Professional Invoice Template Word for Effortless Billing

Creating accurate and clear payment requests is an essential part of any business operation. Whether you’re a freelancer, a small business owner, or part of a larger company, having a streamlined system for generating bills can save time and reduce errors. The right tools can help you quickly create professional documents that enhance your credibility and ensure timely payments.

By using pre-designed formats, you can easily customize essential details like client information, services rendered, and payment terms. This approach eliminates the need to start from scratch each time, allowing you to focus on growing your business rather than getting bogged down in administrative tasks. With the right setup, creating formal payment requests becomes a quick and efficient process.

Utilizing templates provides a practical solution for businesses of all sizes, helping to maintain consistency and professionalism. These ready-to-use formats can be tailored to suit your unique needs, whether you need a simple layout or something more detailed. With a few adjustments, you’ll have a polished document ready for use in minutes.

Benefits of Using Word Invoice Templates

Using pre-designed formats for generating billing documents offers numerous advantages for both individuals and businesses. These solutions provide a convenient way to create polished and consistent records without starting from scratch each time. They help save valuable time, improve accuracy, and contribute to a more organized approach to financial management.

Efficiency is one of the primary benefits. Instead of manually crafting each payment request, you can rely on an existing structure, making the process quicker and reducing the likelihood of errors. Customizing details such as client information and services rendered becomes a simple task that takes only a few minutes, leaving more time to focus on other areas of your business.

Another key advantage is professionalism. Pre-designed layouts ensure that all essential elements are included and formatted correctly, enhancing the overall presentation of your documents. This helps establish trust with clients and can contribute to prompt payments, as a well-organized billing document signals that your business is credible and detail-oriented.

Flexibility is also a significant benefit. These pre-structured designs can be easily customized to suit your specific needs, whether you require a minimalist format or a more detailed, comprehensive record. The ability to make quick changes allows you to adapt the document for various clients or services without the need to reinvent the wheel each time.

How to Create Invoices in Word

Creating detailed billing documents in a text editor is a straightforward process that allows you to maintain accuracy while saving time. By following a few simple steps, you can quickly generate professional-looking records that meet your business needs. Here’s a guide to help you craft a complete and organized payment request.

- Open a New Document – Start by launching your text editor and opening a blank document. This gives you a fresh space to begin working on your billing record.

- Add Business Information – Include your company or personal details at the top of the page. This may include your name or business name, address, phone number, and email. Make sure this section is clear and easily visible.

- Client Details – Next, list the client’s name, address, and contact information. This ensures the bill is properly attributed and can be easily matched to the correct person or company.

- Describe the Services or Products – Detail the goods or services provided, including the quantity, price, and any relevant dates. This information is crucial for transparency and helps clients understand what they are being charged for.

- Include Payment Terms – Specify the payment due date, accepted payment methods, and any late fees or discounts. This ensures both parties are clear on the terms and can prevent future misunderstandings.

- Finalize the Document – Review the entire document for accuracy. Double-check the client’s details, services listed, and payment terms to ensure everything is correct. Once satisfied, save the file in a preferred format and send it to the client.

Following these steps allows you to create an organized and clear payment request with minimal effort. With consistent formatting and attention to detail, your documents will reflect professionalism and accuracy in every transaction.

