Basic Business Invoice Template for Quick and Professional Billing

When running any type of company or freelance operation, clear and efficient communication about payments is essential. A well-structured document outlining services rendered and expected compensation not only ensures timely payments but also reflects professionalism. Having a ready-to-use document that can be tailored to different clients and projects saves time and effort, making financial transactions smoother for both parties involved.

Whether you are a freelancer, a small business owner, or part of a larger company, using an organized payment form can prevent misunderstandings and disputes. By incorporating the necessary details and a clear format, you can help clients understand what they owe and why, making the entire process more transparent. This also helps build trust and credibility with clients, leading to better relationships and repeat business.

In this guide, we will explore how to create an effective payment request document, highlighting the key elements to include, the importance of accuracy, and tips on customizing it for different business needs. With the right tools and understanding, you can ensure that every transaction is professional and hassle-free.

Essential Elements of a Payment Request Document

To ensure smooth transactions and avoid confusion, it’s crucial to include the right details in any document requesting payment. A well-structured document serves as both a reminder and a formal agreement, outlining the terms of the transaction clearly. Without these key components, misunderstandings can occur, potentially delaying payment or causing disputes.

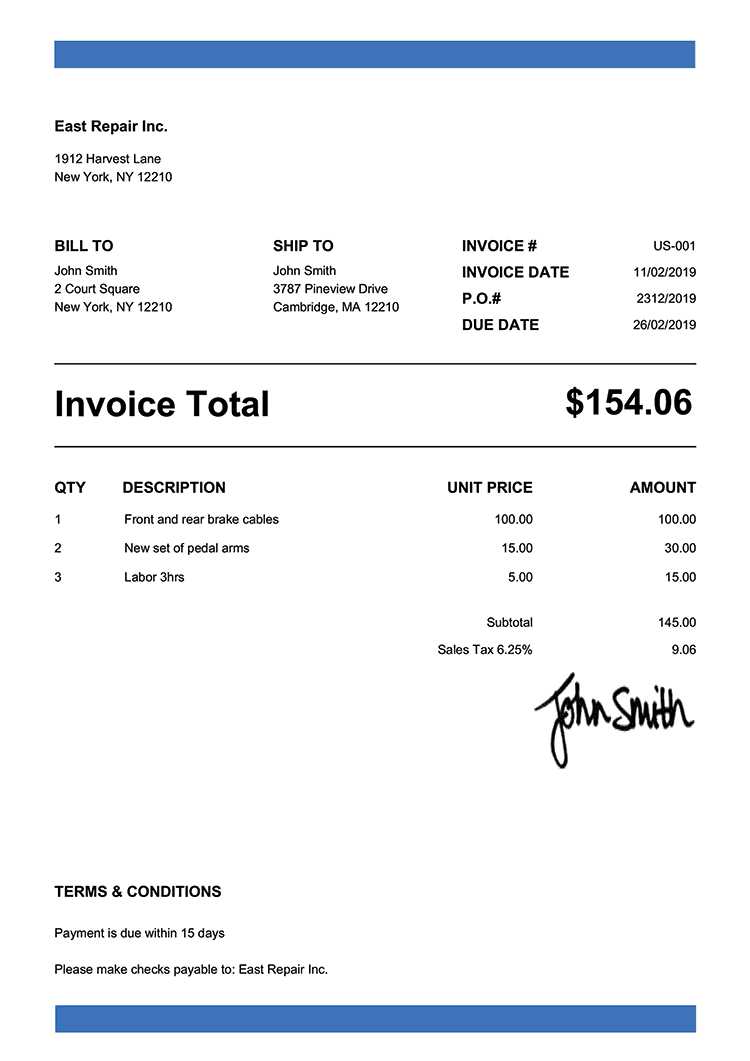

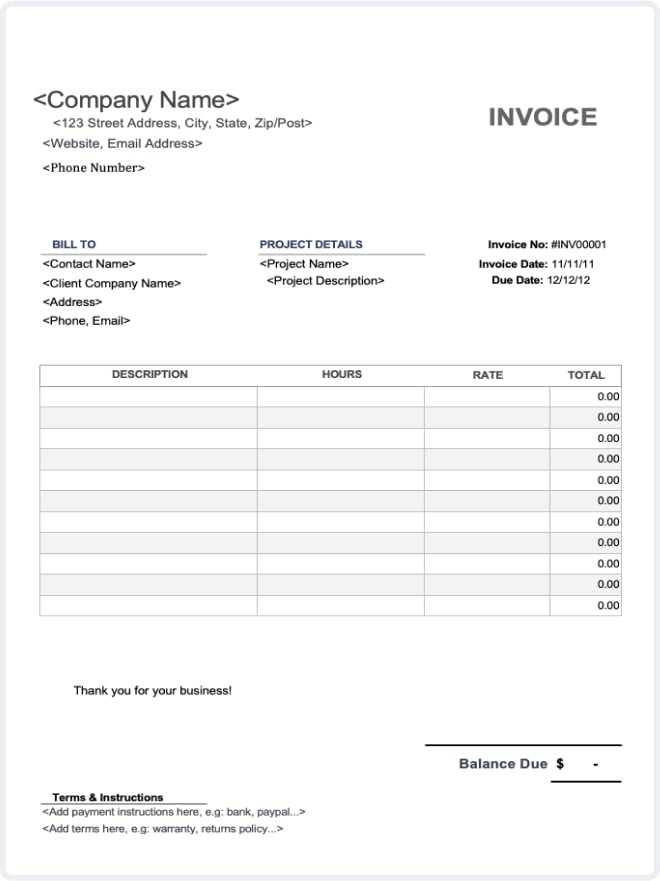

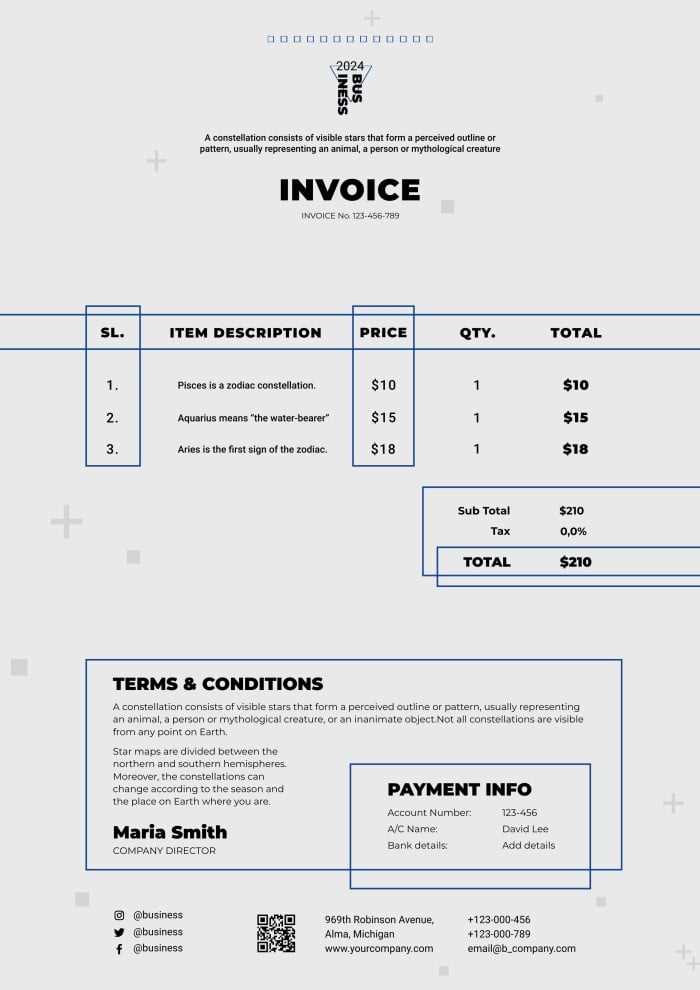

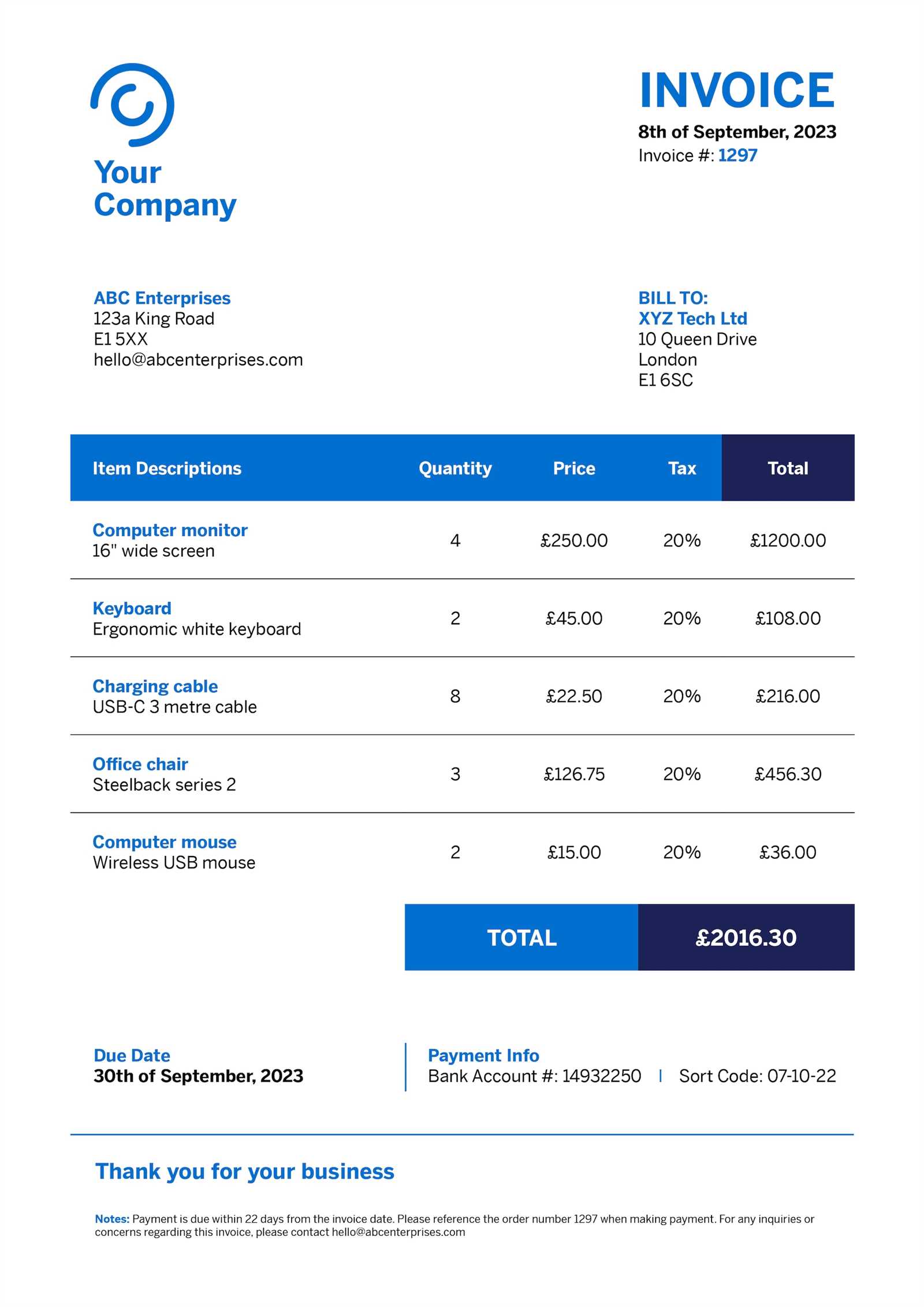

First and foremost, contact information is essential. This should include the name, address, phone number, and email of both the service provider and the recipient. Having these details visible makes it easier for both parties to get in touch in case of any issues or questions. Next, a unique reference number or invoice number is necessary for record-keeping and tracking purposes. This helps differentiate each document and makes it easier to reference in future communications.

