How to Create an Effective Art Invoice Template for Artists

For any artist or creative professional, managing finances and maintaining a professional appearance is essential. One of the most important tasks in this process is ensuring you have a clear, organized way of requesting payment for your work. A well-structured financial document is not just a tool for getting paid; it also reflects your professionalism and commitment to your craft.

Whether you’re a painter, sculptor, photographer, or designer, having a standardized way to bill clients can save time and avoid confusion. By using a well-organized document, you ensure that all necessary details are included and your clients understand the terms of payment. This simple tool helps you keep track of your income, manage business relationships, and maintain a smooth workflow.

In this guide, we’ll explore how to create a professional billing document that is tailored to your specific needs as a creative professional. We will discuss the essential components, best practices, and ways to make your process more efficient and effective. By the end, you’ll be equipped to present yourself with confidence and clarity when it comes to financial transactions.

Creative Billing Document Guide

Managing payments efficiently is crucial for anyone working in a creative field. A well-designed financial document not only ensures clarity but also streamlines the entire process, from completing a project to receiving compensation. Having a standardized way of requesting payment can significantly reduce confusion and errors, making the transaction smoother for both you and your client.

In this section, we’ll walk you through the process of creating a billing document that fits your needs as a creative professional. Whether you’re working on a one-time commission or an ongoing project, it’s important to include all relevant details to avoid misunderstandings and delays in payment. By following a structured approach, you can maintain a consistent and professional appearance with every transaction.

The following guide will cover the essential elements that should be included, as well as best practices for customizing the document to suit your unique style and business needs. With the right tools and knowledge, you’ll be able to handle the financial side of your work with ease and confidence.

Why You Need a Billing Document

For any creative professional, having a formal way to request payment for services rendered is essential. Not only does it ensure you are compensated for your time and effort, but it also helps maintain clear communication with clients regarding the terms of the agreement. A properly structured payment request establishes trust and professionalism in every business transaction.

Using a formalized document also provides a sense of security. It outlines all the details of the work completed, the amount due, and the payment terms, reducing the chances of misunderstandings or delays. By having a clear and organized approach, both you and your client are on the same page, making the process smoother and more efficient.

Furthermore, a well-crafted financial request is essential for keeping accurate records. It helps you track payments, manage your income, and maintain a professional image. Whether you are just starting out or have an established career, using a standardized method for payments is an important step toward building a sustainable and reputable business.

Key Elements of a Billing Document

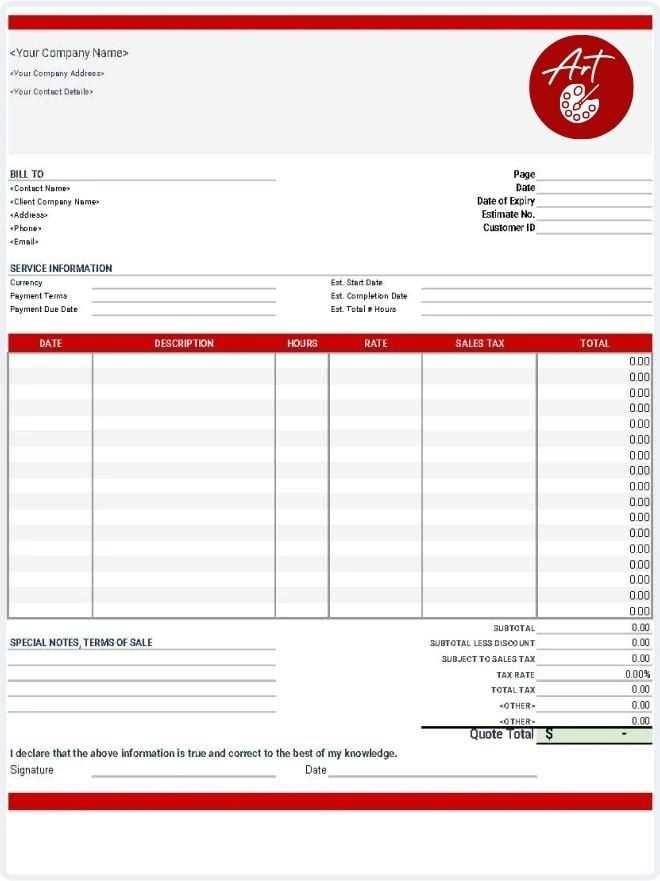

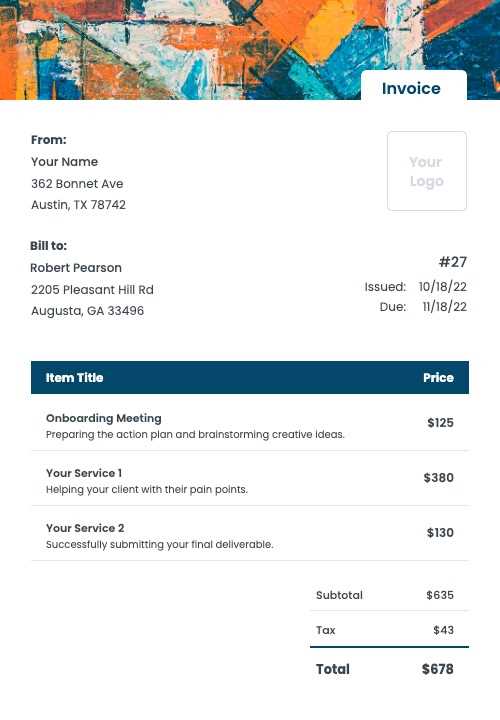

To ensure clarity and professionalism, every financial request should include specific details that both the creator and the client can easily understand. These elements help outline the terms of the transaction and ensure that nothing is overlooked. Below are the essential components that should be included in any well-organized payment request.

Essential Information to Include

- Client Information: Include the full name, address, and contact details of the client. This ensures that both parties can be easily reached if there are any questions or issues.

- Your Information: Your name or business name, contact details, and any relevant registration information should be clearly listed.

- Unique Identifier: A reference number or unique ID for each document helps in tracking and organizing records. This is especially useful for repeat clients or ongoing projects.

- Description of Work: Clearly detail the services or products provided, including any relevant dates, quantities, or specifications. This avoids confusion over what was delivered.

- Amount Due: Specify the agreed-upon amount for the work completed. If there are multiple services or products, break the amounts down for transparency.

- Payment Terms: Include information about when payment is due, the accepted methods of payment, and any late fees or discounts for early payment.

Additional Details to Consider

- Payment Instructions: Provide clear instructions on how and where to send the payment, whether via bank transfer, online platforms, or checks.

