Export Commercial Invoice Template Free Download and Customization Tips

When conducting cross-border trade, clear and accurate paperwork is crucial for smooth transactions. Having a well-structured document that outlines key details of the goods, their value, and shipping terms is essential for both the seller and the buyer. This document ensures proper customs clearance, payment processing, and avoids potential delays in the delivery process.

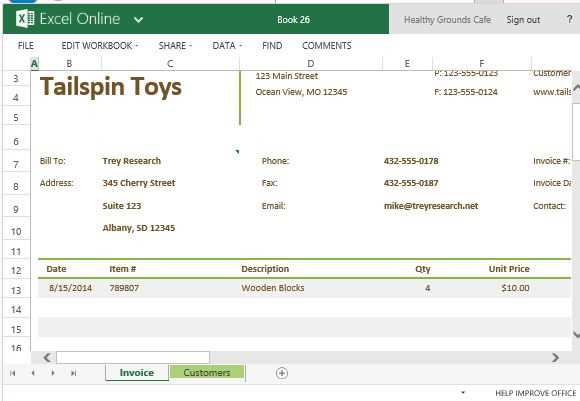

Creating such a document from scratch can be time-consuming and prone to error. Fortunately, using pre-designed forms can significantly streamline this task. These ready-made forms provide a reliable structure that covers all necessary information, reducing the risk of mistakes and ensuring consistency across shipments. Whether you are a small business or a large enterprise, using the right form can save time and help maintain compliance with international trade laws.

Efficient document preparation is key to maintaining good relationships with partners and ensuring timely deliveries. This guide will explore how to customize, use, and implement these forms effectively, helping you avoid common pitfalls and enhance your global trade operations.

