How to Use a Copy of an Invoice Template for Your Business

Efficient financial management is essential for any business, and one of the key elements is having a reliable and well-structured document for charging clients. A standardized document can save time, reduce errors, and ensure clear communication between you and your customers. Whether you’re a freelancer or managing a small business, organizing payment requests effectively is crucial for smooth operations.

By utilizing a pre-designed document that can be easily customized, businesses can focus more on their core activities while ensuring that their clients receive professional and accurate billing information. These documents can be tailored to suit specific needs, from adding unique branding to adjusting the payment terms based on the project or service provided.

Utilizing these ready-made solutions can drastically simplify the process, allowing you to send clear and consistent payment requests with minimal effort. With various formats available, it’s easier than ever to find a solution that fits your workflow and ensures timely payments. Whether you’re working with large corporations or individual clients, the right format can make all the difference in maintaining a professional image and promoting financial clarity.

Invoice Template Benefits for Businesses

Using a standardized payment request document can bring several advantages to any organization. These pre-designed solutions offer a structured approach to managing client transactions, allowing businesses to operate more efficiently and professionally. By adopting such methods, companies can minimize errors, streamline their processes, and ensure clarity in all financial dealings.

Some of the key benefits of utilizing a ready-made document solution include:

- Time-saving: Customizing a pre-made document is faster than creating one from scratch, allowing you to focus on other important tasks.

- Consistency: Using the same format ensures uniformity in all client communications, fostering a professional image.

- Accuracy: These documents typically include all necessary fields, reducing the risk of missing critical information.

- Flexibility: The ability to easily modify the document according to specific needs helps businesses tailor the communication for various clients and services.

- Legal compliance: Many pre-designed documents include features that ensure compliance with industry standards or legal requirements, making it easier to stay on track.

- Recordkeeping: A standardized format simplifies the process of organizing financial records, making it easier to track payments and maintain clear records.

By adopting these solutions, businesses can improve their cash flow management, avoid costly mistakes, and maintain a professional image in their financial dealings. Whether for small operations or larger corporations, a standardized method for requesting payments is a crucial tool for enhancing operational efficiency and client satisfaction.

Why You Need an Invoice Template

Having a structured document for billing is essential for any business looking to maintain clear and professional communication with clients. Without a standardized approach, the process of requesting payments can become disorganized, leading to confusion and potential delays. A well-designed document ensures that all necessary information is included and presented in a consistent manner, saving time and reducing the chance of errors.

Efficiency and Organization

When you use a pre-made document, it significantly improves the efficiency of your billing process. Here’s how:

- Quick Customization: Adjusting a ready-to-use form takes much less time than starting from scratch, enabling you to focus on core business activities.

- Organized Structure: A standardized format ensures that every essential detail, such as payment terms, due dates, and client information, is included every time.

- Professional Presentation: A polished and consistent layout enhances your business’s credibility and leaves a lasting positive impression on clients.

Reducing Risks and Errors

With a pre-designed solution, you eliminate many common mistakes that can occur when creating billing documents manually. Some of the risks reduced include:

- Missing Information: Pre-made forms include all necessary fields, ensuring that no important details are forgotten.

- Inconsistent Formatting: Using the same format for every billing document ensures that all communications follow a professional and uniform style.

- Legal Issues: Templates are often designed to comply with industry regulations, reducing the risk of non-compliance.

In summary, having a ready-to-use document format simplifies and streamlines the billing process, enhancing both efficiency and professionalism in your business operations.

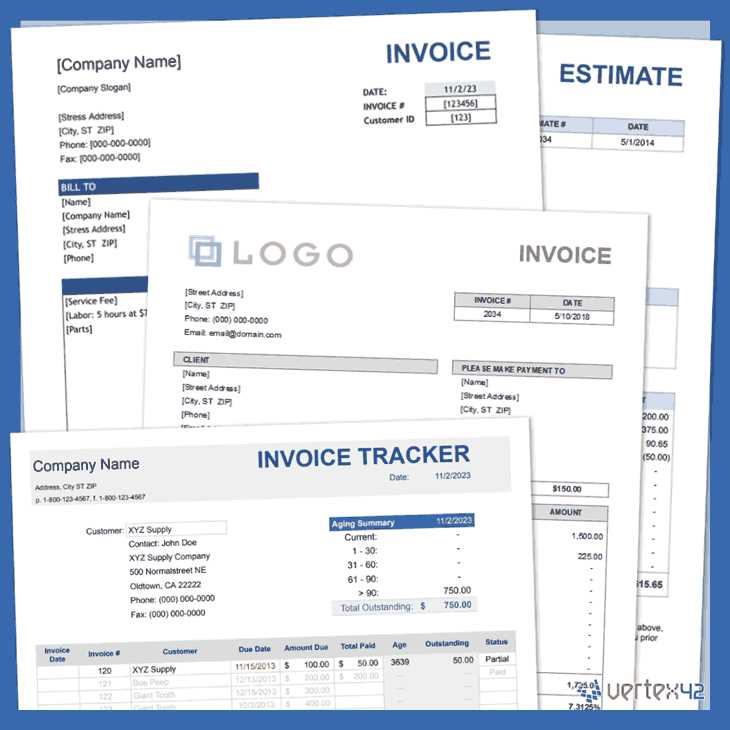

How to Download Invoice Templates

Acquiring a ready-made billing document is a simple and efficient process that can be done in just a few steps. Many platforms offer downloadable versions that cater to various business needs, ensuring that you can find a solution that fits your requirements. Whether you are looking for a basic format or a more advanced design with customizable features, the process remains straightforward and accessible.

To obtain a suitable document for your business, follow these steps:

- Choose a Reputable Source: Look for trusted websites or business platforms that offer professional and secure downloads. Many offer free or paid versions, depending on the features you need.

- Select the Right Format: Decide whether you want a PDF, Word, Excel, or another format. Make sure the format is compatible with your software to ensure smooth editing and use.

- Customize Your Document: After downloading, personalize the document with your business logo, client details, payment terms, and any other relevant information.

- Check for Updates: Periodically visit the source to ensure you’re using the latest version, especially if any legal or regulatory changes affect your documents.

Once downloaded and customized, the document is ready to be used for any billing purpose, helping you maintain an organized and professional approach to client transactions.

