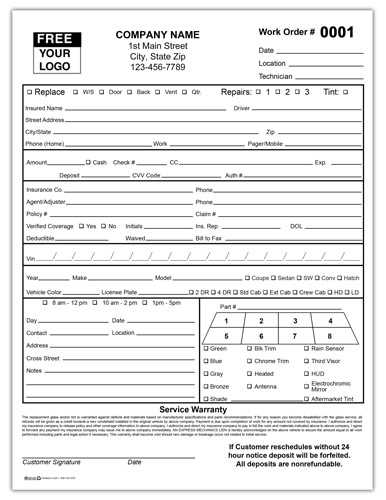

Free Auto Glass Invoice Template for Easy Billing

Efficient billing is the backbone of any successful service-based business. Whether you are dealing with repairs, installations, or other specialized services, having a reliable method to document and request payment is crucial. Many entrepreneurs rely on structured documents to maintain consistency, clarity, and professionalism when managing financial transactions.

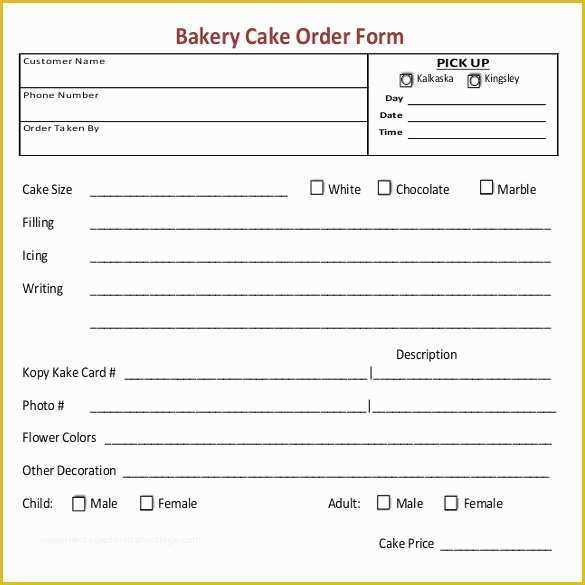

For those in the automotive repair industry, having a customizable and easy-to-use document for client charges can save both time and effort. With the right document at hand, businesses can quickly generate clear and accurate records, making the entire billing process smoother for both the service provider and the customer.

Using customizable solutions can help streamline operations, reduce errors, and ensure that every detail is captured correctly. With various options available, it’s easy to find one that suits your business’s needs and enhances workflow without the need for expensive software or complex tools.

Free Billing Documents for Businesses

For businesses offering specialized repair or installation services, having a standardized document to request payments is essential. These records not only help maintain organization but also ensure that all details are clearly communicated to customers. By using accessible and customizable formats, businesses can easily generate professional paperwork without the need for complex or expensive software.

Many service providers are turning to online resources to find cost-effective solutions that allow for quick and simple document creation. These tools are designed to help businesses create well-structured records that include essential payment details, service descriptions, and pricing. The ability to personalize these documents for each job reduces the chances of errors and makes the billing process more efficient.

Accessible solutions are available that enable businesses to generate accurate and polished documents quickly. With the right approach, creating these records can become a seamless part of your business workflow, allowing you to focus more on service delivery while maintaining a professional standard in all financial dealings.

Why You Need a Billing Document

Having a structured and clear method for documenting services provided and payments due is essential for any business. A well-organized record not only ensures that your clients are billed accurately but also protects your company from misunderstandings or disputes regarding charges. Proper documentation serves as a formal request for payment, helping both parties understand the scope of work and the associated costs.

For businesses in the repair or installation industry, such records are even more critical. Without a clear and consistent method of documenting the work done, there may be confusion about pricing, service terms, or payment schedules. A professional document helps solidify the terms of the transaction and makes the entire billing process more transparent and efficient.

Accurate financial records are vital for maintaining cash flow and ensuring that your business operations run smoothly. By having a standardized document, you not only facilitate timely payments but also enhance your company’s reputation by presenting yourself as organized and reliable to customers.

