communication. |

| Client’s Information | Provide your client’s name, company name, address, and contact information for clarity. |

| Invoice Number | Assign a unique number to each payment request to maintain proper record-keeping and tracking. |

| Service Description | Clearly list the services provided, along with the corresponding dates of completion. Be as detailed as needed. |

| Total Amount Due | Specify the total amount your client owes, including any taxes or additional fees, if applicable. |

| Payment Terms | Set clear payment deadlines and indicate acceptable payment methods (bank transfer, PayPal, etc.). |

This structure serves as a solid foundation for crafting a document that looks professional and functions well for both the provider and the client. By following this basic layout, you can ensure that all the necessary details are covered and that the transaction process goes smoothly.

Why Freelancers Need Invoices

For independent professionals, clear documentation of services provided and payments due is essential for smooth financial operations. A well-structured billing document helps establish a formal agreement between the service provider and the client, ensuring both parties are on the same page regarding compensation. Below are some of the key reasons why such documents are critical in independent work.

Maintaining Professionalism

When working independently, establishing trust with clients is vital. A properly drafted payment request adds a layer of professionalism to your work and helps build confidence. It shows that you are organized and serious about your business, which can lead to more repeat clients and referrals.

Tracking Work and Payments

Tracking completed projects and payments received is much easier when you use clear billing documents. This not only helps you stay organized, but it also provides you with an accurate record for tax purposes, financial planning, and resolving any disputes that may arise.

- Accurate record-keeping for tax purposes

- Helps avoid confusion over services rendered

- Facilitates easy communication with clients regarding payment

Ensuring Timely Payments

Without a formal request for payment, clients may delay sending funds, either intentionally or due to oversight. By issuing a structured payment document with clear terms, you increase the likelihood of timely payment and avoid unnecessary delays.

- Clear due dates and payment methods

- Prevents misunderstandings or missed payments

- Improves cash flow for independent professionals

In conclusion, having a clear, organized billing system is essential for independent workers to maintain professionalism, track their earnings, and ensure they receive timely compensation for their work.

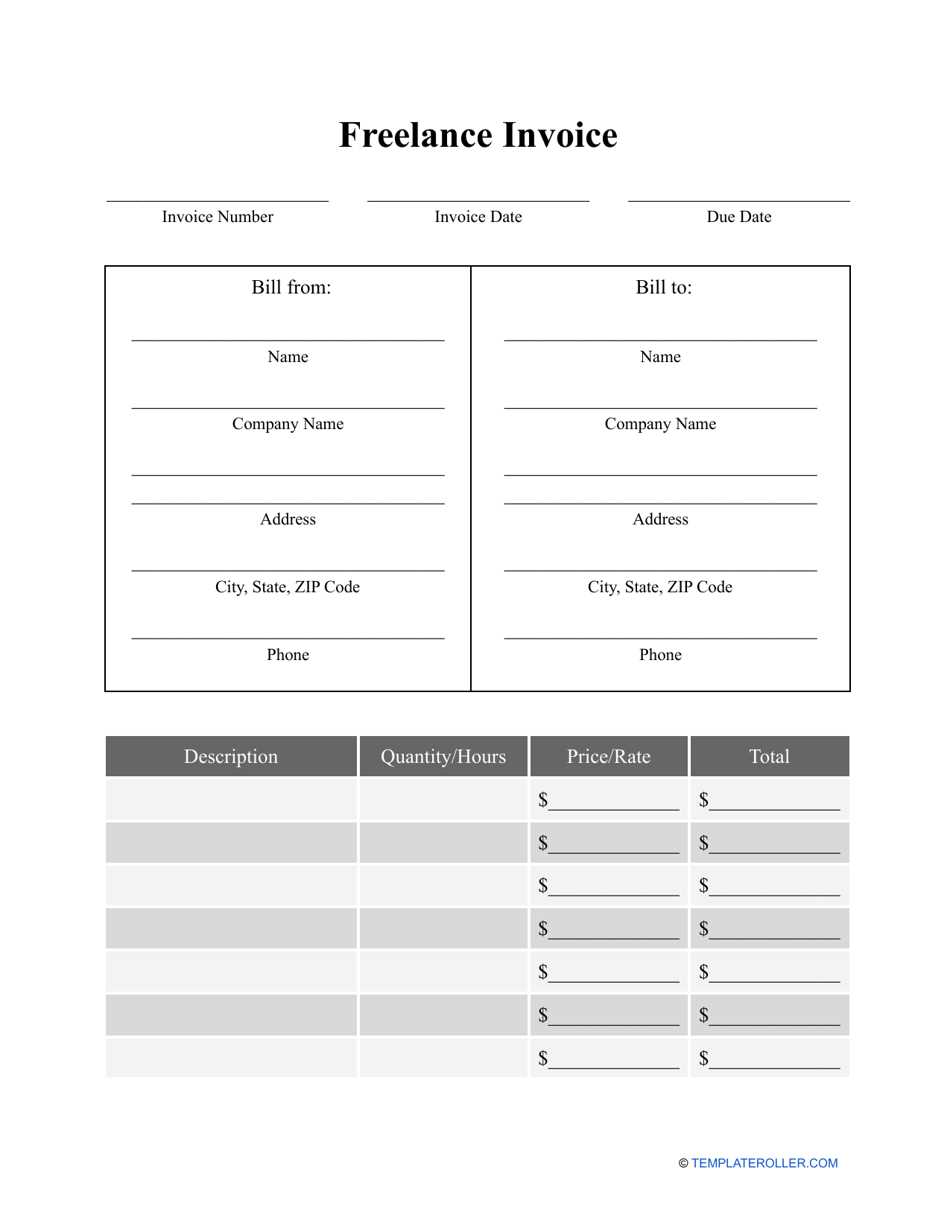

Key Elements of a Freelance Invoice

Creating an effective billing document requires including all the necessary details that ensure both the service provider and the client have a clear understanding of the payment expectations. A well-structured document serves as both a record and a formal request for payment. Below are the essential elements that should be present in any billing document.

Client and Provider Information

The first step in crafting a payment request is to include both parties’ contact information. This ensures that both the service provider and the client can easily get in touch if necessary. Be sure to include the following:

- Your name or business name

- Your address and contact details

- Client’s name or company name

- Client’s address and contact information

Services Rendered and Payment Details

Clearly listing the services provided is crucial for transparency and to avoid disputes. Specify the scope of work, dates when the services were performed, and any agreed-upon rates. Other key details to include are:

- Detailed description of services performed

- Hourly rate or fixed price for each service

- Total amount due

- Applicable taxes or additional fees, if any

By including these details, you create a clear and professional record of the transaction that can be referenced by both parties.

