Retainer Fee Invoice Template for Easy Billing

Managing payments for ongoing services can be challenging, especially when it comes to setting clear expectations and maintaining financial transparency. One of the most effective ways to handle such agreements is by creating structured documents that outline payment terms for continuous work. These documents help both service providers and clients stay aligned, ensuring that there are no misunderstandings regarding payments and service delivery.

In this guide, we’ll explore how to design a reliable and straightforward billing form that simplifies the process. Whether you’re a freelancer, consultant, or small business owner, having a clear structure for recurring charges is crucial. This approach not only protects your interests but also helps clients understand their financial commitments in advance, avoiding any future disputes.

Effective billing practices are an essential part of running a successful service-based business. A well-crafted document makes it easier to establish trust and professionalism while streamlining the payment process. In the following sections, we’ll cover key aspects of creating these important financial documents, along with tips to ensure your terms are fair and legally sound.

Retainer Fee Invoice Template Guide

Creating a clear and organized billing structure is key to managing long-term business relationships with clients. A well-designed document outlining payment terms for ongoing work not only ensures a smooth financial transaction process but also establishes trust between you and your clients. It simplifies communication by detailing the amount, payment intervals, and conditions under which services will be rendered, eliminating confusion and potential disputes.

When drafting such a document, it’s important to include essential elements that provide both you and your client with a clear understanding of the agreement. From specifying the scope of services to setting up payment schedules, each detail plays a critical role in establishing a professional and transparent business relationship.

Essential Components of a Service Billing Document

The primary components of this document should include the client’s details, a description of the services to be provided, and the agreed-upon payment terms. You should also include the payment frequency, whether it’s monthly, quarterly, or upon completion of certain milestones. A clear breakdown of what’s included in the agreement ensures that both parties are on the same page regarding expectations.

Customizing Your Billing Document

Customizing your billing form allows you to adapt it to specific business needs. Include fields for the client’s contact information, a detailed list of services, and any other custom terms that are important for the specific agreement. This flexibility ensures that each client’s unique needs are met while maintaining a consistent and professional approach to billing.

By tailoring your billing documents to match both your business requirements and your clients’ expectations, you can foster long-term, positive working relationships while keeping financial transactions clear and straightforward.

What is a Retainer Fee Invoice

A structured financial document used to request payment for ongoing services is essential for establishing clear terms between service providers and clients. This type of document outlines the agreed-upon amount for a specific period or project, ensuring both parties are aware of their financial obligations. It helps businesses streamline their billing processes, making it easier to track payments and ensure that the terms of the agreement are honored.

Typically, the document is used in situations where a client agrees to pay a set amount in advance or at regular intervals for continuous or future work. It serves as a formal record of the agreed payments, often linked to an ongoing relationship or contract. By defining payment terms upfront, it protects both the service provider and the client from misunderstandings.

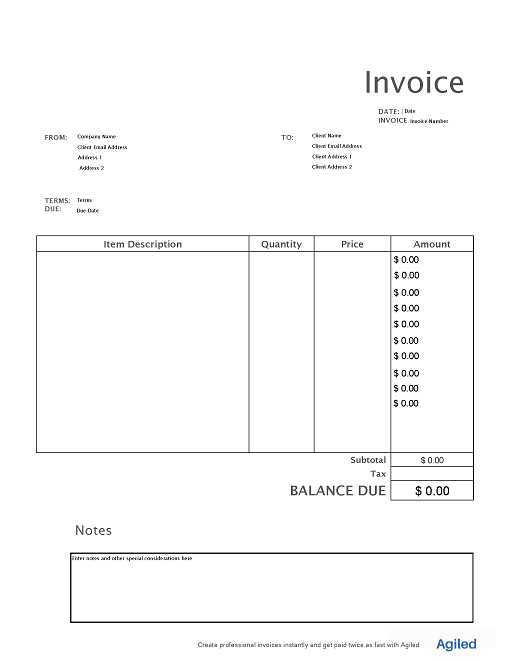

How to Create a Retainer Invoice

Creating a billing document for ongoing services involves a few key steps to ensure clarity and professionalism. The process starts with specifying the agreement between you and the client, detailing the amount to be paid and the services that will be delivered. A well-crafted document provides all necessary information to avoid misunderstandings and ensures smooth financial transactions throughout the project or contract.

To begin, clearly outline the client’s name and contact details at the top of the document. Then, include a description of the services that will be provided, along with the agreed payment amount and any relevant payment terms, such as due dates or installment schedules. Be sure to specify the time frame during which the work will occur, and provide clear instructions on how payments should be made.

Additional sections should include a unique reference number for tracking purposes, your business information, and any terms and conditions related to the service. If applicable, outline any late payment fees or penalties for missed deadlines. The more detail you provide, the easier it will be for both you and the client to manage the financial side of the arrangement.

Benefits of Using a Retainer Invoice

Implementing a structured document for ongoing service payments offers several advantages for both businesses and clients. It helps set clear expectations, streamline financial tracking, and ensure timely compensation for services rendered. By formalizing the payment process, both parties can avoid confusion and maintain a professional relationship throughout the project or contract period.