How to Create Your Own Billing Document

Creating a customized payment record for your services is a straightforward process that helps maintain clarity and professionalism in your transactions. Whether you are a small business owner or part of a larger team, having a method to generate accurate and detailed payment requests can simplify your accounting and ensure smooth financial operations.

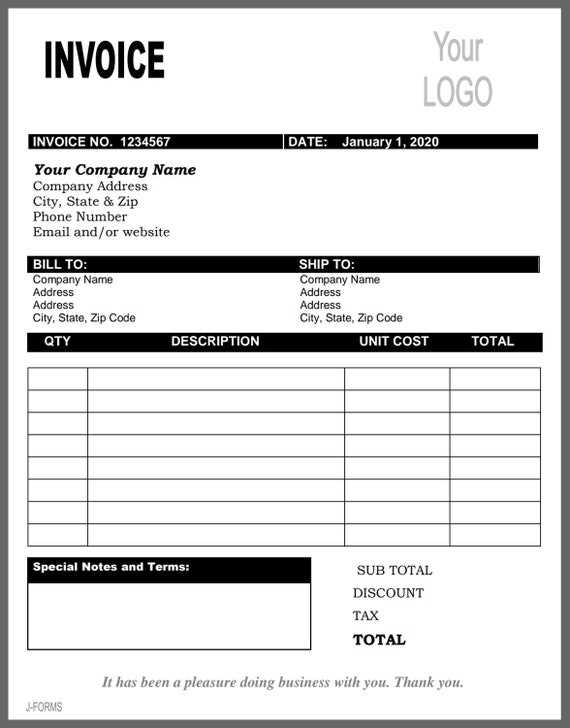

Steps to Creating Your Document

Follow these essential steps to build a payment request that works for your business:

- Start with your business information: Include your company name, contact details, and address at the top of the document.

- Add client details: Clearly state your customer’s name, address, and contact information for easy reference.

- Describe the services: Provide a detailed breakdown of the work performed, including the quantity, description, and cost of each item.

- Set payment terms: Specify the total amount due, payment methods accepted, and the due date for payment.

- Include a unique reference number: This helps both you and the client track the payment and prevent any confusion.

- Keep it professional: Use a clean and simple design that reflects your brand’s image. This can make a strong impression on your clients.

Tools to Help You Create Your Document

If you’re not ready to create your own from scratch, there are several easy-to-use resources that allow you to build your own custom payment documents. These tools typically offer:

- Pre-designed layouts for quick customization

- Fields for all necessary payment details

- Ability to save and reuse your designs for future jobs

- Download and email options for convenience

By following these steps and utilizing helpful tools, you can easily create a professional payment record that will serve your business needs effectively.

Top Features of a Good Billing Document

Creating a clear and professional payment request is key to ensuring smooth transactions between a business and its clients. A well-structured record not only helps avoid confusion but also reflects positively on your business, showing that you are organized and reliable. To achieve this, it’s important to include certain key elements that will make the document both functional and professional.

Here are the most important features that every well-crafted payment document should include:

- Clear identification: The document should include your company name, contact information, and a unique reference number. This helps your clients easily identify the transaction and contact you if necessary.

- Detailed itemization: Break down each service or product provided, with a clear description, quantity, and price. This transparency helps clients understand exactly what they are paying for.

- Accurate payment terms: Clearly state the total amount due, payment methods accepted, and the due date. This prevents delays and misunderstandings related to payments.

- Client information: Include your customer’s name, address, and contact details to ensure both parties know exactly who is involved in the transaction.

- Professional design: The document should have a clean, simple layout that is easy to read. Use consistent fonts, colors, and spacing to create a visually appealing record.

- Legal information: In some cases, including tax identification numbers, registration details, or other legal information may be necessary, depending on your location or industry.

Incorporating these essential features into your billing documents will not only improve your workflow but also help you maintain a professional image and build trust with your clients.

Benefits of Using a Pre-designed Billing Document

Using a pre-designed document for requesting payments offers several advantages for businesses. Whether you’re a freelancer or a large service provider, having a reliable, ready-to-use format can save time, reduce errors, and ensure consistency in your financial transactions. By relying on these ready-made solutions, you can focus on delivering quality services while maintaining a professional approach to handling payments.

