Free Electrical Invoice Template for Easy and Professional Billing

Managing payments efficiently is a key aspect of running any service-based business. Having a well-organized system for issuing bills ensures you get paid on time and maintains professionalism with your clients. One of the easiest ways to enhance your billing process is by using a structured document that allows you to quickly input necessary details, reducing errors and saving valuable time.

By using ready-made forms, you can avoid the hassle of creating billing documents from scratch. These pre-designed formats not only offer simplicity and convenience but also help maintain consistency across all transactions. Whether you’re just starting out or looking for a better way to handle finances, this solution can make the entire process more efficient and less stressful.

In this article, we explore the benefits of using customizable billing forms, how they can improve your workflow, and where to find the best options to suit your needs. With the right tools, managing payments becomes a seamless task that allows you to focus more on growing your business.

Free Electrical Invoice Template for Your Business

Running a business requires efficient methods for tracking payments and billing clients. One of the easiest ways to maintain a professional appearance and ensure you get paid on time is by using a pre-designed document that clearly outlines the details of each transaction. These ready-made forms allow you to input essential information quickly and accurately, streamlining the entire process and reducing potential errors.

For small businesses, contractors, and service providers, having access to professional billing documents can make a huge difference. Not only does it save time, but it also enhances the credibility of your business. Instead of spending time creating a custom document for each client, you can use a pre-made solution that fits your needs.

Why You Should Use Pre-Designed Billing Forms

- Time Efficiency: You no longer have to start from scratch with each transaction.

- Professional Appearance: Ready-made documents look polished and enhance your reputation.

- Customizable: Tailor the form to suit your specific services and client requirements.

- Easy to Use: Fill in the details quickly without worrying about formatting or layout.

- Cost-Effective: No need to invest in expensive software or hire professionals for document creation.

How to Choose the Right Billing Document for Your Business

When selecting a form for your business, consider the following features to ensure it meets your specific needs:

- Clarity: Make sure the document is clear and easy to read, with spaces for all relevant details such as service description, costs, and payment terms.

- Customization: Choose a form that allows you to add your company logo, contact details, and other personalized information.

- Compatibility: Check if the form is easily compatible with your preferred software, whether it’s Excel, Word, or a PDF format.

- Legal Compliance: Ensure the form includes necessary legal language or disclaimers, such as payment terms or tax information, depending on your location.

Using the right tools not only saves you time but also helps you project a professional image to your clients, which is crucial for building long-term business relationships. With a pre-made solution, you can focus on what matters most – growing your business and providing quality services.

Why Use an Electrical Invoice Template

In any service-oriented business, having a consistent and professional way to bill clients is essential. Using a structured document to outline charges, services provided, and payment terms ensures that both parties are clear about expectations. A well-designed document not only saves time but also strengthens your business’s credibility, making transactions smoother and reducing misunderstandings.

For small businesses, contractors, and freelancers, relying on pre-designed forms is a smart choice. These documents help eliminate the need for manual creation of billing records, which can lead to errors or inconsistencies. With a ready-made solution, you can focus on your work while ensuring that every transaction is documented properly.

Key Advantages of Using Pre-Made Billing Forms

- Consistency: Using the same format for all your bills promotes a professional image and keeps your records organized.

- Time-Saving: Instead of starting from scratch, you can quickly fill in the necessary details, speeding up the billing process.

- Accuracy: Standardized forms help reduce mistakes, such as missing information or incorrect calculations.

- Customization: Most pre-designed options allow you to tailor the document with your logo, business details, and other custom information.

How Pre-Designed Billing Documents Can Improve Workflow

By using a structured form, you streamline the administrative side of your business. This not only makes it easier to track payments but also helps you maintain a more organized financial system. Clients will appreciate the clear and professional format, which can lead to faster payments and fewer disputes over charges.

With a template, you can avoid the stress of having to create new bills for every project. Simply fill in the details, print or send the document electronically, and you’re done. This efficiency is particularly beneficial when dealing with multiple clients or larger projects, where time is valuable.

How to Create an Electrical Invoice

Creating a professional billing document for your services is a crucial step in managing your business finances. A well-constructed record not only ensures clarity between you and your clients but also helps maintain accurate financial tracking. The process of generating a billing document is straightforward and involves including specific details that outline the transaction, ensuring both parties are on the same page.

Whether you’re just starting your business or looking to improve your billing process, understanding how to create a polished, clear document is essential. With the right information and a clear format, you can create a document that both reflects your professionalism and helps streamline your payment process.

