Free Sample Invoice Template PDF for Easy Billing

Creating professional financial documents can be time-consuming, especially when you need to maintain accuracy and consistency across all transactions. Having a pre-designed document structure can significantly ease this process, allowing you to focus on the core aspects of your business rather than formatting and organizing every detail from scratch.

Ready-made templates offer a simple yet effective solution to ensure that each record is clear, organized, and complete. These documents are easy to edit, and you can personalize them according to your specific needs, helping you to maintain a professional image while keeping everything streamlined.

Whether you are a freelancer, a small business owner, or a large enterprise, using a well-structured document layout can save valuable time and reduce the risk of errors. In this article, we will explore the various benefits of these customizable formats and show you how to take advantage of them for your day-to-day operations.

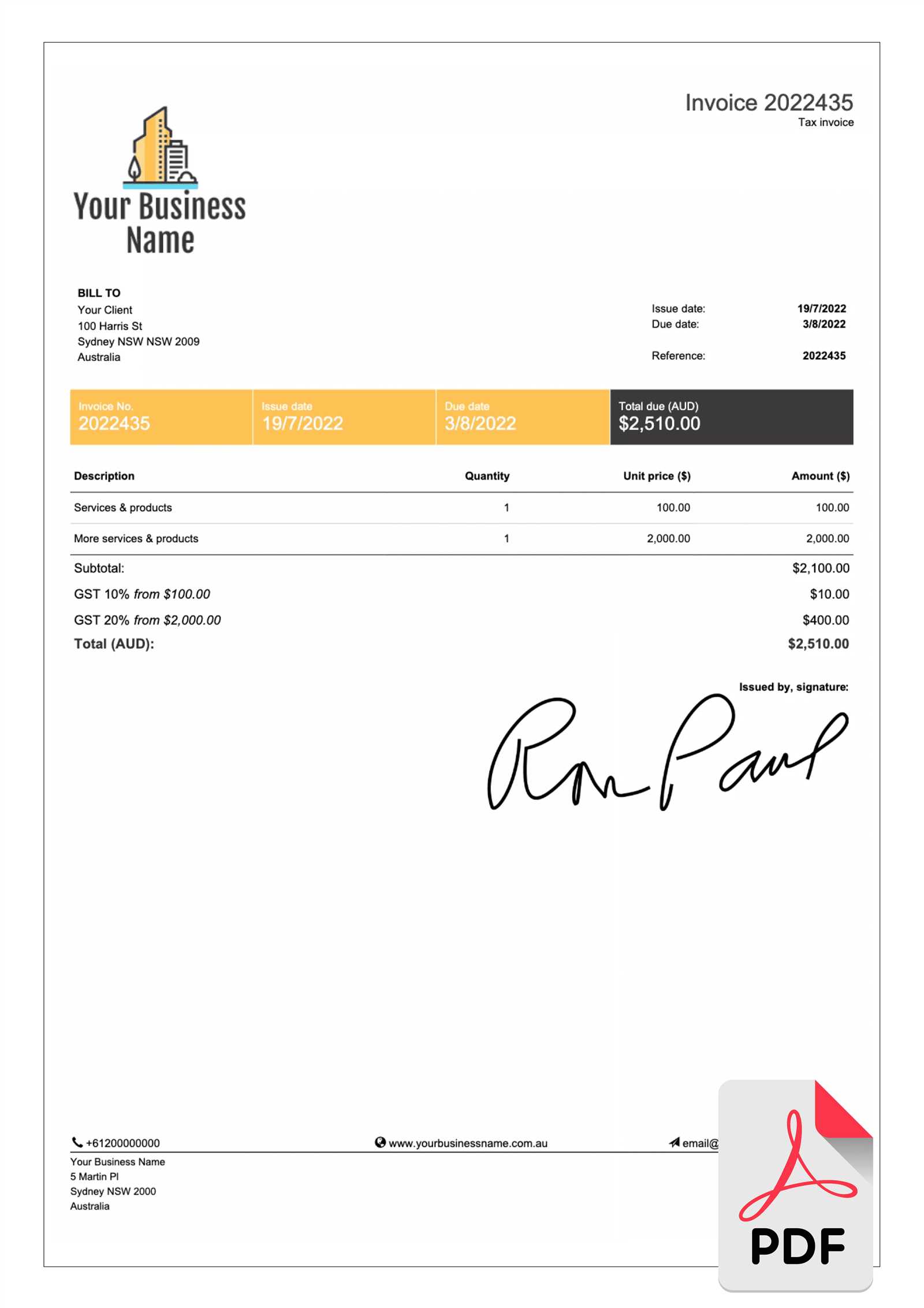

Sample Invoice Template PDF Overview

In today’s fast-paced business environment, it’s crucial to maintain well-organized financial documents. Pre-made designs are a convenient solution, offering businesses an efficient way to keep track of transactions and ensure accuracy in their billing practices. These ready-to-use structures provide a solid foundation that can be easily customized to meet the specific needs of any business.

