Handyman Invoice Templates for Streamlined Billing and Professional Service

For any professional offering repair or maintenance services, keeping financial transactions organized is essential. Having a clear and structured way to request payment helps maintain a positive relationship with clients and ensures timely compensation. Whether you’re an independent contractor or a small business owner, using a consistent billing system can save time and reduce confusion.

Streamlined payment requests not only simplify the job for service providers but also improve trust with clients. By outlining the services rendered and the cost structure, you present yourself as a professional and reliable partner. A well-constructed document serves as both a receipt and a reminder, ensuring that all parties are on the same page.

Creating and managing these financial documents is easier than ever with the right tools. From customizable layouts to automatic calculations, there are many options available to suit your specific needs. This approach helps eliminate errors, prevents disputes, and accelerates the payment process.

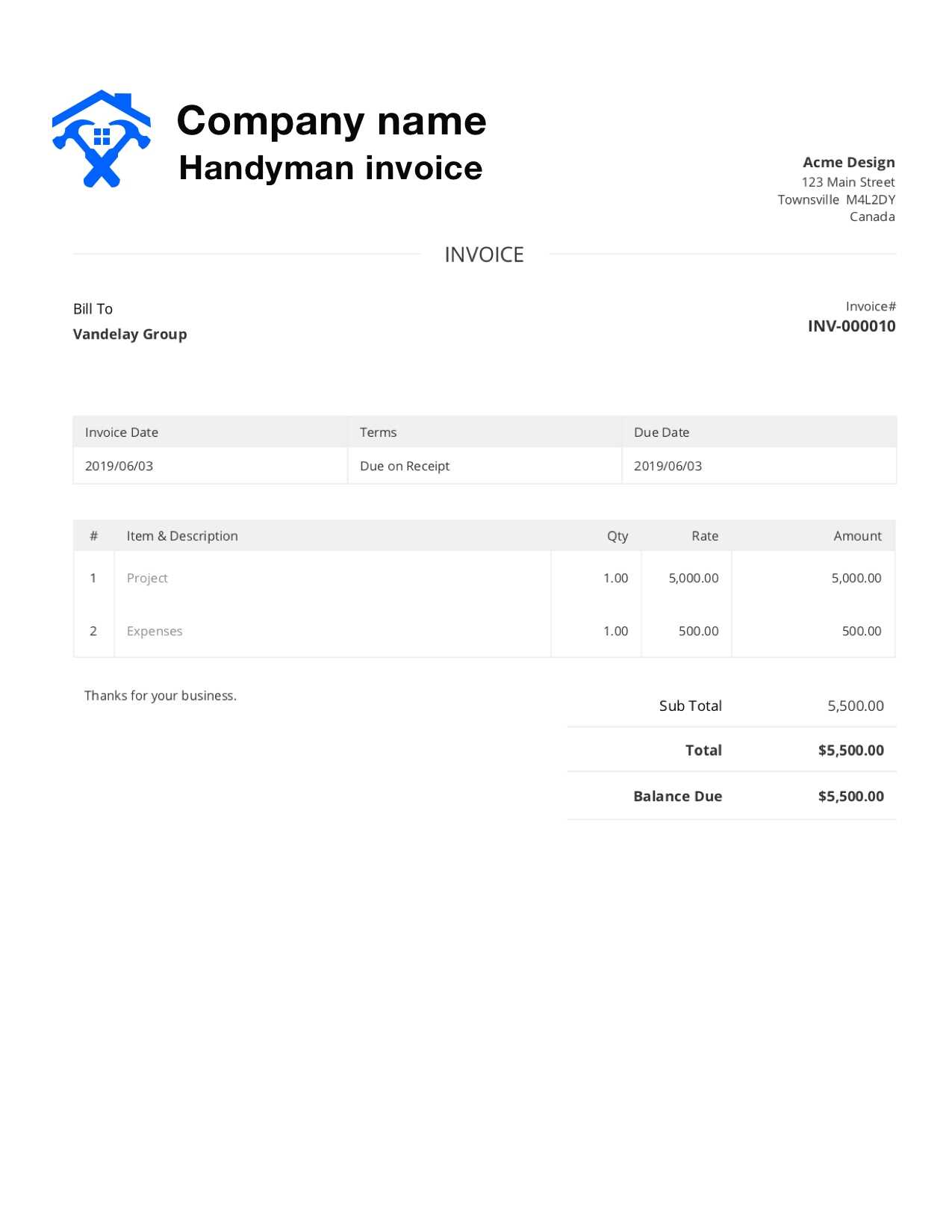

Handyman Invoice Templates Overview

For any service-based professional, having a standardized document for requesting payment is essential. These documents serve as a clear record of the work completed and the amount due, ensuring smooth financial transactions between you and your clients. A well-structured payment request can enhance professionalism and reduce misunderstandings.

When it comes to organizing billing information, there are various options available. These tools can help streamline the entire process, from itemizing services to calculating totals automatically. Choosing the right solution depends on your business needs, the frequency of your work, and how much customization you require.

- Simple and easy-to-use formats for quick payments

- Customizable options for different types of services

- Automatic calculations to save time and reduce errors

- Professional appearance that reinforces your business image

- Options for both one-time and recurring billing cycles

Using a pre-designed framework allows you to focus more on delivering quality work and less on administrative tasks. These solutions can be found in various forms, ranging from free, basic versions to more feature-rich, premium options with enhanced functionalities.

Benefits of Using Invoice Templates

Utilizing pre-designed billing documents offers numerous advantages for professionals managing service-based businesses. These ready-made formats not only save time but also provide a consistent and reliable way to present payment requests to clients. By eliminating the need to create a new document from scratch every time, service providers can focus more on their work and less on administrative tasks.

Time-Saving and Efficiency

One of the biggest benefits of using ready-to-go formats is the time saved. Instead of manually entering the same information repeatedly, you can easily fill in the details for each job, such as hours worked, materials used, and agreed-upon rates. This streamlined process speeds up the overall billing cycle and helps maintain a steady cash flow.

Professional Appearance and Accuracy

Having a polished and consistent billing structure increases the perceived professionalism of your business. Clients are more likely to view your services as credible and trustworthy when you present them with a clear, well-organized payment request. Additionally, these documents often come with built-in calculations, which reduce the risk of errors and ensure accurate billing every time.

