Freelance Makeup Artist Invoice Template for Easy Billing

Running a beauty business requires not only skill but also organization. A smooth billing system is essential to ensure you get paid on time and maintain professional relationships with clients. Whether you offer hairstyling, makeup services, or other beauty treatments, having a structured way to present charges and terms is crucial for keeping everything in order.

One of the most effective ways to stay organized is by using a well-designed document that outlines the details of the work completed, the cost, and the payment method. This document helps you track your earnings and keeps your clients informed. Customizable options allow you to adapt the format to your specific needs while ensuring that all necessary information is included clearly.

By focusing on clarity, simplicity, and professionalism, you can eliminate any confusion around pricing or payment schedules. This not only makes your work easier but also boosts your credibility and trustworthiness with clients, leading to more business and smoother transactions overall.

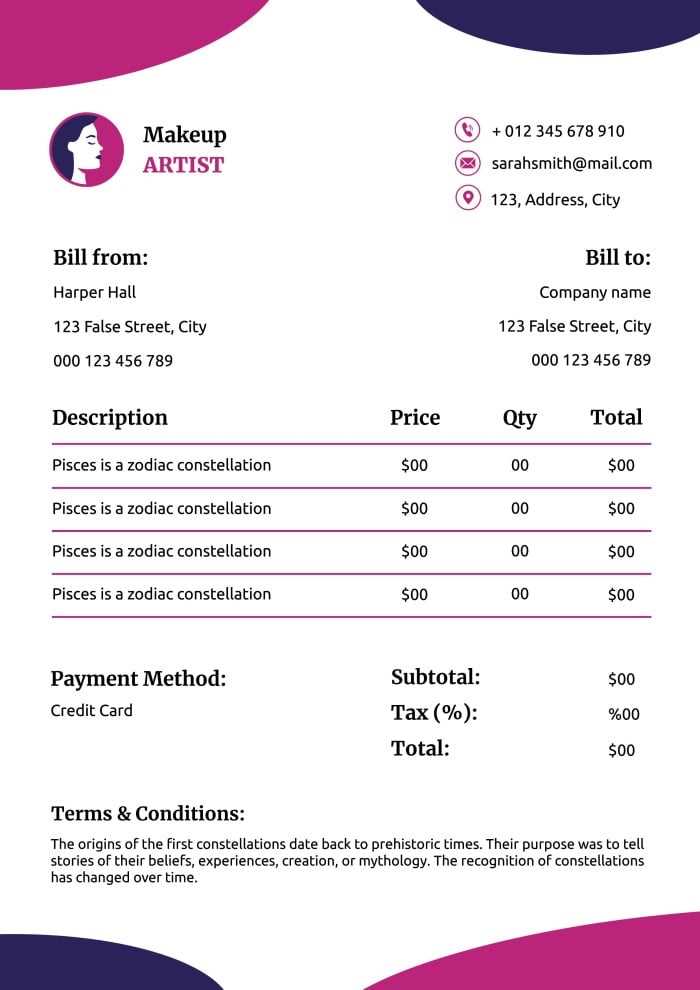

Freelance Makeup Artist Invoice Template

For anyone providing beauty services, a professional way to document transactions is essential. A well-structured document not only ensures clear communication with clients but also helps you maintain an organized record of your work and payments. This tool allows you to track services rendered, calculate total charges, and provide your clients with a transparent overview of their bill.