Key Features of Ready-to-Use Billing Forms

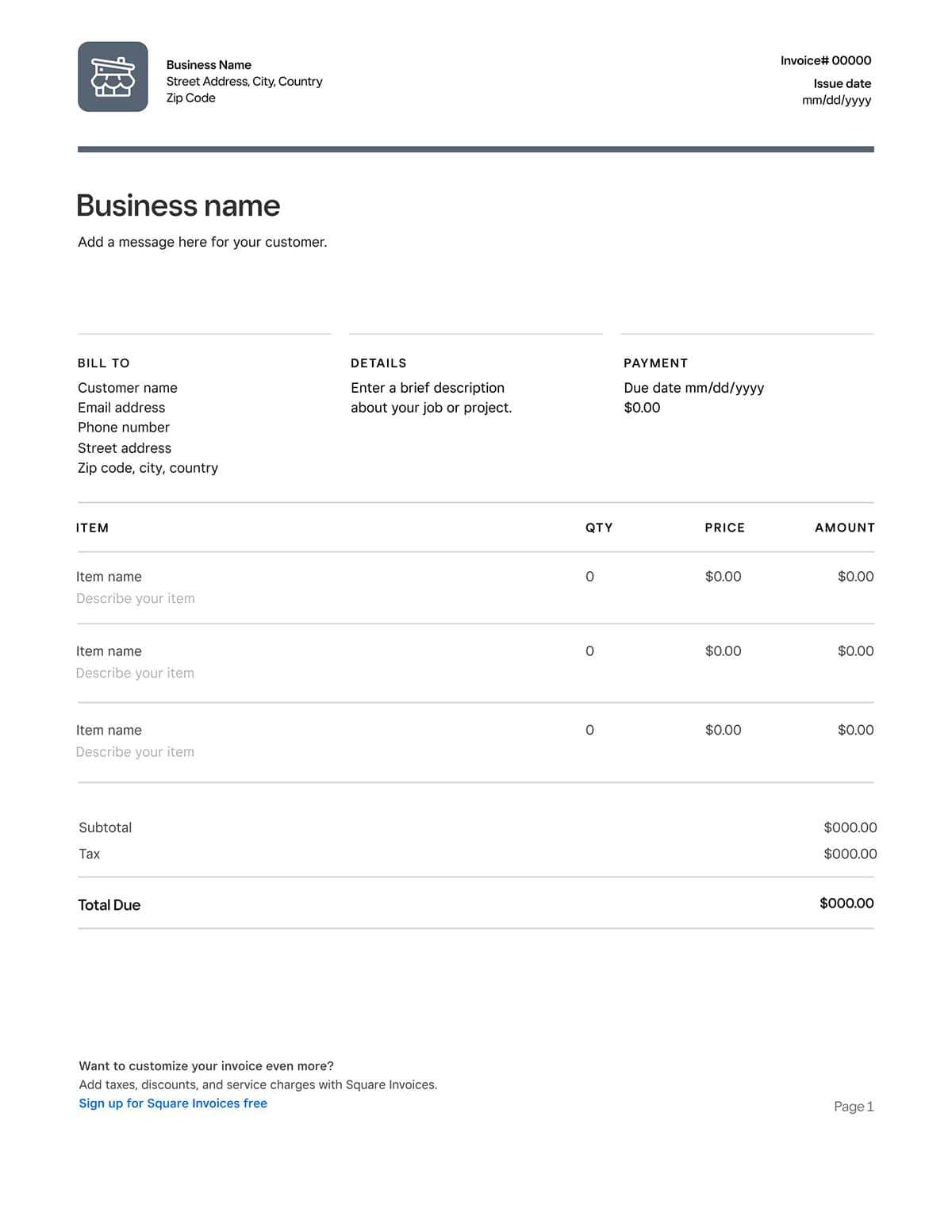

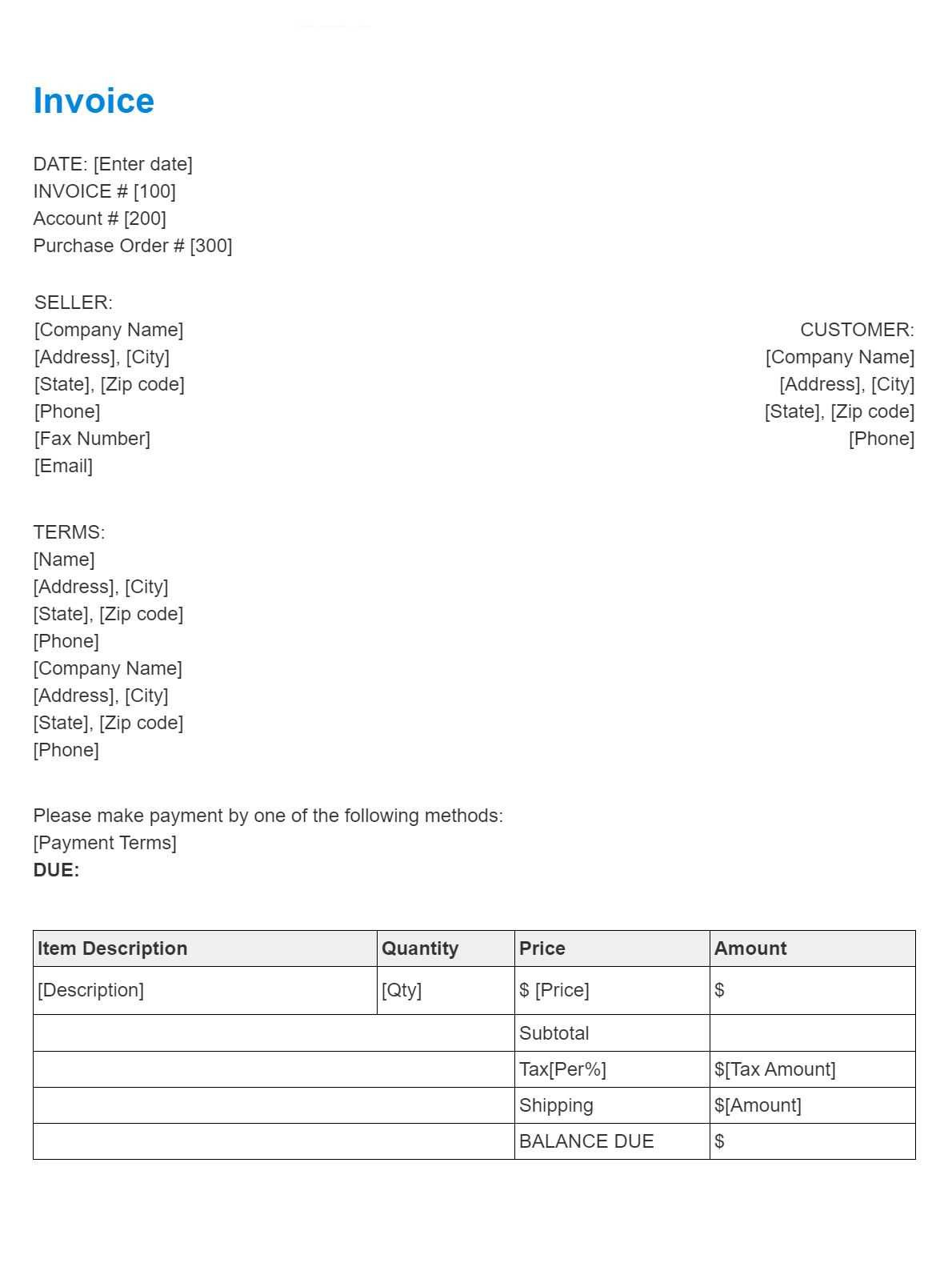

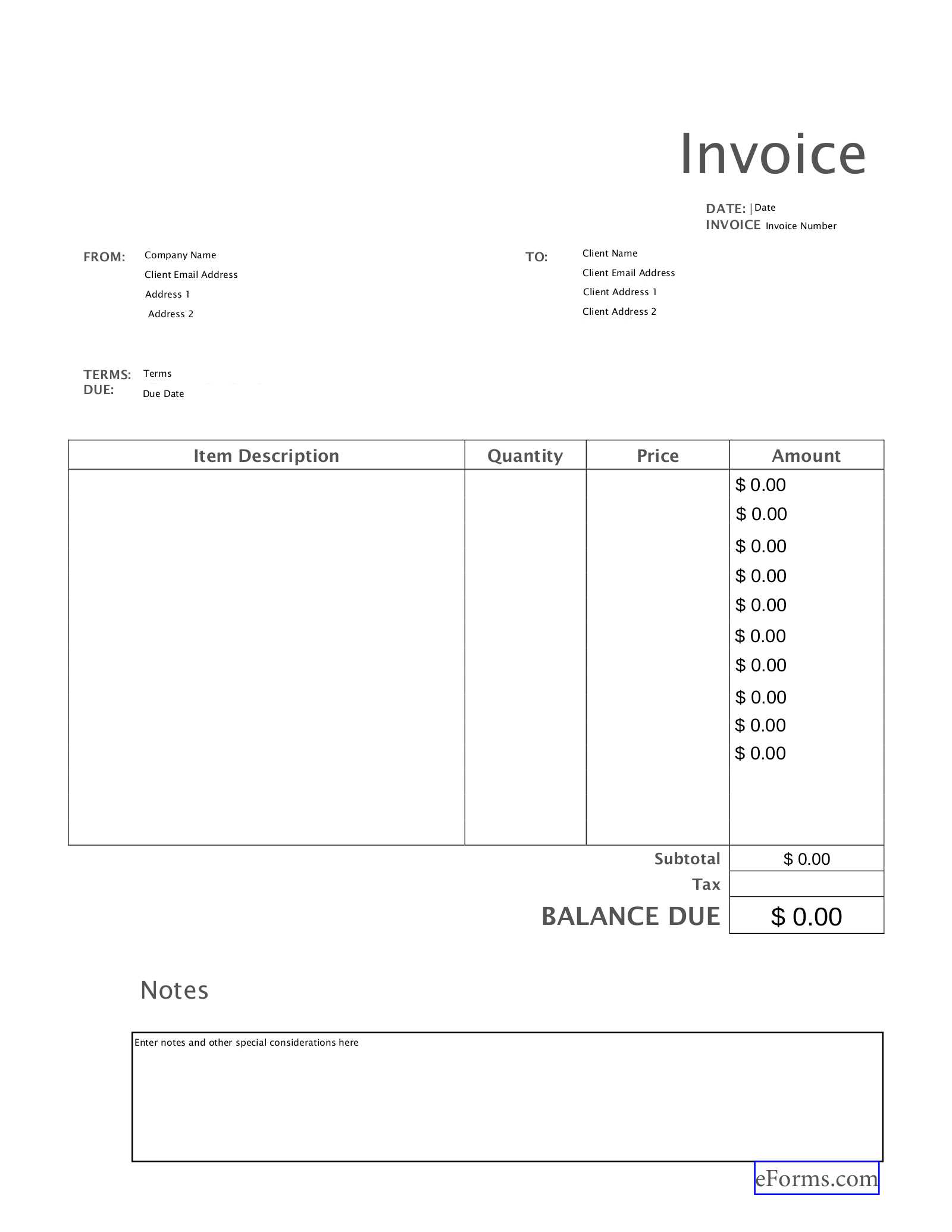

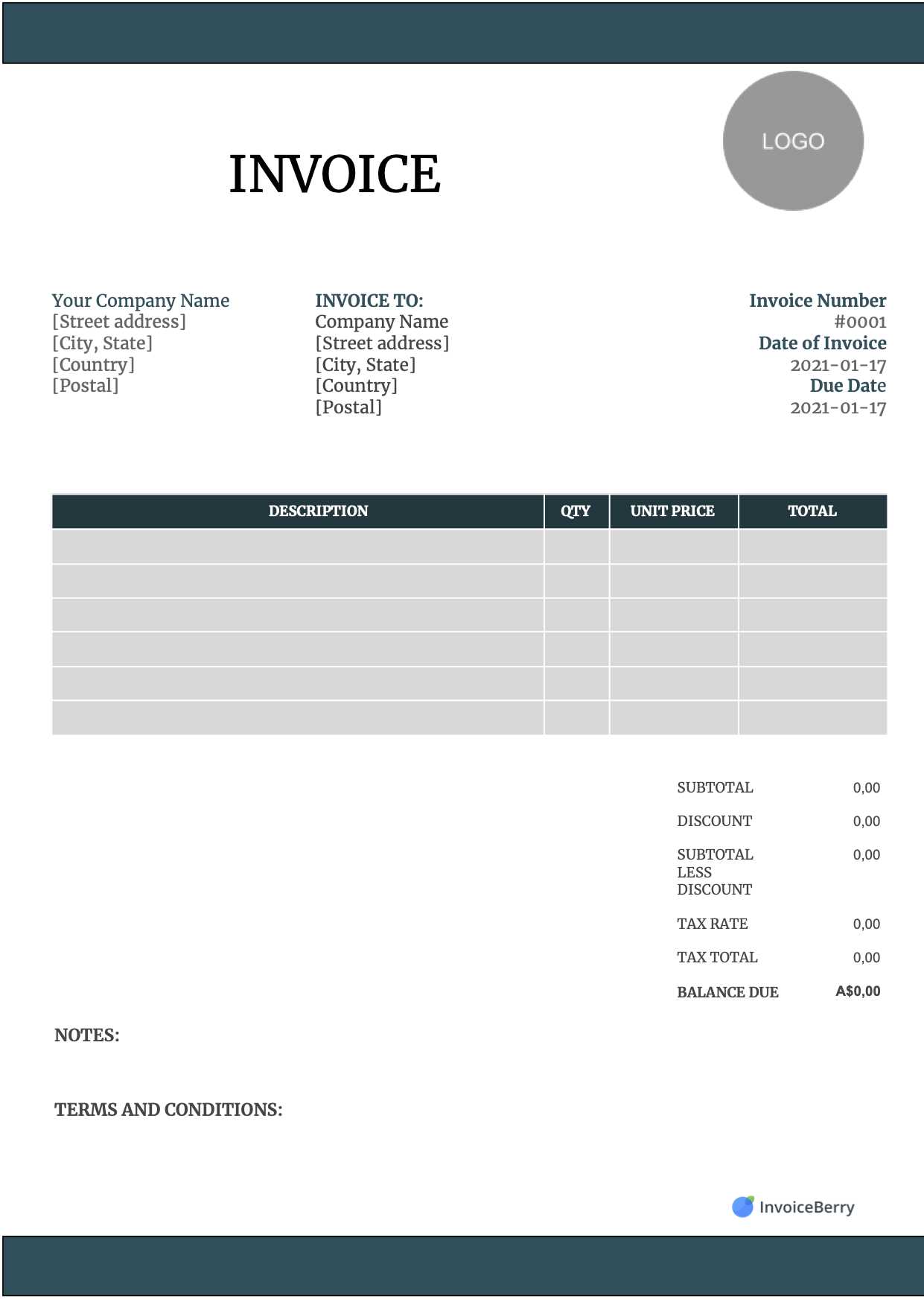

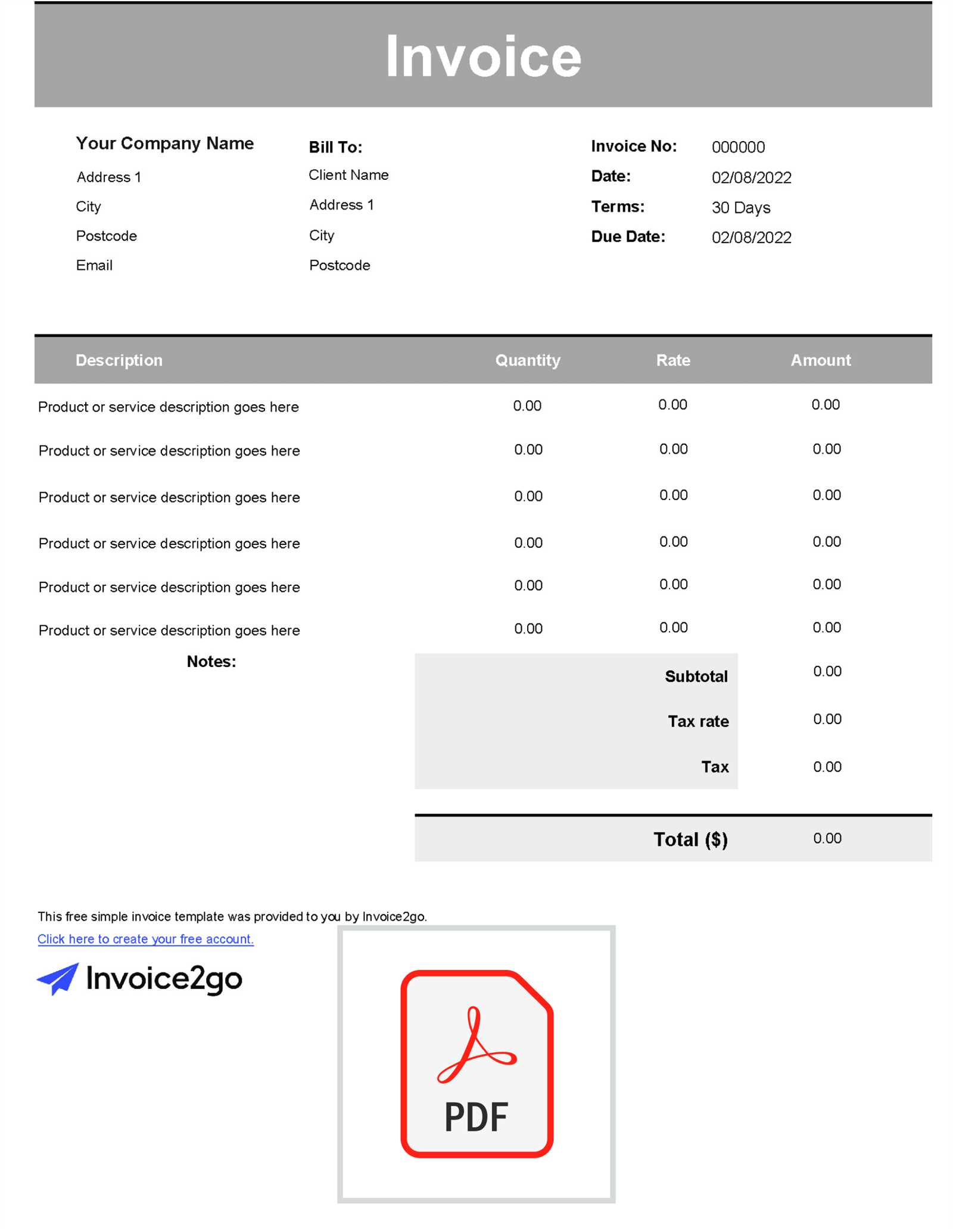

These documents come with essential sections already in place, such as client information, service details, and payment terms. This structure ensures consistency across all records, reducing the chances of missing important information. Customizable fields allow for easy adjustments, helping users adapt the format to their specific requirements.

Why Choose Pre-Formatted Solutions?

Using a pre-formatted billing solution can save time and effort. The flexibility offered by such documents means that businesses can focus more on providing services and less on creating a new document from scratch each time. This not only improves efficiency but also helps maintain a professional appearance, which is critical for building trust with clients.

Benefits of Customizable Invoice Formats

Having the ability to adjust your financial documents to suit specific business needs provides a level of flexibility that can greatly improve your efficiency and professional image. Customizable designs allow users to modify various elements, ensuring that each document aligns with company branding, client preferences, and the nature of the services rendered.

Tailored to Your Business Needs

One of the main advantages of using a flexible format is that it can be personalized to reflect the unique aspects of your business. From adding your company logo to adjusting the layout for ease of use, you can create a document that truly represents your brand. This customization helps build trust with clients, as the documents look more professional and aligned with your business identity.

