Download Free Printable Blank Invoice Template

Creating professional financial documents is essential for any business, whether you’re a freelancer or run a larger organization. Having a structured format for transactions helps streamline the payment process and ensures clarity between parties. Many find it time-consuming to design such documents from scratch, which is why using pre-designed forms can save valuable time and effort.

These preformatted documents can be easily customized to suit your specific needs, allowing you to quickly add details like service descriptions, amounts, and client information. By using an adaptable and ready-to-use format, you ensure consistency and professionalism in every transaction, making a positive impression on clients.

With the right tools, you can create accurate records that are both functional and compliant with regulations. Whether you’re handling one-time payments or recurring billing, utilizing a template makes it easier to manage your finances and maintain organization throughout the process.

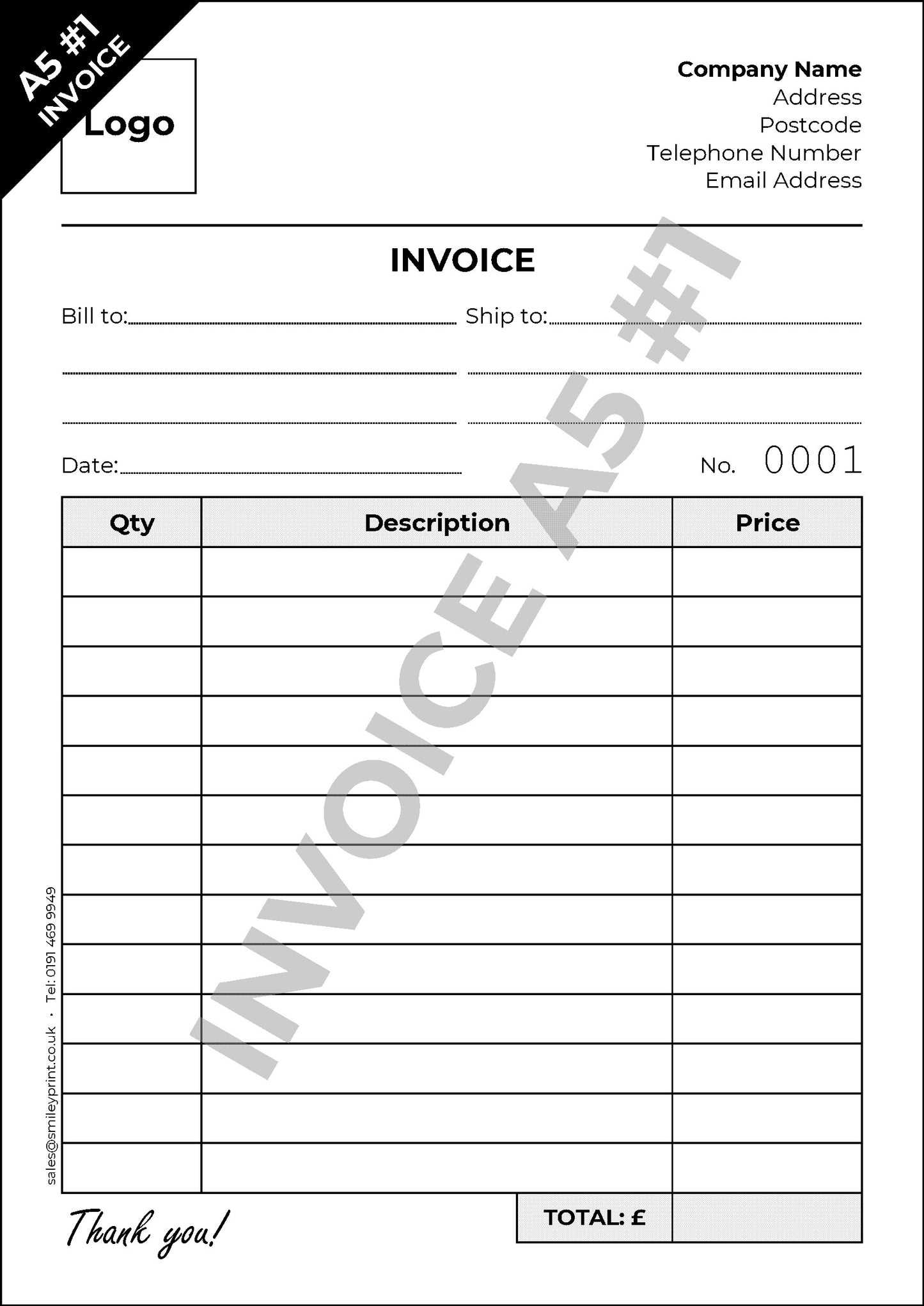

Blank Invoice Template Printable

When it comes to handling transactions efficiently, having a well-structured document is crucial. A ready-made structure allows for quick customization while maintaining a professional appearance. These forms are designed to be flexible, so you can easily add or remove details as necessary, making them ideal for both businesses and independent professionals.