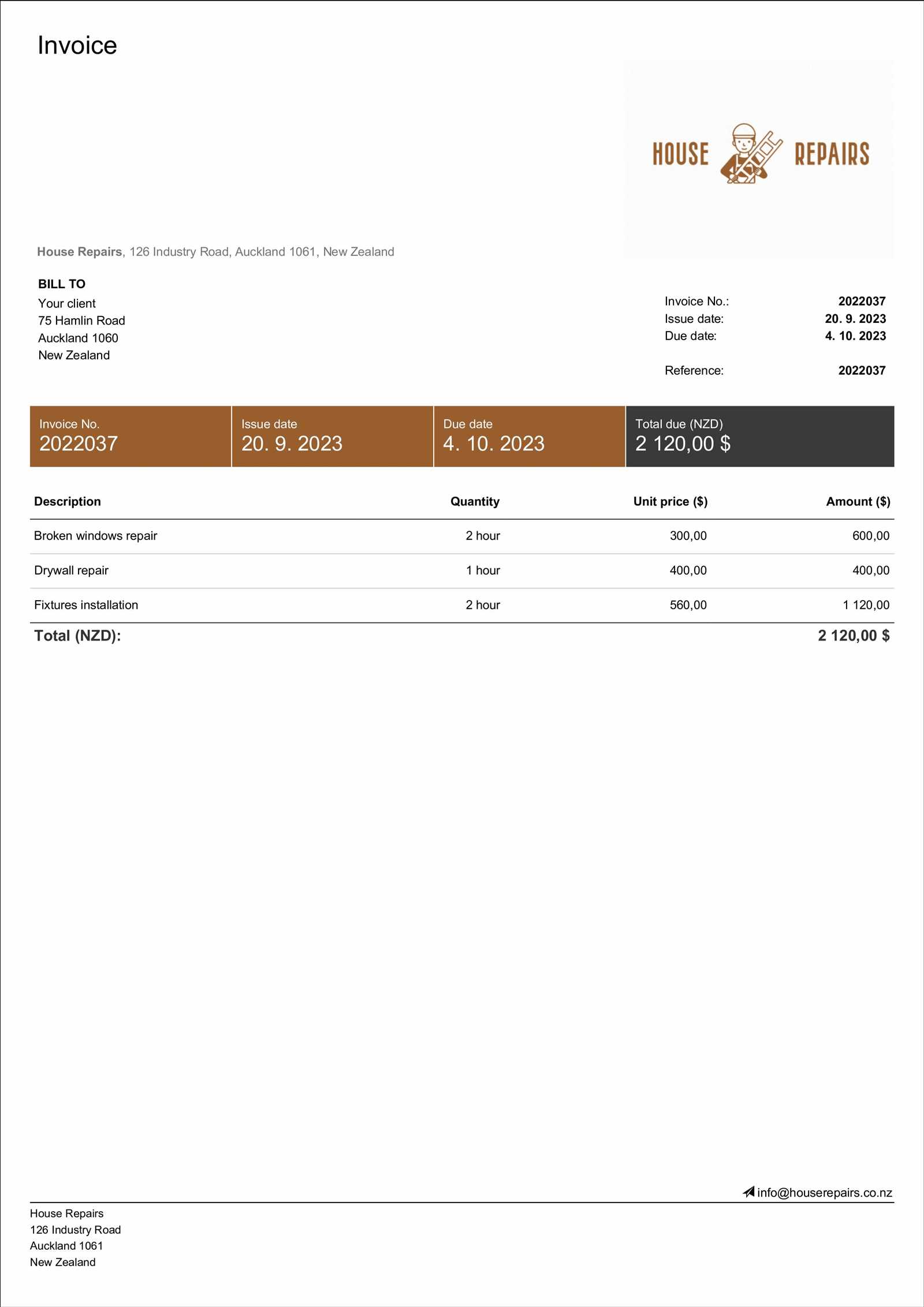

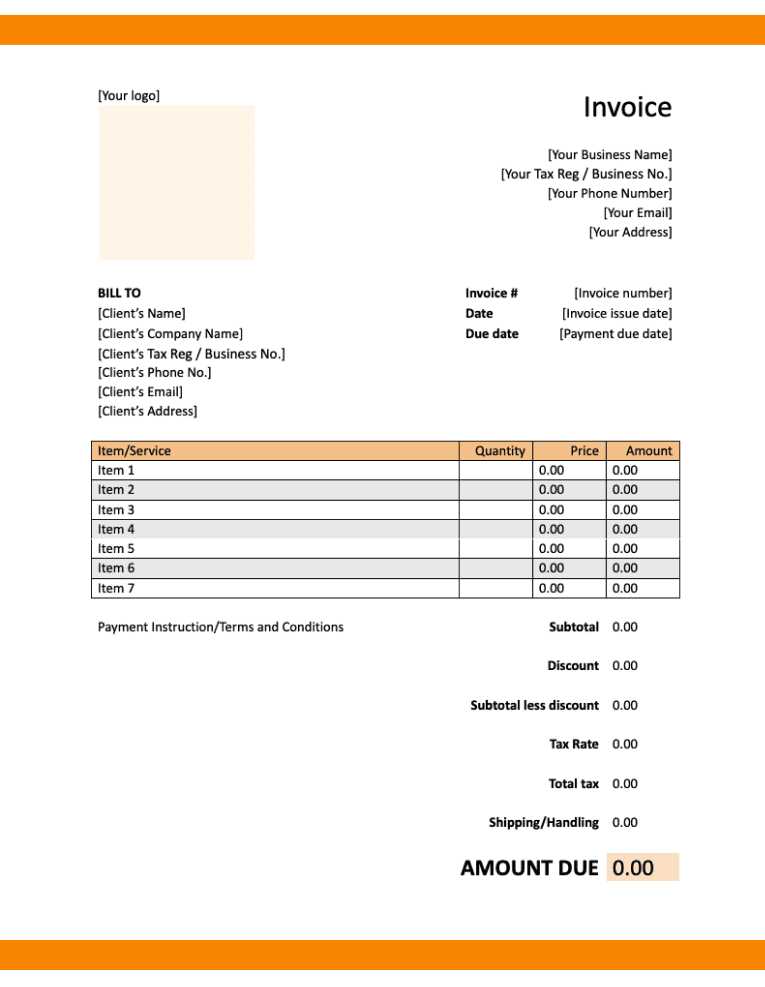

Customizing Your Handyman Invoice

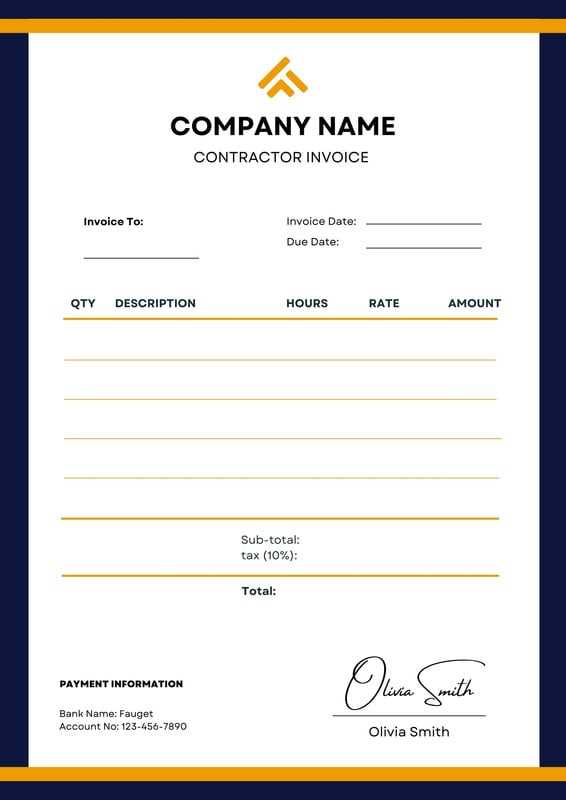

Tailoring your payment request documents to fit your specific business needs can greatly improve both efficiency and client satisfaction. Customization allows you to highlight important details, set your pricing structure, and maintain consistency across all your transactions. By adjusting certain elements, you ensure that each document reflects your unique services while remaining professional and clear.

Personalizing the layout and content of your payment request can make a big difference in how your business is perceived. You can add your company logo, adjust fonts, and even color schemes to align with your brand identity. This not only improves your business image but also creates a more cohesive experience for your clients.

Additionally, customizing fields for specific services, materials, or labor rates allows you to stay organized. Whether you have fixed rates or variable pricing based on the scope of work, tailoring these aspects ensures that you present accurate, transparent charges to your clients. This level of customization also makes it easier to handle different types of projects, from one-off repairs to ongoing contracts.