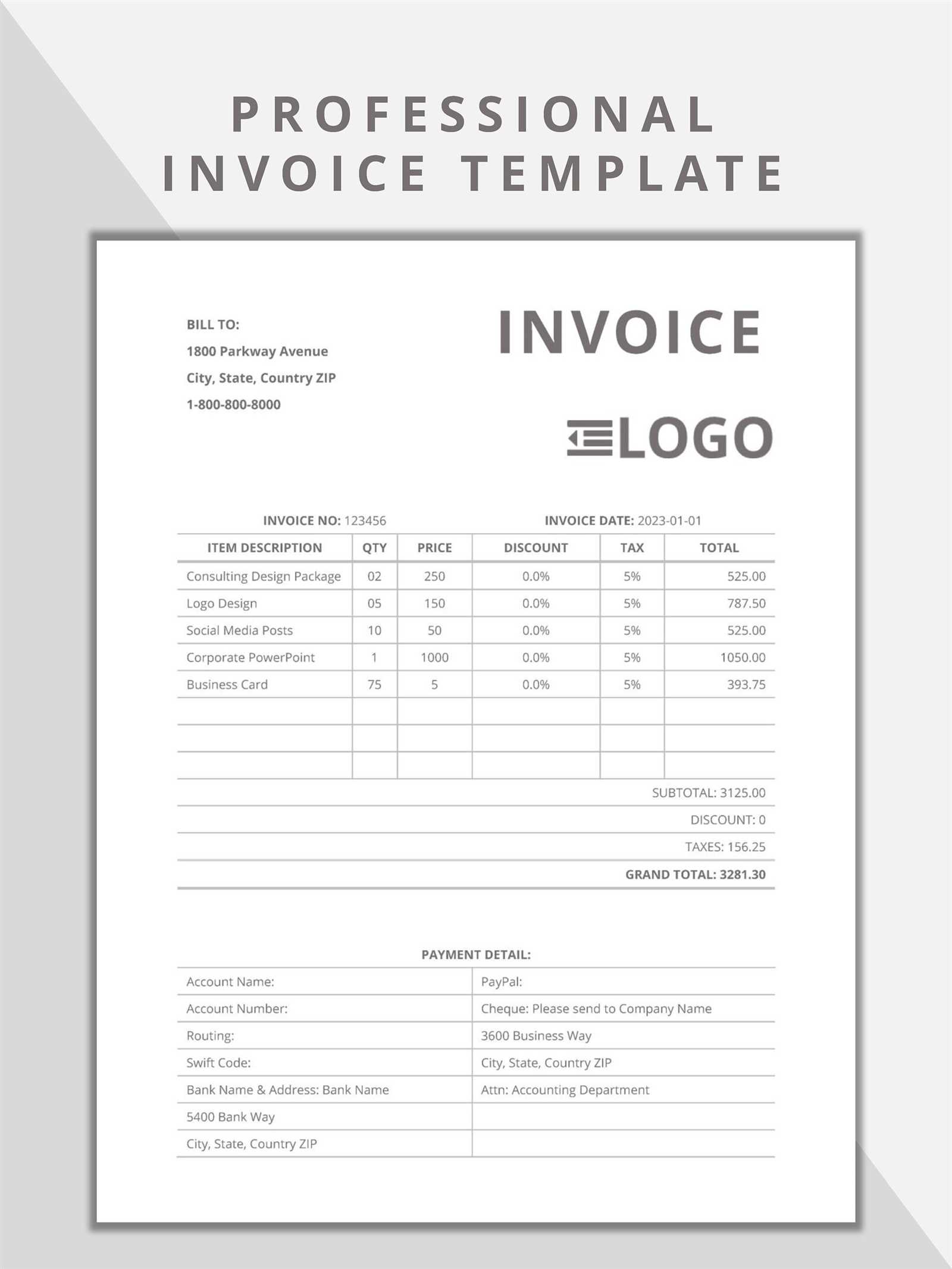

Choosing the Right Invoice Template

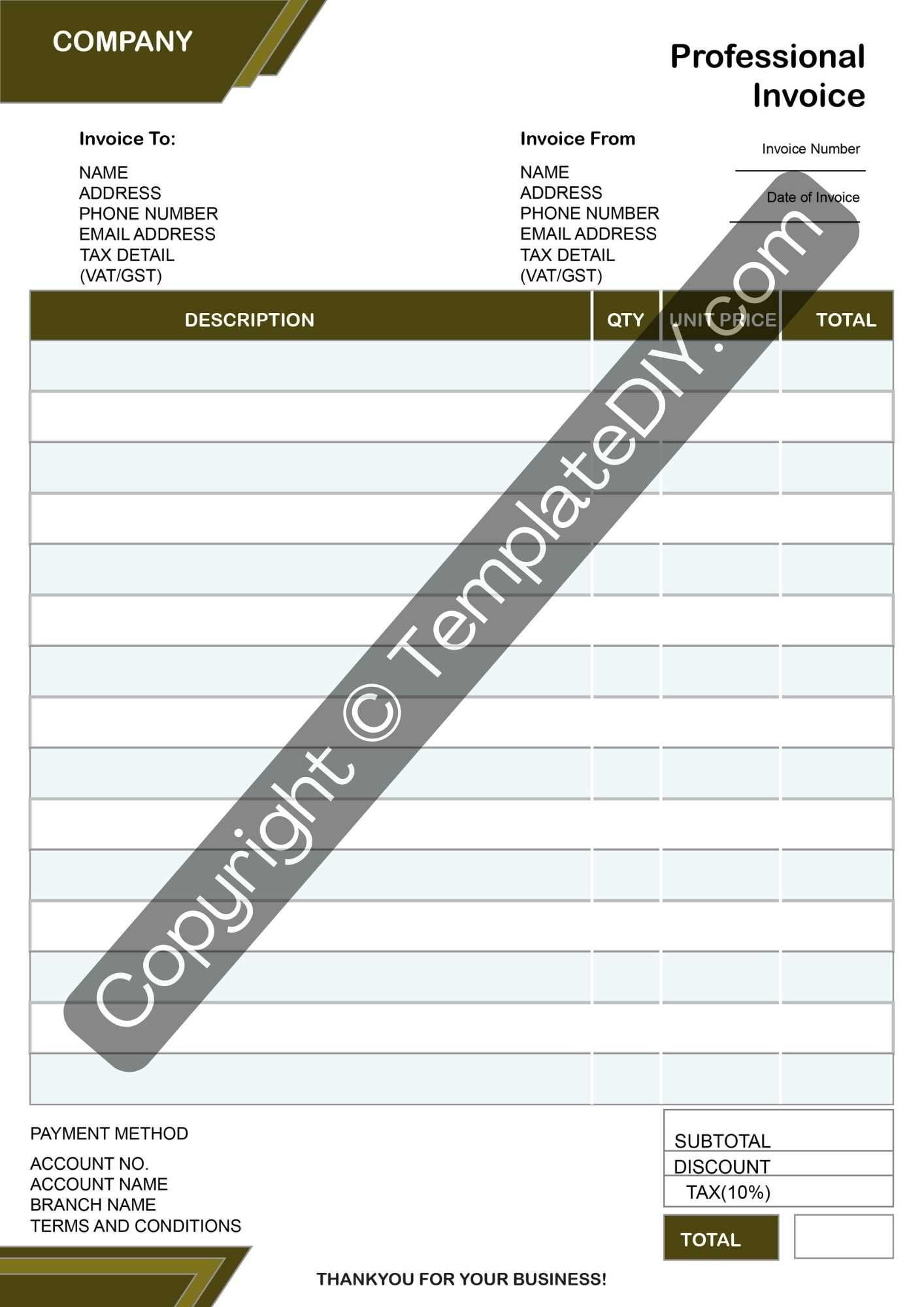

Selecting the right layout for creating billing records is essential for maintaining clarity and professionalism in your financial documents. The right structure can make your payment requests easier to understand and ensure that all necessary details are included. Here are some factors to consider when choosing a suitable design for your documents.

Key Features to Look For

- Clear Structure: Choose a design that organizes all key information, such as client details, services rendered, and payment terms, in a logical and easy-to-read format.

- Customization Options: Make sure the format allows for easy customization, so you can adapt it to different clients or service types without hassle.

- Professional Design: Look for a layout with clean lines and balanced spacing. A simple, well-organized appearance will give your documents a polished look.

- Compatibility: Ensure the design works well with your preferred document software, allowing you to make quick edits and save the files in various formats.

