Free Artist Invoice Template for Professional Billing

As a creative professional, managing payments and keeping financial records organized is crucial to maintaining a successful career. Clear and accurate billing not only ensures you get paid on time but also helps you build trust with your clients. Whether you work in visual arts, design, photography, or another creative field, understanding how to effectively manage your transactions is an essential part of your business.

One of the most important aspects of this process is having a streamlined method for presenting your charges and terms. A well-structured document can save you time, reduce errors, and prevent misunderstandings. By using simple yet effective tools, you can create professional statements that reflect your work and ensure smooth financial exchanges with clients.

Having the right document format is key to making the billing process efficient. It provides clarity, reduces confusion, and ensures that your clients have all the information they need to process payments quickly. With the right resources, you can easily adapt your billing documents to meet your unique needs and requirements, whether you’re working on a one-time project or managing multiple clients at once.

Free Invoice Template for Artists

For creative professionals, having an organized and easy-to-use document for managing payments is essential. It helps simplify the process of requesting compensation and ensures all the necessary details are included in one place. A well-structured form can save time and avoid errors when handling financial matters with clients. Having access to the right tool can make this task far less stressful and more efficient.

There are several online resources that offer downloadable documents specifically designed for this purpose. These documents can be customized to suit individual needs, whether for one-time projects or recurring work. With a few simple edits, you can add your name, project details, payment terms, and other relevant information to create a professional request for payment.

Utilizing such tools not only saves time but also ensures that your documents look polished and reflect the professionalism you bring to your craft. Moreover, it helps maintain consistent records of your transactions, making bookkeeping easier and more accurate in the long run.

Why Artists Need Professional Invoices

Having a structured and formal method of requesting payment is essential for those who provide creative services. It not only helps to clarify the financial expectations of both parties but also enhances your credibility as a professional. When working with clients, presenting a polished payment request ensures that your work is taken seriously and increases the likelihood of timely compensation.

Here are several reasons why it’s important for creatives to use a formal billing method:

- Clarity of Terms: A detailed document ensures that all parties understand the scope of the work, payment amount, due dates, and other essential details.

- Professionalism: Presenting a well-organized request for payment helps establish your reputation as a serious and reliable service provider.

- Record Keeping: Proper documentation allows you to easily track payments and monitor your financial history for tax purposes or future business decisions.

- Protection of Rights: Including clear terms in your payment request protects both you and your client, outlining the expectations and responsibilities for both parties.

- Faster Payment Processing: A formal request reduces confusion and speeds up the payment process, ensuring you get paid on time.

In summary, using a structured method for financial transactions is an important step toward running a smooth and successful creative business. It promotes transparency, reduces the chance of misunderstandings, and helps maintain positive relationships with clients.

Benefits of Using a Template

Utilizing a pre-designed document for financial requests offers numerous advantages, especially for those who manage multiple projects or clients. With a set structure in place, you can save valuable time while ensuring that all essential information is included and formatted correctly. This approach eliminates the need to start from scratch each time you need to send a payment request.

Time Efficiency

One of the main benefits of using a pre-made document is the amount of time saved. By not having to create a new format each time you work with a client, you can focus more on your creative work. The structure is already in place, allowing you to simply fill in the specific details for each job, such as payment amount and deadlines.

Consistency and Accuracy

Using a consistent format ensures that your requests are always professional and clear. It reduces the chance of missing important information or making mistakes in the layout, which can lead to confusion or delayed payments. Additionally, consistency builds trust with clients, as they can easily understand your terms every time they receive a document from you.

Customization is another key advantage. While templates provide a basic structure, they are easily adaptable to meet your specific needs, allowing you to add or remove sections based on the type of work or arrangement with the client.

In summary, using a pre-designed structure for billing is an effective way to streamline your financial management process, reduce errors, and maintain a professional image across all of your transactions.