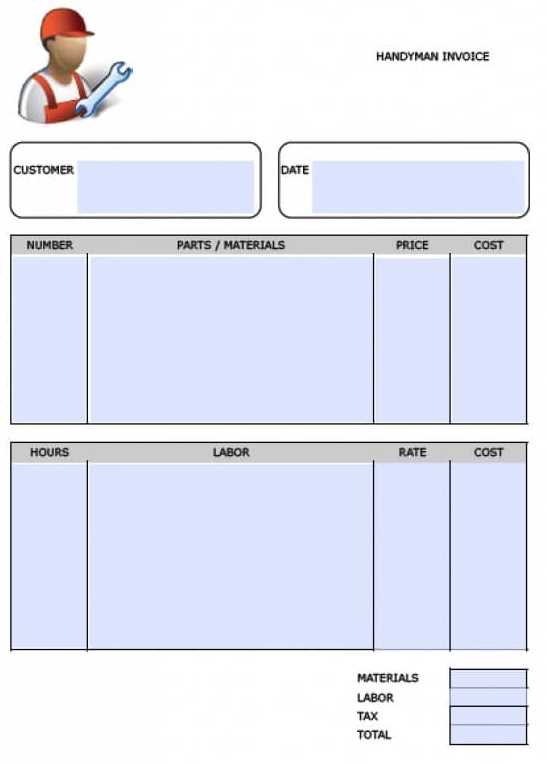

Key Information to Include in Invoices

To ensure smooth transactions and avoid confusion, it’s important to include specific details in every billing document. A well-structured record helps both you and your clients clearly understand the services provided and the amounts due. Including the right information not only makes the document more professional but also ensures compliance with financial and legal standards.

Basic contact information is essential. This includes your business name, address, phone number, and email, as well as your client’s contact details. Having this upfront ensures that both parties can easily reach each other if needed.

Detailed service description is another critical component. Clearly list the tasks performed, along with any materials or products used. This helps justify the charges and provides transparency. If applicable, including hours worked or project milestones adds further clarity to the total amount due.

Payment terms are also vital. Be sure to specify the payment due date, accepted methods of payment, and any late fees that may apply. This information helps prevent misunderstandings and encourages prompt payment.

