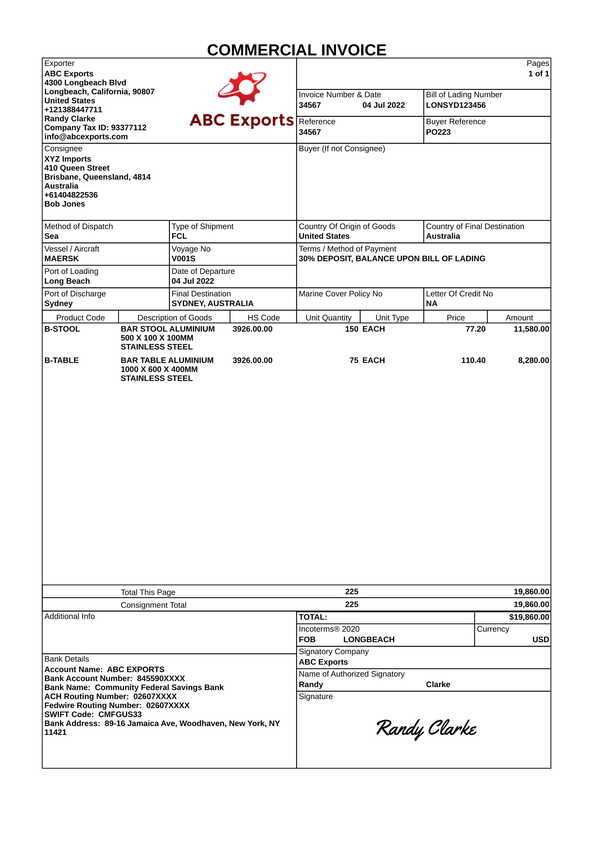

Download Fillable Commercial Invoice Template PDF for Seamless Business Transactions

Efficient billing is essential for maintaining smooth financial operations in any business. Having the right documentation to manage transactions ensures accuracy, timeliness, and professionalism. Using well-structured forms can help simplify this task and reduce the likelihood of errors or delays.

With customizable forms that can be easily completed, businesses are able to generate detailed records for every transaction, regardless of the industry. These tools provide a reliable solution for companies looking to improve their invoicing process and keep their financial records in order.

Whether you’re a small business owner or part of a larger organization, using organized, easy-to-fill forms not only saves time but also ensures that your clients receive accurate and clear billing information every time. These forms can be tailored to suit specific business needs, from listing product details to adding necessary payment terms.

Why Use a Fillable Commercial Invoice Template

Managing billing documents manually can lead to mistakes, confusion, and wasted time. Having a structured, editable form provides a much-needed solution to streamline the process and ensure that all necessary information is included with accuracy. These digital documents offer flexibility while maintaining consistency, making it easier for businesses to track and manage financial transactions.

Here are some key reasons why businesses should use editable billing forms:

- Time Efficiency: Quickly fill in details without having to manually write or format each document. This saves valuable time during busy workdays.

- Reduced Errors: Automated fields and preset structures reduce the risk of making mistakes in essential data like pricing, quantities, and payment terms.

- Professional Appearance: Neatly organized forms create a polished, professional impression for clients and partners, helping build credibility.

- Customization: Easily adjust the layout and fields to suit specific needs or preferences, ensuring every document meets your business standards.

- Easy Record Keeping: Digital files are easy to store, organize, and retrieve, making record-keeping more efficient and secure.

By using these forms, companies can not only improve their billing process but also create a more organized and efficient workflow, ultimately saving time and reducing stress for both employees and customers. This ensures that payments are processed smoothly and accurately, supporting long-term business success.

Benefits of PDF Invoice Templates for Businesses

Using digital billing documents brings numerous advantages to businesses, from enhanced efficiency to better organization. These pre-designed forms can simplify the process of generating and sending payment requests, ensuring that all necessary information is included and formatted correctly. The ability to easily modify these documents allows companies to tailor each one to their unique needs, resulting in more effective transactions and improved client relations.

Improved Accuracy and Consistency

Digital billing forms ensure that the essential fields are always present and properly filled out, minimizing the chance of human error. Additionally, the consistency in layout and structure helps prevent omissions or mistakes in key data, such as prices, quantities, and payment details.

Cost and Time Efficiency

By eliminating the need for manually creating documents, businesses can save both time and money. Pre-made forms allow for quick edits, reducing the effort needed for each transaction. This is particularly beneficial for companies dealing with a high volume of transactions.

| Benefit | Impact on Business |

|---|---|

| Quick Editing | Speeds up the process of generating payment requests, reducing delays in the payment cycle. |

| Error Reduction | Prevents costly mistakes such as missing or incorrect information, leading to smoother transactions. |

| Professional Appearance | Creates a clean and consistent format that enhances brand image and credibility with clients. |

| Easy Storage | Digital records are easier to organize, access, and store for future reference, improving document management. |

By adopting digital forms for business transactions, companies can not only streamline their operations but also improve the overall customer experience. These benefits contribute to a more organized, professional, and efficient billing system, essential for long-term growth and success.