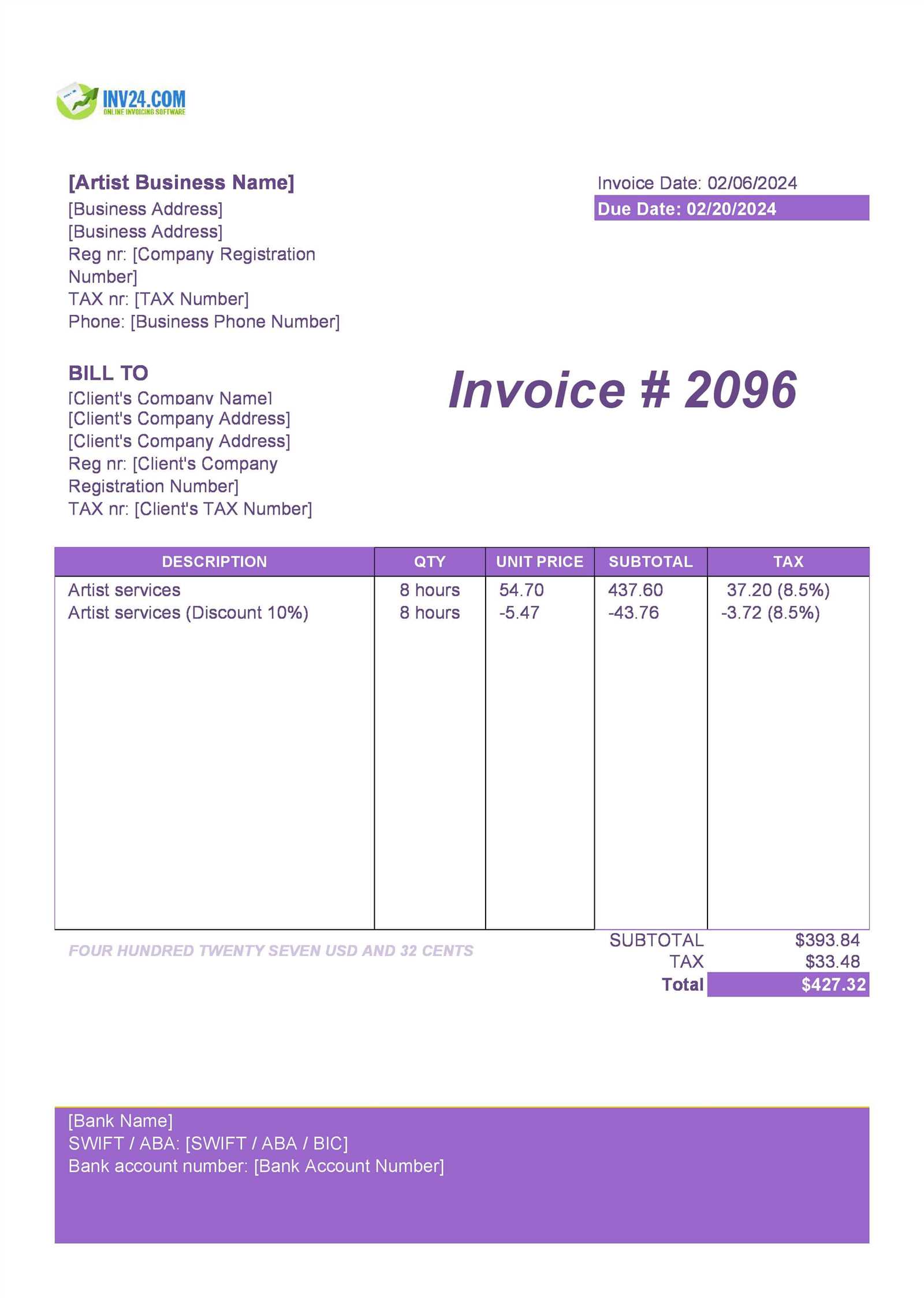

How to Customize Your Artist Invoice

When preparing a payment request for your work, customization is key to ensuring that all relevant details are included and that it suits your specific needs. Tailoring the document allows you to reflect the nature of the project, establish clear expectations, and present your terms professionally. Here are a few steps to help you personalize your financial document effectively.

Key Elements to Modify

Customizing a billing document typically involves adjusting the following sections:

- Your Contact Information: Make sure to include your full name, business name (if applicable), phone number, email address, and physical address for any potential follow-up.

- Client Details: Include the client’s name, address, and contact information to ensure the payment request is directed to the right person or organization.

- Project Description: Briefly describe the work completed, outlining key deliverables, project phases, and any other important details that help clarify the scope of the agreement.

- Payment Terms: Specify the payment amount, any taxes or additional charges, due dates, and acceptable payment methods (e.g., bank transfer, PayPal, etc.).

- Terms & Conditions: Include any specific clauses, such as late fees, cancellation policies, or revision terms, that apply to your work and agreements.

Formatting for Clarity and Professionalism

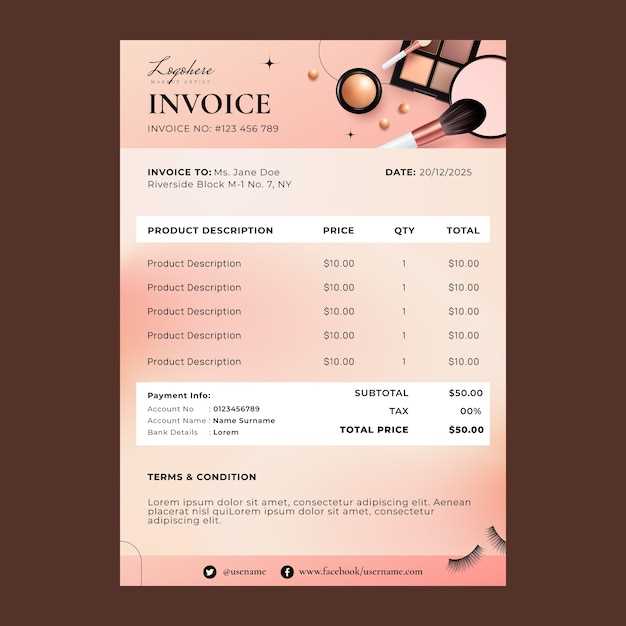

Once the essential sections are added, you can adjust the overall design to match your brand’s aesthetic. Simple adjustments, such as changing fonts, adding your logo, or using colors that reflect your style, will help your document stand out while maintaining a polished look.

