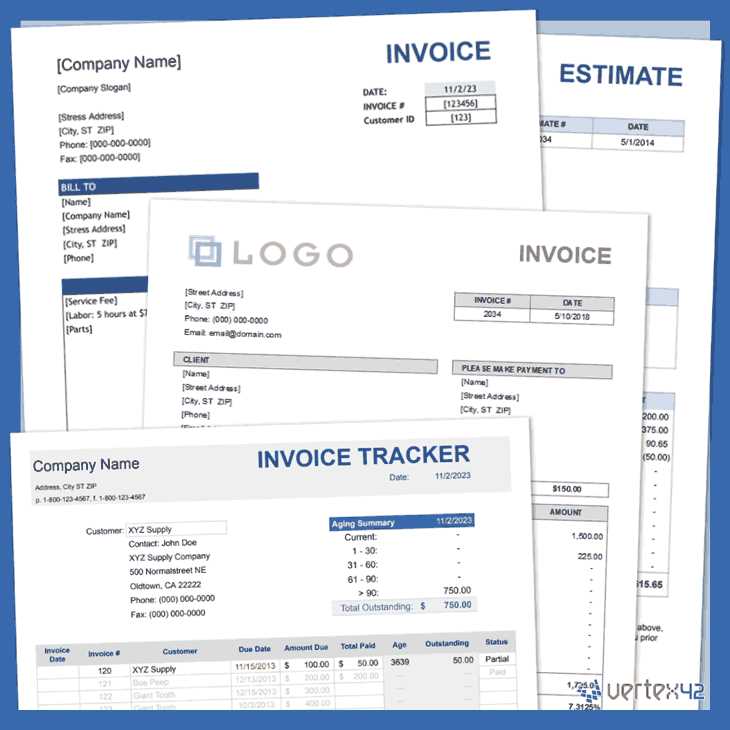

Download Free Invoice Template XLS for Quick and Easy Invoicing

Creating organized and efficient billing processes is essential for any business, whether large or small. Finding an effective way to structure your billing documents can save time, reduce errors, and provide a professional impression to clients. With customizable spreadsheets available, you can quickly manage your records and adapt them to fit specific needs.

With the flexibility of customizable spreadsheet files, companies can simplify record-keeping, track expenses, and manage payments accurately. These formats offer a straightforward solution for preparing clear, consistent documents that are easy to adjust according to your business requirements. Available in a range of layouts, these files allow you to add, remove, and modify fields without hassle.

For those who handle frequent billing, using these spreadsheets means minimal setup time with a high degree of control over details such as costs,

