Free Virtual Assistant Invoice Template for Easy Billing

Essential Guide to Virtual Assistant Invoices

When running a freelance business, clear and efficient billing is essential for maintaining a professional reputation and ensuring prompt payments. A well-structured document for requesting payment not only simplifies financial tracking but also reflects the quality of your services. Understanding the key components and best practices for creating these documents is crucial to avoid delays and misunderstandings with clients.

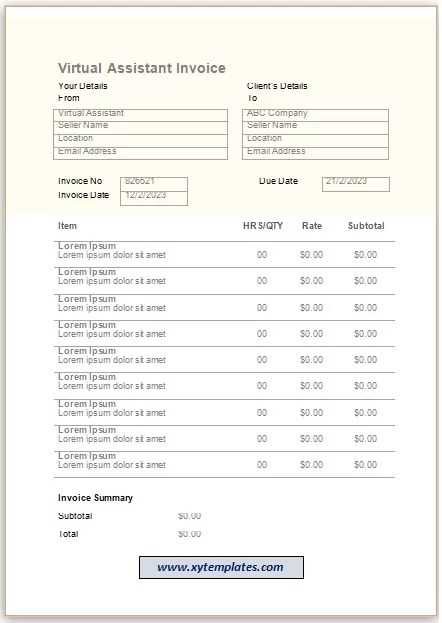

Creating a professional payment request starts with knowing the essential elements that should be included. A comprehensive document serves as both a record for the freelancer and a detailed outline for the client, making it easy to reference the work completed and the agreed-upon fees.

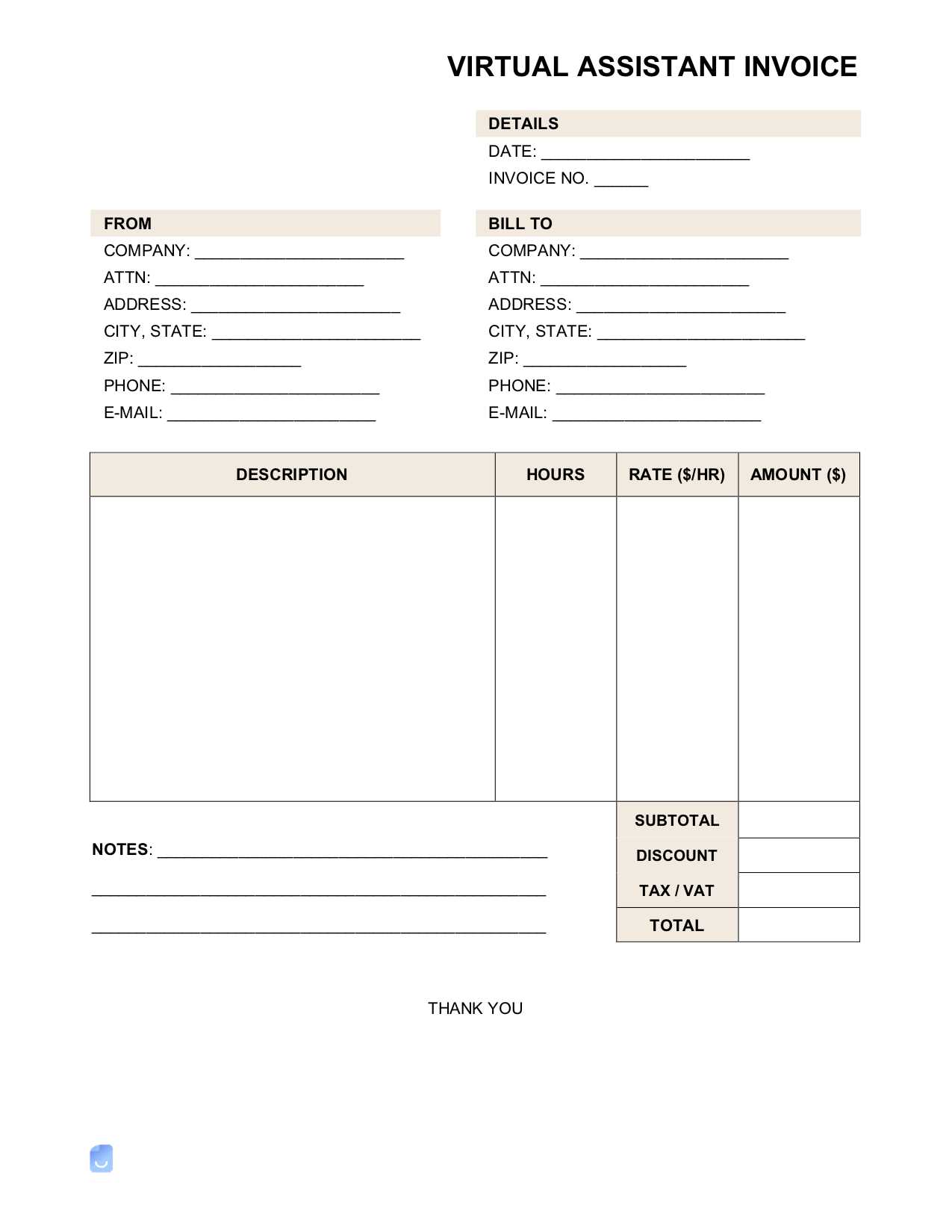

Here are the core components you need to consider when drafting such documents:

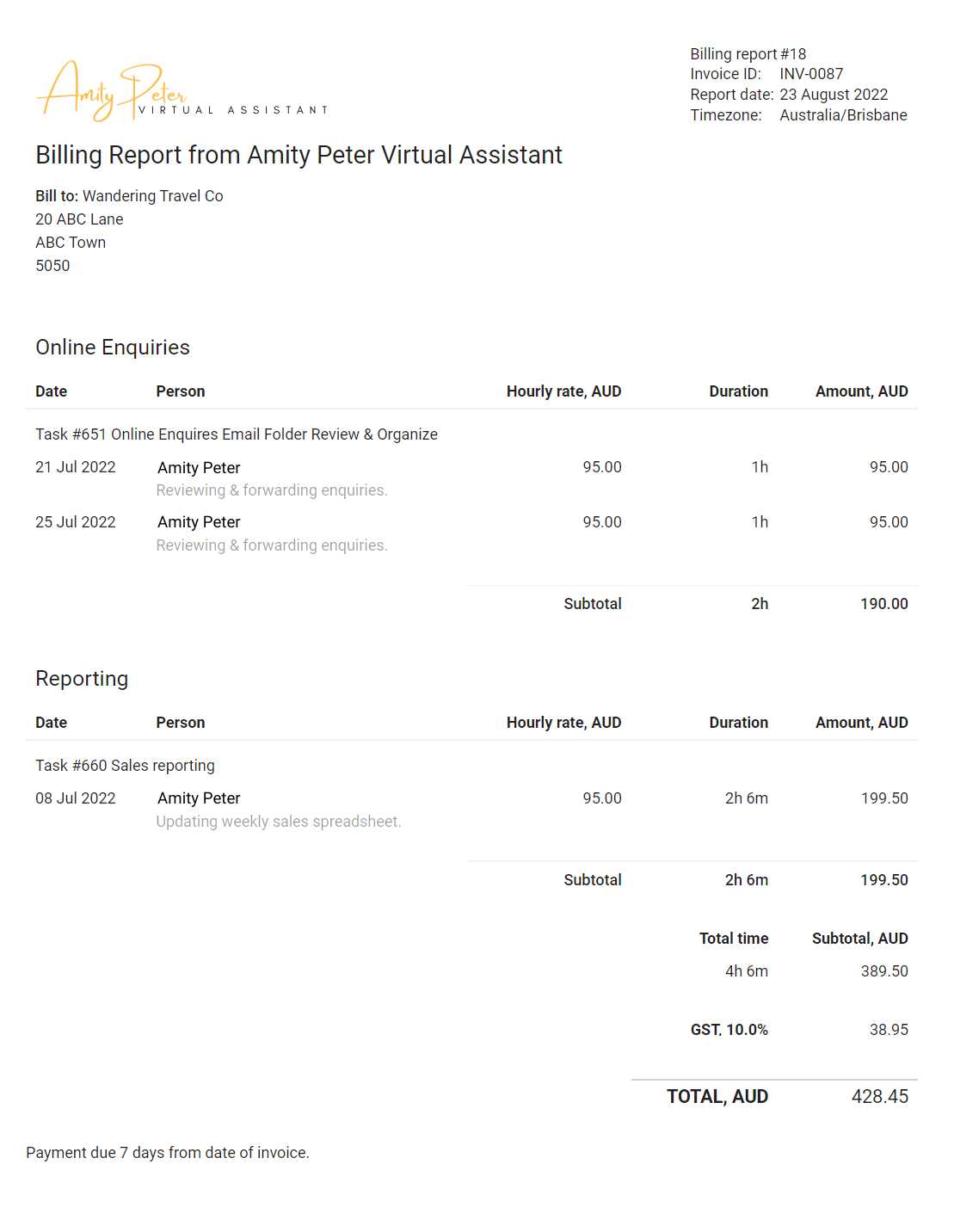

- Client Information: Ensure all relevant details about the client are included, such as their name, business, and contact information.

- Service Details: Clearly outline the tasks completed, hours worked, or specific services rendered, making sure to align with the agreement made with the client.

- Payment Terms: Specify when the payment is due, acceptable payment methods, and any late fees or penalties.

- Total Amount: List the final amount due, broken down if necessary to show hourly rates, project fees, or additional charges.

- Invoice Number: Assign a unique identifier to each document for easy tracking and reference in future communications.

By following these guidelines, freelancers can streamline their billing process, reduce the risk of payment disputes, and ensure a more professional relationship with their clients. These documents also provide a way to track income and manage finances more efficiently.

Why You Need an Invoice Template

When managing your own business or freelance work, having a standardized document for requesting payment is crucial. Without a consistent approach, it’s easy to overlook important details or introduce errors that can cause confusion with clients. Using a pre-designed structure not only ensures accuracy but also saves time, making the billing process smoother and more professional.

Here are several reasons why adopting a ready-made structure for your payment requests is beneficial:

- Consistency: A consistent format ensures that all key information is included every time, reducing the risk of missing critical details.

- Professionalism: A polished document reflects positively on your business, establishing trust and credibility with clients.