Don’t forget to double-check your document for accuracy. Even minor errors in pricing or terms can cause confusion and delay payments. After finalizing, save the file in a format that’s easy for your clients to open, such as PDF.

Customizing your payment request ensures clarity and consistency, making the entire transaction smoother for both you and your clients.

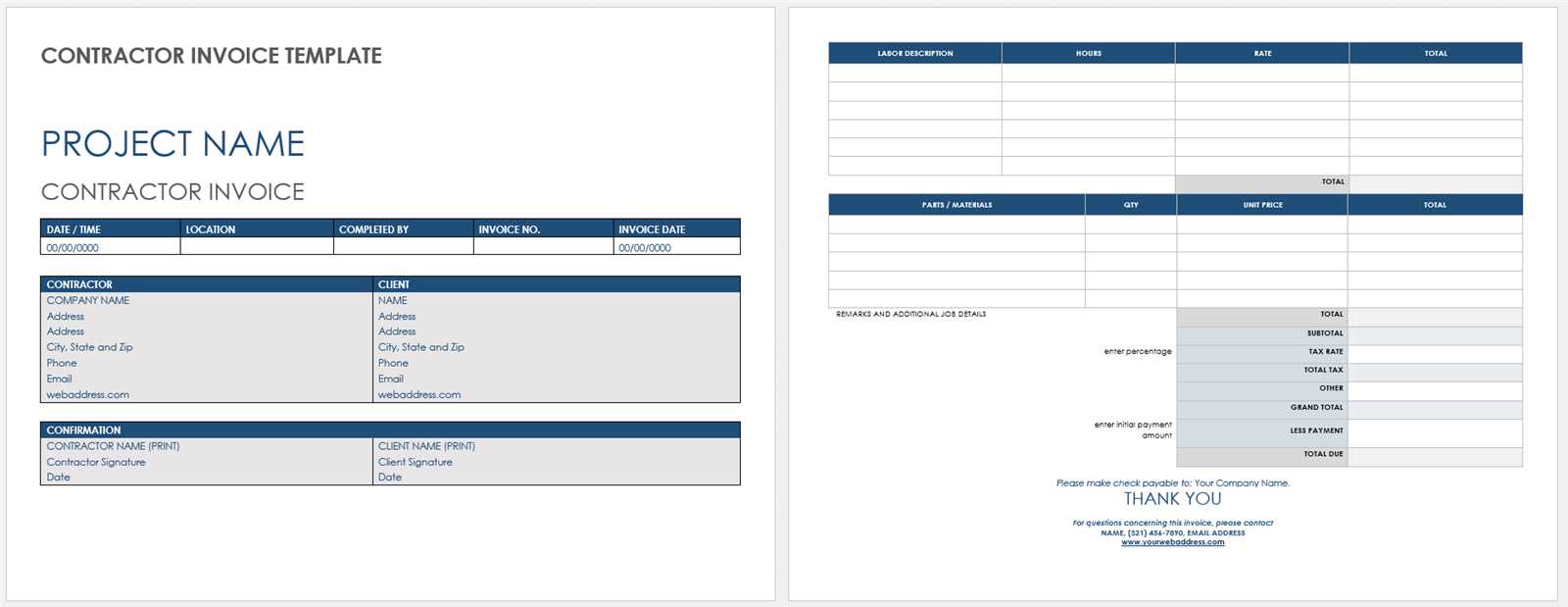

Essential Elements of an Artist Invoice

When requesting payment for your work, it’s crucial to include certain details to ensure the process is smooth and transparent. A well-structured document not only protects you but also helps your clients understand the scope of your work, the terms of the transaction, and the payment expectations. Below are the key elements that should be included to make sure your request is clear and professional.

