Home Staging Invoice Template for Professional Use

For any professional offering property improvement services, having a structured and reliable billing system is crucial. A well-organized document can streamline the payment process and ensure that both service providers and clients are on the same page. This tool serves as an essential part of running a successful business, allowing for clear communication and efficient financial transactions.

By creating a customized form, service providers can present their charges in a consistent manner. Whether for staging, design, or other related services, having a comprehensive document that covers all necessary details is essential. It not only reflects professionalism but also enhances the overall customer experience.

Utilizing such a form offers numerous advantages, including accurate tracking of services rendered, clear payment terms, and the establishment of a professional reputation. With proper customization, these documents become valuable assets in managing business transactions and maintaining long-term client relationships.

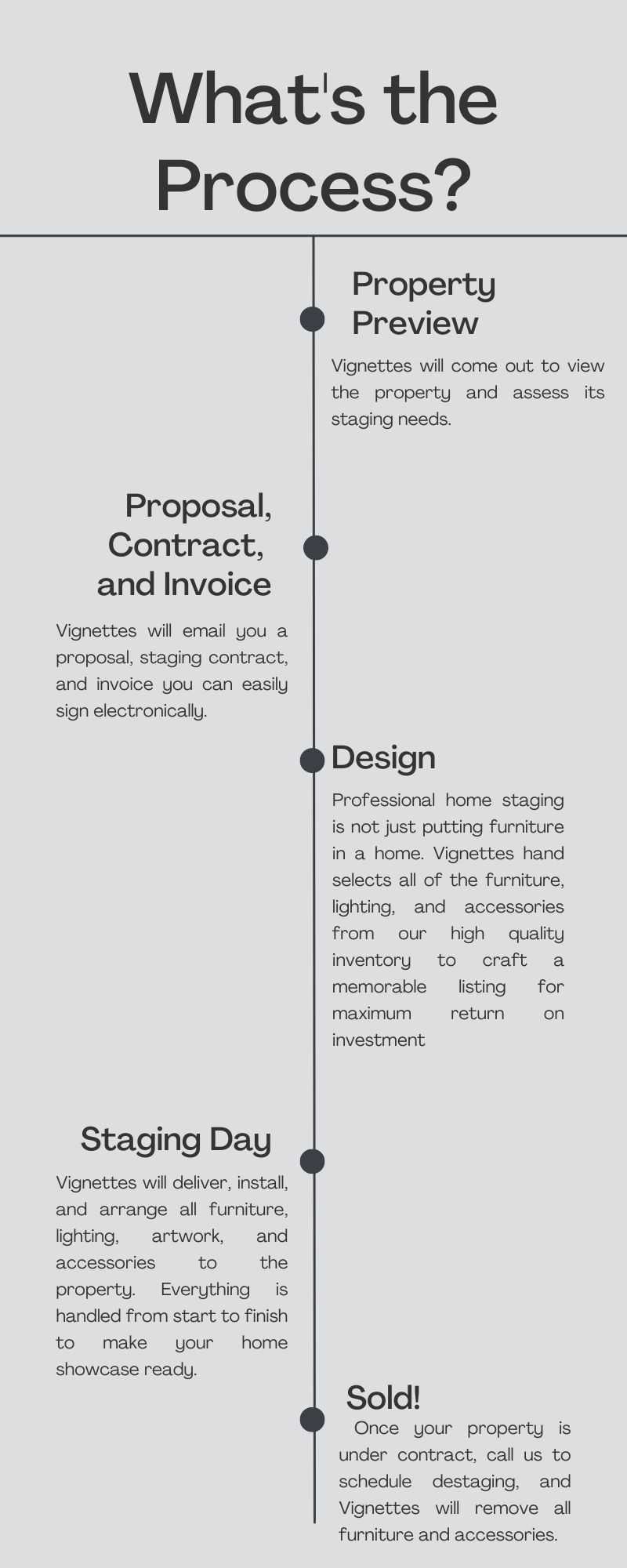

Home Staging Invoice Template Overview

When offering property enhancement services, maintaining a clear and professional billing system is essential for both the service provider and the client. A detailed document outlining charges helps ensure smooth financial transactions, promoting transparency and trust between parties. This system plays a key role in organizing the various costs associated with such services and making the payment process straightforward.

Typically, such a document includes various sections that break down the services provided, the corresponding rates, and any additional fees. The goal is to ensure that both the provider and the client have a clear understanding of the financial agreement. Here are the key elements often included:

- Client Information: Name, contact details, and service address.

