Free Landlord Rental Invoice Template for Easy Rent Management

Managing payments and financial transactions is a critical task for property owners. Clear and accurate records are essential to ensure smooth operations and avoid misunderstandings with tenants. A well-structured document can serve as an efficient tool to streamline this process, making it easier to track due amounts, payment deadlines, and any outstanding balances.

Creating organized financial records provides a reliable method for monitoring rent collections and simplifying communication with tenants. By providing a professional and standardized format, property owners can avoid confusion and maintain transparency in all transactions. These documents can also be easily customized to suit individual needs, whether for residential or commercial properties.

In addition to making financial management easier, having a consistent approach to handling payment requests can help build trust with tenants. Clear documentation allows both parties to stay on the same page, ensuring a smooth and efficient rental process. Whether you’re new to managing properties or an experienced owner, adopting a formalized system can bring significant benefits to your operations.

Document Management Overview for Property Owners

Efficient financial documentation is an essential aspect of property management. Having a clear and standardized method for outlining payment terms helps ensure that both owners and tenants have a transparent understanding of due amounts, deadlines, and payment processes. By using a structured document, property owners can avoid confusion and maintain professionalism in their financial dealings.

Key Benefits of Using a Structured Document

- Consistency: A standardized approach ensures uniformity across all transactions, reducing errors and improving record-keeping.

- Clarity: Clearly outlining the terms and due dates helps prevent disputes and keeps both parties informed.

- Professionalism: Using a formalized document enhances trust and portrays a professional image to tenants.

- Time-saving: A pre-designed structure saves time by eliminating the need to create a new document for each transaction.

