Free QuickBooks Invoice Templates for Effortless Billing

Managing business finances can be a time-consuming task, especially when it comes to preparing and sending payment requests. Having access to reliable, pre-designed documents can significantly ease this process, saving you both time and effort. By utilizing customizable resources, you can ensure that each transaction looks professional while remaining simple to produce.

Instead of starting from scratch with every bill, you can use specialized resources that offer structured formats. These tools allow you to enter the necessary details and instantly generate polished, consistent paperwork that reflects your brand’s identity. With various options available, it’s easier than ever to find the right solution to match your needs.

Whether you are a freelancer, a small business owner, or an established company, leveraging these helpful resources can lead to improved efficiency and accuracy in your billing practices. You no longer need to worry about formatting or design–just focus on the key details of your transaction.

Free QuickBooks Invoice Templates Overview

Managing financial paperwork efficiently is essential for any business. By using ready-made solutions, entrepreneurs and freelancers can streamline their billing process, ensuring both accuracy and professionalism. These pre-designed formats are easily customizable, allowing you to quickly generate the necessary documents while maintaining consistency across all your transactions.

For anyone looking to simplify their workflow, there are various resources available that offer a wide range of customizable formats. These tools help reduce manual input, eliminate errors, and allow you to focus on running your business rather than spending excessive time on administrative tasks. Here’s a breakdown of the core benefits:

- Professional appearance: Well-designed documents create a polished, trustworthy image for your business.

- Time-saving: Pre-made documents eliminate the need for manual formatting, reducing the time spent on each transaction.

- Customization: Tailor the design and content to suit your specific needs, ensuring each bill meets your standards.

- Consistency: Using the same format for all billing tasks ensures uniformity in your communication.

- Ease of use: Most solutions are simple to implement, even for users with minimal experience in financial management.

These resources are particularly useful for small businesses and freelancers, providing an efficient way to manage finances without the need for specialized software or training. Whether you need a basic structure or something more complex, there’s a format that will suit your needs, all while saving you both time and money.

Why Use QuickBooks Invoice Templates

Efficient management of billing documents is crucial for maintaining smooth business operations. Using pre-designed formats can significantly simplify the process of creating and sending financial paperwork. These ready-made solutions not only save time but also ensure that every document you send is professionally formatted and error-free.

Here are some key reasons why incorporating these ready-to-use resources can benefit your business:

1. Saves Time and Effort

Creating financial documents from scratch for each client can be a time-consuming task. By using structured formats, you eliminate the need for repetitive formatting and data entry. This allows you to focus more on important business tasks.

2. Enhances Professionalism

Using a well-designed structure ensures that every document looks polished and consistent. A professional appearance increases credibility and helps build trust with clients, which is essential for long-term business relationships.

- Consistent presentation: Using the same design across all documents gives your business a cohesive look.

- Customized details: Adjust the information and branding to make each document uniquely yours.

3. Reduces Errors

Manual creation of financial documents can lead to costly mistakes, such as incorrect calculations or missed information. Pre-built formats reduce the chances of human error, ensuring that each document is accurate and up-to-date.

4. Easy Customization

These tools are designed to be flexible, allowing you to adjust fields to suit specific needs. Whether you’re dealing with different billing cycles, various payment terms, or specific tax rates, these formats can be tailored accordingly.

- Custom fields: Add or remove details based on what you need for each transaction.

- Simple adjustments: Easily edit the content to match each client’s requirements.

Ultimately, using these pre-designed resources simplifies your workflow, enhances your business image, and ensures you can send out accurate, professional financial documents with minimal effort. It’s a smart choice for anyone looking to optimize their administrative tasks.

How to Download Free Invoice Templates

Accessing ready-made billing documents has never been easier. Many platforms offer downloadable resources that can help streamline your financial paperwork. Whether you’re a small business owner, freelancer, or self-employed professional, you can find customizable solutions to suit your needs. Below are simple steps to guide you through the process of finding and downloading these useful documents.

1. Search for Reliable Platforms

To get started, search for trusted websites that offer downloadable documents. There are many online resources providing high-quality, customizable formats. Look for platforms that allow you to download without hidden costs or complicated procedures.