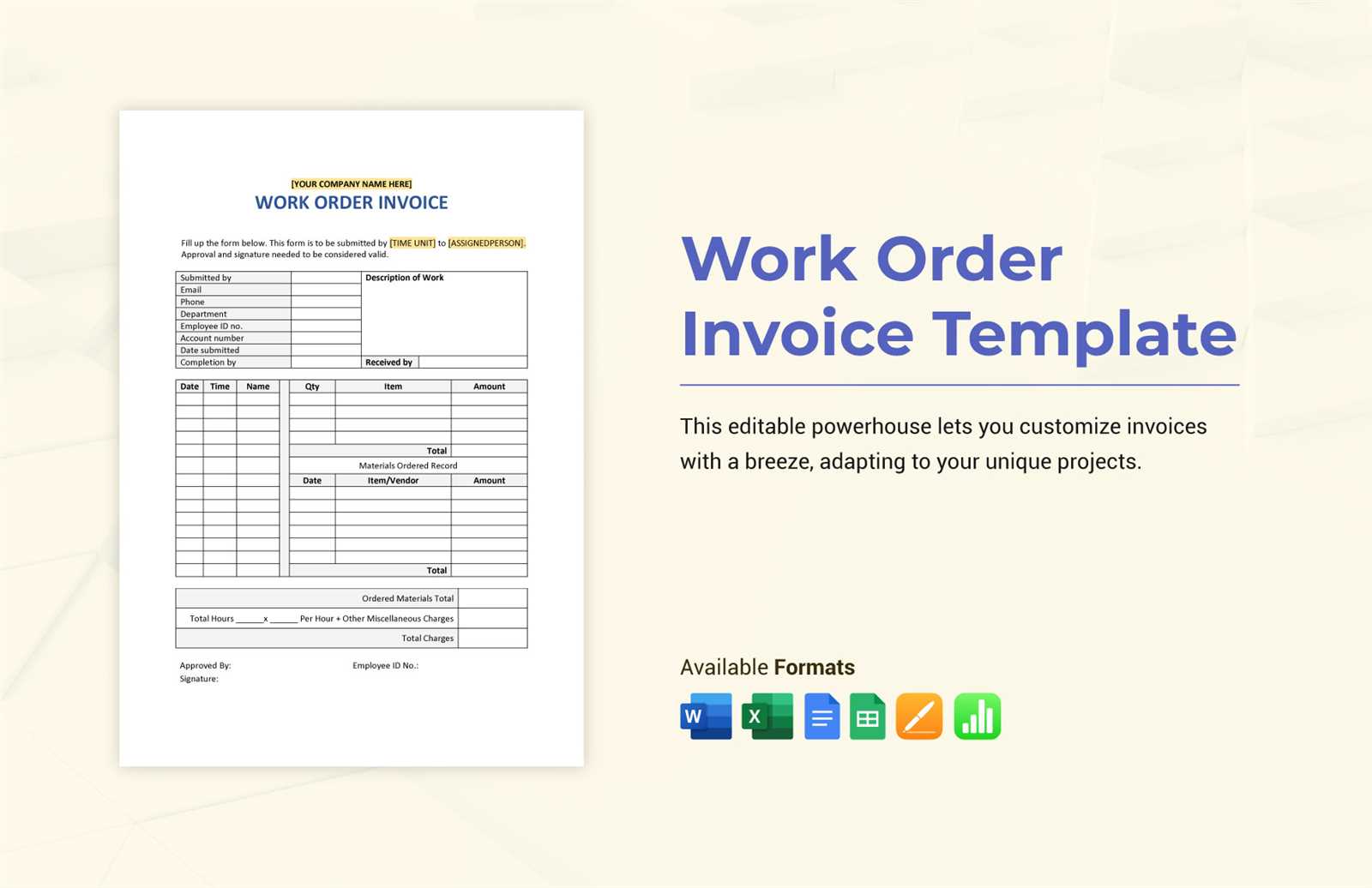

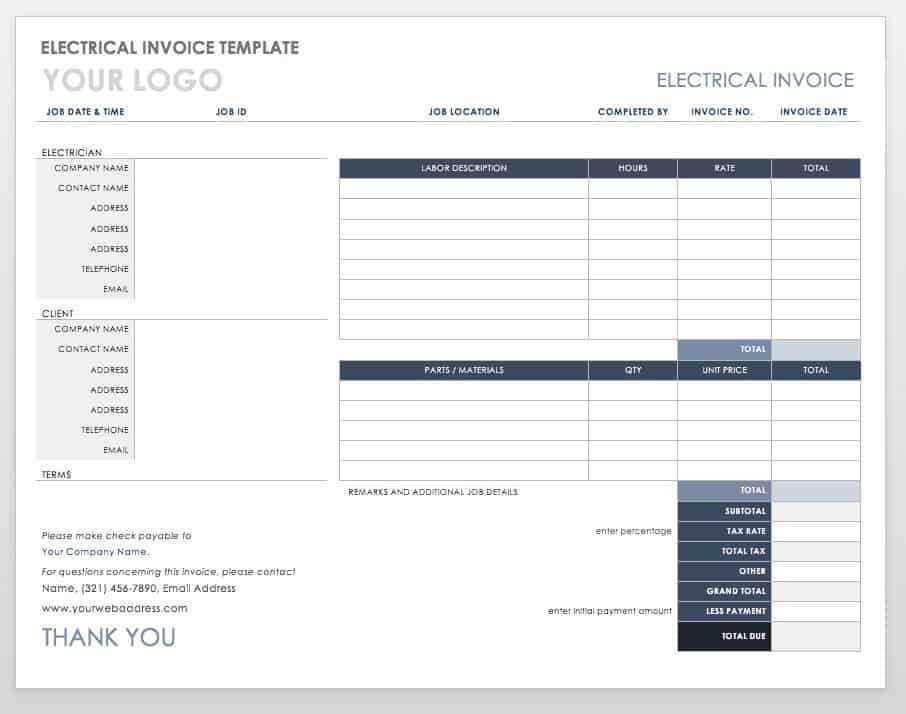

Types of Designs to Consider

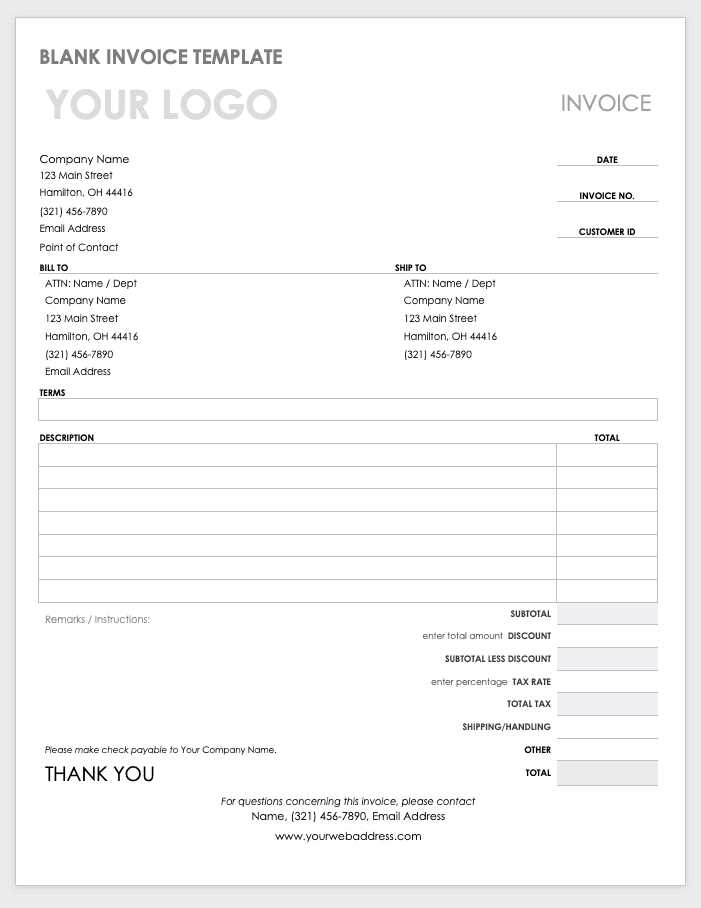

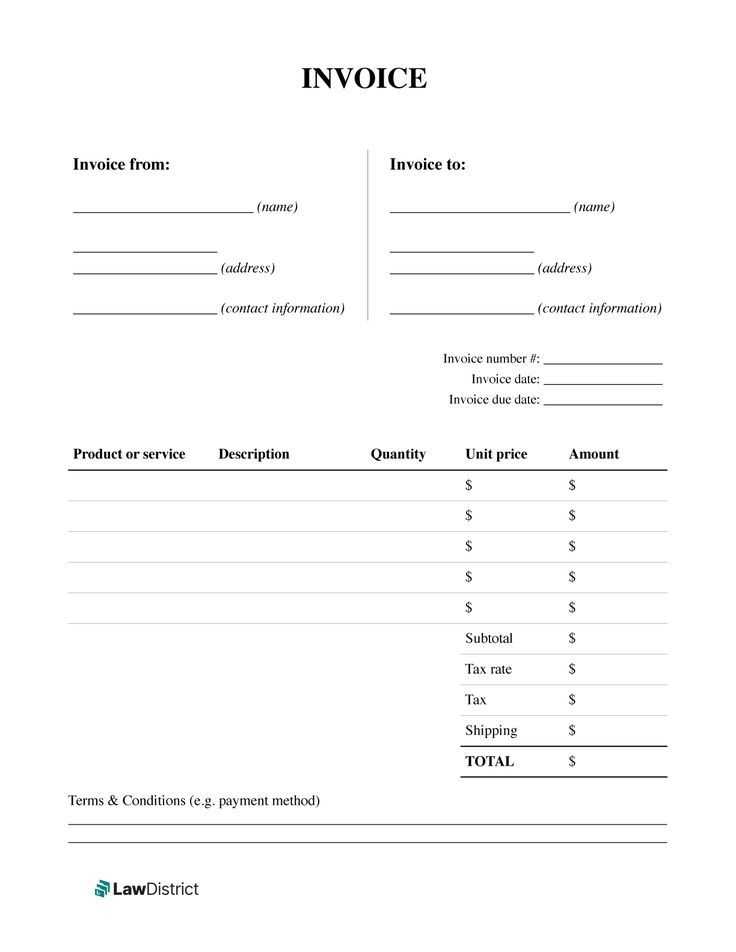

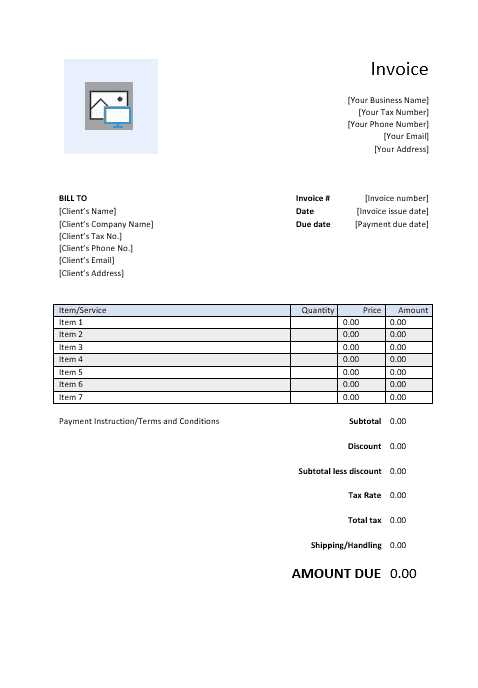

- Simple Layout: Ideal for straightforward billing, with just the essential details like services, payment terms, and due dates. Suitable for freelancers and small businesses.

- Detailed Layout: Perfect for companies that need to itemize products or services, include multiple charges, and track tax rates. This design often includes sections for discounts, shipping, or additional notes.

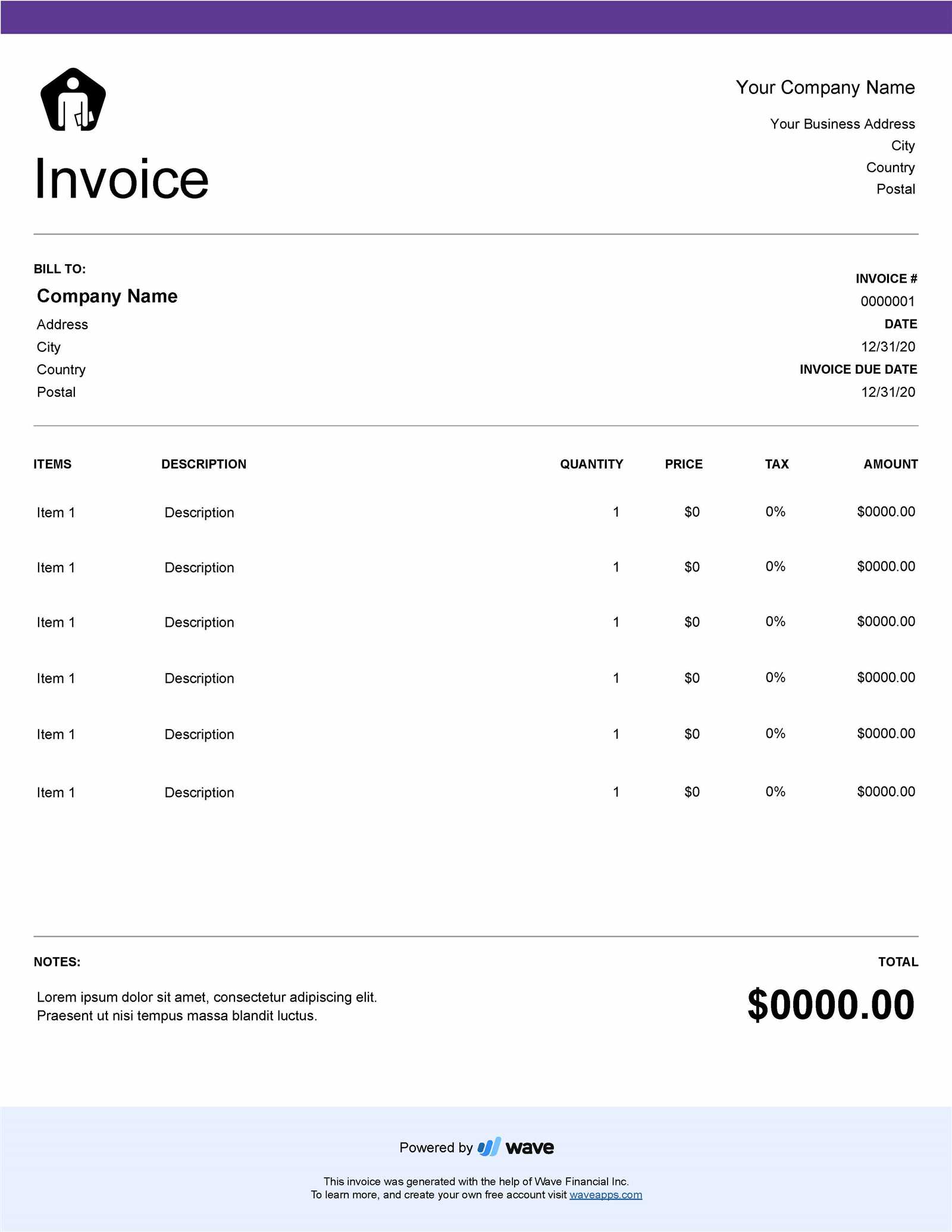

- Modern and Creative Designs: A more stylish option that works well for businesses where branding and aesthetics are important. These templates often incorporate logos, custom colors, and unique typography.

By considering these factors, you can choose a layout that best fits your business needs and ensures that your billing documents remain clear, consistent, and professional.

Customizing Your Invoice for Business Needs

Tailoring your billing document to suit the specific requirements of your business is crucial for maintaining accuracy and ensuring that all relevant details are included. Whether you’re a freelancer or a larger company, adapting the layout and content of your records to match your workflow can streamline the billing process and create a more cohesive experience for both you and your clients.

