How to Use an Invoice Log Excel Template for Better Financial Management

Managing business transactions and keeping track of payments is essential for any organization. Staying organized ensures timely follow-ups, reduces errors, and simplifies financial reporting. One of the most effective ways to streamline this process is through a well-structured spreadsheet that can capture essential details and calculations automatically.

Using a digital sheet allows you to track each transaction clearly, monitor outstanding balances, and evaluate cash flow trends with ease. With a customizable structure, it can be adapted to suit various business needs, from small startups to large corporations. This tool can become the backbone of your financial management, providing clarity and insight into your ongoing operations.

Whether you’re managing client payments, organizing receipts, or keeping a record of services rendered, a well-organized system can save you valuable time and resources. By leveraging the power of spreadsheets, you can ensure that all financial data is easily accessible, up-to-date, and error-free.

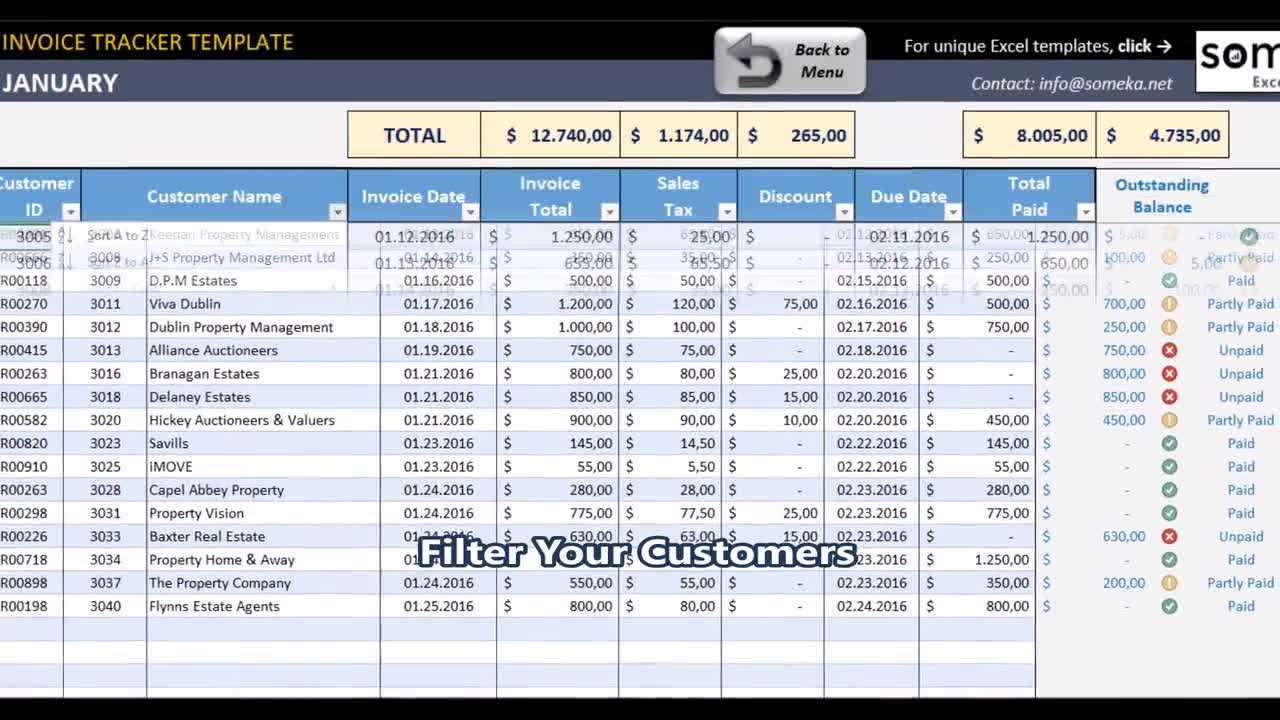

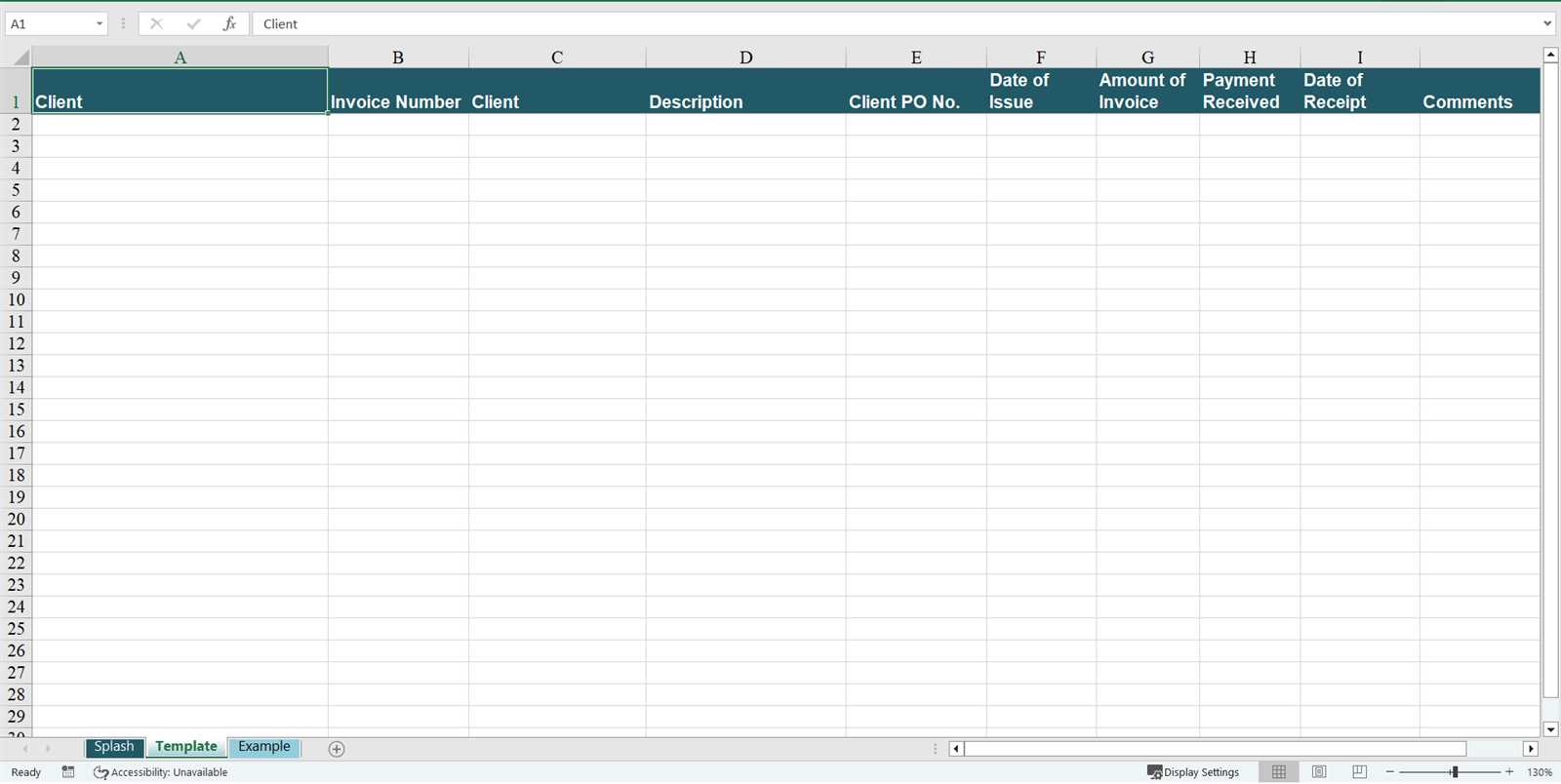

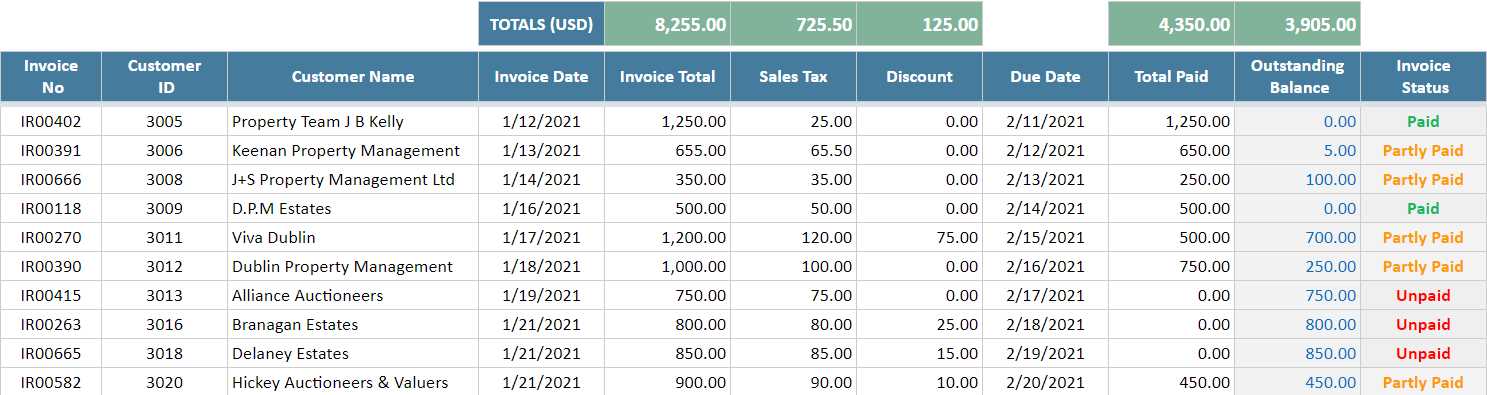

Invoice Log Excel Template Overview

When it comes to managing financial transactions, having a systematic way to track and organize payments is crucial for any business. A well-designed digital system helps businesses maintain clarity, prevent errors, and ensure that financial data is easy to access and analyze. Such systems allow for efficient record-keeping and support decision-making by providing accurate insights into cash flow and outstanding balances.

This specific tool enables users to organize and manage their financial details with ease. It includes a customizable structure that lets you input all relevant transaction information, automatically calculate totals, and sort entries based on various criteria. The result is an organized, easy-to-use file that keeps your financial records up-to-date and manageable.

Key Features of This Tool

- Customizable fields for tracking client names, payment dates, amounts, and other relevant details.

- Automatic calculation of totals, pending amounts, and overdue payments.