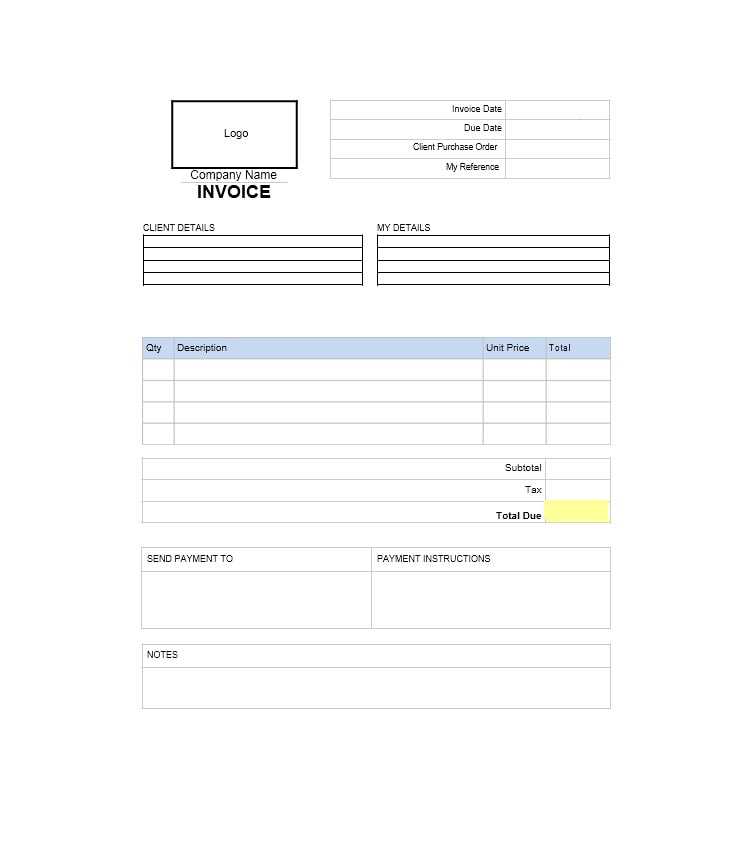

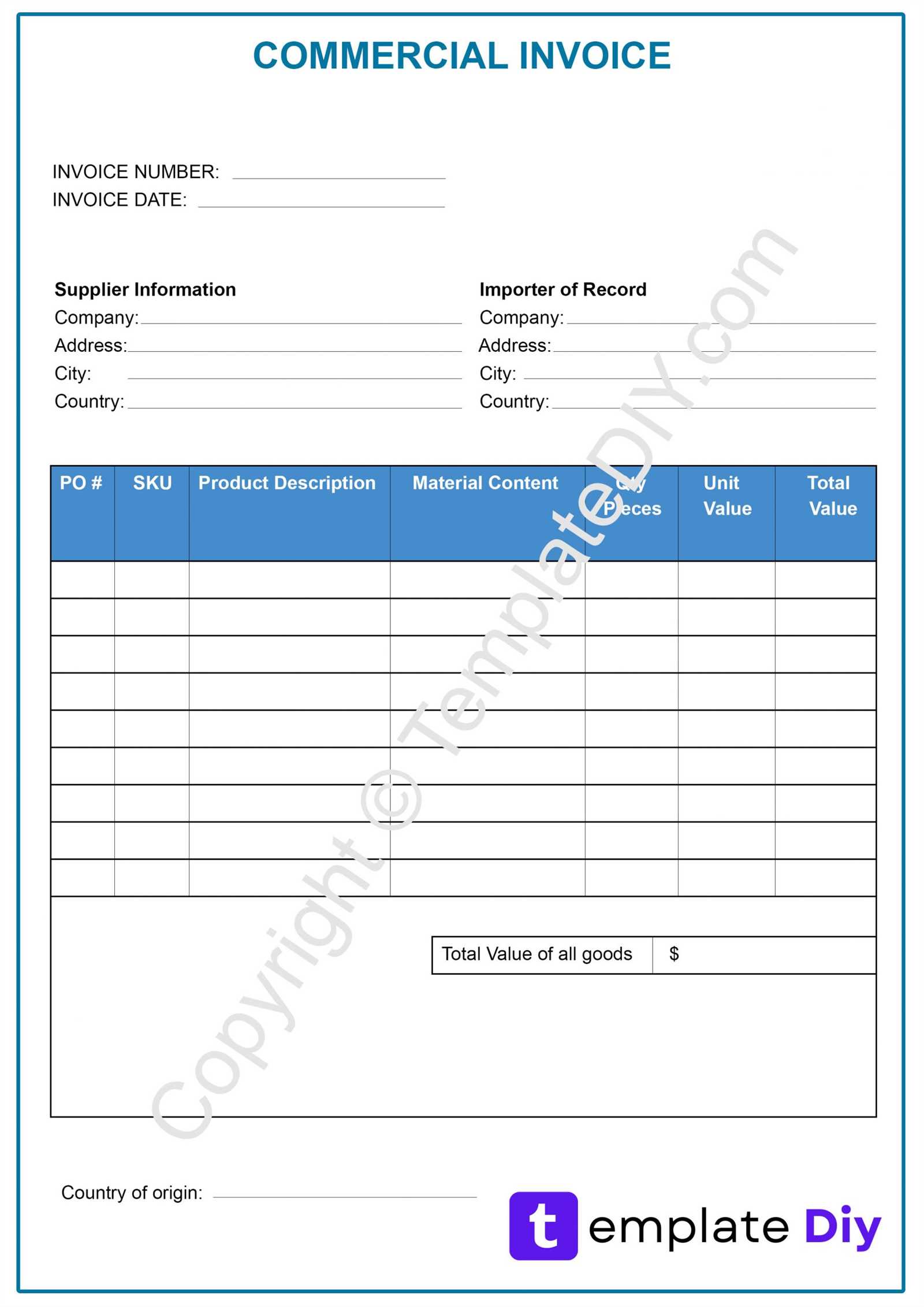

How to Customize a Commercial Invoice

Customizing billing documents allows businesses to tailor them to their specific needs, ensuring that all necessary details are included and presented in a professional manner. Whether you are adjusting the layout, adding or removing fields, or including branding elements, a personalized document helps maintain consistency and clarity in financial communication.

To effectively modify a document, consider these key steps:

- Adjust Layout and Design: Choose a layout that suits your business style. Whether you prefer a simple, minimalist design or something more detailed, the layout should enhance readability.

- Include Company Branding: Add your company logo, colors, and contact information to the document. This reinforces your brand and makes the document look more professional.

- Customize Fields: Depending on your specific needs, you can add or remove fields such as product descriptions, service details, and payment terms. Make sure that all relevant information is clear and accessible.

- Set Payment Terms: Clearly define your payment policies, such as due dates, accepted payment methods, and penalties for late payments. This helps prevent misunderstandings.

Once you’ve made the necessary changes, save the document and ensure it’s easily accessible for future transactions. Customizing each document to match your business requirements ensures that every transaction is processed smoothly and professionally.

