Free Blank Invoice PDF Template for Easy Customization

Creating professional billing documents can be a time-consuming task, but with the right tools, it becomes a seamless part of your workflow. Whether you’re a freelancer, small business owner, or large corporation, having access to a customizable form is essential for managing transactions effectively. With a properly structured document, you can ensure accuracy and consistency in your financial records.

These customizable forms allow you to quickly generate and personalize important details like client information, services rendered, and payment terms. Using a format that suits your business needs can save you valuable time, minimize errors, and enhance the professionalism of your communication. The ability to modify and save these files ensures they remain aligned with your specific requirements, making them ideal for frequent use.

By utilizing editable formats, you can easily adapt to changing needs and ensure that each record is tailored to the individual transaction. This approach streamlines your accounting processes and helps you maintain clear, concise, and well-organized documents for your clients and your records.

Why Use a Blank Invoice Template

Using a ready-to-fill form for billing purposes offers numerous advantages for both individuals and businesses. It simplifies the process of creating accurate and professional financial documents by providing a consistent structure that can be quickly personalized. With such a format, you eliminate the need to start from scratch each time, saving time and reducing the chances of errors in critical areas like amounts and due dates.

One of the key benefits of using these forms is the ability to ensure consistency in your documentation. Whether you’re a freelancer or managing a larger company, maintaining uniformity across all records helps build trust with clients. A well-organized structure reflects professionalism, showing clients that you value clarity and precision in all your transactions.

Additionally, customizable forms are versatile and can easily adapt to different business needs. You can modify fields to suit your specific services, include company branding, and adjust payment terms or tax rates as necessary. This flexibility ensures that your financial records remain accurate and relevant for each transaction, making it a powerful tool for efficient business management.

Benefits of PDF Invoice Formats

Using digital document formats for billing provides numerous advantages over traditional paper methods. They offer convenience, security, and versatility, making them the ideal choice for modern businesses. The ability to send, store, and manage transactions electronically simplifies many aspects of business administration.

Some of the key benefits include:

- Universal Compatibility: PDF files are widely accepted and can be opened on virtually any device or operating system without the need for specialized software.

- Professional Presentation: A well-designed document appears polished and can include branding elements such as logos, fonts, and custom colors, enhancing your business’s professional image.

- Easy Storage and Access: Digital formats are easy to save, categorize, and search, providing quick access to past records whenever needed.

- Security Features: PDFs allow you to add password protection, encryption, and digital signatures, ensuring that your financial information remains secure.

- Reduced Environmental Impact: By using electronic formats, businesses can minimize paper waste and reduce their environmental footprint.

In addition, the ease of sending these documents electronically speeds up communication with clients, making it easier to complete transactions faster and more efficiently. Whether you’re sending them via email or integrating them into automated systems, digital documents offer a streamlined, cost-effective solution for businesses of all sizes.

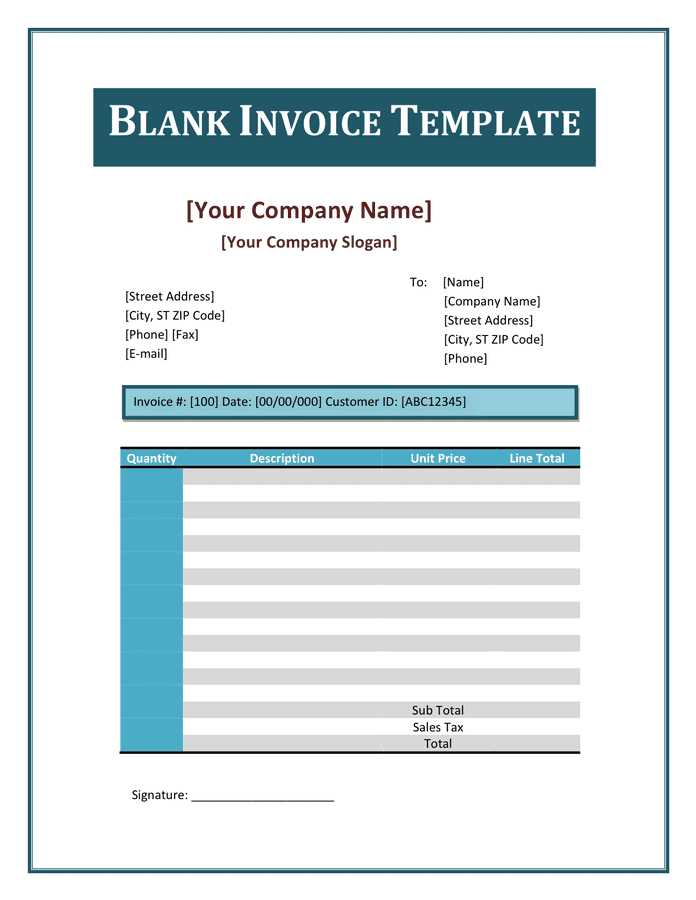

How to Customize Your Invoice Template

Customizing your billing document is a simple yet effective way to ensure that each record aligns with your business’s unique needs. By adjusting specific fields, you can make sure the document reflects your branding, includes accurate details, and meets all the necessary legal and professional requirements. A tailored document not only saves time but also enhances the credibility of your communications with clients.

