Freelance Translation Invoice Template for Efficient Billing

As a professional offering specialized services, having a structured way to request payments is essential. Whether you’re working with clients on a one-time project or on long-term assignments, ensuring clarity in your financial transactions is key to maintaining a successful business. A well-organized document can make this process smoother and more efficient.

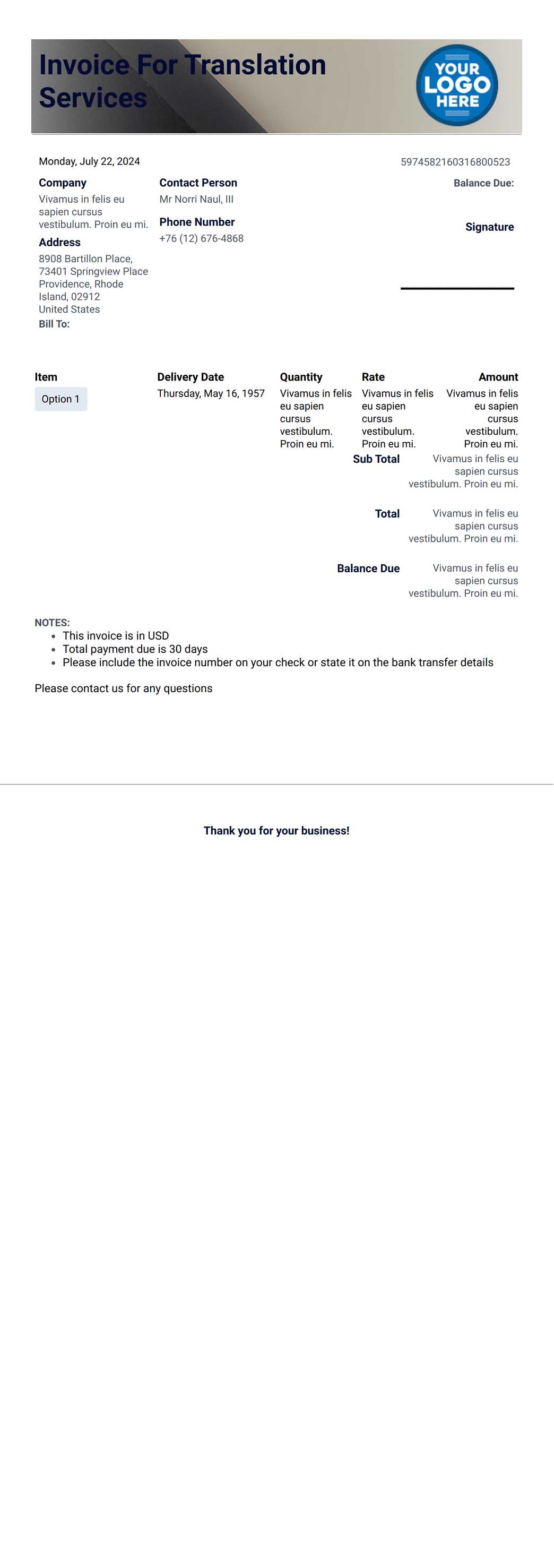

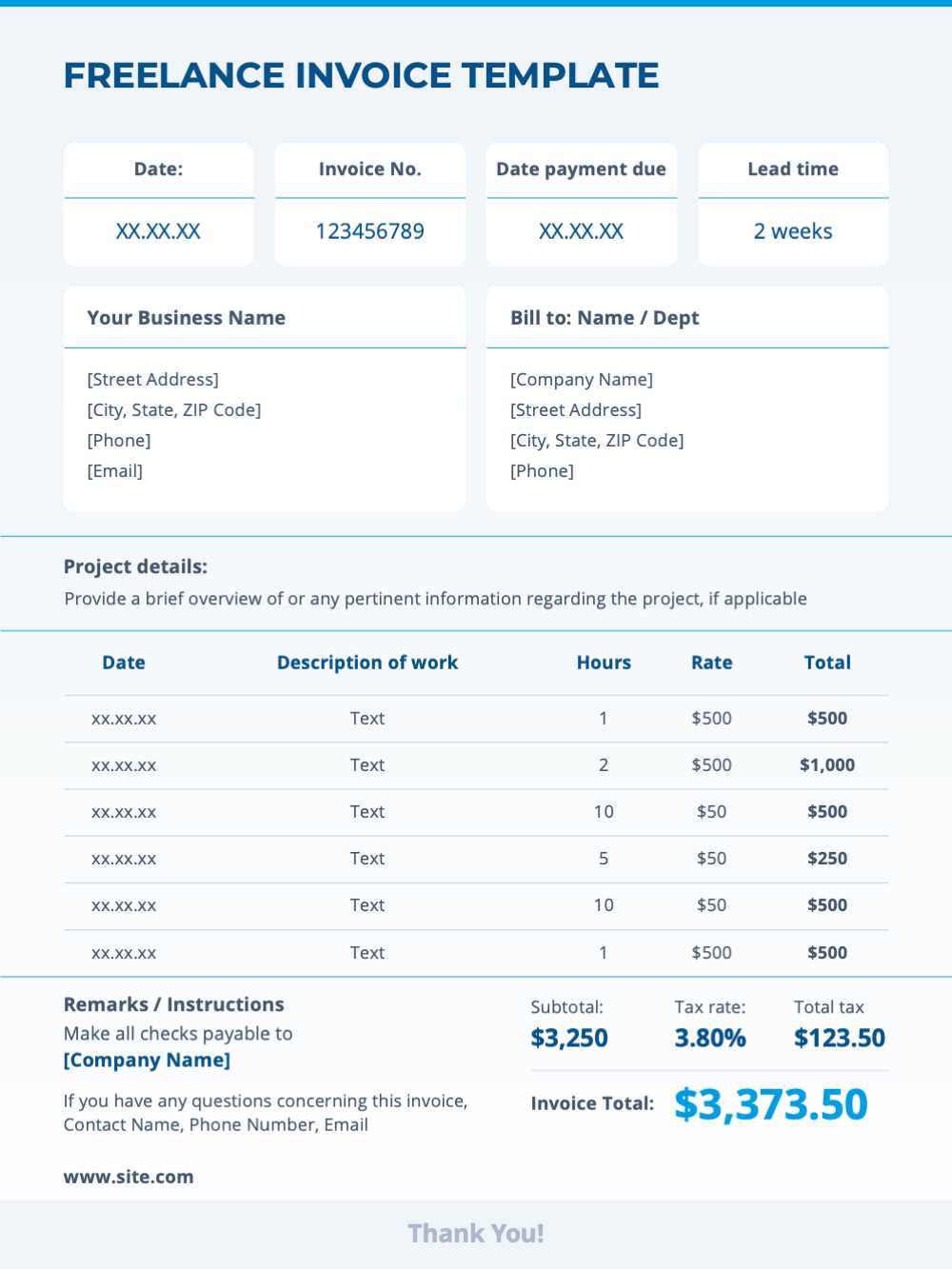

Customizable formats can simplify the way you manage payments and help establish a clear professional image. With the right tools, you can create a document that highlights important details such as rates, payment terms, and due dates, ensuring that nothing is left unclear.

