Free Invoice Template for NZ Businesses Easy and Customizable

Managing financial transactions is a crucial task for any business, large or small. A well-organized document to request payment helps maintain clarity and professionalism in dealings with clients. Whether you’re a freelancer, contractor, or owner of a small enterprise, having the right tools to streamline this process is essential for maintaining good business relationships.

Customizable billing documents can save time, reduce errors, and ensure that all important details are included, such as amounts due, payment terms, and contact information. Many tools are available to assist in creating these records, making it easier for businesses to present a polished image while also improving accuracy in financial reporting.

In this guide, we will explore accessible options that help New Zealand businesses simplify the process of creating these essential records, ensuring efficiency without the need for complex software or costly services. With the right resources, you can keep your transactions organized and professional.

Free Invoice Template NZ: A Complete Guide

Creating well-structured billing documents is essential for businesses in New Zealand to maintain smooth financial operations. Whether you’re offering goods or services, having a reliable and professional way to request payment is key to managing cash flow effectively. With numerous tools available online, it’s now easier than ever to generate these documents quickly and efficiently, without needing specialized software or costly resources.

This guide will walk you through the best options available for generating customized billing forms. From understanding the necessary fields to look out for, to choosing the right platform for your needs, you’ll gain all the knowledge required to produce clear and professional documents that align with your business standards.