- Time Efficiency: Having a ready-to-use layout saves time on formatting and focusing on the content, allowing you to quickly adapt it for different clients.

- Accuracy: Using a pre-set design helps avoid errors, such as incorrect payment terms or missing information, ensuring the document aligns with the agreement.

- Legal Protection: Clear and comprehensive payment requests reduce the chances of disputes or misunderstandings, giving both parties a reference point for the agreed-upon services and amounts.

By using a structured approach, you not only streamline the payment process but also enhance your overall workflow, making it easier to track payments and maintain a professional image in the eyes of your clients.

Key Elements of an Invoice

Creating a document for requesting payment is more than just listing a price. It serves as both a professional record of the work completed and a tool to ensure clear communication with clients. To make sure everything is covered and there are no misunderstandings, it’s important to include specific information that both parties can refer to when needed.

Here are the essential components to include in every payment request:

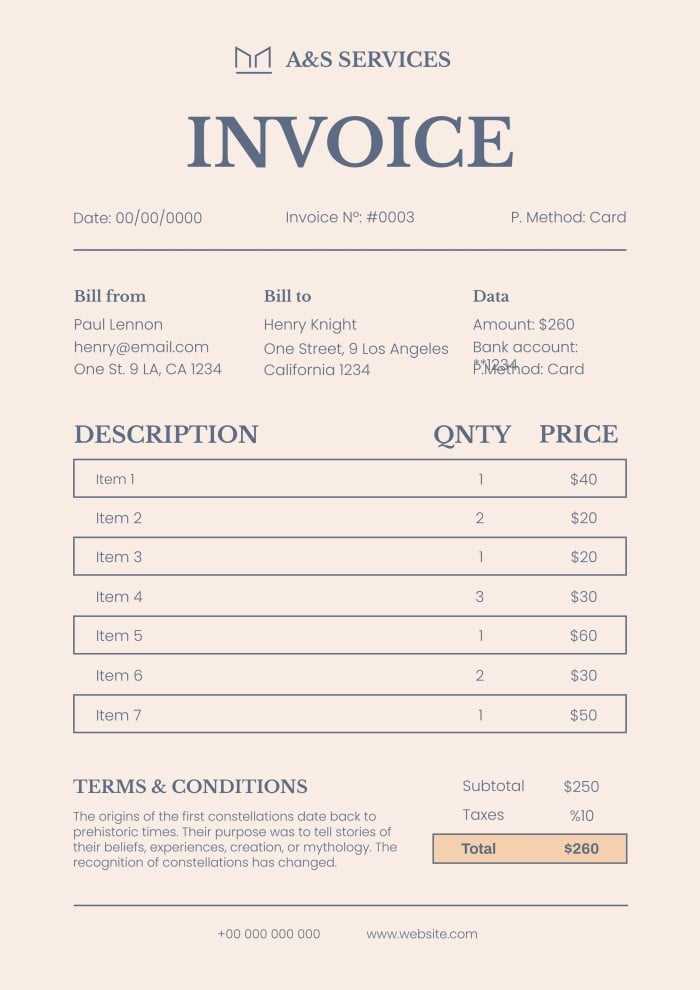

- Client and Business Details: Include the client’s name, address, and contact information, as well as your own. This ensures that both parties can easily verify who the payment is for and who it’s coming from.

- Description of Services: Clearly outline the tasks or services provided, including dates and hours worked if applicable. This helps both you and your client understand exactly what is being charged.

- Amount Due: Clearly list the total amount for the work completed. Break it down if needed to show hourly rates or project-based pricing.

- Payment Terms: Specify the due date for payment, any late fees, and the accepted payment methods (e.g., bank transfer, PayPal, etc.). This sets clear expectations for both parties.

- Unique Identifier: Assign a reference number to each payment request to help track your documents and provide an easy way for clients to reference them when making payments or discussing billing matters.

Including these elements in your payment requests not only helps avoid confusion but also creates a professional, organized approach to managing financial transactions with clients. These details are crucial for protecting both your business interests and ensuring timely payments.

