Sponsorship Invoice Template Excel for Easy Customization and Use

Managing financial transactions in partnership agreements requires precision and clarity. To ensure smooth processing and timely payments, it’s essential to use a structured approach when requesting funds. Having a well-organized document that outlines all necessary details helps maintain professionalism and avoid errors. Whether you are dealing with sponsors, collaborators, or business partners, a clear and adaptable format can simplify this task significantly.

Automating the process through digital tools can enhance efficiency. By choosing the right software, you can customize your documents to meet specific requirements, track payments, and reduce manual work. The flexibility of these tools allows you to tailor the layout and contents, ensuring that every transaction is properly recorded.

With the right approach, these financial documents can not only speed up payment cycles but also contribute to building stronger business relationships. By presenting clear, professional records, you demonstrate accountability and transparency, which are key to fostering trust in any collaborative venture.

What is a Sponsorship Invoice Template

A financial document used to request payment for services provided or funds agreed upon in a partnership agreement is essential for any business. This document typically outlines the details of the arrangement, including amounts due, payment terms, and any other relevant information. It serves as a formal request for compensation after an agreement has been made, ensuring both parties are clear on the financial expectations.

Such a document helps to streamline the billing process, ensuring that all necessary elements are included and presented in an organized manner. By using a structured format, businesses can avoid errors, reduce administrative overhead, and ensure that payments are processed without unnecessary delays.

These tools are customizable and can be adapted to fit the specific needs of each agreement. They allow the inclusion of essential details such as payment methods, due dates, and specific terms, which helps maintain transparency and clear communication between all parties involved.

Benefits of Using Excel for Invoicing

Using a digital tool to create and manage billing documents offers numerous advantages for businesses. By leveraging a spreadsheet application, you can streamline the entire process from creation to tracking, minimizing manual effort and reducing the likelihood of errors. With built-in functions and customizable features, these tools allow for greater accuracy and efficiency when handling financial transactions.

Efficiency and Time-Saving

One of the key benefits of using a spreadsheet application for billing is the ability to automate repetitive tasks. The software can quickly calculate totals, taxes, and discounts, allowing you to focus on other important aspects of the business. You can also create reusable layouts, reducing the time spent on each new request. With simple templates, creating a professional-looking document becomes much faster.

Easy Customization and Flexibility

Another significant advantage is the high level of customization available. You can modify every aspect of the document, from the structure to the content, to suit specific business needs. Whether it’s adjusting for different payment terms or including additional data fields, a spreadsheet allows full control over the presentation and functionality of each file.

| Feature | Benefit |

|---|---|

| Automatic Calculations | Saves time and reduces errors in number crunching. |

| Customization Options | Adapt the layout to specific business needs or client requirements. |

| Data Organization | Easily track payments and outstanding amounts with structured data. |

| Reusability | Quickly create new documents based on saved formats. |

In conclusion, using a spreadsheet application for creating and managing financial documents not only simplifies the process but also enhances the accuracy and professionalism of your communications with clients or business partners.

How to Customize Your Sponsorship Invoice

When preparing a financial request document, it’s important to ensure that it accurately reflects the terms of your agreement and is tailored to the specific needs of the transaction. Customization allows you to add relevant details, such as personalized terms, discounts, or specific payment instructions, which can make the document more efficient and professional. Adapting the format to your business style and client preferences can also improve communication and ensure that all necessary information is clearly presented.

To begin, you can start by adjusting the layout to match the type of arrangement you’re dealing with. This may include adding or removing fields based on the services or goods provided. For instance, if you are dealing with a long-term partnership, you may want to add a section for payment schedules or installment plans. If the transaction involves multiple stages or milestones, you can include detailed breakdowns for each phase.

Another key customization feature is the ability to personalize the design and branding. This could include inserting your company logo, adjusting fonts and colors, or modifying the header and footer to align with your corporate identity. Professional and cohesive branding not only enhances the document’s appearance but also promotes your business’s credibility and consistency in communication.

Finally, you can incorporate specific financial data and calculations. For example, setting up automated formulas for taxes, discounts, or service fees ensures accuracy and helps reduce human error. Additionally, this customization can make it easier for both parties to track progress, due amounts, and deadlines.

