How to Send an Invoice with a Simple Template

When it comes to managing finances, clear and professional communication is essential. Whether you’re a freelancer, a small business owner, or a large enterprise, providing clients with accurate payment requests is crucial for maintaining a smooth cash flow. A well-organized document that outlines the terms of a transaction helps avoid misunderstandings and ensures timely payments.

Creating a structured document for requesting payment doesn’t need to be complicated. By following a few straightforward guidelines, you can craft a document that reflects professionalism and is easy for your clients to understand. This approach will not only improve your business’s credibility but also streamline your financial operations.

In this article, we’ll explore the process of creating an effective billing statement. We will cover essential elements to include, tips for customization, and ways to ensure your document looks polished and professional, setting the stage for efficient transactions and stronger client relationships.

How to Create an Invoice Template

Crafting a well-organized document for requesting payment is an essential step in ensuring smooth business transactions. A clear and professional layout not only helps convey the necessary details but also boosts your credibility. This section will guide you through the key elements and best practices for creating an effective payment request document that meets the needs of both your business and clients.

Essential Components to Include

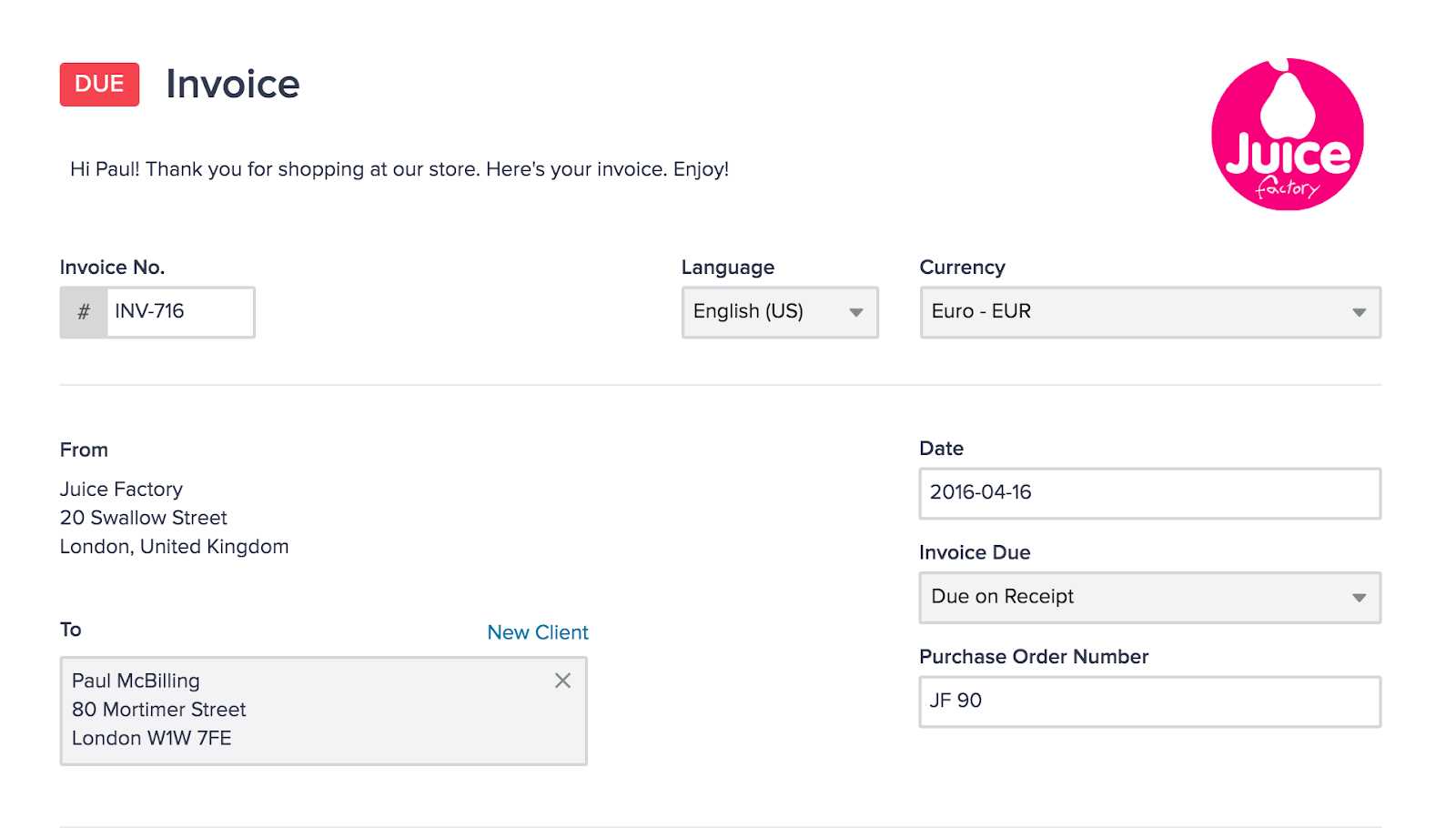

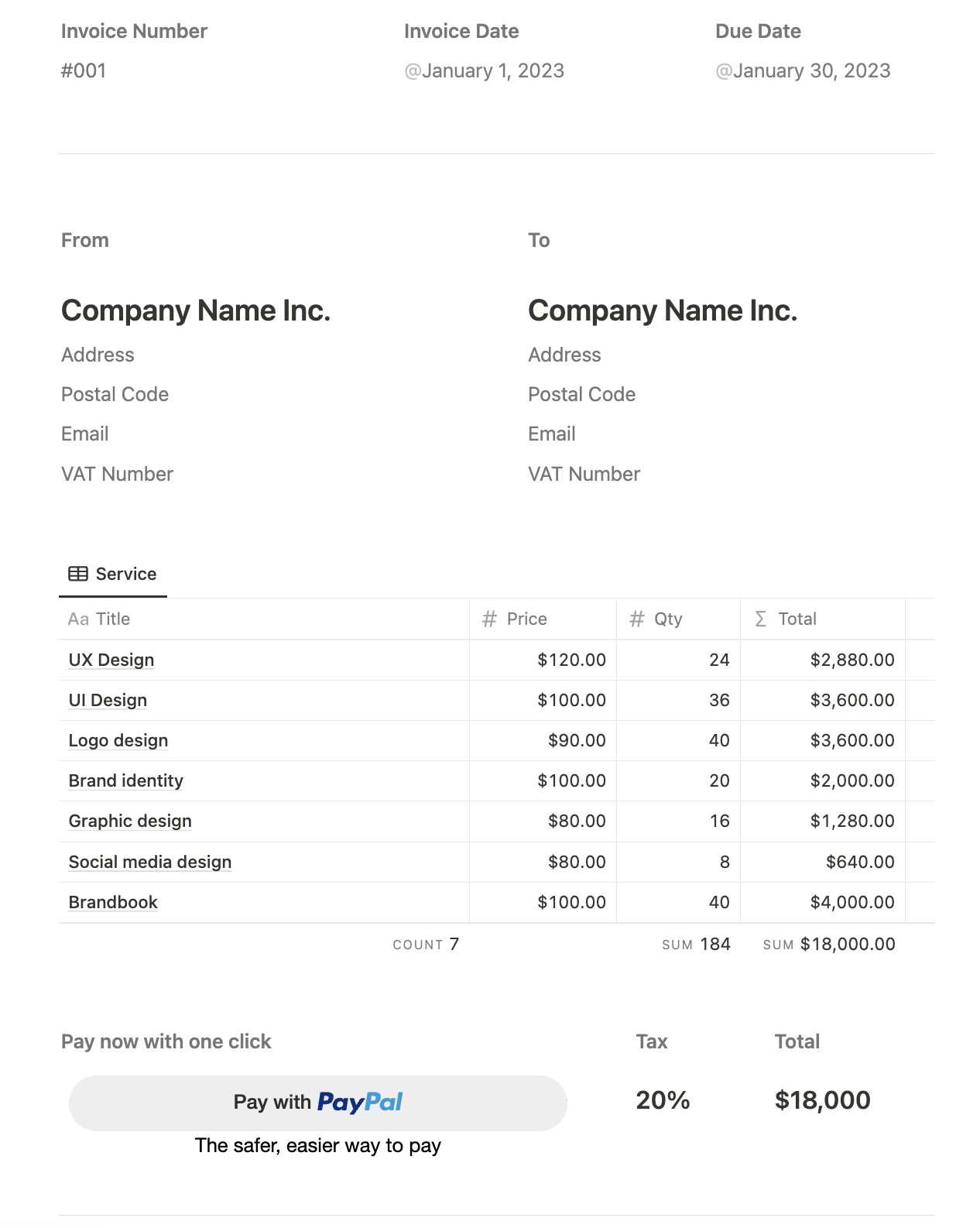

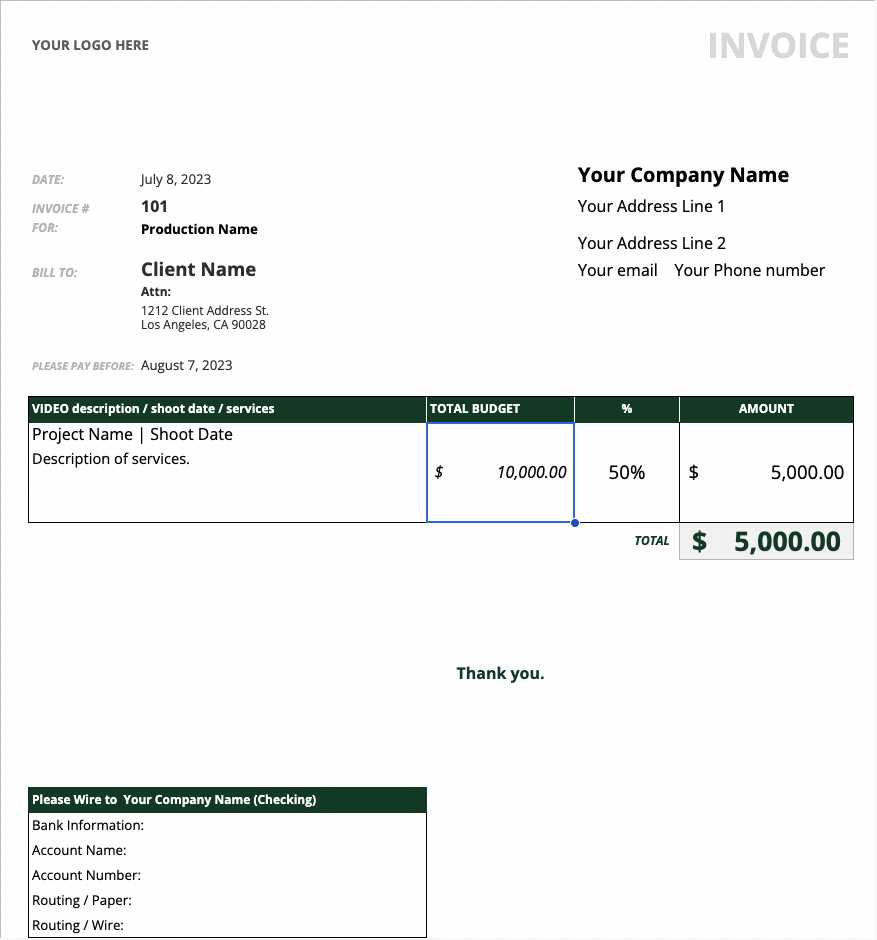

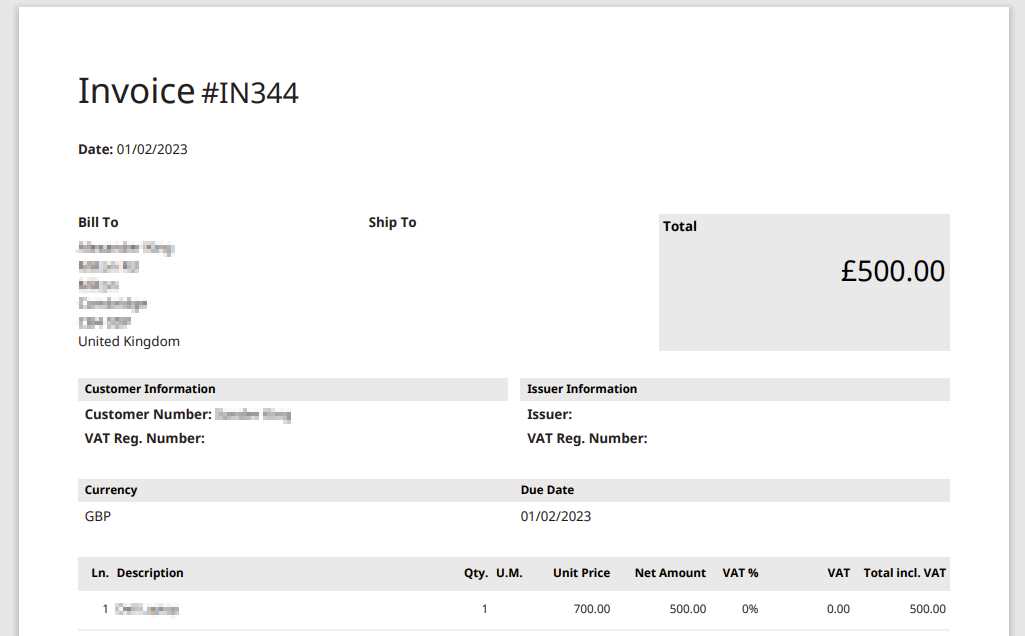

The first step in creating a document is to decide what information it needs to contain. It should clearly list both the services or goods provided, as well as the agreed-upon price. Common sections include contact details, payment terms, date, and due date. Additionally, including an invoice number is essential for tracking and reference purposes. These key elements ensure clarity and make it easier for your client to process the payment promptly.

Customizing the Layout

The layout plays a significant role in presenting information professionally. While it’s important to keep things simple and easy to understand, consider adding your logo, business name, and any other branding elements to make the document look cohesive with your company’s identity. The structure should guide the reader’s eyes from top to bottom, with a clear separation of each section to improve readability.

Step-by-Step Guide to Sending Invoices

