Free MS Excel Invoice Template for Easy Billing

Managing financial transactions can be a challenging task for any business, but having the right tools can significantly simplify the process. One of the most effective ways to keep track of payments and generate professional records is by using structured documents. These documents can be customized to fit your needs, helping you maintain clear and organized billing practices.

Whether you’re a freelancer or a small business owner, the ability to quickly generate accurate and visually appealing records is essential. The software offers numerous features that allow for customization, ensuring that every document you create is tailored to your specific requirements. With just a few adjustments, you can produce high-quality, professional-looking paperwork that reflects the value of your work.

In this guide, we will explore how to leverage the power of this tool to create customized billing records. By the end, you will have the knowledge and resources to streamline your payment tracking, making the entire process more efficient and reliable.

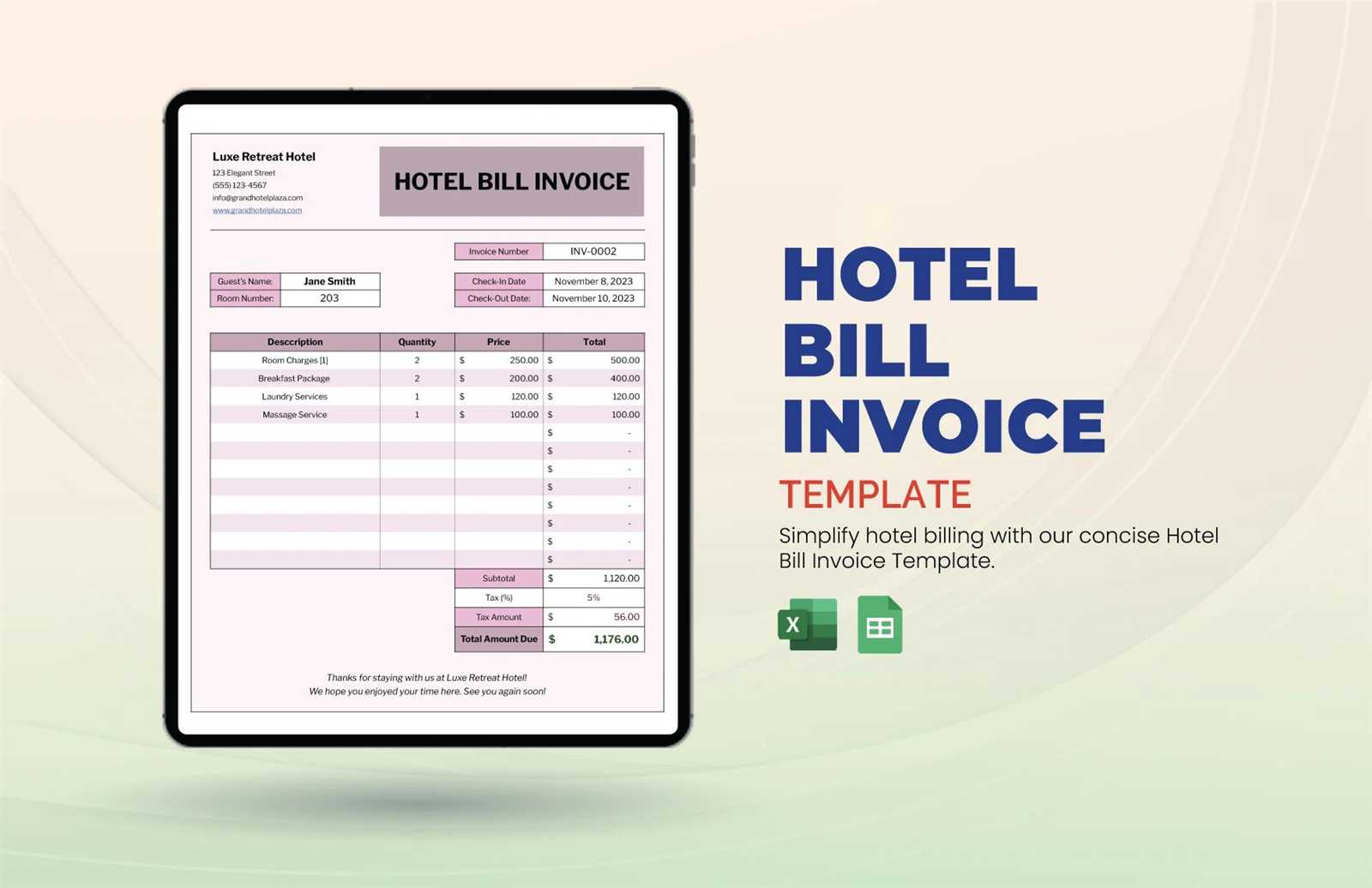

Free MS Excel Invoice Template Overview

Creating professional documents to track payments and transactions is a fundamental task for any business. Using pre-designed structures can significantly reduce the time and effort spent on creating accurate and organized records. With the right setup, anyone can generate clear, consistent documents that meet industry standards without needing extensive design knowledge.

