How to Create an Effective Upwork Invoice Template for Freelancers

As a freelancer, keeping your financials organized and professional is key to maintaining smooth client relationships. One of the most important aspects of managing your business is ensuring that you send clear and accurate payment requests. A well-structured document is essential for getting paid on time and building trust with your clients.

In this article, we’ll explore how to craft the perfect billing document that reflects your professionalism and simplifies the process for both you and your clients. Whether you’re charging hourly rates or fixed fees, understanding the essential elements and layout will help you avoid confusion and disputes.

Customizing your documents to suit your style and specific project needs can set you apart from the competition. By understanding the key components of an effective billing request, you can ensure you’re always prepared to send clear, accurate, and timely payment demands. The following sections will guide you through the necessary steps for creating a polished, straightforward document that aligns with industry standards.

Upwork Invoice Template Overview

For freelancers, sending a professional request for payment is a crucial part of maintaining smooth business operations. A structured document that outlines the services rendered, payment terms, and amounts owed helps ensure both clarity and transparency between you and your client. Creating a clear, easy-to-read format not only minimizes misunderstandings but also enhances your credibility and trustworthiness.

Key Features of a Professional Payment Request

A well-designed payment request should contain all the essential details of the work completed. These include the description of the services, the agreed-upon rate, the total amount due, and any relevant tax information. Including your contact details, the client’s information, and the payment due date is equally important. When these elements are clearly presented, it becomes much easier for your clients to process the payment on time, leading to smoother business transactions.

Why a Consistent Format Matters

Using a consistent format for all your billing documents helps create a sense of professionalism and reliability. A standardized approach makes it easier to track your payments over time, spot any discrepancies, and manage your finances effectively. It also saves you time, as you won’t need to reformat the document for each client or project. Having a clear structure also allows your clients to quickly review the necessary details without confusion.

Efficiency in billing can lead to faster payments and fewer follow-ups. An organized document reflects well on your overall business, leaving a positive impression with clients and ensuring that the payment process is as smooth as possible.

Why You Need an Invoice Template

For any freelance professional, ensuring that payments are processed quickly and accurately is essential to maintaining financial stability. A well-structured billing document serves as a formal record of the work completed and provides clear instructions for the client to follow when making payment. Without a reliable system in place, you may face delays, confusion, or disputes over payment terms.

Benefits of Using a Standardized Billing Document

Having a pre-designed format for your payment requests offers several advantages. It saves time, reduces errors, and ensures consistency across all your projects. A professional approach to billing also helps to present you as a credible and organized contractor, which can improve your relationship with clients and encourage timely payments.

| Benefit | Description |

|---|---|

| Time Efficiency | Using a ready-made document saves you time by eliminating the need to start from scratch with each client. |

| Consistency | A standardized format makes it easier to track payments and ensures you don’t miss any important details. |

| Professionalism | A well-organized document improves your image and encourages clients to respect your payment terms. |

How a Structured Approach Protects Your Business

By adopting a reliable format for payment requests, you reduce the chance of disputes and confusion with clients. A detailed and accurate document ensures that both parties have the same understanding of the work performed and the agreed-upon payment amount. Additionally, having all the necessary components laid out clearly in advance helps avoid mistakes and ensures that nothing is overlooked.

Key Features of Upwork Invoice Template

When creating a billing document for freelance work, it’s crucial to include all necessary components that clearly outline the terms of the agreement and the amount due. A well-structured payment request should provide detailed information in a professional format, making it easy for clients to understand the charges and process the payment without confusion.