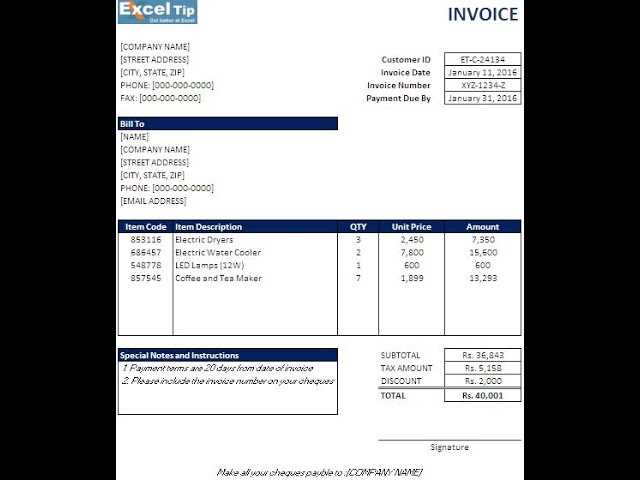

Customizing Your Invoice Template

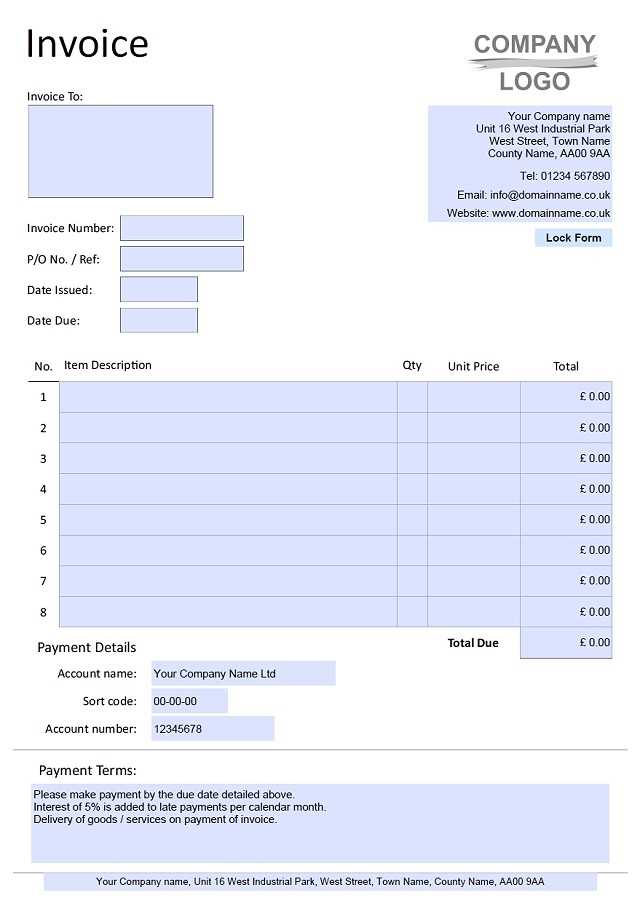

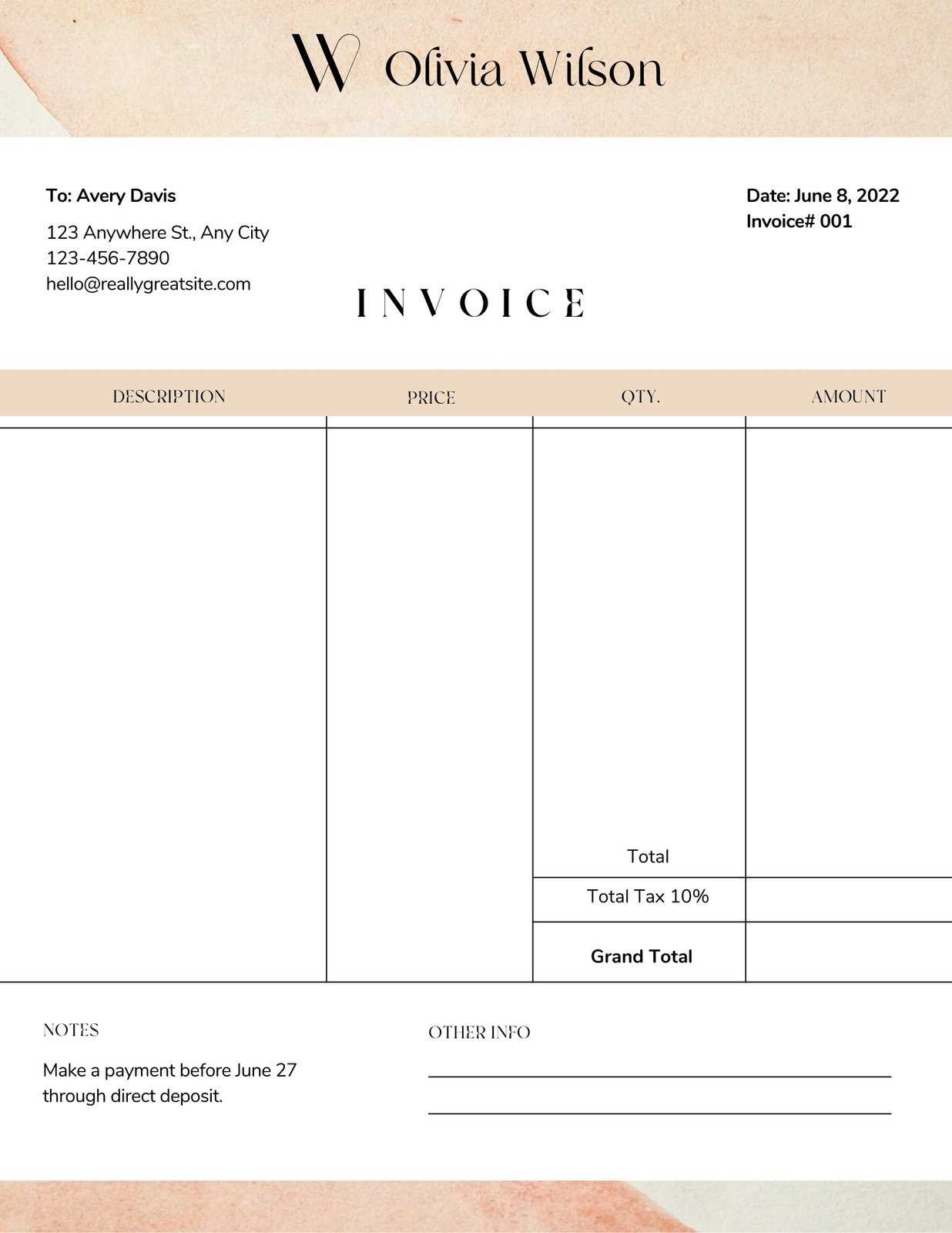

Tailoring your billing document to reflect your brand and meet specific business needs is a crucial step in maintaining a professional appearance. Customizing your document ensures that every detail aligns with your company’s identity, enhances clarity, and makes the document more functional for both you and your clients.

Personalizing the Layout and Design

Adjusting the visual elements of your document can significantly improve its professionalism and user-friendliness. Here are some common customizations:

- Branding: Add your company logo, brand colors, and fonts to ensure the document reflects your business’s visual identity.

- Header Information: Include your business name, contact details, and business registration number for easy client reference.

- Section Organization: Organize the document sections such as services/products, totals, taxes, and payment terms to improve readability.

Adjusting Functional Fields

In addition to design changes, it’s essential to adapt the functional fields to meet your needs:

- Payment Terms: Modify payment due dates, late fees, or discounts based on your specific arrangements with clients.

- Client Information: Ensure that the client’s name, address, and contact details are clearly displayed for accurate processing.

- Itemized List: Tailor the item description, quantity, and price fields to match the services or products you offer.

By customizing your document, you not only create a professional-looking billing statement but also ensure that it meets the unique needs of your business and clients, streamlining the payment process and enhancing overall communication.

Common Mistakes to Avoid in Invoices

When creating billing documents, small errors can lead to confusion, delayed payments, or even disputes. It’s essential to pay attention to details and ensure that the document is clear, complete, and professionally formatted. By being aware of common mistakes, you can avoid costly issues and streamline the payment process.

Missing or Incorrect Information

One of the most common errors is leaving out critical details or providing inaccurate information. Here are some key points to check:

- Client Details: Ensure the recipient’s name, address, and contact information are correct and up-to-date.

- Business Information: Include your business name, contact details, and any registration numbers, such as tax identification numbers or VAT details.

- Payment Terms: Clearly state payment due dates, applicable late fees, or discounts to avoid confusion regarding expectations.

Poor Organization and Formatting

A well-organized document is easy to read and reduces the risk of misunderstandings. Common issues in this area include:

- Unclear Structure: Make sure the sections are logically organized, such as service descriptions, pricing, and taxes, in a manner that flows logically.

- Inconsistent Formatting: Use uniform fonts, sizes, and alignments to create a cohesive and professional appearance.