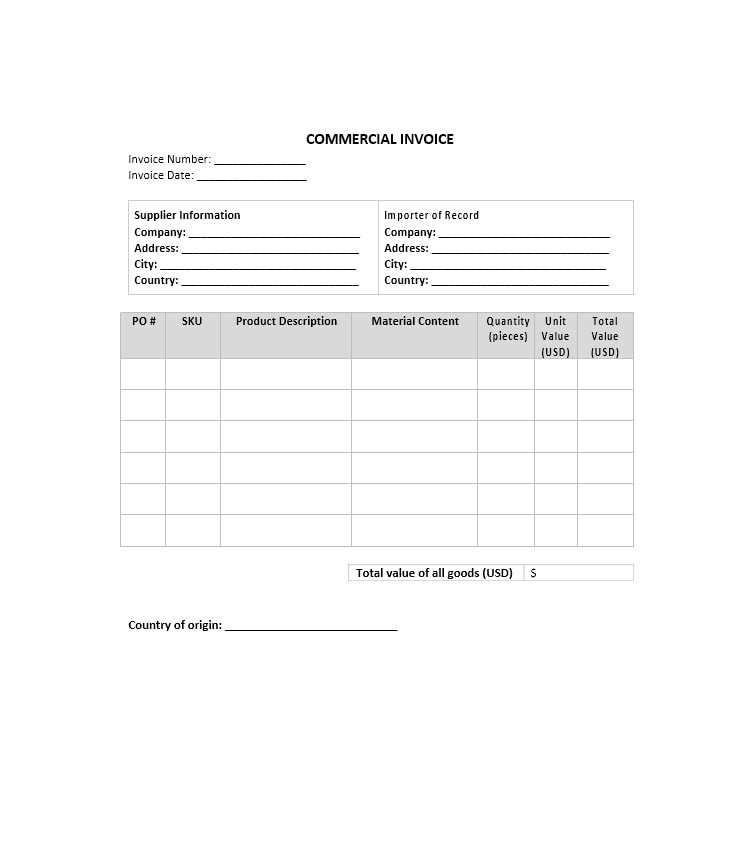

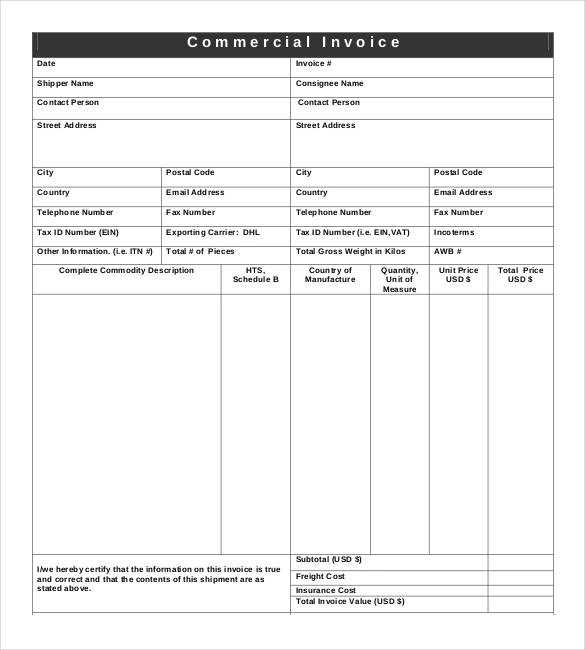

Essential Elements of a Commercial Invoice

For any business, creating clear and accurate billing documents is crucial to ensuring smooth transactions and maintaining professional relationships with clients. A well-structured document not only serves as a payment request but also as an official record for both the business and the customer. To create an effective document, certain key components must always be included to provide all the necessary details for a proper transaction.

Here are the fundamental elements that should be part of every billing document:

- Business Information: Include the full name, address, and contact details of your company, along with any relevant registration numbers or tax IDs. This ensures the client knows who is issuing the request.

- Client Information: Similarly, the customer’s name, address, and contact details must be listed to ensure accurate delivery and communication.

- Unique Document Number: Assigning a unique identifier to each document helps with tracking and future reference. This number should be sequential for organization purposes.

- Transaction Date: The date when the transaction took place should be clearly indicated to avoid confusion about payment due dates or service completion.

- Detailed List of Goods or Services: Provide a clear description of each product or service provided, including quantities, unit prices, and total amounts for each item. This helps the client understand exactly what they are being billed for.

- Payment Terms: Clearly outline the agreed payment conditions, such as the due date, accepted payment methods, and any applicable discounts or penalties for late payments.

- Total Amount Due: The total amount, including taxes or additional charges, should be clearly visible to ensure transparency and prevent any confusion.

Including all these essential elements in every transaction ensures that both parties have a clear understanding of the agreement and payment expectations, fostering trust and reducing the likelihood of disputes.

Where to Download Free PDF Invoice Templates

Finding high-quality, free billing forms is essential for businesses that want to streamline their payment processes without incurring extra costs. Many websites offer easy-to-use, customizable documents that can be downloaded and used immediately. These free resources can help companies save time and money while ensuring their transactions are well-documented and professional.

Here are some trusted sources where you can download free billing documents:

- Online Template Websites: Many websites specialize in providing free, ready-made forms. These platforms allow you to search for the exact type of document you need, with options for customization.

- Accounting and Finance Blogs: Some accounting websites offer free downloadable forms as part of their educational resources. These blogs often also provide tips and guidelines on how to use the forms effectively.

- Business Software Providers: Many software providers offer free templates to encourage businesses to try their products. These documents can often be downloaded and used even without signing up for a full software package.

- Government Websites: Some government sites offer free templates designed for compliance with local business regulations, which can be particularly useful for small businesses or freelancers.

When searching for a free document, make sure it meets your business requirements and offers the flexibility you need. Customization options and professional formatting are key to ensuring that the final document reflects your brand and keeps your records organized.

How to Fill Out a Commercial Invoice Form

Properly completing a billing document is essential for ensuring that transactions are clear, accurate, and legally binding. By filling out the form correctly, you provide your client with all the necessary details, which helps avoid confusion and ensures prompt payment. The process of completing the document involves inputting key information in designated fields, such as product details, pricing, and payment terms.