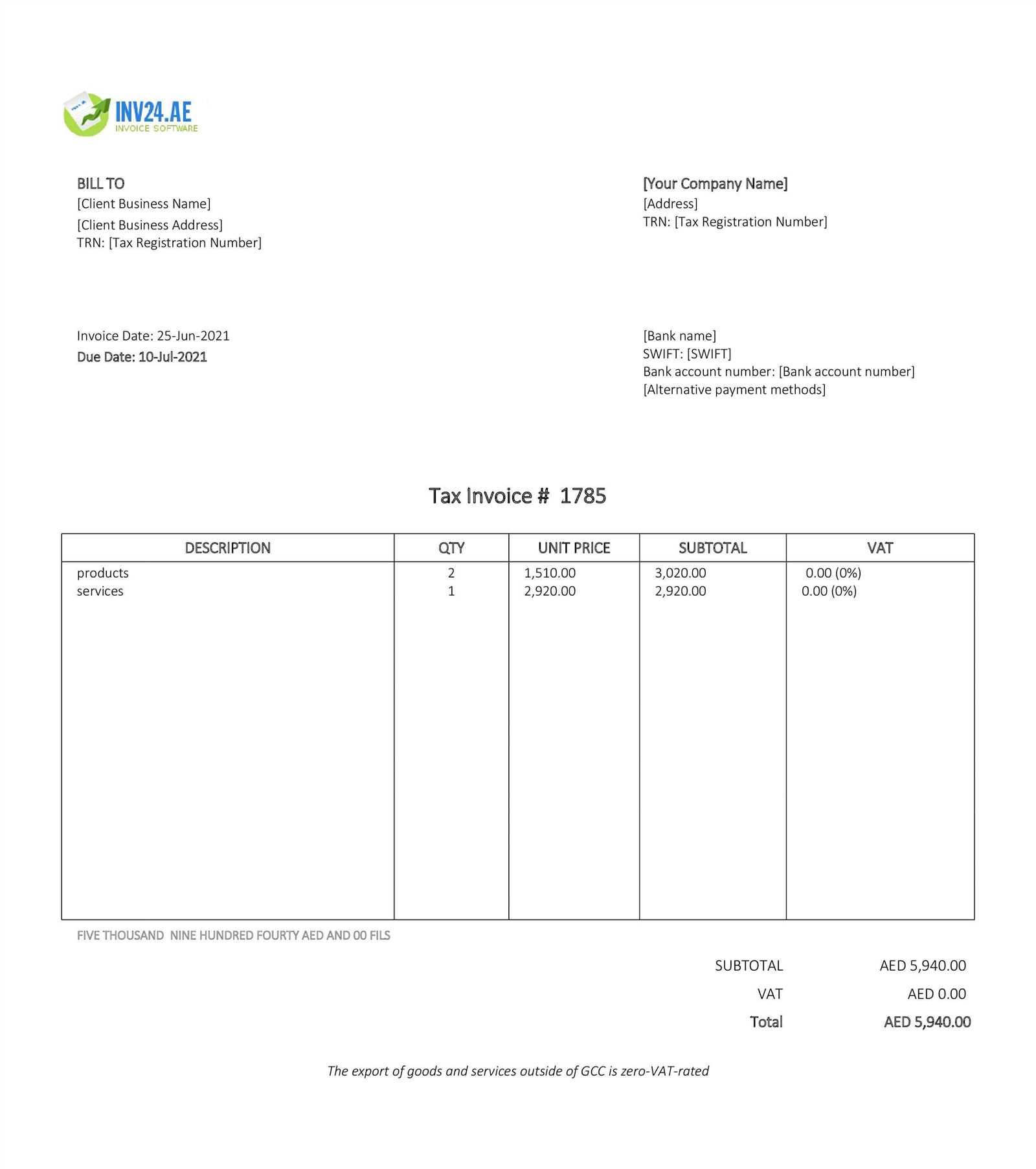

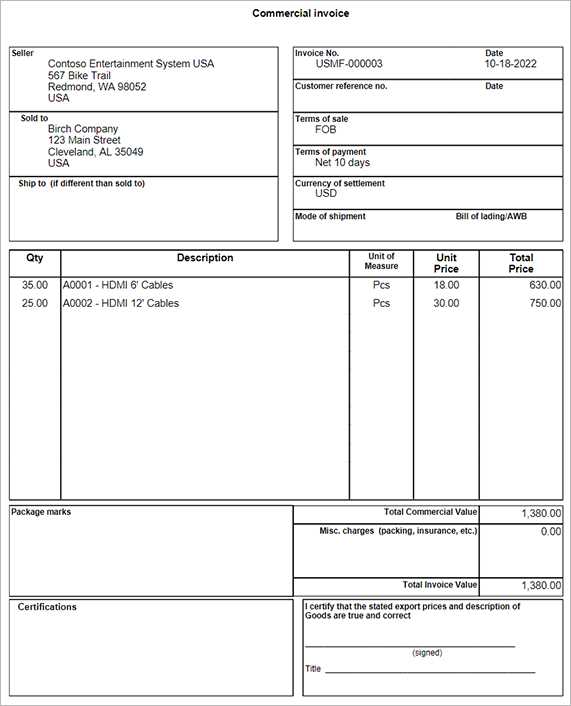

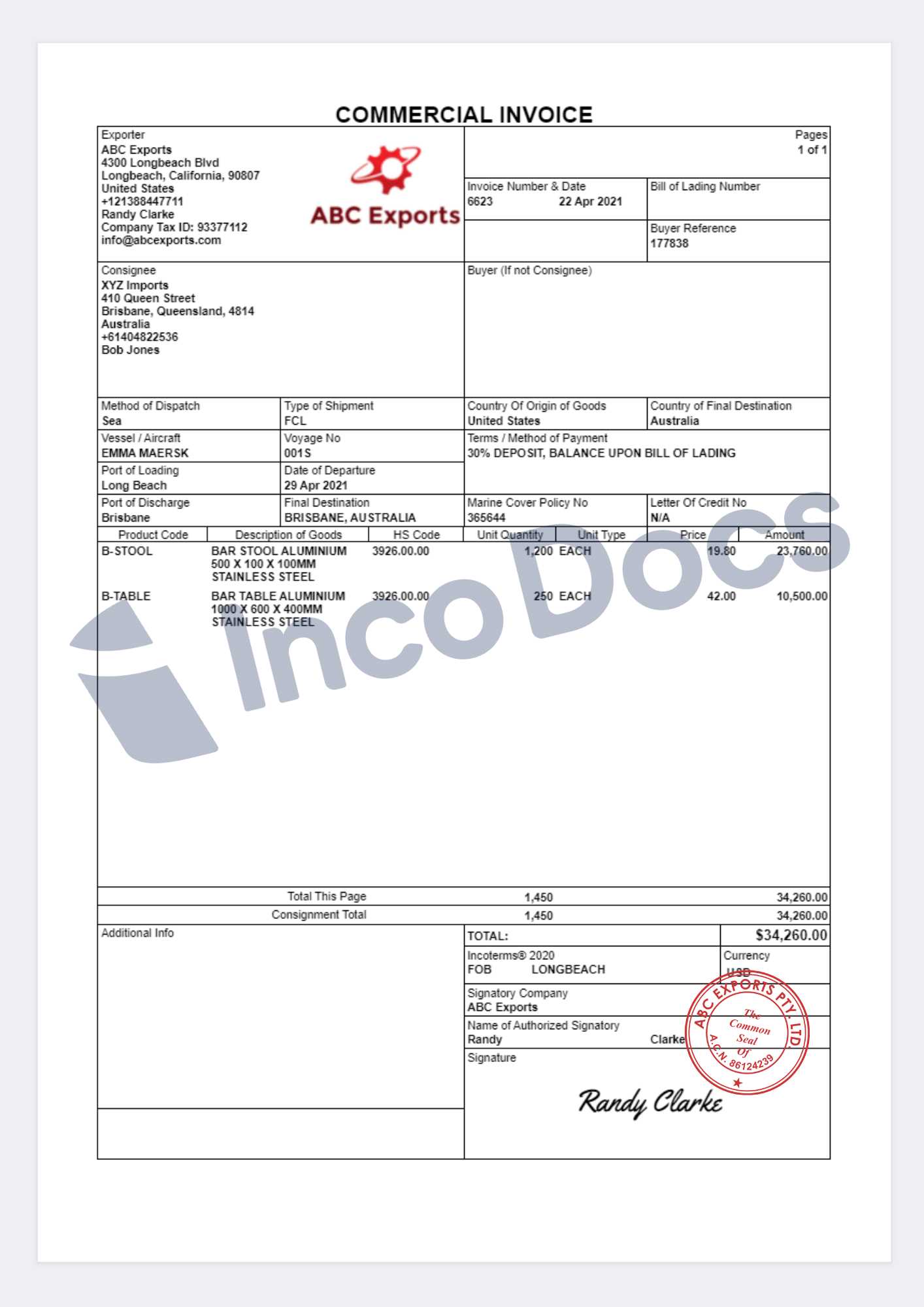

Export Commercial Invoice Template Overview

For any international trade transaction, having the right documentation is essential to ensure smooth processing. This document serves as a detailed record of the goods being shipped, their value, and the terms under which they are being transferred. It plays a crucial role in customs clearance, facilitating both the payment process and regulatory compliance. By using a structured form, businesses can avoid potential delays and reduce the risk of errors in their international dealings.

Pre-designed forms offer a practical solution for businesses, as they provide a standardized structure that covers all necessary information. These forms ensure that every key detail–such as product descriptions, quantities, pricing, and shipping terms–are clearly outlined and easy to understand. By utilizing these forms, sellers can streamline their documentation process, save valuable time, and ensure consistency in their global shipments.

