Free Online Billing Invoice Template for Easy Customization

Managing financial transactions can be a time-consuming process, especially for small businesses and freelancers. Having a standardized document to request payments helps ensure clarity and professionalism, making the entire process smoother for both you and your clients.

Instead of manually creating payment documents each time, utilizing customizable formats allows you to save time and reduce errors. These tools are designed to simplify the creation of professional-looking records that cover all essential details, from payment terms to itemized costs.

By leveraging such resources, you can improve the efficiency of your operations while maintaining a professional appearance. Whether you need to send one-time requests or set up recurring ones, these tools offer flexibility to suit a variety of needs.

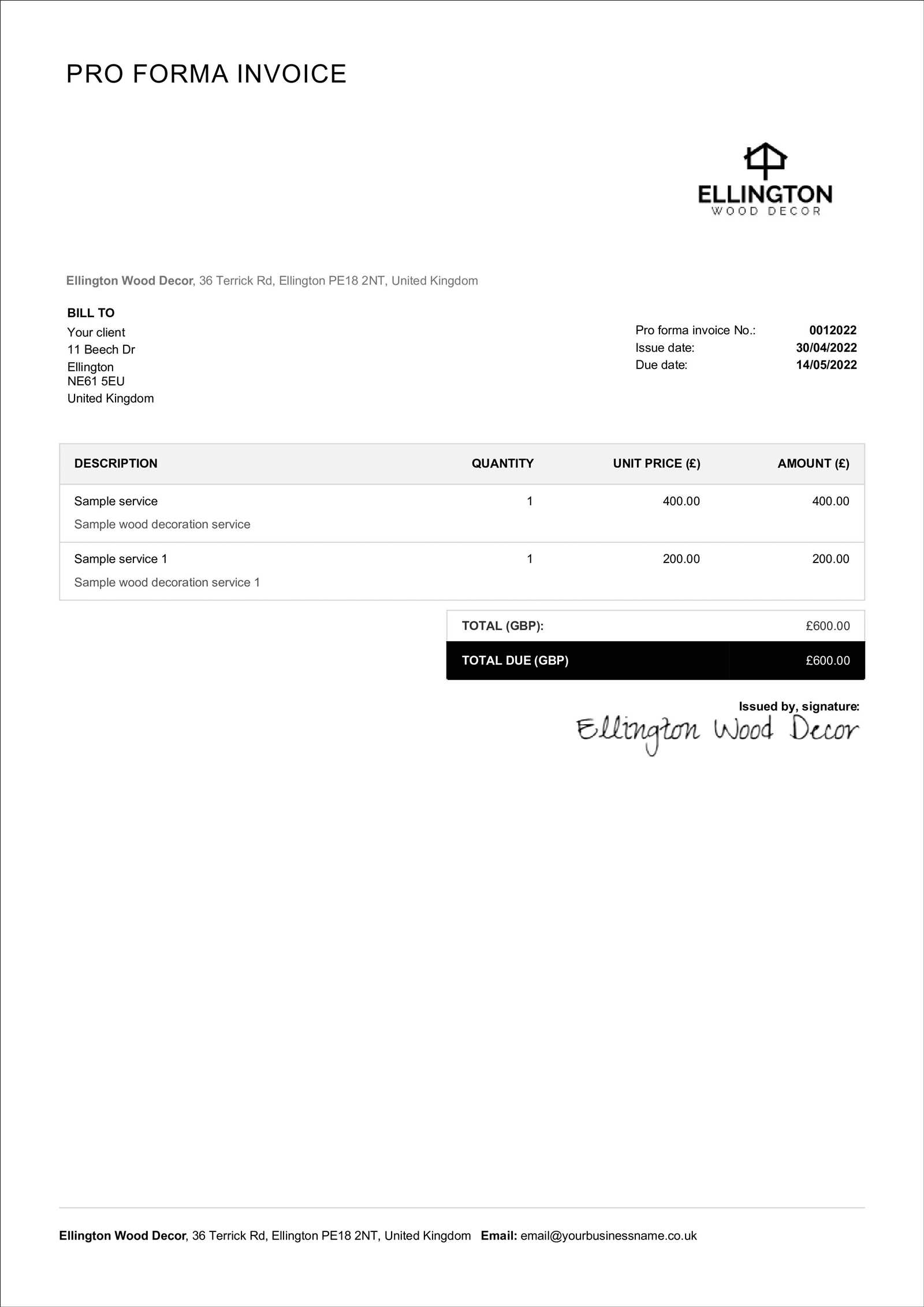

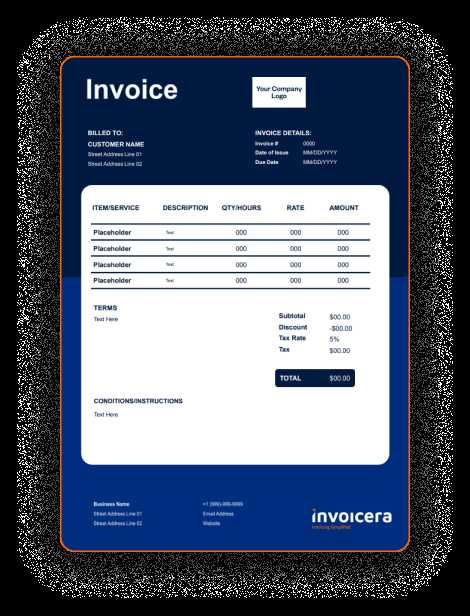

Free Online Billing Invoice Template

Creating consistent and professional payment requests can save time and prevent confusion. When running a business, having a ready-to-use document that clearly outlines transaction details is essential. This type of document helps in maintaining accuracy and ensuring that both parties are on the same page.

Why Use a Ready-Made Document?

Utilizing a pre-designed format simplifies the process of generating payment requests. These documents can be quickly personalized with specific details, which makes them ideal for businesses of any size. The key advantages include:

- Time-saving: No need to create a new document from scratch for each transaction.

- Professional presentation: Maintain a polished and consistent look for all outgoing payment requests.

- Accuracy: Clear layout ensures all essential details are included, minimizing errors.

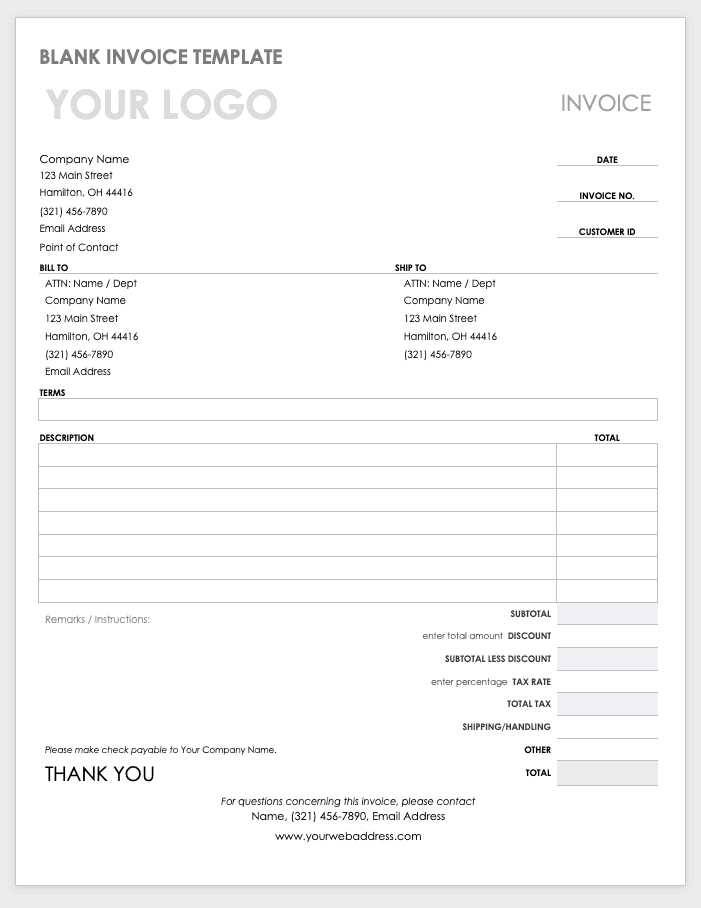

Features to Look for in a Payment Request Document

While choosing a document to request payments, it’s important to consider the features that will make the most difference in your workflow. Here are some essential aspects to look for:

- Customizability: The ability to adjust fields such as item descriptions, prices, and due dates.

