How to Use an Invoice in Spanish Template for Your Business

When working with clients who speak another language, having the right billing tools is crucial for smooth communication and ensuring timely payments. In particular, creating accurate and clear invoices is essential in any business environment, and when doing so in a foreign language, it becomes even more important to follow local conventions and expectations. This guide will help you understand how to create professional financial documents tailored for Spanish-speaking clients.

Whether you are a freelancer, a small business owner, or a company dealing with international clients, adapting your billing system to meet their language and format requirements can boost your professionalism and avoid misunderstandings. Knowing what elements to include, how to structure the information, and which terms to use can make a significant difference in your client relationships and payment processes.

We will walk you through the essential components of these documents, how to customize them for your needs, and provide helpful resources to ensure you are ready to manage your billing effectively. By following this guide, you’ll ensure your financial communication is clear, compliant, and easy to understand, no matter where your clients are located.

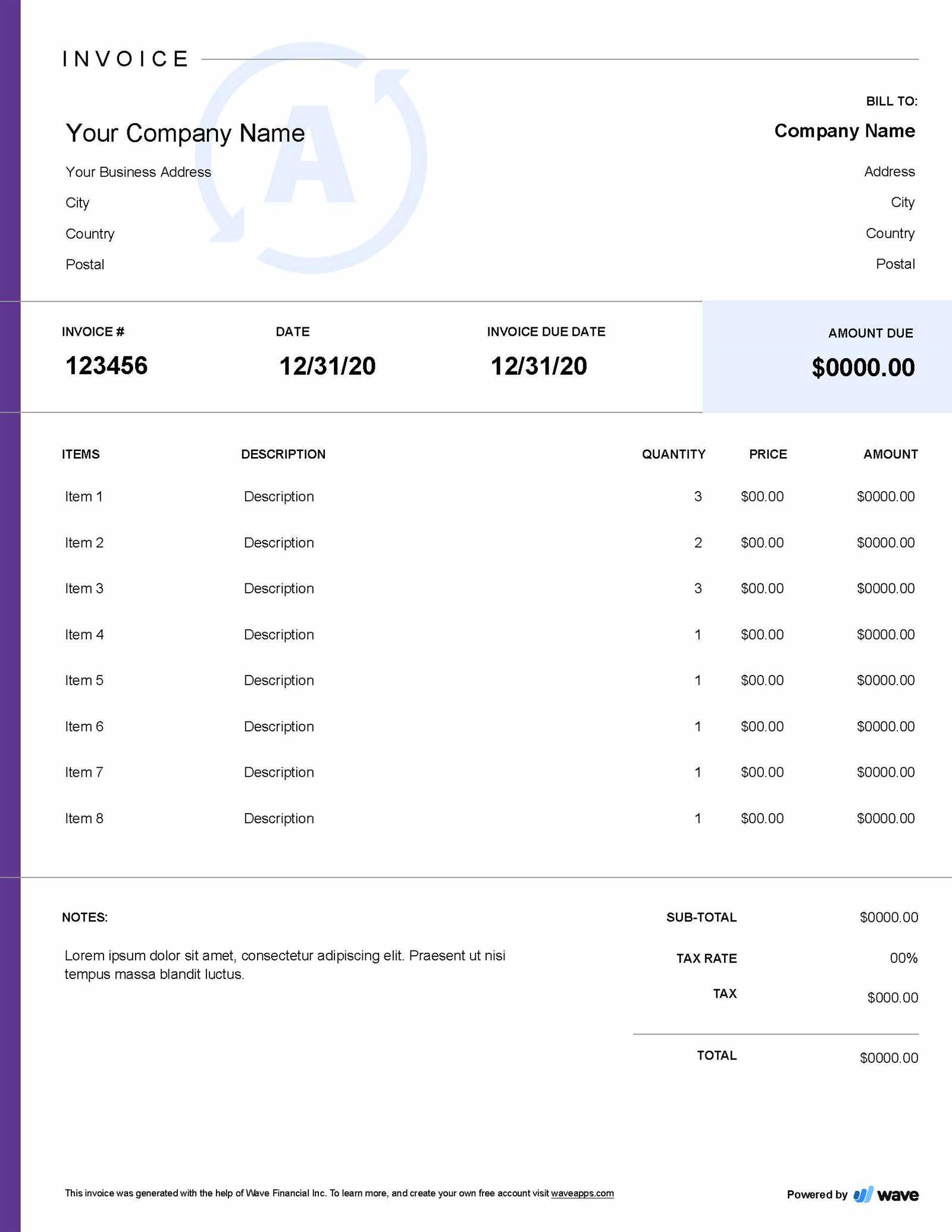

Invoice in Spanish Template Overview

Creating a well-structured billing document is an essential step in maintaining professionalism in any business transaction. When working with Spanish-speaking clients, it’s important to understand the specific formatting and language requirements that apply. This section provides an overview of how such documents are typically structured, the key components to include, and why tailoring them to the local language is essential for clarity and legal compliance.

These documents serve as a formal request for payment, outlining the goods or services provided, payment terms, and the amount due. By using a format designed for Spanish-speaking clients, businesses can ensure that all necessary details are presented clearly and that they meet regional standards. Below, we will explore the key sections that are typically included in such documents.

Key Components of a Standard Billing Document

| Component | Description |

|---|---|

| Header | Includes the name of the business, logo, and contact details. |

| Client Information | Includes the name, address, and contact details of the client. |

| Transaction Details | Lists the products or services provided, along with their prices. |

| Terms of Payment | Outlines the payment methods, deadlines, and penalties for late payments. |

| Total Amount | Summarizes the total amount due, including taxes and any discounts applied. |

Why Localized Formats Matter

Using a format tailored to Spanish-speaking clients not only ensures better understanding but also helps avoid potential legal issues. Certain regions may have specific rules regarding taxes, required information, or formatting. By following the right conventions, businesses can demonstrate attention to detail and respect for local practices, which can enhance their credibility and professionalism in international markets.

Why Use a Spanish Invoice Template