- Service Description: A detailed list of services provided with corresponding costs.

- Payment Terms: Clear terms regarding when and how payment should be made.

- Tax Information: Applicable taxes for services rendered.

- Total Amount Due: The final amount to be paid, including all services and charges.

Having such a system in place not only ensures proper financial tracking but also enhances the overall professionalism of the business. It allows both parties to have a reference point for future communications, reducing any confusion or disputes that may arise regarding payments or services rendered.

What is a Home Staging Invoice?

A financial document used by service providers in the property enhancement industry serves as an official request for payment after completing a project. It outlines the services rendered, associated costs, and payment terms. This document helps ensure transparency between the client and the provider, ensuring that all expectations are met regarding the financial aspects of the job.

Key Information Included

This document typically contains various details to make the transaction clear and professional. Here’s a breakdown of the common elements:

| Section | Description |

|---|---|

| Client Details | Includes the client’s name, address, and contact information. |

| Service List | A detailed description of the services provided with itemized costs. |

| Payment Terms | Clarifies the due date and payment methods accepted. |

| Tax Information | Any applicable taxes that must be included in the total cost. |

| Total Due | The final amount to be paid after applying any discounts, taxes, or additional fees. |

Why It’s Important

Such a document ensures that both the service provider and the client are clear on the charges and terms. It acts as a legal agreement, helping to avoid misunderstandings and providing a reference point in case of any disputes regarding the work completed or payment due.

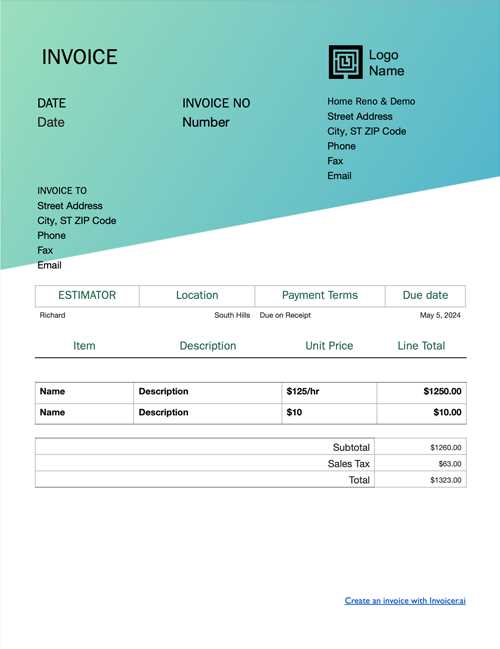

Key Components of an Invoice

An essential document in any business transaction, especially for those providing property enhancement services, needs to include certain critical details to ensure clarity and professionalism. These components are designed to outline the specifics of the service, the cost, and any payment terms, making it easier for both the service provider and the client to understand the financial expectations.

Basic Elements

The following are fundamental parts that should be included in a comprehensive billing document:

- Client Information: Full name, address, and contact details of the client receiving the services.

- Service Description: A clear breakdown of all services provided, including any associated costs for each task performed.

- Pricing Structure: The rate applied to the services and any additional fees, such as transportation or materials.

- Payment Details: Terms for payment, including due dates and accepted payment methods.

Additional Details

In addition to the basics, there are other important elements that further clarify the terms of the financial agreement:

- Tax Information: Any taxes that apply to the charges, including local or national sales tax rates.

- Total Amount Due: The final amount owed after all services, taxes, and any discounts or credits have been applied.

- Payment Instructions: Detailed instructions on how the client should make the payment (e.g., bank account details, online payment portals, etc.).

By including these components, the document serves as a comprehensive record of the transaction, protecting both parties and ensuring that the payment process runs smoothly.

How to Customize Your Template

Personalizing your billing document ensures that it aligns with your business branding and meets the specific needs of each project. Customizing the form helps you present a professional image while ensuring clarity in all financial communications with your clients. By tailoring the document to suit your services, you can provide a more polished and personalized experience.

Steps for Personalization

Here are the main steps to customize your financial form:

- Include Your Branding: Add your business logo, company name, and contact details at the top of the document to create a professional appearance.

- Adjust Layout and Design: Modify the layout to fit your style and business needs. You can change the font, colors, and section arrangement to make the document visually appealing.

- Specify Service Categories: Customize the sections that describe the different types of work performed. You may want to include multiple categories for specific tasks or materials.