- Itemized Descriptions: Ensure that each service or product is listed clearly with adequate detail, such as quantity, unit price, and total amount.

By avoiding these common mistakes, you can improve the clarity, professionalism, and efficiency of your billing documents, leading to smoother transactions and better client relationships.

Types of Invoice Templates to Consider

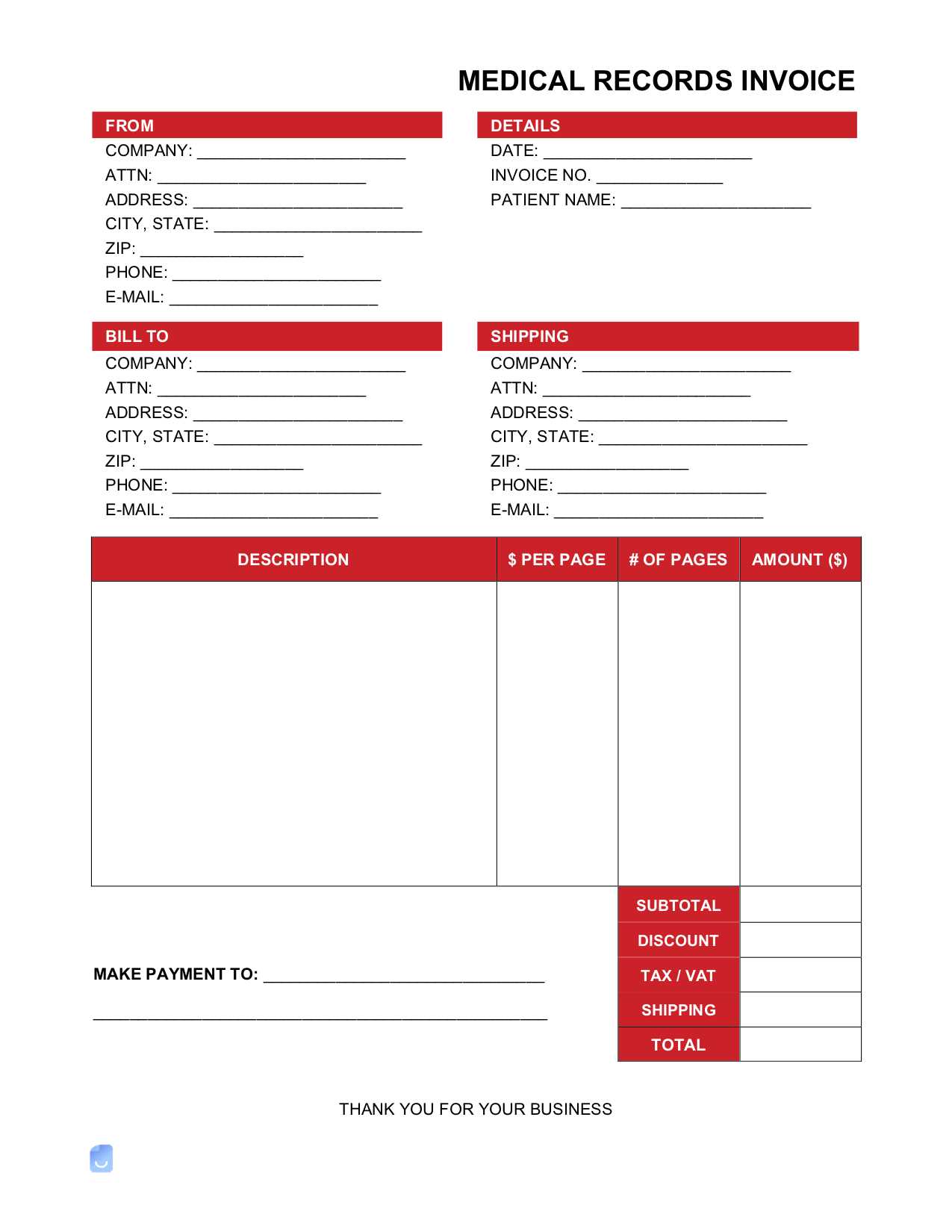

Choosing the right billing document design is essential for effective financial communication. Different businesses have unique needs, and selecting a format that aligns with your operations can make a significant difference in how professional and organized your transactions appear. There are various options available, each tailored to specific industries or business models.