Essential Information to Include

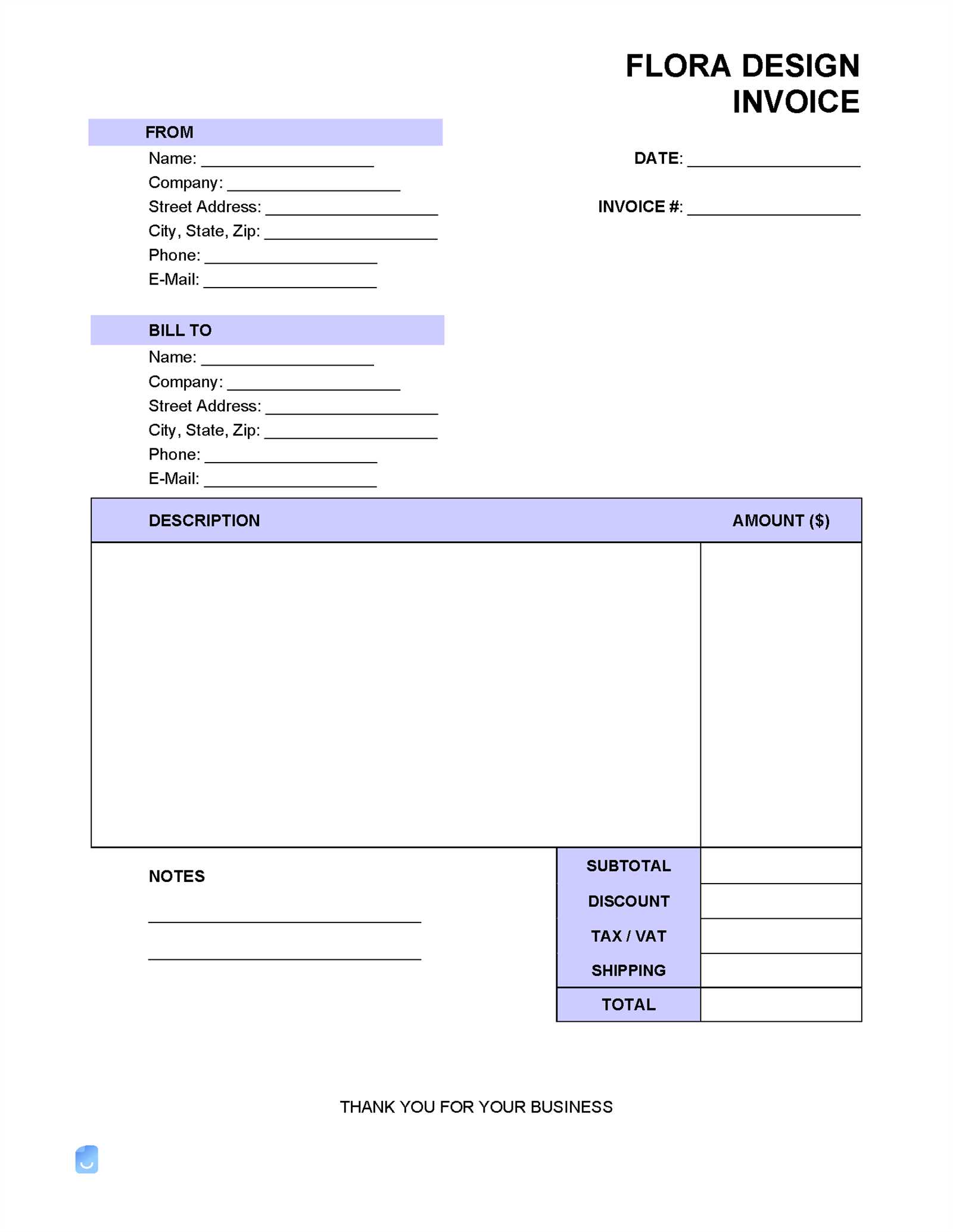

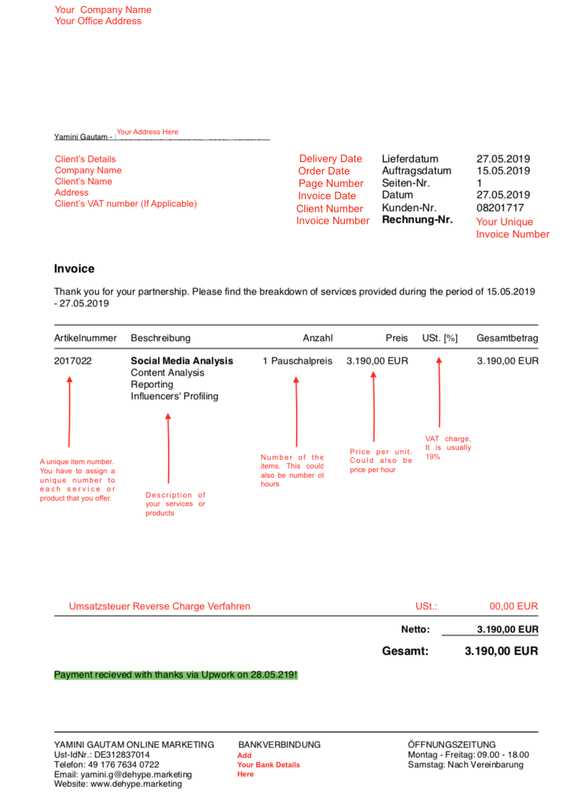

There are several key elements that should be present in every payment request. These include a clear description of the services provided, the agreed-upon rate, the total amount owed, and the payment due date. Including your contact information, along with the client’s details, ensures that both parties can easily communicate if any issues arise. Additionally, providing an invoice number and a breakdown of any taxes applied helps maintain transparency and accountability.

