Free Online Invoice Template UK for Small Businesses and Freelancers

In today’s business landscape, managing finances efficiently is crucial for success. One important aspect of financial management involves creating and sending detailed records of services or products provided. For small businesses and freelancers, the process can sometimes feel complex and time-consuming. Thankfully, practical solutions now exist to help simplify the process.

Whether you’re a self-employed professional or a small business owner, having a reliable format for billing clients makes a significant difference. Many platforms offer customizable formats that allow you to adjust details to reflect your brand while keeping the structure consistent and professional. Using these ready-made formats not only saves time but also enhances clarity, which is essential for clear communication with clients.

For those working in the UK, there are specific standards to consider when issuing requests for payment. Choosing the right approach ensures that your documents are aligned with legal guidelines and meet client expectations. By adopting these efficient methods

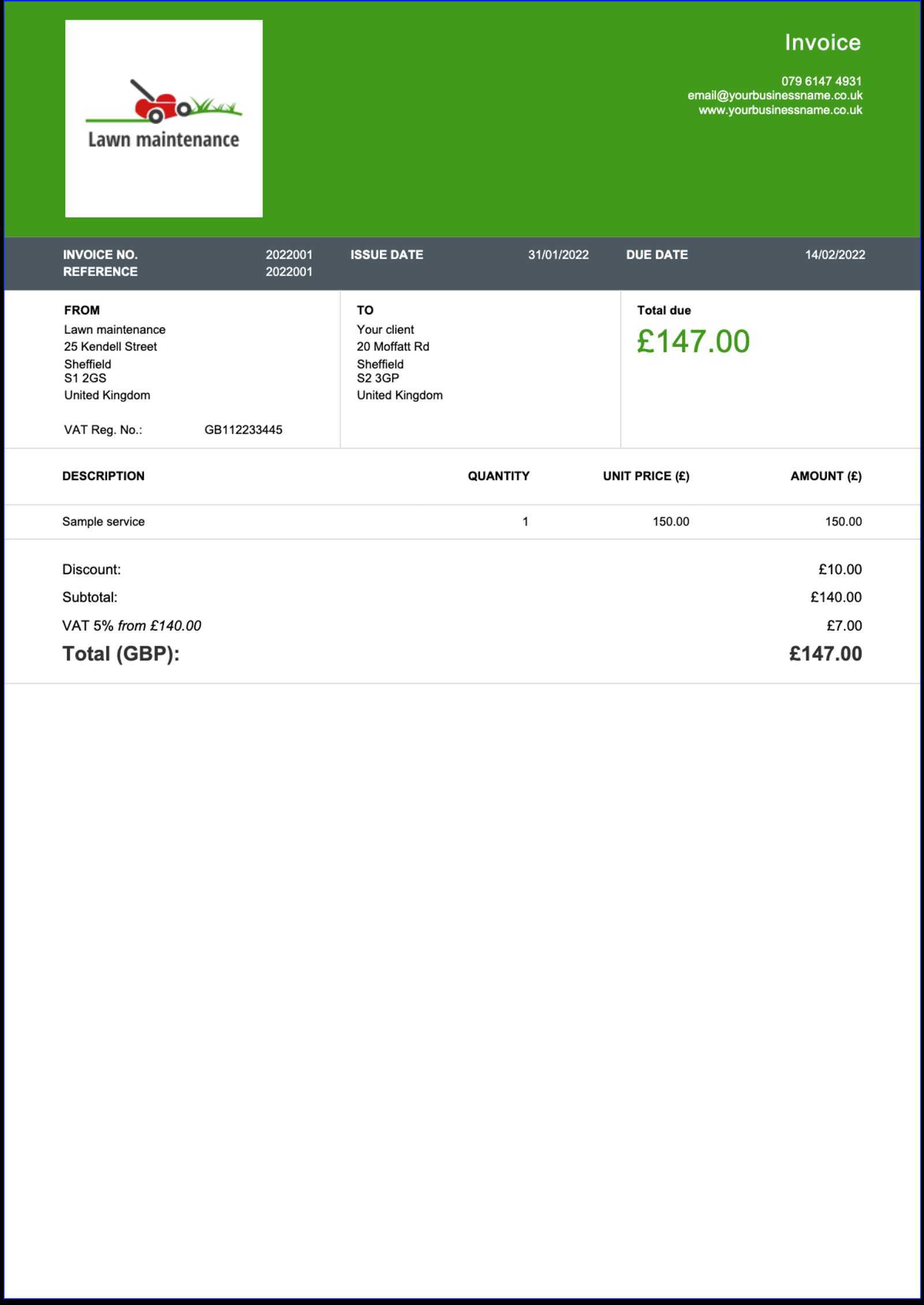

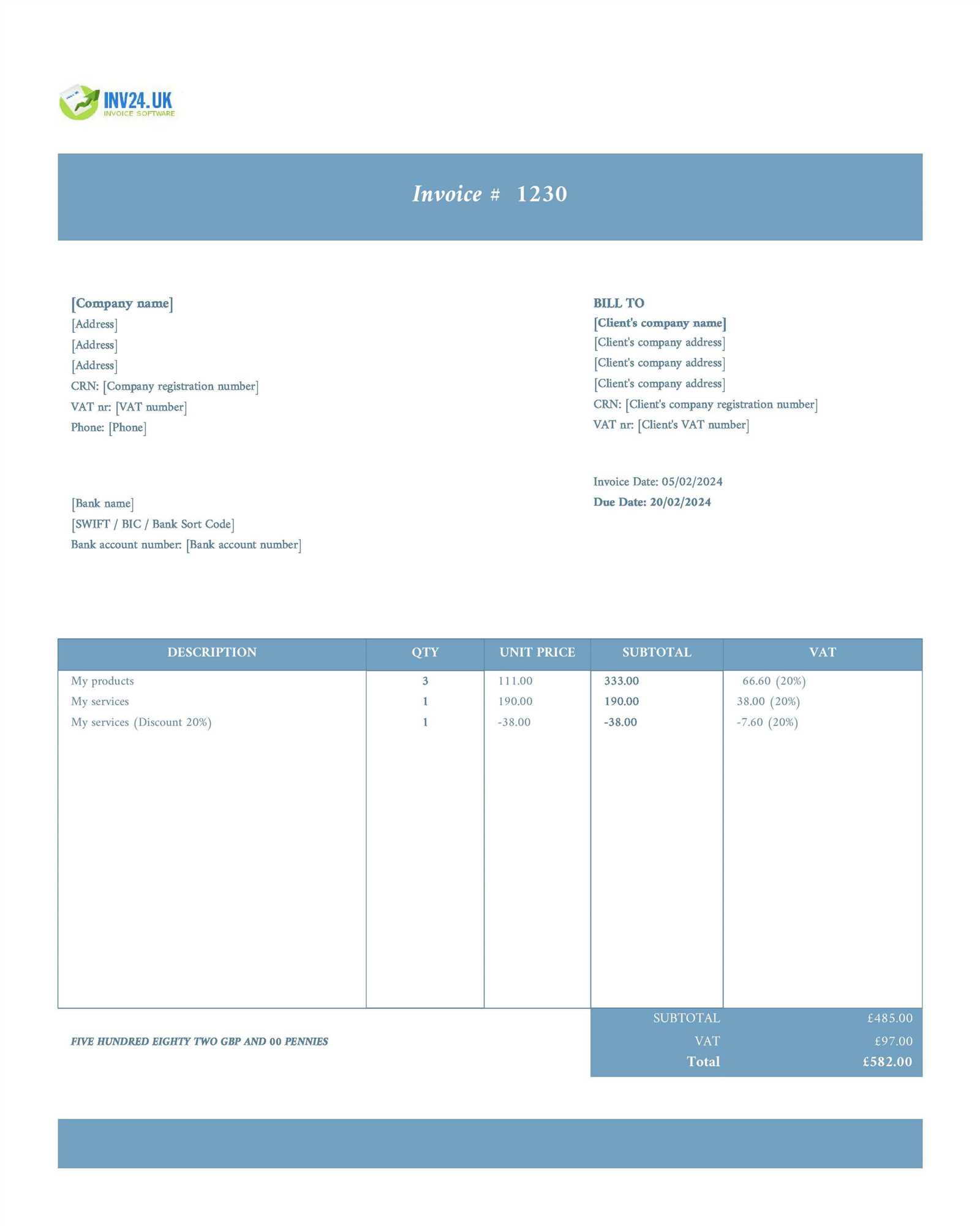

Best Free Invoice Templates for the UK

For businesses and independent professionals across the UK, having access to reliable formats for billing is essential to ensure seamless financial transactions. These structured documents help present a clear outline of services, allowing for transparency between service providers and clients. With a range of adaptable options available, choosing the most suitable one can simplify the entire process, ensuring you capture all necessary details with ease.

Essential Features of High-Quality Billing Formats

A strong billing format typically includes sections that make it easy for both parties to understand the details involved. Look for options that offer structured areas for descriptions, dates, payment terms, and more. Clear segmentation helps reduce potential misunderstandings and keeps your communication consistent and professional. Additionally, choosing adaptable designs allows you to reflect your brand’s identity through personalized elements.

Options Tailored for Various Business Needs

Depending on your industry or

How to Customize Your Invoice Templates

Creating personalized formats for billing can make a strong impression on clients while ensuring that every transaction document is consistent with your brand. Customization not only enhances professionalism but also allows you to highlight essential details in a way that best suits your business needs. Adjusting the layout and design of your billing documents can help them stand out and make record-keeping more efficient.

To start customizing, consider adding your company’s logo and unique branding elements. This can include colors and fonts that reflect your business identity. By aligning visual aspects with your brand, you make the document instantly recognizable and reinforce your professional image.

Another important step is organizing sections to include all critical information. Clearly structured areas for descriptions, itemized lists, payment terms, and due dates improve clarity and help avoid misunderstandings. You can also add personalized messages or notes for clients, making each document feel unique and enhancing client relations. Through thoughtful adjustments, each transaction becomes a seamless extension of your business identity.