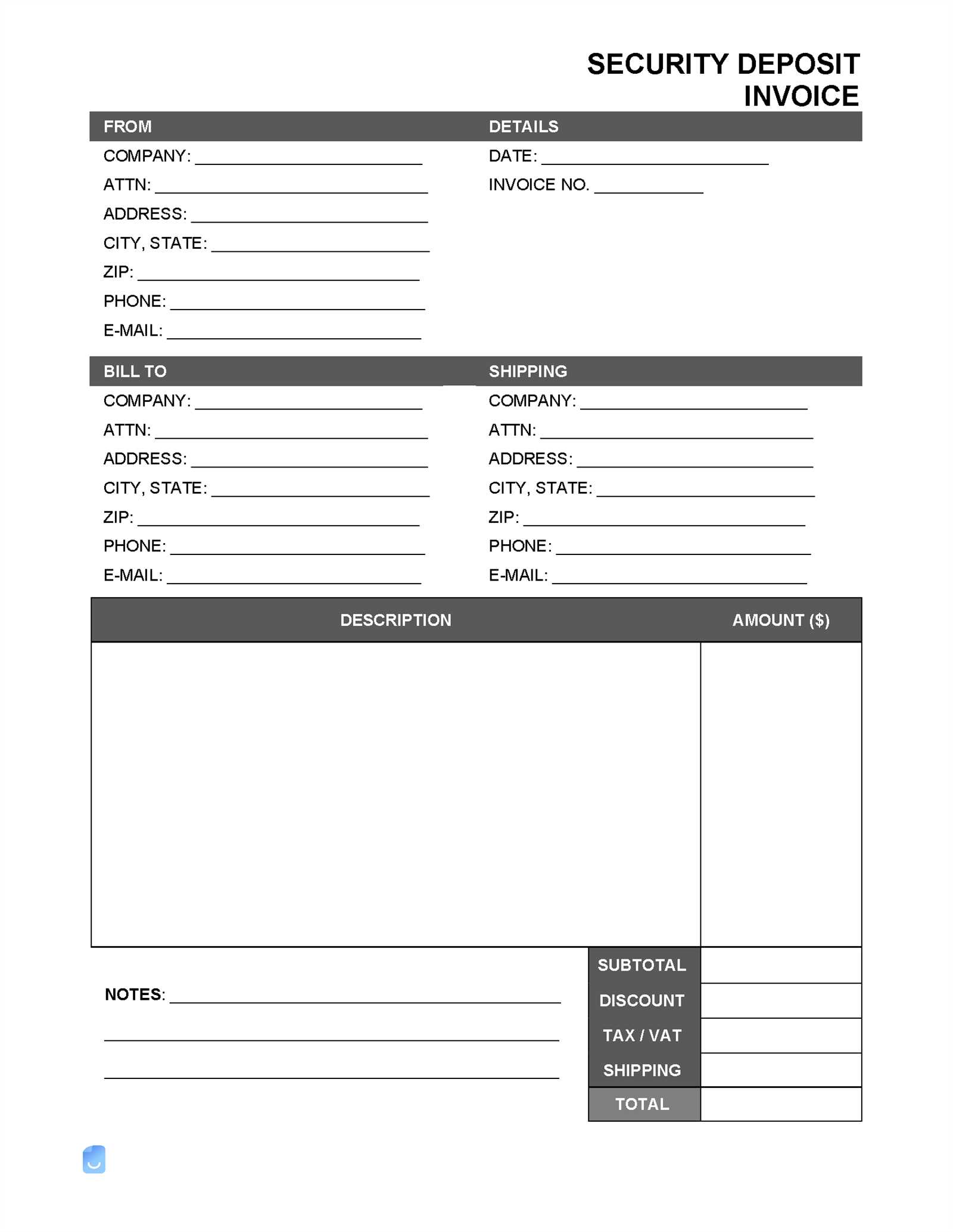

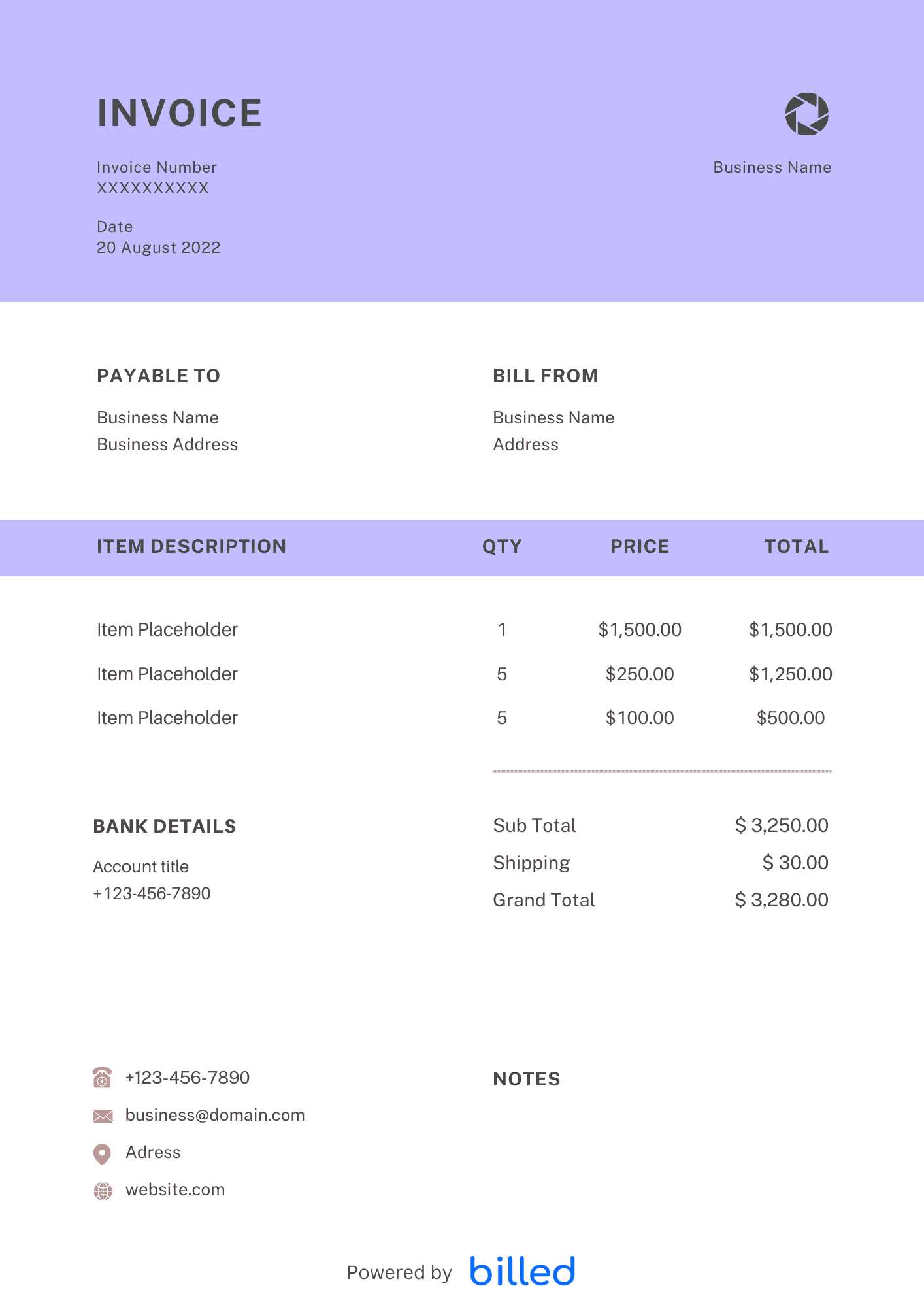

Essential Components of the Document

A well-crafted document includes several key elements to ensure all necessary information is captured. These components typically include:

- Contact Details: Information about the property owner and tenant for easy communication.