- Filtering and sorting capabilities to organize transactions by different categories such as date or amount.

- Clear and concise design that minimizes complexity while providing essential information at a glance.

Why Use This System?

- Streamlines financial record-keeping, reducing manual errors.

- Improves tracking of payments and overdue balances, ensuring timely follow-ups.

- Helps businesses analyze cash flow and identify trends over time.

- Offers flexibility to cater to various business needs, from small enterprises to large organizations.

Incorporating this system into your workflow can significantly improve efficiency and organization in managing financial transactions. Whether for personal use or as part of a larger business strategy, it’s a practical solution for keeping your finances in check.

Benefits of Using an Invoice Tracker

Keeping accurate records of financial transactions is essential for any business, whether you’re a freelancer or part of a large organization. A structured system to track payments, balances, and due dates helps ensure that nothing slips through the cracks. By using a well-organized tracking tool, you gain better control over your financial activities, leading to more efficient and transparent operations.

Improved Financial Organization

One of the main benefits of using a digital tracking system is the enhanced organization it provides. Rather than keeping paper records or relying on memory, you can record all transaction details in one central location. This system automatically stores key information such as dates, amounts, and payment status, making it easier to monitor your financial progress and identify any discrepancies.

Streamlined Cash Flow Management

Another significant advantage is the ability to monitor cash flow more effectively. By tracking payments and outstanding balances, you can easily determine when funds are due, preventing missed payments and late fees. This helps improve your overall financial planning and ensures that your cash flow remains steady.

Overall, a reliable tracking system is a powerful tool for reducing financial stress and improving your business operations. It not only simplifies record-keeping but also boosts your ability to respond to any payment-related issues in a timely manner.