Easy to Adapt for Different Situations

Another benefit is the ability to quickly adapt the format for various scenarios. Whether you are offering a discount, applying different tax rates, or dealing with a unique payment arrangement, a customizable design lets you make these adjustments on the fly without starting from scratch each time. This flexibility makes handling a wide range of transactions far more efficient.

How to Download Invoice Templates

Obtaining a pre-designed billing document is a simple process that can save time and ensure consistency in your financial records. With numerous online platforms offering ready-to-use layouts, you can easily find one that suits your business needs. Here’s how you can quickly download these forms for immediate use.

Steps to Download a Billing Document

- Visit a reliable website offering customizable forms.

- Browse through the available options and select the format that best matches your requirements.

- Choose the file type (often available in multiple formats like Word, Excel, or digital document formats).

- Click on the download button, and the file will be saved to your device.

- Open the document in your preferred software to make necessary customizations.

Where to Find Free and Paid Formats

There are many resources for both free and paid options. Here are some places to explore:

- Free websites with downloadable files for basic formats.

- Premium platforms offering advanced layouts with added features like automated calculations and integration with accounting software.

- Online marketplaces where you can purchase professionally designed documents tailored to your industry.

Whether you choose a free or paid option, downloading these documents is a straightforward task that can help streamline your billing process significantly.