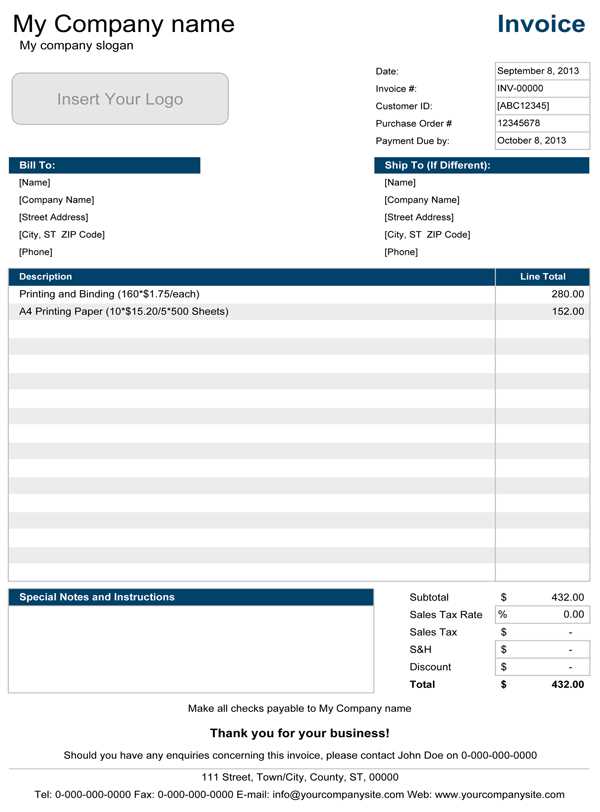

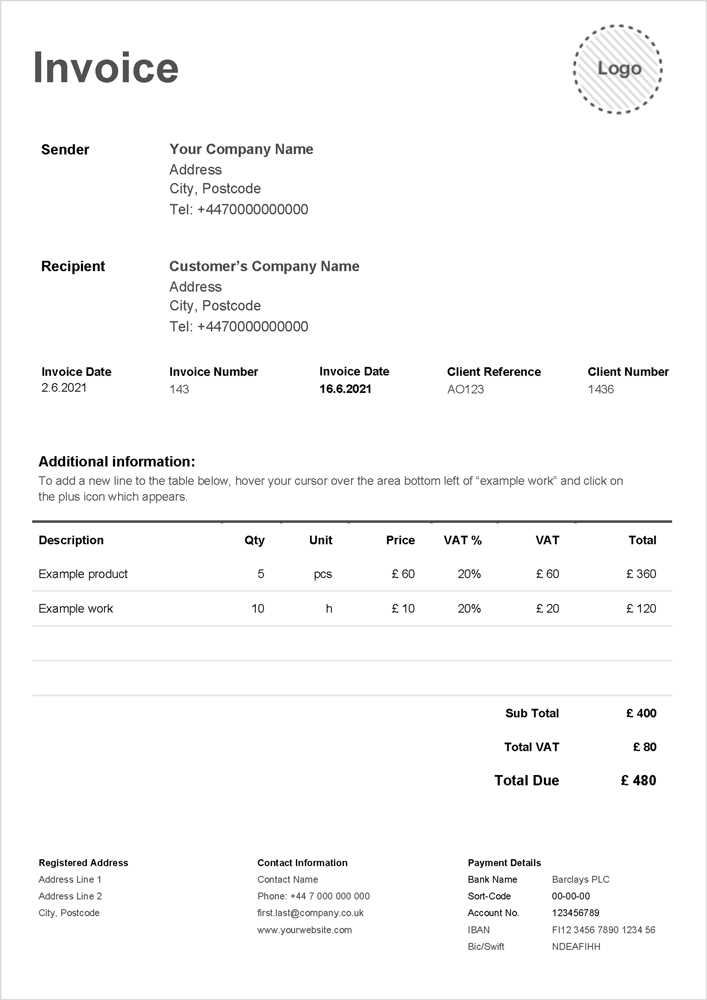

Key Features of Effective Invoice Designs

An effective billing design is structured to communicate essential details clearly, making it easy for both the sender and recipient to understand and process the document. The most impactful designs focus on simplicity, organization, and the inclusion of crucial information to avoid any confusion. Well-crafted layouts not only enhance readability but also streamline payment processes by making important sections easily accessible.

Elements that Improve Clarity and Professionalism

The layout should include distinct sections for key components such as service descriptions, dates, payment conditions, and contact details. Each section should be organized logically to prevent any misinterpretations. By separating these elements, you make it easier for clients to verify each detail without effort, which promotes trust and ensures smooth transactions.

Recommended Structure for a Clear Layout

| Section | Description |

|---|

| Section | Description |

|---|---|

| Header | Include company name, logo, and contact details for instant recognition. |

| Client Information | Add the recipient’s name, address, and relevant contact details. |

| Service Details | Provide a concise list or description of the items or services provided. |

| Totals and Tax | Clearly display the total amount due, including taxes if applicable. |

| Payment Terms | Outline due dates, accepted payment methods, and late fee policies. |

Using this structured approach ensures that all essential details are easy to locate and verify, helping to create a straightforward and professional document for both parties.

Essential Elements of Professional Invoices

Creating well-structured billing documents is crucial for clear and effective communication with clients. A professional format includes several core components that ensure all relevant details are covered, helping both parties understand the transaction terms. Including these elements not only improves readability but also contributes to a trustworthy business image.

Contact Information should always be clearly presented, with your business name, address, and phone number prominently displayed. Providing comprehensive contact details allows clients to reach out easily if they have questions, enhancing transparency.

Service Details are another critical component. Each service or product should be itemized with a brief description, quantity, and

Choosing the Right Template for Your Business

Selecting an appropriate format for billing documents is essential for presenting a polished and organized image to clients. The right choice can simplify your workflow and ensure that all critical information is clearly communicated. Different businesses may require varied layouts, so it’s important to choose a structure that aligns with your unique operational needs.

Identifying Key Requirements

Consider what specific details are essential for your industry. For example, service-based businesses may need sections for itemized descriptions, while retail businesses might require fields for product codes and quantities. Defining these needs early on helps you find a structure that meets both industry standards and client expectations, ensuring clarity and professionalism.

Aligning with Your Brand Identity

A well-chosen format also reinforces your brand. By selecting designs that incorporate your company’s colors, fonts, and logo placement, you create a consistent look across all client communications. This attention to detail not only makes a strong impression but also enhances recognition and

Benefits of Using Digital Invoicing

Adopting electronic billing systems offers numerous advantages for businesses looking to streamline their financial processes. Digital methods not only save time but also enhance accuracy and efficiency in managing transactions. By eliminating the need for paper-based methods, companies can reduce costs and minimize the risk of errors, leading to faster and more reliable payments.

One key benefit is the ability to automate much of the process, from generating documents to sending reminders for overdue payments. Automation reduces the administrative burden and frees up time for employees to focus on more critical tasks. Furthermore, digital records are easy to organize, search, and retrieve, which simplifies bookkeeping and reporting.

Another significant advantage is the ability to integrate digital systems with other business management tools. This integration allows for seamless data exchange between various platforms, making it easier to track expenses, reconcile accounts, and manage cash flow. As a result, businesses can gain better insights into their financial health and make more informed decisions.

How to Save Time with Free Templates

Using pre-designed formats for billing documents can significantly reduce the time spent on administrative tasks. These ready-made structures allow businesses to quickly input necessary details without starting from scratch. By streamlining the process, you can allocate more time to other important aspects of your work, improving overall efficiency.

Customization is a key feature of these pre-made formats. Instead of designing each document individually, you can adjust the layout to suit your business needs. With simple modifications, such as adding your company logo, adjusting fonts, or including specific payment instructions, you can create a professional-looking document in a fraction of the time.