By using an easy-to-follow format, you can avoid common mistakes and ensure that each transaction is documented properly. This not only helps in staying organized but also builds trust with clients, making it easier to track progress and receive payments on time.

Freelance Translation Invoice Template Overview

When providing specialized services, one of the most important aspects of managing your business is ensuring that payment requests are clear, professional, and easy for your clients to understand. A structured document for billing purposes allows you to present all necessary details in an organized manner, minimizing the chance of misunderstandings and ensuring prompt payments.

Such a document serves as a formal record of the work completed, outlining the agreed terms and payment amounts. It helps establish transparency between you and your clients, making it easier to track finances and keep things professional. Below are some key features and benefits of using a well-crafted document for your billing needs.

Key Features

- Clarity: Clearly states the amount due, payment terms, and deadlines.

- Customization: Can be tailored to reflect your unique services, rates, and working conditions.

- Professionalism: Enhances the credibility of your business and fosters trust with clients.

- Efficiency: Saves time and effort by reducing the need for manual calculations and adjustments.

Benefits

- Organized Payments: Helps keep your financial transactions in order, reducing the risk of missed payments.

- Faster Turnaround: With all information presented clearly, clients can process your requests more quickly.

- Improved Communication: Ensures that both you and your clients are on the same page regarding payment expectations.

Why You Need an Invoice Template

Properly requesting payment for your services is a critical part of running a successful business. Without a formal document to outline the work completed and the amount due, the chances of confusion or delays in payment increase. A well-organized payment request ensures clarity, builds trust, and helps establish a professional image with clients.

Having a standardized format for documenting payments also simplifies your administrative tasks. It allows you to easily track payments, manage overdue accounts, and maintain accurate records for tax purposes. Here’s why using a pre-made document is essential for efficient billing.

Consistency and Professionalism

Using a set structure helps present your services in a polished manner every time. It shows clients that you are organized and serious about your work, making them more likely to treat your business with the same level of professionalism.

Time-Saving Benefits

With a reusable format, you can eliminate the need to create a new document from scratch every time you complete a project. This saves time and ensures you don’t forget any important details like payment terms or project specifics.

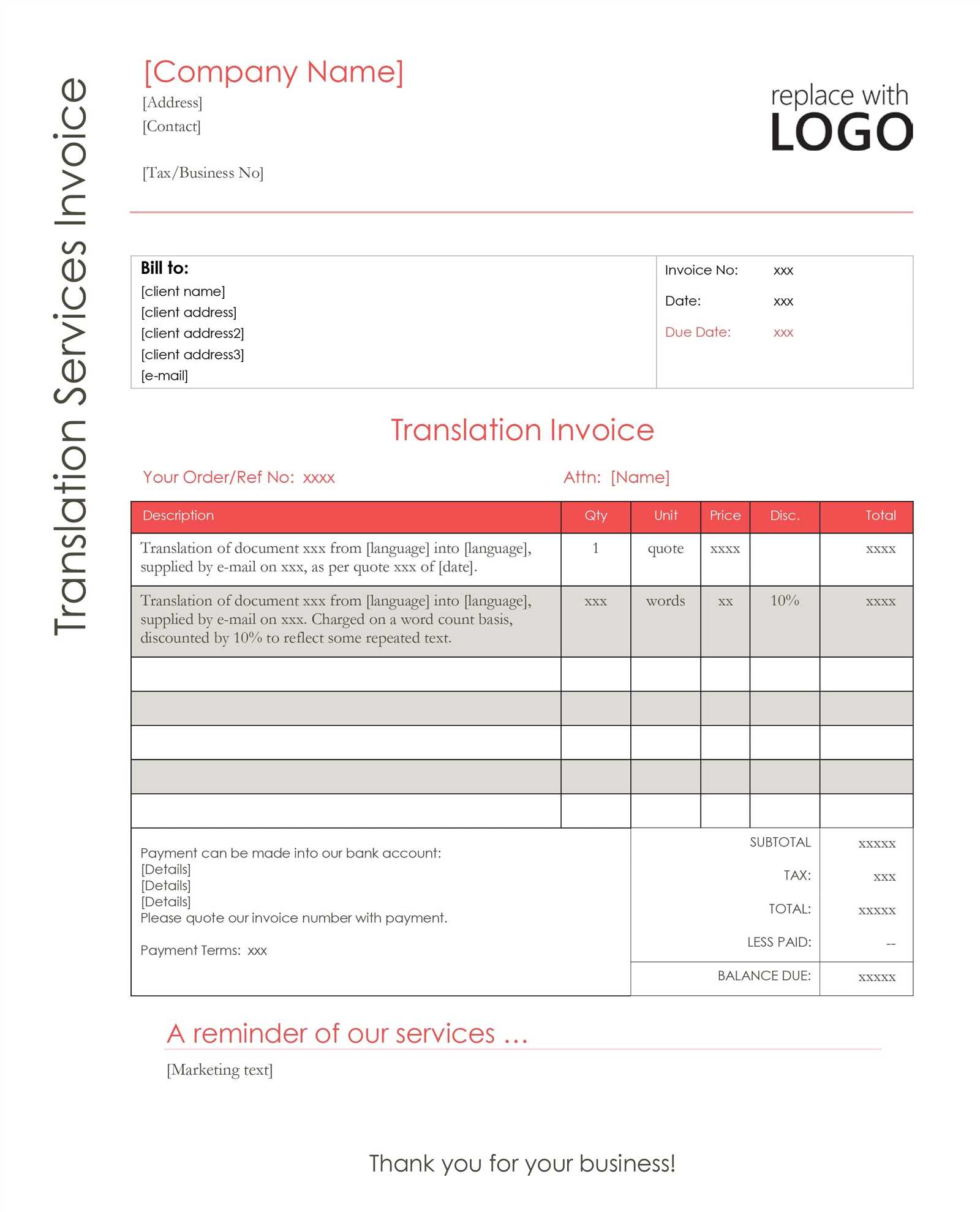

Key Elements of a Translation Invoice

When requesting payment for services rendered, it’s important to include specific details that make the billing process clear and efficient. These elements ensure that both you and your client are on the same page regarding the work completed, the amount due, and the terms of payment. Each section plays a critical role in preventing misunderstandings and ensuring timely payment.