| Feature | Description |

|---|---|

| Service Description | Clearly list the tasks or services completed, including any relevant project details. |

| Payment Terms | Specify the agreed-upon rate and the total amount due for services rendered. |

| Due Date | Set a clear payment deadline to ensure timely payments and avoid confusion. |

| Contact Information | Include both your contact details and the client’s to facilitate communication if needed. |

Formatting and Layout Considerations

A clean and organized layout is essential for making the payment process straightforward. Use clear headings, consistent fonts, and logical sections to separate important details. A professional presentation helps clients quickly locate the information they need and promotes a smoother payment experience. Avoid clutter, and keep the document focused on the essential details to prevent any misunderstandings.

How to Create a Professional Invoice

Creating a professional billing document is essential for freelancers who want to ensure timely payments and maintain a positive relationship with their clients. A well-crafted document not only outlines the services provided but also gives your client confidence in your professionalism. To create a payment request that is both clear and efficient, certain steps and elements must be included in your format.

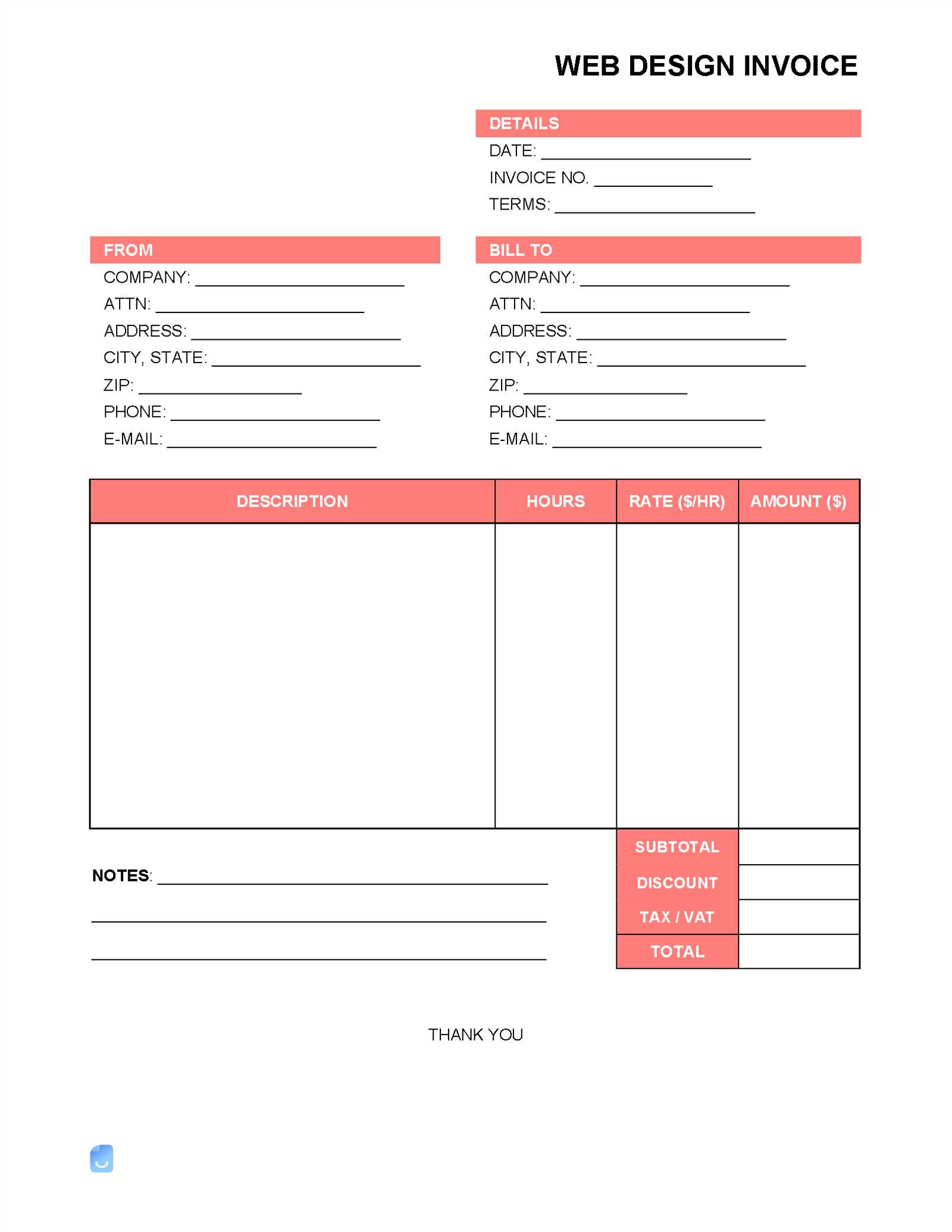

Step 1: Include Key Information

Start by clearly presenting the essential details. These should include your full name or business name, address, and contact information. Next, include the client’s name or business, their address, and any other relevant contact details. The document should also have a unique reference number for tracking purposes, as well as a clear payment due date to ensure that expectations are set regarding payment timelines.

Step 2: Detail Services and Charges

Break down the work completed in a concise and transparent manner. For each service provided, list the tasks and the agreed-upon rates or fees. It’s important to include the total amount due for each task, as well as the grand total for all services rendered. If applicable, provide any tax breakdowns or additional fees, clearly stating how these affect the final amount owed.

| Information | Details |

|---|---|

| Your Contact Information | Full name, business name, email, phone number, and address. |

| Client’s Details | Client name, business name, email, phone number, and address. |

| Service Breakdown | A detailed description of tasks, rates, and total amounts for each service. |

| Payment Due Date | A clear and prominent due date to avoid payment delays. |

Tip: Always double-check the numbers and descriptions to ensure that everything is accurate before sending it to your client. Any inconsistencies can lead to confusion and delays in payment.

