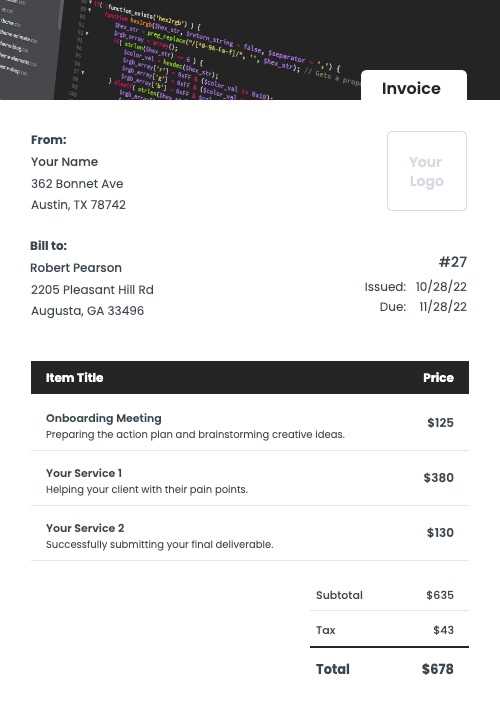

Personal Software Invoice Template for Efficient Billing

Managing financial transactions and ensuring clarity in billing is essential for any business or freelancer offering digital solutions. The right tools can help streamline this process, making it easier to present your charges in an organized and professional manner. Using the appropriate format not only improves communication with clients but also enhances the overall experience for both parties.

With a well-structured document, you can clearly outline the services rendered, payment details, and terms. Whether you’re a freelancer or a small business owner, having a reliable system in place will ensure that payments are processed smoothly and on time. The key is to use a consistent and polished approach that meets both your needs and those of your clients.

By designing your billing documents effectively, you can save time, avoid confusion, and build a reputation for professionalism. A well-crafted statement provides more than just a record of a transaction – it reinforces your brand’s commitment to quality and efficiency.

Personal Software Invoice Template Guide

Creating a billing document that accurately reflects the services provided and ensures clear communication with clients is essential for any business. A well-designed document helps clients understand the charges, payment terms, and overall expectations, reducing confusion and the potential for disputes. It also strengthens your professionalism and builds trust with your audience.

