Invoice Aging Report Template to Optimize Accounts Receivable

Properly tracking unpaid invoices is a crucial aspect of maintaining healthy cash flow in any business. With the right system in place, businesses can easily identify which clients owe money and how overdue these payments are. This process allows you to prioritize follow-ups, reduce financial risk, and keep your operations running smoothly.

By using a structured approach to monitor outstanding debts, companies can gain valuable insights into their receivables. This helps ensure that no payment is overlooked, minimizing the risk of financial loss. A well-organized framework can also help improve relationships with clients by providing clear and accurate information on their payment status.

In this article, we will explore how businesses can create and use tools for tracking overdue payments, offering customizable solutions that fit various needs. Whether you’re a small startup or a large enterprise, having an efficient system to monitor debts can lead to significant improvements in financial management.

What is an Invoice Aging Report?

When managing accounts receivable, it’s important to keep track of outstanding payments from clients. A detailed tool that helps businesses organize unpaid debts based on their age provides a clear view of which accounts require immediate attention. This allows companies to focus on collecting overdue funds, optimize cash flow, and minimize financial risks.

Such a tool typically breaks down the outstanding balances into specific time periods, helping businesses identify which debts are current and which have been left unpaid for an extended period. By categorizing the overdue amounts, this approach makes it easier to prioritize follow-ups and take the necessary steps to collect payments.

| Days Outstanding | Amount Due |

|---|---|

| 0-30 days | $1,200 |

| 31-60 days | $500 |

| 61-90 days | $300 |

| 91+ days | $150 |

By viewing the outstanding amounts in this manner, businesses can take more informed actions when it comes to collecting overdue debts. Whether it’s sending reminders or negotiating payment terms, this tool ensures that no overdue amounts are missed, helping to maintain financial stability.

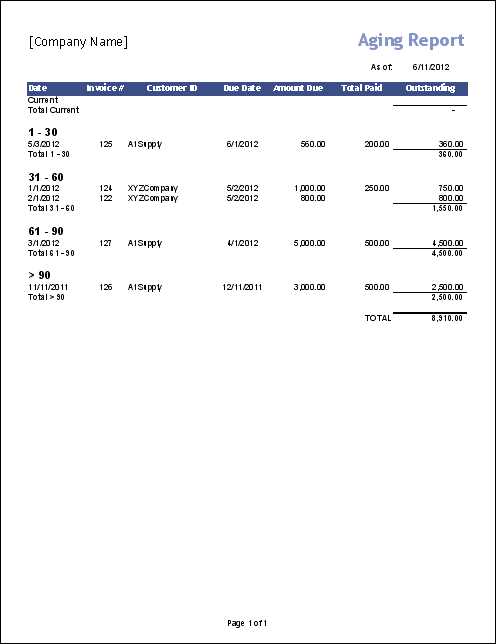

Key Components of an Invoice Aging Report

To effectively manage outstanding payments, it’s important to understand the essential elements that make up a well-structured tool for tracking overdue amounts. This tool provides a comprehensive overview of unpaid invoices, categorizing them based on how long they have been outstanding. By including the right components, businesses can streamline their collections process and identify payment issues before they become critical.

