Free Travel Agency Invoice Template for Easy Use

Managing financial transactions efficiently is crucial for any service-oriented business. Providing clients with clear, professional documents that detail services rendered ensures smooth communication and timely payments. These documents also serve as valuable records for both businesses and customers.

One of the most effective ways to streamline the billing process is by using ready-made formats that can be easily adapted to your needs. By leveraging customizable documents, you can save time and reduce errors, all while maintaining a polished, professional appearance for your business.

Whether you’re dealing with one-time clients or long-term customers, having a consistent and reliable system in place can help you build trust and credibility. These simple yet effective documents provide clarity and transparency, making the payment process more straightforward for both parties.

Free Travel Agency Invoice Template Guide

Managing financial documents effectively is essential for businesses in the service industry. Utilizing pre-designed formats helps create clear and professional records of transactions, saving valuable time and reducing the risk of mistakes. With the right format, creating accurate and consistent records becomes a seamless process.

There are numerous online resources where you can access ready-made billing documents without any cost. These resources offer customizable options, allowing you to input specific details tailored to each transaction. The goal is to simplify the process, ensuring every document reflects the professionalism and attention to detail your business deserves.

Choosing the right format for your needs is crucial. Consider the type of services you offer, the payment methods you use, and the level of detail you need to include. A well-structured document helps maintain transparency and ensures clients are clear on the terms of payment, boosting trust and satisfaction.

Benefits of Using a Free Template

Using ready-made formats for financial documents can bring significant advantages to businesses. These pre-designed options allow for quicker creation of accurate records without compromising professionalism. By leveraging these tools, businesses can focus more on delivering excellent services rather than spending time formatting paperwork.

Time and Cost Efficiency

One of the main advantages of utilizing these ready-to-use documents is the amount of time and money saved. Rather than designing documents from scratch or paying for custom designs, you can quickly input the necessary details and generate professional records. This is especially beneficial for small businesses or those just starting, as it reduces overhead costs and administrative burden.

Consistency and Accuracy

When using a pre-designed format, the risk of mistakes is significantly reduced. Each document follows a standard structure, ensuring consistency across all records. This uniformity helps prevent errors in billing, providing clear communication to clients and maintaining a professional image.

- Quick setup and easy customization

- Consistent format for all transactions

- Reduces the likelihood of mistakes and miscommunications

How to Download a Travel Invoice

Obtaining a pre-designed document for billing is a straightforward process, allowing businesses to quickly implement professional records for their transactions. Many online platforms offer these documents in various formats, ready for immediate use and customization to fit specific needs.

To download one of these ready-made billing documents, follow these simple steps:

- Visit a reliable website that offers downloadable business records.

- Select the document type that aligns with your business requirements.

- Click the download button to save the file in your preferred format, such as PDF or Word.

- Customize the details, including client information and services provided.

- Save or print the completed document for your records or client submission.

These easy steps ensure that businesses can quickly get the documents they need, minimizing the time spent on paperwork and increasing efficiency.

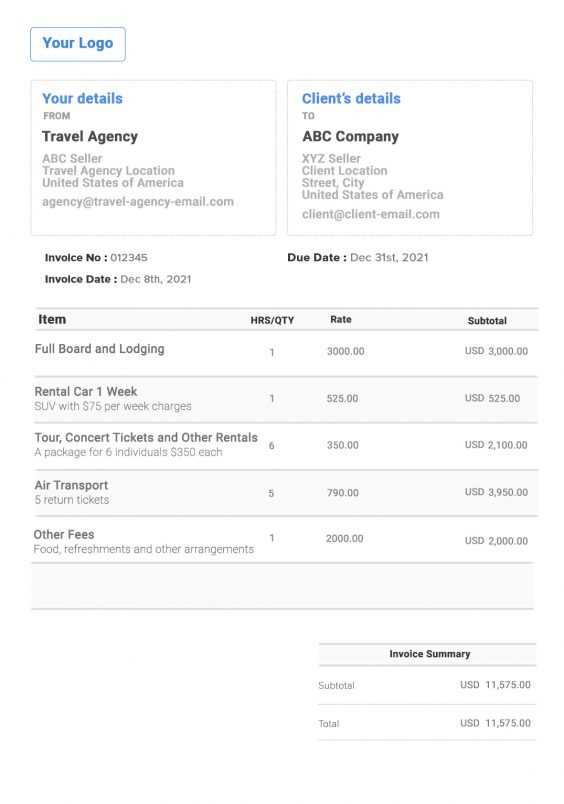

Customize Your Invoice for Clients

Adapting billing records to the unique needs of each client can help ensure clear communication and prevent misunderstandings. By customizing the details and layout, businesses can make their financial documents more relevant and professional, creating a personalized experience for clients.