When conducting business with clients in a foreign language, especially in regions where Spanish is spoken, using the right format for financial documents is crucial for clear communication. Ensuring that the structure and language are appropriate can help avoid misunderstandings and delays in payment. By using a specific format designed for Spanish-speaking clients, you ensure your documents are both professional and legally compliant.

Having a properly structured document tailored to the language and conventions of your client’s region not only fosters trust but also ensures that all essential information is easily understood. This is particularly important when working internationally, where even minor errors can lead to confusion or even legal issues. A customized document streamlines the payment process, making it easier for clients to review the details and proceed with payments on time.

Moreover, using the correct format can save time and effort. By relying on a predefined structure, businesses can avoid the hassle of recreating documents from scratch for every client. Instead, they can simply adjust the necessary details, such as the amounts or services provided, while maintaining the same professional look and legal compliance with each transaction.

Essential Elements of a Spanish Invoice

Creating a professional billing document requires attention to detail. Each section serves a specific purpose to ensure the document is clear, accurate, and legally compliant. Understanding the fundamental elements that need to be included in these documents is key to creating a seamless experience for both the business and the client. Below are the crucial components that should be part of any well-structured billing document for Spanish-speaking clients.

Client and Company Information

The first section should clearly list the details of both the service provider and the client. This includes the full name or company name, address, contact information, and any relevant tax identification numbers. These details are necessary to ensure the transaction is properly recorded and can be referenced later. Additionally, including your business logo and other branding elements can help maintain a professional appearance.

Transaction Breakdown

Another important section is the breakdown of the services or products provided. This should include a clear description of each item, along with its unit price, quantity, and total cost. If applicable, taxes should also be outlined, indicating the percentage and amount. This transparency ensures that both parties understand the costs involved and eliminates potential confusion during the payment process.

Finally, it is essential to include payment terms and deadlines. This helps set clear expectations about when payment is due, any penalties for late payments, and the accepted methods of payment. Including these terms makes the process smoother and prevents disputes, ensuring that both parties are on the same page regarding financial agreements.

How to Customize Your Invoice Template

Personalizing your billing document is an important step in ensuring it reflects your business’s branding and meets the specific needs of your clients. By adjusting key sections, you can tailor the document to include the most relevant details, making it easier to use and understand. Customizing your document helps present a professional image while also complying with any legal or regional requirements.

