Service Charge Invoice Template for Efficient Billing

Managing payments and keeping track of expenses is a crucial aspect of any business operation. Having a well-structured document to detail financial transactions can greatly improve accuracy and reduce misunderstandings. A well-designed document not only simplifies the payment process but also ensures clarity for both the service provider and the client.

Streamlining financial communication helps businesses stay organized, ensuring that all required information is clearly presented and easy to understand. With the right tools, creating such records becomes a simple task, allowing business owners to focus more on their core operations.

In this guide, we explore how to craft a comprehensive and clear record for billing purposes. We discuss the key elements that need to be included and the best practices to follow to ensure everything runs smoothly and efficiently for all parties involved.

Service Charge Invoice Template Overview

When managing financial transactions between businesses and clients, having a structured document is essential for clarity and consistency. This type of document helps ensure that all necessary details are accurately conveyed, from the amount owed to the specific services rendered. By using a carefully designed format, businesses can streamline their billing process and enhance communication with their customers.

Benefits of Using a Structured Format

A well-organized record can save time and reduce errors. With all the required fields clearly outlined, there’s less room for confusion or misinterpretation. Whether you’re dealing with one-off tasks or ongoing services, such a format can help track all the relevant information systematically, making it easier for both parties to review and confirm the details.

Key Features to Include in the Record

Essential elements such as the name and contact details of both parties, a description of the work completed, and the total amount due are necessary for a complete and effective document. Additionally, including payment terms, deadlines, and other specific instructions can make the process more efficient, ensuring no important information is overlooked.

Why You Need a Service Charge Invoice

Having a structured document to outline payments is essential for maintaining transparency and ensuring smooth financial transactions between businesses and clients. This type of record helps to formalize agreements, reduces the chance of misunderstandings, and ensures that both parties are clear about the terms and amounts involved.

Ensuring Clarity and Accuracy

A properly organized record eliminates any room for confusion, ensuring that all relevant details are easily accessible. By including specific terms, descriptions of the work completed, and amounts due, businesses can avoid disputes and streamline the payment process. This clarity is especially important in maintaining a professional relationship with clients.