Key Sections to Include

A comprehensive document should cover the following essential components:

| Element | Description |

|---|---|

| Contact Information | Include your name or business name, address, phone number, and email. Also, list the client’s contact details to ensure both parties can easily communicate. |

| Unique Reference Number | Assign a unique number to each request for tracking purposes. This helps with organization and future reference. |

| Project Description | Briefly outline the scope of the work, including any key deliverables, project timelines, and milestones. |

| Payment Breakdown | List the amount due, including any taxes or extra charges. Be sure to clearly outline the pricing structure so the client understands the total cost. |

| Payment Terms | Specify the due date for the payment and the preferred methods (e.g., bank transfer, online payments, etc.). |

| Terms & Conditions | Include any important clauses, such as late fees, cancellation policies, and other contractual details that govern the transaction. |

Formatting Tips for Professionalism

Once the essential elements are included, you can focus on the document’s overall design. Ensure it is neat and easy to read by using clear fonts, proper spacing, and a logical structure. A clean, organized appearance adds professiona

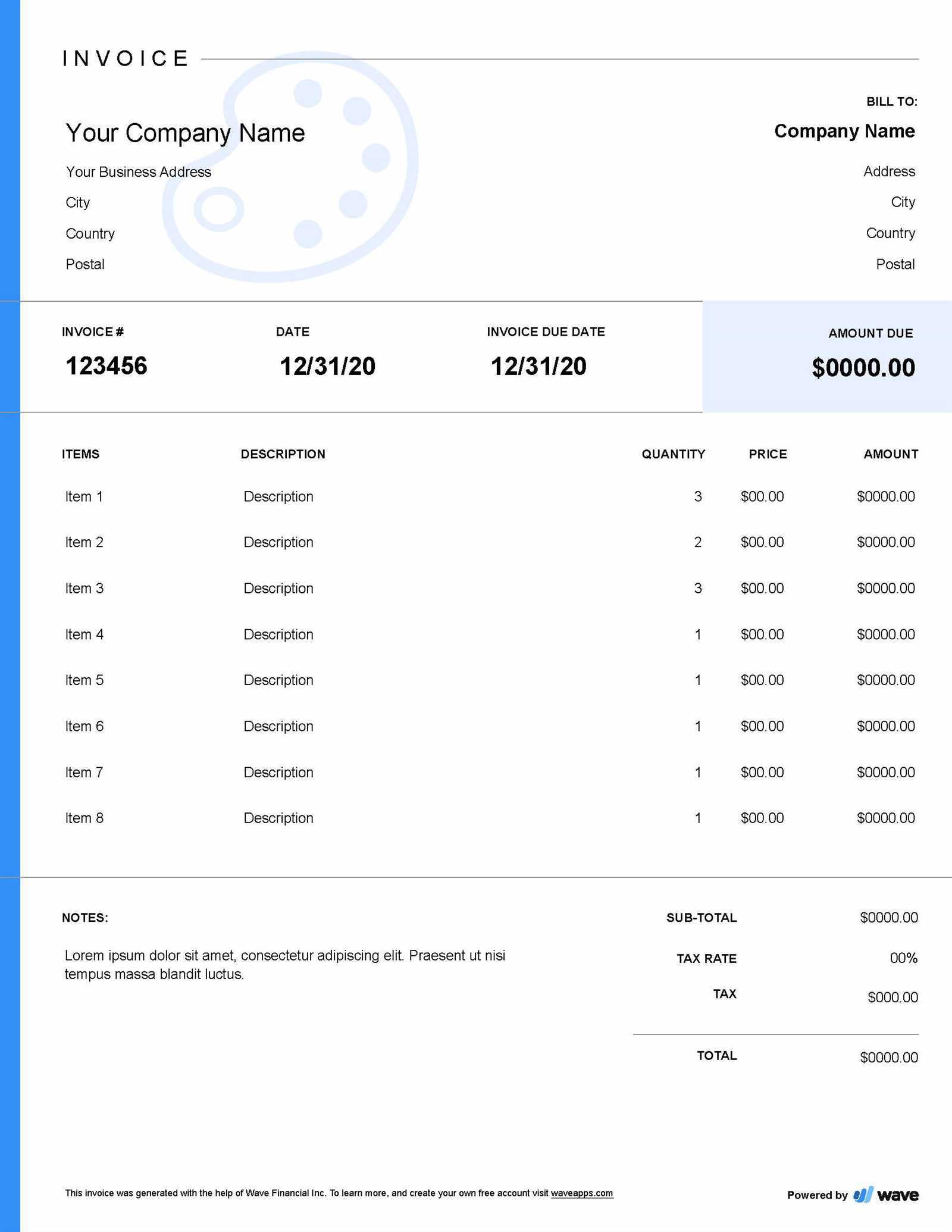

Where to Find Free Invoice Templates

When you need a structured document to request payment for your services, finding a reliable and accessible resource is key. There are numerous platforms and tools that offer downloadable options to help streamline this process. Many of these resources are easily customizable and can be tailored to suit your specific needs. Here are some places where you can find helpful options without any cost.

Online Platforms

Several websites offer a variety of customizable payment request documents. These platforms allow you to select from a range of styles and formats, making it easy to find something that matches your business needs:

- Google Docs: Provides free templates that can be easily edited and shared with clients.

- Microsoft Office: Offers downloadable documents through Word or Excel, which can be customized to your liking.