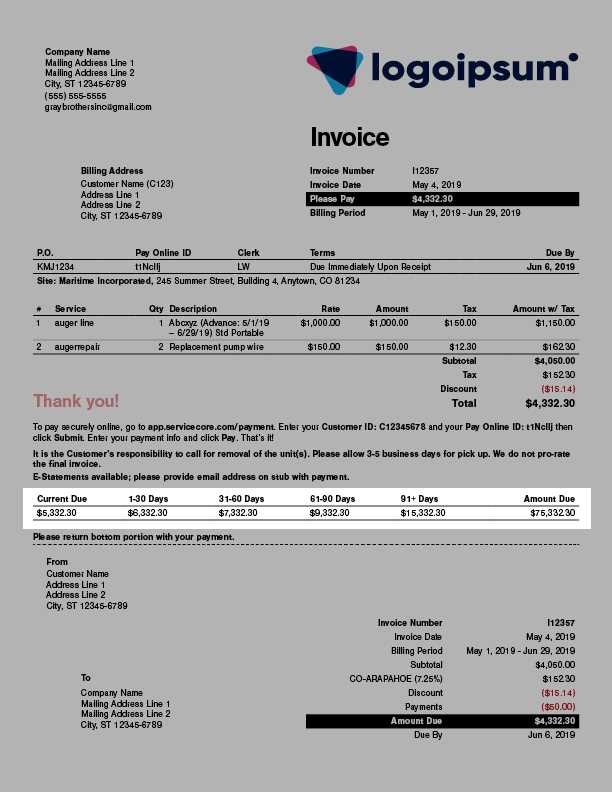

1. Client Information

The first component is the basic client details, which allow businesses to quickly identify the entity responsible for the unpaid balance. This information typically includes:

- Client Name

- Contact Details

- Invoice Number

- Invoice Date

2. Outstanding Amounts and Due Dates

Another key component is the tracking of outstanding amounts. This section breaks down the total unpaid balance and categorizes it according to how long the payment has been overdue. Common classifications include:

- Current (0-30 days)

- 31-60 days

- 61-90 days

- 91+ days

Each overdue category helps businesses prioritize which accounts need immediate action. Additionally, the due date for each balance is included to show how long it has been since the payment was due.

3. Payment Status and Actions Taken

To keep track of communications with clients, businesses often include a column detailing the payment status or actions that have been taken. This might involve:

- Reminder Sent

- Payment Plan Agreed

- Partial Payment Made

- Collection Process Initiated

Including this information helps ensure that businesses know which clients are actively engaged and which may require further intervention.

Why Use an Invoice Aging Report?

Tracking unpaid balances is crucial for any business that extends credit to clients. Without a clear method for identifying overdue amounts, companies risk losing track of outstanding debts, which can negatively affect cash flow and overall financial health. By utilizing an effective tool for organizing unpaid invoices, businesses can stay on top of collections, prioritize follow-ups, and make more informed decisions about their receivables.

1. Improve Cash Flow Management

One of the primary reasons for using this tool is to better manage cash flow. By identifying overdue amounts and categorizing them based on how long they have been unpaid, businesses can address overdue accounts promptly, reducing the risk of financial shortfalls. Timely payments help ensure that the business has sufficient cash on hand to cover expenses, pay employees, and reinvest in growth.

2. Prioritize Collections Effectively

With a clear view of which clients owe the most money and how long those amounts have been outstanding, businesses can prioritize collection efforts. For example, older debts may require more immediate attention or a different approach, such as sending a legal notice or involving a collections agency. By focusing resources on the highest-risk accounts, businesses can increase the likelihood of recovering overdue amounts.

| Client Name | Amount Due | Days Outstanding | Priority Action |

|---|---|---|---|

| Client A | $2,500 | 90+ | Follow-up Call & Legal Notice |

| Client B | $1,200 | 31-60 | Send Reminder Email |

| Client C | $450 | 0-30 | Send Payment Reminder |

This prioritization helps businesses focus their efforts on the accounts that have the most significant impact on cash flow, allowing them to take necessary actions in a timely manner.