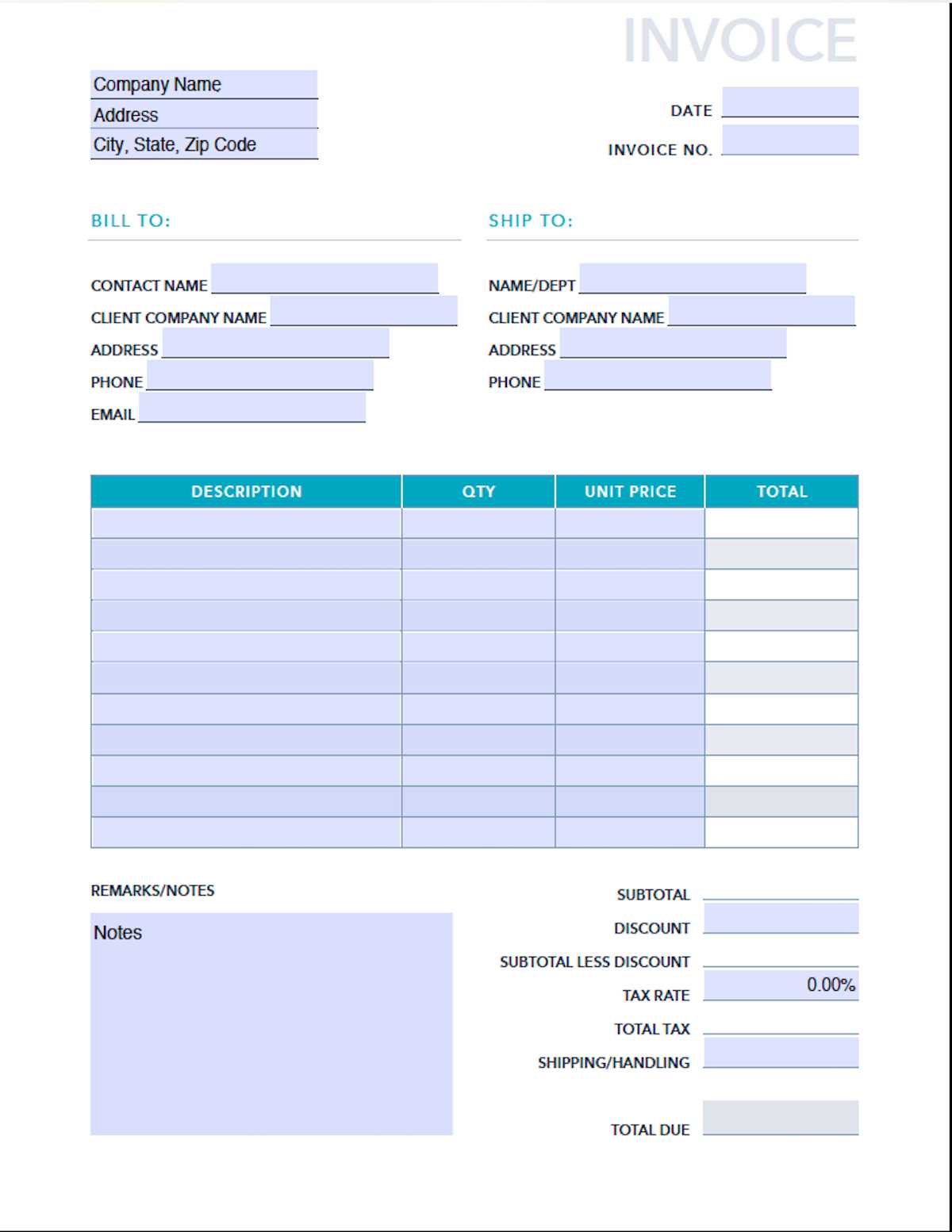

Here are the key areas to focus on when modifying your billing form:

- Business Information: Include your company’s name, address, phone number, and email. This ensures clients can easily reach you if needed.

- Client Details: Make sure to add the client’s name, address, and contact information. This helps avoid confusion and ensures proper delivery of documents.

- Services or Products: Clearly list the items or services provided, including quantities, descriptions, and pricing. This transparency helps build trust and reduces disputes.

- Payment Terms: Customize the payment due date, accepted methods, and any late fees if applicable. Clear payment terms prevent misunderstandings and facilitate prompt payments.

- Branding Elements: Integrate your logo, colors, and fonts into the design to create a professional, branded appearance that reflects your company’s identity.

After customizing the fields, ensure that all the information is correct and aligns with your business processes. A clear, well-structured form not only streamlines the billing process but also contributes to maintaining a professional relationship with clients.