Start by adjusting the header section. This is where your business logo, name, and contact information will be displayed. Make sure the design aligns with your overall branding and that the details are easy to find. Including your company’s tax identification number (if required) is also important for legal purposes.

Next, customize the layout of the itemized list of goods or services provided. Ensure that each product or service is described clearly and with enough detail for your client to understand the charges. You can also adjust the columns to accommodate specific pricing structures, discounts, or taxes relevant to your business. This will make the document more efficient and improve client understanding of what is being billed.

Finally, ensure that the payment terms are customized to reflect the specific conditions agreed upon with the client. This includes payment deadlines, acceptable payment methods, and any penalties for late payments. Having these terms tailored helps avoid misunderstandings and makes the billing process smoother for both parties.

Free Spanish Invoice Templates for Download

If you’re looking for an easy way to streamline your billing process, downloading a ready-made document can save you a significant amount of time. By choosing a pre-designed format, you ensure that your paperwork is both professional and compliant with local conventions. Many platforms offer free, customizable options that cater specifically to the needs of businesses working with Spanish-speaking clients.

These downloadable documents often come in various styles and formats, allowing you to choose one that best fits your business’s needs. Whether you’re a freelancer, a small business, or a large corporation, there are options designed for different types of transactions and industries. Most of these resources also allow you to easily edit the details, ensuring that the final product matches the specifics of your current job or sale.

By using these free resources, you can avoid the hassle of creating documents from scratch while still maintaining a professional standard. Customizing these documents with your company’s details, logo, and specific payment terms can make them look personalized, while the structure will ensure all necessary information is included. Simply search for a platform that offers free downloads and start using a high-quality, ready-to-use solution for your next transaction.

Benefits of Using Spanish Invoice Formats

Adapting your billing documents to meet the specific language and formatting requirements of your clients can significantly improve communication and reduce errors. By using a format tailored to Spanish-speaking clients, you not only ensure legal compliance but also enhance professionalism and streamline the payment process. The following table highlights some of the key advantages of using these specialized formats.

| Benefit | Description |

|---|---|

| Improved Clarity | Localized formats ensure that all terms and charges are easily understood, reducing confusion and the risk of disputes. |

| Faster Payment Processing | By providing all required details in the preferred language and format, clients are more likely to process payments on time. |

| Professional Image | Using an appropriate layout and language boosts the credibility of your business, showing respect for the client’s cultural norms. |

| Legal Compliance | In some regions, there are specific legal requirements regarding the content and structure of financial documents; localized formats help ensure compliance. |

| Efficiency | With ready-made and customizable options, these formats save time by allowing businesses to quickly generate accurate, professional documents. |

By using a properly formatted document tailored to the needs of your clients, you can foster better communication, reduce delays, and ensure that your business transactions run smoothly. The right format is not only a tool for efficiency but also a way to demonstrate attention to detail and professionalism in your international dealings.

Common Mistakes When Creating Spanish Invoices

When preparing financial documents for clients in another language, even small mistakes can lead to confusion, delays, or even legal issues. Many businesses overlook details when adapting their billing formats, which can result in errors that affect payment processing and client satisfaction. Here are some of the most common mistakes to avoid when preparing documents for Spanish-speaking clients.

Failure to Include Required Information

Each region may have specific legal and tax requirements regarding what must be included in a billing document. Missing even one crucial detail can lead to misunderstandings or issues with local authorities. Common omissions include:

- Failure to include the client’s tax identification number (if required)

- Omitting the date of issue or due date

- Not listing payment terms and conditions clearly

Incorrect Language Usage and Terminology

Even if the document is in the correct language, using incorrect or ambiguous terms can cause confusion. Make sure the following are handled carefully:

- Using the wrong term for services or products (e.g., “artículos” vs. “productos”)

- Confusing formal and informal language, especially for client communication

- Incorrectly applying numeric formats (e.g., using commas instead of periods for decimals)

Incorrect language usage can not only delay payments but may also affect the perception of your professionalism. Always double-check your wording and ensure that you are using the correct expressions for your region and client base.

