Housekeeping Invoice Template for Cleaning Services

For any cleaning business, having an efficient and professional way to bill clients is crucial. A well-structured document helps ensure accurate payment processing and enhances the credibility of your service. Organizing your charges clearly and professionally also ensures that both you and your client are on the same page regarding expectations and costs.

In this guide, we will explore how to craft the perfect billing document that reflects your services, simplifies the transaction process, and keeps everything transparent. Whether you are providing residential or commercial cleaning, having the right format can save you time and prevent errors.

Learn how to include all essential details, such as service descriptions, pricing, and payment terms. We will cover options for customization, and highlight common mistakes to avoid, so you can be confident that your documents will meet both your business needs and client expectations.

Understanding Billing Documents for Cleaning Services

In any cleaning business, having a well-structured document to outline the charges and services provided is essential for smooth transactions. These documents act as a clear record of the agreement between service providers and clients, ensuring both parties understand the details of the services rendered and the payment due. A professionally designed billing form helps to maintain consistency and clarity, preventing misunderstandings or errors during the payment process.

The purpose of such a document goes beyond just listing costs. It provides transparency, builds trust, and serves as an official record that can be referenced later if any questions arise. It is important to ensure that all necessary components are included, such as a detailed breakdown of tasks performed, hours worked, rates, and payment terms. A well-organized format also ensures that clients can quickly assess the charges and makes it easier for service providers to track and follow up on payments.

Moreover, the adaptability of these documents makes them suitable for various business models, whether you are offering residential or commercial cleaning. Tailoring the structure to reflect your specific business needs can further streamline your operations and enhance professionalism.

Why Use a Billing Document for Cleaning Services

For any cleaning business, using a standardized format to manage payment details is key to maintaining efficiency and professionalism. By utilizing a structured approach, you ensure that each transaction is documented clearly, minimizing the risk of errors and misunderstandings. A consistent billing method also streamlines your business operations, allowing you to focus on delivering quality services rather than spending time on administrative tasks.

Time-Saving and Efficiency

One of the primary reasons to adopt a structured approach is the time saved in creating accurate records. Rather than starting from scratch for each job, having a pre-designed format allows you to quickly input the necessary information, reducing the time spent on paperwork. This efficiency is especially useful when handling multiple clients or large-scale projects, where consistency and speed are crucial.

Professionalism and Credibility

Using a clear and well-organized document not only improves efficiency but also elevates your business’s professionalism. Clients are more likely to trust a service provider who delivers polished, easy-to-understand billing records. A professional document enhances your business image, builds credibility, and fosters long-term client relationships.

Benefits of Customizing Your Billing Document

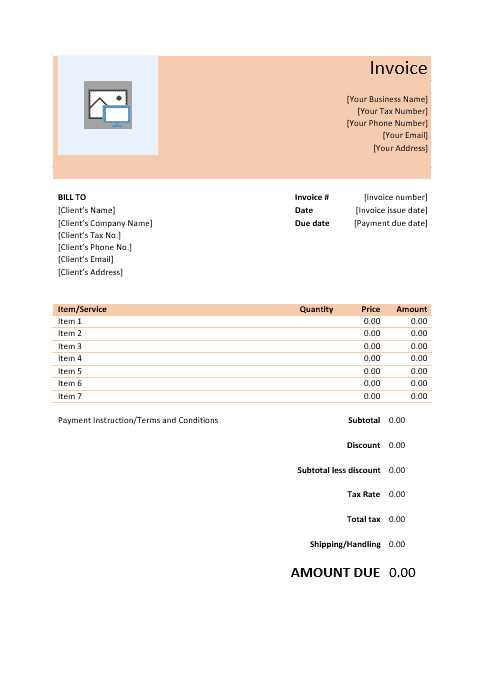

Customizing your billing records can greatly improve both the functionality and presentation of your financial transactions. By tailoring the format to meet the specific needs of your business, you ensure that all necessary details are included, enhancing clarity and reducing the chance of errors. A personalized approach allows you to stand out as a professional while providing a more organized and transparent experience for your clients.

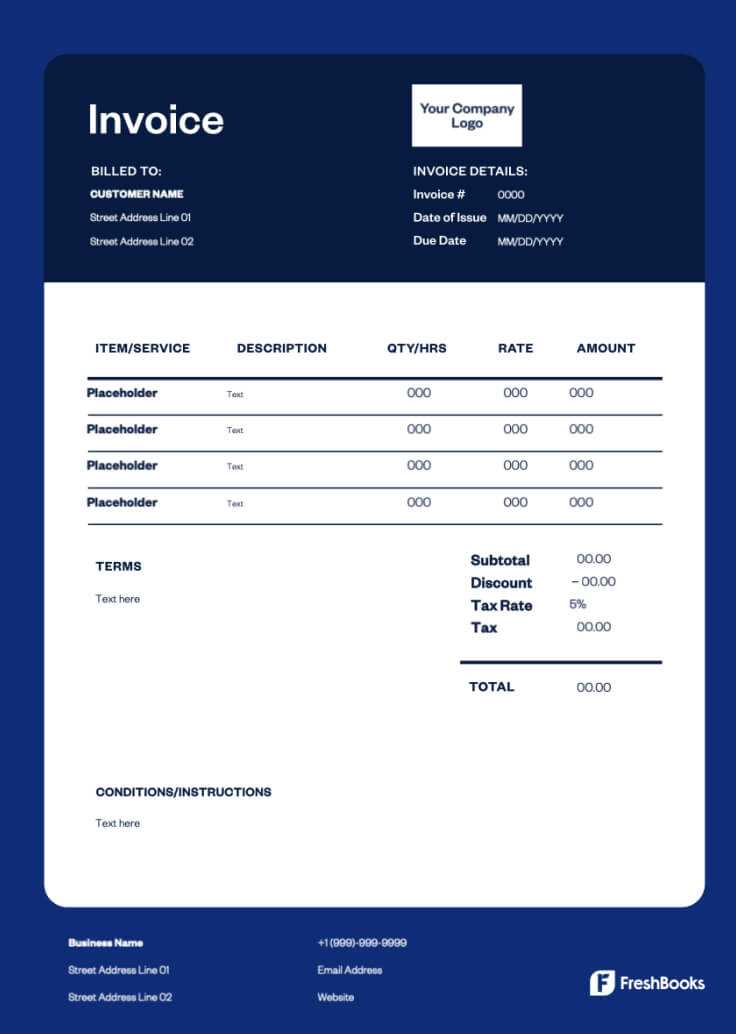

One of the key advantages of customization is the ability to align the document with your brand identity. You can include your company logo, colors, and contact information, making the document not only practical but also a reflection of your business’s image. This small but significant detail can strengthen your brand recognition and leave a lasting impression on clients.