- Reputable websites: Look for popular business platforms or marketplaces that specialize in financial tools.

- Customer reviews: Read feedback from other users to ensure the quality and reliability of the resources.

2. Choose Your Preferred Document Format

Once you’ve found a trustworthy platform, browse through the available options and choose the one that best fits your needs. Many providers offer a variety of formats, such as basic, modern, or itemized documents. Ensure that the design and structure suit your business style and the type of transactions you typically handle.

- Basic design: Ideal for businesses looking for simplicity and clarity.

- Itemized structure: Perfect for businesses that need to detail each product or service provided.

3. Download and Customize

After selecting the appropriate document, simply click the download button. Most websites offer the option to download in popular formats such as Word, Excel, or PDF. Once downloaded, open the file and personalize it by adding your company details, client information, payment terms, and other necessary fields.

- Easy editing: Adjust content to reflect your business details and branding.

- Compatibility: Choose the format that works best with the software you already use.

By following these steps, you’ll quickly have access to all the resources needed to create professional financial documents without spending hours on design or formatting.

Best QuickBooks Invoice Templates for Small Businesses

For small businesses, managing finances efficiently is essential to growth and maintaining healthy cash flow. Using well-designed billing documents helps ensure that transactions are clear, professional, and organized. With the right tools, small business owners can easily generate payment requests that not only look polished but also meet their specific needs. Below are some of the best document formats available for small businesses to streamline their billing process.

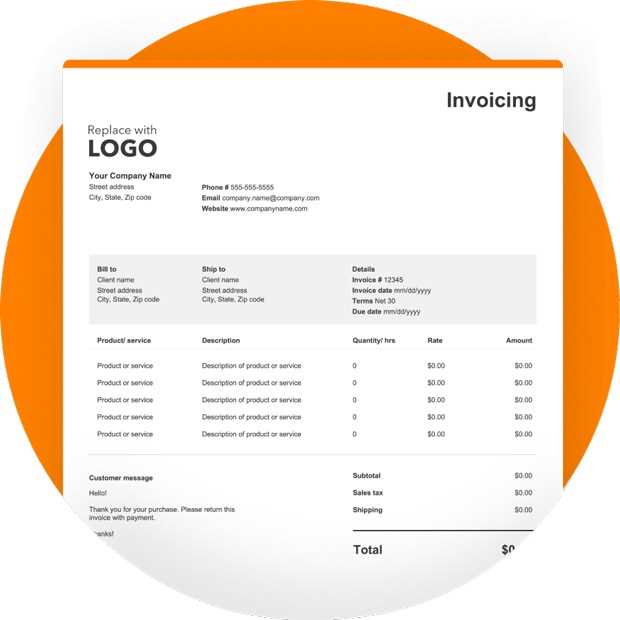

1. Simple and Clean Designs

A minimalist design is often the best choice for small businesses looking to keep things clear and straightforward. Simple layouts focus on the essential details–client information, itemized costs, and payment terms–without distractions. These are ideal for businesses that want to provide a clean and professional look while making it easy for clients to understand the charges.

- Clear sections: Separate areas for services/products, pricing, and contact information.

- Minimalist styling: Simple color schemes and fonts make the document easy to read.

- Easy customization: Quickly adjust the fields to match your branding.