The essential components of a payment request document are straightforward but must be carefully considered. Here are the key elements you should always include:

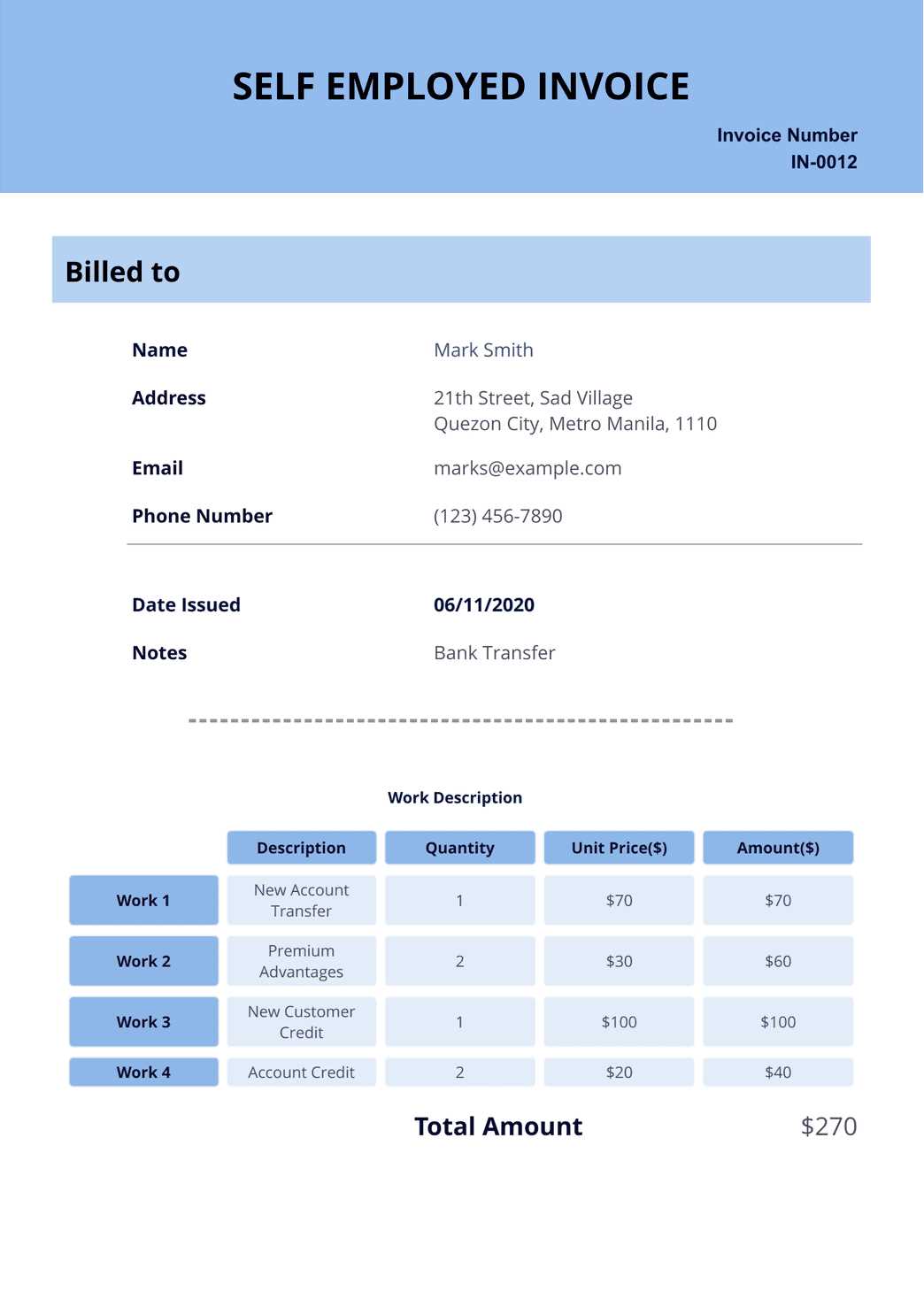

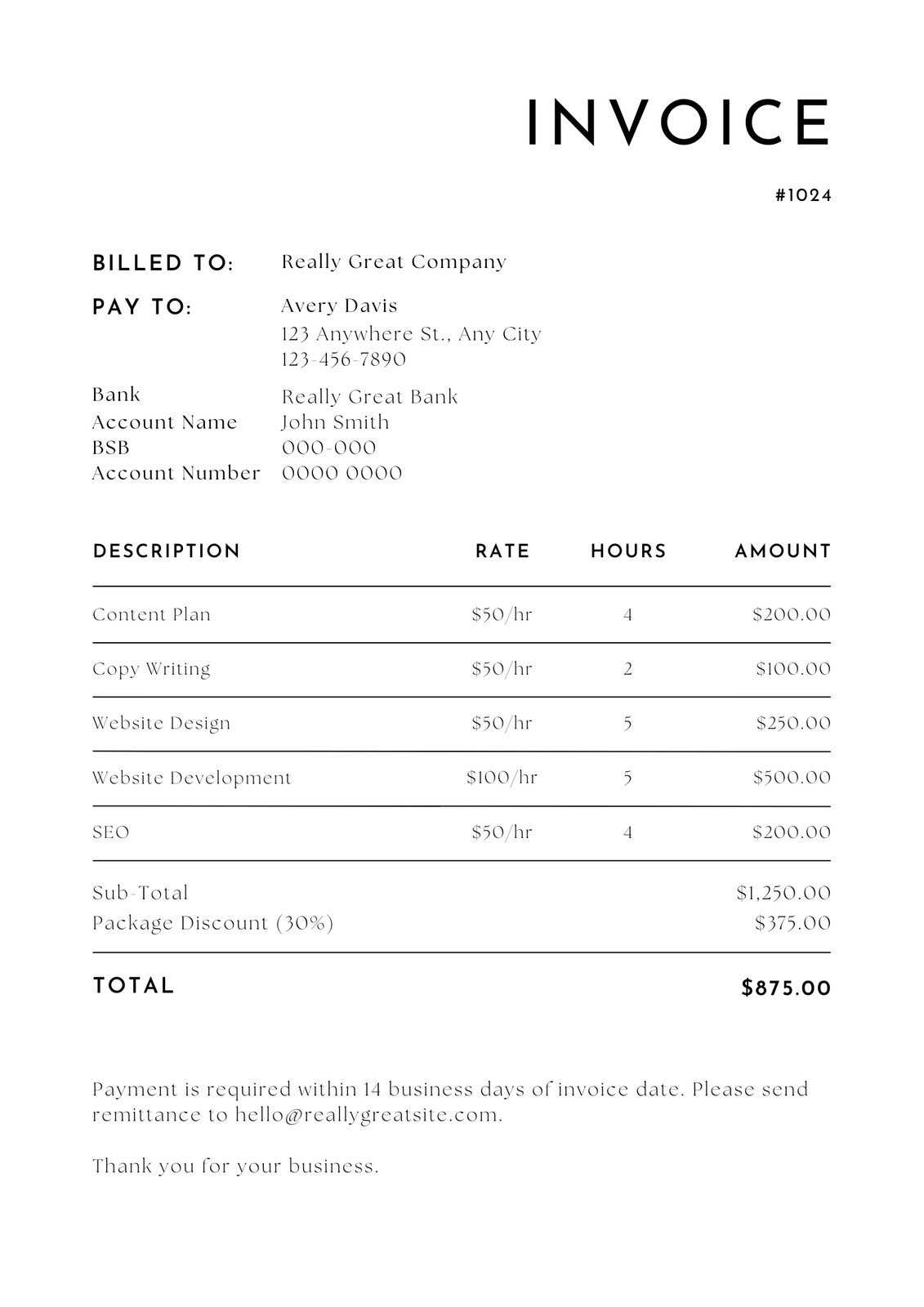

- Client Information: Include the client’s name, address, and contact details. This ensures there’s no ambiguity about who the payment is for.

- Work Description: A brief but clear summary of the services provided, including any relevant project details or milestones.

- Payment Amount: Clearly state the total amount due, breaking it down into units if necessary (e.g., hourly rate, per-word rate, etc.).

- Payment Terms: Specify when the payment is due, any late fees, and accepted methods of payment. This helps avoid delays.

- Invoice Number: Assign a unique number to each request for easy tracking and reference.

- Date: Include the date the document is issued and, if applicable, the due date for payment.