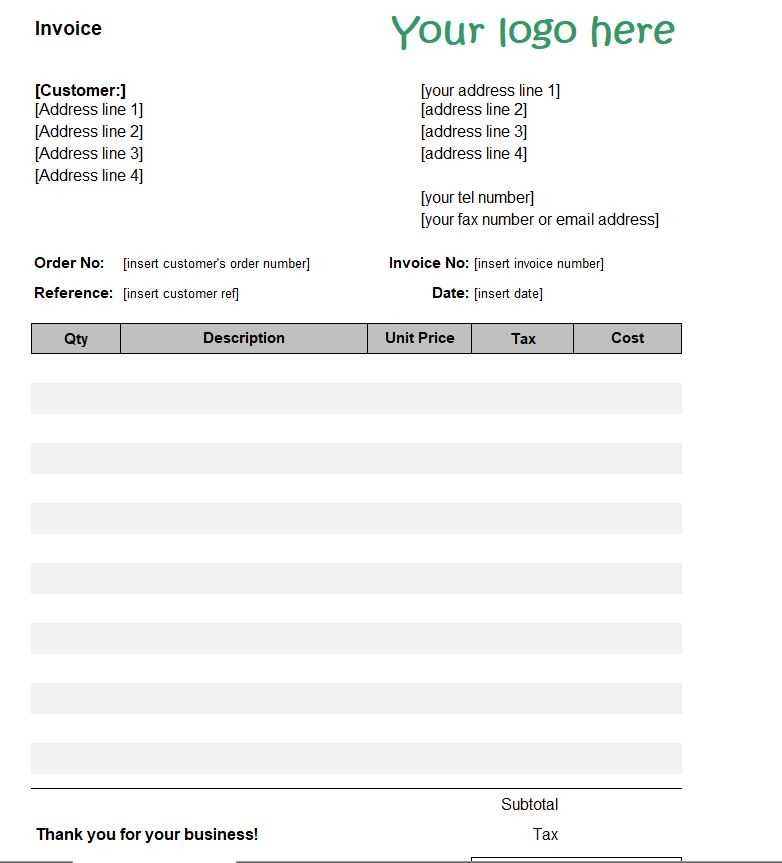

How to Create Your Invoice Tracker

Creating a detailed system to track your financial transactions is an essential step in ensuring accurate record-keeping and smooth operations. Setting up a structured file allows you to efficiently monitor payments, due dates, and any outstanding balances. Whether you are managing multiple clients or tracking recurring charges, a well-organized document can save you time and help maintain financial clarity.

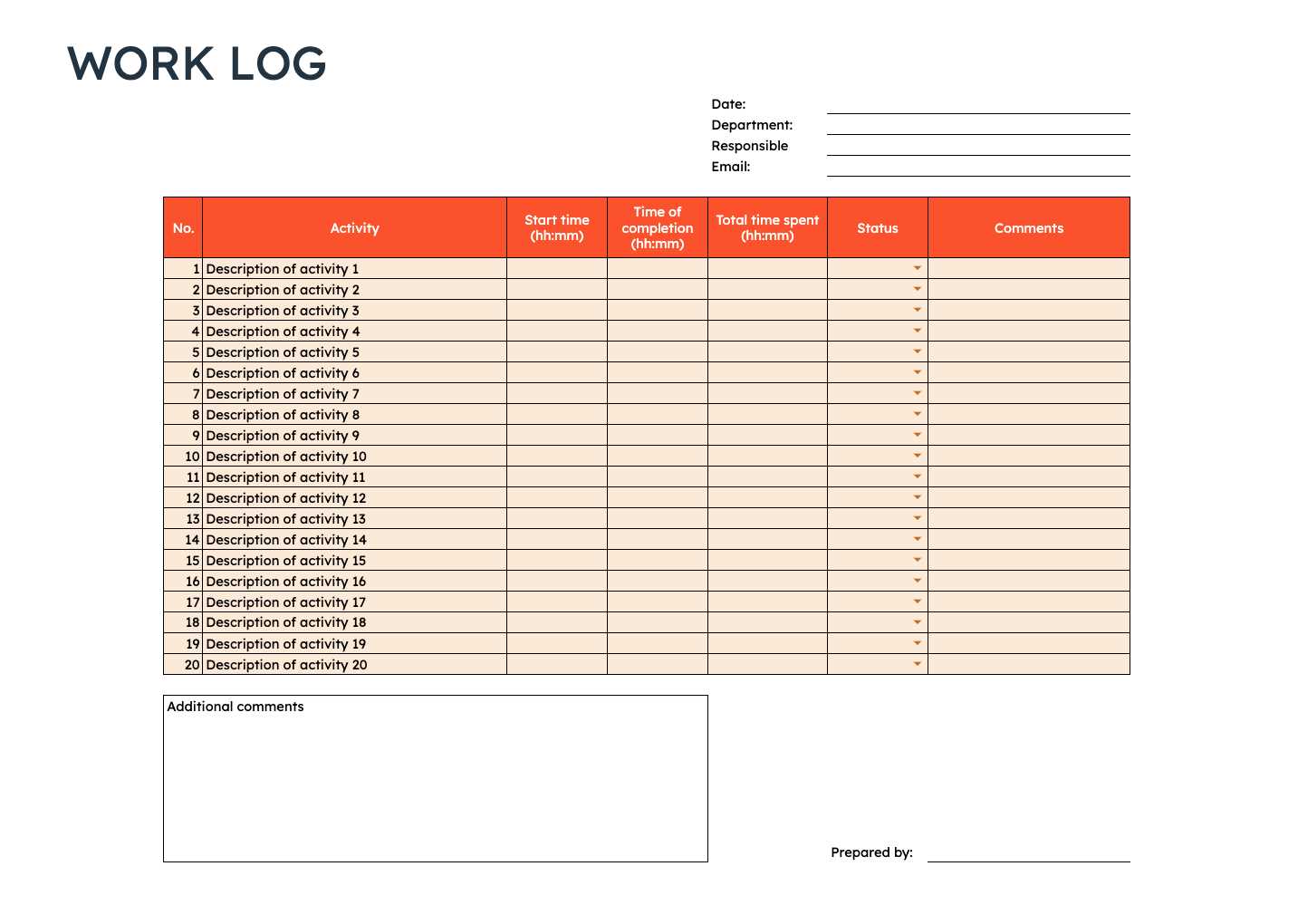

Step-by-Step Guide to Building Your Tracker

- Step 1: Open a new spreadsheet document on your preferred platform.

- Step 2: Label the first row with essential headers such as “Client Name”, “Date”, “Amount”, “Status”, and “Due Date”.

- Step 3: Set up columns for each of these categories, leaving space for data entry as transactions occur.

- Step 4: Add additional columns to track specific details like payment methods or notes, if necessary.

- Step 5: Customize the sheet with formatting to visually highlight overdue or pending payments (e.g., use color-coding or bold text).

Adding Calculations and Features

- Use formulas to automatically sum totals or calculate outstanding amounts based on the status of each transaction.

- Set up conditional formatting rules to highlight overdue payments or upcoming deadlines.

- Incorporate drop-down lists for quicker data entry, such as selecting payment methods or status (paid, unpaid, partial).

Once your structure is set up, the system will be ready to track all relevant details in an organized manner. Regularly updating your tracker will help ensure your financial data stays current, providing clear insights into your cash flow and reducing the risk of errors or missed payments.