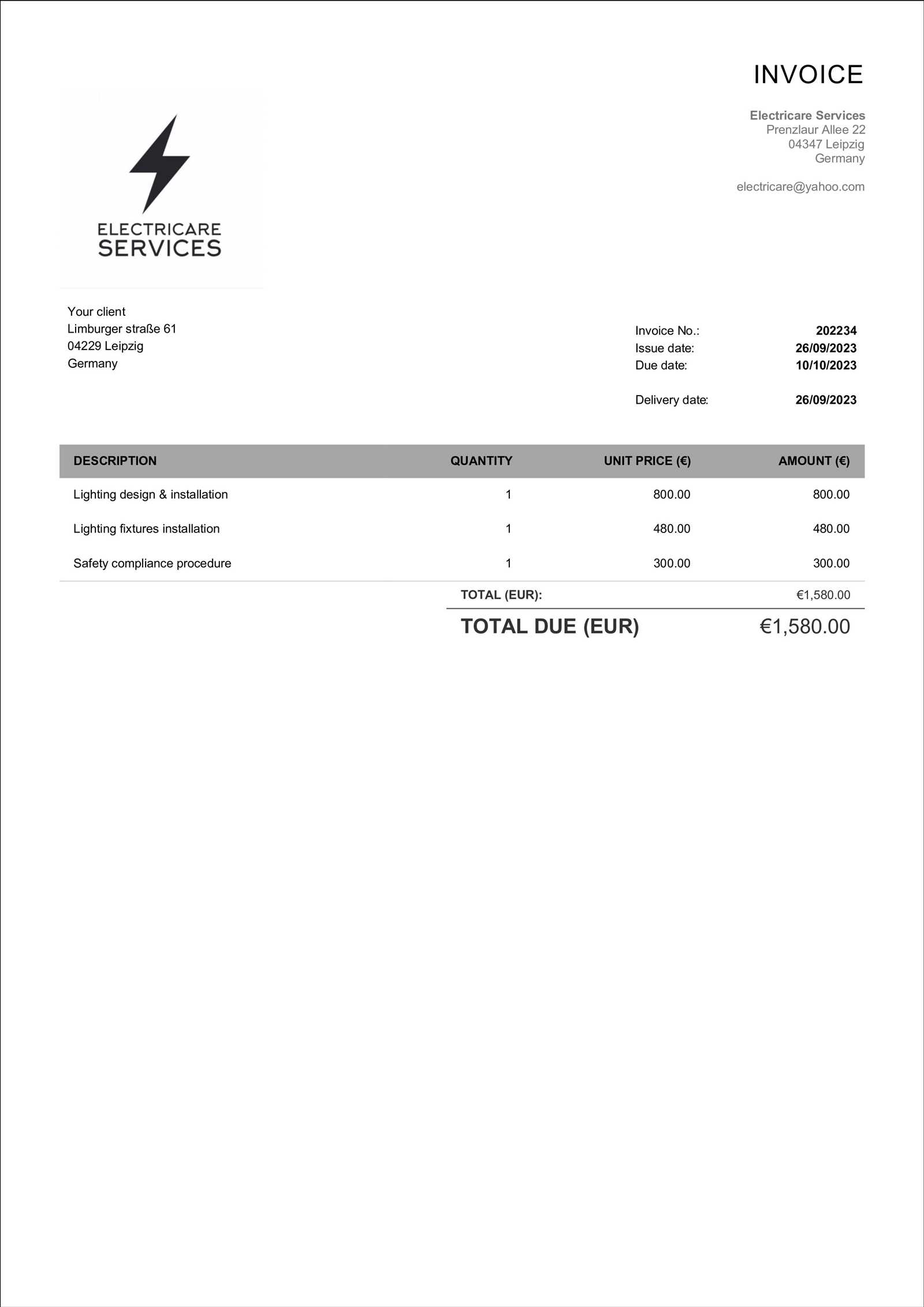

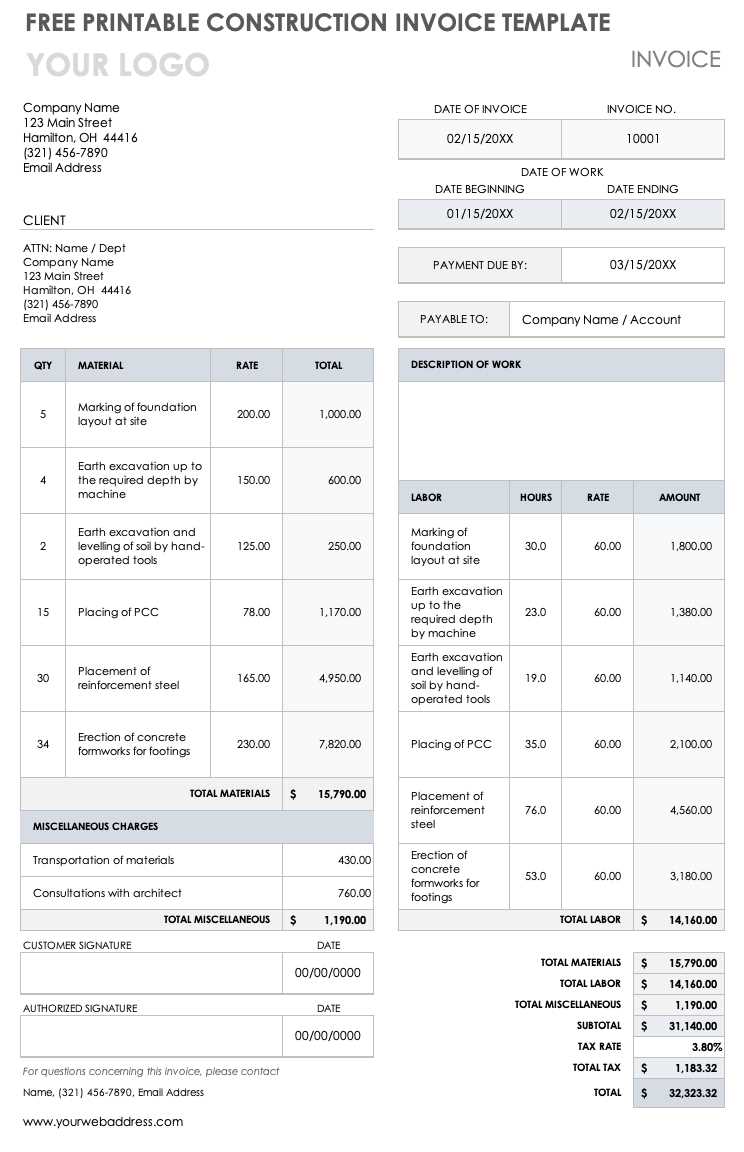

Step-by-Step Guide to Creating a Billing Document

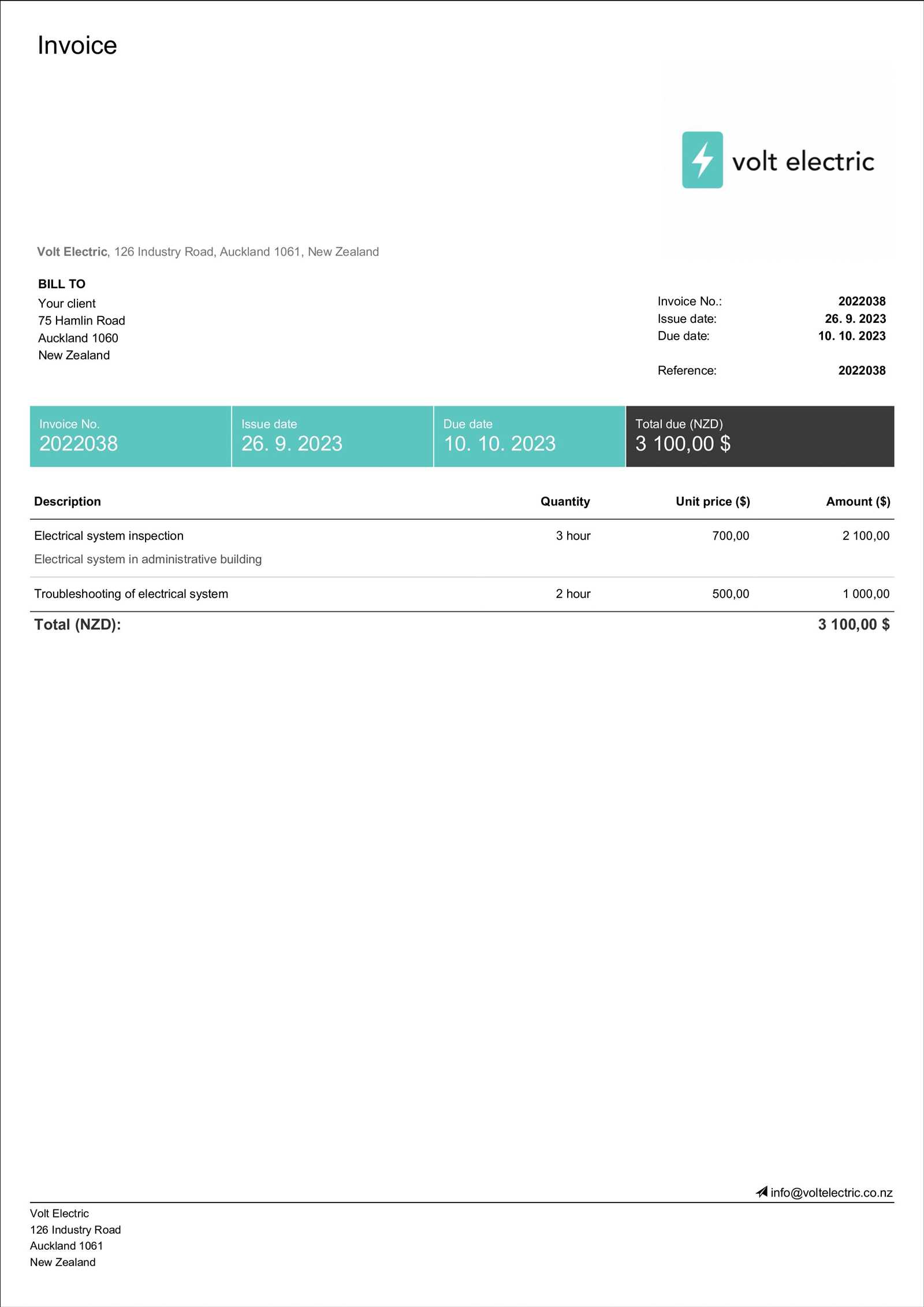

- Include Your Business Information: Start by adding your company name, address, and contact details at the top of the document. This makes it clear who the bill is coming from and gives the client an easy way to contact you if needed.

- Add Client Details: Beneath your own information, include the client’s name, address, and contact information. This ensures that the document is correctly associated with the right customer.

- Describe the Services Provided: Clearly outline the work that was completed or the products delivered. Be specific about the tasks and include dates or times of service to avoid confusion.

- Breakdown of Charges: Provide a detailed list of charges, including rates and quantities. If there are any discounts or additional fees, be sure to mention them to keep everything transparent.

- State Payment Terms: Indicate when the payment is due, whether it’s upon receipt or within a set number of days. Also, mention any penalties for late payments, if applicable.

- Include Your Payment Information: Make it easy for your client to pay by providing relevant payment methods or account details, such as bank information or PayPal instructions.

Additional Tips for Professional Documents

- Formatting: Keep the layout simple and clean, with clear headings and sections to help guide the reader through the document.

- Legibility: Use a readable font size and avoid clutter. Ensure all the key details are easy to find.

- Double-Check for Accuracy: Before sending, carefully review all information to avoid mistakes that could cause confusion or delay payments.

By following these steps, you can create a comprehensive and prof

Benefits of Using Free Invoice Templates

Using pre-designed billing forms offers numerous advantages, especially for small businesses and independent contractors. These ready-made solutions help streamline the entire process of requesting payment, saving time and reducing the likelihood of errors. By utilizing these tools, you ensure that each transaction is documented professionally and consistently, enhancing the overall experience for both you and your clients.