Customizing Your Document for Various Needs

Each business has unique requirements when it comes to documenting services or goods sold. With an adaptable format, you can ensure that all necessary details, such as product descriptions, prices, and client information, are included. This eliminates the need to create a new document every time you complete a transaction, saving time and effort.

Advantages of Using Ready-Made Formats

One of the main benefits of utilizing a pre-designed document is consistency. By using a standardized layout, you ensure that all records are uniform, reducing the risk of errors. Moreover, this approach is not only time-efficient but also helps improve the overall professionalism of your business.

In conclusion, having an easy-to-use structure for managing business transactions is an invaluable tool. It helps maintain organization, boosts productivity, and makes a strong impression on clients.

Why Use a Blank Invoice Template

Having a ready-to-use format for financial documents simplifies the process of managing transactions. By utilizing a pre-designed structure, you save time, reduce errors, and ensure consistency in your business records. This approach is especially beneficial for small businesses and freelancers who need to issue multiple documents quickly and efficiently without compromising professionalism.

Efficiency is one of the primary reasons to use a pre-made form. Instead of spending time creating a new layout for every transaction, you can focus on customizing the details, such as payment amounts, dates, and service descriptions. This allows you to complete tasks faster, allowing for better time management and increased productivity.

Another key advantage is accuracy. When using a standardized format, the risk of missing important information or making formatting errors is minimized. This not only ensures that your documents are complete but also helps maintain a high level of professionalism in the eyes of your clients or customers.

How to Customize a Blank Invoice

Customizing a pre-designed financial document is a straightforward process that allows you to tailor it to your specific needs. By making simple adjustments, you can include all the necessary information and ensure that the final document is accurate and professional. Below are the key steps to personalize your form.

- Add your business details: Include your company name, address, phone number, and email. This ensures that the recipient knows who the document is coming from.

- Input client information: Customize the recipient’s name, company (if applicable), and contact details. This is essential for clear communication and proper billing.

- Describe the products or services: Clearly list what was provided, including a brief description, quantity, and unit price. Be precise to avoid confusion or disputes.

- Include payment terms: Specify the due date and payment methods accepted. This helps set expectations and encourages timely payments.

- Set the totals: Calculate the subtotal, taxes, discounts (if any), and final amount due. Ensure that all numbers are accurate to prevent errors in financial transactions.

Once these adjustments are made, your document will be ready to send. Customizing a form not only saves time but also adds a professional touch to your transactions, making it easier to maintain a consistent business image.

Benefits of Printable Invoice Templates

Using pre-designed forms for creating financial records offers several advantages, especially for businesses and freelancers. These ready-to-use structures can significantly improve efficiency, reduce errors, and ensure consistency in every transaction. Below are some of the key benefits of utilizing such tools.

| Benefit | Description |

|---|---|

| Time-saving | With a pre-made structure, you can quickly fill in the required information, allowing you to focus on other important tasks. |

| Accuracy | Standardized formats help reduce the chances of missing key details or making formatting mistakes, ensuring a professional result every time. |

| Professional appearance | Consistent design and layout present a polished image to clients, boosting trust and credibility. |

| Customizability | Ready-made documents can be easily adjusted to suit specific needs, whether for a one-time project or ongoing billing. |

| Cost-effective | Many of these forms are free to download, offering a budget-friendly solution for businesses of all sizes. |

By incorporating these forms into your workflow, you can streamline your operations, maintain professionalism, and ensure accurate record-keeping.