Additionally, customizing your billing records allows you to adapt to various service offerings. Whether you’re charging by the hour, per project, or offering discounts, you can create a structure that best suits your pricing model. Tailoring the document also makes it easier to accommodate specific client requests or unique terms, ensuring that every bill accurately reflects the work completed.

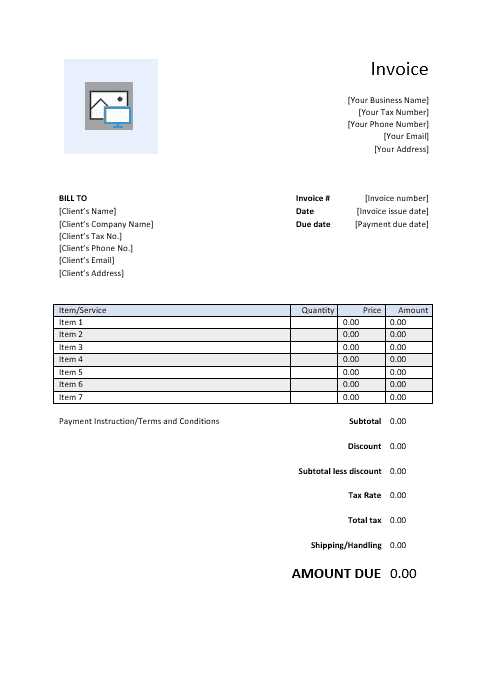

Key Elements of a Billing Document

For any cleaning business, a well-constructed billing record is essential for clear communication between the service provider and client. A properly organized document ensures all necessary information is conveyed accurately, reducing the likelihood of confusion or disputes. It is crucial to include certain key components that cover the scope of the services provided, the pricing structure, and the payment terms.

Some of the essential elements to include are service descriptions, where you detail the specific tasks performed, and hours worked or quantities if applicable. Additionally, pricing should be clearly stated, whether it’s per hour, per service, or a flat rate. The total amount due should also be highlighted prominently, along with any applicable taxes or additional fees.

Another important feature is the inclusion of payment terms, which outline when and how the payment should be made. This could include details such as due dates, accepted payment methods, and any late fees for overdue payments. Finally, ensuring your contact details are easy to find helps clients reach you for any questions or issues related to the billing process.

How to Create a Cleaning Billing Document

Creating an effective billing record for cleaning services requires attention to detail and clarity. This document should reflect the work completed, the time spent, and the cost associated with the services. By following a clear structure, you ensure that both you and your client have a mutual understanding of the charges and expectations, which helps maintain professionalism and transparency.

