Easy to Use Invoice Fill In Template for Your Business

Organizing business finances and ensuring timely payments are essential tasks for any company. Having a ready-made form to handle billing needs can greatly simplify the process, making it easier to maintain professional standards and accuracy. This approach not only saves time but also helps build trust with clients by providing clear, organized documentation.

There are many formats available to suit various business requirements, and choosing one that fits the specific needs of your company can make a significant difference. Whether you manage small transactions or complex projects, an adaptable format helps streamline the entire process from initial setup to final delivery.

In this guide, you’ll learn how to create a simple yet effective billing form that supports transparency, speeds up the workflow, and helps manage client relations more smoothly. Explore best practices, customization options, and the essential elements that will make your billing documents both professional and easy to understand.

Invoice Fill In Template Guide

Creating a structured document for tracking transactions is essential for any business. This guide provides a comprehensive look at how to organize information for billing in a way that ensures clarity and consistency, benefiting both service providers and clients. With an effective format, your company can maintain professionalism, avoid common errors, and streamline the billing process.

First, it’s important to understand the core components that make these documents functional and clear. Each part has a specific role, from client details to payment terms, and they collectively ensure smooth communication. This structure allows you to avoid misunderstandings, establish clear payment expectations, and enhance your company’s credibility.

Furthermore, adapting this approach can save time and minimize administrative work. By using a well-organized format, you’ll quickly find and record transaction details as needed, making document management easier. This guide will walk you through setting up a form that serves

Understanding the Basics of Invoice Templates

For any business, having a reliable method for tracking payments and services is essential. A structured document designed for billing helps organize critical details, providing clarity to both the service provider and the client. Knowing what elements to include and why they matter ensures that each transaction is recorded accurately and professionally.

At the core of these documents are essential fields that capture the transaction details, client information, and payment terms. Each section serves a purpose, from identifying the parties involved to outlining the scope of services and the associated costs. When organized correctly, this setup not only makes transactions straightforward but also builds trust through transparency.

Additionally, understanding these foundational aspects can simplify future modifications or customizations. Whether you’re creating one for a new project or updating an existing format, grasping these basics allows you to adapt efficiently, ensuring the form continues to meet the evolving needs of your business.

Why Use an Invoice Template for Billing

Having a standardized form for documenting services and payments can greatly enhance the efficiency and accuracy of business transactions. This approach simplifies billing, helping businesses stay organized and professional while maintaining clear communication with clients.

Here are some key benefits of using a structured format for billing:

- Consistency: A pre-designed layout ensures that every document includes the necessary details, reducing the risk of missing information and making it easier to review past transactions.

- Time Efficiency: Reusing a ready-made format speeds up the process, allowing you to focus on other tasks without recreating a new document each time a service is provided.

- Improved Accuracy: By following a set structure, you minimize errors and maintain clarity, which can prevent misunderstandings and disputes.

- Key Elements to Include in Invoices

For a well-structured billing document, certain core details are essential to ensure clarity and professionalism. Including these fundamental components helps to communicate information effectively and provides clients with a clear understanding of services rendered, due amounts, and payment terms.

Basic Information for Identification

At the top, include the business’s and client’s contact information. This typically consists of names, addresses, phone numbers, and emails, allowing both parties to identify each other easily. Adding a unique reference number for each document also helps with future tracking and reference.

Detailed List of Services or Products

Outline the specific services or items provided, along with a description of each. For every entry, include the quantity, rate, and subtotal. This level of detail ensures transparency, giving clients a complete breakdown of costs and helping them understand the charges.

Additional sections to consider include:

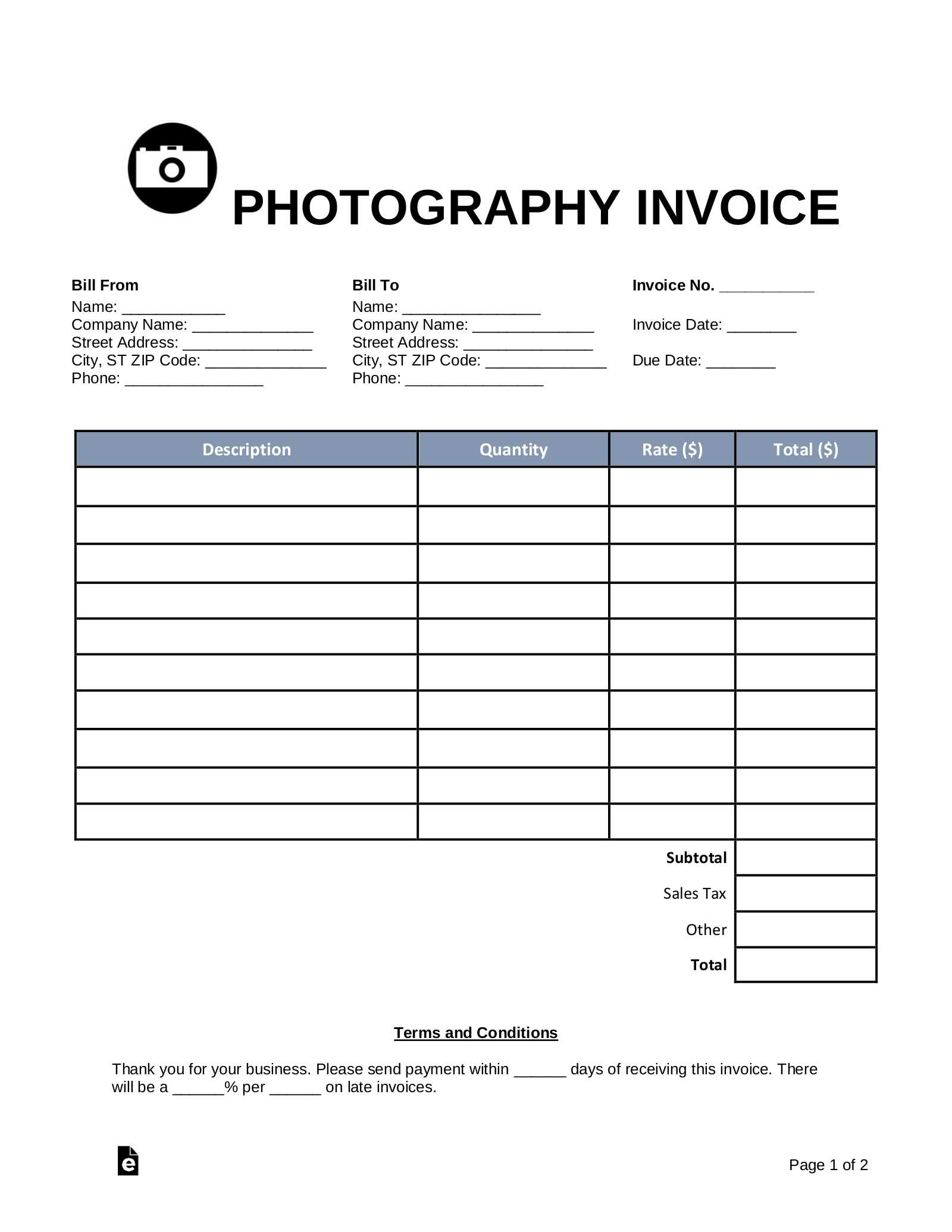

- How to Customize an Invoice Template

Adapting a standard billing form to fit your business’s specific needs can enhance both its effectiveness and its professional appearance. Customization allows you to tailor the document’s design, structure, and content to better align with your brand and the expectations of your clients.