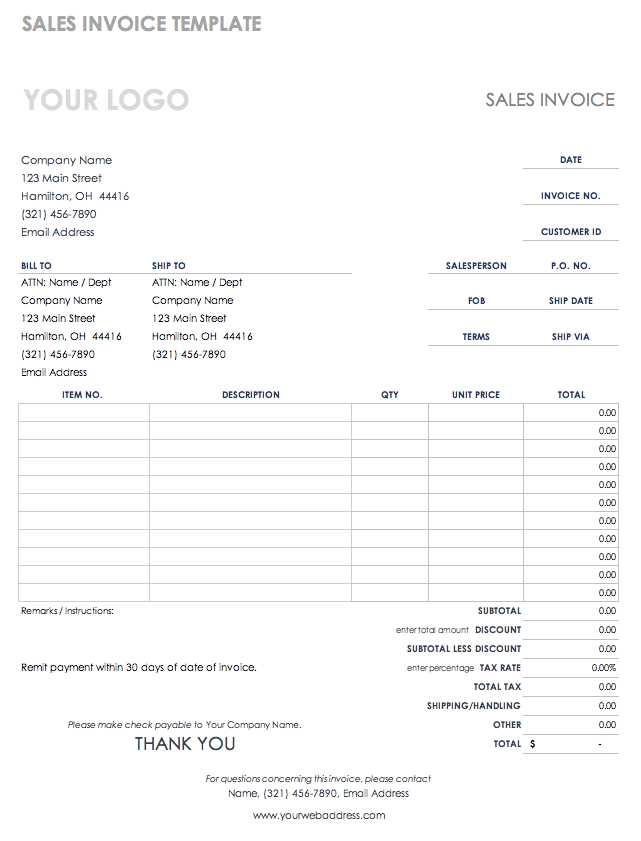

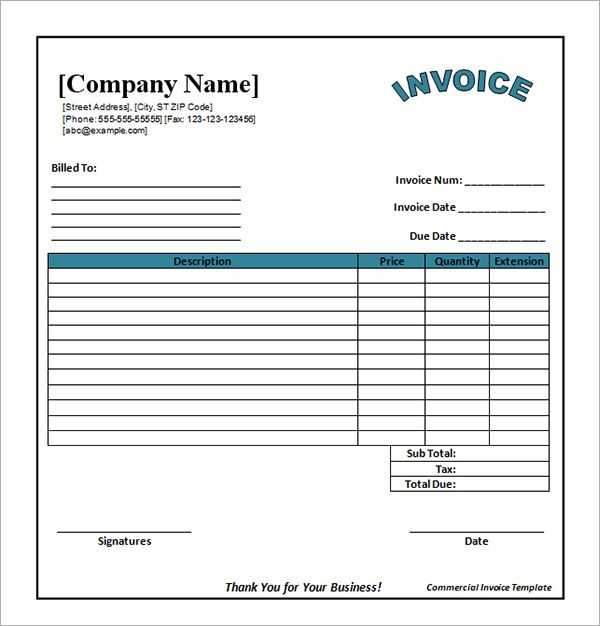

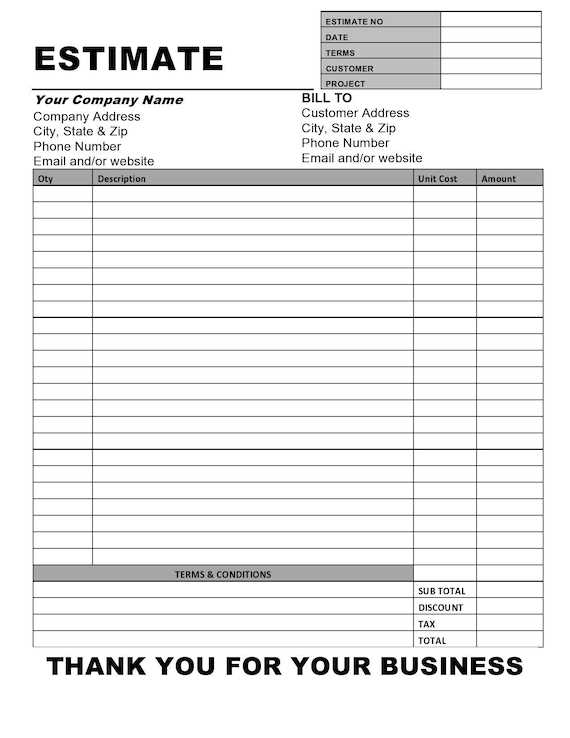

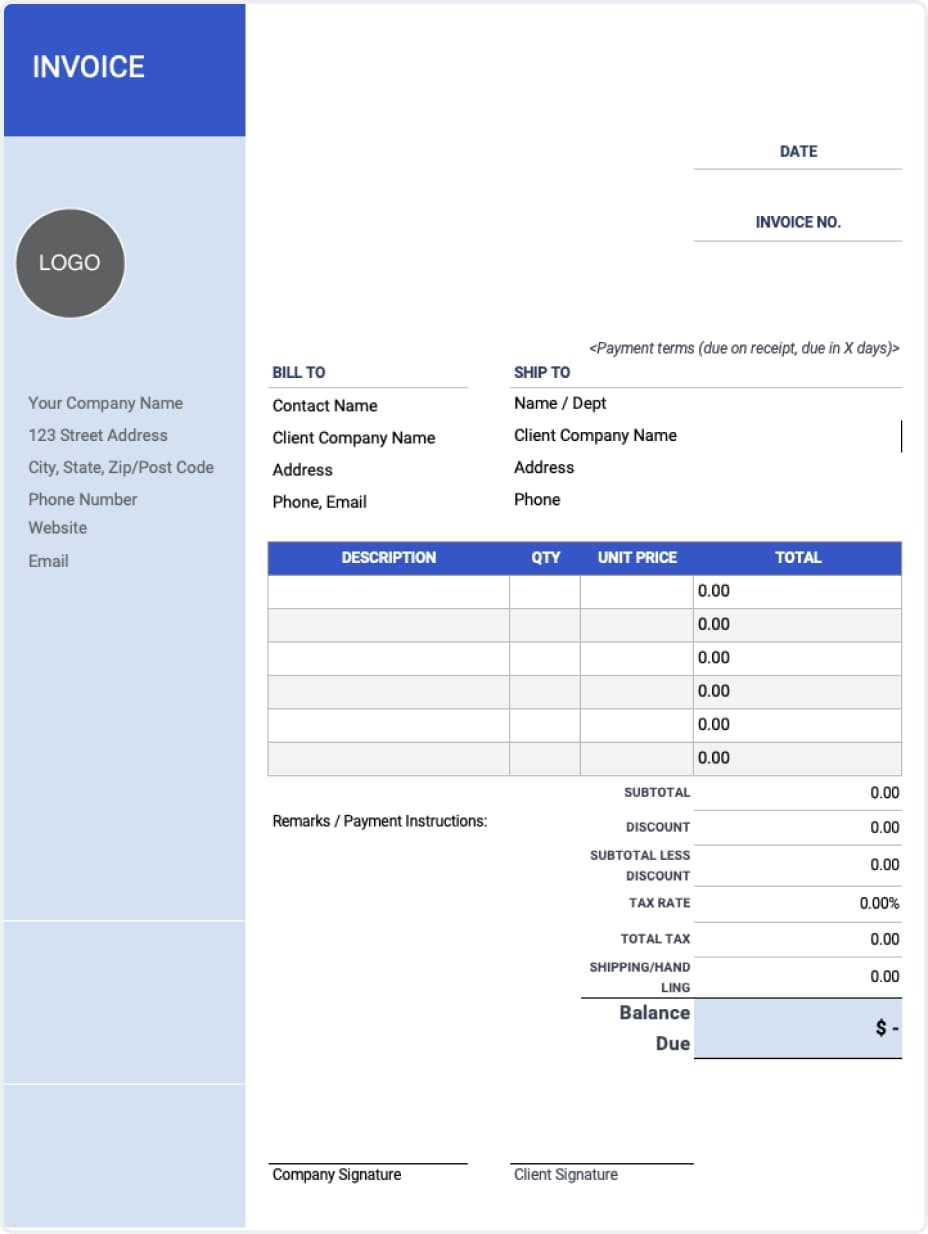

Choosing the Right Invoice Template

Selecting the appropriate billing document layout is a critical step in ensuring smooth financial transactions. The right design not only reflects the professionalism of your business but also helps organize transaction details clearly and effectively. With a variety of formats available, it’s important to choose one that best suits your business type, client preferences, and specific operational needs.

