Unpaid Invoice Letter Template to Request Outstanding Payments

When it comes to running a business, managing finances and maintaining cash flow are essential for long-term success. One of the most common challenges faced by business owners is receiving payments on time. Late payments can create unnecessary strain on your operations, making it crucial to address overdue accounts in a timely and professional manner.

One of the most effective ways to request overdue payments is by sending a well-crafted notice. This communication serves as a reminder to clients or customers about outstanding balances while maintaining a positive business relationship. It’s important to strike the right tone–firm, yet polite–to ensure that your request is taken seriously without causing any friction.

In this guide, we’ll explore how to structure a clear, respectful, and professional message that encourages prompt payment. Whether you are sending your first reminder or following up multiple times, knowing how to approach this situation is key to ensuring that your business remains financially healthy.

Unpaid Invoice Letter Template Overview

Effective communication with clients regarding overdue payments is an essential part of maintaining a steady cash flow. A well-constructed reminder can prompt clients to settle their debts while preserving a professional relationship. The key to success in this process lies in crafting a message that is clear, polite, and to the point, ensuring that your request is understood and acted upon promptly.

In this section, we will explore the general structure and content of a reminder document designed to request outstanding payments. A properly written message should include essential details, such as the amount owed, the due date, and any previous attempts at communication. Additionally, it should convey the urgency of the matter without sounding overly aggressive or confrontational. By adhering to these principles, you can significantly increase the likelihood of receiving timely payments from your clients.

Why Sending Payment Reminders is Crucial

Managing overdue accounts is an integral part of running a successful business. When clients fail to pay on time, it can negatively affect your company’s cash flow and disrupt operations. Timely reminders are a necessary step to ensure that payments are collected promptly, reducing the risk of financial strain.

Sending a well-crafted reminder not only helps you recover funds but also reinforces your professionalism and commitment to business agreements. It serves as a clear signal to clients that you take financial responsibilities seriously. Moreover, regular follow-ups can prevent minor delays from escalating into larger payment issues, ultimately fostering a healthy business relationship based on mutual respect and trust.

Effective communication through payment reminders ensures that clients understand the importance of timely settlement. Without these reminders, payments may be forgotten, delayed, or ignored altogether, which can severely impact your bottom line. By proactively addressing overdue balances, you enhance the likelihood of getting paid on time and maintaining a smooth cash flow.

How to Structure an Unpaid Invoice Letter

When requesting payment for outstanding balances, the structure of your communication plays a key role in achieving a positive outcome. A well-organized message ensures clarity and helps the recipient understand the importance of settling the debt promptly. It’s essential to balance professionalism with firmness, ensuring that your tone conveys the urgency without being confrontational.

The first step is to start with a courteous greeting, establishing a respectful tone. Next, clearly state the purpose of your message by referencing the amount due, the original due date, and any previous communications. It’s important to remain concise while still including all necessary details. Offering a clear payment method and a deadline for payment completion should follow, providing a sense of urgency without overwhelming the client.

Always maintain a professional tone throughout, showing your willingness to resolve any potential issues that may have caused the delay. A closing statement should express gratitude for their attention to the matter, reinforcing a positive relationship despite the request for payment.

Key Elements of an Effective Reminder

Crafting a reminder for overdue payments requires attention to several important details. A well-written reminder should convey necessary information clearly, maintain professionalism, and encourage the recipient to act promptly. Including the right elements ensures that your message is both effective and respectful, making it more likely that you will receive payment without damaging your business relationships.

Clear Identification of the Debt

The first key element is to clearly identify the amount owed and the original payment terms. This information should be presented in a straightforward manner, ensuring that the recipient knows exactly what is expected of them. Mentioning the original due date and any previous communications helps to reinforce the importance of resolving the issue.

Polite Yet Firm Language

While it’s important to be firm about the urgency of the matter, the tone should always remain polite and professional. Using respectful language will help maintain a positive relationship with the client, even as you remind them of their financial obligation. An effective reminder strikes a balance between being assertive and courteous, motivating the recipient to take action without feeling offended or pressured.

By including these key elements–clear debt identification and a balanced tone–you will create a reminder that is both effective and respectful, increasing the likelihood of prompt payment.

Common Mistakes to Avoid in Letters

When sending a reminder about overdue payments, there are several common pitfalls that can diminish the effectiveness of your message. Mistakes in tone, structure, or content can lead to misunderstandings, create tension, or even result in delayed payments. Being aware of these errors is crucial to ensure that your communication remains professional and encourages the recipient to act promptly.

One common mistake is using overly harsh or aggressive language. While it’s important to convey the urgency of the situation, a confrontational tone can alienate the recipient and damage the business relationship. Another error is failing to include all the necessary details, such as the exact amount owed or the original due date. Lack of clarity can confuse the client and delay the resolution of the matter. Lastly, ignoring previous interactions can make the reminder seem impersonal and dismissive of the client’s circumstances, leading to a less favorable response.

By avoiding these mistakes, you can create a more effective reminder that is both professional and productive, ensuring that overdue payments are addressed in a timely manner.

Tips for Polite Yet Firm Communication

When requesting overdue payments, it’s important to strike a balance between being polite and firm. A respectful approach encourages cooperation, while a firm tone ensures that the urgency of the situation is understood. The key is to be clear and direct, without crossing the line into aggressiveness or frustration.

