Free Summer Camp Invoice Template for Easy Payment Management

Managing financial transactions for seasonal programs can be a complex task. Without a structured approach, tracking payments, deposits, and participant details may lead to confusion and missed opportunities. A well-organized document can simplify this process, ensuring accuracy and efficiency in handling financials.

By using a customizable form, organizers can easily create records that reflect all necessary charges, dates, and participant information. This makes it easier to send, track, and maintain accurate financial records, ultimately saving time and reducing errors. Whether you’re overseeing a small event or a larger-scale operation, having the right tools in place is crucial for smooth operations.

Effective financial management ensures that you stay on top of your budget and provides clients with clear, transparent statements. This approach not only fosters trust but also helps maintain a professional reputation for your program. With the right structure, you can focus more on running the event and less on administrative tasks.

Essential Guide to Summer Camp Invoices

Proper financial documentation is a crucial part of running any organized program, ensuring smooth operations and effective communication between organizers and participants. A clear, structured method for recording payments and related transactions helps keep things organized and minimizes the chance of confusion. Understanding the key components of such a document is the first step toward achieving this goal.

One of the most important aspects is accuracy. A well-prepared financial statement allows event managers to clearly outline all charges, payment schedules, and any additional fees. With a reliable system in place, participants will have a transparent view of their obligations, which can prevent misunderstandings down the line.

Key Elements of Financial Documents

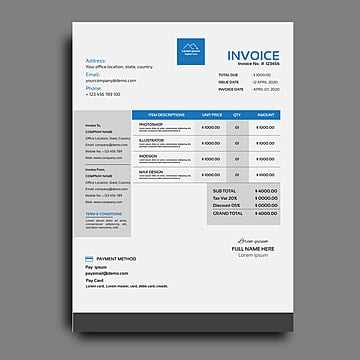

There are several critical pieces of information that must be included for full clarity. At a minimum, the document should list the participant’s name, registration details, the services provided, the total amount due, and payment terms. It’s also important to include a unique identifier for each record to avoid confusion when referencing specific transactions.

Benefits of Structured Financial Management

With a consistent approach to handling financial records, administrators can easily track payments, follow up with overdue balances, and maintain accurate records for reporting purposes. A streamlined system also minimizes the risk of human error and ensures a professional standard in all interactions with clients. The overall result is improved efficiency and stronger trust between all parties involved.

Why Use an Invoice Template for Camps

Managing financial records effectively is essential for any organized program, especially when handling multiple transactions and participants. Having a predefined structure for creating payment documents simplifies the entire process, reducing errors and ensuring accuracy. A well-constructed document allows administrators to stay organized, save time, and maintain professionalism when communicating with clients.

Using a pre-made form eliminates the need for manual creation from scratch, providing a uniform way to track and report charges. This not only makes the task more efficient but also ensures that all necessary details are included, reducing the chance of overlooking important information. With the right system in place, administrators can focus more on running the program and less on administrative tasks.

Benefits of Using a Predefined Form

Here are some key advantages of using a ready-made structure:

| Advantage | Description |

|---|---|

| Time-saving | Pre-designed documents eliminate the need for manual formatting and repetitive data entry. |

| Accuracy | Standardized formats reduce human error and ensure consistency in every document. |

| Professionalism | A well-organized document reflects a higher level of professionalism and builds trust with clients. |

| Flexibility | These forms are customizable, allowing for easy adjustments to fit different needs or charges. |

Ultimately, using a pre-built structure for financial documents enhances efficiency and ensures that organizers can maintain a high standard of accuracy and clarity in all financial transactions.

Benefits of Customizable Summer Camp Forms

Having the ability to adjust your financial documents to meet specific needs is an essential feature for any organizer. Customization ensures that every detail is tailored to the particular services, charges, and requirements of your program. With editable forms, you can easily update information, incorporate new charges, and maintain consistency across multiple transactions without starting from scratch each time.