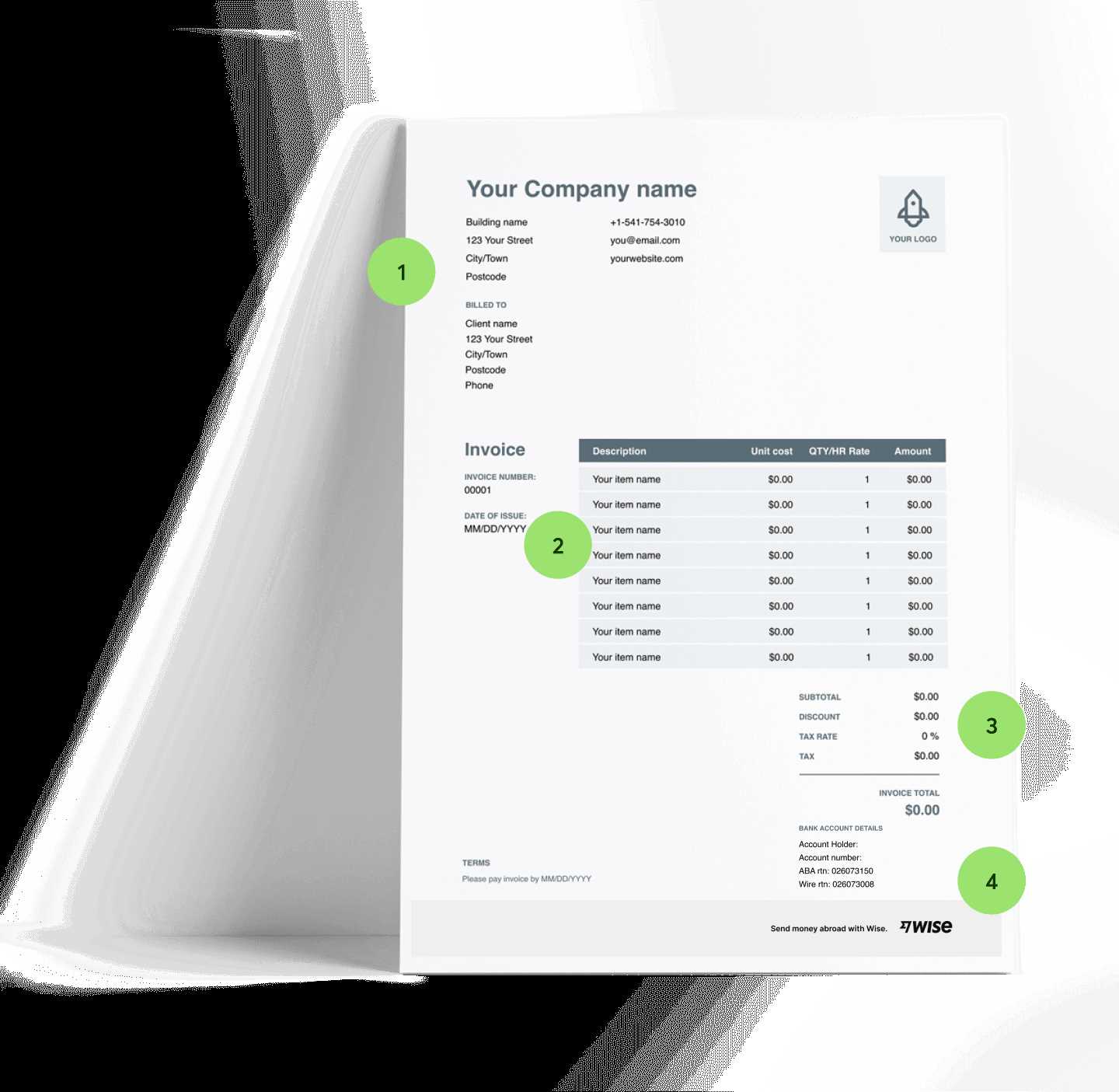

Key Features of a Reliable Billing Document

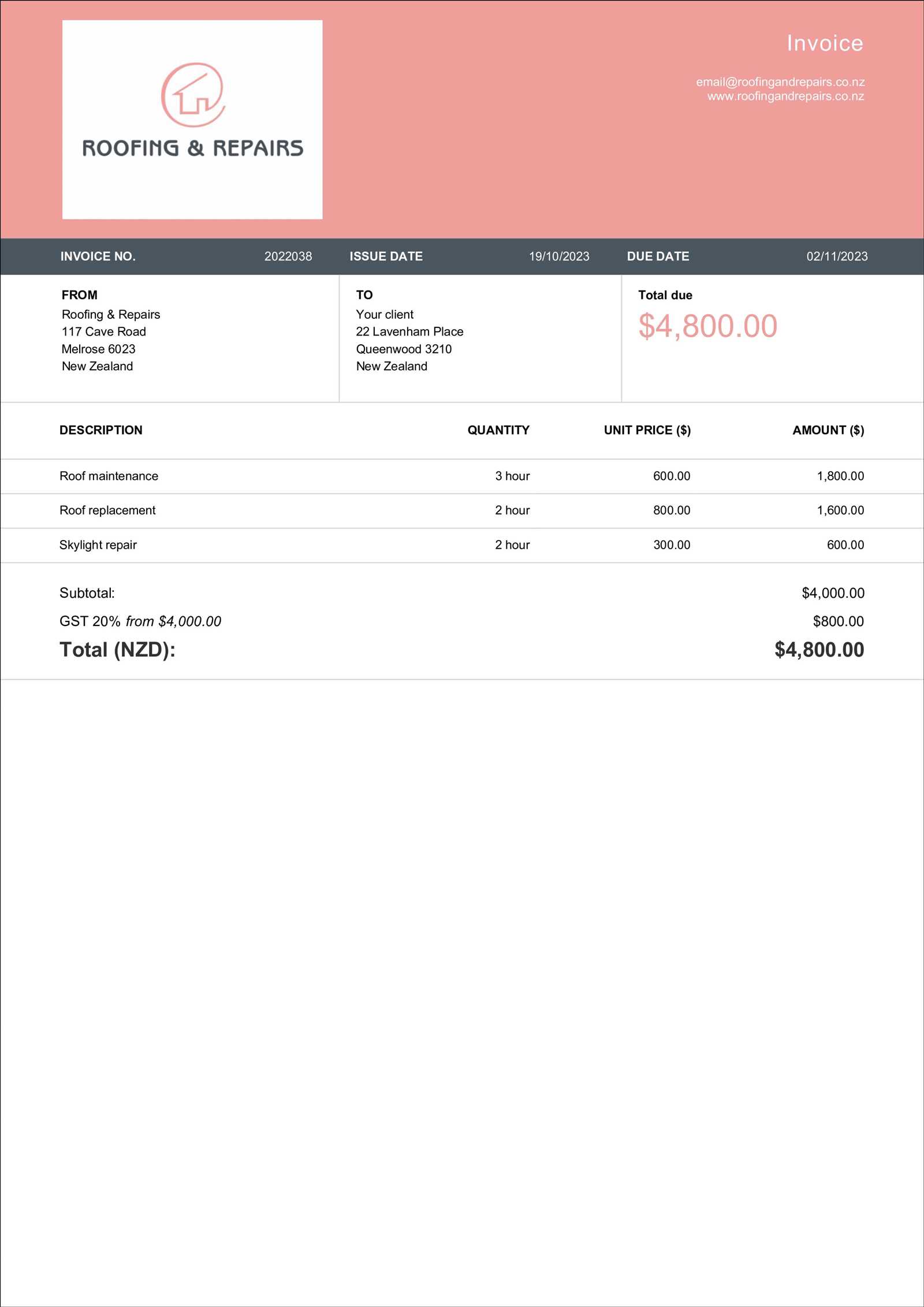

When selecting a solution, it’s important to look for a few key features that ensure your financial records are complete and accurate. These include spaces for essential information like your company’s details, customer contact information, itemized lists of services or products, and clearly stated payment terms. A professional document will also display tax calculations, applicable discounts, and the total amount due. Including all of this information not only helps your clients understand what they’re being charged for but also ensures compliance with local business standards.

Where to Find and How to Use Billing Forms

There are various platforms available for generating professional billing records, many of which offer basic versions at no cost. Once you’ve selected the right tool, customizing the document is simple. You can add your business logo, adjust the design to suit your brand, and input the specific details for each transaction. Whether you choose a downloadable form or an online generator, the process should be intuitive and quick, allowing you to send documents to clients almost instantly.

By utilizing the right resources, businesses in New Zealand can ensure that their financial paperwork remains organized, transparent, and professional, helping to foster trust and efficiency in client relationships.