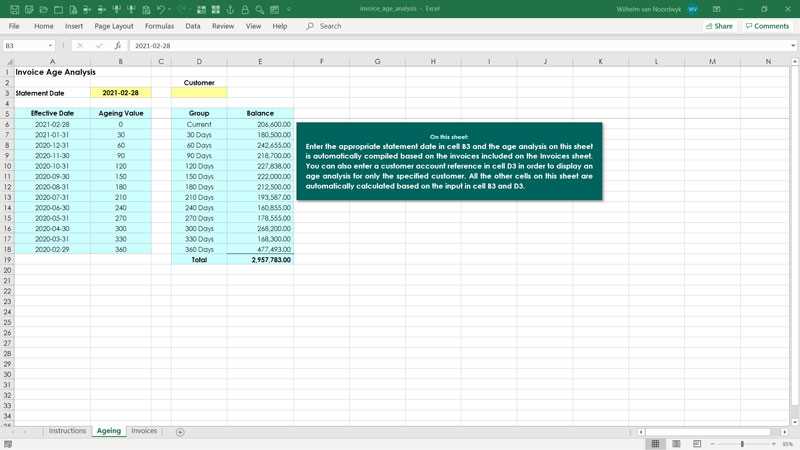

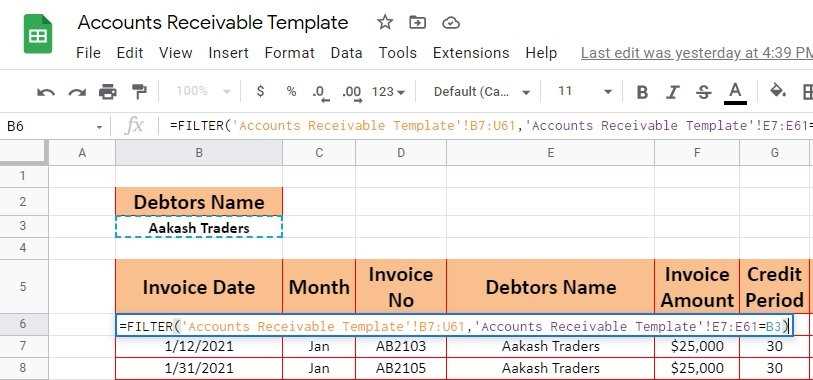

How to Create an Invoice Aging Report

Creating an effective tool for tracking overdue balances involves organizing data in a way that makes it easy to identify which payments are still pending and how long they have been outstanding. By following a structured process, businesses can generate a clear overview of their receivables, enabling them to take action when necessary and reduce the risk of bad debts.

1. Gather Relevant Data

The first step in creating this tool is to collect all relevant information about unpaid invoices. This includes:

- Client names and contact information

- Outstanding amounts

- Invoice numbers and issue dates

- Due dates for payments

Having all this data in one place ensures that you can easily track the status of each outstanding payment. Most businesses maintain these records within their accounting software, making it easier to pull the necessary information for the report.

2. Organize Data by Time Periods

Once you have all the data, the next step is to categorize the unpaid amounts into different time periods based on their age. Typically, businesses use the following ranges:

- 0-30 days

- 31-60 days

- 61-90 days

- 91+ days

Each outstanding balance is then placed into the appropriate category depending on how long it has been since the payment was due. This categorization helps prioritize collections and highlight which accounts may require more immediate attention.

3. Use a Structured Format

Once the data is categorized, it’s important to present it in a clear, easy-to-read format. Typically, this involves creating a table with columns for the client’s name, outstanding amount, and the days the balance has been overdue. The table should be structured like this:

| Client Name | Amount Due | Days Outstanding | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Client A | $3,000 | 45 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Client B | $1,500 | 75 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Client C | $750 | 120 |

| Client Name | Amount Due | Due Date | Days Outstanding |

|---|---|---|---|

| Client A | $1,500 | 10/15/2024 | 10 |

| Client B | $2,000 | 10/01/2024 | 24 |

| Client C | $750 | 09/25/2024 | 30 |

Using a structured system, like the one above, helps you easily track the status of each balance, prioritize follow-ups, and take prompt action when necessary.

Understanding Aging Categories in Reports

When tracking unpaid balances, categorizing them by how long they’ve been overdue helps businesses prioritize collection efforts and understand the financial health of their receivables. These time-based groupings allow companies to quickly assess which debts need immediate attention and which may not be as urgent. The longer a payment remains unpaid, the higher the risk of it becoming uncollectible. Therefore, it’s essential to understand these categories and their significance in managing outstanding balances.

1. Common Time Periods Used in Categories

The most common method for organizing overdue amounts is to break them down into time periods that reflect how long they’ve been outstanding. These categories typically include:

- Current (0-30 days) – Payments that are within the first 30 days of their due date and are typically considered low risk.

- 31-60 days – Amounts that are between 31 and 60 days overdue, indicating a moderate risk of late payment.