In addition to speeding up the process, having a well-organized document also minimizes the risk of non-compliance with international trade regulations. It can help prevent delays at customs, incorrect billing, and even penalties. The goal is to maintain smooth transactions while ensuring that all required information is present and accurate, making the shipping process more efficient for both parties involved.

Importance of Accurate Commercial Invoices

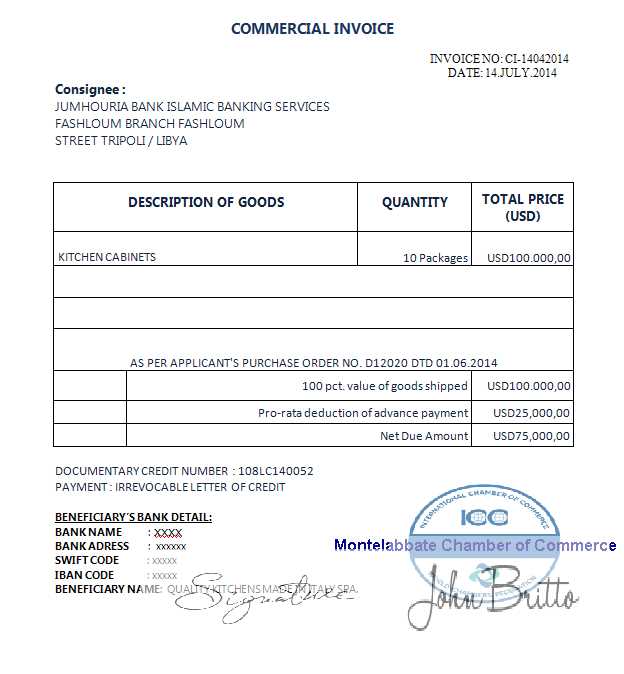

Accurate documentation is the cornerstone of successful international transactions. When selling goods across borders, precise records ensure that all parties involved have a clear understanding of the products being traded, their values, and the terms of the agreement. Without well-prepared paperwork, the risk of delays, disputes, or non-compliance with regulations increases significantly.