Step 1: Include Basic Information

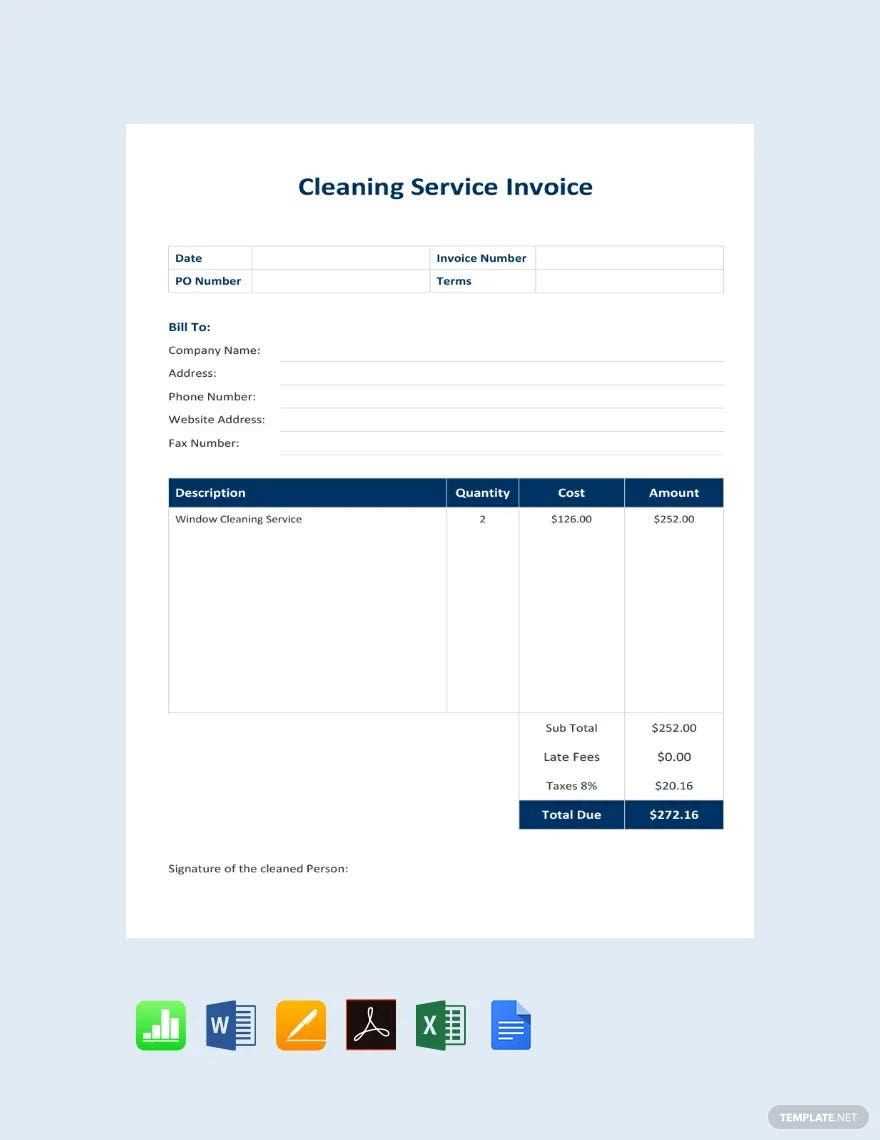

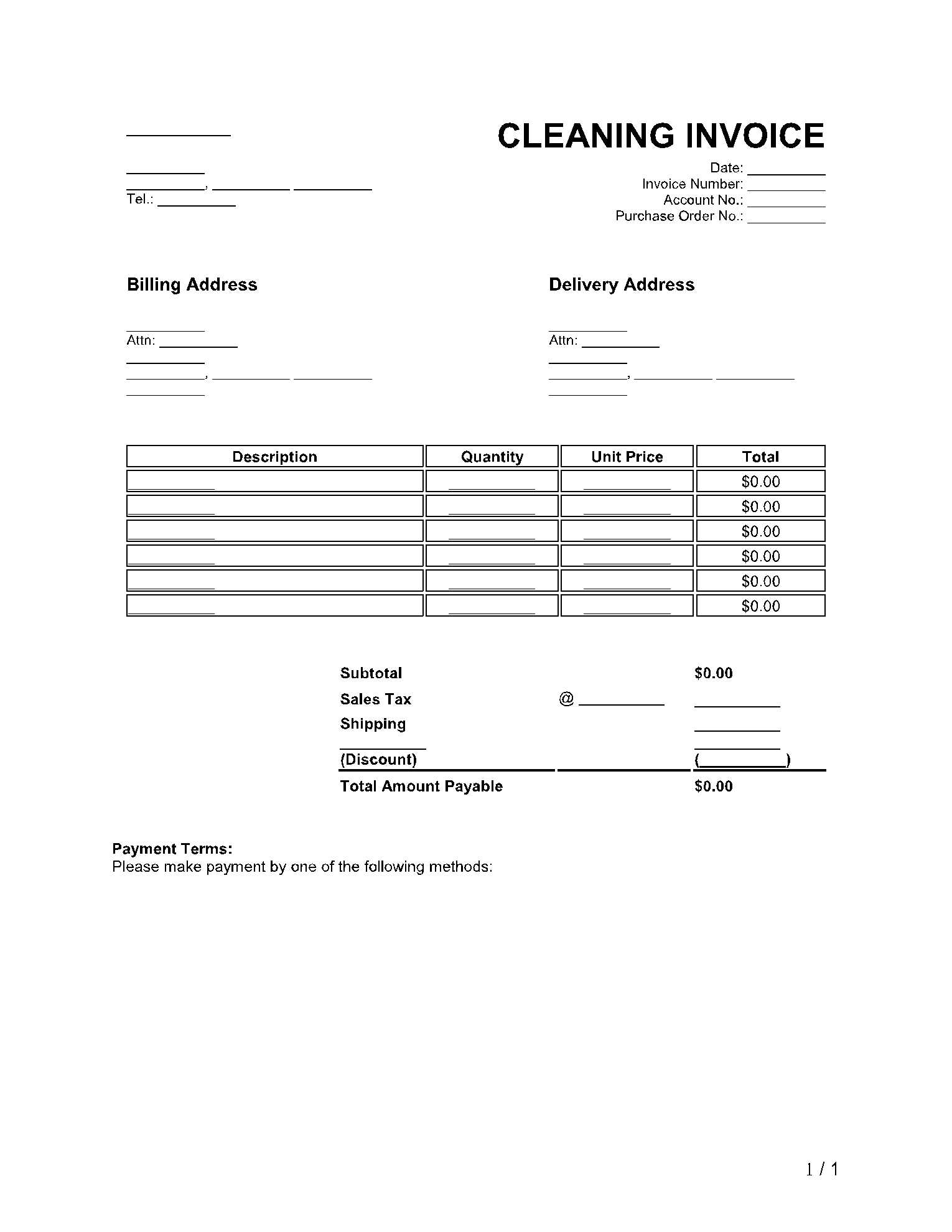

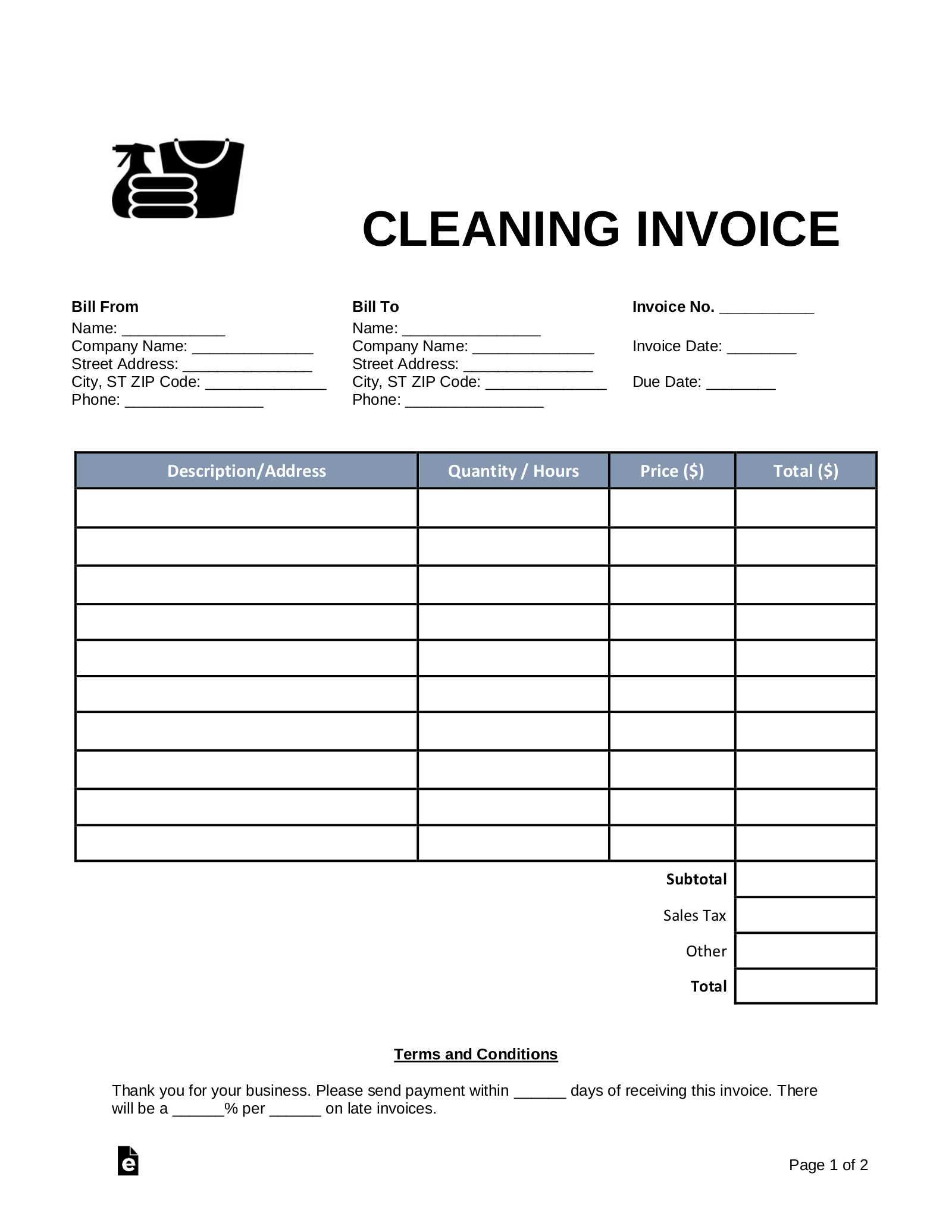

Begin by adding your business details at the top of the document, such as your company name, address, and contact information. Make sure to also include your client’s name, address, and contact details. This ensures both parties can easily identify and reference the record when needed. Don’t forget to add a unique reference number for easy tracking and organization.