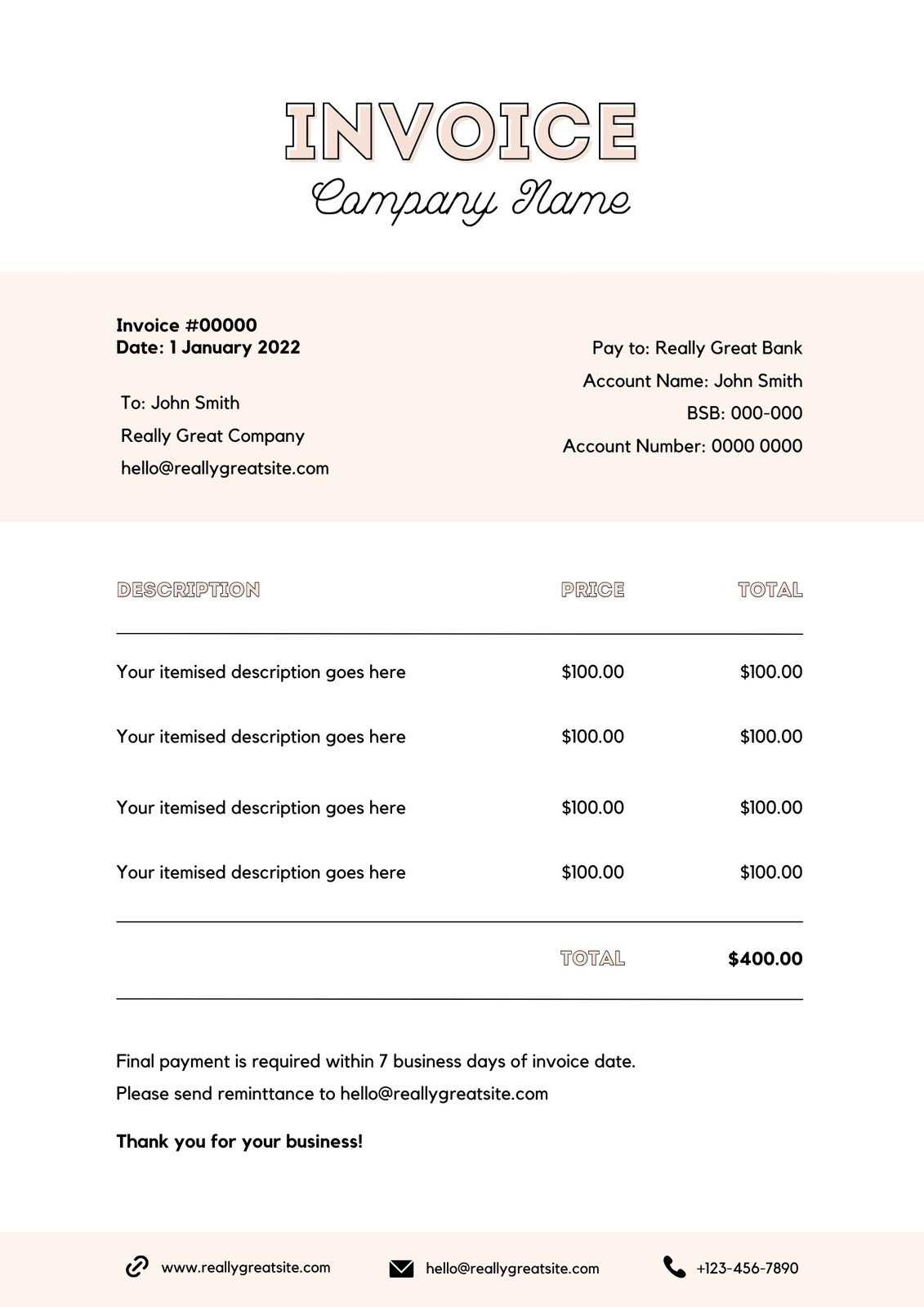

When creating such a document, it’s important to include the following key components:

- Client Information: Include the client’s full name, contact details, and address.

- Service Description: List the specific services provided, such as hairstyling, makeup application, etc.

- Date of Service: Clearly state when the service was performed.

- Itemized Pricing: Break down the cost for each individual service, if applicable.

- Total Amount Due: Clearly display the total charge for all services rendered.

- Payment Terms: Outline when the payment is due, any late fees, and accepted payment methods.

By organizing these details, you ensure both clarity and professionalism. Additionally, a customizable format lets you adapt the document to fit your specific needs, whether you are charging per hour, per session, or based on a set package.

Utilizing this type of document not only helps in streamlining the financial aspect of your business but also fosters trust with your clients by making the billing process transparent and efficient.

Why You Need an Invoice Template

For anyone offering professional services, having a structured way to request payment is essential. A consistent document for billing ensures clarity, reduces errors, and helps establish credibility with clients. This approach allows you to maintain organized records of your services and payments, making it easier to manage finances and avoid misunderstandings.

Benefits of Using a Structured Document

- Clear Communication: A professional layout outlines exactly what was provided, the cost, and the payment due date.

- Time Efficiency: With a pre-designed structure, you save time on every transaction, focusing more on your work than administrative tasks.

- Legal Protection: A formalized bill serves as proof of the agreement and may be helpful in case of disputes.

- Consistency: Using the same format for all clients ensures a uniform, professional approach to billing.

How It Helps with Financial Organization

- Easy Record-Keeping: By keeping track of your service details and payment schedules, you can monitor your cash flow and outstanding balances.

- Tax Reporting: Having a well-documented billing history simplifies tax filing and helps track deductible expenses.

- Client Tracking: A systemized approach enables you to see your client history, payment patterns, and any follow-up needs.

How to Create a Professional Invoice

Creating a well-organized payment request document is essential for maintaining a professional image and ensuring smooth transactions with clients. A clear and detailed statement of charges helps avoid confusion, ensures timely payments, and fosters trust with your customers. Here’s a step-by-step guide on how to craft an effective billing statement.

Step 1: Include Basic Information

- Your Business Details: Make sure to include your name or company name, address, phone number, and email. This helps clients easily contact you if necessary.

- Client’s Information: Include the full name, contact details, and address of the client to ensure clarity and proper record-keeping.

- Document Title: Clearly mark the document as a “Payment Request,” “Bill,” or “Statement” so there is no ambiguity.

Step 2: Outline Services Provided

- Detailed Service List: Itemize each service or product provided, specifying the exact nature of the work done. This helps the client understand what they are being charged for.

- Hourly Rate or Fixed Pricing: Clearly state whether you are charging by the hour or offering a fixed price for each service or package.

- Date of Service: Make sure to list the date when the service was provided to avoid confusion.

Step 3: Specify Payment Terms

- Due Date: Clearly state when the payment is expected, and specify any late fees for overdue payments.

- Accepted Payment Methods: Include options such as bank transfers, credit card payments, or online payment systems.

- Any Discounts or Promotions: If you’ve offered any special pricing, be sure to list those details as well.

By following these steps, you create a professional and transparent document that clearly communicates expectations and terms, helping to build trust and avoid misunderstandings with your clients.

Essential Information for Your Invoice

To ensure that clients receive clear and accurate billing, certain key details must be included in every payment request document. Providing complete and precise information not only helps avoid misunderstandings but also establishes a professional standard in your business dealings. Below are the crucial elements that should always be part of your financial statements.

- Your Contact Information: Include your full name or business name, phone number, email address, and physical address. This allows clients to easily reach out to you if needed.

- Client’s Information: Ensure that the client’s name, address, and contact details are correctly listed. This helps keep records organized and personalized.

- Service Details: Describe the services you provided, being as specific as possible. This could include the type of work performed, duration, or any additional items involved.

- Date of Service: Clearly note the date when the service was completed or the product was delivered. This helps prevent confusion and helps both parties track the timeline.