Properly completed forms provide clarity and reduce the likelihood of errors. Incorrect or incomplete information can lead to misunderstandings with customs authorities, potential fines, or even the rejection of shipments. This is why it’s crucial to ensure that every detail–from item descriptions to payment terms–is accurately captured and presented. Clear documentation also makes it easier for buyers to process payments and for sellers to maintain transparent records.

Inaccurate paperwork not only hinders the flow of goods but can also damage business relationships and harm your reputation. On the other hand, ensuring that all information is correct and up to date contributes to smoother transactions, faster processing times, and greater customer satisfaction. For businesses engaged in international trade, investing time in creating accurate records is essential for maintaining efficiency and compliance in the global marketplace.

What to Include in a Commercial Invoice

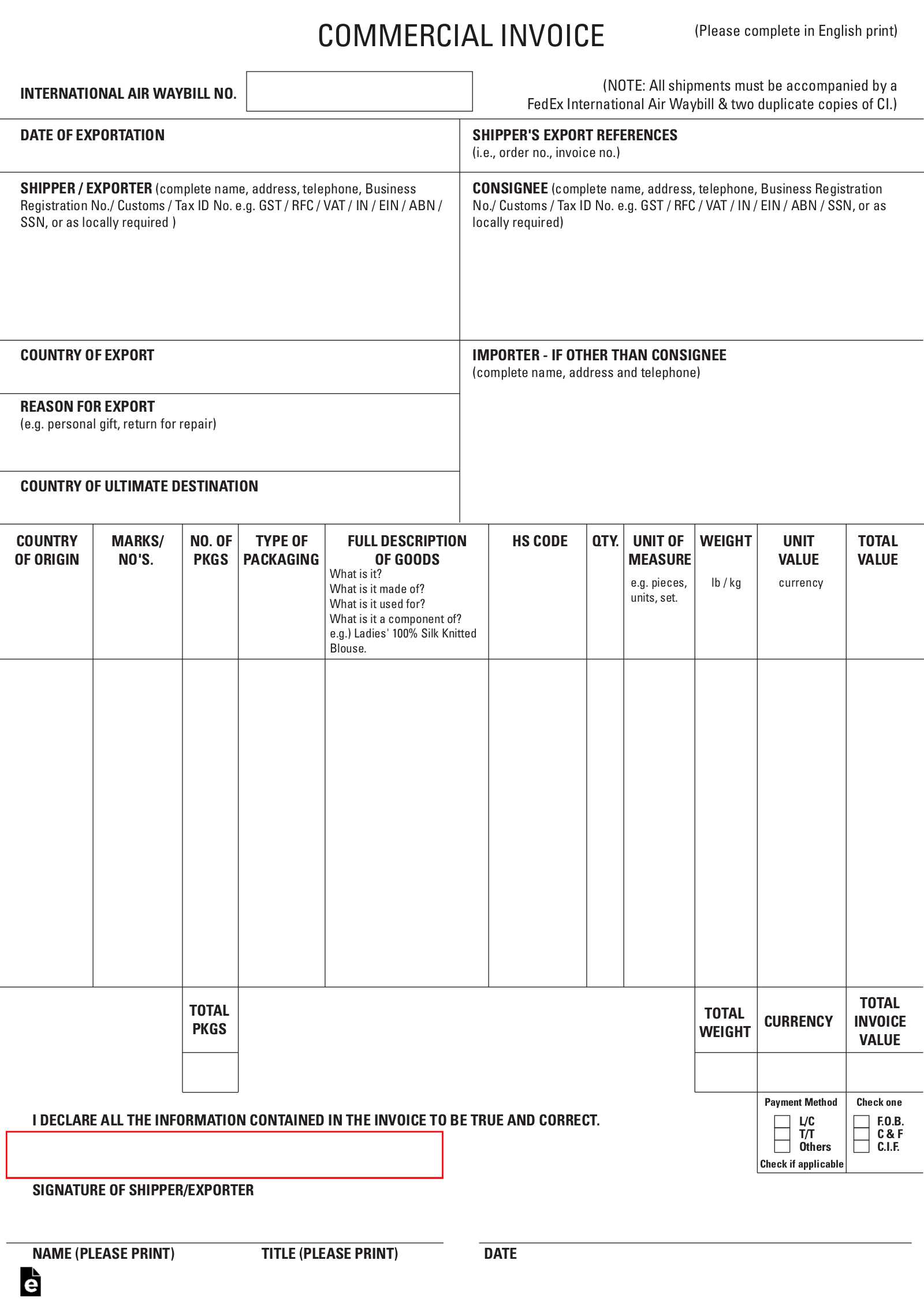

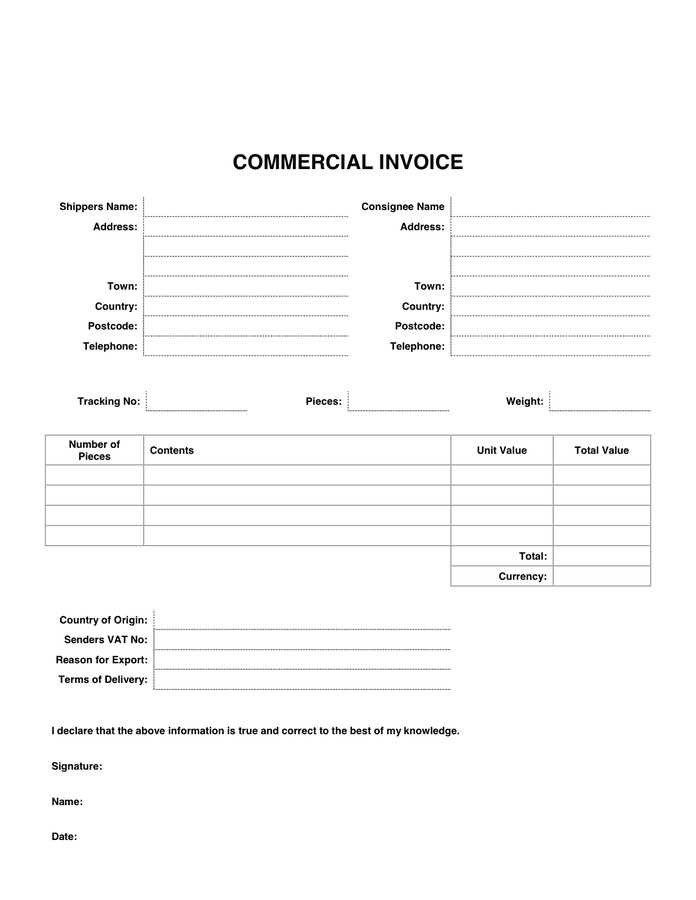

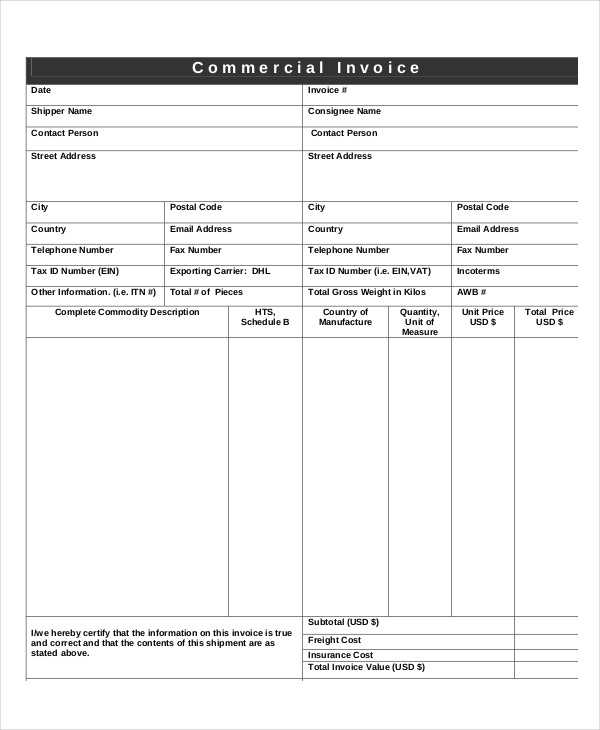

For any international trade transaction, the correct details in the required shipping documents are vital to ensure smooth processing. These documents must clearly outline the nature of the goods, their value, and the terms under which they are being transferred. Including accurate and comprehensive information helps facilitate customs clearance, payment processing, and avoids delays in the delivery process.

Essential Information for Clear Documentation

Each shipping document should contain key elements that provide both the seller and buyer with a complete understanding of the transaction. Below are the primary details that should always be included:

| Information | Description |

|---|---|

| Seller and Buyer Information | Names, addresses, and contact details of both the seller and buyer. |

| Goods Description | Clear description of the products, including quantity, weight, and value. |

| Country of Origin | The country where the goods were manufactured or assembled. |

| HS Code | The Harmonized System code used for classifying the goods. |

| Payment Terms | Details about payment conditions, such as payment method and due date. |

| Shipping Terms | Conditions related to the delivery of goods, such as Incoterms. |

| Value of Goods | The price of the goods being sold, including currency and total value. |

Additional Key Elements

Other helpful information might include shipping methods, tracking numbers, and any special instructions regarding the handling of the goods. These elements ensure that both parties are on the same page, and help streamline the clearance process at customs, making international shipping more efficient.

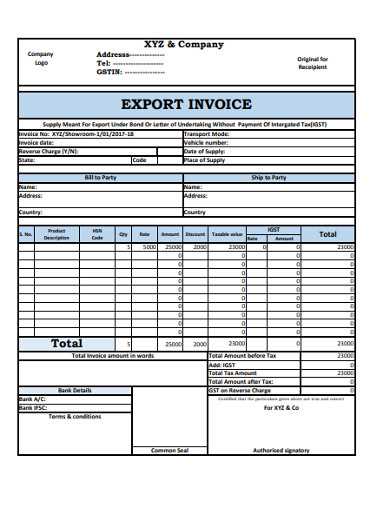

How to Customize Your Invoice Template

Customizing your shipping documentation is a key step in ensuring that all necessary information is clearly presented and tailored to your business needs. By adjusting a standard form to fit your specific requirements, you can make sure that every shipment complies with regulations, maintains professional standards, and reflects your unique brand identity. Here are the steps to modify a pre-designed document for your business use.

Steps to Personalize Your Document

Follow these simple steps to adjust the structure and content of your shipping document:

- Choose the Right Layout: Select a form layout that aligns with your business’s needs. It should be clean, professional, and easy to read.

- Update Business Information: Ensure your company’s details, such as name, address, contact information, and tax ID, are correct and up-to-date.

- Adjust Item Descriptions: Customize the product descriptions to match the specifics of the goods you are shipping. Include relevant details such as dimensions, weight, and product codes.

- Set Payment and Shipping Terms: Tailor payment conditions and delivery terms (like Incoterms) according to your agreements with the buyer.

- Include Additional Notes: Add any special instructions or customs requirements that are specific to the transaction.

Best Practices for Customization

- Consistency: Use a consistent format for all documents to maintain professionalism and avoid confusion.

- Accuracy: Double-check all fields for accuracy, particularly product descriptions, pricing, and payment terms.

- Branding: Incorporate your company’s logo, colors, and font style to enhance the document’s branding and recognition.

- Legal Compliance: Ensure the document complies with local and international regulations, including any tax or customs requirements.

By following these steps and best practices, you can create customized shipping records that are efficient, clear, and well-suited to your business’s needs.