Start with a courteous greeting and use positive language throughout the message. Phrases such as “I hope this message finds you well” or “Thank you for your continued business” help maintain a professional and friendly tone. Next, clearly state the purpose of your communication, but avoid sounding accusatory. Instead of saying “You haven’t paid yet,” try, “I wanted to follow up on the outstanding balance.” This keeps the conversation constructive.

Be specific about the details of the payment, including the amount due and the original due date. This shows that you’re organized and helps avoid any confusion. Finally, emphasize the importance of prompt payment in a way that highlights the mutual benefit of maintaining a good working relationship. For example, “We would appreciate receiving the payment by [date] to continue providing you with the best service.” This reinforces the importance of the issue while preserving a tone of professionalism.

Legal Considerations When Writing a Letter

When requesting payment for overdue amounts, it is essential to be aware of legal aspects to ensure that your communication is compliant with relevant laws. A well-crafted reminder not only increases the chances of prompt payment but also minimizes the risk of legal disputes or claims of harassment. Understanding these key legal considerations can help you protect your business while maintaining a professional tone.

Adherence to Fair Debt Collection Practices

Compliance with debt collection regulations is a critical factor when crafting any message about outstanding payments. Many countries have strict laws that govern how businesses can contact clients regarding overdue balances. For example, the Fair Debt Collection Practices Act (FDCPA) in the U.S. limits the hours during which communication can occur and prohibits any form of abusive or misleading behavior. Always ensure your messages are respectful and do not cross into aggressive or threatening language, as this could expose your business to legal liability.

Clear Terms and Accurate Information

It’s important to provide accurate details in your request, such as the exact amount owed, the due date, and any previous attempts at communication. Misleading information or the omission of critical facts can not only damage your reputation but also lead to disputes that could escalate into legal action. Always double-check the information before sending any reminder to avoid any errors that might inadvertently affect the client’s position.

By understanding and applying these legal considerations, you can write payment reminders that are both effective and legally compliant, reducing the risk of conflicts while maintaining a strong professional reputation.

How to Personalize Your Invoice Reminder

Personalizing your reminder for overdue payments can significantly increase the chances of a positive response. A personalized approach shows the recipient that you value their business and are willing to engage in a way that acknowledges their specific situation. Customizing your message helps foster goodwill, making it more likely that the client will act promptly to settle their balance.

To personalize your message, start by addressing the recipient by name rather than using a generic greeting. This simple touch establishes a more personal connection and shows that the communication is tailored to them. Next, reference any previous interactions or agreements to remind them of your past business relationship. If possible, mention details such as the products or services provided, highlighting the value of what they have received and reinforcing the importance of completing the payment.

Another way to personalize your reminder is by being flexible with payment options. Offering alternatives, such as extended payment terms or installment plans, can make it easier for clients to pay and shows that you are willing to work with them. Finally, ensure your tone remains friendly and professional, expressing appreciation for their business and your confidence in a timely resolution.

When to Send a Second Invoice Reminder

Deciding when to send a follow-up message for an overdue payment can be crucial in maintaining a professional relationship with your client while ensuring that your cash flow remains stable. Timing is key–too soon, and you may come across as impatient; too late, and the client might forget about the debt or feel less urgency to pay. Understanding when to send a second reminder helps strike the right balance.

Factors to Consider Before Sending a Second Reminder

- Payment Terms: Consider the original terms you set. If your client had 30 days to pay, sending a second reminder a few days after the due date can be reasonable. However, if your terms were longer, wait until closer to the end of the grace period.

- Previous Communication: Reflect on how your first reminder was received. If you haven’t heard back or the client did not acknowledge the initial request, sending a follow-up may be necessary to remind them of their obligation.

- Client Relationship: If you have a long-term, positive relationship with the client, give them some leeway. On the other hand, if this is a recurring issue, it might be worth sending a second reminder sooner to emphasize the importance of adhering to agreed-upon payment terms.

Recommended Timing for a Follow-up

Typically, it’s best to send a second reminder after 7 to 10 days from the original due date. This gives the client enough time to process their payment or respond to any issues they might have had. If there is no response after the second message, it may be necessary to escalate the situation, either by contacting them directly or seeking legal advice, depending on your business’s policies.

In any case, ensure your second reminder maintains professionalism, is polite, and reaffirms the importance of settling the amount. A well-timed and respectful follow-up can help prevent further delays and maintain the business relationship intact.

Best Practices for Professional Tone

Maintaining a professional tone in your communication about overdue payments is essential to preserving client relationships and ensuring timely resolution. A professional tone encourages the recipient to address the issue promptly without feeling defensive or alienated. The way you word your message can significantly impact the response, so it’s important to strike the right balance between firmness and courtesy.

Key Elements of a Professional Tone

- Politeness and Respect: Always begin your communication with a courteous greeting and express appreciation for the client’s business. A respectful tone helps maintain goodwill and ensures that the recipient is more likely to respond positively.

- Clarity and Precision: Avoid ambiguity in your message. Be clear and specific about the amount due, the original due date, and any actions required from the recipient. This helps to avoid misunderstandings and makes it easier for the client to act swiftly.