Here are some key benefits of using a pre-designed solution for your payment requests:

- Time-saving: With a ready-made format, you can quickly fill in the necessary details, eliminating the need to design each document from scratch.

- Consistency: Using the same layout for every transaction helps maintain uniformity across your financial records, making them easier to manage and track.

- Accuracy: A structured format reduces the chances of missing important details or making errors when creating payment records, ensuring everything is clearly communicated.

- Professional appearance: Pre-designed formats often include polished, clean designs that enhance your company’s image and create a trustworthy impression with clients.

- Customization options: Many pre-designed solutions allow for easy customization, so you can add your company logo, adjust the layout, or tailor specific fields to suit your business needs.

- Cost-effective: These ready-to-use formats are often available at no cost or at a low price, offering an affordable solution for businesses of all sizes.

By utilizing a pre-designed solution for your payment documents, you can streamline your workflow, improve the accuracy of your records, and create a more professional experience for both you and your clients.

Choosing the Best Payment Document Format

Selecting the right structure for your billing records is essential to ensure clarity and efficiency in the payment process. The format you choose should not only reflect your business’s professionalism but also provide clear and organized information for your clients. Whether you need a simple format or something more detailed, the key is to find one that suits your business operations and customer expectations.

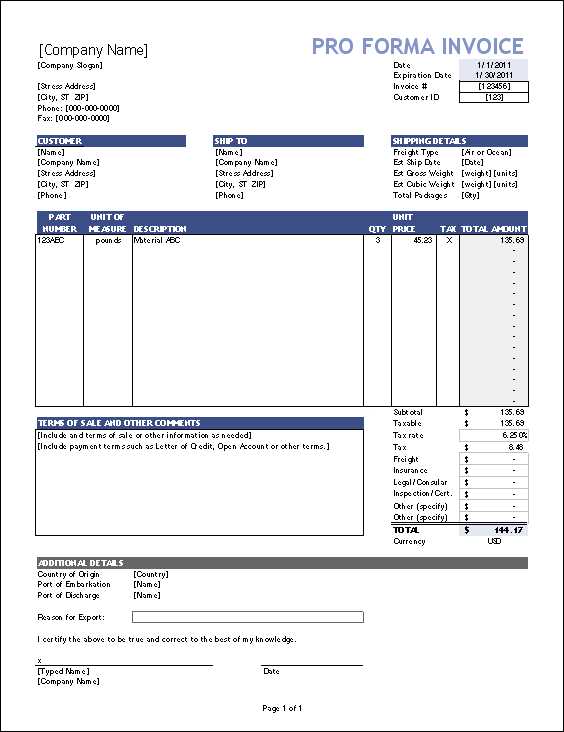

There are different options available when it comes to structuring your payment requests. The choice depends on the complexity of your services, the frequency of billing, and the preferences of your clients. Below is a comparison of common formats to help you choose the best option:

| Format | Best For | Advantages | Disadvantages |

|---|---|---|---|

| Basic Layout | Small businesses or simple transactions | Quick to fill out, easy to understand | Lacks detailed information, may not cover all needs |

| Detailed Breakdown | Companies offering multiple services or products | Provides a clear itemized list, reduces confusion | Can appear complex or overwhelming to clients |

| Professional Design | Businesses that need to maintain a polished image | Appealing layout that boosts credibility | Can require more time and effort to customize |

| Recurring Payment Format | Subscription-based services or repeat clients | Easy to set up for recurring transactions | Less flexibility for one-time charges |

By carefully considering your business needs and client preferences, you can choose the most appropriate structure for your payment documents. Whether you prioritize simplicity, detail, or professional presentation, the right format will help streamline your payment process and enhance your business operations.

Simple Steps to Customize Your Document

Customizing your payment record is an important step to ensure that it accurately reflects your business and the services you provide. With the right approach, you can create a document that is both professional and tailored to your specific needs. Customizing these records is straightforward and doesn’t require advanced skills or expensive software. By following a few simple steps, you can quickly adapt a standard document to suit your business style and client requirements.