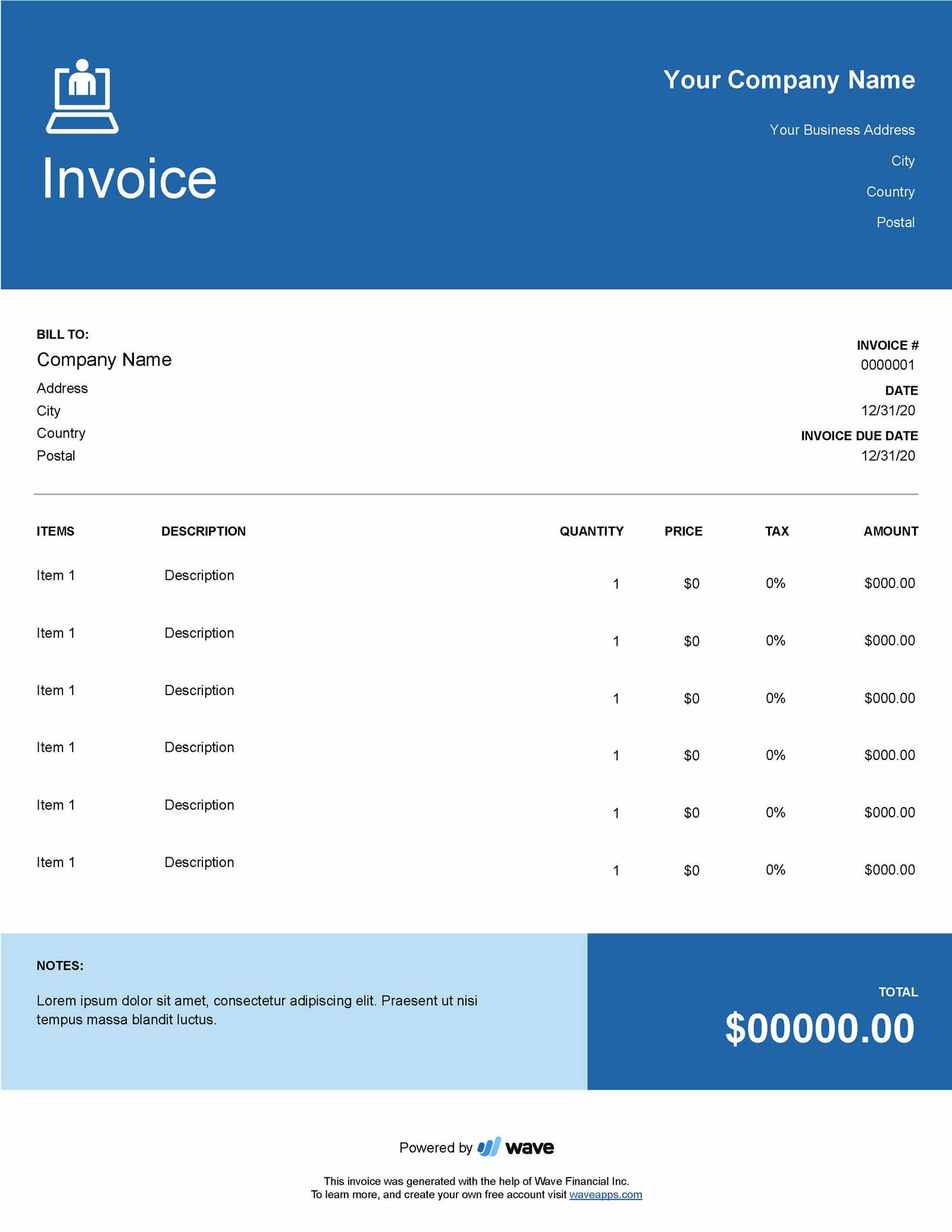

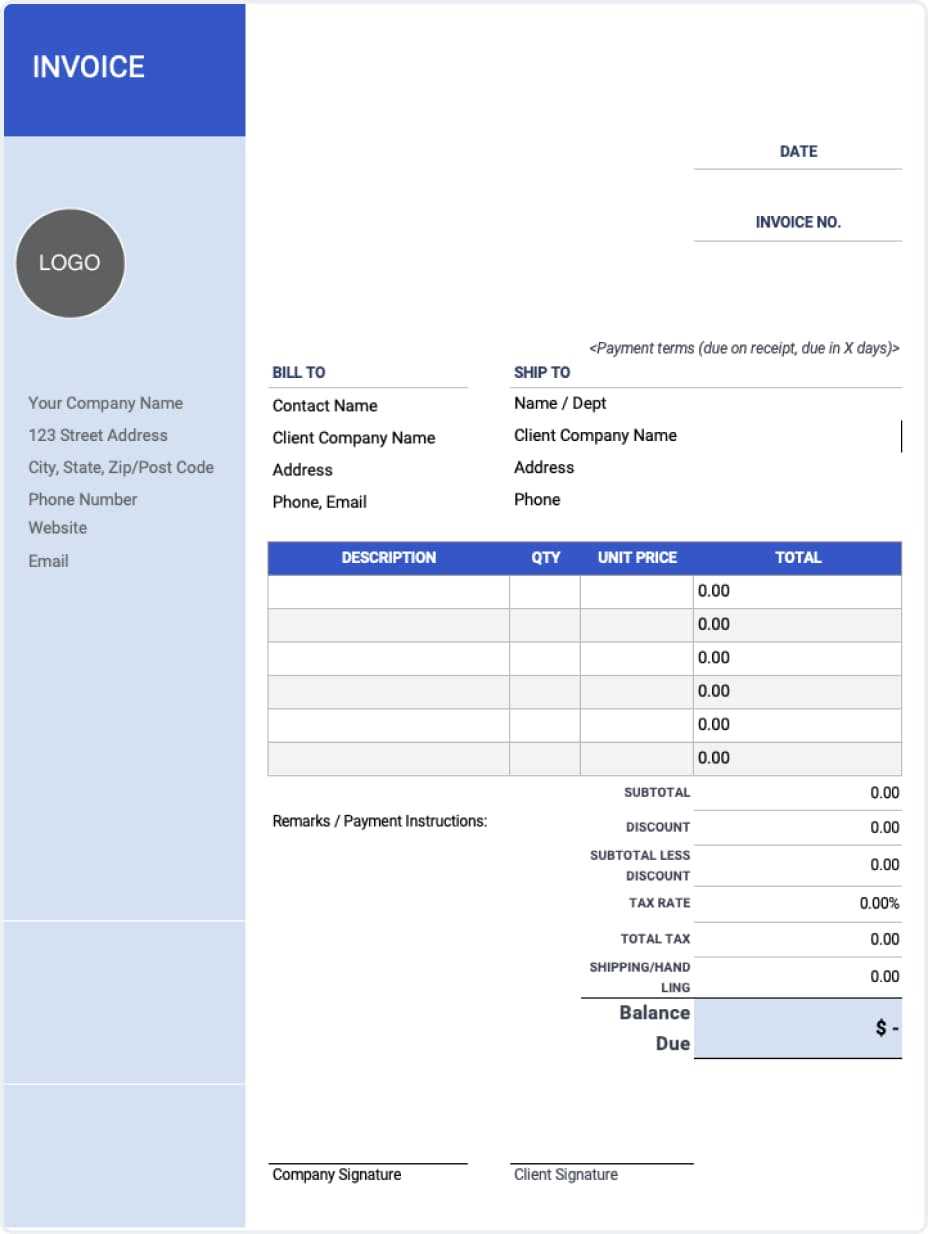

When designing your document, focus on the key elements that need to be included. These usually involve specifying the work done, the agreed-upon fees, and the payment methods. In addition, it is important to include relevant dates, any taxes or discounts applied, and instructions for submitting payments. By keeping everything organized, you ensure that your client knows exactly what is owed and how to proceed.

Customizing the structure of your document to match your specific needs will help you present your services in a clear, effective manner. Whether you are offering a one-time project or ongoing support, having a consistent format helps in managing client relationships and maintaining financial organization.

By following this guide, you will be equipped with the tools to create professional documents that meet both legal requirements and the expectations of your clients. A good billing system is a reflection of your business’s commitment to efficiency and transparency.

What is a Personal Software Invoice?

A billing document is a formal record used to request payment for services rendered. It includes detailed information about the work completed, the cost associated with that work, and payment instructions. This document serves as a clear agreement between the provider and the client, outlining the terms and ensuring both parties are on the same page regarding financial expectations.

For businesses and freelancers who provide digital services, a well-constructed document is crucial for maintaining professionalism and ensuring smooth transactions. The document should include key details such as the date of service, a description of the work, the rate charged, and any applicable taxes or discounts. By maintaining a consistent format, you make it easier for clients to understand and process payments efficiently.

| Element | Description |

|---|---|

| Service Description | A brief summary of the work performed or products delivered. |

| Amount Due | The total cost for the services rendered, including any taxes or fees. |

| Payment Terms | The expected timeline for payment and any specific payment methods accepted. |

| Invoice Number | A unique identifier for the billing document to assist with record-keeping. |

| Due Date | The date by which payment is expected to be made. |

These basic components help structure your document and ensure clarity, providing a clear path for payment and avoiding any misunderstandings between you and your clients.

Benefits of Using an Invoice Template

Having a pre-designed billing document simplifies the process of requesting payment and ensures consistency in your financial communications. By using a ready-made structure, you can save time, reduce errors, and ensure that every detail is accurately included. A well-organized document helps both you and your clients stay on the same page, improving efficiency and avoiding misunderstandings.

Time Savings and Efficiency

Creating a billing document from scratch every time can be time-consuming, especially if you are working with multiple clients or handling numerous projects. Using a pre-designed format allows you to quickly input the necessary information, leaving you with more time to focus on the core aspects of your business. This streamlined approach ensures that you can issue requests for payment faster, leading to a more efficient workflow.

Professionalism and Consistency

Utilizing a structured document ensures that every transaction is presented in a uniform manner. This not only improves your brand’s appearance but also builds trust with your clients. Consistency in your financial documents reinforces professionalism and shows that you take your business operations seriously. A clean and clear design allows your clients to easily understand the details of the transaction, reducing confusion and helping to ensure timely payments.

In summary, using a pre-designed billing structure provides practical advantages that can help streamline your business processes, saving you time and enhancing your professional image.

