Post Production Invoice Template for Streamlined Billing

When managing creative work, clear and organized financial documentation is essential for ensuring smooth transactions. Keeping track of services rendered, costs incurred, and payments received can quickly become overwhelming without the right tools. An effective way to manage these details is by using a structured document designed to simplify the billing process.

A well-designed financial document serves not only as a record of services provided but also as a professional tool that helps maintain transparency with clients. It allows for quick and easy calculation of totals, application of taxes, and inclusion of any additional fees or discounts. With this approach, both clients and service providers can feel confident that the billing process is clear and fair.

By adopting such a document, freelancers and companies alike can streamline their workflow, save valuable time, and reduce the chances of errors. The benefits of using a standardized method for managing charges are evident in the smoother handling of payments and better financial planning overall.

Post Production Invoice Template Overview

In the world of creative services, managing billing efficiently is essential for maintaining a smooth workflow and fostering professional relationships. The right document can make this process much easier, providing clear, concise, and consistent details about charges and payments. These documents help both service providers and clients track the scope of work completed and the financial transactions that follow.

Having a structured document allows you to outline key information, ensuring both parties have a mutual understanding of the terms and services provided. It is important to include certain elements that make the process as transparent and efficient as possible.

Key Features of an Effective Document

- Client Information: Clearly display the client’s details such as name, address, and contact information.

- Services Rendered: A detailed list of the services provided with corresponding prices or hourly rates.

- Payment Terms: Include payment due dates, accepted methods, and any late fees or discounts.

- Tax Information: Clearly outline applicable taxes, ensuring both parties are aware of the financial responsibilities.

- Unique Reference Number: Use a unique reference or invoice number for easy tracking and organization.

Why This Approach Is Beneficial

- Time-Saving: With a structured approach, the process becomes faster, reducing the need for additional back-and-forth communication.

- Clarity: Clear details reduce confusion, making it easier for clients to understand their financial obligations.

- Professionalism: A well-organized document reflects positively on your business, fostering trust with clients.

Why Use a Post Production Invoice

Effective billing is a crucial component in any service-based business, especially in creative industries where project details can be complex. Using a structured document to record and track the financial aspects of a project helps maintain organization and ensures accurate payments. This method simplifies the process, ensuring that both parties are on the same page regarding costs, terms, and expectations.

Utilizing such a document can significantly reduce misunderstandings between the service provider and the client. It serves as a formal record, protecting both parties and ensuring that the agreed-upon compensation is received for the work completed.

Benefits of Structured Billing

- Clear Documentation: Provides a clear breakdown of charges, making it easier for both parties to understand the financial aspects of the agreement.

- Professionalism: A well-organized financial document portrays a professional image, boosting the credibility of the service provider.

- Easy Tracking: A standardized format makes it simple to track and manage payments, reducing the chances of missing or delayed payments.

How It Simplifies the Payment Process

- Fewer Errors: A template ensures consistency, minimizing the chances of errors or omissions in the billing process.

- Time Efficiency: With everything structured, the creation of financial records becomes faster and more straightforward, freeing up time for other tasks.

- Legal Protection: A formal record can serve as proof in case of any disputes, ensuring that terms and agreements are clear and legally binding.