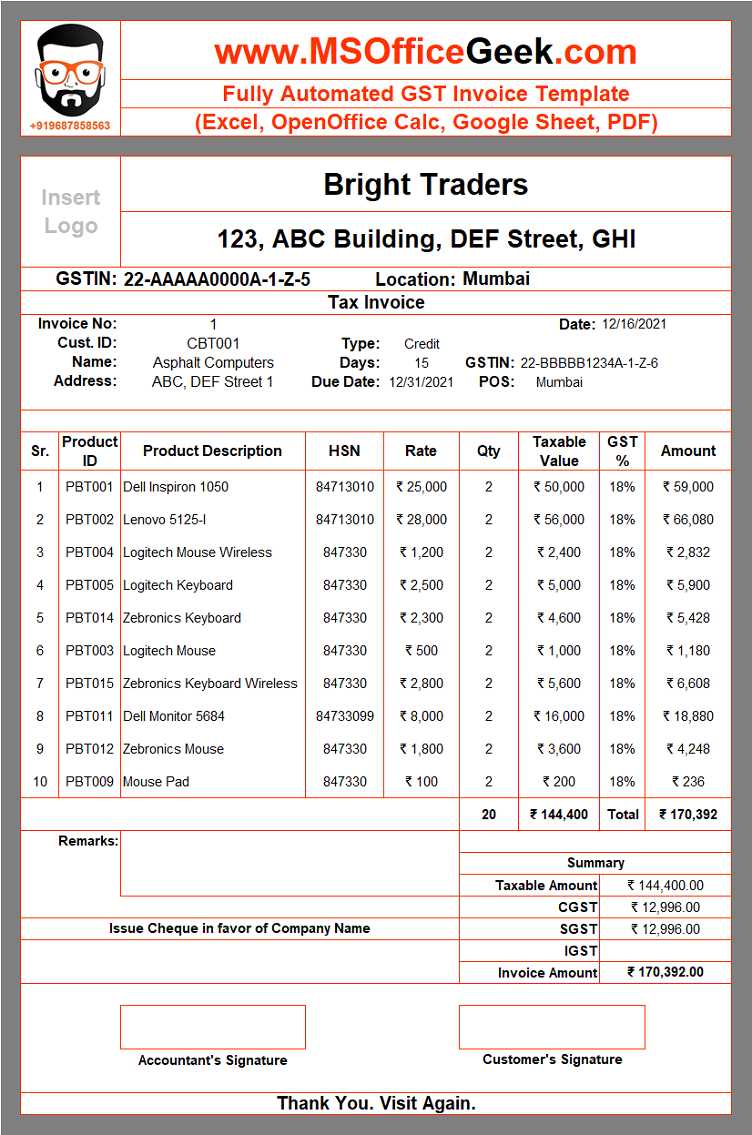

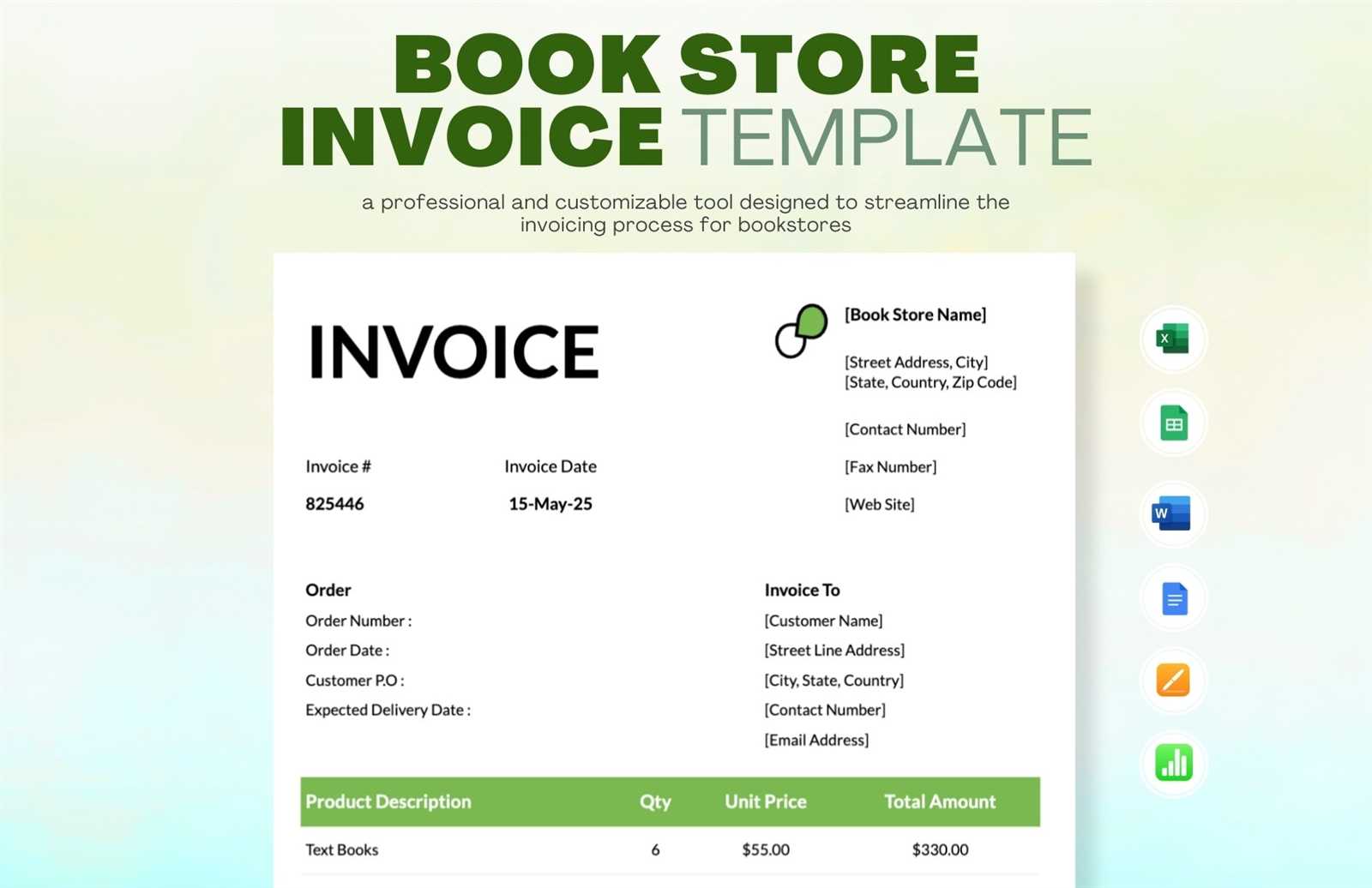

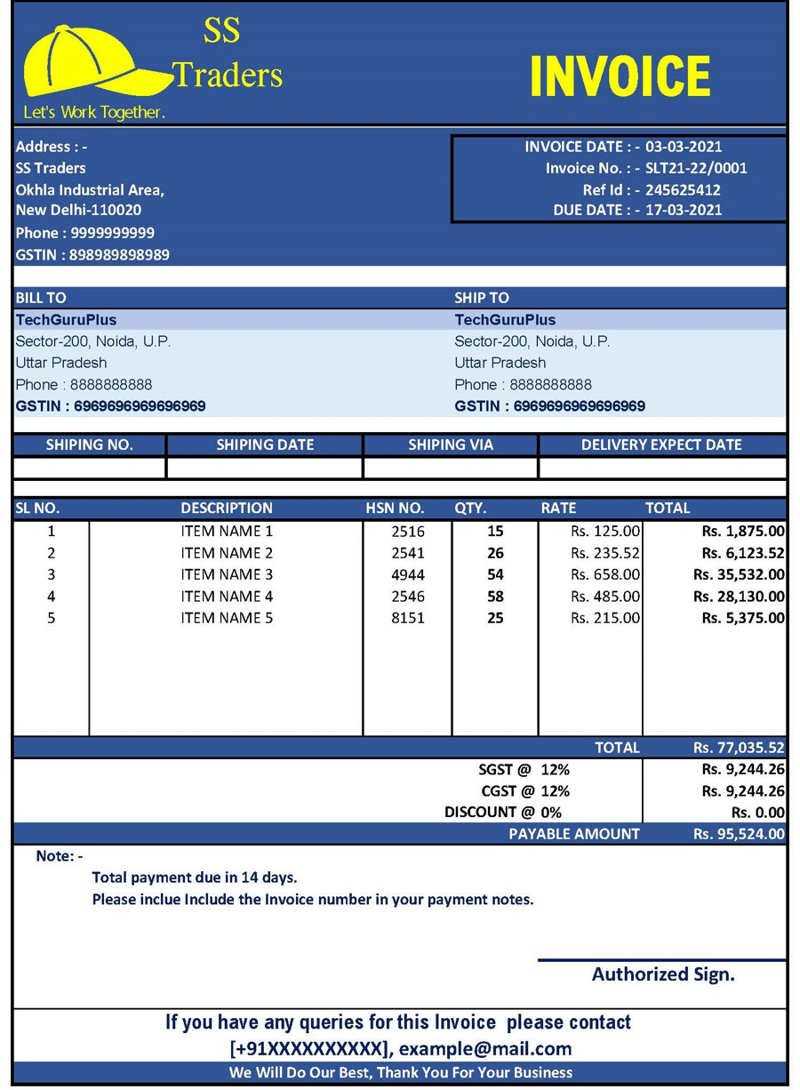

These ready-made formats are customizable and easy to use, offering various fields to include essential details like business information, client data, payment terms, and itemized lists. Whether for a one-time project or ongoing transactions, they ensure every aspect is covered, helping you maintain a polished and professional appearance in every financial exchange.

By opting for a downloadable version, you can save valuable time and eliminate the risk of missing key elements, while also ensuring that your documents stay aligned with your brand’s style and requirements. With these resources at hand, handling your billing process becomes both efficient and straightforward.

Why Choose Excel for Invoices

When managing billing and payment records, having a simple yet powerful tool can make all the difference. A spreadsheet application offers an easy-to-use platform for organizing, calculating, and formatting essential business documents. This flexibility allows users to streamline the process while maintaining accuracy and professionalism in every transaction.

Key Benefits of Using a Spreadsheet Application

- Customizability: You can adjust the layout and design to fit your specific needs, ensuring each record aligns with your brand identity.

- Automated Calculations: Built-in formulas and functions can calculate totals, taxes, and discounts automatically, reducing manual errors.

- Easy Updates: Changes to a template can be made quickly, allowing you to create new records in minutes.

How It Improves Efficiency

- Quick Setup: Templates are ready to use with minimal setup required, allowing for immediate implementation.

- Reusable Format: Once you’ve customized a document, you can save it for future use, creating a consistent billing experience across all transactions.

- Flexible Sharing Options: Documents can be easily shared digitally, ensuring quick delivery to clients and partners.

By choosing a spreadsheet application, businesses can take advantage of these features to create effective and efficient records that save time while ensuring accuracy in their financial dealings.

How to Download the Template

Getting started with pre-designed documents is simple and quick. The process of acquiring a structured format for your records usually involves just a few steps, allowing you to access a resource that can save time and effort. Whether you’re looking for a template to fit your business needs or a customizable layout, obtaining the file is easy and straightforward.

To download a document for tracking payments and managing transactions, follow these easy steps:

- Find a Trusted Source: Search for reliable websites or platforms offering downloadable formats, ensuring the resource matches your requirements.

- Choose the Right Format: Select the version compatible with your software, ensuring smooth functionality once the file is opened.

- Click the Download Button: Once you’ve made your selection, click on the download link to initiate the process. The file will be saved to your device.

- Open and Customize: After downloading, open the document and begin tailoring it to your specific needs by filling in relevant details and adjusting the layout as necessary.

Once you have the document, you can easily customize it and start using it right away, improving your billing workflow and ensuring accurate record-keeping.