- Legal Terms: If necessary, include any legal or contractual terms that apply to the work, such as copyright agreements or confidentiality clauses.

- Notes or Special Instructions: This can be used for any additional information, such as a thank-you note or reminders about specific terms of the agreement.

Including these key elements ensures that both parties are aligned and that the payment process is as smooth as possible. A well-crafted billing document minimizes confusion and helps create a professional and trustworthy relationship with clients.

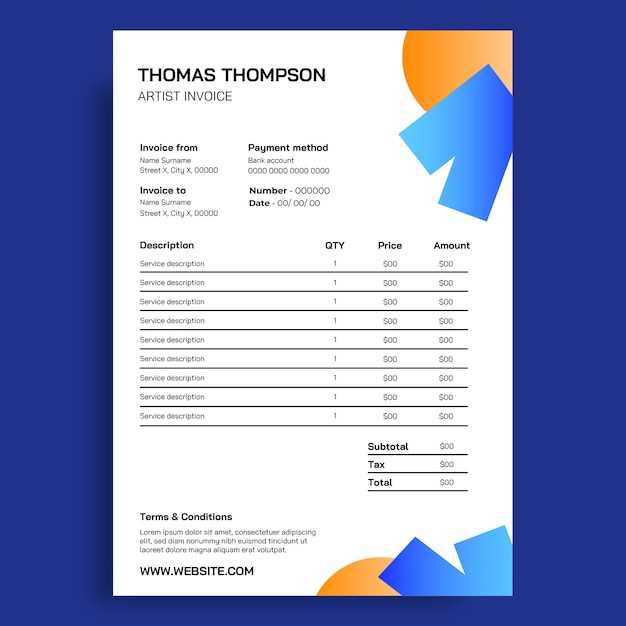

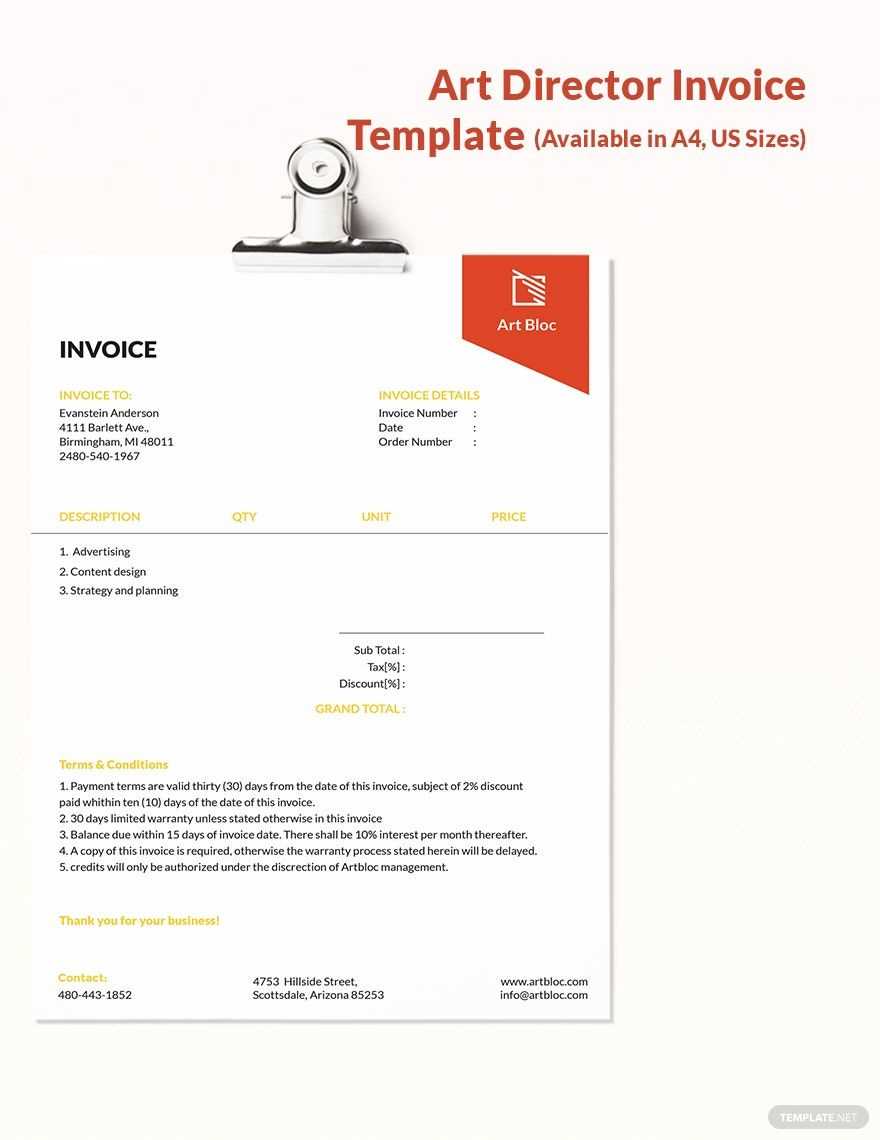

How to Design a Billing Document

Creating a visually appealing and functional financial document is key to presenting yourself as a professional. A well-designed request for payment not only looks polished but also ensures that all necessary information is clear and easy to find. When designing your document, it’s important to balance both form and function–making it simple to read while highlighting the most crucial details.

The design should reflect your personal style or the branding of your business while maintaining a professional appearance. Here are several steps to guide you through the process of designing an effective payment request.

Step 1: Choose a Clean Layout

A cluttered document can be overwhelming and confusing. Opt for a layout that is simple and easy to navigate, with clear sections and plenty of white space. Ensure the following elements are well-organized:

- Header: Place your contact information, client details, and document title at the top. This ensures immediate clarity about who is issuing the document.

- Itemized List: Present the services or products provided in a neat, organized list. Use columns for the description, quantity, unit price, and total cost.

- Total Section: Highlight the total amount due by using bold text or a larger font size, so it stands out to the client.

Step 2: Use Branding and Color

Incorporating your brand’s colors and logo helps give your document a professional touch while making it easily recognizable. However, avoid using too many colors or complicated graphics that might distract from the essential information. Stick to a simple color palette that complements your brand’s identity and ensures the text remains legible.

Step 3: Select the Right Fonts

Choose clear, easy-to-read fonts. Use a professional typeface for the body text, such as Arial or Times New Roman, and perhaps a slightly more decorative font for the headings or title. Keep font sizes consistent to ensure readability, and limit the use of bold or italics to emphasize important points.