Once you’ve created a payment request document, it’s important to ensure that it reaches the right person and is delivered properly. A smooth process increases the chances of timely payment and minimizes any potential confusion. Below is a detailed guide that will walk you through each stage of the transaction process, from preparing to dispatch to following up on outstanding amounts.

Preparing the Document

Before sending any request for payment, make sure your document is clear, complete, and professional. Follow these steps to prepare:

- Double-check that all necessary details are included, such as client information, payment terms, and service descriptions.

- Ensure the document is free from errors–both spelling and mathematical mistakes can create unnecessary delays.

- Save the document in a universally accessible format, such as PDF, to ensure it appears correctly on all devices.

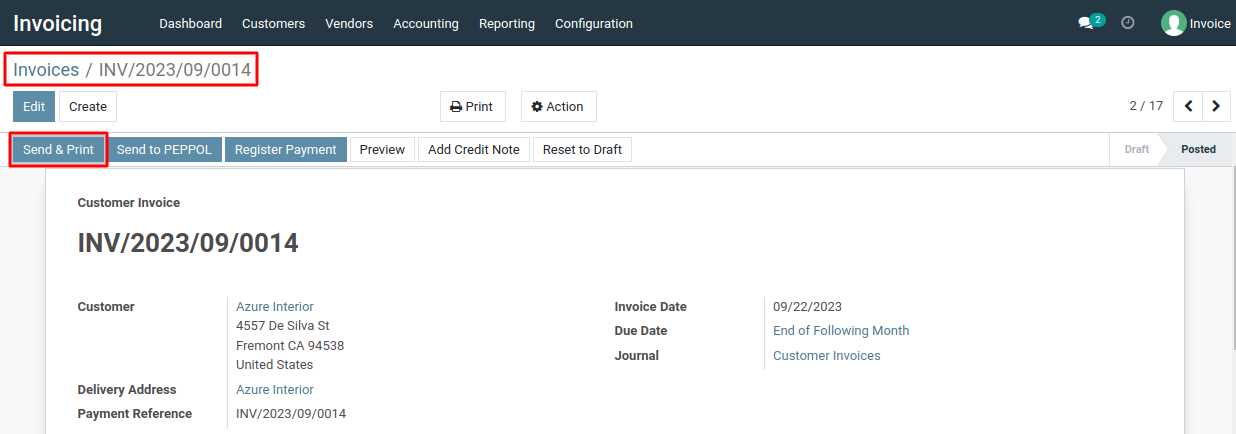

Delivering the Request

Once everything is in order, it’s time to send the document to your client. You can choose from a variety of methods to ensure quick and effective delivery:

- Email: The most common and fastest method. Attach the document as a PDF and include a polite message explaining the payment terms and any other relevant details.

- Postal Mail: If email isn’t an option, mailing a printed version can work. Ensure you send it with tracking for security and confirmation of receipt.

- Online Platforms: If you use an invoicing or accounting software, many platforms allow you to send payment requests directly to your clients’ accounts.