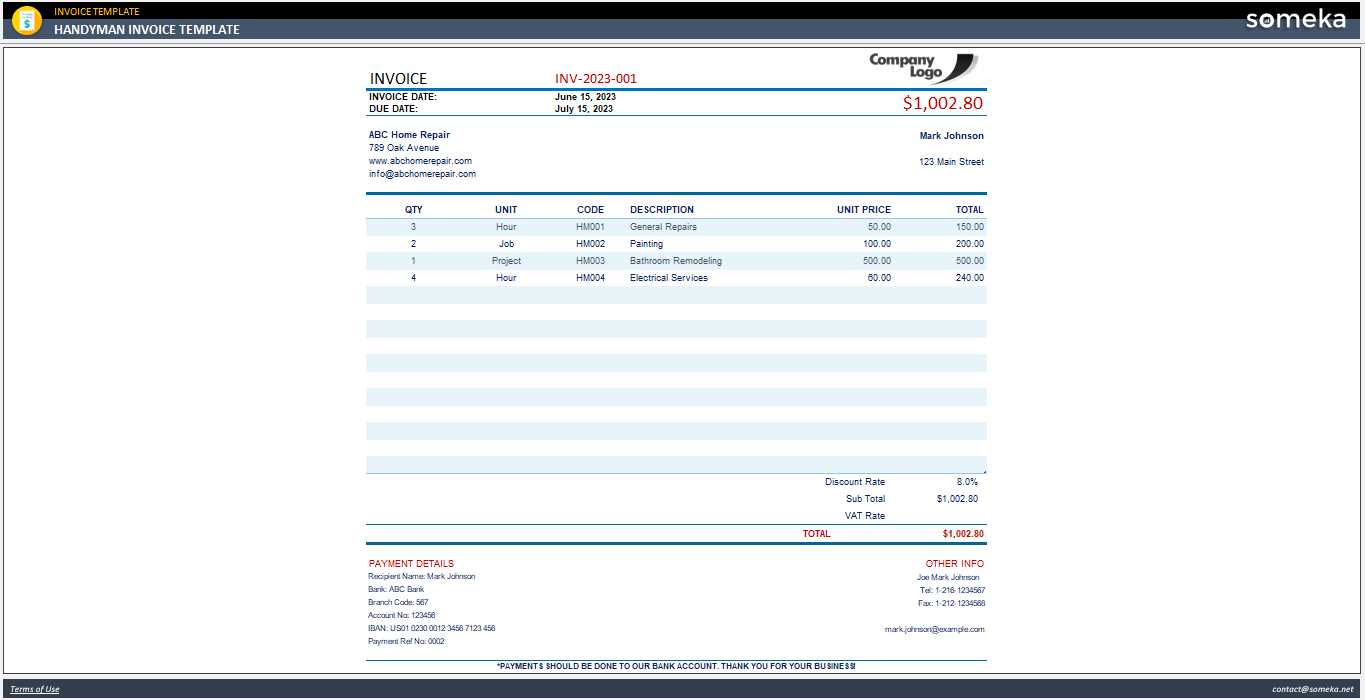

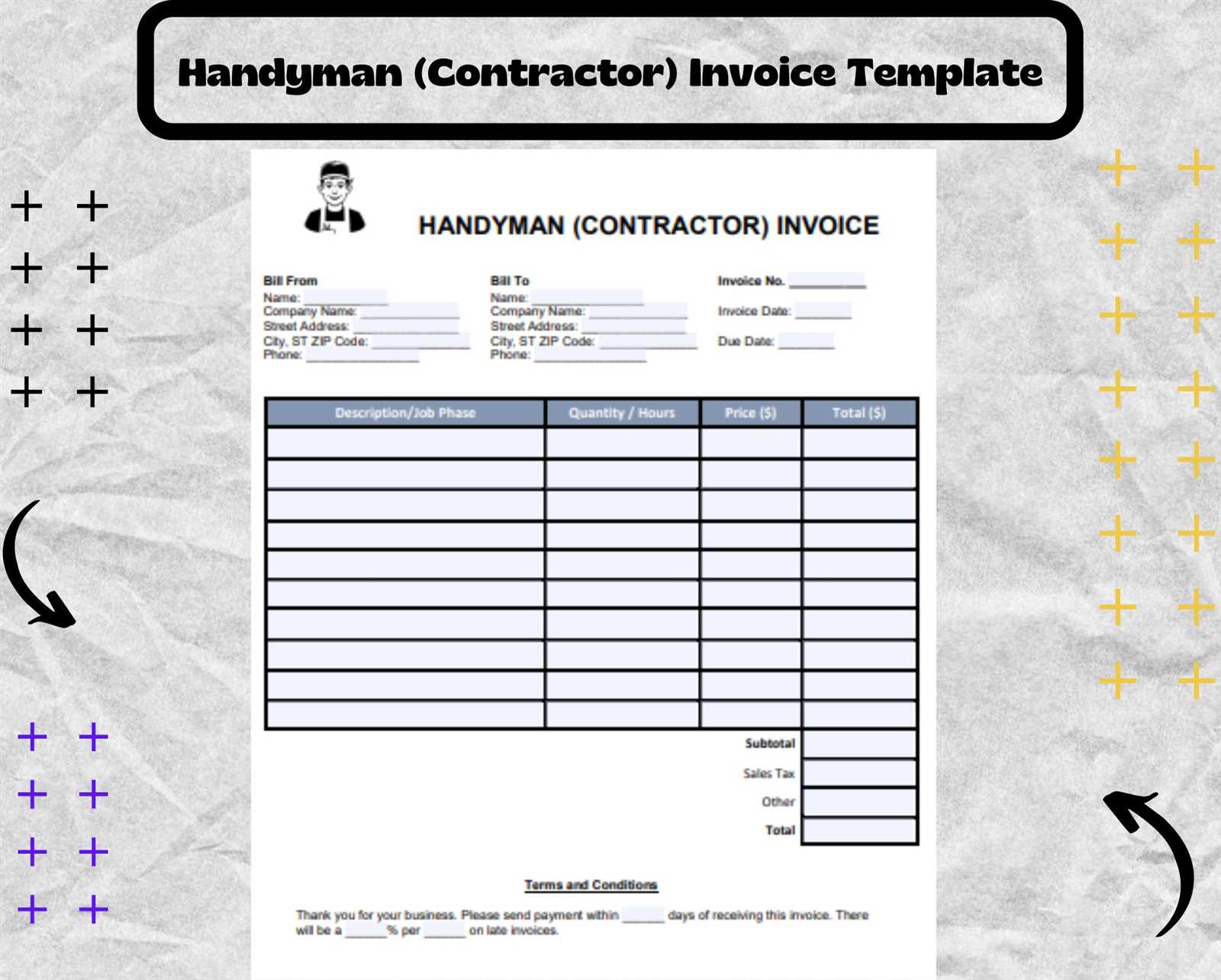

Choosing the Right Invoice Format

Selecting the right document structure for your billing process is crucial for maintaining a professional image and ensuring clear communication with your clients. The format you choose should align with the type of services you offer, the complexity of the work, and the preferences of your clients. A good structure will make it easier to track payments and reduce the chances of errors or disputes.

Factors to Consider

There are several factors to take into account when choosing the best format. These include the level of detail required, how frequently you bill clients, and whether you need to include recurring charges or different payment tiers. Some service providers may prefer a simple, straightforward layout, while others may need a more detailed document to account for additional charges or special conditions.

Common Format Options

Here are a few common formats you can choose from, depending on your business needs:

| Format Type | Best For | Key Features |

|---|---|---|

| Basic Layout | Quick, one-time services | Simple service description, total amount due, and payment terms |

| Detailed Breakdown | Complex or ongoing projects | Itemized list of services, materials, labor rates, and project phases |

| Recurring Format | Long-term contracts or repeat clients | Automated billing for monthly or recurring charges |

By selecting the appropriate structure, you ensure that your payment requests are both clear and aligned with the scope of work, enhancing your professionalism and client satisfaction.

Free vs Paid Invoice Template Options

When choosing a billing document solution, you’ll encounter both free and paid options. Each has its own set of advantages, and the right choice depends on your business size, frequency of transactions, and specific needs. While free options might be appealing for their zero cost, paid versions often offer more advanced features and greater customization to suit professional service providers.