Advantages for Service Providers

- Predictable Cash Flow: Setting up regular payments ensures consistent income, making it easier to manage business expenses.

- Better Client Commitment: Clients who agree to pay in advance or at regular intervals are more likely to remain committed to long-term agreements.

- Reduced Administrative Work: Automating the billing process reduces time spent on invoicing, making it easier to focus on delivering services.

- Clearer Terms: Clear payment agreements prevent misunderstandings about financial obligations, reducing disputes.

Benefits for Clients

- Cost Clarity: Clients know exactly what they’re paying for and when payments are due, helping with budget management.

- Financial Flexibility: Regular payments spread over time can be more manageable than large lump sums.

- Long-Term Relationship Building: A structured payment plan can foster trust and long-term partnerships with service providers.

Overall, using such a billing method creates a smoother workflow for both parties, ensuring financial expectations are aligned and services are delivered as agreed upon.

Key Elements of a Retainer Invoice

Creating a clear and effective document for ongoing service payments requires including several key details that ensure both the service provider and client are aligned. The following elements are essential to any such financial record, as they help define the terms of the agreement and make the billing process transparent and easy to understand.

| Element | Description |

|---|---|

| Client Information | Include the full name, contact details, and address of the client to ensure that all correspondence and records are accurate. |

| Service Description | Clearly outline the services being provided, specifying the scope of work and any agreed deliverables. |

| Payment Amount | State the agreed-upon amount for the services, whether it’s a fixed sum or a recurring charge, and break it down if necessary. |

| Payment Schedule | Define how often payments will be made (e.g., monthly, quarterly) and the due dates for each installment. |

| Payment Methods | Indicate the available methods for making payments (bank transfer, credit card, etc.), and provide necessary account details. |

| Terms and Conditions | Include any relevant terms about late payments, penalties, or additional charges for modifications to the agreement. |

| Contact Information | Provide your business details, including your name, phone number, and email address for easy communication regarding the agreement. |

By incorporating these key elements into your document, you ensure a professional and transparent approach that benefits both parties and sets clear expectations from the outset.

How to Customize a Retainer Template

Adapting a financial document for ongoing services to fit specific business needs allows you to maintain flexibility while ensuring professionalism. Customization ensures that the document aligns with the unique terms of each client agreement, whether it’s adjusting payment schedules, services offered, or the structure of the agreement itself. A personalized approach enhances communication and avoids confusion for both parties involved.

Steps to Personalize Your Document

To begin customizing your financial record, you should first ensure that the basic structure is in place. This includes fields for all necessary information like the client’s details, payment terms, and service descriptions. Afterward, adjust the sections to fit the specific nature of the work being provided. Here are some areas you may want to customize:

| Customization Area | Description |

|---|---|

| Service Description | Be specific about the nature of the work, milestones, or deliverables expected within the agreed period. |

| Payment Structure | Adjust payment amounts, intervals (e.g., weekly, monthly), and terms based on the client’s requirements or the project timeline. |

| Additional Clauses | Include any special terms such as penalties for late payments or conditions for adjusting payment amounts during the contract period. |

| Business Information | Update your company’s details such as contact information, logo, and payment account details to reflect your business identity. |

Ensuring Clarity and Flexibility

Once you’ve customized your document with the necessary information, review it carefully to ensure all terms are clear and concise. A well-crafted, personalized agreement provides transparency, reduces the likelihood of misunderstandings, and fosters a better working relationship between you and your client. Customization also allows you to address any special requirements or conditions unique to each project or client.

Choosing the Right Retainer Fee Structure

Selecting the appropriate structure for ongoing service payments is crucial for both the service provider and the client. The right payment arrangement ensures that both parties feel comfortable with the terms, while also allowing for flexibility in handling different types of projects or services. Whether you’re working on a long-term project or offering ongoing support, it’s important to find a balance that meets the needs of both sides.

Types of Payment Structures

There are several payment structures to consider when setting up an agreement for continuous work. Each structure has its own advantages, depending on the scope of the services and the nature of the relationship between the client and the service provider. Here are a few common options:

- Fixed Monthly Rate: A set amount is paid at regular intervals (e.g., monthly) for a defined scope of work. This structure is ideal for ongoing services with consistent requirements.

- Hourly Rate: Payments are based on the amount of time spent on the work. This can be beneficial for projects where the scope may vary or for clients who need flexibility.

- Milestone Payments: Payments are made at key points throughout the project. This option is suitable for larger projects where specific deliverables are expected at various stages.

- Block Time: A set number of hours or days are allocated each month for services, allowing for flexibility while maintaining predictable payments.

Factors to Consider

Choosing the best payment structure requires careful consideration of various factors:

- Client Needs: Understand the client’s budget, expectations, and the flexibility they require. Some clients may prefer predictable payments, while others might need a more variable approach based on actual work performed.