Steps to Customize Your Template

Customizing your billing document allows you to adapt it to your specific business needs and project requirements. A personalized format not only reflects your branding but also ensures that the document includes all relevant information for each unique client or job. By making small adjustments, you can improve the clarity of your payment requests and enhance your professionalism.

Step 1: Adjust the Layout and Design

Start by selecting a clean and organized layout that suits your style. Use consistent fonts, colors, and spacing to make your document visually appealing and easy to read. Ensure that key sections, such as client details, services rendered, and payment information, are clearly distinguished through headings and sections. A well-structured format makes it easier for clients to navigate and understand the document quickly.

Step 2: Tailor the Content for Each Client

Personalize the content to reflect the specific terms of each project. This includes modifying the service descriptions, hourly rates, or total charges based on the agreement with the client. If applicable, add or remove any special notes, such as discounts, taxes, or payment deadlines. By doing so, you ensure that the payment request is accurate and directly relevant to the current work completed.

| Customization Area | Considerations |

|---|---|

| Design & Layout | Choose a clean, professional look with easy-to-read fonts and distinct section headings. |

| Client Information | Modify the client’s contact details and project-specific terms for accuracy. |

| Services & Charges | Adjust descriptions and rates based on each project’s unique scope and payment agreement. |

Tip: Consistently update your design and content to stay aligned with any changes in your branding or pricing structures. This ensures that your documents remain professional and current.

Essential Information to Include in Invoices

When preparing a formal payment request, it’s crucial to ensure that all the necessary details are included to avoid confusion and ensure timely processing. The information you provide should be clear, accurate, and comprehensive, allowing your client to easily understand the charges and make the payment without delay. By including the right elements, you can help foster trust and prevent misunderstandings.

Client and Your Contact Details

Start by including both your contact information and the client’s details. This includes your name or business name, address, phone number, and email address. Similarly, the client’s name or business name, along with their contact information, should be listed clearly. This ensures that both parties can easily reach each other if there are any questions or issues regarding the payment request.