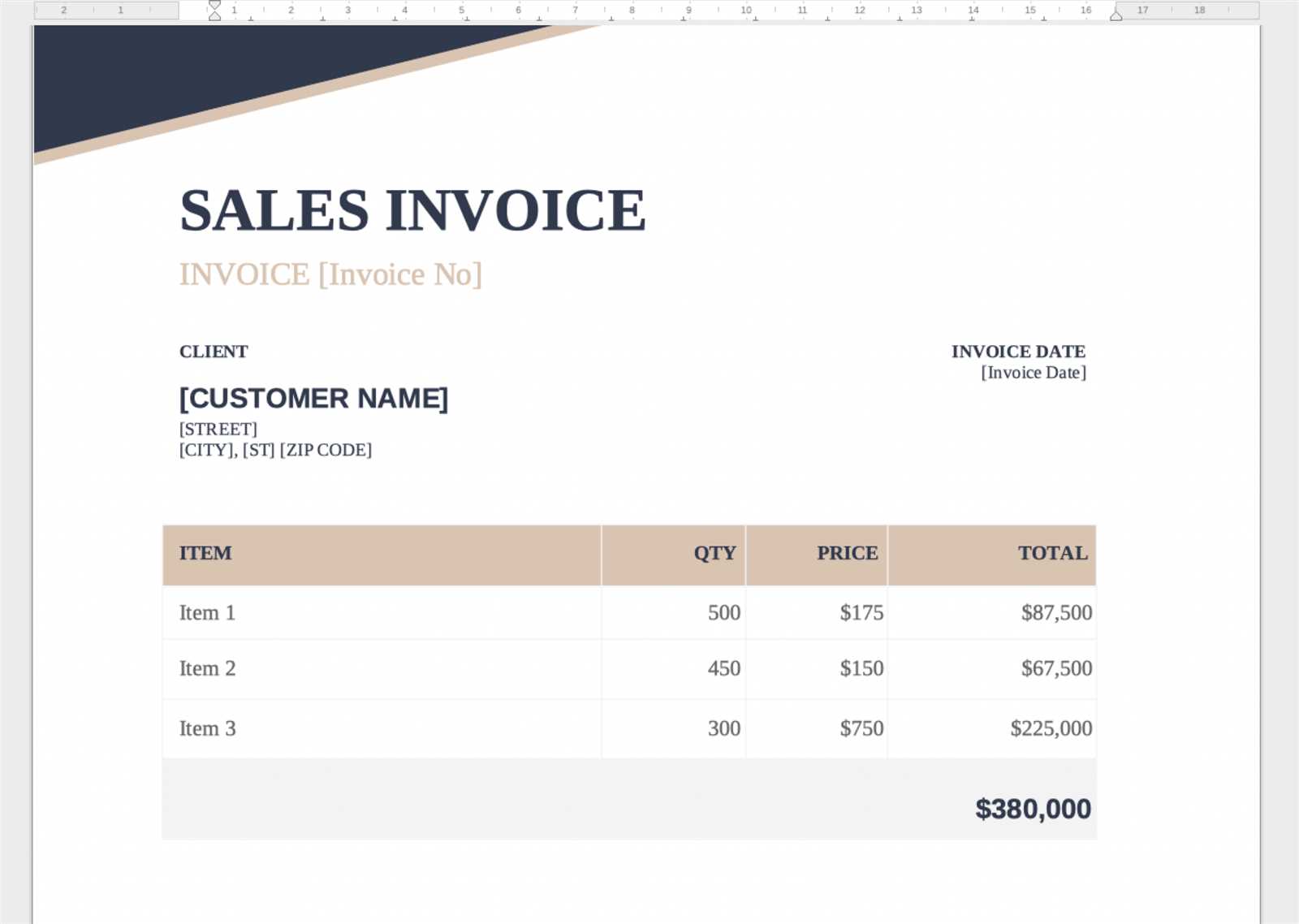

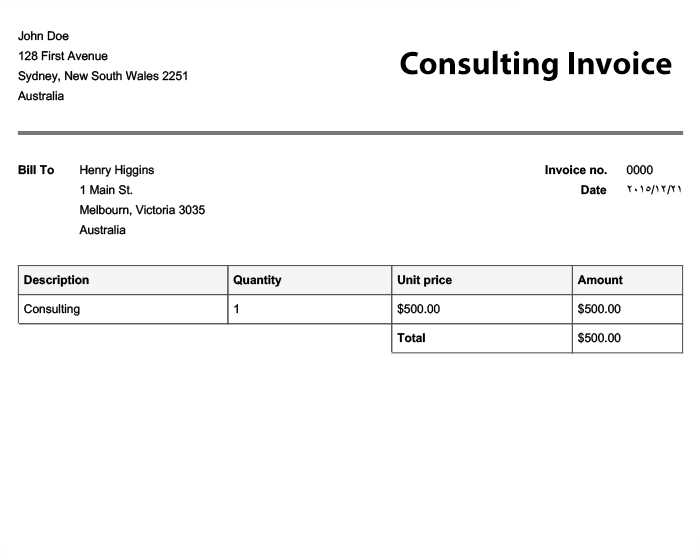

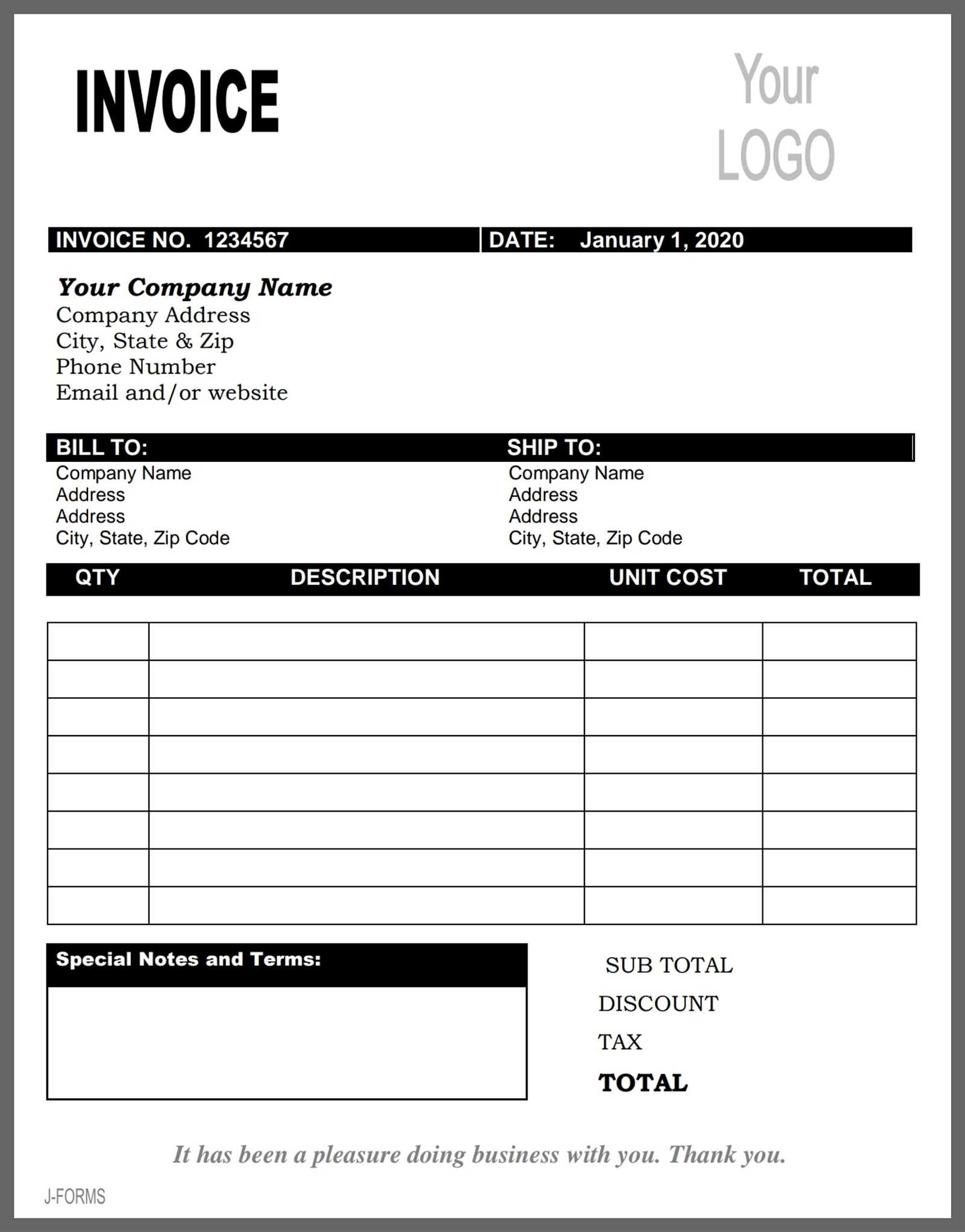

Basic Billing Statements

For small businesses or freelancers, a simple, straightforward billing statement may be the best choice. These documents typically include the essentials such as client details, services rendered, prices, and payment terms.

- Simplicity: Easy to create and customize, ideal for businesses with straightforward services or products.

- Cost-effective: Often free or low-cost, perfect for businesses just starting or those with a low volume of transactions.

- Clear Communication: Simple structure helps avoid confusion for clients and ensures fast processing.