Not only do these forms simplify the task of creating payment requests, but they also provide a cost-effective solution for businesses that may not have the resources to invest in expensive software or hire professionals. The ability to customize these documents ensures they fit your specific needs while maintaining a professional appearance.

Key Benefits of Using Pre-Designed Billing Forms

- Time-Saving: With a structured format already in place, you can focus on entering the necessary details instead of creating a document from scratch.

- Consistency: Using the same layout for all transactions creates a consistent and professional image for your business.

- Cost-Effective: No need for expensive accounting tools or software; these pre-designed forms are often available at no cost, providing a budget-friendly alternative.

- Easy Customization: Personalize the document with your company logo, branding, and specific service details to reflect your business identity.

How Pre-Designed Billing Forms Help Maintain Professionalism

With a polished, easy-to-understand layout, these documents contribute to a more professional image, making clients more likely to pay on time. A well-organized request for payment ensures that clients know exactly what they are being charged for and how to proceed with payment. This clarity reduces disputes and fosters trust, which can lead to better client relationships in the long run.

Using these tools is a simple yet effective way to maintain smooth financial operations while avoiding unnecessary administrative challenges. Whether you’re a freelancer, contractor, or small business owner, the benefits of using ready-made forms far outweigh the effort of creating custom documents for each transaction.

Essential Elements of an Electrical Invoice

Creating a comprehensive and accurate billing document requires attention to detail and the inclusion of specific information that helps both you and your client understand the terms of the transaction. A well-structured payment request should cover key elements that ensure clarity, prevent misunderstandings, and facilitate a smooth payment process. These elements are essential for maintaining professionalism and organization in your financial operations.

Below are the core components that should be included in every payment document to ensure it is clear, complete, and legally sound:

| Element | Description |

|---|---|

| Business Information | Include your company name, address, phone number, and email. This helps clients know exactly who is billing them and how to get in touch if needed. |

| Client Information | Provide the client’s name, address, and contact details. This ensures that the document is directed to the correct recipient. |

| Unique Reference Number | Assign a unique identifier for each transaction. This helps you track invoices and can prevent confusion in case of disputes or questions. |

| Service Description | Clearly outline the work completed or products delivered. Be specific about the tasks, dates, and quantities involved. |

| Cost Breakdown | List the individual charges, including unit prices and totals. If applicable, break down labor, materials, and additional fees. |

| Payment Terms | Include the payment due date, late fees, and any other conditions, such as a discount for early payment or interest charges for overdue payments. |

| Payment Methods | Provide instructions on how clients can pay. This could include bank details, PayPal information, or a link for online payments. |

By ensuring that all these key elements are present in your billing documents, you create a clear, professional, and legally compliant payment request that both you and your client can rely on. This will help you maintain accurate financial records and reduce any potential pay

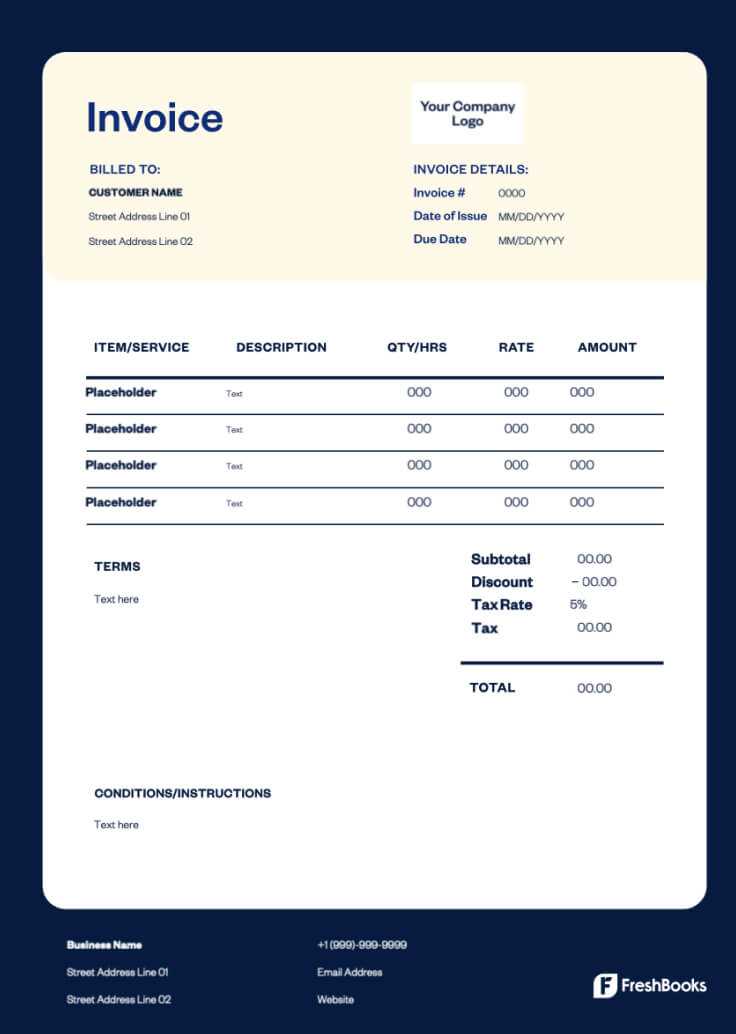

Customize Your Electrical Invoice Template

Tailoring your billing documents to reflect your business identity and specific needs is a key part of maintaining professionalism and ensuring accuracy. Customizing your payment requests not only makes them more recognizable to clients but also helps streamline the process of managing finances. With the right adjustments, you can create a document that works perfectly for your services, while reinforcing your brand.