Why Use an Invoice Template

Efficiently managing business transactions requires a systematic approach to requesting payments. By using pre-designed forms, companies can ensure that all necessary details are included, making the process smoother and reducing the chance of errors. These documents help maintain professionalism, save time, and simplify record-keeping, which is essential for any successful business operation.

Utilizing ready-made forms enables businesses to present clear and concise financial information to clients, fostering trust and transparency. Instead of manually creating new documents from scratch each time, a well-organized structure allows for quick customization with relevant details, ensuring that businesses can focus on their core operations.

Benefits of Using Organized Forms

There are several advantages to relying on pre-designed forms when requesting payment. The following table outlines key benefits:

| Benefit | Description |

|---|---|

| Time-saving | Quickly customize and send documents without starting from scratch each time. |

| Consistency | Ensure all your business records follow the same professional structure. |

| Accuracy | Reduce errors by using pre-set fields for important information like amounts, terms, and contact details. |

| Professionalism | Present a polished image with a clear and organized layout that enhances your business reputation. |

How It Helps in Business Operations

In addition to improving efficiency, using a structured document system can aid in keeping your financial records organized. When all your records are standardized, it becomes easier to track payments, handle disputes, and monitor cash flow. Having this system in place can also help ensure compliance with any local regulations regarding business transactions, ensuring that your company remains up-to-date and in good standing with authorities.

Top Features of Free Invoice Templates

When it comes to creating professional billing documents, certain features can make a significant difference in how easy and efficient the process is. The right tools offer essential elements that simplify customization, improve clarity, and ensure that all necessary details are included. Whether you’re a freelancer or a business owner, understanding the key features of these forms can help you choose the best option for your needs.

These billing forms often include a variety of customizable sections, allowing businesses to tailor each document to their specific requirements. The most common elements are designed to capture all relevant details, such as itemized lists, payment terms, and client contact information. A well-structured design ensures that the document is both clear and professional, ultimately helping you maintain a positive relationship with clients.

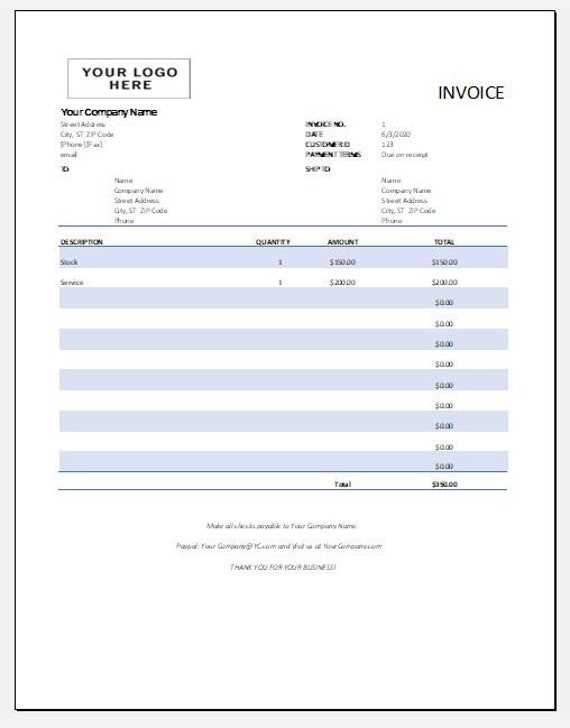

Customizability and Flexibility

One of the most important features of these documents is the ability to customize the layout and content. This allows you to include your business logo, adjust the fonts and colors, and input specific transaction details for each client. Customizability ensures that your documents reflect your brand’s identity while remaining professional and functional.

Essential Information and Fields

Billing records must include several key elements to be effective and legally compliant. These forms typically include fields for your business and client details, descriptions of products or services provided, itemized charges, taxes, and total amounts due. Ensuring that all these sections are clearly marked and easy to understand reduces confusion for both parties and promotes timely payments.

How to Customize Your Invoice Template

Personalizing your billing forms is essential for ensuring they align with your business identity while providing all necessary details. Customizing a document can make it look more professional and tailored to your specific needs, while also ensuring accuracy in each transaction. The ability to adjust key elements like the layout, design, and content allows businesses to create clear, organized records that both you and your clients can easily understand.

Customizing your documents doesn’t have to be complicated. Many platforms allow for quick edits and modifications, making the process fast and efficient. In this section, we will explore the steps to take when tailoring your billing forms, from basic adjustments to more advanced features that help you stay on-brand and improve the client experience.

Adjusting the Layout and Design

The first step in customization is to choose a layout that suits your business style. Most platforms offer various designs that can be easily modified. You can add your company’s logo, adjust colors to match your branding, and choose the font style and size for text. A clean, well-organized layout helps ensure that the document is easy to read and professional-looking, which ultimately leaves a positive impression on clients.

Entering Business and Transaction Details

Once the design is in place, the next step is to input essential information. This includes your business name, address, contact details, as well as the client’s information. You’ll also need to include a list of goods or services provided, along with itemized costs. Ensure that tax rates, discounts, and payment terms are clearly outlined. By carefully entering these details, you can ensure that both parties are clear on the charges and expectations.