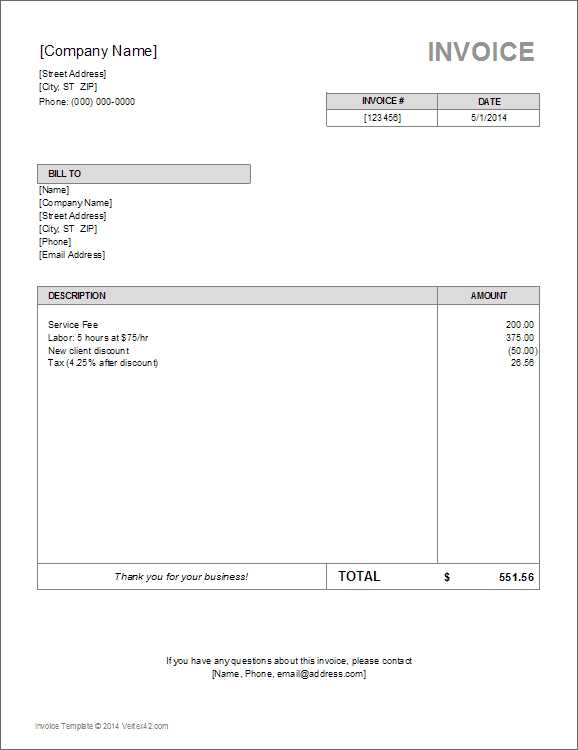

Another important element is the itemized list of services or goods provided. Each service or product should be clearly described along with the corresponding price. This ensures that the recipient understands what they are being charged for. Don’t forget to include the date when the service was rendered or the goods delivered, as well as the due date for payment. Setting a deadline helps avoid delays and encourages prompt settlement.

Finally, the total amount due should be clearly stated, including any applicable taxes, discounts, or additional fees. Clear payment instructions, including methods of payment accepted and bank account details (if relevant), should also be included to simplify the process for the recipient.

Why You Need a Payment Request Format

Having a standardized document for requesting payment is essential for any service provider or company. It not only helps ensure consistency in communication but also reduces errors and saves valuable time. With a pre-designed format, you can easily add the required information, ensuring that all the necessary details are included every time. This level of organization is particularly important when dealing with multiple clients or transactions.

Using a pre-structured form allows you to focus on the content instead of worrying about formatting or what to include. It streamlines the process, making it faster and more efficient. Whether you’re a freelancer or a larger company, having this structure in place helps maintain a professional appearance and reduces the chances of overlooking important information.

The benefits of using such a document are clear. Here’s a comparison of the advantages:

| Without a Structured Document | With a Pre-Designed Format |

|---|---|

| Lack of consistency | Uniformity in every request |

| Time-consuming to create from scratch | Quick to generate with pre-filled sections |

| Higher risk of missing key details | All important fields included by default |

| Potential for errors | Minimized chances of mistakes |

Ultimately, using a pre-designed document helps you create clear, professional payment requests that can be sent out quickly, reducing delays and ensuring a smooth transaction process.

How to Customize Your Payment Request Format

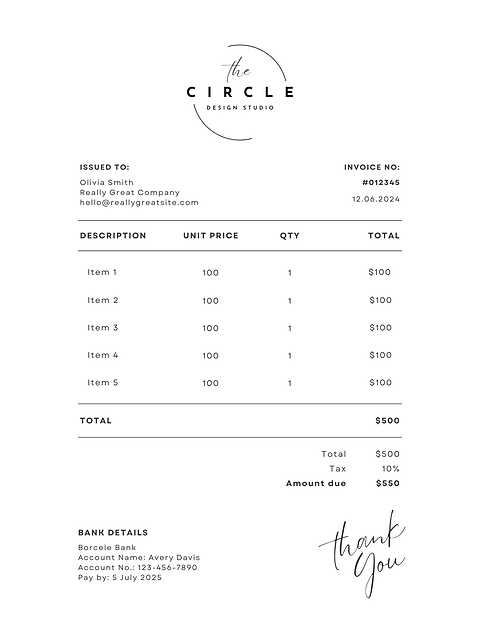

Customizing your payment request format allows you to make it unique to your business and ensures that it reflects your brand and specific needs. By tailoring the design and content, you can enhance clarity and professionalism while making the document more suited to the types of services or products you offer. Adjusting these details ensures that clients receive the information they need in an easily digestible form.