There are several ways to personalize your billing documents to better suit your business. Below are some important aspects to consider when customizing your forms:

Key Areas to Customize Your Billing Document

- Business Branding: Add your company logo, color scheme, and font style to create a consistent brand image. This helps clients immediately recognize your business and adds a professional touch.

- Service Details: Adjust the descriptions of services or products to match what you offer. If your services vary from project to project, make sure to have sections where you can easily modify the specific work provided.

- Payment Information: Include your preferred payment methods, such as bank transfer details, PayPal link, or any other online payment options. Customizing this section makes it easier for clients to pay on time.

- Tax Information: Depending on your location, you may need to include specific tax details. Make sure your documents are updated with the correct tax rates and legal requirements for your area.

- Due Dates and Late Fees: Tailor the payment terms to reflect your standard practices, such as payment due dates, late fees, or early payment discounts. Make these terms clear to avoid confusion.

Benefits of Customization

- Professional Appearance: A customized form helps reinforce your brand and provides a polished, consistent image to your clients.

- Increased Efficiency: By creating a billing document tailored to your business, you reduce the time spent adjusting it for each transaction, allowing you to quickly send payment requests.

- Better Client Communication: With clear, customized sections that match your service offerings, clients will easily understand what they’re being billed for, which reduces the chance of misunderstandings.

Customizing your payment documents ensures that they align with your business model and client expectations. It makes the entire process more efficient and helps establish trust with clients by presenting them with well-organized, professional paperwork every time.

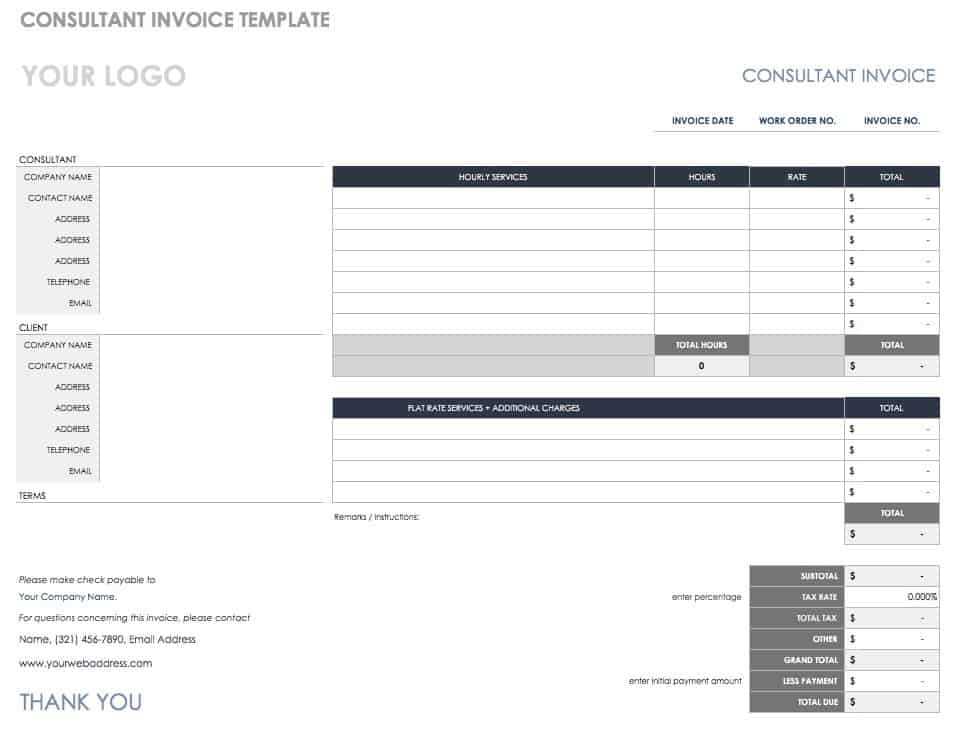

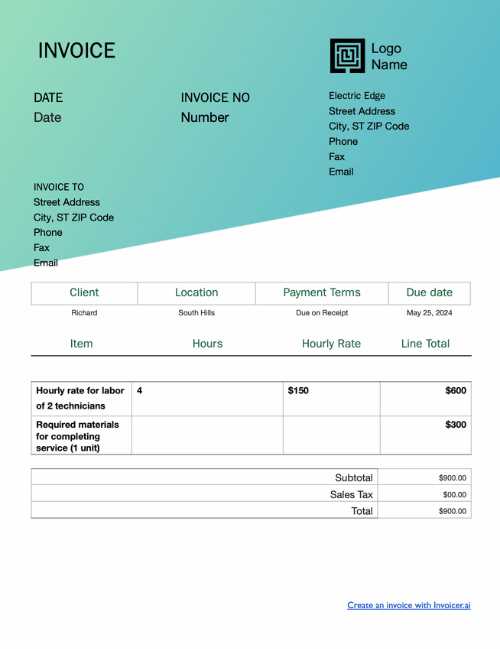

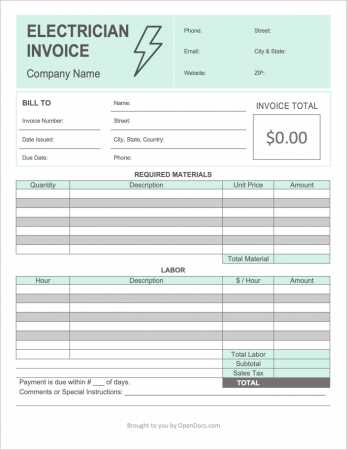

Top Features of Electrical Invoice Templates

When selecting a pre-designed form for billing clients, it’s essential to understand the features that make a payment document both functional and professional. A well-constructed document will not only help ensure clarity but also streamline the entire billing process. Key features enhance its usability, improve organization, and contribute to a seamless experience for both businesses and clients.