Step 2: List Services and Pricing

Next, provide a detailed description of the services performed. Break down each task, such as general cleaning, carpet cleaning, or window washing. Specify the time spent or the rate applied to each service to maintain transparency. Finally, add up all charges, including taxes or additional fees, and clearly state the total amount due. This ensures that clients can easily understand what they are being billed for and why.

Common Mistakes in Billing Records

Creating accurate and professional billing documents is essential for maintaining trust and ensuring timely payments. However, there are several common errors that service providers often make when preparing these records. These mistakes can lead to confusion, delays in payment, or even damage to client relationships. Understanding and avoiding these pitfalls will help streamline your billing process and enhance your business’s professionalism.

Incomplete or Missing Information

One of the most frequent mistakes is leaving out essential details such as service descriptions, contact information, or payment terms. Omitting key elements can create confusion about what services were provided, leading to disputes or delayed payments. Always ensure that your billing document includes a complete breakdown of the tasks performed, the time or quantity involved, and the agreed-upon rates. This transparency helps prevent misunderstandings and builds trust with your clients.

Incorrect Pricing or Calculations

Another common issue is incorrect pricing, whether it’s due to miscalculations, inconsistent rates, or overlooked discounts. Ensure that the rates you apply match what was agreed upon with your client, and double-check your calculations for accuracy. Additionally, ensure any additional fees, taxes, or discounts are clearly itemized, as failure to do so can lead to confusion or dissatisfaction. Accurate pricing is key to maintaining professional relationships and ensuring that you are paid fairly for the services provided.

Essential Information for Accurate Billing

For any cleaning business, ensuring accurate billing is crucial for maintaining cash flow and avoiding misunderstandings. A well-structured record should include all the necessary details to reflect the work completed, the pricing applied, and the payment terms. By including the right information, you create a clear and transparent document that not only helps your clients understand what they are being charged for but also protects your business interests.

Key components of an accurate billing record include client details, such as the name and address of the customer. This ensures that the document can be easily identified and associated with the correct client. Additionally, always include a unique reference number or invoice number to help both parties track payments and services provided.

Another essential element is the service description. This should detail the tasks performed, such as cleaning specific areas, organizing spaces, or other specialized services. It’s also important to include the rate for each service, along with the total amount due, including any applicable taxes or additional charges. Clear and accurate pricing ensures that both you and your client are on the same page about costs and expectations.

Choosing the Right Format for Your Business

Selecting the appropriate document structure is essential for streamlining your billing process and ensuring professionalism. The right format can make it easier to organize your charges, maintain clarity for your clients, and save time during the billing cycle. It’s important to choose a style that fits the needs of your business and suits the services you provide, ensuring you can quickly generate accurate and consistent records for each transaction.

Consider Your Business Model

The first step in selecting the right format is to assess your business model. Are you offering one-time services, or do you provide ongoing contracts? For one-time projects, a simple and straightforward layout might work best, while recurring services may benefit from a more detailed structure that includes terms for regular payments or discounts. Tailoring your format to your business type ensures that it meets both your operational needs and client expectations.

Focus on Simplicity and Clarity

When deciding on a structure, keep in mind that the document should be easy to read and navigate. Avoid clutter by including only essential information and organizing it in a way that’s logical and straightforward. For example, use clear headings for each section, such as service descriptions, pricing, and payment details. A simple design not only reduces errors but also conveys a professional image to your clients.