- Payment Amount: Include a breakdown of costs, showing the price for each service or product. It is important to be transparent with your pricing.

- Payment Terms: Specify when payment is due and any late fees or discounts that may apply. Clients will appreciate knowing when they are expected to settle the bill.

- Payment Methods: Include accepted payment options (such as bank transfer, credit card, or online platforms), making it easier for clients to pay you promptly.

By including these fundamental elements, you ensure that the document is both professional and informative, giving your clients all the necessary details to process their payment with ease.

Customizing Your Payment Request Document

Personalizing your billing document is essential to reflect your business’s unique style and specific needs. A customized approach helps build a stronger brand identity and ensures that all necessary details are tailored to your services. Whether you’re adjusting the layout, adding branding elements, or including additional charges, a personalized statement is key to providing a professional experience for your clients.

Adding Your Branding

One of the easiest ways to customize your billing document is by incorporating your logo and business colors. This not only makes the document more visually appealing but also reinforces your brand identity. A consistent design across all business documents helps establish professionalism and familiarity with clients.

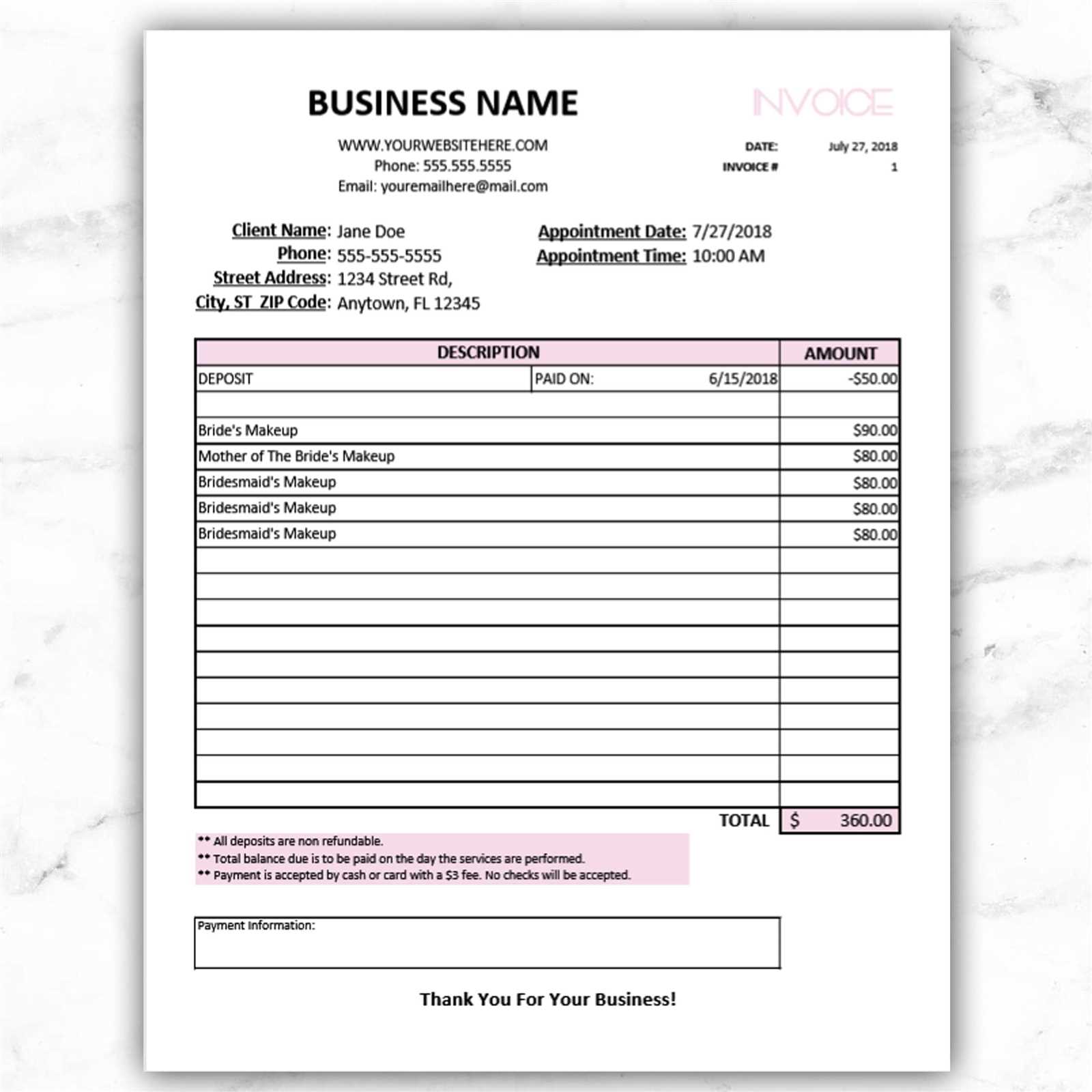

Including Extra Details or Charges

Sometimes, additional costs such as travel fees, materials, or special requests need to be included. You can create specific sections in the document to cover these extras, ensuring that the client understands exactly what they are being charged for. Below is an example layout that includes customizable sections for standard services and additional fees.

| Service Description | Quantity | Price | Total |

|---|---|---|---|

| Basic Service | 1 | $100 | $100 |

| Travel Fee | 1 | $20 | $20 |

| Additional Products | 2 | $15 | $30 |

| Total | $150 |

This customizable format helps clarify exactly what services were provided and how each charge is calculated, improving transparency and client satisfaction.

Common Mistakes to Avoid in Payment Requests

Creating a billing document may seem simple, but even small errors can lead to confusion, delayed payments, or strained client relationships. Ensuring accuracy and professionalism in your financial documentation is essential to maintain trust and avoid unnecessary issues. Below are some common mistakes to watch out for when preparing your payment requests.