- Clear formatting: A clean, easy-to-read layout that ensures all information is accessible at a glance.

- Recurring option: The ability to set up documents for recurring charges or subscriptions.

- Compatibility: Choose formats that are easily compatible with different devices or software.

Using a suitable format will allow you to spend less time on administrative tasks and more on growing your business. These documents can be tailored to meet specific needs, whether for a one-time project or long-term client relationships.

Why Use a Payment Request Document

Maintaining consistency and accuracy in financial transactions is crucial for any business. Using a standardized form to request payments helps ensure that all the necessary details are included and presented in a clear, professional manner. This not only saves time but also minimizes the risk of misunderstandings between you and your clients.

Key Benefits of Using a Pre-Designed Document

Using a ready-made document for payment requests brings several advantages to your workflow:

- Efficiency: Quickly generate professional requests without starting from scratch each time.

- Accuracy: Standardized sections reduce the chances of missing important details.

- Time-saving: Avoid the need for manual formatting, allowing you to focus on more pressing tasks.

- Consistency: Ensure that every payment request looks polished and follows the same structure.

How It Improves Your Business Transactions

By using such resources, you can streamline your financial operations. These forms are designed to cover all the necessary details for a smooth transaction, including payment terms, itemized costs, and due dates. A consistent and professional approach enhances your credibility and helps you build stronger relationships with clients.

- Enhances professionalism: A consistent layout reflects your business’ attention to detail and organization.

- Reduces errors: Clearly labeled fields help prevent mistakes, such as missing payment amounts or incorrect dates.

- Builds trust: Clients appreciate clear and well-structured documents, increasing their confidence in your business practices.

Benefits of Customizable Payment Request Documents

Having the ability to personalize your payment request forms brings a significant advantage, allowing you to tailor the document to fit specific business needs. Whether it’s adjusting the layout, adding new fields, or incorporating branding elements, customization offers flexibility to meet both functional and aesthetic requirements.

Why Personalization Matters

When creating payment requests, a personalized format ensures that all relevant details are clearly presented, helping to avoid misunderstandings. Here are the primary benefits of using customizable resources:

- Flexibility: Adapt the document to suit different services, projects, or customer preferences.

- Brand Consistency: Include your company logo, colors, and fonts to maintain a professional image.

- Increased Control: Tailor sections to include specific fields that match your unique business processes.

Enhancing Client Experience

When you use a customized document for requesting payments, clients receive a more personalized experience, which can positively impact their perception of your business. Key aspects include:

- Clear Communication: Clearly displayed terms, amounts, and descriptions enhance transparency.

- Convenience: Clients will appreciate the simplicity and consistency of the payment request layout.

- Professionalism: A well-designed, branded document shows attention to detail and builds trust.

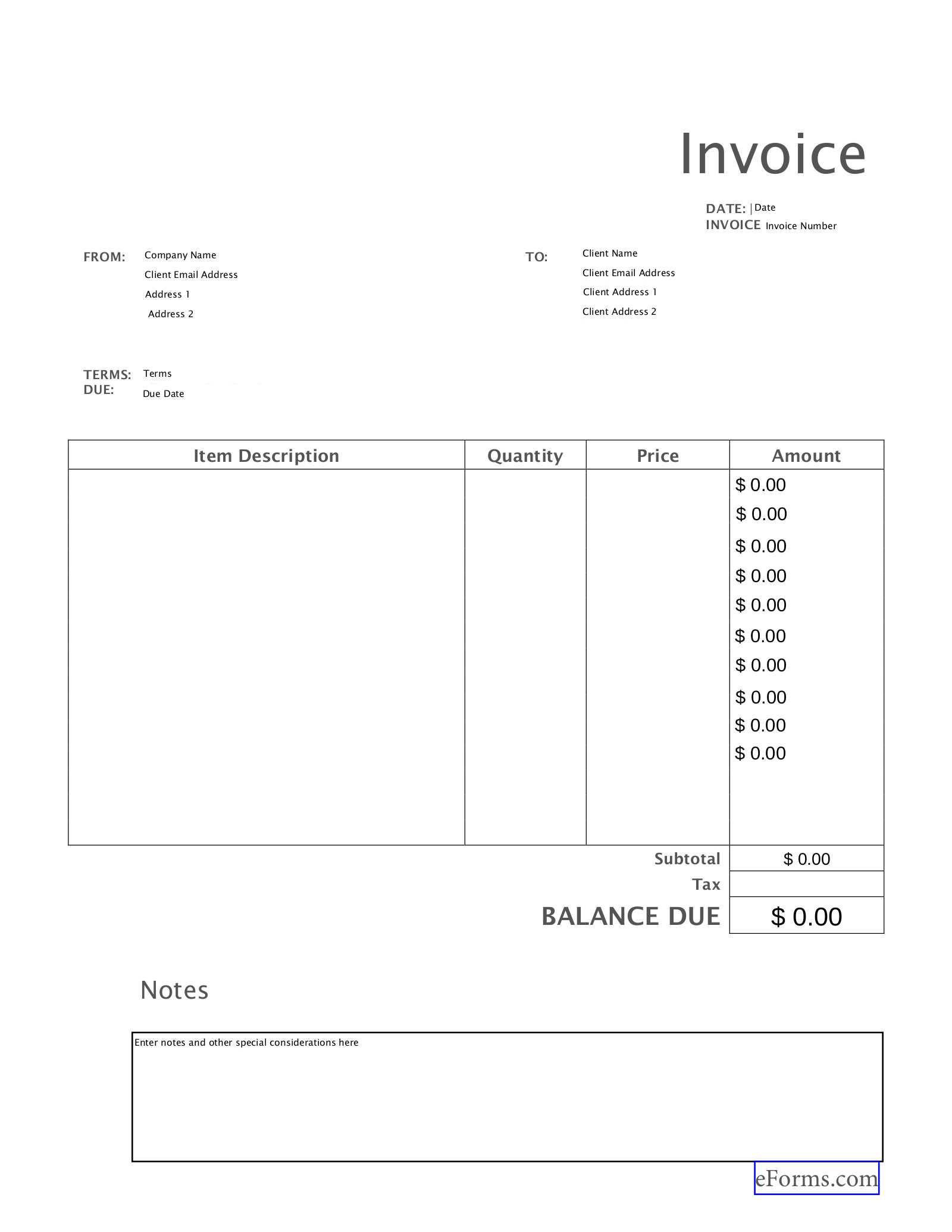

How to Download a Payment Request Form

Getting a pre-designed document for payment requests is a simple process. These ready-made forms are available from a variety of sources and can be easily downloaded for immediate use. The key is finding a reliable website that offers high-quality, customizable options that align with your needs.

Step-by-Step Guide to Download

Follow these straightforward steps to download and start using a payment request form:

- Choose a Trusted Source: Look for reputable websites that offer customizable documents tailored to different industries and needs.

- Browse Available Options: Explore the available selection to find a format that suits your business style and requirements.

- Download the Document: Click the download button to get the document in your preferred file format, such as PDF, Word, or Excel.

- Open and Customize: Once downloaded, open the file and fill in your company details, client information, and other relevant fields.

Considerations Before Downloading

Before downloading a form, ensure that it provides the features you need and fits your business style. Some things to consider include:

- File Format: Choose a file format that you can easily edit and update.

- Customization Options: Ensure the document is flexible enough for you to add or remove sections as needed.

- Design Quality: The layout should be professional and easy to read, making it clear for your clients.