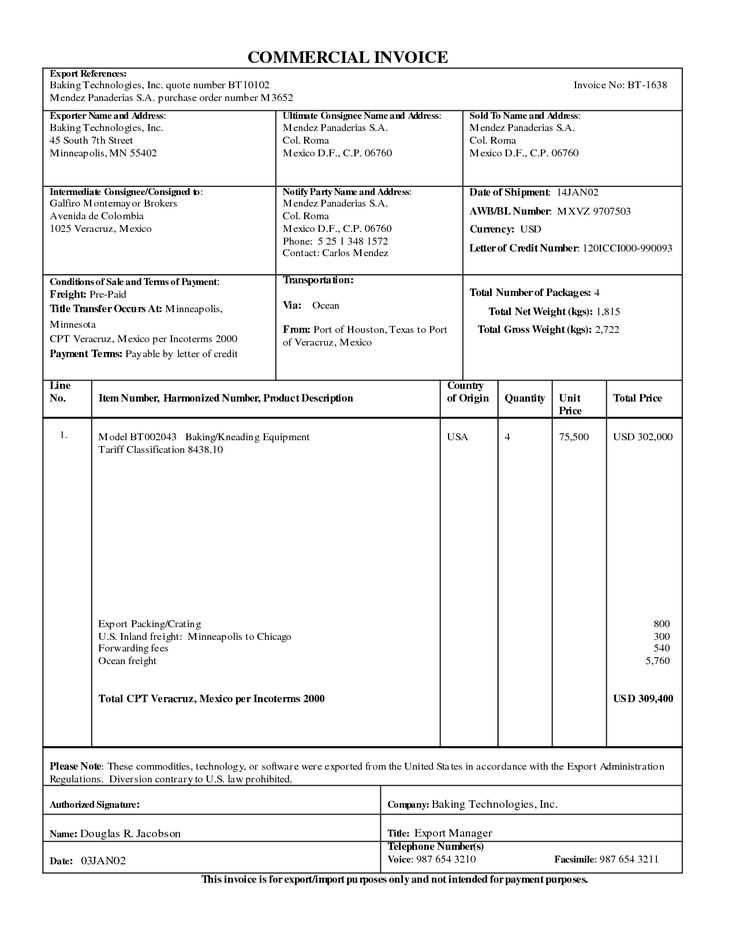

2. Itemized and Detailed Formats

For businesses that offer multiple services or products, detailed documents that itemize each charge are particularly useful. These formats allow you to break down the individual elements of each transaction, which is helpful for clients who prefer more transparency. Detailed billing is also valuable for businesses that provide recurring services or need to track specific line items for internal records.

- Line-by-line breakdown: Perfect for clients who need detailed information on each product or service.

- Tax calculation fields: Include automatic calculations for taxes and discounts.

- Recurring billing options: Great for businesses with subscription models or retainer agreements.

3. Branded and Customizable Designs

Many small businesses benefit from adding their unique branding elements to their billing documents. Customizable designs allow you to include your logo, company colors, and other visual elements that reflect your brand identity. This not only adds a personal touch but also makes your documents easily recognizable to clients.

- Brand identity integration: Add your logo, brand colors, and fonts for a unique look.

- Multiple layout options: Choose between various styles, from formal to more creative formats.

- Personalized fields: Tailor the document to reflect your specific business needs.

Choosing the right design depends on the nature of your business and your client’s preferences. Whether you need a simple, professional format or a more detailed breakdown, thes

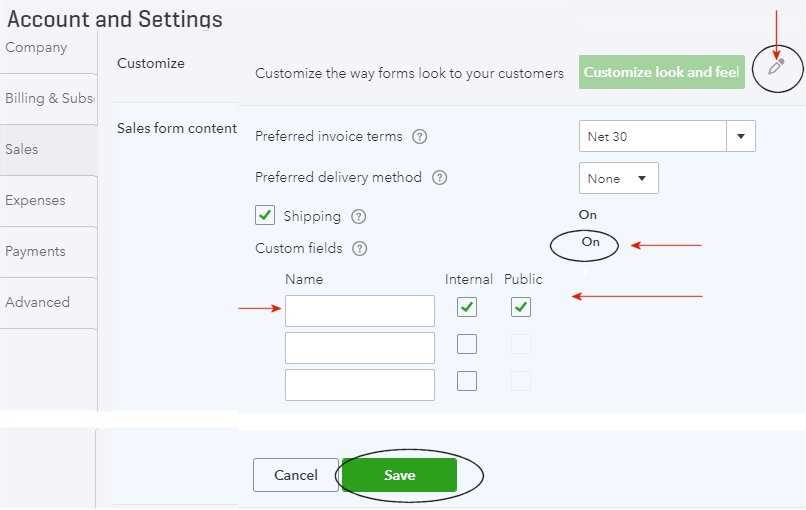

Customizing QuickBooks Invoice Templates

One of the key advantages of using pre-designed billing documents is the ability to customize them to match your business’s unique needs. Personalizing these resources ensures that each document reflects your company’s branding, payment terms, and other specific details. Customization allows you to tailor the appearance and content of your financial paperwork, ensuring it aligns with your professional image and operational requirements.