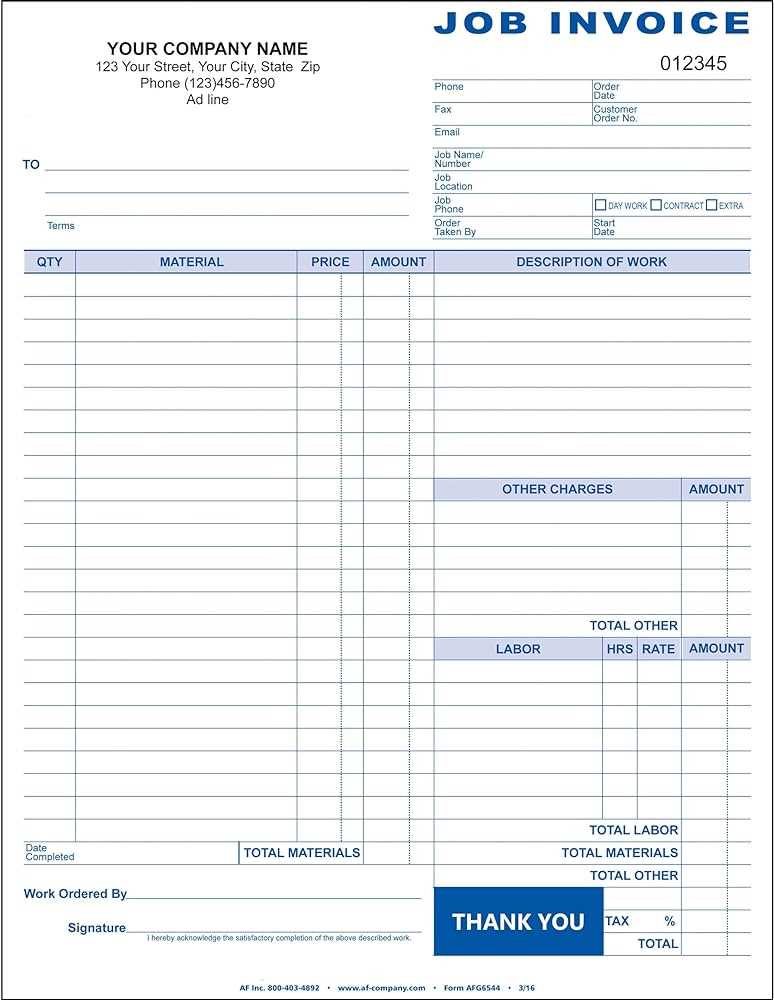

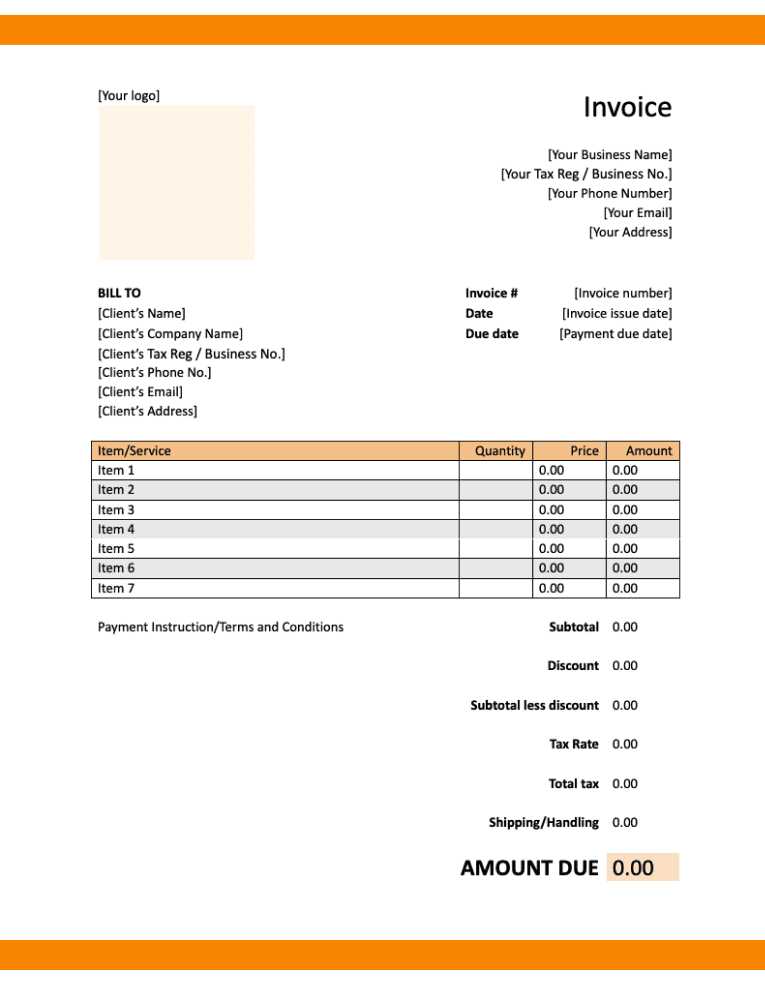

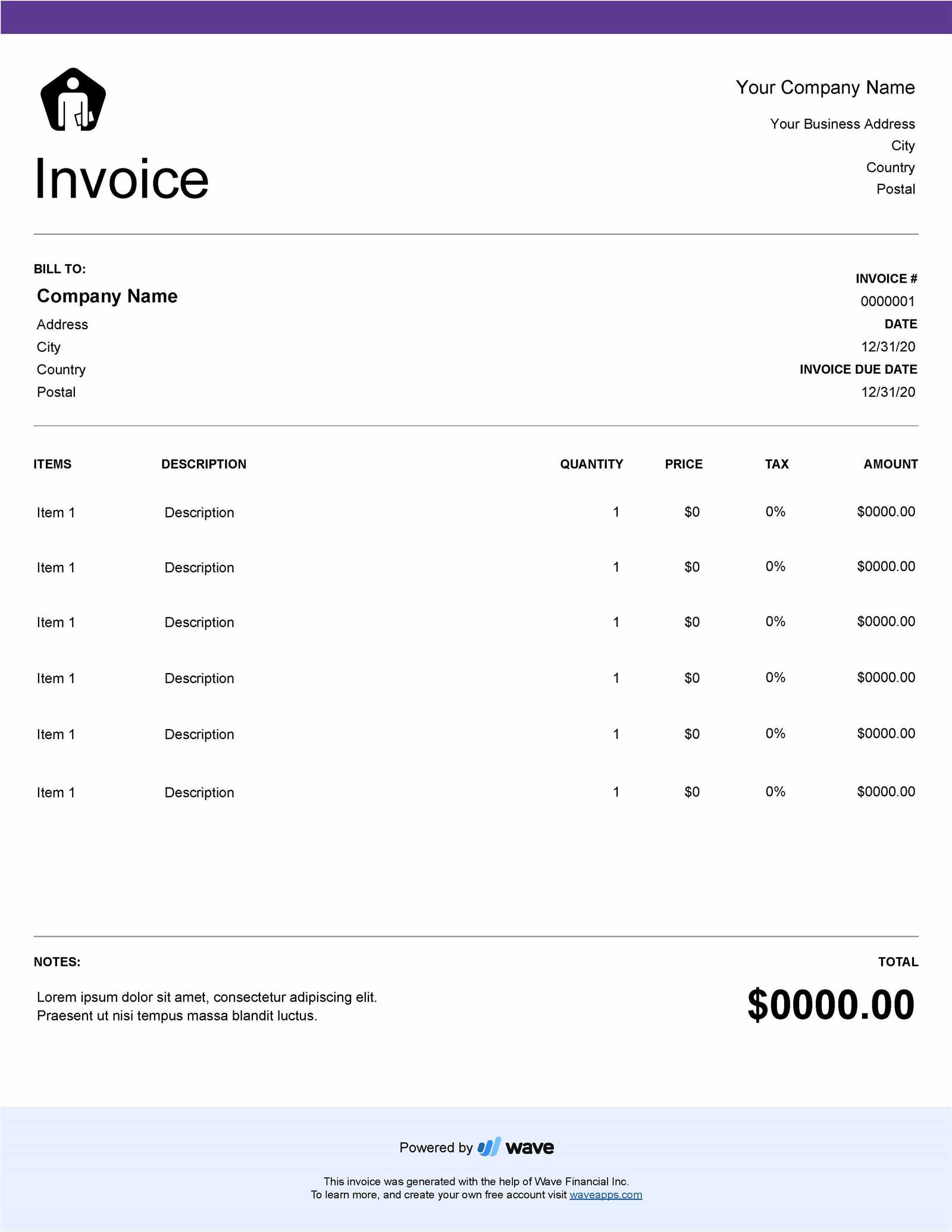

Detailed Invoices for Large Projects

If you offer more complex services or work on larger projects, you may need a more detailed billing solution. These documents often break down the work in greater detail, making it easier to explain charges to clients and justify costs.

- Itemized Lists: Includes detailed descriptions of tasks, time spent, or materials used, which helps clients understand the breakdown of charges.

- Progress Billing: Allows for multiple payments over time, suitable for long-term projects or retainer agreements.