- Property Address: The location of the rental property being invoiced.

- Payment Due Date: The deadline for payment to be made.

- Amount Due: The total rent or fees that need to be paid.

- Payment Instructions: Clear guidelines on how to make the payment (e.g., bank transfer, online payment).

- Late Payment Penalties: Details about any fees that apply if the payment is delayed.

By including these elements, property owners can create an organized and effective document that streamlines payment management and ensures transparency throughout the process.

Why Use a Standardized Payment Document

Having a consistent approach to managing payment requests is essential for maintaining smooth financial transactions between property owners and tenants. Using a standardized document provides clarity, reduces confusion, and ensures all necessary details are included in a professional and organized manner. This method not only helps avoid misunderstandings but also contributes to better record-keeping and improved communication.

Efficiency is one of the main advantages of using a pre-designed payment document. By utilizing a ready-made structure, property owners save time and effort compared to creating a new document from scratch for each transaction. The document can be easily filled out with the specific payment details, minimizing the potential for errors.

Consistency across all payments is another key benefit. A standard document ensures that the same information is provided in each instance, making it easier to track payments over time. This also helps in maintaining organized financial records, which is crucial for both tax purposes and resolving any future disputes.

Furthermore, using a standardized payment document helps build trust with tenants. It conveys professionalism and shows that the owner values transparency and clear communication. Tenants are more likely to feel confident and comfortable when they receive well-organized, easy-to-understand documentation related to their payments.

Benefits of Customizing Payment Documents

Customizing payment documents allows property owners to tailor them to their specific needs, ensuring they are both functional and aligned with their business practices. By adjusting the format and content, owners can enhance communication, ensure clarity, and create a more professional appearance. This flexibility provides a range of advantages, particularly when managing multiple properties or tenants with varying requirements.

Key Advantages of Customization

- Personalization: Tailoring the document allows property owners to include their branding, contact information, or any unique terms relevant to the lease agreement.

- Flexibility: Customization provides the ability to adjust payment details, due dates, and additional charges to suit different tenants or properties.

- Clarity: Owners can emphasize key information, such as overdue amounts or specific payment instructions, making it easier for tenants to understand the terms and avoid confusion.

- Professional Appearance: A personalized document creates a polished and consistent image, which can enhance the reputation of the property owner and help foster trust with tenants.

- Efficiency: By adjusting fields and sections based on specific needs, the document can be quickly updated for each tenant, saving time while maintaining accuracy.

By customizing payment documents, property owners ensure that each one meets their unique needs, improving the efficiency of rent collection and fostering better communication with tenants.

How to Create a Payment Request Document

Creating a professional payment request document is a straightforward process that ensures all necessary details are included for clear communication between property owners and tenants. A well-designed document provides both parties with the information they need to ensure timely payments and avoid confusion. By following a few simple steps, you can create an effective document that serves as an official record of the transaction.

Here are the key steps to creating a clear and organized payment request document:

- Step 1: Add Contact Information – Begin by including the contact details of both the property owner and the tenant. This makes it easy to reach either party in case of any questions or issues.

- Step 2: Specify Property Address – Clearly list the address of the property for which payment is being requested. This is particularly important for owners with multiple properties.

- Step 3: Outline Payment Amount – Include the total amount due, specifying any breakdown of fees or charges (e.g., rent, maintenance costs). Be transparent about any extra fees or discounts applied.

- Step 4: Set Payment Due Date – Clearly state the payment deadline. This helps avoid late payments and sets expectations for both parties.

- Step 5: Provide Payment Instructions – List the accepted payment methods, such as bank transfer, online payment systems, or checks. Make the process as easy and convenient as possible for tenants.

- Step 6: Include Late Fees or Penalties – If applicable, mention any penalties for overdue payments. This ensures tenants are aware of the consequences of late payments.

By following these steps, you can create a well-structured and professional payment document that simplifies the process and promotes transparent communication with tenants.

Essential Elements of a Payment Request Document

To create an effective and professional payment request document, it’s important to include key components that ensure clarity and accuracy. These elements help both the property owner and the tenant stay on the same page, avoid misunderstandings, and facilitate smooth financial transactions. By including the necessary details, you create a document that serves as both a reference and an official record for the transaction.

Here are the essential elements that should be present in every payment request document:

- Contact Information: Include the full names, addresses, and contact details of both the property owner and the tenant. This ensures that both parties can easily communicate if necessary.