Customized documents not only provide flexibility but also save valuable time, allowing organizers to quickly adapt to changing needs. Whether it’s adjusting payment terms, adding discounts, or reflecting additional services, having an editable structure makes managing finances much more efficient. This ability to personalize documents strengthens the overall administrative process and enhances the experience for both organizers and participants.

Key Advantages of Editable Financial Records

Here are some benefits of using customizable forms for your financial management:

- Adaptability: Easily change the layout and content to suit different programs or payment structures.

- Consistency: Maintain uniformity across all financial documents, ensuring professionalism and clarity.

- Ease of Updates: Quickly modify pricing, services, and terms without having to reformat or recreate documents.

- Enhanced Accuracy: Customize fields to include all relevant details, reducing the risk of errors or omissions.

Streamlining Financial Management

Editable documents also help streamline financial management by consolidating all required details into one easy-to-update file. Whether you’re tracking payments, processing refunds, or applying discounts, having a flexible system in place makes managing large volumes of transactions much simpler. Customization gives you full control over the document structure, providing both efficiency and accuracy in every financial record.

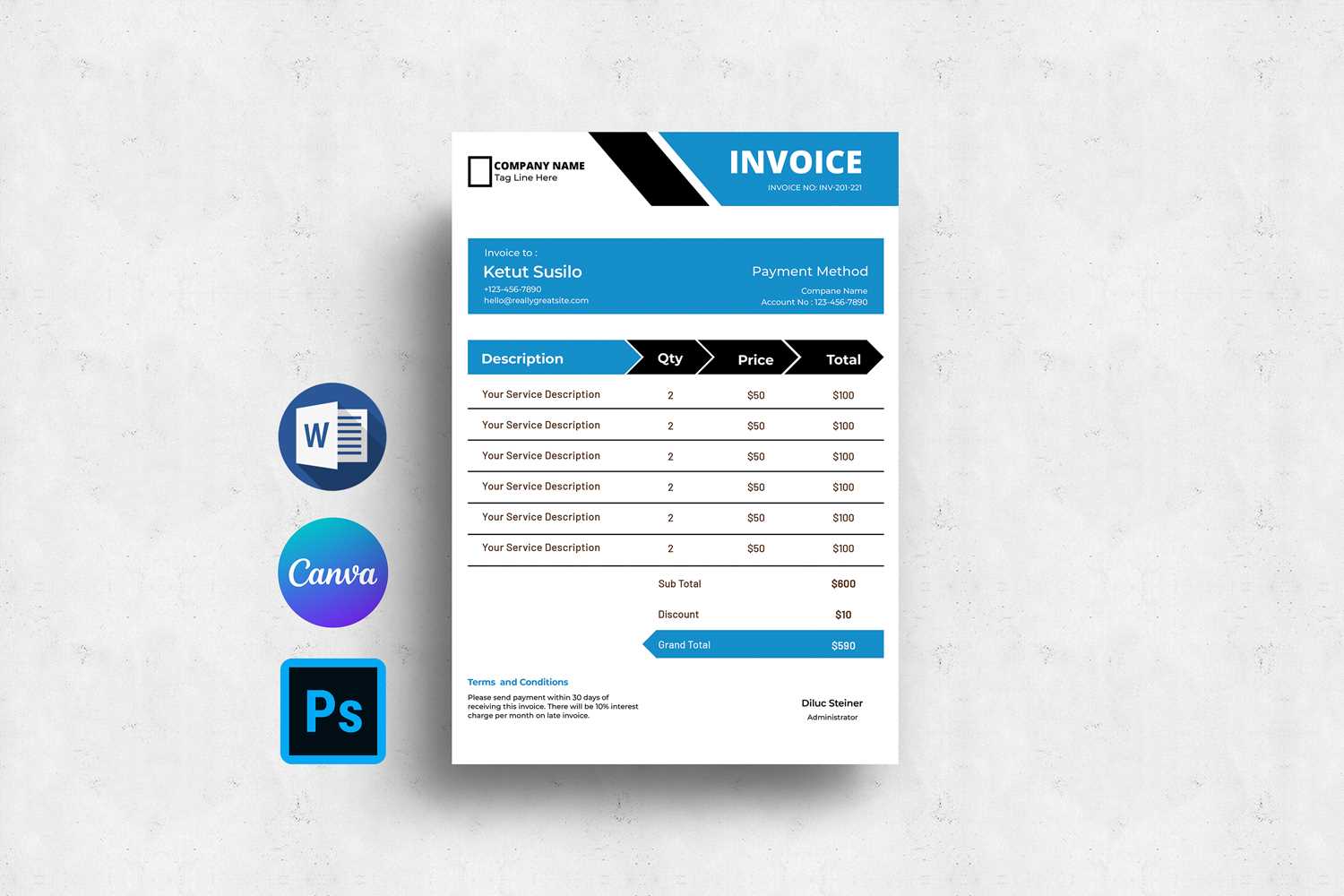

How to Create a Camp Invoice from Scratch

Building a financial document from the ground up can seem challenging, but it is entirely possible with a clear approach and attention to detail. By following a systematic process, you can create a professional document that covers all essential details, ensuring that both organizers and participants are on the same page. A well-constructed document should include payment terms, participant information, and a clear breakdown of charges.

The key to crafting a functional document is to start with a solid foundation. Make sure to include basic details like the event’s name, participant information, payment terms, and a detailed list of services provided. This structured format will allow you to create an accurate, easy-to-understand financial record. Once you’ve laid out the basic information, you can then refine and customize the content to suit your needs.

Steps for Creating a Financial Record

Follow these steps to ensure your document is clear, professional, and comprehensive:

- Step 1: Gather the participant’s details, such as name, address, and contact information.