- Payment Schedules: Clearly outlines payment milestones, reducing the risk of payment delays or misunderstandings.

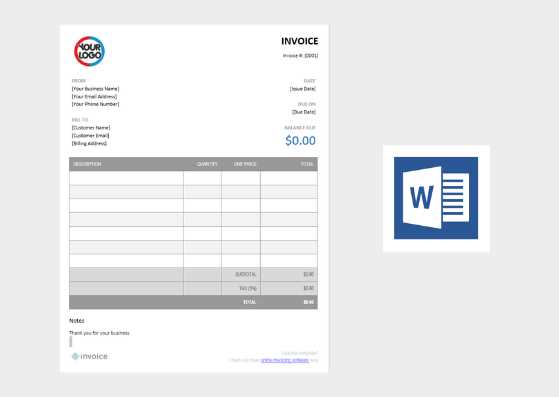

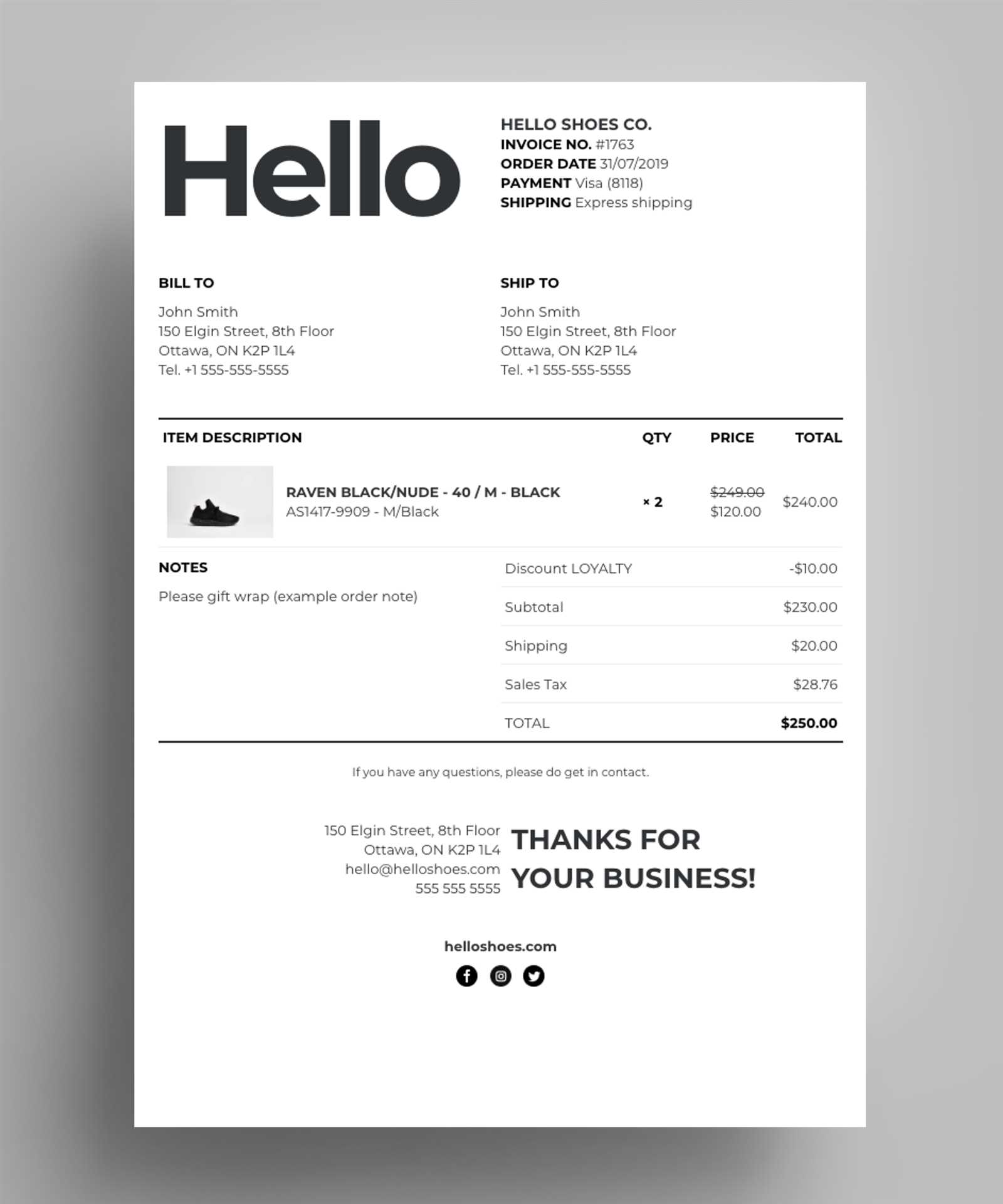

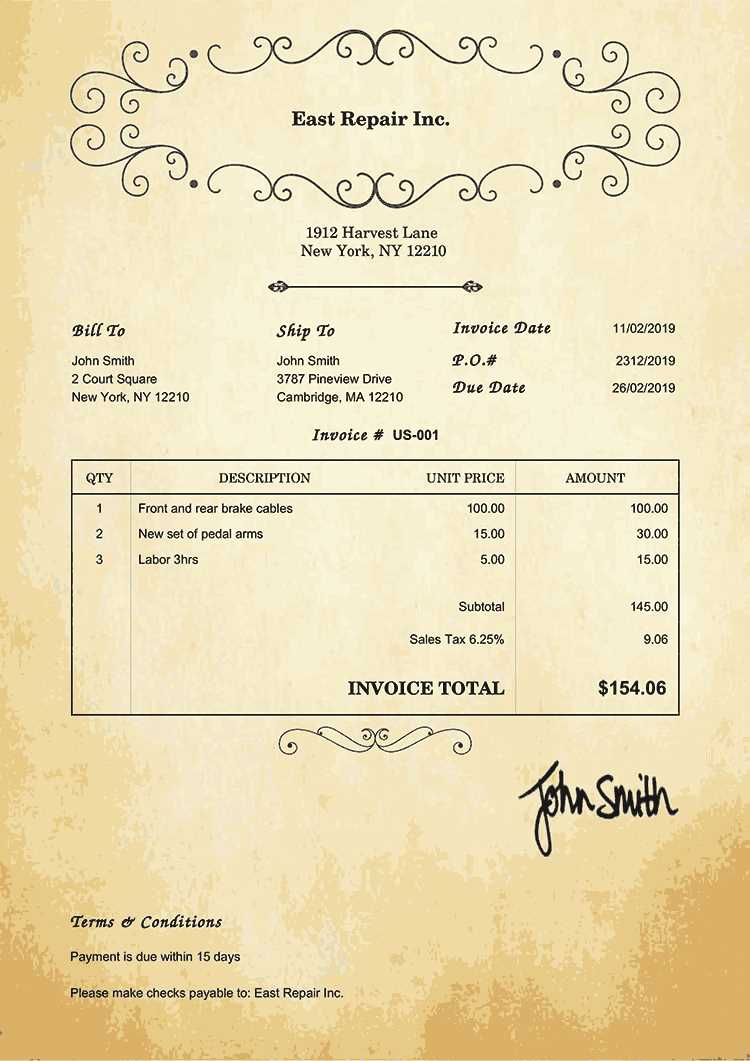

Customizable and Branded Designs

For businesses looking to enhance their brand presence, a customized and branded solution is often the best option. These designs incorporate business logos, color schemes, and personalized fields to ensure consistency with your company’s identity.

- Professional Appearance: Branded documents create a more professional image and reinforce your brand’s presence in client interactions.