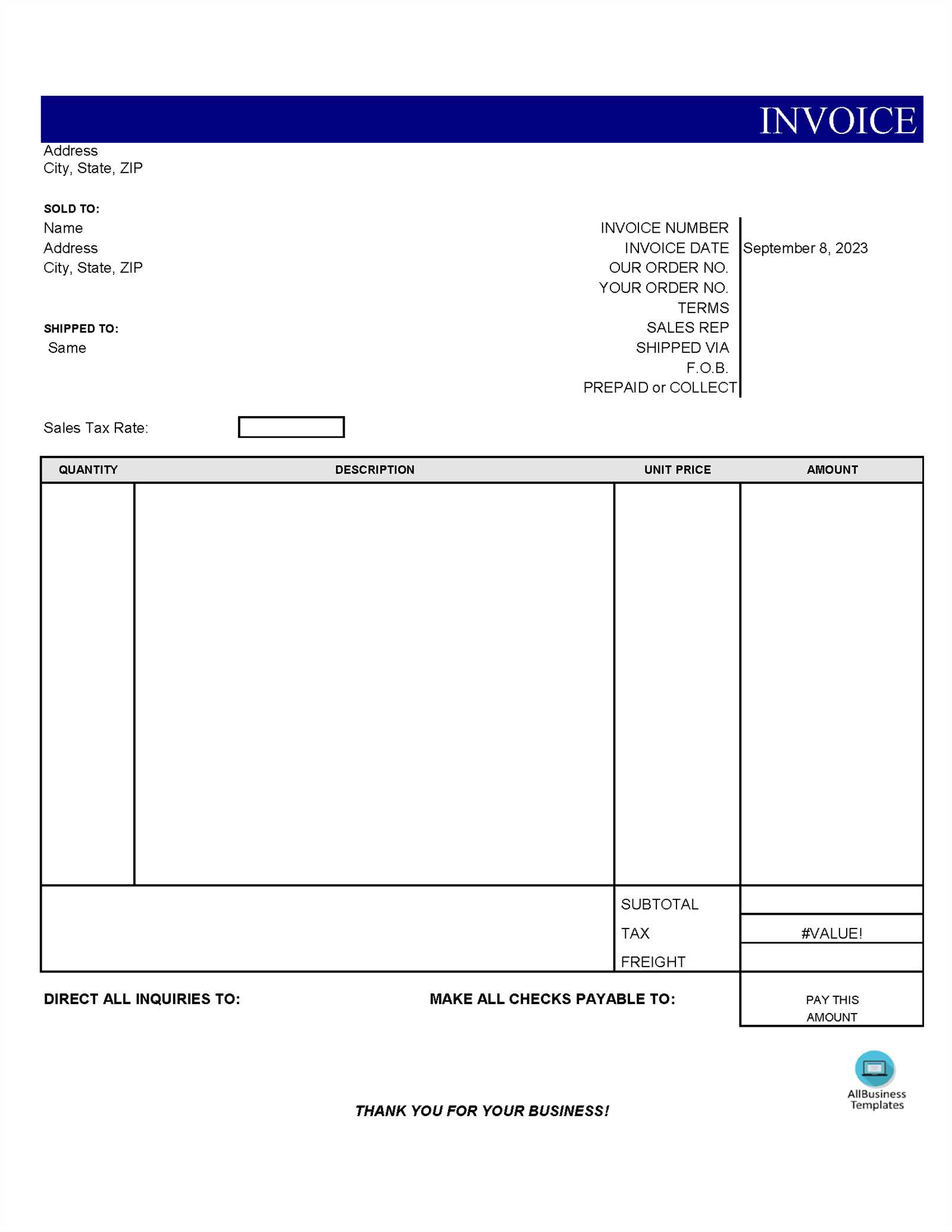

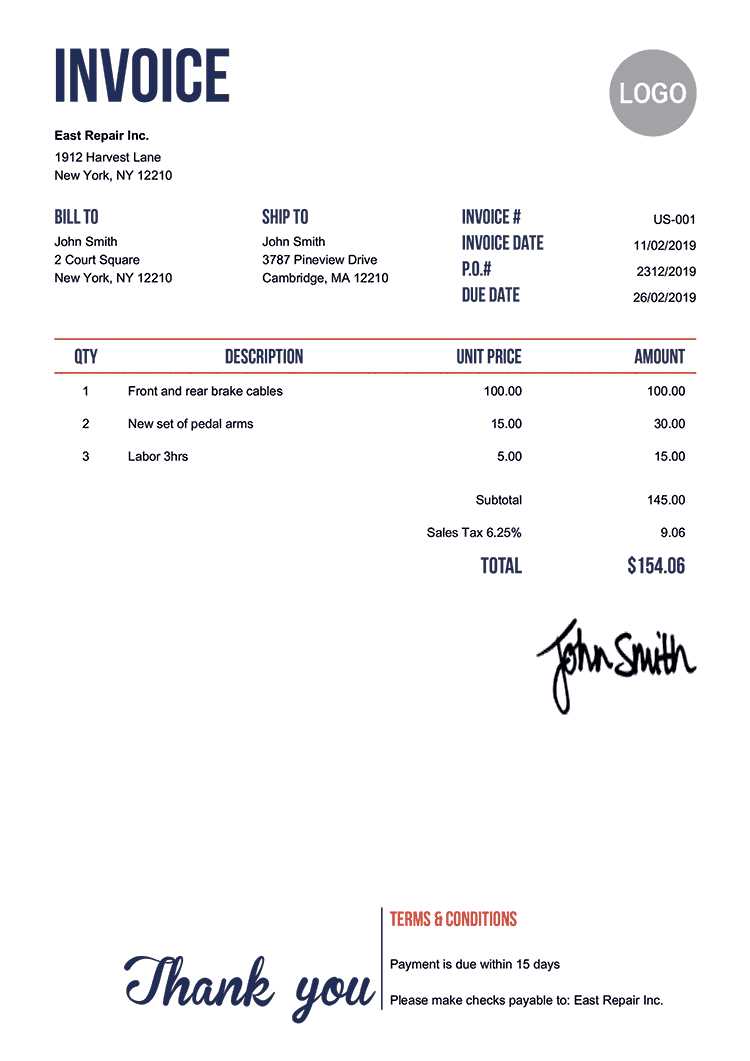

Top Features of a Good Invoice

A well-crafted financial document plays a crucial role in any business transaction. It serves as both a formal record and a reminder for clients, ensuring that payment is made on time and accurately. To achieve this, it’s important to include key elements that not only help clarify the transaction but also maintain professionalism and transparency.

Essential Information

First and foremost, a good document should clearly present all the necessary details. This includes your company name, client’s information, unique reference number, and the date of the transaction. Without these essential components, the document lacks context and may cause confusion for both parties.

Clear Payment Terms

Another important feature is the inclusion of precise payment terms. These should outline the total amount due, any applicable taxes, the payment deadline, and accepted payment methods. If applicable, adding any late fees or discounts for early payments can help ensure timely transactions and minimize delays.