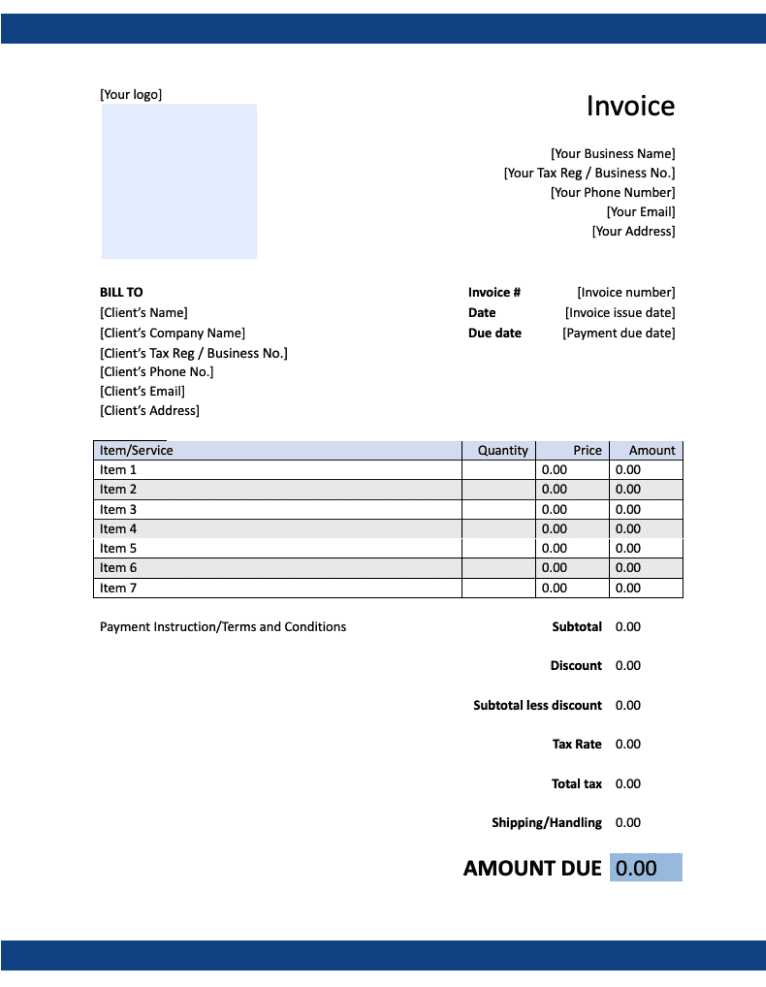

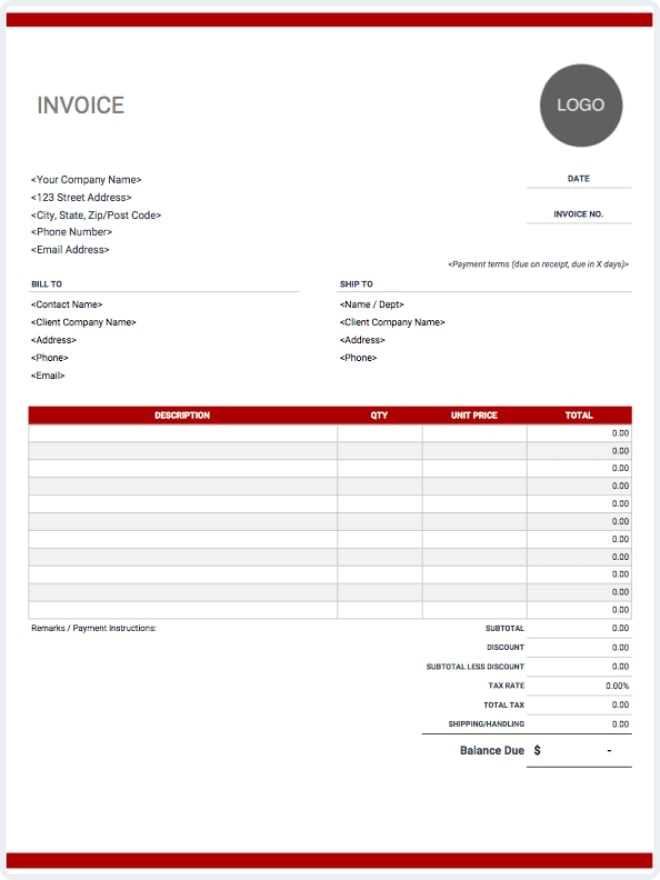

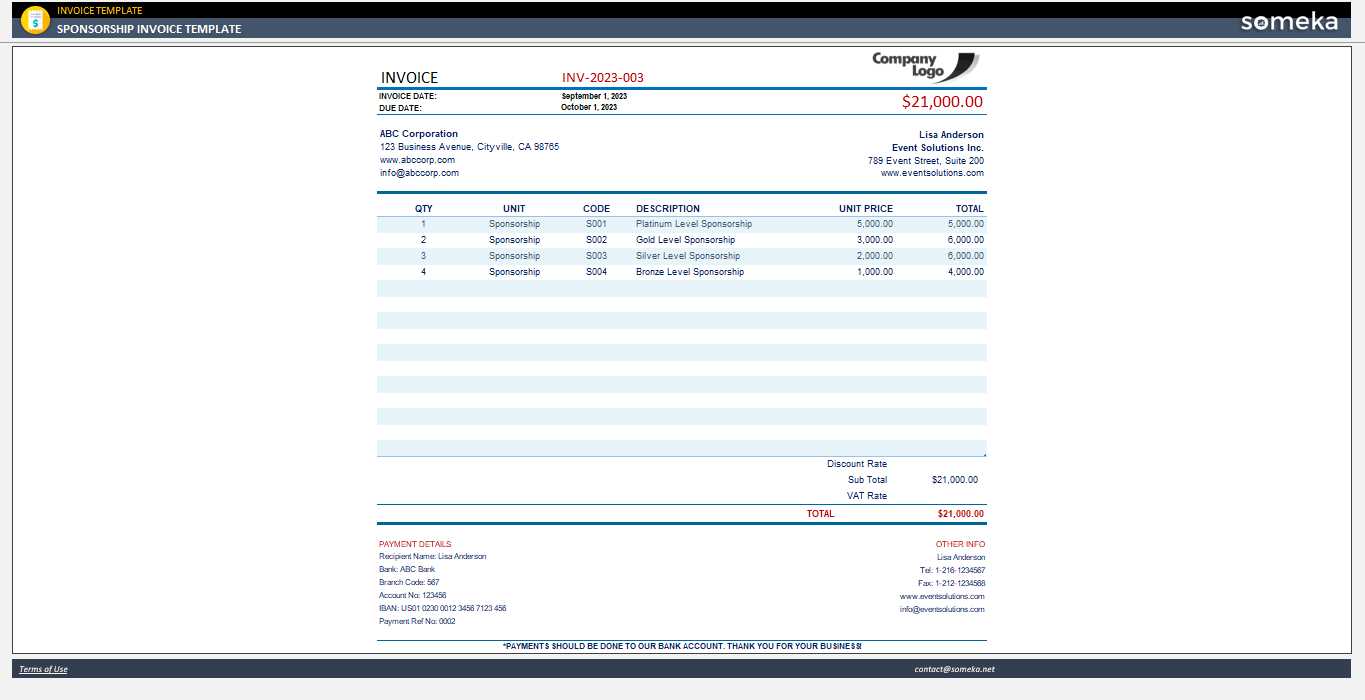

Key Elements of a Sponsorship Invoice

When creating a financial document to request payment, it’s essential to include certain key components that ensure clarity and professionalism. Each element serves a specific purpose, from identifying the parties involved to clearly outlining the amounts due and payment terms. Including all necessary information not only prevents misunderstandings but also helps maintain smooth communication between both parties.

Basic Information

The first thing any such document should include is contact details for both the sender and the recipient. This typically involves the name, address, phone number, and email of both the business or individual issuing the request and the party expected to make the payment. This is crucial for establishing a clear line of communication if there are any issues or questions regarding the transaction.

Financial Breakdown

The most important part of the document is the payment details. This section should clearly list the agreed-upon services, including dates, quantities, and individual costs. Providing a detailed breakdown ensures that both parties are on the same page about what has been provided and the associated costs. If applicable, also include information on any discounts, taxes, or additional fees. Clear calculations are essential to avoid disputes later on.

Additionally, it’s critical to outline payment terms, such as due dates, acceptable methods of payment, and any late payment penalties. Including this information helps ensure that both sides understand the expectations regarding the timing and method of payment, further enhancing transparency and trust.