- Property Address: Clearly state the property address associated with the payment. This is especially important for owners managing multiple properties.

- Amount Due: List the total amount owed. This should include a breakdown of any individual charges (e.g., rent, utilities, maintenance fees) to ensure full transparency.

- Due Date: Specify the exact due date for the payment. This helps set clear expectations and encourages timely payments.

- Payment Instructions: Provide clear details on how the payment can be made, including accepted payment methods (e.g., bank transfer, credit card, check, online payment system).

- Late Fees: If applicable, include any penalties or interest charges for late payments. This encourages timely payment and sets clear consequences for delays.

- Additional Notes: Include any other relevant information, such as discounts, special terms, or reminders about the next payment cycle.

Including these elements ensures that the payment request is clear, comprehensive, and professional, reducing the risk of errors and misunderstandings for both parties involved.

How to Format Your Payment Request Document

Proper formatting is crucial for creating a clear and professional payment request document. A well-organized layout ensures that all necessary information is easy to find and understand. By following a consistent structure, property owners can avoid confusion, enhance communication with tenants, and ensure timely payments. Below are some formatting tips that can help you structure your payment document effectively.

Here are some key formatting steps to follow:

| Section | Description |

|---|---|

| Header | Include your contact information, such as name, address, and phone number, at the top of the document. It’s also helpful to include the tenant’s information for easy reference. |

| Document Title | Clearly label the document as a payment request, statement, or other appropriate term. This ensures the tenant understands the purpose of the document immediately. |

| Payment Breakdown | List the individual charges, such as the base amount, any additional fees (maintenance, utilities), and applicable discounts. Ensure that each charge is clearly labeled and easy to understand. |

| Total Amount Due | At the bottom of the breakdown, highlight the total amount owed. This should be bold and clearly visible to prevent any confusion. |

| Payment Instructions | Provide clear instructions on how to make the payment, including acceptable payment methods, bank details, or online payment links. |

| Due Date | Clearly state the payment due date. This section should be prominently displayed to avoid misunderstandings. |

By following this format, your payment request document will look professional, be easy to read, and contain all the important details that both you and your tenant need to avoid any issues with payments.

Common Mistakes in Payment Request Documents

Creating a payment request document might seem straightforward, but there are several common errors that property owners often make when preparing these documents. These mistakes can lead to confusion, delayed payments, and even disputes with tenants. Being aware of these common pitfalls can help you create clearer, more professional documents that ensure a smooth transaction process.

1. Missing or Incorrect Contact Information

One of the most frequent mistakes is failing to include accurate or complete contact details for both the property owner and the tenant. If there is a mistake in the contact information, it can make it difficult for either party to reach the other if there is an issue with the payment.

- Ensure accuracy: Double-check the contact information before sending out the document.

- Include both parties: The document should have clear details for both the property owner and the tenant.

2. Unclear Payment Terms

Another common issue is when the payment terms are not clearly defined. Vague information regarding due dates, amounts, or payment methods can lead to confusion and missed payments.

- Specify due dates: Always include a clear and prominent due date for the payment.

- Clarify the total amount: Ensure the full amount due is outlined, including any additional charges or fees.

- Provide payment instructions: Be specific about how the tenant should make the payment, such as by bank transfer or another method.

3. Inconsistent Formatting

Inconsistent formatting can make the document harder to read and lead to important information being overlooked. Without a clear, organized structure, it becomes more difficult for the tenant to quickly find and understand the necessary details.

- Use a consistent layout: Make sure all payment documents follow the same format each time for easy recognition.

- Highlight important information: Use bold text or larger fonts to emphasize key details like the amount due and the due date.

By avoiding these common mistakes, you can create clearer, more professional payment request documents that improve communication and ensure a smooth financial process with tenants.

Digital vs. Paper Payment Request Documents

When it comes to managing payment requests, property owners often face the decision between using digital or paper-based methods. Each approach has its own set of advantages and disadvantages, and the best choice can depend on factors such as convenience, security, and the number of properties being managed. Understanding the differences between digital and paper documents can help you determine which method works best for your needs.