Customizing Your Invoice Template

Adapting your billing document to suit your specific business needs is crucial for both professionalism and efficiency. A standardized document can be modified to reflect your unique pricing structure, services, and client relationships, making it a versatile tool for managing payments. Customization helps ensure that the details you need are always front and center, and that your document aligns with your brand.

Customizing the document allows you to include relevant details like project-specific information, payment terms, and other specifics that reflect the nature of your work. The more personalized your document, the clearer the expectations will be for both you and your clients.

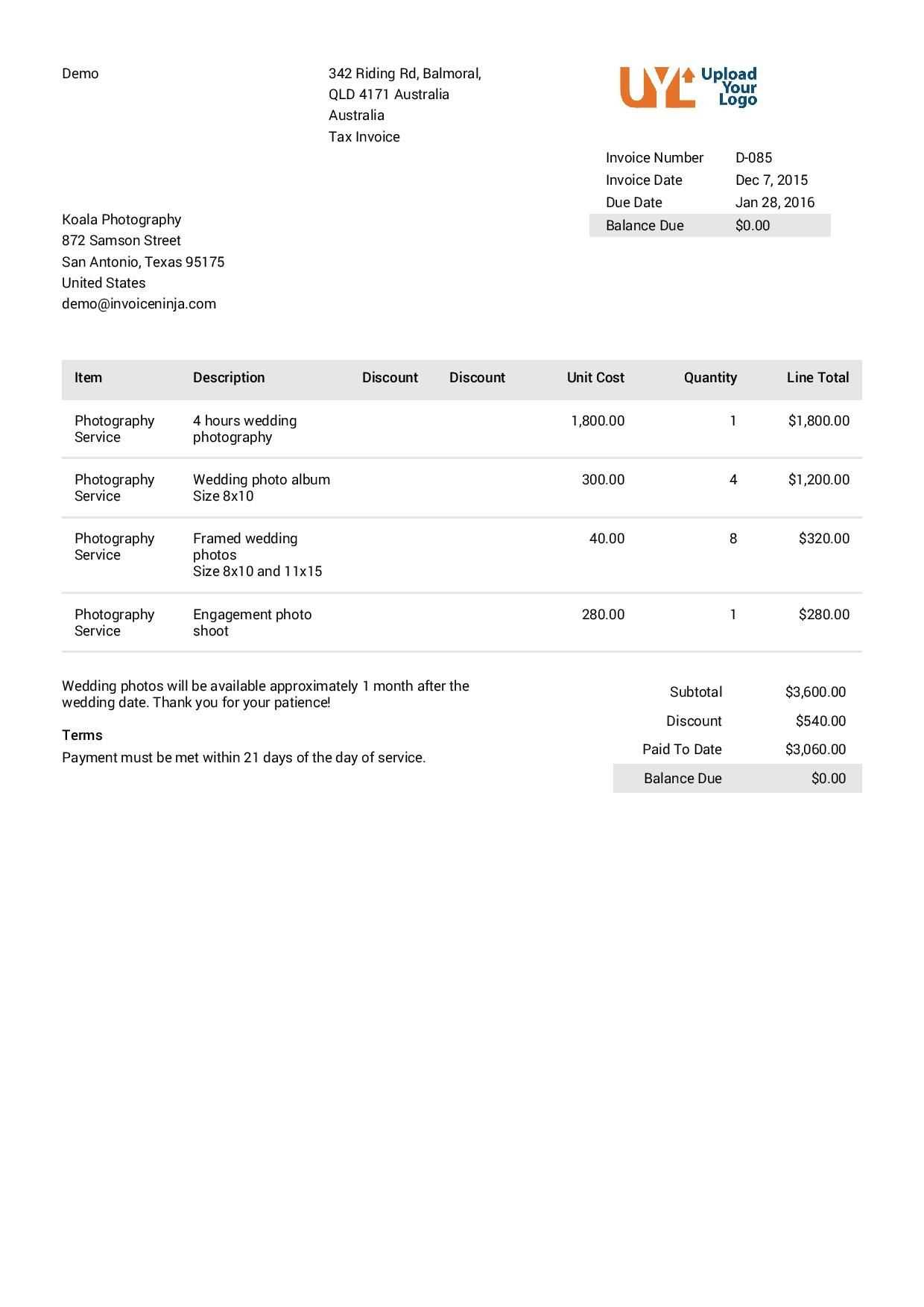

Branding Your Document

Including your logo, business name, and contact information helps reinforce your brand identity. This makes your document look more professional and adds a personal touch to the transaction.