- Missing Contact Information: Not including your full contact details or the client’s information can create confusion or delays. Always ensure that both parties’ names, addresses, and contact information are listed correctly.

- Unclear Service Descriptions: Avoid vague or overly general descriptions of the services provided. Specify exactly what was done, including any special requests or additional work completed to avoid misunderstandings.

- Incorrect Pricing: Double-check the pricing for each service or item. An incorrect rate or math mistake can lead to disputes or delayed payments. Always ensure your pricing is clear and reflects any agreed-upon terms.

- Missing Due Date: Failing to include a due date on the document can cause confusion about when the payment is expected. Clearly state when the payment is due and any penalties for late payments.

- Not Specifying Payment Methods: Always indicate the acceptable methods of payment. Whether it’s bank transfer, credit card, or another method, make sure the client knows how they can pay.

- Omitting Terms and Conditions: Payment terms, such as late fees or discounts, should be clearly stated. If you don’t specify these details, it may lead to misunderstandings about payment expectations.

Avoiding these common errors will help you create clear, accurate, and professional billing documents, leading to smoother transactions and stronger relationships with your clients.

How to Format Your Payment Request

Properly formatting your billing document is essential for making it both professional and easy to understand. A clear, organized layout helps ensure that all necessary information is presented logically and that clients can quickly review the details. By following a few simple formatting guidelines, you can create a document that is both visually appealing and easy to navigate.

First, ensure that your document is structured in a way that flows naturally. Start with your business name, contact information, and the client’s details at the top. Follow this with the list of services provided, including a breakdown of costs. Be sure to clearly separate each section to avoid clutter and ensure readability.

Key Elements to Include

- Header: Your business name or logo should be prominent at the top, followed by your contact details and the client’s information.

- Service List: Include an itemized list of the services provided, with clear descriptions and prices for each item. Group related services together for better clarity.

- Total Amount: Always highlight the total cost at the bottom of the service list, ensuring it is easy for the client to find. This should include any applicable taxes or additional fees.

- Payment Instructions: Clearly list accepted payment methods and any relevant due dates or late fees. This section should be distinct to avoid confusion.

Additional Formatting Tips

- Use Bold and Italics: Make important details stand out, such as the total amount due, payment terms, or due date. A clean design with emphasis on key areas ensures nothing is overlooked.

- Keep it Simple: Avoid overloading the document with unnecessary graphics or distracting elements. The focus should be on the clarity of the information.

- Consistent Font Style: Use one or two easy-to-read fonts throughout the document. Avoid fancy fonts that may be hard to read.

With these tips in mind, you can create a payment request that is both professional and easy for clients to navigate, helping to avoid confusion and ensuring prompt payment.

Tips for Clear and Simple Invoices

A well-organized payment document is essential for maintaining professionalism and ensuring that your clients understand exactly what they’re paying for. Keeping the format clear, straightforward, and easy to navigate will help prevent confusion and encourage prompt payments. Below are some practical tips for creating documents that are simple to understand, yet thorough in detail.

Keep the Layout Clean

- Use a Structured Format: Organize the information in a logical flow. Start with your business and client details, followed by the list of services, total amount, and payment terms.

- Limit Visual Clutter: Avoid using too many colors, fonts, or decorative elements that might distract from the core details. Stick to a simple design with clear headings and sections.

- Use White Space: Leave enough space between sections and around text to prevent the document from feeling crowded. White space makes it easier to read and gives the document a more professional appearance.

Be Transparent with Charges

- Itemize Services: Break down each service with a clear description and cost. Avoid vague terms like “miscellaneous charges.” Clients should know exactly what they are paying for.

- Clearly Display Totals: Make sure the total amount due is easy to spot. It should be prominently displayed at the bottom of the service list, so there’s no confusion.

- Include Payment Terms: Always specify when the payment is due, along with any late fees or discounts. If you accept multiple payment methods, list them clearly.

By following these simple tips, you’ll be able to create a professional and easy-to-understand document that clients can quickly review and pay, improving your cash flow and reducing the chance of errors or disputes.

Including Payment Terms on Payment Requests

Clearly stating the terms of payment in your billing document is crucial for ensuring smooth financial transactions. Payment terms outline when and how the client is expected to pay, as well as any penalties for late payments or discounts for early settlement. A well-defined payment policy helps to avoid confusion and builds trust between you and your clients.

Key Elements of Payment Terms

- Due Date: Specify when the payment is expected. This could be a fixed date (e.g., “Due within 30 days”) or a specific day (e.g., “Due by the 15th of each month”).

- Late Fees: Outline any fees for delayed payments. For example, you could state, “A 5% late fee will be added for every 7 days past the due date.”

- Accepted Payment Methods: Clearly list all acceptable forms of payment, such as bank transfer, credit card, or online payment systems like PayPal.

- Discounts for Early Payments: Offer an incentive for clients to pay early, such as “A 10% discount for payments made within 7 days.”

Example of Payment Terms

| Payment Term | Description |

|---|---|

| Due Date | Payment is due within 30 days of the service date. |

| Late Fee | A 5% fee will be added for every 7 days past the due date. |

| Early Payment Discount | A 10% discount will be applied if payment is made within 7 days. |

| Accepted Payment Methods | Bank transfer, credit card, PayPal, or cash. |

Including clear and specific payment terms ensures that both you and your client are on the same page, making the billing process more transparent and less likely to lead to misunderstandings.