1. Adjusting Document Layout

Many pre-made formats offer flexible layouts that you can modify to suit your needs. Whether you prefer a simple, minimalist design or something more detailed with multiple sections, customization lets you create a layout that best showcases your products and services.

- Rearranging sections: Move or remove sections such as itemized lists or payment instructions to suit your needs.

- Adding or removing fields: Include additional fields like discounts, taxes, or shipping charges as needed.

- Flexible spacing: Adjust the spacing to make sure the document is well-organized and easy to read.

2. Branding and Personalization

Customizing documents with your company’s branding is an important step in making your paperwork unique and professional. This ensures that your clients immediately recognize your business and gives the document a cohesive, polished look.

- Logo placement: Include your company’s logo at the top or in the header for immediate brand recognition.

- Custom fonts and colors: Change the text styles and color scheme to match your business’s visual identity.

- Personalized messages: Add a custom greeting or closing remark to make the document feel more personal.

3. Modifying Payment Terms and Details

Every business has different payment terms, so it’s essential that your documents reflect your specific policies. Customization allows you to adjust payment instructions, due dates, and even acceptable payment methods to meet your business’s needs.

- Custom payment terms: Edit terms such as net 30, early payment discounts, or late fees.

- Preferred payment methods: Include payment options like bank transfer, credit cards, or online payment portals.

- Clear due dates: Ensure the payment deadline is visible and easy to understand to avo

Advantages of Using Free Templates

Leveraging pre-designed billing documents can bring numerous benefits to your business, especially when these resources come at no cost. These ready-made solutions offer convenience, professionalism, and efficiency, making them an excellent choice for entrepreneurs and small business owners. By using these tools, you can significantly reduce the time and effort required to create financial paperwork while maintaining a high standard of presentation.

1. Cost-Effective Solution

One of the most significant advantages of utilizing these resources is that they are available at no charge. This means you can access professional-quality documents without the need to invest in expensive software or hire graphic designers. By eliminating these costs, you can allocate your budget to other areas of your business.

- No upfront costs: Start using professionally designed documents without paying for expensive tools or subscriptions.

- Save on design fees: C

Download Free QuickBooks Invoice Templates for Easy Billing QuickBooks vs Other Invoice Software

When it comes to managing financial documentation, many businesses rely on specialized software to streamline the process. While some platforms are designed specifically for billing and accounting, others offer broader tools that cover a wider range of business operations. Choosing the right software depends on the specific needs of your business, whether you require advanced features or prefer a more straightforward solution.

One of the main differences between platforms is the level of complexity and the range of features they offer. Some software is built with simple, easy-to-use features perfect for small businesses or freelancers, while others include more robust options for larger businesses or those with complex financial needs. Below is a comparison of the key aspects:

1. Ease of Use

Simple software solutions typically offer an intuitive user interface with fewer customization options. They allow users to quickly generate documents without a steep learning curve. In contrast, more feature-rich platforms may require more time to learn, but they provide greater flexibility for users who need advanced features.

2. Features and Functionality

Some platforms offer specialized features like automatic tax calculations, recurring

How to Save Time with QuickBooks

Managing finances can be a time-consuming process, especially when it involves creating and tracking numerous documents for each transaction. Automating and simplifying this process can save you a significant amount of time, allowing you to focus on running and growing your business. By using efficient tools and features, you can streamline various financial tasks and reduce manual work.

1. Automating Billing and Payments

One of the most effective ways to save time is by automating repetitive tasks like billing and payment reminders. Many financial platforms offer built-in automation that allows you to set up recurring transactions and reminders for overdue payments. This reduces the need for manual intervention and ensures that your clients receive consistent, timely reminders without extra effort on your part.

- Recurring transactions: Set up automatic billing for clients who have regular payments.

- Automated reminders: Send automatic notifications when payments are due or overdue.

- Fewer manual steps: Reduce the amount of time spent on routine billing tasks.