Here’s a comparison of both options to help you make an informed decision:

| Aspect | Digital Documents | Paper Documents |

|---|---|---|

| Convenience | Digital files can be sent instantly via email or online platforms, providing quick delivery and easy access. | Paper documents require physical delivery, either in person or by post, which can take more time and effort. |

| Cost | Digital documents are low-cost or free to create, as there are no printing, postage, or paper costs. | Printing and mailing paper documents incur additional costs for materials, postage, and time. |

| Security | Digital documents can be encrypted and protected with passwords, making them more secure from theft or loss. | Paper documents are vulnerable to physical loss or damage and may be easier to misplace or destroy. |

| Record Keeping | Digital files can be easily stored, organized, and backed up on cloud platforms or hard drives, making it easier to track payments over time. | Paper documents require physical storage, which can take up space and be harder to organize or retrieve. |

| Environmental Impact | Digital documents are eco-friendly as they don’t require paper, ink, or shipping materials. | Paper documents contribute to paper waste and have a larger environmental footprint due to printing and mailing processes. |

While both digital and paper options have their place, the choice depends on your specific needs. For greater efficiency, cost savings, and environmental benefits, digital documents tend to be the preferred option. However, for tenants who are less tech-savvy or in situations where physical documents are required, paper documents may

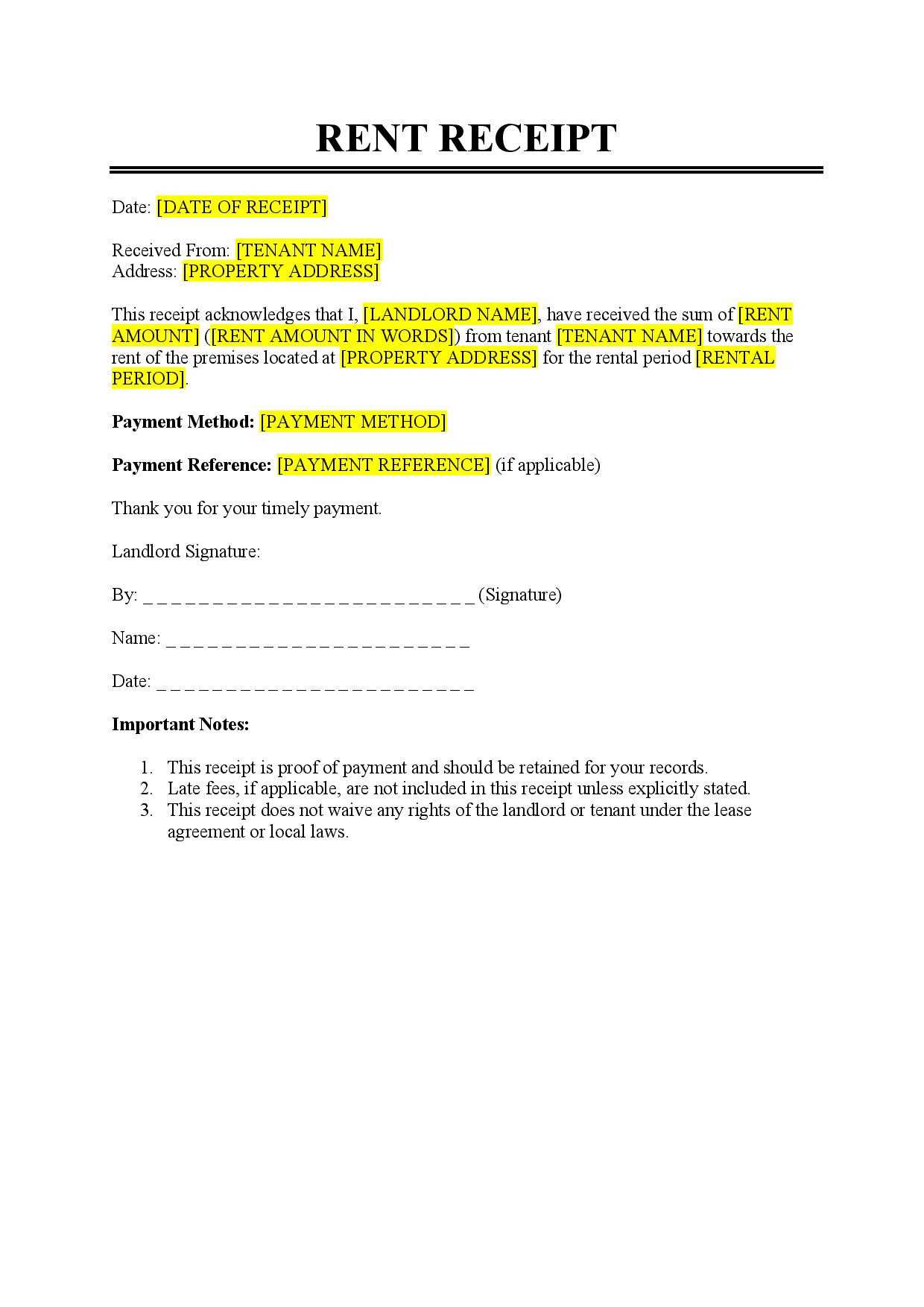

How to Track Payments with Documents

Keeping track of payments is a critical aspect of property management. A well-structured payment document not only outlines the amounts due but also serves as a useful tool for monitoring transactions and ensuring that all payments are made on time. By organizing and tracking payments effectively, property owners can reduce the risk of missed payments, disputes, and financial mismanagement.