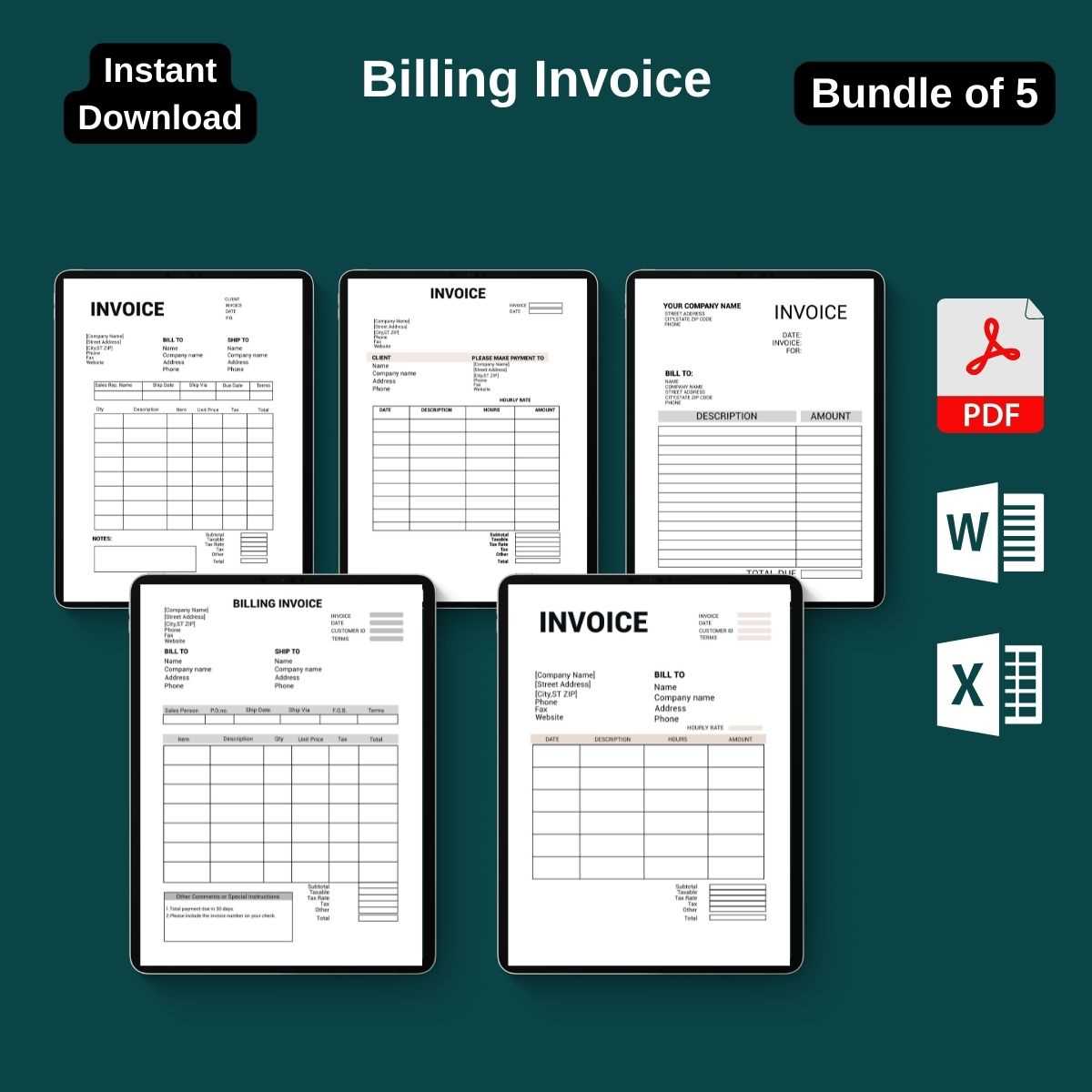

Types of Invoice Templates Available

There are various types of pre-designed forms available for different business needs. Each type is tailored to meet specific requirements, from simple one-time transactions to detailed recurring billing. Choosing the right structure can help streamline your operations and ensure that all necessary information is captured accurately.

Some common variations include:

- Basic Format: A simple design used for one-off transactions, ideal for freelancers or small businesses with straightforward billing needs.

- Service-based Format: Tailored for businesses offering services, this version includes spaces for detailed descriptions of the services rendered and corresponding rates.

- Product-based Format: Used for retail or product-based businesses, this version allows you to list items, quantities, and prices in a clear and organized manner.

- Recurring Billing Format: Ideal for subscription-based services, this structure includes sections for ongoing payments, subscription periods, and renewal dates.

- Detailed Format: Suitable for large projects or long-term engagements, this type allows for detailed descriptions, multiple line items, and complex payment terms.