Essential Customization Options

There are several key areas you can adjust to tailor the document to specific clients. These changes can make a significant difference in how your records are perceived and how easy they are for clients to understand. Below are the most common customizations:

| Customization Area | Description |

|---|---|

| Client Information | Include the client’s full name, address, and contact details for easy identification and communication. |

| Services Rendered | Detail the specific services provided, including quantities, descriptions, and prices for clarity. |

| Payment Terms | Set clear payment deadlines, methods, and penalties for late payments. |

| Branding | Add your company logo, colors, and other design elements for a cohesive, professional look. |

Personalizing the Experience

Including a personalized note or a thank-you message can go a long way in fostering good relationships with your clients. Customizing your documents with relevant details ensures they reflect the specific transaction and provides clients with the clarity they need to make timely payments. By offering a tailored experience, you demonstrate professionalism and attention to detail.

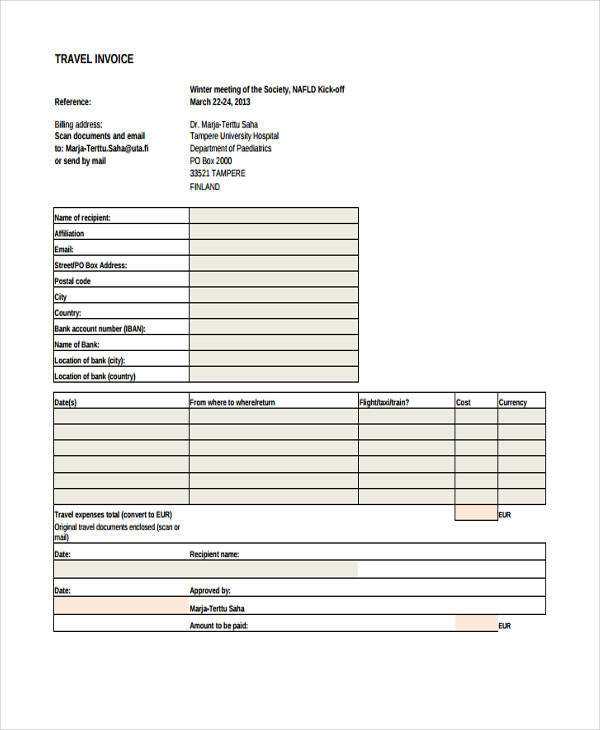

Essential Elements of a Travel Invoice

To create a clear and effective billing document, certain key components are necessary to ensure both parties understand the transaction. These elements help define the scope of services, the financial terms, and the expectations for payment. Including all relevant information in a structured manner helps avoid confusion and ensures timely payment.

The following are the fundamental elements that should be included in any billing document:

- Client Details: Full name, address, and contact information of the client to personalize the document and ensure accurate delivery.

- Service Description: Clear breakdown of the services provided, with dates, quantities, and any other relevant details that outline the scope of the work or service.

- Amount Due: The total charge for the services rendered, including itemized costs, taxes, or additional fees.

- Payment Terms: Information on how and when the payment should be made, including due dates, accepted methods of payment, and any late fees or penalties.

- Unique Identification Number: An invoice or reference number that helps both parties track and reference the document easily.

- Business Information: The name, address, and contact details of the service provider, ensuring clients can reach out for any clarifications or queries.

These components work together to provide a clear, professional document that supports effective communication and ensures smooth financial transactions.

Best Formats for Travel Agency Invoices

Choosing the right format for billing documents is crucial for businesses. Different file types offer various benefits depending on the needs of both the company and the client. Whether for quick editing, secure sending, or ease of access, selecting the correct format ensures clarity and professionalism in every transaction.