Additional Customization Tips

For further adjustments, consider the following:

- Payment Terms: Edit the payment deadlines and accepted methods based on your business preferences.

- Legal Disclaimers: Add any necessary legal terms or conditions relevant to your services or business.

- Tax Information: Customize tax details according to local regulations or specific client requirements.

By customizing each aspect of the document, you can ensure that it fits the unique needs of both your business and your clients, promoting professionalism and transparency.

Why Use an Invoice Template

Using a pre-designed billing document provides numerous benefits for both businesses and clients. It streamlines the financial transaction process, ensuring accuracy and consistency in all forms of communication. With a clear structure in place, you can focus more on your services while maintaining a professional approach to payment management.

Benefits of Using a Pre-Designed Document

Here are several key reasons to consider using a ready-made billing form:

- Time Efficiency: A standardized document saves time on creating new billing forms from scratch, allowing you to focus on other aspects of your business.

- Consistency: It ensures that every transaction follows the same format, making it easier to track payments and manage records.

- Professional Appearance: A well-organized and clear financial document reflects positively on your business and builds trust with clients.

Additional Advantages

In addition to the primary benefits, here are some other reasons why using such a document is advantageous:

- Clarity: All payment details are laid out clearly, reducing confusion and ensuring that both parties understand the terms.

- Customization: You can easily adjust the document to fit the specific needs of each client, including discounts, special terms, or project-specific costs.

- Record Keeping: Pre-made forms help you maintain an organized financial record, making accounting and tax preparation simpler.

By using a standardized billing form, businesses can enhance their professionalism, improve time management, and foster better relationships with clients.

Common Mistakes to Avoid in Invoices

Even the most experienced businesses can make errors when creating financial documents. These mistakes, though often small, can lead to confusion, delayed payments, and dissatisfaction from clients. By being aware of the common pitfalls, you can ensure your forms are clear, accurate, and professional, avoiding potential issues in the payment process.

Frequent Errors in Billing Documents

Here are some of the most common mistakes that should be avoided:

- Incorrect Payment Terms: Failing to specify clear payment deadlines or terms can cause delays or misunderstandings.

- Lack of Contact Information: Not including the business’s contact details or missing important client information can create confusion.

- Unclear Service Descriptions: Providing vague descriptions for the services rendered can lead to disputes over what was delivered.

- Not Including Taxes: Forgetting to account for applicable taxes can lead to unexpected costs for the client or discrepancies in the total amount due.

How to Avoid These Mistakes

By keeping the following tips in mind, you can minimize errors in your financial documentation:

| Common Mistake | How to Avoid |

|---|---|

| Incorrect Payment Terms | Always specify clear payment deadlines and methods. |

| Lack of Contact Information | Ensure all business and client contact details are included and accurate. |

| Unclear Service Descriptions | Be detailed in describing each service, listing quantities and rates where applicable. |

| Not Including Taxes | Double-check that all taxes and fees are properly calculated and added. |

Avoiding these errors will help you create more professional, accurate, and reliable documents that promote smooth business transactions.

Benefits of Professional Billing

Utilizing a structured and organized financial system is key to streamlining business operations. When it comes to managing payments for services rendered, having a professional approach ensures both efficiency and clarity. Not only does it help in maintaining transparency, but it also builds trust with clients, making the entire transaction process smoother and more reliable.

Key Advantages of Using Professional Billing

Here are some primary benefits of adopting a professional approach to your financial paperwork:

- Improved Credibility: A well-organized billing structure presents your business as reliable and trustworthy, helping to create a stronger relationship with clients.

- Faster Payments: Clear and professional documents lead to fewer disputes and quicker payment processing, helping to maintain cash flow.

- Efficient Record Keeping: Proper documentation ensures that all payments are recorded accurately, making tax filing and financial reporting much easier.

- Better Client Communication: Detailed and transparent billing prevents misunderstandings and improves communication with clients regarding the costs of services provided.

Additional Benefits

Aside from the main advantages, there are several other ways that professional financial documentation can help your business:

| Benefit | Description |

|---|---|

| Time-Saving | A consistent billing process reduces time spent on administrative tasks, allowing you to focus on your services. |

| Customizability | Professional billing formats can be easily customized for each client, offering flexibility for different service packages or special offers. |

| Legal Protection | Properly documented payments and agreements can protect your business in case of legal disputes or payment issues. |

Incorporating a professional approach to financial management is not only practical but also beneficial in building long-lasting client relationships and ensuring your business’s smooth operation.