Depending on the nature of your business, selecting the appropriate format will help ensure you maintain clear and accurate records while delivering a professional experience to your clients.

Steps to Fill Out an Invoice

Completing a financial document is a straightforward process if you follow a clear set of steps. Each section of the document is designed to capture specific details about the transaction, ensuring that both the buyer and seller have a complete record. Here are the essential steps to properly fill out your document.

- Enter your business information: Start by adding your company’s name, address, and contact details. This ensures the recipient knows who the bill is from.

- Include client details: Add the customer’s name, address, and contact information. This helps identify the recipient of the document and ensures that the correct party is billed.

- Provide a unique reference number: Assign a unique number to each document. This helps keep your records organized and makes it easier to track payments.

- Detail the items or services provided: List each item, service, or project with a brief description, quantity, rate, and total cost. Be as specific as possible to avoid confusion.

- Include dates: Record the issue date and the due date for payment. This clarifies the timeline for both parties and sets clear expectations.

- Calculate totals: Add up the individual costs, apply any taxes or discounts, and calculate the final amount due. Ensure all calculations are accurate to avoid errors.

- Specify payment terms: State the accepted payment methods, such as credit card, bank transfer, or check. If applicable, mention late fees or penalties for overdue payments.

By following these steps, you ensure that all necessary details are included, making the document clear, professional, and easy to process for both you and your client.

Where to Find Free Invoice Templates

There are many online resources that offer free forms for managing financial transactions. These websites provide a range of ready-made documents suitable for different types of businesses and payment structures. Whether you’re a freelancer or a small business owner, these sources can help you quickly access a suitable design that fits your needs.

Some popular options for finding free downloadable forms include:

- Online Business Platforms: Many business management websites offer free forms as part of their service, including invoicing tools that allow for easy customization.

- Document Sharing Websites: Platforms like Google Docs or Microsoft Office Online offer pre-designed forms that can be accessed, edited, and downloaded for free.

- Freelancer Websites: Websites that cater to freelancers often provide free resources, including document structures specifically tailored to individual service providers.

- Accounting Software Providers: Some accounting platforms offer free versions of their software, which include customizable forms as a basic feature.

- Template Repositories: Numerous sites specialize in offering free downloads for business documents, allowing you to choose a format that best fits your specific requirements.

By exploring these resources, you can find the right form quickly and start creating professional documents without incurring additional costs.

Printable Invoices for Small Businesses

For small businesses, having a professional and easy-to-use system for documenting transactions is essential. Using pre-designed forms can help streamline the billing process and ensure that every transaction is properly recorded. These customizable documents allow business owners to maintain accurate records, ensure timely payments, and project a professional image to clients.

Here are some key reasons why small businesses should consider using pre-designed forms:

- Time-saving: Pre-designed documents save time by eliminating the need to create new forms from scratch for every transaction.

- Consistency: Using the same layout for each transaction ensures a consistent, professional look that builds trust with clients.

- Accuracy: Standardized formats help reduce the risk of errors, ensuring that all necessary details are included in each document.

- Customization: Forms can be easily tailored to suit the specific needs of your business, from adjusting payment terms to adding company branding.

- Affordability: Many free and low-cost options are available, making it an affordable solution for small business owners.

By incorporating these tools into your billing process, you can stay organized, keep transactions clear, and maintain a high level of professionalism in your business operations.

How to Create Professional Invoices

Creating a polished and professional document for your transactions is essential for maintaining a good relationship with clients and ensuring timely payments. A well-structured form not only provides the necessary information but also reflects your business’s attention to detail. By following a few simple guidelines, you can create clear, accurate, and professional-looking records for every transaction.

Essential Components of a Professional Document

To ensure that your document is both informative and professional, make sure it includes the following key elements:

- Your Business Information: Include your company name, address, phone number, and email address. This allows the client to easily contact you if needed.

- Client Information: Clearly list the recipient’s name, company name (if applicable), and contact details. This ensures there is no confusion about who is being billed.

- Unique Reference Number: Assign a unique number to each document for easy tracking and future reference.

- Itemized List of Products/Services: Describe the items or services provided with their quantities, rates, and total costs. This transparency helps avoid misunderstandings.

- Payment Terms: Specify the payment due date, accepted methods, and any additional terms, such as late fees or discounts for early payment.