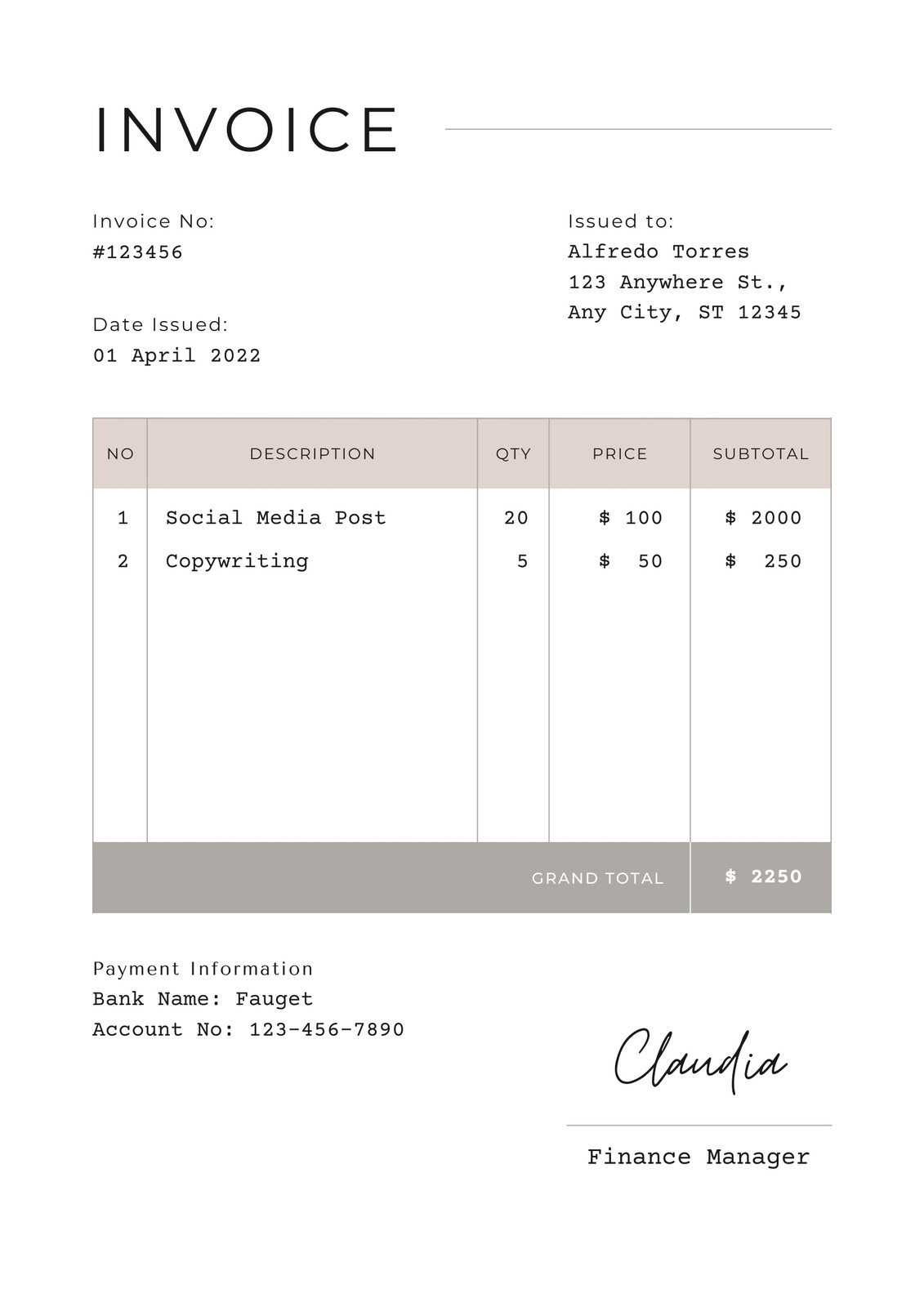

Step 1: Enter Company and Client Information

Start by filling in both your company details and the client’s contact information. This includes names, addresses, and any relevant business identifiers (e.g., tax numbers or registration IDs). Make sure this section is clear and up-to-date to avoid delays in communication.

Step 2: List Items or Services Provided

In the next section, detail each product or service provided. For each item, include the quantity, description, unit price, and total price. Double-check the figures to ensure they match the agreed-upon terms. This will help prevent disputes and ensure transparency for your client.

Once these sections are filled out, review the document for accuracy. Include payment terms, such as the due date and accepted methods, and indicate any taxes, fees, or discounts. A well-completed document will provide clarity for both parties and help facilitate smooth transactions.

Common Mistakes in Commercial Invoices

Creating accurate billing documents is crucial to maintaining smooth business operations. Even small mistakes can lead to delays in payment, confusion with clients, or even legal issues. It’s important to be aware of the most common errors so they can be avoided, ensuring that every transaction is clearly documented and processed efficiently.

Here are some of the most frequent mistakes businesses make when filling out their billing documents:

| Mistake | Impact |

|---|---|

| Missing Client Information | Failure to include the correct contact details can lead to confusion and delayed payments. |

| Incorrect Item Descriptions | Vague or incorrect descriptions can cause misunderstandings about what was delivered and the terms of the transaction. |

| Wrong Calculation of Total Amount | Errors in adding prices, taxes, or discounts can cause discrepancies, which may delay payment and damage trust. |

| Omitting Payment Terms | Failure to clearly state payment methods or due dates can lead to payment delays or disputes. |

| Inconsistent Formatting | Inconsistent fonts, layouts, or organization can make the document difficult to read and may appear unprofessional to clients. |

By staying vigilant and carefully reviewing every document before sending it, businesses can avoid these mistakes and ensure that all transactions are clear, professional, and efficient. A small amount of attention to detail goes a long way in maintaining positive relationships with clients and ensuring smooth financial operations.

Why Accuracy Matters in Invoicing

Ensuring precision in financial documentation is critical for businesses of all sizes. When mistakes are made in billing forms, it can lead to confusion, payment delays, and even damage to your professional reputation. Accuracy not only helps maintain trust with clients but also ensures that your financial records are up to date and legally compliant.

Preventing Payment Delays

One of the most immediate consequences of inaccurate billing forms is delayed payments. If the details on the document–such as amounts, dates, or descriptions–are incorrect, clients may need additional time to clarify the issues before processing payment. This can lead to a lag in your cash flow and disrupt your financial planning.

Maintaining Professional Reputation

Consistency and attention to detail reflect a high level of professionalism. Clients expect clear and error-free documents, and frequent mistakes can harm your reputation and result in clients seeking other providers. When billing forms are precise and well-organized, they demonstrate reliability and enhance client confidence in your business.

By prioritizing accuracy in every financial document, businesses can foster smoother transactions, faster payments, and long-term relationships built on trust and professionalism.