Tip: Always double-check the accuracy of amounts and dates before finalizing the document to avoid any confusion or discrepancies with your clients.

Best Free Invoice Templates for New Zealand

For businesses in New Zealand, having access to well-designed billing forms can make a significant difference in managing transactions efficiently. A variety of tools are available that provide easy-to-use and customizable options, enabling businesses to create professional documents without needing advanced software or costly services. In this section, we’ll explore some of the best resources for generating these essential business documents, ensuring that companies across New Zealand can streamline their payment processes.

Choosing the right tool involves looking for features like simplicity, flexibility, and the ability to add or adjust essential details such as taxes, payment terms, and itemized services. Many platforms offer easy customization, allowing you to tailor each document to your brand’s identity while ensuring that all required fields are included for clarity and compliance with local regulations.

Top Platforms for Creating Custom Billing Documents

Several online platforms cater to New Zealand businesses looking to create professional billing forms. These services typically offer customizable layouts, easy download options, and various formats like PDF or Excel. Here are a few of the best resources:

- Wave Accounting: A cloud-based platform offering customizable billing forms with built-in tools for tax calculations and payment tracking.

- Zoho Invoice: A user-friendly tool with options for personalizing design, adding your logo, and managing recurring payments.

- FreshBooks: Provides customizable documents along with time tracking and expense management features, perfect for small businesses and freelancers.

Customizing Your Documents for New Zealand Businesses

When creating these documents, ensure that you include New Zealand-specific details like the GST tax rate and any relevant legal information, such as your business registration number. Many platforms provide templates that are already compliant with local regulations, saving you time and effort. By choosing the right service and customizing it to your business, you’ll be able to send clear, professional documents to your clients with ease.

Advantages of Digital Invoice Templates

Digital billing solutions have revolutionized the way businesses handle financial transactions. With the rise of online tools, managing payment requests has become more efficient, faster, and less prone to errors. By using digital forms, businesses can streamline the entire process–from creation to submission–while reducing the administrative burden that paper-based systems often create.

The main benefits of using digital forms are efficiency, accessibility, and ease of customization. These forms can be generated quickly and tailored to suit any business, allowing companies to focus on their core operations rather than spending time on paperwork. Additionally, the ability to store and manage these records electronically makes it easier to track payments and manage financial data in the long run.

Time and Cost Efficiency

One of the most significant advantages of digital documents is the time saved. With just a few clicks, you can generate, edit, and send payment requests without the need for printing or manually filling out forms. This eliminates the costs associated with paper, ink, and postage, while also speeding up the entire billing cycle. Clients also benefit from the quick delivery of documents, making it easier for them to review and pay on time.

Improved Organization and Record Keeping

Digital solutions provide better organization of financial records. These systems allow for easy storage and retrieval of past transactions, which is particularly helpful during tax season or for auditing purposes. You can quickly search for specific entries, track payment status, and keep your financial data in one secure location. This reduces the risk of losing important documents and ensures that everything is properly documented and accessible at any time.

How to Download Free Invoice Templates

Accessing and downloading professional billing documents has never been easier. Many online platforms offer easy-to-use tools that allow businesses to create and download customizable forms within minutes. Whether you’re just starting out or looking to streamline your payment process, downloading a pre-designed form can save you valuable time and ensure consistency across all your client communications.

In this section, we’ll guide you through the steps to find, download, and customize these essential business documents to meet your specific needs. From choosing the right format to personalizing the layout, you’ll be able to create professional payment requests without the hassle.

Finding the Right Resource

The first step in obtaining a professional billing document is to find a reliable platform. There are numerous websites and online services that provide downloadable options for businesses. Look for platforms that offer templates compatible with common formats like PDF, Excel, or Word, as these formats are easy to edit and share. Popular websites like Canva, Zoho, and Wave offer customizable forms that are simple to download and use for your business needs.

Steps to Download and Customize

Once you’ve chosen the right platform, the next steps are straightforward:

- Select a design: Browse through available designs and choose one that suits your business style.

- Customize details: Edit sections such as business name, client information, itemized charges, and payment terms.

- Download: After customizing, simply download the form in your preferred format (PDF, Excel, etc.).

- Send to clients: You can now send your finalized document via email or print it for physical delivery.

With these simple steps, you can quickly start using digital billing documents that save time and ensure your business maintains a professional image.