- Neutrality and Avoiding Blame: Do not use accusatory language, even if the payment is overdue. Avoid phrases like “You didn’t pay on time” or “You failed to pay.” Instead, focus on facts, such as “Our records show that payment was due on [date].” This prevents the tone from becoming confrontational.

- Conciseness: Keep your message brief and to the point. A long or complicated message can overwhelm the recipient and may reduce the chances of a timely response.

- Positive Language: Frame the situation in a way that implies collaboration rather than confrontation. For example, instead of saying “You need to pay immediately,” try “We kindly request that the payment be made as soon as possible.”

By following these best practices, you ensure that your communication is professional, respectful, and effective. This increases the likelihood of a positive outcome while preserving the working relationship with your clients.

How to Address Disputes in Payment Letters

Disputes over overdue amounts are not uncommon, and how you handle these situations in your payment reminders can have a significant impact on resolving the issue. Addressing a dispute professionally and calmly is essential to maintaining good business relationships while ensuring that any disagreements are settled fairly and efficiently.

When a client disputes a payment, it’s important to acknowledge their concerns without making assumptions or being confrontational. The first step is to carefully review the situation and verify whether there was an error in your records or if the client has legitimate concerns. If there is a mistake on your part, it’s crucial to take responsibility and offer a resolution. On the other hand, if the dispute is based on misunderstandings, you should provide clear documentation and details to support your position.

Steps for Addressing Payment Disputes

- Acknowledge the Dispute: Begin by expressing understanding and willingness to discuss the matter. Use phrases like “I understand there may be concerns regarding the payment” or “We appreciate you bringing this to our attention.” This shows empathy and a desire to resolve the issue collaboratively.

- Provide Evidence: If the dispute arises from a misunderstanding, provide clear evidence such as contracts, previous communications, or proof of service delivery. This helps clarify your position and ensures transparency.

- Offer a Resolution: If there is a legitimate dispute, work with the client to find a reasonable resolution. Whether it’s adjusting the amount owed or agreeing on a payment plan, offering a solution demonstrates your commitment to fairness and client satisfaction.

- Maintain a Calm and Professional Tone: Even if the dispute feels frustrating, it’s important to remain calm and professional. Avoid escalating the situation with accusatory language. Instead, focus on finding common ground and resolving the issue amicably.

By addressing disputes effectively and professionally, you increase the chances of reaching a satisfactory resolution and preserving your client relationship. Clear communication, empathy, and fairness go a long way in resolving payment issues and avoiding future misunderstandings.