Additionally, using these resources helps eliminate common mistakes often made when creating documents manually. With built-in fields for all necessary information, the risk of omitting important details is minimized, leading to fewer revisions and a smoother billing process. The time saved on corrections and adjustments further enhances productivity, ensuring your workflow remains uninterrupted.

Top Tools for Generating Invoices

Various platforms are available to assist businesses in creating professional billing documents quickly and efficiently. These tools offer a wide range of features, from customizable designs to automatic calculations, helping to streamline the billing process and ensure accuracy. By selecting the right tool, businesses can save time and reduce the risk of errors.

Popular Tools for Billing Documents

- Tool 1: Offers easy-to-use templates with customization options for both individuals and small businesses.

- Tool 2: A versatile platform that integrates with other accounting software, making it ideal for larger businesses.

- Tool 3: Provides real-time payment tracking and reminders to ensure prompt transactions.

- Tool 4: A mobile-friendly option that allows you to generate and send documents directly from your smartphone.

Key Features to Consider

- Customization: The ability to personalize the document design to reflect your business branding.

- Automation: Automating repetitive tasks like calculations and payment reminders.

- Integration: Seamless integration with other financial management systems for easy data syncing.

- Security: Ensuring that your financial data is protected with encryption and secure cloud storage.

How to Improve Cash Flow with Invoices

Effective billing is crucial to maintaining a steady cash flow in any business. By ensuring that payments are processed on time, businesses can avoid cash flow gaps and maintain financial stability. Properly structured documents can help facilitate timely payments and minimize delays, ultimately improving your cash flow management.

Strategies for Faster Payments

- Clear Payment Terms: Clearly state the payment due date, accepted methods, and any late fees. This sets expectations and encourages clients to pay promptly.

- Prompt Billing: Send out bills immediately after delivering goods or services. The sooner you send them, the faster you can expect payment.

- Detailed Descriptions: Ensure that your document includes clear and concise descriptions of services or products provided. The more transparent the bill is, the less likely clients are to dispute it, which can delay payments.

- Automated Reminders: Use tools that automatically send follow-up reminders when payments are overdue, reducing the need for manual intervention and improving efficiency.

Utilizing Technology to Streamline Payments

- Integrated Payment Options: Include direct payment links or integration with payment gateways, allowing clients to pay with ease and reducing delays caused by manual transfers.

- Recurring Billing: For regular clients, set up recurring billing systems to ensure consistent cash flow without additional effort.

- Real-Time Tracking: Track when payments are received and automatically update your records, improving visibility into your financial status.