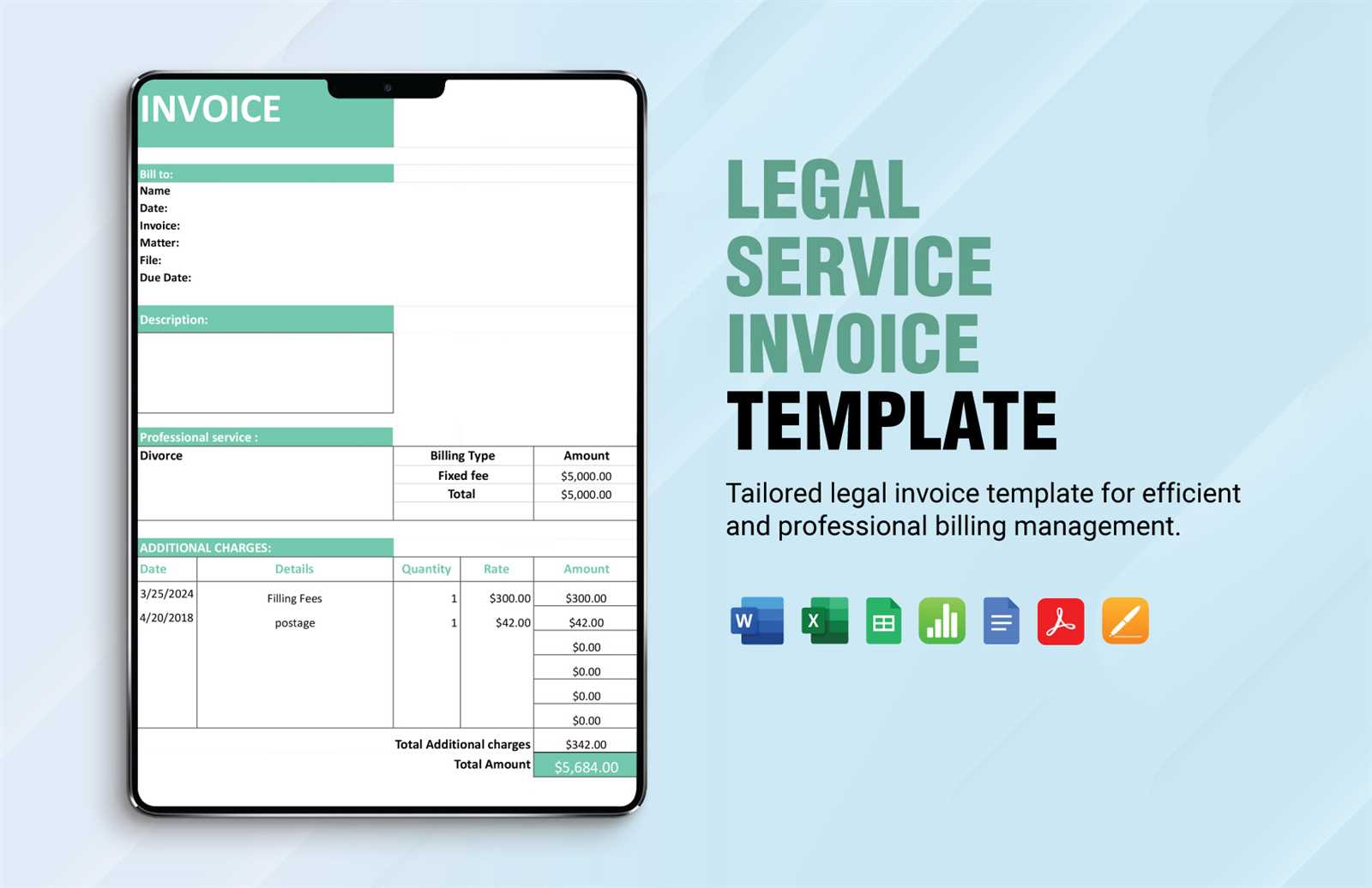

Legal Protection and Compliance

Documenting financial transactions not only helps with clear communication but also provides legal protection in case of any future disagreements. A comprehensive record serves as proof of the agreed-upon terms, offering both businesses and clients peace of mind that all obligations have been met.

Key Features of an Effective Template

To create a useful document for billing purposes, certain features are essential for ensuring clarity and professionalism. These key elements make the process smoother for both the business and the client by providing all the necessary information in an organized and easy-to-understand format. A well-crafted record can help minimize confusion and prevent errors in financial transactions.

Essential Elements to Include

- Contact Information – Both parties’ names, addresses, and contact details should be clearly displayed.

- Detailed Description – A clear outline of the work completed or services provided is crucial for transparency.

- Payment Amount – The total amount due must be stated explicitly, ensuring no room for misunderstanding.

- Payment Terms – Clearly define the payment deadline, method, and any late fee policies.

- Unique Identification Number – Assigning a reference number helps in tracking and managing records efficiently.

Formatting for Easy Use

In addition to the essential elements, formatting plays an important role in making the document user-friendly. A clean, well-organized layout that divides information into distinct sections will improve readability and allow for quick reference when needed.

- Consistent Design – Ensure that the fonts, colors, and sections are uniform throughout the document for a professional appearance.

- Clear Structure – Use headings and subheadings to separate key details, making it easier to find the necessary information.

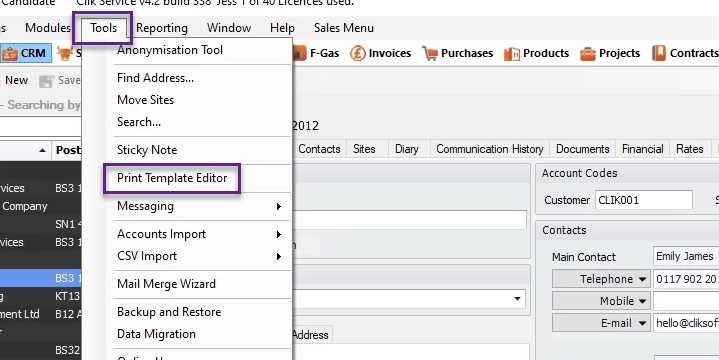

How to Customize Your Invoice Template

Customizing a billing document to meet the specific needs of your business is an essential step toward creating professional and accurate financial records. By tailoring the format, you can ensure that all the necessary information is included and presented in a way that aligns with your brand and business requirements. Here’s how to make the most of your document’s structure and layout.