Additionally, a clear breakdown of the goods or services provided is crucial. Each item or service should be listed with its corresponding price and quantity, ensuring full transparency. This helps avoid disputes and ensures that both you and your client are on the same page regarding what has been delivered.

Finally, a professional design that aligns with your branding can significantly enhance the document’s credibility. This can include adding your company’s logo, using consistent fonts, and maintaining a clean layout. A well-designed document leaves a lasting impression and demonstrates your attention to detail and professionalism.

Steps to Download a Blank Invoice

Downloading a ready-to-use document for billing purposes is a simple process that helps streamline your financial tasks. By obtaining a digital version of the form, you can save time and start customizing it to meet your needs immediately. Below are the key steps to follow to download and access a usable document quickly and efficiently.

1. Choose a Reliable Source

First, select a trustworthy website or platform that offers high-quality, customizable forms. Ensure the provider offers a variety of formats, especially those that align with your specific business requirements.

2. Select Your Preferred Format

Once you’ve identified a reliable source, choose the format that best suits your needs. Many sites offer multiple options, such as editable word processing files or straightforward document formats that can be easily opened on any device.

3. Download the File

Click the download button or link associated with the selected document. In most cases, the file will automatically be saved to your computer or device. Be sure to choose a location where you can easily find it, such as your desktop or designated folder.

4. Open and Customize the Document

After downloading the file, open it using the appropriate software. From there, you can begin adding your company’s details, client information, payment terms, and other necessary data. This customization process ensures that each record accurately reflects the specific transaction.

5. Save and Use the Document

Once you’ve made all the necessary edits, save the document with a new name for easy access. Now you have a personalized record that is ready to be sent or printed for your client.

Editable Invoice Templates for Businesses

For businesses of all sizes, having access to customizable forms for financial transactions is crucial for maintaining efficient operations. Editable forms allow you to tailor each document to fit the unique requirements of your clients and services. This flexibility ensures that every transaction is recorded accurately and professionally, streamlining the billing process and reducing errors.

Some key advantages of using editable documents for your business include:

- Customization: You can easily modify sections such as product descriptions, pricing, and client details to match each specific job or transaction.

- Consistency: Maintaining a standard layout across all records ensures that your documents look professional and are easy to understand for clients.

- Efficiency: By using pre-built structures, you can quickly generate new records without having to recreate them from scratch each time.

- Flexibility: Editable forms can be updated as your business grows, allowing you to add new fields, change payment terms, or include other relevant information based on evolving needs.

- Cost Savings: By using digital versions, you eliminate the need for printing and manual processing, saving time and resources.

Additionally, using customizable documents helps you manage multiple clients and projects simultaneously. Whether you’re a freelancer or a larger organization, these tools ensure that every transaction is documented clearly and consistently, reducing the risk of disputes and helping maintain professional relationships with clients.

Save Time with Invoice Templates

Using pre-designed documents for billing can drastically reduce the time spent on administrative tasks. Instead of creating new records from scratch for each transaction, you can simply modify an existing structure to match the specifics of the job. This approach helps you stay organized, streamline your workflow, and focus on more important aspects of your business.

Here’s how using ready-made forms can help save time:

- Pre-filled Structure: With key sections already in place, you only need to add client details, products or services, and payment terms, significantly cutting down on the time spent creating each document.

- Quick Adjustments: Instead of reformatting or rebuilding your forms, you can easily adjust fields to fit different transactions, saving time with each new job.

- Consistency: By using the same structure for all records, you eliminate the need to check for errors or make adjustments each time, reducing the risk of missing critical information.

- Faster Communication: With a consistent, pre-made format, you can send documents quickly to clients, accelerating the invoicing process and improving cash flow.

Ultimately, using these time-saving documents allows you to manage your workload more efficiently, ensuring that invoicing is no longer a tedious, time-consuming task but a quick and seamless part of your business operations.

How to Print Your PDF Invoice

Once you’ve customized your billing document and are ready to send it, printing a physical copy can be a straightforward process. Whether you need a printed version for your records or prefer to mail it to your client, following a few simple steps ensures that the final result looks professional and is ready for distribution.

Step 1: Open the Document

Start by opening the billing form on your device using a PDF viewer or editor. Ensure that all necessary fields are filled out and that the document is properly formatted before proceeding to print.

Step 2: Select the Printer

Click on the “Print” option, which can usually be found under the “File” menu or by pressing Ctrl + P (Windows) or Cmd + P (Mac). In the print settings, select the printer you want to use. If you’re printing to a physical printer, ensure it is connected and ready.

Step 3: Adjust Print Settings

Before printing, you may want to adjust the print settings. You can select the number of copies, choose a specific page range, or adjust the paper size if necessary. Make sure the document fits well on the page and looks clear when printed.

Step 4: Print the Document

Once you’re satisfied with the settings, click on the “Print” button. The document will be sent to the printer, and a physical copy will be produced. Ensure the printed form looks clear, and all information is legible before sending it out.

Tips for Creating Professional Invoices

Creating a professional document for billing purposes is essential for any business. It not only ensures that you get paid on time but also reinforces your brand’s image. A well-designed financial record reflects professionalism and builds trust with clients. Below are some helpful tips to create documents that are both clear and impressive.

Maintain a Clean and Organized Layout

The design of your document plays a key role in its effectiveness. A cluttered or disorganized layout can confuse clients and cause delays in payments. Ensure that the layout is simple, clean, and easy to read. Key sections such as client information, the list of services provided, and payment terms should be clearly separated and easy to locate.