Here are some key strategies to help you track payments efficiently:

- Record Payment Details: Always update the document with information about each payment received. This should include the date of payment, the amount paid, and the payment method used.

- Include Payment Status: Clearly indicate whether the payment has been made in full or if there are any outstanding balances. This helps both parties easily track progress.

- Use a Payment Log: Create a separate log or spreadsheet to record all transactions. This log should include the tenant’s name, property address, payment amount, and the date of each transaction.

- Monitor Late Payments: Mark overdue payments clearly in your records and take appropriate action to remind tenants of their obligations. Including a late fee structure in the document can help encourage timely payments.

- Set Up Reminders: Use digital tools to automate payment reminders. Setting up alerts or follow-up emails can help ensure that tenants are reminded about upcoming or overdue payments.

By systematically tracking payments, you can keep your financial records organized, reduce errors, and ensure a smoother payment process for both you and your tenants.

Payment Request Document for Commercial Properties

When managing commercial properties, the structure of a payment request document may differ from residential ones due to the specific needs of business tenants. These properties often involve larger amounts, longer-term leases, and additional fees like maintenance, utilities, or common area expenses. It’s important that the document clearly reflects all aspects of the agreement to ensure transparency and avoid confusion.

Below is an outline of what should be included in a payment request for a commercial property:

Key Elements for Commercial Properties

| Section | Description |

|---|---|

| Tenant Details | Include the tenant’s full business name, address, and contact information for clarity and ease of communication. |

| Property Address | List the full address of the commercial property being rented, including suite or unit numbers if applicable. |

| Lease Terms | Include the rental period, whether monthly, quarterly, or annually, and specify the agreed-upon rent amount. It is also useful to note the start and end date of the lease. |

| Additional Fees | Break down any extra charges, such as maintenance fees, utility costs, or common area expenses. Ensure each fee is clearly labeled and explained. |

| Total Due | Clearly display the total amount due, including all base rent and additional fees, so there is no confusion about the payment amount. |

| Due Date | Indicate the payment due date prominently to help prevent any late payments. Specify whether the payment is due on a specific day or within a certain period after the invoice is issued. |

| Payment Methods | Detail the accepted methods of payment (bank transfer, cheque, online payment options) to provide convenience for tenants. |

Customizing the Document for Your Needs

Commercial property agreements often have unique terms, so it’s essential to customize your payment request documen

How to Handle Late Payments in Payment Requests

Dealing with late payments is a common challenge for property owners. Whether it’s due to tenant oversight, financial difficulty, or simple negligence, delayed payments can disrupt cash flow and cause unnecessary stress. To minimize the impact of late payments, it’s important to establish clear policies and procedures in your payment request documents, ensuring both parties are aware of the consequences of missing a deadline.

1. Set Clear Payment Terms

One of the best ways to prevent late payments is by setting clear terms in your payment request documents. When both parties know exactly when payments are due and what happens if payments are delayed, it can help avoid confusion and misunderstandings.

- Specify due dates: Always include the exact due date on the document, and make sure it’s clearly visible.

- Late fee policy: Clearly state if there are any late fees, interest charges, or penalties for overdue payments. This gives tenants a financial incentive to pay on time.

- Grace periods: If you offer a grace period before penalties are applied, make sure it’s defined. A typical grace period is 3 to 5 days after the due date.

2. Communicate with Tenants

Open communication is key when handling late payments. If a tenant fails to pay on time, it’s important to follow up promptly, whether through a phone call, email, or written notice.

- Send reminders: Send a polite reminder before the due date and a follow-up reminder as soon as the payment becomes overdue. A reminder can often encourage tenants to pay promptly.

- Negotiate if necessary: If a tenant is facing financial difficulty, consider negotiating a payment plan or extending the payment deadline. Having a flexible approach can help maintain good tenant relationships.

- Document everything: Keep a record of all communications with tenants regarding late payments, including phone calls, emails, and letters. This documentation can be helpful if the situation escalates.

3. Enforce Consequences

If late payments continue, it may be necessary to enforce the consequences outlined in the original agreement. This could include imposing penalties, terminating the lease, or taking legal action. Make sure to follow the terms laid out in the contract to avoid any potential legal complications.

- Apply late fees: Charge any penalties for overdue payments as specified in the document. Ensure the charges are reasonable and comply with local laws.

- Seek legal advice: If payments remain unpaid for an extended period, consult with a legal professional to understand your options for recovering the debt.