- Step 2: List the services provided, including descriptions and prices for each.

- Step 3: Specify payment terms, including due dates and any applicable taxes or discounts.

- Step 4: Add a unique reference number to help with tracking and future reference.

Example Structure for a Financial Document

Below is an example structure for your document:

| Item | Description | Cost | |

|---|---|---|---|

| Registration Fee | Fee for program participation | $200 | |

| Additional Services | Meals, transportation, and activities | $50 | |

| Discount | Early bird discount | -$25 | |

| Total Due | Sum of all charges | $225 |

| Step | Description |

|---|---|

| Step 1 | Choose an automation tool or software that fits your needs. Many platforms offer built-in automation for event organizers. |

| Step 2 | Set up your pricing structure and services within the software, ensuring all charges and discounts are accurately configured. |

| Step 3 | Input participant data (either manually or via a CSV upload), and ensure the system can retrieve this information when generating records. |

| Step 4 | Define payment terms, deadlines, and applicable taxes within the system to automatically apply them to every generated document. |

| Step 5 | Review and test the automation process to ensure that the generated records are accurate and contain all necessary details. |

By setting up an automated system, you can generate accurate, professional financial records for each participant without manual intervention. This automation reduces administrative burden, improves accuracy, and helps maintain a smooth operational flow.

Common Mistakes in Summer Camp Invoices

Even the most experienced organizers can make errors when creating financial records, which can lead to confusion or even disputes with participants. These mistakes often stem from small oversights or misunderstandings about what needs to be included in the document. Ensuring that all relevant details are properly listed and formatted is crucial for maintaining professionalism and avoiding costly errors.

From inaccurate calculations to missing participant information, several common mistakes can occur when preparing financial records. These errors not only cause delays but can also negatively impact the reputation of the program. By understanding and avoiding these mistakes, organizers can ensure that their financial documents are clear, accurate, and effective.

Common Errors to Avoid

- Incorrect Calculations: One of the most frequent mistakes is failing to properly add up the total charges, including taxes, discounts, or additional fees. This can lead to discrepancies in what participants owe.