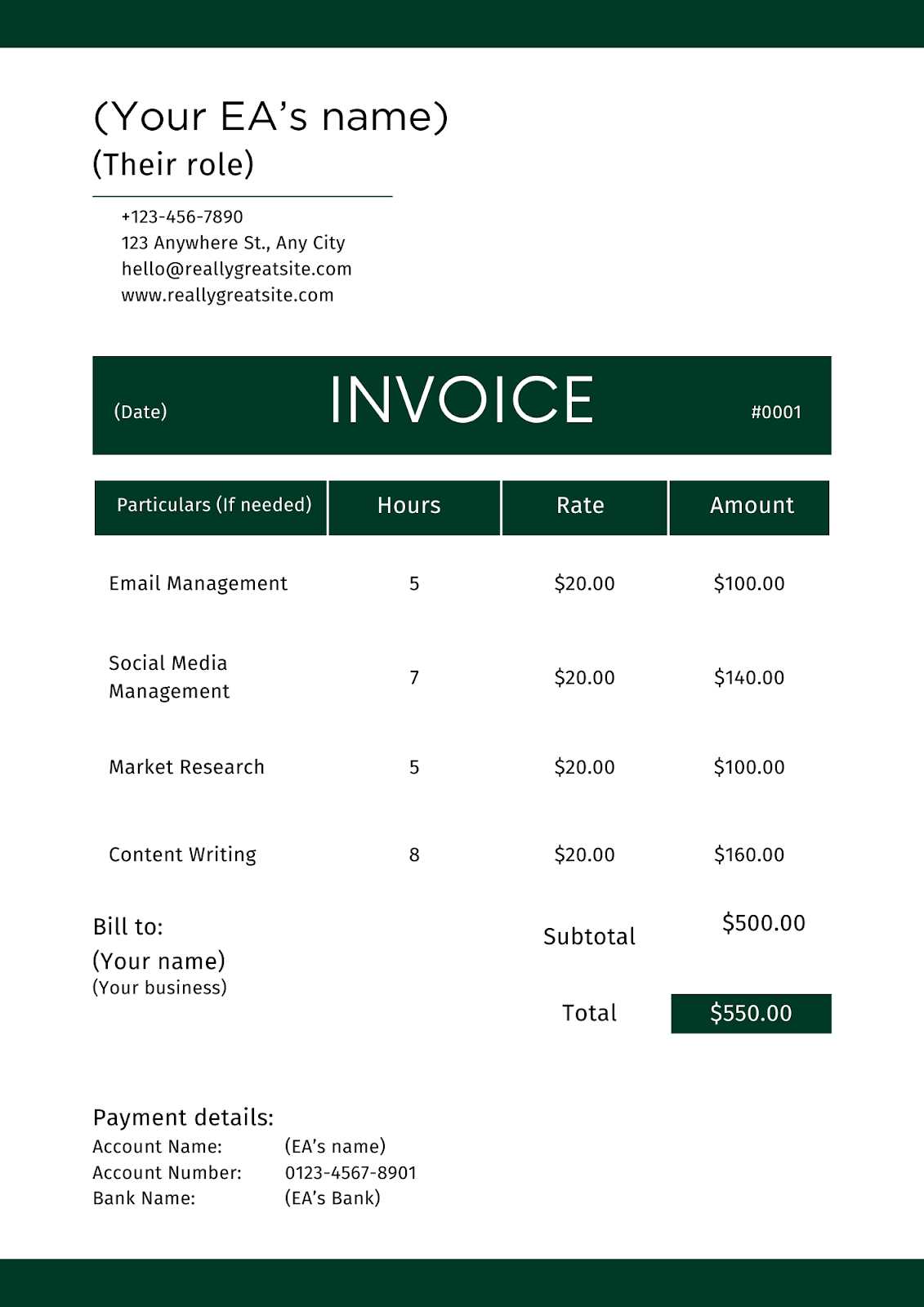

How to Customize Your Invoice

Every business has unique needs, and it’s important to reflect that individuality in the documents you use to request payment. Customizing your payment request ensures it aligns with your brand and clearly communicates all necessary details. Whether you’re working on a one-time project or an ongoing contract, tailoring these documents can make the process more efficient and professional.

1. Add Your Branding

Personalizing the document with your branding helps reinforce your business identity. This could include:

- Logo: Place your logo at the top of the document to create a professional look.

- Business Name: Include your full business name and any relevant registration details.

- Contact Information: Make sure to include your business address, email, and phone number, so clients can easily reach you.

2. Modify the Layout and Design

Adjust the layout to fit your specific needs and preferences. Consider these elements when customizing the structure:

- Font Style and Size: Choose fonts that are easy to read and reflect your brand’s tone, whether professional or more casual.

- Color Scheme: Incorporate colors from your brand palette to make the document visually appealing.

- Sections and Headings: Customize headings and sections to clearly distinguish between different parts of the document (e.g., service description, total cost, payment terms).

By tailoring your request for payment to suit your business style and client needs, you not only make the process smoother but also create a more personal and professional experience for both you and your clients.

Benefits of Using Invoice Templates

Having a pre-designed structure for your billing documents offers a wide range of advantages that streamline your workflow and reduce the chances of errors. Whether you are managing multiple clients or just starting out, using a set format makes the process more efficient, saving you time and effort. With the right approach, it also ensures that your payment requests remain professional and accurate every time.

1. Time Efficiency

One of the biggest benefits of using a predefined structure is the amount of time you save. Rather than starting from scratch each time, you can quickly fill in the necessary information for each new client or project. This allows you to focus on more important tasks, such as delivering your services and managing your workload.

2. Consistency and Professionalism

Using a consistent format for all your billing documents helps maintain a professional image. Clients appreciate the clarity and organization of a well-structured payment request. It reflects positively on your business, showing that you are detail-oriented and reliable, which can help build trust and long-term relationships.

In addition to saving time and enhancing professionalism, a set structure ensures that you never miss key information, such as payment terms, client details, or service descriptions. With everything standardized, the risk of misunderstandings and disputes is greatly minimized.

Choosing the Right Template for You

Selecting the most suitable document structure for requesting payment is an important decision that can significantly impact your business’s efficiency. With numerous options available, it’s essential to choose one that matches the nature of your work and your client relationships. The right format will make your billing process smoother, ensure clarity, and help maintain a professional image.