Below are the top features that should be present in a billing document to make it effective and efficient for everyday use:

Essential Features to Look For

- Clear Layout: A well-organized format with clearly labeled sections, making it easy to fill in necessary details and for clients to understand the charges.

- Customizable Fields: Fields that allow you to easily adjust information like client name, service description, or pricing based on each transaction.

- Professional Design: A visually appealing design that includes your company logo, brand colors, and an overall polished look that projects professionalism.

- Tax and Discount Calculations: Built-in fields for applying tax rates or discounts, ensuring accuracy in the final amount billed to the client.

- Due Date and Payment Terms: Space to clearly specify payment terms, including due dates, penalties for late payments, and any other financial conditions you may have.

Additional Useful Features

- Automatic Calculations: A template that includes formulas for automatic calculations of totals, taxes, and discounts, reducing the chances of human error.

- Itemized List: A section for breaking down the charges by service, product, or hourly rate, giving clients a transparent view of how their bill is structured.

- Multiple Payment Options: Fields where you can specify various payment methods like bank transfer, PayPal, or credit card, making it easier for clients to pay.

- Invoice Numbering System: A built-in feature that generates a unique reference number for each transaction, helping you keep organized records of all payments.

These features help you maintain accuracy, streamline administrative tasks, and create a professional experience for your clients. By choosing a form that incorporates these elements, you ensure that the billing process runs smoothly and efficiently, freeing up more time to focus on growing your business.

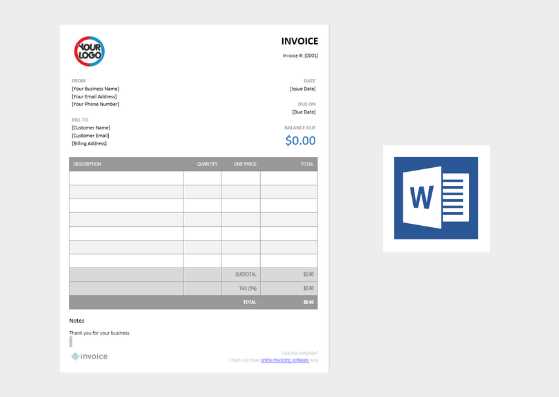

Where to Find Free Invoice Templates

Finding the right tools to manage your billing process is easier than ever. With many online platforms offering ready-made solutions, you can access professional, customizable billing forms at no cost. These forms can be easily adapted to suit your specific business needs, saving you time and ensuring that you maintain a high standard of professionalism in your transactions.

There are numerous places online where you can download or access these documents. Whether you are looking for simple, straightforward formats or more complex options with advanced features, the internet has a wide variety of resources to choose from. Here are some of the best places to look:

- Business Software Websites: Many business management platforms offer downloadable forms for invoicing, often as part of their free resources or starter packages. These sites typically provide a range of options, from basic documents to more advanced, customizable versions.

- Document Creation Platforms: Websites that specialize in document creation, like Google Docs or Microsoft Office, often feature free templates that can be easily downloaded and modified. These are convenient if you already use these platforms for other business tasks.

- Online Marketplaces: Websites like Etsy or other online marketplaces sometimes offer free or low-cost downloadable files created by independent designers. You can often find templates specifically designed for your industry.

- Accounting Websites: Several accounting or finance-focused websites provide free access to forms for invoicing. These resources may include added features, such as tax calculations or integrated payment gateways, that can make billing even easier.

- Business Blogs and Forums: Many business-related blogs and forums offer downloadable billing documents for free as part of their educational content. These resources are particularly useful for small businesses and freelancers.

Regardless of where you choose to look, the key is to ensure that the form you download is customizable to your needs and meets the specific requirements of your industry or service type. With so many resources available online, finding the right form for your business has never been easier.

How to Save Time with Templates

One of the biggest challenges for small business owners and freelancers is managing time effectively while ensuring accuracy and professionalism in daily operations. Using pre-designed forms for billing can significantly reduce the amount of time spent on administrative tasks, allowing you to focus on growing your business or serving your clients. By utilizing a ready-made structure, you eliminate the need to create documents from scratch, streamlining the process and improving efficiency.

With a customizable document in hand, you can quickly adjust key details like client information, services provided, and costs, without worrying about formatting or missing important elements. This not only saves you time but also ensures consistency across all your transactions.

How Templates Help You Work Faster

- Pre-Formatted Layout: The design is already set, so you don’t need to spend time adjusting margins, fonts, or headings. This allows you to focus on adding the necessary information and finalizing the document.

- Reusable Structure: Once you have a template set up, you can reuse it for every client, drastically reducing the time spent on creating new documents for each project or transaction.

- Quick Customization: With fillable fields for specific details like pricing or services, you can quickly input the relevant information without having to reformat or reorganize the entire document.

- Automated Calculations: Many forms come with built-in formulas to automatically calculate totals, taxes, and discounts, ensuring accurate billing while saving time on manual calculations.

The Impact on Your Workflow

Using pre-designed forms for your financial documentation streamlines the billing process, reducing administrative burden and minimizing errors. This allows you to send requests for payment faster, helping to improve cash flow and client satisfaction. Over time, the time saved on repetitive tasks adds up, contributing to overall business efficiency and growth.