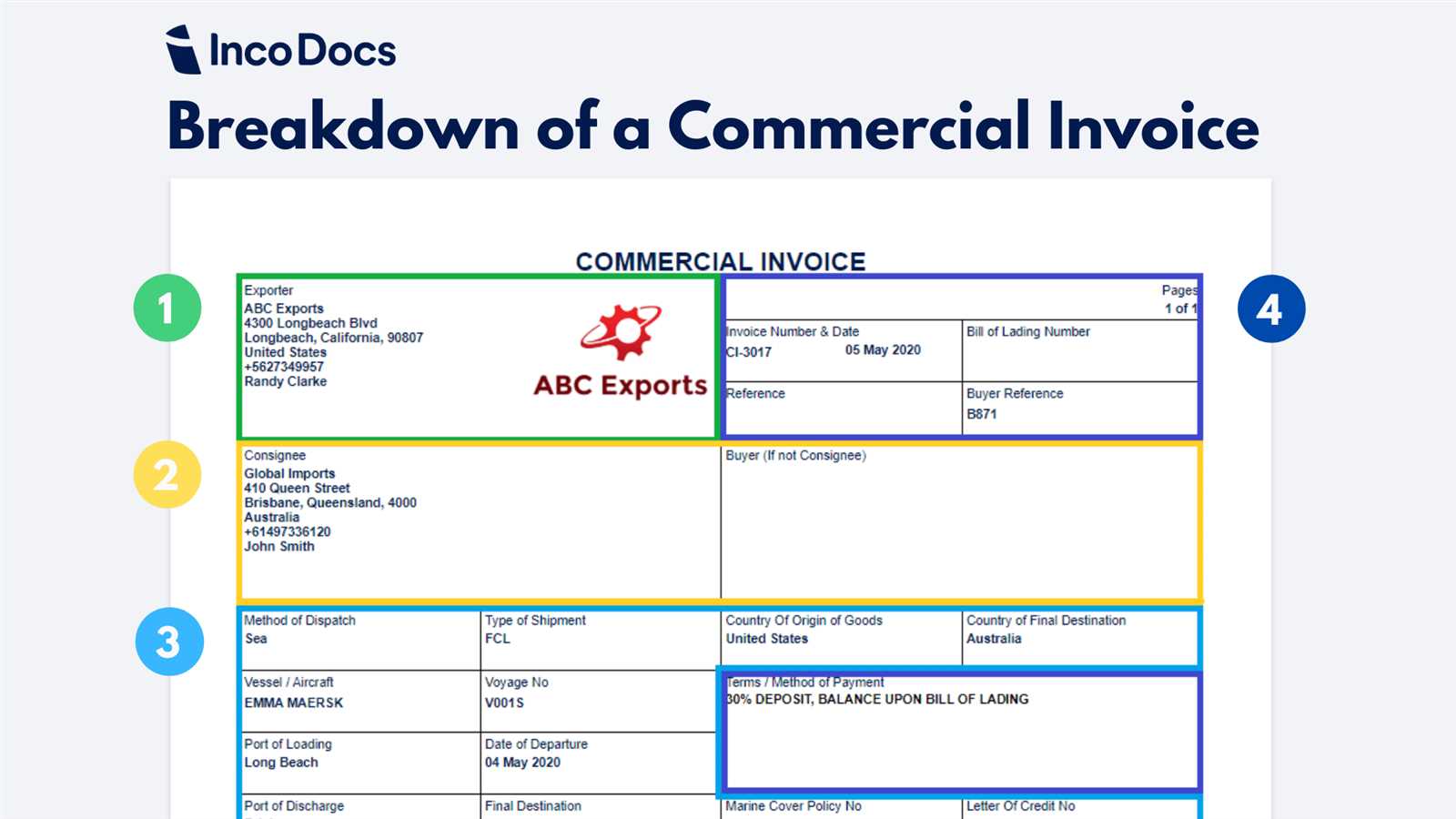

Key Elements of Export Documentation

Proper documentation is essential for any international shipment, as it provides all necessary details for customs clearance, payment processing, and delivery tracking. A well-prepared document helps to avoid delays and ensures that both parties meet their legal and financial obligations. Understanding the key components of these documents ensures that all important information is included and correctly formatted.

Essential Details to Include

Each document should contain a set of critical details to ensure smooth processing of the transaction. Here are the most important elements that must be included:

- Seller and Buyer Information: Full names, addresses, and contact details of both the seller and the buyer.

- Description of Goods: A clear description of the products, including quantity, unit price, and total value.

- Shipping Terms: Shipping conditions like delivery method, Incoterms, and shipping costs.

- Country of Origin: The country where the goods were produced or assembled.

- HS Code: The Harmonized System code used to classify the products for customs purposes.

- Customs Value: The total value of the goods, including any taxes, duties, and charges that apply.

Additional Information to Consider

Depending on the specifics of the transaction, other information may also be important to include:

- Payment Terms: Specific conditions for payment, such as due dates or accepted payment methods.

- Tracking Information: A shipping or tracking number to allow both parties to track the shipment’s progress.

- Special Handling Instructions: Any requirements for the treatment of goods during transport, such as fragile or temperature-sensitive items.

Incorporating these key elements into your documentation ensures that the shipment is processed smoothly, helping to avoid customs issues, delays, or complications in the transaction.

Benefits of Using a Template

Utilizing a pre-designed document for shipping transactions offers numerous advantages that can streamline the process and reduce potential errors. By adopting a standardized structure, businesses can save time, maintain consistency, and ensure that all essential details are properly included. Templates help establish a reliable system for preparing and managing paperwork for international trade.

Key Advantages of Pre-Designed Forms

- Time Efficiency: Templates provide a ready-made format, allowing you to fill in the necessary details rather than creating a new document from scratch each time.

- Reduced Errors: With predefined sections, there’s less room for oversight, ensuring all important fields are included and accurately filled out.

- Consistency: Using the same document structure for every shipment ensures uniformity across transactions, making it easier to track and manage records.

- Compliance Assurance: Templates often include the essential information required for customs clearance, helping you comply with international regulations.

- Professional Appearance: Well-designed forms enhance your company’s professionalism, making a positive impression on clients and customs authorities alike.

How Templates Help in Specific Scenarios

- Global Transactions: Standardized forms are especially helpful for businesses dealing with international customers, as they ensure the necessary details are included for different regions or customs requirements.

- Multiple Shipments: If you manage numerous shipments regularly, having a template speeds up the process and ensures consistency in all your documentation.

- Special Handling or Custom Requirements: Many templates allow for easy customization, so you can add any specific instructions or conditions without redesigning the form each time.

Incorporating a pre-designed document into your business operations ensures greater accuracy, efficiency, and professionalism, which ultimately helps enhance your workflow and maintain smooth international transactions.

Common Mistakes in Commercial Invoices

When preparing documents for international transactions, even small mistakes can lead to significant delays or complications. These errors often arise from missing or incorrect details that affect customs clearance, payment processing, and delivery. Identifying common pitfalls can help ensure that your documents are accurate and fully compliant with regulations.

Frequent Errors to Avoid

- Incorrect Product Descriptions: Failing to provide clear and detailed descriptions of the goods being shipped can cause confusion at customs and lead to shipment delays.

- Missing or Incorrect Contact Information: Inaccurate or incomplete seller and buyer details can result in miscommunication or problems with delivery and payment.

- Omitting Harmonized System (HS) Codes: The absence of proper product classification codes can delay customs clearance and complicate tax assessments.

- Incorrect Pricing and Value Declaration: Errors in pricing, such as missing currency symbols or incorrect total values, can lead to issues with payment or tax calculations.

- Missing Payment Terms: Not specifying payment terms or including vague information about payment methods can lead to confusion between the seller and buyer.

- Inconsistent Shipping Details: Failing to specify clear shipping conditions, such as Incoterms or delivery dates, can cause delays in the shipping process and lead to disputes over responsibilities.

- Omitting Additional Charges: Not accounting for additional costs such as shipping fees, insurance, or taxes can lead to disputes or unexpected expenses for either party.

Impact of These Errors

- Delays in Customs Clearance: Missing or incorrect information can cause shipments to be held up, resulting in costly delays.

- Financial Penalties: Errors in documentation can lead to fines or penalties imposed by customs authorities or tax agencies.

- Damage to Business Relationships: Frequent errors may harm your reputation with customers, suppliers, and partners, potentially damaging trust and long-term relationships.

By carefully reviewing each document and avoiding these common mistakes, businesses can ensure smoother international transactions, faster delivery, and better compliance with regulations.