Improving Billing Efficiency with Templates

Streamlining your billing process can save valuable time and reduce the risk of errors. By using structured forms, businesses can automate much of the administrative work involved in generating payment requests. This not only increases efficiency but also ensures consistency across all transactions, which is essential for maintaining a professional image.

Time Savings with Pre-Formatted Documents

One of the biggest advantages of using ready-made forms is the time saved in preparing each billing document. With preset fields for essential details, there is no need to start from scratch every time. You can quickly input specific data such as product names, quantities, and pricing, significantly reducing the time spent on each document.

Consistency and Accuracy in Billing

Structured documents ensure that every billing request follows the same format and includes all necessary details. This consistency helps prevent errors such as missing information or incorrect calculations. Furthermore, it ensures that every client receives the same professional level of service, which fosters trust and improves the overall experience.

By integrating these streamlined forms into your workflow, you can improve the overall efficiency of your billing process while maintaining a high standard of accuracy and professionalism.

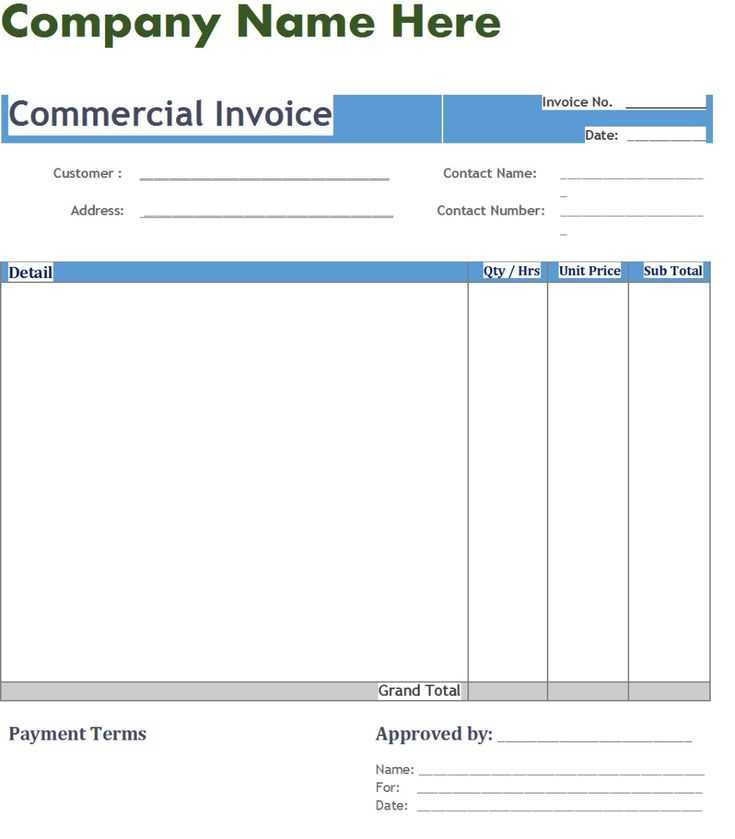

Best Practices for Professional Invoices

Creating high-quality billing documents is essential for maintaining a professional image and ensuring smooth financial transactions. A well-structured document not only conveys clear information but also strengthens client relationships by showing attention to detail and reliability. Adhering to best practices when preparing these forms can help businesses avoid errors, improve payment processing, and foster trust with clients.

Essential Tips for Clear and Professional Billing

To ensure that every billing request is clear, accurate, and professional, businesses should follow these key best practices:

- Use a Clean and Organized Layout: Make sure the form is easy to read, with clear sections for each piece of information. A well-organized document ensures that clients can quickly find the details they need.

- Include All Required Information: Always provide your company’s contact details, a unique reference number, the client’s information, a description of goods or services, and payment terms.

- Double-Check for Accuracy: Before sending the document, ensure that all the details are correct–particularly quantities, prices, and payment dates. Accuracy prevents payment delays and disputes.

- State Payment Terms Clearly: Be explicit about the payment deadline, accepted methods, and any late fees. Clear terms help prevent misunderstandings and set expectations from the start.

Formatting and Presentation

Beyond accuracy, presentation plays a significant role in how your document is perceived by clients. A clean, consistent format enhances professionalism and readability.

| Best Practice | Benefit |

|---|---|

| Use Consistent Fonts and Styles | Improves readability and creates a polished, professional appearance. |

| Include Your Branding | Helps reinforce your business identity and builds recognition with clients. |

| Ensure a Balanced Layout | Prevents confusion and makes the document easier for clients to review. |

| Highlight the Total Amount Due | Ensures that clients can quickly identify the amount they need to pay, preventing payment delays. |

By following these best practices, businesses can create billing documents that not only look professional but also facilitate smoother transactions and enhance customer satisfaction.