Popular Formats for Billing Records

There are several formats available, each serving specific purposes. Some are better for detailed edits, while others are designed for secure, non-editable sharing. Below is an overview of the most commonly used formats:

| Format | Advantages | Disadvantages |

|---|---|---|

| Universally accepted, easy to share, secure from editing | Cannot be easily edited without specialized software | |

| Word Document | Easy to edit, customizable layout, widely used | Less secure, can be edited by recipients |

| Excel Spreadsheet | Ideal for calculations, easy to track and organize payments | Can be overwhelming for clients, not ideal for sharing with non-technical recipients |

| Google Docs | Easy collaboration, real-time updates, cloud-based | Requires internet access, may not be as professional as PDF |

Choosing the Right Format

The choice of format largely depends on your business’s specific needs. For quick, editable records that are easily modified, Word or Excel may be suitable. However, for formal, secure, and professional documents, PDF is often the preferred choice, offering a universal and non-editable format. Regardless of the choice, it is important to select a format that suits both your workflow and your clients’ needs.

How Templates Save Time and Effort

Using pre-designed structures for business documents can significantly streamline the process of generating consistent, professional records. By relying on these ready-to-use frameworks, companies can minimize the time spent on formatting, layout design, and repetitive data entry. This efficiency not only saves time but also reduces the likelihood of errors, leading to smoother transactions and a more organized workflow.

Advantages of Using Pre-Formatted Structures

Here are some of the main reasons why using pre-designed documents can enhance efficiency:

- Consistency: Every document follows the same format, ensuring uniformity across all records, which helps in maintaining a professional image.

- Time-Saving: Templates eliminate the need to start from scratch, speeding up the process of creating essential documents.

- Less Mistakes: With fields already set up, there is less room for errors in formatting or missing important details.

- Easy Customization: Templates allow for quick customization by simply filling in relevant details, making them adaptable to various clients or services.

Practical Benefits for Businesses

By adopting these ready-made solutions, businesses can enhance their productivity and focus on core tasks while reducing administrative burdens. Whether for generating billing statements or other routine documents, relying on these structures ensures a smoother, more efficient process. Ultimately, templates help professionals to work smarter, not harder.