Here are some key factors to consider when choosing the right format for your payment requests:

- Type of Services: Different types of work may require different levels of detail. For example, project-based work may need a more detailed breakdown, while hourly billing might benefit from a simpler layout.

- Client Preferences: Consider how your clients prefer to receive payment requests. Some may prefer digital formats like PDFs, while others might prefer more traditional methods like paper or Word documents.

- Frequency of Billing: If you send payment requests regularly, a more streamlined format can save you time. For one-time projects, you might need a more comprehensive design that includes additional details.

- Branding Needs: Choose a layout that allows you to incorporate your business logo, colors, and fonts, ensuring the document reflects your brand identity.

By evaluating these factors, you can select a payment document that aligns with both your professional needs and your clients’ expectations. Ultimately, the goal is to make the billing process easy, clear, and efficient for both parties.

Common Mistakes to Avoid in Invoices

When preparing documents for requesting payment, even small mistakes can lead to confusion, delays, or disputes with clients. Ensuring that your payment request is clear, accurate, and complete is essential for maintaining professionalism and smooth business operations. By being aware of common errors, you can avoid pitfalls that may hinder your payment process and client relationships.

1. Missing or Incorrect Details

One of the most frequent issues with payment requests is the absence or inaccuracy of key information. Ensure that every document includes:

- Client Information: Double-check that the client’s name, business name, and contact details are correct.

- Service Description: Be clear and specific about the work completed, including dates and project milestones if necessary.

- Payment Terms: Verify that payment deadlines, late fees, and accepted payment methods are stated clearly to avoid misunderstandings.

2. Incorrect Calculation of Amounts

Incorrect calculations are a common issue, especially when dealing with hourly rates or varying project costs. This can lead to confusion and mistrust. To avoid this, consider the following:

- Double-check totals: Ensure that all amounts are correctly calculated and match your agreement with the client.

- Break down costs: If necessary, break down the costs for services provided, taxes, or additional charges to maintain transparency.

By paying attention to these details and avoiding common mistakes, you ensure that your payment requests are professional, clear, and accurate, fostering positive relationships with clients and helping maintain the smooth flow of business.

Invoice Formatting Tips for Clarity

Ensuring that your billing documents are easy to read and understand is crucial for smooth business transactions. Proper formatting not only makes it easier for clients to process payments but also reflects your professionalism. Clear and well-structured payment requests can help avoid confusion, delays, and disputes, making the entire process more efficient for both parties.

1. Use Organized Sections

Organizing your document into clear sections helps clients quickly find the information they need. Typical sections include:

- Header: Includes your business name, logo, and contact information.

- Client Information: List your client’s name, business name, and contact details.

- Service Breakdown: Clearly list the services provided, with dates and hours worked if applicable.

- Total Amount: Clearly state the total due, with a breakdown if necessary.

- Payment Terms: Include payment methods, due dates, and any late fees or penalties.

2. Consistent and Clear Font Usage

Consistency in fonts helps maintain a clean, professional look. Use simple, readable fonts for body text and headers. Avoid using more than two or three different fonts, as this can create visual clutter. Use bold text for headings and important details such as the total amount due or due date.

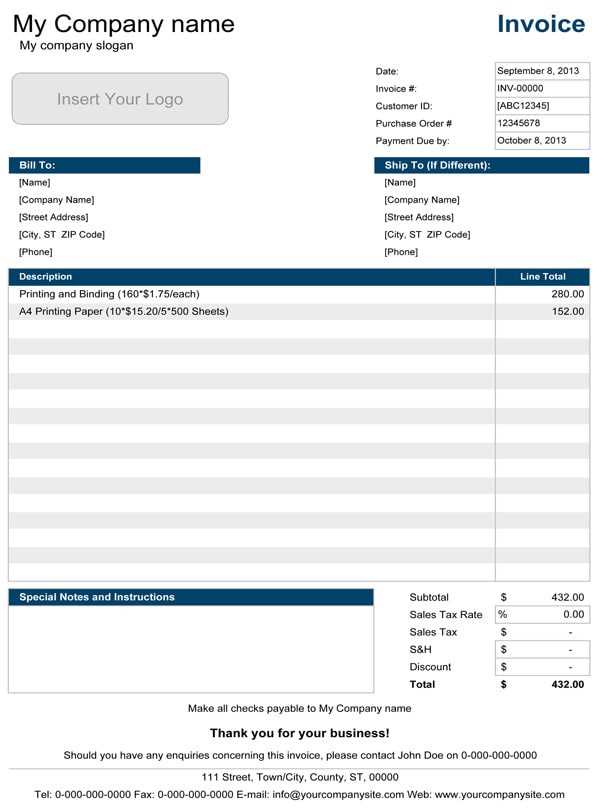

3. Presenting the Service Details in a Table Format

Using a table to display services provided makes it easier for clients to see the breakdown of charges. Below is an example of how to present the information clearly:

| Description of Service | Hours Worked | Rate | Amount |

|---|---|---|---|

| Consultation Session | 5 | $50/hr | $250 |

| Social Media Management | 10 | $45/hr | $450 |

| Total | $700 |

By following these formatting tips, you create documents that are easy to read, understand, and process. This not only ensures that the payment process runs smoothly but also enhances your reputation for professional

Best Software for Creating Invoices

Using the right software to generate payment requests can save time, improve accuracy, and ensure your documents look professional. The right tool can help automate the process, reduce the chances of errors, and offer customizable features to match your specific business needs. With so many options available, it’s important to choose one that fits both your workflow and budget.