Formatting Tips for a Clean Look

To further enhance the professional appearance of your document, keep the layout clean and simple. Use easy-to-read fonts, ensure consistent spacing, and group related information together. Adding your company logo or branding can also create a more personalized and polished look.

By including all essential details and presenting them in a neat, clear format, you’ll ensure that your documents reflect the professionalism and quality of your business.

Design Tips for Custom Invoices

Creating a visually appealing and functional document is crucial for maintaining professionalism and ensuring clarity in every transaction. The design of your financial record can make a significant difference in how it’s perceived by clients. A well-organized and aesthetically pleasing layout not only conveys important information but also enhances your brand’s credibility.

Here are some design tips to help you create a polished and effective document:

- Keep it simple: Avoid clutter by using clean lines, adequate white space, and easy-to-read fonts. A minimalist design ensures that the key information stands out and is easy to navigate.

- Use your brand colors and logo: Incorporating your company’s color scheme and logo adds a personal touch and reinforces your business identity.

- Organize sections logically: Group similar information together. For example, put business details at the top, followed by client information, transaction details, and payment terms.

- Highlight important information: Use bold or larger fonts for critical elements, such as totals, due dates, and payment instructions. This helps the reader quickly identify key details.

- Ensure readability: Choose professional fonts that are easy to read both digitally and in print. Stick to 1-2 fonts, and avoid overly decorative or hard-to-read styles.

By paying attention to the design of your financial documents, you can create a lasting impression while maintaining clarity and professionalism in every transaction.

How to Save Time with Invoice Templates

Managing financial documents efficiently is essential for any business. By using pre-designed structures, you can speed up the process of creating accurate and professional records. These ready-to-use forms allow you to quickly input necessary details, reducing the time spent on formatting and ensuring consistency across all transactions.

Here are several ways you can save time by utilizing pre-made forms:

- Reduce repetitive tasks: Once you’ve customized a document layout, you don’t need to start from scratch each time. Simply input the new transaction details, and your form is ready to go.

- Pre-fill common information: Many structures allow you to save client details, payment terms, or business information. This eliminates the need to enter the same information repeatedly.

- Streamline calculations: With pre-designed sections for subtotals, taxes, and discounts, you can quickly calculate totals without manual calculations, reducing the risk of errors.

- Automate formatting: The layout and design are already set up for you, which means you don’t have to worry about aligning text, adjusting margins, or ensuring that everything fits on the page.

By using these tools, you can focus more on your core business tasks and less on the administrative side of things, all while maintaining a professional standard in your financial documentation.

Common Mistakes to Avoid on Invoices

While creating financial documents, it’s easy to overlook important details or make errors that can cause confusion and delays in payments. Ensuring accuracy is crucial for maintaining professionalism and good relationships with clients. Below are some common mistakes to avoid when preparing these important records.

Missing or Incorrect Information

Omitting essential details: Failing to include your business name, client information, or a unique reference number can make the document unclear. Missing payment terms or due dates can also lead to misunderstandings.

Incorrect client details: Always double-check the recipient’s name, address, and contact information. An error in these details can delay payment or cause the document to be returned.

Calculation Errors

Incorrect totals: Always double-check the sums, including subtotals, taxes, discounts, and the final amount due. Even small errors can cause confusion and affect the trust between you and your client.

Not applying taxes correctly: Make sure that you apply the correct tax rate based on local regulations, especially if you’re dealing with multiple locations or international clients. Miscalculating taxes could result in legal issues or delays in payment.

Formatting Issues

Messy design: A poorly structured or cluttered document can be hard to read, which may lead to errors or misunderstandings. Always ensure that the form has a clear layout with logical sections and that information is easy to find.

Inconsistent formatting: Using different fonts, colors, or inconsistent spacing can make the document look unprofessional. Stick to a consistent style to convey a sense of order and professionalism.

By avoiding these common mistakes, you can ensure that your financial documents are clear, professional, and accurate, helping to prevent delays and fostering positive client relationships.

Legal Requirements for Invoices

When preparing financial documents, it is crucial to comply with legal requirements to ensure that the transaction is valid and that both parties are protected. Many jurisdictions have specific rules that govern what must be included in such records, depending on the type of business and the location of the transaction. Failing to include the required information can lead to delays, disputes, or even legal penalties.