Include Detailed and Clear Information

Make sure that all necessary details are included. The document should clearly state the items or services being billed, along with their corresponding prices, quantities, and total amounts. Avoid ambiguity by providing precise descriptions and avoid abbreviations that might confuse the recipient. Additionally, always include your contact information, business details, and a unique reference number for each transaction.

Use Professional Language and Tone

The language used in your document should be formal and straightforward. Avoid overly casual phrases or jargon that might be confusing to the client. This will ensure that your document is perceived as professional and serious.

Proofread Before Sending

Mistakes in your financial record can lead to confusion or even disputes. Always take the time to carefully proofread the document for any errors in the details, such as misspelled client names, incorrect pricing, or missing fields. A thorough review helps to ensure that all information is accurate and professional.

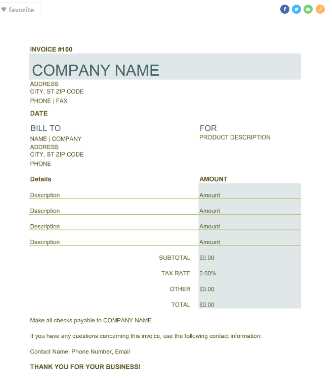

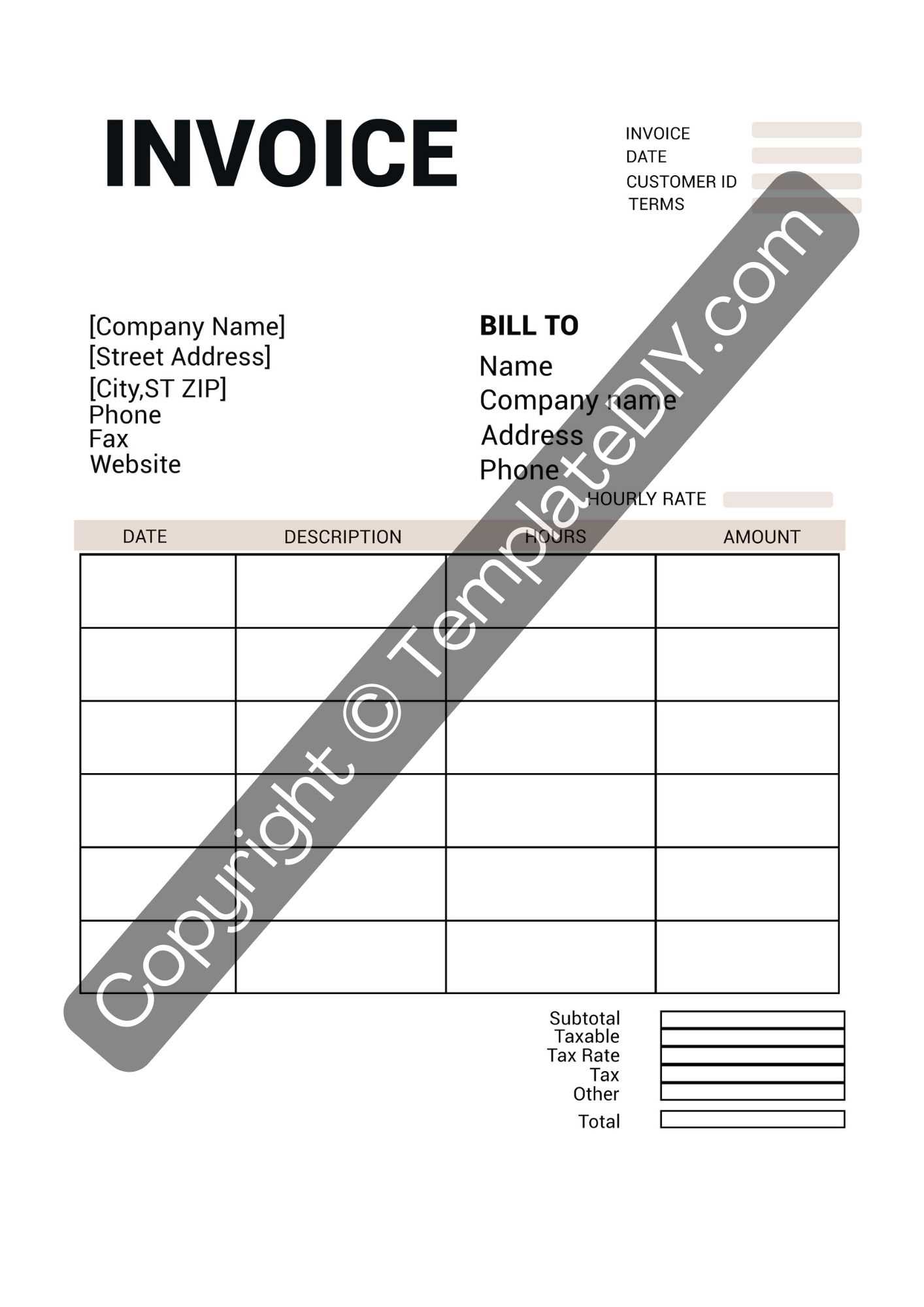

Invoice Templates for Freelancers

For freelancers, having an efficient and professional way to request payment is essential. A customizable document for billing makes it easy to track completed projects, provide clients with a clear record, and ensure that payments are made promptly. With a ready-made structure, freelancers can focus on their work without spending time creating documents from scratch.

Here are some key features that a freelancer’s billing document should include:

- Professional Design: A clean and simple layout that reflects your brand identity makes your document more trustworthy and easier to understand.