Following Up

After dispatching the document, keep track of your clients’ payment statuses. If you don’t receive payment by the due date, consider sending a polite reminder. A simple follow-up email or phone call can help ensure that everything is on track and resolve any potential issues.

Why You Need an Invoice Template

Having a standardized document for requesting payments is essential for any business or individual offering products or services. It not only streamlines the process but also ensures that both parties involved have clear expectations regarding the transaction. By using a well-structured document, you can save time, avoid confusion, and improve the professionalism of your business communications.

Consistency and Professionalism

Using a consistent format for all your payment requests helps build trust with your clients. A clean, well-organized document gives the impression that you run an efficient business and value transparency. Clients are more likely to respond positively when they can easily understand the terms of the transaction.

Time-Saving and Efficiency

Creating a payment request from scratch each time can be time-consuming and prone to errors. By having a pre-designed structure, you can quickly fill in the specific details for each client and transaction. This efficiency not only speeds up the process but also reduces the risk of overlooking important details like the due date, amount, or contact information.

Key Information to Include in Invoices

To ensure that your payment request is clear, effective, and legally sound, certain details must always be included. These elements help both you and your client understand the terms of the transaction and prevent any potential confusion. A well-structured document provides all the necessary information in a straightforward manner, making the process smoother for everyone involved.

Essential Details for Accuracy

The following elements are vital for clarity and proper record-keeping:

- Client Information: Always include the client’s full name or business name, address, and contact details. This ensures that there is no ambiguity regarding the recipient of the payment request.

- Your Business Information: Clearly state your business name, address, and contact information. If applicable, include your tax identification number for transparency.

- Itemized List of Services or Products: Describe each product or service provided, along with the agreed-upon price for each. This ensures that both parties are on the same page regarding the charges.

- Payment Terms: Specify the total amount due, the due date, and any payment methods accepted. Include any applicable taxes, fees, or discounts as well.

Additional Details for Proper Tracking

For organizational and legal purposes, the following elements are also important:

- Unique Identification Number: Assign a distinct number to each payment request for easy reference and tracking in your accounting system.

- Issue Date: Include the date the request is issued, which helps both parties understand the timeline for payment.

- Due Date: Clearly mark when the payment is expected to be received to avoid misunderstandings about deadlines.

Choosing the Right Invoice Format

Selecting the right format for your payment request is crucial for ensuring that the document is both professional and easy to understand. The layout and structure should suit your business style while also accommodating the needs of your clients. By considering the various formats available, you can choose the one that will make the transaction process more efficient and streamlined.

Different Formats to Consider

There are several ways to present your payment request, each with its own benefits. Depending on your business type and preferences, some formats may be more suitable than others. The most common formats include:

| Format | Advantages | Disadvantages |

|---|---|---|

| Universal, professional appearance, preserves formatting | Not editable, requires software to open | |

| Excel | Editable, customizable, easy to track and update | Not always viewed as professional, formatting can be lost |

| Word | Easy to create, customizable, widely used | Formatting may be inconsistent across devices |

| Online Platforms | Streamlined, automatic tracking, easy to integrate with payment systems | Requires a subscription or service fee, internet access |

Choosing the Best Format for Your Business

When deciding which format to use, consider your clients’ preferences and the tools they are most likely to use. If you are working with larger corporations, a PDF may be more suitable for its professional look and universal accessibility. For smaller businesses or frequent updates, an Excel file may be better suited to your needs. In the case of frequent transactions, an online invoicing platform might provide the best efficiency and automation.