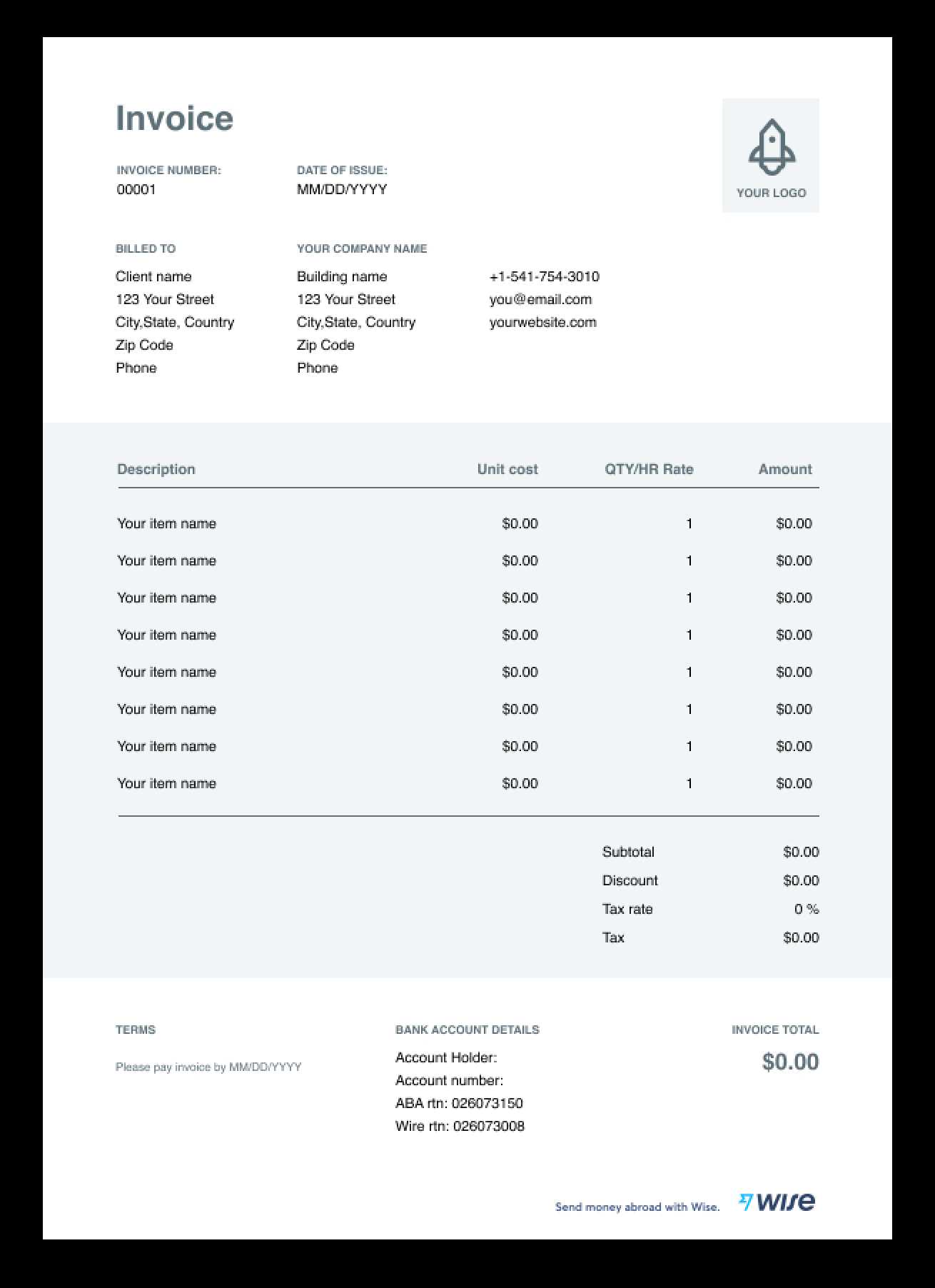

Customizable Invoice Options for Small Businesses

For small businesses, having flexible and adaptable billing documents is essential to ensure they meet both client expectations and business needs. Customizable options allow entrepreneurs to create professional, branded documents that align with their specific service offerings and industry standards. By utilizing these options, small businesses can streamline their billing process and maintain a consistent, professional image.

Key Features to Consider

- Brand Customization: Incorporate your company logo, colors, and fonts to create a unified brand identity across all billing communications.

- Adjustable Layouts: Choose from various layout styles to suit the type of products or services you offer, whether it’s a simple list of items or a detailed breakdown.

- Flexible Fields: Add or remove fields based on your specific requirements, such as discount options, tax rates, or payment terms.

- Multiple Payment Methods: Include multiple payment options like bank transfer details, credit card options, or PayPal links to make it easy for clients to pay.

Enhancing Client Communication

- Clear Payment Terms: Customizing payment due dates and adding discounts for early payments or fees for late payments ensures clarity and encourages timely settlement.

- Service Descriptions: Including detailed descriptions of services or products with customizable item categories makes your documents more transparent and reduces misunderstandings.

- Automated Reminders: Set up automatic reminders to alert clients about approaching due dates or overdue balances, ensuring consistent follow-up without extra effort.

Invoicing Tips for Freelancers and Contractors

For freelancers and contractors, creating clear and efficient billing documents is essential to ensure timely payments and maintain professional relationships with clients. Proper invoicing helps avoid misunderstandings and ensures that compensation is received for work completed. By following key strategies, independent workers can streamline their processes and reduce payment delays.

1. Set Clear Payment Terms: Clearly outline payment expectations in your documents, including due dates, late fees, and accepted payment methods. This transparency helps set professional boundaries and avoids confusion later on.

2. Include Detailed Descriptions: Always include specific details about the work or services rendered, including hours worked, deliverables provided, and any relevant project milestones. This minimizes the risk of disputes and ensures that your clients understand exactly what they are being charged for.

3. Use Professional Branding: Customizing your billing documents with your company logo, contact information, and consistent design enhances your professional image and helps clients remember you as a reliable business partner.

4. Automate Reminders: Setting up reminders for overdue payments can save time and ensure that clients are promptly notified if they miss a payment deadline. Automated follow-ups can be sent directly, reducing the need for manual tracking.

5. Keep Records Organized: Maintain a system for storing all completed documents, payments, and communications. A well-organized record-keeping system makes it easier to track outstanding payments and quickly reference past transactions when needed.