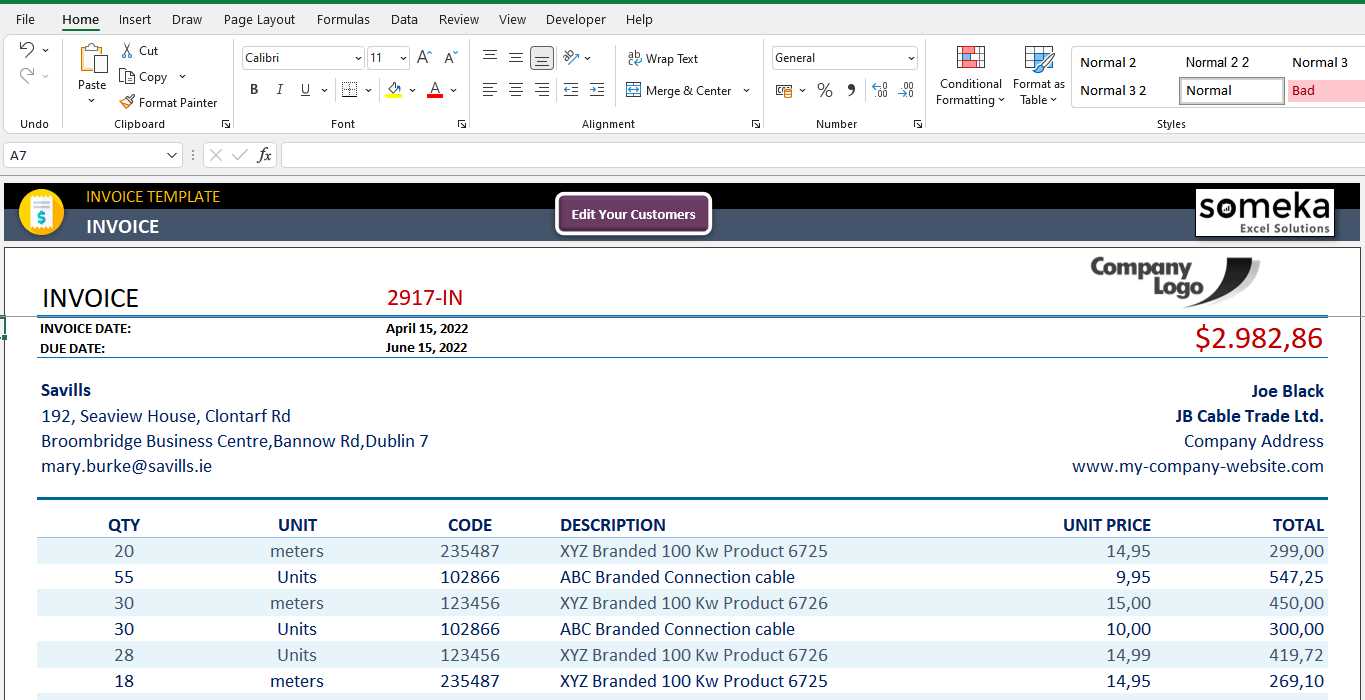

Free XLS Invoice Template Overview

Finding an organized way to handle billing tasks is vital for professionals and businesses that aim for streamlined financial management. A well-structured digital file designed for documenting sales, costs, and payment details can significantly enhance efficiency, allowing for quick adjustments and easy record-keeping. This overview introduces a practical solution for building a consistent approach to managing transactions.