Adjusting Visual Layout

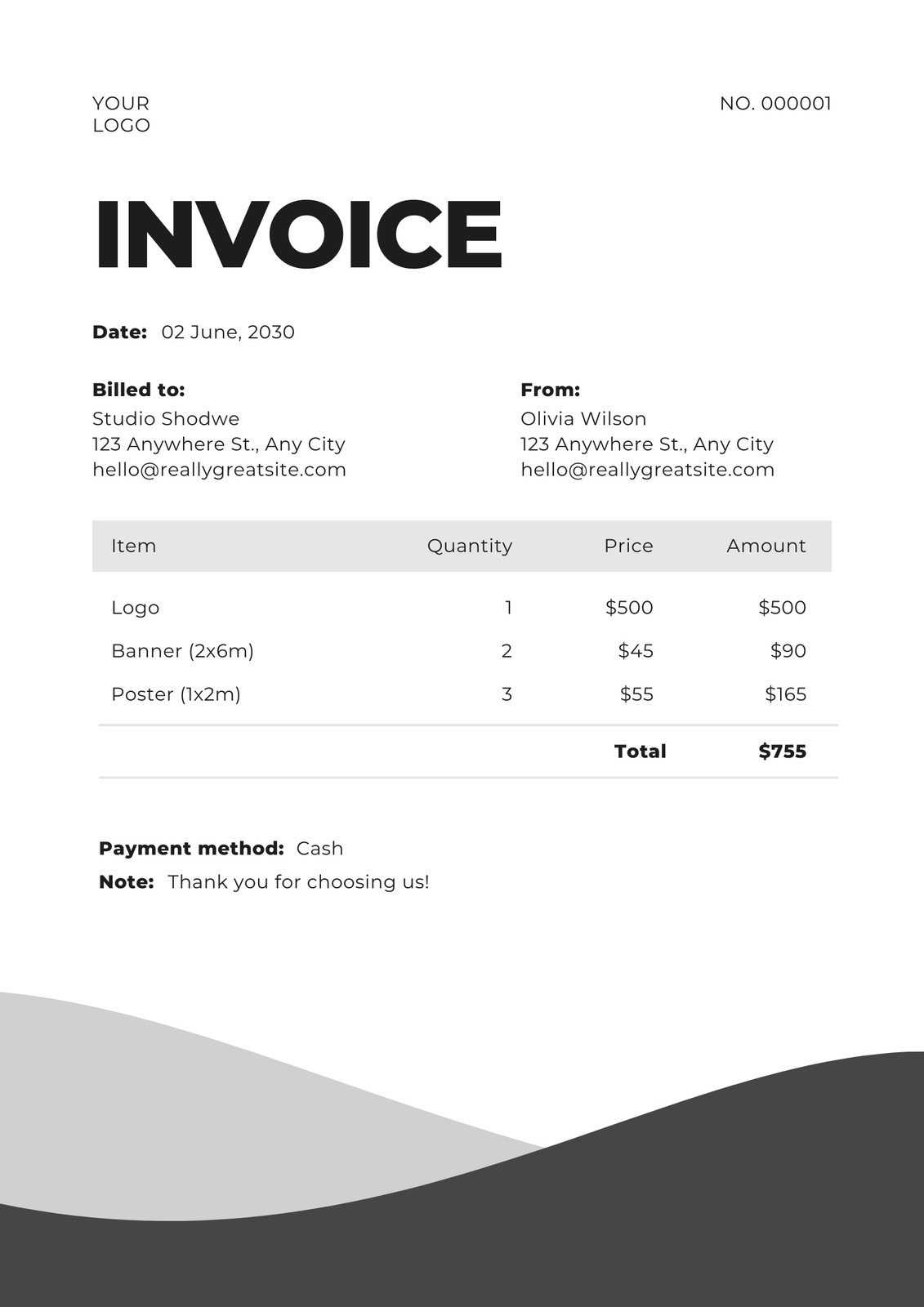

One of the simplest ways to personalize a billing document is by adjusting its visual elements. Consider adding your company’s logo, using brand colors, and selecting a font that reflects your style. These small changes can make your document feel more unique and help reinforce your brand identity.

Adding Custom Fields

Depending on your industry, you may need to include additional sections beyond the standard details. For example, some businesses benefit from adding sections for project milestones, payment installments, or specific terms related to service delivery. These extra fields can provide clarity and e

Benefits of Digital Invoice Templates

Using electronic forms for documenting payments offers numerous advantages over traditional paper-based methods. These digital solutions streamline the billing process, making it more efficient and accessible while also contributing to environmental sustainability.

Here are some key benefits of utilizing digital billing forms:

- Time Efficiency: Automation allows for quicker generation and distribution, reducing manual work and speeding up the overall process.

- Cost Savings: Reduces the need for paper, ink, and postage, leading to significant savings over time.

- Easy Customization: Digital documents can be easily modified to suit specific needs, whether it’s adding new fields, changing layouts, or incorporating branding elements.

- Accuracy: By minimizing human error, digital forms help ensure that the information is correct and clearly presented, preventing potential misunderstandings.

- Accessibility: Digital forms can be accessed from anywhere, allowing businesses to manage transactions and payments remotely, enhancing flexibility.

- Faster Payments: Many digital platforms offer integrated payment options, which can lead to quicker processing and collection of payments.

- Environmentally Friendly: By reducing paper use, digital solutions contribute to environmental conservation, making them an eco-friendly choice.

With all these advantages, switching to digital solutions for managing payments is a smart move for businesses looking to streamline their operations and improve their overall efficiency.