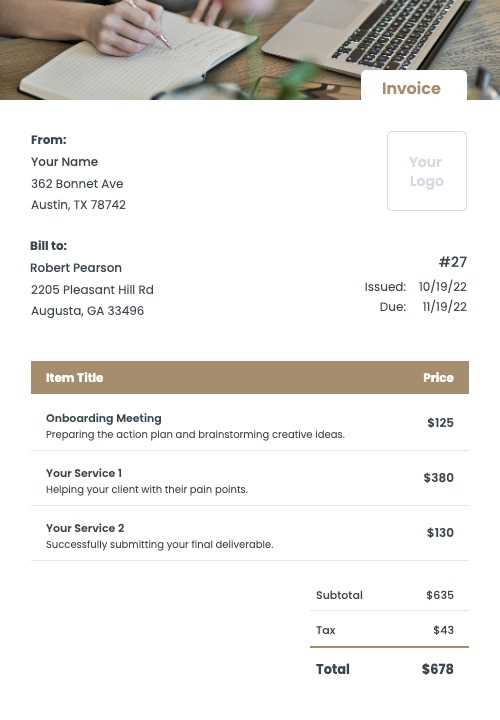

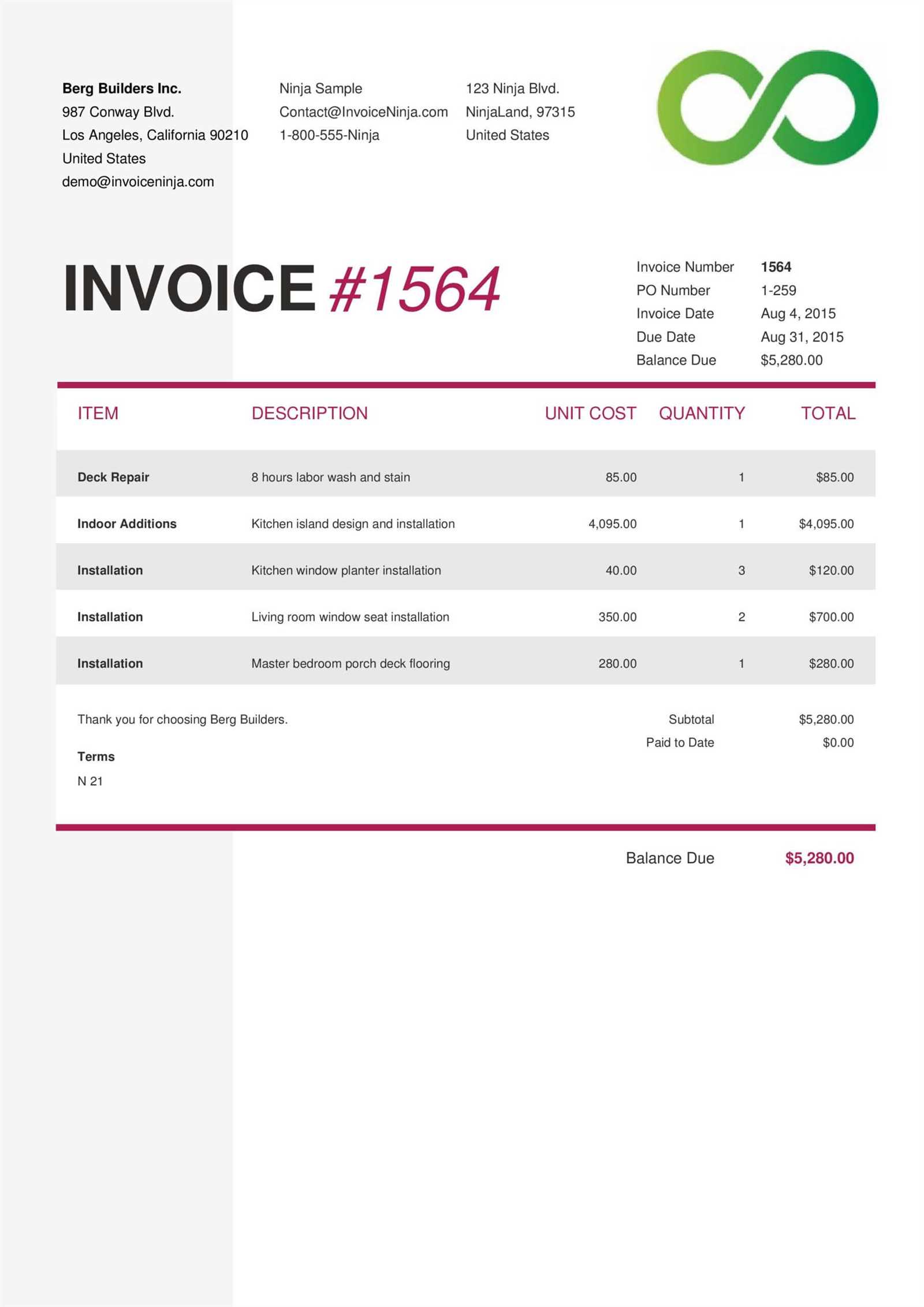

Key Elements of an Invoice Template

A well-structured financial document is essential for clear communication and efficient transactions between service providers and clients. To ensure that all necessary details are included, certain elements must be present. These components not only make the billing process smoother but also help both parties track the services rendered and payments received accurately.

Including the following key details ensures that the document is complete, transparent, and easy to understand for both the client and the service provider.