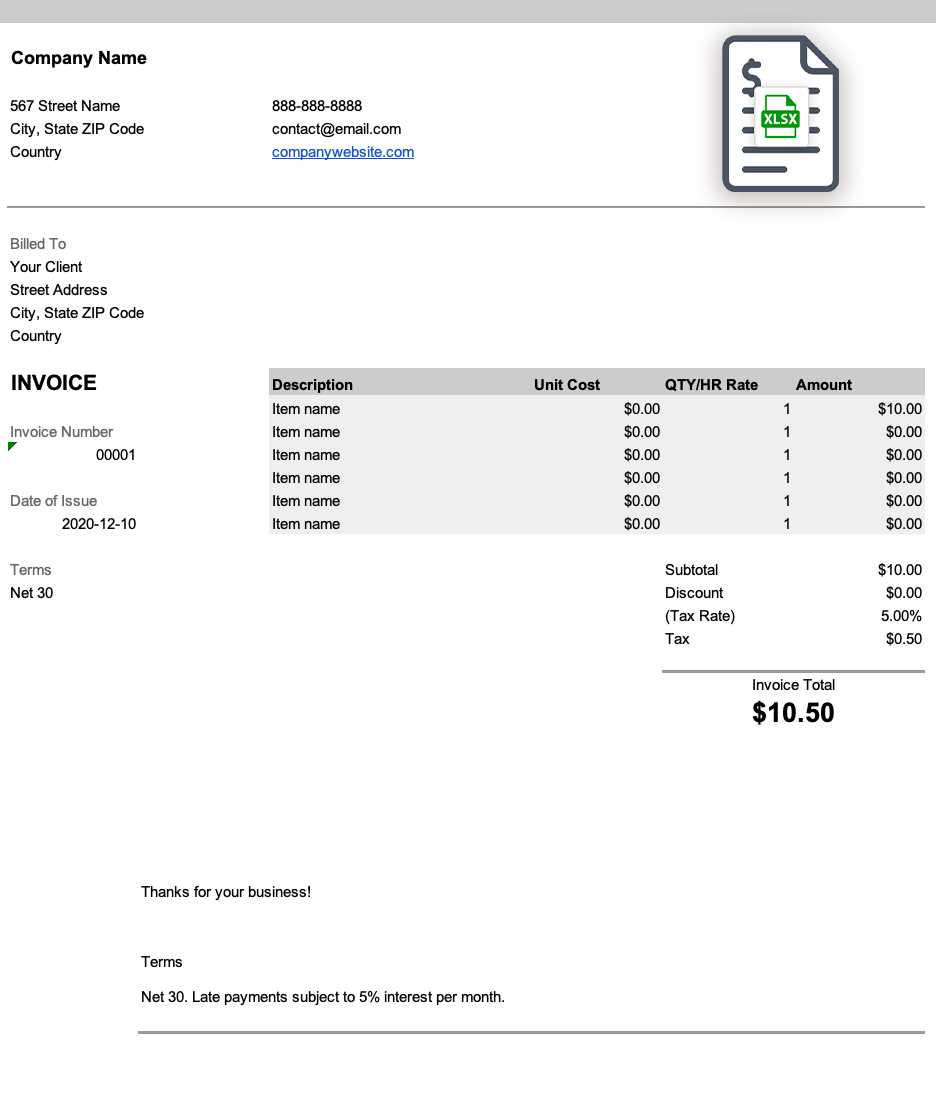

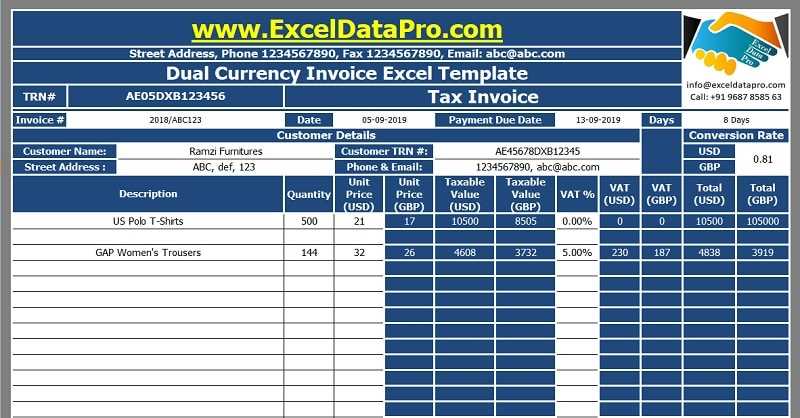

Customizing Your Spreadsheet for Financial Tracking

To maximize the usefulness of your financial tracker, it’s important to customize the document to fit your specific needs. Tailoring the structure allows you to capture the exact data relevant to your transactions, making it easier to monitor, analyze, and report on your financial status. A customized system also helps streamline the data entry process, saving time and reducing the risk of errors.

Begin by identifying the key information you need to track. For example, you may want to include fields for payment dates, amounts, due dates, and payment methods. Depending on the nature of your business, you could also add columns for discounts, taxes, or project details. The more specific the fields, the more relevant and efficient the tracker becomes for your unique financial processes.

Adding Relevant Categories

- Client Information: Add columns to capture client details such as names, addresses, or contact information.

- Payment Status: Include a status column (e.g., “Paid”, “Pending”, “Overdue”) for each transaction to monitor payment progress.

- Tax and Discounts: Customize your tracker to calculate taxes or discounts automatically by adding appropriate formulas or columns.

- Recurring Entries: If you deal with regular clients or subscriptions, set up rows or sections specifically for these repeating transactions.

Using Formulas and Functions

- Auto-calculation: Add formulas to automatically sum totals or calculate outstanding balances based on the payment status.

- Conditional Formatting: Highlight overdue or pending payments by applying color-coding to certain cells or categories.

- Data Validation: Use drop-down lists for easy entry of predefined values such as payment methods, invoice statuses, or currency types.

With these customizations in place, your financial tracking system will not only be easier to manage but will also provide deeper insights into your business performance. This approach ensures that the system grows and evolves with your business, offering flexibility and control over your financial records.

Best Practices for Invoice Management

Efficient management of financial records is essential for maintaining a smooth business operation. Properly tracking payments, organizing receipts, and ensuring timely follow-ups are all part of an effective system that prevents errors, reduces late payments, and provides clarity when needed. Implementing best practices helps maintain organization, improves cash flow, and builds stronger relationships with clients.

Adopting a systematic approach to managing financial records ensures that all transactions are accurately documented and easy to reference. Below are some key best practices that will help improve your overall financial management process.

Key Best Practices

| Practice | Description |

|---|---|

| Keep Records Organized | Maintain clear and concise records, categorizing them by client, date, and payment status. This makes it easier to retrieve data when needed. |

| Regular Updates | Update your financial records regularly to ensure they are current. This prevents backlogs and helps track overdue payments promptly. |

| Use Clear Descriptions | Provide detailed descriptions for each transaction, including service details, payment terms, and dates, to avoid confusion later. |

| Automate Calculations | Set up automatic calculations for totals, taxes, or discounts. This reduces manual errors and ensures consistency in your financial reports. |

| Monitor Payment Status | Track the payment status for each transaction. Use color-coding or other visual cues to easily identify overdue or partially paid balances. |

| Set Reminders | Set up reminders for upcoming due dates or overdue payments to ensure timely follow-up with clients. |

By following these best practices, you ensure a more streamlined and accurate system for managing your financial records. Not only will this help reduce errors and improve cash flow, but it will also save time and effort when dealing with clients or preparing financial reports.