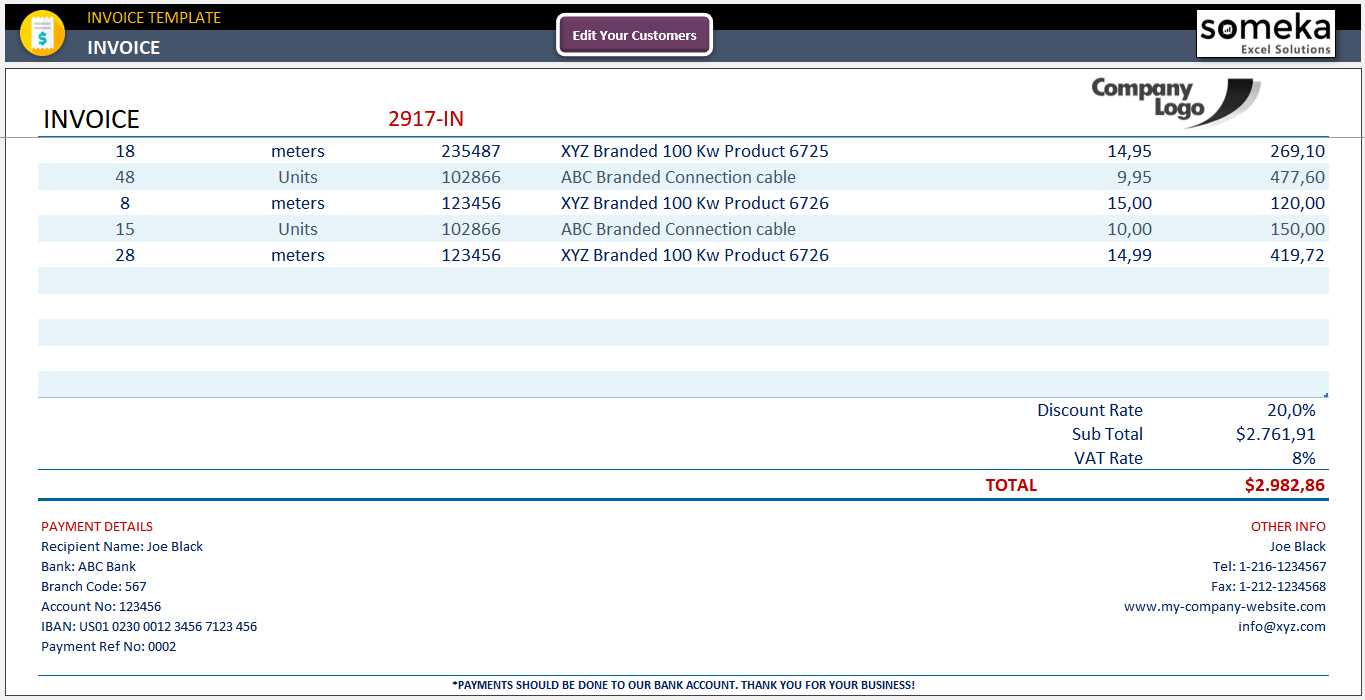

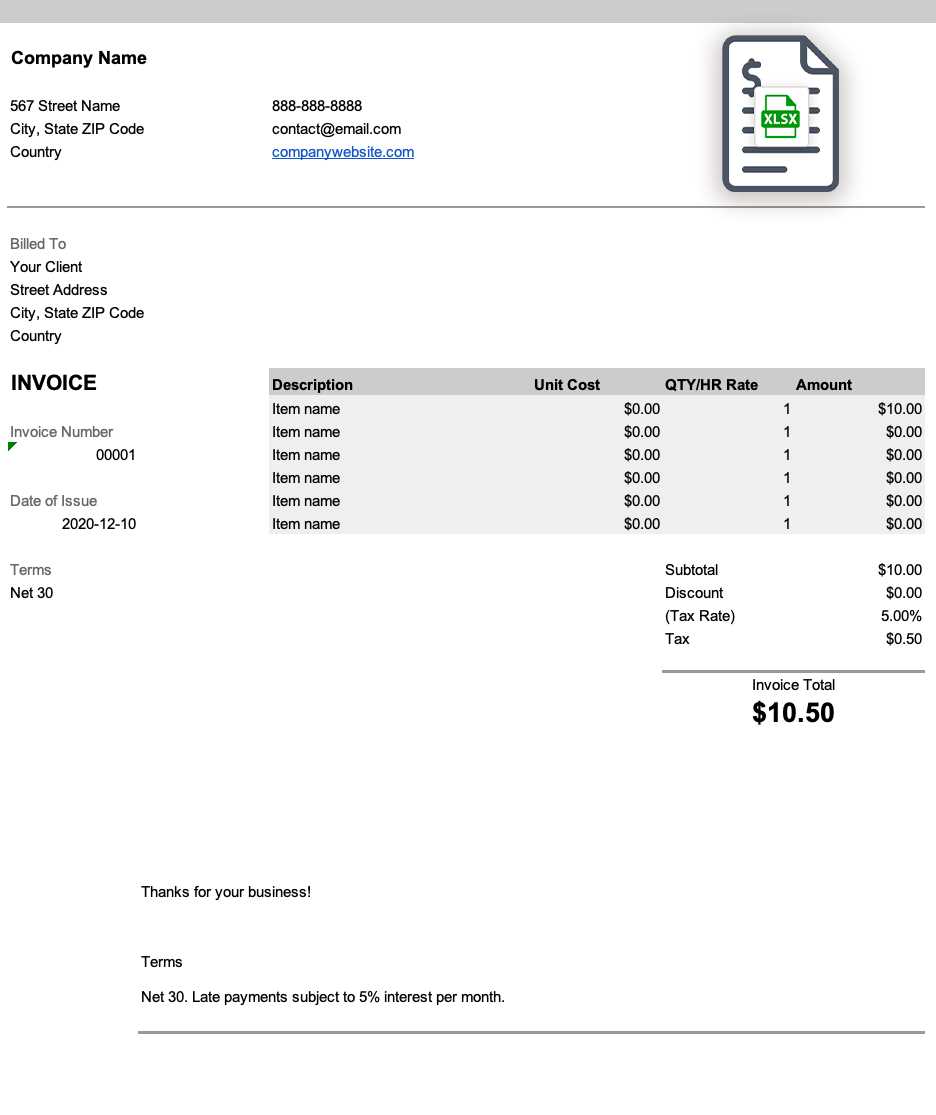

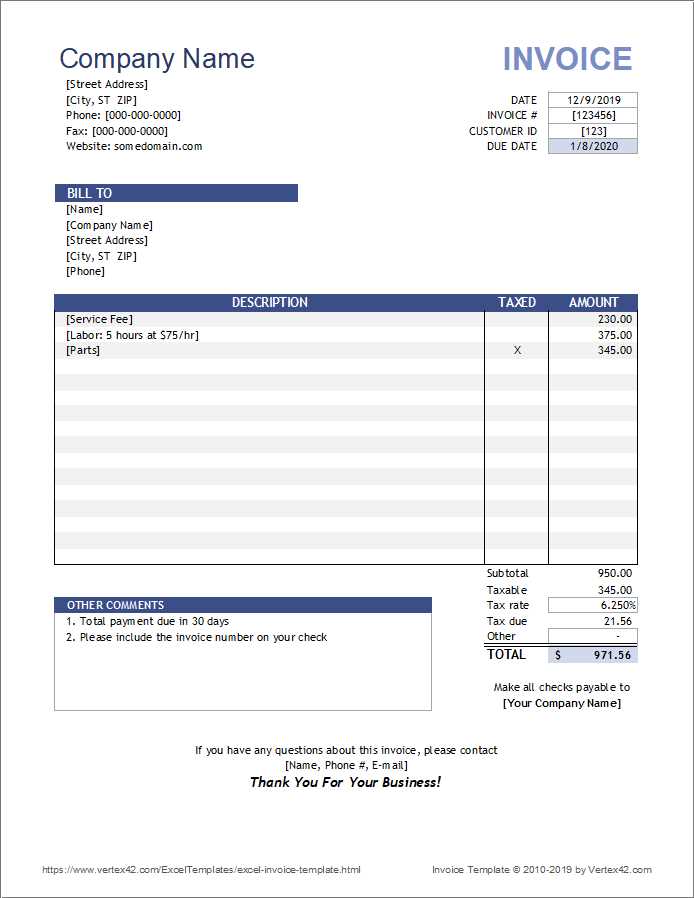

Spreadsheets created for billing purposes provide an intuitive format for inputting itemized services, prices, taxes, and payment terms. This layout offers adaptability, allowing users to tailor fields based on specific needs, which is particularly useful for maintaining detailed and accurate records over time. Using a customizable file ensures that essential information is presented in a clear, organized manner, minimizing errors and improving clarity.