How to Handle Late Payments Professionally

Dealing with late payments can be challenging, but handling the situation with professionalism is key to maintaining a positive client relationship while ensuring you get paid for your work. Clear communication, setting expectations upfront, and following up consistently are all essential strategies for managing overdue payments effectively.

Steps to Address Late Payments

- Set Clear Payment Terms: Ensure that your payment expectations, including due dates and late fees, are clearly communicated in your initial agreement and billing documents. This helps avoid confusion later on.

- Send a Reminder: If the payment is overdue, send a polite reminder to the client. Sometimes, clients may simply forget about the due date.

- Follow Up Professionally: If the payment is still not received after the first reminder, send a second, more formal reminder. Reiterate the terms, including any late fees, and provide details about how to make the payment.

- Be Firm but Courteous: If necessary, enforce your late payment penalties as specified in the agreement. Keep your tone respectful but firm to maintain professionalism.

- Offer Payment Options: If a client is experiencing financial difficulties, consider offering a payment plan or different payment methods to facilitate the process.

Example of a Late Payment Follow-Up

| Stage | Action |

|---|---|

| First Reminder | Send a friendly reminder email stating the due date has passed, with the amount due and payment options provided. |

| Second Reminder | If payment is still overdue, send a more formal email or letter with a clear statement of the late fee and an urgent request for payment. |

| Final Notice | If payment is still not received, send a final notice, outlining potential consequences for non-payment, including suspension of services or legal action. |

By addressing late payments professionally and consistently, you can ensure that your clients understand the importance of timely payments, while maintaining a positive working relationship.

Free vs Paid Payment Request Documents for Creatives

When creating a payment request, professionals often face the choice between using free or paid resources. Both options come with their own set of benefits and limitations. Understanding the differences can help you determine which type of document best suits your business needs and ensures a smooth financial transaction process.

Benefits of Free Payment Documents

- Cost-Effective: The most obvious benefit of free options is that they are, well, free. They are ideal for new businesses or those with tight budgets, as they allow you to get started without additional expenses.

- Easy to Use: Many free templates are designed to be simple and user-friendly, making it easy for anyone to generate a payment request without technical expertise.

- Quick Setup: Free options are usually available for immediate download or use, meaning you can quickly get started on your billing process without waiting for anything to be set up.

Drawbacks of Free Payment Documents

- Limited Customization: Free documents often have rigid structures and limited design options. This may make it harder to fully personalize them to fit your business brand.

- Basic Features: While free templates may cover the basic needs of billing, they often lack advanced features like automated calculations, integration with accounting software, or customizable payment terms.

- Generic Designs: Many free options have a standard, generic layout, which may not make your business stand out or appear as professional as you might like.

Benefits of Paid Payment Documents

- Advanced Features: Paid options often come with features such as automated total calculations, recurring payment settings, and easy integration with accounting software, making them ideal for businesses that need more advanced functionality.

- Highly Customizable: Paid documents typically offer more design flexibility, allowing you to create a fully personalized payment request that reflects your business’s unique branding and style.

- Professional Appearance: Premium designs usually look more polished and are optimized for business, helping you present a professional image to your clients.

Drawbacks of Paid Payment Documents

- Cost: The most significant drawback of paid options is the cost. These services often come with one-time fees or monthly subscriptions, which may not be ideal for small businesses just starting out.

- Learning Curve: Paid options with more advanced features may require additional time to learn how to use them effectively. You may need to invest time in understanding the platform’s full capabilities.

Ultimately, the choice between free and paid payment request documents depends on your business needs. If you’re just starting out and need a simple, cost-effective solution, a free document may be sufficient. However, if you are

How to Track Your Earnings as a Self-Employed Professional

Effectively tracking your income is crucial for managing your finances, planning for taxes, and understanding the financial health of your business. Whether you work on a per-project basis or with recurring clients, having a system in place will help you stay organized and ensure you never miss out on payments or mismanage your earnings.

Step 1: Use a Reliable System for Recording Payments

The first step in tracking your income is to set up a system where you can record each payment you receive. You can use simple tools like spreadsheets, dedicated accounting software, or even a bookkeeping app. The key is consistency and ensuring that all payments are logged accurately.

- Spreadsheets: If you prefer a manual system, a spreadsheet can be an easy, cost-effective solution. Create columns for the date, client name, service rendered, payment amount, and payment method. This simple format will allow you to track your earnings over time.

- Accounting Software: For those who need more features, accounting software like QuickBooks or Xero can automate many processes, such as tracking payments, generating reports, and calculating taxes.

- Apps: There are numerous apps designed specifically for self-employed professionals. Apps like FreshBooks or Wave can track payments, generate invoices, and give you a real-time view of your financial status.

Step 2: Categorize Your Income

It’s essential to keep track of how much you earn from each type of service or project. Categorizing your income helps you see which areas of your business are the most profitable and allows you to plan for growth accordingly. Consider grouping your income into categories like “service fees,” “product sales,” or “consulting,” depending on what applies to your work.

- Project-based Income: If you work on a per-project basis, be sure to note the total amount you earn from each project or contract.

- Hourly Earnings: For hourly work, track the number of hours worked and the corresponding payment for each client. This will give you a clear view of your hourly rate and how much you’re earning in total.

- Recurring Income: If you have clients who pay you regularly, make sure to track those payments separately. This could include monthly retainers or subscription-based services.

Step 3: Regularly Review Your Earnings

Tracking your earnings isn’t a one-time task; it’s somethin

Best Software for Billing and Payment Requests

When it comes to managing your payment requests, using the right software can make a huge difference in terms of efficiency, accuracy, and professionalism. With various options available, selecting the right tool depends on your specific needs, whether it’s for simple invoicing, tracking payments, or managing multiple clients. Here are some of the best software solutions that can help streamline the billing process for self-employed professionals.