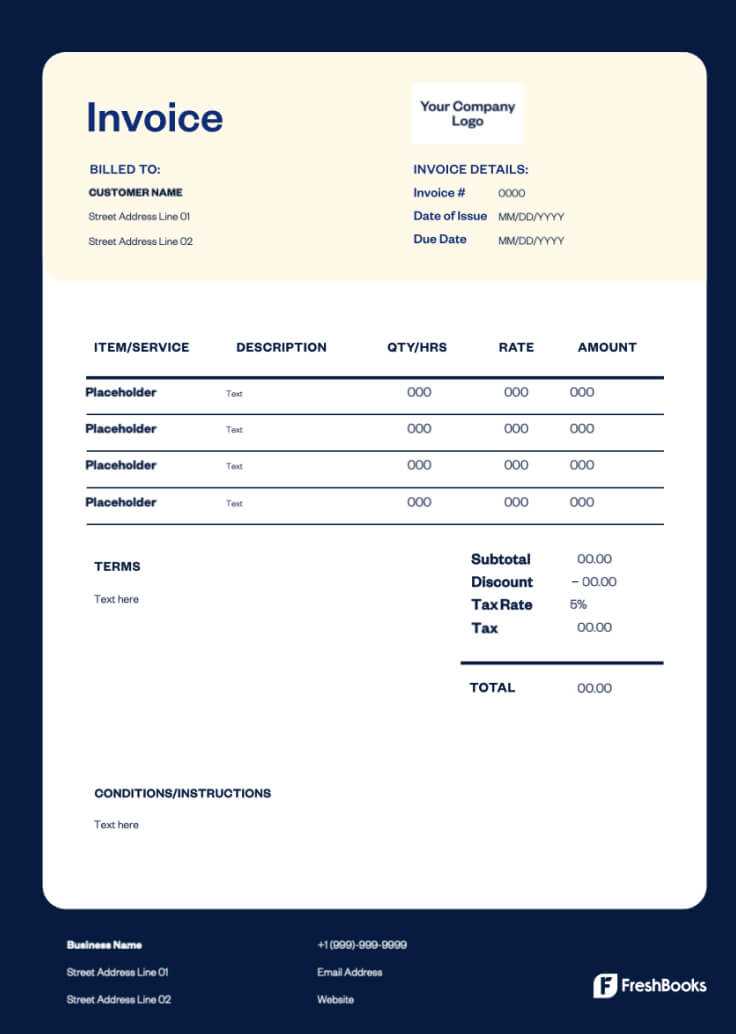

The first step in customization is adjusting the layout and design to suit your preferences. You can change fonts, colors, and add your company logo to make the document align with your branding. Including your company’s contact information at the top and a consistent style throughout helps make the document instantly recognizable and professional.

Next, focus on the content structure. Ensure that all necessary fields are present, such as a unique reference number, a breakdown of services or products provided, and the total amount due. You can also add or remove sections based on your specific business needs. For example, you may want to include a discount section or payment terms if applicable. Adjusting these sections allows you to present a clearer breakdown of what the client is being charged for.

Another important customization is setting payment instructions. You can specify your preferred payment methods, such as bank transfers, credit card payments, or online payment platforms. Including your payment details and terms ensures that clients know exactly how to settle their bills, reducing the chances of delays.

Lastly, consider including personalized notes or messages to further enhance the customer experience. A short thank-you note or instructions about late payment penalties can give your payment request a personal touch while maintaining professionalism.

Understanding the Key Payment Request Fields

To create a clear and effective document requesting payment, it’s crucial to understand the essential fields that should be included. These fields not only ensure that the recipient understands what they are being charged for, but they also provide both parties with the necessary information to complete the transaction smoothly. Missing or unclear information can lead to confusion, delayed payments, or even disputes. Below, we explore the main components that should be included in every payment request form.

Important Fields to Include

Each document should be organized and include the following key sections:

| Field | Description |

|---|---|

| Contact Information | The names, addresses, phone numbers, and email addresses of both the service provider and the recipient. |

| Reference Number | A unique number to identify each transaction for easy tracking and future reference. |

| Service Description | A detailed breakdown of the products or services provided, including quantities and rates. |

| Payment Terms | Any applicable payment deadlines, late fees, or early payment discounts. |

| Due Date | The specific date by which the payment should be made. |

| Total Amount | The total sum due, including taxes, fees, and any additional charges. |

| Payment Instructions | The preferred methods for payment, such as bank transfer, online payment, or credit card details. |

Why These Fields Matter

Including all these key fields not only facilitates smooth transactions but also helps prevent mistakes and delays. By providing all necessary details upfront, you ensure that both parties are on the same page regarding the expectations for payment. Additionally, clear payment instructions and terms help reduce the likelihood of disputes, ensuring timely and hassle-free payments. Properly filled-out forms also enhance your professionalism and foster trust with your clients.

Best Practices for Professional Invoicing

Creating well-organized and clear payment requests is an essential part of maintaining professional relationships with clients. Adopting best practices in your payment documentation can help ensure timely payments, minimize misunderstandings, and project a polished, credible image of your services. A consistent and professional approach to billing shows clients that you are serious about your work and organized in your processes.

One of the most important practices is to ensure that all relevant details are included in every request for payment. This includes accurate contact information, a clear breakdown of services rendered, and the total amount due. It’s crucial to avoid vague descriptions or errors that could lead to confusion. Precision not only helps the client understand what they are being charged for, but it also shows your attention to detail and professionalism.

Another best practice is to set clear payment terms. Always specify the due date, any late fees, and acceptable payment methods. This helps manage client expectations and ensures that both you and the recipient are aware of the payment schedule. Offering multiple payment options, such as credit card, bank transfer, or online payment platforms, can also make the payment process more convenient for your clients and encourage faster settlement.

Consistency is also key. Use the same format for every request, ensuring that all the important fields are included and easy to find. This makes the process more efficient for both you and the client. Additionally, keep a record of all transactions, as this will help you track outstanding payments, identify trends in your billing, and stay organized for tax or accounting purposes.

Finally, always maintain a polite and professional tone in your communication. A simple “thank you” or a short note with payment reminders can go a long way in fostering good relations and ensuring that clients feel valued. It’s these small touches that differentiate professional services from the rest.

Creating a Simple Payment Request Design

Designing a clean and straightforward payment request is essential for maintaining professionalism and clarity. A well-designed document makes it easy for your clients to understand the charges and payment terms, while also presenting your services in an organized and attractive format. The key is to keep the layout simple yet effective, ensuring that important details stand out without unnecessary clutter.

Start by structuring the document with clear sections. Place your contact information, the recipient’s details, and the unique reference number at the top. This makes it easy to quickly identify the parties involved and find important details like the payment number or job description. Use bold headings for each section to guide the reader’s eyes and make the document easy to follow.