How to Add Client Details

In any professional service transaction, it is crucial to accurately record the client’s information. Including comprehensive and correct details ensures that communication remains clear, payments are properly directed, and any future correspondence can be easily referenced. When adding client information, consistency and precision are key to maintaining a well-organized system.

Essential Client Information to Include

Here are the most important details to include when adding client information to your documents:

- Client Name: Ensure the full name of the client or business is included to avoid confusion.

- Address: Include both the billing and, if necessary, the service address for accurate record-keeping.

- Contact Information: Add phone numbers and email addresses for easy communication.

- Business or Individual: Specify whether the client is an individual or a business, as this may affect how payments are processed.

- Account Number or Client ID: If applicable, include a reference number for easy tracking of multiple transactions.

Why Accurate Client Details Matter

Having the correct client details helps ensure a smooth experience for both parties involved. Here’s why:

- Faster Processing: With accurate information, payments can be processed promptly, reducing delays.

- Clear Communication: Complete contact details facilitate quicker and clearer communication.

- Avoiding Mistakes: Accurate records help avoid confusion and errors that may arise from missing or incorrect information.

- Legal Protection: In the case of disputes, having thorough records of the client’s details may be essential for resolving issues.

By ensuring that all relevant client information is correctly entered, you are laying the foundation for smoother transactions and a more professional business approach.

Including Payment Terms in Templates

Clearly outlining the terms of payment is essential for both parties in a professional transaction. Specifying when and how payments are due can help avoid misunderstandings and ensure a smooth financial exchange. By including these details in your documents, you set clear expectations and create a transparent process for payment processing.

Key Elements of Payment Terms

When defining payment terms, certain key elements should always be addressed to prevent confusion and ensure that both parties understand their responsibilities:

- Due Date: Clearly specify when payment is expected, whether it’s upon receipt or a set number of days after the service is completed.

- Late Fees: Include any penalties for late payments to encourage timely settlement of bills.

- Payment Methods: List the accepted forms of payment (e.g., credit card, bank transfer, cheque) to provide clarity for the client.

- Discounts for Early Payment: If applicable, mention any discounts available for early settlement of the bill.

- Installment Options: If payments can be made in installments, outline the schedule and amounts due.

Why Payment Terms Are Important

Including clear payment terms in your documents benefits both the service provider and the client:

- Preventing Delays: Having a clear due date and understanding of late fees helps motivate timely payment.

- Setting Expectations: Clear terms let the client know exactly what is required and when, eliminating confusion.

- Building Professionalism: Detailed terms reflect professionalism and transparency, which can enhance trust.

- Reducing Disputes: Well-defined payment expectations can minimize conflicts and help resolve any issues quickly.

By carefully detailing payment terms, you ensure a more efficient transaction process and avoid unnecessary complications down the line.

Choosing the Right Invoice Format

Selecting the appropriate structure for billing documents is crucial for ensuring clear communication and smooth financial transactions. The format should align with the specific needs of both the service provider and the client while maintaining professionalism. A well-organized billing document not only facilitates easy understanding but also enhances the efficiency of the payment process.

When deciding on the format, it’s essential to consider the level of detail needed, the complexity of the service provided, and the expectations of the recipient. Different billing formats may suit different types of transactions, ranging from simple services to more comprehensive projects.

Here are some factors to consider when choosing the right format:

- Clarity and Simplicity: The layout should be straightforward and easy to navigate, ensuring that all relevant details are easy to find.

- Detailing Costs: Ensure that the structure allows for clear breakdowns of services and associated costs, particularly for more complex jobs.

- Customization: Select a format that allows you to adjust or add details depending on the specific requirements of each job or client.

- Professional Appearance: The document format should reflect the business’s professionalism, potentially including branding, logos, and color schemes.

- Legibility: Make sure the text is readable and the layout is not cluttered, making it easy for clients to review the charges.

Choosing the correct structure for billing is an important step that can affect both the efficiency of your process and the client’s perception of your service.

Tracking Payments with Your Template

Effectively monitoring payments is an essential part of managing financial transactions. By incorporating a well-structured document system, you can easily keep track of payments, due dates, and any outstanding balances. This process ensures a smooth flow of operations and helps prevent any potential payment issues with clients.

To properly track payments, the structure should include designated fields for payment status, dates, amounts, and any notes about partial payments or pending actions. This way, you can quickly reference the payment history and remain organized throughout the transaction process.

Here are some key points to include in your document for payment tracking:

- Payment Status: Include a section to mark whether the payment has been made, is pending, or overdue.