- Missing Participant Details: Forgetting to include basic information, such as the participant’s full name, address, or registration number, can create confusion and make it difficult to track payments.

- Lack of Clear Payment Terms: Not specifying payment deadlines or methods clearly can lead to misunderstandings about when and how payments should be made, potentially delaying funds.

- Failure to Include a Unique Reference Number: Without a unique ID or reference number for each document, tracking and managing multiple records becomes difficult, increasing the chance of miscommunication.

- Omitting or Misstating Fees: Failing to clearly state which services are being charged for or misrepresenting the cost of certain services can lead to disputes over the total amount due.

How to Avoid These Mistakes

To avoid these common errors, double-check all calculations, ensure that every participant’s information is correct, and clearly outline payment terms. Additionally, always review the financial record before sending it out to make sure that all charges are accurate and that no important details are missing. With careful attention, you can avoid these pitfalls and create a clear, professional financial document every time.

How to Handle Payments in Your Template

Managing payments efficiently is one of the most important aspects of running any program. A well-organized financial record helps ensure that all transactions are clear, accurate, and easy to track. It is crucial to outline the payment process, including due dates, accepted methods, and any applicable discounts or late fees. By doing so, you create a transparent and professional system that both organizers and participants can rely on.

When handling payments, it is important to clearly indicate the total amount due, any partial payments made, and the remaining balance. This ensures that both parties are on the same page and reduces the chance of confusion. Additionally, incorporating spaces for payment dates and methods will help streamline the process and make it easier to reconcile records.

Steps to Effectively Handle Payments

Follow these steps to ensure smooth payment handling in your financial records:

- List Payment Methods: Clearly state the accepted payment methods (e.g., credit card, bank transfer, cash) to avoid confusion.

- Specify Payment Terms: Outline the payment schedule, including the due date, late fees, or early payment discounts, to set expectations upfront.

- Track Payments: Dedicate a section to mark payments made, including dates and amounts, so you can easily track outstanding balances.

- Include a Balance Due: Show the remaining balance after any payments have been made to provide a clear picture of what is still owed.

Ensuring Clarity and Accuracy

By including these details in your financial records, you provide clarity and ensure that all parties involved understand the payment process. This will make the entire transaction smoother, reduce misunderstandings, and help maintain a positive relationship between organizers and participants.

Tracking Camp Payments with Invoice Templates

Efficiently tracking payments is crucial for any program to ensure that all transactions are accounted for and that no outstanding balances are overlooked. A well-structured financial document can help organizers monitor which participants have paid, which payments are pending, and when payments were made. This level of organization not only improves financial management but also fosters trust with participants by providing a clear record of their payments.

By using an organized system for tracking payments, organizers can easily manage the inflow of funds, handle late payments, and maintain an accurate record of transactions. A detailed financial document allows you to record each payment, update balances, and ensure that all necessary fees are accounted for. Whether it’s a simple payment schedule or an ongoing tracking system, having a clear, easy-to-use structure helps simplify the process.

How to Effectively Track Payments

Here are the key components to track payments effectively:

| Payment Status | Amount | Payment Date | Balance Due |

|---|---|---|---|

| Paid | $200 | March 15, 2024 | $0 |

| Partial Payment | $100 | March 20, 2024 | $100 |

| Unpaid | $200 | – | $200 |

As shown in the table above, each entry includes a clear payment status, the amount paid, the date of payment, and the remaining balance due. This system ensures that no payments are missed and that any unpaid or partially paid amounts are flagged for follow-up.

Benefits of Payment Tracking

By maintaining accurate payment records, organizers can quickly identify which participants still owe money and send timely reminders. Additionally, tracking payments helps with financial forecasting, making it easier to manage budgets and plan for future needs. With a clear overview of payments, organizers can stay organized, reduce administrative stress, and focus on delivering a successful program.