Customizing Your Invoice in Excel

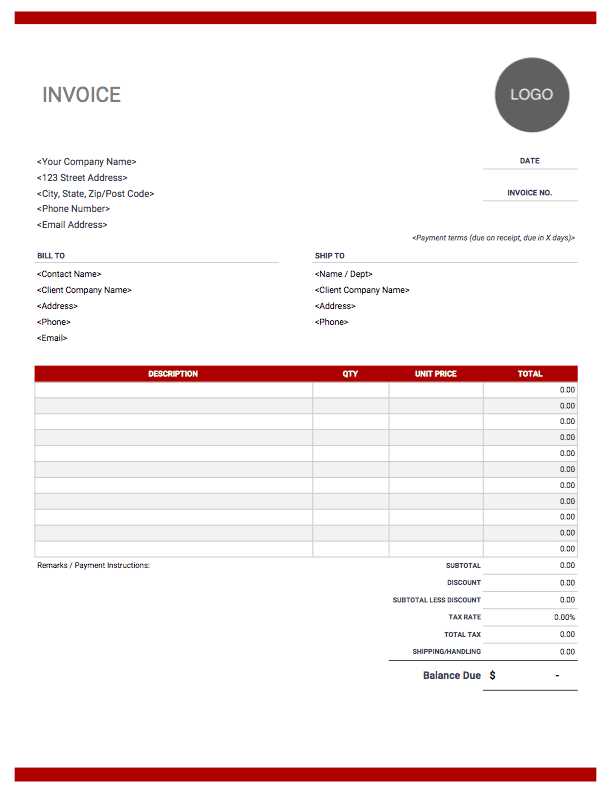

Personalizing your billing documents ensures they reflect your brand and meet your specific needs. By making a few adjustments, you can tailor the layout, fields, and overall design to better suit your business. Customization offers flexibility, allowing you to add, remove, or modify sections to create a document that aligns with your requirements.

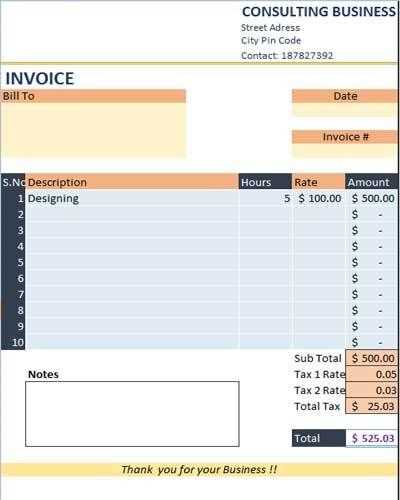

Here are some key areas you can customize:

| Section | Customization Options |

|---|---|

| Company Information | Add your business name, logo, address, and contact details |

| Client Details | Include the client’s name, address, and email address |

| Items and Services | List the goods or services provided, along with descriptions and prices |

| Payment Terms | Set payment due dates, late fees, and accepted payment methods |

| Formatting | Adjust fonts, colors, and borders to match your brand style |

By modifying these sections, you ensure your records are both professional and aligned with your business’s specific needs, making your documentation more efficient and effective.

Key Features of a Good Invoice

A well-structured billing document is essential for ensuring clarity and accuracy in business transactions. It provides a clear record of the services or goods provided, the amount due, and payment terms. A good document also establishes professionalism, helping to maintain strong client relationships and minimizing the risk of disputes.