- Custom Fields: Customizable fields allow you to include specific information that’

Tips for Efficient Invoice Management

Managing billing documents effectively is key to maintaining healthy cash flow and ensuring smooth business operations. A well-organized approach to handling these documents can save time, reduce errors, and improve communication with clients. The following tips can help you streamline the process and avoid common mistakes.

Organize Your Documents

Keeping your billing documents well-organized is essential for easy access and tracking. Consider these steps to stay on top of your financial records:

- Digital Storage: Store all your billing documents electronically in an organized folder system. This makes retrieval faster and more efficient.

- Use a Cloud Service: A cloud storage solution allows you to access your documents from anywhere and provides a secure backup.

- Separate Business and Personal: Ensure that your business documents are distinct from personal records to avoid confusion and maintain professionalism.

Set Clear Payment Terms

Setting clear terms with clients can help prevent misunderstandings and ensure timely payments. Clearly define:

- Due Dates: Specify when payments are expected and include late fees for overdue amounts.

- Accepted Payment Methods: List the payment methods you accept to avoid confusion and delays.

- Discounts: If offering discounts for early payments, be sure to clearly communicate the conditions.

Track and Follow Up on Payments

Monitoring outstanding payments and sending timely reminders can greatly improve your cash flow. Use a system to keep track of unpaid amounts and follow up when necessary. Below is a simple table to help you track payment statuses:

Client Name Amount Due Due Date Status Follow-Up Date Client A $500 2024-11-10 Pending 2024-11-12 Client B $350 2024-11-15 Paid N/A Client C $800 2024-11-20 Pending 20 How to Add Taxes to an Invoice

Incorporating taxes into your billing documents is a crucial step for ensuring compliance with tax regulations and providing clear information to clients. Properly calculating and presenting taxes on your financial documents helps avoid misunderstandings and ensures transparency in the transaction.

Determining the Right Tax Rate

The first step in adding taxes is to determine the appropriate tax rate based on your location and the products or services you offer. Tax rates vary by jurisdiction and can depend on several factors such as:

- Location: Tax rates differ by country, state, and even municipality, so ensure you are using the correct rate for the client’s location.

- Type of Service/Product: Different products or services may be taxed at different rates, so make sure to apply the correct tax category.

- Tax Exemptions: Some clients or products may qualify for tax exemptions, so it’s essential to check if any exceptions apply.

Calculating and Displaying the Tax

Once the correct rate is determined, you can calculate the tax amount and add it to the total. The tax should be clearly itemized so that the client can easily see how it was applied. Here is an example of how the tax is typically displayed in the document:

Description Amount Service A $200.00 Service B $150.00 Subtotal $350.00 Sales Tax (10%) $35.00 Total $385.00 By clearly stating the tax rate and amount, you ensure that both you and your client are on the same page regarding the total cost of the transaction. Always verify the tax rates and regulations relevant to your busin

Legal Requirements for Invoices

Complying with legal standards when issuing billing documents is essential for businesses to ensure transparency, avoid penalties, and maintain accurate financial records. Different regions and industries may have specific legal obligations, but certain key elements are generally required to be included in any official financial statement. Understanding these requirements can help you avoid legal complications and improve your professional reputation.

Essential Information to Include

To meet legal standards, certain details must be present in all business-related billing documents. These typically include:

- Business Information: Your company’s name, address, and tax identification number (TIN) or VAT number, if applicable.

- Client Details: The name and contact information of the recipient, ensuring accurate identification of the party receiving the bill.

- Unique Identifier: Each document should have a unique reference number, which can be used for tracking purposes and to avoid duplicate records.

- Date of Issue: The exact date the document was created is essential for clarity and for tracking payment timelines.

- Clear Breakdown of Charges: A detailed list of products or services provided, along with their respective costs, quantities, and applicable taxes.

Tax and Compliance Information

In addition to the basic details, most jurisdictions require businesses to clearly indicate tax information on financial documents. This includes:

- Applicable Tax Rates: The relevant tax rate for each item or service being billed should be displayed, especially if multiple rates apply.

- Total Tax Amount: The total amount of tax charged, itemized separately from the subtotal.

- Payment Terms: Specify payment deadlines, accepted payment methods, and any penalties for late payments.

Fulfilling these requirements not only ensures legal compliance but also helps maintain trust with your clients, reducing the risk of disputes or misunderstandings. Always keep up-to-date with the relevant laws in your country or industry to ensure your business remains in good standing.

Integrating Billing Documents with Software

Efficiently managing financial documents can significantly improve business operations, and integrating these records with software tools is a smart way to automate the process. By connecting your billing documents to accounting or enterprise software, you can streamline data entry, reduce human error, and speed up transaction processing. This integration offers numerous benefits, from simplifying record-keeping to improving the accuracy of financial reporting.

Benefits of Integration

Integrating your billing documents with software can provide several advantages for your business, such as:

- Time Efficiency: Automates data entry, saving time that would otherwise be spent creating and updating financial records manually.

- Improved Accuracy: Reduces the chances of errors from manual data input, ensuring that all calculations, such as totals and taxes, are correct.

- Consistency: Ensures that all billing documents follow the same format and include the necessary information, making your records more professional.

- Easy Tracking and Reporting: Facilitates tracking of paid and unpaid amounts, providing real-time insights into cash flow and financial health.

How to Integrate Billing Documents with Software

To integrate your billing documents with software, follow these steps:

- Choose the Right Software: Select an accounting or enterprise resource planning (ERP) software that supports invoicing and integrates with other business tools you use.

- Customize the Setup: Configure the software to align with your billing needs, ensuring that it includes all required fields and complies with legal requirements.

- Import and Export Data: Use the software’s import/export feature to seamlessly transfer client information, itemized charges, and payment records between systems.

- Enable Automation: Set up automatic generation of documents based on sales data, with automatic tax calculations and due dates, ensuring timely and accurate billing.

By integrating your billing documents into software systems, you can ensure more efficient financial management, reduce administrative workload, and enhance the accuracy of your financial records. As your business grows, this integration will play a critical role in scaling your operations smoothly.

Setting Payment Terms in Your Invoice

Clearly defining payment terms in your billing documents is essential for maintaining transparency and ensuring smooth transactions between you and your clients. Proper payment terms help set expectations regarding when and how payments should be made, as well as outline any consequences for late payments. This is a crucial aspect of any financial agreement, as it protects both parties and ensures timely payments.

When setting payment terms, it’s important to consider the following elements:

- Due Date: Specify the exact date by which the payment should be made. Common payment terms include “Due in 30 days,” “Due upon receipt,” or a custom timeframe that works for your business and clients.

- Accepted Payment Methods: Clarify which payment methods are accepted, such as bank transfers, credit cards, checks, or online payment platforms. This helps clients know how to make the payment easily.

- Late Payment Fees: Include any penalties for late payments, such as a fixed fee or a percentage of the outstanding amount. This encourages timely payments and reduces the risk of overdue balances.

- Discounts for Early Payments: Some businesses offer discounts for early payment. For example, “2% discount if paid within 10 days” is a common incentive to encourage faster settlement.

Once these terms are defined, it’s important to make sure they are clearly communicated on your billing documents. Having well-established terms not only helps in securing prompt payments but also fosters professionalism in your dealings with clients.

Improving Client Communication with Invoices

Effective communication with clients is essential for building strong relationships and ensuring smooth business transactions. One of the most important tools in this regard is the document used for requesting payments. By utilizing clear, professional, and transparent billing documents, you can not only ensure accurate payments but also improve overall communication with your clients.