- Payment Dates: Track the date when the payment is due and when it is actually made.

- Outstanding Balances: Keep track of any unpaid amounts that are still due from the client.

- Notes for Clients: Add fields for additional comments about payment arrangements, discounts, or payment plans.

- Payment Methods: Specify the payment method used, whether it’s a bank transfer, check, or another option.

By organizing payments in a clear and systematic way, you ensure smooth transactions and greater control over your financial records.

Understanding Tax Considerations in Invoices

When managing payments, understanding the role of taxes is crucial to ensure compliance with local regulations and avoid any legal issues. Different regions have specific tax rules that must be followed, which is why it’s essential to include the correct tax information on financial documents. This helps both businesses and clients maintain transparency and ensures that tax obligations are met accurately.

Tax details can vary based on the location, type of service or product provided, and whether or not the service is taxable. Below are the important aspects to consider when dealing with tax calculations and including them in your documents:

| Consideration | Details |

|---|---|

| Tax Rates | Make sure to apply the correct tax rate based on local regulations or jurisdictional requirements. This can include VAT, sales tax, or other applicable levies. |

| Tax Exemptions | Check if certain services or products are exempt from tax in your area. Include exemptions on the document if applicable. |

| Tax Identification Numbers | Some regions require businesses to display their tax identification numbers (TIN) on financial documents. Ensure this is included if required. |

| Payment and Reporting | Clearly state how taxes should be paid and how the tax is being reported to authorities. This ensures clarity for both parties involved. |

By addressing these factors, you not only comply with tax regulations but also avoid discrepancies or misunderstandings with clients. Including precise tax information in your documents can streamline the entire billing process and foster trust between you and your customers.

Best Practices for Sending Invoices

Sending accurate and professional financial documents is crucial for maintaining a good relationship with your clients. Ensuring that these documents are delivered in a timely and efficient manner not only improves cash flow but also reflects positively on your business practices. Here are some best practices to follow when submitting these important documents:

1. Ensure Accuracy

Before sending any document, double-check the details to ensure accuracy. Mistakes in pricing, service descriptions, or dates can lead to confusion and delays in payment. Verify that:

- The correct client information is included.

- All services or goods are listed clearly with appropriate pricing.

- The payment terms are outlined properly.

2. Choose the Right Delivery Method

Choosing the correct delivery method can make a significant impact on the timeliness and effectiveness of your communication. Some of the most common methods include:

- Email: Fast and efficient for most clients, especially when using digital formats.

- Mail: Physical copies may be preferred for certain clients or in specific industries.

- Online Payment Platforms: Some platforms provide automatic generation and sending of payment requests directly to clients.

3. Set Clear Payment Deadlines

Clearly communicate the due date for payment, as well as any potential late fees or penalties. Including these terms reduces the likelihood of delays and encourages prompt payments.

4. Follow Up If Necessary

If a payment hasn’t been received by the due date, follow up with a polite reminder. Keeping communication respectful and professional ensures that your client feels valued while you secure the payment you’re owed.

5. Maintain Records

Keep a record of all the financial documents sent and received. This helps in managing your cash flow and provides documentation in case of disputes or audits.

By following these best practices, you can streamline the payment process, ensure timely payments, and maintain positive client relationships.

Free vs Paid Template Options

When creating financial documents for your business, there are various options available, including both free and paid solutions. Each type offers its own set of features, and understanding the differences can help you choose the best option for your needs. Below, we explore the key distinctions between free and paid solutions for creating professional financial records.

Free Options

Free solutions often provide basic functionality, making them an appealing choice for individuals or small businesses with minimal needs. While these options can be sufficient for straightforward transactions, there are certain limitations to consider:

- Limited Features: Free versions might not offer advanced customization or additional functionalities, such as tax calculations or branding options.

- Standard Designs: Templates may have generic layouts that lack uniqueness, which can make your documents appear less professional.

- Potential Ads: Some free platforms may display ads, which can detract from the professionalism of your document.

- Restricted Support: Free services might not offer customer support, leaving you on your own if issues arise.

Paid Options

Paid options, on the other hand, generally offer more advanced features and greater flexibility. These solutions are ideal for businesses that require more control and customization in their financial documents. Some benefits include:

- Advanced Customization: Paid services often allow you to personalize the design, include logos, and tailor the layout to better fit your brand identity.

- Extra Functionalities: Many paid options include automated tax calculations, payment tracking, and integration with other financial tools, making them more efficient.