2. Integration with Other Business Tools

Another time-saving feature is the ability to integrate your financial platform with other business tools you already use. Whether it’s your customer relationship management (CRM) system, accounting software, or payment processors, seamless integration reduces the need for double-entry and minimizes the risk of errors. This can help speed up data entry, generate reports automatically, and keep everything synchronized in real time.

- Automatic syncing: Data flows smoothly between systems, eliminating the need for manual updates.

- Quick access to financial data: Easily retrieve transaction history and reports without searching through multiple systems.

- Streamlined workflow: All your tools work together, reducing friction and improving efficiency.

3. Customizable Features for Faster Setup

Customizable features help save time by tailoring the platform to your specific business needs. Whether it’s adjusting billing formats, adding frequently used items, or setting up default payment terms, customization allows you to skip repetitive tasks and focus on what matters most. Once set up, your documents and processes are ready to go with minimal input required.

- Pre-set fields: Customize document fields to automatically include your standard terms and company details.

- Quick-access templates:

Top Features of QuickBooks Invoice Templates

Efficient billing solutions can drastically improve the way businesses handle their financial paperwork. Pre-designed documents offer numerous features that make them both user-friendly and highly functional for business owners. These tools help streamline the process of creating, managing, and tracking payments, saving valuable time while ensuring professionalism in every transaction.

1. Customizable Layouts

One of the key benefits of these pre-made billing formats is the ability to customize the layout according to your business needs. You can adjust sections, change field names, and add company-specific information, allowing you to create documents that align perfectly with your brand and operational requirements.

- Adjustable fields: Tailor fields to fit your specific products, services, or payment terms.

- Branding opportunities: Add your logo, choose colors, and customize fonts to match your business identity.

- Flexible structure: Rearrange or remove sections based on the type of transaction.

2. Automated Calculations

Another powerful feature of these solutions is the ability to perform automatic calculations. Whether it’s calculating totals, applying taxes, or factoring in discounts, automated formulas save time and reduce the risk of human error. This ensures that the final amounts are accurate and ready for your clients without manual input.

- Automatic total calculation: The system calculates item totals and overall amounts in real-time.

- Tax and discount handling: Automatically apply tax rates or discount offers based on the set rules.

- Error-free calculations: Reduce the likelihood of mistakes in total amounts or tax rates.

3. Recurring Billing Options

For businesses that offer subscription-based services or long-term contracts, the ability to set up recurring transactions is an invaluable feature. Pre-designed documents allow you to automate regular billing for repeat clients, ensuring timely payments without the need for manual invoicing every cycle.

- Subscription billing: Set up automatic charges at regular intervals, such as weekly, monthly, or annually.

- Consistent reminders: Automatically send payment reminders and billing statements to clients on schedule.

- Time-saving automation: Minimize the effort required to manage recurring clients.

4. Easy Payment Tracking

Tracking payments and outstanding balances is made simple with these documents. Many tools include built-in payment tracking features that let you monitor the status of each transaction, hel

How to Organize Your Invoices Effectively

Proper organization of your financial documents is crucial for maintaining a smooth workflow and ensuring timely payments. An effective system not only saves you time but also helps you keep track of outstanding balances, due dates, and payment histories. Whether you prefer digital or physical records, setting up a consistent structure will help you stay on top of your billing process.

1. Create a Consistent Naming Convention

A well-defined naming convention is key to quickly identifying and retrieving your documents. Use a clear, consistent format that includes essential details such as the client’s name, date, and a unique reference number. This makes it easier to search for specific documents and prevents confusion when managing multiple transactions.

Example Format Description ClientName_Invoice_2024-05-15 Includes the client’s name, document type (invoice), and the issue date (year-month-day). Invoice_12345 Unique reference number, ideal for high-volume businesses that generate many documents. 2. Use a Categorization System

Group your records by categories such as client, date, or payment status. This method allows you to quickly locate specific documents and keep track of outstanding payments. Whether you choose a folder system on your computer or in physical files, make sure each category is easily accessible and clearly labeled.