Steps to Personalize Your Document

- Adjusting the Header – Include your business logo, name, and contact information at the top. This helps to establish your brand identity and makes the document easily recognizable.

- Choosing a Layout – Select a format that fits the types of services you offer. Whether it’s for one-time tasks or recurring services, ensure that the layout accommodates the specific details of your work.

- Adding Fields for Specific Information – Include customized sections that are relevant to your business, such as project numbers, dates, or a breakdown of hours worked.

- Incorporating Payment Instructions – If your business has specific payment instructions or terms, make sure these are clearly visible, so clients know exactly how and when to make payments.

Designing for Clarity and Professionalism

- Fonts and Colors – Choose a professional font and a color scheme that reflects your brand’s visual identity. This ensures that the document looks polished while being easy to read.

- Spacing and Alignment – Proper use of spacing and alignment helps to organize the information neatly, improving readability and overall presentation.

Choosing the Right Format for Your Business

Selecting the right document format for billing is a critical decision for any business. The format should reflect the nature of your services and how you interact with clients. A well-chosen structure ensures that important details are clearly presented and easily understood, making the entire billing process smoother for both parties involved.

Factors to Consider When Choosing a Format

- Business Size – Smaller businesses may prefer a simple, straightforward structure, while larger companies may require a more complex layout to accommodate multiple service categories or payment terms.

- Type of Services Offered – Whether your business provides one-time tasks or ongoing services, the format should accommodate the specific information needed for each type of transaction.

- Client Preferences – Consider the expectations of your clients, whether they prefer a traditional paper format or an electronic one, as well as their familiarity with different document types.

Comparison of Common Formats

| Format Type | Best For | Advantages |

|---|---|---|

| Standard Paper Format | Small businesses or clients preferring physical documents | Easy to print, familiar to clients |

| Excel Spreadsheet | Businesses with frequent transactions or detailed breakdowns | Highly customizable, easy to calculate totals and taxes |

| PDF Format | Businesses wanting a professional and easily shareable document | Secure, consistent across all devices |

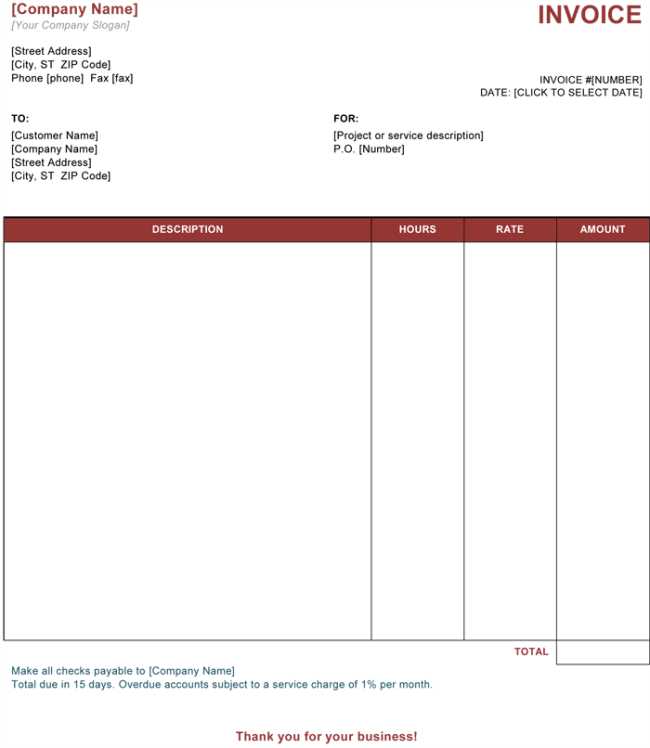

Step-by-Step Guide to Creating an Invoice

Creating a well-organized document to detail payments is essential for any business. The process of preparing such a record involves several key steps that ensure all relevant information is included, allowing both the business and client to easily track the transaction. This guide outlines the necessary actions for generating a professional and accurate financial document.

Steps to Follow

- Include Your Business Information – At the top of the document, provide your company’s name, address, and contact details to ensure clients know who the bill is coming from.

- Client’s Information – Include the client’s full name, address, and contact details. This ensures that the correct recipient is billed.