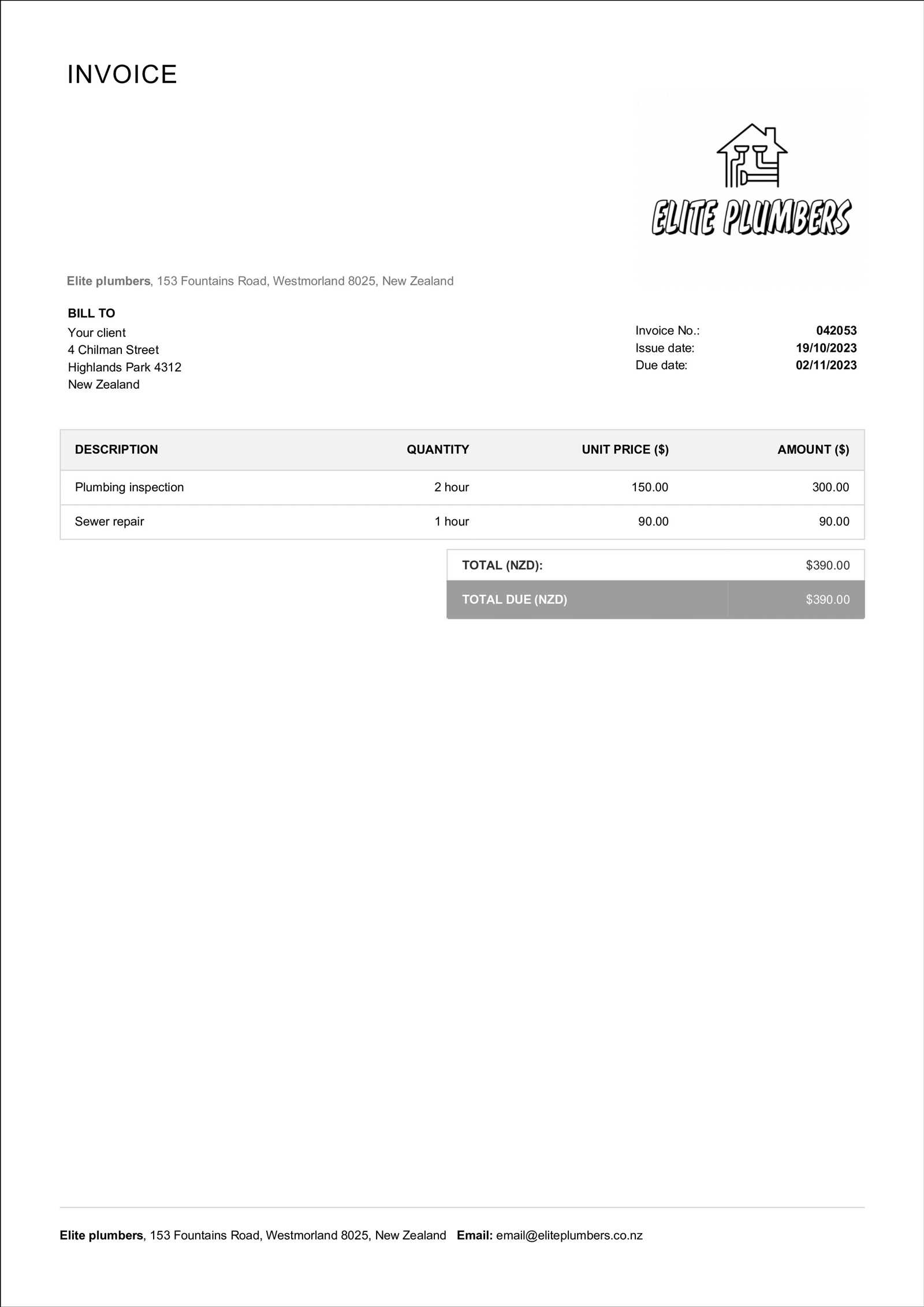

Understanding Invoice Layouts for NZ Businesses

Creating well-structured financial documents is essential for maintaining clarity and professionalism in business transactions. The layout of these forms plays a crucial role in ensuring that all necessary details are included and easy to understand. For New Zealand businesses, it’s important to design payment requests that align with local regulations and meet the expectations of clients, all while maintaining a clear and organized format.

In this section, we’ll explore the key components of a successful document layout for NZ businesses. From the arrangement of essential details to the best practices for clarity, understanding how to structure these forms will help businesses in New Zealand streamline their processes and improve communication with clients.

Whether you’re working with a simple template or customizing a more advanced design, it’s important to prioritize readability and include all necessary fields. By adhering to a clear layout, businesses ensure that their clients can easily review the charges and make payments without confusion or delay.

Tips for Creating Professional Invoices

Crafting a well-organized and professional billing document is essential for maintaining positive relationships with clients and ensuring timely payments. The right design and attention to detail can reflect your business’s professionalism and help avoid misunderstandings. In this section, we will provide practical tips to help you create clear, effective, and professional billing forms that not only look great but also communicate the necessary information efficiently.

Whether you are new to creating payment documents or looking to improve your current process, these tips will help you ensure that all essential elements are included and formatted correctly. By following these suggestions, you can create documents that are both professional and easy to understand for your clients.

Keep the Design Simple and Clean

Clarity is key when creating a billing document. Avoid cluttering the form with unnecessary information or overly complex designs. A clean, minimalistic layout will make it easier for your clients to read and process the details. Use clear headings, simple fonts, and adequate spacing to improve readability. The simpler the design, the more professional it will appear.