- Canva: Features user-friendly design tools, allowing you to create polished and professional-looking payment requests from scratch or using a pre-made layout.

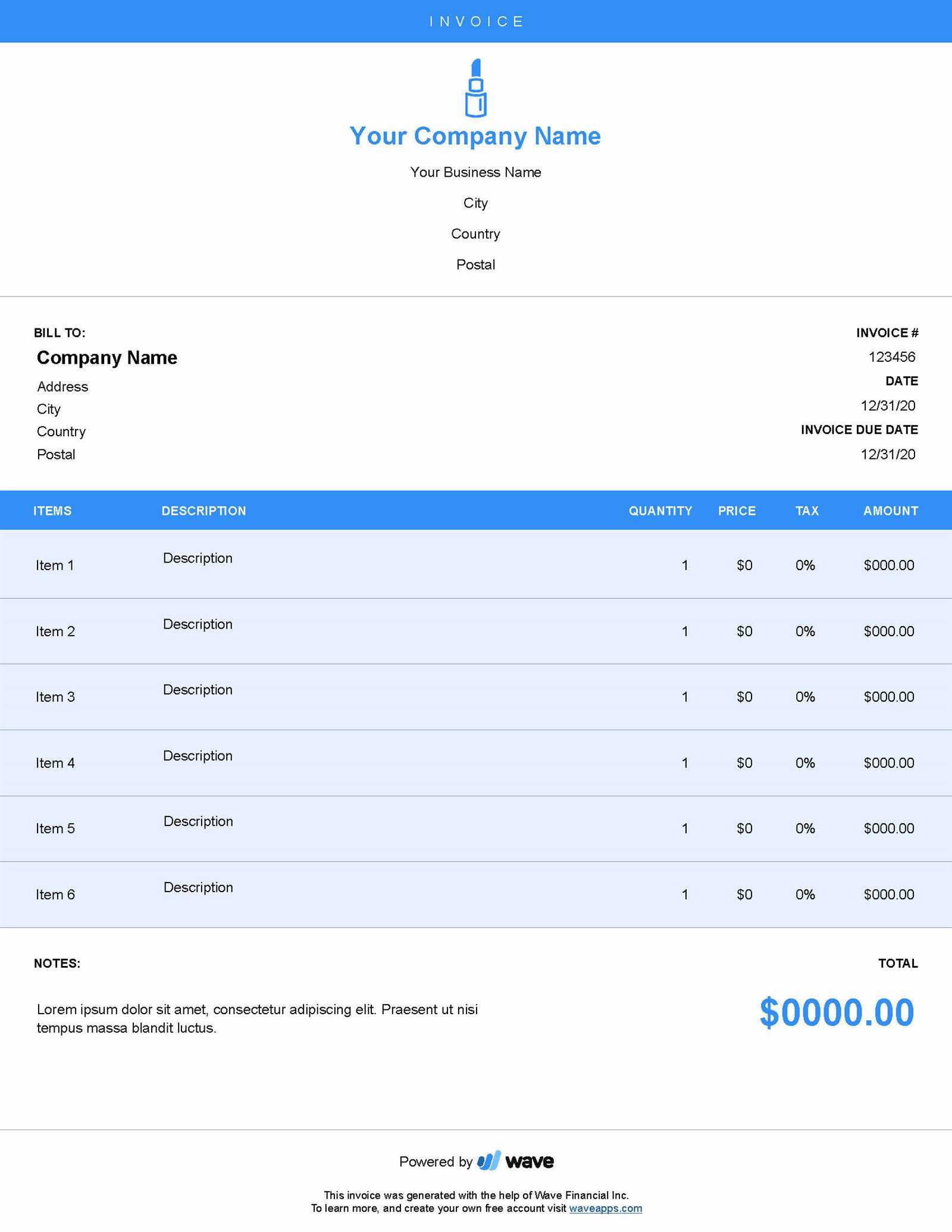

- Wave Accounting: A platform with free tools for managing finances, including templates for payment requests and billing.

Benefits of Using Online Tools

These platforms not only save you time but also ensure that the document is presented in a professional manner. Many online tools also allow you to store and manage your documents in the cloud, making it easier to access and track your requests over time. Most importantly, these resources are simple to use and require no prior experience with design or formatting.

By leveraging these accessible platforms, you can create effective payment requests in no time, ensuring you stay organized and professional in your financial dealings.

Best Free Tools for Creating Invoices

When it comes to managing your finances and creating professional payment requests, using the right tools can make all the difference. Many platforms offer user-friendly, no-cost options to design and customize your billing documents, saving you time and effort. These tools are designed to help you produce polished and accurate documents with minimal input, allowing you to focus on your creative work. Below are some of the best options for generating professional-looking requests.