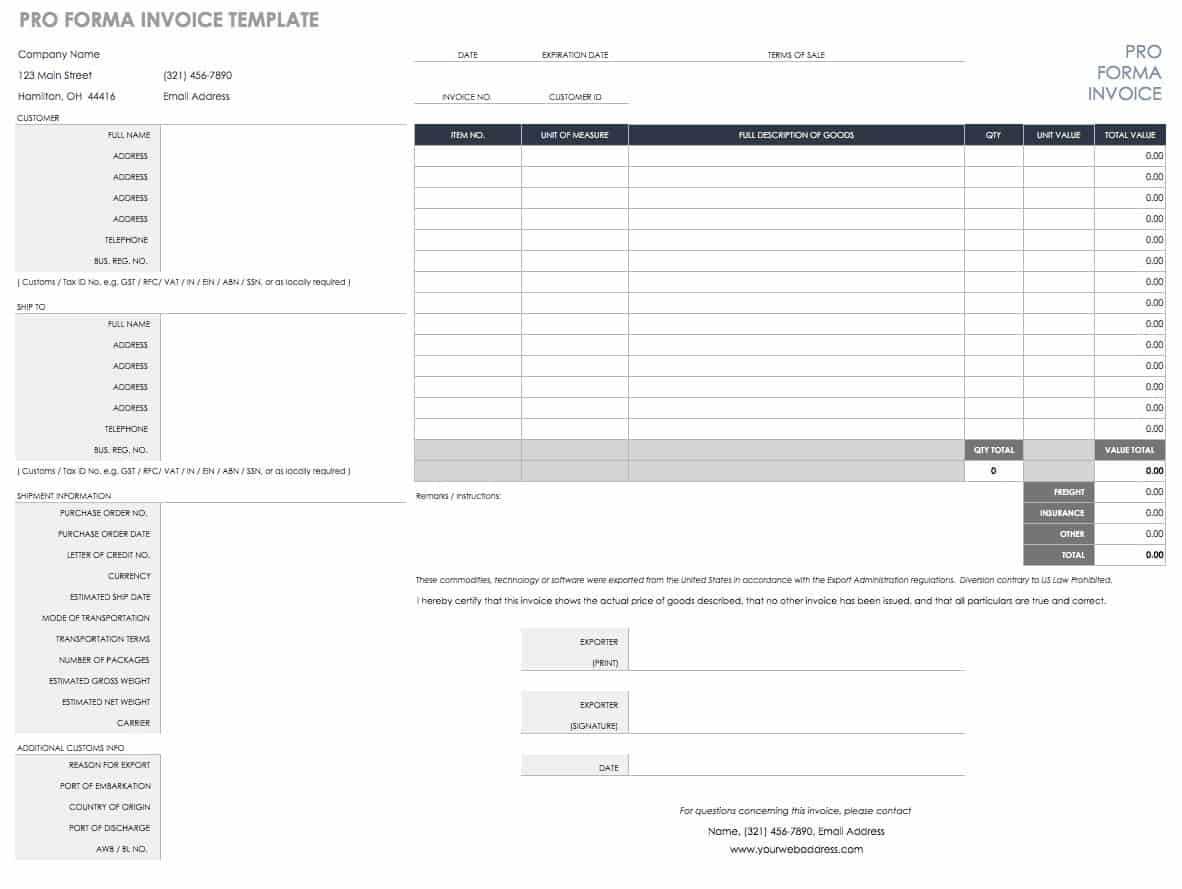

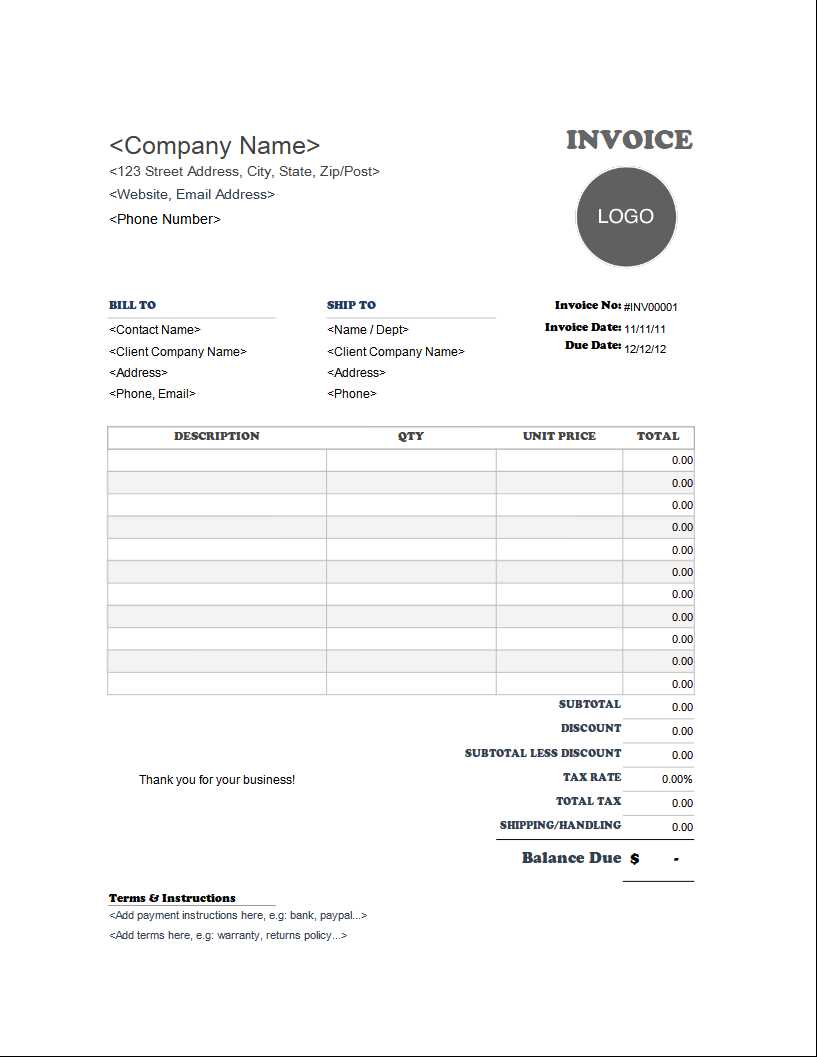

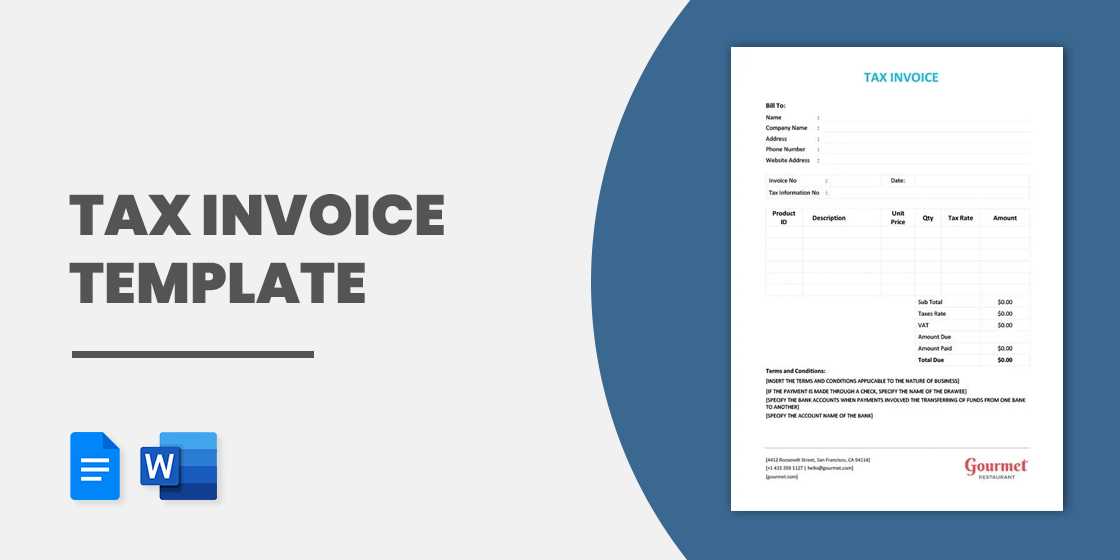

Free Sponsorship Invoice Templates for Download

For businesses looking to simplify the billing process, there are numerous free resources available online that allow you to download ready-made financial documents. These pre-designed files are particularly useful for those who want to save time and ensure that all necessary details are included in a professional format. Whether you need a document for a one-time agreement or a long-term partnership, these free downloads can be customized to fit your needs.

Advantages of Using Free Downloadable Files

One of the main benefits of using these downloadable files is the convenience they offer. Rather than starting from scratch, you can quickly access a layout that already includes all the necessary fields for financial data. These documents often come with built-in formulas for calculations, making it easier to generate accurate totals, taxes, and discounts without manual input.

Customizing Free Templates

While the downloadable documents are pre-made, they are highly customizable. You can modify the content, structure, and design to align with your specific requirements. Add your company logo, adjust the fonts, or insert additional sections as needed. Customizing these resources ensures they reflect your brand and fit the exact terms of your agreements.

Best Practices for Sponsorship Billing

When it comes to managing financial requests in business agreements, following best practices ensures efficiency, accuracy, and a professional approach. Proper billing helps maintain clear communication, avoid errors, and strengthen relationships with partners. By adopting a structured approach to financial transactions, you can streamline the process and create a smooth experience for both you and your client.

Essential Tips for Effective Billing