Include All Necessary Details

Ensure that your document includes all relevant information for both you and your client. This typically includes your business name, contact details, and the client’s information. A list of products or services provided, along with quantities, prices, and total amounts, should be clearly outlined. Don’t forget to include your payment terms, such as due dates and methods of payment, to avoid any confusion.

Tip: Double-check your document for accuracy, as errors in amounts or details can delay payments and harm your professional reputation.

How to Add Your Business Details

Including accurate and professional business information on your payment requests is essential for both clarity and compliance. Your clients need to easily identify your company, know how to contact you, and understand the terms of your business relationship. Properly including these details not only helps ensure smooth transactions but also builds trust with your clients.

In this section, we will guide you through the key business details that should be included in your documents, ensuring that your forms are complete, professional, and easy to read. These elements are essential for clear communication and legal requirements, particularly for businesses in New Zealand.

Essential Business Information to Include

Make sure your document includes the following details:

- Business Name: Clearly state the full name of your company or trading name.

- Business Address: Include the physical location of your business, as well as any relevant postal address.

- Contact Information: Provide a phone number, email address, and website (if applicable) for clients to easily reach you.

- GST Number: If applicable, include your Goods and Services Tax (GST) number, especially if your business is registered for GST in New Zealand.

Placement and Design Tips

Place your business details at the top of the document, where they are immediately visible. This ensures that clients can quickly find your contact information in case they have questions or need clarification. Use a font size that is large enough to be readable, but ensure it does not overpower the rest of the content. Keeping a balanced layout is key to maintaining a professional appearance.

Common Mistakes to Avoid in Invoicing

Creating billing documents may seem straightforward, but small mistakes can lead to significant problems, including delayed payments, confusion with clients, or even legal issues. Ensuring that your documents are accurate, clear, and professional is crucial to maintaining a positive business relationship and keeping your cash flow on track. In this section, we’ll highlight some of the most common mistakes made when preparing billing forms and offer tips on how to avoid them.

By paying attention to these key details and implementing best practices, you can avoid costly errors and improve the overall efficiency of your payment process. Let’s dive into the common pitfalls that businesses often face and how you can prevent them from affecting your operations.

1. Missing or Incorrect Contact Information

One of the most common mistakes is failing to include the correct business contact details, such as your name, address, phone number, and email. If clients cannot reach you to clarify payment terms or resolve disputes, it can delay payments or lead to frustration. Always ensure that your business details are complete, accurate, and up to date.

2. Incorrect Payment Terms or Amounts

Another frequent error is the incorrect calculation of charges or listing inaccurate payment terms. Double-check all amounts and ensure that taxes, discounts, and any additional fees are properly calculated. Also, clearly specify payment due dates, late fees, and accepted payment methods to avoid confusion. Incorrect amounts or ambiguous payment terms can lead to delayed payments or disputes.

Tip: Take the time to carefully review the document before sending it to your client. Accuracy is key in maintaining professionalism and ensuring timely payments.

How to Calculate Taxes on Your Invoice

Calculating taxes correctly on your billing documents is essential for compliance and ensuring accurate payments. In New Zealand, the Goods and Services Tax (GST) is typically added to most goods and services provided, and understanding how to calculate and apply this tax is critical for both businesses and clients. Getting it right not only helps you stay compliant with tax regulations but also avoids any confusion or discrepancies with your customers.

In this section, we’ll explain the basic steps for calculating taxes on your payment requests, including how to apply the correct GST rate and how to properly display tax amounts on the document. By following these guidelines, you can ensure your documents are accurate and professional, keeping your transactions smooth and trouble-free.

Step 1: Understand the GST Rate

In New Zealand, the standard GST rate is 15%. This rate is applied to most goods and services. It’s important to note that certain products or services may be exempt or zero-rated, so it’s essential to know which categories apply to your business. Be sure to stay updated on any changes to the GST rate or rules to remain compliant with tax laws.

Step 2: Calculate the GST Amount

To calculate the tax on your charges, simply multiply the price of each item or service by the GST rate. For example, if you’re charging $100 for a service, the GST amount would be $15 (15% of $100). Add this amount to the base price to calculate the total amount due.

Formula: Tax = Price × GST rate

If you want to calculate the total including tax, simply add the GST amount to the original price:

Formula: Total = Price + Tax

Be sure to clearly separate the base price, the tax amount, and the total price on your document to avoid any confusion for your clients.

Importance of Clear Payment Terms

Clear and well-defined payment terms are essential for any business transaction. They set expectations for both the business and the client, helping to ensure that payments are made on time and reducing the risk of misunderstandings. Without clear terms, businesses may face delays in receiving payments or encounter disputes regarding the amount due or payment deadlines.

Having a precise payment structure in place not only helps maintain professional relationships but also improves cash flow and financial planning. In this section, we will discuss the key reasons why setting clear payment terms is crucial and how they can benefit both your business and your clients.