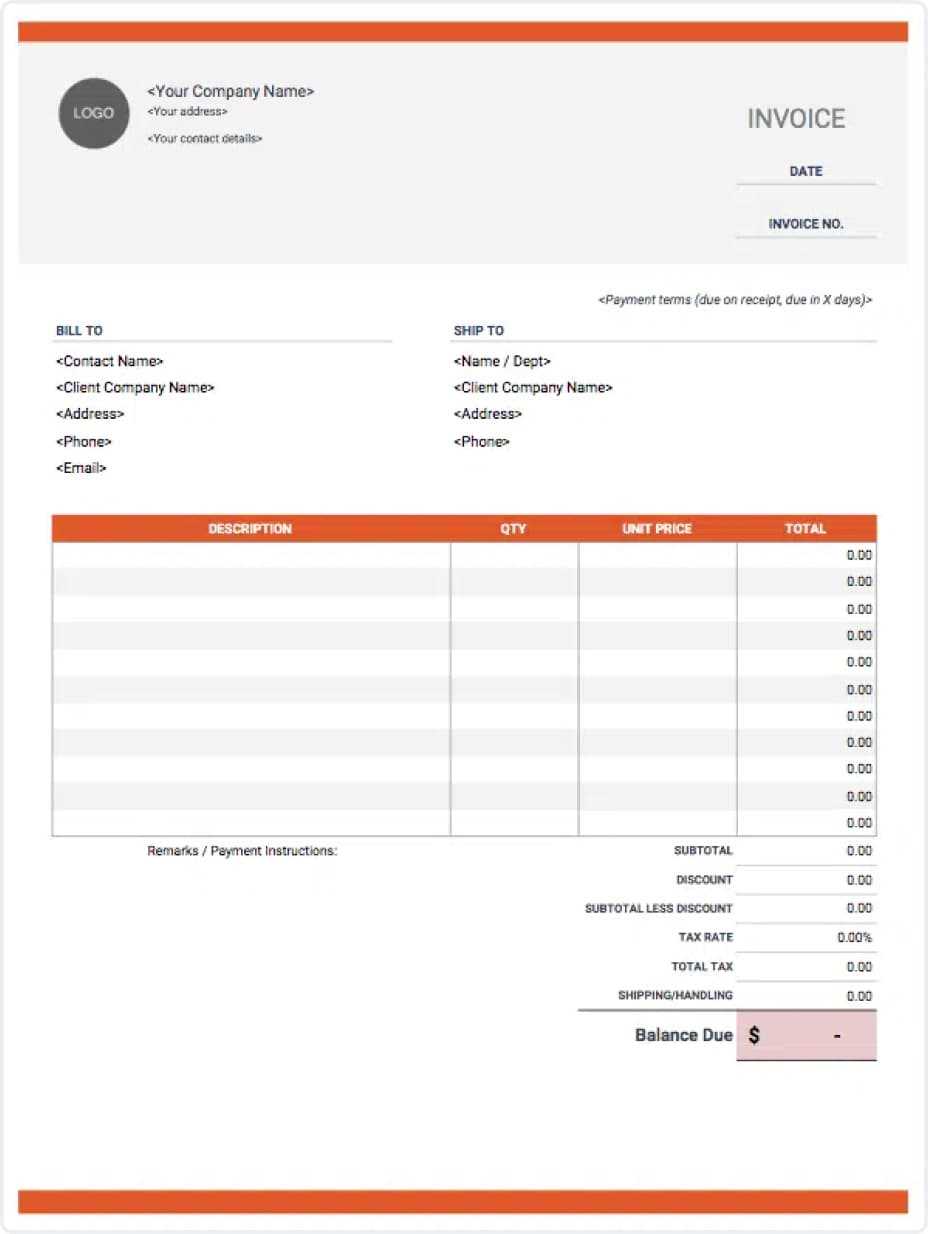

How to Customize Your Invoice Template

Customizing your billing document is an essential step in making it fit your business needs and brand identity. A personalized format not only helps ensure clarity but also allows you to reflect your unique business style. With the right adjustments, you can create a document that is both functional and professional, tailored to the specific services you offer and your client’s expectations.

Key Elements to Personalize

When customizing your billing document, there are several important elements to consider. These include your business logo, contact details, payment terms, and the format of the service descriptions. Ensuring these key areas are personalized allows you to present a cohesive and professional image to your clients. Here are some crucial areas to modify:

| Element | Customization Tips |

|---|---|

| Header Section | Include your logo, business name, and contact details to make it clear where the document is coming from. |

| Payment Terms | Set your payment expectations, such as due dates, accepted payment methods, and late fees if applicable. |

| Service Descriptions | Tailor the descriptions to reflect the nature of the work you performed, ensuring the client understands exactly what they are paying for. |

| Color Scheme | Use colors that match your brand to create a cohesive look, while ensuring readability. |

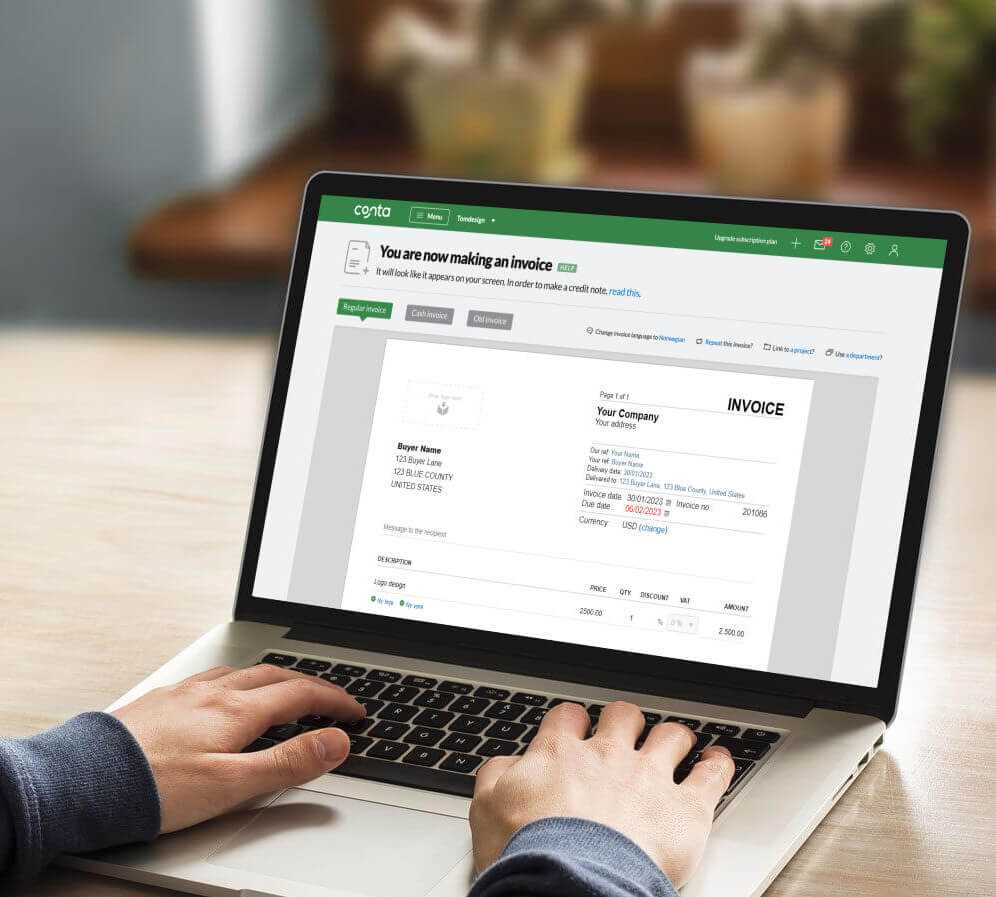

Using Software to Customize

If you’re not comfortable designing the document from scratch, consider using software or online tools that allow you to customize pre-designed formats. These platforms usually provide options to add your branding, adjust the layout, and ensure all necessary information is included. This approach offers an easy way to create professional documents quickly, even if you have little experience with design.