Adjusting Payment Details

You can modify sections such as payment methods, due dates, and even discount offers or penalties for late payments. Tailoring these aspects to fit your business model can help keep things streamlined and ensure smoother financial management.

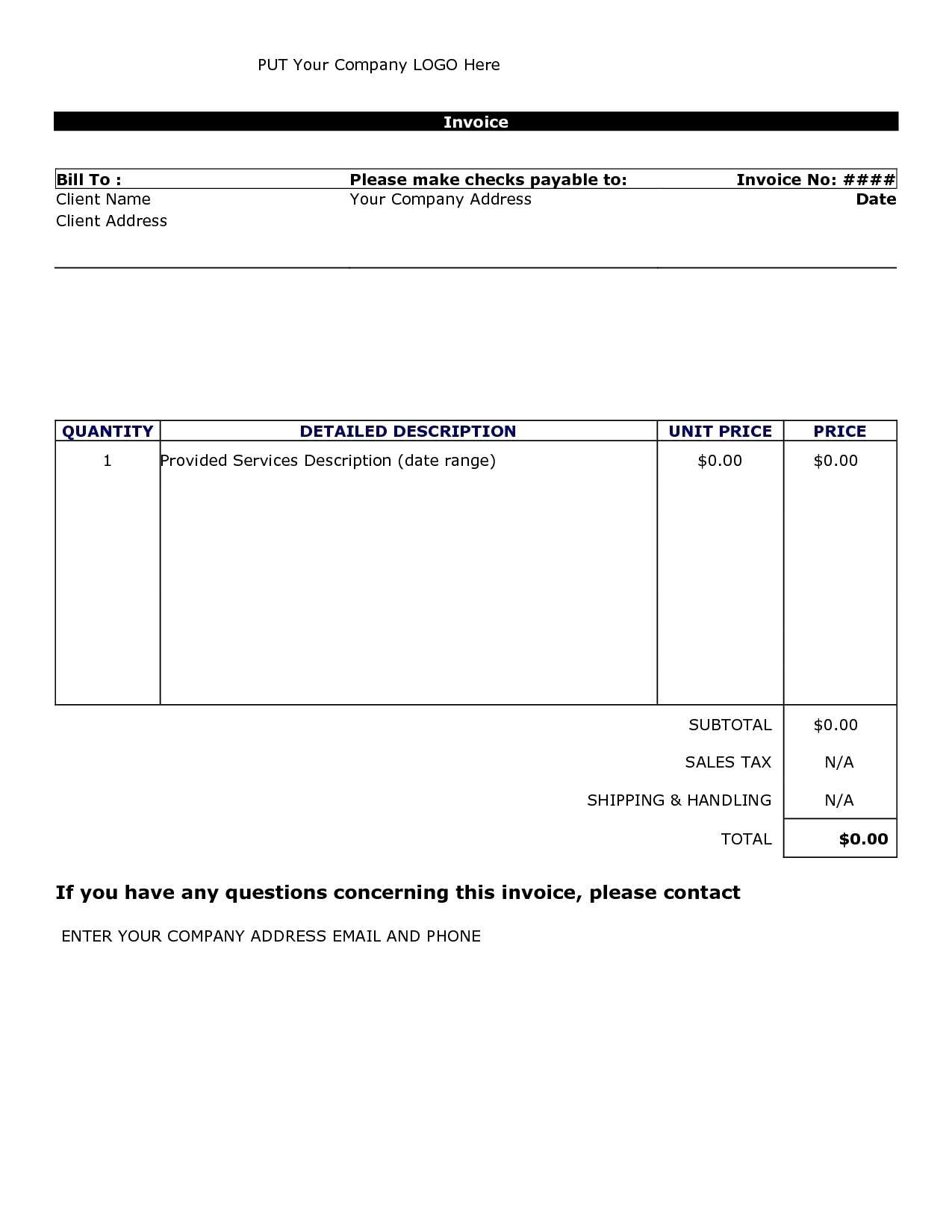

Essential Information to Include in Invoices

To ensure that your payment requests are clear and professional, certain key details must be included. These elements not only help establish transparency but also protect both parties involved by clearly outlining the terms and expectations. Missing or incomplete information can lead to confusion and delays in payment.

The following are critical details that should always be included in your payment requests to ensure smooth transactions:

- Client’s Contact Information: Include the name, address, and phone number of the client to avoid any confusion about who the payment is directed to.

- Your Contact Information: Your business name, address, and phone number should also be present to maintain clarity and ease of contact.

- Payment Amount: Specify the exact amount due, breaking it down if necessary (e.g., hourly rates, flat fees, or project milestones).

- Description of Services: Provide a brief overview of the work completed, including any specific tasks or deliverables.

- Payment Terms: Clearly state the payment due date, available payment methods, and any applicable late fees or discounts for early payment.

- Unique Reference Number: Include an invoice or reference number for easy tracking and record-keeping.

- Dates: Include the date the request was issued, as well as the due date for payment.