By adopting these ready-made solutions, you free up valuable time that can be spent on more important tasks, such as working with clients or developing new products. The time-saving benefits of using pre-designed forms extend beyond just invoicing and can be applied to other areas of your business, helping you stay organized and focused.

Best Practices for Electrical Invoicing

Creating clear, accurate, and timely billing documents is essential for maintaining a smooth cash flow and healthy client relationships. Adhering to best practices in this area ensures that your requests for payment are professional, transparent, and easy to understand. Following these guidelines can help avoid confusion, minimize delays, and improve overall business efficiency.

To ensure that your billing process is effective, there are several key practices that you should follow when generating requests for payment. These practices not only help improve client trust but also streamline your financial processes, making them more organized and less prone to errors.

Key Practices to Follow

- Be Clear and Detailed: Always provide a comprehensive breakdown of the work completed, including services provided, dates, and costs. This reduces the likelihood of disputes or misunderstandings and provides clients with clarity on what they’re being billed for.

- Use Professional Language: Ensure your document is written in a professional tone and that all information is precise. Avoid any vague descriptions that might confuse your client.

- Set Clear Payment Terms: Clearly state payment due dates, accepted payment methods, and any late fees or discounts for early payment. This sets expectations from the outset and helps prevent payment delays.

- Include Unique Reference Numbers: Assign a unique identifier to each billing document. This makes it easier for both you and the client to reference specific transactions and helps you stay organized for future audits or record-keeping.

- Proofread Before Sending: Always double-check for any errors in your documents before sending them out. This includes checking client information, prices, and any tax rates that might apply.

By following these best practices, you’ll ensure that your payment requests are clear, professional, and effective in securing prompt payments from your clients. With consistent, high-quality documentation, you’ll foster stronger relationships with your clients while streamlining your business operations.

Tips for Professional Invoice Design

A well-designed payment request not only ensures that your clients can easily understand the details of the charges, but it also creates a strong, professional impression of your business. The right design can set the tone for the entire transaction, helping clients trust your professionalism and encouraging timely payments. When creating a payment document, it’s important to focus on clarity, aesthetics, and ease of use.

Here are some key design tips that will help you create a polished, professional-looking payment request every time:

Key Design Elements to Consider

- Consistent Branding: Use your company logo, colors, and fonts to maintain brand consistency across all your business documents. This helps reinforce your identity and creates a cohesive, professional look.

- Clear Layout: Ensure that all sections of the document are clearly separated and easy to navigate. Use headings, bullet points, and ample white space to create a clean, organized design that’s easy to read.

- Readable Font Choices: Choose a simple, legible font for the body text, such as Arial or Helvetica. Avoid overly decorative fonts that may make the document difficult to read.

- Logical Flow of Information: The details should be presented in a logical order, starting with your business information, followed by the client’s information, services provided, and then the payment details. This structure ensures clarity and makes it easy for the client to review the document.

- Highlight Important Information: Use bold text or colored accents to draw attention to key elements such as due dates, total amounts, and payment methods. This ensures that the client sees the most important information immediately.

Additional Design Tips

- Include a Payment Summary: A clear, concise summary of charges (including taxes, discounts, and totals) will help the client understand the full scope of what they’re paying for at a glance.

- Maintain a Professional Tone: Keep the language formal and polite, ensuring that your payment request is courteous yet firm. This reflects well on your business and sets the right tone for the transaction.

- Use High-Quality Formatting: Avoid cluttered or unaligned text. Consistent alignment, clean borders, and well-organized sections contribute to a polished, professional appearance.

By following these design tips, you’ll create a payment document that not only looks professional but also enhances the overall clie

How to Avoid Common Billing Mistakes

Billing errors can create unnecessary confusion, delays, and frustration for both you and your clients. Whether it’s incorrect charges, missing details, or unclear payment terms, mistakes in your payment documents can damage your professional reputation and delay payments. By being proactive and paying attention to the details, you can avoid these common issues and ensure a smooth, efficient billing process.

Here are some simple yet effective ways to prevent billing mistakes and keep your financial transactions running smoothly:

Essential Steps to Avoid Errors

- Double-Check Client Information: Ensure that the client’s name, address, and contact details are correct before sending the document. Errors in this basic information can cause delays and confusion, especially if your client has multiple addresses or departments.

- Verify Service Details: Always review the services or products listed on the document to ensure they match what was agreed upon with the client. Be specific in your descriptions to avoid ambiguity.

- Accurate Pricing: Double-check the rates, quantities, and totals to ensure the amounts billed are correct. An incorrect rate or an error in calculations can lead to disputes or delayed payments.

- Clear Payment Terms: Make sure your payment due date, methods, and any late fee terms are clearly outlined. Clients should know exactly when and how to pay, with no ambiguity about penalties or discounts.

- Include Correct Tax Information: Ensure that the applicable tax rates are correctly calculated and added to the total. Incorrect or missing tax information can cause legal issues or result in clients rejecting the document.

Additional Tips to Minimize Mistakes

- Use Built-in Calculations: Many modern tools and forms come with automatic calculation features. Take advantage of these to reduce the risk of human error in your totals, taxes, and discounts.

- Consistent Format: Use a consistent format for all your payment requests. A familiar layout helps prevent mistakes by making it easier to spot errors or missing information.

- Review Before Sending: Always take the time to carefully proofread the document before sending it to the client. A quick review can catch simple mistakes that may have been overlooked during the initial creation process.

