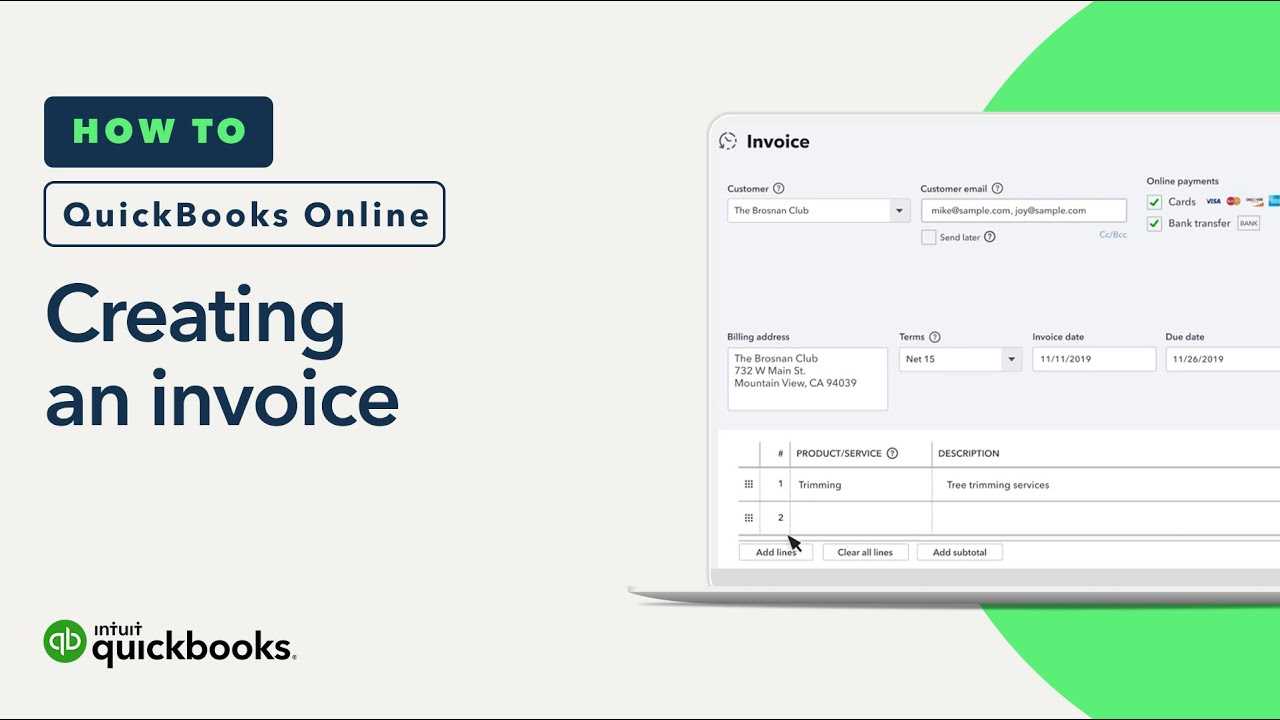

How to Create a New Invoice Template in QuickBooks Online

Every business needs a professional way to present their charges to clients, ensuring that all necessary details are clear and well-organized. Personalizing these documents to reflect your brand identity can make a significant impact on how your business is perceived. By modifying key elements like design, layout, and information placement, you can craft a document that stands out and fosters trust.

In this guide, we will walk you through the process of customizing a billing document within an accounting platform, helping you adapt it to your specific needs. Whether it’s adjusting the appearance or adding your company’s branding, you’ll learn how to fine-tune every aspect of the document to align with your preferences and business style.

With just a few simple steps, you can transform a generic document into a fully customized version that not only looks professional but also enhances your workflow. The following sections will provide detailed instructions, so you can easily tailor your billing experience without any technical expertise.

How to Create a New Invoice Template in QuickBooks Online

When managing client transactions, it’s important to ensure your billing documents align with both your brand and the nature of your business. Customizing these documents allows you to add your company logo, adjust the layout, and modify the content to make it both professional and functional. This process helps create a streamlined approach to managing your financial interactions with clients, making them not only easier to generate but also more visually appealing.

To begin customizing your billing forms, follow these simple steps to set up and adjust your document design and content. In the next sections, you will learn how to access the customization options and apply changes that fit your needs.

Access the Customization Area

To begin making changes, you need to navigate to the customization section within your accounting software. This area gives you access to pre-made designs that can be easily modified or replaced with a fully personalized version. Here’s a breakdown of how to access this feature:

| Step | Action | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | Login to your account and navigate to the “Settings” menu. | |||||||||||||||

| 2 |

| Item Description | Unit Price | Quantity | Total |

|---|---|---|---|

| Consulting Services (Hourly) | $100 | 5 hours | $500 |

| Website Design | $1500 | 1 | $1500 |

| Domain Renewal | $20 | 1 | $20 |

In this example, each item is described in detail, ensuring that the client knows exactly what they are being charged for. You can adjust descriptions to be as specific or as general as needed. Additionally, setting the correct unit price and quantity is essential for accurate billing and for avoiding errors.