Advantages of Free Options

Free billing documents can be a great starting point for small businesses or those just beginning their journey. Here are some benefits:

- Zero cost, making them an ideal choice for startups or those on a tight budget

- Simple to use with no complicated setup

- Basic customization to include your business name and contact details

- Accessible on various platforms, often with no need for downloads or installations

Benefits of Paid Options

While free formats are functional, opting for a paid version provides additional perks that can enhance your workflow. Paid solutions offer:

- More customization options, allowing you to tailor your document to match your business branding

- Advanced features, such as automated calculations, recurring billing, and integration with accounting software

- Professional-looking layouts and high-quality design elements

- Customer support for troubleshooting and technical assistance

- Ability to track payments, manage outstanding balances, and send reminders

In summary, free options are useful for those just starting or with minimal needs, while paid versions provide the functionality and scalability required for larger or more established businesses.

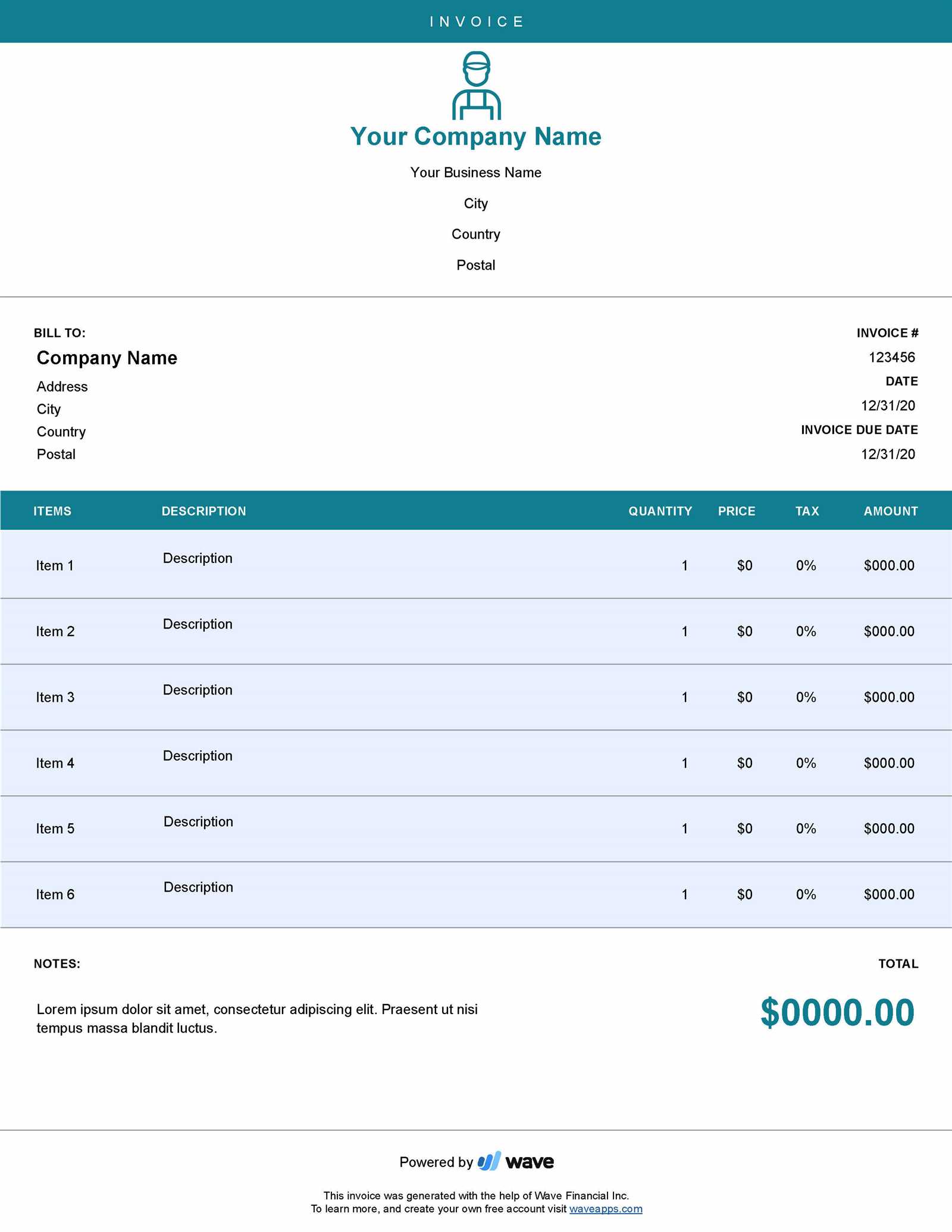

How to Create Professional Invoices

Creating a professional billing document is crucial for maintaining a good relationship with your clients and ensuring timely payments. A well-designed and clear request for payment reflects positively on your business and helps build trust with customers. It also reduces the chance of confusion or disputes over charges.

Essential Elements to Include

To create an effective payment request, there are several key elements you must include:

- Business Information: Include your company name, logo, contact details, and any other relevant information, such as your website or social media links.

- Client Details: Make sure to list the client’s full name, address, and contact details to ensure accuracy.

- Service Description: Provide a detailed breakdown of the services rendered, including hours worked, materials used, and any specific project milestones.

- Payment Terms: Clearly state the total amount due, payment methods, and the due date for payment. It’s also important to mention any late fees or discounts, if applicable.

Design Tips for a Professional Look

The design of your payment request document can make a significant impact on how it is perceived. Here are a few tips for creating a polished and professional appearance:

- Consistency: Use consistent fonts, colors, and styles that match your branding. This will help create a cohesive business identity.

- Clear Layout: Ensure the document is easy to read with clearly defined sections. Use headings, bullet points, and adequate spacing for better readability.

- Use of Branding: Including your logo and business colors can make your document look more professional and personalized.

By paying attention to these details, you can create a payment request that not only looks professional but also encourages prompt payment and enhances your business reputation.

Automating Invoice Generation for Service Providers

Automating the creation of billing documents can save time, reduce errors, and improve consistency for service-based professionals. By implementing an automated system, you can generate accurate and professional payment requests with minimal effort, allowing you to focus more on delivering quality work. Automation not only speeds up the process but also ensures that you never miss a payment cycle.

Advantages of Automation

Here are several reasons why automating the payment request process is beneficial:

- Time Efficiency: Generate billing documents quickly without manually entering details each time.

- Accuracy: Automated systems reduce the chances of human error, ensuring all information is correct and up to date.