Essential Fields for a Professional Invoice

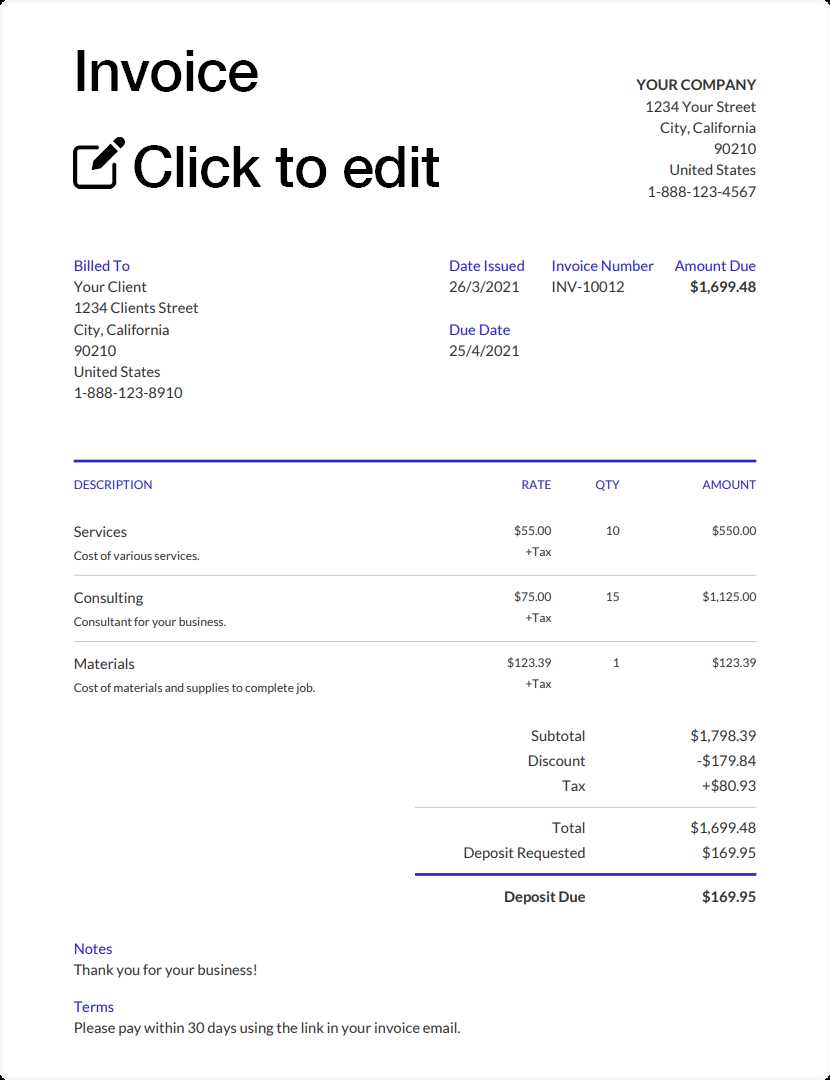

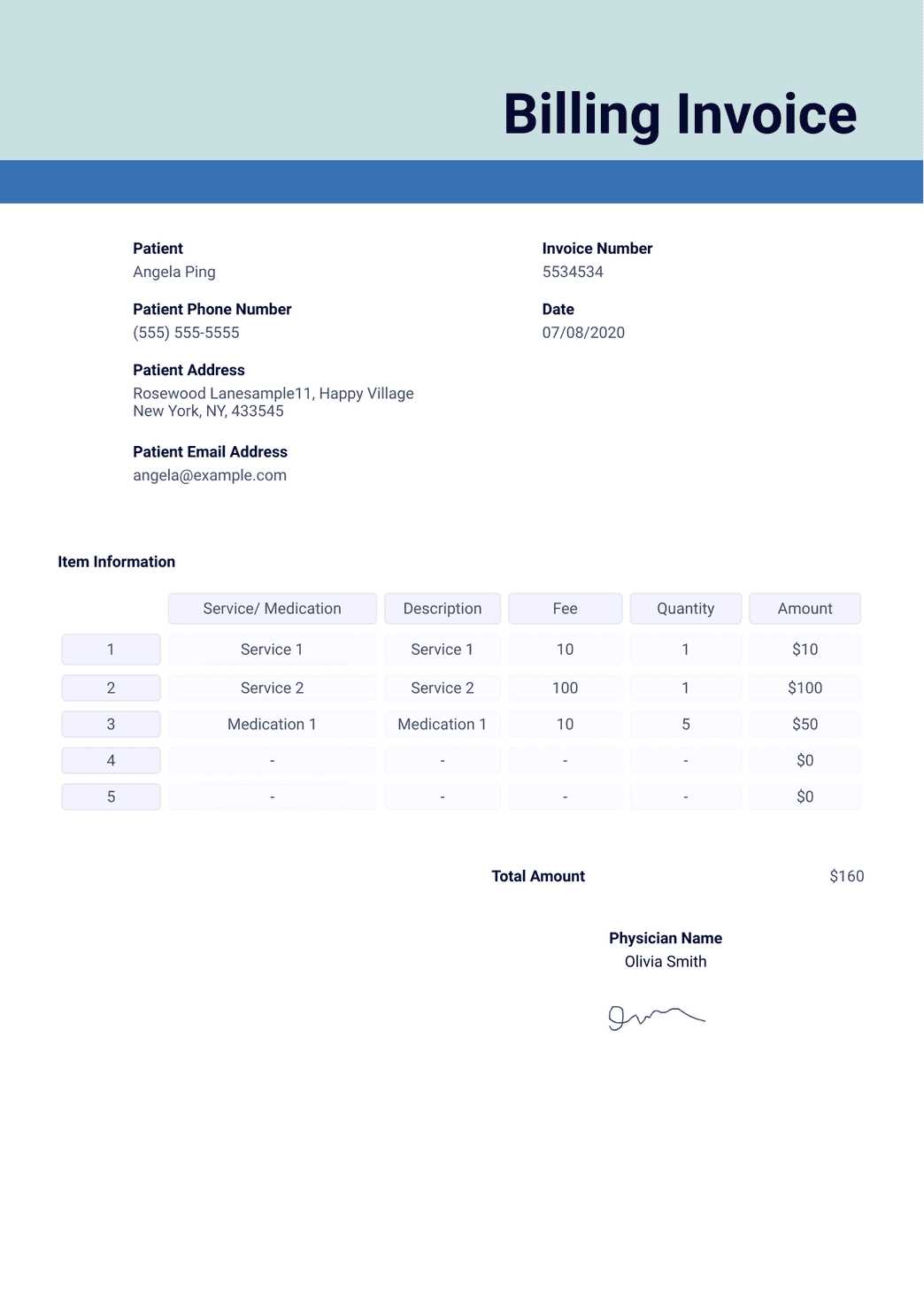

Creating a well-organized and professional billing document requires the inclusion of specific details that ensure clarity, accuracy, and professionalism. These essential components help both businesses and clients keep track of transactions efficiently.