By using a digital file for billing, you gain control over both layout and functionality. With built-in formulas, it’s easy to automate calculations for totals, taxes, and other adjustments, reducing manual work and saving time. These pre-made sheets are also highly portable and compatible with various software, making them ideal for businesses

Benefits of Using an XLS Invoice

Organizing financial transactions in a structured and efficient way is essential for any business. Digital spreadsheets are particularly valuable tools for handling records with precision and ease. This approach enables professionals to manage costs, taxes, and service details in a user-friendly format, offering several practical advantages that streamline financial tasks.

- Customization: Digital spreadsheets are highly adaptable, allowing businesses to tailor fields, sections, and calculations based on specific needs. This flexibility makes it easy to personalize documents for various clients or project requirements.

- Automated Calculations: Built-in formulas simplify the process of totaling amounts, calculating taxes, and adjusting fees. This automation minimizes the risk of human error and speeds up the overall process.

- Compatibility and Portability: These files are compatible with a wide range of software, making them accessible on different devices. They can also be easily shared with clients or colleagues, adding convenience to your workflow.

- Enhanced Record-K

How to Download a Free Invoice Template

Accessing a ready-made digital file for organizing business transactions can significantly simplify your workflow. With a few steps, you can download a structured document that allows for efficient customization and management of financial records. Whether for personal projects or business needs, downloading one of these files offers a quick and user-friendly solution for keeping track of charges, services, and payments.

Step 1: Choose a Reliable Source

To begin, search for a reputable platform that provides a selection of downloadable spreadsheets designed for managing finances. Well-known websites for business tools or productivity software often offer a variety of choices. Make sure the site is trusted to avoid potential issues with file integrity or compatibility.