Legal Considerations for Camp Invoices

When preparing financial documents, it is important to consider the legal requirements that may apply to ensure compliance with local regulations. Properly formatted records not only protect both the organizer and the participant but also help prevent misunderstandings and disputes. Understanding the legal aspects of these documents ensures that they are enforceable, clear, and free from potential challenges.

There are several key legal elements to consider when creating financial records. These include the accurate display of all charges, the inclusion of applicable tax rates, and clear terms regarding payment deadlines and refund policies. Additionally, ensuring that the document contains the necessary legal disclaimers, such as terms of service or cancellation policies, is critical for avoiding legal complications.

Essential Legal Elements

Here are the key legal considerations to keep in mind when creating financial documents:

- Clear Payment Terms: It’s important to specify the payment schedule, including the due date and any applicable late fees. This protects both parties by setting clear expectations for payment deadlines.

- Accurate Tax Information: If taxes apply, make sure that the tax rate is correctly calculated and clearly listed on the document to comply with local tax laws.

- Refund and Cancellation Policy: Clearly outline the conditions under which refunds are issued, including any non-refundable fees or deadlines for cancellation, to avoid legal disputes later.

- Participant Consent: Depending on the jurisdiction, it may be necessary to include a statement that confirms the participant’s agreement to the terms and conditions of the financial document.

- Legally Binding Terms: Ensure that the terms outlined in the document are clear and enforceable in a court of law. Having the right disclaimers and legal language can help protect your organization in case of disputes.

Staying Compliant

By carefully reviewing your financial records to ensure they meet legal standards, you can avoid potential pitfalls and protect your business. Regularly updating your documents to reflect any changes in local laws or regulations is also important for maintaining compliance. With the right legal considerations in place, your financial documentation will be secure, transparent, and legally sound.