- Add a Unique Reference Number – Assign a unique identifier to the document to make it easy to track in your system and refer to if needed.

- List the Work Done – Clearly describe the tasks or services provided, including the duration, materials, or any special terms that apply. Ensure everything is accurately noted to avoid confusion.

- Specify the Amount Due – Include the total amount payable, breaking it down if necessary to show how the price was calculated.

- State Payment Terms – Indicate the deadline for payment, any applicable taxes, and the preferred payment methods. This clarifies when and how the payment should be made.

- Finalize with a Thank You Note – Add a polite closing message to maintain a positive relationship with your client, thanking them for their business.

Formatting and Design Tips

- Clarity is Key – Use easy-to-read fonts and appropriate spacing. A clear layout helps clients quickly understand the charges and payment terms.

- Consistency – Ensure the design matches your brand’s visual identity. This helps maintain a professional image and makes the document recognizable.

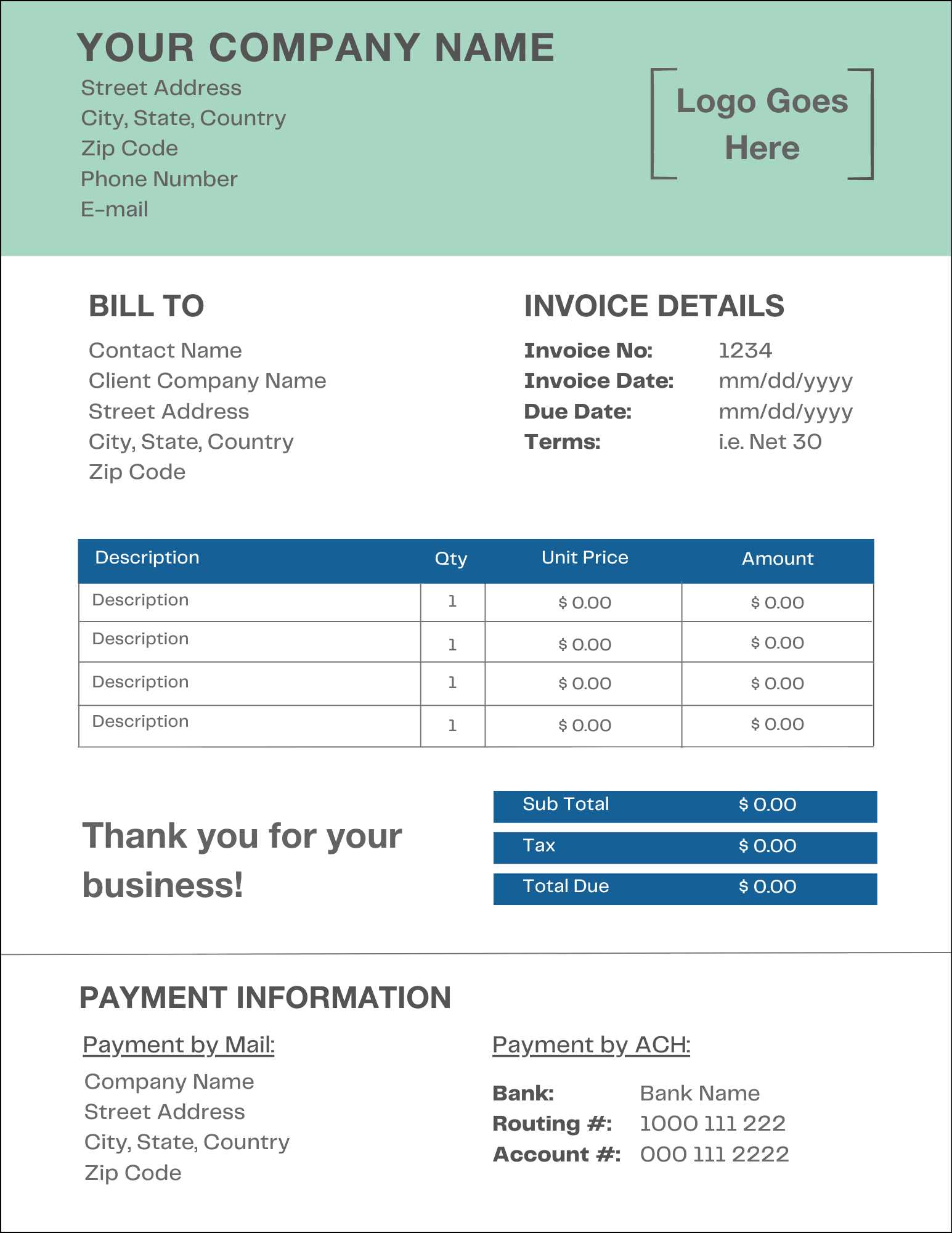

Important Details to Include in the Invoice

To ensure clarity and transparency in your billing records, it is crucial to include all the necessary information in your document. By providing a complete overview of the transaction, both you and your client can avoid any misunderstandings or disputes. Here are the essential elements that should be present in every record of payment.

Key Information to Include

- Header Information – This includes the name and contact details of both parties. Ensure that the details for both your business and the client are clearly listed at the top of the document.

- Unique Reference Number – Assign a unique ID or number to the document. This helps with organization and easy tracking of the record for future reference.

- Description of Services or Products – A brief yet clear explanation of the services or goods provided is essential. This ensures both parties understand what was delivered and the corresponding costs.

- Payment Amount – Clearly list the total amount due, including a breakdown of charges if necessary. This makes it easier for clients to see how the total was calculated.

- Due Date – Specify when the payment is due. This helps set expectations for when the payment should be made and helps avoid delays.

- Payment Methods – List acceptable payment methods, whether it’s via bank transfer, credit card, or another platform, to make it easier for clients to complete the transaction.

- Late Fees or Penalties – If applicable, clearly state any late fees or penalties for overdue payments. This ensures clients are aware of any additional charges that may arise from delayed payments.

Additional Considerations