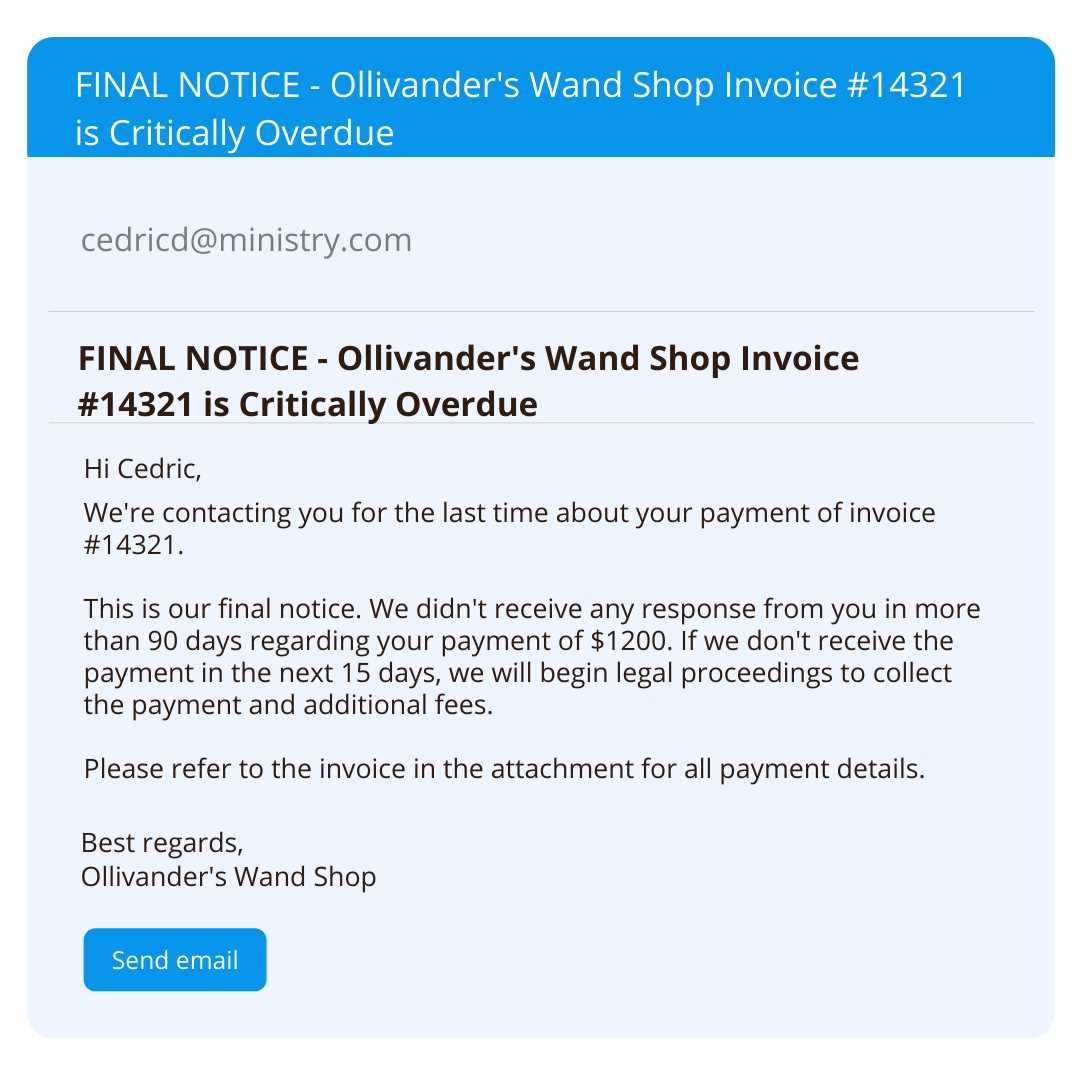

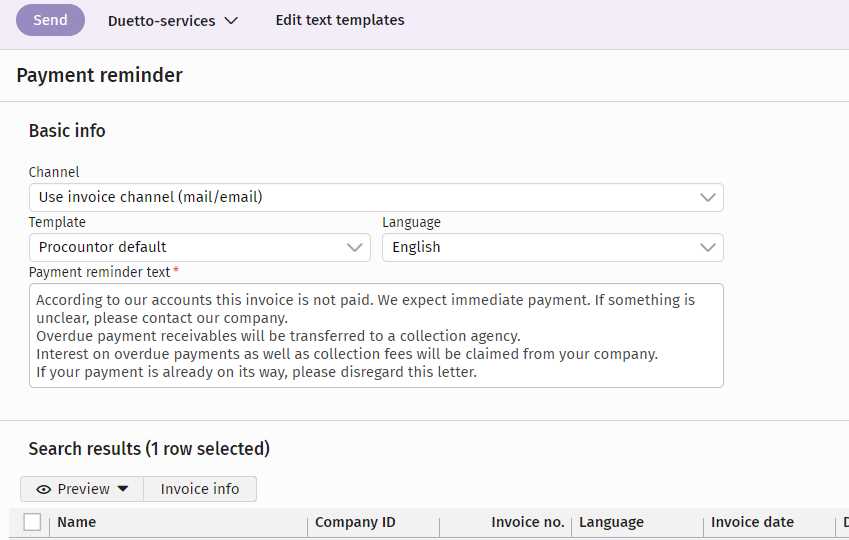

Automating Invoice Reminder Letters

Automating payment reminders can save your business valuable time while ensuring that overdue accounts are addressed consistently and promptly. By setting up automated systems, you can reduce the need for manual follow-ups and avoid the risk of forgetting to contact clients about overdue payments. Automation also allows you to maintain a professional approach without overwhelming your team with administrative tasks.

Benefits of Automation

- Time Efficiency: Automated reminders are sent without the need for manual intervention, freeing up time for other important tasks.

- Consistency: Automation ensures that every client receives a reminder at the appropriate time, reducing the risk of delays or errors.

- Professionalism: Pre-set templates ensure that all reminders are well-crafted and maintain a consistent, polite tone, improving your business’s reputation.

How to Set Up Automated Reminders

To set up automated reminders, you can integrate payment processing software or CRM systems that allow for automated email notifications. These tools can be customized to send reminders based on specific timelines, such as a few days after the due date, with follow-ups at regular intervals. Additionally, some systems allow for customization of the message, so you can adjust the tone and content to fit your business needs.

By automating your payment reminders, you can improve efficiency, enhance consistency, and ensure that your business maintains a professional approach in dealing with overdue payments.

Impact of Late Payments on Your Business

Delayed payments can have significant consequences for your business, affecting not only your cash flow but also your operations and client relationships. When clients fail to pay on time, it creates a ripple effect that can disrupt your ability to meet financial obligations, invest in growth, and maintain a stable business environment. Understanding the impact of late payments is crucial for managing your finances and protecting your business from long-term damage.

Effects on Cash Flow

Cash flow issues are one of the most immediate consequences of late payments. When payments are delayed, it limits the funds available for day-to-day operations, such as paying employees, suppliers, and covering overhead costs. This can create a cycle of financial strain, where you may need to rely on credit or loans to bridge the gap, leading to potential debt accumulation and additional financial pressure.

Damage to Business Relationships

While a delayed payment is a transactional issue, it can also affect your relationship with clients. If the delay is not addressed promptly, it can lead to frustration and mistrust. Clients may feel that they are not being taken seriously or that they are being unfairly pressured, even if the delay is their fault. This can erode goodwill and potentially harm long-term business partnerships, reducing the likelihood of future cooperation.

Late payments also increase the administrative burden on your business. The need to send reminders, follow-up communications, and potentially engage in debt recovery processes can consume valuable time and resources. This takes away from your ability to focus on other critical aspects of your business, such as customer acquisition, product development, or marketing.