Remember, you can also add or remove items based on the services rendered or products delivered, allowing you to tailor each document to the unique circumstances of every transaction. Clear, concise item descriptions and up-to-date rates ensure that your clients are informed and confident in their purchase decisions.

Adding Tax Information to Your Invoice

Including tax details in your billing documents is essential for compliance and clarity. Properly adding tax information ensures that your clients understand the breakdown of charges and that your business meets legal requirements. Whether it’s sales tax, VAT, or other applicable taxes, correctly displaying this information helps maintain transparency and avoids any confusion regarding final amounts due.

Determining the Tax Rate

The first step in adding tax information is determining the applicable tax rate. This will vary based on factors such as your location, industry, and the type of goods or services provided. Ensure you apply the correct tax rate for each item, as this can differ depending on local regulations. Many businesses need to account for:

- Sales Tax – Applied on the sale of goods or certain services, this is the most common form of tax.

- Value-Added Tax (VAT) – Often used internationally, this tax applies at each stage of production and distribution.

- Service Tax – Some jurisdictions impose taxes on specific types of services, rather than physical goods.

Displaying Tax Information on the Document

Once the correct tax rate is applied, it’s important to clearly display this information in the document. Most financial documents include a section where tax is calculated separately from the main total, making it easy for clients to see how much tax they are being charged. You should include:

- Tax Rate – Specify the percentage or amount applied to the total cost of the items or services being billed.

- Tax Amount – Clearly show the total tax amount that has been added to the final sum.

- Final Total – Include a final total that accounts for both the item cost and the applicable tax, ensuring clarity about the full amount due.

By properly adding and displaying tax information, you help build trust with your clients and ensure that your business stays compliant with tax regulations. Always verify local tax laws to make sure you are charging the correct rates and following proper invoicing procedures.