- Scope of Work: If the work is ongoing and consistent, a fixed-rate structure might be more suitable. However, for unpredictable or project-based work, hourly or milestone-based payments may be more appropriate.

- Long-Term Relationship: If you’re looking to build a long-term partnership, a stable, predictable payment method can help maintain trust and avoid financial strain.

Choosing the right structure can significantly impact the success of the business relationship. By understanding both your needs and the client’s preferences, you can create a mutually beneficial arrangement that ensures fair compensation and clear expectations.

Retainer Fee Invoice Examples

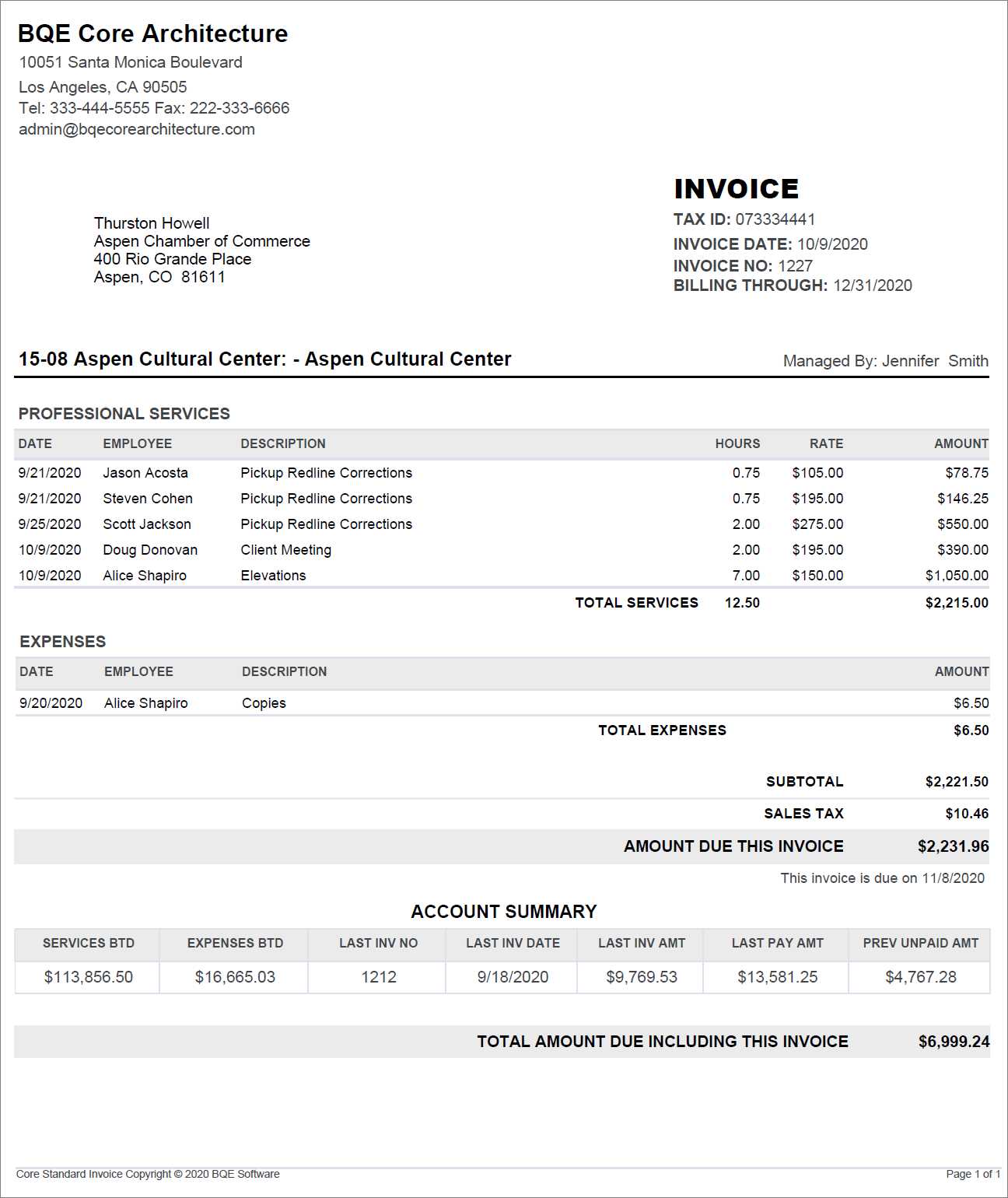

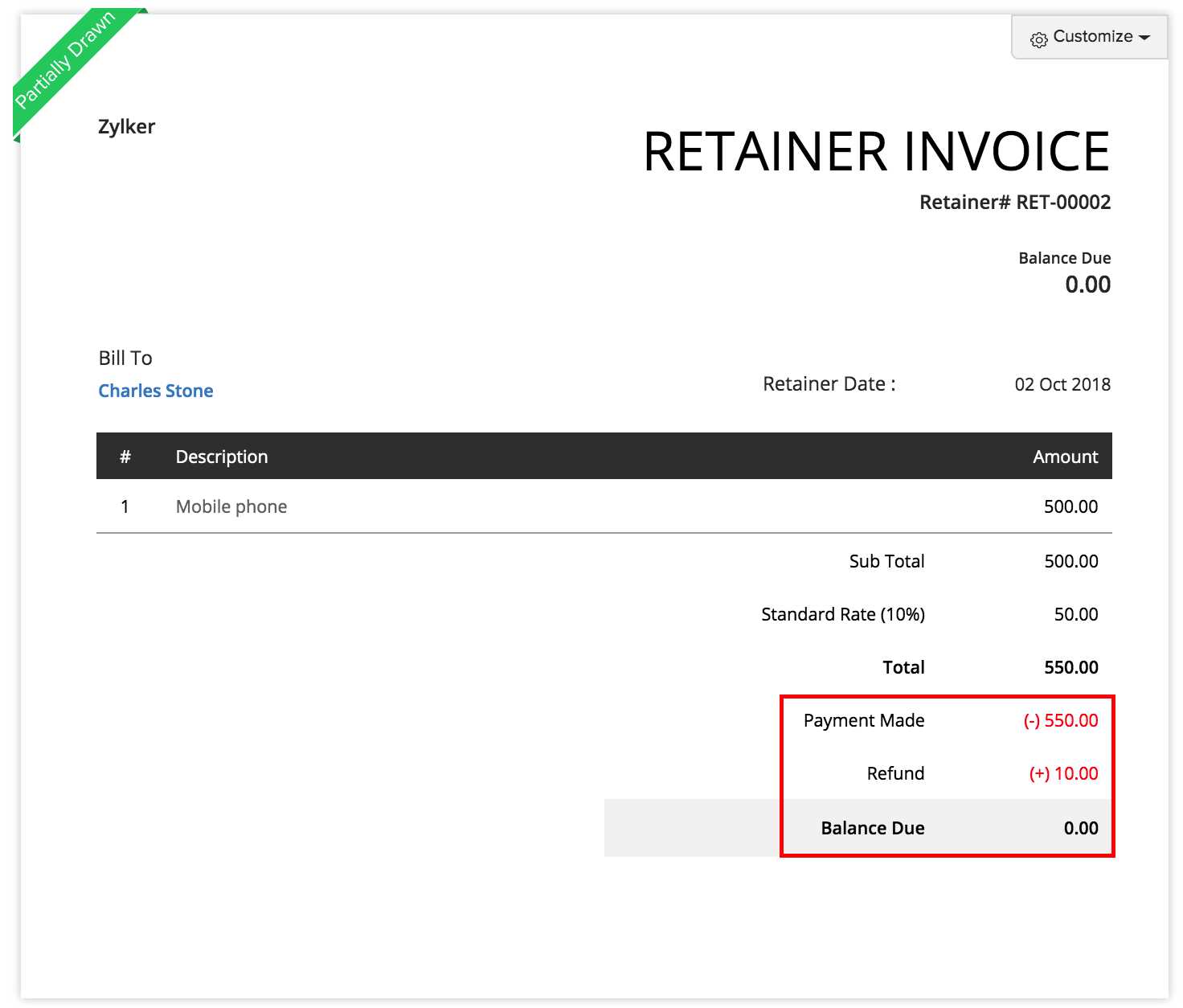

Providing clear examples of billing records for ongoing services can help both service providers and clients understand what to expect from the payment process. These examples illustrate how various details should be organized, from payment amounts and schedules to the specific services rendered. A well-structured document not only ensures financial clarity but also fosters trust in the business relationship.

Below are a few examples of how such a document can be laid out for different service arrangements. Each example includes essential details tailored to specific types of agreements. By following these examples, you can adapt your own billing process to suit the nature of the work and the preferences of your clients.

Example 1: Monthly Retainer for Ongoing Services

This example is ideal for long-term service agreements where a fixed monthly amount is paid for a defined set of services.

| Client Name | Service Description | Amount | Payment Due Date |

|---|---|---|---|

| John Doe Enterprises | Monthly Social Media Management | $2,000 | 1st of each month |

Additional Notes: Payment is due at the start of each month. The amount covers up to 30 hours of work per month, including content creation and strategy development.

Example 2: Block Time Agreement for Consulting

This example works for situations where a certain number of hours are purchased in advance for consulting or advisory services.

| Client Name | Service Description | Hours Purchased | Amount | Payment Due Date |

|---|---|---|---|---|

| ABC Corp | Consulting Services (Block of 20 hours) | 20 hours | $4,500 | Due upon signing agreement |

Additional Notes: The client can use the hours over a 3-month period. Any unused hours after 3 months will expire, unl

Best Practices for Retainer Billing

When managing payments for ongoing services, it’s essential to establish clear and professional practices that benefit both the service provider and the client. A well-organized payment structure helps ensure smooth transactions, reduces the risk of disputes, and fosters long-term relationships. Implementing best practices in your billing process can significantly enhance the clarity and efficiency of your business operations.