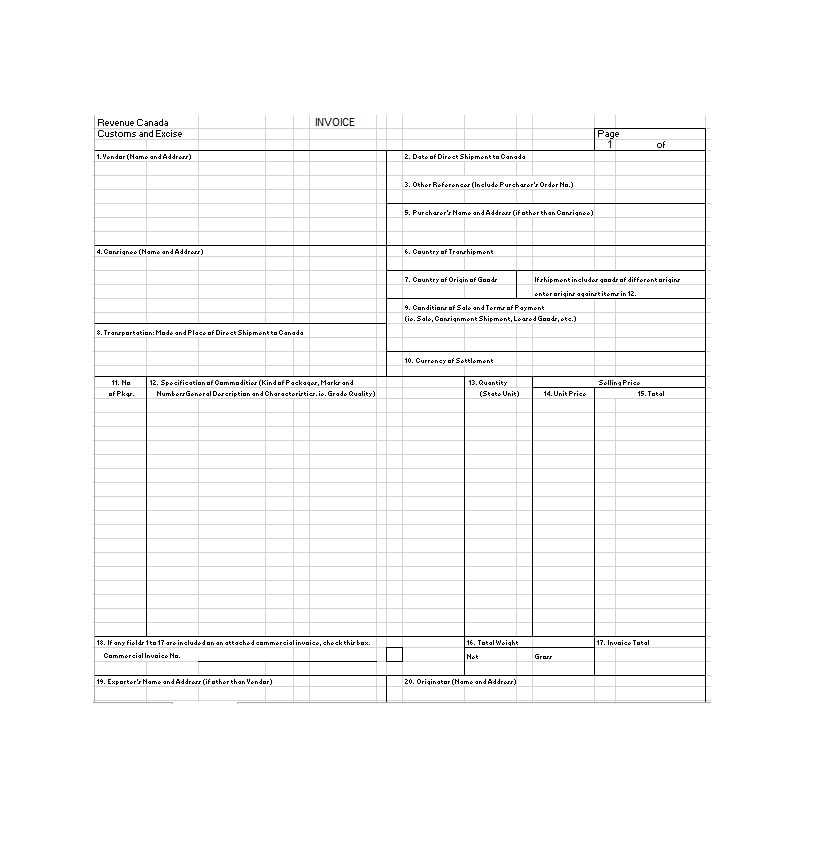

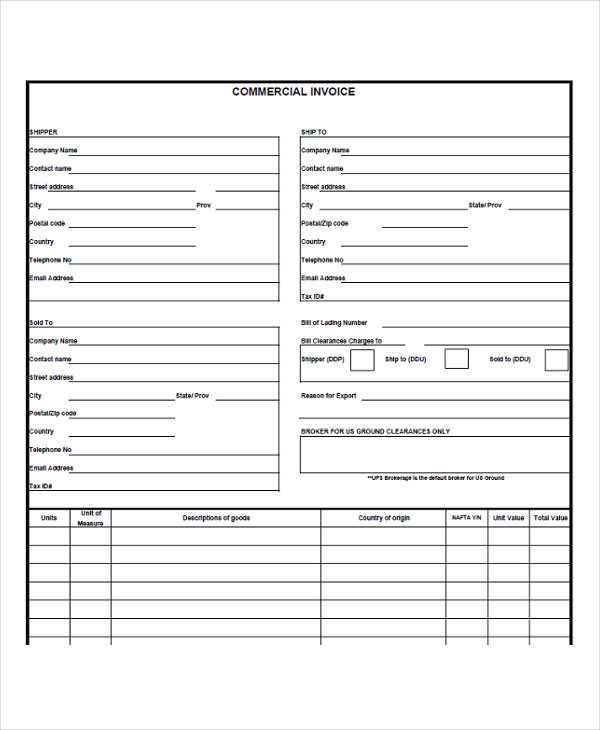

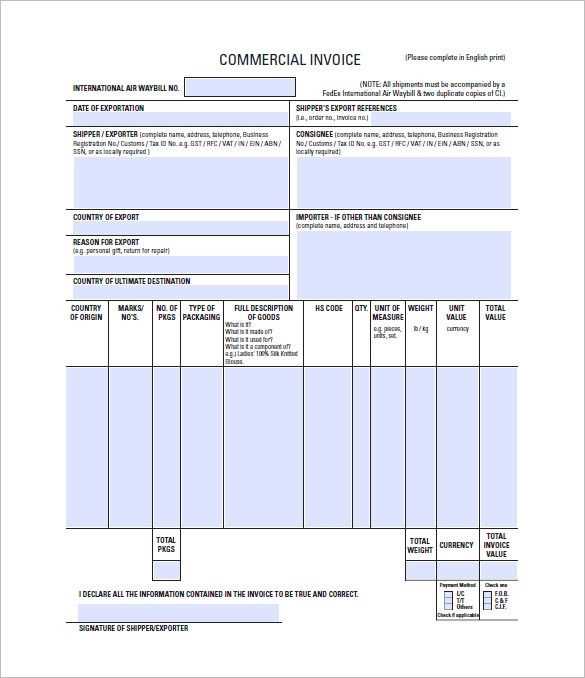

Legal Requirements for Commercial Invoices

In business transactions, proper documentation is crucial not only for clarity and organization but also for legal compliance. Certain elements must be included in financial documents to meet legal standards, especially when dealing with taxes, international trade, or official audits. Failing to comply with these legal requirements can result in penalties, delays in payment, or complications with tax authorities.

Each country has its own set of legal standards for financial documents, but there are several common requirements businesses should be aware of to ensure their records are compliant:

| Legal Requirement | Description |

|---|---|

| Unique Identification Number | Each document must have a unique reference number to prevent confusion and ensure proper tracking for tax purposes. |

| Full Company and Client Information | The legal names, addresses, and business identification numbers (e.g., tax IDs) of both the issuing company and the client must be included. |

| Clear Description of Goods or Services | Each item or service provided should be clearly described, including quantities, unit prices, and any relevant details, for legal transparency. |

| Tax Information | If applicable, tax amounts (such as VAT) should be clearly stated, showing the rate applied and the total tax charged. |

| Payment Terms and Conditions | Clearly outline the payment due date, accepted payment methods, and any penalties or discounts related to early or late payments. |

Ensuring that these elements are included in every financial document will help businesses remain compliant with legal and regulatory standards. This is particularly important when dealing with cross-border transactions, where different jurisdictions may have specific documentation rules. Taking the time to understand and apply these legal requirements will minimize risks and help maintain smooth business operations.

How to Save and Send Your Invoice

Once you’ve completed your billing document, it’s important to save it in a secure and easily accessible format. Additionally, choosing the right method to send the document ensures that it reaches the recipient promptly and safely. Whether you’re delivering the document electronically or in print, following best practices can help ensure that your communication is clear, professional, and efficient.

Here are the key steps for saving and sending your billing document:

Saving Your Document

Before sending your document, it’s essential to save it in a format that preserves its integrity and can be easily accessed by both you and your client. The most common method is saving the document as a file on your computer or cloud storage service.

- Save in a Standard Format: Use a widely accepted format, such as a Word or Excel file, for easy editing. For final versions, consider saving the document as a PDF to ensure that formatting remains intact and it cannot be easily altered.

- File Naming: Name the document in a way that makes it easy to identify. Include the client name, date, or reference number in the file name to avoid confusion.

- Backup Your Files: Store a backup copy of all completed documents in cloud storage or external drives to prevent data loss.

Sending Your Document

After saving your document, it’s time to send it to your client. The method of delivery will depend on your client’s preferences, but it’s important to use a secure, professional method.

- Email: This is the most common method for sending billing documents. Attach the saved file to an email and ensure you write a clear subject line and professional message in the body of the email. Always double-check the recipient’s email address before sending.