- Client Information: Clearly list the client’s name, address, and contact details to ensure proper identification.

- Service Description: Provide a detailed description of the services performed, including dates and hours worked, if applicable.

- Cost Breakdown: List individual charges for services provided, including any taxes, fees, or additional costs.

- Payment Terms: Clearly state the payment due date, accepted payment methods, and any late fees or discounts that may apply.

- Unique Reference Number: Assign a unique identifier to each document for easy tracking and record-keeping.

- Tax Information: Include applicable taxes and clearly explain how they are calculated to avoid confusion.

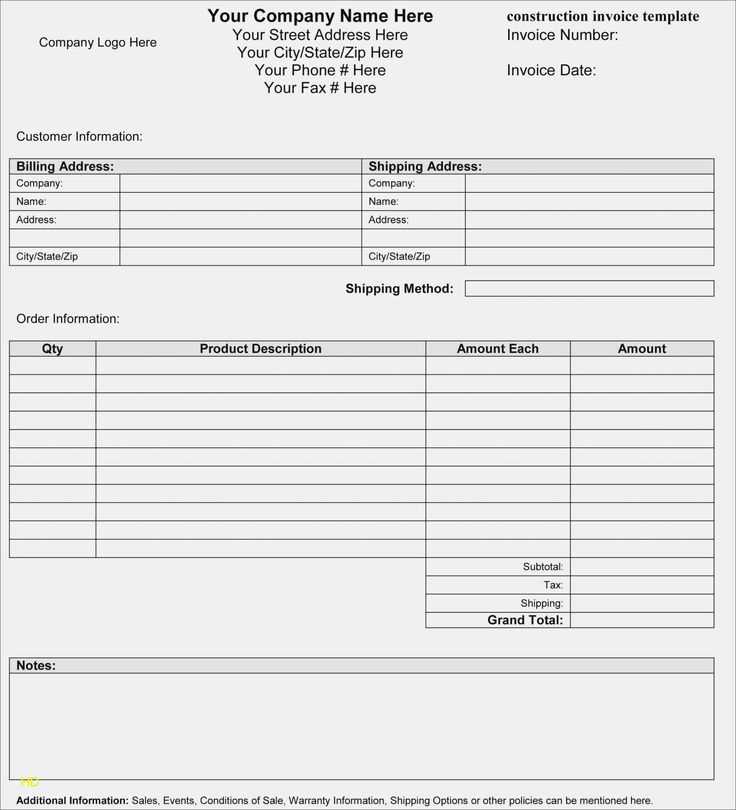

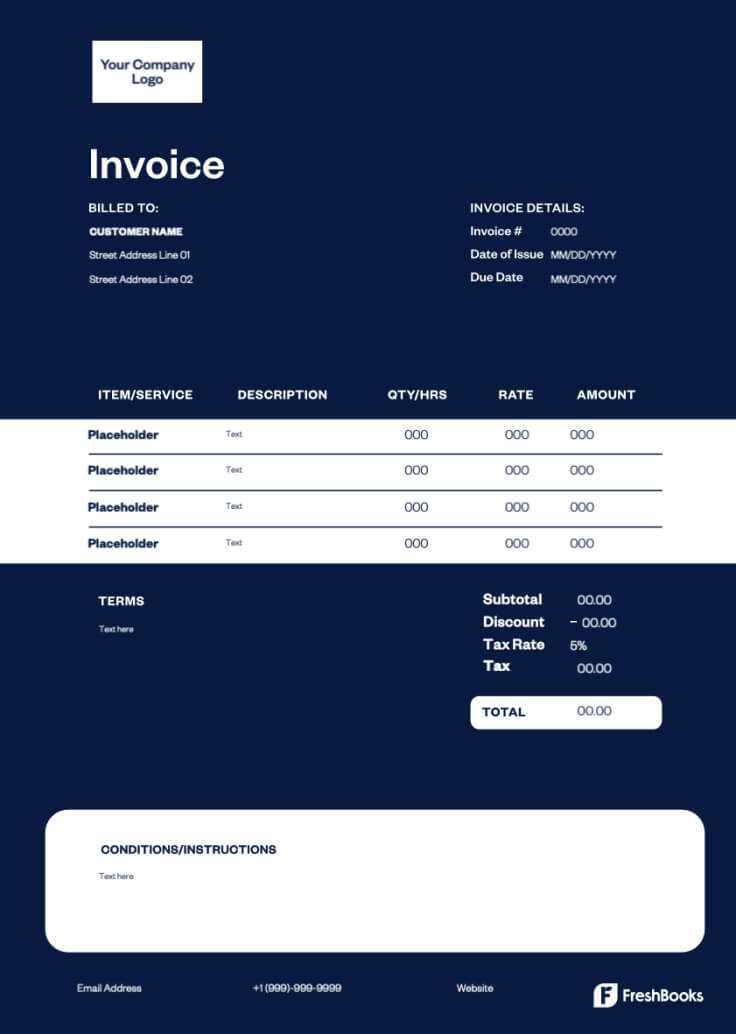

How to Customize Your Invoice

Customizing a billing document allows you to tailor it to your specific needs and the requirements of your clients. By adjusting certain fields and elements, you can ensure that the document accurately reflects the services provided, the terms agreed upon, and any unique details of the transaction. Customization not only makes the document more personal but also helps in maintaining consistency across your financial records.

Here are a few key steps to customize your document effectively:

| Section | Customizable Elements |

|---|---|

| Client Information | Add client’s name, address, phone number, and email to ensure accurate contact details. |

| Service Description | Specify the exact services or products provided, including quantities, hours, and unit costs. |

| Payment Terms | Adjust payment due dates, methods of payment, and include any discounts or penalties for late payment. |

| Tax Calculation | Include the appropriate tax rate based on your location or client’s requirements. |

| Formatting | Change fonts, colors, or add your business logo to match your branding. |

By making these adjustments, you can create a professional and efficient financial document that suits your specific business needs and client expectations.

Benefits of Using a Template

Utilizing a pre-designed document for managing financial records offers numerous advantages that streamline the billing process. By relying on a standard format, businesses can save time, reduce errors, and ensure consistency across all client transactions. These benefits can improve the efficiency of handling multiple projects and ensure a professional presentation every time.

Here are some key advantages of using a standardized approach:

Efficiency and Time-Saving

- Quick Setup: A ready-made structure reduces the need to create a new document from scratch, allowing you to focus on the content.