Next, focus on the layout of the payment breakdown. Include an itemized list of products or services provided, along with their quantities and individual prices. This transparency helps clients understand exactly what they are paying for and minimizes confusion. Use simple tables or bullet points to make this information clear and concise. Avoid cluttering the document with unnecessary text or too many design elements that can distract from the main content.

For the design, choose a clean, professional font and stick to a limited color palette. While some branding can be incorporated, it’s important to maintain readability above all else. A well-organized, minimalist design will reflect your professionalism and make the document easy to navigate.

Finally, ensure the total amount due is prominently displayed, either in a larger font size or highlighted with bold text. This makes it clear to the recipient what the final payment amount is, helping to avoid any misunderstandings.

Free Payment Request Formats and Tools

There are numerous free resources available online to help you create professional payment request documents without the need for complex software or design skills. These tools and formats can simplify the process, allowing you to quickly generate well-structured forms with all the necessary details. Whether you’re a freelancer, small business owner, or part of a larger organization, using these free resources can save time and ensure that you send clear and accurate payment requests every time.

Free Resources for Creating Payment Requests

- Google Docs: Offers customizable templates for creating payment requests with easy-to-use features.

- Microsoft Word: Provides downloadable and editable formats that can be tailored to suit your needs.

- Canva: An online design tool with free payment request layouts that are visually appealing and easy to customize.

- Zoho Invoice: A free invoicing software with templates and tools to create and send payment requests online.

- PayPal: Allows you to create and send professional payment requests directly from your PayPal account.

Useful Online Tools

- Invoice Generator: A simple, no-signup-needed tool to create quick and professional payment requests.

- Wave Accounting: Free accounting software with built-in invoicing features to create and track payment requests.

- FreshBooks: Provides free invoicing templates and tools, with the option to upgrade for additional features.

These free resources make it easy for anyone to generate payment requests with minimal effort. By using them, you can create professional-looking documents that meet all your business needs, while saving both time and money.

Legal Requirements for Payment Requests

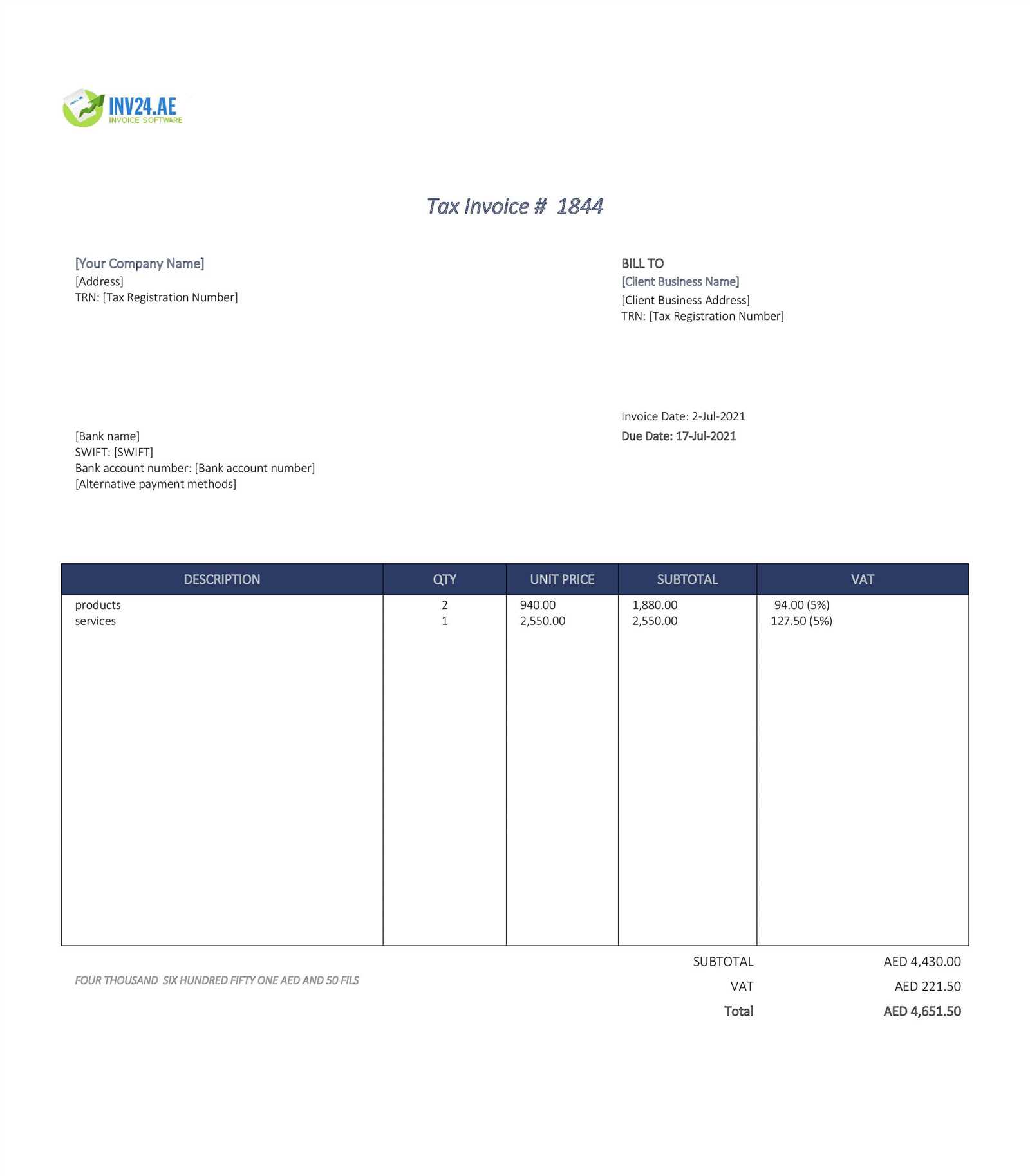

When creating documents to request payment, it’s essential to comply with the legal standards set by your country or region. These requirements ensure that the document is valid for financial and tax purposes, and they help prevent disputes between service providers and clients. Understanding the necessary elements can also protect your rights and make your payment requests more professional and legally sound.