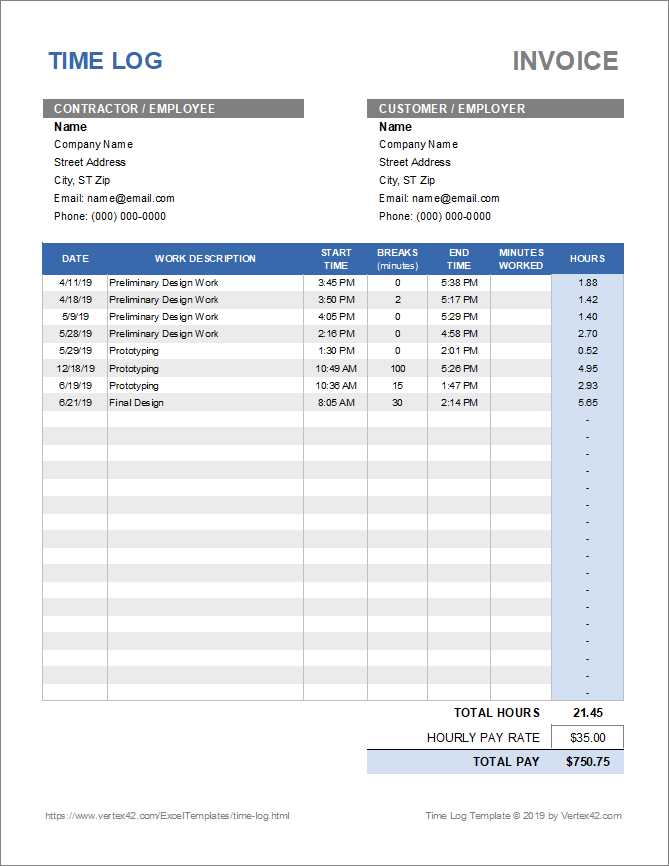

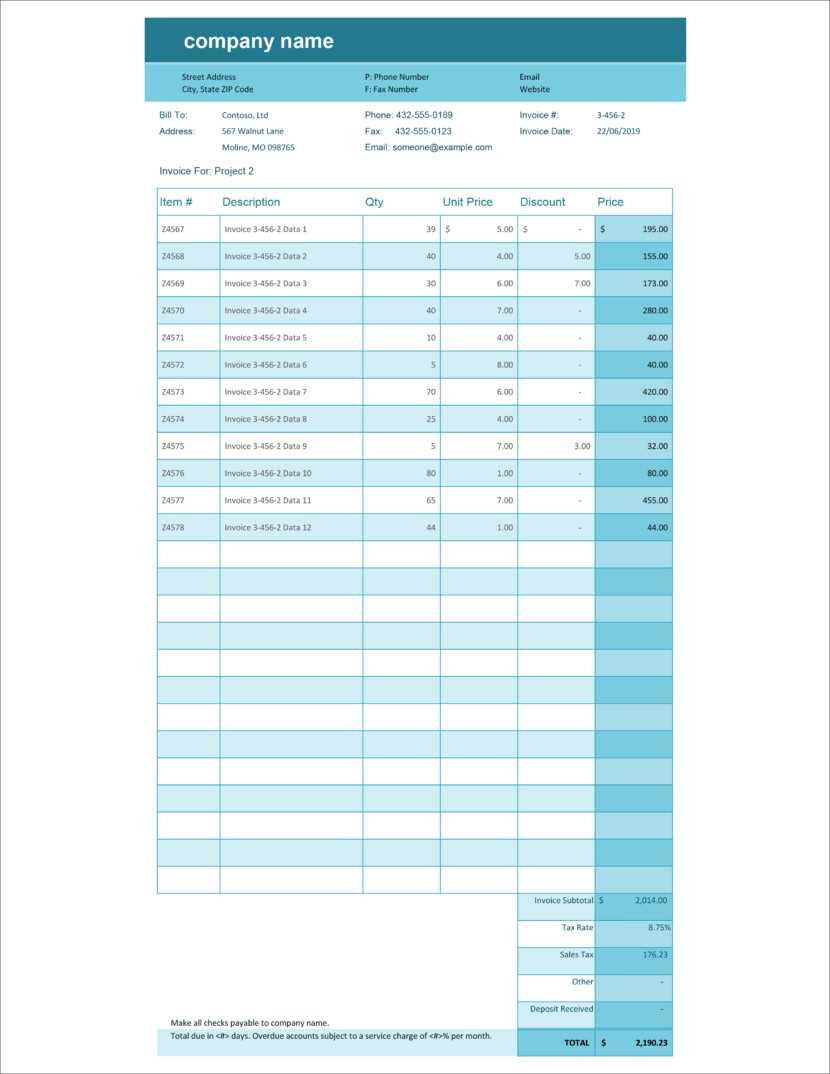

Tracking Payments with Spreadsheet Tools

Effectively monitoring payments is a crucial aspect of financial management, ensuring that all transactions are accounted for and any outstanding amounts are easily identifiable. A structured spreadsheet system allows you to keep track of when payments are made, when they are due, and what remains unpaid. By doing so, you gain better control over your cash flow, ensuring that you never miss a payment or overlook any overdue balances.

Using a digital tracking tool enables you to maintain an organized record of each payment and automatically update balances as payments are received. This process saves time, reduces the chances of errors, and provides a clear picture of your financial situation at any given time.

Setting Up Your Payment Tracking System

- Track Payment Dates: Add a column for payment dates to monitor when clients or customers pay their bills. This helps you identify overdue payments.

- Update Outstanding Balances: Include a column for the remaining amount due, which automatically updates when payments are received.

- Use Payment Status Indicators: Set up columns that show payment status, such as “Paid,” “Pending,” or “Overdue,” to quickly identify transactions that need attention.

- Organize by Client or Project: Sort or filter by client names or project numbers to track payments related to specific clients or work done.

Using Formulas to Streamline Payment Tracking

- Calculate Total Payments: Use a formula to sum up all payments made within a specified period, such as monthly or quarterly totals.

- Monitor Overdue Payments: Set up conditional formatting to highlight overdue payments in red or another color to make them stand out.

- Automate Remaining Balances: Use formulas to subtract payments from the original balance, automatically calculating the remaining amount due.