Essential Legal Information

To meet the legal standards, make sure to include the following key elements:

- Business Information: Your business name, address, and registration number (if applicable) should be clearly stated. This identifies you as the seller and is necessary for tax purposes.

- Client Details: Include the name, address, and contact information of the buyer. This helps ensure that the document is valid and can be used for future reference.

- Transaction Date: Always list the date the document is issued as well as the date the goods or services were provided. This provides a clear timeline for both parties.

- Unique Reference Number: Each document must have a unique number or code for tracking purposes. This helps avoid confusion and provides a reference point in case of disputes.

- Detailed Description: A clear description of the products or services provided, including quantities, rates, and totals, is required for transparency and compliance.

- Payment Terms: Clearly state the payment due date, any applicable taxes, and the payment methods accepted. In some regions, this is mandatory for tax reporting purposes.

Country-Specific Legal Requirements

In addition to these basic requirements, there may be country-specific regulations to consider:

- Tax Identification Numbers: In many countries, businesses are required to include their tax identification number (TIN) or VAT number on the documents for tax reporting purposes.

- Currency and Language: Depending on the country, you may need to specify the currency used and provide translations of the document if dealing with international clients.

- Electronic Invoices: Some regions allow or mandate the use of digital versions, which may require additional compliance with electronic invoicing standards.

Ensuring that your financial documents meet all the legal requirements in your region not only helps you stay compliant but also boosts your credibility and protects your business from potential legal issues.

How to Handle Invoice Payments

Managing payments for goods or services provided is a vital part of running a successful business. Ensuring that payments are received on time and processed efficiently helps maintain positive relationships with clients while keeping your cash flow healthy. Clear communication and well-defined terms are key to avoiding confusion and delays in payment.

Setting Clear Payment Terms

One of the most important aspects of handling payments is setting clear expectations from the beginning. Establishing terms for when payments are due, how they can be made, and any potential penalties for late payments will help prevent misunderstandings. Here are some important payment terms to include:

- Due Date: Clearly state when the payment is expected. Common terms include “Net 30” (30 days from the date of issue) or “Due on Receipt.”

- Accepted Payment Methods: Specify how payments can be made (e.g., credit card, bank transfer, PayPal, check). Offering multiple options may help speed up the process.

- Late Fees: Include any applicable late fees if payments are not made by the due date. This can encourage timely payments and cover any administrative costs of delays.

Following Up on Late Payments

Sometimes, despite clear terms, payments may be delayed. Having a plan in place for following up on overdue amounts is essential for keeping your business financially stable. Here’s how to handle late payments professionally:

- Send a Reminder: If the payment is overdue, send a polite reminder email or letter with a clear explanation of the overdue amount and any late fees incurred.

- Offer Payment Plans: If the client is facing financial difficulties, consider offering a payment plan or extending the due date to maintain a positive relationship.

- Use Collection Services: If a payment is significantly overdue and communication has broken down, consider involving a collection agency or seeking legal assistance.

By setting clear terms and maintaining open lines of communication, you can ensure smooth transactions and protect your business’s cash flow.

Using Invoices for Tax Purposes

Accurate documentation is essential for tax reporting and compliance. Financial records play a crucial role in helping businesses track their earnings and expenses, which are necessary for calculating taxes owed. Properly formatted transaction records not only serve as proof of income and expenditure but also ensure you remain in good standing with tax authorities.

Tracking Income and Expenses

For tax purposes, it’s essential to maintain clear records of all business transactions. Each documented sale or service rendered should include detailed information such as the amount charged, taxes applied, and payment terms. Here’s how well-organized documents contribute to your tax filing process:

- Accurate Income Reporting: By documenting all income, you create an accurate record for tax filings. This ensures you report the right amount of earnings for tax calculation.

- Tracking Deductible Expenses: For businesses, certain expenses can be deducted from taxable income. Maintaining thorough records allows you to track these costs and potentially reduce your tax liability.

- Supporting Tax Audits: In case of an audit, having well-organized documents helps you quickly provide evidence of your financial activities, making the process smoother and less stressful.

Tax Compliance and Legal Requirements

Most countries require businesses to maintain specific records for tax reporting. These requirements can vary, but some standard practices include:

- Tax Identification Numbers: Include your business’s tax ID number on all financial records to meet legal standards.

- Sales Tax Documentation: In regions where sales tax is applicable, ensure that the tax amount is clearly stated and complies with local tax rates.