- Always Include Clear Payment Terms: Specify due dates, payment methods, and any penalties for late payments. This ensures both parties are aligned on expectations.

- Break Down Costs: Provide a detailed breakdown of all services or products provided. This will help the recipient understand what they are being charged for and make the document easier to review.

- Use Consistent Formatting: Maintain consistency in the layout and structure of your documents to create a professional and easy-to-read appearance.

- Incorporate Contact Information: Always include your contact details as well as the recipient’s to ensure quick resolution in case of discrepancies.

- Track Payments Effectively: Keep an organized record of payments received and outstanding amounts to avoid any confusion or missed payments.

Common Mistakes to Avoid

- Omitting Key Information: Never leave out critical data like payment terms, service descriptions, or contact information.

- Failing to Specify Taxes or Discounts: Make sure to clearly state any taxes or discounts that apply to avoid misunderstandings.

- Not Including Payment Instructions: Always provide clear instructions on how the payment can be made to ensure the process is seamless.

- Not Tracking Payments: Keep a record of each transaction, noting dates, amounts, and payment status.

By following these best practices, you can enhance the professionalism of your billing process, reduce the risk of mistakes, and ensure that payments are processed smoothly and on time.

How to Format Sponsorship Invoices in Excel

Creating a well-structured financial document in a spreadsheet program ensures accuracy and professionalism. Proper formatting not only makes the document easier to read but also helps in automating calculations and tracking. By organizing the layout efficiently, you can streamline the entire billing process, ensuring that all necessary details are included and clearly presented.