Essential Elements for Clarity

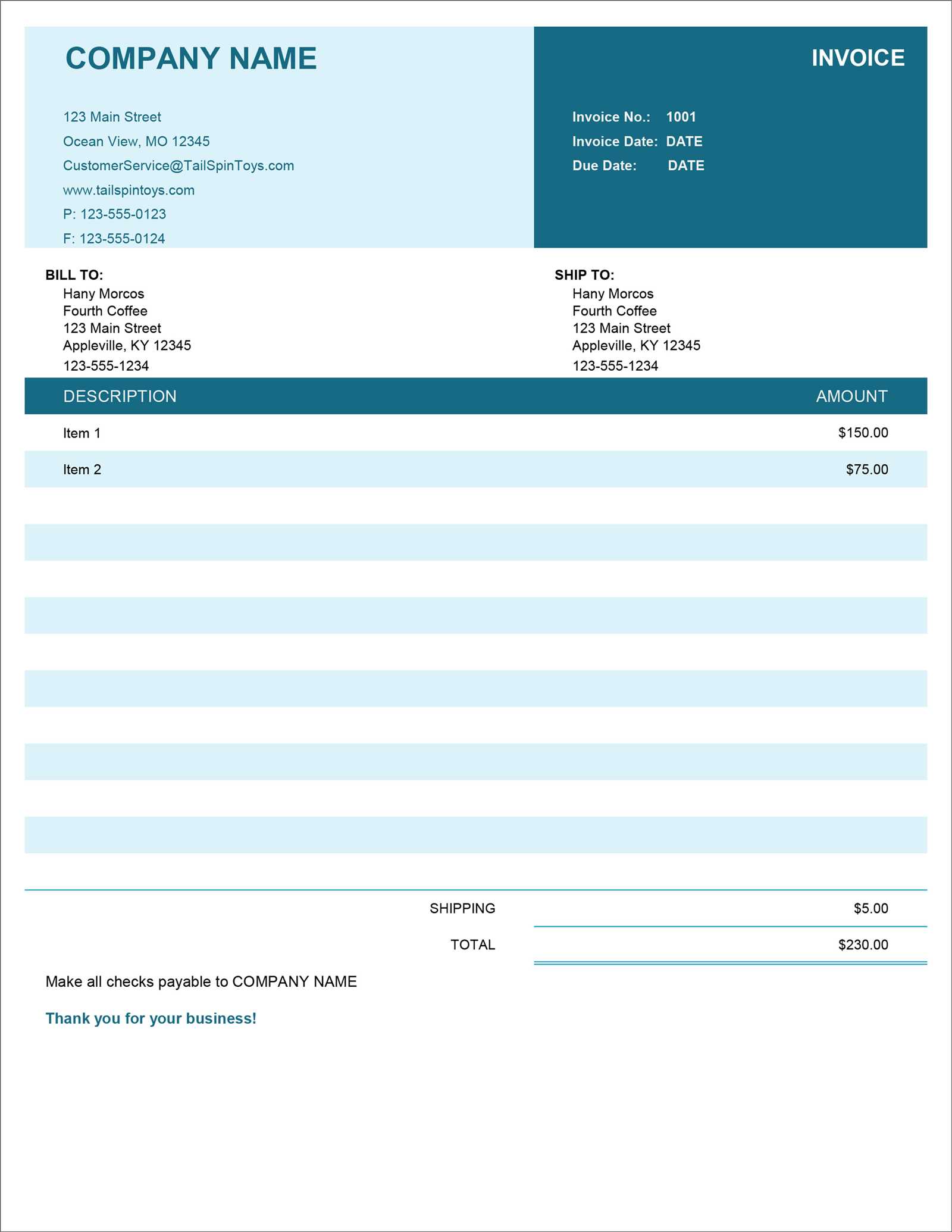

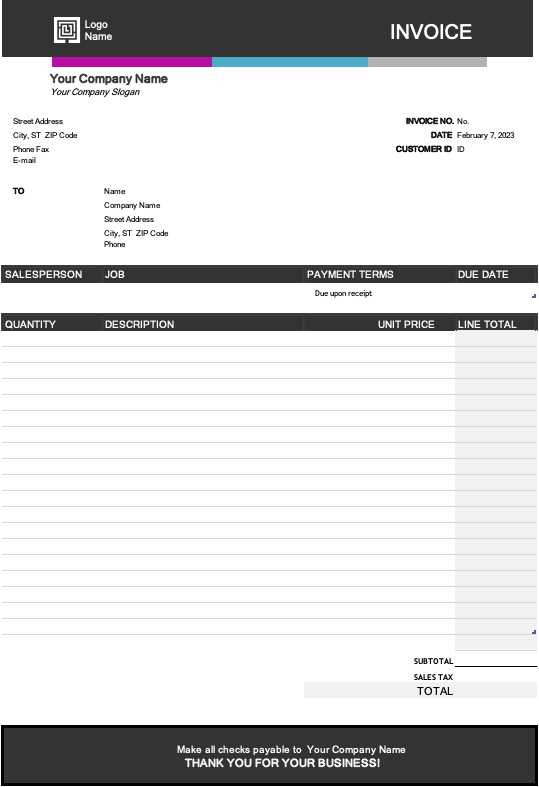

- Business Information: Include your company name, address, and contact details so clients can easily reach you for inquiries or issues.

- Client Information: Clearly list the client’s name and address to avoid confusion, especially in case of disputes or queries.

- Unique Identification: Assign each record a unique number for tracking purposes, making it easier to reference in future correspondence.

- Itemized List: Break down services or goods provided, including quantities, unit prices, and any applicable taxes, to provide transparency.

Professional Appearance

- Readable Layout: Use a clean and organized format that allows all key details to be easily identifiable.

- Payment Terms: Specify when the payment is due and any penalties for late payment, ensuring both parties are aware of their obligations.

- Consistent Branding: Use your company’s logo, colors, and fonts to maintain a consistent brand image throughout the document.

By including these key features, you ensure that your billing documents are professional, clear, and effective in facilitating smooth financial transactions.

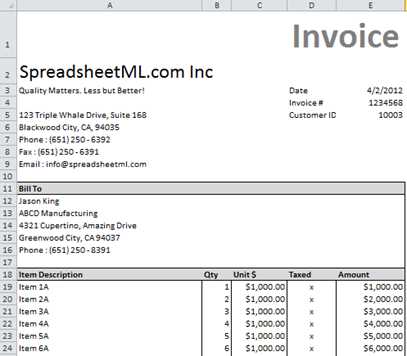

Setting Up Your Company Details

Including accurate and complete company information is crucial for any official document. This section ensures your clients can easily identify your business and reach out if necessary. Properly displaying your company’s name, contact details, and other relevant data establishes professionalism and credibility in your communication.

Start by adding your company’s full legal name, along with your business address and phone number. Make sure the contact details are up-to-date and easy for your clients to find. It’s also helpful to include your business email address for inquiries, and if applicable, your website URL for clients to access more information about your services. Additionally, if your business has a logo, incorporate it into the document for a cohesive and branded appearance.

By setting up this section correctly, you not only make it easier for clients to get in touch but also reinforce your company’s professionalism and transparency in every transaction.

Adding Payment Terms to Your Invoice

Clear payment terms are essential for establishing mutual expectations between you and your clients. By specifying when and how payments are due, you ensure that both parties understand their responsibilities, which helps prevent misunderstandings or delays. This section should detail the deadlines, accepted payment methods, and any consequences for late payments.

Start by including the due date for payment, making it clear when the client is expected to settle the balance. You can also specify if early payments are eligible for discounts or if there are late fees after the due date. Additionally, outline the accepted forms of payment, such as bank transfers, checks, or credit cards, to avoid confusion. Make sure the payment terms are concise, easy to read, and visible in the document.

Including well-defined payment terms not only protects your business but also creates a transparent, professional relationship with your clients.

How to Include Tax Information

When preparing any official billing document, including accurate tax details is crucial for compliance and clarity. This ensures that both you and your clients are aware of the applicable taxes on goods or services provided, and that the amounts due are correctly calculated. Including tax information helps maintain transparency and can prevent any potential confusion regarding the final total.

Start by clearly indicating the applicable tax rate on the document. For example, if sales tax applies, specify the percentage rate (e.g., 10%) and the total amount of tax charged. If your business operates in multiple regions with different tax rates, make sure to specify which tax rate applies to which goods or services. In addition, include your tax identification number, if required by local regulations, to further assure clients of the legitimacy of the charges.

Clearly presenting this information not only ensures that the transaction is fully transparent but also supports a smooth, legal process for both your business and your clients.