Step 4: Include Clear Payment Instructions

Clearly outline how and when the client should make the payment. Include your preferred methods, whether it’s via bank transfer, online payment platform, or check. Make sure to provide any relevant payment details, such as account numbers or links, in a dedicated section at the bottom.

By following these steps, you can create a visually appealing and functional billing document that reflects your professionalism and ensures a smooth transaction process with your clients.

Choosing the Right Billing Software

When it comes to managing payments and financial records, the right software can make all the difference. Using a digital tool to generate and track your payment requests can save you time, reduce errors, and ensure a more professional presentation. With many options available, it’s important to choose software that suits your specific needs and business style.

Below are key factors to consider when selecting the right tool for creating and managing payment documents:

| Factor | Considerations |

|---|---|

| Ease of Use | Choose software with an intuitive interface that allows you to create, customize, and send documents quickly. A simple design will reduce the learning curve and speed up the process. |

| Customization Options | Look for software that allows you to personalize the document layout, colors, and logo placement to match your brand identity. The more flexibility, the better it will reflect your business style. |

| Payment Integration | Select a tool that supports seamless integration with online payment platforms, allowing clients to pay directly from the document. This makes the payment process faster and more convenient. |

| Tracking and Reporting | Opt for software that includes tracking features, such as payment status, overdue reminders, and financial reports. This will help you stay organized and keep on top of your payments. |

| Security Features | Ensure the software uses encryption and secure cloud storage to protect sensitive client and payment information. This is essential for maintaining trust and safeguarding data. |

| Cost | Consider your budget and look for software that offers a good balance of features and price. Some tools have free versions with basic features, while others offer advanced capabilities for a fee. |

By carefully considering these factors, you can choose the right software that meets your needs, helps streamline your billing process, and enhances your overall professionalism. A reliable tool will not only save you time but also provide a smooth and secure experience for your clients.

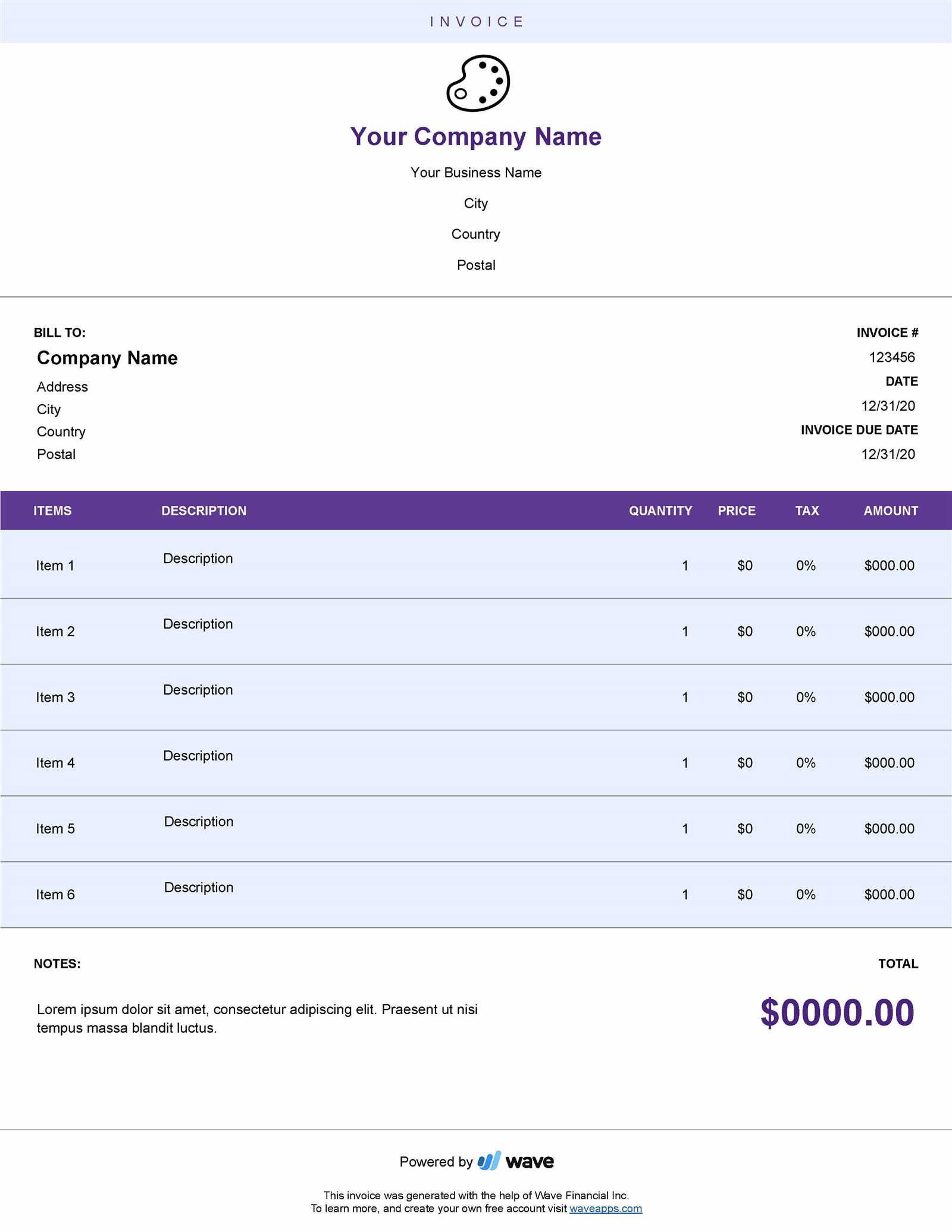

How to Personalize Your Billing Document

Customizing your financial documents is a great way to make them stand out and reflect your personal style or brand identity. By adding unique elements, you not only make your documents more professional, but you also create a memorable experience for your clients. Personalization can be as simple as adjusting the design or as detailed as adding specific terms and conditions that align with your business practices.

Below are several ways to customize your payment request to suit your needs and preferences:

| Personalization Option | Benefits |

|---|---|

| Logo and Branding | Incorporating your logo and business colors makes your document instantly recognizable. It adds a professional touch and reinforces your brand identity with every interaction. |

| Custom Fonts | Choose fonts that reflect your style, but ensure they are easy to read. A distinctive font can make your documents feel more personal while maintaining legibility. |

| Personalized Message | Include a thank-you note or a personal message at the end of the document to express your appreciation for the client’s business. This can help strengthen your professional relationship. |

| Service Descriptions | Instead of using generic terms, describe the services or products with language that is unique to your work. This can make the request feel more tailored to the specific project. |

| Payment Terms and Conditions | Adjust the payment terms according to your specific needs. Whether it’s setting deadlines for payment or offering discounts for early settlements, customizing this section ensures your document aligns with your business model. |

| Background Design | Choose a background design or pattern that complements your personal or business style. Just make sure it doesn’t overwhelm the text or reduce readability. |

By taking the time to personalize your billing document, you demonstrate attention to detail and enhance the professionalism of your business. A customized request not only improves the client experience but also helps you stand out in a competitive market.