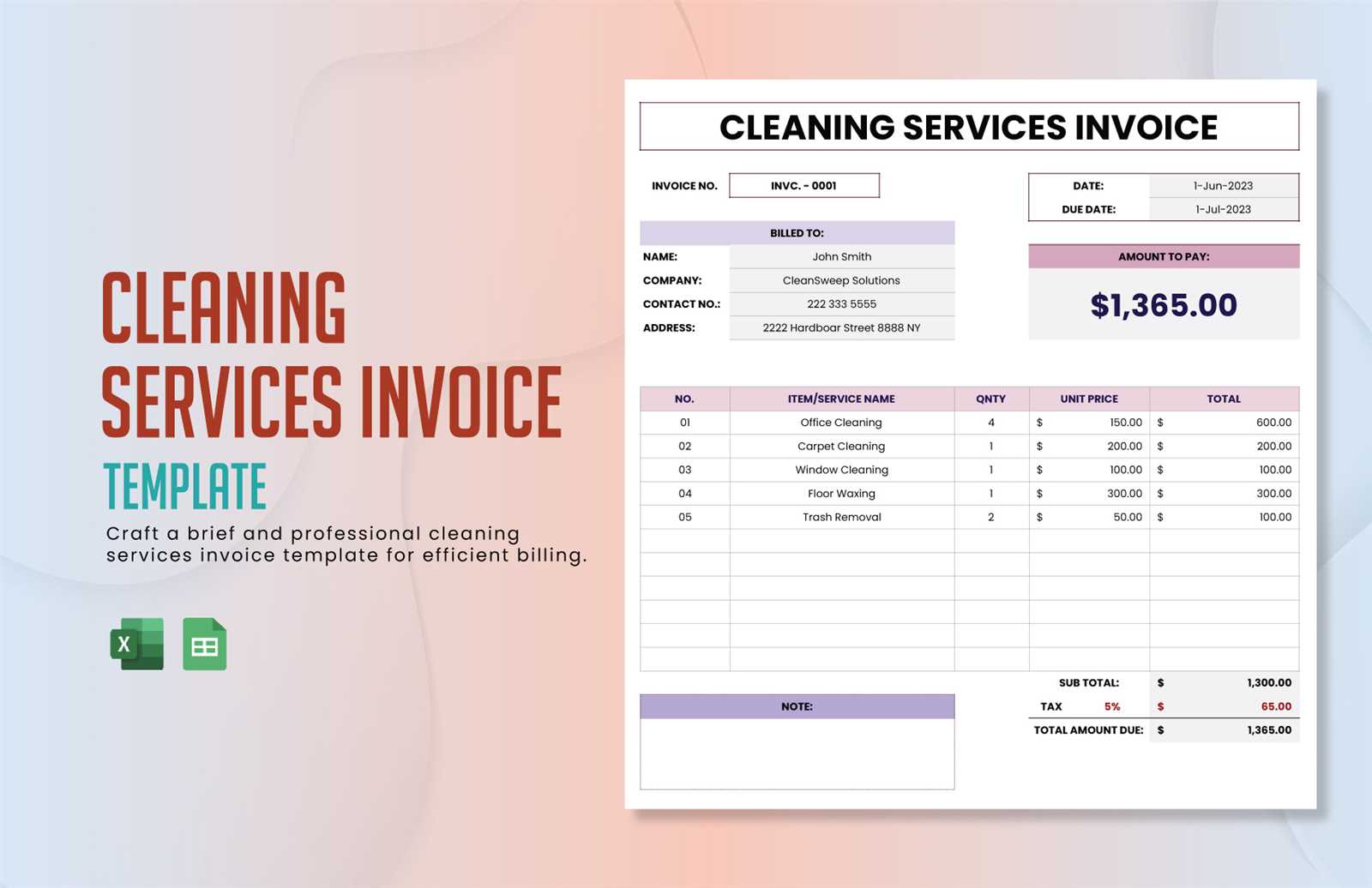

How to Include Discounts and Taxes

Including discounts and taxes in your billing records is essential for providing clients with a clear breakdown of the final amount due. Accurately calculating and presenting these elements helps avoid confusion and ensures that both parties understand the cost structure. Properly incorporating discounts and taxes can also demonstrate transparency and professionalism, which can build trust with your clients.

Here are some steps to effectively include these components:

- List discounts clearly: If you’re offering a discount, make sure to specify the percentage or flat amount and the reason for the discount (e.g., a seasonal promotion or loyal customer discount). Deduct the discount from the total amount before applying taxes.

- Apply taxes correctly: Calculate taxes based on the applicable rate in your region or the client’s location. Include the tax amount as a separate line item so clients can easily identify it.

- Show the final amount: After listing all services, discounts, and taxes, ensure the total amount due is clearly stated. This should be the final number that your client needs to pay, which includes all adjustments.

By following these practices, you ensure that discounts and taxes are accurately reflected, leaving no room for misunderstanding or disputes. This also enhances the clarity and professionalism of your business transactions.