Key Customization Areas

- Business Branding: Add your logo, brand colors, and a custom header to ensure that the document aligns with your company’s visual identity. This gives your payment requests a professional and consistent appearance.

- Client Information: Include specific details such as the client’s full name, address, phone number, and email. Customizing this section ensures that all communications are directed to the correct person or department.

- Service Descriptions: Adjust the service or product descriptions to reflect the exact nature of what you provided. Whether you’re offering hourly work or a fixed-price service, be specific to avoid any confusion.

- Payment Terms: Customize the payment terms section to reflect your preferred conditions, such as accepted payment methods, discounts for early payment, or penalties for late payment. Clear terms help prevent misunderstandings.

- Additional Sections: Depending on your business, you might need to include extra fields for taxes, shipping charges, or discounts. Adding custom sections can help you accommodate these unique aspects without cluttering the main content.

Making Your Document Versatile

- Flexibility in Design: Choose a format that allows for easy adjustments. Whether you need to add more line items, change fonts, or adjust spacing, having a flexible layout ensures you can make edits as needed.

- Clear Payment Instructions: Including straightforward payment instructions, such as your bank account details or online payment links, can make the process smoother for your clients, ensuring faster transactions.

- Multi-Currency or Tax Settings: If you deal with international clients or different tax rates, customizing your billing document to accommodate multiple currencies or tax codes can simplify your invoicing process.

Customizing your payment request documents to meet the specific needs of your business not only enhances professionalism but also ensures that you are communicating clearly and effectively with your clients. This tailored approach can help you maintain consistency in your records while adapting to different business situations.

Understanding Key Invoice Elements

To ensure that your billing documents are both clear and effective, it’s important to include all necessary components. Each part of a payment request serves a specific function, and having a well-structured document can prevent confusion and ensure timely payments. Below are the key elements that every billing record should contain.

Essential Components of a Billing Document

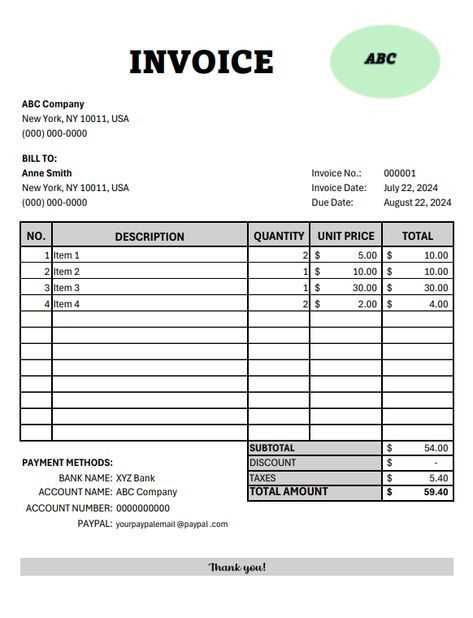

- Header Information: This section typically includes your business name, logo, and contact details, as well as the client’s information. This makes it easy to identify both parties involved in the transaction.

- Unique Identification Number: Every document should have a distinct reference number for tracking purposes. This helps both you and your clients to keep records organized and avoid mistakes when referring to a specific payment request.

- Itemized List of Goods or Services: A clear breakdown of what was provided, including quantities, unit prices, and total amounts, is essential. This section helps your clients understand exactly what they are being charged for and ensures transparency in the transaction.

- Payment Due Date: Including a clear due date helps set expectations and reminds your clients when the payment should be made. This prevents delays and promotes timely settlement of the amount due.

- Payment Instructions: Clearly outline how you want to receive payment. Whether it’s by bank transfer, check, or online payment platforms, providing these details ensures that there are no delays in the transaction process.

- Terms and Conditions: Any specific terms, such as early payment discounts, late fees, or other policies, should be included in this section. These terms help avoid misunderstandings and set clear guidelines for both parties.

Additional Considerations

- Tax Information: If applicable, be sure to include tax details, such as the applicable tax rates and the amount charged for taxes. This helps comply with local regulations and gives the client a clear understanding of the total amount due.

- Notes or Special Instructions: If there are any additional details or special requests, such as a reminder of previous payments or a thank-you note, this section provides the opportunity to communicate them professionally.

- Balance Due: Clearly state the total amount owed at the bottom of the document. This helps avoid confusion and makes it easy for the client to see the final amount that needs to be settled.

Incorporating these key elements into your billing documents ensures that both you and your clients have a mutual unders

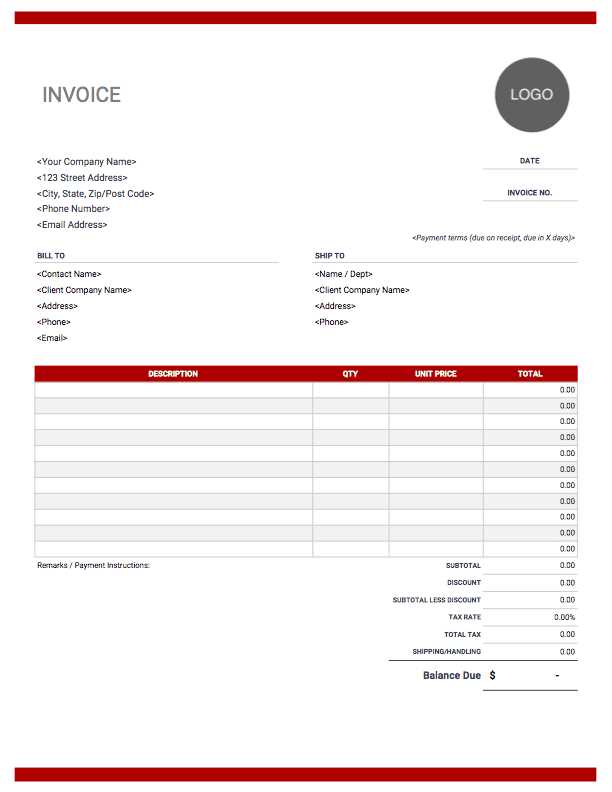

Design Tips for Professional Invoices

Creating clear and visually appealing payment documents is essential for maintaining a professional image and ensuring that your clients can easily understand the details of their transactions. The design of your billing document plays a key role in communicating important information effectively. Below are some design tips to help you create clean, organized, and aesthetically pleasing records.

Maintain a Clean and Simple Layout

Simplicity is key when designing your billing document. Avoid cluttering the page with too many elements or overly complex details. A clean layout helps your clients focus on the most important information. Ensure there is adequate white space between sections, which will make the document easier to read and give it a polished look.

Use Readable Fonts and Sizes

Choose easy-to-read fonts that are professional and straightforward. Sans-serif fonts like Arial or Helvetica are commonly used for business documents because they are clear and legible. Ensure the font size is large enough to be easily readable but not too big to take up unnecessary space. A font size between 10 and 12 points is usually ideal for body text.