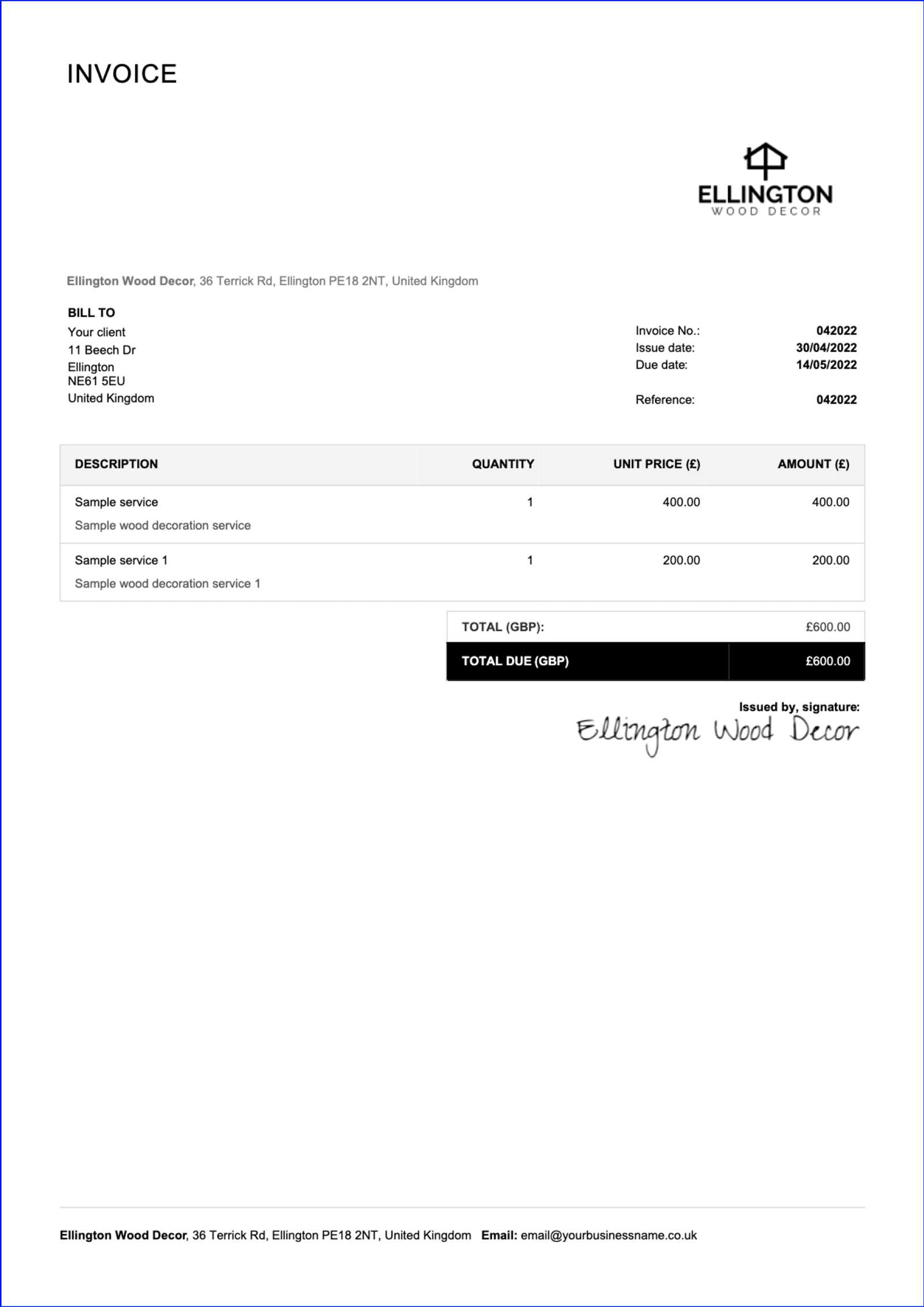

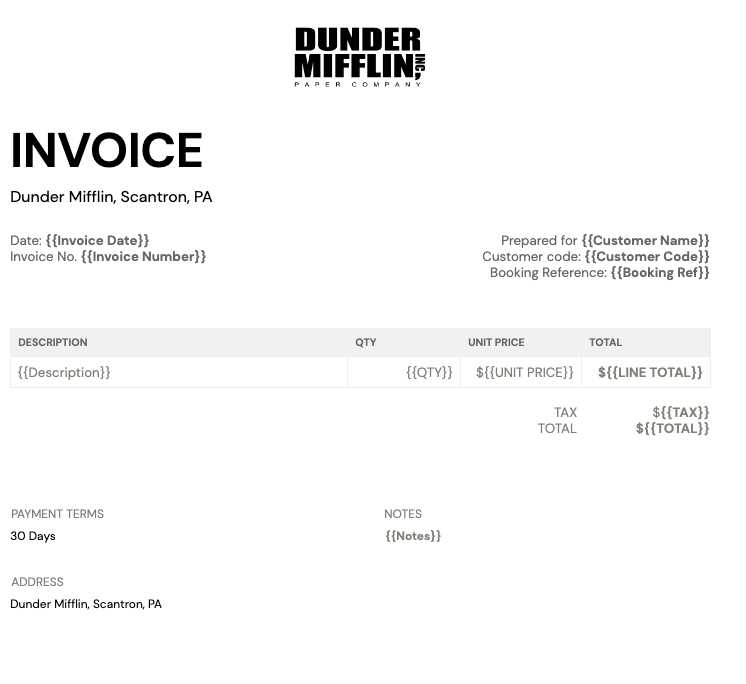

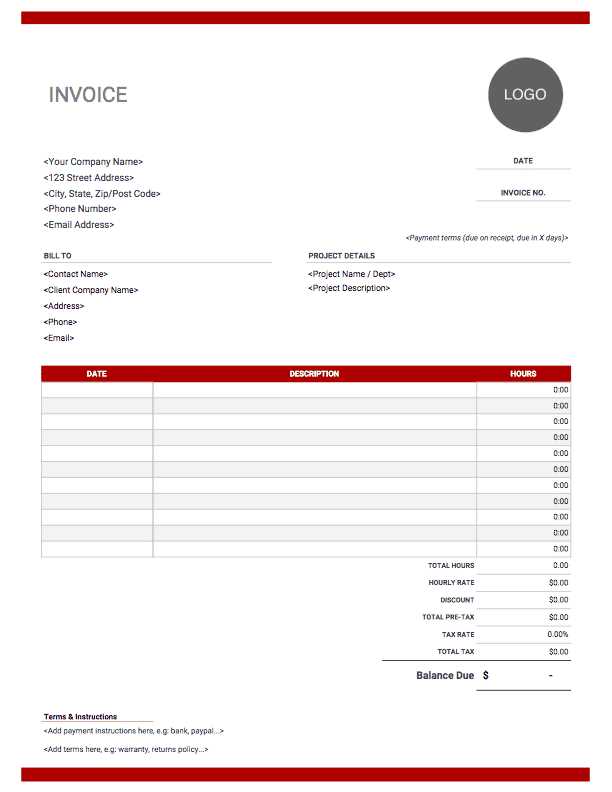

How to Customize Your Invoice Template

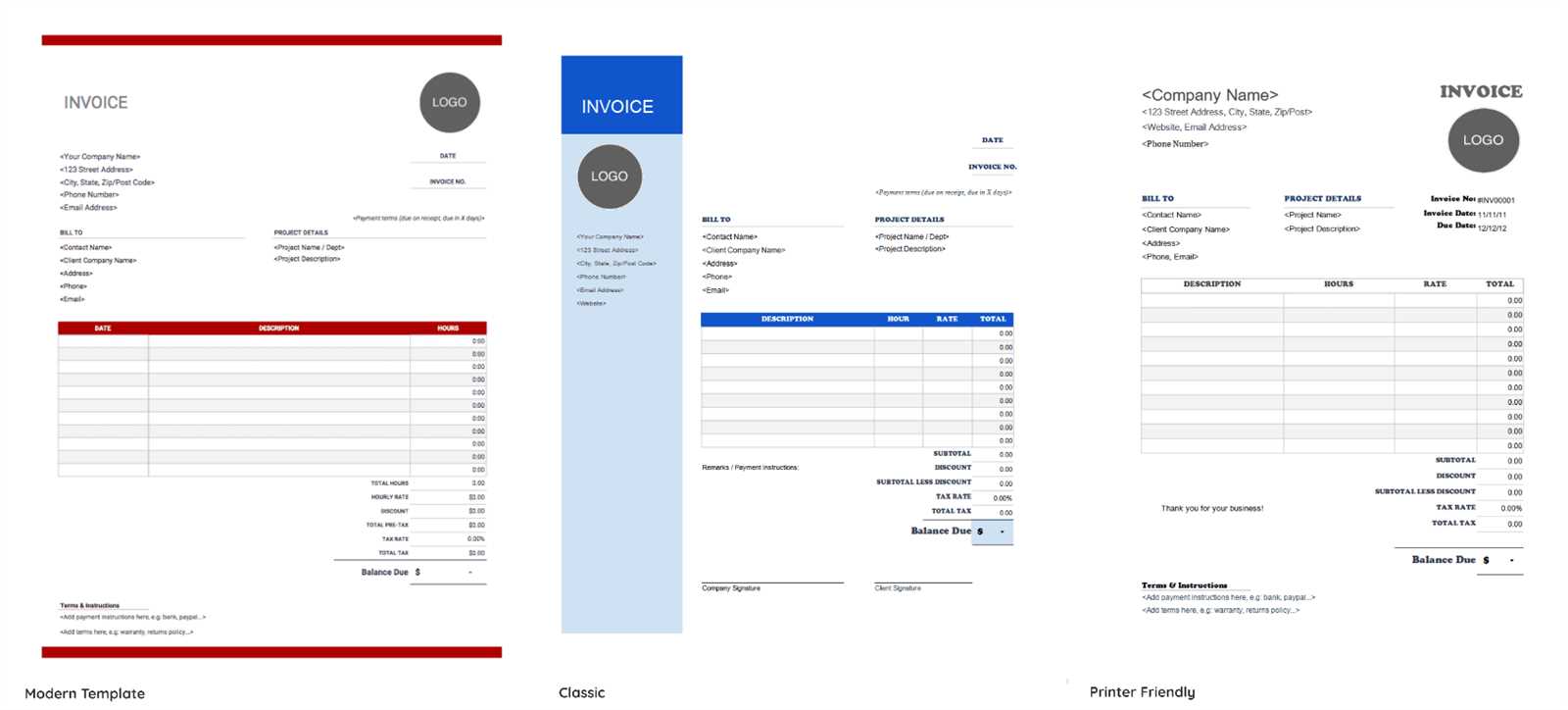

Customizing your billing document to reflect your brand and specific business needs can help make a professional impression and ensure clarity for your clients. While a standard structure works, adding personal touches and adjusting the layout to suit your business can improve both functionality and client satisfaction. Below are steps to customize your payment request document effectively.

Adjusting the Layout

The layout of your document should be clean, simple, and easy to navigate. Make sure the most important information stands out. Here are a few ways to adjust the design:

- Include your logo at the top to create a professional look.

- Ensure there is plenty of white space for readability.

- Use consistent font styles and sizes throughout.

- Place key sections like payment terms, services, and totals in clearly defined sections.

Personalizing with Specific Details