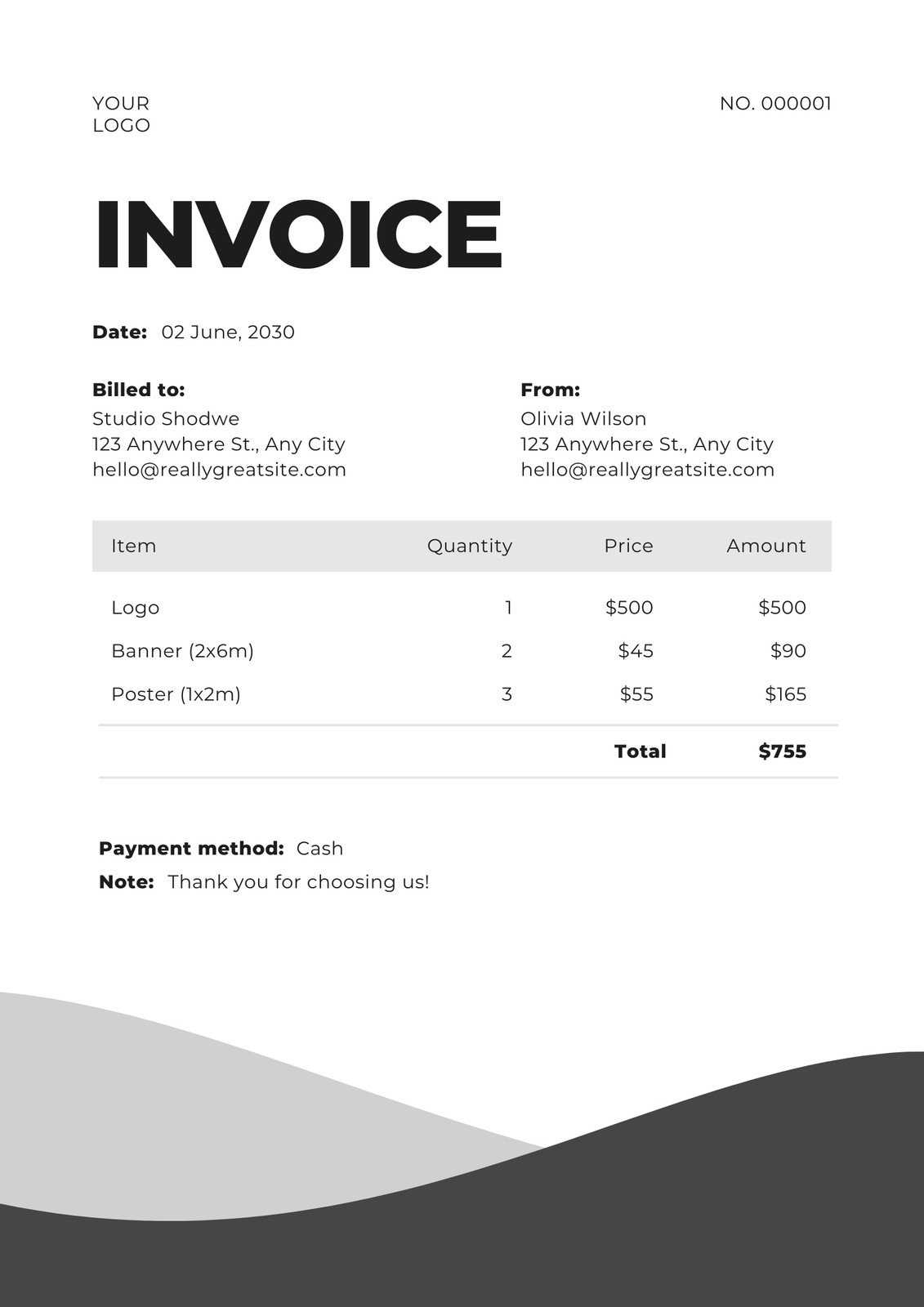

How to Personalize Your Invoice Template

Personalizing your payment request document is a great way to make it more aligned with your brand identity and establish a stronger connection with your clients. A customized layout not only adds a professional touch but also ensures consistency in your business communications. By making small adjustments, you can reflect your unique style and reinforce your company’s image with every transaction.

Start by incorporating your logo, company colors, and other branding elements to make the document instantly recognizable as part of your business. You can also include a personalized message, such as a thank you note or a reminder about payment terms, to build rapport with clients. The key is to strike a balance between professionalism and personalization while keeping the document clean and easy to read.

Another important aspect is ensuring that the language used in your document matches your business’s tone. If your company is more casual, a friendly and approachable tone may be appropriate. However, for corporate clients, a formal and straightforward tone is often more fitting. Tailoring your communication style to the specific relationship can help strengthen your client rapport.

Common Mistakes to Avoid When Sending Invoices

Submitting a payment request might seem straightforward, but there are several pitfalls that can delay payment or cause misunderstandings. By avoiding common errors, you can ensure that the transaction process is smooth and professional. Here are some key mistakes to watch out for when preparing and dispatching your payment requests.

Key Mistakes to Avoid

- Missing or Incorrect Client Details: Always double-check that the recipient’s name, address, and contact information are accurate. Mistakes here can delay payment or cause confusion.

- Failure to Include Clear Payment Terms: Be specific about the amount due, the due date, and any payment methods accepted. Vague terms can lead to delayed payments or disputes.

- Forgetting to Number the Request: Each payment request should have a unique reference number. This helps both you and your client track the transaction and avoid any confusion about payment history.

- Not Tracking Payments: Once the request is sent, it’s essential to keep track of payments received and follow up on overdue amounts. Failing to do so can lead to missed payments.

- Inconsistent Formatting: Ensure that your document looks clean and professional. A messy layout with incorrect fonts or misplaced information can make the request look unprofessional and difficult to read.

How to Prevent These Errors

- Double-Check Details: Before dispatching the document, verify that all information is accurate and up-to-date. It’s better to take a few extra minutes to ensure everything is correct than to deal with the fallout later.

- Set Clear Deadlines: Include a due date and specify the payment method in your request to avoid confusion. If applicable, mention late fees or penalties for overdue payments.

- Use Accounting Software: Many software tools can automatically generate and number your requests, making it easier to stay organized and consistent.

- Follow Up Promptly: If payment is overdue, send a polite reminder or contact your client to resolve the issue quickly and professionally.

Best Practices for Invoice Timing

Choosing the right moment to issue a payment request is just as important as the document itself. The timing of when you ask for payment can impact how quickly you receive it and the overall relationship with your client. By following strategic timing practices, you can improve cash flow, reduce delays, and maintain positive business interactions.

When to Issue a Payment Request

Issuing a payment request at the right point in the transaction process is crucial. Here are some key considerations:

- At the Completion of Work: The most common approach is to issue a payment request once you’ve completed the work or delivered the product. This ensures the client has received the service or goods and understands the value of what they are paying for.

- On a Regular Schedule: For ongoing services or subscriptions, it’s often best to set up a regular billing cycle. Monthly or quarterly requests can help maintain consistency and make it easier for both you and your client to plan financially.

- After Milestones: For larger projects, consider requesting partial payments after reaching specific milestones. This ensures that you receive compensation as you progress and reduces the risk of non-payment at the end of the project.

How to Ensure Timely Payments

Once you’ve decided on the best time to issue a request, it’s important to set clear expectations with your client regarding deadlines. Here are a few best practices:

- Communicate Deadlines Clearly: Be explicit about the payment due date. Include this in your document and make sure the client understands the terms from the start.

- Send Reminders: If the deadline approaches and payment hasn’t been made, send a gentle reminder. A polite follow-up email or call can help ensure the payment is processed on time.

- Consider Early Payment Incentives: Offering a small discount for early payment can encourage clients to settle bills promptly, benefiting both parties.