Consistency in Styling

Ensure consistent styling throughout the document. Use the same font, font size, and color scheme for headers, subheaders, and body text. This consistency creates a cohesive and polished look. If you choose to highlight certain information, such as the total amount due or payment terms, use bold text or a different color to make it stand out.

Incorporate Your Brand Identity

Incorporating your brand elements can make your billing document look more personalized and professional. This includes adding your logo, using your brand colors, and ensuring the design aligns with the overall aesthetic of your business materials. A branded document helps reinforce your company’s identity and builds trust with your clients.

Organize Information Clearly

Ensure the key details are easy to locate by organizing the information logically. Typically, business details should be placed at the top of the document, followed by the client’s information, a description of services or products, payment terms, and any relevant notes. Using borders, lines, or shading to separate different sections can also improve readability.

Make Payment Details Stand Out

Since the primary goal of the document is to request payment, make sure that the payment details are prominently displayed. The total amount due should be easy to find, ideally at the bottom or in a bold, larger font. Consider using a shaded box or a colored background to highlight the final payment amount.

By following these design tips, you can create a billing document that is not only functional but also conveys pr

Why Word is Ideal for Invoices

When it comes to creating payment documents, the software you choose can significantly impact the ease of use and quality of your final result. Using a reliable word processing tool offers a range of advantages that make it the ideal choice for generating clear and customizable billing records. Below are the reasons why this particular program stands out as a top choice for businesses.

Advantages of Using Word for Billing Documents

- Ease of Use: The interface of word processing software is user-friendly, making it easy for both beginners and experienced users to create and edit documents. You don’t need advanced technical skills to craft a clean and professional-looking payment request.

- Customizability: With a word processing program, you can fully tailor your document. Whether you need to adjust fonts, layout, or content, these tools give you complete control to match the design to your needs, ensuring it reflects your brand identity.

- Pre-Designed Layouts: Most word processors come with pre-made layouts, which can save you time. You can quickly select a structure that suits your business and then customize it as needed to reflect specific service details or client requirements.

- Formatting Flexibility: The program offers a wide range of formatting options, such as tables, text alignment, borders, and shading. This flexibility allows you to create a structured and well-organized document that clearly presents all necessary information.

- Compatibility: Documents created with word processors are compatible with most operating systems and can easily be shared, printed, or saved in multiple file formats, such as PDF, which makes it easier to deliver your documents to clients.

- Cost-Effective: Word processing software is often available as part of common office suites, which makes it an affordable option for both small businesses and larger companies. There are also free alternatives that offer similar functionality, making it accessible for businesses of all sizes.

Additional Benefits

- Document Security: Many word processors allow you to password-protect documents, providing an added layer of security for sensitive financial information.

- Cloud Integration: With cloud storage options, you can access and edit your billing documents from any device, ensuring you never miss an update or modification, even while on the go.

- Versatility: Aside from creating payment requests, you can use word processing tools to write letters, reports, proposals, and other important business documents, making it a multi-functional tool for your company.

Given these advantages, it’s clear that using word processing software for creating payment recor

Steps to Save and Print Invoices

Once you’ve created your billing document, it’s important to save it properly and ensure it is ready for printing or digital delivery. Proper saving and printing ensure that the document remains intact and professional in appearance. Here’s a simple guide on how to save and print your payment requests effectively.

How to Save Your Document

- Review the Document: Before saving, make sure that all the necessary details are accurate, including client information, services, amounts, and payment terms. Double-check for any spelling or formatting errors.

- Choose a File Format: Decide on the format in which you want to save your document. Common options include PDF, DOCX, or XLSX. PDF is ideal for sharing as it preserves formatting and is widely accepted.

- Save Locally or in the Cloud: Choose where you want to store your document. You can save it on your computer or in cloud storage for easy access from any device. Be sure to organize your files in a way that makes them easy to locate later.

- Name the File Appropriately: Give the file a meaningful name that includes key details, such as the client’s name, the date, or the invoice number. This will make it easier to find the file when needed.

How to Print Your Document

- Check Printer Settings: Before printing, ensure that your printer is properly connected and has enough paper and ink. Set the printer settings to match your document size (typically A4 or Letter).

- Preview the Document: Use the “Print Preview” feature to check how the document will appear on paper. This will help you spot any formatting issues and make adjustments if necessary.

- Adjust Margins and Layout: If necessary, adjust the document’s margins, layout, and orientation (portrait or landscape) to ensure everything fits properly on the page and nothing is cut off.

- Print the Document: Once you are satisfied with the preview, select “Print.” Depending on your printer and settings, you may be able to print directly or choose additional options such as printing multiple copies or printing in color.

Additional Tips

- Save Backup Copies: Always keep backup copies of your documents in different locations to avoid loss due to technical issues or