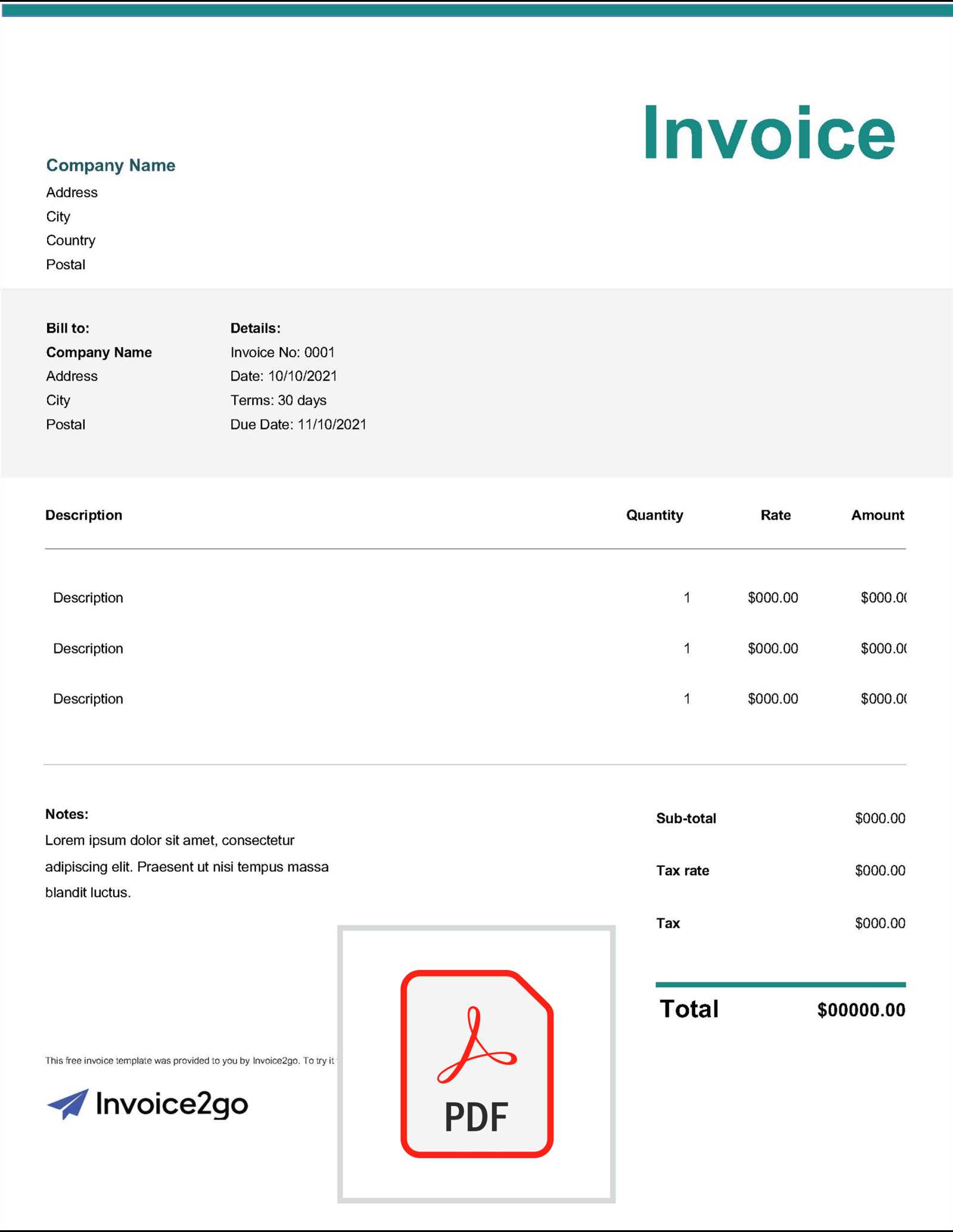

Formatting Tips for Professional Invoices

Proper formatting is essential to ensure that your payment request is clear, organized, and easy for clients to understand. A well-structured document not only presents a professional image but also helps avoid confusion, ensuring prompt payments. Simple changes in layout and design can make a significant difference in how your work is perceived.

When creating a payment document, it’s important to focus on readability and clarity. A clean, consistent layout will guide your client’s attention to the key elements, making it easier to process the request. Below are a few formatting tips to keep in mind when preparing your documents.

Use of Clear Headings

Headings should be clear and easy to locate. Use bold text or a larger font size to highlight sections such as payment details, services rendered, and terms of payment. This helps clients quickly find the information they need without wasting time.

Consistent Font and Layout

Choose a professional, legible font and keep the style consistent throughout the document. Avoid using multiple fonts, as this can create a cluttered and unprofessional appearance. A consistent layout with well-spaced sections makes the document easy to follow.

| Section | Tip |

|---|---|

| Header | Use bold or larger text for business name and contact details |

| Service Details | Clearly list services with bullet points or numbered items |

| Payment Terms | Highlight due date and payment methods in bold |

| Footer | Include a thank-you note or reminder for the due date |

Setting Payment Terms for Clients

Establishing clear and fair payment terms is essential for maintaining a professional relationship with clients. By outlining when and how payments are due, you ensure that both parties understand the expectations and responsibilities. Well-defined payment terms help avoid misunderstandings and delays, ensuring a smoother financial process for your business.

When setting payment terms, consider factors such as the scope of the work, the timeline, and any specific agreements made with the client. Flexibility can be important, but it’s essential to have a written agreement that clearly states your payment expectations. Below are some key considerations when determining payment terms.

| Payment Term | Description |

|---|---|

| Due Date | Specify when the payment is due, such as within 15, 30, or 60 days after the work is completed. |

| Late Fees | Outline any additional charges for overdue payments, such as a percentage of the total amount or a fixed fee. |

| Accepted Payment Methods | List the methods by which clients can pay, such as bank transfer, credit card, or online payment platforms. |

| Deposit or Partial Payment | Indicate whether a deposit is required before starting the work, or if partial payments are acceptable throughout the project. |

| Currency | Specify the currency in which payment should be made, especially when working with international clients. |

How to Calculate Translation Rates

Determining the right rate for your services is essential to ensure fair compensation for the time and effort spent on each project. The calculation of your rates should consider a variety of factors, from the type of work involved to the complexity of the task. By understanding the various components that influence pricing, you can set rates that reflect your skill level and the value you provide to clients.

When calculating how much to charge, it’s important to take into account both the direct and indirect costs associated with the job. Below are some factors to consider when determining your pricing structure:

- Word or Hourly Rate: Decide whether to charge by word count, by the hour, or based on project milestones. Word count is common for text-based tasks, while hourly rates may apply for more complex work that requires additional time.

- Experience and Expertise: Your experience in the field and expertise in a particular subject matter should influence your rate. The more specialized your skill set, the higher your rate can be.