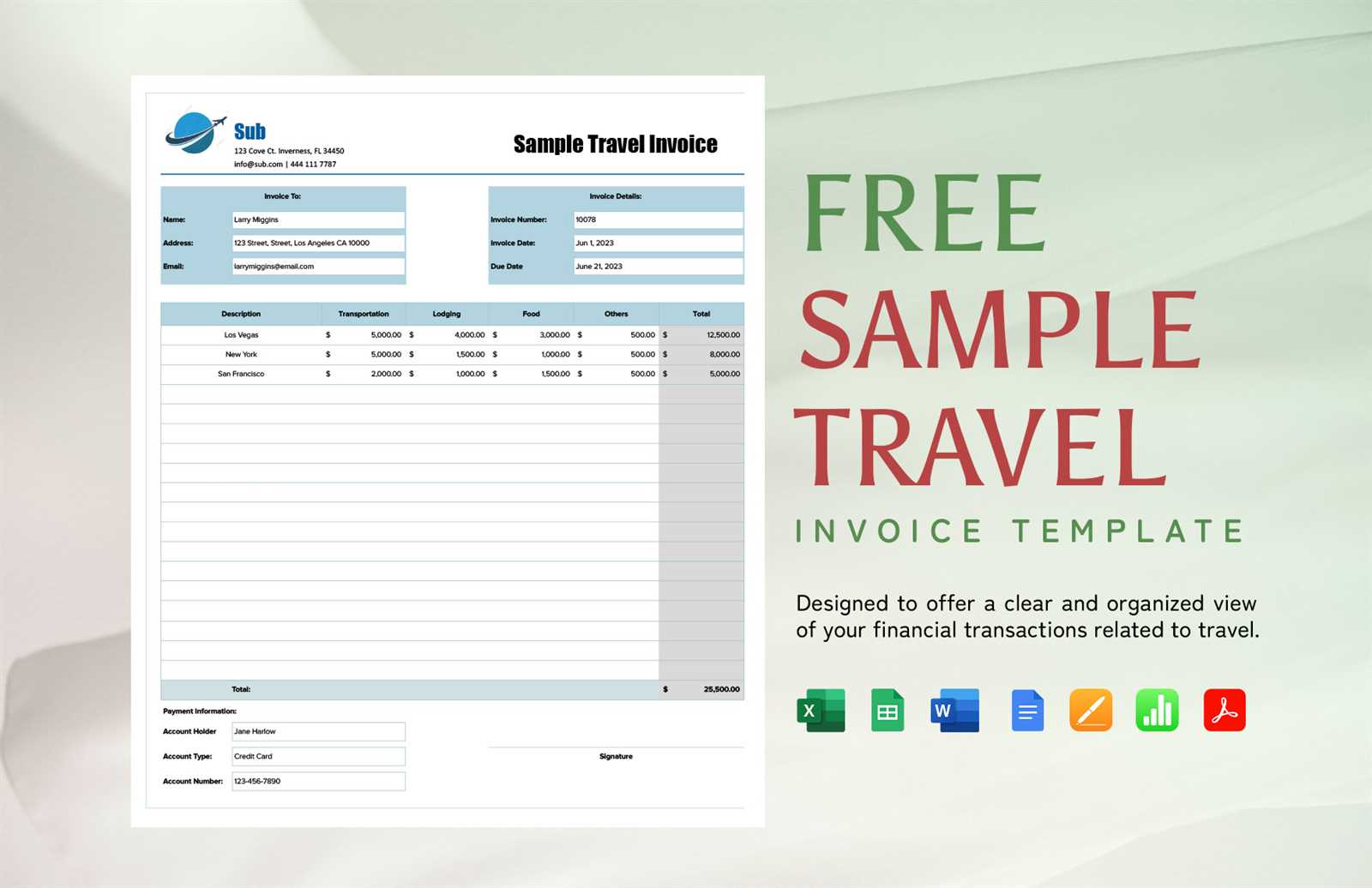

Top Features in Travel Invoice Templates

When creating essential business documents, certain features are crucial for making them functional, professional, and easy to use. Whether you’re handling client transactions or managing accounts, having the right components in your document layout ensures clarity, accuracy, and efficiency. Below are some of the key characteristics to look for when choosing the best solution for your needs.

Key Components to Include

These elements are important to make sure that every record serves its purpose effectively:

- Client Information: Proper fields for client names, addresses, and contact details ensure that every record is traceable and can be easily matched with a specific customer.

- Detailed Service Descriptions: A clear section where the offered services are outlined in detail helps avoid confusion and maintains transparency.

- Accurate Pricing: Pre-set fields for itemized costs allow for precise calculations, which are essential for transparency and avoiding misunderstandings.

- Payment Terms: Including payment deadlines, methods, and other conditions ensures both parties understand expectations and requirements.

- Dates and Unique Identifiers: Having spaces for the document issue date and a reference number simplifies tracking and helps avoid errors in records management.

Design and Usability Features

The structure and layout of your business documents should be user-friendly. A clean and organized design helps make the entire process of filling out and reviewing these documents smoother. Some additional features include:

- Pre-Formatted Layouts: Easy-to-read designs with clear sections allow for quick customization without compromising on professionalism.

- Automated Calculations: Built-in formulas for calculating totals and taxes save time and reduce the chances of arithmetic errors.

- Branding Options: Customizable fields for adding logos and company colors help maintain brand consistency and enhance your business’s image.

By using a document structure with these essential features, you can create polished, accurate, and easy-to-manage records that will serve both your business and your clients well.

Using Templates for International Clients

When dealing with clients from different countries, it’s important to ensure that your documentation meets the needs of diverse markets. The right structure can help avoid misunderstandings, streamline communication, and ensure compliance with international standards. Below are some considerations for tailoring your documents to suit global clients.

Key Considerations for Global Business

When working with clients from different countries, certain adjustments should be made to ensure smooth transactions and clear communication:

- Currency Conversion: Ensure that your records clearly display the correct currency for each transaction. Some regions may prefer to see the price in their local currency, so it’s helpful to include multiple currency options.

- Time Zones: Different regions operate in various time zones, which could impact deadlines and payment schedules. Make sure to specify the time zone used for dates and deadlines.

- Language Preferences: Providing translated versions of your documents can avoid confusion, especially if your clients speak different languages.