Here are some key guidelines to follow when setting up and managing recurring payment agreements with clients:

1. Set Clear Payment Terms

From the outset, both you and your client should have a mutual understanding of payment terms. Specify the amount, frequency, and due dates of payments, and outline the payment methods you accept. This clarity helps prevent confusion and ensures that both parties are on the same page. It’s also advisable to discuss and agree upon any potential additional charges or penalties for missed payments upfront.

2. Define the Scope of Services

Be specific about the services you will provide and the expectations for each payment period. Clearly outline the deliverables, project milestones, or work hours included in the agreement. This helps manage client expectations and avoids scope creep, where additional services are requested without adjustment to the payment structure.

3. Offer Flexibility in Payment Schedules

Consider the financial situation of your clients and offer flexibility in payment terms where possible. For example, you might allow clients to pay in installments or set up different pricing options based on the duration or frequency of the services. Offering flexibility can help build trust and make it easier for clients to commit to long-term agreements.

4. Automate Billing Whenever Possible

To save time and reduce errors, consider automating your billing process. Many accounting tools and software solutions allow you to set up recurring payments or send automatic reminders for due dates. Automation ensures that payments are made on time and eliminates the administrative burden of manual tracking.

5. Maintain Regular Communication

Keep an open line of communication with your clients, especially regarding payment reminders and any changes to the agreement. Sending friendly reminders before payment due dates and providing updates on the progress of the work can help build rapport and keep everything running smoothly. Transparent communication reduces the likelihood of misunderstandings.

6. Include Detailed Records and Documentation

Each payment document should include a breakdown of the services rendered, the payment amount, the due date, and any additional terms. Having detailed records not only keeps your billing organized but also provides a point of reference for both you and your client. In case of any disputes, this documentation will serve as a helpful record of the agreed-upon terms.

7. B

Common Mistakes in Retainer Invoices

While managing billing for ongoing services, it’s easy to overlook small details that can lead to misunderstandings or delays in payments. These common errors often stem from a lack of clarity or insufficient documentation, which can cause frustration for both service providers and clients. By being aware of these frequent mistakes, you can take steps to ensure your billing process is smooth and professional.

1. Lack of Clear Payment Terms

One of the most common mistakes is not specifying payment terms clearly. This can result in confusion about due dates, amounts, and payment intervals. Without clear guidelines, clients may not know when or how much they need to pay, leading to late payments or disputes.

- Ensure the payment amount is specified clearly.

- Define payment intervals (e.g., weekly, monthly, or quarterly).

- Include the payment due date to avoid delays.

2. Not Detailing the Scope of Work

Failing to outline the exact services included in the agreement can cause issues down the line. Clients may assume certain tasks are included in the price when they are not, or they may request additional work without understanding that it requires extra compensation.

- List all services that will be provided within the payment period.

- Be specific about deliverables and timelines.

- Consider including language that clarifies extra charges for additional work.

3. Missing or Incorrect Client Information

Another common error is failing to include the correct client details or leaving them out entirely. This can result in delays or confusion, especially if there are multiple clients or projects involved.

- Ensure the client’s name, contact information, and address are correct.

- Check that all details match the client’s records to avoid confusion.

4. No Clear Payment Instructions

Without proper payment instructions, clients may struggle to make payments or use incorrect methods. This can delay the payment process and create unnecessary back-and-forth communication.

- Provide clear instructions on how payments should be made (e.g., bank transfer, credit card, etc.).

- Include relevant details such as account numbers or online payment links.

5. Failing to Address Late Payments

Not specifying penalties for late payments is a mistake that can lead to financial issues for service providers. Without a clear late payment policy, clients may delay payments without consequences, affecting cash flow.

- Outline late

When to Use a Retainer Invoice

Certain types of service agreements require ongoing payments that cover both the expected workload and the time dedicated to the client’s needs. These payment arrangements are often ideal when the work requires long-term commitment or when services are provided regularly over a period of time. Understanding when to implement a consistent payment model can help ensure that both the service provider and the client have clear expectations about financial terms and scheduling.

For Ongoing Services with Predictable Workload

When your business provides continuous or recurring services that are consistent in nature, it’s helpful to set up a regular billing cycle. This is particularly useful for services like consulting, legal advice, digital marketing, or maintenance work where the tasks are well-defined but will extend over an indefinite period.

Key Benefits:

- Helps secure consistent income.

- Ensures both parties agree on service terms up front.

- Reduces the need for frequent renegotiations.

For Clients Who Require Priority Access

If your clients need priority or dedicated access to your services, it may be appropriate to set up an arrangement where a regular, upfront payment ensures their place in your schedule. This model is especially beneficial for high-demand clients who need guaranteed availability or fast responses to issues.

Key Benefits:

- Establishes a premium relationship with clients.

- Ensures that you are compensated for your availability.

- Helps manage workload and client expectations effectively.

These types of agreements are commonly used in industries where service providers must guarantee a certain level of availability or ongoing support. By using a structured payment approach, you can manage your time and resources more efficiently while meeting the needs of your clients.