By following these steps, you can ensure that your billing process is error-free, which helps build trust with clients and ensures timely payments. A mistak

Streamline Your Billing Process with Templates

Efficient billing is crucial for maintaining smooth cash flow and ensuring that your business operations run seamlessly. Using ready-made documents designed for billing allows you to save time, reduce errors, and focus more on serving your clients. By adopting a standardized structure for all your payment requests, you eliminate the need for creating new documents from scratch each time, making the entire process more efficient and organized.

With the right structure in place, your billing process becomes faster and more reliable. Ready-to-use forms can be easily customized to fit each specific transaction, yet maintain consistency in format and content. This not only saves time but also enhances your professional image and helps you stay organized.

How Ready-Made Forms Help

- Consistency and Accuracy: Pre-designed forms ensure that every document you send out follows the same format and includes all necessary information. This reduces the chance of errors and ensures that clients receive the same level of professionalism with each bill.

- Faster Turnaround: Templates allow you to quickly input the details of each transaction, from client information to services provided, without spending time formatting or worrying about layout. This significantly speeds up the process of generating a payment request.

- Easy Customization: Most pre-designed documents offer editable fields that allow you to easily tailor each one to the specific needs of the transaction. Whether it’s adjusting prices, adding new services, or changing terms, these forms can be adapted quickly without much effort.

Streamlining Your Workflow

By incorporating ready-made forms into your workflow, you simplify your administrative tasks and reduce the time spent on each billing cycle. These forms can also be integrated into accounting software or other business management tools, further automating the process and freeing up time for more important tasks.

Ultimately, using these tools not only saves you time but also enhances your client experience by ensuring clear, accurate, and timely requests for payment. Whether you’re a freelancer or running a small business, streamlining your billing process with standardized forms can contribute to smoother operations and better financial management.

What to Include in Your Billing Document

To ensure that your payment requests are clear, professional, and legally sound, it’s important to include all the necessary information in your documents. A well-structured request for payment provides your client with everything they need to understand the charges, know when and how to pay, and avoid any confusion. Each element should be carefully considered to ensure accuracy and completeness.

Here are the essential components that should always be included in your payment document:

Key Information to Include

- Your Business Details: Include your company name, address, phone number, and email address. This ensures that your client can easily contact you if needed.

- Client Information: Make sure to list your client’s full name or business name, along with their contact details and billing address. Accurate client information is essential for clear communication and for record-keeping purposes.

- Document Number: Each billing document should have a unique identifier, such as an invoice or reference number. This helps both you and your client keep track of specific transactions.

- Date of Issue: Always include the date when the payment request was issued. This provides a reference point for both parties and ensures transparency regarding payment terms.

- Due Date: Clearly specify the payment due date. This helps set expectations and can prevent delays or misunderstandings regarding when payment should be made.

- Description of Services or Products: Provide a detailed list of the work done or products supplied. This section should be as clear and specific as possible to avoid confusion. Include dates, quantities, unit prices, and any additional information that clarifies the charges.

- Amount Due: List the total amount to be paid, including a breakdown of individual charges, taxes, and discounts if applicable. A clear and transparent pricing structure helps clients understand exactly what they’re paying for.

- Payment Terms: Clearly outline the accepted payment methods (e.g., bank transfer, credit card, PayPal) and any applicable terms, such as late fees or early payment discounts.

Additional Considerations

- Tax Information: If applicable, include any relevant tax information, such as sales tax or VAT, along with the tax rate and the total tax amount. This is important for legal and accounting purposes.

- Notes or Terms: If there are any special terms, conditions, or additional notes (such as warranty details or return policies), include them at the bottom of the document to avoid any confusion later on.

By including all of these key elements in your payment reques

Why Free Templates Are Ideal for Startups

For startups, managing finances and maintaining a professional image can be challenging, especially when resources are limited. One of the best ways to ensure smooth operations while keeping costs low is by using pre-designed documents for your billing and payment processes. These ready-made forms help startups streamline administrative tasks, save time, and avoid costly mistakes, all while maintaining a high level of professionalism.

For emerging businesses, every penny counts. Using pre-made documents designed for financial transactions helps you avoid unnecessary expenses while ensuring that your business can focus on growth. Below are the key reasons why these forms are ideal for new businesses.

Benefits for Startups

- Cost-Effective: Startups often have tight budgets, and spending money on custom-designed billing solutions can be a luxury they can’t afford. Pre-designed documents are available at no cost, helping reduce overhead costs without sacrificing quality.

- Time-Saving: Instead of spending time creating billing documents from scratch, startups can use ready-made solutions that can be quickly customized. This saves valuable time that can be invested in core business activities, such as product development and marketing.

- Professional Appearance: High-quality pre-designed documents give a polished, professional look to your transactions. This helps build credibility with clients and partners, which is especially important for businesses trying to establish themselves in a competitive market.

- Easy to Customize: Ready-made forms can be quickly tailored to meet the specific needs of each transaction. Whether it’s adjusting the services listed or changing payment terms, the flexibility of these documents allows startups to maintain efficiency while adapting to unique client requirements.

How Pre-Designed Forms Help in Scaling

As startups grow, the administrative workload often increases. Having a set of standardized forms in place makes it easier to scale operations. With consistent, easy-to-edit documents, businesses can ensure that the billing process remains smooth and error-free, even as the number of clients and transactions increases. This consistency also helps maintain professional standards as the company evolves.

For startups looking to manage their finances effectively and efficiently, utilizing pre-made forms is a smart solution that enables them to focus on growing their business without the extra financial burden or time commitment.