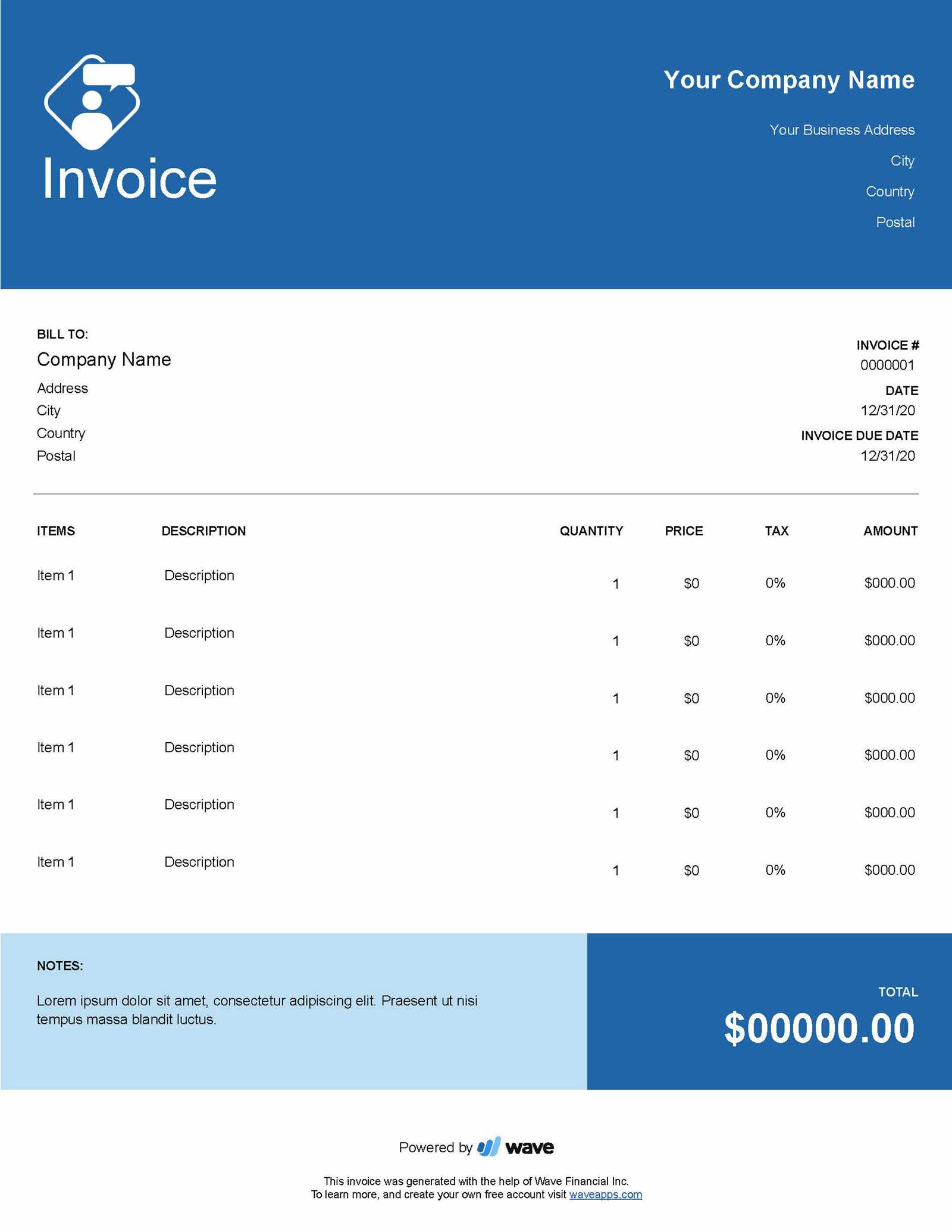

Choosing the Right Payment Request Document for Your Business

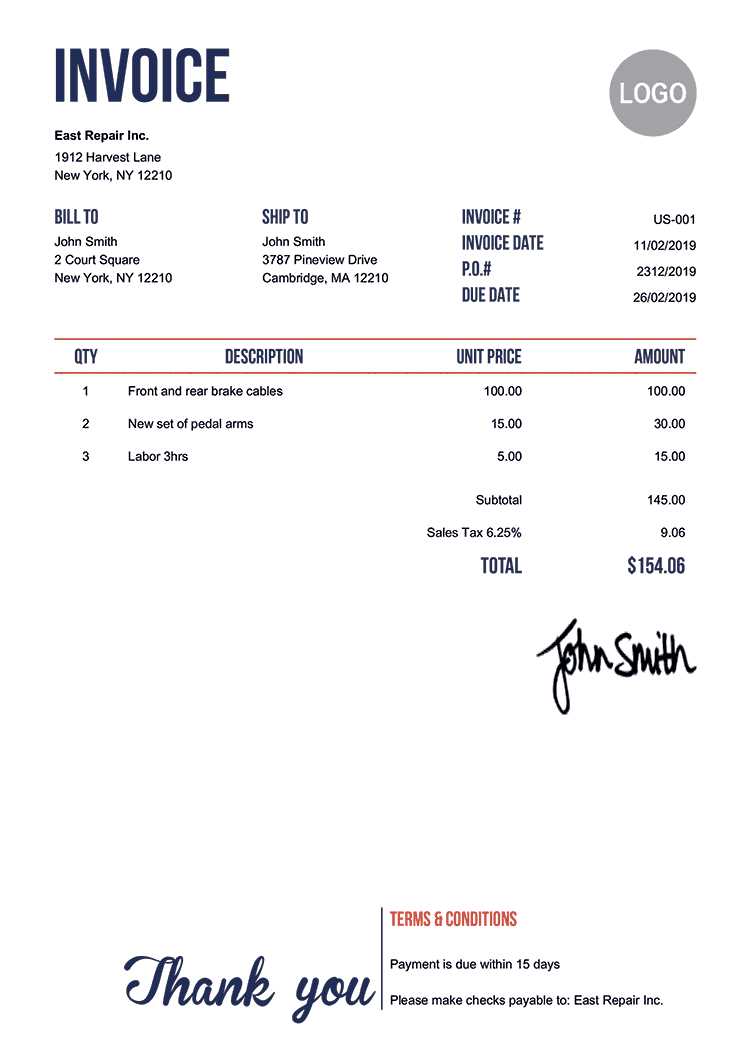

Selecting the right form for requesting payments is a crucial decision for any business. The document you use needs to reflect your company’s professionalism, meet legal requirements, and fit the specific needs of your industry. With a variety of formats available, it’s important to evaluate which one will provide the best functionality and presentation for your business operations.