- Consistency: Reusing the same format ensures all financial records are organized in a consistent manner, making them easier to track and manage.

Professionalism and Accuracy

- Enhanced Clarity: Clear, well-organized documents help avoid misunderstandings, ensuring both parties are on the same page regarding the details of the agreement.

- Reduces Errors: A predefined layout reduces the chances of missing essential information or making mistakes in the billing process.

Common Mistakes to Avoid in Billing

When managing financial documents, avoiding common errors is essential to ensure smooth transactions and maintain a professional relationship with clients. Mistakes in billing can lead to misunderstandings, delayed payments, and strained business relationships. By being aware of these potential pitfalls, you can improve your process and ensure accurate and timely payments.

Below are some of the most common errors to watch out for when handling billing records:

| Common Mistake | How to Avoid |

|---|---|

| Missing Client Information | Ensure that all necessary client details, such as name, address, and contact information, are correctly included. |

| Unclear Service Descriptions | Provide a clear and detailed breakdown of services rendered, including quantities, hours worked, and any specific charges. |

| Omitting Payment Terms | Clearly state the payment deadline, methods of payment, and any additional fees or discounts that apply. |

| Incorrect Tax Calculation | Double-check tax rates and ensure accurate calculations based on your location and applicable laws. |

| Failure to Use a Unique Reference Number | Assign a unique reference number to each document for easy tracking and record-keeping. |

By being mindful of these mistakes and taking the necessary steps to avoid them, you can ensure that your financial documentation remains professional and accurate, leading to smoother transactions and fewer disputes.

How to Organize Your Invoices

Efficient organization of financial records is crucial for maintaining clear business practices and ensuring timely payments. By setting up a structured system for managing your billing documents, you can easily track outstanding payments, stay on top of deadlines, and retrieve important information quickly when needed. Proper organization not only simplifies your workflow but also promotes a professional image for your business.

Here are some tips to help you effectively manage and organize your records:

- Use a Centralized System: Store all your records in one place, whether it’s a physical filing system or a digital platform, for easy access and management.

- Label Documents Clearly: Ensure each document is clearly labeled with relevant details such as client names, service dates, and unique reference numbers.