Clear and Transparent Information

When creating billing documents, providing comprehensive and easily understood information is key to avoiding misunderstandings. Consider including the following:

- Detailed Breakdown: Clearly list all products or services provided, with corresponding prices, quantities, and any additional fees.

- Precise Terms: State the payment due date, accepted payment methods, and any other relevant conditions (e.g., discounts or late fees) in a straightforward manner.

- Contact Details: Include up-to-date contact information so clients know how to reach you with any questions or concerns.

Building Trust Through Professionalism

Sending well-structured, error-free billing documents reflects professionalism and fosters trust between you and your clients. Clear communication not only helps avoid disputes over payment but also enhances your reputation as a reliable business partner. When clients can easily understand the payment request and feel confident in the transaction process, they are more likely to maintain a positive working relationship with your business.

By using billing documents effectively, you can ensure that all client interactions are transparent, efficient, and professional, ultimately contributing to long-term business success.

Billing Documents for Freelancers and Contractors

For freelancers and independent contractors, managing finances efficiently is crucial to maintaining a smooth workflow and ensuring timely payments. One of the most essential tools in this process is a well-structured payment request. These documents help present the work completed, outline the amount owed, and establish clear payment expectations between the contractor and the client.

Using a customized billing structure is particularly important for freelancers, as it allows for flexibility in addressing different types of projects, timelines, and payment schedules. By adopting a professional approach to documenting work and requesting compensation, freelancers can ensure that clients understand exactly what is being billed and why. A well-crafted payment request not only facilitates prompt payment but also establishes a sense of professionalism and trust between both parties.

Freelancers and contractors can tailor these documents to suit the specifics of their business model, whether they charge per hour, per project, or with additional fees for rush work. Having a reliable and efficient system for issuing payment requests also helps maintain organized financial records, which is essential for tax purposes and overall business management.

Managing Multiple Billing Documents

For businesses and freelancers handling various types of services or clients, managing different billing documents can become complex. Whether you offer multiple services, work with diverse industries, or have varied pricing models, having different formats for your payment requests is essential for clarity and efficiency. Each type of billing document should be tailored to meet the specific needs of the client and the nature of the work done.

Organizing Different Billing Structures

To streamline the process, it’s important to categorize and organize your payment requests. This ensures you use the correct format for each client or project. Consider the following:

- Service-Specific Documents: Create distinct formats for different service categories, such as consulting, design, or technical work.

- Client-Specific Documents: If your clients have unique requirements (e.g., special payment schedules or custom terms), tailor your documents to meet those needs.

- Flexible Payment Terms: Depending on the nature of the job, you may need to offer documents with different terms, such as milestone payments or hourly rates.

Utilizing Technology for Efficiency

One of the best ways to manage multiple formats is by using digital tools that allow you to create, store, and access various billing documents quickly. Many software solutions enable you to save different versions of your documents, so you can easily customize them based on the client’s needs. This not only saves time but also reduces the likelihood of errors and ensures consistency in your financial communications.

With a proper system in place, managing different billing formats becomes a streamlined and efficient task, allowing you to focus on your work while ensuring timely and accurate payments.

How to Track Payment Status

Keeping track of payments is essential for any business, as it ensures that all financial transactions are properly recorded and that you receive the compensation you’re owed. Tracking payment status helps you manage your cash flow, follow up on outstanding debts, and maintain clear financial records. This process can be streamlined with the right strategies and tools, making it easier to stay on top of payments.

Methods for Tracking Payment Status

There are several ways to track the status of payments, from manual tracking to using automated systems. Consider the following options:

- Manual Tracking: For small businesses or freelancers, tracking payments manually in spreadsheets or physical ledgers can be effective. This method requires entering each payment received, the date, and the outstanding balance.

- Accounting Software: Many accounting tools offer automated tracking systems, where payments are logged and reminders are sent for overdue amounts. This can save time and reduce the chances of human error.

- Payment Platforms: If you use platforms like PayPal, Stripe, or bank transfers, these systems often have built-in tracking features that let you view payment history and outstanding balances easily.

Steps to Effectively Track Payments

To ensure payments are properly tracked, follow these steps:

- Record All Details: As soon as you issue a payment request, record the date, amount, and expected due date. This information should be accessible for easy reference.

- Set Up Payment Reminders: Automate reminders for clients about upcoming or overdue payments to prevent delays.

- Mark Payments as Received: Once a payment is made, mark it as received in your tracking system and note the payment date for future reference.

- Review Regularly: Check your payment records periodically to ensure there are no discrepancies and that all outstanding amounts are followed up on promptly.

By adopting a consistent and organized system for tracking payments, you can avoid payment delays, reduce administrative overhead, and keep your business running smoothly.

How to Save Time with Pre-designed Billing Documents

Managing your financial transactions efficiently is crucial for any business. Using pre-designed billing documents can significantly save time by simplifying the process of creating and sending payment requests. These ready-to-use structures eliminate the need for starting from scratch each time you need to bill a client, allowing you to focus on other critical tasks while ensuring accuracy and consistency.

Benefits of Using Pre-designed Billing Documents

There are several advantages to utilizing pre-designed formats for your financial requests:

- Consistency: Pre-designed forms ensure that all your financial documents maintain a uniform structure, helping you maintain professionalism and clarity with clients.

- Time Efficiency: Instead of manually entering details in each document, you can quickly fill in the necessary information, reducing the time spent on creating each request.

- Accuracy: These forms often come with fields for important information, such as payment due dates, amounts, and terms, reducing the chances of errors or omissions.

How to Maximize Time Savings

To get the most out of pre-designed billing documents, follow these tips:

- Automate the Process: Use accounting software that integrates with your pre-designed forms. This way, your system can automatically fill in client information, making the process even faster.

- Standardize Your Requests: Develop a consistent format for all your financial documents so that you can simply update the necessary details without worrying about layout or structure.

- Use Digital Platforms: Take advantage of digital invoicing tools that allow you to create, send, and track payments with just a few clicks, streamlining the entire billing process.

By adopting pre-designed billing structures, you not only save valuable time but also improve the efficiency of your financial operations, ultimately helping your business grow.

Understanding Document Security Features

When dealing with financial documents, security is paramount. Protecting sensitive client and payment information is essential to ensure trust and prevent fraud. Many businesses are now incorporating advanced security measures into their billing documents to safeguard data and ensure the integrity of the transaction process. These features not only help secure the document but also provide a sense of reliability to clients and partners.

Key Security Features for Billing Documents

There are several security features that can be implemented in billing documents to protect sensitive information:

- Password Protection: Passwords can be set to restrict unauthorized access to sensitive documents, ensuring that only those with the proper credentials can view or edit them.

- Watermarks: A watermark placed on a document can prevent unauthorized copying or tampering. It acts as a visible marker that identifies the document as a legitimate and official request.

- Digital Signatures: A digital signature can verify the authenticity of the document, ensuring that the contents have not been altered since they were signed by the authorized individual or entity.

- Encryption: Encryption can be applied to both the document and its contents, ensuring that even if the document is intercepted, the information remains unreadable without the decryption key.

Best Practices for Document Security

To ensure that your billing documents remain secure, consider implementing the following best practices:

- Regular Updates: Keep your security software and document management systems up to date to protect against the latest threats.

- Limit Access: Restrict access to sensitive billing documents by assigning permissions based on roles within your organization, ensuring that only authorized personnel can make edits.

- Use Secure Platforms: When sending or receiving billing documents, always use secure platforms that offer encryption and other security measures to protect the information during transit.

By implementing these security features and practices, you can protect your financial documents from unauthorized access and potential fraud, enhancing both the safety and professionalism of your business transactions.