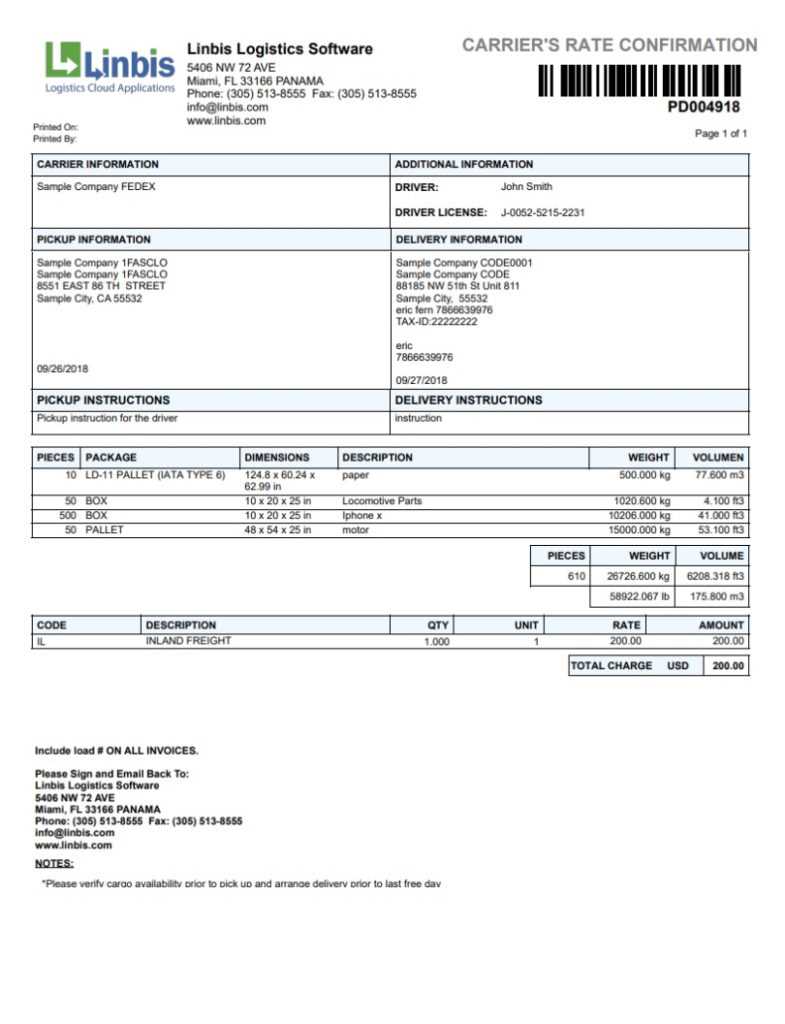

How to Handle Multiple Shipments

Managing multiple shipments efficiently requires careful organization and attention to detail. Whether you are sending goods to different locations or handling several orders at once, it’s essential to keep all necessary records organized and ensure that every shipment is properly documented. This helps avoid errors, delays, and confusion in tracking each delivery.

Strategies for Efficient Shipment Management

To handle multiple shipments smoothly, follow these best practices:

- Use a System for Tracking: Implement a centralized tracking system that allows you to monitor all shipments in one place. This will help you stay on top of delivery dates, tracking numbers, and the status of each shipment.

- Organize Documentation: Prepare and store all necessary documents for each shipment, ensuring that all required details–such as recipient information, product descriptions, and shipping terms–are accurate and accessible. Consider creating a separate file or folder for each order.

- Group Shipments When Possible: If you’re sending multiple items to the same customer or location, consider grouping them together in one shipment to save on costs and simplify tracking.

- Clarify Shipping Terms: Clearly define shipping terms for each order, including delivery methods, expected dates, and responsibilities. This helps set expectations with customers and avoids misunderstandings.

- Monitor Payment and Shipping Timelines: Ensure that all payments are received and that goods are dispatched according to the agreed-upon timelines. Keeping track of payments and shipments will help prevent bottlenecks or delays.

Tools and Solutions to Simplify the Process

- Shipping Software: Use shipping management software to automate tracking, invoicing, and documentation. This can help reduce human error and streamline the entire process, especially for businesses with frequent shipments.

- Bulk Labeling Systems: If handling multiple shipments, bulk labeling systems can save time by allowing you to print all shipping labels at once, reducing manual effort.

- Third-Party Logistics Providers: Partnering with third-party logistics providers can help manage large volumes of shipments. They often offer support in areas such as inventory management, packaging, and delivery, which can simplify the entire process.

By implementing these strategies and utilizing the right tools, managing multiple shipments becomes more streamlined, helping businesses save time, reduce costs, and improve customer satisfaction.

Understanding Export Tax and Duties

When engaging in international trade, it’s crucial to understand the various taxes and fees that may apply to your transactions. These financial obligations, typically imposed by the government of the importing country, can significantly affect the cost of goods and the profitability of the trade. Knowing how taxes and duties work can help you avoid unexpected expenses and ensure that your shipments comply with local regulations.

Types of Taxes and Duties

There are different types of taxes and duties that may apply depending on the nature of the goods and the countries involved in the transaction:

- Customs Duties: These are taxes imposed on goods entering or leaving a country, often based on the value, weight, or classification of the products. Customs duties are typically calculated as a percentage of the total value of the goods.

- Value Added Tax (VAT): Many countries impose VAT or sales tax on imported goods. The VAT rate varies by country and is usually calculated as a percentage of the value of the goods plus any customs duties.

- Excise Taxes: Certain products, such as alcohol or tobacco, may be subject to additional excise taxes. These are specific duties levied on particular types of goods due to their nature or potential for abuse.

- Anti-Dumping Duties: These are special duties applied to goods that are sold below market value to protect local industries from unfair competition.

How to Calculate and Pay Taxes and Duties

To properly calculate the applicable duties and taxes, you will need to gather the following information:

- Product Classification: Each product is assigned a code under the Harmonized System (HS Code), which helps determine the duty rate. Be sure to accurately classify your goods to ensure the correct tax is applied.

- Customs Value: The value of the goods is critical in determining the amount of duty and tax owed. This is usually based on the transaction price, including shipping costs, insurance, and any other charges incurred in bringing the goods to the importing country.

- Import Country Regulations: Each country has its own customs regulations and duty rates. Research the specific rules for the destination country to avoid overpaying or facing delays due to incorrect paperwork.

By understanding these key factors, you can better manage the financial aspects of international trade, ensuring that you stay compliant with regulations and avoid unnecessary costs.

Choosing the Right Invoice Format

Selecting the correct document format for your transaction is essential for ensuring clarity and accuracy in your records. The format you choose should align with the specific requirements of the transaction, the recipient, and the nature of the goods or services provided. A well-organized form helps prevent confusion, supports timely processing, and ensures compliance with relevant regulations.

When choosing the best layout for your documents, consider factors such as ease of use, the information required by both parties, and any legal or industry-specific standards. The format should be simple, yet comprehensive enough to include all necessary details clearly.

Key Factors to Consider When Choosing a Format

| Factor | Description |

|---|---|

| Clarity and Readability | The format should be easy to read and understand, with clearly defined sections and appropriate spacing. |

| Compliance | Ensure that the document format complies with any local or international regulations, including tax and customs requirements. |

| Customization | The ability to adjust or add sections to fit specific transactions, such as additional terms, conditions, or product details. |

| Automation | Consider using a format that can be easily integrated into software systems for automated filling, reducing errors and saving time. |

| Professional Appearance | Choose a format that reflects your business’s professionalism, incorporating your logo and brand elements if needed. |

By carefully selecting the most appropriate document format, you can ensure a smooth process for both you and your customers, while also minimizing errors and improving the overall efficiency of your operations.