- Tax Information – Include any applicable taxes, and specify the rate applied if necessary. This ensures compliance with local regulations and provides clients with a complete breakdown.

- Terms and Conditions – If relevant, include any specific terms regarding payment, delivery, or other agreements related to the transaction.

How to Calculate Service Charges Accurately

Accurately determining the total amount due for the work performed requires careful calculation of all relevant factors. Whether you’re billing based on time, materials, or a fixed rate, it’s important to ensure that your figures are clear, precise, and fair. This section outlines the steps to follow to calculate the total amount owed without errors.

Steps for Accurate Calculation

- Determine the Rate – First, decide if you’ll be charging by the hour, a flat fee, or another method. Ensure that the rate reflects your expertise and market value.

- Account for Time – If your work is billed by the hour, track the exact amount of time spent on each task. Be sure to account for any breaks, pauses, or delays to ensure accuracy.

- Consider Materials and Additional Costs – Include any additional costs such as supplies, equipment, or special tools used to complete the job. Factor these into the final price to ensure you’re reimbursed for any expenses incurred.

- Apply Discounts or Promotions – If applicable, subtract any discounts or special offers that the client is eligible for. This ensures the final amount is adjusted accordingly.

- Include Taxes – Add any applicable sales taxes or VAT based on local laws to arrive at the total amount due.

Example Calculation

| Description | Amount |

|---|---|

| Hourly Rate (5 hours) | $100 |

| Materials (supplies used) | $50 |

| Discount | -$10 |

| Subtotal | $140 |

| Sales Tax (10%) | $14 |

| Total Amount Due | $154 |

Common Mistakes to Avoid in Invoicing

Inaccurate or incomplete billing can lead to confusion, delayed payments, and strained business relationships. Even simple mistakes in preparing a payment record can cause unnecessary complications. It is important to be aware of these common errors to ensure that the billing process runs smoothly and efficiently.

Top Mistakes to Avoid

- Missing or Incorrect Contact Information – Always double-check that the details for both your business and the client are correct. Incorrect contact information can delay the processing of payments.

- Unclear Payment Terms – Clearly state the due date, payment method, and any other relevant terms. Ambiguity in payment instructions can lead to misunderstandings and delayed payments.

- Omitting a Reference Number – Without a unique reference number, it becomes difficult to track and manage payments. Always assign a number to each document for easier record-keeping.

- Failing to Break Down Costs – Providing a detailed list of charges and costs is essential. Failing to break down individual items or services can lead to confusion and disputes over the amount due.