Step 2: Select the Appropriate Format

Once you’ve found a suitable source, select the file type that ma

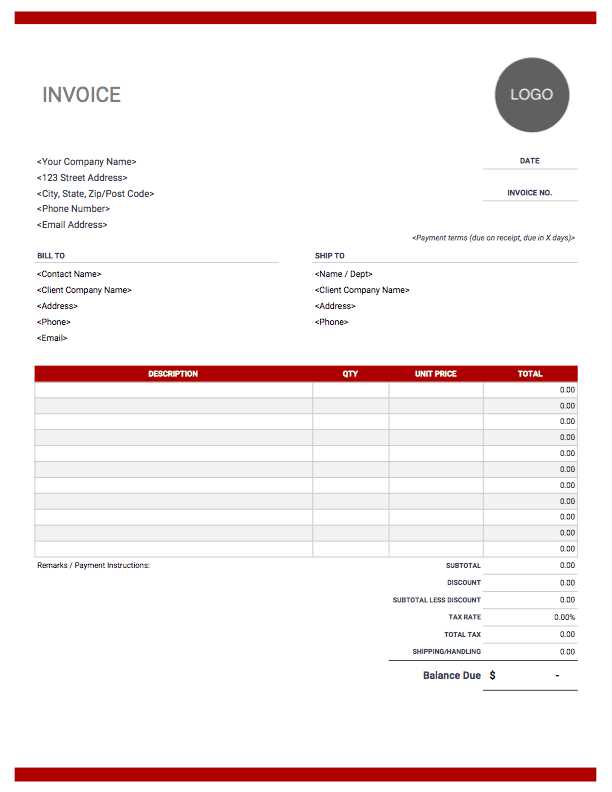

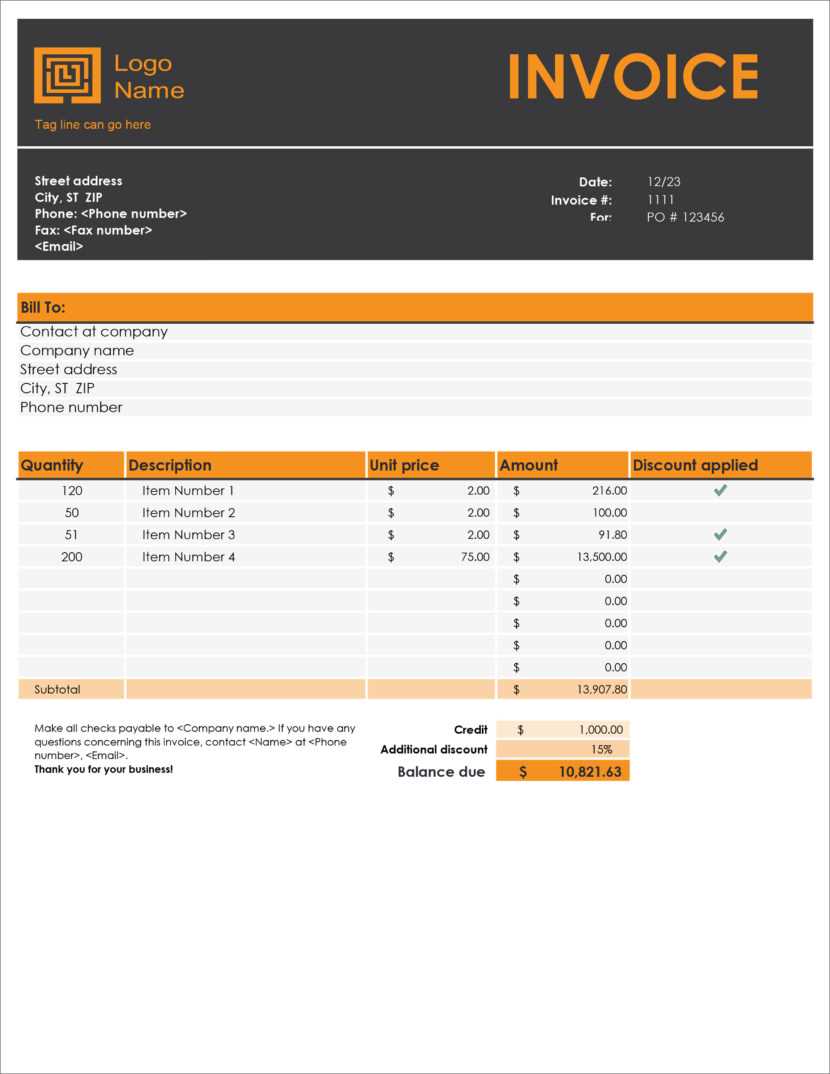

Step-by-Step Guide to Customize Your Invoice

Adapting a pre-made financial document to suit your business or project needs can make a significant difference in professionalism and clarity. A structured document can easily be tailored to reflect your brand, services, and specific requirements. This step-by-step guide will walk you through the customization process, ensuring you make the most out of your financial records.

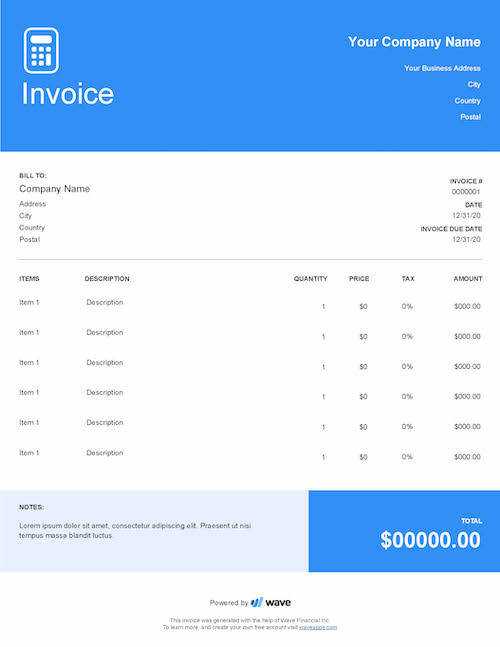

Step 1: Add Your Branding

- Logo: Insert your company’s logo at the top of the document. This adds a professional touch and reinforces brand identity.

- Contact Information: Include your business name, address, phone number, and email. These details make it easy for clients to reach you with questions or for further engagements.

Step 2: Customize Fields and Headings

Step-by-Step Guide to Customize Your Invoice

Adapting a pre-made financial document to suit your business or project needs can make a significant difference in professionalism and clarity. A structured document can easily be tailored to reflect your brand, services, and specific requirements. This step-by-step guide will walk you through the customization process, ensuring you make the most out of your financial records.

Step 1: Add Your Branding

- Logo: Insert your company’s logo at the top of the document. This adds a professional touch and reinforces brand identity.

- Contact Information: Include your business name, address, phone number, and email. These details make it easy for clients to reach you with questions or for further engagements.

Step 2: Customize Fields and Headings

- Edit Service Descriptions: Modify existing fields to list specific products or services. Ensure each description is clear and accurately represents the work or goods provided.

- Add Columns as Needed: If necessary, add columns for additional details such as discount rates or item codes, depending on what information is useful for you and your clients.

Step 3: Set Up Formulas for Automated Calculations

- Total Costs: Use formulas to automatically calculate totals based on item quantities and unit prices, saving time and minimizing errors.

- Tax Calculations: Insert a formula to apply relevant taxes. This will ensure the document reflects accurate amounts without manual adjustments.

By following these steps, you can create a personalized and efficient financial document that suits your business needs, is easy to understand, and leaves a professional impression on your clients.

Best Practices for Filling Out an Invoice

Completing financial documents accurately and efficiently helps to maintain professionalism and clarity in your business interactions. Consistency and thoroughness are essential to avoid misunderstandings and ensure that all necessary information is clearly conveyed. Here are some recommended practices to follow when filling out billing documents.

- Use Clear and Accurate Descriptions: List each service or product with a concise, precise description. This helps the client understand exactly what they are being charged for and reduces potential queries.

- Specify Quantities and Rates: For each item, include the quantity and rate

Managing Invoices Efficiently with Templates

Streamlining the process of managing financial records is essential for any business looking to save time and reduce errors. Pre-designed documents can provide a structured, consistent approach to keeping track of services rendered, amounts due, and payments received. By using these ready-made solutions, businesses can ensure accuracy and efficiency in their billing process.

Organizing Financial Records with Ease

Customizable digital files allow for quick updates and easy organization. Once the basic structure is in place, you can adjust fields to suit different services, clients, or project requirements. This flexibility ensures that each transaction is recorded correctly and can be accessed without hassle when needed.