Unclear Item Descriptions

It’s crucial to provide clear and precise descriptions for each item or service listed. Avoid vague terms that could be misunderstood. Be specific about what was provided, including quantities, unit prices, and any discounts or additional charges. Lack of clarity in this section can lead to payment delays or disputes.

Ignoring Local Tax Regulations

Different countries and regions have varying tax laws that affect the total amount due. Failing to correctly apply taxes or include them in the appropriate section can result in undercharging or legal issues. Ensure you:

- Understand local tax rates (e.g., VAT or sales tax)

- Clearly break down taxes and other fees

- Include the applicable tax identification number, if necessary

By avoiding these common mistakes, businesses can create clear, accurate, and professional financial doc

How to Add Taxes on a Spanish Invoice

Properly applying taxes on financial documents is crucial for maintaining compliance with local tax regulations and ensuring accurate billing. In many Spanish-speaking regions, businesses are required to include specific tax rates, like VAT (Value Added Tax), on their bills. Adding these taxes correctly is not only a legal requirement but also ensures transparency with your clients, avoiding potential misunderstandings.

To include taxes accurately, start by identifying the applicable tax rate. Depending on the country and the nature of your product or service, the tax rate can vary. In some regions, different products or services may be subject to different tax rates, so it’s important to confirm the correct rate before proceeding. You should also ensure that the rate is clearly stated on the document.

Next, calculate the tax amount based on the total cost of the goods or services provided. If the price is before tax, multiply the total by the appropriate tax rate to calculate the tax due. If the price already includes tax, make sure to indicate this clearly so the client understands the total cost breakdown. It’s best to show the amount before tax, the tax rate, and the total amount separately to avoid confusion.

Here’s a simple breakdown of how to structure tax information:

- List the subtotal or total amount before tax

- Indicate the tax rate applied (e.g., 21% VAT)

- Clearly show the tax amount calculated based on the subtotal

- Summarize the final total, including the tax

By following these steps, you can ensure that taxes are applied correctly, keeping your business compliant with local laws and fostering trust with clients by providing clear, transparent billing details.

Legal Requirements for Invoices in Spain

When conducting business in Spain, it’s essential to comply with the country’s specific legal requirements for financial documents. These requirements ensure that your transactions are properly documented, transparent, and in line with local tax laws. Whether you’re a small business owner or a freelancer, understanding and adhering to these regulations is key to avoiding fines or legal issues.

Key Legal Elements to Include

In Spain, certain information must be included in all official billing documents. Failure to include any of the required details can result in penalties or the invalidation of the document. Here are the key elements that must be present:

- Issue Date: The date when the document is generated or issued.

- Unique Sequential Number: Each document must have a unique identifying number for tracking purposes.

- Seller’s Information: Full name or company name, address, and tax identification number (NIF).

- Buyer’s Information: Name, address, and tax identification number (NIF) of the client, when applicable.

- Detailed Description: A clear list of the goods or services provided, including quantities and prices.

- Tax Breakdown: The applicable tax rate (e.g., VAT) and the amount charged must be clearly listed.

- Total Amount: The final amount due, including taxes.

Additional Considerations

Besides the basic requirements, businesses should also be aware of the following:

- Taxpayer Identification Number (NIF): Both the seller and the buyer must provide their respective NIF (or CIF for companies) to ensure proper tracking for tax purposes.

- Tax Exemptions: If any goods or services are exempt from VAT or other taxes, this must be clearly indicated on the document.

- Electronic Invoices: Electronic records are legally accepted in Spain, but they must meet the same criteria as paper documents and be properly stored.

By following these legal guidelines, businesses can ensure that their financial documentation is both accurate and compliant with Spanish regulations, which helps avoid legal complications and fosters smooth business operations.

How to Translate an Invoice into Spanish

When expanding your business to include Spanish-speaking clients, it’s essential to ensure that your financial documents are accurately translated to avoid misunderstandings. Translating a document correctly goes beyond just converting words–it’s about ensuring the content is culturally appropriate and legally compliant. Here’s a guide on how to approach the translation of your billing documents into Spanish.

Start by focusing on the key components of your document. Every item, service, and term needs to be carefully translated to make sure that the client fully understands the charges and conditions. While automatic translation tools can be helpful for general phrases, it’s important to have someone fluent in both the language and the context of the document review the final version. Certain terms, like legal or tax-related language, must be translated with precision to avoid errors that could affect the payment process or lead to compliance issues.