- Project Complexity: If the work requires extensive research, technical knowledge, or creative input, adjust your pricing to reflect the complexity of the task.

- Deadline: Tight deadlines often require more time and may demand a higher rate due to the urgency of the work.

- Market Rates: Research the going rates in your industry and region. While you want to remain competitive, make sure that your rates are aligned with the quality of service you provide.

After considering these factors, you can set a fair and accurate rate that meets both your needs and those of your clients. Be prepared to adjust your rates for different types of projects, clients, or deadlines, but always ensure that the price reflects the true value of your work.

Common Mistakes in Freelance Invoicing

When creating a payment request, even small errors can lead to delays or misunderstandings. Avoiding common mistakes ensures smooth transactions and helps maintain professionalism. By addressing these issues early, you can streamline your billing process and prevent complications with clients.

Here are some of the most common mistakes people make when requesting payment:

- Missing Client Information: Failing to include the client’s name, address, or contact details can cause confusion or prevent proper payment processing.

- Unclear Payment Terms: Not clearly stating the due date, payment method, or late fees can lead to delays or disputes.

- Incorrect Calculation of Charges: Mistakes in calculating the total amount due, or failing to break down the charges clearly, can create confusion or dissatisfaction.

- Not Including a Unique Reference Number: Without a unique reference or invoice number, both you and the client may struggle to track or identify the transaction.

- Failure to Specify Service Details: Not including a description of the services provided or the deliverables makes it difficult for the client to understand exactly what they’re paying for.

- Omitting Currency Information: If you’re dealing with international clients, not specifying the currency can lead to misunderstandings and complications with payment transfers.

- Overlooking Professional Branding: A lack of clear branding, such as your business name and logo, can make your document appear unprofessional and less trustworthy.

By paying attention to these key elements and avoiding common mistakes, you ensure that your payment requests are both professional and easy for clients to process.

Using Online Tools for Invoices

Leveraging online tools to create and manage payment requests can significantly simplify your financial operations. These tools provide templates, automation, and additional features that save time and reduce the risk of errors. With the right online solution, you can create professional-looking documents in minutes and track payments with ease.

Online platforms offer various functionalities that can enhance your invoicing process, such as recurring billing, integration with payment gateways, and automatic reminders for overdue payments. Here are a few reasons why using these tools is beneficial:

Automation and Efficiency

Many online tools automate tedious tasks, such as calculating totals, applying taxes, and setting up reminders for unpaid balances. This reduces manual effort and helps ensure that no detail is overlooked.

Professional Designs and Customization

These tools often provide a range of pre-designed formats that can be customized with your branding and personalized details. This allows you to present a professional appearance to clients without the need for graphic design skills.

Additionally, online platforms often integrate with other tools, such as accounting software, which can help you keep track of payments, expenses, and client records in one place. By using these services, you can streamline your billing process and improve overall business management.

How to Send Your Invoice Effectively

Sending a payment request correctly is just as important as creating it. A well-structured, timely submission ensures that your client understands the terms and can process the payment without confusion. The method you choose for sending, along with the timing and follow-up, can all impact the speed at which you receive compensation.

Here are a few key steps to follow to send your payment request effectively:

Choose the Right Delivery Method

- Email: Sending your document via email is the most common and efficient method. Ensure that the file is attached in a universally accepted format, like PDF, to avoid compatibility issues.

- Online Platforms: If you’re using an invoicing tool or accounting software, many platforms allow you to send requests directly through the platform, often with features like tracking and automatic reminders.

- Postal Mail: In some cases, sending a hard copy may be necessary, especially if your client prefers traditional methods. Ensure you use a reliable service to avoid delays.

Include All Necessary Details

- Clear Subject Line: If sending via email, ensure the subject clearly indicates that it’s a payment request, including relevant details such as the invoice number or date.

- Friendly, Professional Message: Include a polite, concise message that outlines the payment terms, provides a brief overview of the attached document, and thanks the client for their business.

- Confirmation: After sending, follow up to confirm the client received the payment request and has no questions about the details.

By taking these steps, you can ensure that your payment requests are clear, timely, and easy for clients to process, minimizing the chance of delays and misunderstandings.

Managing Client Expectations with Invoices

Setting clear and realistic expectations is key to maintaining a positive relationship with your clients. By managing how and when you present your payment requests, you can avoid misunderstandings and delays. Properly communicating expectations up front and throughout the process helps ensure that both parties are aligned on what to expect in terms of cost, payment deadlines, and terms.

Here are some ways to manage client expectations effectively when submitting a payment request:

Clarify Payment Terms Early On

Before you even start the work, it’s important to discuss and agree upon payment terms with your client. This ensures that they are aware of deadlines, payment methods, and any additional charges, such as late fees. By clearly outlining these details at the outset, you minimize the potential for confusion later.

Provide a Transparent Breakdown of Costs

Clients appreciate transparency when it comes to pricing. Break down the cost of services clearly, showing the client what they are paying for and why. This could include an hourly rate, per-word charge, or any additional services or expenses that might apply. The more transparent you are, the less likely there will be disputes over the charges.

Use the following table as a basic structure for a clear cost breakdown:

| Service | Rate | Quantity | Total |

|---|---|---|---|

| Service 1 | $50/hour | 5 hours | $250 |

| Service 2 | $30/unit | 10 units | $300 |

| Total | $550 | ||

By clearly breaking down charges and providing transparent details, you help your client understand the total cost and avoid any surprises when the payment is due.

Ultimately, managing client expectations through clear communication and transparency is essential for maintaining a professional and trusting relationship. Setting realistic timelines and providing easy-to-understand breakdowns makes the entire process smoother for everyone involved.

Tracking Payments and Overdue Invoices

Keeping track of outstanding payments and overdue requests is crucial for maintaining your business’s financial health. Effective tracking not only ensures that you get paid on time but also allows you to take proactive measures when payments are delayed. By monitoring payment statuses regularly, you can minimize cash flow disruptions and maintain a smooth financial operation.

Here are some key steps to help you track payments and manage overdue accounts:

Use a Payment Tracking System

One of the most efficient ways to track outstanding payments is by using a payment tracking system. This can be as simple as a spreadsheet or as advanced as accounting software, depending on your needs. The system should include key details such as the payment due date, the amount owed, and the current payment status. Regularly update this system to ensure you’re aware of any overdue amounts.