Incorporate specific details related to your business, service, or clients to make each document unique. Customization ensures that your billing requests stand out and are tailored to your work style:

- Add a custom note or message thanking your client for the business.

- Include a discount or loyalty incentive, if applicable.

- Set personalized payment terms based on your relationship with the client.

- Adjust date formats, currency symbols, and tax details depending on your location or industry.

By making these adjustments, your billing document becomes more than just a request for payment–it becomes an extension of your professional image and your commitment to high-quality service.

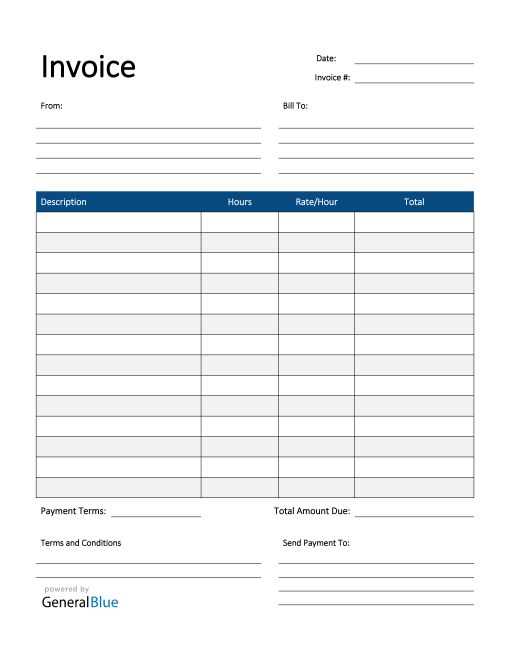

Freelance Invoice Formatting Tips

Properly formatting your billing document is essential to ensure clarity and professionalism. An organized layout helps both you and your client quickly locate important details, such as the services provided, the amount due, and the payment terms. Following a few simple formatting tips can make your document more effective and easy to read.