How to Save Time with Templates

Using pre-designed documents can significantly streamline your business processes, especially when it comes to preparing paperwork for international transactions. By utilizing a ready-made structure, you can reduce the time spent on repetitive tasks, eliminate manual errors, and ensure that all necessary information is included consistently. This efficiency can lead to faster processing, fewer mistakes, and a smoother workflow for both you and your clients.

Key Benefits of Pre-Designed Forms

- Quick Setup: Pre-designed documents save time by providing you with a consistent format that only requires you to fill in specific details, rather than starting from scratch every time.

- Consistency: Using the same structure for every transaction ensures uniformity across your records, making it easier to manage and track multiple shipments or orders.

- Reduced Errors: Pre-built forms help minimize human error by guiding you to include all necessary information in the correct fields, reducing the chances of missing important details.

- Ease of Customization: You can quickly modify a pre-made form to fit specific needs or customer requirements, without having to design a completely new document each time.

- Integration with Systems: Many pre-designed forms can be integrated into your existing software systems, allowing for automatic population of fields and faster data entry.

How to Maximize Efficiency with Pre-Designed Documents

- Use Templates for Repetitive Tasks: For tasks that require the same type of document repeatedly, such as international orders or routine shipments, pre-made formats help you complete the process much faster.

- Automate Data Entry: Integrate your forms with your business’s database or accounting software to auto-fill common fields, such as company information, customer details, or product descriptions.

- Update Forms Regularly: Regularly review and update your pre-designed documents to ensure they reflect the latest business requirements and regulatory changes, making sure you’re always working with the most accurate version.

By leveraging pre-designed forms, businesses can streamline their administrative tasks, reduce manual effort, and improve overall efficiency–saving time and focusing more on core activities.

Free vs Paid Invoice Templates

When choosing a document format for your business transactions, you may encounter a variety of options–both free and paid. While free options are accessible and cost-effective, paid solutions often come with additional features and customization options that could be beneficial for businesses with specific needs. Deciding between free and paid options depends on factors such as business size, frequency of use, and the level of customization required.

Comparison of Free and Paid Options

| Feature | Free Templates | Paid Templates |

|---|---|---|

| Cost | Free to use, no upfront cost. | Requires a one-time or subscription fee. |

| Customization | Basic customization, limited to fields provided. | Highly customizable, allowing for brand logos, colors, and unique design. |

| Ease of Use | Simple and easy to use, but may lack advanced features. | Often more user-friendly with advanced features like auto-calculation and integration with other systems. |

| Support | Limited support, often community-based forums. | Dedicated customer support, often with tutorials and direct assistance. |

| Additional Features | Basic document formats without extra tools. | Additional tools like data importing, automatic calculation, and professional templates tailored for specific industries. |

Which Option is Best for Your Business?

The right choice between free and paid formats depends on the specific needs of your business:

- Free Options: Ideal for small businesses, startups, or individuals who need a simple solution with minimal customization and only occasional use.

- Paid Options: Recommended for larger businesses or those who need frequent, customizable documents with professional features such as auto-populated fields, recurring billing options, and integration with accounting or CRM software.

While free options provide a straightforward and no-cost solution, paid options can offer more flexibility and efficiency, making them better suited for businesses with more complex needs.

Managing Currency and Payment Information

Accurate handling of currency and payment details is essential for smooth financial transactions, especially when dealing with international business. Correctly managing these aspects ensures that both parties are aligned on pricing, avoids misunderstandings, and facilitates faster and more reliable payments. Whether dealing with different currencies or various payment methods, clear and precise documentation is key to ensuring successful transactions.

Handling Currency Details

When working with international clients or suppliers, currency management becomes a critical aspect. It’s important to clearly specify the currency in which the payment is expected to avoid confusion and errors. Additionally, fluctuations in exchange rates can impact the final amount, so it’s important to clarify whether the agreed price is fixed or subject to change based on market conditions.

- Specify the Currency: Always indicate the currency being used, along with the appropriate currency code (e.g., USD for US dollars, EUR for euros), to prevent any ambiguity.

- Consider Exchange Rates: If payments are made in different currencies, include provisions for exchange rate adjustments if necessary, especially in long-term contracts or large transactions.

- Currency Conversion Fees: Clarify who will bear the cost of currency conversion if applicable–either the buyer or the seller–so that there are no surprises at the time of payment.

Managing Payment Methods

Clear communication of accepted payment methods and their associated terms is just as important. Whether your customers prefer wire transfers, credit cards, or online payment services, it’s essential to outline the method clearly in the documentation.

- Specify Accepted Payment Methods: List all the payment options you accept, such as bank transfers, credit cards, PayPal, or other electronic payment platforms. This avoids confusion and ensures a smooth transaction process.

- Payment Deadlines: Establish clear deadlines for when payments should be made, along with any late fees or penalties for overdue payments.

- Payment Terms and Conditions: Include any necessary details regarding payment schedules (e.g., full payment, deposits, or installments), as well as whether payment is due before shipment or upon receipt of goods.

By carefully managi

Exporting to Different Countries and Regulations

When conducting international trade, understanding the diverse regulatory frameworks in different countries is critical for ensuring that shipments and transactions proceed smoothly. Each country has its own set of rules and requirements, including specific documentation, taxes, tariffs, and compliance standards that must be met. Familiarizing yourself with these requirements helps reduce the risk of delays, fines, or issues at customs.

Key Considerations for International Trade

Every country has different import and export rules, so businesses must be aware of the unique requirements for each destination. These can include:

- Customs Requirements: Each country may have its own documentation requirements, such as certificates of origin, safety inspections, and specific customs declarations. Be sure to research and understand the paperwork necessary for each destination to avoid delays or fines.

- Taxes and Duties: Import duties, taxes, and tariffs vary by country and product type. Understanding the specific rates and who is responsible for these costs (either the buyer or the seller) is essential to avoid misunderstandings.

- Prohibited and Restricted Goods: Certain products may be restricted or banned in specific countries. It’s essential to check the destination country’s list of prohibited items before shipping to ensure compliance with local laws.

- Labelling and Packaging Standards: Many countries have specific regulations about product labelling, packaging materials, and language requirements. These standards may include safety warnings, product ingredients, or even specific packaging to ensure the protection of the goods during transit.

How to Ensure Compliance with Different Regulations

To avoid delays and issues with international shipments, it is essential to follow these best practices:

- Research the Destination Country’s Requirements: Always check the specific import rules for each country. This includes understanding the required documentation, applicable tariffs, and any customs-specific details.