- Consistency: Automation ensures that all documents follow the same format and contain the necessary information every time.

- Recurring Billing: Automatically create and send regular payment requests for ongoing projects or repeat clients.

How to Automate the Process

There are several tools and software available to help automate the generation of payment documents. Consider the following options:

- Accounting Software: Many accounting platforms offer built-in automation features that allow you to create and send billing documents automatically based on job details and client records.

- Online Payment Solutions: Platforms like PayPal or Stripe offer automated invoicing features that can handle recurring payments and reminders.

- Customizable Templates: Using specialized tools, you can set up templates that automatically populate with client data and service details, creating a streamlined workflow.

By adopting automation, you not only make the billing process more efficient but also enhance your business’s overall professionalism and reliability.

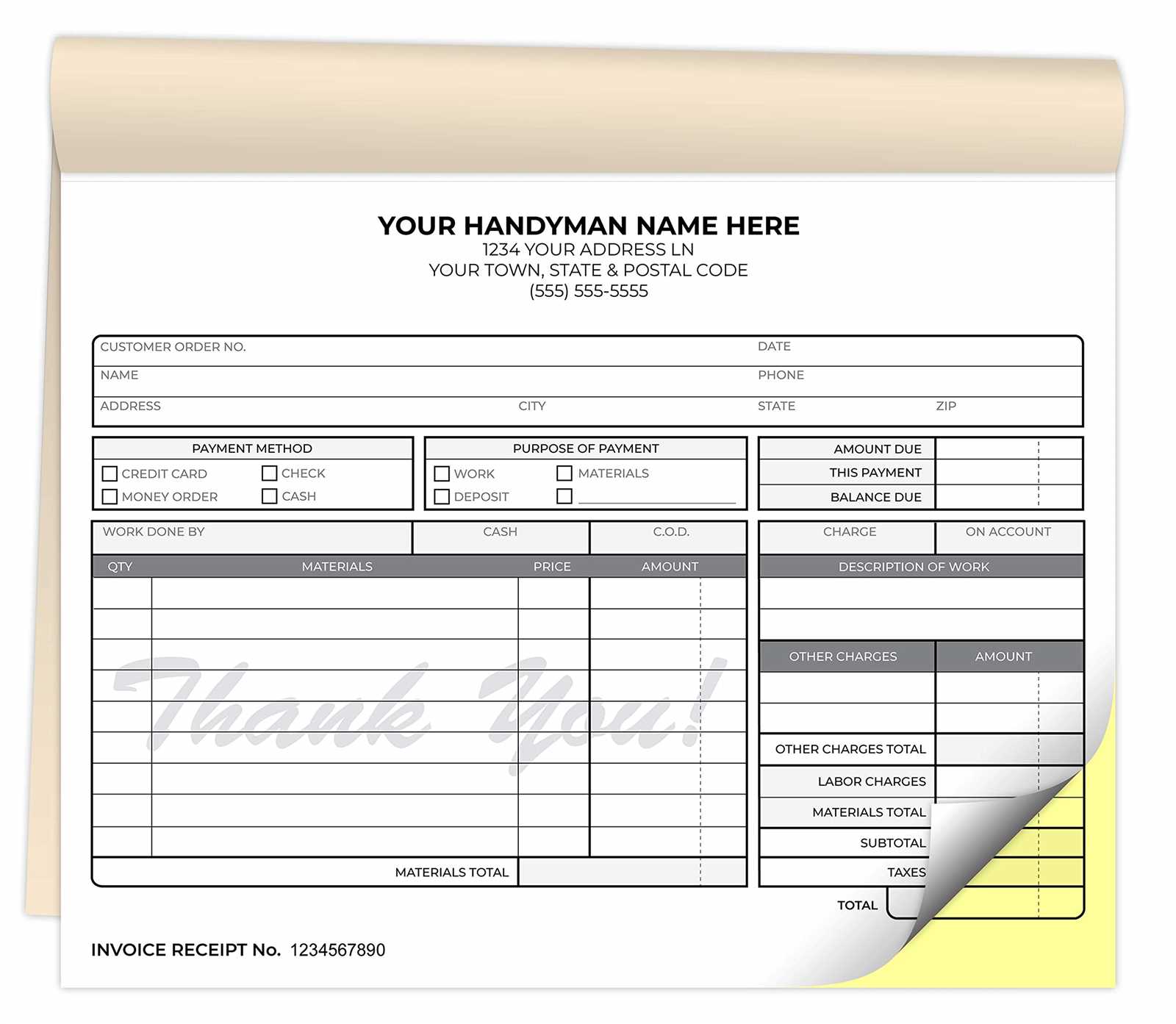

Best Practices for Handyman Billing

Efficient billing practices are essential for maintaining a smooth financial process and fostering positive relationships with clients. A clear, transparent approach not only helps ensure timely payments but also minimizes misunderstandings and disputes. By following best practices, service providers can enhance their professionalism and streamline their operations.

Key Practices for Smooth Billing

Adopting the following practices can significantly improve the billing experience for both service providers and clients:

- Clearly Define Your Rates: Make sure your pricing is transparent and agreed upon before beginning any work. Whether you charge by the hour, by the project, or use a flat rate, clarity upfront avoids confusion later.

- Provide Detailed Service Descriptions: Itemize services performed with enough detail to justify the charges. Including specific tasks, materials used, and labor hours ensures both you and the client understand the work completed.

- Specify Payment Terms: Clearly outline payment expectations, including due dates, accepted methods of payment, and late fees if applicable. This helps set clear expectations for your clients.

- Send Invoices Promptly: After completing a job, send the billing document as soon as possible. The quicker you send it, the sooner you’ll be paid.

- Keep Records Organized: Maintain a well-organized system to track all outstanding payments, previous jobs, and payment history. This helps you stay on top of your finances and quickly resolve any issues that arise.

Handling Late Payments

Late payments can be a common issue, but having a plan in place to address them is important:

- Set Clear Deadlines: Include a clear payment deadline in each request. This helps clients prioritize their payments and reduces delays.

- Follow Up Promptly: If a payment is overdue, follow up with a polite reminder. In some cases, sending an additional statement or offering flexible payment options can encourage timely payment.

- Charge Late Fees: Consider implementing a reasonable late fee if payments are delayed beyond a certain point. This can serve as an incentive for clients to pay on time.

By adhering to these best practices, service providers can ensure smoother transactions, increase the likelihood of timely payments, and foster better relationships with clients.