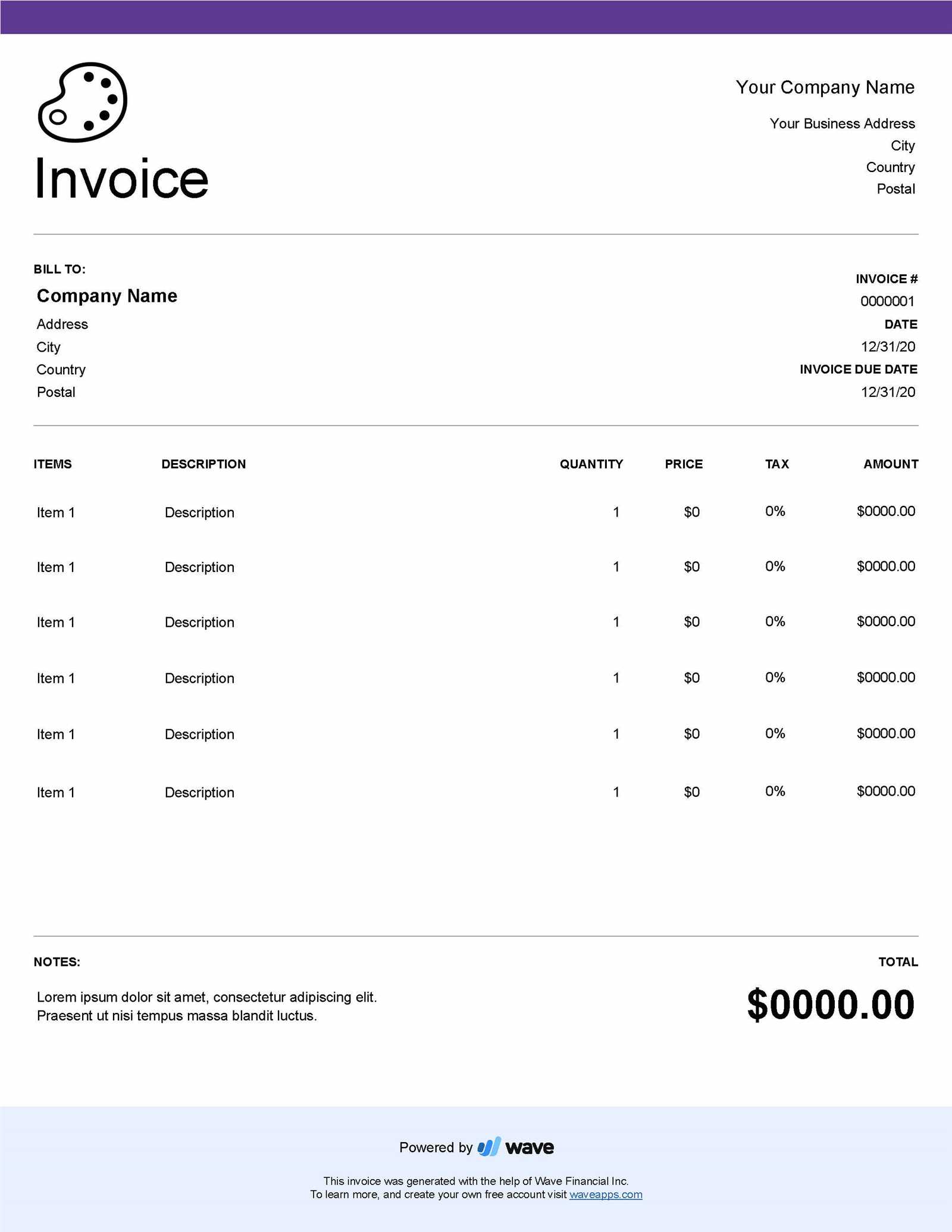

Free Billing Documents to Use

For creative professionals looking to streamline their payment process, there are numerous free resources available that allow you to quickly generate professional payment requests. These free tools provide ready-to-use formats that can be customized to your specific needs, saving you time while ensuring consistency and professionalism in your financial transactions.

Below is a list of free options to help you get started:

Popular Free Tools for Creating Payment Requests

| Tool | Features |

|---|---|

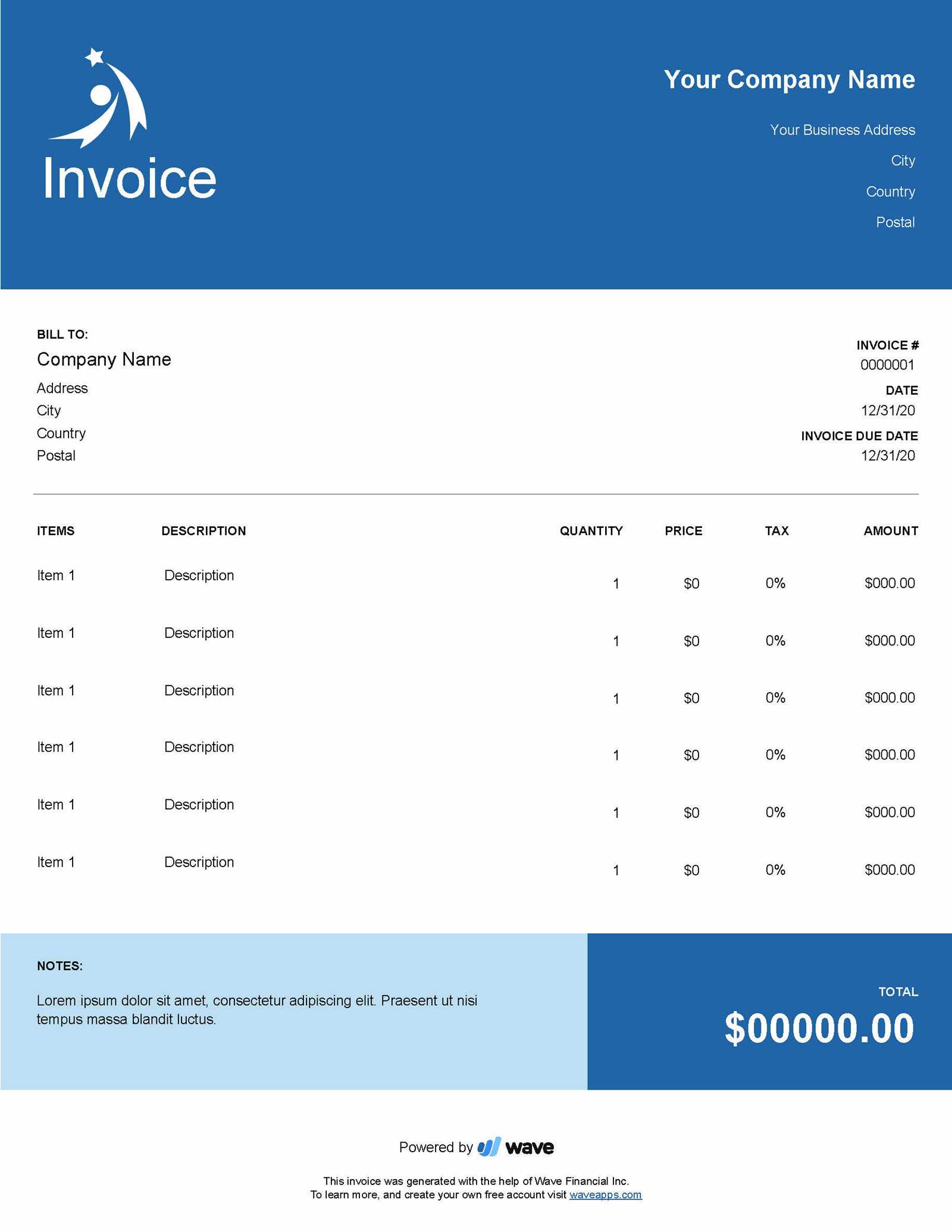

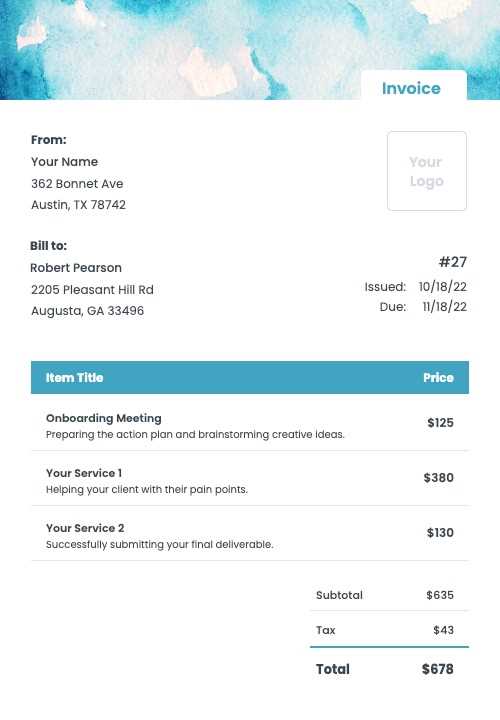

| Canva | Canva offers customizable billing formats with a wide range of styles and templates. It’s simple to use and provides design flexibility for those who want to personalize their documents. |

| Invoice Generator | This tool offers a straightforward, no-frills format where you can enter your information, adjust the amount due, and download the document. It’s ideal for quick, efficient billing. |

| Zoho Invoice | Zoho provides a free plan with templates for creating and managing billing requests. It includes payment tracking and automatic reminders, which is especially useful for ongoing projects. |

| Wave | Wave is a robust free software offering customizable invoices, accounting features, and receipt management. It’s ideal for creatives looking to manage both finances and payments in one place. |

| PayPal | If you already use PayPal, their free tool allows you to generate and send billing documents directly to clients. It also integrates with PayPal’s payment system for quick, secure transactions. |

Benefits of Using Free Tools

Using these free tools can help you create professional billing documents without the need for costly software. Most offer easy-to-use interfaces, and you can customize them to fit your specific needs, ensuring that your financial records are organized and accurate. Additionally, these tools often come with features like payment tracking, automated reminders, and integration with payment platforms, streamlining the entire process.

By using free resources, you can efficiently manage your payments and create a polished, professional experience for your clients while keeping your costs down.

Common Mistakes to Avoid in Billing

When managing financial transactions, even small errors in your payment requests can lead to misunderstandings or delayed payments. It’s essential to avoid common mistakes that can complicate the process or damage your professional reputation. Below are some of the most frequent mistakes to watch out for when creating and sending your financial documents.

Key Mistakes to Avoid

- Missing Client Information: Always ensure that your client’s name, address, and contact details are correct. Missing or incorrect information can lead to confusion and delays in payment.

- Vague Descriptions of Services: Avoid unclear or generic descriptions. Clearly outline the work provided with detailed descriptions, including dates, quantities, and any additional costs.

- Not Including Payment Terms: Clearly specify the payment due date, late fees (if applicable), and accepted payment methods. Leaving this out can cause confusion and missed deadlines.

- Forgetting to Number the Document: Failing to include a unique reference number for each document can make it difficult to track payments and manage records, especially when working with repeat clients.

- Incorrect Pricing or Totals: Double-check your calculations before sending the document. Errors in pricing or totals can cause frustration for both you and your client.

- Lack of Contact Information: Always include your full name, business name, and contact details in case your client needs to reach you for clarification or to discuss the payment.

- Overcomplicating the Design: A cluttered or overly complicated document can confuse the client. Keep your layout clean and easy to navigate, with clearly labeled sections.

- Not Keeping a Copy: Always save a copy of the document for your records. This is essential for accounting purposes and to reference in case there are any discrepancies or payment issues later on.

Avoiding these common mistakes can help ensure that your billing process is smooth, professional, and free of complications. By taking the time to double-check your documents and maintain clear communication, you can build better relationships with clients and receive payments on time.

How to Calculate Commission Fees

When working on custom projects, it’s essential to determine a fair and transparent commission fee. Accurately calculating this fee not only ensures you are properly compensated but also helps set clear expectations with your clients. There are several methods to calculate your fees, and the right approach depends on the specifics of the project, the time required, and your level of experience.

Steps to Calculate Your Commission Fee

- Determine Your Hourly Rate: Start by calculating an hourly rate that reflects your skill level, experience, and the market rate for similar work. Consider factors like your expenses, the complexity of the project, and the value you bring to the client.

- Estimate Time Required: Estimate how many hours you expect the project to take. Include time for revisions, communication, and any unexpected delays. This helps provide a more accurate fee estimate.

- Calculate Materials and Costs: If the project involves physical materials or other direct expenses, be sure to include these costs in your calculation. This ensures that you are not losing money on out-of-pocket expenses.