- Legal Requirements: Ensure that your documents comply with local regulations. Some countries may require specific legal text or additional fields, such as tax identification numbers.

Benefits of Customizing for Global Clients

Using well-structured documents that address the needs of international clients provides several advantages:

- Clear Communication: By adapting your document to the client’s language, currency, and legal expectations, you enhance understanding and reduce potential errors.

- Professional Image: Offering a document that aligns with international standards portrays your business as reliable and well-organized, which can boost client trust.

- Increased Efficiency: Pre-configured layouts for various regions help you save time while maintaining consistency across all client communications.

Customizing your documents to meet the needs of international clients helps maintain smooth business relationships and ensures that all parties are on the same page, regardless of location.

Common Mistakes to Avoid in Invoices

Inaccurate or incomplete documentation can lead to delays, confusion, and even disputes between businesses and their clients. When preparing billing statements, it’s crucial to avoid common errors that can negatively impact both your workflow and client relationships. Below are some typical mistakes that should be carefully avoided.

1. Missing or Incorrect Contact Information

Always ensure that the recipient’s contact details, including name, address, and phone number, are accurate. Incorrect or missing information can lead to miscommunication or the document being sent to the wrong recipient. Similarly, make sure your own contact information is included for easy reference.

2. Inaccurate or Unclear Dates

Dates are one of the most critical aspects of any billing document. It’s essential to clearly indicate the date of the transaction and any payment deadlines. Misleading or missing dates can create confusion about when payments are due and may result in unnecessary follow-ups.

3. Not Including Sufficient Item Descriptions

When listing services or products, ensure that each item is described clearly and with enough detail. Vague descriptions may lead clients to question the charges. Be specific about what is being billed to avoid any misunderstandings.

4. Failing to Include Payment Terms

Clearly specify your payment terms, such as due dates, accepted payment methods, and any penalties for late payments. Without clear payment instructions, clients may be unsure how to proceed, potentially delaying payments.

5. Incorrect Calculations

Double-check all amounts and ensure that the calculations are correct. Incorrect math can damage your credibility and lead to disputes. Always confirm totals, including taxes or discounts, before sending any document.

6. Ignoring Local Regulations

Depending on your location or the client’s region, there may be specific legal requirements that need to be included. Failing to adhere to these regulations can result in fines or complications. Make sure to research the necessary legal details relevant to each transaction.

Avoiding these common mistakes ensures that your documents remain professional, clear, and free of errors, which can lead to smoother transactions and stronger business relationships.

How to Include Taxes and Fees

When creating billing documents, it’s essential to properly calculate and list applicable taxes and fees. These charges are often required by law and can vary depending on location, product, or service type. Ensuring accuracy and transparency in these calculations not only maintains compliance but also fosters trust with clients.

Understanding Tax and Fee Categories

Before including any tax or fee, it’s important to understand the specific charges that apply to your transaction. Different regions or industries may require unique rates or conditions. The most common categories include:

- Sales Tax: Typically applied to the sale of goods or services.

- Service Fees: Additional charges for specific services provided, such as delivery or handling.

- Customs Duties: For international transactions, these fees are imposed by governments for imports and exports.

- Environmental Fees: In some regions, certain products or services may carry an additional eco-tax to support environmental initiatives.

Steps to Properly Include Taxes and Fees

Follow these steps to ensure that all applicable charges are added correctly:

| Step | Description |

|---|---|

| 1. Research Tax Rates | Look up the applicable tax rates based on the client’s location or the type of service or product sold. |

| 2. Calculate Each Charge | Multiply the item cost by the tax rate, or add any service fees or other charges to the total amount. |

| 3. List Charges Clearly | Ensure all taxes and fees are separately listed on the document to avoid confusion. This should include the name of the tax or fee and the corresponding amount. |

| 4. Review for Accuracy | Before finalizing the document, double-check that all calculations are correct and that taxes are applied according to local laws. |

By clearly listing taxes and fees, you ensure that both you and your clients understand the full cost of the transaction. This promotes transparency and can prevent any disputes regarding charges later on.