- Establish a Filing Structure: Create a consistent method for sorting your records, such as by client, date, or service type, to help you quickly locate past transactions.

- Track Payment Status: Keep a record of paid and outstanding amounts to monitor overdue payments and avoid confusion.

- Backup Your Files: Regularly back up your files to avoid losing important records in case of technical issues.

By organizing your records in this manner, you can ensure that your financial documents are always up to date, accurate, and easy to manage.

Legal Requirements for Billing Documents

When managing financial transactions, it is important to be aware of the legal requirements that govern the preparation and delivery of billing records. Compliance with these laws ensures that your documents are legally valid, and helps to avoid any potential disputes or penalties. The requirements may vary depending on the region, industry, and the nature of the services provided, but certain elements must always be included to meet legal standards.

Below are key components that should be included to ensure your financial records are legally compliant:

- Business Information: Your business name, address, and contact details must be clearly listed on the document.

- Client Details: Include the full name, address, and contact information of the client you are billing.

- Clear Description of Services: Clearly describe the work performed, including quantities, dates, and detailed breakdowns of services rendered.

- Tax Information: The applicable taxes, including rates and the amount charged, must be clearly stated according to local regulations.

- Payment Terms: Include the due date for payment, payment methods accepted, and any late fees or discounts that apply.

- Unique Reference Number: Each document should have a unique identifier to facilitate tracking and organization.

- Legal Disclaimers: If required by law, include any necessary disclaimers or statements related to payments or services.

By ensuring that your billing records meet these legal requirements, you will avoid potential issues and maintain a trustworthy and professional business image.

How to Track Payments Efficiently

Tracking payments is a crucial part of managing financial transactions in any business. By keeping an accurate record of incoming payments, you can ensure that your cash flow remains healthy, identify any outstanding debts, and maintain a good relationship with your clients. Efficient payment tracking also helps with budgeting, forecasting, and overall financial planning.

Here are several strategies to effectively track payments:

- Use Accounting Software: Leverage modern accounting tools to automate tracking, send reminders for overdue payments, and generate reports with ease.

- Maintain a Payment Log: Keep a detailed log of each payment received, including the client’s name, date of payment, and payment amount. This can be done manually or using digital tools.

- Set Clear Payment Terms: Specify payment due dates and any penalties for late payments in your agreements, making it easier to monitor outstanding balances.

- Utilize Payment Reminders: Send periodic reminders to clients before the due date and follow up promptly on overdue payments to ensure timely settlement.

- Reconcile Payments Regularly: Consistently match your payment records against your bank statements to ensure accuracy and identify discrepancies quickly.

By implementing these practices, you will have a more organized approach to managing your payments, reducing the chances of missing or overlooking transactions.

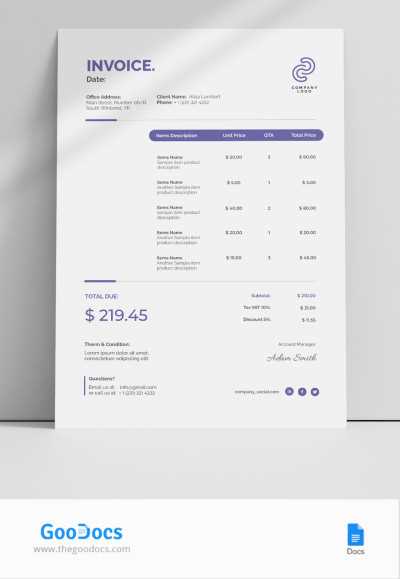

Best Practices for Invoice Design

Designing a clear, professional, and well-organized billing document is essential for smooth business transactions. A properly structured bill not only enhances your professional image but also ensures that clients can easily understand the details of the charges. A clean and intuitive layout improves efficiency, reduces errors, and makes it easier for clients to process payments on time.

Here are some key design principles to follow:

- Simple Layout: Keep the design uncluttered with a clear division of sections. Use adequate white space to enhance readability and make the document user-friendly.

- Company Information: Ensure that your business name, logo, contact details, and any necessary legal information are clearly visible at the top of the document.

- Clear Payment Terms: Highlight the payment terms, including the due date, payment methods, and any late fees. This information should be easy to locate.

- Itemized Charges: Break down the charges into individual items with descriptions, quantities, rates, and subtotals for clarity. This makes it easier for clients to understand what they are paying for.