Common Mistakes to Avoid in Invoices

Even with the best intentions, errors can occur when creating payment requests, which can lead to delays in receiving payment or misunderstandings with clients. Being aware of common mistakes can help you ensure that your documents are professional, clear, and accurate. Avoiding these pitfalls will save you time and reduce the chances of disputes.

Key Mistakes to Watch Out For

Here are several common mistakes that many professionals make when generating billing documents:

- Missing Client Information: Failing to include the client’s full name, address, or contact details can create confusion. Ensure that all client information is accurate and up to date.

- Incomplete Service Descriptions: Skipping over detailed descriptions of the work performed can lead to disputes. Always include a breakdown of services, hours worked, and materials used to provide clarity for your client.

- Incorrect Pricing: Mistakes in rates, whether it’s hourly charges or material costs, can lead to overcharging or undercharging. Double-check your pricing before sending any document.

- Omitting Payment Terms: Not specifying payment due dates, methods, or late fees can cause delays. Clearly outline the payment schedule and expectations to avoid confusion.

- Forgetting Tax Details: Failing to include applicable taxes or not specifying the tax rate can lead to discrepancies. Make sure to add taxes where necessary and show the tax rate applied.

How to Prevent These Errors

To ensure your payment documents are error-free and professional:

- Double-Check All Information: Before finalizing, review all fields for accuracy, including client details, service descriptions, and pricing.

- Use Clear Formatting: Make sure that your payment request is easy to read, with clear section headings and well-organized data.

- Set Reminders: Stay on top of payment due dates and follow up with clients as necessary. Automated systems can help you with this task.

By being mindful of these common mistakes and taking proactive steps to avoid them, you can ensure that your payment requests are accurate, clear, and professional every time.

How to Manage Outstanding Payments

Managing overdue payments is a critical aspect of running a successful service-oriented business. Whether due to forgetfulness or financial difficulties on the client’s part, unpaid balances can disrupt your cash flow. Having a clear and structured approach to handle these situations can help ensure that you get paid on time, while also maintaining good relationships with your clients.

Effective Strategies for Handling Late Payments

Here are a few strategies to help you manage outstanding balances effectively:

- Set Clear Payment Terms Upfront: Make sure that your clients understand the payment schedule and expectations before work begins. Clearly define the due date, payment methods, and any late fees to prevent confusion.

- Send Timely Payment Reminders: As the payment due date approaches, send friendly reminders to your clients. A polite, early reminder can encourage clients to make their payments promptly.

- Follow Up Professionally: If the payment is overdue, send a follow-up message or letter. Be polite but firm, and include the amount due, the original due date, and any relevant late fees.

- Offer Flexible Payment Options: In some cases, clients may be struggling financially. Offering payment plans or alternative payment methods can help them pay off their balance in manageable increments.

Steps to Take if Payments Remain Unpaid

If all reminders and follow-ups fail, consider the following steps to recover outstanding payments:

- Send a Final Notice: A final payment notice should clearly state that legal action may be taken if payment is not made within a certain time frame. This can be a strong motivator for clients to settle their balance.

- Use Collection Agencies: If the client still fails to pay, consider working with a collection agency. While this will reduce the amount you recover, it may be an effective way to recover outstanding balances.

- Seek Legal Advice: As a last resort, you may want to consult with a legal professional to explore your options for pursuing the debt through small claims court or other legal channels.

By following these steps and maintaining consistent communication, you can reduce the number of overdue payments and keep your business running smoothly.

Tracking Your Work with Invoices

Using billing documents as a tool to track your completed tasks is an effective way to keep a detailed record of the work you’ve done. Not only do these records provide a clear history of services rendered, but they also help you stay organized and monitor the status of payments. This practice helps you easily reference past jobs, identify any outstanding balances, and ensure everything is accounted for when it comes time to file taxes or assess your financial performance.

Each request for payment should include specific details about the work performed, including dates, hours worked, materials used, and the corresponding costs. By keeping a consistent record of this information, you can easily track the progress of each project and avoid potential disputes over services provided.

Additionally, tracking your services in this manner can provide valuable insights into your business performance, helping you identify trends, evaluate profitability, and plan for future work. Whether you’re handling a single project or managing multiple ongoing contracts, maintaining organized records will help ensure that nothing slips through the cracks.

Legal Requirements for Billing Documents

When creating payment requests for services rendered, it’s important to understand the legal requirements that must be met. These requirements ensure that your records are compliant with tax laws and business regulations. Failing to meet these standards can lead to complications during audits, potential fines, or even legal disputes. Understanding the key elements that need to be included in your billing documents can help you maintain transparency and stay on the right side of the law.

In most regions, a service-based professional is legally obligated to provide clients with a clear and accurate breakdown of charges. This includes documenting the services performed, payment terms, and tax obligations. Additionally, certain information may be required, such as business registration details, tax identification numbers, and compliance with local invoicing laws.

To avoid legal issues, it’s crucial to stay informed about the specific rules and regulations that apply in your area. Consulting with a legal or financial professional can also help ensure that your payment requests meet all necessary legal standards and protect your business interests.

Creating Recurring Invoices for Regular Clients

For service providers with regular clients, creating recurring billing documents can save time and ensure consistent payments. Rather than generating new requests for payment each time a service is provided, a recurring system automates the process, reducing the chances of human error and missed payments. By setting up recurring requests, you can maintain a steady cash flow and focus on the work at hand, knowing that your financial transactions are taken care of.

Setting Up Recurring Payment Requests

When setting up recurring billing, it’s important to clarify the following details with your clients:

- Billing Frequency: Define how often the payment request will be sent – whether it’s weekly, monthly, or based on a specific schedule.

- Amount Due: Agree on a set amount or formula that will be invoiced regularly. Make sure both parties understand any variables that may change the total.

- Payment Method: Choose the payment methods that will be accepted and ensure they remain consistent for the duration of the recurring arrangement.

Benefits of Automating Recurring Billing

Automating recurring requests for payment has several benefits:

- Efficiency: Once set up, recurring billing runs automatically, saving you time and effort on each transaction.

- Predictable Cash Flow: With consistent payments from repeat clients, you can better manage your business’s finances and plan for future expenses.

- Improved Client Relationships: Recurring payment arrangements create a sense of trust and reliability, making it easier to maintain long-term client relationships.

By offering regular billing options, you can streamline your processes, improve financial stability, and provide a better experience for your clients.