First, always keep the document clean and straightforward. Avoid clutter by using clear headings and separating sections with adequate spacing. This helps the client quickly understand the breakdown of the charges and the payment process. Additionally, align your text neatly–left-aligning text is typically the most readable, especially for large blocks of information.

Another important tip is to use bold or larger fonts for key information such as your business name, the total amount due, and the payment due date. This ensures these details catch the reader’s eye and prevent important information from being overlooked.

Also, keep the document consistent by sticking to a single font style throughout. Choose a professional font like Arial, Helvetica, or Times New Roman, and avoid decorative or overly complex fonts that may hinder readability.

Finally, remember that the visual appeal of your document is just as important as the information it contains. A well-formatted request not only looks professional but also makes the process of payment smoother and quicker for your client.

Common Mistakes to Avoid in Invoices

Even the most experienced professionals can make errors when preparing a billing document. These mistakes can lead to confusion, delayed payments, and unnecessary back-and-forth with clients. By being aware of the common pitfalls, you can ensure that your requests for payment are clear, accurate, and professional. Below are some of the most frequent mistakes to watch out for.

Missing or Incorrect Contact Information

One of the most common mistakes is failing to include accurate contact details for both yourself and your client. If your client cannot reach you easily, or if the information is incorrect, payment may be delayed. Always double-check that your contact information is complete and up to date.

Unclear or Incomplete Service Descriptions

Vague descriptions of the work performed can lead to misunderstandings. Ensure that each service is described in enough detail for the client to understand what was delivered. Include dates, hours worked, or any other relevant information that helps clarify the nature of the work.

Forgetting to Include Payment Terms

Another mistake is not specifying the payment terms clearly. Whether you expect payment upon receipt, within 30 days, or by another deadline, make sure the terms are explicitly stated. Failure to do this can result in late payments or disputes over when payment is due.

Incorrect Calculation of Amounts

Errors in the total amount due are another common issue. Always double-check your math, including rates, quantities, and taxes. Mistakes in calculations can not only delay payments but also damage your professional reputation. Using automated tools or software can help minimize these errors.

Not Including a Unique Identifier

For proper tracking and reference, each payment request should have a unique identification number. Without it, you or the client may have trouble locating and distinguishing specific transactions in the future. This is especially important when handling multiple clients or projects.

Overlooking Late Fees or Discounts

If you offer early payment discounts or charge late fees, be sure to include them clearly in the document. Omitting these details could result in a loss of income or confusion regarding the terms. Always outline these fees in a transparent and professional manner.

By avoiding these common mistakes, you can ensure that your payment requests are clear, professional, and efficient, ultimately leading to smoother transactions and better relationships with your clients.

Setting Payment Terms on Your Invoice

Clearly defined payment terms are crucial for ensuring timely payments and maintaining a professional relationship with your clients. Setting expectations upfront helps prevent confusion and ensures both parties understand when payment is due and how it should be made. Whether you prefer immediate payment, a set period after delivery, or specific payment methods, outlining these terms on your billing document is essential.

Define the Due Date

The due date is one of the most important elements to specify. Whether you expect payment upon receipt or within a set period (such as 7, 15, or 30 days), make sure the due date is clear and unambiguous. A well-defined timeline helps prevent misunderstandings and ensures that your client knows when to settle the balance.

Specify Accepted Payment Methods

Different clients may prefer different ways of paying. Whether it’s bank transfer, PayPal, credit card, or another method, clearly indicate your preferred payment options. By specifying these upfront, you avoid delays that can arise from clients having to ask for details or use an unfamiliar payment method.

Include Late Fees or Penalties

If you plan to charge interest or fees for late payments, be sure to include this in your payment terms. Outline the fee structure, such as a flat fee or a percentage of the total amount for each day or week the payment is overdue. Make sure this is stated clearly to encourage prompt payment.

Offer Early Payment Discounts

If you want to encourage clients to pay sooner, offering a discount for early payment can be an effective strategy. Clearly specify the discount amount or percentage and the time frame within which it applies. This incentive can motivate clients to prioritize your payment over others.

Set Clear Payment Conditions for Ongoing Work

If your work involves multiple phases or ongoing projects, set payment terms for each stage of the project. For example, you may require a deposit before beginning work and the remaining balance upon completion of the project. These terms should be laid out clearly to avoid disputes about payments at various stages of the work.

By setting clear, fair, and realistic payment terms, you create a transparent agreement that benefits both you and your clients, leading to smoother transactions and better working relationships.

Including Taxes in Your Invoice

When preparing a billing document, it’s essential to include any applicable taxes to ensure that the total amount due is accurate and complies with local tax regulations. Whether you’re charging sales tax, VAT, or other forms of taxation, being transparent about these charges helps prevent confusion and ensures timely payments. Below are some tips on how to properly incorporate taxes into your payment request.

Understanding Tax Requirements

Before including taxes in your billing request, it’s important to understand the tax laws in your region or the region of your client. Some areas require professionals to charge tax on certain goods or services, while others may offer exemptions. Research the specific tax rates that apply to your industry and location to ensure compliance.

How to Calculate Taxes

Once you know the applicable tax rate, calculating the amount to add to your total is straightforward. To calculate the tax amount:

- Multiply the cost of your services or products by the tax rate (e.g., 5% or 0.05).

- Ensure you’re using the correct tax rate for the type of work you’re doing and the location of the client.

- Add the tax amount to the total sum to reflect the final amount due.

Example: If you provided services worth $500 and the applicable tax rate is 5%, you would charge an additional $25 in tax, making the total amount due $525.

Clearly Displaying Tax Information

It’s crucial to clearly outline any taxes applied to the final amount. This includes:

- Listing the type of tax (e.g., sales tax, VAT) and the rate applied.

- Separating the tax from the total amount to avoid confusion.