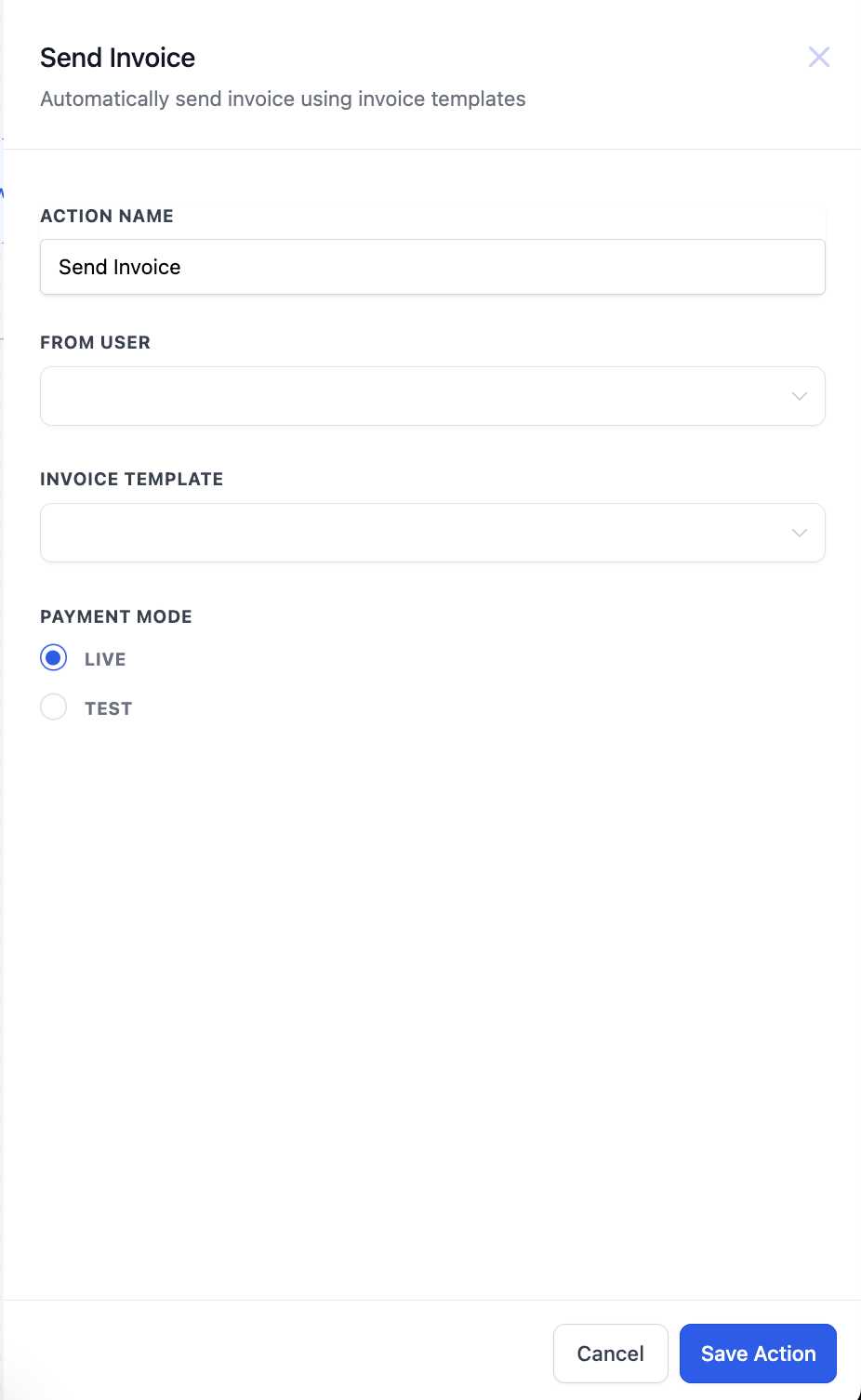

How to Automate Invoice Creation

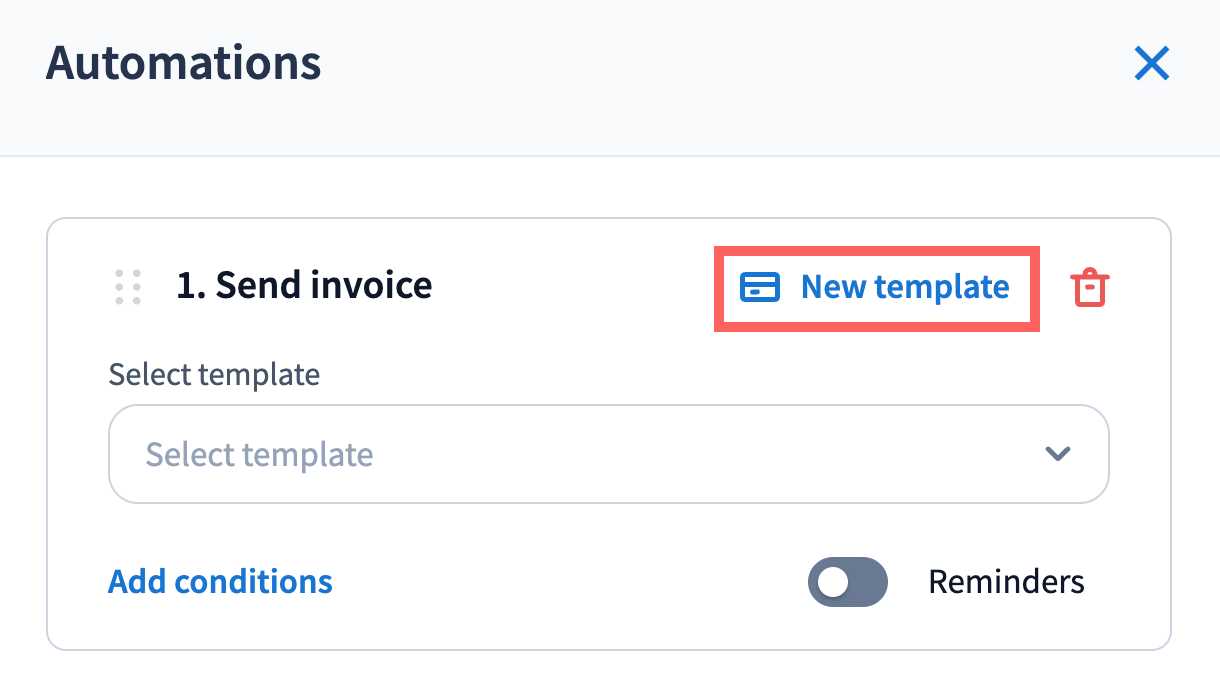

Automating the process of generating payment requests can save you significant time and effort, especially if you deal with a high volume of transactions. By using automation tools, you can eliminate the repetitive tasks of manually creating and sending each document, reducing errors and speeding up the billing process. Automation allows you to focus on other aspects of your business while ensuring that payments are requested promptly and consistently.

There are several ways to set up an automated system for creating payment requests. Many accounting and invoicing platforms offer features that allow you to generate documents automatically based on the details you input once, such as your client’s contact information, products or services provided, and payment terms. Once these details are entered into the system, you can configure the software to generate and deliver requests based on preset schedules, without needing to start from scratch each time.

Automation also enables the creation of recurring requests for subscription-based services or regular clients. With just a few initial configurations, these systems can create and send requests on a set schedule, such as weekly or monthly, ensuring you don’t miss any deadlines. Additionally, some tools offer features like automatic tax calculations, personalized messages, and payment tracking, all of which can streamline your billing process further.

What to Do After Sending an Invoice

Once your payment request has been delivered, the process doesn’t end there. It’s important to actively monitor and follow up on the status of the payment to ensure it’s processed within the agreed time frame. Taking the right steps after the document has been sent can help prevent delays, maintain good client relationships, and ensure your cash flow remains steady.

The first step after dispatching the payment request is to keep track of when the payment is due. Mark the due date in your calendar or accounting software to ensure you are prepared to follow up promptly. If you haven’t received payment by the deadline, it’s essential to reach out with a polite reminder. A well-worded follow-up can help prompt action without damaging the business relationship.

If the payment is delayed or disputed, maintaining professionalism is key. Reach out to the client to address the issue calmly, and be prepared to offer assistance if there is confusion or a misunderstanding regarding the terms. Some clients may need additional documentation or clarification, so being responsive and accommodating can help resolve the matter quickly.

Finally, once the payment is received, confirm the transaction and send a thank you note to your client. Not only does this maintain a positive relationship, but it also reinforces your professionalism and encourages future business interactions. Regularly reviewing your payment tracking process will ensure that you’re always prepared for the next request.

How to Track Outstanding Invoices

Keeping track of unpaid amounts is crucial to maintaining a healthy cash flow and ensuring that no payment request goes overlooked. Whether you have one client or many, it’s essential to have a system in place to monitor outstanding balances and ensure timely follow-ups. By staying organized and using the right tools, you can easily track pending payments and take appropriate actions when necessary.