When translating financial terms, ensure that you use the proper equivalents for common phrases such as “total amount,” “due date,” or “tax rate.” These may vary slightly depending on the region, so it’s useful to research the specific terminology used in the country where your client is based.

Additionally, make sure to adjust any formatting or numerical conventions. For example, in many Spanish-speaking countries, commas are used for decimal points and periods are used to separate thousands. These small but important details ensure that the translated document appears correct to the reader and avoids confusion when processing payments.

Finally, always double-check that the translation accurately conveys the tone and professionalism of the original document. A clear, concise, and culturally appropriate translation will reflect positively on your business and build trust with your clients.

Best Software for Creating Spanish Invoices

When managing billing for clients in Spanish-speaking regions, having the right software can make all the difference in ensuring your financial documents are both accurate and professional. There are several tools available that offer customizable features, making it easier for businesses to create documents that are compliant with local standards. The following software options stand out for their ease of use, flexibility, and ability to handle the specific needs of international clients.

Top Software for Efficient Document Creation

Below is a comparison of the best tools that can help streamline the process of generating clear, professional billing documents for Spanish-speaking clients.

| Software | Key Features | Best For |

|---|---|---|

| QuickBooks | Customizable templates, multi-currency support, tax calculations | Small businesses and freelancers looking for an all-in-one accounting solution |

| FreshBooks | Simple interface, automated reminders, invoice tracking | Freelancers and service-based businesses needing easy invoicing and time tracking |

| Zoho Invoice | Multi-language support, recurring invoices, expense tracking | Small to medium-sized businesses looking for detailed financial reporting |

| Wave | Free to use, customizable invoices, integration with payment gateways | Freelancers and startups on a budget |

Choosing the Right Software for Your Business

When selecting software for creating your billing documents, consider the size of your business, your client base, and the level of customization you need. If you’re working with clients across multiple countries, choose a platform that supports various currencies and tax laws. Additionally, many of these tools allow you to automate certain processes, saving you time and reducing the risk of human error. Whichever software you choose, make sure it offers the necessary features for creating compliant and professional documents that foster trust and clarity with your clients.

Creating Professional Spanish Invoices Online

Creating polished and accurate financial documents online is an efficient way to streamline your billing process. With a variety of tools available on the web, businesses can easily generate well-structured, professional documents in just a few minutes. The ability to customize these documents and automate certain aspects of the process allows businesses to save time, reduce errors, and maintain a high standard of professionalism, especially when dealing with clients from Spanish-speaking regions.

Steps to Create a Professional Document Online

To ensure your document looks professional and meets all necessary requirements, follow these essential steps:

- Choose a Reliable Online Tool: Use a trusted platform that offers customization options, such as currency, tax rates, and language preferences. Many tools allow you to create and save documents online, making it easier to access them whenever needed.

- Input Your Business Information: Include key details such as your company name, logo, tax identification number, and contact information. This not only establishes professionalism but also makes the document legally valid in many regions.

- List Products or Services: Clearly describe the goods or services you are billing for. Include prices, quantities, and a detailed breakdown to avoid misunderstandings.

- Apply the Correct Tax Rates: Ensure that the applicable tax rates (e.g., VAT) are correctly applied to the subtotal and clearly listed. This step is crucial for legal compliance and client transparency.

- Review and Send: Before sending, double-check all information for accuracy, and ensure that the document is formatted correctly. Many online platforms allow you to directly email the document to your client.

Advantages of Using Online Platforms

- Efficiency: Creating and sending documents online is much faster than manual methods.

- Customizability: Adjust templates and fields to meet your specific needs, whether it’s for different types of services or clients.

- Compliance: Online tools often include automatic updates for local tax laws and regulations, ensuring your documents are always up to date.

- Access Anywhere: Online platforms let you create and manage documents from any device, providing flexibility when on the go.