Here are the essential steps to customize your payment request:

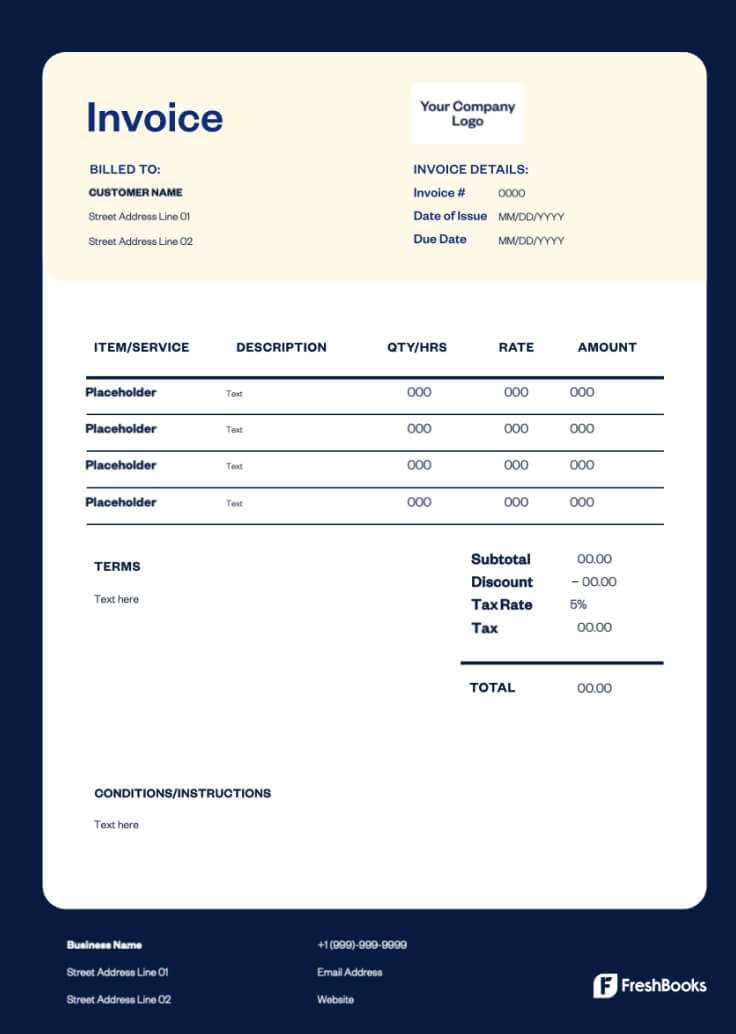

- Choose the right layout: Start by selecting a clean, easy-to-read format that fits the type of services you offer. Simple designs are often more effective than complex ones, especially for straightforward transactions.

- Add your business details: Include your company name, logo, contact information, and business address at the top of the document. This makes it easier for clients to recognize your brand and contact you if needed.

- Personalize client information: Be sure to include your client’s name, address, and contact details. This personal touch makes the document feel more professional and ensures the correct recipient is billed.

- List your services clearly: Provide a detailed breakdown of the work performed, including descriptions, quantities, and prices. This helps avoid confusion and ensures that the client understands exactly what they are paying for.

- Set payment terms: Clearly specify the amount due, the due date, and acceptable payment methods. This reduces the chances of late payments and ensures both parties are aligned on the terms.

- Finalize with your branding: Consider adding custom elements such as colors, fonts, and branding to make the document reflect your business’s identity. This creates a cohesive and professional image for your company.

By following these simple steps, you can easily create a customized payment document that not only meets your needs but also enhances your business’s professional appearance.

Free Online Tools for Creating Payment Records

There are a variety of online tools available that allow businesses to easily create and manage their payment documents. These resources are especially helpful for companies that need a simple, efficient solution without the need for complex software or expensive subscriptions. Many of these platforms provide customizable templates, making it easy to adapt each document to your specific needs while saving valuable time.