- Include a Profit Margin: Many professionals add a profit margin on top of their time and material costs. This could be a percentage of the total or a fixed amount, depending on the nature of your work.

- Factor in Project Complexity: If the project is particularly complex, requires specialized skills, or has a tight deadline, consider charging a higher rate. This compensates you for the increased effort and expertise required.

- Consider the Client’s Budget: It’s important to balance your fee with the client’s budget. While it’s critical to value your work appropriately, being flexible when necessary can help secure more projects and build long-term relationships.

Common Pricing Models

- Flat Rate: Charging a fixed price for the entire project based on an estimated number of hours or complexity.

- Hourly Rate: Charging based on the actual time spent working on the project. This model is ideal for projects that may have an unpredictable scope.

- Percentage of Total Value: Some professionals charge a percentage of the total value or price of the final product. This is common in some industries where the project’s value can increase significantly based on the final result.

By taking these factors into account, you can ensure that your commission fee is both fair and reflective of the work involved. A clear, transparent pricing structure helps set expectations and prevents misunderstandings with clients, leading to smoother transactions and better professional relationships.

Best Practices for Billing

Creating clear, accurate, and timely financial documents is essential for maintaining strong professional relationships and ensuring smooth transactions. Adhering to best practices when managing billing will help you avoid errors, ensure fair compensation, and foster trust with your clients. Below are key strategies to follow when creating and sending your payment requests.

Key Practices to Follow

- Use Clear, Detailed Descriptions: Always provide a thorough breakdown of the services or products delivered. This includes specifying quantities, delivery dates, and any other relevant details that help clarify what the client is paying for.

- Be Transparent with Pricing: Clearly state your rates or fees for each service, ensuring there are no hidden charges. Transparency helps build trust and avoids confusion down the line.

- Set Clear Payment Terms: Specify payment deadlines, accepted methods of payment, and any penalties for late payments. Be upfront about your expectations and allow enough time for the client to make the payment.

- Maintain Consistency: Use the same format for all your payment documents, keeping them consistent in terms of layout, language, and details. This professional consistency creates a sense of reliability.

- Send Documents Promptly: Issue your financial documents as soon as the project is completed or at agreed-upon milestones. Timely billing not only helps with cash flow but also shows your professionalism.

- Include Contact Information: Make it easy for your clients to contact you with questions or concerns. Include your full name or business name, email, phone number, and any other relevant details.

- Track Your Payments: Keep detailed records of the payments received and outstanding amounts. Using software or digital tools can help you stay organized and follow up with clients if needed.

- Send Reminders for Overdue Payments: If a payment is overdue, send polite, professional reminders. A gentle nudge can encourage timely payments without damaging your relationship with the client.

- Be Professional in Communication: Whether you’re sending

Legal Considerations for Billing Documents

When preparing payment requests, it’s crucial to ensure that your documents comply with applicable laws and regulations. Legal considerations not only help protect your business but also clarify expectations between you and your clients. Understanding these considerations will help you avoid disputes and ensure that your financial dealings remain professional and enforceable.

Important Legal Elements to Include

- Clear Payment Terms: Always include specific terms regarding payment deadlines, penalties for late payments, and any other conditions, such as deposits or partial payments. Clear terms reduce the chances of misunderstandings.

- Legal Name and Contact Information: Ensure that your full legal business name, address, and contact details are accurately listed. This provides the necessary information for any legal follow-ups or correspondence.

- Client’s Information: Including the correct details of your client, such as their full name or business name and contact information, is important in case of disputes or legal actions.

- Accurate Descriptions of Services or Goods: Providing a detailed and clear description of the goods or services provided is essential. This ensures there is no ambiguity about what was agreed upon and can be important if legal action is necessary.

- Tax Information: If applicable, include your tax registration number and the relevant sales tax or VAT charges. This is required in many jurisdictions to ensure proper tax reporting.

- Late Payment Fees: If you intend to charge interest or late fees for overdue payments, make sure these terms are clearly stated in the payment request and in your contract with the client.

Legal Protections and Best Practices

- Use Written Contracts: Whenever possible, supplement your financial documents with a written contract that outlines the terms of the project, including payment structure, deadlines, and deliverables. A contract provides stronger legal protection in case of a dispute.

- Retain Copies: Always keep a copy of the payment request and any related correspondence for your records. This can serve as evidence in case you need to pursue legal action for unpaid amounts.

- Know Your Local Laws: Familiarize yourself with the laws that govern contracts, payments, and business practices in your jurisdiction. This knowledge ensures that you are compliant with all legal requirements and helps avoid potential legal issues.

- Dispute Resolution: In the event of a dispute, consider including a clause in your contract or document specifying the method of dispute resolution, such as mediation or arbitration, to avoid lengthy court proceedings.

- Intellectual Property Rights: If your work involves intellectual property, ensure that the terms regarding the use and ownership of that work are clearly outlined, especially if the work is being licensed or sold under specific terms.

By including these legal considerations in your billing documents, you ensure that your business practices are legally sound and protect both your rights and those of your clients. A well-crafted document not only promotes professionalism but also safeguards against potential legal challenges.

How to Handle Late Payments

Late payments are a common challenge for many professionals, and how you address them can have a significant impact on your cash flow and business relationships. Effectively managing overdue payments requires a mix of professionalism, patience, and clear communication. By establishing clear terms upfront and handling late payments with care, you can minimize delays and maintain positive working relationships with clients.

Steps to Take When Payments Are Late

- Review the Payment Terms: Before taking any action, double-check the agreed-upon payment terms to ensure that the payment is truly overdue. This includes the due date, payment methods, and any grace periods that may have been provided.

- Send a Polite Reminder: If the payment is just a few days overdue, start by sending a polite reminder. Sometimes clients simply forget or miss the due date, and a gentle nudge can help resolve the issue quickly.

- Follow Up with a Firm Reminder: If the payment remains unpaid after the initial reminder, send a more formal follow-up. Clearly state the amount due, the original due date, and any late fees that may have been outlined in your payment terms.

- Offer Flexible Payment Options: If a client is struggling to pay, consider offering a payment plan or alternative methods of payment. Flexibility can help resolve the issue while maintaining a good relationship with the client.

- Charge Late Fees: If your payment terms include penalties for overdue payments, don’t hesitate to enforce them. Clearly outline any additional fees in your follow-up communication and remind the client of these terms.

When to Take Further Action

- Escalate to a Collection Agency: If the payment remains unpaid after multiple attempts to resolve the issue, consider working with a collection agency. They have the experience and tools to recover funds, though this should generally be a last resort.