Using online tools to create professional billing documents not only simplifies the process but also ensures you maintain a high level of professionalism and accuracy in your business transactions. Whether you’re managing a small freelance business or a growing company, these platforms can help y

Spanish Invoice Template for Freelancers

For freelancers working with clients in Spanish-speaking countries, having a clear and professional document for billing is essential. A well-structured record not only helps in maintaining accurate financial documentation but also ensures a smooth and transparent transaction with clients. Freelancers can benefit from having a customized layout that includes all the necessary details, such as services rendered, payment terms, and applicable taxes, tailored for the Spanish-speaking market.

Key Elements of a Freelancer’s Billing Document

When creating a document for services provided, it’s important to include certain elements to ensure it is clear, complete, and legally compliant. Here are the essential components for a freelancer’s document:

- Your Contact Information: Include your full name or business name, address, and tax identification number (NIF or CIF in Spain).

- Client’s Details: Add the client’s name or company name, address, and their tax identification number if applicable.

- Description of Services: Clearly list the services you provided, including the date or time period of work, the quantity of hours, or specific tasks completed.

- Payment Terms: Specify the agreed-upon payment methods and due date.

- Tax Information: Clearly show the applicable taxes (e.g., VAT) and any exemptions if applicable.

- Total Amount Due: Provide a clear breakdown of charges, including the subtotal, tax, and final amount due.

Advantages of Using a Standardized Document

Having a standardized format offers several benefits for freelancers, especially those dealing with multiple clients or projects:

- Consistency: Using the same format for each billing document ensures clarity and professionalism in every transaction.

- Time-Saving: Once you have a template in place, you can easily customize it for each new project, saving you time.

- Transparency: Clear and detailed breakdowns reduce the likelihood of misunderstandings regarding services rendered or payments due.

- Compliance: A well-structured document helps ensure you are meeting the legal and tax requirements specific to the region.

For freelancers, a properly formatted and accurate document is not just a tool for receiving payments–it’s also a reflection of professionalism and reliability. By using a consistent layout, you can foster stronger relationships with clients and maintain smooth financial operations.

How to Include Payment Terms on Invoices

Clearly outlining payment terms is an essential part of any financial document, ensuring both parties are on the same page regarding expectations. Whether you’re working with clients in local or international markets, specifying payment details can prevent misunderstandings and delays. By establishing clear terms, you can foster trust with your clients and help maintain a steady cash flow for your business.

Start by specifying the payment deadline. This is the date by which you expect to receive payment, and it’s crucial to set it according to the agreement with the client. Standard terms often range from 15 to 30 days, but these can vary based on the nature of the work and your relationship with the client. It’s important to be explicit to avoid confusion.

Next, detail the accepted methods of payment. Whether you accept bank transfers, credit card payments, or online payment platforms, make sure to include all relevant information such as bank account details, payment links, or instructions for electronic payments. This ensures the client knows exactly how to proceed and prevents any delays due to unclear instructions.

You should also include any late payment penalties or interest fees. If you plan to charge a fee for overdue payments, be sure to state this clearly on the document. Many businesses include a small percentage (e.g., 1.5% per month) as a deterrent for late payments. It’s also helpful to mention when the penalty will apply (e.g., after 30 days) to provide clear expectations for the client.

Finally, consider including any early payment discounts if applicable. Offering a discount for early payment can be an incentive for clients to settle their bills quicker. For example, you might offer a 2% discount if the payment is made within 10 days of the document’s issue date.

By making your payment terms clear and easy to understand, you protect both your business and your client’s interests, helping to ensure smooth and timely transactions.

Common Payment Methods on Spanish Invoices

When dealing with clients in Spanish-speaking regions, it’s important to include the most common payment methods on your billing documents. Offering clear and concise options for payment not only simplifies the process for your clients but also helps ensure that you receive payments in a timely manner. Different regions may have preferred payment methods, so it’s crucial to adapt to local practices while providing flexibility for your clients.

Popular Payment Methods in Spanish-Speaking Countries

Here are some of the most commonly used payment methods that you should consider including on your billing documents:

- Bank Transfers: One of the most common methods for business-to-business transactions. Clients can transfer funds directly to your business account. Ensure that you include your IBAN or other relevant banking details for a smooth transfer process.

- Credit and Debit Cards: Many clients prefer using credit or debit cards for convenience. If you accept cards, provide the necessary payment processor details, such as the name of the platform or gateway you use.