- Not Including Taxes – Always include any applicable taxes in your calculation. Failing to account for taxes can lead to incorrect totals and potential legal issues.

- Leaving Out Payment Details – Ensure that the accepted methods of payment are clearly listed. This will help your clients know how to settle their balance quickly and efficiently.

Additional Considerations

- Inconsistent Formatting – Inconsistent fonts, styles, or layouts can make a document hard to read and cause confusion. Keep the design professional and clear.

- Not Tracking Past Due Payments – It’s important to follow up on overdue payments promptly. Failing to do so can result in cash flow issues for your business.

Integrating Service Charge Invoices with Accounting Software

Efficiently managing your financial records becomes much easier when you integrate billing documents with accounting systems. Automation of the process ensures that transactions are accurately recorded, saving time and reducing the chance of human error. This integration can help you streamline your workflows, generate reports, and improve overall business efficiency.

By linking your billing process to accounting software, you can automate key tasks such as payment tracking, tax calculations, and client records management. The right system allows for seamless data exchange, ensuring that all financial data is up to date and correctly categorized without requiring manual entry. This not only improves accuracy but also speeds up the overall payment process.

Benefits of Integration

- Improved Accuracy – Automated data transfer reduces the risk of errors in calculations and data entry, ensuring that your financial records are always correct.

- Time Efficiency – Integration eliminates the need for manual entry, freeing up time to focus on other important tasks within your business.

- Easy Access to Reports – Accounting software can automatically generate detailed reports based on the data from your documents, making it easier to track business performance and prepare for tax season.

- Better Cash Flow Management – With real-time updates and tracking, you’ll have better insight into outstanding payments, helping you manage cash flow more effectively.

Key Features to Look for in Software

- Invoice Syncing – Ensure that your billing system syncs with your accounting software so that all transactions are automatically recorded.

- Payment Tracking – Look for software that can track paid, pending, and overdue amounts in real-time.

- Tax Calculations – Ensure that your software can calculate taxes based on local regulations to avoid errors.

- Customizable Reports – Choose a system that offers customizable reports to track revenue, expenses, and profit margins easily.

Best Practices for Managing Invoice Payments

Managing payments efficiently is a key aspect of maintaining a healthy cash flow and ensuring the financial stability of your business. Adopting best practices for handling payments will help reduce late payments, avoid confusion, and streamline your operations. Proper management of payments not only improves your relationships with clients but also ensures that you get paid on time.

Effective Payment Management Tips

- Establish Clear Payment Terms – Always define payment terms at the start of your contract. This includes setting a due date, specifying acceptable payment methods, and outlining any penalties for late payments.

- Send Timely Reminders – Send reminders before and after the payment due date to encourage timely settlement. Regular follow-ups can help maintain a good payment schedule.

- Offer Multiple Payment Options – Providing clients with a variety of payment options, such as bank transfers, credit cards, and online payment systems, makes it easier for them to pay on time.

- Track Payments Systematically – Use a system that helps you track each payment in real time. This makes it easy to identify any overdue payments and follow up promptly.

- Provide Detailed Statements – Ensure that each payment document includes all the necessary details, such as the breakdown of costs, taxes, and total amounts due. Transparency helps clients understand what they are paying for and reduces disputes.

Example Payment Tracking Table

| Client Name | Amount Due | Due Date | Amount Paid | Payment Status |

|---|---|---|---|---|

| Client A | $200 | 2024-11-10 | $200 | Paid |

| Client B | $350 | 2024-11-15 | $0 | Unpaid |

| Client C | $150 | 2024-11-05 | $150 | Paid |

By implementing these best practices and maintaining clear communication with clients, you can ensure smooth and timely payment processing for your business. A well-organized approach will ultimately lead to better cash flow management and stronger client relationships.

Legal Requirements for Service Charge Invoices

When preparing billing documents for any business transaction, it is essential to ensure that they comply with local and international legal standards. These legal requirements govern the details that must appear on the document, ensuring transparency, accountability, and proper taxation. Failure to meet these obligations can result in financial penalties or legal disputes, so understanding what must be included is crucial for businesses of all sizes.

Key Legal Considerations

- Business Information – The document should clearly state the name, address, and contact details of the issuing business. This ensures the recipient can easily identify the source of the document.