Key Legal Elements to Include

- Unique Reference Number: Every payment request should have a unique identification number to help track transactions and avoid confusion.

- Service Provider and Recipient Information: Include the full names, addresses, and contact details of both parties involved in the transaction.

- Detailed Description of Goods or Services: Clearly list the items or services provided, along with quantities, unit prices, and dates of delivery or performance.

- Payment Terms: Specify payment due dates, accepted payment methods, and any late fees or discounts for early payment.

- Tax Information: Include tax identification numbers (such as VAT or sales tax) where applicable, and break down any tax charges in the document.

- Total Amount Due: State the total amount owed, ensuring that taxes, discounts, and additional charges are clearly outlined.

- Signature: Depending on your location, a digital or physical signature may be required to validate the document.

Regional Variations and Compliance

- Value Added Tax (VAT): In many countries, businesses must include VAT information and ensure that the appropriate tax rate is applied to goods and services.

- Local Regulations: Certain countries or states may have specific rules regarding payment request formatting, including required disclosures for freelancers or small businesses.

- Currency and Language: In some regions, the currency and language used on the document must align with local standards or laws.

- Retention Period: Most jurisdictions require that payment requests be kept for a certain number of years for accountin

How to Include Payment Terms Effectively

Clearly stating the payment terms in any request for payment is crucial to ensure that both you and your client understand the expectations for the transaction. Well-defined terms help avoid confusion, delays, and disputes. Whether you offer flexible payment options or have specific conditions like early payment discounts or late fees, it’s important to communicate these terms in a way that is clear, concise, and easy to follow.

Start by defining the due date clearly. This is one of the most important elements of any payment request, as it sets the expectation for when the client must pay. Be specific and avoid vague language like “due soon” or “as soon as possible.” Use a fixed date (e.g., “Payment due by December 15, 2024”) to leave no room for confusion.

If you offer any discounts for early payment, make sure to mention them in the terms. For example, you could write: “A 5% discount will be applied if payment is received within 10 days.” This encourages clients to pay sooner, benefiting both parties. Be clear about the deadline for the discount to avoid any misunderstandings about when it expires.

On the other hand, if you charge late fees, it’s essential to specify the exact penalties for delayed payments. Include both the rate (e.g., a fixed fee or percentage) and when the fee will be applied. For instance, “Late payments will incur a 1.5% fee for each week past the due date.” This ensures that clients are aware of the consequences and are motivated to pay on time.

Additionally, consider offering multiple payment methods and clearly stating which methods you accept. Whether you prefer bank transfers, credit card payments, or online platforms like PayPal, make sure these options are included in the payment request. Providing flexibility in payment options makes it easier for clients to pay you promptly.

Lastly, always keep the payment terms simple and easy to read. Avoid overly complicated language, and make sure that everything is laid out in a l

Common Mistakes to Avoid in Payment Requests

Even small mistakes in a payment request can lead to confusion, delays, or even disputes with clients. To ensure that your documents are clear and professional, it’s important to avoid certain common errors that can complicate the payment process. By being mindful of these pitfalls, you can streamline your billing system and maintain a positive relationship with your clients.

One of the most common mistakes is incorrect or missing contact information. If any party’s contact details, such as the name, address, or phone number, are wrong or incomplete, it can cause confusion, especially if there are issues with the payment. Always double-check that the recipient’s information is accurate and up-to-date to avoid unnecessary back-and-forth.

Failure to include a unique reference number is another frequent issue. Without a unique identifier, tracking and managing multiple payments becomes difficult, and it may lead to problems if a client needs to reference a specific transaction. Always include a unique number that makes it easy to trace the payment to the correct service or product.

Vague descriptions of products or services can also create confusion. If you only provide a general statement like “consulting services” or “product delivery,” the client might not fully understand what they are being charged for. Be specific about what was provided, including quantities, rates, and dates of service, so that both parties are on the same page.

Omitting tax information is another serious error, especially in regions with sales tax or VAT. If applicable, always ensure that tax rates are clearly stated and that taxes are included in the total amount due. Failing to include this information can lead to legal complications or disputes over the total cost.

Another mistake is unclear payment terms. If the due date, accepted payment methods, or late fee policies aren’t explicitly stated, it can lead to misunderstandings or delayed payments. Always specify the exact date by which payment is due and any additional conditions, such as discounts for early payment or penalties for late payments.

Lastly, not proofreading the document is a mistake many people overlook. Even a small typo can make a payment request appear unprofessional. Always double-check for spelling and grammatical errors, as well as for any inconsistencies in numbers or amounts, to ensure that your document is as clear and accurate as possible.

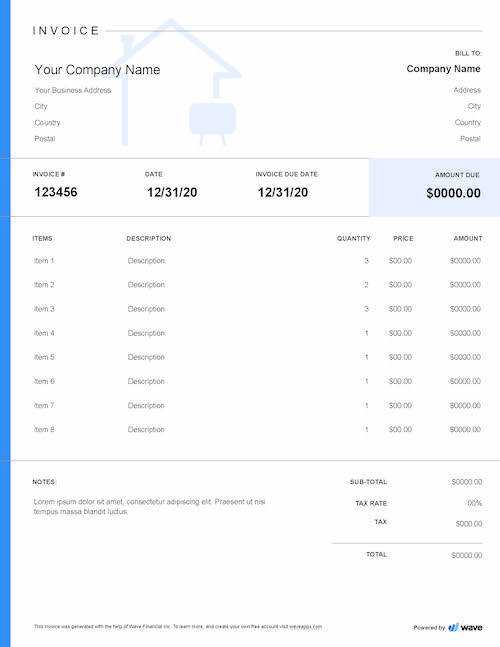

How to Format Your Payment Request for Clarity

Formatting your payment request clearly is crucial to ensure that both you and your client understand the details of the transaction. A well-structured document reduces the chances of errors, confusion, and payment delays. Proper formatting allows the recipient to easily locate essential information such as payment terms, due dates, and a breakdown of charges. Below are some key strategies for creating a clear and professional payment request.