Breakdown of Services and Charges

Clearly outline the work that was completed, including a detailed description of each service or task. For each item, include the rate charged and the total amount for that specific task. If you’ve agreed to hourly rates, include the total hours worked and the corresponding fee. If there are any taxes, discounts, or additional charges, these should also be clearly shown to provide full transparency.

| Information | Description | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Client’s Details | Include the client’s full name or company name, address, and contact information. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Your Information | List your name or business name, address, and contact details. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Service Description | Provide a clear description of each service completed, including any relevant project details. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Payment Breakdown | List the rate, hours worked, total for each service, and any applicable taxes or dis

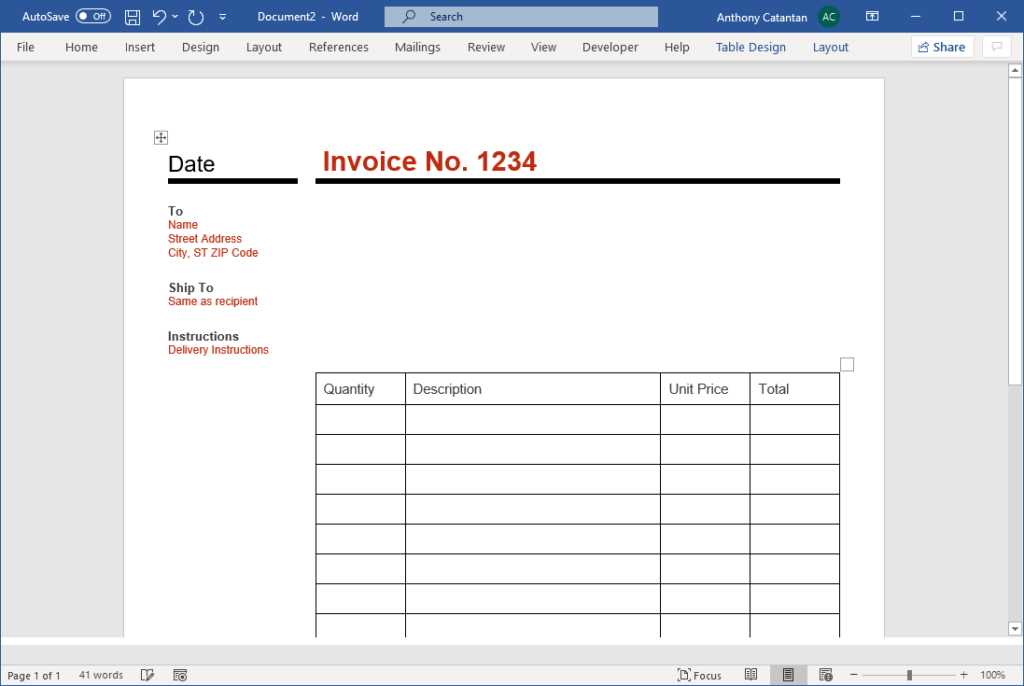

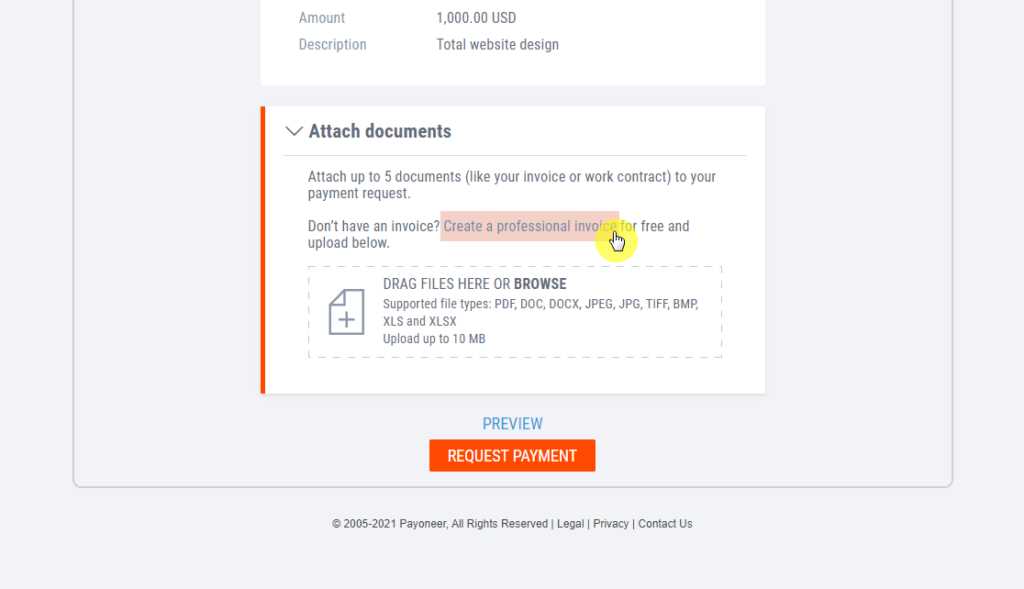

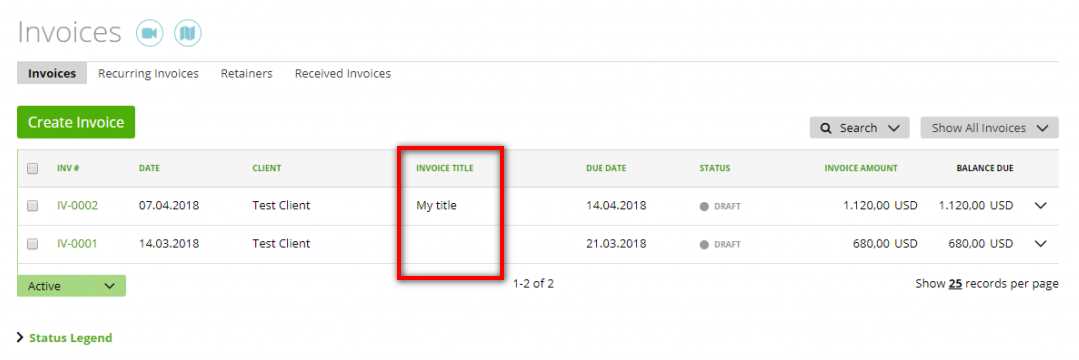

Best Tools for Designing Upwork InvoicesDesigning a professional billing document requires the right tools to ensure that the layout is clean, organized, and easy to understand. There are several platforms and software options available that allow you to create customized, visually appealing payment requests without needing advanced design skills. These tools offer various features to help streamline the process, making it easier for freelancers to send polished and accurate payment requests to clients. 1. Microsoft Word or Google DocsFor those who prefer simplicity and familiarity, using word processing software like Microsoft Word or Google Docs can be an excellent choice. Both platforms allow you to create basic but effective billing documents using pre-made templates or customized layouts. With easy-to-use features for adding tables, text, and other elements, these tools are great for freelancers who need a quick solution without investing in more complex software. 2. Invoice Ninja

Invoice Ninja is an online platform designed specifically for creating professional billing documents. It offers a variety of customizable templates, allowing you to adjust colors, fonts, and layout styles to match your branding. In addition to generating clean invoices, Invoice Ninja also enables you to manage clients, track payments, and send reminders–all in one place. This tool is perfect for freelancers who want an all-in-one solution for managing their payments and clients. 