- PayPal: Widely used for international transactions, PayPal offers both speed and security. Including a PayPal link or account email can make it easy for clients to pay promptly.

- Cash on Delivery (COD): Common for smaller businesses and retail, this method allows the client to pay at the time of delivery. It’s important to specify whether this is an option for your clients.

- Cheque: While less common, some clients still prefer to pay by cheque. Include the necessary mailing instructions if you accept this form of payment.

- Mobile Payment Platforms: Apps like Bizum in Spain or other local mobile payment solutions are becoming more popular. These platforms allow for quick and easy payments directly from smartphones.

Why It’s Important to Offer Multiple Payment Options

Providing a variety of payment methods can help facilitate smoother transactions and increase the likelihood of prompt payments. By accommodating your clients’ preferred payment methods, you reduce friction in the payment process, ultimately fostering a better relationship with them. Always ensure that you provide clear instructions on how to pay, including any relevant details such as account numbers, payment links, or app details to ensure a seamless experience.

Customizing Spanish Invoices for Your Business

Customizing your billing documents to match the unique needs of your business is a crucial step in maintaining a professional image and ensuring smooth financial operations. Whether you’re a small freelancer or managing a larger business, tailoring your billing documents allows you to present your brand effectively while meeting legal and tax requirements. Personalizing the design and content of your financial records can also enhance client trust and clarity regarding your services.

One of the key aspects of customization is including essential business details, such as your company name, logo, and contact information. Additionally, adapting the layout to suit the type of business you run can help make the document more relevant and professional. Here are some customization options to consider:

| Customization Option | Details |

|---|---|

| Branding | Add your business logo and use brand colors to make the document look more professional and aligned with your corporate identity. |

| Service Breakdown | Provide a detailed list of services or products, including descriptions, quantities, and prices. This transparency helps avoid confusion. |

| Payment Terms | Customize payment terms based on the agreement with your client, such as discounts for early payments or late payment penalties. |

| Taxes and Fees | Include relevant tax rates (e.g., VAT) or service charges applicable to your location or industry, ensuring compliance with local laws. |

| Language Options | If you’re dealing with international clients, consider offering multilingual options to accommodate different languages, especially if your clients are in Spanish-speaking regions. |

Customizing your billing documents ensures that they are not only tailored to the needs of your business but also compliant with local tax regulations. Offering a professional, clear, and personalized billing experience can foster stronger relationships with clients, streamline communication, and ultimately contribute to the success of your business.

How to Send Spanish Invoices to Clients

Sending accurate and timely financial documents to clients is essential for maintaining smooth business operations and ensuring prompt payments. The process of delivering these documents should be clear, efficient, and professional. Whether you’re sending them via email, through a postal service, or using an online platform, it’s important to follow best practices to avoid confusion and delays.

Steps to Send Financial Documents to Clients

Follow these steps to ensure your documents are delivered properly and in a timely manner:

- Review the Document: Before sending, double-check that all the details are correct, including the client’s information, services rendered, prices, payment terms, and taxes. Ensure there are no spelling or calculation errors.

- Choose a Delivery Method: Depending on your client’s preference, choose the best method for sending your financial records. The most common options include email, physical mail, or using an online invoicing platform.

- Email: If you’re sending the document via email, attach it as a PDF or another secure format to preserve its integrity. Include a brief, polite message in the body of the email, explaining the document and requesting payment by the agreed-upon date.

- Postal Mail: If you need to send a physical copy, print the document on company letterhead for a professional touch. Ensure the address is correct and send it via registered mail or a trusted courier service to track the delivery.

- Online Invoicing Platform: If you use an online invoicing system, simply send the document directly from the platform. These systems often have built-in features to track when the document has been viewed, which can help you stay informed about payment status.

Best Practices for Sending Financial Documents

To maintain professionalism and streamline the payment process, consider these best practices when sending documents:

- Include a Clear Subject Line: In your email or message, use a clear subject line like “Payment Request for [Service/Product Name]” to make it easy for clients to identify the purpose of the document.

- Keep Communication Polite: Whether sending a message by email or post, ensure that your tone is professional and courteous. Remember that this document represents your business.

- Track the Document: If using post