- Postal Service: For clients who prefer physical copies, you can print the document and send it through the mail. Make sure to use a reliable mailing service and keep a record of the dispatch details.

- Secure File Sharing: For sensitive or large documents, consider using secure file-sharing platforms like Dropbox or Google Drive. Provide your client with a link to download the document and set the appropriate privacy settings.

By following these steps, you ensure that your documents are saved in a secure format and delivered to your clients in a professional manner, reducing the risk of errors and improving the overall efficiency of your billing process.

How PDF Invoices Enhance Business Transactions

In today’s digital world, using electronic documents for financial transactions has become increasingly important. These electronic records streamline the process, making it easier to send, track, and store important information. With the right tools, businesses can ensure that their billing is accurate, efficient, and professionally presented, all while reducing the risks associated with manual processing.

Improved Efficiency and Speed

Electronic documents significantly improve the speed at which transactions can be processed. Unlike traditional paper forms, digital records can be created, modified, and shared instantly. This means that billing can be done without delays, and clients can receive their requests promptly. As a result, businesses can reduce waiting times for payments and improve their cash flow.

Enhanced Accuracy and Security

Digital formats also help ensure greater accuracy. The ability to store and modify information easily allows for quick corrections if errors are spotted, preventing mistakes that could lead to payment disputes. Additionally, electronic records offer better security features, such as encryption and password protection, which reduces the risk of unauthorized access or loss of sensitive information.

By adopting digital solutions for financial documentation, businesses can enhance the accuracy of their transactions, expedite the payment process, and create a more secure system for handling important data. These improvements help strengthen client relationships and foster trust, ultimately driving business growth.

How to Organize Your Invoice Files

Keeping financial documents organized is essential for efficient business operations. Whether you’re managing a small business or a large enterprise, maintaining an orderly system for your billing records ensures that you can easily track payments, manage taxes, and retrieve important information when needed. A well-organized filing system helps reduce the risk of errors, lost documents, and unnecessary stress during audits or client inquiries.

Best Practices for Organizing Your Files

To stay on top of your financial documentation, it’s important to follow some basic principles for organization. Here are a few tips that can help streamline your process:

- Use Folders for Categories: Create separate folders for different types of transactions, such as sales, services, or returns. This helps keep your files grouped logically and makes them easy to access.

- Organize by Date: Sorting documents by date is one of the simplest ways to maintain order. You can arrange files either by year or by month, depending on the volume of transactions.

- Label Files Clearly: Use clear, consistent naming conventions for all files. Include essential details such as the client name, transaction date, and reference number in the file name to make retrieval easier.

Digital and Physical Storage Options

Depending on your preference and the volume of your records, you may choose to store your documents digitally, physically, or both. Each option has its advantages and can be used in tandem for added security.

| Storage Method | Advantages |

|---|---|

| Digital Storage | Easy to access, secure, and share. Reduces physical space and allows for quick backups. |

| Physical Storage | Provides a tangible backup, useful for clients who prefer paper documentation, and can be organized in filing cabinets or folders. |

Whichever storage method you choose, it’s important to have a clear and systematic approach. Regularly review your organization system to ensure it’s still effective and up to date with your business needs. Properly organized records will save time, reduce stress, and ensure that all your transactions are easy to track and manage.