1. QuickBooks

QuickBooks is one of the most popular accounting software platforms for small business owners. It allows users to easily create and send payment requests, track income and expenses, and even handle taxes. Its user-friendly interface and automation features make it a great choice for those who want a complete financial management system.

- Features: Create custom payment documents, track overdue payments, generate financial reports, manage recurring clients.

- Best For: Professionals who need a comprehensive accounting solution that goes beyond just billing.

- Price: Monthly subscriptions starting from $25.

2. FreshBooks

FreshBooks is known for its simplicity and ease of use, making it a favorite among small business owners and freelancers. The platform allows users to create personalized payment documents, track payments, and even set up automatic reminders for overdue bills. It’s perfect for those who prefer an intuitive interface without complicated accounting jargon.

- Features: Customizable payment requests, time tracking, recurring billing, client management, and reporting tools.

- Best For: Professionals looking for an easy-to-use billing solution with excellent customer support.

- Price: Plans start at $15 per month.

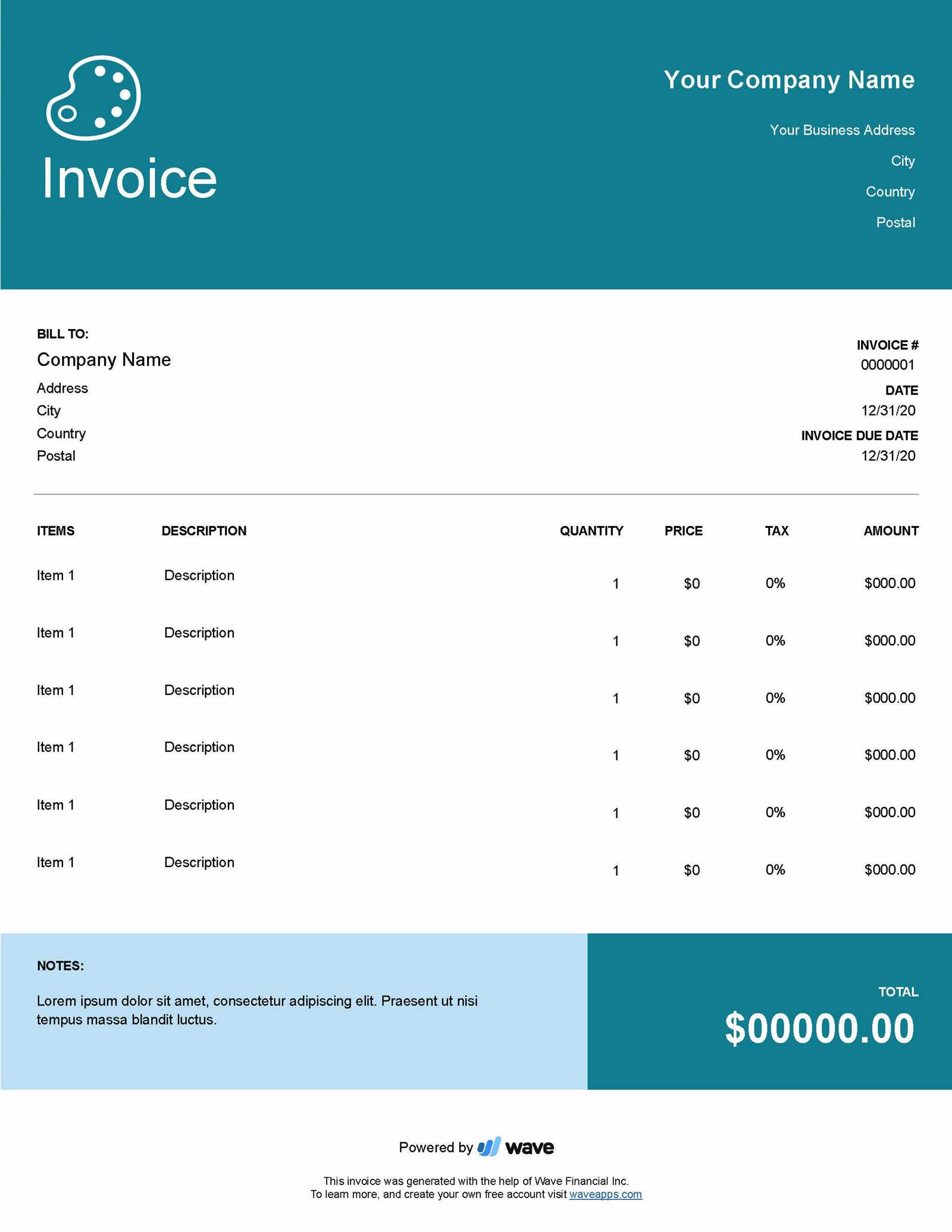

3. Wave

Wave is a free accounting software that offers robust features for small business owners, including the ability to create and send payment requests, track payments, and manage finances. It’s a great choice for professionals who want to keep their costs low while still benefiting from a reliable tool.

- Features: Create and customize payment requests, automated reminders, simple financial tracking, and invoicing.

- Best For: Those on a tight budget looking for a free yet feature-rich platform for billing.

- Price: Free (additional paid services available for payroll and payment processing).

4. Zoho Invoice

Zoho Invoice is another powerful tool for managing payments, offering a range of customizable features designed for small businesses. The platform includes automation features for recurring billing, automated reminders for late payments, and the ability to track expenses and income.