By following these best practices, you can create a document that is both professional and practical, leading to better communication and more efficient transactions.

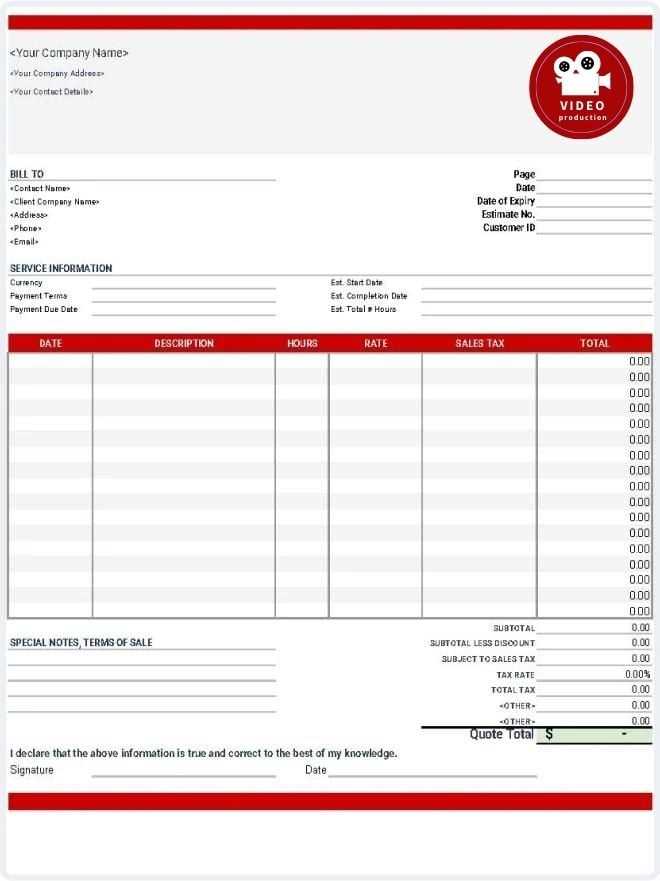

How to Include Project Details

Including project-specific information in your billing document is crucial for transparency and ensuring that both parties are on the same page regarding the work completed. Clearly detailing the scope, deliverables, and timelines helps clients understand the value of the services rendered and prevents any misunderstandings. A well-organized breakdown of project information ensures that the payment process goes smoothly.

Key Information to Include

- Project Title: Include a clear, descriptive title that reflects the nature of the work or project. This helps clients quickly identify the purpose of the document.

- Description of Services: Provide a brief summary of the tasks completed, the services provided, or any milestones achieved during the project.

- Project Dates: Specify the start and end dates of the project, as well as any important milestones or deadlines that were met.

- Deliverables: List all final deliverables, including any documents, files, or assets provided to the client. This ensures clarity on what was completed and handed over.

Organizing Project Details

Use clear and concise language to describe the project details. Organize this information in a separate section of your document, making it easy for clients to refer to. This organization not only clarifies the work completed but also aids in faster processing of the payment when all necessary information is present.