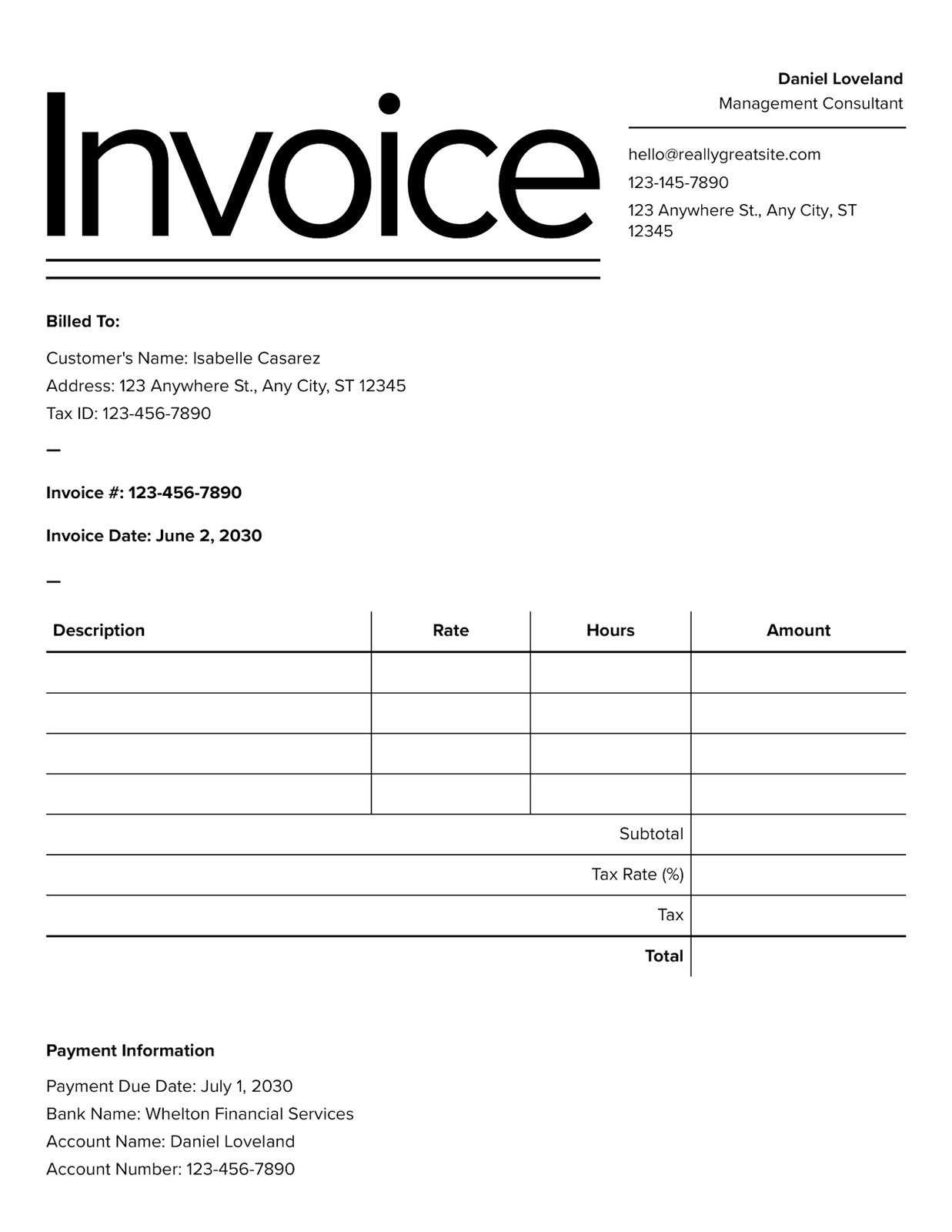

Contact Information

At the beginning of the document, it is crucial to include the contact details of both parties. This includes the name, address, phone number, and email address of the company and the client. Clear identification of both entities helps avoid confusion and facilitates easy communication.

Clear Description of Services or Products

A detailed list of services rendered or products delivered should be included, along with specific information such as the quantity, unit price, and subtotal. This ensures transparency, enabling the client to understand exactly what they are being charged for.

Additional fields to consider include:

- Unique Reference Number: This helps in tracking and referencing the billing document in future communications or records.

- Amount Due: Clearly stating the total amount payable allows the client to know the exact sum required for payment.

- Payment Terms: Including the due date and any late fees ensures both parties are aware of the expectations for timely payment.

Incorporating these key fields not only makes the document more professional but also enhances the efficiency of the entire transaction process.

How to Format Your Document Correctly

Proper formatting is essential to creating a professional and clear billing record. A well-structured document ensures that the details are easy to read and understand, improving the chances of quick payment and avoiding potential misunderstandings.

Follow these guidelines to ensure your document is formatted correctly:

- Use a Clear Header: Begin with a bold title at the top of the page, indicating the document’s purpose, such as “Payment Statement” or “Transaction Summary”.

- Keep Information Organized: Arrange all details in a logical order. Start with the contact information, followed by the breakdown of services or products, and end with the payment information.

- Choose a Readable Font: Use simple, clean fonts like Arial or Times New Roman in a size that’s easy to read, such as 11-12 pt.