Category Details Client Name Organize by client for easy retrieval when a client inquires about their balance or history. Date Sort documents by month or year to quickly find older or more recent transactions. Payment Status Group documents by status (paid, pending, overdue) to easily monitor outstanding payments. 3. Implement Digital Tools for Tracking

Using digital tools to organize and track your financial documents makes the entire process much more efficient. Platforms that offer automatic tracking and reminders help you stay on top of payment schedules and overdue accounts. Additionally, dig

Managing Invoice Templates in QuickBooks

Efficient management of your billing documents is key to maintaining a smooth financial workflow. Being able to organize, customize, and update your document layouts ensures that you can generate professional paperwork quickly and accurately. Understanding how to effectively manage these document structures can save you both time and effort, especially when dealing with multiple clients or complex transactions.

1. Creating Custom Document Layouts

One of the first steps in managing your billing documents is creating layouts that align with your business needs. Customizing the design allows you to tailor each document according to your preferences, ensuring that all relevant details are presented clearly and professionally. You can adjust fields, add your logo, or even modify color schemes to match your branding.

- Modify fields: Add or remove sections such as payment terms, client information, or service descriptions.

- Design elements: Insert your logo, choose fonts, and adjust colors to match your brand.

- Save settings: Once customized, save your layout for quick reuse with future clients or transactions.

2. Organizing and Storing Your Layouts

Proper organization of your customized documents is essential for easy access and efficient use. Once you have created multiple layouts, organizing them into categories will help you quickly find the right one based on the type of transaction or client. Whether you organize by client, job type, or payment structure, having a clear system in place saves time and reduces confusion.

- Category-based storage: Sort your documents by client type, frequency of use, or project specifics.

- Folder structure: Create folders for different types of transactions (e.g., recurring, one-time, services, or products).

- Easy retrieval: Name each layout clearly so that it’s simple to find the correct format when needed.

3. Updating and Modifying Existing Layouts

As your business evolves, your billing requirements may change. It’s important to have the ability to update existing document layouts to reflect new policies, payment terms, or branding updates. Keeping your documents current ensures consistency and accuracy in your financial communications.

- Edit existing layouts: Modify specific fields, update tax rates, or adjust terms as needed.

- Version control: Keep track of changes by saving previous versions of your layouts for reference.

- Consistent updates: Regularly review and update your documents to reflect any change

Tips for Designing Custom Invoices

Creating personalized billing documents not only helps establish a professional image but also ensures clarity and consistency in your transactions. Well-designed documents can improve communication with clients, reduce confusion, and help maintain a smooth financial workflow. By focusing on a few key design elements, you can craft documents that are both visually appealing and functional.

1. Prioritize Clarity and Simplicity

The goal of any billing document is to clearly communicate key financial information. Avoid cluttering the layout with unnecessary elements. Keep it simple and focused on the essential details such as payment terms, amounts due, and due dates.

- Clear headings: Use bold headings to separate sections like “Amount Due,” “Payment Terms,” and “Client Information.”

- Whitespace: Ensure there is enough space between sections to make the document easy to read.

- Minimal colors: Stick to one or two primary colors to keep the design clean and professional.

2. Include All Relevant Information

Make sure your document contains all the necessary details that a client needs to understand the charges and make payment. Include information like your company name, client’s name, date, itemized charges, payment instructions, and contact details for any queries.

- Itemized breakdown: List each product or service separately with corresponding prices.

- Contact information: Include your phone number or email address for client communication.

- Payment options: Clearly specify how clients can pay (bank transfer, credit card, etc.).

3. Use Consistent Branding

Incorporating your brand’s identity into your documents not only makes them look professional but also reinforces your business’s image. Consistent use of logos, colors, and fonts ensures that your documents align with the overall feel of your business.

- Logo placement: Place your logo at the top or in a prominent location to ensure brand visibility.

- Font consistency: Choose one or two complementary fonts for all text to maintain a cohesive look.

- Color scheme: Use colors that match your business’s branding to create a visually unified document.

4. Make It Mobile-Friendly

Many clients may view your documents on mobile devices, so it’s important to design them to be mobile-friendly. Ensure that your layout adapts well to smaller screens and that the text is legible even on handheld devices.

- Readable fonts: Use larger, easy-to-read fonts that remain legible on smaller screens.