Step-by-Step Guide to Formatting Your Document

- Set Up Your Header: Start with your business name, logo, and contact details. Clearly label the document as a payment request to avoid any confusion.

- Include Client Information: Add the recipient’s name, address, phone number, and email. This ensures that the document is addressed correctly and can be easily referenced.

- Use Clear Date and Reference Fields: Include fields for the date of issuance, payment due date, and a unique reference number for easy tracking.

- Structure the Breakdown of Services: Create separate columns for service descriptions, quantities, rates, and totals. This makes it easier for both parties to review the charges.

Formatting Tips for Readability

- Align Data Properly: Ensure that numbers are aligned to the right for easy comparison, while text should be left-aligned for readability.

- Use Bold for Headings: Bold key labels, like “Total Due” and “Service Description,” to make important information stand out.

- Incorporate Borders and Shading: Use borders for separating different sections and shading to highlight totals, taxes, and discounts.

- Utilize Formulas for Automation: Add simple formulas to automatically calculate totals, taxes, and discounts based on the data inputted.

Final Steps

Once the document is formatted, double-check all the fields for accuracy. Verify that the totals match, the payment terms are clear, and that all relevant information is included. A well-formatted document not only increases efficiency but also reinforces professionalism and clarity, improving the likelihood of timely payments.

Common Mistakes in Sponsorship Invoicing

Even with the best intentions, creating accurate financial documents can sometimes result in mistakes that cause delays in payment or confusion between parties. These errors, whether minor or major, can affect the professionalism of your business and potentially damage relationships with clients or partners. Recognizing common pitfalls and learning how to avoid them can streamline the process and ensure that the billing cycle remains smooth and efficient.

Key Errors to Avoid

- Incomplete or Missing Details: Failing to include crucial information, such as the recipient’s contact information, payment terms, or service descriptions, can lead to confusion. Always ensure that every section is filled in completely and correctly.

- Incorrect Calculations: One of the most common errors is failing to properly calculate totals, taxes, or discounts. Always double-check formulas and make sure that the numbers add up as expected. Small errors can cause delays or mistrust in the billing process.

- Unclear Payment Terms: Not specifying the due date, late fees, or acceptable payment methods can create misunderstandings. Always ensure that the payment terms are clearly stated and easy to follow.

- Omitting Reference Numbers: Not including a unique reference number or identifier for each document can make it difficult to track payments. This can be especially problematic in ongoing or large-scale projects.

How to Prevent These Mistakes

- Double-Check All Information: Before sending out any financial document, carefully review it for accuracy. This includes checking that all numbers are correct, all fields are filled out, and all details are clearly presented.

- Use Automated Features: Many digital tools offer features that automate calculations, making it easier to avoid errors. Take advantage of formulas and templates that handle repetitive tasks.

- Standardize Your Documents: Create a consistent format that you use for all requests. This reduces the chance of forgetting key elements and helps ensure that each document looks professional.

By being aware of these common mistakes and proactively addressing them, you can improve the accuracy of your financial requests and maintain positive relationships with your clients or partners.

How Excel Simplifies Sponsorship Payments

Managing payments in business agreements can often be a time-consuming and complex task, especially when dealing with multiple transactions or clients. However, using a spreadsheet application can greatly streamline this process by offering features that automate calculations, track payments, and organize financial data. This can save time, reduce errors, and enhance the overall efficiency of handling payments.

With the ability to set up customizable fields and automated formulas, these programs make it easy to calculate totals, apply taxes, and factor in discounts with a few simple inputs. Instead of manually doing calculations for each transaction, you can rely on built-in functions to ensure that all amounts are accurate and consistent. This not only reduces human error but also speeds up the process, allowing businesses to focus on other important tasks.

Additionally, spreadsheet tools allow for better tracking of outstanding payments. You can easily set up columns to indicate whether a payment has been received, and if not, you can include due dates and reminders for follow-up. This feature ensures that you stay on top of each transaction, avoiding any missed payments or miscommunications.

Overall, using a spreadsheet program to manage payments provides a flexible, efficient, and accurate solution to keep business finances organized and on track.

Tracking Payments with Sponsorship Templates

Efficiently tracking payments is crucial for maintaining smooth financial operations and ensuring that all transactions are completed on time. With the right tools, businesses can easily monitor the status of each payment, prevent overdue balances, and reduce the chances of miscommunication. Proper tracking also helps businesses quickly identify discrepancies, so they can take action before issues escalate.

Key Features for Payment Tracking

- Payment Status Columns: Include a column to track whether the payment has been made, is pending, or overdue. This allows for quick identification of outstanding amounts.

- Due Dates: Set up clear due dates for each payment, making it easy to spot overdue transactions and follow up with clients if necessary.

- Amount Received: Create fields to note down the exact amount received for each transaction, helping to confirm that payments match the amounts requested.