- Use Tables for Itemization: For services or products provided, list each item in a table with clear columns for quantity, description, unit price, and subtotal. This makes it easier to see the breakdown of costs.

- Highlight Important Dates: Emphasize the due date for payment by making it bold or placing it in a separate section, so it stands out.

- Leave Space for Signatures: If necessary, include a section for signatures at the end of the document to confirm receipt of the goods or services.

By following these simple formatting rules, your document will not only look professional but also ensure that all the necessary details are clearly presented and easy to understand.

Making Invoices Look Professional

Creating a polished and professional billing document helps reinforce your business’s credibility and ensures that clients take your communication seriously. A well-presented record reflects your attention to detail and commitment to quality, which can positively influence your reputation and payment speed.

To make your document look professional, follow these guidelines:

- Consistent Branding: Use your company logo, colors, and fonts to create a cohesive look that aligns with your brand identity. This adds a personal touch and reinforces your brand recognition.

- Clean Layout: Ensure your document is easy to read by using adequate spacing and organizing information logically. A clutter-free design makes a better impression and helps avoid confusion.

- Accurate and Complete Information: Make sure all fields are filled out completely, including contact information, service details, and payment instructions. Double-check for any missing data to avoid errors.

For the layout of service details, consider using a structured table:

Item Description Quantity Unit Price Total Service or Product 1 2 $50.00 $100.00 Service or Product 2 1 $30.00 $30.00 By focusing on these elements, your billing documents will not only look professional but also communicate your attention to detail, helping foster better relationships with clients.

Top Mistakes to Avoid in Invoices

Ensuring that your billing documents are accurate and professional is key to maintaining good relationships with clients and ensuring timely payments. However, there are common mistakes that can cause confusion, delay payments, or even damage your reputation. Avoiding these errors will help streamline your invoicing process and present your business in the best light.

1. Missing or Incorrect Contact Information

It’s essential that both your business and your client’s contact details are accurate. Double-check that phone numbers, addresses, and emails are up to date to prevent miscommunication or delays.

2. Unclear Payment Terms

Not specifying clear payment terms can lead to confusion and delays. Always mention the due date, late fees, and accepted payment methods to avoid misunderstandings.

3. Failing to Include Detailed Descriptions

Be specific about the services or products provided. Ambiguity can lead to questions or disputes about what is being charged. Clearly describe each item or service to ensure transparency.

4. Inaccurate Calculations

Double-check your calculations, including unit prices, quantities, and totals. Simple math errors can cause delays and can diminish your professionalism. Use automated tools if needed to reduce the risk of mistakes.

5. Not Keeping Consistent Formatting

Inconsistent font sizes, styles, or layouts can make your billing document look unprofessional. Stick to a simple, organized format to make it easy for the recipient to follow and understand.

6. Overcomplicating the Layout

A cluttered or overly complex design can make the document difficult to read. Keep it clean and straightforward, using sufficient spacing and clear headings to separate sections.

Avoiding these common mistakes will help create clearer, more effective documents that not only enhance your professionalism but also improve payment efficiency.

Different Types of Invoice Templates

When managing billing, choosing the right format is crucial to ensure clarity and efficiency. Various document styles exist to cater to different business needs, each designed to suit specific requirements. Understanding these options allows you to select the one that best fits your workflow and client expectations.

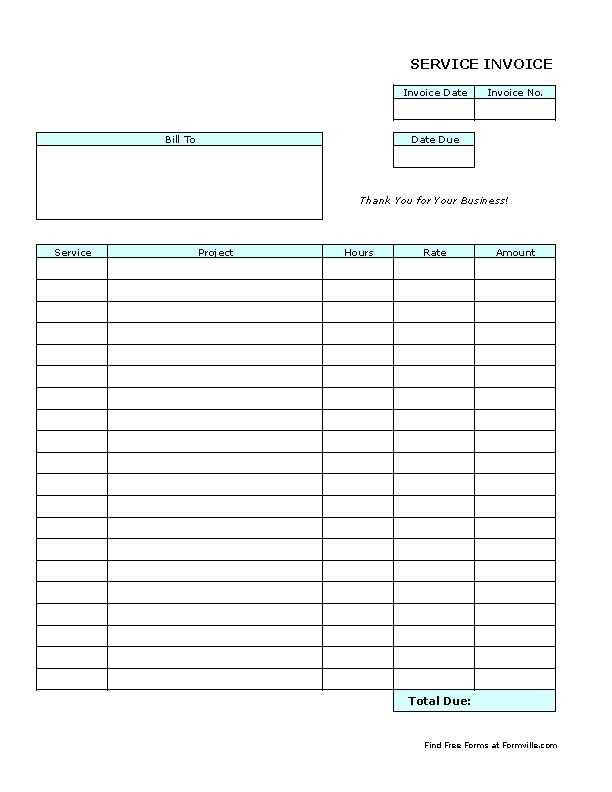

1. Standard Format

The standard version is the most commonly used document type. It includes essential fields such as the seller’s information, client details, services rendered, and payment terms. This format is ideal for businesses that offer straightforward products or services with a fixed price.