By organizing your payment information in a systematic way and leveraging formulas, you can easily track what has been paid and what is still pending, reducing the risk of missing payments and keeping your financial records up to date.

Organizing Financial Data in Spreadsheets

Properly organizing your financial records is key to ensuring efficiency and accuracy in managing payments, receipts, and balances. A well-structured document can help you track every transaction, streamline data entry, and make it easier to find and analyze essential information. With an organized system, you can easily sort, filter, and update details, making your financial management much more effective.

Using a digital system to organize transaction data allows you to store all the information in one place, ensuring quick access whenever you need it. Whether you’re dealing with a few clients or managing multiple accounts, having a clear structure in your file will save time and reduce the risk of errors.

Key Steps to Organize Your Financial Data

- Define Categories: Create specific columns for the necessary details such as client name, payment amount, due date, and status. This will allow for clear categorization and ease of access.

- Use Filters and Sorting: Organize data by different parameters such as date or payment status. Filters allow you to view only relevant data, while sorting helps arrange it in a logical sequence.

- Group by Client or Project: To easily track payments and balances, group your entries by client name or project number. This method ensures that you can quickly pull up all records related to a specific client or job.

- Keep Track of Due Dates: Highlight or separate the records that are due or overdue. This visual cue ensures that you never miss a deadline.

Advanced Tips for Efficient Data Organization

- Conditional Formatting: Use color-coding or other visual cues to highlight overdue payments, completed transactions, or other important milestones.

- Use Drop-down Lists: Set up predefined options for categories like payment methods, statuses, or terms to ensure consistency and speed in data entry.

- Automate Calculations: Use formulas to calculate totals, outstanding amounts, or taxes automatically. This ensures greater accuracy and reduces manual entry errors.

By following these organizational strategies, you can maintain a clean and efficient record-keeping system that provides accurate insigh

How to Track Due Dates Effectively

Tracking due dates is an essential part of maintaining good financial practices. Whether it’s payments, renewals, or other deadlines, keeping an eye on these dates helps prevent late fees, disruptions in service, and strained client relationships. A well-organized system for monitoring deadlines ensures that nothing slips through the cracks, giving you ample time to take action when necessary.

By leveraging a structured system, you can set reminders, create alerts, and even automate date tracking to stay on top of all due dates. This proactive approach ensures that you meet deadlines without scrambling at the last minute, improving your overall financial management.

Effective Ways to Track Due Dates

- Set Clear Date Fields: Always include a dedicated column or field for due dates, making them easy to locate and update. This is your main reference for deadlines.

- Use Conditional Formatting: Apply color-coding to highlight upcoming or overdue due dates. For example, red can signify overdue, yellow for upcoming, and green for completed tasks.

- Sort by Due Dates: Sort your entries by due dates to instantly identify which tasks are approaching or have passed. Sorting helps you focus on the most urgent items first.

- Set Reminders and Alerts: Use automated reminders or notifications to alert you a few days before the due date. This allows time for preparation or follow-up.

Advanced Tips for Managing Deadlines

- Recurring Due Dates: If you have regularly scheduled payments or tasks, set them up to repeat automatically in your system to avoid manual tracking every time.

- Link Due Dates with Payment Status: Create a visual indicator that connects due dates with payment status, so you can easily see if a payment is due or has been completed.

- Review Regularly: Make it a habit to review your upcoming deadlines weekly or monthly. This will keep you prepared for upcoming tasks and reduce the risk of missing key dates.

By implementing these strategies, you can track due dates more effectively, ensuring that all deadlines are met and your financial operations remain on schedule.

Using Formulas for Automatic Calculations

Automating calculations is a powerful way to increase efficiency and reduce errors in your financial records. By using formulas in your tracking system, you can automatically compute totals, outstanding balances, and other important figures without having to manually update them each time. This not only saves time but also ensures that your calculations are always accurate and up-to-date.

Formulas can be applied to a wide range of tasks, from summing totals to calculating taxes or applying discounts. By setting up these automated processes, you ensure that every entry is correctly calculated and reflects any changes in your data.

Common Formulas to Use

- SUM: Use the SUM function to automatically add up totals from a selected range of cells. This is particularly useful for tracking total amounts for multiple entries or clients.

- SUBTOTAL: The SUBTOTAL function is great for summing up values while excluding filtered or hidden data. This is ideal for more dynamic lists where some entries may not always be visible.

- IF: The IF function allows you to apply conditional logic. For example, you can set up a formula to check if a payment is overdue and automatically adjust the payment status accordingly.

- AVERAGE: If you need to calculate average payment amounts or averages over time, the AVERAGE function simplifies the process and eliminates the need for manual calculations.

Advanced Formula Uses

- Conditional Calculations: Combine functions like IF with other mathematical operations to automatically adjust amounts based on certain conditions, such as applying a discount for early payments or calculating tax rates based on location.

- Running Balance: Set up a running balance formula that automatically subtracts payments from the total amount due as each transaction is recorded, so you always know how much is left to be paid.

- Percentage Calculations: Use formulas to calculate percentages for things like discounts, taxes, or late fees. These calculations can be done automatically as entries are added.

By utilizing formulas for automatic calculations, you can make your financial tracking system much more efficient, accurate, and less time-consuming. This helps you stay on top of your finances without having to manually update figures every time a new transaction occurs.

How to Sort and Filter Financial Entries

Efficiently sorting and filtering your financial records is essential for managing large volumes of data. By organizing entries according to different criteria, you can quickly find specific information, identify trends, and focus on the most relevant data at any given time. Sorting helps you arrange your records in a logical order, while filtering enables you to display only the information you need.

Using sorting and filtering features in your tracking system allows you to analyze your data more effectively, ensuring you can make informed decisions about overdue balances, payment statuses, and other important financial details.

Sorting Financial Entries

- Sort by Date: Arrange records in chronological order, from the oldest to the most recent. This helps you keep track of payment schedules and identify upcoming or overdue entries.

- Sort by Client or Project: Group records based on client names or project numbers. This makes it easier to view transactions related to a specific client or job.

- Sort by Amount: Sort entries by amount to identify large payments or outstanding balances. This can help you prioritize clients with larger amounts due.

- Sort by Payment Status: Sort by the payment status column to focus on unpaid, partially paid, or completed transactions.

Filtering Financial Entries

- Filter by Date Range: Use filters to display entries within a specific time frame, such as a week, month, or quarter. This is helpful for reviewing performance over a set period.

- Filter by Payment Status: Filter records to show only paid, unpaid, or overdue entries. This helps you focus on the most urgent tasks and follow up on pending payments.

- Filter by Client: Apply a filter to display transactions from a specific client. This is especially useful for managing multiple clients and ensuring no payment is overlooked.