Ultimately, the key to effective customization is making sure the document reflects your business and simplifies communication with your clients. By following these steps, you can create a tailored billing system that promotes clarity and strengthens your brand’s presence.

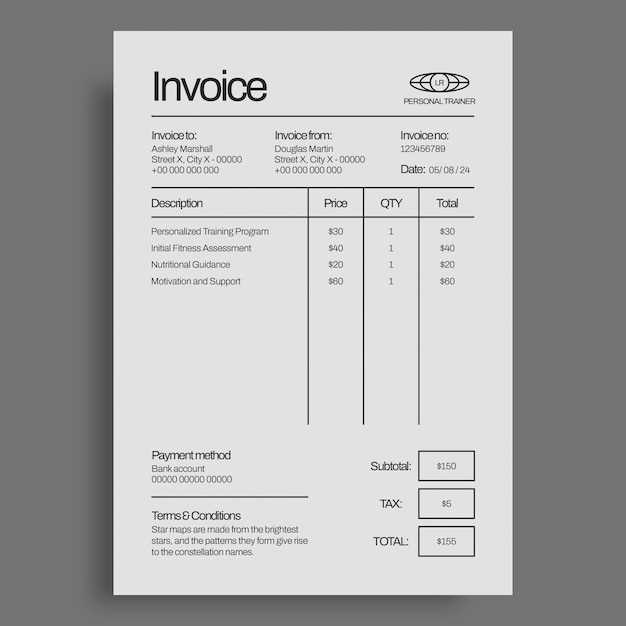

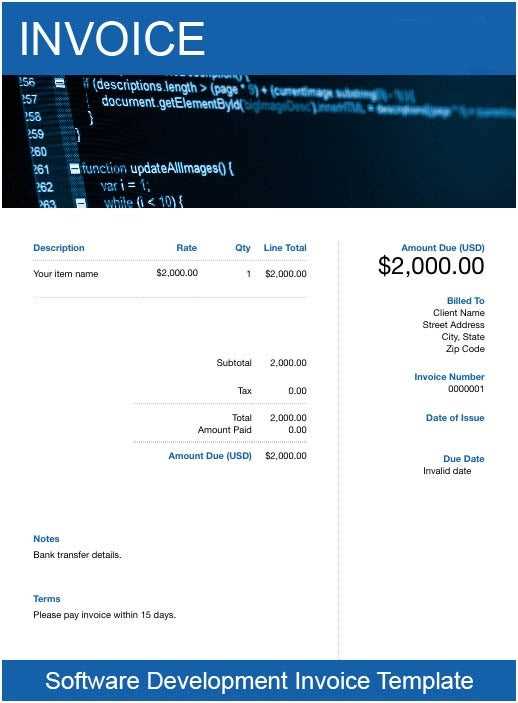

Essential Elements of a Software Invoice

When creating a billing document, it’s crucial to include specific information to ensure transparency and avoid any misunderstandings. A well-structured document not only facilitates smooth transactions but also helps maintain professional relationships with clients. By incorporating the right components, you provide all the necessary details for your client to understand the charges and payment expectations clearly.

Below are the key elements that should be included in every billing document:

| Element | Description |

|---|---|

| Business Information | Include your business name, logo, contact details, and any relevant registration numbers to establish your identity. |

| Client Information | Provide the client’s name, address, and contact details to ensure the document is directed to the correct recipient. |

| Service Description | Detail the work performed or product provided, including the quantity and type of service offered, so the client can easily understand what they are being charged for. |

| Cost Breakdown | Provide a clear breakdown of the costs, including any hourly rates, flat fees, taxes, and discounts to ensure transparency. |

| Payment Terms | Clearly specify payment due dates, methods of payment accepted, and any penalties or interest for late payments. |

| Invoice Number | A unique identifier for tracking and referencing the billing document. |

| Issue and Due Date | Include the date the document is issued and the due date for payment to set clear expectations. |

Including all these elements in your document will not only help ensure smooth and timely payments but also reinforce your professionalism. A clear and detailed statement is key to maintaining healthy client relationships and keeping your financial transactions organized.

Common Mistakes to Avoid in Invoices

Even small mistakes in your billing document can lead to confusion, delays in payment, and potential misunderstandings with clients. Ensuring that your document is accurate and complete is essential to maintaining professionalism and facilitating smooth transactions. By being aware of common pitfalls, you can avoid these issues and create more effective, error-free documents.

1. Missing or Incorrect Contact Information

One of the most common mistakes is leaving out important contact details or providing incorrect information. Ensure that both your and your client’s contact information is clearly stated and up-to-date. This includes your business name, address, phone number, and email address. If any of this information is missing or incorrect, it can cause delays in communication and payment.

2. Failing to Include Clear Payment Terms

Without specifying clear payment terms, such as the due date, accepted payment methods, and any late fees, your client may not know exactly when and how to pay. This can lead to confusion and missed payments. Always include specific payment instructions to avoid unnecessary delays. If payment is due immediately or within a certain period, clearly state this so there are no ambiguities.

Other common errors include failing to provide a unique document number, not breaking down charges in a clear way, and neglecting to list tax rates or additional fees. Even seemingly minor oversights can affect your business operations, so taking the time to double-check your work is crucial.

By avoiding these common mistakes, you can ensure that your financial transactions are processed smoothly and on time, helping to strengthen client trust and enhance your business reputation.