2. Recurring Billing Format

This type is best suited for businesses that deal with subscription models or regular payments. It includes information on recurring charges, the payment cycle, and any applicable discounts. It helps streamline the process for both parties when payments are made at regular intervals.

3. Pro Forma Format

A pro forma document serves as a preliminary bill, issued before the final transaction takes place. It typically outlines estimated charges and provides the recipient with a breakdown of expected costs. This version is ideal for quoting purposes before formal agreements are made.

4. Credit Memo Format

This version is used when a business needs to issue a refund or provide a discount for previous transactions. It outlines the adjustment to a previously issued bill, offering clarity on the amount that has been credited back to the customer.

5. Timesheet Billing Format

For businesses that charge based on hours worked, the timesheet format is ideal. It breaks down the total hours spent on a project, rates per hour, and the total cost. This method is commonly used by freelancers, consultants, or agencies offering time-based services.

6. Commercial Billing Format

This version is used primarily for large-scale transactions involving goods or services. It includes more detailed information like item descriptions, quantities, unit prices, and taxes. It’s typically used by wholesalers or businesses selling physical products.

By selecting the correct style, businesses can streamline the billing process and ensure that both parties are on the same page, fostering smooth transactions and maintaining professional relationships.

How to Fill In an Invoice Efficiently

Creating a detailed payment request document can be a time-consuming task, but with the right approach, it can be done quickly and accurately. Streamlining the process ensures that important details are not overlooked and that everything is recorded correctly. By following a simple structure, you can make the process more efficient and minimize the risk of errors.

1. Use a Predefined Structure

Start by using a consistent layout for every document. A predefined structure helps you avoid having to redesign each one from scratch. Many digital tools offer templates that automatically place the necessary fields in the correct spots, saving you time in the long run.

2. Include Essential Information

Make sure to include key details such as your business name, client information, description of goods or services, and payment terms. This ensures that both parties are clear on the terms and that all required information is present for processing the transaction.

3. Automate Calculations

If possible, use software that can automatically calculate totals and apply taxes. This eliminates the need for manual calculations, which can lead to mistakes. By automating the process, you can focus on adding the appropriate details rather than performing repetitive math.

4. Double-Check for Accuracy

Before sending the document, double-check the amounts, client details, and any terms. Even a small mistake could lead to confusion or delays in payment. Reviewing the document ensures it is correct and professional.

5. Save Frequently Used Details

If your business has recurring clients or services, consider saving commonly used information, such as contact details or standard terms. This makes it easier to populate future documents without having to re-enter the same data each time.

By following these simple steps, you can complete your payment request efficiently and accurately, ensuring that both you and your client are satisfied with the outcome.

Choosing the Right Template for Business

When creating a formal document for financial transactions, selecting the appropriate structure is crucial for both clarity and professionalism. A well-organized format ensures that all essential information is presented clearly and consistently, reducing the chances of errors and misunderstandings. The right layout will reflect the unique needs of your business while maintaining a standard of professionalism that clients expect.

Consider Your Business Needs

Different types of businesses may require different types of documents. For example, a freelance consultant might need a simple, straightforward structure, while a service-based company may need more detailed sections. Consider the following when choosing:

- Service or Product Details: Make sure the format allows you to clearly describe the goods or services provided.

- Payment Terms: Look for a structure that includes clear instructions on payment methods, due dates, and any applicable taxes.

- Branding: Ensure the design aligns with your business’s visual identity, reflecting your brand’s professionalism.

Key Features to Look For

When evaluating a format, certain features can improve both efficiency and clarity. Keep an eye out for:

- Easy Customization: Choose a layout that can be easily adjusted to meet your specific requirements.

- Automation Capabilities: Opt for a system that supports auto-calculation of totals and taxes to save time and reduce mistakes.

- Mobile-Friendly: Ensure the design is readable and usable on mobile devices, especially if you work with clients who might access documents on the go.

By carefully selecting the right format, you can streamline your business processes and present a professional image to your clients, ultimately making your financial documentation more efficient and effective.

Creating a Simple Invoice from Scratch

Designing a basic document for billing purposes can be done easily by following a few key steps. The goal is to ensure all essential details are included, such as the services or products provided, payment terms, and the client’s information. A simple layout will ensure clarity and avoid unnecessary complexity, making the process efficient for both you and your client.

Steps to Create a Basic Billing Document

To begin, you should include the following essential sections:

- Your Information: Include your business name, address, and contact details for easy reference.

- Client Information: Ensure the client’s name, address, and contact details are included to avoid confusion.

- Description of Services/Products: Clearly list the items or services provided with a brief description.

- Amount Due: Specify the price for each item or service and include the total amount owed.

- Payment Terms: Mention any relevant payment instructions, including due dates, methods of payment, and any applicable taxes.

Example of a Basic Billing Document

Item Description Unit Price Quantity Total Price Consulting Services $100 3 hours $300 Website Design $500 1 $500 Total Due $800 By following these simple steps, you can create a clear and professional document for your transactions. The key is to keep it simple and straightforward while ensuring all necessary details are included for clarity and ease of processing.