Here are some of the top software options for creating payment documents:

| Software | Key Features | Pricing |

|---|---|---|

| FreshBooks | Easy-to-use interface, customizable templates, automated reminders, integration with accounting software | Starts at $15/month |

| QuickBooks | Customizable layouts, expense tracking, recurring billing, tax calculation | Starts at $25/month |

| Wave | Free billing, recurring invoices, customizable templates, unlimited invoices for small businesses | Free |

| Zoho Invoice | Customizable designs, multi-currency support, automated billing, time-tracking features | Starts at $9/month |

| PayPal | Easy integration with PayPal accounts, simple design, payment tracking | Free with PayPal account |

Choosing the right software depends on your specific needs, such as whether you need advanced features like time tracking, recurring billing, or integration with other tools. Many of these platforms offer free trials, so it’s a good idea to test a few options before committing to one. The right tool can make your billing process more efficient, organized, and professional.

How to Track Payments Effectively

Managing payments is a critical part of running a business, especially for freelancers and small business owners. Keeping track of payments ensures that you stay organized, avoid late fees, and maintain a positive cash flow. Effective tracking can also help you identify trends, such as which clients pay on time and which ones require follow-ups, allowing you to take proactive steps to manage your finances better.

Here are some strategies to track payments effectively:

- Use Accounting Software: Accounting tools like QuickBooks, FreshBooks, or Wave can automatically track payments and sync with your bank account, providing real-time updates on incoming funds. These tools also allow you to easily match payments with outstanding balances, reducing the risk of errors.

- Create a Payment Log: If you prefer a more manual approach, maintain a detailed log of all payments received. This can be done in a spreadsheet where you track the date, client name, amount paid, and method of payment (e.g., bank transfer, PayPal, check).

- Send Payment Reminders: Setting up automatic reminders for overdue payments is essential. This keeps clients aware of their outstanding balances and encourages timely payments. Most invoicing software offers this feature, sending automatic emails once a payment is overdue.

- Reconcile Your Accounts Regularly: At least once a month, review your payment records and reconcile them with your bank statements. This ensures that there are no discrepancies between the payments recorded and the actual amounts deposited into your account.

- Set Up Alerts: Many digital payment systems allow you to set up payment alerts. These notifications can inform you whenever a payment is received, helping you stay up to date without having to manually check your accounts constantly.

By implementing these strategies, you can stay on top of your payments, reduce administrative errors, and ensure that your business remains financially stable. Consistent payment tracking also builds trust with clients, as it demonstrates professionalism and organization in your financial processes.