- Clearly stating the final amount due, including both services and taxes.

For instance, you might show the following breakdown on your payment request:

- Services: $500

- Tax (5%): $25

- Total: $525

Including taxes in your billing documents not only ensures compliance but also demonstrates professionalism and clarity to your clients. By being transparent about how taxes are calculated, you build trust and avoid potential disputes over the final payment amount.

Invoice Payment Methods for Freelancers

Choosing the right payment methods is crucial for both you and your clients. Offering multiple payment options can help ensure that your clients can pay you quickly and conveniently, reducing the likelihood of delayed payments. It’s important to select methods that suit your business needs while being accessible to your clients. Below are some of the most common and effective payment methods to consider when requesting payment for your services.

| Payment Method | Description | Pros | Cons | |||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Bank Transfer | Direct transfer from the client’s bank account to yours. Common for large payments or long-term contracts. | Secure, no third-party fees, ideal for large amounts | May take several business days to process, requires bank details | |||||||||||||||||

| PayPal | A widely-used online payment platform for quick payments. Can be linked to a debit/credit card or bank account. | Fast, secure, accepted globally, easy to use | Transaction fees for international payments, may require creating a PayPal account | |||||||||||||||||

| Credit/Debit Cards | Clients can pay using their cards through payment processors like Stripe, Square, or PayPal. | Instant payment, widely accessible | Processing fees, potential chargebacks | |||||||||||||||||

| Wire Transfer | Similar to bank transfers, but usually for international payments. Often used for larger transactions. | Safe for large amounts, international access | High fees, can take time, requires sharing sensitive information | |||||||||||||||||

| Checks | Traditional method where clients send a physical check to be deposited into your bank account. | No transaction fees, secure if handled properly | Slow processing, risk of bounced checks, requires waiting for the mail | |||||||||||||||||

| Cryptocurrency | A modern option that allows clients to pay via digital currencies like Bitcoin, Ethereum, etc. | Low transaction fees, fast international payments, growing

How to Send Invoices ProfessionallySending a well-prepared and timely payment request is a key element in maintaining a professional relationship with your clients. The way you present and send your billing document reflects your business practices and can have a significant impact on your reputation. Below are important steps to ensure that you are sending your payment requests in a professional manner. Use the Right Communication Channel Ensure you are using the preferred communication method for your client when sending the payment request. Whether it’s email, a project management platform, or another method, make sure the delivery is reliable and secure. Email is typically the most common method, but some clients may prefer to receive it via a client portal or other digital tools. Double-Check for Accuracy Before sending any payment request, take the time to review all the details. Verify that the amounts, payment terms, and client information are correct. A small mistake can cause delays and confusion, so it’s important to ensure the accuracy of the document. Additionally, check that any taxes or discounts are applied correctly. Attach the Document Properly Attach your payment request as a PDF or another widely accessible format. PDFs are ideal because they maintain formatting and cannot be easily altered. In the email body, provide a brief message explaining the attachment, along with a polite reminder of the payment terms and due date. Include a Personal Message While the main purpose of the communication is to request payment, including a short, professional message can strengthen your client relationship. A simple note thanking your client for their business or offering assistance with any questions they may have shows professionalism and consideration. Set Clear Expectations for Payment Clearly state your payment terms within the document and in your message. Include the due date, preferred payment methods, and any applicable late fees. If you offer early payment discounts, make sure those are clearly outlined as well. Setting clear expectations will help avoid any misunderstandings. Follow Up When Necessary If the due date passes without payment, send a polite reminder email. Avoid being aggressive; simply remind your client of the due date and ask if there are any issues with the payment process. Regular follow-ups help maintain professionalism while ensuring you get paid on time. By following these best practices, you ensure that your payment requests are not only clear and professional but also help foster long-term, positive relationships with your clients. Tracking Payments with Invoice TemplatesEffective tracking of payments is essential for keeping your business finances organized and ensuring timely receipt of funds. A well-structured billing document can help you monitor outstanding payments and keep an accurate record of transactions. By using a consistent format and incorporating key tracking features, you can simplify the payment process and avoid confusion about what has been paid and what remains due. Adding Payment Status Indicators