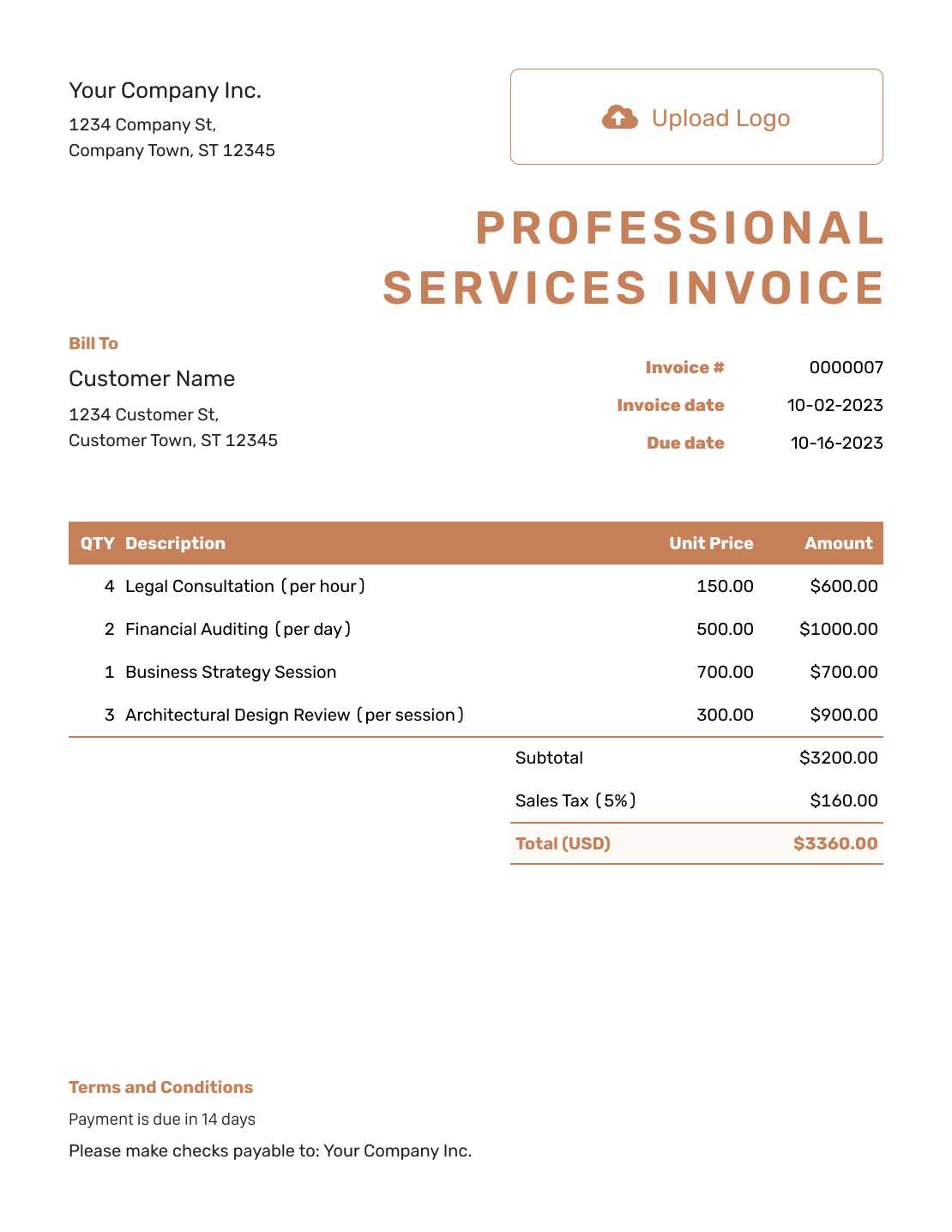

Using Invoice Templates for Freelancers

For freelancers, keeping track of payments and maintaining a professional image is key to building strong client relationships. Using pre-designed billing formats helps streamline this process by ensuring consistency, accuracy, and saving valuable time. These ready-made structures can easily be customized to reflect the unique details of each project, making it simpler to send clear and professional payment requests.

Why Freelancers Should Use Pre-Designed Formats

- Time-Saving: Pre-designed billing formats save time by providing a ready structure that only needs to be filled in with project-specific details, rather than creating a new document from scratch each time.

- Consistency: Using the same layout for every client ensures your billing process is consistent and professional, which helps build trust and credibility over time.

- Accuracy: With the right design, you’re less likely to forget key elements, such as project details, due dates, or payment terms, helping you avoid mistakes and ensuring your records are precise.

- Customization: These formats are highly flexible, allowing freelancers to adjust information like the payment amount, client details, and services offered, making them ideal for a variety of freelance work.

Essential Features for Freelance Billing Documents

- Client Information: Always include the client’s name, address, and contact details. This ensures there’s no confusion about who the billing document is intended for.

- Detailed Project Description: Clearly describe the work completed, including deliverables, deadlines, and any relevant milestones. This helps avoid any misunderstandings about the services provided.

- Payment Terms: Set clear expectations by outlining payment methods, due dates, and penalties for late payments. This section helps ensure timely payments and prevents disputes.

- Professional Design: Choose a simple, clean layout that reflects your personal or business brand. A polished design creates a lasting impression and shows clients that you take your work seriously.

Additional Tips for Freelancers

- Consider Offering Discounts: If you want to encourage early payments, consider including a discount option for clients who pay before the due date. This can be easily added to your template.

- Track Your Payments: Keep a record of all the documents you send out and mark when payments are received. This can be easily done by naming and organizing your files by date or client.

- Include Notes or Personal Touches: Adding a thank-you note or personalized message to

Automating Invoices with Word Templates

For businesses that generate multiple billing documents regularly, automating the process can save significant time and reduce the chances of errors. By using a well-structured document layout, it’s possible to streamline the creation of payment requests, making the process quicker and more efficient. This section explores how to use pre-designed formats to automate your billing workflow, minimizing repetitive tasks and ensuring consistency in your documents.

Benefits of Automating Billing Documents

- Time Efficiency: Automation reduces the amount of manual work required to create each document, allowing you to focus more on core business activities.

- Consistency: By using the same structure for every request, you ensure that all important information is included and formatted consistently, which helps maintain a professional image.

- Reduced Errors: Automating the process reduces the chances of making mistakes, such as missing fields, incorrect totals, or incomplete client details.

- Easy Updates: If you need to adjust pricing, terms, or other details, updating the original format ensures that these changes are reflected across all future documents without the need to redo each one manually.

How to Automate Your Billing Process

- Set Up a Master Document: Create a master document with fields and placeholders for key details, such as client information, services provided, payment terms, and total amounts. This document can serve as a template for every new payment request.

- Use Fillable Fields: Many word processors allow you to add fillable fields that can be easily updated for each new request. This allows you to quickly update client information, amounts, and other variables without having to alter the document’s structure.

- Incorporate Auto-Numbering: Use automatic numbering to generate unique references for each document. This eliminates the need to manually enter invoice or document numbers, ensuring that they are sequential and properly formatted.

- Save as a Template: Save your customized document as a reusable template. This way, you can create new payment requests by simply filling in the required fields without worrying about the layout or structure.

Additional Automation Tools

- Macros: Some word processing

Common Mistakes in Invoice Creation

Creating clear and accurate billing documents is crucial for ensuring timely payments and maintaining a professional image. However, it’s easy to make mistakes during the process that can lead to confusion, delayed payments, or even disputes. Understanding the common errors that people make can help you avoid them and create documents that are both accurate and effective.

Typical Mistakes in Payment Request Documents

Common Mistake Explanation Impact Missing or Incorrect Client Details Forgetting to include or incorrectly listing the client’s name, address, or contact information. Leads to confusion and could cause payment delays if the client cannot be identified. Unclear Payment Terms Not clearly specifying the payment deadline, late fees, or accepted payment methods. Causes misunderstandings and delays in payment as clients are unsure of when and how to pay. Wrong Totals or Calculation Errors Making errors in adding up totals or failing to account for taxes or discounts. Leads to discrepancies and disputes, delaying payment or requiring a revised document to be sent. Omitting Project Details Not providing a clear description of the work completed, such as services rendered or products delivered. Can create confusion and lead to clients questioning what they are being charged for, delaying payment. Incorrect Document Numbering Using the same number for multiple documents or failing to use a consistent numbering system. Creates confusion and complicates tracking of payment history, potentially resulting in lost documents. How to Avoid These Mistakes

- Double-Check All Details: Always review client information, dates, payment terms, and amounts before sending out any document.

- Include Clear Payment Instructions: Specify the exact due date, accepted payment methods, and any penalties for late payments.

- Use Reliable Calculation Tools: Ensure all numbers are correct by using automated tools to calculate totals, taxes, and discounts, or double-check manually.

- Provide Detailed Descriptions: Clearly outline what the client is being charged for, including quantities, services, and any relevant dates.

- Implement a Consistent Numbering System: Use a sequential numbering system that’s easy to follow, ensuring no two documents

Invoice Templates for Small Businesses

For small business owners, managing administrative tasks efficiently is essential to keeping operations running smoothly. One of the most important tasks is creating accurate and professional billing documents. By using structured layouts designed for billing purposes, small businesses can save time, reduce errors, and present a more polished image to clients. These formats can easily be customized to suit the unique needs of each business, helping to streamline the billing process and maintain financial organization.