By setting clear expectations, maintaining communication, and enforcing consequences, you can minimize the likelihood of late payments and handle them efficiently when they do occur.

Legal Requirements for Payment Request Documents

When creating a payment request for a tenant, it’s important to ensure that the document complies with local laws and regulations. Different jurisdictions may have specific requirements regarding what must be included in such documents, how they should be delivered, and how long they must be kept on record. By understanding these legal requirements, property owners can avoid potential disputes and ensure they are operating within the bounds of the law.

Here are some key legal considerations to keep in mind when preparing a payment request:

- Proper Identification: The document must clearly identify both parties involved. This includes the name of the property owner or management company, as well as the tenant’s full name and address. Ensuring accurate identification helps prevent any ambiguity in case of legal disputes.

- Payment Details: A legally compliant payment request should outline the specific amount owed, the services provided, and the payment period. This includes any additional charges, such as maintenance costs or late fees, and ensures that the tenant understands what they are being charged for.

- Clear Due Date: The payment due date should be clearly stated on the document. In some regions, a grace period is required before penalties or fees can be applied, so it’s important to be aware of the exact time frame specified by law.

- Late Payment Terms: If there are penalties or late fees associated with overdue payments, these should be detailed explicitly. Be sure to comply with local laws regarding the maximum amount that can be charged for late payments or interest.

- Payment Methods: Clearly outline the acceptable methods of payment (e.g., bank transfer, check,

How to Automate Payment Request Documents

Automating the process of generating and sending payment documents can save property owners significant time and reduce the risk of errors. By using automation tools, property owners can ensure that payment requests are created, delivered, and tracked efficiently, without needing to manually prepare each document. This can be particularly beneficial for those managing multiple properties or tenants, as it streamlines administrative tasks and ensures timely communication.

Here are some practical steps to automate payment request documents:

- Use Property Management Software: Many property management platforms offer built-in automation features that allow you to set up recurring payment requests for tenants. These tools can generate documents automatically based on predefined lease terms, saving you from having to create them manually each time.

- Set Up Recurring Billing: If you charge tenants on a regular schedule, such as monthly or quarterly, set up recurring billing through your accounting software or payment platform. This will ensure that payment requests are sent automatically on the agreed-upon date, with the correct amount.

- Template Creation: Create a digital version of your payment request document with placeholders for key details like tenant name, property address, payment amount, and due date. Automation tools can then populate these fields automatically with the appropriate information, making each document unique without manual effort.

- Automate Reminders: Set up automatic payment reminders for tenants before the due date and follow-up reminders for overdue payments. Email automation systems can help ensure that tenants receive timely notifications about upcoming payments or any missed deadlines.

- Integrate with Payment Systems: Link your automated document system with an online payment gateway, so tenants can pay directly through the document or invoice. This integration not only streamlines the payment process but also provides a seamless experience for both you and your tenants.

- Monitor Payment Status: Many automation tools allow you to track the status of each payment request. You can easily see which payments have been made, which are overdue, and send additional follow-up communications as necessary.

By automating the creation, delivery, and tracking of payment requests, you can significantly reduce your administrative workload and improve your cash flow management. Whether you use dedicated property management software or integrate automation tools into your existing systems, automation is a key strategy for enhancing efficiency and reducing errors in your payment processes.

Free vs Paid Payment Request Documents

When creating a payment request for tenants, property owners have the option of using either free or paid tools. Both options offer their advantages, but the choice between them depends on the specific needs of the property owner, the complexity of the transactions, and the level of customization required. Free tools may be more accessible, but paid solutions often provide added features, support, and professional designs that can make the process smoother and more efficient.

Below is a comparison of the benefits of free and paid payment request tools:

Feature Free Options Paid Options Cost Free to use with no upfront costs Monthly or annual subscription required Customization Limited customization options for design and structure High level of customization, including logos, colors, and additional fields Ease of Use Simple tools, may lack advanced features More intuitive, often comes with templates designed for specific needs Additional Features Basic functionality (e.g., fill-in fields, save as PDF) Advanced features like automatic billing, reminders, tracking, and integration with accounting systems Support No or limited customer support Dedicated customer service, including troubleshooting and technical support Security Basic security, may not offer encryption or data protection Enhanced security with encryption and data protection, especially in paid platforms Professional Appearance Simple, may look less polished High-quality, professional design with more options for branding Choosing between free and paid options ultimately depends on how much you are willing to invest in the process and how important professional-grade tools are for your business. Free options can be a great way to get started or for smaller property portfolios, while paid options offer enhanced functionality, security, and customization for

Tools for Creating Payment Request Documents

Creating a payment request for tenants can be made much easier with the right tools. Whether you are managing one property or a large portfolio, using the appropriate software or platform can help streamline the process, reduce errors, and ensure that all necessary details are included. There are various tools available–ranging from basic document editors to specialized property management software–that can assist in generating professional, accurate payment requests.