Factors to Consider When Selecting a Format

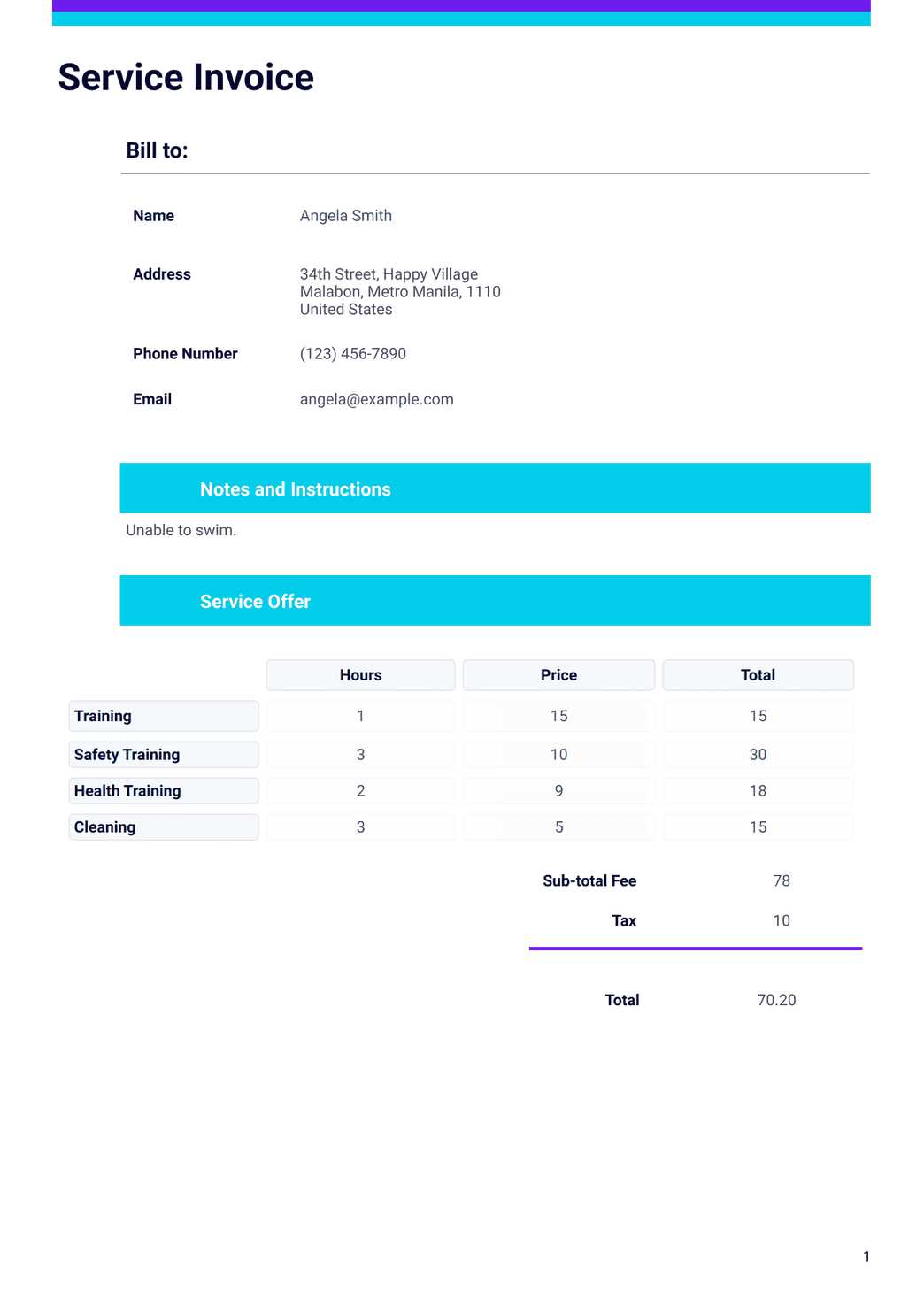

- Business Type: Different industries may require specific fields or layouts. For example, service-based businesses might need more space for work descriptions, while product sellers focus on quantity and prices.

- Customization: Ensure that the document is easy to modify, allowing you to add or remove sections as needed.

- Professional Appearance: A clean, well-organized design will leave a positive impression on clients and ensure clarity in communication.

- Functionality: Choose a format that accommodates the necessary features, such as tax calculations, discounts, or payment terms.

- Compatibility: Ensure the document works well with your existing software systems for easy editing and integration.

Where to Find the Best Formats

There are several places to explore when searching for the right design:

- Free websites offering basic layouts suitable for small businesses or freelancers.

- Premium services that provide more complex and industry-specific options.

- Marketplaces where you can purchase professional designs tailored to your business requirements.

By taking these factors into account, you can ensure that the selected format will help streamline your billing process, making it more efficient and professional.