- 61-90 days – Payments that are between 61 and 90 days overdue, usually indicating a higher risk of non-payment.

- 91+ days – Accounts that are more than 90 days overdue, which are at the highest risk of becoming uncollectible.

2. Why These Categories Matter

These time-based categories serve multiple purposes in the collections process. They help businesses:

- Prioritize collections: Focusing efforts on accounts that are most overdue increases the likelihood of recovery.

- Identify trends: If a large portion of overdue balances falls into the 60-90 day category, it may signal a problem with your payment terms or client cash flow.

- Track client behavior: Frequent overdue amounts in the 90+ day category may indicate clients who consistently delay payments, which may require a change in approach or stricter terms.

| Client Name | Amount Due | Days Outstanding | Category | ||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Client A | $1,200 | 25 | Current | ||||||||||||||||||||||||||||||||||

| Client B | $750 | 45 |

| Client Name | Amount Due | Days Outstanding | Status |

|---|---|---|---|

| Client A | $1,200 | 45 | Reminder Sent |

| Client B | $500 | 30 | Disputed |

| Client C | $1,800 | 75 | Follow-up Needed |

By addressing these mistakes and applying the right strategies, businesses can more effectively manage overdue amounts, reduce the risk of bad debts, and improve cash flow over time.

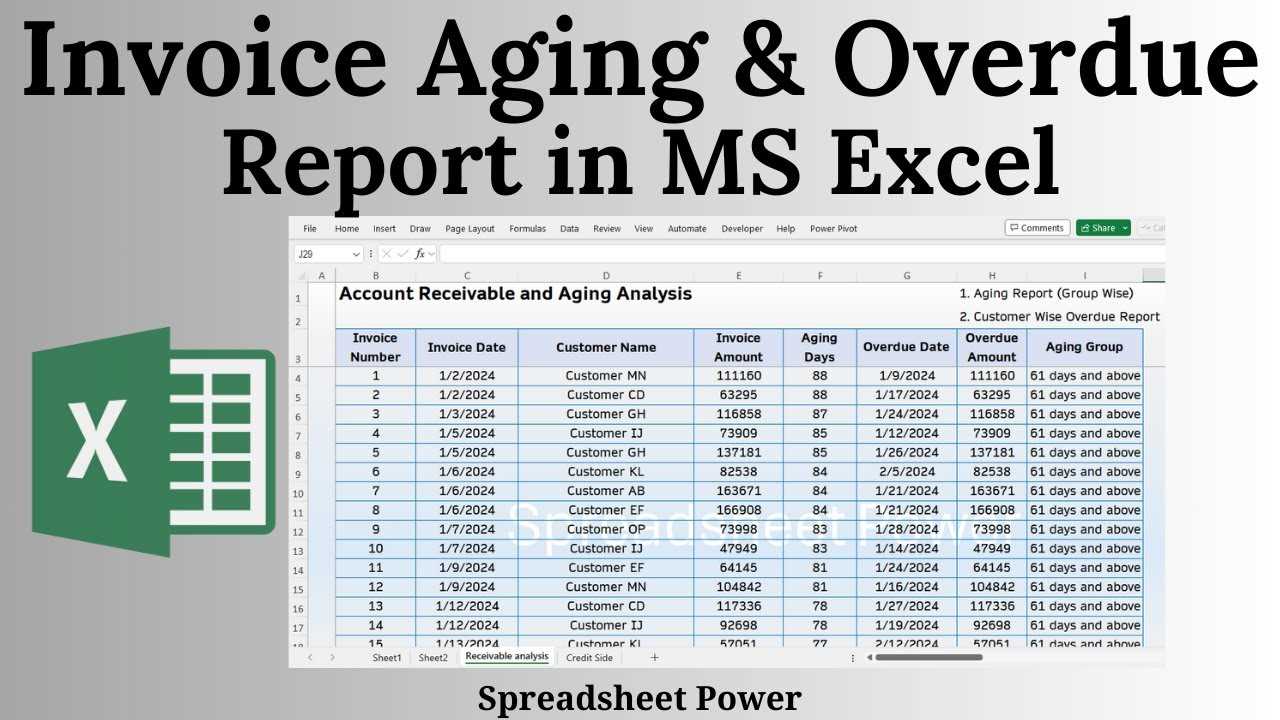

How to Interpret Invoice Aging Data

Analyzing outstanding balances is key to maintaining healthy cash flow and minimizing financial risks. By interpreting data about overdue payments, businesses can gain valuable insights into their receivables and take proactive steps to address potential issues. Properly understanding this data allows you to prioritize follow-ups, make informed decisions, and improve overall financial stability.