Prevents Misunderstandings

When the payment terms are clearly outlined, both parties know exactly what is expected, reducing the chances of confusion. Whether it’s the due date, accepted payment methods, or any late fees, clear terms ensure that the client is aware of all conditions before the payment is due. This transparency helps avoid disputes and ensures that the transaction is completed smoothly.

Encourages Timely Payments

Well-established payment terms, such as specifying a due date or offering early payment discounts, can motivate clients to pay promptly. Clear terms act as a reminder of the deadlines and provide clients with the necessary information to make payments on time. This reduces the likelihood of late payments, helping to maintain a steady cash flow for your business.

Tip: Consider including penalties for late payments to further encourage clients to meet deadlines, while also providing a grace period if needed for flexibility.

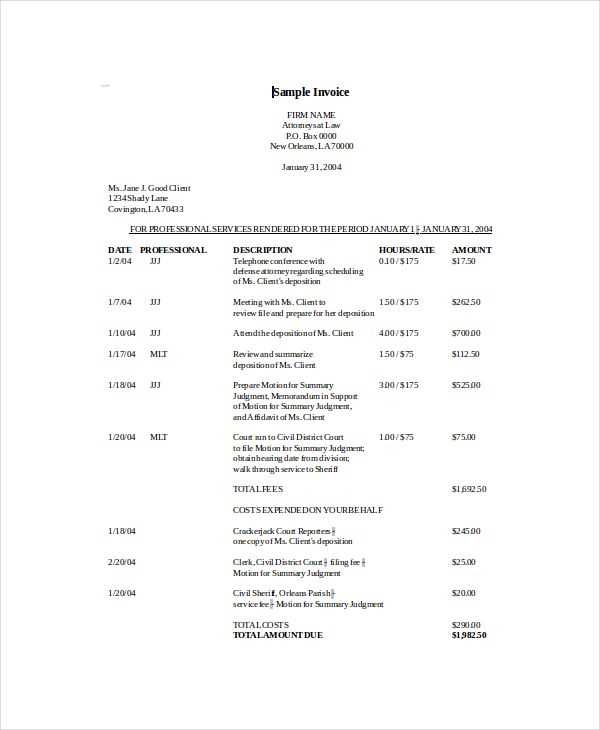

Invoice Templates for Freelancers and Contractors

For freelancers and contractors, managing payments can be a challenge, especially when it comes to ensuring that all necessary details are included and clearly communicated. Creating well-structured billing documents is vital for maintaining professionalism and ensuring timely payment. These documents need to capture all relevant information, including services provided, payment terms, and contact details, in a way that’s easy for clients to understand and process.

This section will explore the importance of using customized forms for freelancers and contractors, offering tips on what to include, how to structure your billing documents, and why having a clear format is crucial for maintaining smooth financial transactions.

Key Information for Freelancers and Contractors

When creating payment requests as a freelancer or contractor, it’s essential to include specific details that reflect your unique business model. Below is a list of elements that should be included in your billing documents:

| Element | Description |

|---|---|

| Client Information | Include the name, address, and contact details of the client receiving the service. |

| Services Rendered | Provide a clear description of the work completed, including the hours worked and rate charged. |

| Payment Terms | State the payment due date, method of payment, and any penalties for late payments. |

| Business Details | Include your business name, contact information, and GST number if applicable. |

| Tax Information | If applicable, ensure that the correct tax rate is added to the total amount for transparency. |

Customizing Your Document for Different Projects

As a freelancer or contractor, you may work on a variety of projects, each with different billing requirements. For example, some clients may prefer hourly rates, while others may request flat fees for specific deliverables. Customizing your billing document to suit the nature of each project is essential to ensure clarity and avoid confusion. By including the relevant details for each specific job, you create a clear understanding between you and the client, helping to build trust and prevent disputes over payments.

How to Send Invoices Effectively

Sending payment requests efficiently is crucial for maintaining smooth cash flow and ensuring timely payments from clients. An organized and professional approach to submitting your billing documents not only helps build trust but also reduces the chances of delays or misunderstandings. It’s important to choose the right method for delivery, communicate clearly, and follow up when necessary to ensure that the payment process goes smoothly.

In this section, we will discuss effective strategies for sending your payment requests, including best practices for delivery, timing, and follow-up. By implementing these steps, you can streamline the process and make sure your clients receive and process their payments promptly.

Choose the Right Delivery Method

The first step to sending your billing documents effectively is selecting the right delivery method. You can send your documents via email, post, or even through a payment platform. Each method has its advantages, but email is often the most efficient and preferred option for both you and your clients. It ensures quick delivery and allows you to easily track whether the document has been opened. When using email, be sure to include the document as a clear, attached file (preferably PDF) to avoid formatting issues.

Ensure Clear Communication

Along with your document, it’s important to include a brief but clear message explaining the payment request. Be sure to include key details such as the amount due, payment due date, and any relevant instructions on how to make the payment. If your clients have specific questions or need clarification, providing clear contact information will help them reach you quickly to resolve any issues.

Tip: Avoid sending the document without any introductory message; this can come across as impersonal and may cause confusion. A simple, polite note can go a long way in establishing positive communication.