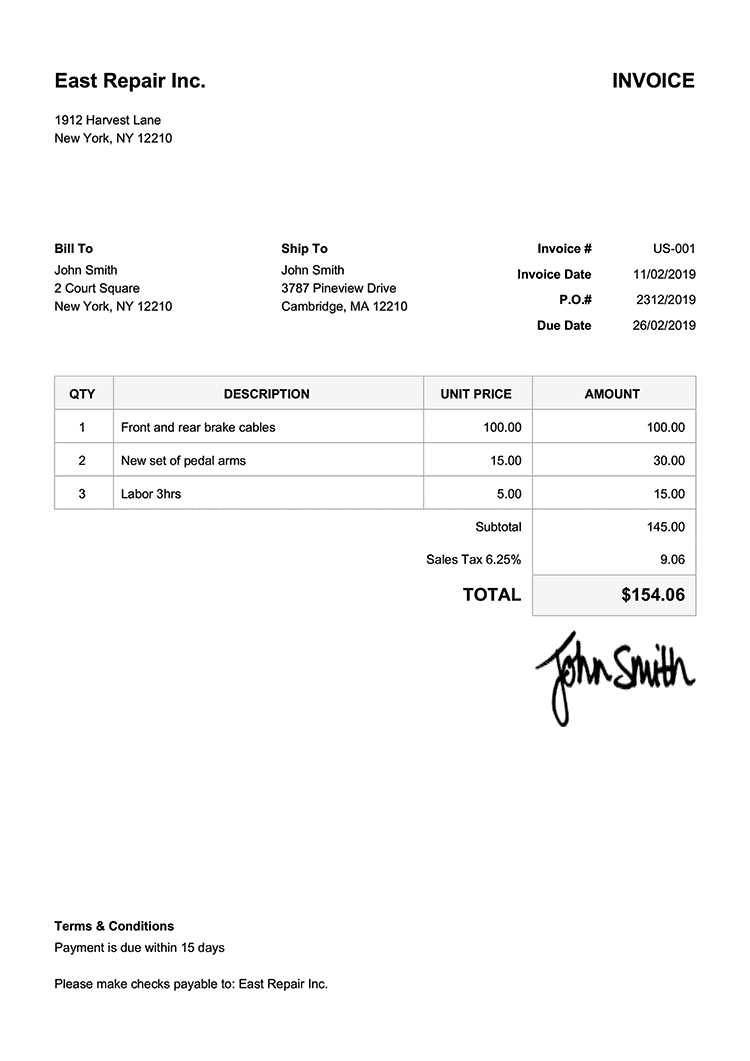

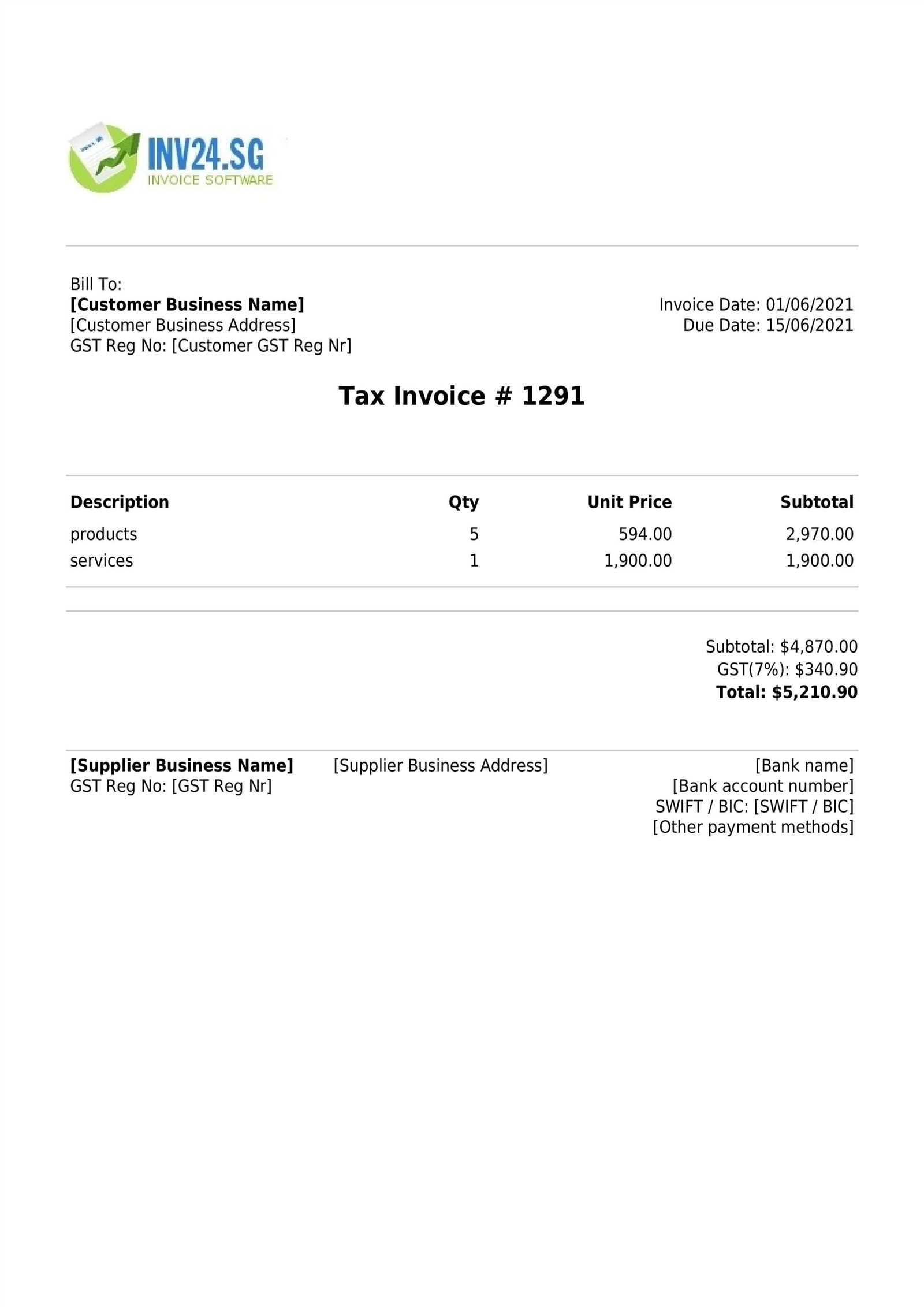

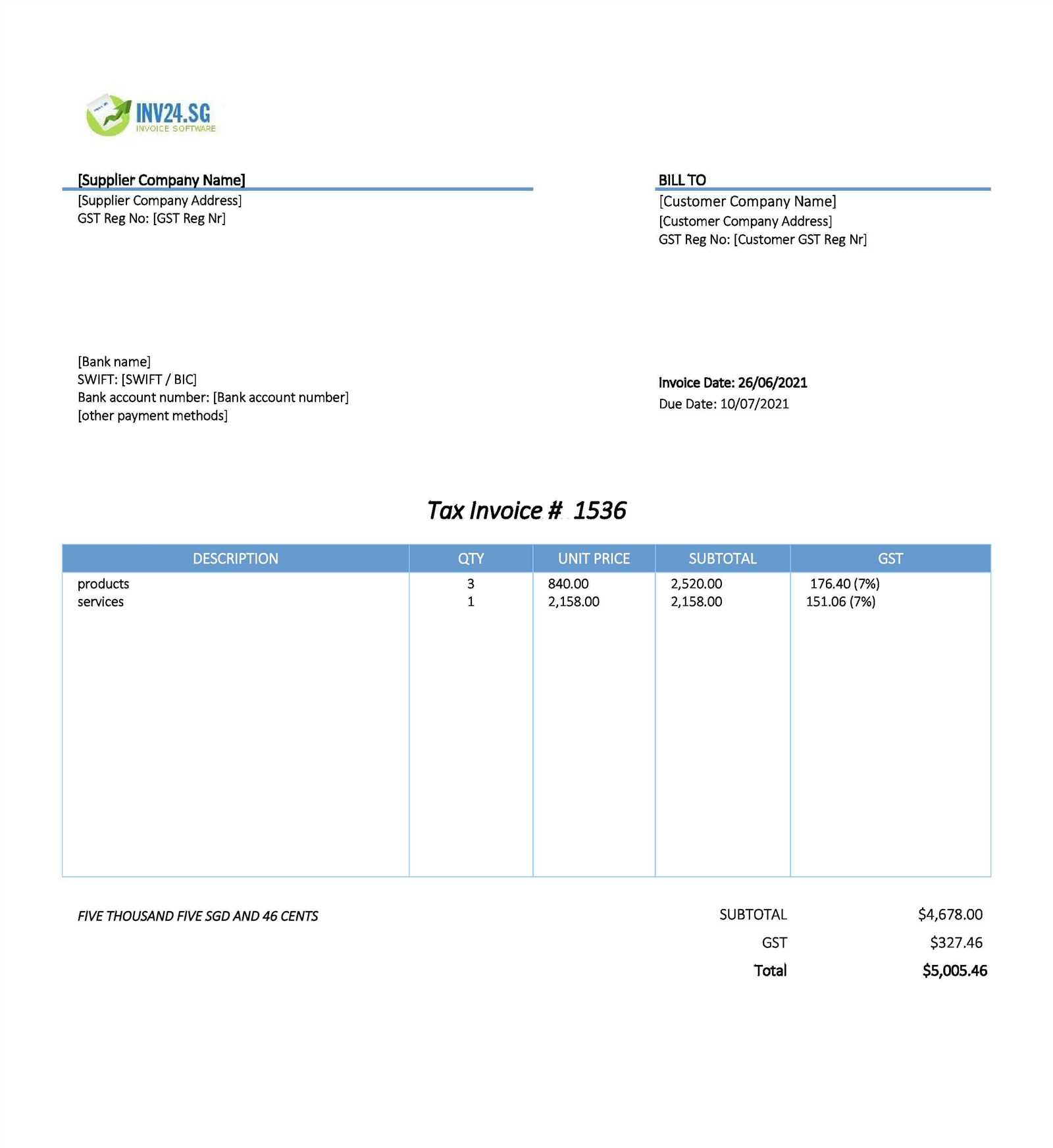

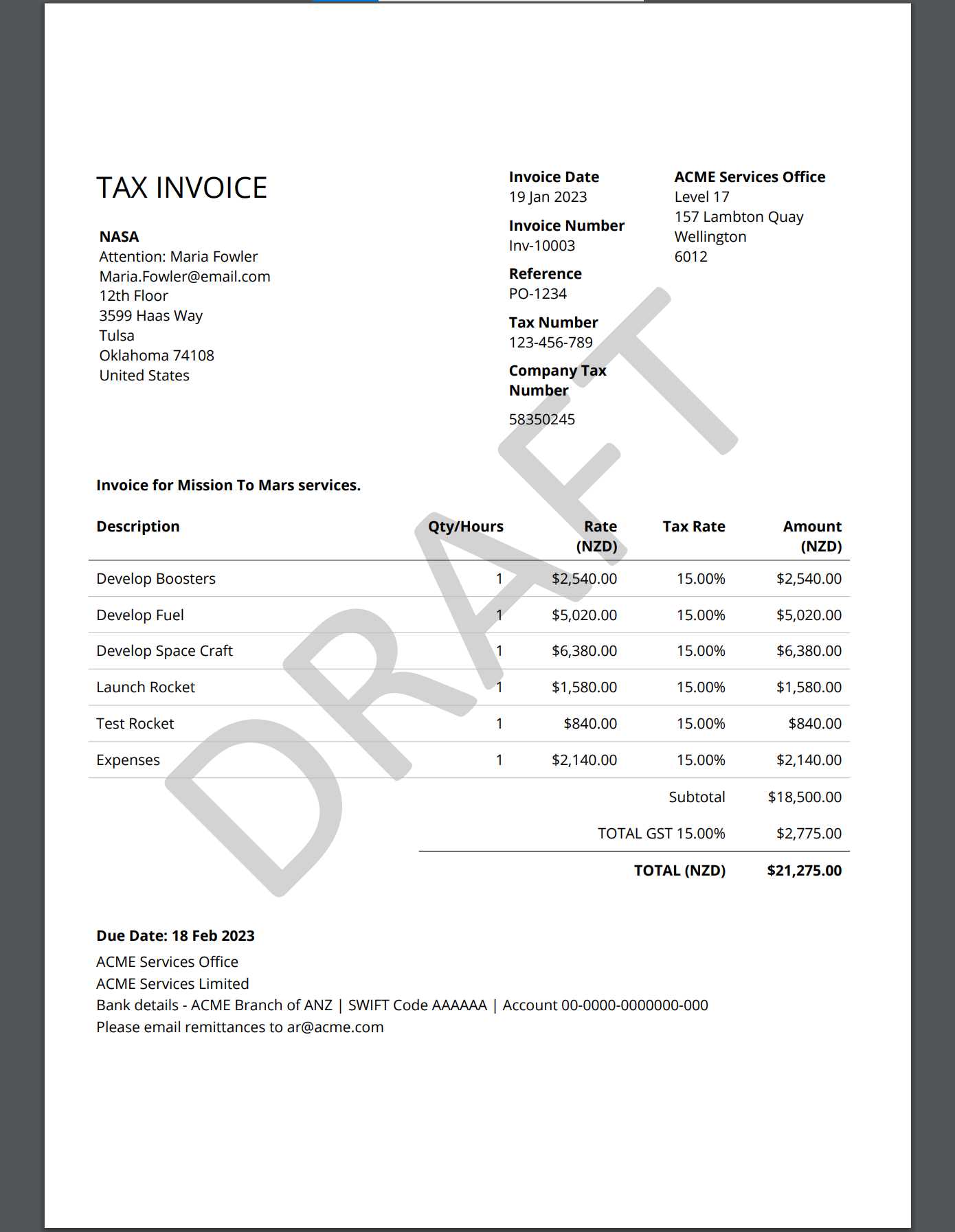

Essential Components of an Invoice

To ensure clarity and prevent errors, every billing document must include certain key elements that provide the necessary information for both the service provider and the client. These essential components help establish the legitimacy of the transaction, ensure proper record-keeping, and make the payment process smoother. Understanding what should be included in a well-structured document is crucial for effective business operations.