One effective way to track unpaid amounts is by using a detailed log or an accounting system. This can help you record important information such as due dates, amounts owed, and payment statuses. A simple table can also serve as a quick reference for monitoring outstanding balances and following up on overdue payments.

| Client Name | Amount Due | Due Date | Status | Follow-up Date |

|---|---|---|---|---|

| Client A | $500 | 2024-10-15 | Pending | 2024-10-22 |

| Client B | $300 | 2024-10-18 | Overdue | 2024-10-25 |

| Client C | $200 | 2024-10-20 | Paid | 2024-10-21 |

Regularly reviewing this information will help you stay on top of overdue payments and make sure you follow up promptly. You can set reminders to contact clients as the due date approaches, and if payments are overdue, reach out with a polite reminder to keep the process moving forward.

Creating Professional Invoices with Templates

Crafting a polished and consistent payment request is key to maintaining professionalism and ensuring smooth transactions with your clients. A well-designed structure not only reflects your business’s credibility but also helps avoid misunderstandings and delays. Using a structured framework for your payment requests can save time, reduce errors, and enhance the overall experience for both parties involved.

When creating your payment request, the following elements are essential to maintain professionalism and clarity:

- Clear Branding: Make sure your company name, logo, and contact information are prominently displayed. This reinforces your business identity and makes it easier for clients to reach you if necessary.

- Itemized List of Charges: Break down the products or services provided, including individual prices, quantities, and any applicable taxes or discounts. This gives clients a detailed overview of what they are paying for.

- Accurate Payment Terms: Include specific details about the total amount due, the due date, and accepted payment methods. Clearly state any late fees or penalties for overdue payments to set clear expectations.

- Unique Reference Number: Assign a unique number to each request. This helps both you and your client easily track and reference the document for future communication.

Using a pre-designed structure can ensure that all of these elements are included consistently. It allows you to focus on the content rather than the layout, while also reducing the chance of missing important details. Whether you choose a simple layout or a more advanced design, consistency and clarity should always be your top priority.

Legal Considerations for Sending Invoices

When creating and dispatching payment requests, it’s crucial to understand the legal aspects involved. Proper documentation and adherence to regulations can help avoid potential disputes, delays, or legal complications. By ensuring that your payment request complies with local laws and contractual agreements, you protect both your business and your clients.

Key Legal Aspects to Consider

- Accurate Information: Make sure all details on the document are correct, including your business name, client details, and the services or products provided. Errors could lead to misunderstandings or disputes over the terms of payment.

- Clear Payment Terms: Specify the amount due, payment methods, and deadlines clearly. Any ambiguity regarding payment terms could lead to delays or non-payment. Additionally, include any penalties for late payments if applicable.

- Tax Requirements: Ensure you comply with local tax laws by including the appropriate tax information (such as VAT or sales tax) and registration numbers. Failure to include this information could lead to legal issues with tax authorities.