1. Identify Payment Patterns

The first step in interpreting this data is to identify trends in your clients’ payment behaviors. Look for patterns such as consistent late payments or frequent delays in particular time periods. For example, if a large portion of overdue balances is in the 60-90 day category, this may indicate a problem with your payment terms or your clients’ financial stability.

- Example: A client with multiple invoices in the 60-90 day range may need closer monitoring or adjusted payment terms.

- Solution: Analyze clients with the highest overdue balances and review their payment history to identify recurring issues.

2. Assess Financial Risk

Understanding the age of unpaid amounts helps you assess the risk associated with them. The longer a payment remains outstanding, the less likely it is to be paid. This is especially true for balances that are over 90 days overdue. By categorizing the data, you can prioritize which debts need immediate action and which can be left for later follow-up.

- Example: A significant amount of overdue debt in the 90+ days category should prompt more aggressive collection efforts, such as involving a collections agency or renegotiating payment terms.

- Solution: Regularly review overdue balances, focusing first on the high-risk accounts with longer payment delays.

| Client Name | Amount Due | Days Outstanding | Priority Action |

|---|---|---|---|

| Client A | $1,000 | 25 | Reminder Email |

| Client B | $3,500 | 75 | Follow-Up Call |

| Client C | $4,200 | 120 | Collections Agency |

By understanding these categories and interpreting the data correctly, businesses can take appropriate actions to recover overdue payments, protect their financial health, and reduce the risk of bad debts.

Benefits of Automating Invoice Aging Reports

Automating the process of tracking overdue payments brings a range of advantages to businesses. By integrating automated tools into your financial workflow, you can eliminate manual errors, reduce the time spent on administrative tasks, and ensure that the management of outstanding balances is always up to date. Automation enhances efficiency, enabling teams to focus on more strategic actions, such as improving client relationships or negotiating payment terms.

1. Improved Accuracy and Consistency

Manual tracking of unpaid balances often leads to human errors, such as incorrect data entry or missed updates. By automating the process, businesses can ensure that the data is consistently accurate and up-to-date. Automation removes the risk of forgetting to update records, ensuring that the aging categories and amounts are always current.

- Benefit: Automation helps eliminate mistakes that can arise from manual entry, ensuring that data is always correct.

- Benefit: Automated systems can flag discrepancies and inconsistencies, allowing businesses to resolve issues before they become bigger problems.

2. Time and Resource Savings

Automating the tracking and categorizing of overdue balances reduces the need for manual intervention, freeing up time for employees to focus on more important tasks. Instead of manually checking and updating spreadsheets, automation tools can run calculations, generate summaries, and send out reminders automatically. This leads to significant time savings and allows teams to dedicate their efforts to high-priority actions, such as pursuing collections or negotiating payment terms with clients.

- Benefit: Time spent on administrative tasks is minimized, making the entire collections process more efficient.

- Benefit: Automation reduces the need for extra staff hours and allows current staff to focus on other critical activities.

3. Enhanced Cash Flow Management

By automating the tracking of overdue payments, businesses can gain real-time insights into their outstanding balances and more accurately forecast cash flow. Timely, automated reminders and follow-ups ensure that overdue debts are addressed quickly, which can improve cash inflow and reduce the risk of financial shortfalls.

- Benefit: Automated follow-ups can accelerate payments, improving overall liquidity and financial stability.

- Benefit: Real-time data helps businesses anticipate cash flow gaps and take proactive measures to maintain healthy finances.

| Client Name | Amount Due | Days Outstanding |

|---|