Automating Calculations and Reducing Errors

One of the key benefits of using pre-structured documents is the ability to incorporate automated calculations. By setting up formulas to calculate totals, taxes, and discounts, businesses can significantly reduce the risk of errors. This not only saves time but also ensures that every document is consistent and accurate.

With the right tools in place, managing financial records becomes a seamless part of business operations, allowing professionals to focus on other important aspects of their work while ensuring that payments are tracked and processed with minimal effort.

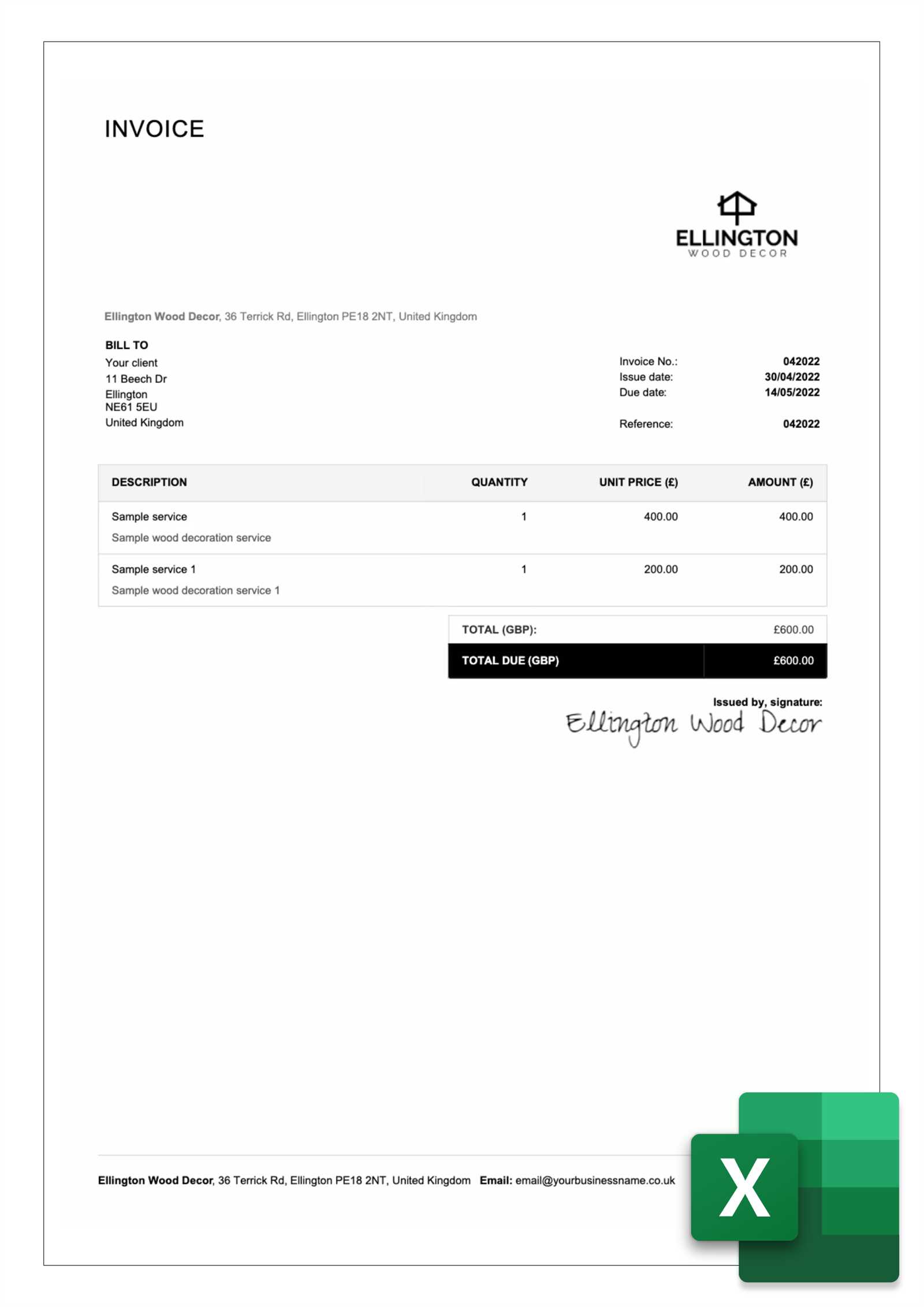

Converting XLS Invoice Templates to PDF

Once a financial document is complete, converting it into a more universally accessible format can be an important step. PDF files preserve the integrity of the layout and design, making them perfect for sharing with clients or colleagues. Converting a digital record to this format ensures that the document appears the same on any device, eliminating issues related to compatibility or accidental changes to the content.

Why Convert to PDF?

- Consistent Layout: The PDF format keeps the document’s appearance intact, regardless of where it is opened or on which device. This ensures that your layout and design stay professional and consistent.

- Security: PDFs can be password-protected, preventing unauthorized access and ensuring sensitive financial information remains secure.

- Easy Sharing: PDF files are widely supported and can be easily shared via email or cloud storage platforms, making them a convenient option for business communication.