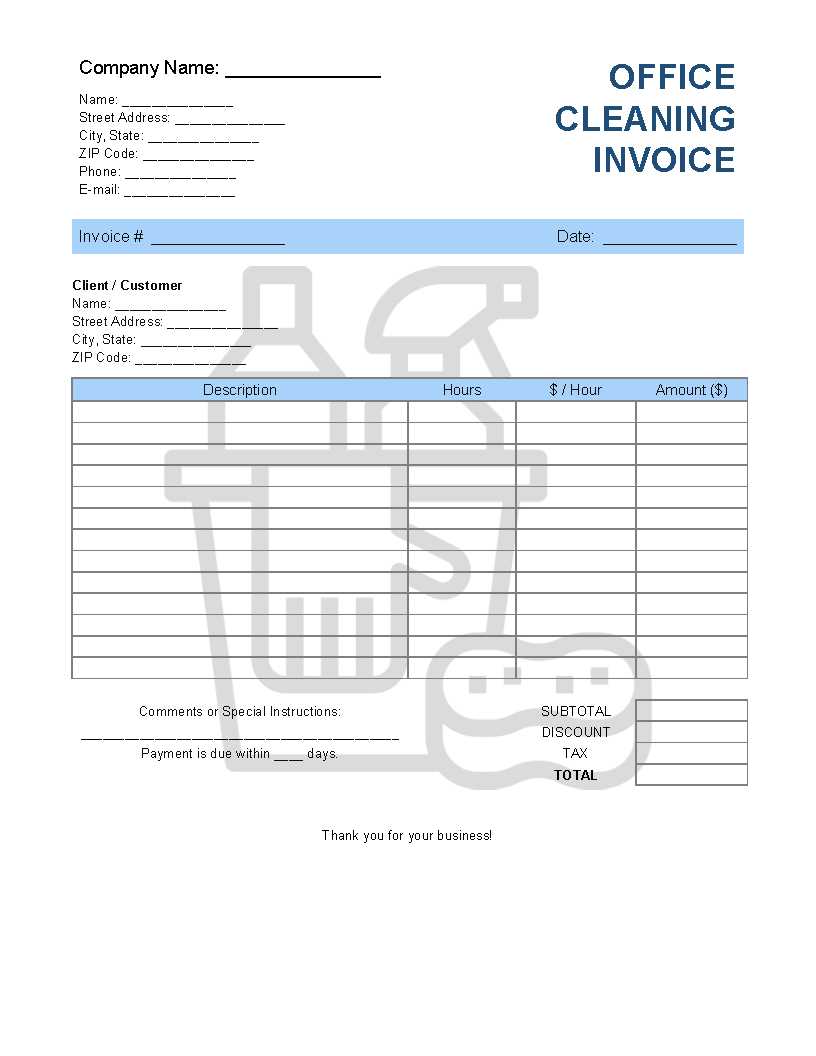

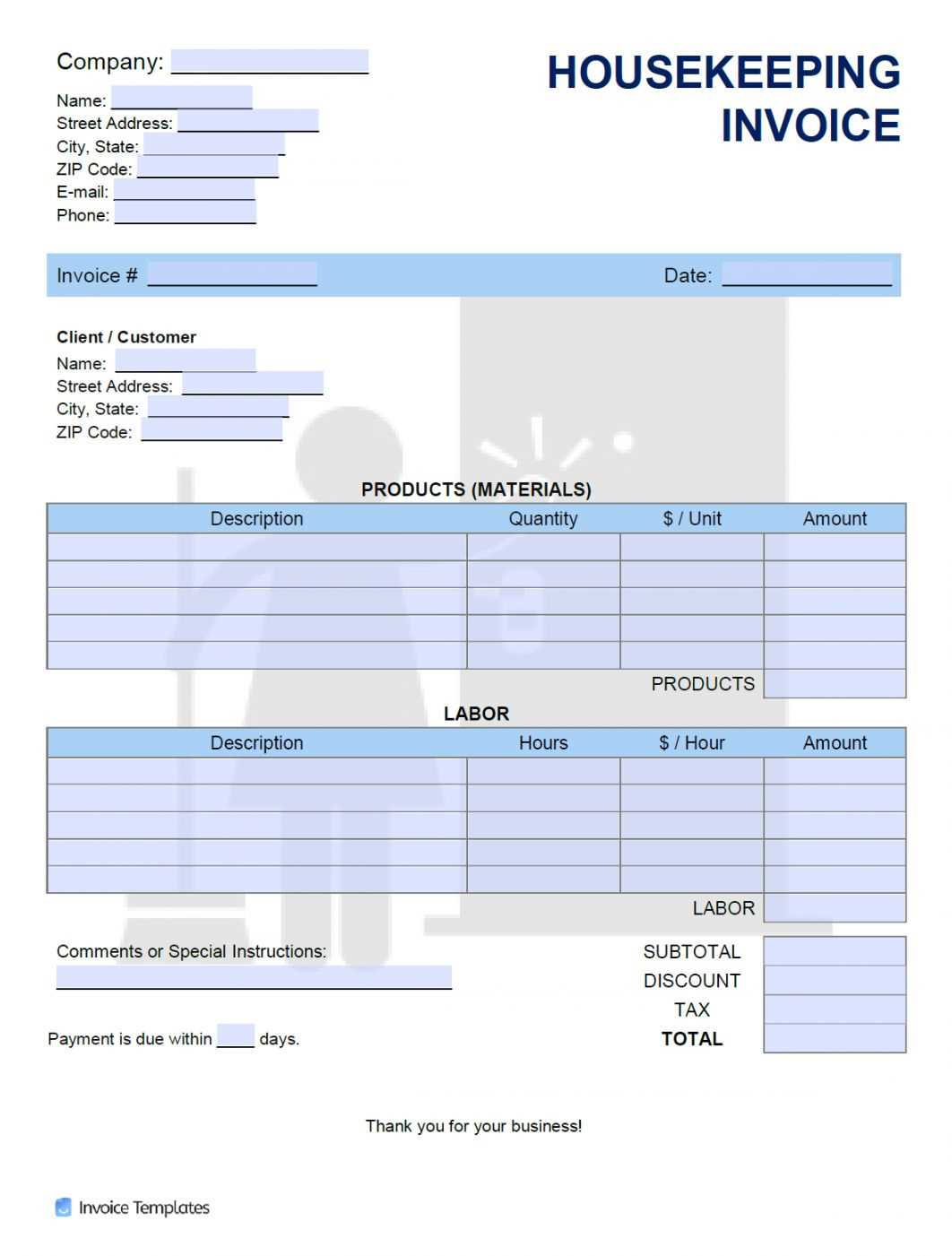

Billing Formats for Residential Cleaning

When offering residential cleaning services, having a structured and easy-to-use billing format is essential for both the service provider and the client. A clear document helps clients understand what they are being charged for, including the specific tasks performed, and makes it easier for you to track payments. This is especially important when handling multiple clients or recurring services, as it ensures accuracy and consistency in all your transactions.

Customizing Your Billing Document

For residential cleaning, the layout of your billing document should reflect the services you offer. For example, you can create sections that break down the tasks performed, such as kitchen cleaning, bathroom sanitization, or carpet vacuuming. Providing a detailed description of the services and the time spent on each task can help justify the charges and keep things transparent. Also, consider including special rates for specific services, such as deep cleaning or seasonal tasks.

Essential Information to Include

A well-structured billing document should include certain key pieces of information to ensure clarity. At a minimum, include your business name, contact details, and a unique reference number. The client’s name and contact details should also be specified. The total amount due should be clearly highlighted, with all services, rates, and taxes itemized. Don’t forget to mention payment terms, such as due dates and accepted payment methods, to ensure a smooth transaction.