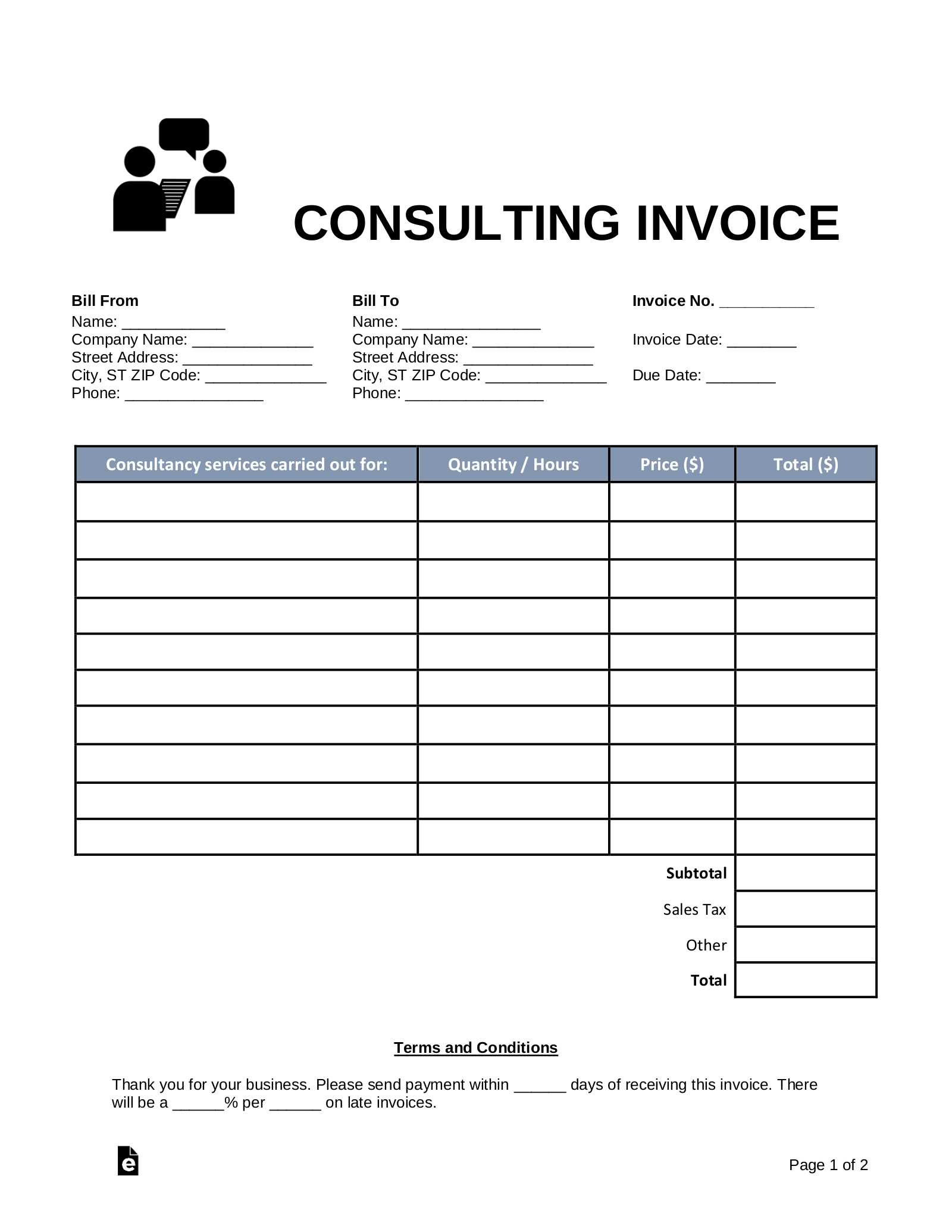

How to Create a Professional Software Invoice

Creating a polished and professional billing document is crucial for maintaining a positive relationship with clients and ensuring timely payments. A well-designed document not only reflects your business’s professionalism but also ensures that all important details are clearly presented. To achieve this, it’s essential to follow a few key steps and guidelines that help you craft an effective and accurate record of services provided.

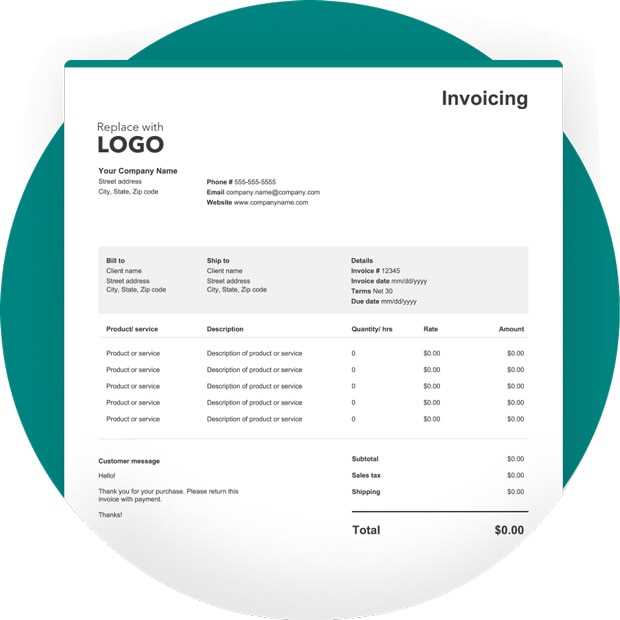

The first step in creating a professional document is to choose the right layout. A clean, easy-to-read structure with clear headings and sections helps ensure that all critical information is easily accessible. Begin with your business’s contact details at the top, followed by the client’s information, the description of the work completed, and the total amount due. Providing a breakdown of services and costs adds transparency, which builds trust with your clients.

Key Elements to Include

A professional document should always contain certain key details. These include:

| Element | Description |

|---|---|

| Business Details | Clearly list your name, logo, contact information, and any relevant registration numbers. |

| Client Details | Ensure the client’s name, address, and contact information are accurate and up to date. |

| Work Description | Provide a concise summary of the work completed, including any necessary details to avoid confusion. |

| Cost Breakdown | List the charges for services rendered, including any taxes, fees, and discounts applied. |

| Payment Instructions | Specify the payment methods accepted, due date, and any penalties for late payments. |

Design Tips for a Professional Appearance

In addition to including the necessary information, the design of the document plays a key role in its professionalism. Use a simple, clear layout with appropriate fonts, colors, and spacing. Make sure that your business’s logo and branding elements are placed strategically to reinforce your brand identity. Also, ensure that the document is free from any typographical or formatting errors, as these can undermine your credibility.

By following these steps, you will create a clear, professional document that not only ensures a smooth billing process but also helps you establish credibility and trust with your clients.

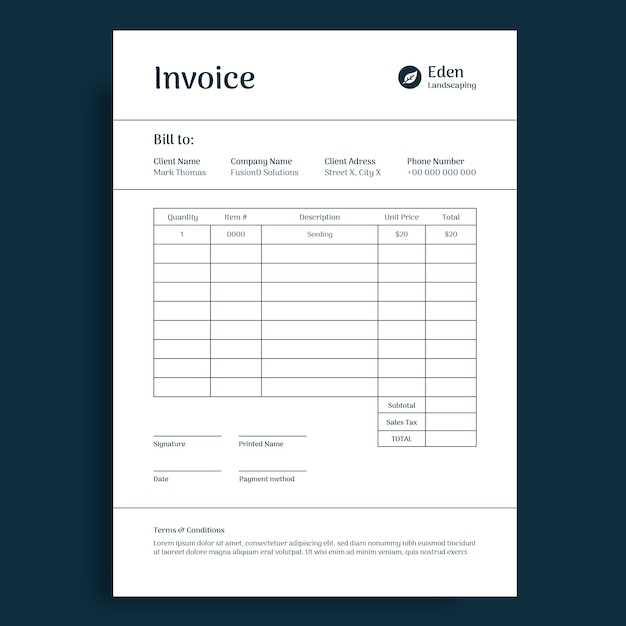

Choosing the Right Invoice Format

Selecting the appropriate structure for your billing document is essential for ensuring clarity and efficiency in your financial transactions. The right format will allow both you and your clients to quickly understand the details of the payment, including services rendered, amounts due, and payment terms. A well-organized document reduces errors, speeds up the payment process, and enhances your business’s professionalism.