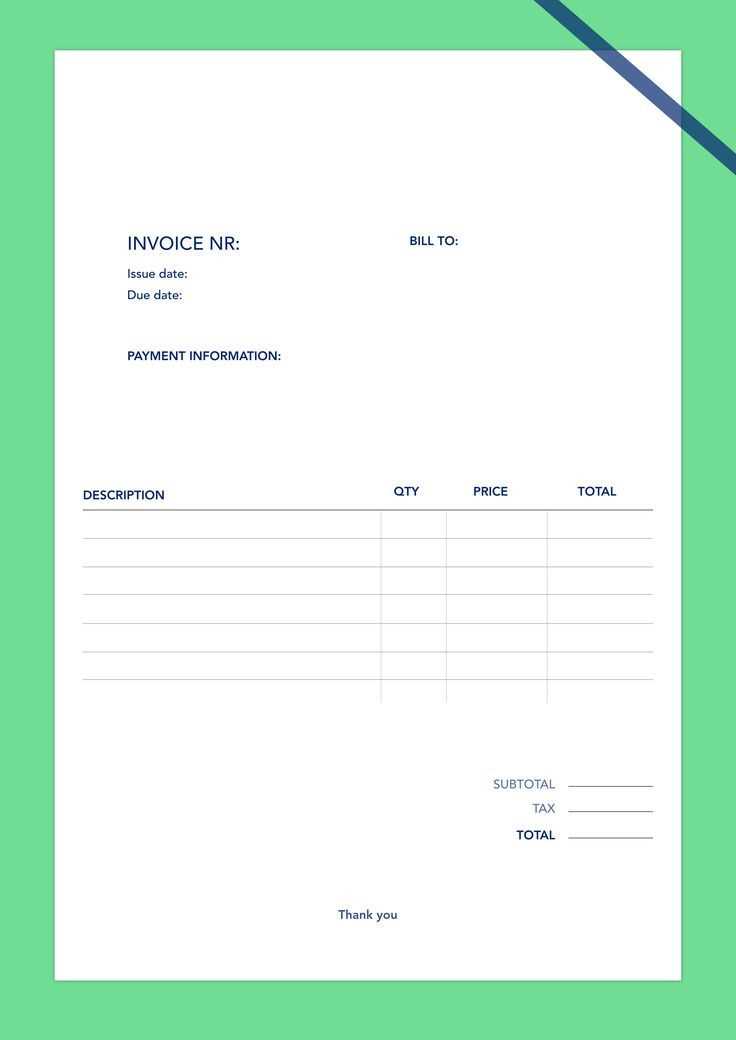

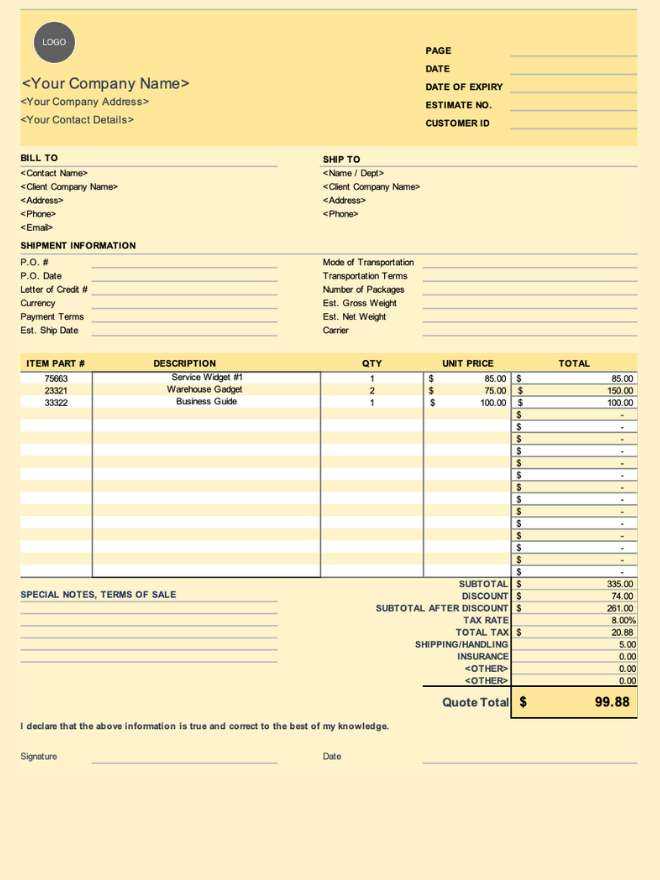

Consider Your Business Type

Different industries and business models have varying requirements for financial documents. It’s essential to choose a format that aligns with the nature of your work. Here are a few things to keep in mind:

- Service-Based Businesses: Choose a format that allows for detailed descriptions of services rendered, along with agreed-upon rates.

- Product-Based Businesses: Select a design that accommodates itemized lists of products, quantities, and prices.

- Freelancers: Look for simple formats that clearly outline your hourly rate, project scope, and payment terms.

Key Features to Look For

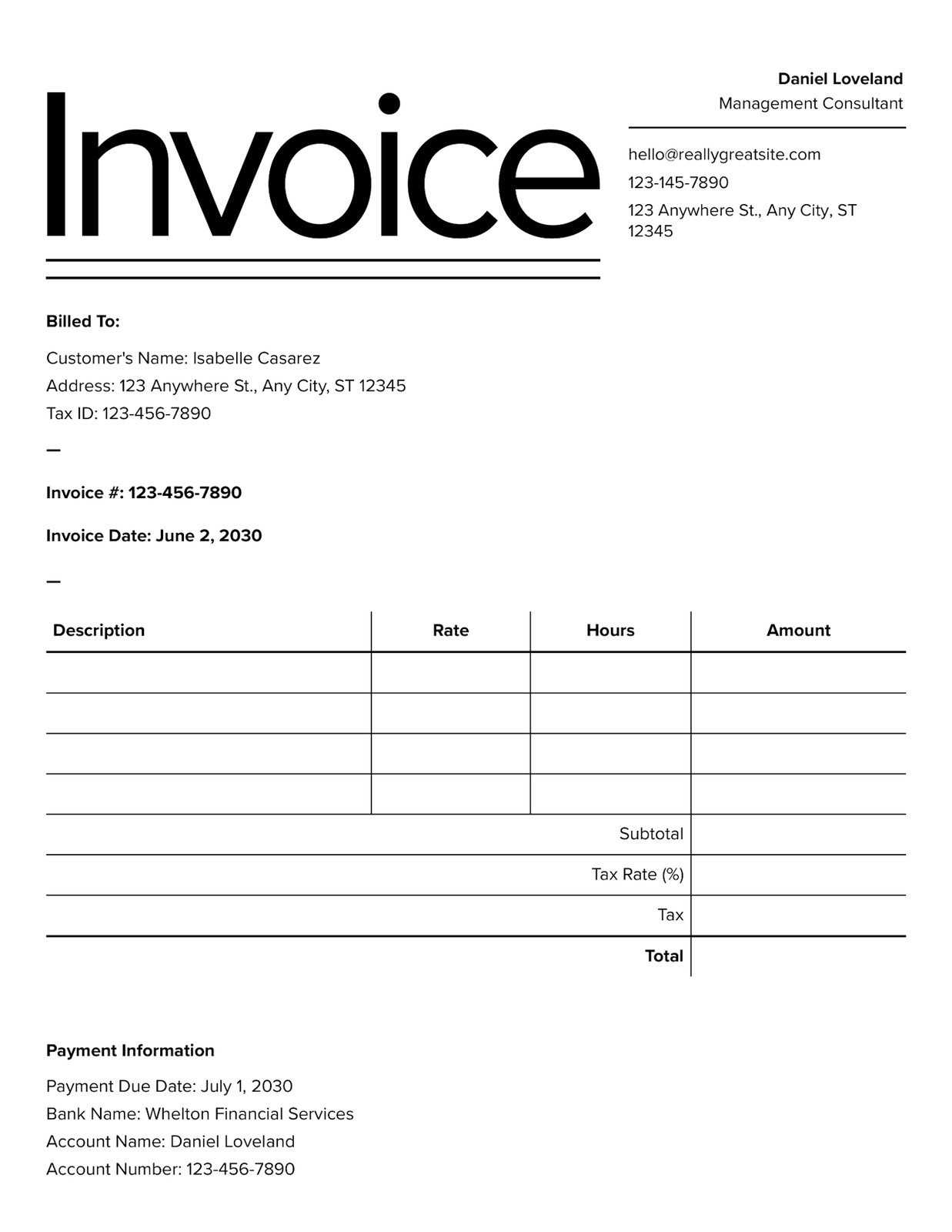

The right form should include several key features that make managing payments easy. These elements ensure that the document is comprehensive, clear, and professional:

- Customization: The ability to modify fields based on your specific needs, such as adding taxes, discounts, or project milestones.

- Professional Design: Choose a layout that is clean, simple, and easy to read. A polished document reinforces your brand identity.

- Legal Compliance: Ensure the document complies with any legal requirements specific to your location or industry.