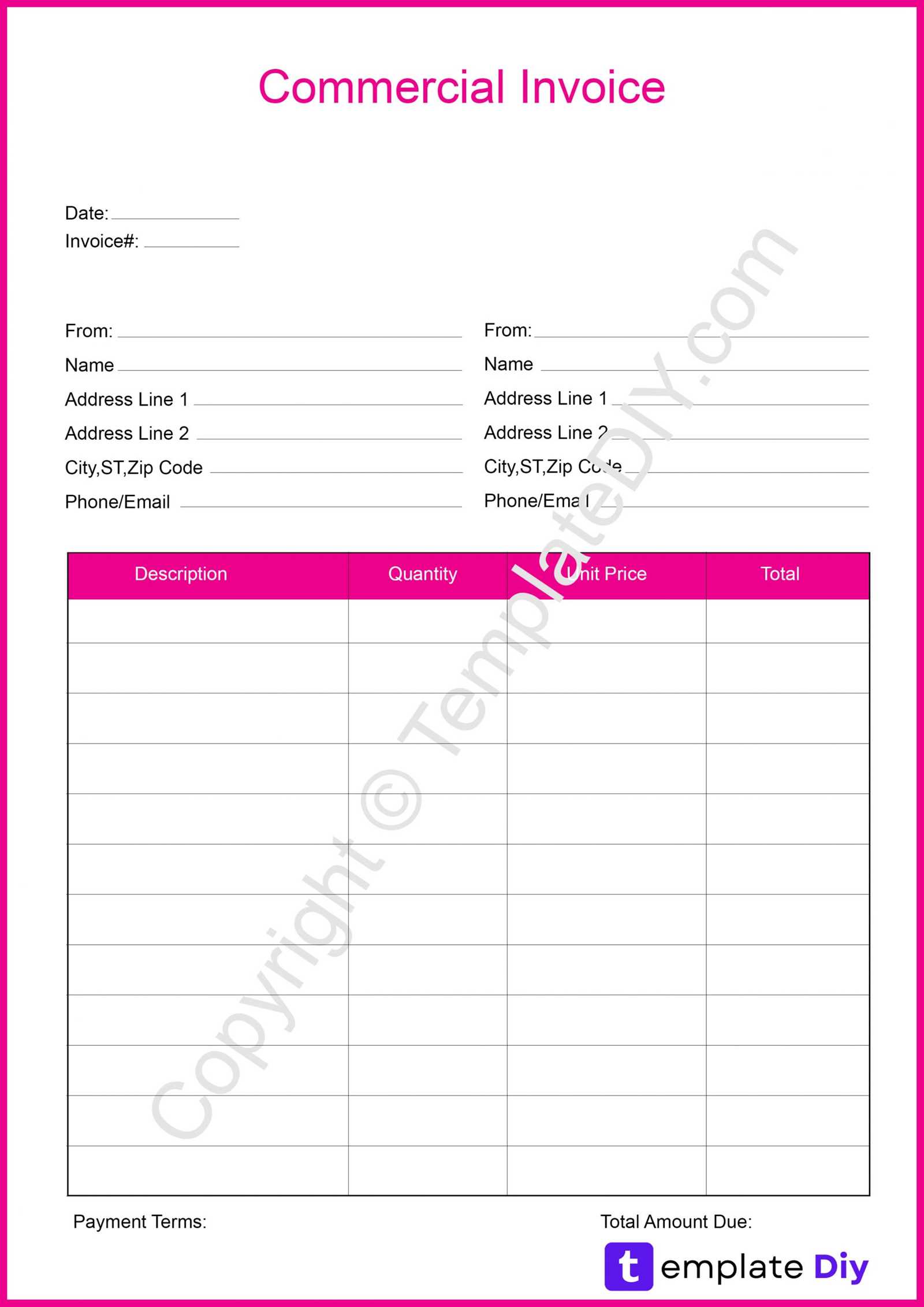

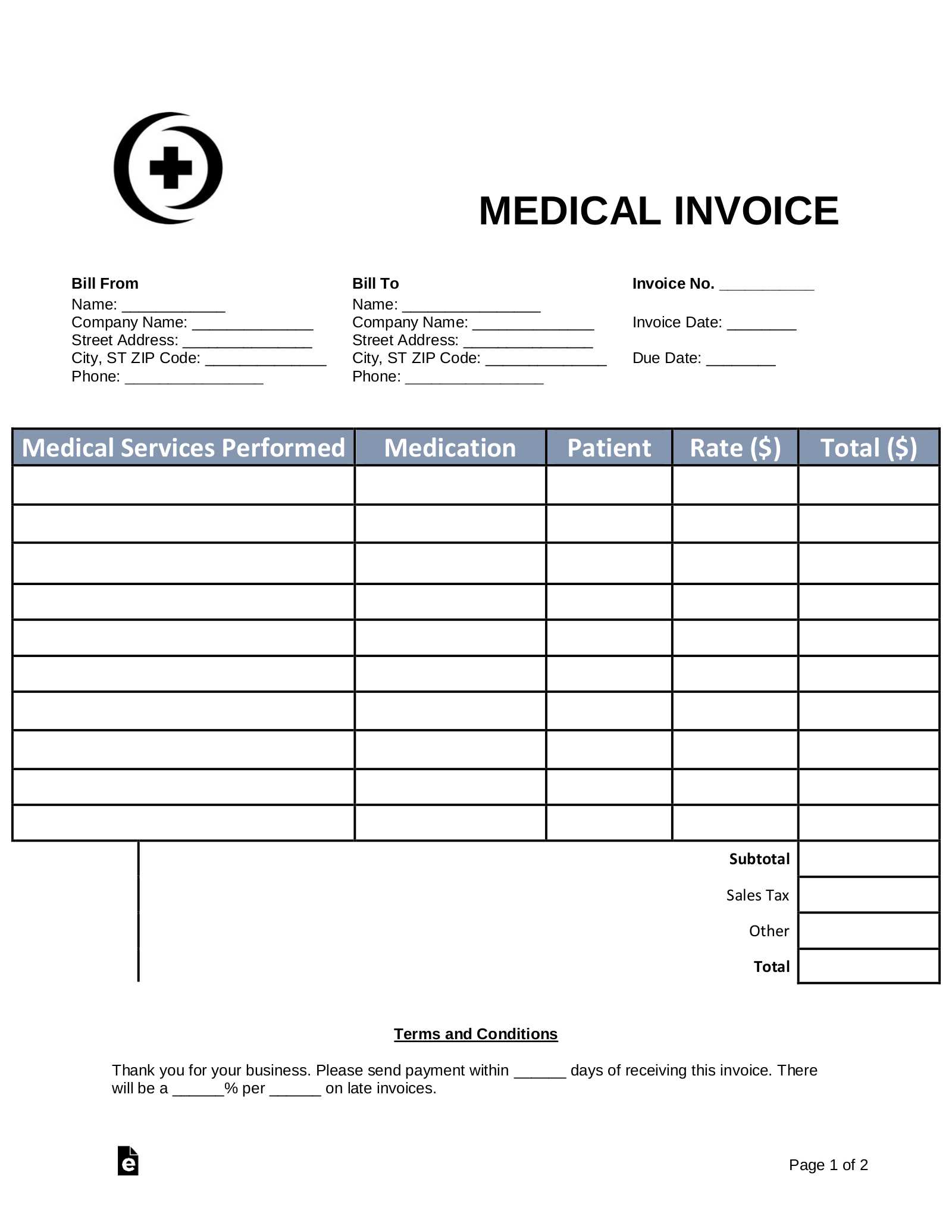

Choosing the Right Invoice Template for Your Needs

Selecting the correct format for your billing documents is crucial for efficiency and professionalism. The right design not only helps ensure that all necessary details are included but also sets the tone for your relationship with clients. Whether you’re dealing with small projects or large transactions, using a structured document tailored to your business needs can simplify the process and enhance communication.

Key Considerations When Choosing a Billing Format

Before selecting a billing layout, it’s important to consider a few key factors to ensure the document aligns with your business type and the specific needs of your clients:

- Business Size and Transaction Volume: Larger businesses or those with complex billing requirements may need more detailed forms, while smaller businesses or freelancers can often make use of simpler layouts.

- Client Preferences: Understand your client’s preferences for receiving documents. Some clients may require specific formats, while others may be flexible. Knowing their preferences will help ensure smooth communication.

- Legal or Tax Requirements: Depending on your location and the nature of your transactions, there may be legal requirements for what must appear on the document. Make sure to choose a layout that accommodates these needs.

Types of Billing Formats and Their Benefits

There are various styles of billing documents available, each with distinct features. Below is a comparison to help you choose the best one for your business:

| Format Type | Best For | Key Benefits |

|---|---|---|

| Basic Layout | Small businesses or freelancers with simple transactions | Quick to complete, easy to customize, and suitable for basic billing needs |

| Detailed Layout | Medium to large businesses, or those with complex products and services | Allows for multiple item entries, tax calculations, and detailed client information |

| Customizable Design | Businesses requiring a unique appearance or branding on their documents | Can incorporate logos, custom fields, and specific payment terms |

Choosing the right layout for your business will help you stay organized and ensure you provide clients with all the necessary information in a clear, professional format. By considering these factors and selecting a format that fits your needs, you can improve your billing process and reduce potential errors or delays.