Setting Payment Terms in the Document

Establishing clear payment terms is essential for maintaining smooth transactions and fostering good relationships with clients. These terms outline when payments are due, acceptable methods of payment, and any late fees or discounts that may apply. By specifying these details upfront, you avoid confusion and ensure that both parties understand the financial expectations involved.

When setting payment terms, it’s important to consider various factors such as your business model, industry standards, and the specific needs of your clients. Clearly defined terms help manage cash flow and set a professional tone for future dealings.

| Payment Term | Description |

|---|---|

| Due Date | The specific date when the full amount must be paid. Ensure that this is realistic and clear. |

| Early Payment Discount | Offer a discount for clients who pay ahead of the due date, typically within a set number of days (e.g., a 2% discount if paid within 10 days). |

| Late Payment Fee | Define the consequences for late payments, such as a fixed fee or a percentage of the outstanding balance after a certain period. |

| Payment Methods | List the accepted methods of payment, such as bank transfer, credit card, or check, to provide clients with clear options. |

| Installment Plans | If applicable, offer payment options in installments, specifying the amounts and due dates for each installment. |

By clearly specifying payment terms, you set expectations from the start and reduce the chances of misunderstandings. Whether you’re offering a discount for early payment or charging a late fee, making these terms clear ensures a more professional transaction process for both you and your clients.