In the long run, consistent late payments can undermine your profitability and growth. By taking proactive measures to address overdue balances, you can help safeguard your business’s financial health and maintain positive relationships with clients.

Using Templates to Save Time and Effort

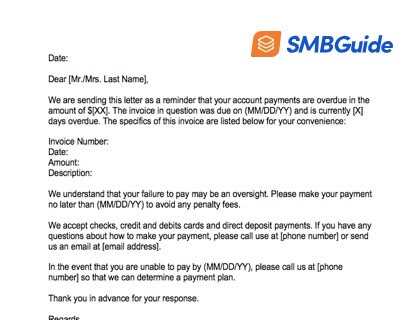

Utilizing pre-designed frameworks for payment reminders can greatly enhance efficiency, reducing the time and effort spent on drafting messages from scratch. By having a ready-to-use structure, you can streamline the communication process, ensuring consistency and professionalism without compromising on quality. Templates allow you to quickly tailor messages for different clients, making it easier to address overdue balances promptly.

With customizable formats, templates help you focus on the specifics of each situation without needing to craft new content each time. Whether it’s adjusting the tone, adding specific details, or including client-specific information, having a structured approach ensures that your messages are clear, professional, and delivered without delay. Templates also reduce the likelihood of errors or omissions, ensuring that important details are always included.

By saving time on repetitive tasks, you free up valuable resources to focus on more strategic aspects of your business. Additionally, using consistent language and format across all communications reinforces your brand’s professionalism, fostering trust and maintaining a strong relationship with clients.

Examples of Payment Reminder Templates

Having a few pre-drafted frameworks for communicating about overdue payments can make your job much easier. By using examples that can be easily customized, you save time and ensure that your reminders maintain professionalism and clarity. Below are several examples that can be adapted to your needs, depending on the situation and the relationship with the client.

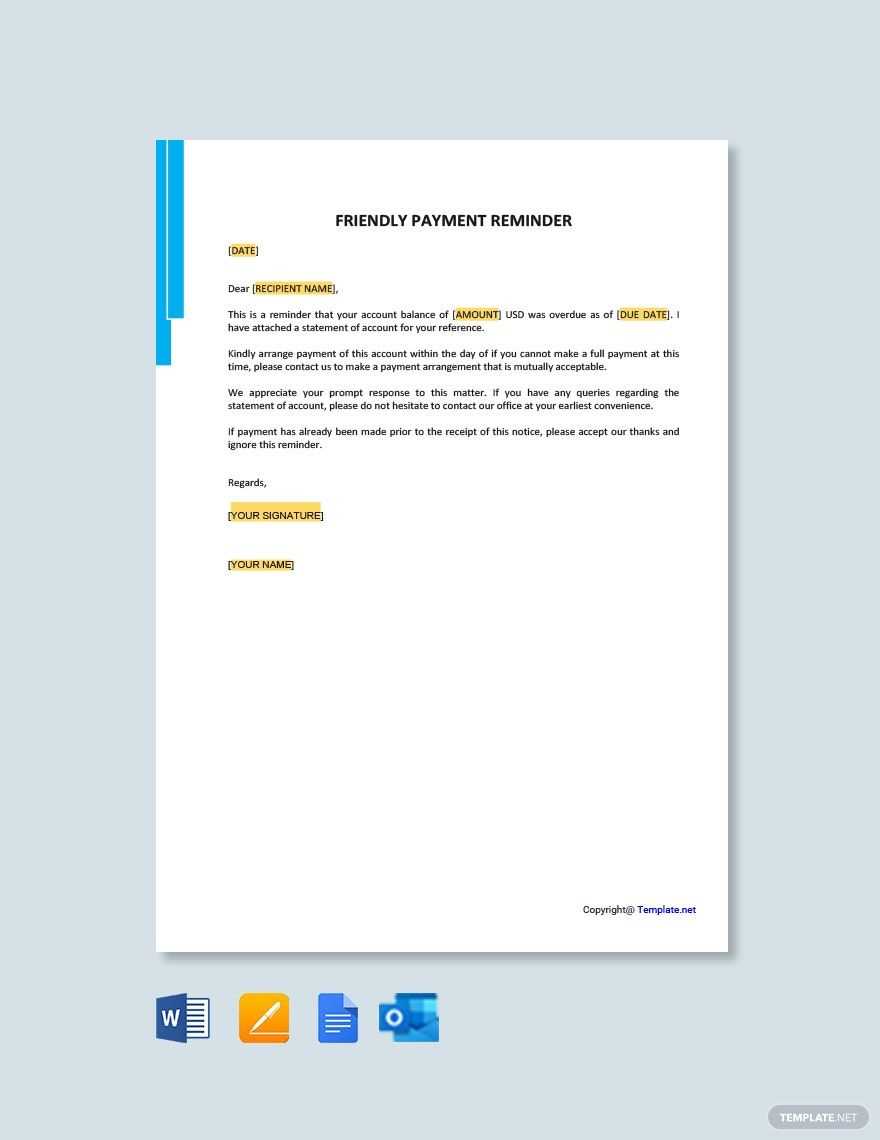

Example 1: Initial Reminder

Dear [Client’s Name],

I hope this message finds you well. Our records indicate that the payment of [amount] for [service/product] was due on [date]. We kindly request that you arrange payment at your earliest convenience. Please let us know if there are any issues or if you need further assistance regarding this matter.