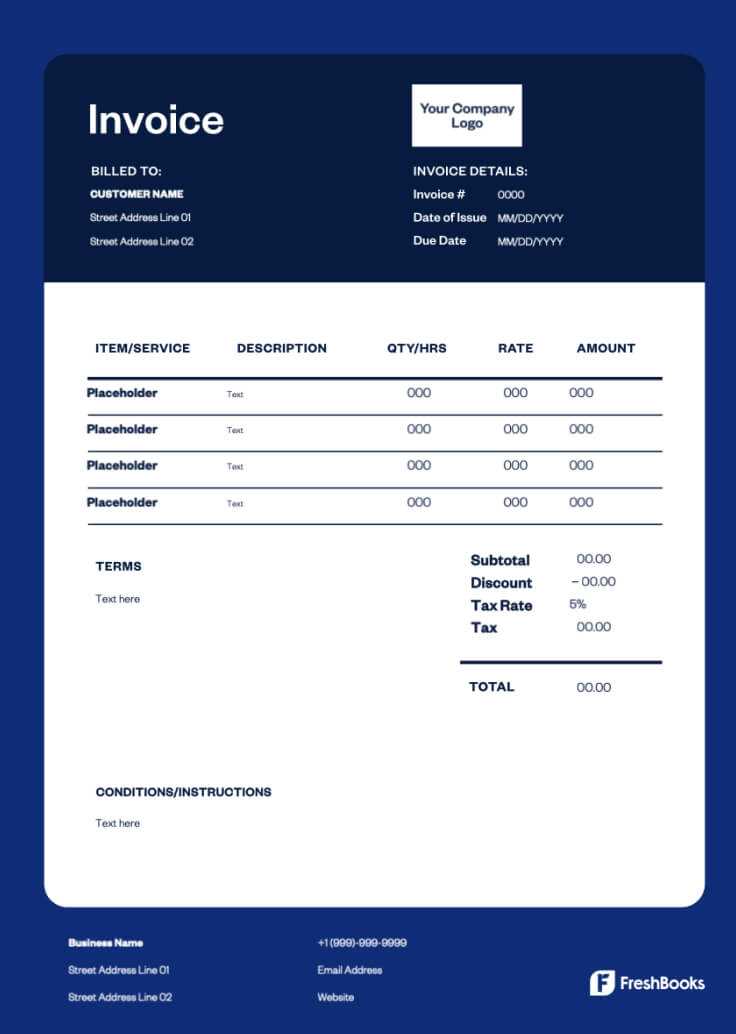

Incorporating Taxes and Discounts

When preparing a financial document for services rendered, it’s essential to account for any applicable taxes and discounts. These elements can significantly affect the final amount a client is required to pay. Properly including taxes ensures that you are complying with legal requirements, while offering discounts can help maintain positive client relationships or incentivize early payments. A clear breakdown of both taxes and discounts adds transparency and helps prevent confusion during the payment process.

How to Calculate Taxes

Taxes vary depending on the jurisdiction, so it’s important to research the specific tax rates that apply to your industry and location. Generally, taxes should be calculated based on the total amount due before discounts are applied. Here’s an example of how to calculate and include taxes:

| Description | Amount |

|---|---|

| Subtotal | $500.00 |

| Tax (10%) | $50.00 |

| Total After Tax | $550.00 |

Including Discounts

Discounts can be added as a percentage of the total amount or as a fixed sum. Clearly indicate the discount applied and whether it’s a promotional offer or a negotiated deal. Below is an example of how to factor in a discount after taxes have been calculated:

| Description | Amount |

|---|---|

| Subtotal | $500.00 |

| Tax (10%) | $50.00 |

| Total Before Discount | $550.00 |

| Discount (5%) | -$27.50 |

| Final Total | $522.50 |

Ensure that both taxes and discounts are clearly labeled and calculated in a manner that is easy for clients to understand. This transparent approach promotes trust and clarity throughout the billing process.

Managing Multiple Invoices at Once

Handling several financial documents at once can be challenging, especially when dealing with a large volume of transactions. Organizing these documents efficiently and ensuring that each one is processed correctly requires a well-structured system. By implementing certain strategies, you can streamline the process and minimize errors, saving time and effort in the long run.

Organizing Your Documents

When managing multiple financial documents, organization is key. Here are some tips to help you stay on top of things:

- Categorize your documents: Divide them by client, date, or project to make it easier to track their status.

- Use numbering systems: Assign unique numbers to each document to ensure they are easy to reference and track.

- Group similar items: Group invoices for similar services or projects together to streamline processing and review.

Utilizing Digital Tools

Using digital solutions can significantly reduce the complexity of managing multiple financial records. Here are some helpful options:

- Invoice management software: These platforms allow you to automate the creation, sending, and tracking of your documents.

- Spreadsheets: Tools like Excel or Google Sheets can help you track due dates, amounts, and payment statuses in one central location.

- Cloud storage: Storing your documents on the cloud makes it easier to access them from anywhere, providing you with a backup in case of data loss.

Tracking Payment Status

When handling multiple financial documents, it’s important to keep track of their payment status. Here are some methods to do so:

- Create a tracking system: Use a spreadsheet or software to monitor payment deadlines and amounts paid.

- Set reminders: Set up reminders for upcoming due dates to ensure payments are received on time.

- Keep clients informed: Send follow-up messages to clients if payments are overdue, maintaining clear communication throughout the process.

By staying organized and leveraging the right tools, managing multiple financial documents becomes a much simpler and more efficient process.