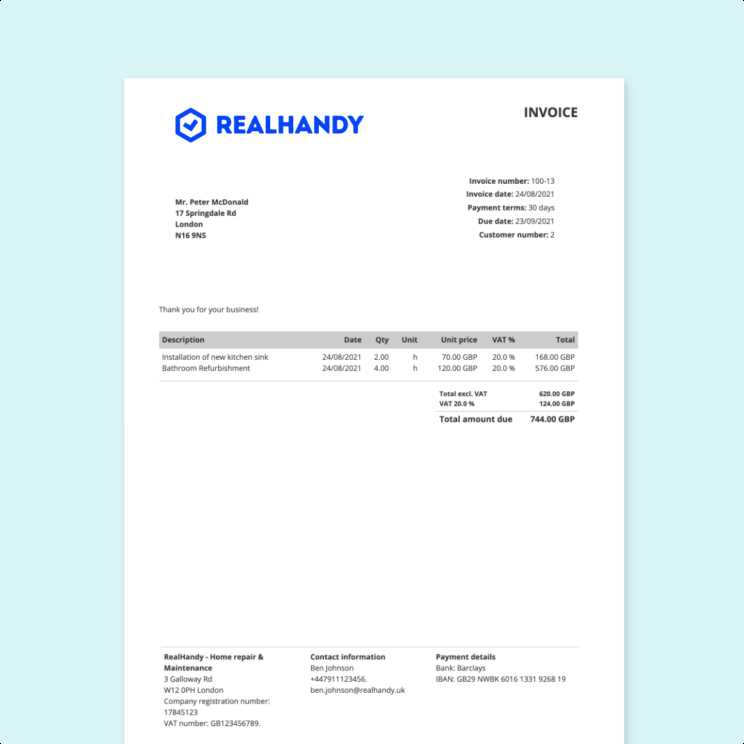

Basic Information Required on Payment Requests

For a payment request document to be effective, it must include essential details that clearly outline the terms of the transaction. Including all necessary information ensures that there is no confusion between you and your client, and it helps to streamline the payment process.

Essential Details to Include

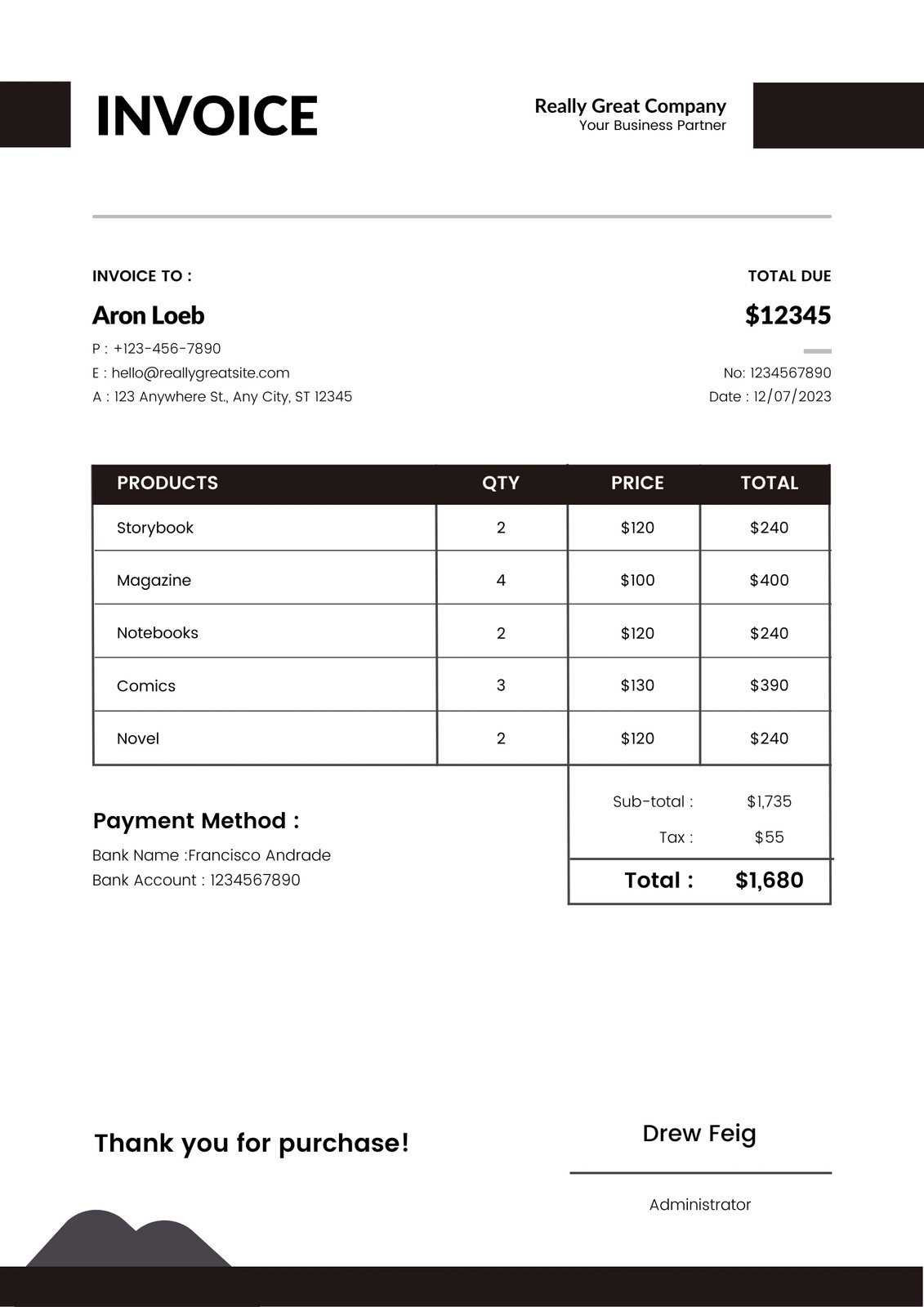

Here are the fundamental elements that should be part of every payment request document:

- Contact Information: Include the full name or business name, address, phone number, and email of both the payer and payee.

- Unique Document Number: Assign a unique reference number to each request for easy tracking and record-keeping.

- Issue and Due Dates: Clearly state the date when the payment request is issued and the due date for payment.

- Detailed Breakdown: Provide a clear description of the services or products provided, along with their corresponding prices.

- Payment Terms: Specify the payment methods accepted and any late payment penalties or discounts for early payment.

Additional Information to Consider

While the basics cover the essentials, there are other optional fields that can add clarity and professionalism to your document:

- Taxes and Discounts: Indicate applicable taxes, discounts, or any other adjustments to the final amount.

- Bank Account or Payment Link: If necessary, include your payment details, such as bank account information or online payment links for easier transactions.

- Terms and Conditions: Outline any contractual terms related to payment and other services or goods provided, if relevant.

How to Customize Your Payment Request Form

Customizing your payment request document allows you to tailor it to your specific business needs, helping to ensure clarity, professionalism, and functionality. By adjusting various elements, you can make the document reflect your brand and business practices, as well as meet the expectations of your clients.

Key Elements to Personalize

There are several important aspects you can modify to make the document more suited to your business:

- Company Information: Include your business name, logo, and contact details at the top to maintain a professional appearance.

- Document Layout: Adjust the structure, such as the position of text, sections for items or services, and overall design for readability.

- Payment Terms: Customize the payment terms to reflect your business policies, such as due dates, accepted payment methods, and late fees.

- Description Fields: Add or remove specific fields depending on the details you want to include, such as project milestones, taxes, or discounts.

Additional Customization Tips

Further customization can help improve client experience and create a more streamlined workflow for your business:

- Branding: Incorporate your business’s color scheme and fonts to create a cohesive brand image.

- Itemized Lists: If your business involves selling products, create a detailed breakdown of each item with quantities and unit prices.

- Legal Compliance: Ensure that the document meets legal requirements specific to your region or industry, such as including necessary tax information or terms of service.

Common Mistakes to Avoid in Payment Requests

When creating payment request documents, it’s essential to avoid common errors that can lead to confusion, delays, or even disputes. A well-organized and accurate document ensures a smooth transaction process and builds trust with your clients. Here are some frequent mistakes to watch out for when preparing these forms.

Key Errors to Avoid

Ensuring accuracy and clarity is critical. Here are the most common mistakes businesses make:

- Missing Contact Information: Omitting important contact details such as your business name, phone number, or email can lead to communication problems.