Key Formatting Tips

- Use Clear Headings: Divide your document into distinct sections with clear headings such as “Payment Details,” “Service Breakdown,” or “Total Amount Due.” This makes it easy for the recipient to find key information quickly.

- Organize Information Logically: Place the most important details at the top, such as your contact information and the recipient’s details, followed by the service description, payment terms, and the total amount due.

- Break Down Charges: Present charges in a table format, listing each service or product, along with the corresponding price and quantity. This ensures the recipient understands exactly what they are paying for.

- Highlight the Total Amount: Make the total amount due stand out by using bold text or a larger font size. This draws attention to the most critical part of the document.

- Include Payment Instructions: Make sure to list accepted payment methods and provide clear instructions on how to make the payment, including any relevant account details or links to online platforms.

Additional Considerations for Easy-to-Read Formats

- Consistent Font and Spacing: Use a readable font (like Arial or Times New Roman) and maintain consistent spacing throughout the document. Avoid large blocks of text; instead, use short paragraphs and bullet points to break up information.

- Avoid Clutter: Keep the design simple and free of unnecessary graphics or text. A clean and professional layout helps ensure that the document is easy to read and doesn’t overwhelm the recipient with too much information.

- Use a Logical Order: Present the payment details in a logical order, such as first listing the services or products provided, then the payment terms, followed by the total amount due and the payment instructions.

By formatting your payment requests clearly and professionally, you make it easier for your clients to understand and process their payments promptly, ultimately leading to fewer dela

When to Send a Payment Request After Work

Timing is crucial when it comes to sending a payment request after completing a project or providing a service. The right moment to send the document can help ensure timely payment and foster a positive relationship with your clients. Understanding when to issue a payment request can prevent unnecessary delays and ensure that your cash flow remains steady.

Factors to Consider Before Sending

- Completion of Work: Send a request only after the work has been completed or the service has been fully delivered. This ensures that the client has received everything they are paying for and is satisfied with the result.

- Agreement Terms: Review the terms agreed upon with the client. If your contract specifies a particular date for submission, make sure to adhere to that timeline. Many contracts also outline when payment requests should be sent–either immediately after completion or after a certain period.

- Project Milestones: If the project is divided into stages, it may be appropriate to send a request for payment at each milestone. For example, after the completion of a specific phase, like design or development, you can send an invoice for the work done thus far.

Best Practices for Timing

- Send Immediately After Completion: For smaller projects or short-term services, it’s often best to send a payment request as soon as the work is finished. This keeps the transaction fresh in both your and the client’s mind.

- Within 24 to 48 Hours: If the project spans a longer period, aim to send your payment request within 1-2 days after completion. This gives both you and the client enough time to wrap up any final details while maintaining momentum in the process.

- Consider Client Preferences: Some clients may prefer to receive payment requests on a specific schedule (e.g., monthly or at the end of a particular week). Be flexible if they request a specific time frame, but make sure it’s consistent with your business processes.

Ultimately, the timing of your payment request should align with the completion of the work, the client’s expectations, and any agreements in place. By understanding the best time to issue your request, you help ensure a smooth and efficient payment process.

Tracking Paid and Unpaid Payment Requests

Keeping track of paid and unpaid transactions is essential for maintaining accurate financial records and ensuring timely cash flow. A clear and organized system for monitoring payments helps you quickly identify outstanding amounts, follow up with clients, and avoid missed payments. Whether you handle a few transactions a month or several, having a strategy in place for tracking payments is crucial to managing your finances effectively.

Methods for Tracking Payment Status

- Manual Records: One of the simplest ways to track payments is by maintaining a physical or digital ledger. You can create a table with columns for the payment request number, date issued, client name, amount due, and payment status (paid or unpaid). This method is effective for small volumes of work, but can become cumbersome as your business grows.

- Spreadsheet Tracking: Using spreadsheet software like Excel or Google Sheets is a more flexible option. You can create a detailed tracking sheet with customizable columns to monitor each request’s payment status. This allows for easy sorting, filtering, and updating of payment statuses. Additionally, you can use formulas to calculate outstanding balances or overdue payments.

- Accounting Software: Many modern accounting platforms (such as QuickBooks or FreshBooks) offer built-in tools to track payments. These tools automatically update payment statuses and provide detailed reports on both paid and unpaid requests. With this option, you can also set up reminders or automated follow-ups for unpaid amounts.

Handling Unpaid Transactions

- Follow Up Promptly: If a payment request remains unpaid after the due date, it’s important to follow up promptly. Send a friendly reminder to your client, specifying the outstanding amount and requesting immediate payment. Be polite but firm, and clearly state any late fees or penalties if applicable.

- Document Communication: Keep a record of all communication with your clients regarding overdue payments. This could be helpful if you need to escalate the situation or resolve any disputes.

- Offer Payment Plans: If a client is unable to pay the full amount at once, offering a payment plan can be a helpful solution. Document the agreed-upon terms clearly to avoid any future misunderstandi

How to Integrate Payment Requests with Accounting Software

Integrating payment requests with accounting software streamlines your financial management by automating record-keeping, improving accuracy, and saving time. By connecting your payment records with accounting systems, you can easily track income, manage taxes, and ensure that all transactions are accounted for without manual effort. Whether you’re a small business or a larger enterprise, linking your billing system with accounting tools can significantly enhance efficiency and reduce errors.