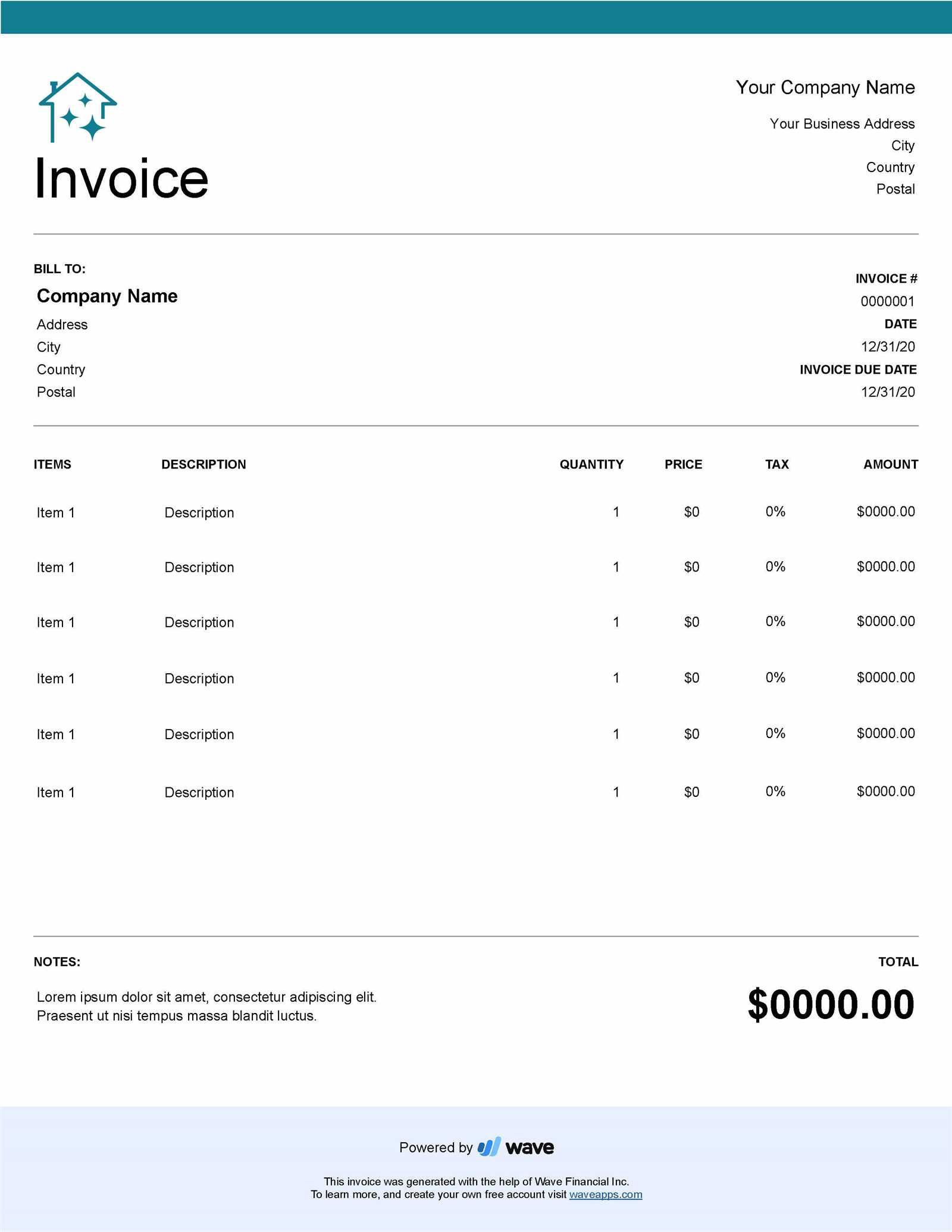

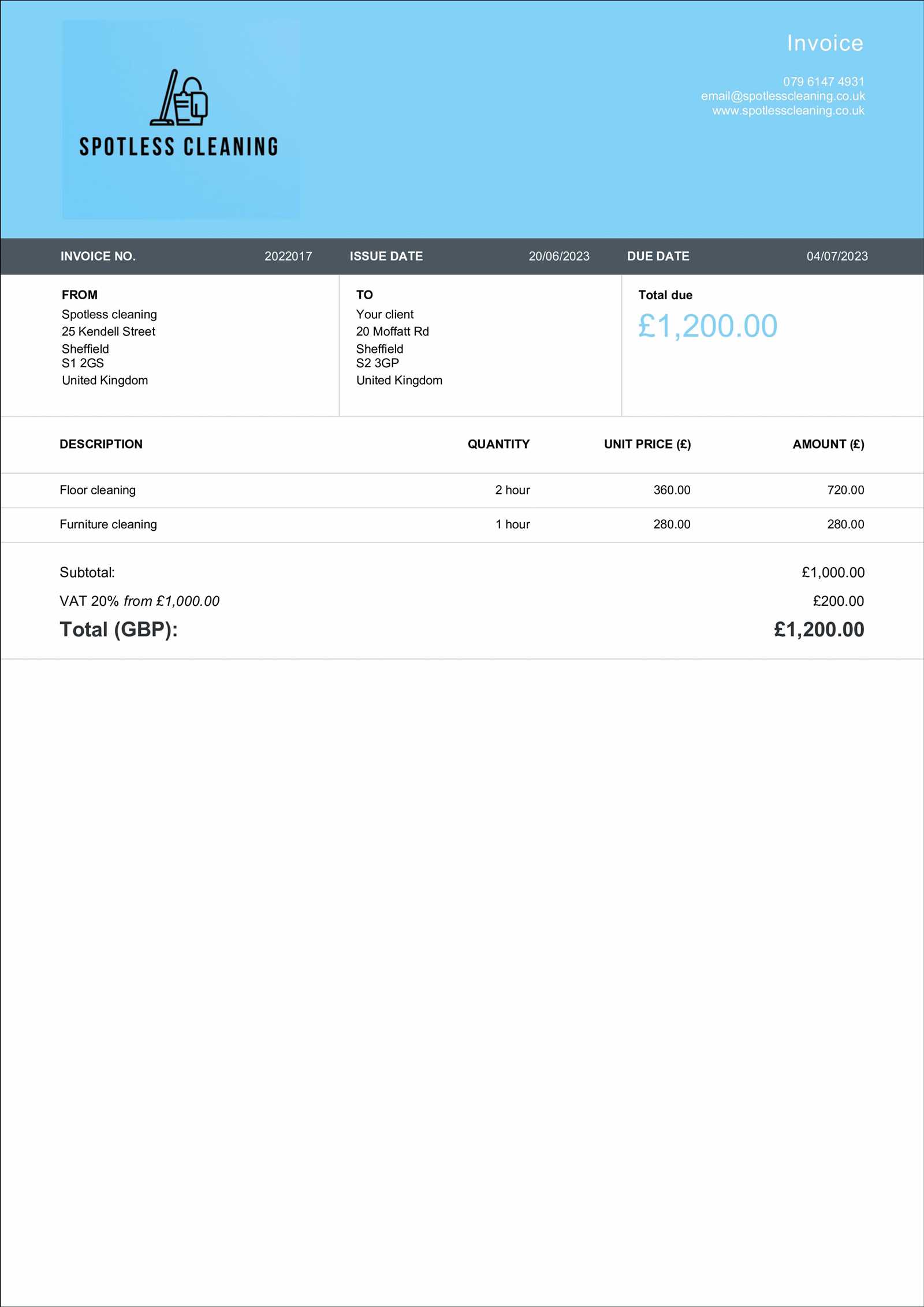

Billing Documents for Commercial Clients

When providing services to commercial clients, having a detailed and professional billing record is crucial for maintaining clear communication and ensuring timely payments. Commercial accounts often involve more complex agreements, such as recurring services, large-scale cleaning projects, or additional fees for specialized tasks. Therefore, the billing format must be clear, accurate, and adaptable to meet the unique needs of business clients.

Key Components for Commercial Clients

For commercial accounts, billing documents should be more comprehensive than those for residential clients. Key elements include:

- Service Breakdown: List each service separately, such as office cleaning, floor waxing, or window washing. This helps clients understand exactly what they are being charged for.

- Contractual Terms: Include references to any pre-existing contracts or service agreements that outline pricing structures, service schedules, and any discounts applied.

- Payment Terms: Commercial clients often have specific payment terms, such as net-30 or net-60 days. Clearly state these terms to avoid payment delays.

- Additional Fees: If there are extra charges for special services, such as after-hours cleaning or emergency tasks, these should be clearly itemized.

Creating a Custom Billing Document

When dealing with commercial clients, it’s essential to have the flexibility to customize your billing documents based on the type of service provided and the client’s specific needs. Whether it’s for a one-time project or a long-term contract, your document should be adaptable while maintaining a consistent structure. Include a clear payment schedule, outline the terms for cancellation or contract renewal, and ensure that any additional costs are outlined to avoid disputes later on.

Online Tools for Document Creation

Creating and managing billing documents can be time-consuming, especially for businesses with a high volume of clients. Fortunately, there are numerous online tools available that streamline the process, making it easier to generate accurate and professional records quickly. These tools allow users to customize their documents, track payments, and even automate recurring charges, offering a simple solution for businesses of all sizes.

Benefits of Using Online Tools

Online tools provide several advantages that can help businesses save time and ensure accuracy. Some of the key benefits include:

- Ease of Use: Most platforms are user-friendly and require no prior experience, allowing you to create documents in just a few clicks.

- Customization Options: Many tools offer customizable fields, letting you adjust the layout, include specific service details, and personalize with your logo or branding.

- Time-Saving Features: With features such as automated calculations and recurring billing options, online tools can save valuable time and reduce errors.

- Access Anywhere: Since these tools are cloud-based, you can create, edit, and send documents from any location with an internet connection.

Popular Tools for Document Creation

Several online platforms stand out for their ease of use and feature sets. Some of the most widely used tools include:

- Wave: A free tool that offers customizable document creation with automatic payment tracking and invoicing features.

- Zoho Invoice: Known for its professional-looking formats and advanced features like time tracking and automated reminders.

- FreshBooks: Offers a user-friendly interface with customizable templates, recurring billing, and expense tracking.

- QuickBooks: A robust platform with powerful financial management tools, including document creation and payment integration.

Using an online tool can simplify your billing process and reduce the likelihood of mistakes, making it easier to focus on providing excellent service to your clients.