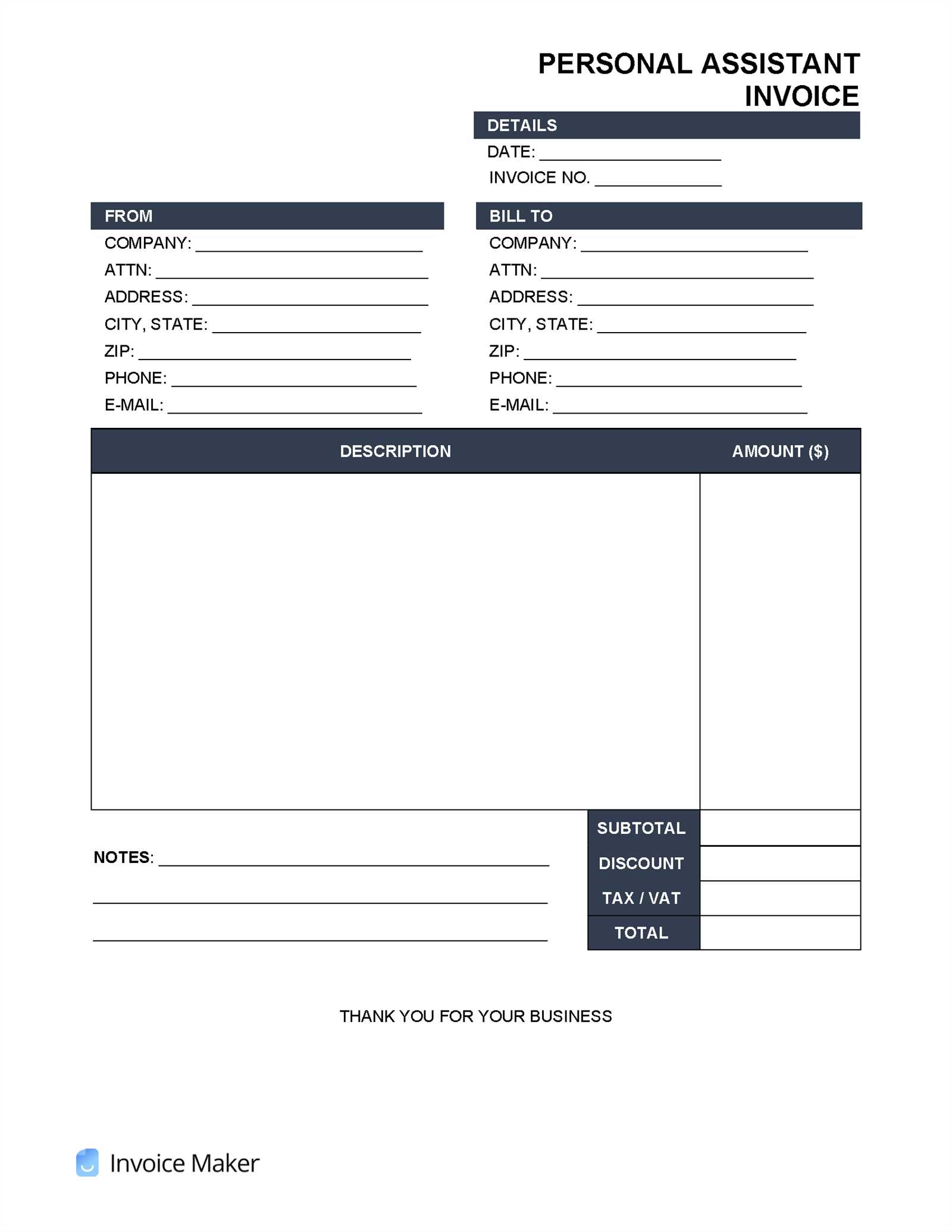

What to Include in Client Details

Accurate client information is essential for maintaining clear communication and ensuring smooth financial transactions. Including the correct details in your payment requests helps avoid any confusion and makes it easier for both parties to refer to specific information when necessary. By including the right elements in the client section, you ensure that both you and your clients have all the necessary data at hand to complete the payment process efficiently.

1. Basic Contact Information

Start by including the client’s full name or business name, along with the address and contact details. This allows both parties to easily identify and communicate with each other if there are any questions or issues regarding the payment. Key elements to include:

- Client Name: The full name or business name of the person or company you’re working with.

- Address: Include the physical address, which is useful for reference and sometimes necessary for legal purposes.

- Phone Number and Email: Provide the most reliable contact details so that you can quickly reach the client if needed.

2. Additional Information for Specific Situations

Depending on the nature of your work, you may need to include additional client details to ensure clarity and compliance. These may include:

- Company Registration Number: For businesses, including a registration number can help authenticate the client’s identity.

- Tax Identification Number (TIN): If required, especially for larger companies or specific industries, a tax ID can be helpful for tax purposes.

- Billing Contact: If the client has a dedicated billing department, include the contact information of the person who handles payments.

Including these key details not only ensures smooth transactions but also fosters a professional relationship between you and your client. Clear and accurate client information makes it easier for both parties to stay on the same page and avoid unnecessary misunderstandings.

Setting Payment Terms and Due Dates

Clear payment terms and due dates are vital for ensuring timely compensation for services rendered. By setting these expectations upfront, both you and your clients can avoid misunderstandings and delays. Well-defined payment policies help create a professional framework for the transaction, promoting transparency and trust between both parties.

1. Defining Clear Payment Terms

Payment terms outline the conditions under which payment is to be made, and these should be communicated clearly to the client. Common terms to consider include:

- Payment Method: Specify how payments should be made (e.g., bank transfer, credit card, PayPal, etc.).

- Late Fees: Indicate if there are any penalties for late payments, such as a fixed percentage or a flat fee for overdue amounts.

- Discounts for Early Payment: Consider offering a discount to clients who pay early, which can encourage faster payments.

- Recurring Payments: If applicable, define whether payments are one-time or recurring (e.g., monthly, quarterly), and include any relevant terms for such arrangements.

2. Setting a Realistic Due Date

Choosing the right due date is crucial for maintaining positive client relationships. While you want to ensure that payments are made promptly, it’s important to set due dates that are reasonable for your clients. Common practices include:

- Net 30: The client must pay within 30 days of receiving the payment request. This is one of the most common due dates used for business transactions.

- Net 15: A quicker payment deadline of 15 days, which may be used for smaller projects or clients you have an ongoing relationship with.

- Due on Receipt: Payment is due immediately upon delivery of the document. This is often used for short-term projects or for new clients.

Setting clear payment terms and realistic due dates helps you manage your cash flow while providing clients with enough time to process payments. By clearly outlining these expectations from the start, you can avoid delays and ensure smoother transactions.

Handling Late Payments in Invoices

Late payments can disrupt your business’s cash flow and create unnecessary stress. When clients fail to meet agreed-upon payment deadlines, it’s important to address the issue professionally and promptly. Having a clear strategy for dealing with overdue payments ensures that you maintain control over your financial operations while preserving positive relationships with clients.

Here are a few strategies for handling late payments effectively:

1. Send a Friendly Reminder

Sometimes, clients simply forget to pay on time. A gentle reminder can resolve the issue without any friction. Consider sending a polite email or message that includes:

- Reference to the original due date: Remind the client of the agreed-upon payment terms and the past due date.

- Reiteration of the amount due: Clearly state the amount still outstanding and the total balance remaining.

- Contact Information: Provide an easy way for the client to contact you if they have any questions or concerns regarding the payment.