- Simple layout: Avoid overly complex designs that may not display well on mobile devices.

Free Invoice Templates for Freelancers

Freelancers often manage their own billing and administrative tasks, making it crucial to have a reliable and professional method of requesting payment. Using pre-designed documents can save time and help maintain consistency across projects, especially when working with multiple clients. These customizable layouts are essential for ensuring that all important details, such as hours worked, rates, and payment terms, are included in a clear and professional manner.

1. Simple Yet Effective Layouts

Freelancers benefit from using straightforward document formats that are easy to understand. Simple layouts ensure that clients can quickly identify the important details, such as total due amount, project scope, and payment methods, without being overwhelmed by excessive information.

- Clear headings: Use sections like “Client Information,” “Work Details,” and “Total Due” for easy navigation.

- Minimal design: Focus on essential fields like payment due date, hourly rate, and work description, keeping everything simple yet comprehensive.

- Readable fonts: Choose legible fonts that make it easy for clients to scan the document, even when viewing on mobile devices.

2. Customizable Fields for Different Services

Freelancers often work on a variety of projects, each with its own set of requirements. Customizable fields allow you to tailor the layout to different types of services, whether you’re offering web design, writing, or consulting. Being able to adjust the content ensures that each document accurately reflects the scope of work completed.

- Service descriptions: Add sections where you can specify the type of work performed, including details like hours worked or milestones completed.

- Hourly or project rates: Include separate fields for hourly charges or fixed project fees, depending on your pricing structure.

- Discounts and promotions: Offer clients discounts or special offers and easily apply them to the overall total.

3. Professional Design Elements

While simplicity is important, the visual presentation of your billing documents also matters. A professional-looking document helps establish your credibility and leaves a positive impression with clients. Consider including design elements that reflect your personal or business brand, such as your logo, business name, or custom color schemes.

- Brand consistency: Ensure that your document design aligns with your overall brand ide

QuickBooks Invoice Template for Online Sales

For businesses engaging in e-commerce, having a streamlined and efficient way to generate billing documents is essential for maintaining organization and ensuring prompt payments. A well-designed document for online transactions should clearly present the details of the sale, including items purchased, pricing, and payment instructions, while also incorporating branding elements that align with your business. This is particularly important in online sales, where clients may be purchasing items from various locations and at different times.

1. Key Components for E-commerce Sales Documents

When managing online transactions, it is crucial to ensure that all necessary information is included in your billing documents. A comprehensive layout should contain specific details such as product descriptions, prices, transaction dates, and customer contact information to ensure clarity and avoid confusion.

- Product Details: List each product or service purchased along with quantity, unit price, and total price.

- Order Number: Include a unique order number for easy tracking of sales and transactions.

- Payment Methods: Clearly outline the accepted payment methods (e.g., credit card, PayPal, bank transfer).

- Customer Information: Include customer name, email address, and shipping address for easy reference.

2. Including Shipping and Handling Charges

For businesses involved in the sale of physical products, shipping charges should be clearly stated to avoid any confusion with customers. A well-designed document will allow you to easily include shipping costs, as well as any additional fees for expedited delivery or handling.

- Shipping Details: Include the shipping method and expected delivery date.

- Handling Fees: If applicable, add handling or packaging fees as separate line items.

- Shipping Discounts: Offer shipping discounts or free shipping for orders over a certain amount, and clearly list these on the document.

3. Payment Terms and Deadlines

Clearly communicating payment terms and deadlines helps avoid confusion and ensures timely payments. Your billing document should clearly state when payments are due and include any late fees or penalties for overdue payments.

- Due Date: Specify when payment is due (e.g., “Payable within 30 days”).

- Late Payment Fees: Include any penalties or interest for late payments to encourage timely remittance.

- Early Payment Discounts: If you offer discounts for early payment, clearly state this as an incentive for customers to pay sooner.

4. Customizing for Your E-commerce Brand

Personalizing your documents is key to establishing a strong brand identity. Incorporating your logo, colors, and fonts into the layout will ensure that your business appears professional and consistent across all customer touchpoints.

- Logo: Place your logo at the top of the document for clear brand visibility.