- Features: Customizable billing, time tracking,

What to Include in Your Payment Instructions

Clear and concise payment instructions are essential for ensuring that clients know exactly how to settle their bills. Providing this information helps avoid confusion and delays, making the transaction process smooth and professional. Below are the key elements that should be included to ensure your payment instructions are complete and easy to follow.

1. Payment Methods

Specify the methods through which you accept payments. This could include options such as bank transfers, credit/debit cards, online payment platforms, or checks. The more options you provide, the easier it will be for clients to make a payment according to their preference.

- Bank Transfer: Provide your bank account details, including the bank name, account number, sort code (or IBAN/SWIFT code for international transfers).

- Online Payment Platforms: Include links to platforms like PayPal, Stripe, or others you may use. Make sure to mention any necessary email addresses or IDs for receiving payments.

- Credit/Debit Card: If you accept cards, clarify whether clients can pay via an online payment gateway or in person.

- Checks: If you accept checks, provide your mailing address where clients can send the payment.

2. Payment Due Date

Be sure to include a specific due date by which the payment should be made. This is essential to avoid misunderstandings and ensure that clients know when the payment is expected. You may also consider adding a late fee clause if the payment is not made on time.

- Due Date: Clearly state the date when the payment is due, whether it is based on the receipt of the document or on a specific calendar date.

- Late Fees: If applicable, outline any late fee charges for payments made after the due date, including the amount or percentage charged per day/week/month of delay.

3. Payment Amount

Ensure that the total amount owed is clear. Break down any charges if necessary, so clients understand how the total was calculated. This can help eliminate any confusion or disputes over the final amount due.

- Total Due: Mention the exact total amount, including any taxes or additional fees.

- Itemized Charges: If applicable, provide a detailed list of the services or products that make up the total amount,

Handling Taxes in Billing Requests

When operating as a self-employed professional, understanding how to handle taxes in your payment requests is essential for legal compliance and financial organization. Taxes can vary depending on your location, the type of services you provide, and whether you operate under a specific business structure. It is crucial to include the appropriate tax details in your payment requests to avoid issues with local tax authorities and ensure transparency with your clients.

1. Understand the Tax Requirements for Your Business

The first step in handling taxes is to understand the tax laws that apply to your services. This includes whether you need to charge sales tax, value-added tax (VAT), or other local taxes. Depending on your location and the nature of your work, different rules may apply.

- Sales Tax: Some regions require you to collect sales tax for the services you provide. You’ll need to know whether your services are taxable and the applicable rate.

- VAT: In many countries, VAT applies to services. Be sure to check if you need to register for VAT and how to include it on your requests.

- Self-Employment Tax: If you operate independently, you may need to account for self-employment taxes on your earnings. This is typically handled when filing your annual tax return, but understanding your obligations will help you plan your finances better.

2. Including Taxes in Your Payment Requests

Once you understand which taxes apply to your business, it’s important to clearly communicate this information on your payment requests. This not only helps you stay compliant but also ensures that your clients understand the total amount they owe.

- Specify Tax Rates: Include the applicable tax rate(s) on your payment requests. If you charge sales tax, for example, make sure to indicate the percentage of tax being added to the total cost of services.

- Itemized Tax Breakdown: Clearly show the tax amount as a separate line item on your payment request. This makes it easy for your clients to see how much they are being charged for tax and ensures transparency.

- Include Tax Identification Number (TIN): Depending on your region, you may need to include your tax ID number (e.g., Employer Identification Number or VAT number) on your payment requests. This ensures your clients have the correct details for tax reporting purposes.

3. Setting Up a Tax-Tracking System

To manage taxes effectively, it’s important to set up a system for tracking your taxable income and expenses. This will help you calculate how much tax you owe and make tax filing easier at the end of the year.

- Use Accounting Software: Platforms like QuickBooks, FreshBooks, and Wave can help you track income and expenses, including taxes. Many of these tools automatically calculate tax rates for you based on your location.

- Maintain Detailed Records: Keep track of all payments, tax rates, and any tax-exempt transactions. This will help you in case of an audit or when filing your taxes.

- Consult a Tax Professional: Tax laws can be complex, especially if you’re unfamiliar with them. Consider consulting a tax professional to ensure you’re in compliance with local tax regulations.

4. Tax Deductions for Business Expenses

In addition to charging taxes on your services, you may also be able to claim deductions on certain business expenses when filing your taxes. These deductions can help reduce your taxable income and lower the overall amount of tax you owe.

- Business Expenses: Items like office supplies, software subscriptions, and travel expenses related to your work may be deductible. Be sure to keep detailed records of these expenses.

- Home Office Deduction: If you work from home, you might qualify for a home office deduction, which can cover a portion of your rent, utilities, and other related expenses.

- Professional Services: Fees for accountants, consultants, and other professionals you hire to help with your business can also be deducted from your taxable income.

Incorporating tax information into your payment requests not only ensures legal compliance but also helps streamline your business’s financial processes. Whether you’re a new entrepreneur or have been in business for years, understanding and applying tax laws correctly will help you sta

How to Use Billing Documents for Client Management

Billing documents serve as an essential tool for maintaining professional relationships with clients. They not only help you collect payments but also act as a record of your transactions, which is crucial for both you and your clients. By incorporating well-organized billing documents into your client management strategy, you can streamline communication, track progress, and ensure timely payments. Here’s how to effectively use billing documents to enhance client management.

1. Tracking Client History

One of the main advantages of using billing documents is that they help you maintain a comprehensive record of all your transactions. With organized billing records, you can quickly review past projects, payment histories, and client preferences.

- Client Records: Each billing document can serve as a permanent record of the services provided to each client. Over time, this builds a complete history that can help you understand recurring needs and adjust your offerings accordingly.