- Incorrect Amounts: Double-check the amounts for each item or service, as well as any taxes or discounts, to avoid errors that could lead to disputes.

- Unclear Payment Terms: Not specifying payment deadlines, methods, or late fees can cause confusion and delays in payments.

- Failure to Include a Unique Reference: Every request should have a unique identifier for tracking and reference purposes, which is often overlooked.

Additional Pitfalls

Beyond the key mistakes, there are a few other aspects to be cautious about:

- Not Updating Regularly: If you don’t revise the document template periodically, you may miss out on adding new fields or necessary changes to reflect your business’s evolving needs.

- Unprofessional Design: Using complicated layouts or cluttered designs can make your document look unprofessional and difficult to understand. A clean, simple design is always more effective.

- Omitting Legal Information: Ensure that the document complies with all legal requirements, including tax identification numbers or terms and conditions, where applicable.

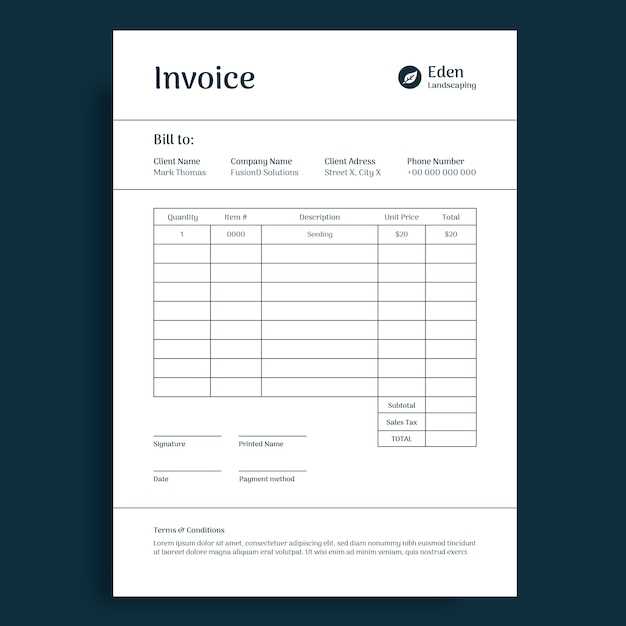

Tips for Professional Payment Request Design

A well-designed payment request document not only ensures clarity but also reflects your business’s professionalism. The design plays a crucial role in how your clients perceive your services or products, and it can influence how quickly they process payments. A clean, organized, and visually appealing layout makes it easier for clients to understand the details and makes your brand look more credible.

Essential Design Elements

To create a polished and functional document, focus on the following key design elements:

- Simplicity: Avoid clutter by keeping the layout simple and easy to follow. Too many elements can make the document look chaotic and unprofessional.

- Branding: Incorporate your business logo, colors, and fonts to maintain consistency with your other materials, like business cards or websites.

- Readability: Use clear headings, bullet points, and ample white space to make the document easy to read and scan quickly.

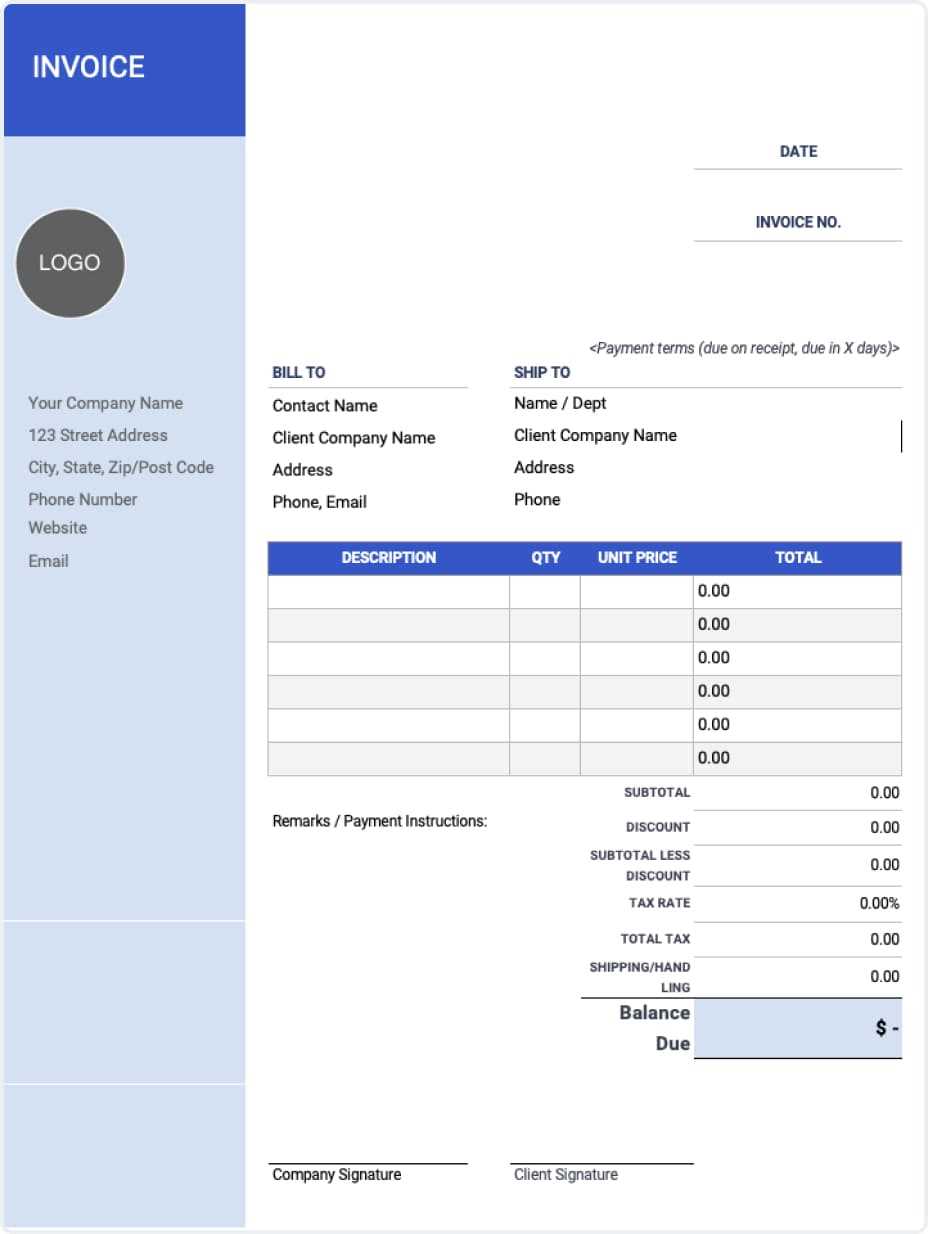

Organized Layout

A structured layout makes it easier for your clients to locate important information, such as amounts due and payment terms. Consider using tables to clearly organize the data:

| Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Consultation Fee | 1 | $150.00 | $150.00 |

| Web Design Services | 3 | $250.00 | $750.00 |

| Total | $900.00 |

Using this type of structured layout helps clients quickly understand the breakdown of costs and ensures a more professional appearance.

How to Save Time with Pre-designed Forms

Efficiently managing financial documents is crucial for any business. By utilizing pre-designed forms, you can eliminate repetitive tasks and focus more on critical aspects of your operations. These ready-to-use structures help you quickly input details and ensure consistency across all your records, saving you time and effort in the long run.

Key Time-saving Benefits

Using pre-designed forms offers numerous advantages that significantly reduce the time spent on manual document creation:

- Reduced Repetition: Once you’ve set up a basic form, you don’t have to recreate it from scratch each time, speeding up the process.

- Consistency: Using the same layout and structure for all your documents ensures uniformity, making them easier to review and process.

- Fewer Errors: With pre-built fields and structure, you reduce the chance of missing crucial details or making mistakes in formatting.