- Record Retention: Depending on local laws, you may be required to keep financial records for a certain number of years. This helps ensure that you have access to them during audits or future tax filings.

By using well-organized records for every transaction, you can simplify tax filing, ensure compliance with regulations, and avoid any potential issues with tax authorities.

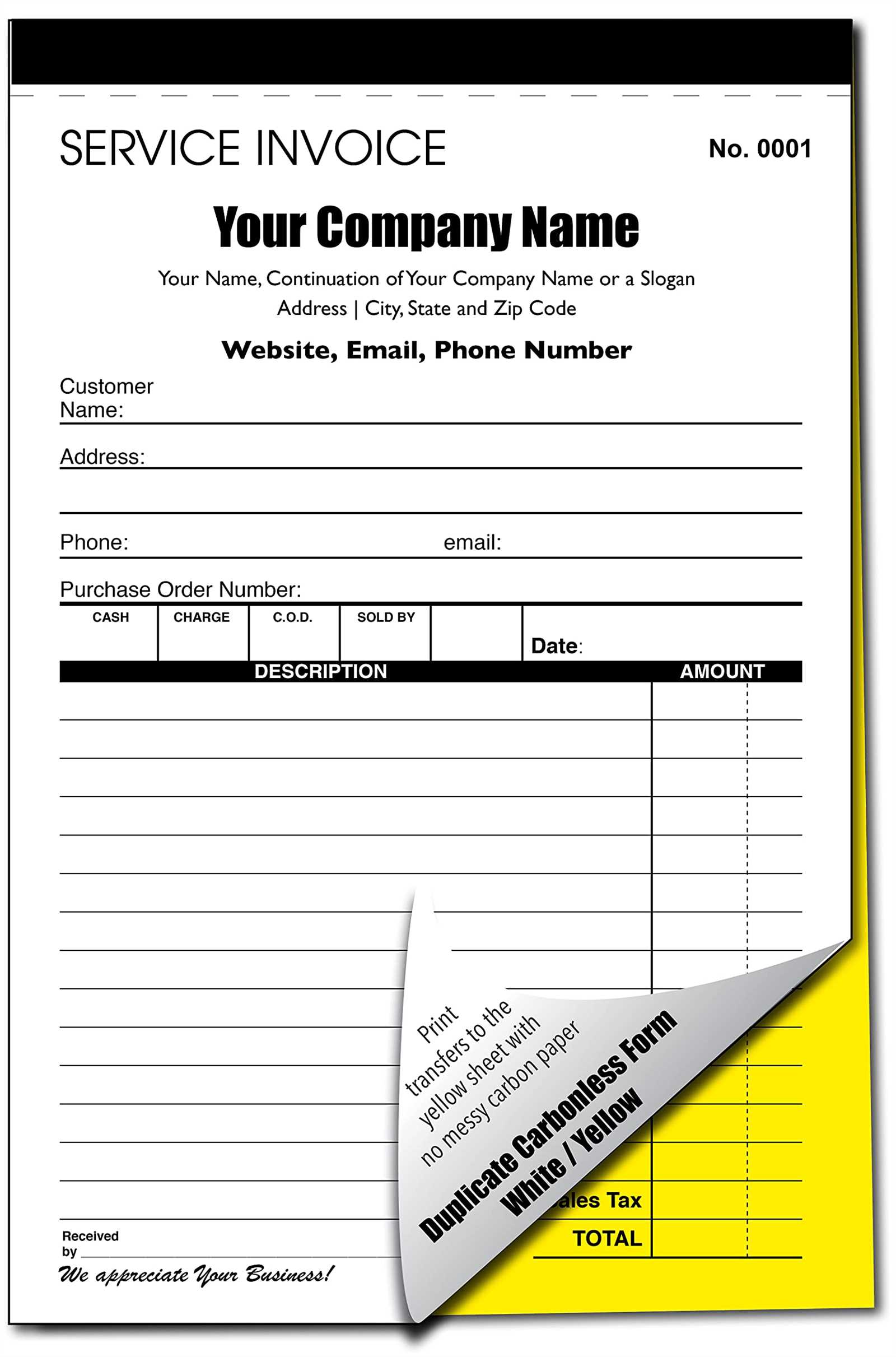

Printing Invoices from Templates

Once you have created a structured financial record, printing it for physical distribution or archiving is an essential step. Utilizing pre-designed forms can streamline this process, allowing you to quickly generate and print professional-looking documents. This approach ensures consistency, reduces errors, and saves valuable time when preparing documents for clients or business records.