- Payment Status: With detailed information about payment deadlines and amounts due, you can easily track which clients have paid and which still owe. This helps to manage follow-ups and avoid any misunderstandings.

- Recurring Services: For clients who request ongoing services, your billing records will allow you to track regular payments and schedule future work, keeping both parties aligned.

2. Professionalizing Client Communication

Using professional billing documents also enhances your overall communication with clients. It creates a clear and formal structure for how you present costs and payment instructions, contributing to a positive, professional image.

- Clear Payment Terms: A well-structured document outlines payment schedules, due dates, and any late fees, which helps prevent confusion and ensures clients know exactly when and how to pay.

- Branded Documents: Customizing your billing documents with your business logo and contact details reinforces your branding. It makes your transactions feel more formal and trustworthy, improving client confidence.

- Detailed Breakdown: Providing an itemized list of services and charges helps clients see exactly what they’re paying for, fostering transparency and reducing the likelihood of disputes.

3. Improving Efficiency and Workflow

Billing documents can also make your business processes more efficient. With templates, you can quickly generate billing requests, saving you time while maintaining consistency across all client communications.

- Quick Generation: Rather than creating a new document from scratch each time, you can use an existing template to automatically fill in the client’s information, services rendered, and payment terms.

- Automatic Calculations: If you use a digital template or software, the document can automatically calculate totals, taxes, and discounts, reducing the chance of errors and ensuring accuracy.

- Tracking and Reminders: Many digital tools allow you to track payment statuses and set up automatic reminders. This helps you stay on top of unpaid bills and manage your cash flow more effectively.

4. Strengthening Client Relationships

By using billing documents effectively, you create a more organized and efficient process for your clients, which can lead to stronger, longer-lasting relationships. Transparent billing practices help build trust and enhance the client experience.

- Timely Follow-ups: Automated reminders for pending payments show clients that you value their business and respect deadlines, encouraging timely payments and positive interactions.

- Consistent Communication: Sending billing documents with clear terms helps avoid misunderstandings, ensuring that clients know exactly what to expect and when to expect it.

- Streamlined Dispute Resolution: In case of any issues

Why Consistency is Key in Billing

Maintaining consistency in how you manage client payments and financial documentation is crucial for both organizational efficiency and fostering trust with clients. Whether you are a small business owner or an independent professional, uniformity in your billing practices helps create a predictable and professional experience for your clients. From using the same structure for every transaction to ensuring timely delivery, consistency streamlines your workflow and minimizes the chances of errors or misunderstandings.

1. Building Trust with Clients

Consistency helps establish a sense of reliability and professionalism with your clients. When clients receive clear, well-structured payment requests on a regular schedule, it reinforces the expectation of professionalism in your business operations.

- Regular Payment Schedules: Sending out billing documents on the same day each month or after every service ensures that clients know when to expect them. This helps prevent delays in payments and sets a professional tone for your business.

- Uniform Structure: Using the same format for all billing records gives your clients a sense of familiarity and confidence. They’ll know where to find important details such as due dates, service descriptions, and payment instructions every time.

- Predictable Communication: Consistent communication surrounding payments, such as timely reminders or follow-ups for overdue balances, helps manage client expectations and reduces the need for additional clarifications.

2. Streamlining Your Financial Management

When your billing practices are consistent, it’s easier to track payments, manage cash flow, and prepare for tax filing. A uniform system minimizes confusion, reduces the risk of errors, and makes financial tracking much simpler.

- Efficient Tracking: Having a standard format for documenting payments means you can quickly refer to past transactions without wasting time looking for specific details or formats.

- Faster Processing: By automating or standardizing how you create and send billing records, you can cut down on administrative tasks and focus more on growing your business.

- Clear Tax Records: Consistency helps you maintain organized financial records, which is essential when preparing taxes or dealing with audits. The clearer and more uniform your records, the easier it is to report accurate figures.

Ultimately, a consistent approach to billing not only enhances the client experience but also improves your internal operations. By standardizing how you handle payments, you foster trust, reduce mistakes, and ensure that all financial dealings are handled professionally and efficiently.

Streamlining Your Workflow with Billing Documents

Efficient workflows are essential for success in any business. By automating and organizing certain tasks, you can save valuable time and reduce errors. One area where professionals often struggle is managing payments and keeping financial documentation in order. By integrating standardized billing documents into your daily operations, you can streamline this process, ensuring smoother transactions and better overall organization. These tools not only make it easier to track earnings but also help improve communication with clients.

1. Simplifying Payment Collection

Managing payments doesn’t have to be time-consuming. When you have a structured method for presenting charges to clients, you reduce the back-and-forth communication and ensure that both parties are on the same page from the start.

- Clear Payment Terms: A well-structured billing document includes all necessary payment information, such as due dates, amounts, and preferred payment methods, so clients know exactly what is expected.

- Quick and Easy Setup: Using pre-designed documents or digital tools, you can fill in specific details quickly, saving time on manual calculations and formatting. This means fewer administrative tasks and faster payment processing.

- Faster Payments: Clear billing details reduce misunderstandings and delays, encouraging clients to pay promptly and in full.

2. Reducing Errors and Misunderstandings

One of the biggest challenges when managing financial transactions is ensuring accuracy. Even small mistakes in payment details can lead to confusion, delayed payments, or dissatisfaction. Streamlining your approach helps to eliminate these errors and create a more professional experience for your clients.

- Automatic Calculations: Many digital billing tools allow you to automatically calculate totals, including taxes or discounts, which reduces the chance of human error and ensures that the amounts are correct every time.

- Standardized Format: Using the same structure for every transaction ensures that nothing i