Basic Information Required

There are several core pieces of information that every document should contain:

- Contact Information: Both the business and client details, including names, addresses, and phone numbers.

- Unique Identifier: A reference number to identify the transaction easily, preventing confusion in future communications.

- Issue Date: The date when the billing document is issued, which is critical for tracking payments and deadlines.

- Due Date: The deadline for payment, which helps ensure timely settlements.

Details of Goods or Services

For transparency, it is essential to clearly describe the products or services provided:

- Description: A brief yet clear explanation of what was delivered or performed.

- Quantity and Pricing: Specific amounts, rates, or quantities related to the transaction.

- Subtotal: A breakdown of the costs before any taxes, discounts, or additional charges are applied.

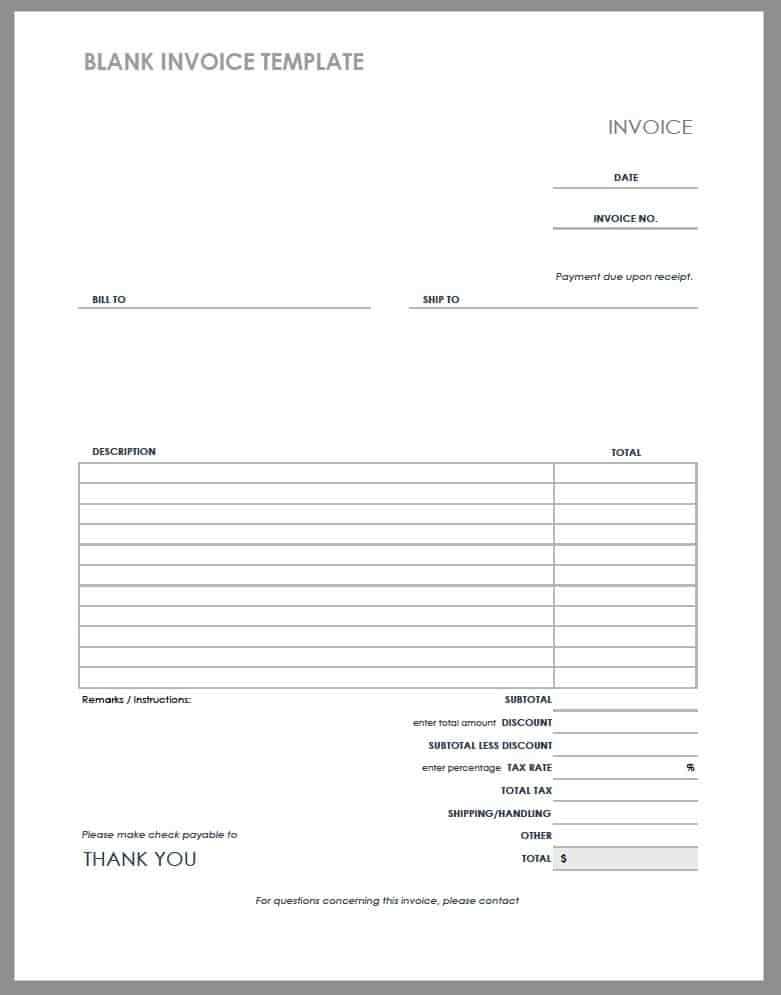

How to Fill Out an Invoice Template

Completing a billing document correctly is essential for ensuring smooth transactions and maintaining a professional image. Accurately filling out all the required sections helps avoid errors and ensures that both the business and client are on the same page. Below is a step-by-step guide to help you fill out a pre-designed layout with the necessary details.

Step 1: Enter Contact Information

The first thing you should do is input the details of both parties involved in the transaction. This includes:

- Your business name, address, and contact information

- Client’s name, address, and contact details

Make sure all contact details are up to date to avoid any communication issues.

Step 2: Add Transaction Details

Next, provide specific details about the transaction:

- Unique identifier: Assign a reference number for easy tracking.

- Date: Indicate the date when the document is issued and, if applicable, the payment due date.

- Description of goods or services: List the products or services provided, along with any relevant details such as quantity, unit price, and rates.

Step 3: Calculate the Total

Ensure that you calculate the total amount accurately. This includes:

- Subtotal: Add up the individual costs of each item or service.

- Taxes and discounts: Apply any relevant taxes or discounts, if applicable.

- Total amount: The final sum to be paid after all calculations.

Once you have filled out all the necessary sections, review the document for any errors before sending it to your client. A well-completed document will make the payment process seamless and help you maintain a good relationship with your clients.

PDF vs Other Invoice Formats

When it comes to choosing the right format for your financial documents, several options are available, each offering distinct advantages and drawbacks. Understanding the differences between these formats can help you make an informed decision based on your business needs. Below is a comparison of the most common file formats used for creating billing documents.

| Format | Advantages | Disadvantages | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

|

|

||||||||||

| Word Document (DOCX) |

|

|

|||||||||

| Excel Spreadsheet (XLSX) |

|

|

|||||||||

| Plain Text (TXT) |

Common Mistakes When Creating InvoicesCreating accurate and professional billing documents is essential for smooth financial transactions, but there are several common mistakes that can lead to confusion, delays, or even disputes. Whether you’re a freelancer or a business owner, it’s crucial to be aware of these pitfalls and take steps to avoid them. Below are some of the most frequent errors that people make when preparing their records. Missing or Incorrect DetailsOmitting or incorrectly entering key information is one of the most common mistakes. This can lead to confusion or even payment delays. Some of the most frequent errors include: Errors in CalculationAnother frequent issue involves miscalculating the amounts due. Even small errors can lead to significant problems. Common mistakes include: To avoid these issues, double-check all entries before finalizing the document and ensure that all the calculations are accurate. It’s also helpful to use automated tools for generating and calculating billing documents to reduce human error. How to Avoid Invoice ErrorsEnsuring that your billing documents are accurate is crucial for maintaining smooth transactions and positive client relationships. Mistakes in financial records can lead to confusion, delayed payments, and even loss of trust. By following a few key practices, you can significantly reduce the risk of errors and ensure that your documents are always correct and professional. Double-Check All InformationOne of the most effective ways to avoid mistakes is to carefully review every detail before sending the document. Pay close attention to: Use Automated ToolsManual entry increases the risk of human error. To minimize mistakes, consider using automated tools or software that can generate and calculate billing documents for you. These tools can: By incorporating these strategies, you can reduce the likelihood of errors in your financial documents, making your billing process more efficient and professional. Best Practices for Invoice DesignA well-designed financial document not only ensures clarity and professionalism but also facilitates smooth transactions. Properly structured layouts make it easier for clients to understand the details of the transaction and make timely payments. By following some best practices, you can create documents that are both functional and visually appealing. Key Elements for a Professional Design