3. CanvaCanva is a popular design tool that provides a variety of pre-made templates for creating visually attractive billing documents. With a drag-and-drop interface, Canva makes it easy to personalize templates with logos, brand colors, and other design elements. The free version offers plenty of customization options, while the paid version unlocks additional features like premium fonts and images. 4. FreshBooksFreshBooks is a comprehensive accounting tool designed for freelancers and small business owners. It offers customizable billing templates that can be personalized with your business details, client information, and service descriptions. FreshBooks also integrates with other accounting features, such as tracking expenses and generating reports, making it an excellent tool for freelancers who want to manage their finances in one place. 5. QuickBooks OnlineQuickBooks Online is another robust solution for freelancers who need more than just a billing document generator. QuickBooks offers customizable invoice templates that can be easily modified to suit your needs. In addition to creating invoices, QuickBooks can handle accounting, payroll, and tax reporting, making it an all-in-one tool for managing your freelance business Common Mistakes to Avoid When BillingWhen preparing a formal payment request, it’s important to ensure that all details are correct and clearly presented. Even small mistakes can lead to delays in payment, confusion with clients, and a loss of professionalism. Being aware of the most common errors can help you avoid them and streamline the billing process, ensuring that your payments are processed smoothly and on time. 1. Missing or Incorrect Client InformationFailing to include the correct contact details or client information can cause delays or complications. Always double-check that the client’s name, company name, address, and contact information are accurate before sending the request.

2. Lack of Clear Payment TermsOne of the most common billing mistakes is not clearly stating the payment terms. This includes the due date, payment method, and any penalties for late payment. Clear terms help avoid confusion and ensure that your client knows exactly when and how to pay you.

3. Incorrect Billing Amounts

Submitting the wrong amount–whether too high or too low–can create trust issues with your clients. Ensure that the rate and total charges reflect the agreed-upon price for the services rendered. This includes reviewing hourly rates, project fees, or additional charges such as taxes or expenses.

4. Failing to Add a Unique Reference NumberWithout a unique reference number or invoice ID, it may be difficult for both you and your client to track payments. A reference number provides a clear identifier for each request and ensures that payments are processed without confusion.

|