Steps to Convert a Digital Document to PDF

- Step 1: Complete your financial record with all relevant information, including amounts, services, and contact details.

- Step 2: In your spreadsheet software, go to the ‘File’ menu and select the ‘Save As’ or ‘Export’ option.

- Step 3: Choose the PDF format from the list of available options and select a destination folder to save the file.

- Step 4: Review the PDF to ensure the formatting is correct, and the content is preserved as intended.

Converting documents to PDF is a simple yet effective way to ensure they remain professional and secure, streamlining your business’s billing and record-keeping process.

Tips for Organizing Your Invoices

Keeping financial records well-organized is essential for any business. A clear and efficient filing system helps to track payments, manage cash flow, and ensure that all transactions are easily accessible when needed. Implementing a proper system can save time and reduce stress when reviewing or preparing financial documents.

Create a Consistent Naming Convention

Establishing a uniform naming convention for your documents helps you easily locate specific files. Include relevant details in the file name, such as the client’s name, date, or a unique reference number. This makes searching for specific records much simpler and ensures that every document is uniquely identifiable.

Use Digital Folders for Categorization

Organize your records into digital folders based on criteria such as client names, months, or payment status. This system allows you to categorize and group your documents efficiently, making it quicker to locate any specific entry. You can further refine your folders by adding subcategories for better organization.

By applying these organization strategies, you can improve workflow, enhance document retrieval efficiency, and maintain a streamlined approach to managing financial records.

Tracking Payments with Invoice Templates

Managing payments is crucial for maintaining healthy cash flow in any business. Using structured documents can simplify the process of tracking outstanding balances, received payments, and payment dates. By organizing this information clearly, businesses can ensure that all transactions are accounted for and easily accessible for future reference.

Keep Payment Records Up to Date: Regularly updating payment records helps you stay on top of outstanding amounts and monitor incoming funds. It is important to ensure that each payment is correctly recorded, including the amount paid, the payment method, and the date received. This helps prevent errors and missed payments.

Set Up Payment Status Indicators: Marking whether a payment has been received or is still pending on your document provides a quick visual reference. You can use color-coding or simple checkboxes to indicate the payment status, making it easier to follow up on any overdue amounts.

Tracking payments efficiently allows businesses to keep a clear overview of their financial health and helps avoid confusion or disputes with clients.

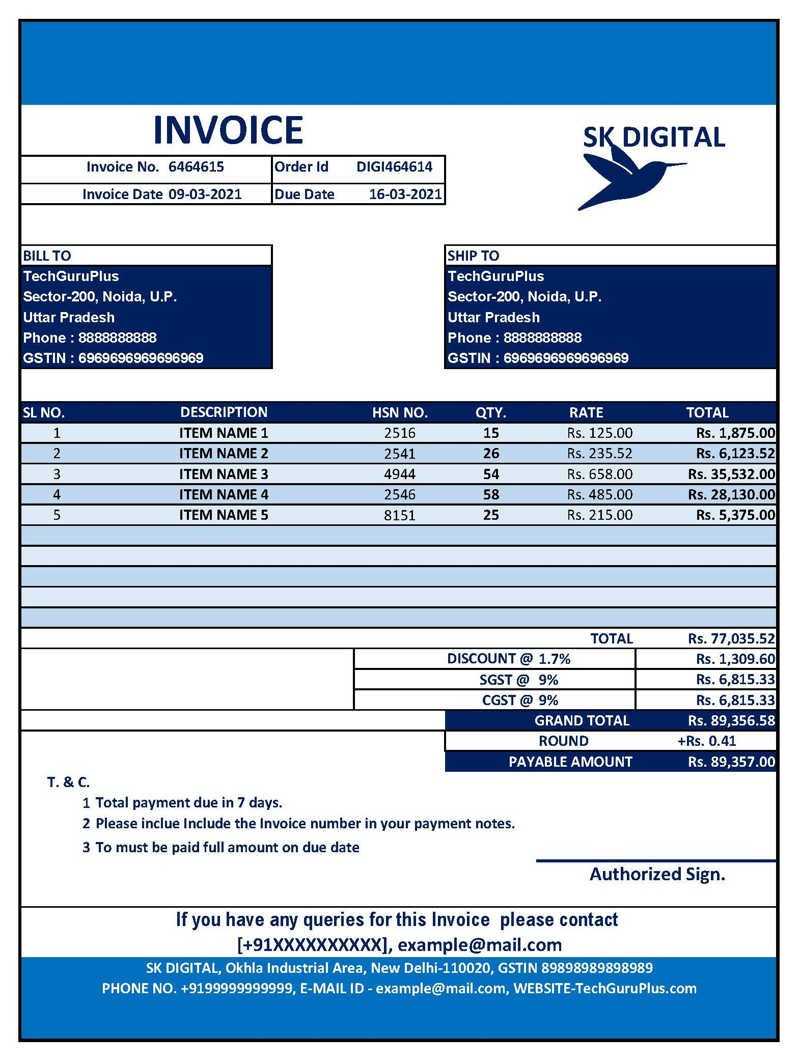

How to Include Taxes in an Invoice

Including taxes in your financial records is an important step to ensure compliance with local tax laws and provide transparency to your clients. By clearly outlining tax amounts, businesses can avoid confusion and ensure that both the business and client are aware of the total amount due, including any applicable charges.