- Recipient Information – Similar to the business details, the recipient’s name and address should also be listed to avoid confusion and ensure proper identification.

- Unique Reference Number – Each document must have a unique identification number that helps track the transaction. This number aids in organization and can be critical for future reference or audits.

- Clear Description of Goods or Services – A detailed breakdown of what is being billed must be included. This should provide clarity on the nature of the transaction, including quantities, rates, and any applicable discounts.

- Tax Information – Depending on local tax laws, businesses must include tax identification numbers and indicate whether VAT or other taxes are included. The document should specify the tax rates applied to the transaction.

Complying with Local Regulations

- Currency and Language – Some regions require that all financial documents be issued in the local currency and language, while others may allow flexibility in using foreign currencies or languages as long as the transaction details are clear.

- Payment Terms and Due Dates – It’s essential to include specific details about payment deadlines, including any late fees or penalties for overdue payments. This helps both the business and the client manage expectations regarding timing and obligations.

- Electronic vs. Paper Documents – Many jurisdictions now permit electronic versions of such documents, but they must meet the same standards as paper versions. Businesses should ensure that their electronic documents comply with digital signature or authentication requirements when applicable.

By adhering to these legal requirements, businesses can ensure smooth transactions, avoid penalties, and maintain trust with clients. It is always advisable to consult with a legal expert or accountant to stay up to date on evolving laws that may affect billing practices in your region.

How to Ensure Clarity in Your Invoice

Clear communication in business documents is essential for maintaining transparency between parties. When crafting a billing document, ensuring that all details are easy to understand can help prevent confusion, disputes, and delays in payment. It’s important to structure the document in a way that makes each element obvious to the recipient, from pricing to payment terms.

Key Elements to Include for Clarity

- Clear Itemization – Break down each product or service provided with precise descriptions and quantities. This will prevent any misunderstandings about what the recipient is being charged for.

- Accurate Pricing – List the cost of each item or service and any additional charges separately. Make sure that all rates are clearly visible and easy to understand.

- Payment Terms – Specify the payment due date, acceptable methods of payment, and any penalties for late payments. Clear terms help set expectations and avoid confusion.

- Visual Layout – Use clear headings, bullet points, and sections to organize the document. A well-structured layout makes it easier for recipients to navigate and find the information they need.

- Contact Information – Include the business contact details, ensuring the recipient knows who to reach out to in case of any questions or issues with the document.

Formatting Tips for Enhanced Readability

- Consistent Fonts and Text Size – Use legible fonts and maintain a consistent text size throughout the document to ensure readability.

- Clear Headings – Use headings to distinguish different sections of the document, such as product descriptions, pricing, and total amount due.

- Avoid Jargon – Use simple, direct language that is easy to understand. Avoid technical terms or jargon that may confuse the reader.

- Highlight Important Information – Bold or underline key details, such as the total amount due, to make them stand out and ensure they are not overlooked.

By focusing on these aspects, you can create a billing document that is not only informative but also easy to read and understand. This improves both the professionalism of your business and the likelihood of timely payments.

Automating Invoice Generation and Delivery

In today’s fast-paced business environment, automating the process of creating and sending billing documents can save time, reduce errors, and streamline your workflow. By using automation tools, businesses can generate documents with predefined information, ensuring consistency and accuracy while minimizing manual effort. This process not only speeds up operations but also helps in maintaining a professional image with timely delivery.

Benefits of Automation

- Time Efficiency – Automation eliminates the need to manually create each document, allowing you to focus on other important tasks.

- Consistency – With predefined templates, you ensure that each document follows the same format, reducing errors and discrepancies.

- Improved Accuracy – Automated systems reduce the risk of human error in calculations or missing details.

- Faster Delivery – Automated processes can send documents instantly via email or other platforms, speeding up the delivery time.

- Better Tracking – Automated tools can track when the document is sent, viewed, or paid, providing valuable insights for your business.

Steps to Automate the Process

- Choose the Right Software – Select a tool or platform that allows you to generate and send documents automatically, integrating with your existing systems such as accounting or CRM software.

- Set Up Predefined Information – Configure templates with details like client information, pricing, and payment terms, so these elements are automatically filled in for each document.

- Configure Delivery Methods – Set up automatic email sending or integration with your preferred communication channels for document delivery.