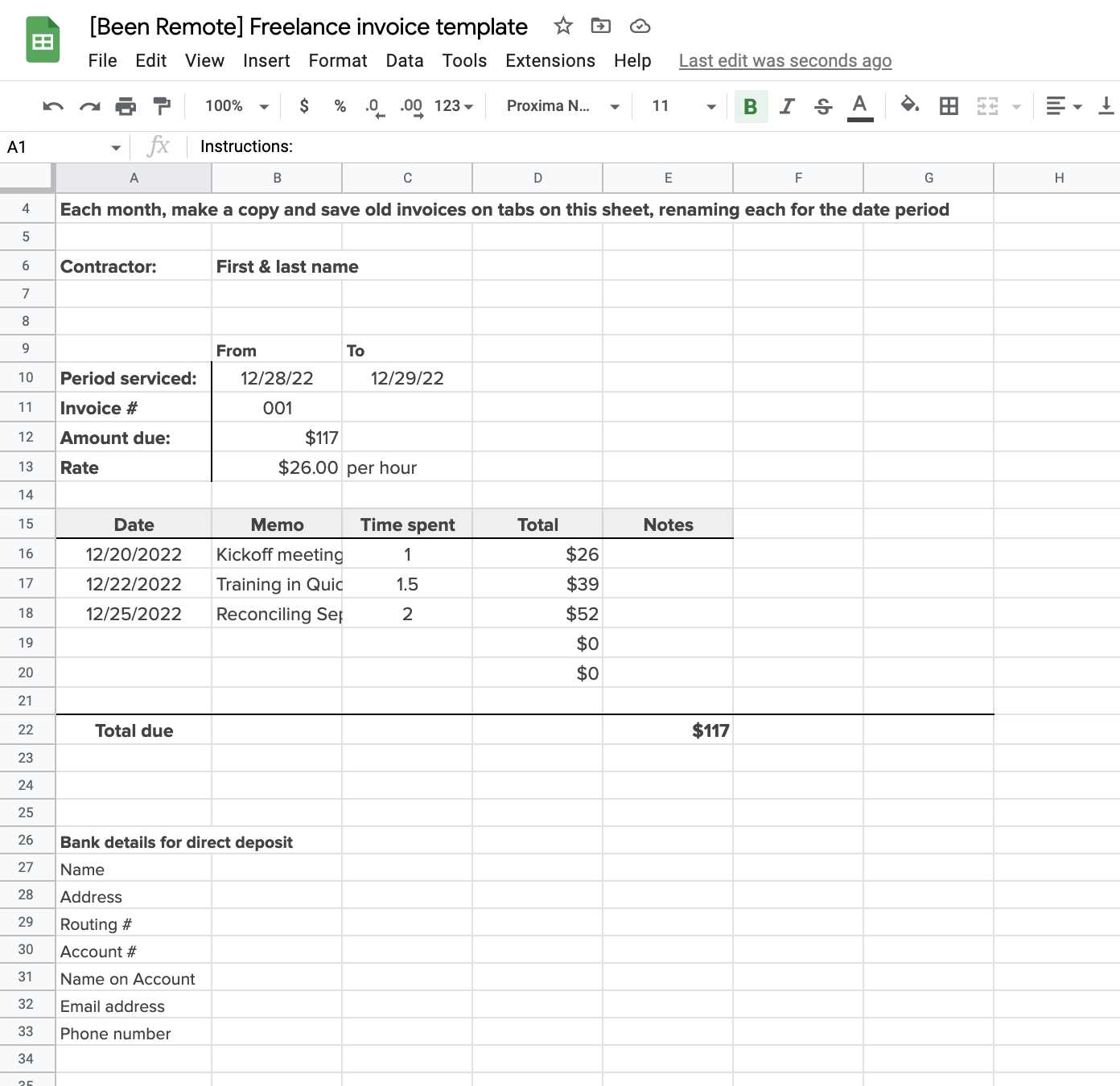

One of the simplest ways to track payments is by clearly marking the payment status on each billing document. Including status indicators such as “Paid,” “Unpaid,” or “Partially Paid” makes it easy to keep track of which transactions are complete and which are still pending. You can also add a section that shows the amount paid and the outstanding balance, ensuring transparency with your clients. Example: If you’ve received part of the payment, you can write “Partial Payment Received” with the exact amount paid and the remaining balance. This helps you and your client stay on the same page. Using Invoice Numbers and Dates