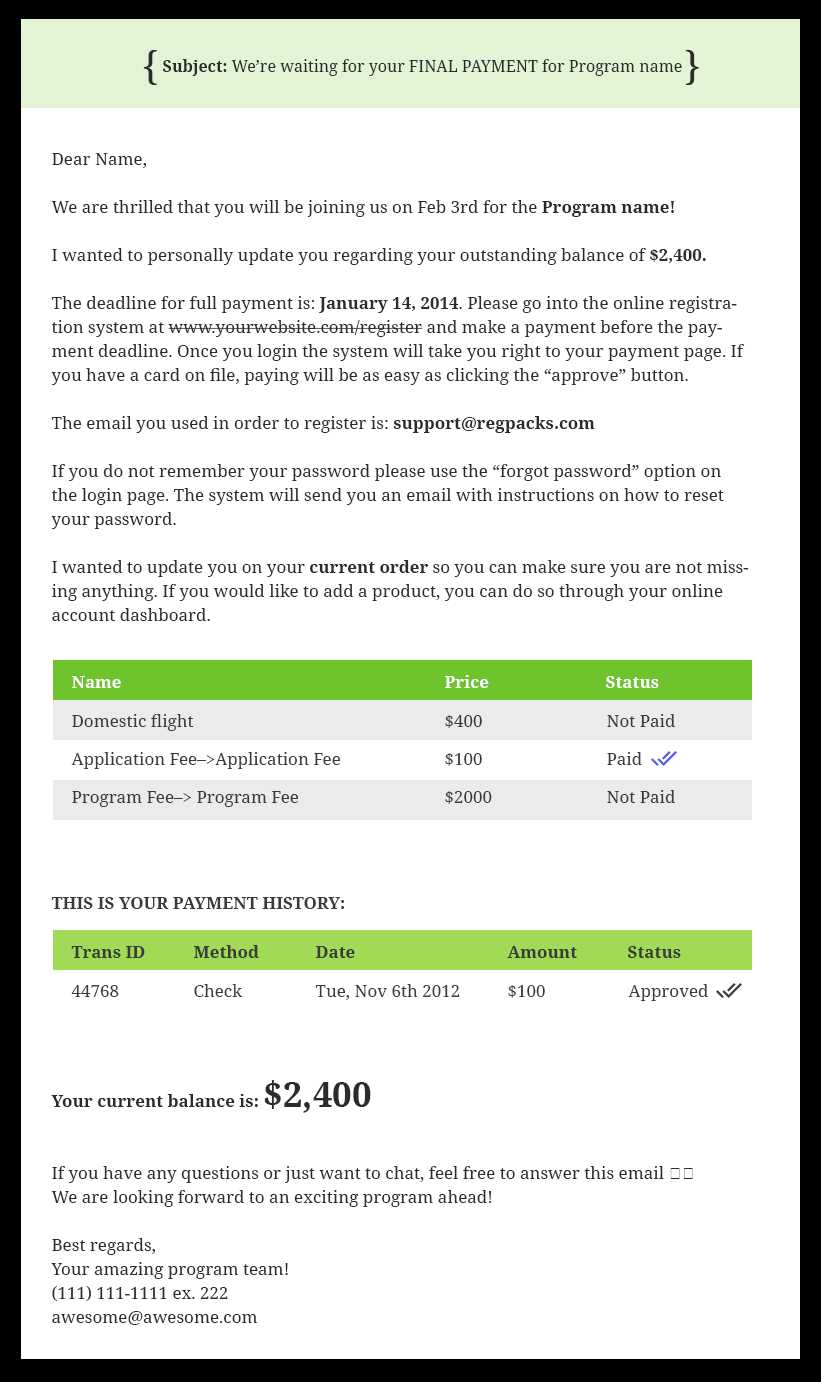

Best Practices for Sending Camp Invoices

Sending financial documents in a timely and professional manner is critical for maintaining smooth operations and ensuring that all payments are made promptly. The process involves more than just preparing the document; it requires attention to detail, proper timing, and clear communication to avoid confusion and delays. By following best practices, organizers can streamline the process, minimize errors, and ensure that participants receive their statements with all the necessary information for prompt payment.

To effectively manage the distribution of financial records, it’s essential to establish a system for sending and tracking payments. This includes choosing the right delivery method, clearly communicating payment terms, and following up with reminders when necessary. By following these best practices, organizers can maintain a positive relationship with participants while ensuring that payments are handled efficiently.

Best Practices for Sending Financial Documents

- Send Documents Promptly: Make sure to send financial records as soon as services are rendered or at the agreed-upon time. This helps avoid delays and sets clear expectations from the start.

- Use Professional Delivery Methods: Whether it’s through email, a secure online portal, or traditional mail, ensure the method used is professional and appropriate for your audience. Email with a clear subject line is often the most efficient method.

- Double-Check Information: Before sending, carefully review the document for accuracy, including participant details, amounts, payment terms, and any applicable taxes or discounts. Mistakes can lead to confusion or payment delays.

- Clarify Payment Instructions: Clearly indicate the payment methods available, due dates, and any relevant details like bank account information or online payment links to make it easy for participants to pay.

- Follow Up with Reminders: If payments are overdue, send a polite reminder with all the relevant information, including the amount due and the original due date. A friendly reminder helps avoid confusion and ensures timely payments.

- Track Sent Documents: Keep a record of each document you send, whether it’s through email or mail. This will help you keep track of outstanding payments and avoid missed follow-ups.

Organizing Follow-Ups and Communication

Following up with participants who haven’t paid by the due date is an important part of the process. By establishing a clear communication plan for reminders, you can ensure that payments are made on time while maintaining a positive relationship with your clients. Make sure to always be polite and professional in follow-up communication to encourage prompt action.

By adhering to these best practices, organizers can ensure that the process of sending and tracking financial documents is efficient, accurate, and professional, leading to smoother operations and a better experience fo

How to Adapt Your Invoice for Different Camps

Each program or event can have unique requirements, and it’s important to tailor your financial documents to fit the specific needs of each one. Whether you’re organizing a sports retreat, an educational workshop, or a recreational gathering, customizing your records ensures they reflect the specifics of the services provided, the pricing structure, and the expectations of your participants. Understanding how to adapt your financial documents will help keep your operations smooth and professional across different types of activities.