Legal Considerations for Retainer Agreements

When entering into an ongoing service agreement with a client, it is essential to ensure that the terms are legally sound and clearly understood by both parties. A well-drafted agreement not only protects the interests of both the service provider and the client but also helps to avoid potential conflicts or misunderstandings down the line. Legal considerations play a crucial role in defining the scope of work, payment terms, and dispute resolution processes.

1. Clear Definition of Services

One of the most important aspects of a service contract is a clear and detailed description of the work being provided. Vague or ambiguous terms can lead to disputes regarding the expectations of the client and the obligations of the service provider. It is essential to specify what services will be provided, any limitations, and the expected outcomes.

- Define the scope of work: Clearly outline the tasks, deliverables, and timelines for each service provided.

- Set limitations: Address any exclusions or limitations to prevent scope creep.

2. Payment Terms and Conditions

Payment structures should be explicitly defined in the agreement. This includes the amount, frequency, method of payment, and due dates. It is also essential to address what happens in case of late payments, missed payments, or any changes to the original payment schedule. A clear and enforceable payment clause is essential to avoid potential legal issues.

- Include payment deadlines: Specify when payments are due and the accepted payment methods.

- Late payment clauses: Address penalties or interest rates that apply to overdue payments.

- Adjustments: Clarify how payments will be handled if the scope of work changes or additional services are requested.

3. Termination and Renewal Provisions

Another critical aspect to include is the conditions under which the agreement can be terminated or renewed. Both the service provider and the client should have clear guidelines for ending the relationship if necessary. This includes any notice period required for termination, the process for renewal, and any fees associated with early termination.

- Termination clauses: Define how either party can end the agreement and under what conditions.

- Renewal terms: Specify if the agreement is renewable and outline the renewal process.

4. Confidentiality and Intellectual Property Rights

For many service agreements, especially those involving creative work, research, or proprietary information, confidentiality clauses and intellectual property rights are essential. Both parties should agree on how sensitive information will be handled and who will own any intellectual property created during the course of the agreement.

- Confidentiality: Ensure both parties agree not to disclose sensitive information to third parties.

- Ownership of work: Clarify who owns any intellectual property created during the engagement, including copyrights or patents.

5. Dispute Resolution and Governing Law

Dispute resolution clauses are critical for addressing any conflicts that may arise during the course of the agreement. The contract should specify the method of resolving disputes, such as mediation or arbitration, and the governing law under which the contract will be interpreted. This ensures that both parties know how to proceed if disagreements occur.

- Dispute resolution process: Include a process for handling disputes, such as mediation or arbitration.

- Governing law: Specify which jurisdiction’s laws will govern the contract.

By considering these legal elements, you can create a clear, enforceable, and fair service agreement that helps protect both parties. Proper legal protections ensure that your business runs smooth

Managing Retainer Payments Efficiently

Managing ongoing payments for long-term client relationships requires both organization and precision. Streamlining the payment process helps maintain a positive working relationship while ensuring that cash flow remains steady. Establishing a consistent and efficient method for tracking and processing these payments can reduce administrative burdens and prevent errors, which ultimately supports a smoother workflow for both service providers and clients.

1. Automate Payment Scheduling

One of the most effective ways to manage recurring payments is through automation. Automated systems help ensure that payments are processed on time, reducing the risk of missed or late payments. By using billing software or online platforms, you can set up regular billing cycles that automatically send reminders or process transactions on specific dates.

- Set up automated reminders: Send clients regular reminders about upcoming payment dates to keep everything on track.

- Schedule recurring payments: Use payment platforms that allow clients to authorize automatic payments on a set schedule.

2. Keep Detailed Records of Payments

Maintaining accurate and organized records of all transactions is critical. This includes tracking the amount paid, payment date, and any changes made to the original payment terms. Proper documentation ensures that both parties have a clear understanding of the financial relationship, and it simplifies the process when reviewing past payments or addressing discrepancies.

Payment Date Amount Paid Payment Method Balance Remaining 2024-11-01 $500 Credit Card $2000 2024-10-01 $500 Bank Transfer $2500 3. Set Clear Terms for Adjustments

In the case of changes to the scope of services or payment schedules, it’s important to establish clear terms regarding adjustments. Ensure that any modifications are documented and agreed upon by both parties, including updated amounts, payment dates, and terms of service. This helps avoid confusion and maintains transparency in your financial arrangements.

- Clarify payment adjustments: Address any additional charges or discounts before they are implemented.

- Communicate changes: Notify clients promptly when adjustments are made,

How to Send a Retainer Invoice

When it comes to sending payment requests for ongoing services, clarity and professionalism are key. Ensuring that your clients understand the payment process and the specifics of the amount due is essential for maintaining a smooth working relationship. Sending a payment request involves more than just issuing a document; it requires clear communication, proper documentation, and timely reminders. Follow these steps to ensure the process goes smoothly.

1. Prepare the Payment Request

The first step is to ensure all relevant information is included in the payment request. This will help your client easily understand the amount due, the services being provided, and the payment terms. Accuracy is crucial to avoid confusion.