- Legal Action: If the amount due is significant and all other methods have failed, you may need to consider taking legal action. Consult with a legal professional to understand your options and ensure that you follow the proper procedures.

- Terminate Future Work: In some cases, you may need to stop work with the client until the outstanding payment is settled. Make it clear that future projects will be contingent upon clearing their current balance.

Handling late payments in a professional manner is essential for maintaining cash flow and business integrity. While patience and communication are key, having clear payment terms and a structured follow-up process can help reduce the likelihood of delays in the first place.

Using Digital Payments for Creatives

In today’s digital age, more professionals are opting for electronic payment methods to streamline transactions and ensure faster, more secure payments. For those in creative fields, accepting digital payments can be a game changer, offering convenience for both the service provider and the client. By embracing online payment platforms, you can reduce the hassle of managing cash or checks, and also provide clients with flexible, quick options for settling their balances.

Advantages of Digital Payments

- Faster Transactions: Digital payments are processed in real time, allowing you to receive funds quickly, even across borders. This is especially beneficial for international clients or those on tight schedules.

- Security: Payment platforms are designed with encryption and fraud protection, offering a higher level of security than traditional methods like cash or checks. This helps protect both parties from potential financial risk.

- Convenience: Clients can pay from anywhere, at any time, using various devices. This flexibility makes it easier for clients to settle payments promptly, improving cash flow for your business.

- Record Keeping: Digital payment systems automatically generate receipts and records of all transactions, making it easier to track payments and maintain financial records. This reduces the risk of errors and helps with accounting tasks.

- Reduced Costs: By eliminating the need for checks, physical invoicing, and other paper-based methods, digital payments can reduce administrative costs and save time on managing payments manually.

Popular Digital Payment Platforms

- PayPal: One of the most widely recognized platforms, offering easy integration and protection for both buyers and sellers. PayPal allows you to send invoices and accept payments via credit cards, bank transfers, or PayPal accounts.

- Venmo: A mobile payment system that is increasingly popular for smaller, personal transactions. It is a great option for freelancers working with smaller amounts or clients who prefer mobile payments.

- Stripe: Known for its robust features for businesses, Stripe allows users to accept credit card payments and automate recurring billing. It’s ideal for those running e-commerce stores or subscription-based services.

- Square: Square provides a comprehensive suite of payment processing tools, including point-of-sale systems and invoicing. It’s an excellent option for those who also need a physical payment solution in addition to digital options.

- Bank Transfers: Direct bank transfers are another option, offering lower transaction fees than some of the more common payment processors. Many digital payment platforms integrate with bank accounts for easy transfers.

Utilizing digital payment platforms can simplify your business operations and ensure prompt, secure payments. With a variety of options available, it’s important to choose the platform that best fits your workflow and client preferences. By doing so, you’ll streamline your payment processes and focus more on your creative work.

Tracking Your Invoices and Payments

Keeping track of payments and financial documents is essential for maintaining a smooth business operation. Proper tracking ensures that you can quickly identify outstanding balances, avoid errors, and manage your cash flow effectively. By organizing and monitoring your payment records, you can stay on top of your finances and avoid potential issues with clients.

Why Tracking Matters

- Improved Cash Flow: By keeping track of when payments are due and received, you can avoid cash flow disruptions. This helps you plan your expenses, pay bills on time, and ensure you have the funds necessary to grow your business.

- Avoid Overdue Payments: Regular tracking allows you to identify overdue amounts early, so you can follow up with clients before the situation escalates. Sending reminders promptly improves the likelihood of on-time payments.

- Efficient Record Keeping: Accurate tracking ensures you maintain organized records for tax purposes or future reference. Well-organized documentation simplifies bookkeeping and makes it easier to prepare financial reports.

- Dispute Resolution: In case of a dispute, having clear, well-maintained records allows you to quickly resolve any misunderstandings regarding payment terms, amounts, or deadlines.

Methods for Tracking Payments

- Manual Logs: A simple method is to keep a manual log of all financial transactions. This can be done with spreadsheets or even handwritten notes, though it requires careful attention to detail to avoid errors.

- Accounting Software: For more efficient tracking, accounting software like QuickBooks, FreshBooks, or Xero can automatically record payments, generate reports, and send reminders for overdue amounts. These platforms save time and reduce the risk of mistakes.

- Online Payment Platforms: Many online payment platforms, such as PayPal or Stripe, provide built-in tools to track transactions. These platforms often allow you to see real-time payment statuses and offer easy-to-download reports for bookkeeping purposes.

- Spreadsheets: Using a spreadsheet to record each transaction provides an affordable and customizable method for tracking payments. You can categorize payments, set due dates, and calculate balances due, making it a flexible option for those with fewer transactions.

Whichever method you choose, the key is consistency. Regularly updating your payment records, setting reminders, and using tools that automate part of the process will save you time and help you stay organized. Tracking your payments ensures that you are always aware of your financial status and can act quickly when necessary.

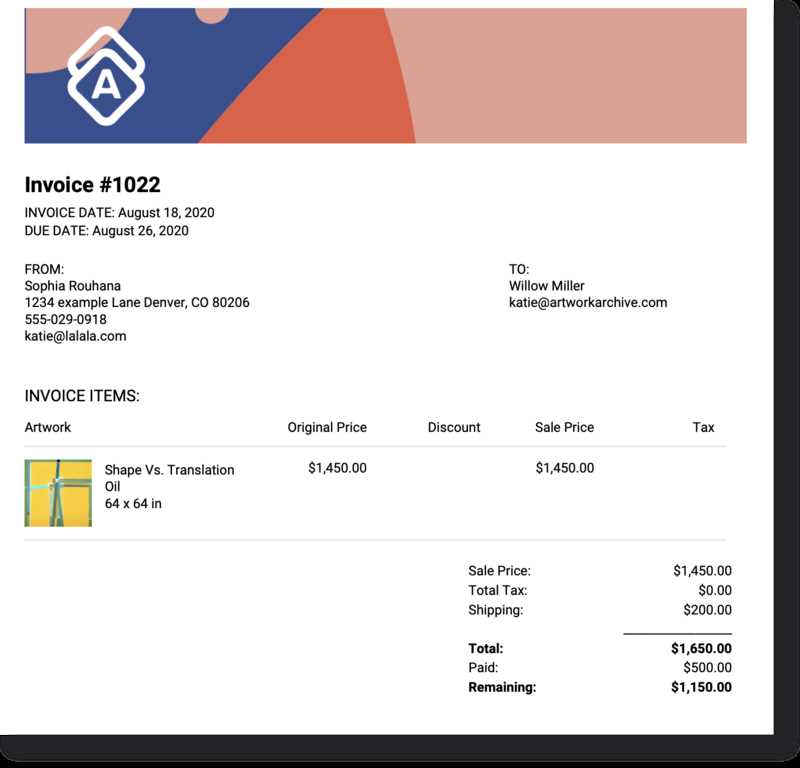

Creating Professional Billing Documents

When designing payment requests, creating a polished, well-organized document is essential for presenting yourself as a professional. A well-structured financial document not only ensures clarity but also reflects your business’s attention to detail and commitment to professionalism. By following certain guidelines and utilizing the right elements, you can craft a document that will impress clients and streamline the payment process.