- Outstanding Balances: Automatically calculate and display any remaining balances that need to be paid, ensuring that no payments are missed.

How to Set Up Effective Payment Tracking

- Create a Clear Payment Log: Organize your document by listing all payments in a chronological order, including due dates and amounts due. This allows you to quickly see the full scope of transactions at a glance.

- Use Conditional Formatting: Use colors or symbols to highlight overdue payments or completed transactions. This helps differentiate between different payment statuses without needing to sift through every row.

- Set Up Alerts: In advanced tools, you can set up automatic reminders or alerts for upcoming due dates or overdue balances, ensuring nothing slips through the cracks.

- Maintain a Summary Section: Include a summary at the top of your document that quickly displays the total amount due, amount received, and outstanding balance. This gives you a snapshot of the payment status without having to go through every entry.

By implementing these tracking features, you can ensure a more organized approach to managing payments, which reduces the risk of financial discrepancies and enhances business efficiency.

Creating Professional Sponsorship Invoices

Crafting a professional financial document is essential for businesses to ensure that they maintain a positive image and encourage prompt payments. A well-structured document not only reflects professionalism but also helps build trust with clients and partners. To create a document that is both functional and professional, certain key elements should be considered in the design and layout.

Essential Elements of a Professional Document

- Clear and Concise Information: Make sure all the necessary details are included without overcomplicating the layout. Avoid clutter by using simple, easy-to-read fonts and clear sections.

- Business Branding: Incorporate your company’s logo, color scheme, and other branding elements to create a consistent, polished look that aligns with your business identity.

- Professional Tone: Use formal language and a respectful tone throughout the document. Avoid casual phrases and focus on clear, business-like communication.

- Complete Contact Details: Include both your business’s and the client’s contact information, ensuring there are no issues reaching either party if any questions arise regarding the transaction.

Formatting Tips for a Professional Appearance

- Use Structured Layouts: Organize information into sections such as “Client Information,” “Service Breakdown,” and “Payment Details.” A clean structure helps the recipient easily navigate through the document.

- Align Data Consistently: Align numbers (such as amounts and quantities) to the right and text to the left. This improves readability and helps the document appear more organized.

- Highlight Key Information: Bold important sections like the total amount due or due dates to draw attention to the most critical aspects of the document.

- Include Payment Terms: Clearly outline payment terms, including due dates, late fees, and preferred payment methods. This helps set clear expectations for both parties.

By following these guidelines, you can create a polished financial document that not only looks professional but also facilitates smooth transactions and strengthens your business’s reputation.

How to Add Taxes to Sponsorship Invoices

Incorporating taxes into financial documents is an essential part of ensuring compliance and accurately reflecting the true cost of services provided. By properly calculating and including taxes, businesses maintain transparency with clients and ensure that all necessary obligations are met. The process of adding taxes can be simplified by using clear formulas and organized layouts, making it easier to generate correct and consistent totals.

Steps for Adding Taxes to Financial Documents

- Identify the Tax Rate: Determine the applicable tax rate for your region or industry. This can vary based on location and the type of service or product provided. Be sure to use the correct rate to avoid discrepancies.

- Calculate the Taxable Amount: Identify the total amount that will be taxed, which typically includes the service charges but may exclude certain fees depending on local regulations.

- Apply the Tax Rate: Multiply the taxable amount by the tax rate to calculate the total tax. The formula should be: Tax = Taxable Amount x Tax Rate.

- Include the Tax in the Total: Once the tax is calculated, add it to the subtotal to get the final total amount due.

Example of Tax Calculation in a Financial Document

| Description | Amount |

|---|---|

| Service Fee | $1,000.00 |

| Tax Rate (8%) | $80.00 |

| Total Amount Due | $1,080.00 |

By following these simple steps and including a clear breakdown of taxes, you can ensure that the final amounts are accurate and comply with the necessary tax regulations. This approach not only maintains professionalism but also prevents any potential confusion for both the business and its clients.

Automating Invoicing with Excel Templates

Automating financial document generation can significantly streamline the billing process, saving time and reducing errors. By utilizing automation features within spreadsheet software, you can set up predefined structures and formulas that handle repetitive tasks such as calculations, data entry, and formatting. This ensures consistency and accuracy across all documents while eliminating the need for manual updates.

How Automation Simplifies Billing

- Automatic Calculation of Totals: By using formulas, you can automatically calculate the total amounts based on input data. This removes the need to manually add up figures and ensures that all amounts are accurate.

- Data Entry Shortcuts: With predefined fields and drop-down lists, data entry becomes faster and less prone to mistakes. This is especially helpful when dealing with recurring charges or services.

- Consistency Across Documents: Templates ensure that each document follows the same structure, so clients receive a consistent experience and can easily compare documents over time.