1. Document Creation Software

One of the simplest ways to create a payment request is by using document creation tools such as word processors or spreadsheet software. These tools allow for full customization, enabling you to design your own payment request format that suits your needs.

- Microsoft Word or Google Docs: These word processors offer customizable templates for creating payment requests. You can personalize fields such as tenant information, amounts due, and due dates, while also saving the document in various formats (PDF, DOCX) for easy sharing.

- Excel or Google Sheets: Spreadsheets can be an effective tool for tracking payments, especially if you manage multiple properties. You can use built-in formulas to calculate totals and late fees automatically, saving you time when preparing each payment request.

2. Property Management Software

For more comprehensive solutions, property management platforms offer built-in tools for generating payment requests. These platforms often integrate other aspects of property management, such as lease tracking, payment collection, and maintenance requests, making them ideal for landlords managing multiple properties or tenants.

- AppFolio: AppFolio is a popular property management software that includes an invoicing system with features for automatic billing, recurring payments, and payment reminders. It also integrates with accounting systems to streamline financial tracking.

- Buildium: Buildium allows property owners to create and send payment requests with customizable fields. It also offers automatic late fee calculations, tenant portals for easy payment, and detailed reporting features to track payment histories.

- Rentec Direct: Rentec Direct offers robust invoicing capabilities, including customizable templates and automated payment reminders. It also integrates with accounting software, making it a comprehensive choice for managing finances and payments.

3. Online Payment Platforms

Online payment platforms are another useful tool for creating and sending payment requests, as they allow for automated payment collection. These platforms often provide customizable invoicing features, along with easy integration with payment systems.

- PayPal: PayPal offers an invoicing tool that allows property owners to create and send professional-looking payment requests, as well as accept online payments directly. It’s a simple and convenient option for small-scale property management.

- Stripe: Stripe offers an invoicing feature that automatically generates and sends payment requests, calculates taxes, and accepts online payments. This platform is best for property owners who want to streaml

Best Practices for Rent Invoicing

Creating accurate and timely payment requests is crucial for maintaining a smooth cash flow and fostering a positive relationship with tenants. By following best practices, property owners can ensure that their payment documents are clear, professional, and legally compliant. Establishing a consistent invoicing process not only helps ensure timely payments but also reduces the likelihood of disputes or confusion down the line.

Here are some key best practices to follow when preparing payment documents:

- Be Clear and Concise: Clearly outline all charges, including the amount due, due date, and any additional fees (e.g., late fees or maintenance costs). Avoid using jargon or ambiguous terms, and provide a detailed breakdown of the charges to ensure tenants fully understand what they are paying for.

- Include All Necessary Information: Each payment request should include essential details such as the property address, tenant name, payment due date, and the payment method. This information helps prevent misunderstandings and ensures that tenants can easily identify the purpose of the document.

- Set Clear Payment Terms: Define your payment terms, such as due dates, late fees, and acceptable payment methods, in a clear and easy-to-understand manner. Make sure these terms are consistent across all requests, and ensure they are communicated to tenants at the time of signing the lease agreement.

- Send Payment Requests on Time: Consistently send payment requests on time, whether it’s monthly or quarterly. A timely payment request helps tenants plan their finances accordingly and ensures that you receive payments without delay. Automating the process can help ensure that no payment request is forgotten.

- Use Professional Templates: A well-designed, professional document helps reinforce the credibility of your business and demonstrates that you take the payment process seriously. While you can create custom designs, consider using pre-made templates for consistency and ease of use.

- Maintain Records: Keep a copy of every payment request you send out, along with any communications regarding payments. This documentation is crucial for tracking payments and resolving any potential disputes. It also helps in the event of tax reporting or audits.

- Offer Multiple Payment Methods: Offering various payment methods (e.g., bank transfer, online payment portals, or checks) gives tenants flexibility and makes it easier for them to pay on time. Make sure to include payment instructions clearly on the document.

- Follow Up on Late Payments: If a payment is not made by the due date, follow up promptly with a polite reminder. You can send a second notice or contact the tenant directly to discuss the payment. Having a formal process for managing late payments ensures that overdue accounts are addressed quickly and professionally.

By implementing these best practices, property owners can create a more efficient invoicing process, reduce administrative overhead, and foster good relationships with tenants. Consistency, clarity, and professionalism are key elements that ensure both you and your tenants stay on track with payments.