- Filter by Project or Service: Use filters to see records related to specific projects or services. This helps track revenue and payments associated with particular work.

By effectively sorting and filtering your data, you can significantly improve your ability to manage and analyze financial records. These features make it easy to extract relevant information, streamline your workflow, and stay on top of important financial tasks.

Integrating Multiple Financial Records in One File

Managing multiple sets of financial data within a single document can greatly simplify your workflow, especially when you’re handling numerous clients, projects, or services. By integrating different records into one centralized file, you can keep all your data in one place, making it easier to track, update, and analyze. This method helps you avoid the clutter of multiple files and ensures that everything is well-organized and easily accessible.

When combining several financial logs into one document, it’s important to structure the data correctly, using separate sections or sheets for each category or client. This approach will help maintain clarity while allowing you to compare and report on all transactions more effectively.

Steps to Integrate Multiple Logs

- Use Multiple Sheets: Divide your data into different sheets for each client, project, or service type. Each sheet should have the same structure for consistency.

- Standardize Columns: Ensure that all sheets use the same columns, such as dates, amounts, payment status, and descriptions. This makes it easier to consolidate and analyze the data.

- Link Data Across Sheets: Use references or formulas to link data between sheets. This allows you to pull information from different sections into one summary sheet or dashboard.

- Consolidate with Pivot Tables: Create pivot tables that summarize data from all sheets, allowing you to view aggregate totals and trends across your entire financial system.

Organizing and Analyzing Integrated Logs

- Use Filters Across Sheets: Apply filtering options to the master sheet or individual sheets to view specific data, such as payments due, completed transactions, or specific client details.

- Generate Reports: With all your data in one place, you can create comprehensive reports that consolidate information from different categories. Use charts and graphs to visualize trends and performance.

- Ensure Data Consistency: Regularly check for discrepancies between sheets to ensure that all records are accurate and aligned. This is crucial when working with multiple sets of data.

By integrating multiple sets of financial data into a single document, you can save time, reduce errors, and maintain a clear overview of all your transactions. This method streamlines your process and ensures you’re always up to date on your financial records across different areas of your business.

Common Errors in Tracking Financial Records

Tracking financial data can be a complex process, and even small mistakes can lead to significant issues. From missed payments to inaccurate totals, common errors in managing financial records can disrupt cash flow, lead to discrepancies, and create confusion. Identifying and addressing these mistakes early on is crucial for maintaining accurate and reliable financial management.

Understanding where these errors occur and how to prevent them can save time, improve accuracy, and ensure that you always have a clear picture of your financial situation. Below are some of the most common mistakes people make when tracking financial transactions.

Common Tracking Errors

- Missing or Incorrect Due Dates: Failing to enter the correct due dates or forgetting to update them can lead to overdue payments or unnecessary late fees. It’s essential to keep track of deadlines accurately.

- Duplicate Entries: Accidentally entering the same transaction multiple times can lead to inflated totals and misreporting. Double-check your entries for accuracy and consistency.

- Incorrect Amounts: Entering the wrong amounts, whether due to a typo or oversight, can throw off your entire record. Always verify amounts before finalizing any entries.

- Not Updating Payment Status: Failing to update the payment status (e.g., paid, pending, overdue) after receiving payments can create confusion and cause you to overlook outstanding balances.

How to Avoid These Errors

- Set Up Reminders: Use automated reminders to help you track payment deadlines and ensure that all due dates are met.

- Double-Check Data Entry: Implement a regular review process to verify amounts, dates, and payment statuses to minimize the chance of errors.

- Use Consistent Naming Conventions: To avoid duplicate entries, ensure you use clear and consistent identifiers for each record, such as client names or transaction IDs.

- Leverage Automation: Take advantage of automated features like formulas and conditional formatting to reduce manual entry and improve accuracy in your tracking system.

By recognizing and addressing these common tracking errors, you can maintain more accurate financial records, reduce confusion, and ensure smooth operations across your business.

How to Share Your Financial Tracking Document

Sharing your financial records with colleagues, clients, or business partners is an essential part of maintaining transparency and collaboration. Whether you need to send an updated report, share payment details, or provide insights into outstanding balances, having an efficient and secure method to share your records is key. Fortunately, there are several ways to share these documents, each offering different levels of access and control.

When sharing your financial document, it is important to choose the right method based on the sensitivity of the information and who needs access. Below are some common approaches to sharing your records while maintaining security and accuracy.

Methods for Sharing Your Financial Record

- Email Attachments: For quick sharing, sending the document as an email attachment is a simple option. Just ensure the file is in a widely accepted format, such as PDF or CSV, and consider password-protecting sensitive information.

- Cloud Storage Services: Uploading the document to a cloud storage service like Google Drive, Dropbox, or OneDrive allows you to share a link to the file with specific individuals or teams. You can also set access permissions, such as view-only or edit access, to maintain control over who can make changes.

- Shared Collaboration Platforms: If your team uses platforms like Microsoft Teams, Slack, or Asana, you can upload and share your document directly within these tools, making it easy for others to access and collaborate on the data in real-time.

- Custom Dashboards: For a more advanced solution, you can create custom dashboards using tools like Google Data Studio or Tableau. These platforms allow you to present your financial data in an interactive format, where stakeholders can access updated information without needing to download files.

Tips for Secure Sharing

- Limit Access: Always ensure that only the necessary individuals have access to your records. Set up specific permissions to control who can view, edit, or download your files.

- Use Password Protection: If sharing sensitive information, consider encrypting your files or using a password to ensure that only authorized recipients can access them.

- Track Changes: If you’re using cloud-based storage, enable version control to track changes and prevent data loss. This way, you can always revert to previous versions if necessary.

- Stay Organized: When sharing large volumes of data, consider organizing your records into clear folders and labels so that recipients can easily navigate the information without confusion.

By choosing the right method and following best practices

Securing Your Financial Record Data

Securing your financial data is essential to protect sensitive information, avoid unauthorized access, and ensure compliance with privacy regulations. With increasing risks of cyber threats and data breaches, it’s crucial to implement strong security measures to keep your records safe. Whether you are managing client payments, project expenses, or outstanding balances, securing your financial data should always be a top priority.

There are various strategies you can use to protect your records from potential risks. From encryption to controlled access, each method enhances the security of your information, ensuring it remains confidential and accessible only to authorized individuals.

Security Measures for Financial Data

- Password Protection: Use strong passwords to protect your files. Ensure passwords are unique, and consider using multi-factor authentication for added security.

- Data Encryption: Encrypt sensitive data to make it unreadable to unauthorized users. Encryption is particularly important when sharing files online or storing them in the cloud.