Steps to Integrate Payment Records with Accounting Systems

- Choose Compatible Software: First, ensure that your accounting software supports integration with your payment request system. Popular accounting platforms like QuickBooks, Xero, or FreshBooks typically allow for seamless integration with various invoicing tools. Some invoicing platforms even offer built-in integrations with specific accounting software.

- Connect Your Accounts: Most accounting platforms will offer a straightforward process to connect your invoicing tool or payment gateway. This may involve linking your bank account, setting up APIs, or logging into both systems to sync data automatically.

- Import Payment Data: Once the connection is established, you can begin importing payment data directly into your accounting software. This often includes transaction details such as dates, amounts, client information, and payment status, which will be automatically recorded in your financial system.

- Automate Categorization: Some software allows for automatic categorization of payments into specific revenue streams, such as products or services. Setting this up ensures that your financial reports are more accurate and reflective of your business’s financial health.

Benefits of Integration

- Time Savings: Automating the process of transferring payment details to your accounting system saves you time that would otherwise be spent manually entering data. This reduces human error and frees up time for other important tasks.

- Real-Time Financial Tracking: Integration provides you with up-to-date information on your earnings and expenses. This makes it easier to make informed decisions and plan for future expenses, taxes, and budgeting.

- Accurate Tax Reporting: With integrated software, tax calculations and reports become more streamlined. You can quickly see what’s taxable and how much you owe, ensuring compliance with local tax regulations.

By integrating your payment records with accounting software, you create a more organized and efficient workflow. The seamless connection between these two systems enhances financial management and ensures that you always have accurate data when you need it.

Automating Your Payment Request Process

Automating your payment request system can significantly improve efficiency, reduce human error, and save time. By leveraging technology to handle repetitive tasks such as generating and sending payment requests, you can focus more on delivering value to your clients while ensuring timely payments. Automation allows you to streamline the entire process from the moment the work is completed to the final payment confirmation.

Steps to Automate Your Payment Requests

- Use Invoicing Software: There are many software platforms that allow you to automatically create, send, and track payment requests. Tools like FreshBooks, QuickBooks, and Zoho Invoice allow you to input client details and service information once, then automatically generate and send requests whenever needed.

- Set Up Recurring Billing: For ongoing projects or subscription-based services, automation software allows you to set up recurring payment requests. These invoices are automatically generated and sent to clients at regular intervals, reducing the need for manual tracking and follow-ups.

- Integrate with Payment Gateways: Connect your invoicing system with payment gateways like PayPal, Stripe, or Square. This integration not only allows clients to pay directly from the payment request but also enables you to automatically mark transactions as paid when the payment is received.

- Automate Payment Reminders: Many invoicing tools offer automatic reminders for overdue payments. Set these reminders to be sent at specific intervals, ensuring that clients are notified before the payment is considered late, reducing the time you spend chasing overdue invoices.

Benefits of Automating the Payment Request Process

- Time Savings: Automation eliminates the need to manually create and send payment requests. With a few clicks, you can generate a batch of payment requests for multiple clients, saving you hours each week.

- Improved Accuracy: Automated systems reduce the risk of errors, such as incorrect totals, missing details, or miscommunication. This ensures that your requests are always accurate and professional, reflecting the quality of your work.

- Faster Payments: With automatic reminders and easy payment options, clients are more likely to pay on time. This leads to improved cash flow and helps maintain a steady revenue stream.

- Better Client Experience: Clients appreciate the convenience of receiving clear, professional payment requests, especially when they can pay quickly online. This can improve client relationships and increase repeat business.

By automating the payment request process, you not only streamline your operations but also create a more efficient system that benefits both you and your clients. The ability to focus on other aspects of your work while ensuring timely payments is a key advantage for any business.

Improving Cash Flow with Proper Payment Requests

Effective management of payment requests is crucial for maintaining a healthy cash flow in any organization. By ensuring that your payment documents are clear, timely, and accurate, you can encourage faster payments, reduce overdue amounts, and avoid cash flow gaps. Implementing sound invoicing practices helps you track income, manage expenses, and keep operations running smoothly without unnecessary delays.

Key Factors to Improve Cash Flow

Factor Description Timely Issuance Sending payment requests promptly after completing a project or delivering a service ensures that clients are billed on time, leading to quicker payments and reducing the chance of delays. Clear Payment Terms Clearly outlining payment terms, such as due dates and late fees, in each payment request helps set expectations upfront and reduces confusion or disputes over payment timing. Multiple Payment Options Providing clients with various payment methods (credit card, bank transfer, online payment platforms) can make it easier for them to settle their bills quickly and on time. Early Payment Incentives Offering discounts or other incentives for early payments can encourage clients to pay faster, improving your cash flow and reducing the time spent waiting for funds. Automated Reminders Setting up automatic reminders for upcoming or overdue payments reduces the effort needed for follow-ups and keeps your clients aware of their payment obligations. Additional Strategies for Better Cash Flow

- Keep Track of Outstanding Payments: Regularly review your payment request records to identify unpaid amounts. Follow up promptly with clients who haven’t paid on time to minimize delays.

- Set Up Payment Milestones: For larger projects or long-term services, consider dividing payments into smaller, more manageable milestones. This ensures that cash is flowing in regularly rather than waiting until the project’s completion.

- Incorporate Clear Penalties for Late Payments: Include late payment fees in your terms to encourage clients to pay on time. This can be a significant motivator for avoiding delays and ensuring that payments are received promptly.

By incorporating these invoicing practices into your workflow, you create a system that not only improves cash flow but also fosters strong, professional relationships with clients. Properly managed payment requests help keep your business running smoothly, reducing stress and ensuring you have the funds necessary for continued growth.