- Priority Support: With paid services, you’ll typically have access to customer support, ensuring any issues are resolved quickly.

- Ad-Free Experience: Paid solutions often provide a clean, ad-free interface, presenting a more professional appearance to clients.

Ultimately, the choice between free and paid solutions depends on your specific requirements. If you need something quick and simple, free options may suffice. However, for businesses looking for enhanced features and customization, a paid service is often worth the investment.

How to Create a Consistent Brand Image

Establishing a cohesive and recognizable brand image is essential for building trust with your audience and standing out in a competitive market. A consistent brand identity not only makes your business more memorable but also communicates professionalism and reliability. This section explores key strategies for maintaining a unified image across all aspects of your business.

1. Define Your Brand’s Core Elements

Before you can create a consistent brand image, you must define the core elements that make up your brand identity. These elements serve as the foundation for all your communications and designs.

- Logo: A strong, memorable logo is crucial. It should represent your brand’s values and be versatile enough to work across various media.

- Color Palette: Choose a set of colors that reflect your brand’s personality and stick to them across all materials. Consistency in color helps reinforce your brand’s visual identity.

- Typography: Select fonts that align with your brand’s tone and ensure they are easy to read. Use the same fonts for all written materials to maintain consistency.

2. Maintain Consistency in Communication

Once you’ve defined your brand’s core elements, it’s important to maintain consistency in how you communicate with your audience. This includes both visual and written content.

- Voice and Tone: Decide on the tone of voice you will use in all your communications. Whether formal, friendly, or casual, ensure your messaging is consistent across platforms.

- Imagery: The images you use should reflect the same style and values as your brand. This applies to photos, illustrations, and graphics.

- Brand Guidelines: Creating a set of brand guidelines can help ensure that everyone in your team, or anyone working on your behalf, stays aligned with your brand image.

By defining your brand’s core elements and maintaining consistency in how you communicate, you create a strong, unified image that resonates with your audience and strengthens your business’s identity.

Legal Requirements for Home Staging Invoices

When providing services, it’s important to ensure that all billing documents comply with relevant legal standards. These documents not only serve as a formal request for payment but also protect both the service provider and the client in case of disputes. Understanding the legal requirements for creating and issuing such documents is essential for maintaining professionalism and avoiding potential legal issues.

Basic Information

For a billing document to be legally valid, certain details must be included. These typically consist of:

- Service Provider’s Information: Include your full name or business name, address, phone number, and email address.

- Client’s Information: Ensure that the client’s name or company name, address, and contact details are correctly noted.

- Document Number: Each billing document should have a unique reference number to help track payments and maintain proper records.

Tax Details

If applicable, the tax information must be accurately reflected. This includes the tax registration number and any relevant tax rates that apply to the services provided. Properly including taxes ensures transparency and legal compliance in financial transactions.

Payment Terms

It’s essential to clearly outline payment terms. Specify the due date, any late fees, and acceptable payment methods. These terms protect both parties by setting clear expectations for the transaction.

Adhering to these legal requirements helps create clear and professional documentation that safeguards both the service provider and the client, ensuring smooth financial transactions and compliance with relevant regulations.

Tips for Effective Invoice Management

Efficient management of billing documents is crucial for maintaining smooth cash flow and keeping track of financial transactions. By staying organized and implementing a few best practices, you can ensure that payments are processed on time, and potential issues are avoided. Here are some useful tips to improve your management process.

1. Keep Track of All Transactions

- Ensure every payment and transaction is documented and categorized correctly. Use accounting software or a digital system to manage records effortlessly.

- Maintain a log of sent documents, including the date, amount, and payment terms.

2. Set Clear Payment Terms

- Be specific about the due dates, payment methods, and any late fees in your billing documents. Clear terms prevent confusion and encourage timely payments.

- Consider offering incentives for early payments or flexible payment options to suit your clients’ needs.

3. Automate Your Billing Process

- Automating your billing system can save you time and reduce human error. Use invoicing software that sends reminders and tracks overdue payments.

- Consider setting up recurring payments for regular clients to streamline the process.

4. Stay Consistent

- Consistency in format and communication will help create a professional image. Stick to a clear and easy-to-read design for all billing documents.

- Ensure you follow the same process for every transaction, regardless of the client size, to maintain organization.

By following these practices, you can improve the efficiency of your financial processes, reduce administrative burdens, and maintain better relationships with clients by ensuring smooth and timely payments.