When choosing a format, consider factors such as the complexity of the services provided, the nature of your business, and the preferences of your clients. Whether you’re a freelancer working with individuals or a business providing services to other companies, your document should be clear, easy to read, and tailored to your specific needs. There are several formats available, each with its own strengths and applications.

Common Formats to Consider

There are different styles you can use for your billing document depending on your needs. The most common formats include:

| Format Type | Best For |

|---|---|

| Basic Layout | Freelancers or small businesses offering simple, one-time services. |

| Detailed Breakdown | Companies or individuals providing complex services or multiple items, requiring a clear breakdown of costs. |

| Recurring Format | Businesses with ongoing contracts or subscription-based services. |

| Professional Design | Large businesses or those looking to impress clients with a branded, polished document. |

Choosing the Best Fit for Your Needs

It’s important to select a format that matches the way you do business. If your services are straightforward and involve one-time payments, a simple layout may be sufficient. However, if your work is more complex or ongoing, you might opt for a format that allows for detailed itemization or recurring payment schedules. The goal is to create a structure that makes it easy for both you and your clients to track the transaction details and manage payments.

Ultimately, the right format will ensure that your financial documents are clear, professional, and easy to process, benefiting both you and your clients in the long run.

Free vs Paid Invoice Templates

When it comes to creating billing documents, choosing between free and paid formats is an important decision that can affect both the efficiency and professionalism of your financial transactions. Each option has its own set of advantages and limitations, depending on your specific needs and the scale of your business. Understanding the differences between these choices can help you select the best solution for managing your billing process.

Free billing formats are widely available and often come with basic features, making them an excellent option for small businesses, freelancers, or anyone just starting out. However, while free formats can be a good starting point, they may lack advanced features or customization options. Paid solutions, on the other hand, generally offer more professional designs, customizable options, and additional features that can streamline your financial processes and help present a more polished image to clients.

Advantages of Free Formats

Free formats are ideal for individuals or businesses that need a quick and simple solution without the need for customization. They usually come in basic designs with the essential components included, such as service descriptions, amounts due, and payment terms. These options are great for those who want to create and send billing documents without a significant upfront investment. Additionally, many free formats are available online or as downloadable files, which makes them easily accessible.

Benefits of Paid Options

Paid solutions often provide a more professional appearance, with customizable features that allow you to adjust the layout, branding, and structure of your documents. These options might include advanced functionalities like automated billing, recurring payment scheduling, or integration with accounting software, saving you time and reducing the risk of errors. Moreover, paid formats typically offer better customer support, ensuring that you have help when you need it.

In summary, the choice between free and paid formats depends largely on the complexity of your billing needs. If you’re just starting out or have basic requirements, a free format may suffice. However, if you’re looking for more customization, advanced features, or want to ensure your business is presented professionally, investing in a paid solution can be a worthwhile choice.

How to Add Payment Terms to Your Invoice

Clear payment terms are essential for ensuring that both parties are on the same page regarding the financial expectations of a transaction. By outlining when and how payments are expected, you avoid misunderstandings and ensure a smoother process. Whether you are providing a one-time service or establishing an ongoing contract, including precise payment details helps build trust and professionalism.

Payment terms typically include the due date, acceptable payment methods, any late fees, and conditions for early payment discounts. By specifying these details in your billing document, you set clear expectations for your clients and reduce the chances of late payments. Here’s how to effectively add payment terms to your document:

Include the Due Date and Payment Methods

The most important aspect of payment terms is specifying when the payment is due. You can either set a specific date (e.g., “Due by November 15th”) or a timeframe after the service is completed (e.g., “Due within 30 days of service date”). Additionally, list the acceptable methods of payment, whether it’s bank transfer, credit card, PayPal, or another method. Clear instructions on how to pay ensure that clients don’t face any confusion during the transaction process.

Specify Late Fees or Penalties

If you charge late fees, make sure these are outlined in your billing document as well. For example, you can state something like “A 5% late fee will be applied for every week payment is delayed beyond the due date.” This encourages clients to pay on time and helps you manage cash flow. Similarly, you might offer discounts for early payment, which can motivate clients to settle their balance ahead of schedule.

Remember to clearly state all these terms in your document. Providing comprehensive and well-defined payment conditions not only protects your business but also helps foster positive, transparent relationships with clients.

Why Software Invoices Matter for Freelancers

For freelancers, having a structured billing system is essential for maintaining professional relationships and ensuring timely payment. A clear and detailed document helps set expectations with clients, making it easier to track payments, avoid misunderstandings, and stay organized. Whether you’re working on a one-time project or an ongoing contract, a well-crafted document serves as both a record of the transaction and a tool for smooth financial management.

Freelancers often juggle multiple clients and projects simultaneously, which makes it even more critical to have an efficient way to request payment. A clear billing statement reduces the chances of confusion, ensures that no important details are overlooked, and helps you get paid faster. In this section, we’ll explore why having a solid system for requesting payment is especially important for freelancers.

Clarity and Transparency for Clients

For freelancers, maintaining clarity and transparency is key to building trust with clients. When you provide a detailed document that clearly outlines the services rendered, the amount due, and payment terms, clients are more likely to view you as professional and organized. This can help foster a good working relationship and reduce the likelihood of payment disputes or delays.

Efficient Record-Keeping and Tax Preparation

For tax purposes and financial management, freelancers must keep accurate records of all transactions. A properly structured document provides a comprehensive record of your work and income, making it easier to track payments and prepare for tax season. With a reliable system in place, you can avoid stress and ensure that you have all the necessary documentation when it’s time to file your taxes.

In summary, clear billing documents are an essential tool for freelancers. They not only ensure that you are paid on time but also help streamline your business operations, build trust with clients, and maintain accurate financial records.