- Clear Payment Terms: Clearly outline payment deadlines, preferred payment methods, and any late fees or discounts for early payment.

- Project Details: Include descriptions of the work performed, hours worked (if applicable), and the agreed-upon rates, ensuring full transparency for your clients.

- Unique Reference Number: Adding a unique number to each document helps both you and your clients keep track of transactions and avoid confusion.

- Contact Information: Your contact details and business information should always be included, giving clients easy access to reach out with questions or concerns.

By using a pre-made structure, freelancers can quickly customize the document for each client or project, saving time while ensuring accuracy and professionalism. This not only simplifies the billing process but also helps build a positive reputation with clients, encouraging repeat business and timely payments.

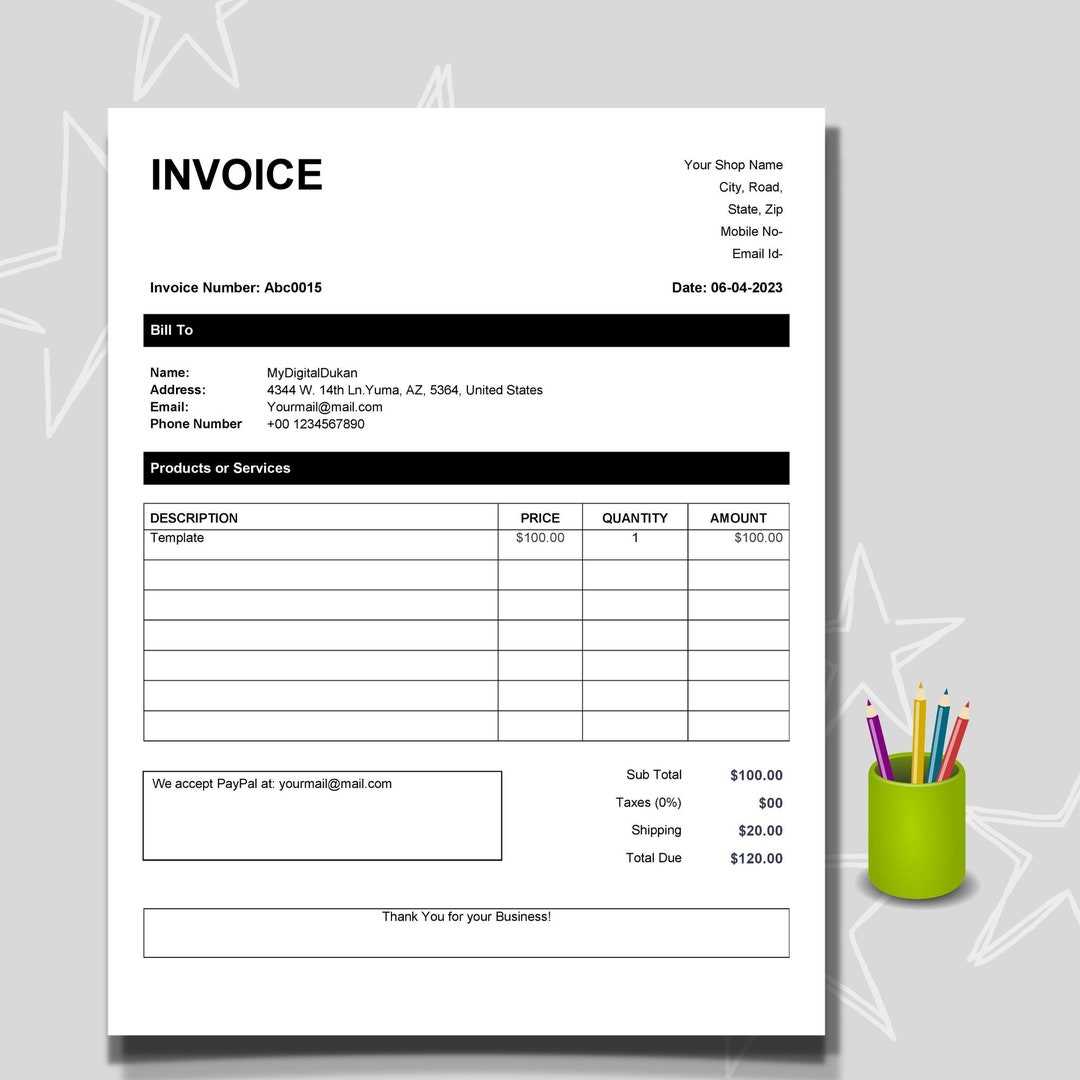

Using Invoice Templates for Small Businesses

For small businesses, managing administrative tasks efficiently is crucial to maintaining smooth operations. One of the most important aspects of running a business is handling payments promptly and professionally. Utilizing pre-designed billing documents can help streamline the process, ensuring consistency and saving valuable time while maintaining a professional image.

Why Small Businesses Benefit from Pre-Designed Forms

Having a ready-made structure for billing makes it easier to manage financial transactions, especially when your time is limited. These forms allow business owners to quickly customize and issue payment requests without worrying about formatting or missing important details. Here are some reasons why small businesses benefit from using these documents:

- Time-Saving: Pre-designed documents eliminate the need to start from scratch every time you need to create a billing record. You can easily adjust the existing structure to fit each unique transaction.

- Consistency: Using the same format for every billing request ensures a uniform look and makes it easier for clients to understand the details of their payments.

- Professional Appearance: A polished and formal structure can help your small business appear more credible and trustworthy to clients, leading to better client relations and more prompt payments.