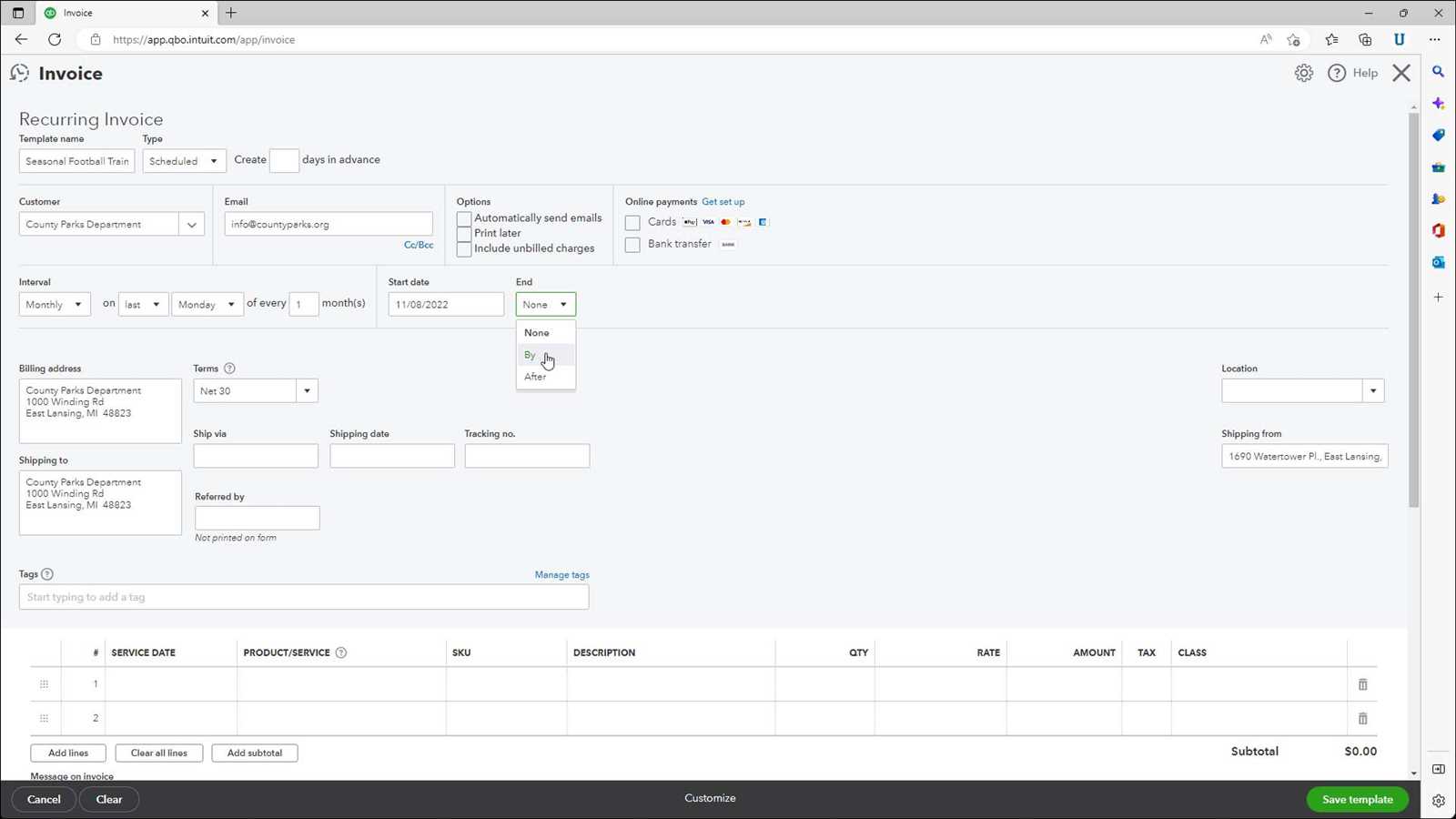

Setting Up Invoice Numbering and Dates

Properly organizing and assigning numbers and dates to your financial documents is crucial for maintaining accurate records and ensuring smooth business operations. A consistent numbering system helps track transactions, while clear date formatting provides transparency regarding deadlines and payment schedules. By setting up a logical structure for both, you ensure that your documentation is professional and easy to manage.

The two most important elements to configure are the numbering system and the dates. Here’s what to consider:

Establishing a Numbering System

A well-defined numbering structure makes it easier to reference and organize documents. It’s important to choose a format that works for your business and provides a clear trail for every transaction. Key points to keep in mind include:

- Sequential Numbering – Assign a unique number to each document, progressing in a consistent order. This prevents any duplicates and makes it easier to find past records.

- Custom Prefixes or Suffixes – You can add prefixes (such as “INV”) or suffixes (like year or client code) to make it easier to categorize and track your documents.

- Year or Period Codes – Some businesses prefer adding the year or a specific period code (e.g., “2024-001”) to track billing cycles or fiscal years more effectively.

Setting the Date Format

Choosing the right date format is essential to avoid confusion, especially if you work with international clients. Consider the following elements when adding dates to your documents:

- Issue Date – This is the date when the document is created. It should be cle

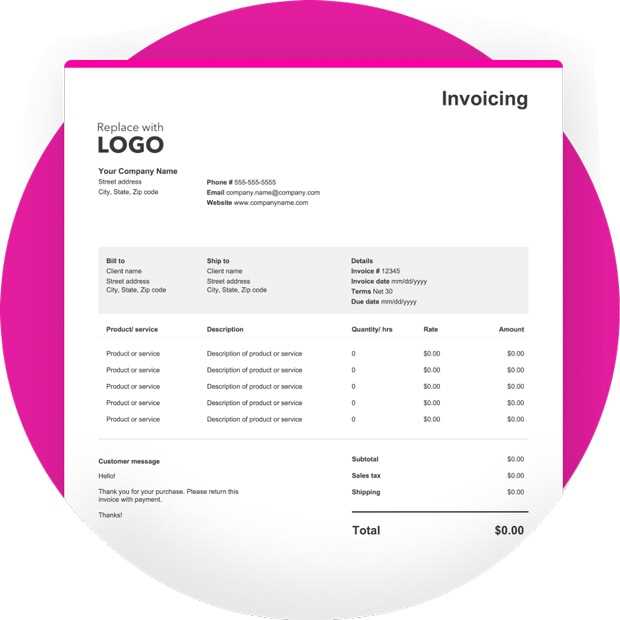

Previewing Your Customized Invoice Template

Once adjustments have been made to your billing layout, it’s crucial to assess how these modifications appear before finalizing. This step allows you to ensure that all elements are positioned correctly and that the overall aesthetic aligns with your expectations.

Steps to View Your Modified Layout

- Navigate to the section where your adjustments are saved.

- Select the option to view the design.

- Examine each component carefully, focusing on details such as logos, colors, and fonts.

- Look for any misalignments or areas that may require further refinement.

What to Look For During the Preview

- Consistency in branding elements.

- Clarity of information presented to clients.

- Proper placement of terms and conditions or additional notes.

- Overall visual appeal and professionalism.

This review process is essential for ensuring that the final output meets both your standards and those of your clients, leading to more effective communication and a polished presentation.

Saving and Naming Your New Template

Finalizing your design involves more than just ensuring that all elements are correctly placed. It’s equally important to securely store your layout with a recognizable identifier, allowing for easy retrieval in the future. A well-thought-out name can facilitate organization and quick access.