How to Use Pre-designed Forms Effectively

To make the most of ready-to-use forms, follow these tips:

- Customize Fields: Adjust fields to suit the specific needs of your business, whether it’s adding extra sections or rearranging details.

- Save as a Master Copy: Keep a master copy that includes your business logo, address, and other essential information. This will allow you to quickly update only the necessary details, like client names and amounts.

- Automate Repetitive Tasks: Many tools allow you to automate parts of the process, such as calculating totals or adding up taxes, saving you even more time.

Example of a Pre-designed Structure

Here’s an example of a simplified layout that you can use to save time:

| Item/Service | Quantity | Unit Price | Total |

|---|---|---|---|

| Consultation | 1 | $100 | $100 |

| Web Development | 5 | $200 | $1000 |

| Total | $1100 |

With this layout, you can easily update quantities, prices, or services, ensuring a quick turnaround every time.

Understanding Different Payment Request Formats

Choosing the right document format for financial transactions is essential for maintaining clarity and professionalism. Various formats cater to different business needs, and understanding these options can help streamline your processes. Each format has its unique features, and selecting the most suitable one can improve communication with clients and ensure accurate record-keeping.

Common Formats for Financial Requests

Different formats serve different purposes, whether you’re requesting payments for services, goods, or ongoing contracts. Here are a few of the most widely used types:

- Standard Request: This is the most common format, where you list services or products with their corresponding prices and totals. It’s simple and effective for one-time transactions.

- Recurring Request: Used for regular, ongoing services, this format includes automatic dates and amounts to be billed at specified intervals.

- Proforma Document: This type of request outlines expected charges but is often used for advance payments or estimates before the actual transaction occurs.

Factors to Consider When Choosing a Format

When selecting a format, consider the following factors:

- Type of Service or Product: The nature of what you’re offering may influence whether you need a one-time request or a recurring one.

- Payment Terms: If your terms include installments or multiple phases, you may prefer a detailed breakdown over a more basic request.

- Client Preferences: Some clients may have preferred formats for record-keeping or internal processing, so it’s important to accommodate their needs where possible.

By understanding these different formats, you can make informed decisions that save time and ensure clear communication with clients.

Tracking Payments with Structured Forms

Monitoring payments efficiently is an integral part of maintaining a healthy cash flow. Using structured forms to record transactions ensures that all payments are documented correctly, making it easier to track outstanding balances and reconcile accounts. By integrating tracking elements into your forms, you can streamline the payment management process, reduce errors, and maintain better control over your financial records.

Key Features for Effective Payment Tracking

Incorporating the right tracking elements into your documents can help you manage payments more effectively. Some of the key features to include are:

- Payment Due Date: Clearly specifying the due date helps avoid late payments and keeps both parties accountable.

- Payment Status: Including a field for tracking whether the payment has been made, is pending, or overdue helps keep your records organized.

- Unique Reference Numbers: Assigning reference numbers to each payment request makes it easier to cross-reference payments and identify specific transactions.

- Payment Method: Noting the payment method used (e.g., credit card, bank transfer) can help with reconciliation and tracking funds.

How to Update Payment Status Efficiently

Keeping track of payment statuses can be simplified by following these steps:

- Update Regularly: After receiving each payment, promptly update the status in your records to avoid confusion.

- Automate Reminders: Set up automatic reminders or notifications for payments that are approaching their due date or overdue.

- Provide Clear Instructions: Make sure your clients understand how and when to make payments, as well as any late fees or penalties for overdue balances.

By implementing these strategies into your forms, you can streamline the process of tracking payments, ensuring your financial records are always up to date.

How to Add Tax and Discounts

In many transactions, adding taxes or offering discounts is essential to reflect the true cost of goods or services. Properly including these elements ensures transparency and accuracy in your financial records, and can also help you comply with local regulations. This section outlines how to properly incorporate taxes and discounts into your documents to ensure clarity for both you and your clients.

Adding Taxes to Your Financial Records

When applying taxes, it is important to calculate the appropriate amount and clearly display it to avoid confusion. Follow these steps:

- Determine the Tax Rate: Identify the applicable tax rate for your product or service, as it may vary depending on location or type of transaction.

- Calculate the Tax Amount: Multiply the total price of the goods or services by the tax rate to determine the amount to be added.

- Clearly Display Tax: Show the tax amount as a separate line item, making it easy for clients to see how much tax is being charged.

- Include Tax Identification: If applicable, include your tax identification number to ensure compliance with local tax authorities.

Incorporating Discounts into Your Documents

Offering discounts can be an effective way to incentivize payments or reward loyal clients. Here’s how to add discounts to your documents:

- Specify Discount Terms: Clearly define the type of discount (e.g., percentage off, fixed amount) and the conditions for eligibility.

- Apply Discount Before Tax: If applicable, apply the discount to the subtotal before calculating any taxes to ensure proper pricing.

- Show Discount Clearly: Indicate the discount amount and the percentage or fixed rate used, ensuring transparency for the client.

By including taxes and discounts clearly and accurately, you provide a transparent and professional service while maintaining compliance and improving customer satisfaction.

Sending Invoices Online Efficiently

Sending payment requests through digital channels can save time and increase convenience for both you and your clients. By using electronic methods, you can ensure that your transactions are completed faster and more securely. Efficiently managing this process can help reduce delays, improve client satisfaction, and streamline your workflow.

Steps for Sending Digital Payment Requests

To send payment requests quickly and professionally, follow these steps:

- Choose a Reliable Platform: Use a secure and trusted platform to send your documents to ensure they are delivered safely and promptly.

- Ensure Proper Formatting: Make sure your documents are well-organized and formatted in a way that is easy to read and understand.

- Include All Relevant Details: Double-check that the document contains all the necessary information, such as amounts due, due dates, and payment methods.

- Send with Tracking: Consider using services that provide delivery confirmation or tracking so you can verify that the recipient has received your payment request.

Benefits of Sending Requests Digitally

Digital transmission offers several advantages over traditional methods:

- Faster Processing: Digital delivery ensures immediate receipt, reducing wait times compared to postal mail.

- Improved Record Keeping: Electronic copies are easy to store, search, and retrieve when needed for future reference or reconciliation.

- Enhanced Security: Sending via encrypted channels ensures that sensitive financial details are kept safe from unauthorized access.

By adopting electronic methods for sending payment requests, you can enhance the efficiency of your operations while providing better service to your clients.

How to Ensure Invoice Accuracy

Maintaining accuracy in payment requests is critical for ensuring smooth transactions and preventing misunderstandings with clients. A well-detailed and error-free document helps avoid delays in payment, fosters professionalism, and improves your credibility with customers. There are several practices you can follow to verify that the details provided in each document are correct before sending it out.

Key Steps for Ensuring Accuracy

Follow these essential practices to double-check and confirm the precision of your documents:

- Review Basic Information: Ensure that the names, addresses, and contact information for both you and your client are up to date and accurate.

- Verify Payment Details: Double-check the amounts, taxes, and any discounts to ensure they match the agreed terms. This includes cross-referencing with previous contracts or agreements.

- Include Proper Dates: Confirm that the issue date and due date are correctly stated. Missing or incorrect dates can lead to confusion or delayed payments.

- Cross-Check Itemization: If applicable, verify that all items or services are listed correctly, with the proper descriptions, quantities, and rates.

Tools to Improve Accuracy

To further improve the precision of your documents, consider using these tools:

- Automated Calculations: Use software or tools that automatically calculate totals, taxes, and discounts to minimize human error.

- Templates with Pre-Set Fields: Utilize pre-made layouts that have standardized fields, reducing the chances of missing essential details.

- Verification Software: Some platforms offer real-time validation to check for errors, such as mismatched totals or invalid contact details.

By implementing these steps and tools, you can significantly reduce the likelihood of errors, ensuring that each document you send is both clear and accurate.