- Reduced Time Spent on Formatting: Automated formatting features, such as conditional formatting and cell borders, save time by ensuring the document looks professional without manual adjustments.

Steps to Automate Your Documents

- Create a Structured Layout: Set up a clear layout with predefined sections for service descriptions, amounts, payment terms, and taxes. This will ensure that you only need to enter new data in the appropriate fields.

- Set Up Formulas: Use built-in functions like SUM, IF, and VLOOKUP to automate calculations, such as adding totals or applying discounts.

- Incorporate Drop-Down Menus: For fields like payment methods or service categories, create drop-down lists so you can select pre-defined options instead of entering data manually each time.

- Use Conditional Formatting: Apply conditional formatting rules to highlight due dates, overdue payments, or important totals, making the document easier to read and navigate.

By automating your financial documents with these features, you can reduce the administrative burden and ensure that your documents are generated quickly, accurately, and professionally. Automation also ensures that you can easily replicate and modify documents for multiple clients or projects without starting from scratch each time.

Understanding Sponsorship Agreement Terms

When entering into a business agreement, it’s crucial to fully understand the terms and conditions outlined within the contract. These terms define the roles, responsibilities, and expectations of each party involved. By carefully reviewing these provisions, you ensure that both sides are clear about deliverables, payment schedules, and any other obligations, which helps avoid confusion and ensures a smooth partnership.

Key Terms to Know in a Business Agreement

- Payment Schedule: This section outlines when payments are due, the amount of each payment, and any conditions tied to those payments. It is important to confirm the dates and amounts to avoid disputes.

- Deliverables: This term specifies what goods or services will be provided as part of the agreement, as well as the timeline for delivery. Clear deliverables help ensure that expectations are met on both sides.

- Duration and Termination: The agreement should specify the length of the relationship and conditions under which the contract can be terminated early. Understanding this term ensures that both parties are clear on the contract’s timeline.

- Confidentiality: Many agreements include clauses about confidentiality, specifying what information must remain private and for how long. This protects sensitive data from being shared without permission.

- Dispute Resolution: This section outlines how disputes will be resolved, whether through negotiation, arbitration, or legal action. Knowing the process in advance helps both parties understand how conflicts will be handled.

Example of Key Terms in a Business Agreement

| Term | Description |

|---|---|

| Payment Schedule | Details when payments are due and any associated conditions. |

| Deliverables | Lists what services or products will be provided and when. |

| Duration | Specifies the time frame of the agreement and the conditions for termination. |

| Confidentiality | Clarifies which information must remain private during and after the agreement. |

| Dispute Resolution | Describes how conflicts will be resolved, including potential legal actions. |

Understanding these terms is essential for both parties to avoid misunderstandings and to ensure that the agreement operates smoothly throughout its duration. By paying attention to these details, you help

Ensuring Legal Compliance in Invoicing

Maintaining legal compliance in financial documentation is crucial for businesses to avoid disputes, penalties, and legal challenges. Adhering to local, regional, and international tax laws ensures that your business operates transparently and within the law. Understanding the legal requirements related to payments, taxes, and document presentation can help protect your company and establish trust with clients.

Key Considerations for Legal Compliance

- Accurate Tax Calculations: Always ensure that applicable taxes are correctly calculated and displayed in the document. This includes sales tax, VAT, or any other region-specific levies. Using incorrect tax rates can lead to fines or legal repercussions.

- Proper Documentation of Terms: Clearly outline payment terms, due dates, and penalties for late payments. This protects your business by establishing the legal obligations of both parties.

- Correct Business Information: Your business name, address, tax ID, and contact details should be prominently displayed on each document. This helps ensure that your documents meet local business regulations and can be traced back to your company if necessary.

- Compliance with Currency and Language Requirements: In international transactions, make sure the correct currency is listed and, where necessary, provide translations or use international standards for terms and conditions.

- Legal Recourse and Dispute Resolution: Clearly state how disputes will be resolved, whether through mediation, arbitration, or legal proceedings. This ensures that both parties understand the process if issues arise.

Steps to Ensure Compliance

- Understand Regional Tax Regulations: Research and stay up to date with the tax laws applicable to your business operations in different regions. This includes rates, tax filing deadlines, and any special rules for the services you provide.

- Use Standardized Formats: Adhere to the legal standards for business documents. This includes following regulations for document structure, item descriptions, and mandatory legal disclosures.

- Consult a Legal Expert: When in doubt, consult with an accountant or legal professional to ensure that your financial documentation complies with all applicable laws and industry standards.

- Regular Audits: Conduct regular audits of your business practices to ensure ongoing compliance. This can help you catch any potential errors before they become larger issues.

By implementing these steps, you can reduce the risk of legal challenges and maintain a transparent, trustworthy relationship with clients. Legal compliance is not only a regulatory requirement but also a vital aspect of professional business practice that safeguards your company’s reputation.