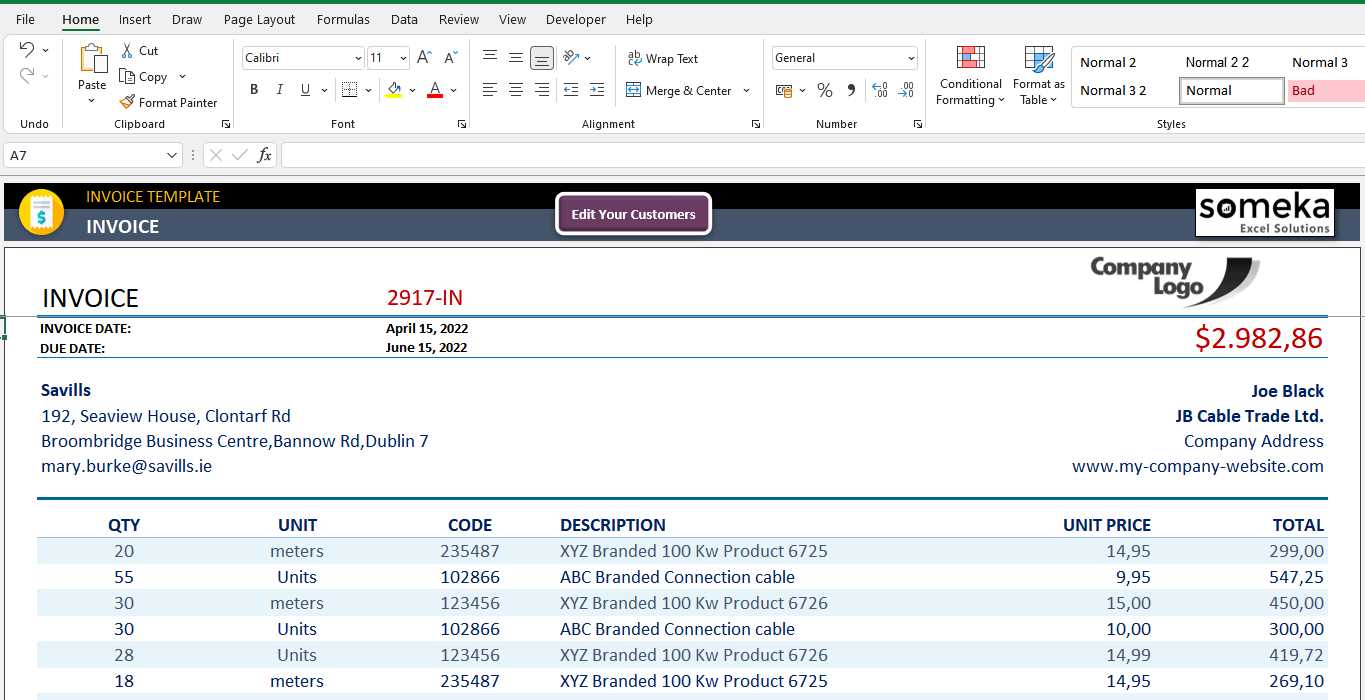

Incorporating Itemized Lists in Excel

Including a detailed breakdown of products or services in your billing document is an effective way to provide clarity and ensure your clients understand the specifics of what they are being charged for. By organizing the information in an itemized format, you can offer a more transparent view of the transaction, which helps in preventing disputes and facilitating smoother payments.

Benefits of Itemized Lists

An itemized list allows you to show the quantity, description, unit price, and total for each item. This level of detail enables the client to verify each charge and helps ensure accuracy. It also gives you the flexibility to adjust individual line items easily if any changes need to be made. Providing this structure can lead to better communication and trust with your clients.

How to Organize Items Effectively

To incorporate a clear and concise itemized list, consider creating separate columns for item descriptions, quantities, unit prices, and total costs. Align these columns in a way that ensures easy readability, and ensure that all figures are correct to avoid confusion. You can also add additional columns for any applicable discounts, tax, or shipping charges to give a full picture of the pricing breakdown.

By structuring your charges in an itemized list, you offer full transparency and increase the professionalism of your billing documents.

Saving and Sharing Your Invoice

Once you have completed your billing document, it is essential to save it in a format that preserves its structure and makes it easy to share. The right file format ensures compatibility across various platforms and helps maintain the integrity of the document when viewed by clients. Additionally, sharing the document in a professional manner can lead to quicker payments and improved client relationships.

The most common file formats for saving such documents are PDF or spreadsheet formats, both of which are widely accepted and accessible. Saving as a PDF ensures that your document will appear the same across different devices and operating systems. Alternatively, using spreadsheet formats allows you to make future edits easily if necessary.

How to Save Your Document

To save your file, simply click on the “Save As” option in your software and choose the desired file format. For most purposes, PDF is preferred for sending finalized documents to clients. However, if you plan to make further adjustments or need to send an editable version, a spreadsheet format may be more suitable.

Sharing Your Document

Sharing your document can be done through various methods, such as email or cloud services. If emailing, simply attach the file to your message, ensuring that it is clearly named and includes any relevant details in the subject line for easy identification. Using cloud storage services provides the added benefit of easy access for both you and the recipient, along with the ability to track when the document has been downloaded or viewed.

By properly saving and sharing your billing document, you ensure its accessibility, protect its formatting, and improve the overall efficiency of your business processes.

Automating Invoice Generation in Excel

Automating the process of creating billing documents can save valuable time and reduce human error, especially for businesses that generate a large volume of such records. By using built-in tools, formulas, and features within your spreadsheet software, you can streamline the generation of these documents, making the process faster and more efficient. Automation allows for greater consistency and accuracy in your business transactions, ensuring you meet deadlines and provide accurate financial records to your clients.

Key Steps to Automate the Process

- Setting up reusable fields: Design your document with specific placeholders for customer details, item descriptions, prices, and totals. These fields can be populated automatically using data from other sheets or external sources.

- Using formulas: Incorporate formulas to automatically calculate totals, taxes, discounts, and balances. These formulas will adjust based on the input data, ensuring accuracy in every document.

- Leveraging Macros: Macros are scripts that automate repetitive tasks. By recording a macro, you can set up your document to auto-generate with a simple click, streamlining the entire process.