- Contractual Agreements: Always refer to any prior agreements or contracts when preparing your payment request. This ensures that the terms of the request align with the initial understanding and helps avoid future conflicts.

How to Avoid Legal Issues

- Stay Transparent: Provide a detailed breakdown of all charges to ensure that both you and your client are on the same page. Transparent communication reduces the likelihood of disputes.

- Set Realistic Deadlines: When setting due dates, be mindful of the agreed-upon terms with your clients. Offering flexibility or a grace period may help maintain a positive relationship while also protecting your business.

- Retain Records: Keep copies of all payment requests and communication with clients. In case of any disputes, having a paper trail can be crucial in resolving the issue quickly and fairly.

Tips for Handling Invoice Disputes

Disputes over payment requests can arise for various reasons, whether due to unclear terms, discrepancies in charges, or misunderstandings between parties. While these situations can be frustrating, how you handle them can significantly impact your relationship with the client and the outcome of the situation. By approaching disputes with professionalism, transparency, and clear communication, you can resolve issues efficiently and maintain positive business relationships.

The first step in addressing a dispute is to remain calm and listen carefully to the client’s concerns. Understanding their perspective is essential before responding. Often, disputes can be resolved through simple clarification of the terms or a revision of the details. Be prepared to review the request thoroughly to identify any errors or misunderstandings.

Documenting all interactions and agreements is crucial when handling disputes. Keep a record of all communications and ensure that any revisions or agreements are confirmed in writing. This not only protects both parties but also provides a clear reference in case the dispute escalates further.

Ultimately, the goal is to reach a mutually agreeable solution while protecting your business interests. Whether through renegotiating the terms, offering a partial refund, or setting up a payment plan, remaining flexible and open to discussion can help resolve conflicts without damaging the client relationship.

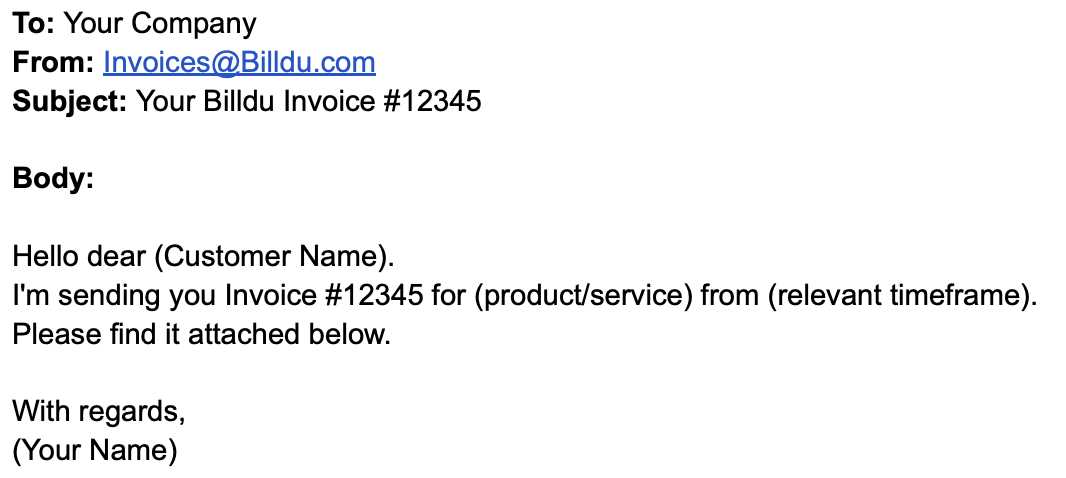

How to Send Invoices via Email

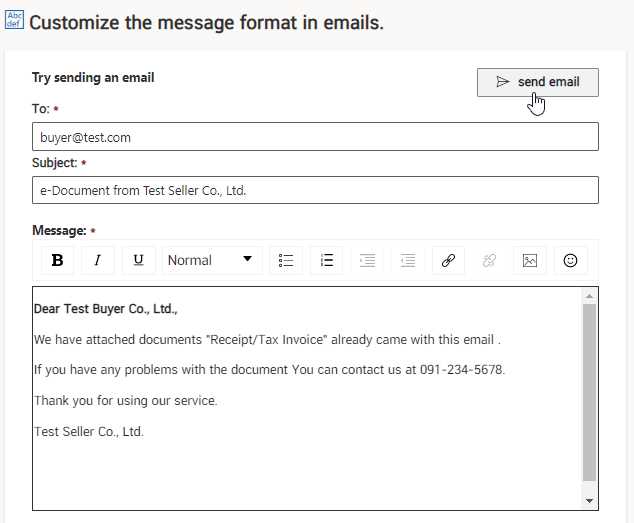

Email is one of the most efficient methods for delivering payment requests. It allows for quick delivery, easy tracking, and can be more convenient for both you and your clients. However, to ensure that your documents are received professionally and promptly, it’s important to follow the right approach when dispatching them via email.

When sending a payment request through email, start with a clear and concise subject line. This should indicate the purpose of the email and make it easy for the recipient to identify its importance. For example, “Payment Request for [Service/Product] – Due [Date].” This helps the client prioritize the message and understand its content immediately.

In the body of the email, be polite and professional. Begin with a brief introduction, such as thanking the client for their business or referencing the work completed. Then, mention the attached payment request and its due date, and provide any relevant payment instructions or terms. You may also want to include your contact information in case the client has any questions or concerns.

Always ensure the attachment is in a common and easily accessible format, such as PDF. This prevents any compatibility issues and ensures that the document appears professional and is easy to print or save. Before sending the email, double-check the attachment to confirm it is the correct and final version of the document.

Finally, remember to follow up if the payment is not received by the due date. A polite reminder can help ensure timely payment without causing tension between you and your client.