Here are the key steps to follow when printing your financial records:

- Customize the Document: Before printing, make sure that all details–such as client information, product or service descriptions, totals, and payment terms–are correctly filled out. Double-check for any errors to ensure accuracy.

- Select the Right Format: Choose whether you need to print in portrait or landscape orientation based on the layout of your document. A landscape format can provide more space for detailed descriptions and itemized lists.

- Preview the Document: Always preview the document before printing to ensure everything is aligned correctly. This step helps you avoid unnecessary print runs due to formatting issues.

- Choose the Right Paper Size: Depending on your preference, you can print on standard letter-sized paper (8.5″ x 11″) or custom sizes. Ensure the document fits neatly on the chosen paper size to avoid cutoffs or extra blank space.

- Print Quality: Select a high-quality print setting to ensure the text is sharp and clear. A poor print quality can make the document look unprofessional and harder to read.

Consider Digital and Physical Copies: Many businesses prefer to keep a digital copy for easier storage and future reference. While printing the document is useful for in-person transactions or filing, you may also want to keep a digital version for emailing or archiving electronically.

By following these steps, you can ensure that your financial records are presented clearly and professionally, whether you’re distributing them to clients or keeping them for your own business documentation.

How to Track Invoice Payments

Tracking payments for goods or services rendered is essential for maintaining healthy cash flow and avoiding payment disputes. By keeping a record of each transaction, you can ensure that payments are received on time, monitor outstanding balances, and follow up with clients when necessary. A streamlined process for tracking payments helps keep your financial records organized and reduces the risk of missed payments.

Set Up a Payment Tracking System

To effectively track payments, it’s important to use a system that suits your business needs. Here are some steps to establish a simple yet effective method:

- Create a Record for Each Transaction: For every transaction, keep a detailed record including the amount billed, payment terms, and the due date. This can be done manually or by using accounting software.

- Monitor Payment Status: Regularly update the status of each transaction. Mark payments as “paid,” “pending,” or “overdue” so you can easily track what’s been paid and what’s still outstanding.

- Use a Payment Log: Keep a log (either digital or physical) that tracks payment dates, amounts, and methods (e.g., bank transfer, credit card, check). This will help you stay organized and offer a quick reference point if a dispute arises.

Automate Payment Tracking

Using Accounting Software: Accounting platforms like QuickBooks, Xero, or FreshBooks provide automated tools that track payments and generate reports. With these systems, you can send automatic reminders for overdue payments and generate payment reports with just a few clicks.

Integrate Payment Systems: Many businesses now integrate their payment processors with invoicing and accounting software. This allows for automatic updates on payment status and real-time tracking, so you’re always up to date on which transactions have been completed.

By establishing a reliable payment tracking system, you can keep your business finances organized and minimize the stress of overdue payments.

Choosing the Right Invoice Format

Selecting the correct layout for your billing documents is crucial for ensuring clarity and professionalism in your business transactions. The format you choose should be easy to understand for both you and your clients, and it should include all necessary details. A well-organized document helps avoid confusion, minimizes errors, and expedites the payment process.

Consider the Nature of Your Business

When choosing a layout, consider the specifics of your business operations. For example:

- Service-Based Businesses: If you’re providing services, it’s important to clearly list the work performed, along with hours worked, hourly rates, and any additional fees or taxes.

- Product-Based Businesses: If selling products, ensure you have a detailed list of items, quantities, prices, and applicable discounts or shipping charges.

- Recurring Payments: For businesses that operate on subscriptions or recurring billing, a format that clearly tracks previous payments, dates, and amounts is essential.

Simple vs. Detailed Formats

Depending on your business needs, you might prefer a more streamlined document or one with greater detail:

- Simple Format: This is ideal for smaller transactions or businesses that don’t require extensive documentation. It usually includes basic information such as the client’s name, the amount owed, and payment terms.

- Detailed Format: For larger transactions or complex services, you may want to include itemized lists, taxes, discounts, and multiple payment options. A detailed format helps ensure that every aspect of the transaction is clearly communicated and transparent.

By selecting a format that matches your business needs, you can ensure that your billing documents are both effective and professional, reducing the risk of errors or disputes.