How to Implement Automation

To begin automating your billing document creation, set up a database or a list where customer details and itemized data are stored. Use functions like VLOOKUP or INDEX-MATCH to pull this information into the document. For calculations such as totals or tax rates, utilize built-in formulas to automatically update whenever the input data changes.

By incorporating these automated techniques, you can ensure that your documents are consistent, accurate, and efficiently generated every time, saving both time and effort.

Top Tips for Professional Invoices

Creating polished and professional billing documents is essential for maintaining a positive relationship with clients and ensuring timely payments. A well-designed document not only provides the necessary details but also reflects the credibility and professionalism of your business. By following a few key strategies, you can enhance the effectiveness and appearance of your billing documents.

Essential Features for a Professional Look

- Clear Contact Information: Ensure that both your business and the client’s contact details are clearly visible. This should include names, addresses, phone numbers, and email addresses for easy communication.

- Structured Layout: Use a clean, organized layout with distinct sections. Include areas for item descriptions, quantities, rates, and totals, making it easy for clients to understand and review the charges.

- Consistent Branding: Incorporate your company logo and color scheme to align with your overall branding. This adds a personal touch and enhances professionalism.

Important Information to Include

- Payment Terms: Clearly outline payment terms, including due dates, late fees, and accepted payment methods. This helps manage expectations and prevents delays.

- Unique Identifiers: Include a unique reference number for each document to facilitate easy tracking and future reference.

- Itemized Charges: Break down each service or product you’re charging for with clear descriptions and individual prices. This adds transparency and avoids misunderstandings.

By focusing on these details, you can create billing documents that not only look professional but also promote trust and clarity between you and your clients.

Ensuring Accuracy and Clarity

Accurate and clear documentation is key to effective communication and smooth business operations. When preparing a billing document, it is crucial to double-check all information for accuracy and ensure that everything is easily understandable by the recipient. Inaccurate details or unclear formatting can lead to confusion, delayed payments, and strained client relationships.

Steps to Ensure Accuracy

- Review All Details: Before finalizing any document, verify that all client details, service descriptions, and charges are correct. This includes checking dates, quantities, prices, and totals.

- Double-Check Calculations: Ensure that all sums are accurate. Even small mistakes in calculations can undermine the professionalism of your document and cause disputes.

- Verify Contact Information: Ensure that both your contact details and the client’s are accurate, as this is crucial for correspondence and future reference.

Improving Clarity for the Recipient

Clarity in your document helps avoid confusion, ensuring that the recipient fully understands the charges and expectations. Here are some ways to enhance readability:

- Use Simple Language: Avoid jargon and overly complex terms. The document should be straightforward and easily understood by anyone who reads it.

- Organize Information Clearly: Use headings, bullet points, and tables to divide sections and make the content easier to follow.

- Break Down Charges: Clearly list all individual charges, providing enough detail for each item. This transparency helps the client understand what they are paying for.

Example of a Clear Billing Table

| Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Consulting Service | 5 hours | $50/hour | $250 |

| Design Work | 3 hours | $60/hour | $180 |

| Total | $430 |

By focusing on accuracy and clarity, you create documents that are professional, trustworthy, and easy to understand, which can lead to smoother business transactions and satisfied clients.

Common Mistakes to Avoid in Billing Documents

Creating clear and accurate billing documents is essential for maintaining a professional relationship with clients. However, certain errors can undermine the effectiveness of these documents, leading to confusion, payment delays, and misunderstandings. It’s important to recognize and avoid these common pitfalls to ensure smooth transactions and client satisfaction.

1. Missing or Incorrect Details

One of the most significant mistakes is failing to include complete or accurate details. This could range from incorrect client information to errors in service descriptions. When essential details are missing or wrong, it can create confusion and result in delayed payments or disputes.

- Incorrect client contact information: Make sure that the recipient’s name, address, phone number, and email are accurate.

- Unclear service descriptions: Always provide clear and concise descriptions of the goods or services provided, including quantity, hours worked, and any applicable rates.

2. Mathematical Errors

Another common mistake involves incorrect calculations. Errors in adding up totals or applying tax rates can lead to billing discrepancies. Even small mathematical mistakes can make the document appear unprofessional and may require time-consuming corrections.

- Double-check all numbers: Ensure that unit prices, quantities, and totals are calculated correctly.

- Verify tax calculations: Make sure that any applicable taxes are properly calculated and displayed.

3. Lack of Clear Payment Terms

Not specifying payment terms can create confusion about when and how the client should pay. It’s crucial to include clear information on due dates, payment methods, and any late fees to avoid misunderstandings down the line.

- Be specific about due dates: Clearly state when the payment is expected and whether there are penalties for late payment.

- Provide payment methods: Make sure to include details about the accepted methods of payment, such as bank transfer, credit card, or check.

Avoiding these common mistakes ensures that your documents are professional, clear, and facilitate timely payments. Always review your documents carefully before sending them to clients to prevent unnecessary errors.