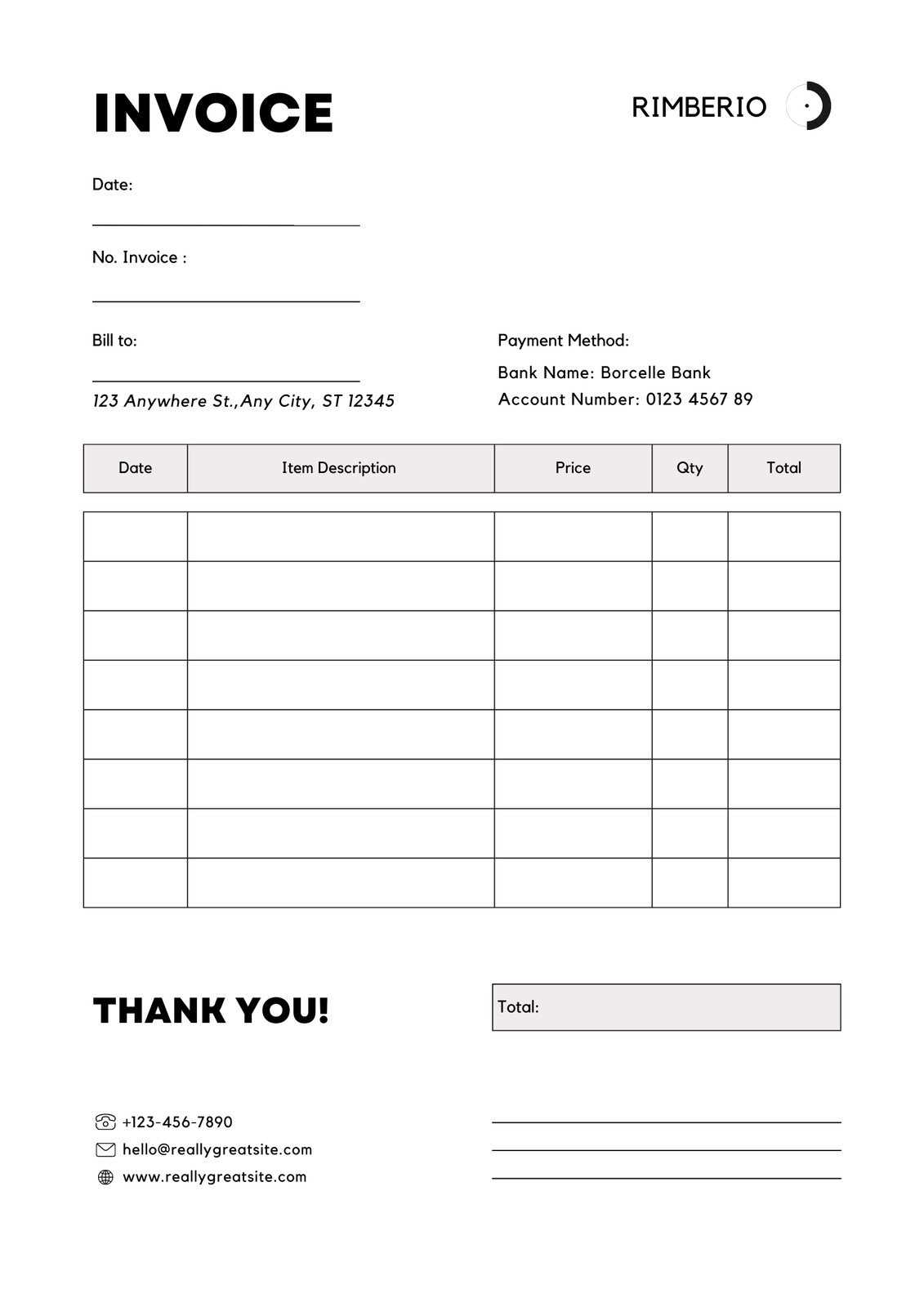

What to Include in an Invoice Footer

The footer of a payment request document is an essential part that should not be overlooked. It serves as the final section that can include important information that clients may need for future reference or payment processing. A well-structured footer can help ensure clarity and provide additional details that strengthen the overall communication of your business transaction.

Key Elements to Include

Here are the key components to consider adding to the footer of your document:

- Payment Instructions: Provide clear and concise directions on how clients can complete the payment. This may include bank account details, online payment methods, or other relevant instructions.

- Late Payment Terms: It’s helpful to include any applicable late fees or penalties for overdue payments. Be sure to specify the time frame in which payments are considered late.

- Thank You Note: Including a short, polite message expressing gratitude for the client’s business can leave a positive impression.

- Contact Information: Ensure that your contact details, such as phone numbers, email addresses, or customer service links, are easily visible in case the client needs to reach out.

- Legal Terms: If necessary, include any terms and conditions related to the sale or transaction. This can help clarify any legal aspects of the agreement.

Additional Considerations

Depending on your business and the nature of the transaction, you may want to include other specific information in the footer, such as:

- Discount Terms: If discounts or promotional offers apply, state the details or any restrictions regarding their use.

- Currency Information: Make sure to specify the currency used for the transaction, especially if you are dealing with international clients.

Including these elements in the footer not only adds professionalism but also ensures that your clients have all the information they need to process the payment smoothly and efficiently.

Creating Recurring Invoices with Templates

Automating payment requests for regular transactions can save a significant amount of time and effort. By setting up documents that automatically reflect recurring charges, you can streamline your accounting process and ensure that clients are billed promptly and consistently. A structured document designed to be reused at specific intervals can help maintain an organized record of ongoing services or subscriptions.

Setting Up Recurring Payment Requests

To create an effective schedule for ongoing payments, follow these steps:

- Define the Frequency: Establish how often the charges occur–whether it’s weekly, monthly, quarterly, or annually. This will help you set a fixed cycle for the recurring entries.

- Automate Details: Ensure that the basic details, such as services provided, amounts, and due dates, are pre-filled in the document. This reduces the time spent on data entry each time the document is sent.

- Specify Payment Methods: Include a clear method of payment for each transaction cycle, whether through credit cards, bank transfers, or any other accepted method.

Advantages of Using Pre-Designed Formats

By utilizing pre-designed documents, you can:

- Reduce Errors: Pre-set fields and details help minimize mistakes that can occur when manually creating documents each time.

- Ensure Consistency: The structure remains uniform with each billing cycle, making it easier for clients to recognize and process.

- Save Time: With key information already included, generating new documents for the next cycle becomes a much quicker task.

With these recurring payment setups, businesses can create an efficient system for managing regular charges without needing to start from scratch each time.

Where to Find More Free Templates

When you need to generate professional-looking documents for your business or personal use, it’s helpful to know where to find well-structured formats that save you time and effort. Many resources are available to help you create and download customizable documents that meet your specific needs. Whether you’re looking for a simple layout or a more detailed design, there are plenty of places to find reliable options.

1. Websites Offering Document Creation Tools

There are several websites that offer comprehensive document creation platforms. These sites allow users to create, modify, and download various forms to suit their needs. Some of the most popular sites include:

- Canva – A user-friendly platform with a variety of customizable designs.

- Google Docs – Provides a collection of reusable layouts for various business documents.

- Zoho – Known for offering simple and customizable business-related document solutions.

2. Document Libraries and Marketplaces

If you’re looking for a wider variety of professional designs, marketplaces and document libraries might be the best choice. These platforms often offer pre-built layouts that cater to different industries and professions. A few examples include:

- Template.net – Offers a large range of documents for various business needs, including easily customizable options.

- Envato Elements – A subscription-based service providing access to a wide range of design resources, including document formats.

- Microsoft Office Templates – The official library offers a variety of forms suitable for both personal and business purposes.

3. Open Source and Community-Driven Platforms

Another great place to explore is open-source platforms where users can upload and share their creations with others. These resources are especially useful if you are looking for specific designs or formats that cater to niche needs. A couple of open-source platforms to check out include:

- GitHub – Some users share their document designs on GitHub, allowing others to download and adapt them freely.

- OpenOffice – Similar to Microsoft Word, OpenOffice provides a range of templates for free download.

By exploring these resources, you’ll find a variety of customizable documents that suit your business or personal needs, saving you time and effort in creating them from scratch.