Best Tools for Invoice Template Creation

Creating professional documents for billing purposes has become easier with the availability of various tools designed for simplicity and efficiency. These tools offer a range of customizable features to help you generate clean, clear, and accurate billing statements. With the right tool, you can streamline the process, save time, and focus more on your business.

1. Microsoft Word

Microsoft Word offers a wide variety of pre-designed layouts that can be easily customized. It allows you to add company logos, change fonts, and adjust the layout to suit your business style. Word is perfect for those who need simple yet professional documents without requiring advanced design skills.

2. Google Docs

Google Docs is a free, web-based alternative to Microsoft Word. It’s a great option for collaboration, allowing you and your team to work on documents simultaneously. With a range of customizable designs, Google Docs provides an easy-to-use platform for creating clean and organized billing statements.

3. Canva

Canva is a versatile design tool that makes creating visually appealing documents easy. It offers customizable templates, a vast library of images and icons, and drag-and-drop features. With Canva, you can add creative touches to your billing statements while maintaining professionalism and clarity.

4. Zoho Invoice

Zoho Invoice is a comprehensive tool specifically designed for creating, sending, and managing billing documents. It includes pre-built layouts that can be customized to meet your business needs, and it offers additional features like automatic calculations, expense tracking, and payment reminders.

5. FreshBooks

FreshBooks is another specialized tool that automates much of the process, allowing users to create and send invoices in just a few clicks. With customizable templates, built-in time tracking, and expense management features, FreshBooks simplifies billing for small businesses and freelancers.

By using these tools, you can ensure your billing documents are professional, consistent, and easy to manage. Choose the one that best fits your needs and start creating with confidence.

Organizing and Managing Invoice Templates

Efficient organization and management of billing documents are crucial for maintaining consistency and reducing errors. A well-structured system allows for quick access to previously used layouts and ensures that all necessary fields are included each time. By using proper management techniques, businesses can save time, improve workflow, and avoid confusion.

1. Categorize Templates by Purpose

One of the most effective ways to stay organized is by categorizing your billing formats based on the type of transaction. For example, separate templates for services, products, or freelance work. This will help you quickly find the right layout depending on the situation, making your process more efficient.

2. Use Cloud Storage

Cloud storage services like Google Drive, Dropbox, or OneDrive offer an excellent way to organize your files. You can create folders for different categories of billing documents and have them accessible from any device. Cloud-based solutions also allow you to back up your documents and share them easily with team members or clients.

3. Standardize Layouts and Formats

Consistency is key when managing billing documents. By standardizing the layout and design of your documents, you ensure that each document looks professional and contains all the necessary fields. This consistency also helps avoid errors when you are creating a new statement.

4. Automate the Process

Using software tools to automate document creation can greatly reduce the time spent on manual input. Many platforms offer automatic population of fields such as client information and transaction details, allowing you to focus on other important tasks while maintaining accuracy.

5. Maintain Version Control

As you update your billing layouts or add new features, it’s essential to track changes to avoid confusion. Keep previous versions in a separate folder, clearly labeling each one with the version number or date. This way, you can easily revert to an earlier version if necessary.

By implementing these strategies, you can improve the management of your billing documents, ensuring efficiency and professionalism in every transaction.

Tracking Payments Using Invoice Templates

Monitoring payments efficiently is essential for maintaining healthy cash flow and ensuring accurate financial records. Properly designed billing documents can help track when payments are made, what is still due, and prevent missed transactions. A clear and organized approach allows businesses to follow up on unpaid amounts while staying on top of their finances.

1. Include Payment Status Fields

Each document should have a clear section indicating the payment status. Including fields such as “Amount Due”, “Amount Paid”, and “Remaining Balance” helps to quickly assess the situation and identify any outstanding amounts. This also makes it easier to update the document after a payment is received.

2. Use Payment Due Dates

Adding a specific payment due date to each document can help establish a clear timeline for both parties. When the due date passes without payment, you can easily identify overdue amounts and send reminders or take further action. This practice helps reduce delays and keeps the financial process on track.

By consistently using these methods, businesses can streamline the process of monitoring payments, ensuring that all transactions are tracked accurately and promptly.

Improving Cash Flow with Efficient Billing Practices

Effective management of financial transactions is crucial for any business looking to maintain a steady cash flow. Properly structured documents for requesting payments can help track due amounts, minimize delays, and ensure timely collection. By focusing on these aspects, companies can improve their liquidity and keep operations running smoothly.

1. Set Clear Payment Terms

Clearly outlining payment terms is essential to avoid misunderstandings. Specify details such as:

- Due dates

- Accepted payment methods

- Any late fees or interest charges for overdue amounts

Having this information in place will encourage prompt payments and help you avoid unnecessary delays.

2. Offer Multiple Payment Options

Offering a variety of payment methods can increase the likelihood of receiving funds promptly. Consider accepting online payments, credit cards, or bank transfers to provide clients with convenient options. The easier it is for your clients to pay, the quicker you can improve your cash flow.

By optimizing your billing practices, you can enhance financial efficiency, reduce payment delays, and strengthen your business’s overall cash flow.

- How to Customize an Invoice Template