Key Elements of a Professional Billing Document

- Your Contact Information: Include your full name or business name, address, phone number, email, and any other relevant contact details. This allows clients to easily reach you if there are any questions or issues regarding the payment.

- Client’s Information: Ensure that you have the correct name, company name (if applicable), and contact details of the client. This helps avoid confusion and ensures that the document is properly addressed.

- Clear Payment Terms: Clearly define the payment due date, any applicable late fees, and payment methods. Specifying these terms helps prevent misunderstandings and encourages timely payments.

- Detailed Description of Services or Goods: Provide an itemized list of the work completed or products delivered. This can include quantities, unit prices, and any applicable discounts or taxes. A detailed breakdown reduces the likelihood of disputes and ensures transparency.

- Unique Identification Number: Assign a unique number to each payment request to help both you and your client track it more easily. This is especially helpful for bookkeeping and future references.

- Total Amount Due: Clearly state the total amount due, including any taxes, shipping costs, or other additional charges. This makes it easy for clients to understand exactly what they are paying for.

- Payment Instructions: Provide clear instructions for how the client can pay, including bank account details, online payment links, or other relevant methods. The easier you make it for clients to pay, the more likely you are to receive prompt payments.

Designing a User-Friendly Document

- Keep It Clean and Simple: Avoid cluttering the document with excessive text or unnecessary information. A clean, easy-to-read layout ensures that all the important details are immediately visible and accessible to the client.

- Use Professional Fonts and Colors: Stick to easy-to-read fonts and a professional color scheme that reflects your business’s brand. Overly stylized fonts or bright, distracting colors may undermine the professionalism of the document.

- Incorporate Your Branding: If you have a business logo or specific brand elements, incorporate them into the document. This adds a personalized touch and reinforces your brand identity.

How to Invoice for Exhibitions

When participating in an exhibition, whether as a vendor, organizer, or artist, having a clear and professional method for requesting payment is essential. The process of charging for services or items displayed during an event involves more than just listing prices–it’s about creating a document that reflects your professionalism and ensures timely compensation. By following specific guidelines, you can streamline the payment process and avoid confusion, ensuring that both you and your clients are clear on the terms.

Steps to Follow When Requesting Payment

- Specify the Services or Items: Clearly outline what services you provided or what items were part of the exhibition. This could include booth rentals, artwork displayed, event coordination, or promotional services. A detailed list helps avoid misunderstandings about what is being charged for.

- Set Clear Payment Terms: Define when the payment is due, whether it’s before, during, or after the event. If the exhibition includes an extended payment plan or requires deposits, make sure these details are included, along with any applicable late fees or penalties for overdue payments.

- Include Event Details: Clearly indicate the event’s name, date, location, and other relevant details, such as the duration of the exhibition or the agreed-upon setup and take-down times. This ensures that your client knows exactly which event the charges apply to.

- Provide Payment Instructions: Specify how the payment should be made, whether via bank transfer, credit card, check, or through an online payment platform. The easier you make the process, the more likely it is that the client will pay on time.

- Account for Additional Charges: If there are any additional fees, such as shipping costs for items or commissions taken by event organizers, include them in the total amount due. Transparency is key to ensuring clients are not surprised by unexpected costs.

Common Mistakes to Avoid

- Unclear Payment Terms: Be specific about when and how you expect payment. Vague terms can lead to delays or disputes. Always state whether payment is due upon receipt or if there’s a grace period.

- Missing Event Information: Not including key event details, such as dates, location, or specific services provided, can cause confusion. Ensure the document is easy to reference for both parties.

- Not Including Late Fees: If late payments will incur a fee, ensure that this is clearly outlined in the agreement. If it’s not mentioned upfront, clients may not understand why they’re being charged extra.

- Omitting Contact Information: Always include your contact details and encourage clients to reach out if there are any questions or issues. This helps foster clear communication and prevents delays in the payment process.

By following these steps and being clear in yo

How to Invoice for Custom Orders

When working with custom orders, whether creating a bespoke product or providing a personalized service, it’s essential to ensure that the payment process is clear and professional. A custom project often involves specific details and unique terms that need to be accurately reflected in a payment request. By providing a well-structured document, you can ensure both you and your client are on the same page regarding expectations and deliverables, reducing the potential for confusion or disputes.

Steps to Create a Clear Payment Request for Custom Work

- Define the Project Scope: Clearly outline the agreed-upon details of the custom work, including the specifications, timeline, and any special requirements. This ensures that both you and your client are clear on what is being delivered and the timeline for completion.

- Provide a Breakdown of Costs: List the cost for each aspect of the project. This may include a base price, any additional materials, design revisions, or special requests. A detailed breakdown helps clients understand exactly what they are paying for and can prevent misunderstandings later on.

- Set Payment Terms: Specify the due dates for the payment, including any deposits required before work begins, and the final payment upon completion or delivery. Be clear if you expect full payment upfront, in installments, or upon delivery of the finished product.

- Include Delivery or Completion Dates: Clearly state the expected timeline for completion of the custom order. If there are multiple phases to the project, such as design approval or the final delivery, outline these milestones and the associated payment schedule.

- Outline Any Refund or Revision Policies: For custom orders, it’s important to specify your policy on revisions, cancellations, and refunds. This sets expectations early on and ensures both you and your client know the procedures if changes are needed during the process.

Best Practices for Custom Work Payment Requests

- Use a Clear, Professional Format: Ensure that your payment request is well-organized and easy to read. Include all relevant project details, payment terms, and contact information, and use a clean, professional design to maintain a good image.

- Be Transparent About Costs: Break down all costs associated with the custom order, including labor, materials, shipping, and any other fees. Clients appreciate transparency and it helps build trust.

- Set Clear Deadlines: Provide clear timelines for when payments are due and when the client can expect to receive the completed work. Clear deadlines keep both parties accountable and help prevent delays in the project.

- Communicate Regularly: Keep your client updated throughout the process, especially if there are any changes or de