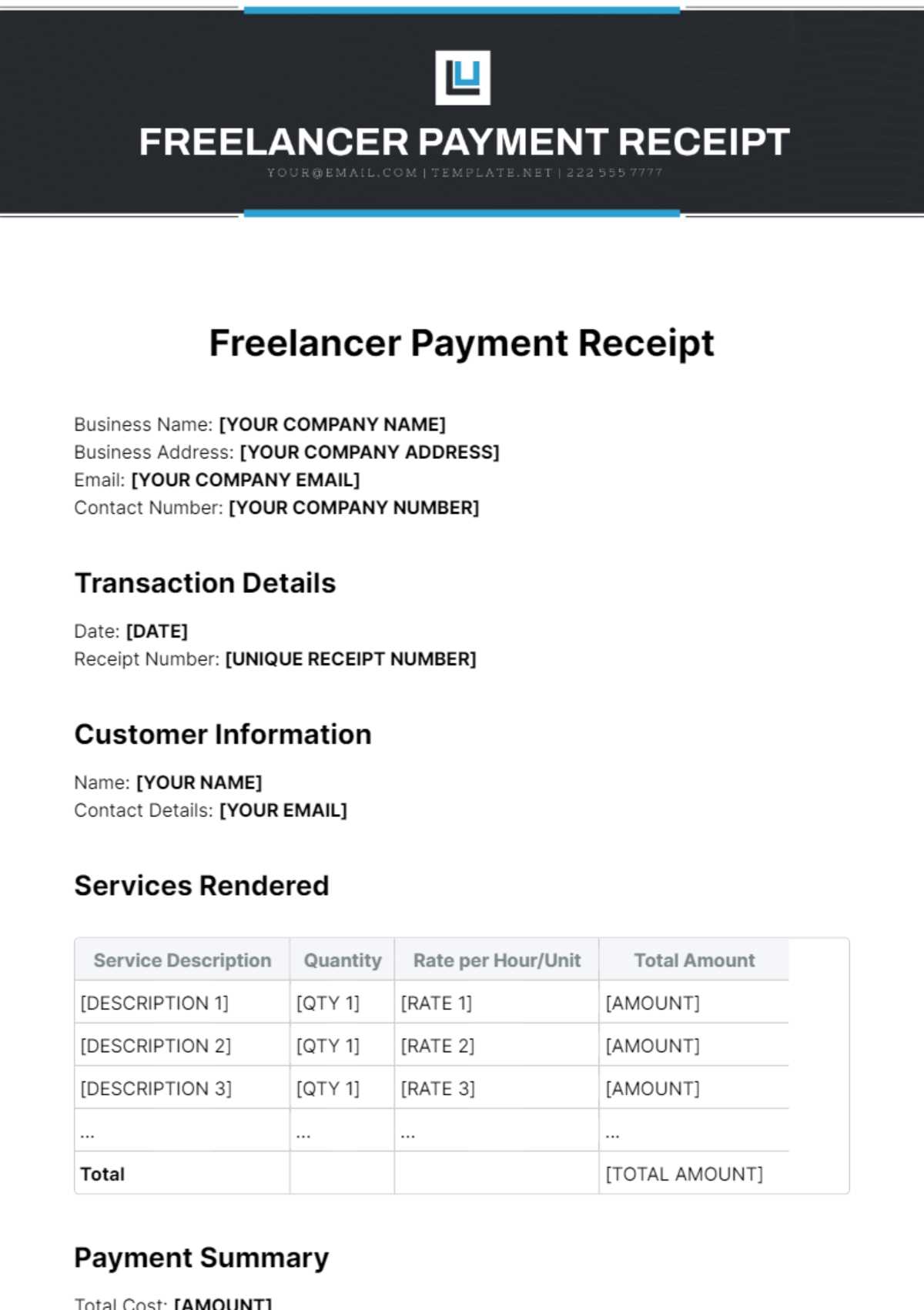

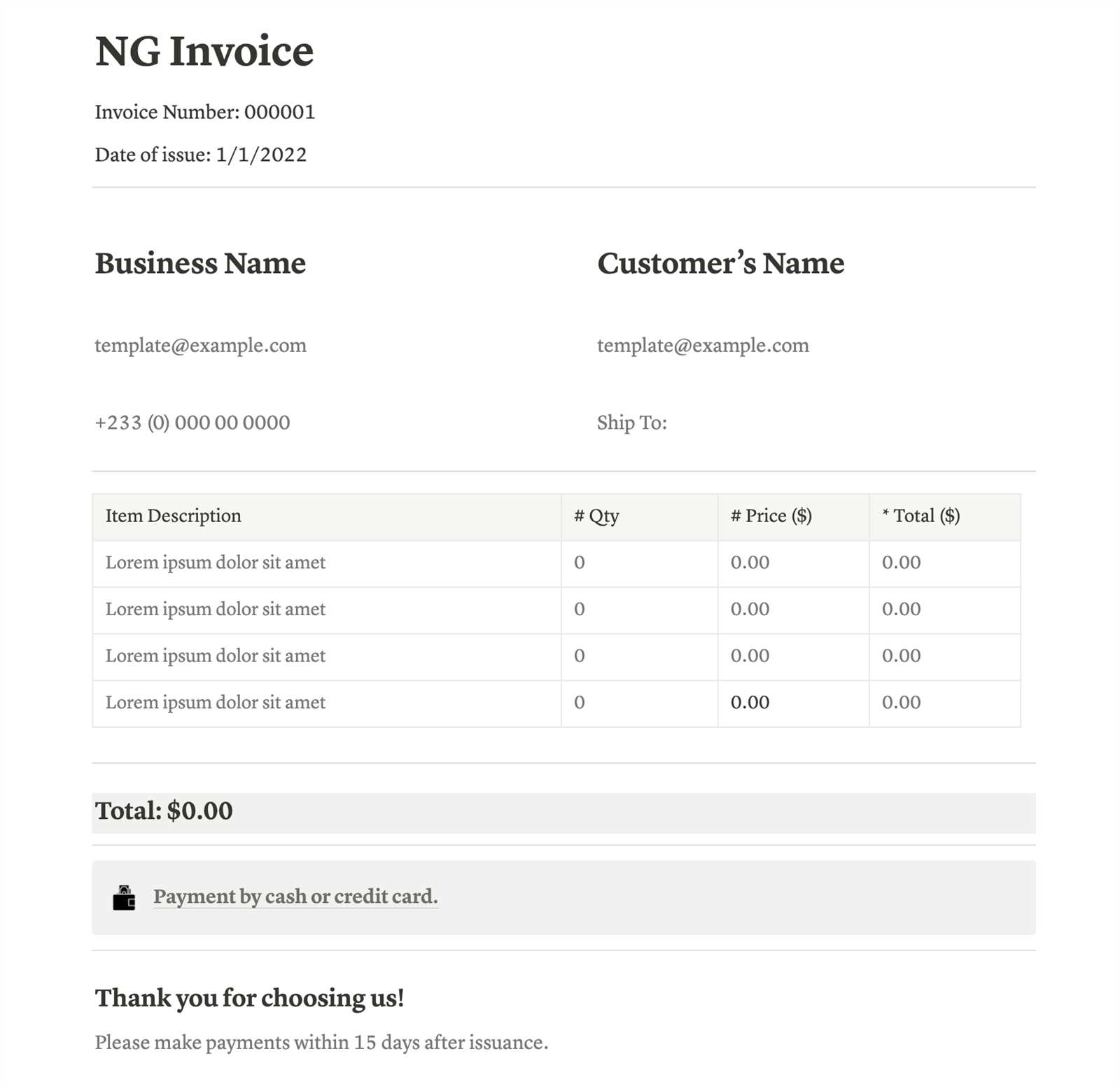

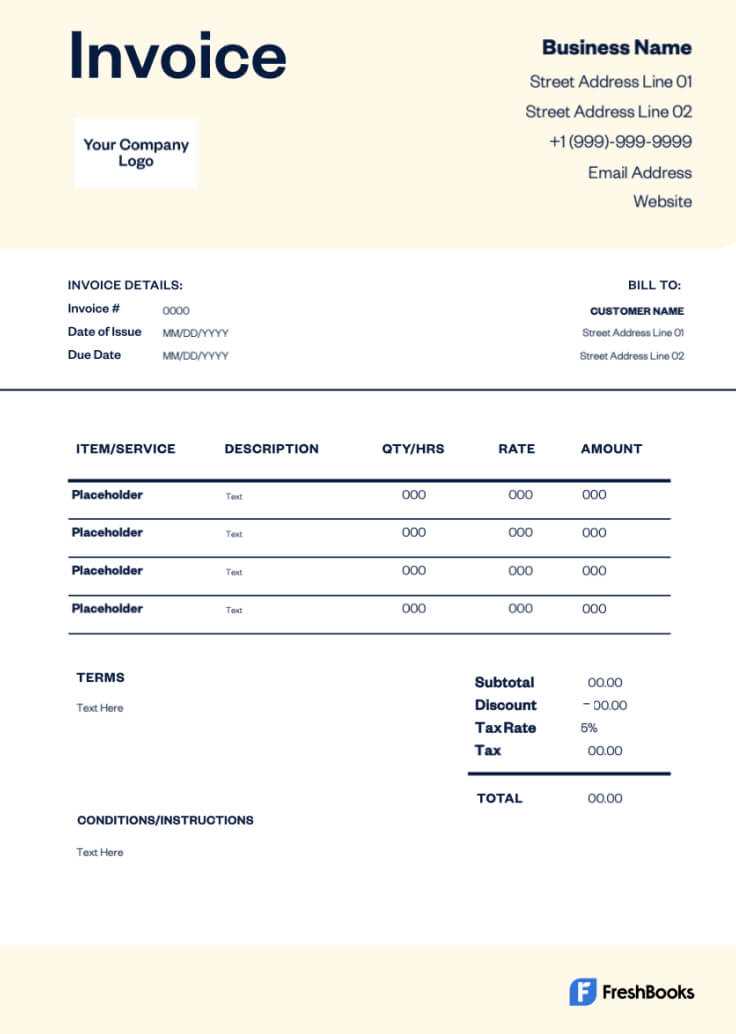

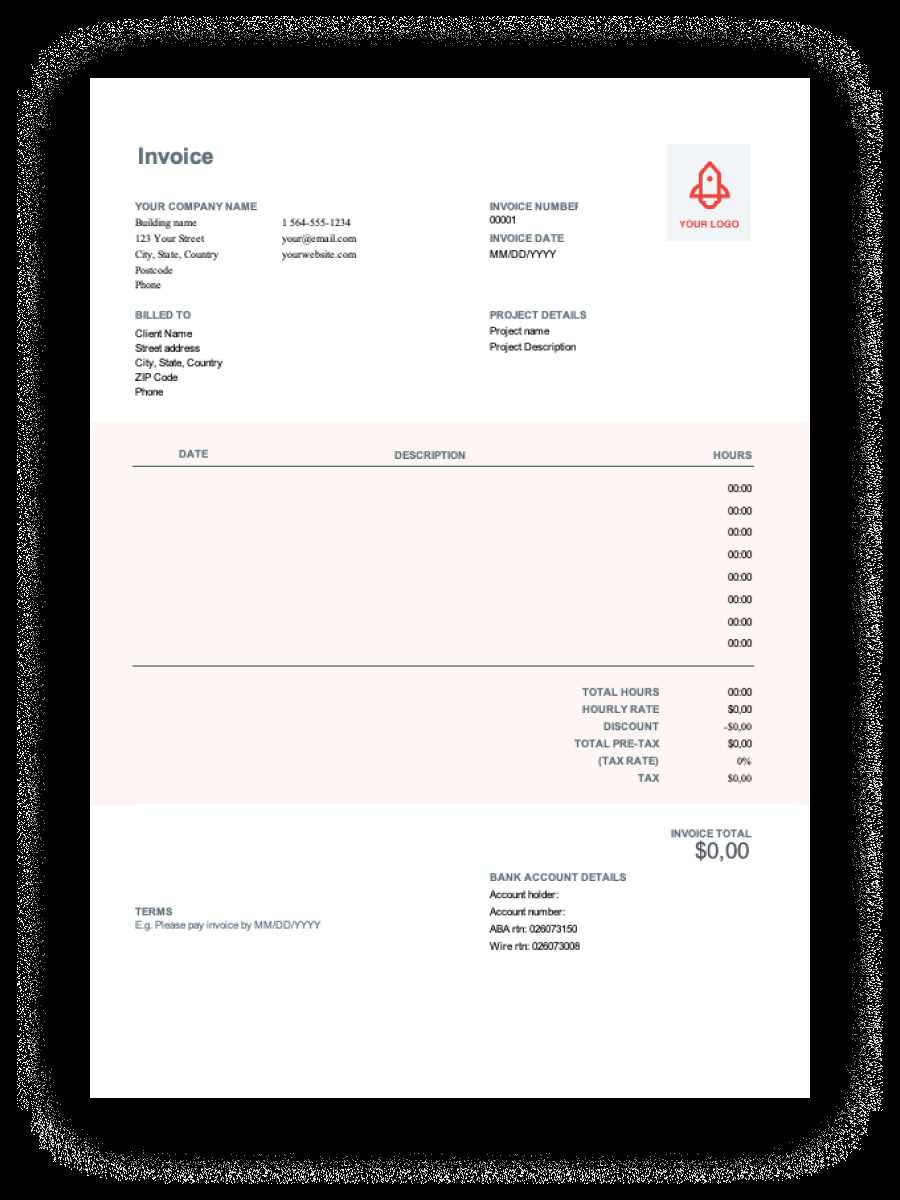

Assigning a unique number to each payment request not only helps you keep your records organized but also makes it easier to reference a specific transaction. Along with the invoice number, include the date the document was issued and the due date. These details will assist you in tracking payment deadlines and following up on overdue balances. Example: An invoice might include the number #INV-2024-001, with an issue date of January 15th and a due date of February 15th. If payment has not been received by the due date, you can easily identify the document and follow up accordingly. Tracking payments in this way ensures that you can quickly and efficiently manage your finances, sending reminders when necessary and ensuring all transactions are properly recorded for accounting and tax purposes. Freelance Invoice Template for BeginnersIf you’re just starting out in your independent work, one of the first things you’ll need to master is how to request payment from your clients in a clear and professional manner. Creating a structured and straightforward billing document is an essential skill for new professionals. This document not only ensures you get paid on time, but also helps you build trust and credibility with clients. Essential Information to IncludeA simple payment request should include a few key details to ensure everything is clear and professional. Start by including your full name or business name, contact details, and the date the document was issued. It’s also important to include the client’s name and contact information. Make sure you specify the work completed and any agreed-upon rates or amounts, as well as the total amount due. Example: A basic format could include a section like this:

Making Your Document Clear and Professional

Even if you’re new to working independently, presenting your billing document professionally can go a long way in fostering good client relationships. Use a clean, easy-to-read layout, with bold headings and sufficient space between sections. Avoid clutter and make sure your clients can quickly find the information they need, such as the amount due, payment terms, and any applicable taxes or discounts. Tip: You can find free or paid templates online that can help you structure your document, but always make sure to customize them to suit your specific needs and style. Consistency is key, so once you create a basic template, you can easily reuse it for future projects. By following these simple steps, you can start sending professional payment requests that will keep your business organized and help ensure timely payments from your clients. Using Invoice Software for Efficiency