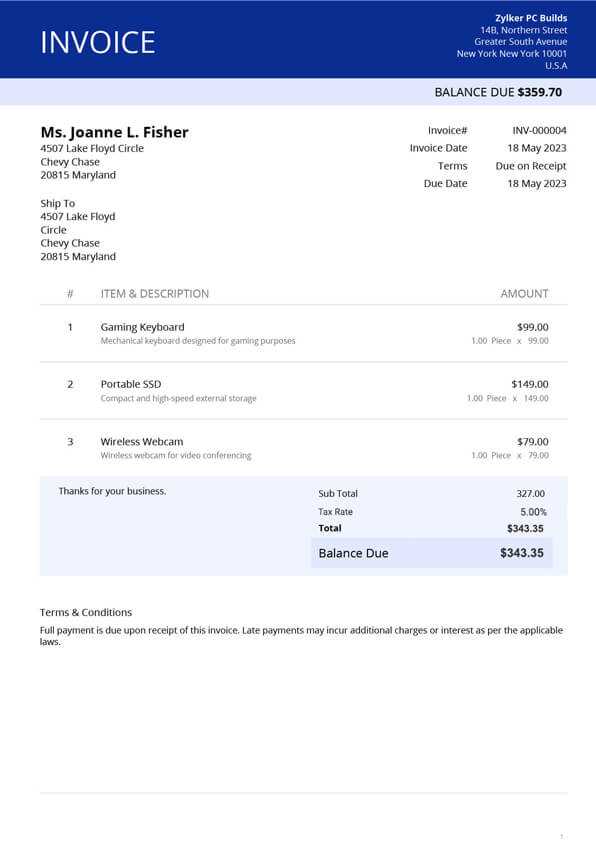

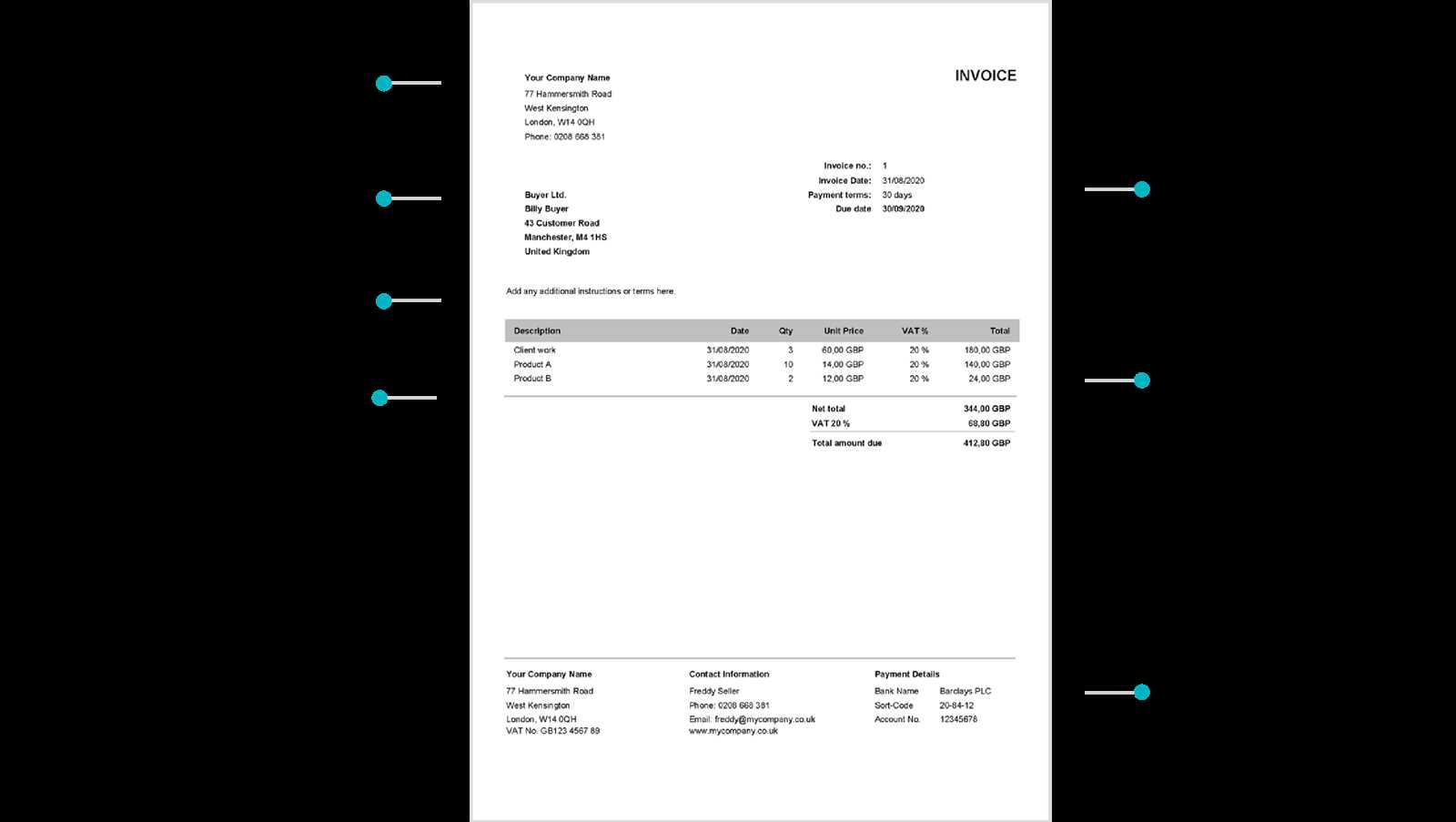

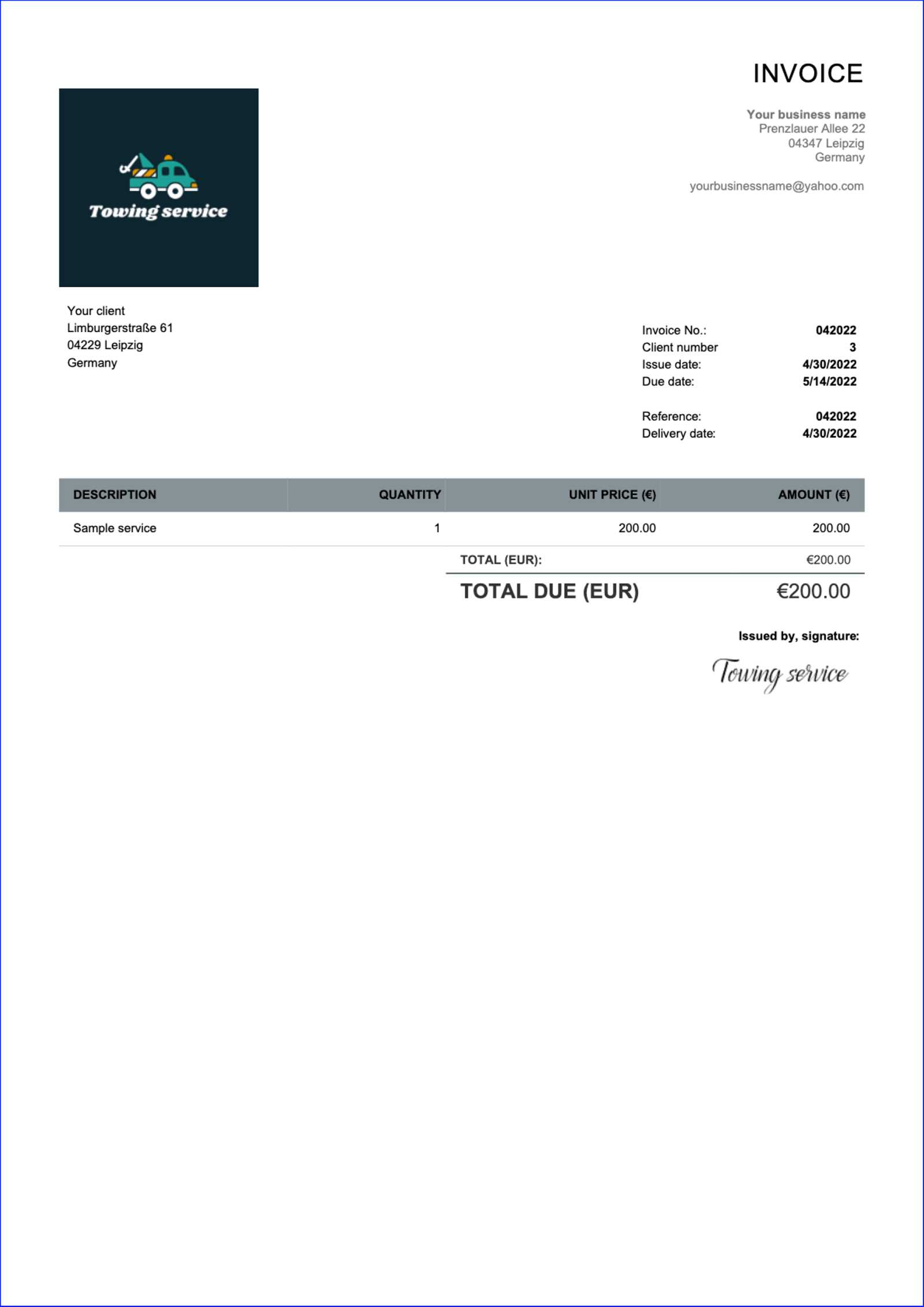

Step-by-Step Guide to Using Invoice Templates

Creating professional billing documents doesn’t have to be a complicated task. With the right tools, you can streamline the process and ensure that your documents are clear, consistent, and meet all business requirements. Here’s a simple guide to help you get started with customizable billing documents.

1. Choose a Suitable Document

Select the right format that suits your business needs. Some options are designed for simple services, while others may be more comprehensive for larger projects or detailed product listings.

2. Add Your Business Information

Start by inputting your company’s details, such as the business name, logo, contact information, and payment methods. This ensures that your clients have all the information they need to reach you and make payments easily.

3. Include Client Details

Enter the client’s name, address, and contact information. Accurate client details help to avoid confusion and ensure that your document is properly addressed.

4. List Products or Services

- Describe the Work: Clearly explain the services provided or products delivered, including any relevant quantities or hours worked.

- Set the Pricing: Specify the cost per item or service, and calculate the total amount due. Be sure to include any applicable taxes or discounts.

5. Set Payment Terms

- Due Date: Clearly indicate when payment is expected, whether it’s due immediately or within a set number of days after delivery.

- Late Fees: Specify if there are any late payment penalties and the conditions under which they apply.

6. Review and Send

Before sending, double-check all information for accuracy. Once everything is correct, you can send the document to your client via email, postal service, or another preferred method.

Why Free Invoice Templates Are Reliable

Many businesses rely on accessible and customizable billing documents to ensure smooth financial transactions. These resources are designed to offer flexibility and accuracy while saving time and effort. Even without a cost, these tools are reliable because they often meet essential business requirements and can be tailored to specific needs.

1. Consistency and Professionalism

Using well-structured documents helps maintain a professional image for your business. By using standardized formats, clients are more likely to trust your business practices, leading to stronger client relationships.

2. Customization for Specific Needs

- Tailored Design: Customize fields, logos, and layout to fit your branding and the services you offer, ensuring that each document is unique to your business.