How to Track Payments Using Excel

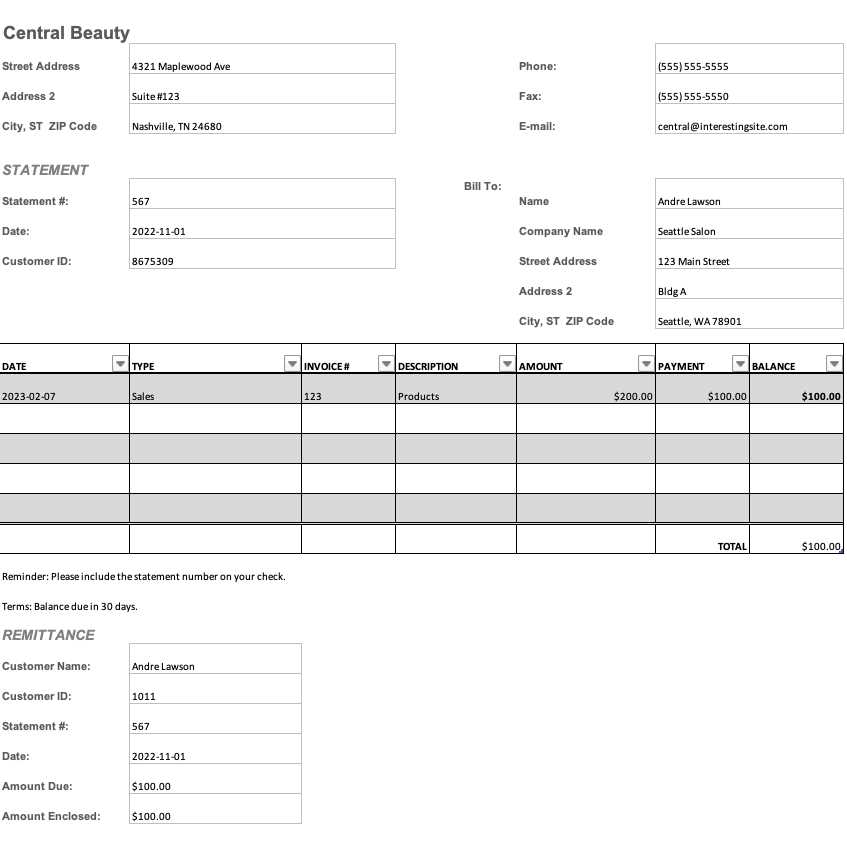

Tracking payments efficiently is crucial for maintaining financial accuracy and ensuring that all transactions are accounted for. By using a simple and organized system, you can easily monitor payments, keep an eye on outstanding balances, and ensure timely follow-ups. This method helps in reducing errors and improving cash flow management.

To set up an effective tracking system, create a table that includes the key information related to each transaction. Here’s a breakdown of what you should include:

| Date | Client Name | Amount Due | Amount Paid | Payment Status | Payment Date |

|---|---|---|---|---|---|

| 01/15/2024 | John Doe | $500 | $500 | Paid | 01/16/2024 |

| 01/20/2024 | Jane Smith | $350 | $350 | Paid | 01/22/2024 |

| 01/25/2024 | ABC Corp | $1,200 | $600 | Partial Payment | 01/28/2024 |

In this table, each column serves a specific purpose. The date column helps you keep track of when the transaction occurred, while the client name and amount due provide essential identification and billing details. The payment status column shows whether the payment is fully completed or partial, and the payment date ensures that you can quickly check when the payment was made.

Additionally, you can use simple formulas to calculate the outstanding balance for each client. This will help you easily identify any unpaid or partially paid amounts and streamline your follow-up process.

By regularly updating and reviewing this table, you can effectively manage payments and reduce the chances of missing important financial details.

Why Excel Is Ideal for Small Businesses

Managing business operations efficiently often requires versatile tools that can handle various tasks, from financial tracking to data organization. For small enterprises, having a reliable and user-friendly solution can be a game-changer, especially when working with limited resources. A widely accessible software provides the necessary functionalities for running everyday operations smoothly, without the need for expensive or complex systems.

One of the key benefits of using a spreadsheet program is its simplicity and flexibility. It allows users to create customized documents that can be easily adjusted to fit specific business needs. Whether you’re tracking expenses, creating financial summaries, or organizing customer details, this tool can handle diverse tasks with ease. Additionally, it is cost-effective and doesn’t require significant investment or technical expertise to get started.

Another advantage is its data analysis and visualization capabilities. By utilizing built-in functions like formulas, charts, and graphs, small business owners can quickly interpret financial data, monitor performance, and identify trends. This enables more informed decision-making, helping to drive growth and manage cash flow effectively.

With easy sharing options, this software also allows for collaboration with team members or external partners, making it easier to work together on projects and updates. In summary, its accessibility, functionality, and adaptability make this tool a perfect choice for small businesses looking to streamline operations and manage resources efficiently.

Integrating Your Invoice Template with Accounting Tools

Efficient business management involves integrating various systems to streamline processes and minimize manual effort. One of the key areas where integration proves beneficial is in linking financial documents with accounting tools. By connecting billing information to your accounting software, you can automate the flow of data, ensuring accuracy and reducing the risk of errors. This connection not only simplifies bookkeeping but also enhances your ability to track income, expenses, and financial performance in real-time.

When integrating financial documentation with accounting platforms, it’s essential to ensure seamless data transfer between systems. Many modern software solutions support importing and exporting information in formats that are compatible with various tools. This feature allows you to easily update records without having to re-enter data manually, saving both time and effort. With the right setup, this integration can facilitate better financial forecasting and more accurate reports for business decision-making.

Key Benefits of Integration

- Time-saving automation: Reduce manual data entry and potential errors by syncing data across platforms.

- Real-time updates: Keep your accounting system up-to-date as soon as a transaction is completed.

- Improved accuracy: Automated data synchronization eliminates human mistakes and inconsistencies.

- Better financial oversight: Easily access comprehensive reports and insights by consolidating your financial data.

How to Link Your Documents

To connect your documents with accounting tools, you can either manually upload files or set up an automated workflow. Many accounting platforms offer integration options, such as importing CSV files or linking with cloud-based storage solutions. By mapping the relevant fields (such as customer names, amounts, and dates), the software can automatically categorize and organize your financial data.

Integrating these tools enables smoother financial tracking, making it easier to manage your business’s cash flow and generate accurate reports without the need for constant updates or manual reconciliation.

| Platform | Integration Method | Benefits |

|---|---|---|

| QuickBooks | CSV Import, Direct Sync | Easy integration, fast updates, real-time financial insights |

| FreshBooks | API Connection | Automatic invoicing, expense tracking, and reporting |

| Xero | Cloud Sync | Comprehensive data management, real-time synchronization |