Top Tools for Designing Payment Requests

Here are a few of the most popular tools that can help you create effective and organized payment requests:

| Tool | Features |

|---|---|

| Wave | Free accounting software with customizable billing features, easy-to-use templates, and automated payment tracking. |

| Zoho Invoice | Simple platform offering customizable designs, multi-currency support, and automatic payment reminders. |

| PayPal | Allows you to create and send payment requests directly through your PayPal account with easy customization options. |

| Google Docs | Offers several free editable document templates for creating payment requests, and easily shareable with clients. |

| FreshBooks | Cloud-based tool for invoicing and accounting with free templates, automatic calculations, and payment tracking features. |

Why Use These Tools?

Each of these platforms offers a variety of features designed to make your billing process easier. Whether you need to track payments, create recurring requests, or simply design a one-time document, these tools can help. The best part is that they are all either completely free or offer robust free versions with plenty of options for customization.

By leveraging these resources, you can ensure that your payment requests are professional, clear, and easy to process, allowing you to focus more on your work and less on paperwork.

How to Calculate Your Rates Accurately

Accurately determining how much to charge for your services is essential to ensure that you are fairly compensated for your time and expertise. Setting the right price involves evaluating various factors such as the complexity of the work, your experience, industry standards, and your business expenses. Properly calculating your rates will help you avoid underpricing or overpricing, ensuring both your financial sustainability and client satisfaction.

Factors to Consider When Setting Your Rates

To calculate your rates, it’s important to take into account the following elements:

| Factor | Explanation | ||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Experience Level | More experienced professionals can generally charge higher rates due to their established skills and reputation. | ||||||||||||||||||

| Complexity of the Work | Consider how intricate or time-consuming the task will be. More complex projects may justify higher charges. | ||||||||||||||||||

| Industry Standards | Research typical rates for your field and adjust based on your experience and location to stay competitive. | ||||||||||||||||||

| Time Investment | Estimate how many hours the project will take and ensure your hourly rate reflects the time commitment required. | ||||||||||||||||||

| Business Costs |

| Error | Why It Matters | How to Avoid It |

|---|---|---|

| Incorrect or Missing Contact Details | If the recipient’s or your contact information is wrong, clients may not be able to reach you for clarification or payment. This can cause delays or confusion. | Double-check all contact details before sending the document. Ensure both parties’ names, phone numbers, email addresses, and addresses are correct. |

| Vague Project Description | A lack of clarity about what services were provided can lead to misunderstandings or disputes over payment. | Provide a clear and detailed description of the services you provided, including deliverables, hours worked, and any other relevant information. |

| Omitting Payment Terms | If the terms are not specified, it can lead to confusion about due dates, late fees, or payment methods. | Clearly outline the payment due date, acceptable payment methods, and any penalties for late payments. |

| Missing or Incorrect Payment Amount | Errors in the amount due can create delays in processing and may affect client trust. | Verify that the payment amount is accurate, including any taxes, discounts, or additional charges. |

| Not Using a Unique Reference Number | Without a unique reference, it can be difficult to track payments or differentiate between multiple requests. | Assign a unique number or code to each payment request for easy identification and reference. |

Failure to P

Creating Clear Payment Terms for ClientsEstablishing clear and transparent payment terms is essential for fostering trust and ensuring smooth transactions between you and your clients. Well-defined terms help to avoid confusion, delays, and disputes regarding payments. By outlining expectations clearly from the beginning, both parties can agree on how and when payments will be made, ensuring the process is simple and professional. Key Elements to Include in Payment TermsTo avoid any ambiguity, ensure that your payment terms cover the following key points:

How to Communicate Payment Terms EffectivelyOnce your payment terms are established, it’s important to communicate them clearly to clients. Here are a few best practices:

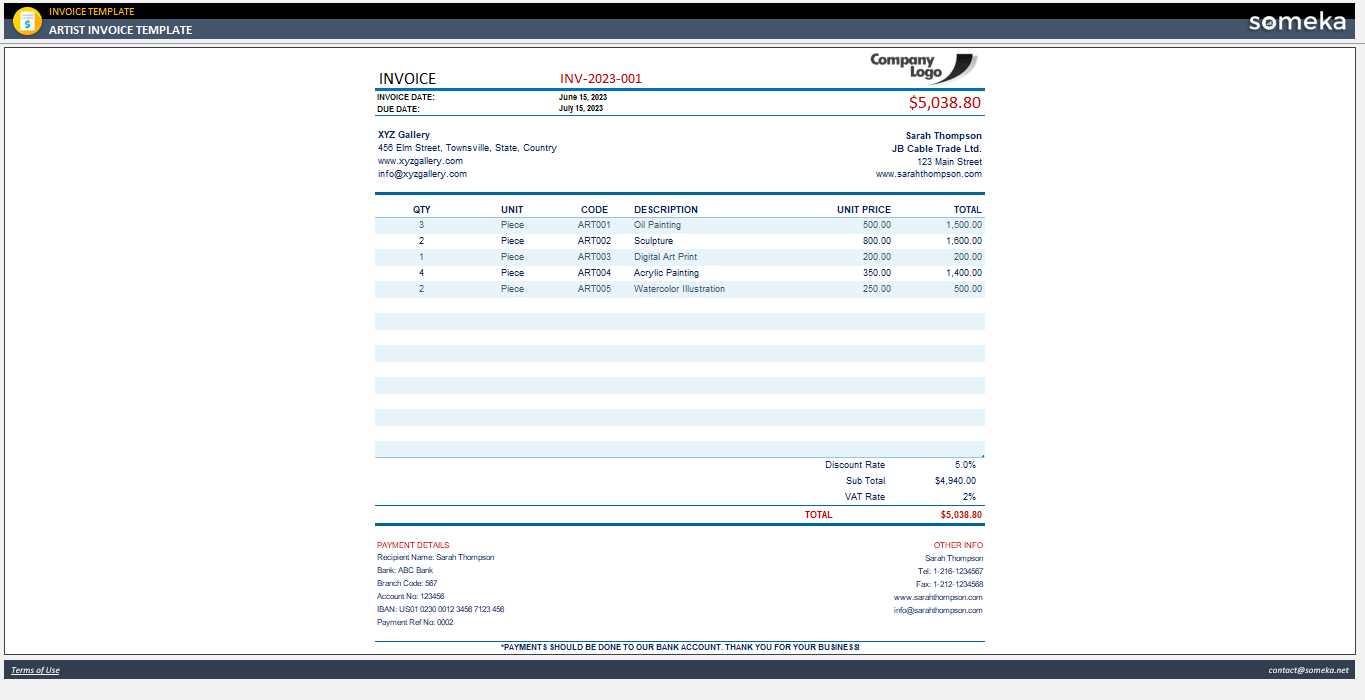

By outlining clear paymen Invoicing for Different Art Services

When providing creative services, the way you request payment can vary greatly depending on the nature of the work and the scope of the project. Different types of projects, from commissions and design work to workshops and performances, may require distinct approaches to billing. Tailoring your payment requests to the specific service you’re offering ensures clarity and avoids confusion, setting proper expectations for both you and your clients. Billing for Custom CommissionsCustom commissions typically involve a more detailed agreement due to the unique nature of the work being produced. For these types of services, it’s essential to clearly outline the project’s scope, deliverables, and deadlines in your payment request. Many professionals require a deposit upfront to secure the project, with the balance due upon completion. This helps cover the initial time investment and ensures both parties are committed to the project.

Billing for Workshops and ClassesWhen teaching workshops or offering educational services, it’s important to establish a clear pricing structure for your sessions. You may charge per class, per hour, or for the entire course. Regardless of the pricing model, include details such as the session dates, location (if in-person), or platform (if online), and any materials that are included or need to be provided by the participants.

By tailoring your payment requests to the type of service you’re providing, you ensure that both you and your client have a mutual understanding of the project expectations, timelines, and fees. Clear communication about pricing will help build stronger professional relationships and reduce the risk of payment issues down the line. How to Handle Late Payments ProfessionallyLate payments are a common issue that many professionals face, but how you handle them can significantly affect your reputation and client relationships. While it’s important to maintain a firm stance on payment deadlines, it’s equally essential to address late payments with professionalism and courtesy. Taking a calm, systematic approach can help you resolve the situation without damaging the relationship with the client. 1. Send a Polite ReminderIn many cases, clients may simply forget about a payment or miss the due date. Before jumping to conclusions, send a friendly reminder. A courteous message is a great first step, as it gives the client the benefit of the doubt while gently prompting them to fulfill their obligation.

2. Offer Flexible Payment OptionsSometimes late payments occur due to financial difficulties or unexpected issues. Offering flexible payment options can show empathy while still ensuring you get paid. For example, you could propose a payment plan or extend the deadline in cases where the client is genuinely unable to pay the full amount immediately.

3. Implement Late Fees (If Agreed Upon)If late payment penalties were outlined in your original agreement, it’s time to enforce them. A professional approach to late fees ensures that you are not only protecting your business interests but also reminding the client of the importance of adhering to the payment schedule. Be sure to clearly communicate any additional charges and the reasons behind them.