- List the services: Clearly state the services provided during the billing period.

- Include the payment amount: Make sure the total amount due is specified, including any taxes or additional costs.

- Specify payment terms: Define due dates, payment methods, and any penalties for late payments.

2. Choose the Right Method for Sending the Request

Once you’ve prepared the payment request, choose the most suitable way to send it. This could vary depending on your client’s preferences and your business practices. You can use email, online payment platforms, or even physical mail if necessary.

- Email: Send the payment request via email for quick delivery, and include a digital copy of the payment request as an attachment.

- Online platforms: Many businesses use online platforms that allow clients to view and pay directly. These platforms often automate reminders and confirmations.

- Physical mail: In some cases, particularly with larger clients or formal contracts, sending a printed payment request may be more appropriate.

3. Send Timely Reminders

To ensure that payments are made on time, it’s important to send reminders ahead of the due date. Timely communication can help prevent late payments and keep both parties aligned on expectations.

- First reminder: Send a gentle reminder about a week before the payment due date.

- Second reminder: If the payment is still not received, follow up with a more urgent reminder closer to the due date.

- Final notice: If necessary, send a final notice indicating any late fees or consequences of non-payment.

4. Confirm Payment Receipt

Once the payment has been made,

Tracking Retainer Fees in Your System

Effectively managing and tracking ongoing client payments is crucial for maintaining a steady cash flow and ensuring the accuracy of your financial records. By setting up a streamlined tracking system, you can keep a clear overview of payments received, outstanding balances, and the services provided. This process helps avoid confusion, reduces administrative time, and allows for better financial planning. Whether you use manual methods or digital tools, proper tracking is essential to running a successful business.

1. Set Up a System to Record Payments

The first step in tracking client payments is to have a dedicated system for recording each transaction. Whether you use accounting software, spreadsheets, or a paper ledger, it’s important to capture all relevant details of each payment.

- Use accounting software: Tools like QuickBooks, FreshBooks, or Xero can automatically track transactions and generate financial reports.

- Spreadsheets: For smaller businesses, a simple spreadsheet can be used to record payments. Create columns for the client name, payment date, amount, and payment method.

- Paper ledger: If you prefer manual tracking, maintain a detailed ledger with each payment entry, keeping physical copies of receipts or records.

2. Monitor Payment Status Regularly

Regularly reviewing your records will help you stay on top of payments and ensure that no outstanding amounts go unnoticed. By checking your system frequently, you can spot any discrepancies early and follow up with clients promptly if necessary.

- Weekly checks: Perform weekly checks to ensure all payments have been recorded accurately.

- Generate reports: Use your system to generate periodic reports that summarize payment history, outstanding balances, and upcoming payment due dates.

- Client communication: Regularly communicate with clients about their payment status, and notify them if there are any discrepancies or upcoming dues.

3. Track Adjustments and Changes

Throughout the course of an ongoing arrangement, there may be adjustments made to the payment schedule or amounts due. It’s essential to track any changes in the agreement to maintain accuracy in your records.

- Document changes: Keep detailed notes about any adjustments, whether they are due to changes in the scope of work or agreed-upon modifications.

- Notify clients: Whenever adjustments are made, inform clients in writing so that both parties are clear on the new terms.

- Update your system: Adjust the tracking system accordingly to reflect any changes in amounts or payment schedules.

By staying organized and proactive in tracking payments, you can ensure that both you and your clients are on the same page. This approach not only helps with financial accuracy but also improv

Retainer vs. Hourly Billing Explained

When it comes to charging clients for services, businesses often face a choice between two common pricing structures: upfront payment arrangements and hourly rates. Each method has its own advantages and challenges, depending on the nature of the services being provided and the preferences of both the service provider and the client. Understanding the key differences between these billing models can help you choose the best approach for your business and establish clearer expectations for your clients.

1. Upfront Payment Arrangements

With upfront payment arrangements, clients agree to pay a certain amount for a set block of services, usually in advance. This model provides a predictable and steady income for the service provider, making it easier to manage cash flow. It also gives clients peace of mind knowing they are covered for the duration of the agreement.

- Benefits for businesses: Ensures upfront payment, reducing the risk of late or missed payments. Helps with financial planning.

- Benefits for clients: Predictable costs for a set amount of work, often with a discount or added value for committing to a longer-term relationship.

- Considerations: May require clear communication about the scope of services to avoid misunderstandings.

2. Hourly Billing Model

Hourly billing involves charging clients based on the actual time spent working on their project or services. This model is often preferred for tasks where the scope is uncertain or where it’s difficult to predict how many hours will be required. Hourly rates can be adjusted depending on the level of expertise or urgency of the project.

- Benefits for businesses: Charges clients based on the time spent, which is ideal for projects where the workload fluctuates or is unpredictable.

- Benefits for clients: Only pays for the actual time spent, which can be fairer when the amount of work varies.

- Considerations: Can lead to unexpected costs for clients if the project takes longer than anticipated. Requires detailed tracking of time spent on tasks.