- Editable Fields: Add or remove elements such as discounts, taxes, or payment terms based on the transaction, making it easy to create the right document every time.

3. Time and Cost Efficiency

- No Extra Fees: Using free resources eliminates costs associated with purchasing specialized software or templates, allowing businesses to allocate funds elsewhere.

- Quick Setup: These tools are easy to use, helping you quickly create professional billing documents and send them to clients without delay.

Common Mistakes to Avoid in Invoicing

When preparing billing documents, it’s important to ensure accuracy and professionalism. Even minor mistakes can lead to confusion, delayed payments, or a loss of trust with clients. Below are some common errors businesses should avoid when creating payment requests.

1. Missing or Incorrect Client Information

- Client Contact Details: Always double-check that the client’s name, address, and contact details are correctly listed. Mistakes here can cause the document to be delayed or misdirected.

- Company Details: Ensure your business information, including your contact info and logo, is included and accurate. This adds a professional touch and facilitates easy communication.

2. Incorrect Payment Terms

- Due Date: Clearly specify when payment is expected. Not including a payment deadline can result in late payments and confusion.

- Late Fees: If applicable, make sure you outline late fees or penalties for overdue payments. Lack of clarity on this point could lead to clients not paying on time.

3. Ambiguous or Incomplete Descriptions

- Service or Product Descriptions: Be clear and concise when detailing the work or items provided. Ambiguous descriptions can result in disputes over what was delivered or performed.

- Pricing Information: Ensure the pricing for each item or service is clearly stated. Failing to break down costs can create confusion about how the total is calculated.

4. Failing to Include Payment Methods

Always list acceptable payment methods on the billing document. Whether you accept bank transfers, credit cards, or other forms of payment, clients should know how to pay you easily.

5. Overcomplicating the Format

A simple and straightforward layout works best. Avoid overcrowding the document with unnecessary information or overly complex formats. A clean, professional design enhances clarity and improves the chances of timely payments.

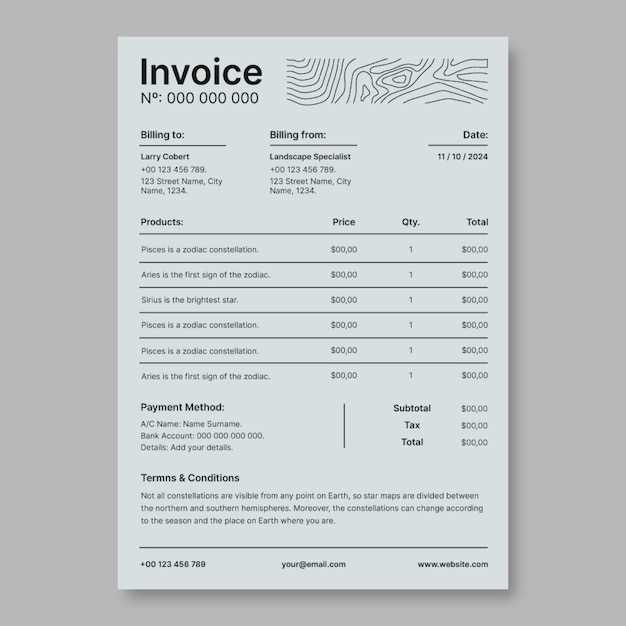

How to Add a Professional Touch to Invoices

A well-designed billing document can leave a lasting impression on clients, showcasing your business’s professionalism and attention to detail. By incorporating certain design elements and ensuring clarity, you can elevate the overall presentation and enhance your brand image.