Free vs Premium Billing Formats

When it comes to creating professional billing records for your business, there are numerous options to choose from, ranging from free versions to premium solutions. Each has its own set of advantages and limitations. Free options are often sufficient for small businesses or those just starting out, while premium options can offer advanced features and customization that may be beneficial for larger operations or those with more complex needs.

Advantages of Free Formats

Free billing formats are a popular choice for small businesses or freelancers looking to keep costs down. Some of the key benefits of using free tools include:

- No Cost: As the name suggests, these formats come with no financial investment, which is ideal for businesses with a tight budget.

- Simplicity: Free options are typically straightforward, offering basic features that make them easy to use without much customization.

- Quick Setup: These tools are often ready to use immediately, requiring little to no setup or learning curve.

Benefits of Premium Formats

Premium billing solutions offer a more comprehensive set of features for businesses looking for advanced functionality and greater control over their billing records. These formats typically come with the following advantages:

- Customization: Premium options often allow for more in-depth customization, such as branded layouts, personalized service descriptions, and multiple language support.

- Advanced Features: You can access features like automated billing, recurring payments, integrated payment gateways, and reporting tools that can save time and improve accuracy.

- Priority Support: Premium plans often come with access to dedicated customer support, which can be invaluable when issues arise.

While free solutions may be sufficient for basic needs, upgrading to a premium option can help businesses scale and streamline their operations more efficiently.

How to Bill for Different Cleaning Services

Billing for various types of cleaning services requires a clear and structured approach to ensure that clients are accurately charged for the work performed. Depending on the scope and nature of the cleaning tasks, the billing method can vary. From one-time deep cleans to ongoing maintenance contracts, each service requires specific details to be included in the documentation to reflect the work and pricing correctly.

Key Factors to Consider

When creating a billing record for cleaning services, several elements must be considered to ensure that all charges are transparent and comprehensive:

- Scope of Work: Clearly outline the tasks performed. For example, a deep clean might include tasks like carpet shampooing, while a routine cleaning may only cover dusting and floor mopping.

- Service Frequency: For recurring services, include the frequency (weekly, bi-weekly, monthly) and the total number of hours or sessions completed.

- Materials and Supplies: If cleaning materials are provided, it’s important to list any costs for these items separately or as part of the total price.

- Time Spent: Billing by the hour is common for certain cleaning services. Make sure to include the total hours spent and any applicable hourly rates.

Types of Cleaning Services and Billing Methods

Different cleaning services may require distinct billing methods. Here are some common service types and how to approach billing:

- Standard Residential Cleaning: This typically involves routine cleaning tasks. Charges can be based on time or per room, with rates reflecting the size of the home.

- Deep Cleaning: For thorough cleaning tasks that take more time, such as scrubbing hard-to-reach areas or cleaning appliances, charges may be higher, and an hourly rate is often used.

- Move-In/Move-Out Cleaning: This service requires more detailed work and can be priced as a flat rate based on the size of the property and the condition it is left in.

- Commercial Cleaning: For businesses, billing is usually done on a per-square-foot basis or as part of a regular maintenance contract.

By clearly defining the services rendered and how they are priced, you ensure both clarity for the client and accuracy in payment.

Tracking Payments with Cleaning Bills

Effectively tracking payments is essential for maintaining financial accuracy in any service-based business. By organizing and keeping track of payments received for cleaning jobs, you can avoid errors, ensure timely follow-ups, and maintain a smooth cash flow. A well-structured system allows you to monitor outstanding balances and make informed decisions regarding future services or contracts.

To manage payments efficiently, it’s important to establish clear documentation for every transaction. This includes detailing when a payment was made, the amount, the method of payment, and any outstanding balances. Using a digital or paper-based tracking system can help you stay on top of what’s been paid and what’s still due, preventing confusion and ensuring financial transparency with your clients.

Incorporating features such as payment due dates, payment methods (cash, card, or online transfer), and notes on partial payments can streamline the process. By organizing payment details clearly, you not only maintain better records but also provide your clients with reliable references for their own records. This minimizes misunderstandings and strengthens client relationships.

Legal Requirements for Cleaning Bills

When providing professional services, it’s crucial to adhere to legal requirements regarding financial documentation. Ensuring that your billing records meet these regulations not only guarantees compliance with the law but also enhances your credibility with clients. There are specific details that should be included in every payment request to avoid disputes and to remain transparent in your business practices.

Each jurisdiction may have its own legal guidelines regarding what must be included on service bills. However, there are common elements that are universally required in most regions to ensure accuracy and legitimacy. These elements help protect both the service provider and the client and provide a clear reference for any future legal considerations.

| Required Detail | Description |

|---|---|

| Business Information | Include your business name, address, and contact details. This is necessary for identification and communication. |

| Client Information | Record the client’s name, address, and contact details for proper identification and future reference. |

| Service Description | Clearly list the services rendered, including specific tasks performed and the time spent on each task. |

| Tax Information | Provide details about applicable taxes, including tax rates and amounts. This ensures tax compliance. |

| Payment Terms | State the payment due date, late fees (if applicable), and accepted payment methods to avoid misunderstandings. |

| Unique Invoice Number | Include a unique reference number for tracking and record-keeping purposes. This is important for both accounting and legal purposes. |

Being aware of and incorporating these requirements can help prevent legal issues and disputes, while ensuring that you maintain a professional reputation. Always stay up-to-date with local laws to ensure your documents meet the necessary legal standards.

Tips for Professional Invoice Presentation

Presenting financial documents in a professional manner is key to fostering trust and building strong client relationships. A well-structured and clear statement not only ensures prompt payment but also reflects positively on your business. Whether you’re submitting a bill for residential cleaning or commercial services, the presentation plays an essential role in making a lasting impression.

To achieve a polished look and ensure clarity, it’s important to follow certain guidelines. A professionally presented document provides not only the necessary details but also creates a seamless and trustworthy experience for your clients. Here are a few best practices for crafting documents that look both clean and organized:

- Use a Clean and Simple Layout: Avoid clutter and use clear headings, well-spaced sections, and readable fonts. A streamlined layout ensures the client can quickly find the key information.

- Consistent Branding: If you have a logo or brand colors, incorporate them into the document design. This reinforces your business’s identity and creates a cohesive experience across your communications.

- Clear and Accurate Dates: Include both the date the service was provided and the payment due date. This prevents confusion and ensures both parties are on the same page regarding payment timelines.

- Breakdown of Services: Clearly itemize the services rendered, including any additional charges or discounts. Transparency helps build trust and clarifies any potential questions the client might have.

- Professional Language and Tone: Use formal, courteous language. Avoid slang or overly casual wording to maintain a professional tone throughout the document.

By following these tips, you will not only make it easier for clients to understand the charges but also present yourself as a professional and trustworthy service provider. Proper presentation ensures that clients take your bills seriously, leading to quicker payments and stronger client relationships.