Integrating Payment Methods in Templates

Incorporating various payment options into your financial documents makes it easier for clients to settle their balances promptly. Offering multiple methods helps ensure that payments are received smoothly and without delay. Whether through online platforms, bank transfers, or other options, clear integration of payment choices can improve efficiency and client satisfaction.

Common Payment Methods to Include

Here are some common payment methods that you can integrate into your financial documents:

- Bank Transfers: Provide your bank details (account number, routing number) for clients who prefer to transfer funds directly.

- Online Payment Platforms: Include links to services such as PayPal, Stripe, or Square for easy digital payments.

- Credit/Debit Cards: If you use a payment gateway, add the option for clients to pay with credit or debit cards securely.

- Checks: For clients who prefer traditional methods, mention the payable name and address where checks should be sent.

How to Integrate Payment Methods Seamlessly

Integrating these payment options efficiently into your financial documents requires a well-organized approach. Follow these steps:

- Clear Payment Instructions: Clearly specify the payment methods available, with instructions on how to use each option.

- Payment Terms: Include terms regarding payment due dates, late fees, or discounts for early payments to manage expectations.

- Payment Links and QR Codes: For online payments, you can integrate clickable payment links or QR codes that direct clients to a payment page.

By integrating various payment options directly into your financial documents, you can streamline the payment process and enhance your clients’ experience. This flexibility helps in maintaining timely and hassle-free transactions.

Automating Billing for Creative Projects

Automating the billing process for your creative work can save time, reduce human error, and streamline operations. By implementing an automated system, you can ensure that all financial transactions are handled efficiently, allowing you to focus more on the creative aspects of your projects. This not only speeds up the payment process but also improves consistency in how you manage financial records.

Benefits of Automation

- Time Savings: Automating repetitive tasks, such as generating and sending payment requests, reduces the time spent on manual processes.

- Accuracy: Automated systems eliminate errors that often occur with manual data entry, ensuring that billing details are accurate every time.

- Improved Cash Flow: By sending reminders and payment requests automatically, clients are more likely to pay on time, enhancing your cash flow.

- Better Organization: Automation allows you to keep track of all transactions in one centralized system, making it easier to manage your finances.

How to Set Up Automated Billing

To automate your billing process, follow these simple steps:

- Choose an Automated System: Select software or an online platform that integrates with your workflow, providing billing solutions tailored to your needs.

- Customize Your Billing Workflow: Set up templates for different types of payments and configure reminders for overdue bills.

- Integrate Payment Methods: Allow clients to pay directly from the automated system through integrated payment gateways like PayPal or bank transfers.

- Track Payments: Use the automation system to track payments and send automatic receipts once the payment is confirmed.

By automating the billing process, you not only reduce administrative workload but also ensure that your financial transactions are seamless and professionally managed. This can lead to faster payments, better client relationships, and a more organized financial system.

Saving Time with Automated Billing Formats

Using pre-designed formats for managing your billing process can drastically reduce the time spent on administrative tasks. These ready-made structures allow you to quickly input essential details, eliminating the need to start from scratch each time you need to request payment. By having a consistent, streamlined process, you can focus more on your core tasks and less on paperwork.

How It Saves Time

- Quick Setup: Instead of creating a new document for every transaction, you can use a pre-set structure that only requires filling in project-specific information.

- Reduced Errors: The standardized format ensures that all necessary fields are included, minimizing the chances of forgetting important details, such as payment terms or contact information.

- Consistency: By reusing a proven format, you ensure that your documents maintain a professional appearance and adhere to a standard structure each time.

- Faster Communication: The time it takes to send a payment request is shortened as you no longer have to manually format every document. This leads to faster responses and smoother transactions.

Key Features of Efficient Formats

- Pre-filled Fields: Automatically populated fields like client name, project details, and payment terms make the process faster.

- Customizable Sections: You can adjust certain areas based on the specifics of the work, such as adding or removing services or changing pricing details.

- Automated Calculations: Having formulas for taxes, discounts, and totals in place reduces manual input and the likelihood of mistakes.

- Easy Conversion: Formats often allow you to convert documents into different file types, such as PDFs, for easy sharing and archiving.

By implementing pre-designed formats for billing, you streamline the entire process, reduce the chance for errors, and ultimately save valuable time that can be spent on other important aspects of your business.