3. Key Differences and Choosing the Right Approach

Choosing between upfront payment arrangements and hourly billing depends on several factors, including the type of service, client preferences, and the project scope. It’s important to assess the nature of the work before deciding which model is best suited for both parties.

- Predictability vs. flexibility: Upfront payments offer predictability, while hourly billing provides flexibility but may lead to budget uncertainty.

- Scope of work: If the work is well-defined and can be completed in a set number of hours, an upfront agreement may be better. For more open-ended or evolving tasks, hourly billing may work best.

- Client relationships: Some clients may prefer the predictability of a fixed rate, while others may feel more comfortable paying for only what is done on an hourly basis.

Ultimately, the best billing model will depend on your specific business needs and the preferences of your clients. It’s important to clearly communicate your pricing structure and ensure that both parties understand the terms to avoid misunderstandings.

Automating Retainer Fee Invoices

Managing regular client payments can be time-consuming, especially when dealing with recurring billing cycles. Automating the payment request process can save valuable time, reduce human error, and ensure that payments are consistently sent on schedule. By implementing automation tools, businesses can streamline the way they handle regular payment requests, making it more efficient for both the service provider and the client.

Automation helps businesses create, send, and track payment requests with minimal manual intervention. This ensures that all clients receive their payment requests at the right time, and any outstanding amounts can be quickly followed up on without requiring extra effort. Automating the process also improves the overall efficiency of your financial operations, allowing you to focus on other important aspects of your business.

1. Use Accounting Software

Modern accounting software can be an invaluable tool for automating the creation and sending of payment requests. Many software options allow you to set up recurring payment schedules and automatically generate and send the requests to clients. This ensures that payments are requested on time and reduces the administrative burden of creating individual documents for each cycle.

- QuickBooks: Offers automated billing features that can handle recurring payments, helping businesses stay organized.

- FreshBooks: Allows you to create automated payment requests and set up payment reminders for clients.

- Xero: Another accounting tool that automates billing, invoicing, and reminders, streamlining your payment process.

2. Set Up Recurring Billing Cycles

Automating the timing of your payment requests is essential to staying organized and keeping a consistent cash flow. By setting up recurring billing cycles, you can ensure that clients are charged at regular intervals without needing to manually track when a payment is due. Most accounting platforms allow you to set payment frequency preferences, such as monthly, quarterly, or annually, and will automatically send out the request for you.

- Monthly Billing: Send payment requests automatically at the beginning or end of each month.

- Quarterly Billing: Set up quarterly payment schedules and let the system handle the reminders.

- Annual Billing: Automate annual payments to avoid manually creating and sending requests each year.

3. Integrate Payment Processing Systems

To further streamline the process, integrate a payment processing system with your automation tools. This allows clients to pay directly from the payment request, making it even easier for both you and your clients to complete transactions. Payment gateways such as PayPal, Stripe, or Square offer integration with many accounting tools, enabling seamless payments and automated transaction tracking.

- PayPal: Integrates with many accounting tools to process payments quickly and securely.

- Stripe: Popular for online transactions, Strip

How Retainer Invoices Help Cash Flow

Managing consistent cash flow is one of the most important aspects of running a successful business. For many companies, especially service providers, ensuring that payments are received regularly and on time can be challenging. By setting up structured, pre-arranged payments, businesses can improve cash flow, reduce financial uncertainty, and better plan for future expenses. This model ensures that funds are available when needed, providing financial stability and reducing the risks associated with delayed payments.

1. Predictable Revenue Stream

One of the biggest advantages of structured prepayments is that they create a predictable revenue stream. By securing payments in advance, businesses can avoid the stress of fluctuating income, allowing them to manage operational costs and invest in growth opportunities. This predictability helps businesses plan for expenses such as payroll, inventory, and operational overheads.

- Better budgeting: With regular payments coming in on a set schedule, companies can create more accurate budgets and forecasts.

- Reduced financial stress: Knowing that you have a steady flow of income can help mitigate the stress that comes with unpredictable payment cycles.

- Enhanced planning: Pre-arranged payments allow businesses to plan long-term and take on more ambitious projects with confidence.

2. Reduces the Risk of Late Payments

Late payments can cause serious cash flow disruptions, especially for small businesses and freelancers. By agreeing on fixed payment terms upfront, businesses reduce the risk of having to chase down overdue payments. With structured agreements in place, the need for constant reminders and follow-ups is minimized, as clients are aware of the schedule and terms from the outset.

- Increased efficiency: Automatic or scheduled payments help avoid the time-consuming process of chasing clients for payments.

- Minimized cash flow gaps: Regular payments reduce the possibility of gaps between client payments and the funds required to run operations.

- Improved client relationships: When payment terms are clear and agreed upon, businesses can avoid misunderstandings and maintain healthy working relationships with clients.

In summary, implementing a structured payment system that ensures consistent cash flow not only provides financial security but also enhances business operations by reducing the administrative burden. This approach benefits both businesses and clients, allowing for better planning, smoother cash management, and more successful outcomes.