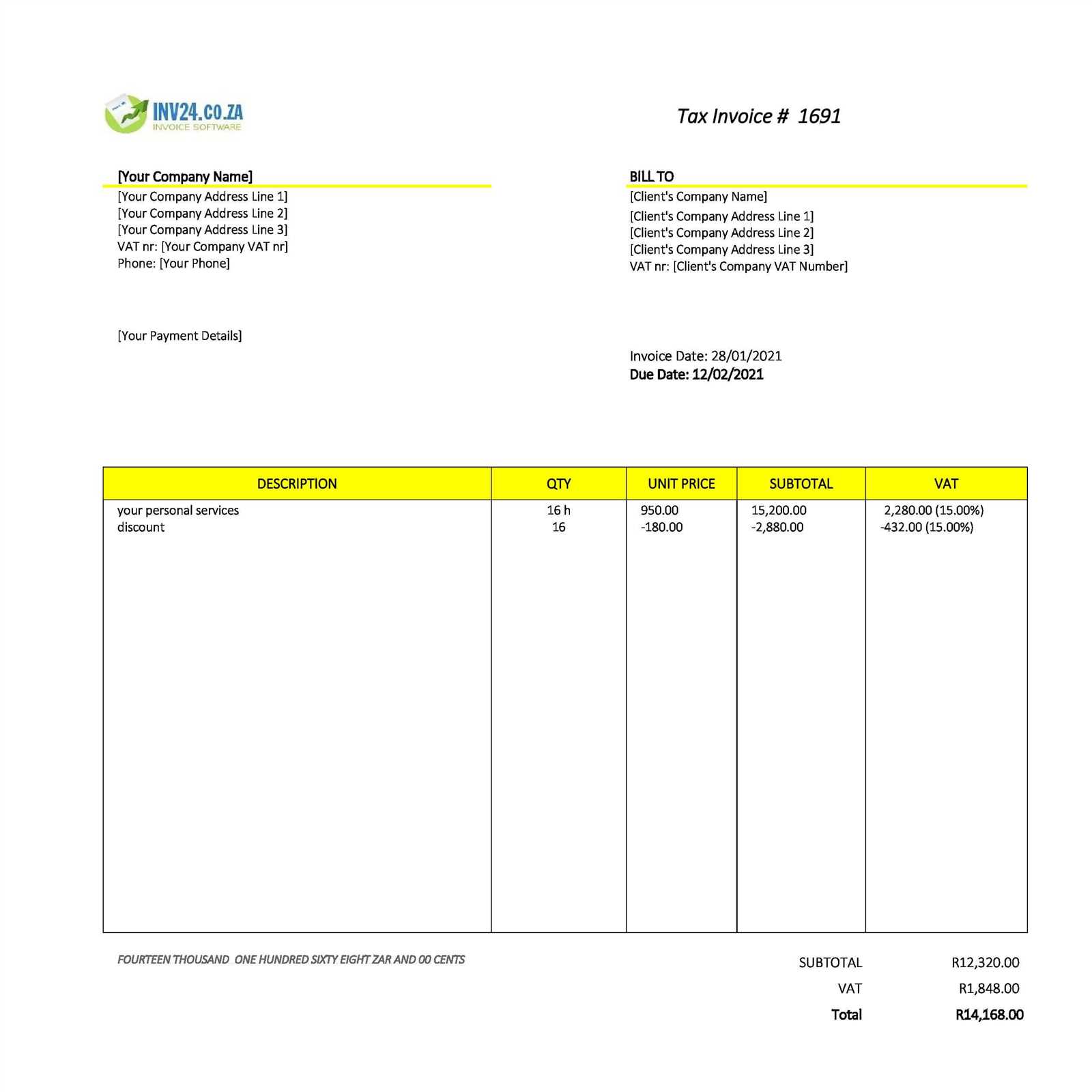

How to Handle Taxes in Billing Documents

When creating billing records, it’s crucial to account for taxes to ensure compliance with local regulations and avoid any potential legal issues. Taxes can vary depending on the type of service or product provided, your location, and your client’s location. Properly including tax information in your billing documents helps both you and your clients understand the total amount due and prevents confusion regarding payment expectations.

To manage taxes effectively, first, make sure you understand the tax rates that apply to your services or products. This can include sales tax, value-added tax (VAT), or other region-specific taxes. Once you have the correct tax rates, you’ll need to clearly indicate them on your billing record, showing the amount charged and the total after taxes. Transparency in this area helps build trust and ensures that your clients know exactly what they’re paying for.

Including Taxes in Your Billing Record

When adding taxes to your billing document, follow these steps:

- Specify the tax rate: Clearly list the percentage of tax being applied to the total amount.

- Itemize the tax: If possible, break down the tax separately from the base cost to provide more clarity.

- Include a tax identification number: For businesses subject to VAT or other taxes, include your tax ID number to ensure legitimacy and transparency.

- Adjust the total amount: After calculating the tax, ensure that the final total on your document reflects the base cost plus the applicable tax.

Different Tax Rates for Different Locations

If you are dealing with clients in different regions or countries, it’s essential to be aware of varying tax rates. In some cases, certain services may be exempt from taxes, or the rates may differ based on the client’s location. Ensure that your document reflects these variations and consider consulting with a tax professional if you are unsure about the applicable rates.

By accurately handling taxes in your billing records, you protect your business from potential tax issues, ensure your clients are well-informed, and maintain a professional approach to financial transactions.

Best Practices for Numbering Billing Documents

Effective numbering of your billing documents is key to maintaining organized records and ensuring smooth business operations. A clear, consistent numbering system helps both you and your clients keep track of transactions, avoid confusion, and simplify financial reporting. Additionally, it plays an important role in compliance, especially when managing taxes or dealing with audits.

A well-structured numbering system ensures that each document can be easily identified and referenced. By following best practices for numbering, you not only improve your internal organization but also present a more professional image to clients. Here are some key guidelines for setting up an efficient and reliable numbering system for your billing documents.

1. Use a Sequential Numbering System

One of the most important aspects of numbering your documents is to ensure that they follow a sequential order. This makes it easy to track the progression of transactions and helps you avoid duplication. Starting with a simple numbering system (e.g., 001, 002, 003) ensures that each document is unique and can be easily referenced in the future. For larger businesses, adding year identifiers (e.g., 2024-001, 2024-002) can help distinguish documents from different periods.

2. Include Year or Month in the Numbering

Incorporating the year or month into your numbering system adds an additional layer of organization, especially if you handle a large volume of transactions. For example, if you are issuing multiple documents each month, using a format like “2024-01-001” or “01-2024-001” makes it easier to identify when the document was created. This also simplifies searching for past records, particularly when working with clients over long periods.

3. Avoid Skipping Numbers

It’s important to avoid skipping numbers in your system. Skipped numbers can lead to confusion, especially if your records are audited or referenced at a later time. If you accidentally skip a number, make a note of it in your records to ensure everything remains in chronological order.

By adhering to these best practices, you will create a reliable and organized system for numbering your billing documents. This will not only improve the efficiency of your business operations but also help establish credibility and professionalism with clients.

What to Include in a Service Description

A clear and detailed service description is essential for ensuring both you and your clients are aligned on the expectations of a project or transaction. It helps avoid misunderstandings by specifying exactly what work is being performed, the scope of services, and any relevant details. Including a comprehensive service description in your billing record or agreement not only improves transparency but also reinforces professionalism.