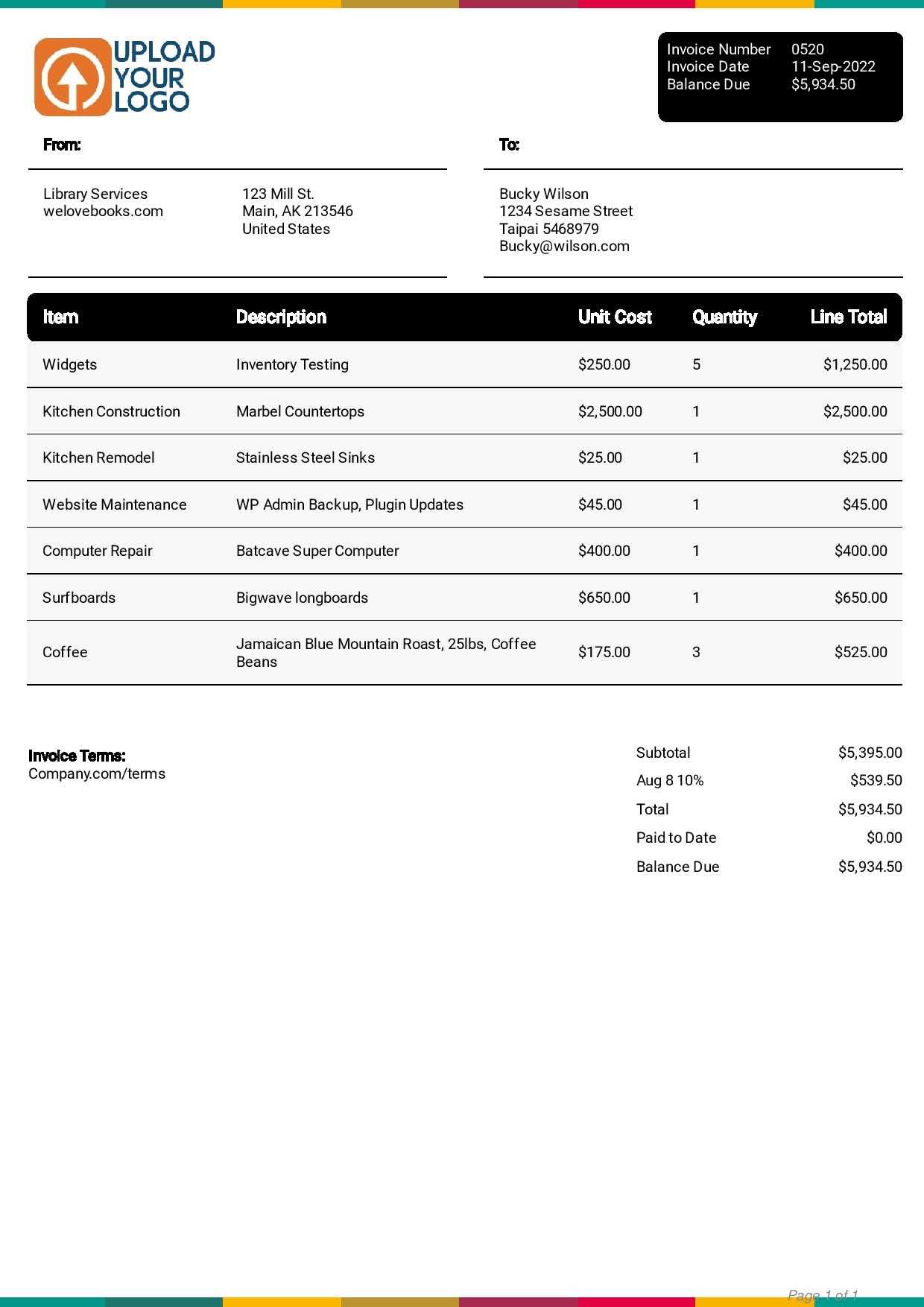

How to Handle Multiple Services in Documents

When offering several different offerings to clients, it’s important to organize and present the charges clearly. A well-structured document that itemizes each service ensures transparency and avoids confusion for both parties. Whether you’re providing a variety of services or bundled packages, each service should be listed with its own price and description for clarity.

Breaking Down Services

To properly handle multiple services, it is crucial to detail each one with its own line item. This way, clients can easily see what they are paying for and can verify each charge. For clarity, include:

- Service Name: The specific offering being provided.

- Description: A brief explanation of the service to ensure the client understands what is being billed.

- Amount: The cost associated with each individual service, without ambiguity.

Grouping Related Services

In some cases, services can be grouped together to make the document more organized. For example, if a set of services is provided as part of a package deal, list them under a common heading with a combined price. This helps to avoid overwhelming the client with excessive line items, while still showing the breakdown of individual services. For instance:

- Package A: Includes three services at a bundled price, detailing each service below.

- Service 1: Description and price.

- Service 2: Description and price.

- Service 3: Description and price.

Clearly handling multiple offerings ensures that clients are informed and that they can easily review the document for accuracy, creating a professional and organized appearance for the transaction.

Design Tips for Professionalism

Creating a well-designed document can enhance the perception of your business and strengthen client relationships. A polished and cohesive look communicates professionalism, ensures clarity, and builds trust. A clear layout and thoughtful design elements can make the document both functional and visually appealing, ensuring that your clients have a positive experience when reviewing their charges.

Key Design Elements to Include

A well-organized layout can make a significant difference in how your document is received. Consider incorporating the following elements to ensure your document appears professional:

- Company Branding: Include your logo and consistent branding to reinforce your business identity.

- Clear Layout: Use proper spacing, alignment, and sections to make the content easy to read.

- Readable Font: Choose a simple and professional font that is easy to read, avoiding overly stylized fonts.

- Headings and Subheadings: Use clear headings and subheadings to organize the sections, allowing clients to navigate the document easily.

Helpful Table Format for Clarity

A table format is one of the best ways to display detailed information. It allows you to break down the charges and details in an organized manner. Here’s an example:

| Service Description | Quantity | Price | Total |

|---|---|---|---|

| Consultation Fee | 1 | $100 | $100 |

| Delivery Charge | 2 | $25 | $50 |

| Total Amount | $150 |

By following these design tips, you ensure that the document not only looks professional but also provides your clients with all the necessary information in a clear, organized manner.

Free vs Paid Document Formats

When it comes to generating business documents, professionals often face the choice between using no-cost resources or opting for a paid version. Each option comes with its own set of advantages and limitations. Choosing the right one depends on the specific needs of the business, as well as the volume and complexity of the documents required.

Advantages of Using Free Formats

Free resources are an attractive option for those who are just starting out or those on a tight budget. Here are some of the key benefits:

- Cost-effective: As the name suggests, there is no charge for these resources, making them ideal for businesses that need to minimize overhead costs.

- Ease of Access: Many free formats are available for instant download or online use, allowing for quick setup and use without the need for additional investments.

- Basic Features: Free versions often offer the essential features required for most businesses, making them suitable for simpler needs.

Benefits of Paid Formats

On the other hand, investing in a paid resource can offer significant advantages, especially for businesses with more complex needs. Consider these benefits:

- Advanced Customization: Paid options often provide more design flexibility, enabling businesses to tailor the document to their specific branding and client requirements.