Popular Tools for Generating Payment Records

Below is a list of online platforms that can help you create professional billing documents quickly and easily. These tools typically offer intuitive interfaces and basic customization features to help you produce clear and accurate records for your clients:

| Tool | Features | Best For |

|---|---|---|

| Invoice Generator | Simple design, customizable fields, download and email options | Small businesses and freelancers |

| Zoho Invoice | Multiple templates, recurring billing options, integration with accounting software | Growing businesses with multiple clients |

| Wave | Free invoicing, tracking, and reporting tools, payment processing integration | Small businesses and independent contractors |

| PayPal Invoicing | Easy to use, fast payment processing, mobile-friendly | Businesses looking for quick online payments |

Advantages of Using Online Tools

Using these online tools offers several advantages:

- Cost-effective: Most tools offer basic services at no cost or with affordable subscription plans.

- Time-saving: Pre-designed formats allow for fast document creation without manual formatting.

- Customizable: Easily adapt the design and content to match your business needs.

- Convenient: Create and send documents from anywhere with internet access.

By

How to Include Important Information

When creating a document to request payment for services rendered, including all the necessary details is crucial to avoid confusion and ensure smooth financial transactions. The more thorough and precise the document, the easier it will be for both you and your client to track the payment process. Including the right information helps clarify the terms of the deal and prevents any potential disputes.

Essential Details to Include

Here are the most important pieces of information you should always add to your payment request:

- Your Business Details: Include your business name, address, phone number, and email. This ensures that clients can easily contact you with questions or concerns.

- Client Information: Clearly state the name, address, and contact details of the client to avoid any mix-ups, especially for repeat customers.

- Unique Reference Number: Assign a unique reference or invoice number to each document. This makes it easier to track and reference specific transactions.

- List of Services Provided: Provide a detailed description of the services or products provided, including any quantities and individual prices. This transparency prevents confusion about what the client is paying for.

- Payment Terms: Specify the total amount due, due date, and accepted payment methods. Clear payment terms help set expectations and minimize delays.

- Tax Information (if applicable): Include any relevant tax details, such as sales tax or VAT, to ensure compliance and clarity in the financial transaction.

Formatting and Clarity

When organizing this information, make sure it is presented in a clean, easy-to-read format. Use clear headings, bullet points, and ample spacing to ensure that each detail stands out and can be quickly referenced. A well-structured document with all the necessary information will not only help prevent errors but will also establish your professionalism in the eyes of your clients.

Making Your Payment Records Look Professional

Presenting a polished and professional document for your financial transactions is essential for maintaining a positive image with your clients. A well-designed document not only ensures clarity but also reflects your business’s credibility and attention to detail. When clients receive a clear, well-organized payment record, they are more likely to trust your services and value your professionalism.

To ensure your payment documents look polished and convey professionalism, consider the following tips:

- Use a Clean, Structured Layout: A clear and easy-to-read format ensures that all the important details are easily accessible. Avoid cluttering the document with unnecessary information, and focus on simplicity and organization.

- Incorporate Your Branding: Include your logo, business name, and contact details in a consistent, prominent location. This not only reinforces your brand but also makes the document easily identifiable to your clients.

- Choose Professional Fonts: Opt for simple, easy-to-read fonts such as Arial or Helvetica. Avoid using overly decorative fonts that could distract from the content and make the document harder to read.

- Ensure Accurate and Consistent Formatting: Consistent use of font size, bolding, and alignment can make the document look more cohesive. Double-check for any errors in spelling, dates, or pricing to avoid appearing unprofessional.

- Use High-Quality Paper or Digital Files: If you are sending a physical record, use high-quality paper to make a lasting impression. For digital records, make sure the file is formatted correctly (PDF is a popular and reliable format) for easy viewing and printing.

By focusing on clarity, branding, and attention to detail, you can create a payment record that not only looks professional but also reinforces your company’s commitment to quality and customer satisfaction.

Common Mistakes in Payment Requests

While creating payment records may seem straightforward, many businesses still make common errors that can lead to confusion, delays, or even disputes with clients. Avoiding these mistakes is essential for maintaining a professional relationship and ensuring timely payments. By being aware of the most frequent pitfalls, you can ensure that your documents are accurate, clear, and efficient.

Here are some of the most common mistakes to avoid when preparing financial documents:

- Missing Contact Information: Failing to include your business’s contact details or the client’s information can lead to communication breakdowns and confusion about who is involved in the transaction.