Key Features of Billing Documents for Small Businesses

Feature Explanation Benefit Clear Branding Incorporating the business logo, colors, and contact information into the document. Helps create a professional appearance and reinforces brand identity with clients. Detailed Service Descriptions Providing clear descriptions of the products or services provided. Ensures transparency, preventing misunderstandings and disputes with clients. Payment Terms Outlining the payment due date, accepted methods, and any late fees or discounts for early payment. Clarifies expectations and encourages timely payments, which is crucial for cash flow. Itemized Charges Listing each charge separately, such as products sold or services performed. Improves transparency and makes it easier for clients to see what they are paying for. Document Numbering Assigning a unique number to each document for tracking and organization. Helps maintain an organized record system and makes it easier to reference or follow up on specific documents. Benefits of Using Pre-Structured Billing Documents

- Saves Time: Using ready-made structures eliminates the need to create new documents from scratch every time, speeding up the billing process.

- Improves Accuracy: A consistent layout helps reduce errors, such as missing client details, incorrect totals, or forgotten charges.

- Increases Professionalism: A well-organized billing document reflects positively on your business, helping you appear more trustworthy and reliable to clients.

- Customizable: Even pre-designed structures can be easily tailored to suit the specific services, charges, or branding of your business.

- Consistency: Using the same layout for every document helps maintain consistency, ensuring that clients always receive clear and understandable billing information.

How to Ensure Invoice Accuracy

Ensuring that billing documents are accurate is essential for smooth business operations. Mistakes in payment requests can lead to confusion, delayed payments, and even strained client relationships. By following specific steps and using reliable tools, businesses can reduce errors, maintain clarity, and ensure that all important details are correctly represented. Here are some key strategies to guarantee accuracy in your billing process.

Steps to Achieve Accurate Billing Documents

- Double-Check Client Information: Always verify client names, addresses, and contact details before finalizing the document. Even small mistakes in client details can lead to confusion and delayed payments.

- Review Service Descriptions: Clearly describe the services or products provided, including dates, quantities, and any relevant details. Ensuring the accuracy of this section will help prevent misunderstandings.

- Verify Amounts and Calculations: Double-check the numbers, including unit prices, totals, taxes, and any discounts applied. Using automated tools for calculations can reduce the risk of errors.

- Confirm Payment Terms: Clearly state the payment due date, methods of payment, and any penalties or incentives for early or late payments. This ensures your client knows exactly what is expected.

- Use Consistent Numbering: Implement a consistent and sequential numbering system for each payment request to avoid confusion and to help track payments effectively.

Tools and Tips for Improved Accuracy

- Use Pre-designed Layouts: Pre-built billing formats help ensure all necessary details are included and laid out correctly. Templates with fixed fields can reduce the risk of missing or misplacing information.

- Automated Calculations: Use software that automatically calculates totals, taxes, and discounts based on the data entered. This minimizes human error and speeds up the process.

- Review Before Sending: Always take a moment to review the document one last time before sending it to your client. Even if you’re using a template, a final review helps catch any overlooked details.

- Seek Feedback: If you’re uncertain about any part of the document, seek feedback from a colleague or an expert. They can often spot mistakes that you might have missed.

By adopting these practices, you can significantly reduce the chances of errors and ensure that every billing document you send is clear, accurate, and professional. Accuracy not only helps maintain healthy business relationships but also contributes to better financial management and a smoother workflow.

Managing Multiple Invoices in Word

For businesses that handle numerous billing requests on a regular basis, managing multiple documents efficiently is crucial. Whether you are dealing with clients, projects, or orders, keeping track of various requests can become overwhelming without a proper system in place. By organizing your files and using structured formats, you can easily manage several documents, streamline your workflow, and ensure consistency in all your payment requests.

Effective Strategies for Handling Multiple Billing Documents

- Use a Centralized Folder: Keep all your billing documents in one organized folder with clear subfolders for clients, dates, or project types. This will make it easier to locate any document quickly.

- Implement Sequential Numbering: Assign a unique number to each document to help track and reference them. This numbering system can be based on the client, project, or date to maintain order.

- Create a Master Document: Use a master document format that can be easily duplicated and customized for each new billing request. This reduces the need to create a new layout from scratch every time.

- Automate Where Possible: Use built-in features like auto-numbering or merge functions to speed up document creation and reduce the risk of mistakes.

Using a Table for Better Organization

When managing multiple billing requests, a table can be a helpful tool to keep track of essential information, such as document numbers, due dates, and payment statuses. Below is an example of how you can organize your documents using a table:

Document Number Client Name Amount Due Date Status #1001 Client A $500 2024-11-15 Paid #1002 Client B $750 2024-11-20 Pending #1003 Client C $300 2024-11-25 Paid By using a table like this, you can easily monitor the progress of each document, track payments, and follow up when needed. This organized approach ensures that no request is overlooked, and every client is bil

Legal Considerations for Invoices

When creating billing documents, it’s important to ensure that they are not only accurate and clear but also legally compliant. A properly structured payment request can serve as a crucial document in case of disputes, audits, or legal issues. By including the necessary legal elements and adhering to local regulations, businesses can avoid potential legal complications and ensure their financial records are protected.

Essential Legal Elements to Include

- Client Details: Make sure the client’s full legal name, address, and contact information are included. This ensures clarity in identifying both parties involved in the transaction.

- Clear Payment Terms: Specify the agreed-upon payment terms, including the due date, acceptable methods of payment, and any penalties for late payments. These terms should be outlined clearly to avoid misunderstandings.

- Tax Identification Numbers: Depending on the jurisdiction, including a business tax ID or VAT number may be legally required for transactions. This provides transparency and complies with tax reporting obligations.

- Itemized Breakdown: Include a detailed list of services or products provided, along with the corresponding prices. This helps prevent disputes by providing clarity on what is being charged.

- Payment Due Date: Clearly state when the payment is due. Having an explicit due date helps avoid confusion and ensures that the client understands when payment is expected.

- Legal Language: Some regions may require specific legal language to be included in payment requests, especially if late fees or interest rates apply. Consult local regulations to ensure compliance.

Compliance with Local Regulations

- Understand Tax Laws: Different countries and regions may have specific tax rules for billing documents. Make sure you understand local tax rates and include them correctly in the document if applicable.

- Follow Consumer Protection Laws: Ensure that the payment request complies with consumer protection regulations, which may include specifying refund policies, warranty terms, or dispute resolution procedures.

- Preserve Records: Keep copies of all billing documents for a designated period, as required by law. This helps in case of audits, disputes, or legal challenges.

- Electronic Records: If submitting or storing documents electronically, ensure compliance with laws governing digital contracts and electronic signatures in your jurisdiction.

Failure to adhere to legal requirements in billing documents can lead to costly disputes, delayed payments, or regulatory penalties. By including the necessary legal elements and staying informed about local laws, businesses can safeguard themselves and ensure that their