- Access Control: Restrict access to your records by assigning permissions to specific users. Only allow authorized individuals to view, edit, or share the data.

- Backup Systems: Regularly back up your financial records to prevent data loss in case of system failures, accidental deletion, or cyberattacks. Ensure that backups are also stored securely.

- Version Control: Use version control to keep track of changes made to your records. This allows you to revert to earlier versions if needed and ensures you don’t lose important data.

Best Practices for Securing Data

| Security Practice | Benefit |

|---|---|

| Use Strong Passwords | Prevents unauthorized access to your files and records. |

| Implement Encryption | Ensures data is unreadable without the decryption key, even if intercepted. |

| Set User Permissions | Limits access to only those who need it, reducing the risk of unauthorized changes. |

| Regular Backups | Protects data from accidental loss or damage. |

| Monitor and Audit Access | Allows you to track who accessed your data and what changes were made. |

By implementing these security measures and following best practices, you can protect your financial data and ensure that it remains secure, confidential, and accessible only to the right people.

Exporting Financial Records to Other Formats

Exporting your financial data to different file formats allows for easier sharing, storage, and further analysis. Whether you need to send a report to a client, integrate with other systems, or back up your data in a more portable format, exporting records can improve the flexibility and accessibility of your information. There are various formats available that cater to different needs, each with its advantages depending on how the data will be used.

By converting your data into a suitable format, you ensure that it can be easily shared across platforms or systems, making collaboration and data exchange more efficient. Below are some common formats and scenarios where exporting financial records is beneficial.

Common Export Formats

- PDF: Exporting to PDF is ideal for creating reports that need to be shared in a universally accessible format. PDF files preserve the layout and formatting, ensuring that the recipient sees the data as intended.

- CSV: A CSV (Comma-Separated Values) format is perfect for exporting data that will be used in other software or databases. It allows for easy manipulation and analysis of raw data in spreadsheet or database tools.

- XML: XML (eXtensible Markup Language) is useful when exporting data for integration with other systems or applications. It’s a structured format that can be easily parsed and read by software for automated processes.

- JSON: JSON (JavaScript Object Notation) is a lightweight data-interchange format that is commonly used for sharing data between web applications or APIs. It’s ideal for developers needing to process financial data programmatically.

Benefits of Exporting Financial Records

- Improved Accessibility: Exporting your data to widely used formats like PDF or CSV makes it accessible to a broader audience, regardless of the software or tools they use.

- Easy Sharing: Different formats make it simple to share your data with clients, accountants, or business partners without worrying about compatibility issues.

- Data Integration: Exporting to structured formats like XML or JSON allows for seamless integration with other software tools, automating data transfer and processing.

- Archiving and Backup: Exporting records ensures you have a backup in multiple formats, which can be stored securely for future reference or compliance purposes.

By exporting your financial records to the appropriate format, you enhance the flexibility of your workflow and make it easier to share, store, and integrate your data across different systems and platforms.

Tips for Managing Recurring Billing

Managing regular payments and billing cycles efficiently is crucial for maintaining a smooth cash flow and ensuring that nothing falls through the cracks. For businesses that offer subscription-based services or ongoing contracts, staying on top of recurring payments is essential for sustaining revenue and building strong client relationships. By implementing the right practices, you can automate processes, reduce human error, and make sure payments are tracked and invoiced consistently.

Here are some practical tips to help you manage recurring billing with ease and ensure timely payments from your clients or customers.

Key Strategies for Efficient Billing Management

- Automate Billing Cycles: Set up automated payment reminders or recurring billing schedules in your accounting or invoicing system to reduce the manual effort required for each transaction.

- Track Payment Dates: Always maintain an updated record of payment due dates. Using automated alerts or calendar reminders can help you stay on top of upcoming charges.

- Offer Multiple Payment Options: Providing clients with various payment methods, such as credit cards, bank transfers, or online payment systems, can increase the chances of receiving payments on time.

- Review Subscription Terms: Make sure all terms of the recurring agreement, such as billing amounts, payment dates, and renewal processes, are clearly defined and communicated with clients.

- Monitor Payment Status: Regularly review your payment history to ensure that payments are being processed correctly and that no payments are missed or delayed.

Best Practices for Recurring Billing

| Best Practice | Benefit |

|---|---|

| Use Automated Reminders | Helps ensure timely payments by notifying clients before due dates. |

| Maintain Clear Payment Terms | Prevents confusion by clearly outlining payment expectations and schedules. |

| Offer Convenient Payment Methods | Increases the likelihood of receiving on-time payments from clients. |

| Monitor Transactions Regularly | Allows you to quickly identify and address missed or delayed payments. |

By implementing these strategies, you can streamline the process of managing recurring payments and reduce the chances of errors or delays. Consistent tracking and automation will not only save you time but also ensure a steady flow of income and client satisfaction.

How to Maintain an Accurate Financial Record

Keeping a precise and up-to-date financial record is essential for tracking payments, managing cash flow, and ensuring that no transaction is overlooked. Accurate record-keeping helps businesses stay organized, reduces errors, and ensures compliance with tax and accounting regulations. Whether you’re handling payments from clients or managing outgoing expenses, maintaining a clear and reliable log is key to smooth financial operations.

To ensure your records are accurate, it’s important to follow best practices that include regular updates, systematic categorization, and secure storage. By adhering to these principles, you can minimize the risk of missing important transactions and ensure financial transparency for yourself or your business.

Steps to Keep Accurate Financial Records

- Regularly Update Your Records: Make it a habit to update your financial records immediately after a transaction. This reduces the chance of forgetting or overlooking any payments or expenses.

- Categorize Transactions Clearly: Ensure that all transactions are classified according to their nature, such as income, expenses, or refunds. Proper categorization will make it easier to track specific types of payments and generate reports.

- Double-Check Data Entry: Always review data entries for accuracy before saving them. A single mistake in a number can lead to discrepancies that may complicate your finances later.

- Keep Supporting Documentation: Retain receipts, contracts, or any other supporting documents for each transaction. These documents serve as proof of payments and can be useful for auditing purposes.

Best Practices for Maintaining Records

- Use Software Tools: Take advantage of digital tools or accounting software to automate and streamline the process of tracking your transactions. These tools can reduce human error and offer built-in checks and balances.

- Set Regular Review Dates: Set a schedule to review your financial records on a weekly or monthly basis. This will help catch any errors early on and keep your data current.

- Secure Your Data: Store your records in a secure location, whether it’s in a cloud service or a locked physical storage area. Data security is crucial to protecting sensitive financial information.

By following these steps, you can ensure that your financial records are accurate, organized, and up-to-date, leading to more effective financial management and easier decision-making for your business.