Follow Up Promptly

It’s common for clients to miss the payment due date or forget to process the payment. Setting up a system to follow up is key to maintaining your cash flow. If the payment is overdue, send a polite reminder email or make a follow-up phone call. Many clients appreciate a gentle reminder and will respond quickly once they’re aware of the overdue status.

Tip: If necessary, set up automated reminders using invoicing software or schedule periodic follow-ups to stay on top of overdue payments.

Legal Requirements for Invoices in NZ

In New Zealand, businesses are required to comply with specific regulations when creating payment documents, especially when it comes to Goods and Services Tax (GST) and other legal obligations. Ensuring that your billing documents meet these requirements not only helps you stay compliant but also protects your business from potential legal issues or disputes with clients. Understanding what information must be included and how it should be presented is crucial for any business operating in New Zealand.

This section outlines the key legal requirements for billing documents in New Zealand, helping you understand what is legally necessary for your records and how to ensure that your documents meet all tax and business regulations.

Essential Information to Include

According to New Zealand law, certain details must be included in your billing documents to be considered valid for GST purposes. These include:

- Business Name and Address: Your legal business name and address must be clearly stated.

- Client Details: The name and address of the client receiving the goods or services must be included.

- GST Number: If your business is registered for GST, you must display your GST number.

- Date: The date the document is issued is crucial for tax reporting purposes.

- Description of Goods or Services: Clearly list the items or services provided, including quantities and unit prices.

- Total Amount and GST: The total amount due, including the GST amount, must be clearly stated.

Correct Tax Calculation and Documentation

For businesses registered under GST, it’s crucial that you calculate and display the GST amount correctly. When selling goods or services, you must apply the current GST rate of 15% unless the transaction is exempt or zero-rated. Your billing document should clearly show the GST exclusive amount, the GST amount, and the total inclusive of tax.

Tip: Ensure that your GST calculations are accurate and that your documents are easy to understand. This will help prevent any confusion and potential legal issues down the line.

Tracking Payments with Invoice Templates

Efficiently tracking payments is crucial for managing your business’s cash flow and ensuring that all transactions are properly documented. With well-structured billing forms, you can easily monitor outstanding amounts, identify paid invoices, and stay on top of overdue payments. Proper tracking not only helps you maintain accurate financial records but also improves communication with clients regarding payment status.

This section explores how to effectively track payments using organized forms, ensuring that each transaction is recorded clearly and systematically. By incorporating a few simple tracking methods, you can streamline your payment process and reduce the risk of missed or delayed payments.

Tracking Payment Status

One of the most important features of a good payment document is the ability to clearly track the payment status. This allows you to quickly identify which invoices have been paid, which are still pending, and which require follow-up. Including a payment status column in your form can save you time and reduce the chances of overlooking overdue accounts.

| Invoice Number | Client | Amount Due | Payment Status | Payment Date |

|---|---|---|---|---|

| #001 | Client A | $500 | Paid | 2024-10-01 |

| #002 | Client B | $300 | Pending | – |

| #003 | Client C | $700 | Overdue | – |

Organizing Payment Information for Easy Reference

Organizing your billing documents with clear columns for payment status, due dates, and client details helps ensure that you can quickly access the information you need. By keeping everything in one place, you can prevent confusion and easily follow up with clients who have overdue payments. Additionally, using digital tools such as accounting software or spreadsheets can help automate the tracking process, making it even easier to stay on top of you

Free Invoice Templates vs. Paid Options

When it comes to creating professional billing documents, businesses have a choice between using no-cost solutions or investing in paid options. While both types offer unique advantages, each comes with its own set of features, limitations, and considerations. Understanding the differences between these two options will help you make an informed decision based on your business needs, budget, and the level of customization you require.

This section compares the advantages and drawbacks of using no-cost templates versus premium services, highlighting the factors that will guide your decision. Whether you’re just starting out or looking for more robust features, there are key points to consider when choosing the right billing system for your business.

Advantages of Free Billing Documents

No-cost billing options can be appealing, especially for small businesses or freelancers just starting out. These solutions typically provide basic structures and easy-to-use formats, which can be customized to suit your needs. However, there are some limitations when it comes to advanced features and ongoing support.

| Pros | Cons |

|---|---|

| Cost-effective | Limited features and customization options |

| Easy to use and accessible | May lack integration with other software (accounting tools, etc.) |

| Basic templates for quick setup | No customer support or advanced tracking features |

Benefits of Paid Billing Solutions

Paid services generally offer more robust options, including advanced features such as automation, better customization, and integrated payment tracking. These tools can be particularly useful for businesses that require more than just basic documents and need greater efficiency in managing their financial processes.

| Pros | Cons |

|---|---|

| Advanced features (customization, tracking, reporting) | Recurring costs |

| Seamless integration with accounting software | May require time to learn all features |

| Professional designs and templates | Not always suitable for small or one-person businesses |

Tip: If your business is growing and you need features like automated reminders or seamless integration with accounting tools, a paid solution might be worth the investment. For simpler needs, no-cost options can be sufficient.