- Brand Colors:How QuickBooks Templates Improve Business Workflow

Efficient administrative processes are essential for smooth business operations, especially when it comes to managing finances. Streamlined document layouts can significantly enhance how a business handles transactions, reduces errors, and ensures consistency. By utilizing pre-designed, customizable layouts, businesses can automate routine tasks, improve accuracy, and save valuable time.

1. Streamlining Billing and Payment Processes

When managing payments and customer interactions, time is of the essence. Pre-designed layouts help eliminate the need for creating documents from scratch every time a transaction occurs, ensuring that all necessary information is included. With well-structured formats, business owners can quickly generate clear, professional documents that include all the relevant payment details, reducing the likelihood of mistakes and customer confusion.

- Time-saving automation: Automatically populate fields like customer details, payment amounts, and service descriptions.

- Consistency: Ensure that every document has the same format, tone, and essential information.

- Reduced errors: Pre-designed formats help reduce human error by providing a framework for every document.

2. Enhancing Client Communication

Clear communication is a key to maintaining good relationships with clients. Using a professional and consistent format ensures that clients have a positive experience every time they receive a document. This level of professionalism not only fosters trust but also reflects well on the business’s brand image.

- Professional presentation: Enhance your brand image with well-organized and polished layouts that clients will appreciate.

- Clear payment terms: Easily include payment deadlines, methods, and discounts, improving transparency.

- Personalization: Customize layouts to include your branding elements, such as logos, colors, and contact information.

3. Improving Financial Organization

For businesses to thrive, proper financial management is crucial. Using structured documents allows for better tracking of sales, payments, and overdue balances. With predefined fields and easy-to-read layouts, businesses can stay on top of their financial records, ensuring that all transactions are properly accounted for and easily accessible when needed.

- Easy tracking: Keep a record of payment statuses, including “paid,” “pending,” and “overdue.”

- Organized documentation: Automatically generate and store records for every transaction, which can be reviewed later for accounting purposes.

- Quick access: Use digital systems to easily retrieve documents whenever they are needed, improving efficiency and response

Getting the Most Out of QuickBooks Templates

To optimize business operations and ensure smooth financial processes, leveraging pre-designed document structures is a smart approach. These customizable formats allow businesses to save time, increase accuracy, and maintain a professional appearance for all financial communications. By understanding how to fully utilize these structures, you can significantly streamline your workflow and enhance client relationships.

1. Customizing for Your Business Needs

The beauty of pre-designed formats is their flexibility. By tailoring them to fit your specific business requirements, you can ensure that all necessary details are captured and presented consistently. This includes adjusting fields to reflect the products or services you offer, adding business-specific branding, and modifying the layout for easy readability.

- Business Information: Include your logo, contact details, and payment methods to maintain consistency across all client communications.

- Custom Fields: Add any additional fields that are relevant to your business, such as service descriptions or project codes.

- Consistent Formatting: Ensure all documents follow a uniform style, making it easier for clients to recognize and understand your documents.

2. Automating Routine Tasks

By automating common tasks, businesses can save time and reduce manual errors. Using automated systems to generate, send, and track documents ensures that you never miss a payment deadline and that customers receive timely and accurate information. This can be especially beneficial for businesses with recurring billing cycles or large customer bases.

- Automatic Data Population: Pre-fill customer details and transaction information to save time and reduce manual entry.

- Recurring Billing: Set up automatic generation and delivery of documents for recurring transactions.

- Automatic Reminders: Send payment reminders based on customizable timelines to encourage timely payments.

3. Ensuring Accurate Record Keeping

Accurate financial records are essential for smooth business operations and successful tax preparation. Well-structured documents provide a reliable source of truth for your business’s financial history. By keeping all records organized and easily accessible, you can easily review past transactions, track outstanding balances, and generate reports for analysis.

Feature Benefit Automatic Tracking Easily track the status of payments, whether they are paid, pending, or overdue. Comprehensive Reports Generate detailed reports for any time period to analyze business performance. Archiving Store and access past documents quickly for reference or tax purposes. 4. Maintaining Professionalism

Consistently delivering professional and polished documents is key to maintaining a positive image with clients. Customizing d