As a professional offering services, managing payment requests and keeping track of finances can quickly become time-consuming. Using specialized software to automate the process can save you time and reduce the likelihood of errors. These tools are designed to help you create and send requests faster, track payments efficiently, and stay organized with minimal effort. With invoicing software, you can streamline many aspects of the billing process, from generating documents to sending reminders. These platforms often come with built-in features that allow for easy customization and integration with accounting systems, making it easier to manage your business finances in one place. Key Benefits of Using Invoicing SoftwareThere are several advantages to adopting invoicing software for your business:

Example: Using software like QuickBooks or FreshBooks, you can generate an invoice with a few clicks, set due dates, and even send automatic reminders when a payment is overdue. These tools save you from manually entering data and help maintain a more professional workflow. By incorporating invoicing software into your business, you not only save time but also improve the accuracy and efficiency of your payment processes. This leads to smoother client interactions and better financial organization, allowing you to focus more on delivering quality work and growing your business. Free vs Paid Invoice TemplatesWhen it comes to creating payment requests, one of the first decisions you’ll face is whether to use a free or paid solution. Both options have their own advantages and drawbacks depending on your needs. Free options often provide a basic structure, while paid tools typically offer more advanced features and customization. Understanding the differences between these two can help you choose the right one for your business. Advantages of Free Templates

Free solutions are a great starting point, especially if you’re just beginning or have a small client base. Here are some of the key benefits:

Drawbacks of Free Templates

While free templates can be useful, they come with some limitations:

Benefits of Paid SolutionsPaid options are designed to offer more features and flexibility, making them ideal for businesses that need more than just a simple payment request. Here’s why they might be worth the investment:

|