When creating a service description, it’s important to be specific and concise, outlining the key aspects of the work performed. Here are the key elements you should include to create a thorough service description:

Key Elements to Include

- Service Overview: Provide a brief summary of the service or work provided. This should give the client a clear understanding of what they are paying for.

- Details of Work: Break down the specific tasks or activities performed. Be as detailed as possible, listing individual components or milestones.

- Timeframe: Include any deadlines or time periods during which the work was completed. If relevant, mention any stages or phases of the project.

- P

Legal Considerations for Billing Documents

When creating billing documents, it is essential to ensure that they are legally compliant and protect both parties involved in the transaction. A well-structured document does more than just request payment; it serves as a legal record that outlines the terms of the agreement, protects your rights, and minimizes potential disputes. Understanding the key legal elements of a billing document can help safeguard your business and ensure that you adhere to relevant regulations.

There are several important legal considerations to keep in mind when drafting billing records. These include clear payment terms, correct tax applications, and accurate documentation of services rendered. Below are some key legal aspects to consider when creating and managing your billing documents:

1. Clear Payment Terms

One of the most important legal aspects of any billing record is the inclusion of clear and concise payment terms. These terms should outline the due date for payment, accepted payment methods, and any penalties or fees for late payments. For example, you may specify that a payment is due within 30 days of the service date or that a late fee of 5% per month will apply for overdue balances. Defining these terms protects your rights and ensures that the client knows what is expected of them.

2. Tax Compliance

Depending on your location and the nature of the services or goods you provide, you may be required to collect taxes on your transactions. Make sure to include any applicable tax rates, such as sales tax or value-added tax (VAT), in your billing document. Failing to include the proper tax information can result in legal penalties, so it’s crucial to stay informed about your local tax laws and apply them correctly. Additionally, always ensure that your tax identification number is included if required by law.

3. Service Description and Documentation

Accurate documentation of the services provided is essential for legal protection. A well-detailed description of the work, including the scope, timeline, and agreed-upon terms, helps to prevent disputes or misunderstandings. In the event of a conflict, having clear records of the services performed can serve as evidence to support your claims. Ensure that both parties agree on the details before finalizing the billing document.

4. Retaining Records for Legal Protection

It is important to retain copies of all billing documents for legal purposes, especially if you need to refer back to them in the event of a dispute. Keeping organized records can also be helpful during audits or tax filings. Ensure that all documents are stored securely and are easily accessible when needed.

In summary, understanding the legal aspects of your billing records is vital for ensuring compliance and protecting your business. By clearly outlining payment terms, applying taxes correctly, documenting services in detail, and retaining copies of your records, you reduce the risk of legal issues and enhance the professionalism of your business practices.

How to Track Payments with Billing Documents

Keeping track of payments is crucial for managing your finances and ensuring that you are paid promptly for your work. A well-organized system for monitoring payments helps you stay on top of outstanding amounts and provides clarity in case any issues arise. By using a clear, consistent system, you can easily track which clients have paid, which payments are overdue, and what the current status of each transaction is.

There are several effective ways to monitor payments through your billing records. Below are some key practices for tracking payments and ensuring that you maintain control over your financial transactions:

1. Assign Unique Identification Numbers

Each billing document should have a unique identifier, typically a number, that allows you to easily reference and track payments. When you assign a number to each document, it becomes easier to locate specific transactions, especially if you deal with multiple clients. This unique number should be recorded and referenced when checking payment status.

2. Use Payment Status Indicators

Tracking the status of each transaction is essential. Consider adding a column or section to your records that clearly marks the status of each payment, such as:

- Paid: Indicating that the full payment has been received.

- Pending: When the payment is expected, but has not yet been made.

- Overdue: For payments that have not been made within the agreed-upon timeframe.

- Partially Paid: When only a portion of the payment has been made.

By tracking the payment status, you can easily determine which clients require follow-up and which payments are still outstanding.

3. Set Up Payment Reminders

To ensure that you do not miss any follow-ups, set up automated reminders for overdue or pending payments. Many accounting tools and software can automatically send reminders to clients when their payment is approaching or has passed the due date. This proactive approach reduces the chances of delayed payments and helps maintain a steady cash flow.

4. Maintain Detailed Payment Records

Every time a payment is made, update your records immediately. Include the payment date, the amount paid, the method of payment (e.g., credit card, bank transfer), and any relevant notes (such as partial payments or adjustments). This detailed record-keeping allows you to track payment history for each client and helps when reconciling your accounts or preparing for taxes.

5. Use Accounting Software for Easier Tracking

Accounting software can simplify the payment tracking process by automating many of the tasks involved, such as generating reports,

How to Automate Your Billing Process

Automating your billing process can save you significant time and reduce errors, allowing you to focus more on delivering value to your clients rather than managing administrative tasks. With the right tools and systems in place, you can streamline your entire billing workflow–from generating documents to sending reminders and tracking payments. Automation not only improves efficiency but also ensures consistency and professionalism in your transactions.

Here are some practical steps you can take to automate your billing process and enhance the overall experience for both you and your clients:

1. Choose the Right Automation Tools

To start automating your billing process, you need to choose the right software or platform. There are various tools available that can automatically generate and send billing documents based on pre-defined settings. Look for features such as:

- Customizable templates for generating documents

- Automated payment reminders

- Payment tracking and reporting

- Integration with payment gateways

Popular platforms like QuickBooks, FreshBooks, and Xero offer automation features that simplify the entire process, reducing the need for manual input and making it easier to stay organized.

2. Set Up Recurring Billing

If you offer subscription-based services or regularly bill clients for ongoing projects, setting up recurring billing is a key automation feature. You can set the frequency (e.g., weekly, monthly, or annually) and have the system automatically generate and send invoices on the specified dates. This eliminates the need to manually create and send each billing document, ensuring that payments are requested on time and consistently.

3. Automate Payment Reminders

Another key benefit of automation is the ability to send payment reminders automatically. Many billing platforms allow you to schedule reminders for upcoming payments or overdue balances. This feature ensures that clients are reminded to pay on time without you having to follow up manually. You can set reminders for a few days before the due date and additional follow-ups if the payment is delayed.

4. Streamline Payment Collection

Integrating payment gateways with your billing system is an effective way to streamline payment collection. By allowing clients to pay directly through the billing document–via credit card, bank transfer, or other online methods–you reduce friction in the payment process. Most invoicing platforms integrate with popular payment processors like PayPal, Stripe, or Square, making it easy for clients to pay instantly and for you to track payments in real time.

5. Monitor and Report Payments Automatically

Automated systems can also help you monitor and track payments in real time. Many tools provide detailed reports on payments received, outstanding balances, and client histories. This makes it easy to keep track of your financial status without manually updating records. You can set up automatic reporting t