Monitor Payment Deadlines

It’s important to keep an eye on the due dates for all your payment requests. By doing so, you can take action before an account becomes overdue. Setting up reminders can help ensure that you follow up promptly with clients if the payment is not received on time.

Here’s an example of how you can structure your tracking table to monitor outstanding payments:

| Client | Amount Due | Due Date | Status | Follow-Up Date |

|---|---|---|---|---|

| Client A | $300 | October 1 | Paid | – |

| Client B | $450 | October 10 | Overdue | October 15 |

| Client C | $700 | October 20 | Pending | October 25 |

By using a table like this, you can stay organized and efficiently follow up with clients who have missed payment deadlines. The clearer and more structured your tracking system is, the easier it will be to manage overdue accounts.

In case of overdue payments, you can take necessary actions such as sending reminder not

How to Handle Multiple Clients’ Invoices

Managing requests for payment from multiple clients can quickly become overwhelming if not organized properly. Effective management ensures timely payments and keeps your finances in order. The key is creating a system that allows you to track and manage each request individually while maintaining an overall view of all your accounts.

Organize Your Payment Requests

To handle multiple clients efficiently, start by organizing their payment requests in a way that works best for you. Here are a few methods that can help:

- Client-based folders: Create a folder for each client, either digitally or physically, and store all their payment details and records in these folders. This will make it easy to track each client’s outstanding amounts.

- Dedicated software or apps: Use accounting tools or apps that are designed to track multiple accounts and clients. These apps often provide reminders, allow you to categorize payments, and give you an overview of due or overdue amounts.

- Spreadsheets: If you prefer working with spreadsheets, create a detailed table for each client that includes all necessary payment information like due dates, amounts, and payment statuses.

Set Clear Payment Terms for Each Client

Clear payment terms help avoid confusion and make the process smoother. Ensure each client understands the payment schedule and any penalties for late payments. Having set terms allows you to maintain professionalism and manage expectations. Consider including:

- Payment due dates (e.g., within 30 days of the request)

- Late fees or interest charges for overdue payments

- Preferred payment methods

Having this information in writing and agreed upon by both parties will help you enforce deadlines and prevent misunderstandings.

Follow Up Regularly

Tracking multiple accounts can lead to some payments being missed. It’s important to set a routine to follow up on overdue amounts. Here’s how you can approach it:

- Automated reminders: Set up automated reminders through your payment system or accounting software to remind clients about upcoming or overdue payments.

- Personalized follow-ups: If automated reminders aren’t effective, follow up personally with an email or phone call. Be polite but firm in asking for payment.

By maintaining an organized system and setting clear communication with each client, handling multiple requests for payment becomes more manageable a

Legal Considerations in Freelance Invoicing

When requesting payment for services rendered, it is essential to be aware of the legal aspects that govern how these transactions should be handled. Understanding the legal requirements can help prevent disputes and ensure you are protecting both your rights and the client’s. This section outlines the key considerations you should be aware of when creating and sending payment requests.

Contractual Agreements

Before any work begins, it is important to have a clear agreement in place between you and the client. This agreement should outline the scope of work, payment terms, and any other relevant details that might impact the project. Having a written contract is not only a good business practice but also provides legal protection in case of disputes. Make sure to include the following:

- Payment terms: Specify how much is to be paid, when payment is due, and any late fees that will apply.

- Work deliverables: Clarify what services will be provided, and define the timelines and quality expectations.

- Cancellation and refunds: Include the terms under which either party can cancel the contract and any refund policies that apply.

Tax Obligations

It is crucial to be aware of your tax obligations when requesting payment for services. Depending on your location and business structure, you may be required to report income, collect sales tax, or adhere to other specific regulations. Make sure to include your tax identification number (TIN) or VAT number on any billing documentation if required. Failure to comply with tax laws can result in penalties, so be sure to consult with a tax professional to ensure you are following the rules.

Protecting Your Rights

In cases where payment is not received in a timely manner, legal steps may be necessary to protect your financial interests. Some of the rights you have as a service provider include:

- Right to withhold services: Until payments are made in full, you have the right to withhold further work or deliverables as stipulated in your contract.

- Legal action: If payments are significantly overdue, you may need to take legal action, such as hiring a collections agency or seeking court intervention.

By understanding the legal considerations involved in requesting payment, you can ensure that both you and your clients are protected throughout the process.

Best Practices for Freelance Billing

Effective billing practices are essential for maintaining professional relationships and ensuring timely payments. Clear communication, accuracy, and consistency are key components that help ensure both you and your clients have a smooth financial experience. By adhering to some simple guidelines, you can make the payment process more efficient and avoid common pitfalls.

Maintain Clear and Consistent Records

Accurate record-keeping is vital when managing payments. This ensures that there is no confusion between you and your client regarding the work completed, the amount due, and the payment terms. Keep detailed records of all transactions, including:

- Work performed: Keep track of the specific services or tasks you provided and any hours worked.

- Client communications: Document any important conversations or agreements, particularly those regarding payment terms or changes in the scope of work.

- Payment history: Track all incoming payments and any outstanding balances.

Be Transparent with Payment Terms

It’s important to clearly define payment expectations from the outset. This helps prevent misunderstandings and sets a professional tone for your relationship with clients. Some best practices include:

- Define deadlines: Always specify when the payment is due, whether it’s upon completion, after a set number of days, or in installments.

- Late fees: Clearly state the penalties for overdue payments. This could include a percentage fee or a flat charge for each day or week a payment is late.

- Payment methods: Offer several convenient payment options, such as bank transfers, online payment systems, or credit cards, depending on your client’s preferences.

Send Professional and Timely Payment Requests

Sending clear, timely requests for payment helps ensure that your clients remember to pay on time. Adhering to these practices can make the process smoother:

- Issue requests promptly: Send payment requests immediately after completing work or after the agreed-upon milestone.

- Provide all necessary details: Include all relevant information, such as the amount due, due date, your payment details, and a breakdown of services rendered.

- Follow up on overdue payments: If a payment is overdue, send a polite reminder or follow-up to ensure it gets processed as soon as possible.

Utilize Technology for Efficiency

With many tools available today, managing billing can be made easier through automation. Using software or online platforms designed for billing can help you:

- Generate and send requests: Quickly create and send payment requests, reducing errors and saving time.

- Track payment status: Automatically monitor which payments have been made and which are still pending.

- Send reminders: Set up automatic reminders to follow up