- Incorrect or Missing Dates: Not including or misdating important fields like the service date or payment due date can cause delays or disagreements over when payments are expected.

- Ambiguous Descriptions: Vague descriptions of services or products make it unclear what the client is being charged for, which can lead to confusion or disputes about the charges.

- Inconsistent Pricing: Errors in pricing, such as adding taxes or fees incorrectly, can lead to problems with clients who feel they are being overcharged or undercharged.

- Lack of Clear Payment Terms: Not specifying clear payment terms, such as due dates, acceptable payment methods, and late fees, can result in misunderstandings and delayed payments.

- Omitting Taxes or Discounts: Forgetting to add applicable taxes or discounts can lead to inaccuracies in the final amount due, affecting both your revenue and the client’s expectations.

By avoiding these common mistakes, you can streamline your payment process, build trust with your clients, and ensure that transactions are completed smoothly and without confusion.

How to Handle Payment Requests Effectively

Managing payments efficiently is key to maintaining smooth financial operations and healthy client relationships. Whether you’re a freelancer, small business owner, or part of a larger company, handling payment requests properly ensures timely transactions and reduces the risk of missed or delayed payments. Establishing clear processes and maintaining consistent communication can help you stay organized and professional when managing financial transactions.

Here are some best practices to handle payment requests effectively:

Establish Clear Payment Terms

Setting clear payment expectations from the beginning can help prevent misunderstandings and delays. Include the following terms in your payment requests:

- Due date: Clearly specify when the payment is due to avoid any confusion.

- Accepted payment methods: List the payment methods you accept, such as credit cards, bank transfers, or online payment platforms.

- Late fees or penalties: If applicable, specify any fees for late payments to encourage clients to pay on time.

Maintain Clear Communication

Effective communication is critical throughout the payment process. Make sure to:

- Send reminders: If payment due dates are approaching, send friendly reminders to ensure clients are aware of their obligations.

- Provide contact information: Make it easy for clients to contact you if they have questions about the payment or need clarification.

- Follow up promptly: If payments are overdue, follow up in a timely and professional manner to resolve any issues as quickly as possible.

Offer Multiple Payment Options

Offering different payment methods can make it easier for clients to pay on time. Consider providing options such as:

- Bank transfers

- Credit or debit card payments

- Payment processors like PayPal or Stripe

- Mobile payment options

By offering convenience and flexibility, you increase the chances of prompt payments.

Track Payments Efficiently

Keep track of all incoming payments to ensure they are processed correctly. Use accounting software or a simple spreadsheet to record payment dates, amounts, and any outstanding balances. Regularly review this information to stay on top of your finances and ensure that no payment goes unaccounted for.

By following these steps, you can handle payment requests professionally and efficiently, helping your business maintain a smooth cash flow and bu

Integrating Payment Documents with Accounting Software

Incorporating payment documents with accounting software is a highly effective way to streamline financial processes and ensure better accuracy and efficiency in managing your business’s finances. By linking your payment records directly with accounting platforms, you can automatically track transactions, generate reports, and minimize manual errors. This integration helps save time and ensures that all financial data is consistently up-to-date and organized.

Benefits of Integration

Integrating your payment records with accounting software offers several advantages:

- Automated Record Keeping: When you link payment documents to your accounting software, the system can automatically record transactions, eliminating the need for manual data entry.

- Real-Time Tracking: With integrated systems, you can track payments in real time and get an up-to-date view of your business’s cash flow.

- Improved Accuracy: Integration reduces the risk of errors that may occur during manual data entry, ensuring that both your financial records and client transactions are accurate.

- Faster Billing Process: Automating the creation and processing of payment requests speeds up the entire billing cycle, helping you get paid faster and more efficiently.

- Comprehensive Reporting: Integrated software allows you to generate comprehensive financial reports, such as profit and loss statements, tax reports, and sales analytics, to better understand your business’s financial health.