1. Include Your Business Branding

Adding your company’s logo, color scheme, and fonts can make the document feel cohesive with your brand’s identity. A strong, consistent visual presence reassures clients and helps them recognize your business instantly.

2. Organize the Layout Clearly

- Simple Structure: Keep the layout clean and organized. Use clear headings and bold section titles to guide the reader through the key information, such as the payment due and itemized services.

- Legible Fonts: Use easy-to-read fonts for the main content and ensure that the text size is appropriate for clarity. Avoid using too many different fonts, as this can make the document look cluttered.

3. Professional Language and Tone

While the design is important, the language used on your document also plays a significant role in how professional it appears. Use formal, concise language, and ensure there are no spelling or grammatical errors. Polite phrases like “Thank you for your business” or “We appreciate your prompt payment” can go a long way in fostering positive client relationships.

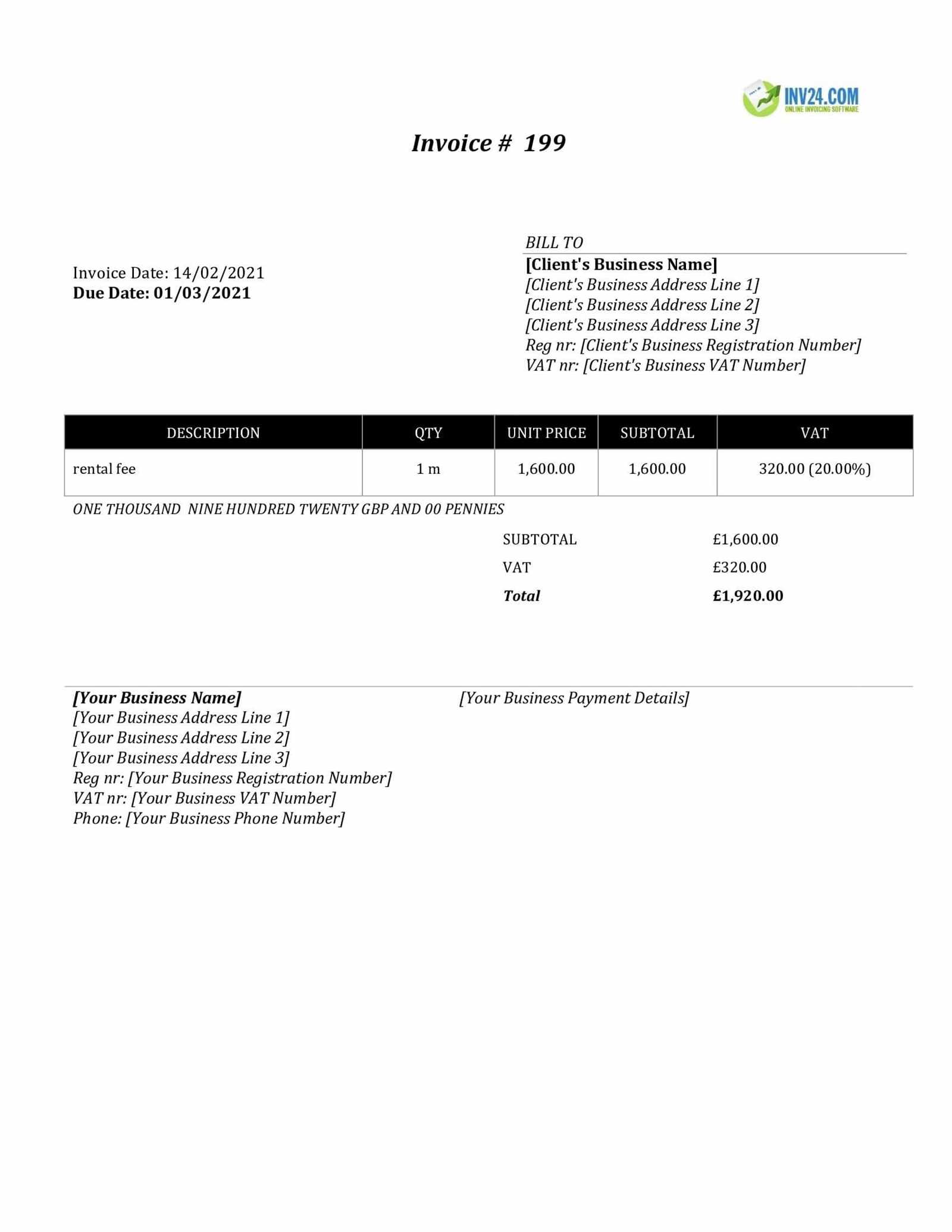

Legal Requirements for Invoicing in the UK

When issuing billing statements to clients, it’s crucial to ensure that all legal obligations are met. In the UK, there are certain criteria that must be included in any formal payment request. This helps maintain transparency and ensures that both parties are on the same page regarding payment terms and obligations.

Key Information to Include

- Business Details: Your full business name, registered address, and VAT registration number (if applicable) should be clearly stated on every document.

- Client Details: Include the client’s full name or company name, address, and contact information.

- Unique Reference Number: Each statement should have a unique number for easy identification and record-keeping.

- Date of Issue: The exact date the payment request is generated must be clearly indicated.

- Description of Goods or Services: An accurate, detailed breakdown of the goods or services provided, including quantities, prices, and any applicable discounts.

- Payment Terms: The date by which payment should be made, along with any terms such as late fees or interest charges.

- Amount Due: The total amount payable, clearly itemized and calculated with taxes included (if applicable).

Additional Legal Considerations

- VAT Compliance: If your business is VAT registered, make sure to include the appropriate VAT rate and ensure your document complies with HMRC guidelines.

- Record Retention: Keep all payment requests for a minimum of six years, as required by UK tax law, for tax and audit purposes.