By adjusting key elements of your financial documents, you can easily reflect different pricing models, services, and conditions that may vary between programs. This flexibility will ensure that each participant receives an accurate and relevant statement that aligns with the type of event they are attending. Here are some important considerations for adapting financial records for different kinds of events or programs.

Key Considerations for Adaptation

- Service Breakdown: Depending on the nature of the event, the services provided may vary. Some activities may require additional costs for materials, meals, or special sessions. Make sure to clearly list all services and their respective charges.

- Pricing Structure: Programs may have different pricing structures, such as tiered pricing based on age, skill level, or length of participation. Tailor your financial records to reflect these variations to avoid confusion.

- Discounts and Promotions: If you offer group rates, early-bird discounts, or other promotions, ensure that these are properly applied to the financial document. Adjust the total amount to reflect any special pricing.

- Payment Terms: Payment schedules may differ depending on the type of event. For example, some programs might require a deposit up front with the balance due later, while others may require full payment in advance. Make sure your financial record clearly reflects the correct terms.

- Additional Fees: Some activities may have additional fees for equipment rentals, transport, or special events. Include a line for each additional cost to ensure transparency.

Adjusting for Specific Programs

For instance, an outdoor adventure may have specific charges related to gear rental, transport, or insurance, while an arts workshop might include costs for materials or guest instructors. By adjusting your financial documents to reflect these additional details, you ensure that each participant is billed fairly and accurately.

Customizing your financial records for different types of events also means paying attention to the details that are most relevant to each participant. For example, some programs may require additional terms regarding cancellations or refunds, while others may need to emphasize payment installments or late fees. Tailoring your approach to each unique event will help ensure clarity and maintain professional standards throughout.

Improving Client Experience with Camp Invoices

Providing an excellent client experience goes beyond offering great services; it also includes how clients interact with their financial documents. By ensuring that these records are clear, professional, and easy to understand, you can significantly enhance the overall experience for your clients. A well-organized financial statement can reduce confusion, speed up payment processing, and foster trust between your organization and participants. It’s essential to approach this aspect with care, as the way you present financial details directly influences your clients’ satisfaction and perception of your program.

When clients receive their financial documents, they should immediately understand the charges, payment deadlines, and any other relevant details. A transparent and user-friendly document not only makes it easier for them to pay but also shows that you are organized and trustworthy. In this section, we will explore key strategies to improve the client experience through better financial recordkeeping.

Key Strategies to Enhance Client Experience

- Clarity and Transparency: Make sure that every charge is clearly listed, with detailed descriptions where necessary. This eliminates ambiguity and helps clients feel confident about the breakdown of costs.

- Easy-to-Understand Format: Present the information in a structured format that is easy to follow. Use tables or itemized lists to display charges, taxes, and discounts, so clients can quickly identify relevant details.

- Customizable Options: Tailor the financial document to suit the client’s specific situation. For example, some clients may have special payment arrangements or discounts that should be clearly reflected in their statement.

- Friendly Payment Reminders: Sending timely and polite reminders when payment is due helps prevent delays and demonstrates professionalism. A courteous reminder can encourage prompt payment and help maintain positive relationships.

- Accessible Payment Methods: Provide a range of convenient payment options (e.g., online payments, bank transfers, checks) and ensure these details are clearly presented on the financial record, making it easy for clients to pay.

Fostering Trust with Transparent Communication

By offering clear, concise, and well-organized financial documents, you build trust and make it easier for clients to navigate their payment process. Additionally, clear communication regarding refund policies, payment schedules, and any additional charges can prevent misunderstandings and promote a smooth experience from start to finish. Transparency in financial matters helps solidify your reputation as a professional and reliable service provider.

Improving the client experience through clear and well-structured financial records ensures that participants feel valued, reduces frustration, and enhances overall satisfaction