2. Apply Late Fees

If you’ve established late payment penalties, it’s important to enforce them. Clearly outline the late fee structure in your original agreement or terms, and apply the fee consistently for overdue accounts. Late fees can be structured as:

- A percentage of the overdue amount: A common approach is to charge a certain percentage (e.g., 5%) of the outstanding amount for each week or month the payment is delayed.

- A flat fee: This can be a fixed amount added to the overdue balance after a certain period (e.g., $25 for payments overdue by 30 days).

Late fees should be included in your original payment terms and communicated upfront to prevent surprises for your clients. This approach helps motivate prompt payment while maintaining professionalism.

3. Offer Flexible Payment Options

If a client is having trouble paying, consider offering alternative payment options. Flexibility can sometimes lead to faster resolution and preserve your business relationship. Options might include:

- Payment Plans: Break down the amount into smaller installments if the client is unable to pay the full amount at once.

- Extended Due Dates: In cases of genuine financial difficulty, extending the payment period may help avoid further delays and maintain a positive relationship.

By addressing late payments promptly and professionally, you ensure that you’re paid for your work while maintaining the integrity of your client relationships. Setting clear expectations around payment timelines and penalties is key to ensuring smoother transactions and financial stability.

Free vs Premium Invoice Templates

When it comes to generating payment requests, you have the option of using either free or paid tools. While both options can help you create professional-looking documents, there are significant differences between the two in terms of features, customization, and support. Understanding the advantages and limitations of each can help you choose the best solution for your business needs.

1. Advantages of Free Templates

Free options are appealing for many small business owners or freelancers just starting out, as they require no upfront investment. Here are the key benefits of using free tools:

- Cost-Effective: The most obvious advantage is that they are free. This makes them an attractive option for individuals or businesses on a tight budget.

- Simplicity: Free tools are often simple and easy to use, with basic features that can be sufficient for straightforward billing needs.

- Quick Setup: Many free tools are easy to download and use immediately, allowing you to start creating documents without a steep learning curve.

2. Advantages of Premium Templates

While premium tools require an investment, they offer additional benefits that can make them worth the cost for growing businesses or professionals who need more features and flexibility. Here’s why you might consider upgrading to a paid option:

- More Customization Options: Premium tools often provide a greater variety of templates, fonts, colors, and designs, allowing you to create fully customized documents that match your brand identity.

- Advanced Features: Paid tools often include additional features such as automatic calculations, recurring billing options, or integration with accounting software, making the process more efficient.

- Customer Support: With premium options, you typically gain access to dedicated customer support, which can help you resolve issues more quickly and ensure your templates work smoothly.

- Better Security: Premium tools may offer more robust security features, ensuring that your client and payment data is stored and processed securely.

Choosing between free and premium tools depends on your specific needs and the complexity of your billing process. For small or infrequent transactions, free options can be sufficient. However, if you run a growing business or need additional functionality, a premium option may be the best investment for streamlining your financial operations.

How to Keep Your Invoices Professional

Creating well-organized and polished payment requests is essential for maintaining a professional image and building trust with your clients. A clean, clear, and professional document not only helps ensure timely payments but also reflects your commitment to quality. By paying attention to the details and formatting, you can create documents that enhance your credibility and leave a positive impression on clients.

1. Use a Clear and Simple Layout

A cluttered or confusing layout can make it difficult for clients to find the information they need. Keeping the layout simple, logical, and easy to read ensures that your payment request is clear and professional. Here are some layout tips:

- Header: Include your business name, logo, and contact information at the top for easy identification.

- Client Information: Clearly list the client’s details (name, address, phone number, etc.) in a separate section.

- Itemized List: Include a detailed breakdown of services or products provided, with quantities, descriptions, and costs.

- Due Date: Highlight the payment due date so clients are aware of when the payment is expected.

- Footer: Include payment methods and any relevant notes or terms at the bottom of the document.

2. Ensure Accuracy and Consistency

Accuracy is key when it comes to professional documents. Any mistakes or inconsistencies can give the wrong impression and may even delay payments. Double-check the following elements:

- Spelling and Grammar: Review the entire document for any typos or grammatical errors that could undermine your professionalism.

- Correct Figures: Ensure that all amounts are accurate, including the total and any taxes, discounts, or fees.

- Consistent Formatting: Use consistent font sizes, colors, and styles to make the document visually appealing and easy to follow.

3. Use Professional Language

While the tone of the payment request can be friendly, always use respectful and professional language. Keep your communication clear and polite to foster positive relationships with clients. Here’s how to achieve that:

- Formal Tone: Avoid slang or overly casual language in your requests. A formal but approachable tone is best.

- Be Clear About Expectations: Clearly state the payment amount, due date, and any penalties for late payments without sounding threatening.

4. Sample Professional Payment Request

Here’s an example of a clean and professional layout:

| Item | Description | Quantity | Unit Price | Total | ||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Consulting Service | One-hour strategy session | 1 | ||||||||||||||||||||||||||||||

| Item | Description | Quantity | Unit Price | Total |

|---|---|---|---|---|

| Consulting Service | One-hour strategy session | 1 | $150.00 | $150.00 |

| Monthly Retainer | Ongoing support and maintenance | 1 | $300.00 | $300.00 |

| Subtotal | $450.00 | |||

| Tax (5%) | $22.50 | |||

| Total Due | $472.50 | |||