Thank you for your attention to this matter. We appreciate your prompt response.

Sincerely,

[Your Name]

[Your Position]

[Your Company]

Example 2: Second Reminder

Dear [Client’s Name],

I am writing to follow up on our previous communication regarding the outstanding payment of [amount], which was due on [date]. As of today, we have not yet received payment, and we kindly ask that you prioritize this matter to avoid any further delay.

If there are any issues or concerns preventing payment, please reach out so we can address them as soon as possible. We greatly value your business and hope to resolve this quickly.

Thank you for your prompt attention to this matter.

Best regards,

[Your Name]

[Your Position]

[Your Company]

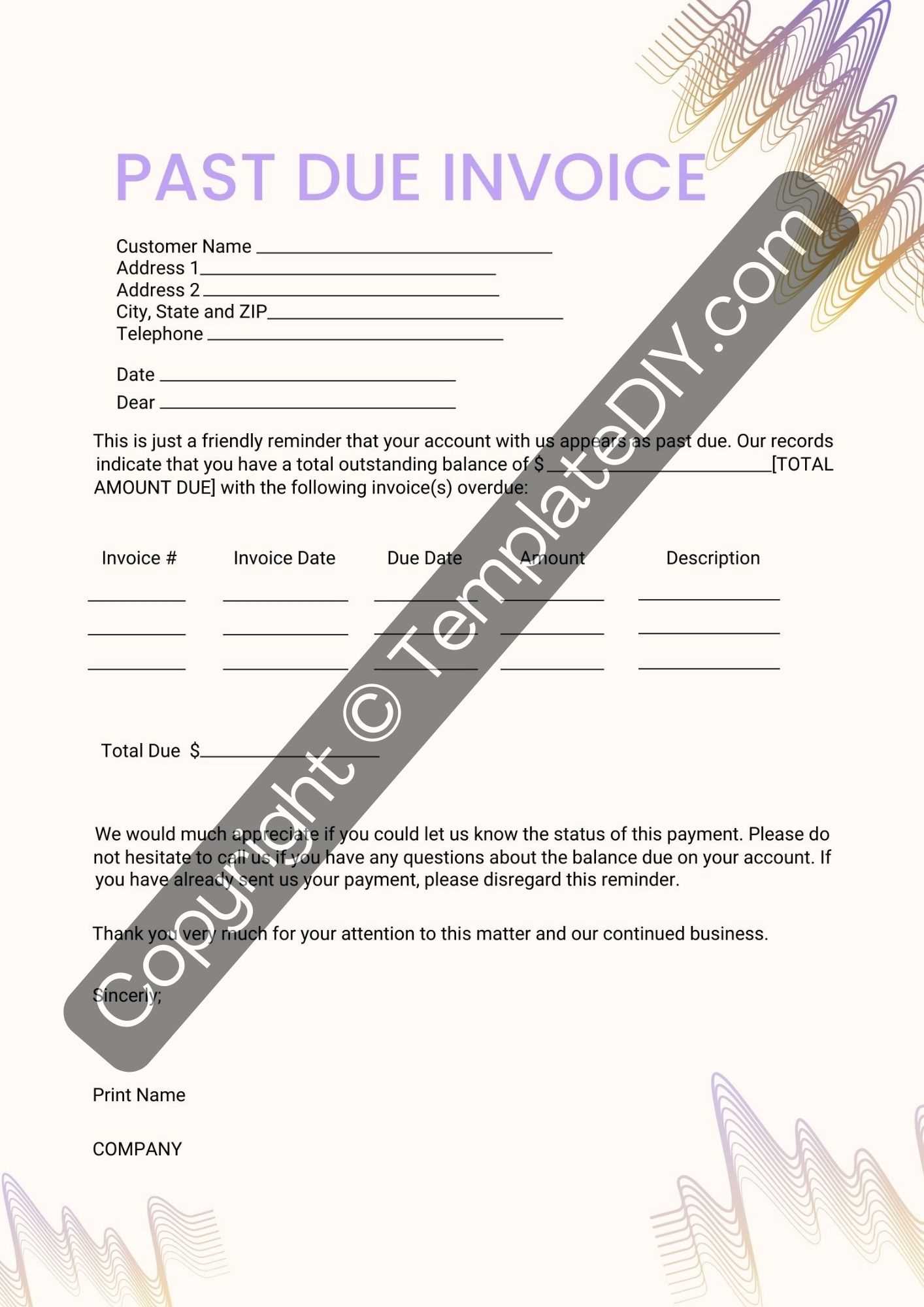

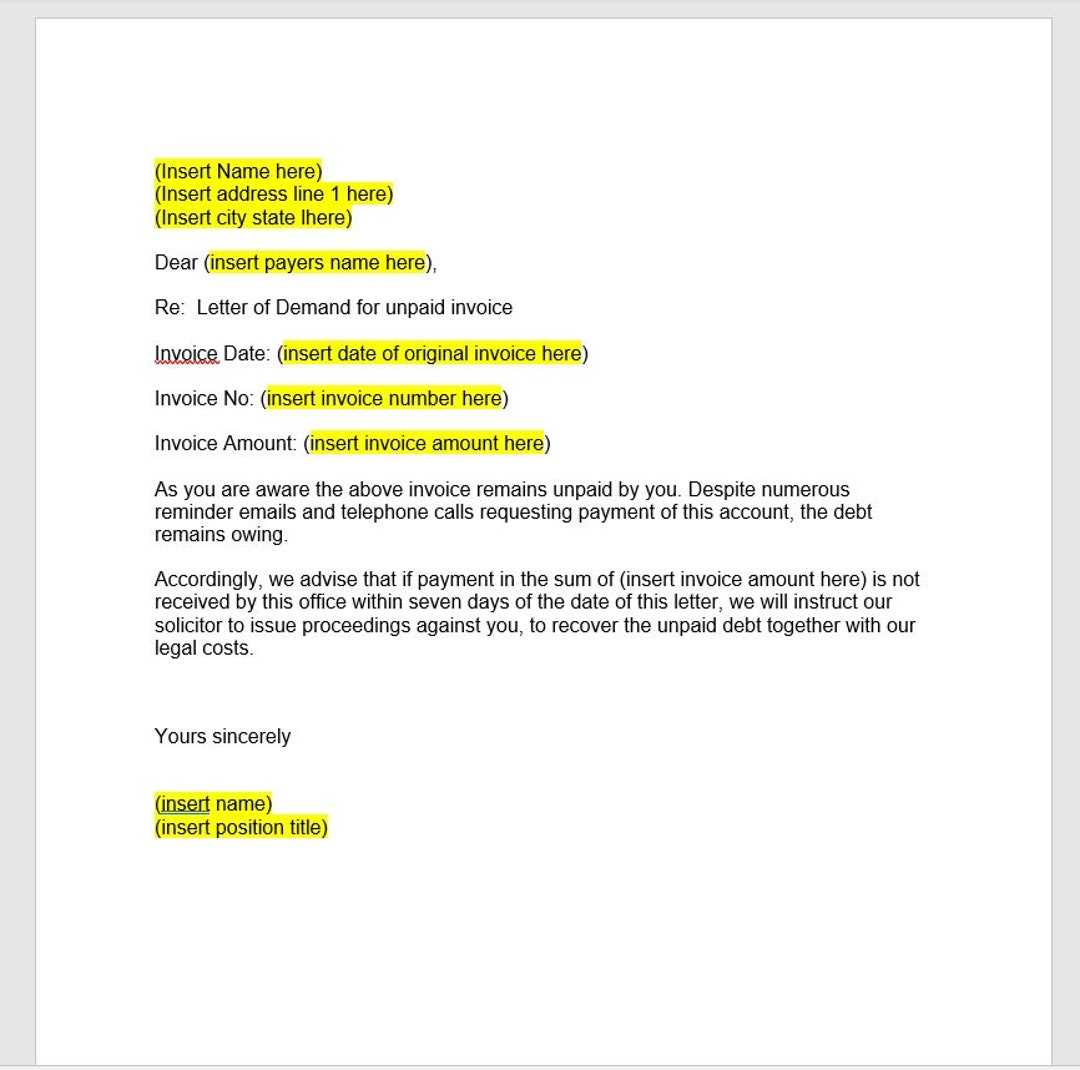

Example 3: Final Reminder

Dear [Client’s Name],

This is a final reminder regarding the payment of [amount], which was due on [date]. As we have not received payment or heard from you regarding this matter, we request that payment be made immediately. Failure to settle this balance may result in [mention any potential consequences, e.g., suspension of service, late fees, or legal action].

We hope to avoid any further action and appreciate your immediate attention to this matter. Please contact us if there are any issues preventing payment.

Kind regards,

[Your Name]

[Your Position]

[Your Company]

These examples can be customized based on the tone and urgency of your specific situation. By adapting the message to the client’s history and your company’s policies, you can maintain a respectful, yet firm, approach in collecting overdue payments.

Steps to Take if Payment is Still Pending

If payment has not been received by the expected due date, it’s important to take timely and measured steps to follow up and resolve the situation. Here are key actions you can take to address overdue payments and ensure that they are eventually settled, all while maintaining professionalism and protecting your business interests.

1. Send a Friendly Reminder

The first step is usually to send a polite reminder. Often, late payments are the result of oversight, and a gentle nudge is all that’s needed to resolve the issue. This reminder should be professional but not too demanding.

- Be clear about the amount owed and the original due date.

- Provide easy payment instructions and remind them of your payment terms.

- Offer assistance if there are any issues that may be causing the delay.

2. Follow Up with a Stronger Message

If the first reminder doesn’t result in payment, follow up with a more direct communication. This message should express urgency while remaining polite, and it can mention any consequences of continued non-payment.

- Reiterate the payment terms and include the overdue amount.

- Consider offering a specific deadline for payment, such as “Please settle by [date].”

- Highlight any late fees or potential disruptions in services if payment isn’t received.

3. Contact Them Personally

If the payment is still pending after a couple of reminders, it may be time to contact the client directly. A phone call or personal email can help resolve any issues that may not be clear in written communication.

- Be prepared to listen to any concerns or disputes the client may have regarding payment.