4. Keep Communication Open

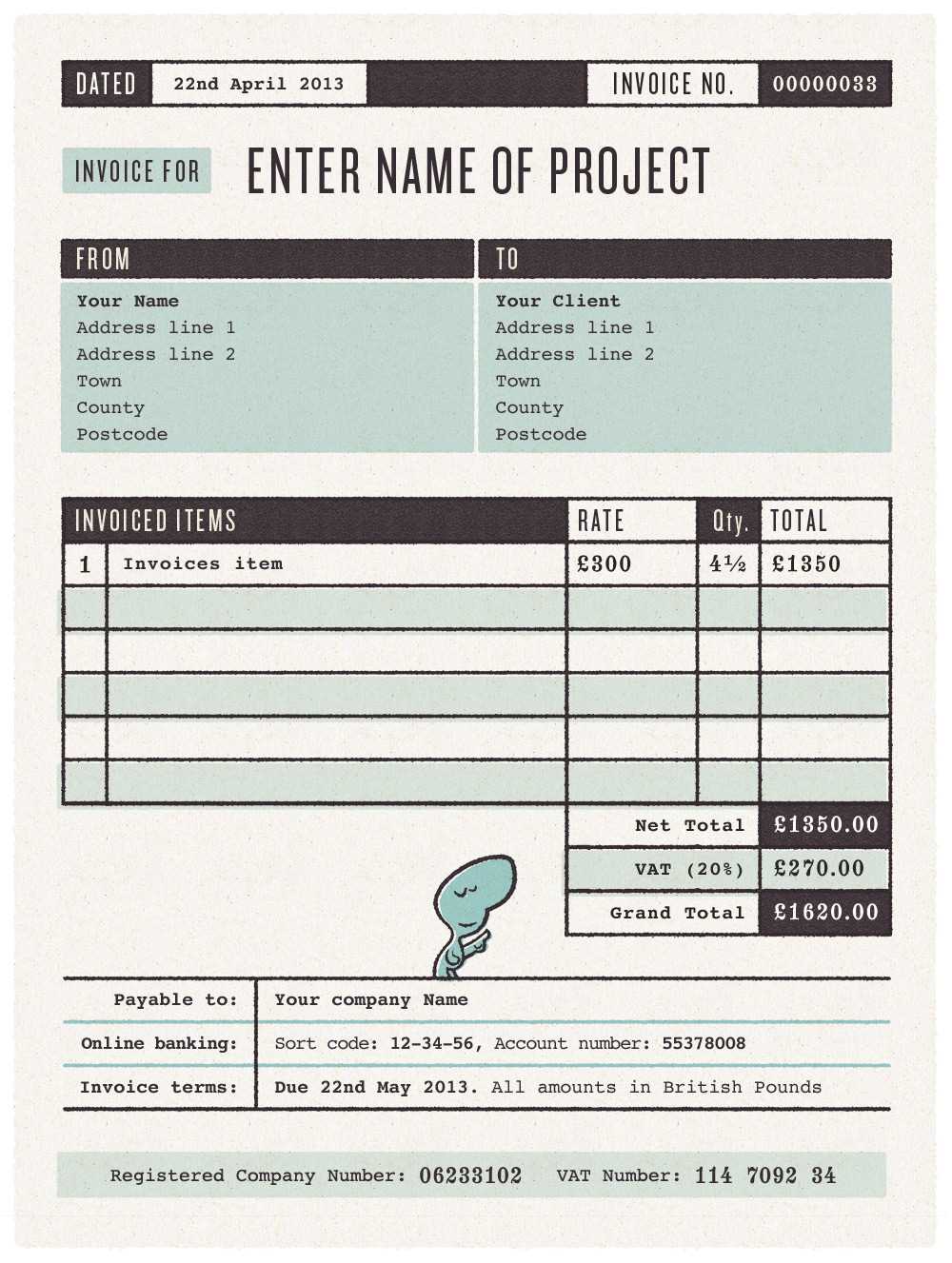

Always maintain open lines of communication with your clients throughout the payment process. If the client is experiencing difficulties, listening to their situation can help you come to a resolution that benefits both parties. A cooperative approach can preserve the relationship and prevent the issue from escalating. 5. Know When to EscalateIf repeated reminders and flexibility fail to result in payment, you may need to consider escalating the situation. This could involve sending a formal letter or even seeking legal advice if the situation warrants it. However, this should always be a last resort, as es Design Tips for Attractive InvoicesAn aesthetically pleasing payment request can enhance your professional image and make the process smoother for both you and your clients. A well-designed document not only reflects your attention to detail but also helps ensure that key information is easily accessible. The visual presentation of your request can also play a role in how seriously your client takes your terms, which may encourage timely payments. 1. Keep It Clean and Simple

Cluttered documents can be overwhelming and difficult to navigate. Aim for a clean, minimalistic design that highlights the most important information clearly. Use ample white space and avoid overloading the page with unnecessary elements.

2. Include Your Branding

Incorporating your branding into your payment request adds a professional touch and reinforces your identity. Adding your logo, business name, and contact information at the top of the document creates a cohesive look and reminds your client of your services.

3. Organize Information for Easy NavigationPresent the payment details in a structured manner to ensure clarity. Group related information together and separate sections using clear headings and lines. Clients should be able to find what they need at a glance.

4. Make Payment Information Stand OutIt’s important that the payment section is easy to spot and understand. Use bold or larger fonts for payment instructions or totals to ensure clients know exactly where and how to pay.

|