- Additional Features: Paid versions may include features such as automatic calculations, integrated payment systems, and other enhancements that can save time and reduce errors.

- Customer Support: Many paid services come with dedicated support, ensuring that any issues can be resolved promptly and efficiently.

Choosing between no-cost and premium resources depends on the level of functionality and customization required. For small businesses or those with simple needs, free formats may suffice. However, businesses that require more advanced features and support may find the investment in a paid version worthwhile.

Legal Considerations for Billing Documents

When creating business documents for financial transactions, there are several important legal aspects that must be taken into account. Ensuring compliance with applicable regulations helps protect both the business and the client, and avoids potential disputes. Understanding these legal requirements is essential for maintaining transparency and professionalism in any business transaction.

One of the primary considerations is the accurate documentation of financial exchanges. The document should clearly list the agreed-upon terms, such as the total amount due, any taxes or additional charges, and payment terms. This helps avoid misunderstandings between the business and the client, ensuring both parties are on the same page regarding the transaction.

It is also crucial to include relevant business details, such as the company’s legal name, address, and contact information, as well as the client’s information. In many regions, these elements are legally required for a document to be recognized as valid for tax or regulatory purposes. Additionally, businesses should specify payment deadlines and any penalties for late payments, as these clauses help protect their financial interests.

Finally, businesses should be aware of specific industry regulations that may apply to certain services or regions. These regulations could include requirements for specific disclosures, refund policies, or consumer protection laws. Familiarizing oneself with the legal landscape in the relevant jurisdiction is an important step in ensuring compliance and minimizing the risk of legal issues down the line.

How to Track Payments with Billing Documents

Monitoring payments effectively is essential for maintaining smooth financial operations. Proper tracking ensures that businesses can follow up on outstanding balances, manage cash flow, and avoid overdue payments. Using detailed financial records helps both the service provider and the client stay informed about the payment status and any remaining dues.

1. Include Clear Payment Terms and Deadlines

To avoid confusion, it’s crucial to specify the payment terms clearly. This includes the total amount due, the due date, and any late fees if applicable. When these terms are laid out in a structured manner, it becomes easier to track when payments are expected and when they were actually received. Additionally, if payments are made in installments, documenting this can help both parties keep track of the balance remaining.

2. Create a Payment Log or Tracking System

Establishing a method for logging payments is an excellent way to stay organized. Businesses can use a digital or physical payment log to record the details of each transaction. This should include:

- Invoice reference number

- Payment date

- Amount paid

- Payment method

- Remaining balance (if applicable)

By keeping an updated log, you can quickly identify if there are any outstanding amounts and follow up with clients when necessary.

3. Use Digital Tools for Easier Monitoring

Many businesses benefit from using accounting software or payment management tools. These tools automate the process of tracking payments and provide real-time updates. Some programs even send reminders to clients when payments are due or overdue, making it easier for businesses to stay on top of collections without needing manual follow-up.

Why Choose a Complimentary Format for Your Business

Using a no-cost structure for official billing documents offers significant benefits, especially for businesses looking to streamline operations without additional expenses. It provides the perfect balance between simplicity and professionalism, making it easier to manage financial transactions while saving on software or custom service costs.

1. Cost-Effective Solution

One of the primary reasons businesses opt for no-charge formats is the financial savings. Rather than investing in expensive software or paying for specialized designs, businesses can access ready-made solutions that require minimal setup. This is particularly beneficial for small businesses and startups working with limited resources.

2. User-Friendly and Accessible

Complimentary options are often designed to be intuitive, allowing businesses to quickly generate the necessary documents without needing advanced skills. Many are compatible with various software programs and can be customized easily to fit specific needs, from adding business logos to modifying payment structures.

3. Quick Customization

These formats can be adjusted quickly to reflect changes in service offerings, pricing, or other business aspects. The ability to make instant edits ensures that your documents remain up-to-date without the need for extensive revisions or the use of complicated tools.

4. Ready-to-Use Features

- Pre-built sections for business details

- Space for client information

- Sections for service descriptions

- Simple calculation fields

These features allow businesses to maintain consistency while providing a polished look to each document, enhancing professionalism and clarity.