- Discuss potential solutions, such as a payment plan or adjusted terms if appropriate.

- Stay calm and professional, even if the conversation becomes tense.

4. Consider Offering a Payment Plan

If the client is struggling financially, offering a payment plan can be a viable option. Breaking the outstanding balance into smaller, manageable payments can help facilitate the settlement and maintain the business relationship.

- Set clear terms regarding the payment schedule and deadlines.

- Ensure both parties understand the consequences of missing any payments under the plan.

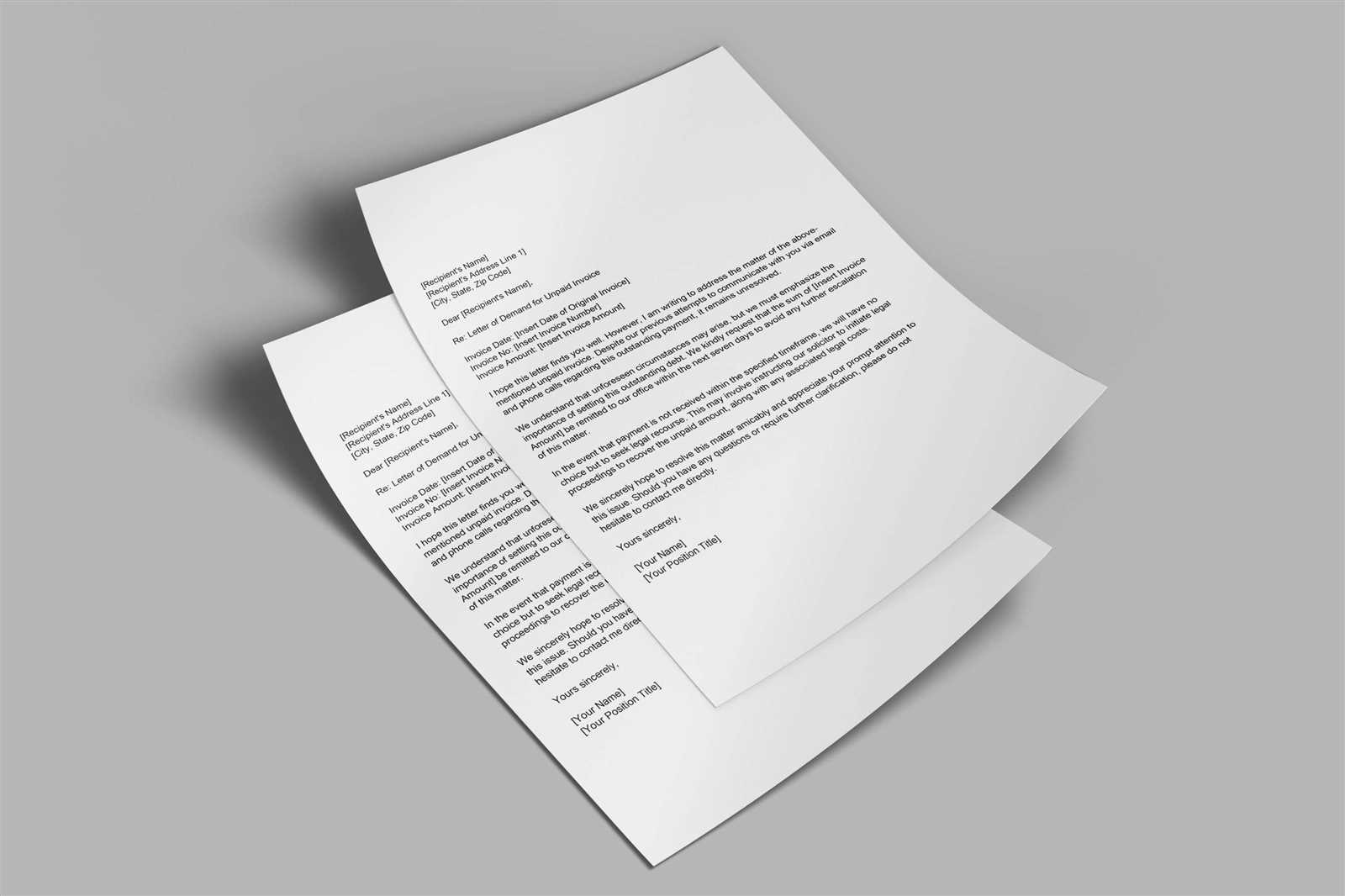

5. Send a Formal Demand

If all else fails and payment is still not received, a more formal approach may be necessary. This could include sending a demand letter outlining the payment owed, along with the consequences of non-payment, such as legal action or service disruption.

- Provide all relevant details, such as the due date, amount, and previous communications.

- Make it clear that this is a final warning before further steps are taken.

6. Consider Legal Action or Debt Collection

As a last resort, if payment remains unresolved despite your best efforts, you may need to consider legal action or hire a collection agency. This is a step that should only be taken after all other options have been exhausted, as it can significantly damage the business relationship.

- Consult with a legal professional to understand the best course of action.

- Be prepared for the possibility of long-term effects on the client relationship and your reputation.

By following these steps, you can effectively manage overdue payments while balancing professionalism and persistence. Taking action early and strategically increases the likelihood of successful payment collection and minimi