Key Features to Look for in Billing Forms

When choosing a document for your small business, it’s important to ensure that it includes all the necessary fields to avoid confusion and ensure accurate record-keeping. Key features to look for include:

- Company Information: Your business name, contact details, and logo should be clearly displayed.

- Payment Terms: Clearly define payment methods, due dates, and any applicable late fees or discounts.

- Itemized List: Break down the goods or services provided, their prices, and any taxes applied, providing clarity for your clients.

- Unique Reference Number: This helps you keep track of transactions and makes it easier to identify specific requests in the future.

By using a consistent, pre-designed billing system, small business owners can save time, improve organization, and ensure that payments are processed more efficiently.

Common Mistakes in Invoice Creation

Creating a professional document for billing is an essential part of any business, but it’s easy to make mistakes during the process. Even small errors can lead to confusion, delayed payments, or disputes with clients. Understanding the most common mistakes can help you avoid costly oversights and improve the accuracy of your billing records.

Frequent Errors in Payment Requests

Several common mistakes can undermine the clarity and professionalism of your payment documents. Some of the most frequent issues include:

- Missing Client Information: Failing to include the correct details for both you and your client, such as names, addresses, or contact information, can delay the payment process or cause confusion.

- Unclear Payment Terms: Not specifying payment deadlines, acceptable payment methods, or penalties for late payments can lead to misunderstandings and missed deadlines.

- Incorrect Amounts: Errors in pricing or calculations, such as failing to apply discounts or tax rates, can result in inaccurate totals and lead to payment disputes.

- Absence of Unique Reference Numbers: Without a reference number for each document, tracking payments and managing your records becomes difficult, especially when dealing with multiple clients or transactions.

- Omitting Descriptions of Goods or Services: When the list of products or services is too vague, it can cause confusion and result in delayed payments as clients may not fully understand what they are being charged for.

How to Avoid These Mistakes

To avoid these common mistakes, ensure that every document includes all necessary information and is double-checked for accuracy. Here are a few tips to help:

- Double-check Client Details: Always verify the correct information before sending any billing document.

- Clearly Define Payment Terms: Make sure that payment instructions and deadlines are clear and unambiguous.

- Review All Figures: Double-check the pricing and tax amounts to ensure they are accurate and complete.

- Include Itemized Descriptions: Provide clear and concise descriptions of the work or products provided to avoid confusion.

By avoiding these common mistakes, you can ensure that your payment requests are accurate, professional, and efficient, helping you maintain strong client relationships and timely payments.

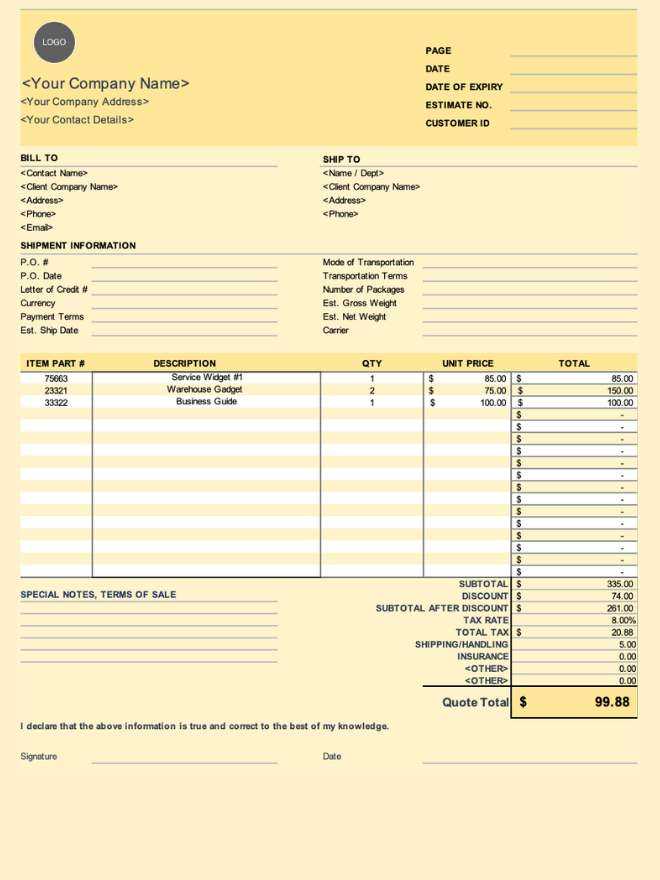

How to Include Taxes in Your Invoice

When creating a billing document, it’s essential to account for taxes to ensure accurate financial records and compliance with tax laws. Including taxes correctly on your payment request can avoid misunderstandings with your clients and prevent legal complications. The process involves calculating the appropriate tax rate and clearly stating it in the document, so both parties know exactly what is being paid.

Follow these steps to properly include taxes on your billing document:

| Description | Amount | Tax Rate | Tax Amount | Total Amount |

|---|---|---|---|---|

| Product/Service 1 | $100.00 | 10% | $10.00 | $110.00 |

| Product/Service 2 | $50.00 | 10% | $5.00 | $55.00 |

| Total | $150.00 | $15.00 | $165.00 |

In the table above, the tax rate is applied to each item’s cost, and the total amount is calculated by adding the tax to the original amount. Here’s how to approach this:

- Identify Tax Rate: Ensure you know the applicable tax rate for the products or services provided. This can vary by region or industry.

- Calculate Tax Amount: Multiply the item price by the tax rate to get the tax amount for each product or service.

- State Tax Clearly: Clearly display the tax amount alongside the price and indicate it as a separate line item for transparency.

- Calculate Total Amount: Add the tax amount to the original price to get the total amount due.