- Work with Customs Brokers or Freight Forwarders: Engaging professionals with expertise in international shipping can help ensure that all regulatory requirements are met, reducing the chance of delays or fines.

- Stay Updated on Changing Regulations: International trade regulations are subject to change. Regularly monitor updates from trade organizations, government sources, or international trade associations to ensure your practices remain compliant.

By fully understanding the unique regulations of each country you trade with, you can avoid costly mistakes, ensure smoother transactions, and build a stronger reputation with international clients.

How to Automate Your Invoicing Process

Automating your document creation and payment collection processes can significantly improve your business’s efficiency. By reducing manual effort and streamlining repetitive tasks, automation saves time, minimizes errors, and accelerates the payment cycle. Implementing an automated system allows you to focus more on core business activities, while ensuring that all financial documentation is consistent and accurate.

Steps to Automate Your Documentation Process

To effectively automate your invoicing, follow these key steps:

- Choose the Right Software: Invest in software or a cloud-based solution that allows you to create, send, and track documents automatically. Many platforms integrate with your existing accounting or ERP systems to streamline the entire workflow.

- Set Up Recurring Templates: For regular transactions, set up recurring document templates that automatically populate with customer information, product details, and pricing. This reduces the need to manually enter the same data repeatedly.

- Integrate with Payment Gateways: Automate payment collection by linking your system with online payment gateways. This allows you to automatically send payment reminders and collect payments online, reducing delays in receiving funds.

- Automate Reminders and Notifications: Set up automatic reminders for clients when payment is due, as well as notifications when payments are successfully processed. This keeps both you and your customers informed without manual intervention.

- Track and Report Automatically: Use software that provides automated tracking and reporting tools, so you can easily monitor payment statuses, outstanding amounts, and any issues that arise, all in one place.

Benefits of Automation

- Reduced Errors: Automation minimizes human errors such as missed payments, incorrect amounts, or forgotten details, ensuring that all documentation is accurate and complete.

- Faster Processing: With automated workflows, the time it takes to generate, send, and track your documents is dramatically reduced, allowing you to focus on other business priorities.

- Consistency: Using automated systems ensures consistency in your documentation, as each transaction follows the same structure and format, regardless of who is handling it.

- Improved Cash Flow: By automating payment reminders and collection processes, businesses can speed up payment cycles, improving overall cash flow and reducing the chances of overdue payments.

By automating your documentation and payment processes, your business will run more smoothly, with fewer mistakes and faster payments. Automation not only saves time but also enhances the customer experie

Best Practices for Invoice Compliance

Ensuring that all financial documents meet regulatory and legal requirements is essential for any business. Compliance with local and international standards helps avoid costly penalties, delays, or disputes. By adhering to the best practices for document preparation and submission, businesses can maintain transparency, reduce errors, and strengthen their relationships with clients and authorities alike.

Key Practices for Maintaining Compliance

To stay compliant with legal and regulatory standards, consider the following best practices:

- Accurate Data Entry: Always ensure that all details, such as the buyer’s information, product descriptions, prices, and payment terms, are accurate and match your records. Incorrect or missing data can lead to compliance issues and delays.

- Follow Local Tax Regulations: Different regions have specific tax laws that must be reflected in your documents. Ensure you apply the correct tax rates, provide proper tax identification numbers, and include relevant tax details to avoid issues with authorities.

- Clear Payment Terms: Clearly outline payment methods, due dates, and any penalties for late payments. This will help prevent misunderstandings and disputes between you and your clients.

- Proper Documentation: Depending on the nature of the transaction, you may need additional documentation, such as certificates of origin, export licenses, or product safety certifications. Always check the legal requirements for the specific market you’re operating in.

- Stay Up to Date: Laws and regulations change regularly. It is important to stay informed about any updates to the compliance rules relevant to your industry and geography. Regularly review your processes to ensure your documentation practices align with the latest standards.

How to Ensure Ongoing Compliance

Maintaining compliance is an ongoing effort. To stay ahead, consider these strategies:

- Use Compliance Management Software: Invest in software tools that can help track regulatory changes, automate compliance checks, and keep your documents aligned with the latest legal requirements.

- Train Your Team: Regularly educate your staff on best practices for document preparation and legal compliance. This ensures that everyone involved in creating or processing transactions is aware of the current rules and standards.

- Engage with Professionals: Consider working with legal and accounting professionals who specialize in your industry to ensure that your documents meet all regulatory and tax requirements. This can provide peace of mind and reduce the likelihood of costly mistakes.

By implementing these best practices, your business can minimize the risk of non-compliance, streamline its operations, and build trust with clients and regulatory bodies. Compliance not only protects your business f

How to Share Your Commercial Invoice

Sharing financial documents efficiently and securely is essential in maintaining a smooth business operation. Whether you’re dealing with international clients, suppliers, or internal teams, ensuring that the right information is transmitted correctly and promptly can prevent delays, disputes, and misunderstandings. The method you choose for sharing these documents plays a crucial role in streamlining your business’s financial processes.

Best Methods for Sharing Financial Documents

There are various methods to share your documentation, each with its advantages and considerations. The key is to select a method that ensures security, clarity, and accessibility for the intended recipient.

- Email: Sending your document via email is the most common and simple way to share. Make sure to attach the document in a widely accepted format like PDF, ensuring it’s easily accessible and readable for the recipient. Always use a professional subject line and ensure the document is password-protected if sensitive data is included.

- Cloud Storage: Using cloud services such as Google Drive, Dropbox, or OneDrive is an efficient way to share large or multiple documents. These platforms allow you to control access permissions, such as read-only or edit permissions, and offer a secure way to store and share files remotely.

- Accounting Software: Many businesses use accounting or financial management software that includes the ability to generate and share documents directly from the platform. Sharing documents via this method ensures that everything is logged, tracked, and stored in one place for easy reference.

- Secure FTP: For more sensitive transactions, a secure FTP (File Transfer Protocol) is often used to share documents. This method ensures that files are transmitted securely over the internet, offering an additional layer of protection for confidential information.

Key Considerations When Sharing Documents

Regardless of the method you choose, there are several key factors to keep in mind to ensure a smooth sharing process:

- Ensure Accuracy: Double-check that the document is correct before sharing. Any errors or omissions can lead to confusion and delays.

- Use Clear File Names: Always name your documents clearly and consistently. A descriptive file name, such as “Invoice_CompanyName_Date”, helps recipients quickly identify and locate the document in their inbox or cloud storage.

- Keep Security in Mind: If the document contains sensitive information, make sure to encrypt the file or use password protection to prevent unauthorized access.

- Follow Up: After sending the document, follow up with the recipient to confirm they’ve received it and that there are no issues with the information provided.

By choosing the right method and paying attention to detail when sharing your documents, you can ensure timely and secure transactions with all parties involved, while maintaining a professional and efficient workflow.