Determine Applicable Tax Rates

Before including taxes, it is essential to identify the tax rates that apply to your products or services. Tax rates can vary depending on the type of service, location, and other factors. Make sure to research and use the correct rates for your area to ensure accuracy.

Break Down Taxes Clearly

Clearly separate the base price and tax amounts in your records. This allows clients to see the tax applied and understand the total cost. You can include a line for the tax rate, followed by the amount of tax applied to the subtotal. Additionally, it’s helpful to display the total amount due after tax for clarity.

Example: If a service costs $100 and the applicable tax rate is 10%, the total amount due would be $110. It’s crucial to make this distinction clear in the document to maintain transparency and avoid any misunderstandings.

Accurately including taxes ensures that your financial documents are complete and comply with regulations, while also making the payment process more transparent for your clients.

Adding a Logo to Your Invoice Template

Incorporating your brand’s logo into your financial documents helps create a professional appearance and reinforces your brand identity. This simple addition not only improves the visual appeal but also ensures that clients easily recognize your business. A logo acts as a mark of authenticity, giving your documents a more polished and official look.

Choose the Right Placement: When adding a logo, it’s important to position it where it won’t interfere with the key details, such as the total amount due or payment terms. Typically, placing the logo in the header section, either at the top left or center, works best. This ensures it’s visible but doesn’t distract from the core content.

Keep the Image Quality High: Ensure that the logo image is of high quality and resolution. A blurry or pixelated logo can give a poor impression and reduce the professionalism of the document. Save the logo in a commonly used format, such as PNG or JPEG, for best results.

By adding a logo to your financial documents, you not only enhance the visual appeal but also convey a sense of professionalism and attention to detail, fostering trust and recognition with your clients.

Common Errors in Invoice Templates

While creating financial documents, there are several mistakes that can occur, potentially causing confusion or delays in payment. These errors can range from simple formatting issues to more serious omissions of crucial details. Identifying and correcting common mistakes is key to maintaining accuracy and professionalism in your business communications.

Missing or Incorrect Information

- Client Details: Ensure that the client’s name, address, and contact information are accurate and complete. Incorrect details can lead to misunderstandings and delays.

- Product or Service Descriptions: A vague or missing description of the goods or services provided can cause confusion. Always be specific and clear about what has been delivered.

- Payment Terms: Forgetting to include payment due dates or terms can lead to late payments or disputes. Always specify when the payment is due and any late fees, if applicable.

Calculation Mistakes

- Incorrect Totals: Double-check the subtotal, tax, and total amounts. Small errors in calculations can cause discrepancies that might delay payment processing.

- Tax Calculations: Ensure the correct tax rate is applied and that it’s calculated based on the subtotal, not the total amount due, if applicable.

By carefully reviewing and correcting these common mistakes, businesses can ensure that their financial records are clear, accurate, and professional, reducing the risk of payment issues and improving client satisfaction.

Protecting Your Invoice Data in XLS

When managing financial records in a digital format, safeguarding sensitive information is crucial. Your documents often contain personal, client, and financial details that need to be kept secure to prevent unauthorized access or data breaches. Implementing proper security measures ensures your records remain confidential and protected from potential threats.

Securing Files with Passwords

One of the simplest ways to protect your documents is by adding a password. This restricts access to only those with the correct credentials. Most spreadsheet software offers the ability to set passwords for files, ensuring that sensitive data remains protected even if the file is shared or stored in less secure locations.

Encryption and Backup

Encrypting your file adds an additional layer of security. This makes it nearly impossible for unauthorized users to open the file without the proper decryption key. Furthermore, regularly backing up your files in secure locations (like encrypted cloud storage) helps ensure that your data is recoverable in case of a system failure or data loss.

By incorporating these security practices, you can significantly reduce the risk of data breaches and ensure that your financial documents are kept safe and confidential.

Using Formulas to Automate Totals

Automating calculations within your financial documents can save time and reduce errors. By using formulas, you can quickly calculate totals, taxes, discounts, and other financial elements without needing to do the math manually each time. This helps ensure accuracy and efficiency, especially when managing multiple entries.

Basic Mathematical Formulas

The most common formulas include SUM for adding up amounts, SUBTRACT for calculating differences, and AVERAGE for finding the mean. These basic functions can automatically compute the total amount due by summing line items or subtracting discounts, ensuring consistency across multiple documents.

Advanced Formulas for Detailed Calculations

For more complex calculations, functions like IF, VLOOKUP, and ROUND can be incredibly useful. The IF function helps in applying conditions, such as calculating a discount only when certain criteria are met. The VLOOKUP function can be used to retrieve data from other sheets, and the ROUND function ensures that the final amounts are rounded to the correct decimal places.

By incorporating these formulas into your records, you can streamline the entire process and minimize the risk of human error.