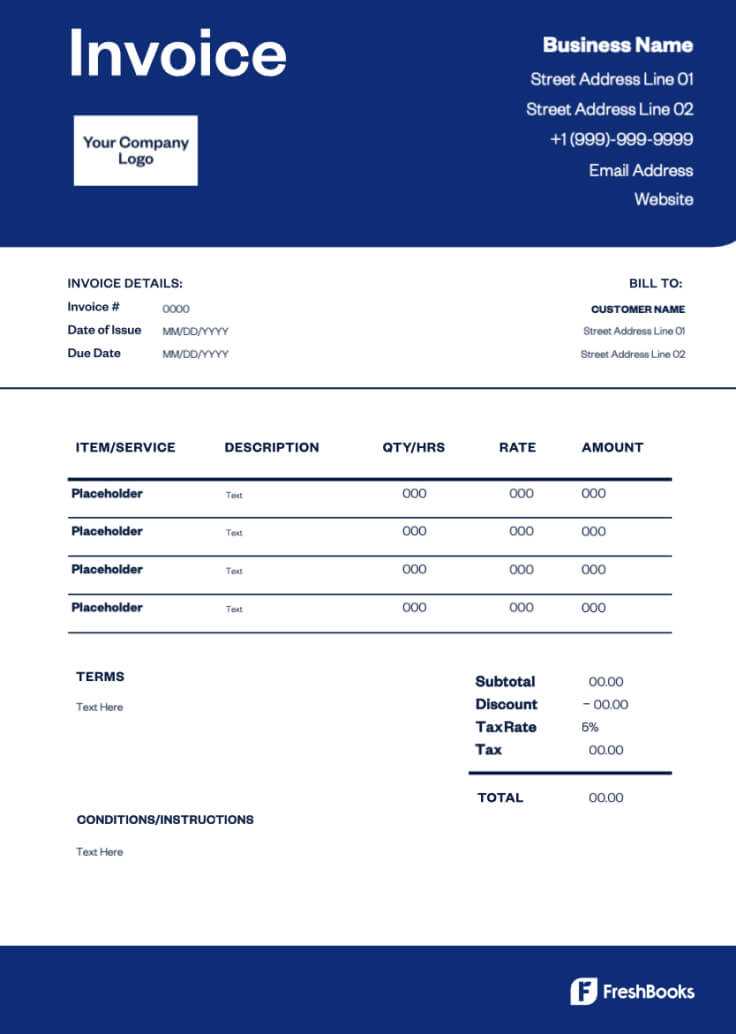

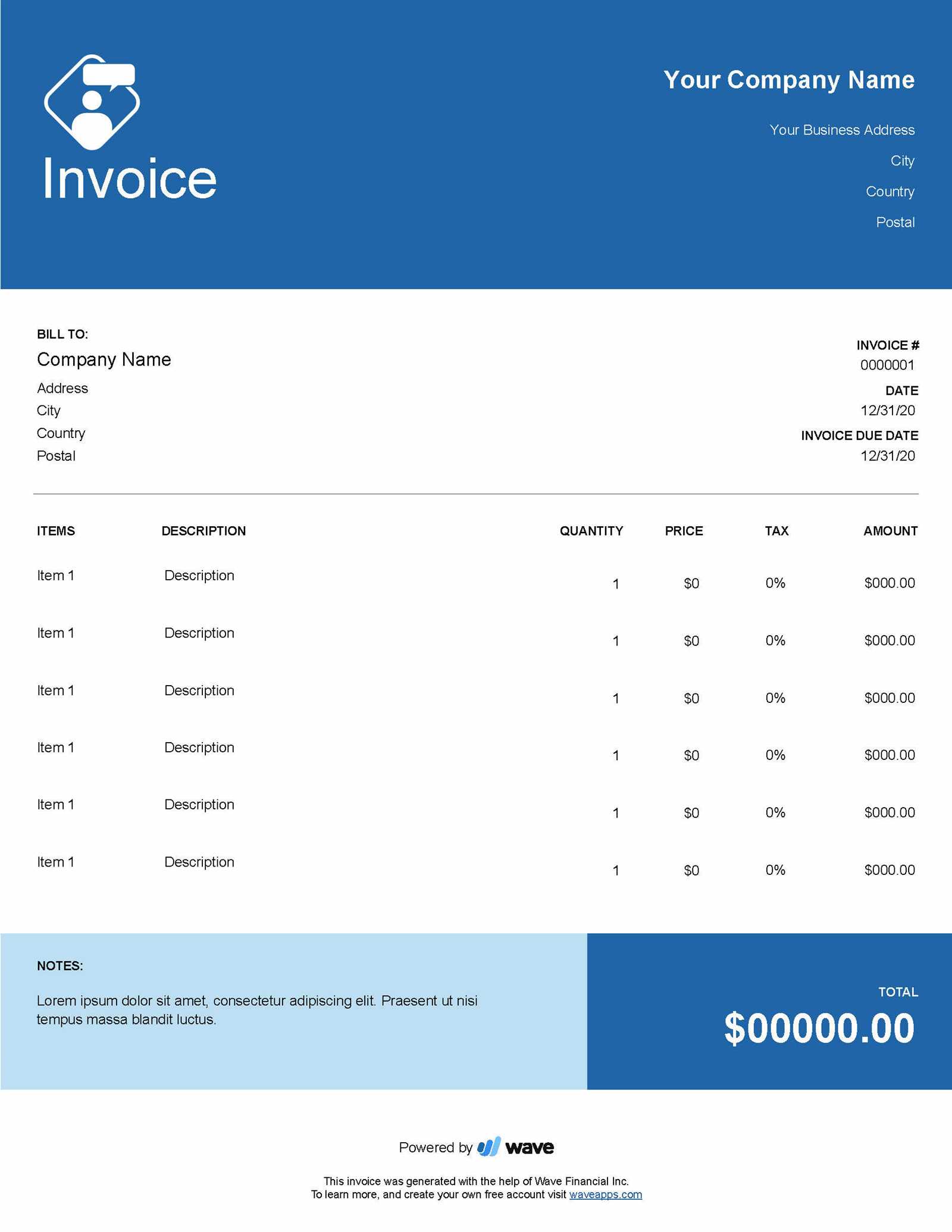

When designing your billing documents, certain elements should always be included to ensure clarity and completeness: Design Tips for Clarity and EfficiencyTo further enhance the functionality and visual appeal of your documents, consider these additional design tips: By following these best practices, your billing documents will not only be functional but also reflect a high level of professionalism, which can improve client satisfaction and prompt payments. How to Personalize Your Invoice Template

Customizing your billing document is an important step in establishing your brand identity and making your financial transactions more professional. A personalized layout not only helps you stand out but also provides your clients with a more tailored experience. Here are some ways you can personalize your billing records to reflect your business and enhance your client relationships. Incorporate Your Brand ElementsOne of the easiest ways to personalize your document is by incorporating your company’s branding. This includes: Customize Layout and ContentBeyond the basic details, there are other ways to personalize your billing document’s content: By incorporating these personalized elements, you not only make your billing documents unique but also convey professionalism, which can leave a positive impression on your clients and encourage prompt payments. Adding Branding to Your Invoices

Incorporating your company’s branding into your billing documents not only enhances professionalism but also helps create a memorable experience for your clients. A consistent visual identity across all of your business communications can strengthen your brand recognition and build trust. Below are several ways to effectively add your branding elements to your financial documents. Key Elements of Branding in Billing Documents

When adding branding to your financial documents, focus on these essential elements:

Other Tips for Effective Branding

In addition to the basic visual elements, there are other ways to enhance your document with your brand: By incorporating these branding elements, your billing documents become an extension of your business’s identity, helping build credibility a How to Edit a PDF Invoice Template

Editing your billing documents is an essential skill for businesses that want to provide accurate and professional records. Whether you need to adjust details, update prices, or personalize a document, knowing how to edit your billing files ensures that you can easily make the necessary changes. Below are some simple methods for editing a financial document without losing formatting or causing errors. Using PDF Editing SoftwareOne of the most effective ways to modify your document is by using dedicated PDF editing software. Programs like Adobe Acrobat, Foxit, or Nitro offer a wide range of features for editing, annotating, and modifying your records. These tools allow you to: Using Online PDF EditorsIf you don’t have access to paid software, there are several free online tools available to edit your document. Websites like Smallpdf, PDFescape, or Sejda allow you to upload, edit, and download your financial records directly from your browser. These online editors are convenient and easy to use for simple edits, including: Both PDF editing software and online tools offer great flexibility for modifying your documents. Choose the method that best suits your needs and be sure to save your work regularly to avoid losing any changes. Automating Invoice Creation with TemplatesStreamlining the process of generating billing documents is crucial for businesses looking to save time and reduce errors. By using pre-designed formats and automating data entry, you can speed up the process while ensuring accuracy. Automation not only improves efficiency but also helps maintain consistency across all your financial records. Benefits of Automating Billing Documents

There are several key advantages to automating your billing process: How to Automate Document Creation

Automating the creation of your billing documents can be done using a few different tools: By incorporating automation into your document creation process, you can reduce administrative overhead, minimize mistakes, and provide your clients with accurate, timely records every time. Ensuring Invoice Accuracy and ComplianceMaintaining accuracy and compliance in financial documents is critical for businesses to build trust with clients and avoid legal or financial issues. Whether you’re handling sales, services, or recurring transactions, every document you send must be correct, clear, and in accordance with applicable laws and regulations. By following best practices, you can ensure that your records are both precise and legally compliant. Steps to Ensure AccuracyTo avoid errors and ensure that your billing records are always accurate, consider the following steps: Ensuring Legal Compliance

Compliance with local laws and industry regulations is another key aspect of creating legally sound documents. To maintain compliance: By focusing on these areas, you can reduce the chances of errors and ensure that your financial records are both accurate and legally compliant, ultimately building better relationships with your clients and protecting your b Sharing and Sending PDF Invoices

Once your billing document is complete and ready, the next step is sharing it with your clients. Whether you’re sending a one-time charge or a recurring payment request, how you deliver the document plays a significant role in ensuring it is received promptly and without confusion. Modern tools allow you to send documents securely and efficiently, making the process smoother for both you and your clients. Methods for Sending Billing DocumentsThere are several options available for sharing your billing records. Here are the most common methods: Best Practices for Sending Billing Documents

When sharing your documents, it’s essential to maintain a professional approach. Consider these best practices: |