Integrating Billing Documents with Accounting Software

Integrating your payment requests with accounting software can significantly improve the efficiency of your financial management. By automatically syncing your documents with your accounting system, you can streamline the entire billing and payment tracking process. This integration ensures that all payments are recorded accurately, minimizes the risk of errors, and provides a clear overview of your financial standing.

There are several advantages to connecting your billing system with accounting software:

| Benefit | Description |

|---|---|

| Time-Saving Automation | Automates the process of recording payments and updating financial records, reducing manual data entry. |

| Accuracy | Reduces human errors by ensuring that the billing information is automatically transferred into your accounting system. |

| Better Financial Tracking | Provides real-time updates on income and expenses, allowing you to track the status of outstanding payments and monitor cash flow. |

| Tax Compliance | Helps ensure that all necessary tax information is recorded and organized, making it easier to prepare for tax season. |

Many accounting software platforms, such as QuickBooks, Xero, and FreshBooks, offer integration with popular payment systems, allowing you to seamlessly connect your billing documents. This makes it easier to generate reports, manage clients, and keep track of any pending or overdue payments.

By integrating your payment requests with accounting software, you can simplify your financial workflows and focus more on growing your business.

Design Tips for a Polished Billing Document

Creating a professional and visually appealing billing document is key to making a positive impression on clients. A well-designed payment request not only enhances your brand image but also improves clarity, making it easier for your clients to understand the services provided and the amount due. With a clean, organized design, you can ensure your clients have a smooth experience when reviewing and processing their payment.

Essential Design Elements

Here are some design tips that will help you create a polished and professional payment request:

| Design Element | Tip |

|---|---|

| Consistent Branding | Use your logo, business colors, and fonts to make the document reflect your brand identity. This reinforces professionalism. |

| Clear Structure | Organize information into distinct sections (client details, services, costs, total amount due). This helps your client quickly find the information they need. |

| Readable Fonts | Choose easy-to-read fonts and maintain a consistent font size. Avoid cluttering the page with too many font styles or sizes. |

| Space and Margins | Ensure there is plenty of white space between sections. This creates a clean, open layout and makes the document easier to digest. |

| Professional Colors | Use a color scheme that complements your brand but doesn’t overwhelm the content. Keep the focus on the numbers and key details. |

Additional Design Tips

Besides the basics, consider the following tips to further enhance the appearance of your payment request:

- Use Bold for Important Information: Highlight the total amount due and payment terms by making them bold or using a larger font size.

- Include a Payment Button or QR Code: If your clients can pay online, consider adding a direct link or a QR code for easy access.

- Check Alignment: Make sure all text and numbers align properly. This will give the document a neat, organized look.

By focusing on these design elements, you will create a more professional and visually appealing document that stands out and provides clarity for your clients, helping to build trust and streamline the payment process.

How to Handle Disputed Billing Documents

Occasionally, clients may dispute the charges or details outlined in a payment request. Disputes can arise from misunderstandings about the scope of work, errors in the document, or disagreements over pricing. Addressing these issues promptly and professionally is crucial to maintaining a positive client relationship while ensuring that your business gets paid for the services rendered.

Here are some steps to take when handling a disputed billing document:

Steps to Resolve a Billing Dispute

- Stay Calm and Professional: When a client disputes a charge, remain calm and polite. Approach the situation with a problem-solving attitude rather than defensiveness.

- Review the Details: Double-check the payment request and any related documentation. Ensure that all charges are accurate, and verify that no mistakes were made in the description of the services provided.

- Communicate Clearly: Reach out to the client to discuss the issue. Make sure to listen to their concerns fully before offering a solution. Clear, open communication can often resolve misunderstandings.

- Offer Solutions: If an error was made, correct the document and send the updated version to the client. If the dispute is over pricing, consider offering a discount or payment plan to keep the client satisfied.

- Document Everything: Keep detailed records of all correspondence and any agreed-upon solutions. This documentation can be helpful if the dispute escalates further.

Preventing Future Disputes

- Clarify Expectations: Set clear terms with your clients before starting any work, including scope, pricing, and timelines. This reduces the chances of future disputes.

- Provide Detailed Payment Requests: Include comprehensive descriptions of services, materials, and any applicable taxes or fees. A transparent document leaves little room for confusion.

- Regularly Follow Up: Follow up with clients during and after the job to ensure everything is proceeding as expected. Proactive communication can help address concerns early on.

Handling disputes effectively can turn a potentially negative situation into an opportunity to demonstrate professionalism and customer service. By addressing the issue with care, you can maintain strong client relationships and reduce the likelihood of future conflicts.

Ensuring Timely Payments with Billing Documents

Timely payments are essential for maintaining a healthy cash flow and ensuring the continued success of your business. One of the key ways to encourage prompt payments is by crafting clear and well-structured payment requests. By setting expectations upfront, providing clients with accurate and detailed documents, and using strategic techniques, you can improve the chances of receiving payments on time and avoid unnecessary delays.

Best Practices for Encouraging Timely Payments

- Set Clear Payment Terms: From the outset, define when payments are due and what the consequences are for late payments. Be clear about whether you offer discounts for early payments or charge interest for overdue balances.

- Send Documents Promptly: Ensure that payment requests are sent immediately upon completion of the job or at regular intervals. A quick turnaround on your end will help your clients know when to expect a bill and reduce delays.

- Offer Multiple Payment Options: Make it as easy as possible for your clients to pay by offering multiple payment methods, such as credit card, bank transfer, or online payment platforms.

- Include Clear Instructions: Ensure that your payment document provides clear instructions on how to pay, including bank details or links to online payment systems. The easier it is for clients to pay, the more likely they are to do so quickly.

Follow-Up Strategies for Overdue Payments

- Send Friendly Reminders: If a payment is overdue, send a polite reminder email or message. It’s often just a simple oversight, and a reminder can prompt a prompt resolution.

- Be Consistent: Maintain a consistent follow-up schedule. Whether you choose to remind clients after 7, 14, or 30 days, having a regular cadence for follow-ups helps you stay on top of overdue payments.

- Maintain Professionalism: Even if the payment is late, always keep your communication professional. An approach based on mutual respect fosters better client relationships and increases the likelihood of timely future payments.

By implementing these strategies, you can increase the likelihood of receiving payments on time and reduce the stress that comes with chasing overdue balances. Clear communication, well-organized documents, and timely follow-ups will help you maintain steady cash flow and improve client satisfaction.