- Set Reminders – Automate reminders for pending payments or late fees to ensure timely follow-up with clients.

- Monitor and Optimize – Regularly review and fine-tune your automated processes to ensure they are meeting your needs and improving efficiency.

By automating the creation and delivery of billing documents, businesses can improve their efficiency, accuracy, and customer satisfaction, all while reducing administrative costs and overhead.

How to Track Unpaid Service Charges

Keeping track of outstanding payments is a critical aspect of managing your business’s cash flow. When clients fail to settle their dues on time, it’s important to have an effective system in place to monitor and follow up on those unpaid amounts. By implementing the right tracking methods, you can stay on top of overdue balances and take prompt action to ensure payments are received efficiently.

To begin tracking unpaid amounts, start by creating a clear and organized record for each transaction. Use accounting software or spreadsheets to log details like due dates, amounts owed, and payment status. This allows you to quickly identify which balances remain unpaid and assess the overall financial health of your business.

Another key practice is setting up reminders or alerts for overdue payments. Many accounting tools offer features that can automatically notify you when a payment is past due. This proactive approach helps you stay on top of outstanding balances and reduces the likelihood of forgetting about late payments.

Additionally, it’s essential to maintain consistent communication with clients who have overdue payments. Reach out to them promptly with gentle reminders and provide clear instructions on how to settle the balance. Clear communication not only encourages timely payment but also strengthens your professional relationship with clients.

Tips for Streamlining the Billing Process

Efficiently managing your billing procedures can significantly improve cash flow and reduce administrative workload. By optimizing your billing system, you can save time, minimize errors, and ensure timely payments. Below are some helpful strategies for streamlining the entire process.

1. Automate the Process

Automating your billing system can eliminate the need for manual data entry and reduce the risk of human error. Many software solutions allow you to set up recurring billing cycles and automatically generate and send payment requests at specified intervals. This helps you maintain consistency and accuracy in your financial operations.

2. Maintain Clear and Consistent Documentation

Having a standardized format for all your billing documents is essential. By using a consistent layout and language, you ensure that your clients understand the payment terms and expectations. Well-organized records also help you quickly address any discrepancies that may arise in the future.

3. Implement Online Payment Options

Providing clients with easy and secure online payment options can greatly speed up the payment process. Platforms like PayPal, credit card payments, and bank transfers allow customers to settle their dues without delays, making it convenient for both parties.

4. Set Up Payment Reminders

Send timely reminders before and after payment deadlines. By notifying clients in advance, you encourage them to settle their balances on time. Automated email reminders or alerts can be set to go out at specific intervals, saving you the effort of manual follow-ups.

5. Review and Simplify Terms

Ensure that your payment terms are straightforward and easy to understand. Complex or unclear conditions can cause confusion, leading to delays or disputes. Simplifying terms, such as setting a standard due date or offering clear instructions, makes it easier for clients to comply with your billing requests.

6. Track Payments Regularly

Regularly review your payment records to stay on top of any outstanding balances. Keeping an eye on overdue accounts helps you take action early, reducing the risk of missed payments. You can use accounting software to monitor payment statuses and automatically flag overdue accounts.

By implementing these strategies, you can optimize your billing process, improve cash flow, and foster better relationships with your clients.

Final Thoughts on Service Charge Invoices

As a business owner or service provider, it is crucial to have a well-organized system for managing payment requests. The process of creating and sending formal requests for payment should be straightforward, clear, and legally compliant. When done correctly, it ensures that you are paid promptly and that your financial records remain accurate and transparent.

Importance of Consistency

Consistency in the way you create and send payment requests is vital for maintaining professionalism. A well-structured document not only clarifies the terms of the agreement but also helps build trust with your clients. By providing a clear breakdown of charges and expectations, you reduce the chances of misunderstandings or disputes.

Efficiency Through Automation

Automating the process of creating and sending payment requests can save time and minimize errors. By leveraging modern tools and software, you can automate recurring requests and keep your records updated without the need for manual intervention. This allows you to focus more on growing your business rather than dealing with administrative tasks.

In conclusion, the proper management of payment documentation is a key aspect of running a successful business. By streamlining the process, maintaining consistency, and utilizing the right tools, you ensure that your operations are more efficient, organized, and reliable.