How to Integrate Payment Documents with Accounting Software

To integrate your payment records with accounting software, follow these steps:

- Choose the Right Software: Ensure that your accounting software supports integration with your chosen payment record system. Popular accounting tools like QuickBooks, Xero, or FreshBooks often offer this feature.

- Use Compatible Formats: Most accounting platforms can accept various file formats, including PDFs and CSV files. Ensure your payment records are in a compatible format for smooth integration.

- Link Your Accounts: Connect your accounting software to your payment system (such as PayPal, Stripe, or your bank account) to automatically sync payment transactions.

- Set Up Automation: Once linked, set up automatic features such as sending payment reminders, generating reports, and updating the status of unpaid balances.

By integrating your payment records with accounting software, you not only save valuable time but also reduce the risk of errors, improve client relationships, and gain a better understanding of your business’s financi

Protecting Your Business with Accurate Payment Records

Maintaining accurate financial documentation is essential for safeguarding your business against disputes, legal issues, and financial discrepancies. Precise records help establish clear agreements with clients and provide a strong defense in case of payment disputes. When you present your clients with detailed and correct payment requests, you not only ensure transparency but also protect your business from potential financial risks.

Here are several ways that accurate financial records can protect your business:

- Legal Protection: A well-documented transaction with all the correct details acts as a legal safeguard in case of a dispute. It serves as proof of what was agreed upon and the terms of payment, providing clarity should any issues arise.

- Clear Communication: Providing detailed and accurate payment requests eliminates confusion and sets clear expectations, reducing the chances of misunderstandings between you and your clients.

- Reduced Risk of Non-Payment: When clients clearly understand the terms, amounts, and due dates, they are less likely to delay payments or dispute the charges, ensuring that your business receives the funds it’s owed.

- Tax and Audit Compliance: Accurate records are necessary for meeting tax obligations and preparing for audits. Organized payment documents allow you to quickly provide necessary information to tax authorities and financial auditors, reducing the risk of penalties or compliance issues.

- Improved Cash Flow Management: Accurate and timely payment documentation helps you keep track of outstanding balances and monitor cash flow. This ensures that you can plan your finances more effectively and avoid any cash shortages.

By creating accurate and professional payment records, you’re not just enhancing your business’s reputation and efficiency – you’re also ensuring that your company is well-protected and compliant with legal and financial standards.

Why No-Cost Payment Forms Are a Great Choice

For small businesses, startups, and independent contractors, managing expenses and keeping costs low is essential for success. Utilizing no-cost options for administrative tasks, such as creating payment records, can save valuable resources while maintaining professionalism. These readily available, easy-to-use forms help businesses streamline their billing process without the need for expensive software or complicated setups.

Benefits of Using No-Cost Payment Forms

There are several advantages to opting for no-cost payment forms:

- Cost Savings: One of the most significant benefits is the obvious financial advantage. By using a no-cost form, you avoid the need to purchase expensive software or subscription services, making it ideal for businesses with limited budgets.

- Time Efficiency: No-cost payment forms are often designed to be simple and straightforward, which means you can create and send payment records quickly without having to spend time learning complex software.

- Customization: Many no-cost forms are highly customizable, allowing you to personalize the layout, content, and design to match your business branding and unique needs. This flexibility helps you present a professional image to clients.

- Ease of Access: No-cost payment forms are often available online, allowing you to access them from any device. This means you can create and send payment records at any time, even while on the go.

- Simple Record Keeping: With these forms, tracking your payment requests becomes easier. You can store digital copies or print hard copies for your records, making it simple to stay organized and ensure no payments are overlooked.

How to Make the Most of No-Cost Payment Forms

To get the most out of no-cost payment forms, consider the following tips:

- Choose the Right Format: Select a form that suits your business needs, whether it’s a basic document or one that includes additional fields for discounts, taxes, and service details.

- Keep It Professional: Even though you’re using a no-cost form, ensure it is clear, well-organized, and professional. This reflects well on your business and helps foster trust with clients.

- Stay Consistent: Use the same format consistently for all payment requests. This helps streamline your processes and makes it easier for both you and your clients to understand the details of the transaction.

By choosing no-cost payment forms, you can maintain a professional and efficient billing process while keeping your business expenses to a minimum.