By including taxes in this structured manner, your clients will have a clear understanding of how the tax is calculated, ensuring smoother transactions and fewer disputes.

Automating Invoice Generation with Templates

Streamlining the process of creating billing documents can significantly save time and reduce errors. Automating document generation helps businesses quickly produce accurate payment requests without having to manually fill in every detail. By setting up a system that uses pre-designed formats, you can ensure consistency and efficiency in your accounting process.

Here are the key benefits of automating the creation of payment documents:

- Consistency: With a pre-set structure, all documents will have the same look and feel, maintaining a professional appearance across all transactions.

- Time-Saving: By automating repetitive tasks, you can reduce the time spent on administrative work, allowing you to focus on more important aspects of your business.

- Accuracy: Automation reduces the likelihood of human error, ensuring that all calculations are correct and that important details, such as due dates and amounts, are included correctly.

- Customizable: While automation speeds up the process, it also offers flexibility, allowing for adjustments to suit the specific needs of each transaction, whether that includes discounts, taxes, or special terms.

- Integration with Other Systems: Automated billing systems can often be integrated with inventory, CRM, or accounting software, providing a seamless workflow and eliminating the need for manual data entry.

Steps to automate your billing process:

- Choose the Right Software: Select a solution that fits your business size and needs. Many tools allow for easy integration with existing software and offer various templates to suit different industries.

- Create a Default Format: Design a standard document layout that will be used for all generated bills. Include essential fields such as company details, client information, services or products, and payment terms.

- Set Up Automation Rules: Configure the system to automatically populate key information like the amount due, tax rates, and payment methods based on predefined inputs.

- Review and Adjust: Before fully automating the process, review the generated documents to ensure everything is accurate. Make any necessary adjustments to the template or automation rules to align with your business needs.

- Implement and Monitor: Once the system is set up, implement it into your workflow and monitor its effectiveness. Continuously refine the process to improve efficiency and keep up with any changes in regulations or client preferences.

By automating the process of generating your billing documents, you can streamline your operations, reduce errors, and ensure that every transaction is handled professionally and efficiently.

Free vs Paid Invoice Templates

When choosing a document format for billing, businesses often face the decision between using free or paid options. Both types offer unique advantages depending on the complexity and needs of your business. Understanding the differences can help you make an informed choice that best suits your requirements.

Advantages of Free Options

Free formats are a great starting point for small businesses or startups with limited budgets. These basic layouts provide all the essential elements, such as client information, payment terms, and itemized lists, without any additional costs. Here are some of the key benefits:

- Cost-Effective: Naturally, the most significant benefit of free options is that they come at no cost, which is ideal for new or small businesses looking to minimize expenses.

- Quick and Easy: Free formats are typically easy to download and use, with no need for complex setup processes.

- Basic Customization: While free options might not offer advanced features, they usually allow for basic changes like adding your business logo or modifying text.

Benefits of Paid Options

On the other hand, paid solutions provide a higher level of customization and professionalism. Businesses that need more advanced features or a unique look might prefer these options. Here’s why:

- Professional Design: Paid formats often come with sleek, modern designs that help your business stand out and look more established to clients.

- Advanced Features: These options frequently offer additional functionality, such as automatic tax calculations, integration with accounting software, or the ability to add multiple payment methods.

- Customization Options: Paid formats typically offer more flexibility in adjusting the layout, fonts, colors, and more, allowing you to create a personalized document that reflects your brand identity.

- Customer Support: Many paid options come with access to customer support, ensuring that any issues can be quickly addressed.

In conclusion, the choice between free and paid formats depends on your business’s specific needs. If you’re just starting or have simple billing requirements, free options might suffice. However, if your business requires a more professional appearance, additional features, or customization, investing in a paid solution could be worthwhile.

Where to Find Blank Invoice Templates

Finding a suitable billing document format is essential for ensuring smooth and professional transactions with your clients. There are various sources available online and offline where you can discover useful layouts that meet your specific business needs. Whether you’re looking for a simple, no-frills design or a more advanced format with additional features, there are many options to explore.

1. Online Template Websites

Numerous websites offer a wide range of customizable formats for billing purposes. These sites typically provide free or paid downloads, with the advantage of having professionally designed layouts. You can search for specific types of formats or browse through categories such as “business”, “freelancer”, or “small business”. Some popular websites include:

- Canva: A user-friendly platform that provides free designs with drag-and-drop functionality.

- Template.net: Offers a variety of paid and free options suitable for businesses of all sizes.

- Microsoft Office Templates: A trusted resource for straightforward, editable formats, especially for users familiar with Word and Excel.

2. Accounting Software

If you’re already using accounting software for your business, there’s a high likelihood that it offers built-in billing formats. These tools often allow you to easily create, customize, and send professional billing documents directly to your clients. Some software solutions also have pre-designed formats with options for tax calculations, payment terms, and due dates. Popular accounting platforms include:

- QuickBooks: Offers a range of customizable billing documents that integrate seamlessly with other features of the software.

- FreshBooks: A cloud-based platform known for its easy-to-use billing formats designed for freelancers and small businesses.

- Zoho Books: A comprehensive accounting solution that includes a variety of billing formats for different business needs.

3. Downloadable File Repositories

Some websites specialize in offering downloadable files, including Excel sheets or Word documents, which you can quickly modify to fit your needs. These formats often allow for easy personalization without the need for specialized software. Some file-sharing platforms you might explore include:

- Google Docs: Search the template gallery within Google Docs for free editable formats that you can easily personalize and store in the cloud.

- Dropbox: A cloud storage platform that offers various community-created resources, including format files.

Ultimately, the choice of where to find a suitable document layout depend