Steps for Properly Storing Your Design

- After making all desired changes, locate the save option within the interface.

- When prompted, input a descriptive title that reflects the purpose of your layout.

- Consider using keywords that will help you quickly identify the layout later on.

Best Practices for Naming

- Be Specific: Include details such as client type or project name to differentiate between various formats.

- Keep It Concise: Aim for brevity while still conveying the essence of the design.

- Use Version Control: If you anticipate making adjustments, consider adding version numbers to your names.

- Stay Consistent: Use a similar naming convention across all layouts for improved organization.

Following these steps will ensure that your customized format is not only saved successfully but also easily accessible whenever needed, streamlining your workflow and enhancing efficiency.

Applying the Template to New Invoices

Utilizing your customized layout for billing communications streamlines the process of generating financial documents. By applying the designed format, you ensure consistency in presentation and enhance professionalism in your interactions with clients.

Steps to Utilize Your Customized Format

- Begin by accessing the section where you can initiate a financial document.

- Locate the option to select a format from your saved designs.

- Choose the specific layout you wish to apply from the list.

- Verify that all relevant information is populated correctly within the chosen format.

Considerations When Applying the Format

- Ensure all client details are accurate and up-to-date.

- Review the document for any additional items or notes that may need inclusion.

- Confirm that the overall appearance matches your intended style before finalizing.

- Make any last-minute adjustments to enhance clarity or visual appeal.

By following these steps, you can effectively leverage your customized layout, facilitating efficient document generation while maintaining a cohesive brand image throughout your communications.

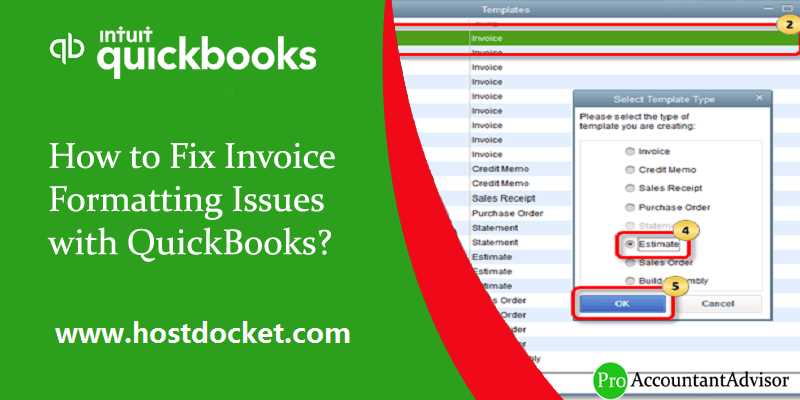

Editing Your Invoice Template Later

Making adjustments to your billing format is an important aspect of maintaining accuracy and relevance. Over time, you may find that certain elements require updates to better reflect your business needs or client expectations. Modifying your design allows for enhanced communication and professionalism.

Steps for Accessing and Modifying Your Design

- Navigate to the section where your saved layouts are stored.

- Select the specific format you wish to modify.

- Initiate the editing process by clicking on the appropriate option.

- Make the necessary adjustments, such as altering text, colors, or layout positions.

Important Considerations When Editing

- Review Previous Changes: Take note of any modifications made previously to ensure continuity.

- Test Functionality: After adjustments, preview the layout to verify that all elements function correctly.

- Solicit Feedback: Consider seeking input from colleagues or clients on the updated design.

- Keep a backup of the original layout in case you need to revert changes.

Regularly revisiting your design ensures that your financial documents remain effective tools for communication, reflecting both your brand identity and the evolving needs of your clientele.

Sharing and Printing Your Custom Invoices

Once you have finalized your personalized billing documents, the next step involves disseminating them effectively to your clients or stakeholders. Whether you choose to send these documents electronically or produce physical copies, ensuring that they are presented professionally is essential for maintaining a positive image.

Sharing Options

Utilizing digital methods to share your documents offers convenience and speed. Consider the following approaches:

- Send via email: Attach the file directly to an email message, ensuring that it is formatted correctly for easy viewing.

- Use cloud storage: Upload your document to a secure cloud service and share a link with clients for access.

- Direct access through a client portal: If available, provide clients with access to a secure online space where they can view and download their documents.

Printing Considerations

If you opt to produce physical copies, ensure that the quality of the print reflects the professionalism of your business. Here are some tips:

- Select quality paper: Use good-quality paper to give a more polished appearance.

- Check printer settings: Ensure that your printer settings are configured to produce high-quality prints.

- Review before printing: Always preview the document before printing to catch any errors or formatting issues.

Effectively sharing and printing your personalized billing documents not only enhances communication but also reinforces your brand’s commitment to quality and professionalism.